ASSESSING THE

ECONOMIC IMPACTS OF

ALASKA AIRLINES

OCTOBER 2018

OCTOBER 2018

PROJECT TEAM

Andrew Bjorn, Project Manager

Brian Murphy, Principal

Claire Miccio, Senior Associate

Kristin Maidt, Associate

Sherrie Hsu, Associate

“Helping Communities and Organizations Create Their Best Futures”

Founded in 1988, we are an interdisciplinary strategy and analysis rm providing integrated,

creative and analytically rigorous approaches to complex policy and planning decisions.

Our team of strategic planners, policy and nancial analysts, economists, cartographers,

information designers and facilitators work together to bring new ideas, clarity, and robust

frameworks to the development of analytically-based and action-oriented plans.

2200 Sixth Avenue, Suite 1000

Seattle, Washington 98121

P (206) 324-8760

www.berkconsulting.com

SUMMARY

Since its founding in 1932, Alaska Airlines has grown to become the fth-largest air carrier

in the United States, providing service that connects 44 million guests a year to over 115

destinations in the US, Mexico, Canada, and Costa Rica. To achieve this growth, Alaska has

had several periods of strategic expansion. Alaska Air Group (AAG), which includes Alaska

Airlines, Horizon Air, and McGee Air Services, most recently acquired and integrated Virgin

America in 2016.

The Seattle metropolitan area is an important partner in Alaska Airlines’ development

as it has been home to the corporate headquarters since the 1940s. Today, about

40% of the 21,000 employees with Alaska Airlines and Horizon Air are sited at the

corporate headquarters in SeaTac, WA and the main hub at Sea-Tac International Airport.

Understanding the role of Alaska Airlines in the regional economy and communities

throughout the state is essential for managing regional and statewide partnerships. Alaska

Airlines provides benets across different areas, ranging from increased economic activity

from operations to improved regional, national, and international access for business

travelers and tourists.

Some of the major economic impacts from AAG operations include:

The total economic impact of AAG companies

across the economy of Washington state was $7

billion in 2017 and has grown at an average

of 5.9% per year over the past ve years. This

total impact consists of about $4.1 billion in

direct impacts, $1.6 billion in indirect impacts,

and $1.2 billion in induced impacts.

The operations of AAG companies supported

23,561 jobs in Washington state in 2017.

This includes 9,916 jobs directly with AAG

companies, as well as 5,978 jobs with

companies in the supply chain and 7,667 jobs

supported by the earnings of employees. This

amounts to a total of 2.4 jobs in the economy

for every job with AAG companies, or about

5.7 jobs per $1 million in output.

i

ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES · ALASKA AIRLINES

OCTOBER 2018

Alaska Airlines and Horizon Air accommodated

22 million passengers through Seattle-Tacoma

International Airport, representing about half

of all trafc from Seattle’s main airport.

Passenger service supports access to national

and international destinations for cities across

Washington state.

Over the past ve years, Alaska Airlines has

made nearly $2.4 billion worth of aircraft

purchases from Boeing, which created $3.4

billion of additional economic activity in

Washington. This activity has also supported an

average of nearly 1,600 jobs across the state

per year.

AAG companies did business with 3,557

vendors in 2017, which has more than doubled

the number of companies in its immediate

supply chain over the past ve years. This has

expanded the number of regional businesses

that benet from growth of AAG companies,

and provides exposure to locally sourced

products, primarily food and beverages, with

airline customers.

Outgoing cargo from Seattle-Tacoma

International Airport amounted to $24 million

in freight revenue in 2017, which is 97%

of the total cargo revenue generated from

Washington state airports. Alaska Air Cargo

has recently increased its freight capacity,

which will increase cargo services as a business

line in the future.

In 2017, AAG companies provided about

$15.5 million in corporate donations, including

cash grants and nancial support, travel, and

employee volunteer time. Washington state

charities received $8 million in 2017, more than

half of total corporate donations.

ALASKA AIRLINES · ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES

ii SUMMARY · OCTOBER 2018

CONTENTS

INTRODUCTION 1

ECONOMIC IMPACTS 3

Employment 3

Direct Employment 3

Employment Effects 6

Labor Union Participation 8

Business Operations 9

Capital Expenditures 11

Aircraft Procurement 11

Investment in Facilities 12

Suppliers 13

PASSENGER TRAFFIC AND TRENDS 17

Overview 17

International Destinations 18

North American Destinations 20

Washington State Destinations 23

CARGO SERVICES 25

CHARITABLE GIVING 27

CONCLUSIONS 31

iii

ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES · ALASKA AIRLINES

OCTOBER 2018

ALASKA AIRLINES · ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES

iv CONTENTS · OCTOBER 2018

INTRODUCTION

Since 1932, Alaska Airlines has grown from the Alaskan bush pilots of McGee Airways

and Star Air Service into the fth-largest air carrier in the US, and the only major airline

headquartered on the West Coast. Currently, it provides service to destinations in US,

Mexico, Canada, and Costa Rica through direct ights, and worldwide through Alaska

Global Partners. Alaska Airlines’ growth has been marked by periods of strategic expansion.

Alaska Air Group (AAG), which includes Alaska Airlines, Horizon Air, and McGee Air

Services, most recently acquired and integrated Virgin America in 2016.

Alaska Airlines has been headquartered in the Seattle area since the 1940s, and regular

air service to Anchorage and Fairbanks from Seattle began in the 1950s. Alaska Airlines

has been a reliable customer for Boeing commercial jet aircraft since 1966, when the rst

Boeing 727–100 planes were put into service with the Alaska Airlines eet. Currently, many

of the over 21,000 employees of Alaska Air Group companies work at the Alaska Airlines

corporate headquarters in SeaTac, WA and the hub at Sea-Tac International Airport.

Assessing the impacts of Alaska Air Group companies on the regional economy and on

communities throughout the state is essential to understanding the role Alaska Airlines plays

in the state. In addition to its role as a major employer, Alaska Airlines has a major hub for

national and international passenger travel and cargo at Sea-Tac International Airport,

providing the state and region with greater accessibility to destinations for business and

tourism worldwide in cooperation with Alaska Global Partners. The charitable contributions

made by Alaska Airlines to organizations in the state support important causes in the Seattle

region. Additionally, Alaska Airlines supports the local economy by sourcing from local

suppliers and providing a platform for advertising for local companies.

To provide a greater understanding of these roles, this report presents a review of the

impacts of Alaska Airlines and the other AAG companies on the state of Washington and the

Seattle region. This study focuses on the benets associated with having the primary hub and

headquarters for Alaska Airlines located in the region and highlights how these benets have

grown in recent years.

1

ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES · ALASKA AIRLINES

OCTOBER 2018

The report is organized into four main sections:

We describe the economic impacts of AAG companies within the Seattle region and the

state, including the major roles Alaska Airlines plays in local and state economies.

Passenger trafc information is also provided to highlight how passenger services

support international, national, and regional access to the state.

We provide a review of cargo services provided by Alaska Airlines to explain how this

activity contributes to the local economy.

The effects of charitable giving on local communities are described, with a description

of how Alaska Airlines works with community partners on projects and ongoing initiatives.

ALASKA AIRLINES · ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES

INTRODUCTION · OCTOBER 20182

ECONOMIC IMPACTS

Alaska Air Group companies provide signicant economic benets to the Seattle metropolitan

area and the state of Washington. These benets relate not only to local employment, but

also to the activities necessary to support airline operations and the business activity spurred

by this spending. This is due primarily to the role of the Seattle metropolitan area as the

major hub and headquarters for Alaska Airlines and other AAG companies.

This section outlines the economic impacts associated with the operations in the Seattle

metropolitan area and Washington state, with a focus on employment, local suppliers, and

local aircraft procurement. This analysis was conducted using the IMPLAN economic impact

model, which relies on available data from national and regional economic accounts to

support state and regional input-output analysis.

EMPLOYMENT

Direct Employment

AAG companies have employed a growing number of people over the last ten years,

offering a variety of jobs at over 100 locations. In addition to growth in Alaska Airlines and

Horizon Air, there have also been other recent corporate expansions:

AAG acquired Virgin America for $2.6 billion in 2016 and over 90% of the

integration milestones will be complete by 2019.

In 2016, McGee Air Services was created as a subsidiary of Alaska Airlines to

provide airline support services, including baggage handling and gate agent

services. This subsidiary, headquartered in Renton, also provides airline support

services in Phoenix, Portland, San Jose, and San Francisco.

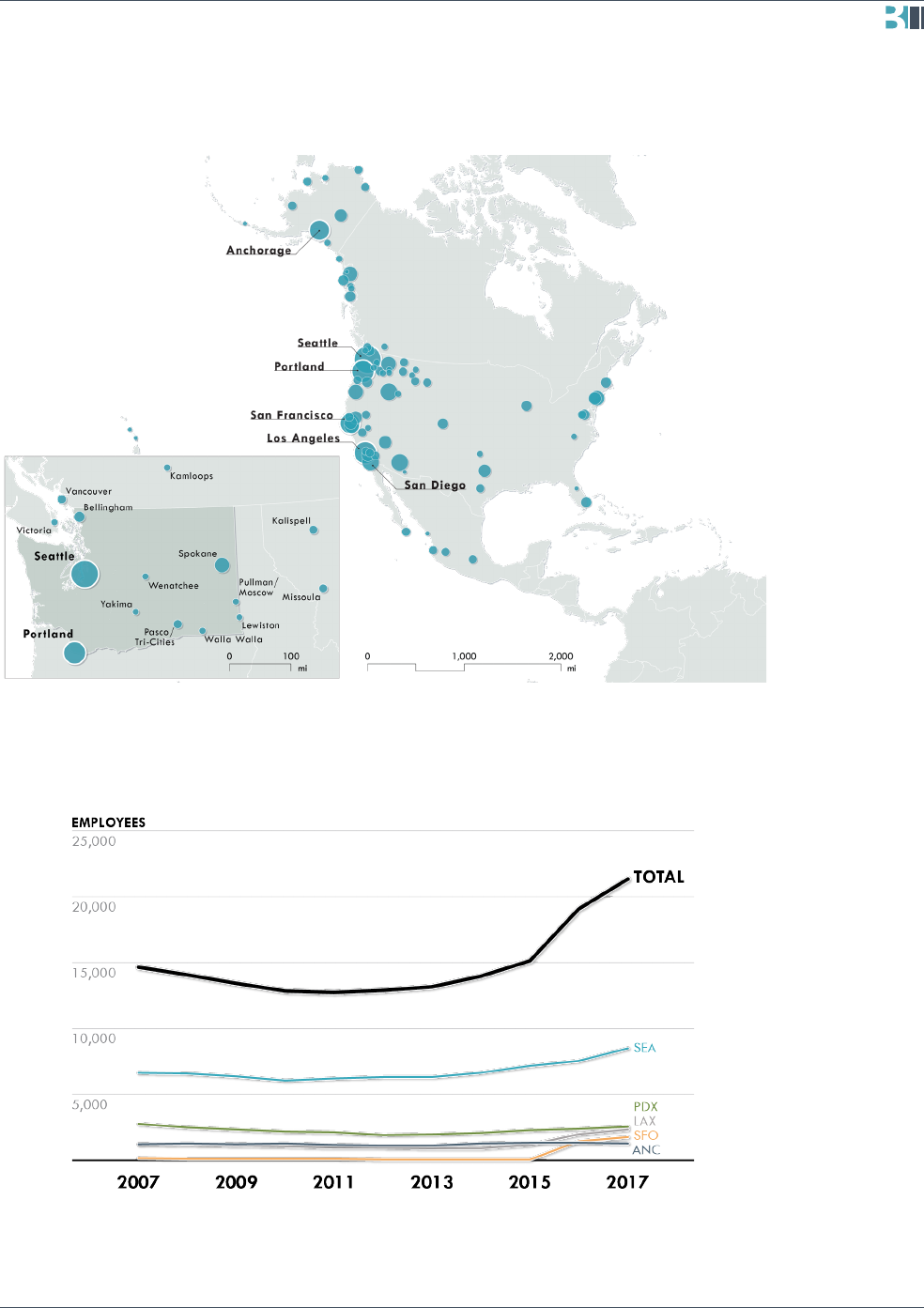

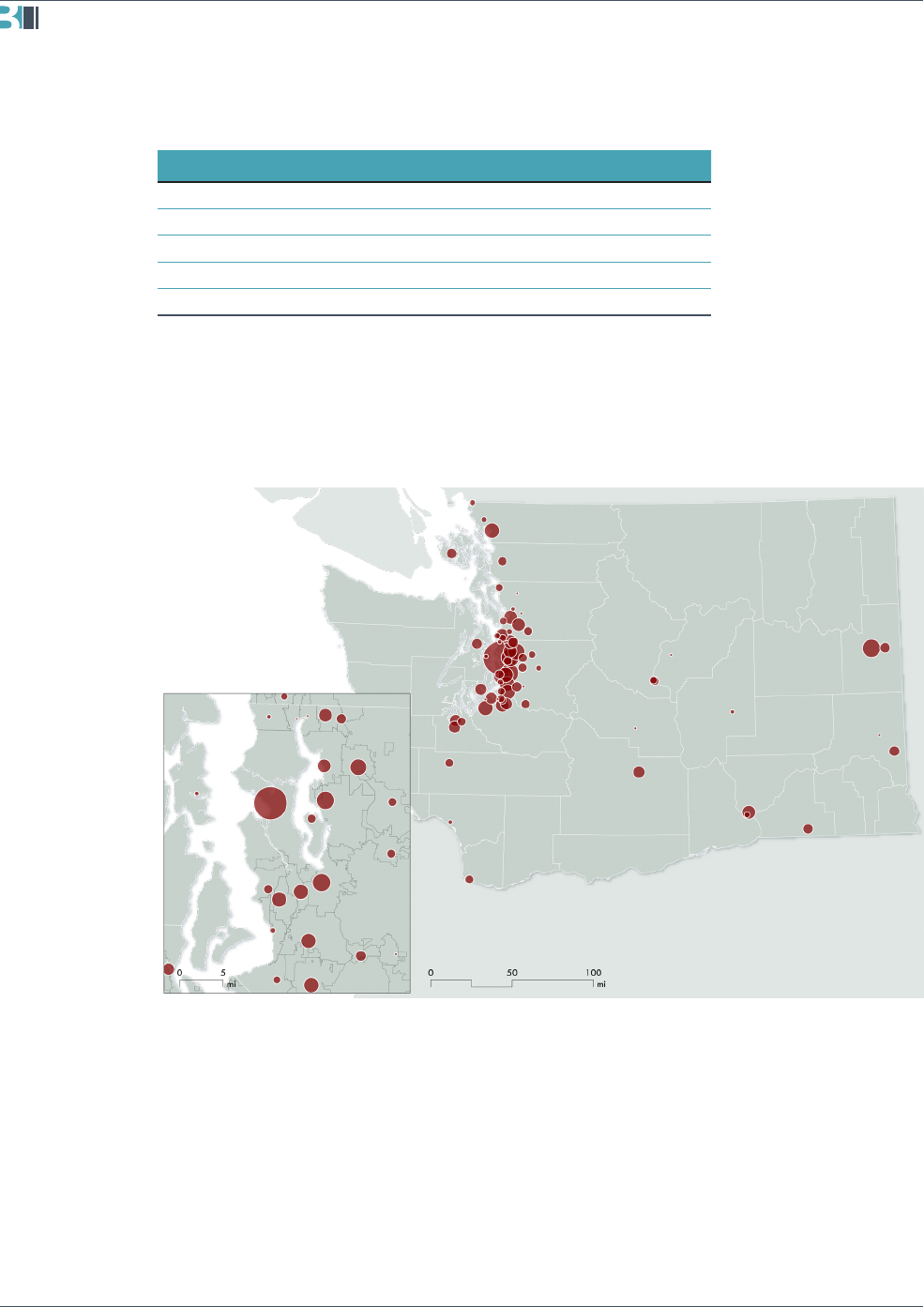

Exhibit 1 shows employment at AAG companies for all airports in Washington, and Exhibit 2

provides Alaska Airlines and Horizon Air jobs at major hubs and focus cities. Looking more

broadly at employment with AAG companies, Exhibit 3 shows the location of all employees

of Alaska Airlines and Horizon Air, and Exhibit 4 provides trends for this employment at

major airports.

3

ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES · ALASKA AIRLINES

OCTOBER 2018

Exhibit 1 Employment with Alaska Air Group companies in Washington state, 2017.

COMPANY

EMPLOYMENT AT WASHINGTON AIRPORTS

TOTALSEA GEG BLI PSC EAT PUW YKM ALW

Alaska Airlines

1

7,475 - 2 - - - - - 7,477

Horizon Air 1,021 281 45 20 17 17 16 13 1,430

McGee Air Services 1,009 - - - - - - - 1,009

Total 9,505 281 47 20 17 17 16 13 9,916

Source: Alaska Airlines, 2018; BERK, 2018.

1

Alaska Airlines totals include previous Virgin America employees

Exhibit 2 Alaska Airlines and Horizon Air jobs by hubs/focus cities outside Washington state, 2017.

COMPANY

EMPLOYMENT AT HUB/FOCUS CITY AIRPORTS

ALL EMPLOYEESPDX LAX SFO ANC SAN

Alaska Airlines

1

1,231 2,095 1,745 1,242 539 17,382

Horizon Air 1,333 233 - 49 - 3,940

Total 2,564 2,328 1,745 1,291 539 21,322

Source: Alaska Airlines, 2018; BERK, 2018.

1

Alaska Airlines totals include previous Virgin America employees

ALASKA AIRLINES · ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES

ECONOMIC IMPACTS · OCTOBER 20184

Exhibit 3 Employee locations for Alaska Air Group airlines, 2017.

Source: Alaska Airlines, 2018; BERK, 2018..

Exhibit 4 Total employment, Alaska Airlines and Horizon Air, 2007–2017.

Source: Alaska Airlines, 2018; BERK, 2018.

5

ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES · ALASKA AIRLINES

OCTOBER 2018 · ECONOMIC IMPACTS

Key highlights include the following:

Seattle and Washington state are a major site for employment in AAG

companies. As of 2017, AAG companies had 9,916 employees in Washington

state, with 7,475 jobs with Alaska Airlines, 1,021 with Horizon Air, and 1,009 with

McGee Air Services. This includes about 40% of all Alaska Airlines and Horizon

Air employment, which are primarily located at Sea-Tac International Airport and

Seattle area headquarters.

Total employment with AAG companies is growing signicantly. Over the past

ve years, total employment with Alaska Airlines and Horizon Air grew by about

35% at the Seattle hub, or about 6.2% per year. During that same period, overall

employment with Alaska Airlines grew by 36%, and Horizon Air by 32%. The

integration of Virgin America into Alaska Airlines has added 3,516 employees

company-wide above this growth, and the creation of McGee Air Services has

added another 1,009 jobs in the Seattle metropolitan area.

Employment Effects

In addition to direct employment, AAG companies support other types of employment in

communities across the state, including:

Indirect employment by suppliers and other businesses that do business with AAG

companies.

Induced employment by businesses that support the employees of AAG companies

and their suppliers.

For this analysis, employment effects for AAG companies are framed in two ways:

The effects of employment at AAG companies’ headquarters and the Seattle-

Tacoma International Airport within the Seattle metro area.

The effects of employment statewide by AAG companies.

Exhibit 5 provides a summary of the total employment effects at the Seattle metropolitan

and state levels for 2017, and Exhibit 6 presents the trends of the employment impacts for

operations across the state.

This overall analysis of employment impacts indicates the following:

Statewide, AAG companies supported 23,561 jobs in 2017. In addition to the

9,916 direct employees of AAG companies, including Alaska Airlines, Horizon Air,

and McGee Air Services, an additional 5,978 jobs are supported through the supply

chain, and 7,667 jobs are supported with induced demand from households.

ALASKA AIRLINES · ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES

ECONOMIC IMPACTS · OCTOBER 20186

Exhibit 5 Total employment impacts for AAG companies, Seattle

metropolitan area and Washington state, 2017.

ECONOMIC IMPACT

JOBS

MULTIPLIERDIRECT INDIRECT INDUCED TOTAL

Seattle metropolitan area 9,505 5,320 6,758 21,583 2.27

Statewide 9,916 5,978 7,667 23,561 2.38

Source: Alaska Airlines, 2018; BERK, 2018.

Exhibit 6 Total employment impacts of AAG companies

in Washington state, 2010–2017.

Source: Alaska Airlines, 2018; BERK, 2018.

7

ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES · ALASKA AIRLINES

OCTOBER 2018 · ECONOMIC IMPACTS

The Seattle metropolitan area is a major employment center for AAG companies

in the state. A majority of Washington state employees of AAG companies are in

the Seattle metropolitan area, with major operations at Sea-Tac International Airport

and major headquarters located in SeaTac and Renton. Altogether, this amounts

to 9,505 direct employees, with an additional 12,078 jobs supported through the

supply chain and induced demand from households.

Every job created by AAG companies in the state resulted in a total of 2.4 jobs

added to the economy in 2017. Additionally, every $1 million in demand for

services from AAG companies resulted in the creation of about 5.7 jobs across the

economy. These jobs are related both to activity in the supply chain and wages and

other earnings being spent in the local economy.

Total statewide employment impacts grew by 42% over the past ve years. In

2013, Alaska Airlines and Horizon Air supported 16,637 jobs across the entire state

economy, including 6,672 direct employees of these two companies. Over the past

ve years, the total employment impact across the state economy has increased by

about 42%, or about 9.1% per year, while direct employment has increased by

about 49%.

Contributions to local employment in the City of SeaTac are signicant. The

impacts of employment from AAG companies also impacts local communities as

well. From 2017 PSRC estimates of covered employment, AAG companies account

for about 23% of the jobs in SeaTac (outside of the self-employed and domestic

workers), where the Alaska Airlines headquarters is located.

Labor Union Participation

The rate of union participation by AAG companies is considerable: with at least 17,000

union members across Alaska Airlines, Horizon Air, and McGee Air Services, these companies

well exceed the industry average of 38% union membership. This high rate of membership

supports both workers’ rights and higher wage rates across the workforce.

The seven unions that provide representation to employees of AAG companies include the

following:

Association of Flight Attendants (AFA), representing about 6,300 ight attendants

with Alaska Airlines and Horizon Air, and comprising the largest representative of

employees across AAG companies.

International Association of Machinists (IAM), representing airport, reservation,

ofce and clerical staff, and ramp and stores agents with Alaska Airlines and ramp

agents of McGee Air Services.

ALASKA AIRLINES · ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES

ECONOMIC IMPACTS · OCTOBER 20188

Airline Pilots Association (ALPA), representing about 2,900 Alaska Airlines pilots.

International Brotherhood of Teamsters (IBT), representing 1,100 Horizon Air pilots

and technicians.

Airline Mechanics Fraternal Association (AMFA), representing about 700 aircraft

technicians with Alaska Airlines.

Transport Workers Union (TWU), representing dispatchers with Alaska Airlines and

Horizon Air.

Unifor, representing about 40 Horizon Air employees in Canada.

BUSINESS OPERATIONS

The benets of business activity from AAG companies in the state and region not only

includes the value of the services and the compensation provided to employees, but also

the impacts of spending by the companies and employees across the entire economy. These

effects can be divided into three main categories:

Direct impacts of the operations of AAG companies and the value of the goods and

services produced, including passenger and cargo services;

Indirect impacts resulting from spending on intermediate inputs, such as catering

services, airport fees, and fuel for aircraft; and

Induced impacts derived from the salaries and compensation of employees of AAG

companies and their suppliers being spent in the regional economy.

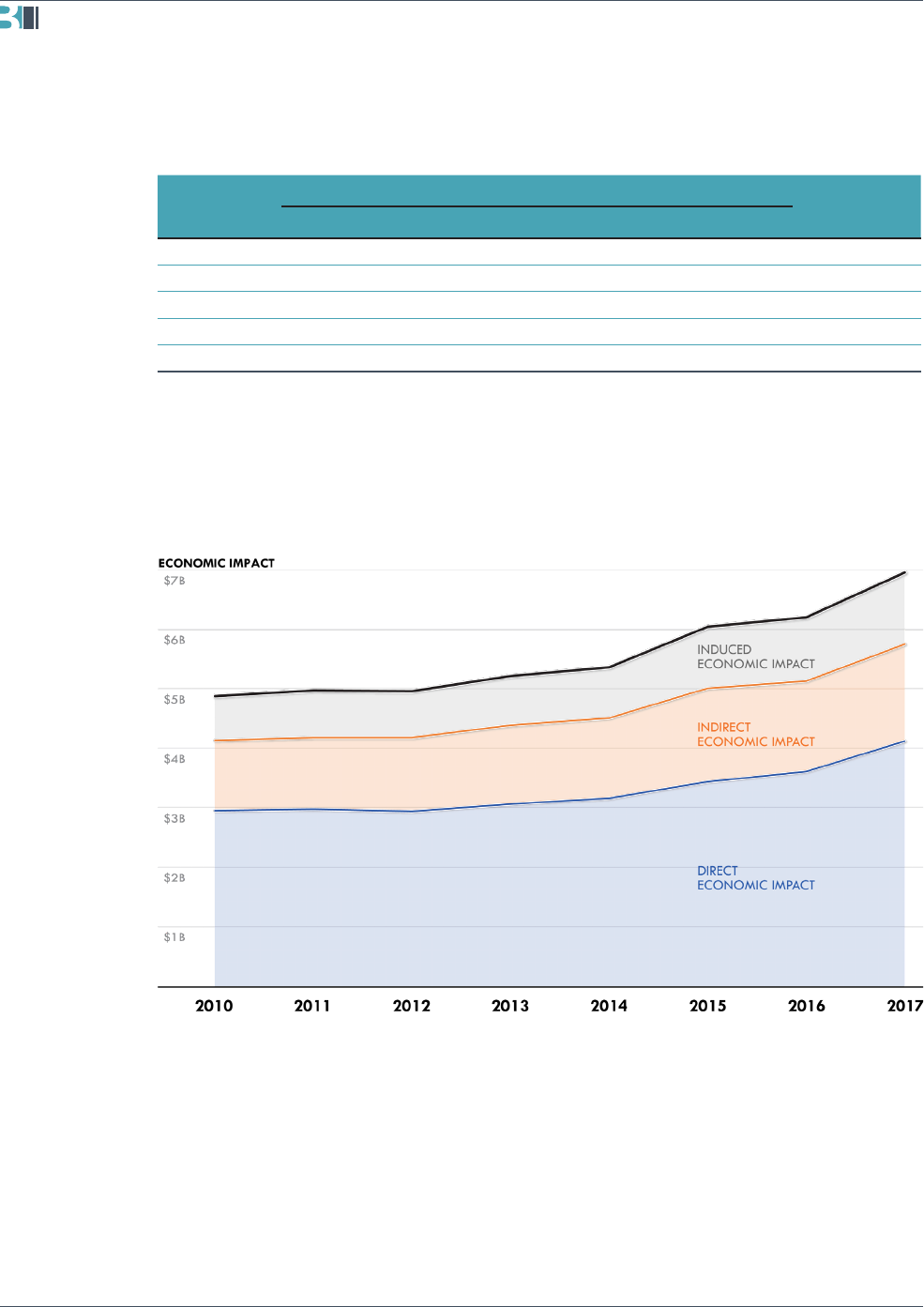

Exhibit 7 provides a summary of the total economic impacts from the activities of AAG

companies, with a chart of the total economic impact over time provided in Exhibit 8.

Key insights from this assessment include the following:

Alaska Air Group companies had an economic impact of about $7 billion in the

state in 2017. This overall impacts of AAG companies consists of about $4.1 billion

in direct impacts, $1.6 billion in indirect impacts, and $1.2 billion in induced impacts.

In 2017 dollars, this represents a 12% increase from 2016, and 5.9% yearly growth

on average over the past ve years.

Every dollar of output from AAG companies results in a total of 1.68 dollars of

economic activity for the Seattle metropolitan area. This includes an additional

9

ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES · ALASKA AIRLINES

OCTOBER 2018 · ECONOMIC IMPACTS

Exhibit 7 Total employment impacts for AAG companies, Seattle metropolitan

area and Washington state, 2017 dollars, 2013–2017.

YEAR

ECONOMIC IMPACT

ECONOMIC

MULTIPLIERDIRECT INDIRECT INDUCED TOTAL

2013 $3,063M $1,321M $829M $5,213M 1.7

2014 $3,154M $1,355M $855M $5,363M 1.7

2015 $3,439M $1,574M $1,025M $6,039M 1.8

2016 $3,609M $1,518M $1,071M $6,198M 1.7

2017 $4,124M $1,628M $1,202M $6,953M 1.7

Source: Alaska Airlines, 2018; BERK, 2018.

Exhibit 8 Summary of the total economic impact of AAG companies

in Washington state, 2017 dollars, 2010–2017.

Source: Alaska Airlines, 2018; BERK, 2018.

ALASKA AIRLINES · ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES

ECONOMIC IMPACTS · OCTOBER 201810

0.39 dollars from indirect impacts from the supply chain and 0.29 dollars from

induced impacts in the economy.

CAPITAL EXPENDITURES

In addition to the benets provided from ongoing business activities, capital expenditures

by AAG companies provide further economic activity in the state and region. These capital

expenditures are primarily related to aircraft procurement, but the construction of the new

facilities at the SeaTac corporate campus and Sea-Tac International Airport also represent

expenditures that will have economic impacts in the region and state.

Aircraft Procurement

As with any other airline, major capital expenditures are related to purchasing commercial

aircraft. For Alaska Airlines this amounted to approximately $511 million in expenditures in

2017 for eet expansion.

However, unlike many other airline companies these expenditures provide additional benets

for the state and region. The core of the Alaska Airlines aircraft eet consists of 157 Boeing

737s, which reects a relationship between Alaska Airlines and Boeing that has been in

place since the 1960s. Additional orders for new Boeing aircraft are currently in place,

including orders for the new Boeing 737 MAX 9 due to be delivered in 2019.

Exhibit 9 Statewide impacts of aircraft purchases by Alaska Airlines,

2017 dollars, 2013–2017.

YEAR

ECONOMIC IMPACT EMPLOYMENT

DIRECT INDIRECT INDUCED TOTAL DIRECT INDIRECT INDUCED TOTAL

2013 $379M $85M $70M $533M 407 353 447 1,207

2014 $473M $113M $89M $675M 481 474 564 1,519

2015 $584M $146M $113M $843M 612 623 732 1,966

2016 $452M $114M $87M $654M 468 479 557 1,505

2017 $511M $129M $99M $739M 529 542 630 1,701

Source: Alaska Airlines, 2018; BERK, 2018.

11

ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES · ALASKA AIRLINES

OCTOBER 2018 · ECONOMIC IMPACTS

The purchase of new, locally-built aircraft like the 737 provides additional demand for the

local aircraft manufacturing industry, which in turn supports employment and further economic

activity. Exhibit 9 shows the annual effect of aircraft purchases on the regional economy (in

2017 dollars), including the indirect impacts on aircraft suppliers and induced effects from

additional employment statewide.

Highlights from this analysis include the following:

Local purchases of aircraft increase economic activity in the Seattle area. Since

2013, Alaska Airlines has spent nearly $2.4 billion in aircraft from Boeing (in 2017

dollars), which has resulted in over $3.4 billion of new economic activity in the state.

These impacts are most noticeable with Boeing operations in Renton, but there are

also wider impacts for aerospace suppliers and other businesses statewide.

Aircraft procurement also supports local aerospace jobs and other employment.

Purchases of Boeing aircraft also support local aerospace manufacturing, suppliers,

and other businesses. Altogether, direct employment supported from purchases over

the past ve years averages about 500 jobs, with an additional 1,080 jobs arising

from related demands in the economy.

Investment in Facilities

In the Seattle metropolitan region, there are also major projects for facilities investment that

Alaska Airlines is currently pursuing:

Alaska Airlines hub expansion (Copper River Project). Alaska Airlines is currently

pursuing a long-term four-phase development of a 6.8-acre site adjacent to the

Alaska Airlines headquarters in the city of SeaTac. The rst phase of this project,

expected to be completed by early 2020, includes a new 128,000-square-foot

ofce building (“The Hub”), parking garage, and pedestrian improvements across

International Boulevard. The ofce building will accommodate recruiting, uniform

tting, operations, e-commerce, and IT staff. Overall, this represents a long-term

investment in SeaTac as a focus location for the company.

Seattle-Tacoma International Airport. Alaska Airlines has been working with the

Port of Seattle on ongoing improvements to the airport to accommodate increasing

volumes of trafc and modernize older facilities. The North Satellite Modernization

Project, expected to be complete by 2021, will update the existing North Satellite

with new environmentally-conscious upgrades that will provide improvements to

passenger services, employee workspaces, baggage handling, and accessibility.

Alaska Airlines will contribute $41 million to this work, which will include the

construction of a new lounge facility for the airline.

ALASKA AIRLINES · ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES

ECONOMIC IMPACTS · OCTOBER 201812

New Paine Field (PAE) service. Alaska Airlines also announced in 2017 that it will

begin ights from Paine Field in Everett to provide additional connections for the

north Seattle metro area. Non-stop ights to eight West Coast cities have been

announced, which will be supported by a new terminal built and operated by

Propeller Airports. This new passenger service and supporting facilities will provide

additional benets for Snohomish County and areas to the north of Seattle.

SUPPLIERS

The relationships that Alaska Airlines has with major and minor suppliers are important to

the overall economic impact on the metropolitan area and state. These connections promote

employment to the wider community and bring the benets of growth in business to the

Seattle metropolitan area and Washington as a whole.

Exhibit 10 provides a summary of the number of vendors and contractors in Washington

state, and Exhibit 11 shows the distribution of expenditures to vendors and other agencies by

jurisdiction for the state and the immediate Seattle metropolitan area (for total charges over

$50,000 between 2013 and 2017 only).

Vendors included in this summary are from the following supplier categories:

Catering

Commercial real estate management

Deicing

Fleet agents

Fueling

Health insurance

IT support

Maintenance

For cities with airports, major expenses are associated with landing fees, facility rents, and

other costs for the use of airport facilities. However, the largest single set of vendor expenses

is with the company health insurance provider operating in Seattle, which is a substantial

share of total vendor activity.

This information about vendor distribution indicates the following:

Alaska Airlines is expanding the use of vendors. Alaska Airlines increased the

number of vendors in their supply chain from 1,719 in 2013 to 3,557 in 2017,

doubling the number of these suppliers in ve years. This represents about 16%

13

ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES · ALASKA AIRLINES

OCTOBER 2018 · ECONOMIC IMPACTS

Exhibit 10 Number of Alaska Airlines vendors and contractors, 2012–2017.

YEAR VENDORS CONTRACTORS

2013 1,719 17

2014 2,027 16

2015 2,365 15

2016 2,934 12

2017 3,557 38

Source: Alaska Airlines, 2018; BERK, 2018.

Exhibit 11 Distribution of major vendor spending by Alaska

Airlines in Washington cities, 2012–2017.

Source: Alaska Airlines, 2018; BERK, 2018.

ALASKA AIRLINES · ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES

ECONOMIC IMPACTS · OCTOBER 201814

growth per year in the vendor roster, and it expands the ability for businesses in the

region to benet from the expansion of Alaska Airlines.

Vendors are clustered in the Seattle metro area. Generally, the distribution of

vendors is clustered in the Seattle metropolitan area, with minor clusters around

other airports in Washington state and in the state capital. This indicates that the

supply chains for Alaska Airlines are strongly tied to the metro area, and the indirect

impacts associated with the supply chain are focused there as well.

The company provides opportunities to market Washington state products at

the national and international level. Alaska Airlines and Horizon Air give local

businesses visibility with passengers through in-ight service, especially those that

produce gourmet food and drinks. Starbucks and AAG companies have partnered

for 28 years to provide customers with fresh brewed coffee on board ights.

These opportunities have extended to other Seattle-area companies as well, with

companies such as Beecher’s Cheese, Cucina Fresca Gourmet Foods, Tim’s Potato

Chips, Emily’s Chocolate, and Tree Top highlighted in meal services. Paired with

high customer satisfaction with the Alaska Airlines and Horizon Air brand, this can

signicantly boost positive market exposure.

15

ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES · ALASKA AIRLINES

OCTOBER 2018 · ECONOMIC IMPACTS

ALASKA AIRLINES · ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES

ECONOMIC IMPACTS · OCTOBER 201816

PASSENGER TRAFFIC

AND TRENDS

OVERVIEW

Alaska Airlines and Horizon Air are primarily passenger airlines, with ights to destinations

in North America and continuing services for world-wide destinations through Alaska Global

Partners. Although hosting the headquarters of the company has economic benets for the

region, facilitating access to the world can also support Washington state communities in

several ways:

National and international business access for the Seattle region. As the Seattle metro

region maintains and expands its role as a major center for innovation and high-tech

industry, accessibility to the region is crucial. Alaska Airlines and Horizon Air provide

access through direct ights and ights with Alaska Global Partners across the region,

nation, and world.

International access to local and regional tourism. Alaska Airlines and Horizon Air

provide air services that bring tourists to the Seattle region and other locations in

Washington state from the US, Canada, and countries worldwide. This accessibility

catalyzes tourism throughout the state, encouraging visitors and spurring further growth in

the tourism industry.

Business access for smaller cities. Smaller cities in Washington served by Alaska

Airlines and Horizon Air can access national and international destinations, which

supports important business connections in other regions. This is especially important as

reliable and frequent air service is linked to local businesses accessing larger markets.

This section focuses on passenger trafc for three different categories of destinations:

International destinations, including destinations served by Alaska Airlines and Horizon

Air in Canada, Mexico, and Costa Rica, as well as other international locations accessible

by Alaska Global Partners.

National and North American destinations served by Alaska Airlines, Horizon Air, and

Alaska Global Partners.

Regional destinations within Washington state and the Pacic Northwest, including

locations primarily served by Horizon Air.

17

ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES · ALASKA AIRLINES

OCTOBER 2018

INTERNATIONAL DESTINATIONS

Passenger service to international locations,

both directly and through Alaska Global

Partners, supports access to the world from the

state and the Seattle region. It also provides

opportunities for international visitors to come

to the region, which is essential for business

and tourism.

Exhibits 12 and 13 provide the top worldwide

destinations for customers of Alaska Airlines,

Horizon Air, and Alaska Global Partners that

have touched Seattle by starting or ending a

trip at Seattle-Tacoma International Airport,

or transiting through Seattle during an

international trip.

Key ndings from these statistics include the

following:

Alaska Airlines and Horizon Air support

global access to Seattle through Sea-Tac

Airport. Major international destinations

served by Alaska Airlines and Horizon

Air directly and through Alaska Global

Partners include key locations in Canada,

Mexico, Asia, and Europe, with many of

these locations reecting the growing roles

that Alaska Airlines and Horizon Air play

in making Seattle an international travel

hub.

Greater international access to and from Seattle is supported by the Alaska Airlines

network. Codeshares with Alaska Global Partners are also accessible through other

major hubs such as Los Angeles and San Francisco. This provides greater access to

international routes via Alaska Global Partners, which are key to supporting more

international passengers with the Alaska Airlines network.

ALASKA GLOBAL PARTNERS

As of 2018, Alaska Airlines has

relationships with the following

Alaska Global Partners for service to

additional national and international

destinations:

Aer Lingus

American Airlines

British Airways

Cathay Pacic

Condor

Emirates

Fiji Airways

Finnair

Hainan Airlines

Icelandair

Japan Airlines

Korean Air

LATAM Airlines

PenAir

Qantas

Ravn Alaska

Singapore Airlines

ALASKA AIRLINES · ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES

PASSENGER TRAFFIC AND TRENDS · OCTOBER 201818

Exhibit 13 Top international passenger volumes touching Seattle by origin/destination,

Alaska Airlines, Horizon Air, and Alaska Global Partners, 2017.

2017 PASSENGER VOLUME

2016 TOTAL

VOLUME CHANGEORIGIN DESTINATION TOTAL

YVR Vancouver, BC 128,351 139,454 267,805 279,138 -4.1%

YYJ Victoria, BC 67,959 78,125 146,084 153,622 -4.9%

SJD Cabo San Lucas, Mexico 70,926 70,842 141,768 137,100 3.4%

PVR Puerto Vallarta, Mexico 57,705 58,157 115,862 104,275 11.1%

YYC Calgary, AB 52,817 59,317 112,134 114,897 -2.4%

YEG Edmonton, AB 46,850 54,642 101,492 112,087 -9.5%

YLW Kelowna, BC 41,106 45,431 86,537 96,769 -10.6%

CUN Cancun, Mexico 29,483 29,563 59,046 56,774 4.0%

PEK Beijing, China* 21,272 28,134 49,406 49,116 0.6%

PVG Shanghai, China* 15,498 18,510 34,008 28,265 20.3%

GDL Guadalajara, Mexico 15,438 13,308 28,746 34,618 -17.0%

ICN Seoul, South Korea – Incheon

International*

14,409 13,828 28,237 31,104 -9.2%

MZT Mazatlán, Mexico 11,385 12,182 23,567 21,363 10.3%

FRA Frankfurt, Germany* 10,935 10,991 21,926 22,056 -0.6%

LHR London, United Kingdom –

Heathrow*

10,503 9,934 20,437 21,011 -2.7%

MNL Manila, Philippines* 10,737 8,991 19,728 18,172 8.6%

Source: Alaska Airlines, 2018; BERK, 2018.

Exhibit 12 International passenger volume touching Seattle by origin/destination,

Alaska Airlines, Horizon Air, and Alaska Global Partners, 2017.

Source: Alaska Airlines, 2018; BERK, 2018.

19

ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES · ALASKA AIRLINES

OCTOBER 2018 · PASSENGER TRAFFIC AND TRENDS

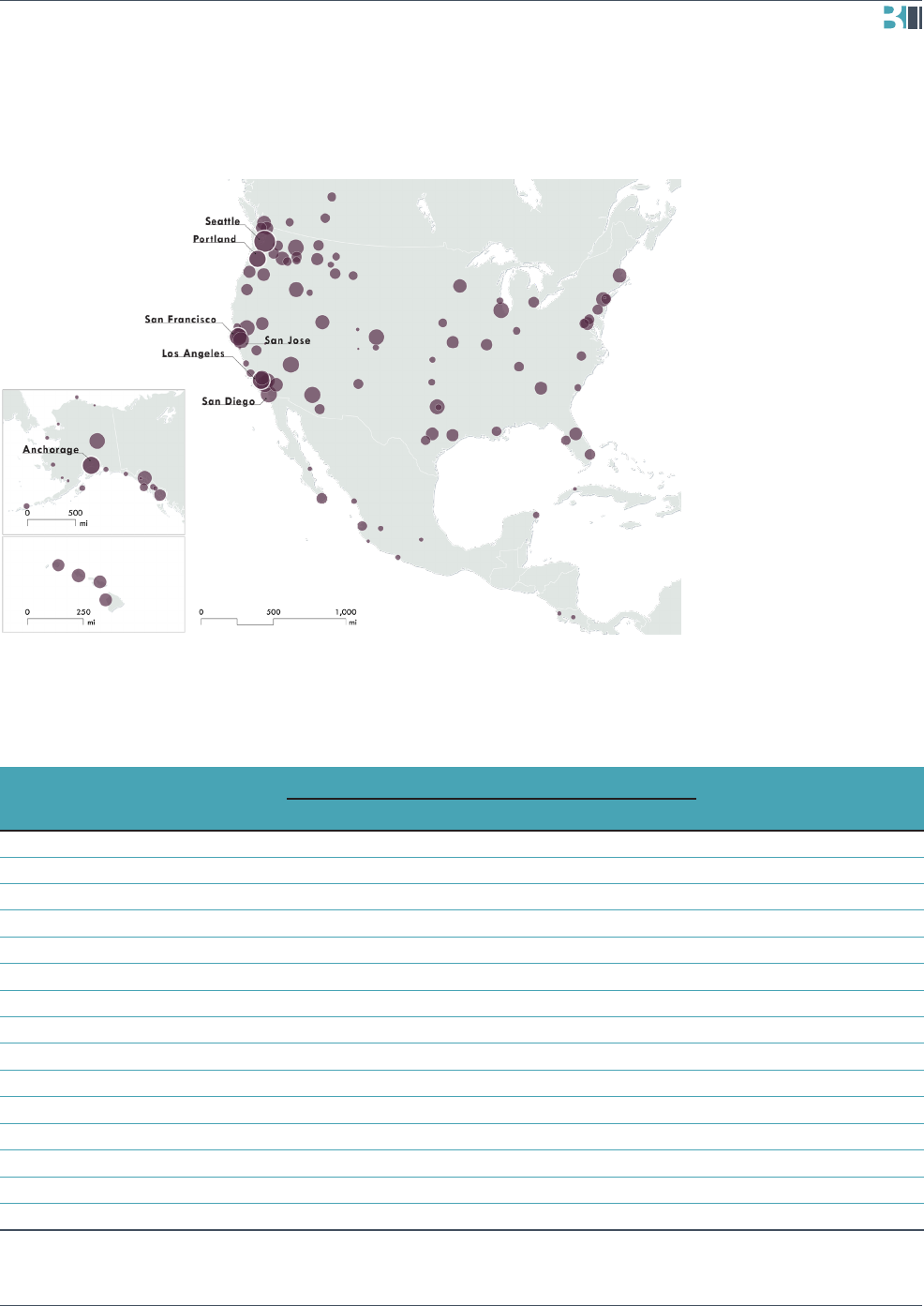

NORTH AMERICAN DESTINATIONS

Outside of Washington, Alaska Airlines and

Horizon Air provide passenger service to 76

destinations across 34 states. In addition to

the headquarters at Sea-Tac, Alaska Airlines

has major hubs in Anchorage, Los Angeles,

San Francisco, and Portland. Two “focus cities,”

San Diego and San Jose, are also bases for

frequent routes.

Exhibit 14 shows passenger volumes on Alaska

Airlines and Horizon Air ights in 2017 that

have originated, ended, or passed through

Sea-Tac International Airport, with Exhibit

15 showing statistics for ights to and from

US destinations, and Exhibit 16 showing

international destinations in Canada, Mexico,

and Costa Rica. Key conclusions from these

statistics include the following:

Sea-Tac Airport is a major hub for

Alaska Airlines and Horizon Air.

Nearly 15 million passenger trips pass

through Sea-Tac on Alaska Airlines

planes. According to US transportation

statistics, Alaska Airlines and Horizon

Air managed about 26 million of total

revenue passenger enplanements in 2017,

and over half the number of ights in the

Alaska Airlines system started or ended in

Sea-Tac.

Alaska Airlines provides a major

air connection to Alaska via Seattle.

Passenger trafc between Anchorage and

Sea-Tac accounts for 1.4 million total trips.

Given that Sea-Tac is the top origin and

destination for Anchorage, this reinforces

the historic transportation and economic

connections between Seattle and Alaska.

INTERNATIONAL DIRECT

SERVICE LOCATIONS

In addition to destinations in the

US, Alaska Airlines and Horizon Air

provides direct passenger service

locations in Canada, Mexico, and

Costa Rica:

Calgary International Airport

(YYC)

Cancún International Airport

(CUN)

Miguel Hidalgo y Costilla

International Airport,

Guadalajara (GDL)

Kelowna International Airport

(YLW)

Daniel Oduber Quirós

International Airport, Liberia,

Costa Rica (LIR)

Loreto International Airport (LTO)

Los Cabos International Airport,

Cabo San (SJD)

Playa de Oro International

Airport, Manzanillo (ZLO)

General Rafael Buelna

International Airport, Mazatlán

(MZT)

Mexico City International Airport

(MEX)

Licenciado Gustavo Díaz Ordaz

International Airport, Puerto

Vallarta (PVR)

Juan Santamaría International

Airport, San Jose, Costa Rica

(SJO)

Vancouver International Airport

(YVR)

Victoria International Airport

(YYJ)

Ixtapa-Zihuatanejo International

Airport (ZIH)

ALASKA AIRLINES · ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES

PASSENGER TRAFFIC AND TRENDS · OCTOBER 201820

Exhibit 15 Top international passenger volumes touching Seattle by origin/destination,

Alaska Airlines, Horizon Air, and Alaska Global Partners, 2017.

2017 PASSENGER VOLUME

2016 TOTAL

VOLUME CHANGEORIGIN DESTINATION TOTAL

SEA Seattle, WA* 7,455,922 7,438,272 14,894,194 14,250,926 4.5%

ANC Anchorage, AK* 709,568 716,117 1,425,685 1,371,953 3.9%

LAX Los Angeles, CA* 703,223 695,920 1,399,143 1,427,336 -2.0%

SFO San Francisco, CA* 530,810 545,686 1,076,496 1,026,157 4.9%

LAS Las Vegas, NV 473,817 472,895 946,712 910,516 4.0%

GEG Spokane, WA 425,582 416,262 841,844 897,015 -6.2%

PDX Portland, OR* 413,624 418,011 831,635 922,933 -9.9%

SAN San Diego, CA 362,097 359,298 721,395 684,200 5.4%

SJC San Jose, CA 328,487 327,646 656,133 644,042 1.9%

SNA Orange County, CA 315,154 315,978 631,132 652,280 -3.2%

PHX Phoenix, AZ 313,264 309,770 623,034 580,946 7.2%

DEN Denver, CO 256,683 253,951 510,634 483,570 5.6%

SMF Sacramento, CA 240,139 240,533 480,672 507,428 -5.3%

FAI Fairbanks, AK 217,833 219,556 437,389 418,091 4.6%

ORD Chicago, IL 210,456 214,324 424,780 423,930 0.2%

Source: Alaska Airlines, 2018; BERK, 2018.

Note: * indicates major hub in Alaska Airlines network

Exhibit 14 North American Alaska Airlines and Horizon Air passenger volume touching

Seattle, by origin or destination and percent of total airport volume, 2017.

Source: Alaska Airlines, 2018; BERK, 2018.

21

ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES · ALASKA AIRLINES

OCTOBER 2018 · PASSENGER TRAFFIC AND TRENDS

Exhibit 16 Alaska Airlines and Horizon Air passenger volume statistics for trips touching Seattle,

destinations in Canada, Mexico, and Costa Rica, 2017.

2017 PASSENGER VOLUME

2016 TOTAL

VOLUME CHANGEORIGIN DESTINATION TOTAL

YVR Vancouver, Canada 130,203 141,099 271,302 276,574 -1.9%

YYJ Victoria, Canada 66,574 75,404 141,978 148,021 -4.1%

SJD Los Cabos, Mexico 69,186 68,705 137,891 133,799 3.1%

YYC Calgary, Canada 53,824 59,717 113,541 117,414 -3.3%

PVR Puerto Vallarta, Mexico 55,970 56,667 112,637 101,200 11.3%

YEG Edmonton, Canada 48,375 53,358 101,733 111,255 -8.6%

YLW Kelowna, Canada 41,024 43,931 84,955 91,259 -6.9%

CUN Cancún, Mexico 26,624 26,406 53,030 49,103 8.0%

GDL Guadalajara, Mexico 13,172 11,613 24,785 26,796 -7.5%

MZT Mazatlán, Mexico 10,479 11,695 22,174 19,773 12.1%

ZIH Zihuatanejo, Mexico 6,432 6,417 12,849 11,035 16.4%

LTO Loreto, Mexico 5,237 4,220 9,457 7,065 33.9%

SJO San Juan, Costa Rica 4,696 4,743 9,439 9,672 -2.4%

MEX Mexico City, Mexico* 3,937 5,315 9,252 N/A N/A

LIR Liberia, Costa Rica 4,225 4,029 8,254 8,051 2.5%

ZLO Manzanillo, Mexico 3,599 3,058 6,657 5,864 13.5%

Source: Alaska Airlines, 2018; BERK, 2018.

Alaska Airlines and Horizon Air connect Seattle to cities across the US and Canada.

In addition to the other connections in the Alaska Airlines network, passenger services

connect Sea-Tac to major destinations in California, Arizona, and Colorado. There are

also notable regional connections to western Canadian cities such as Victoria, Vancouver,

Edmonton, Kelowna, and Calgary.

ALASKA AIRLINES · ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES

PASSENGER TRAFFIC AND TRENDS · OCTOBER 201822

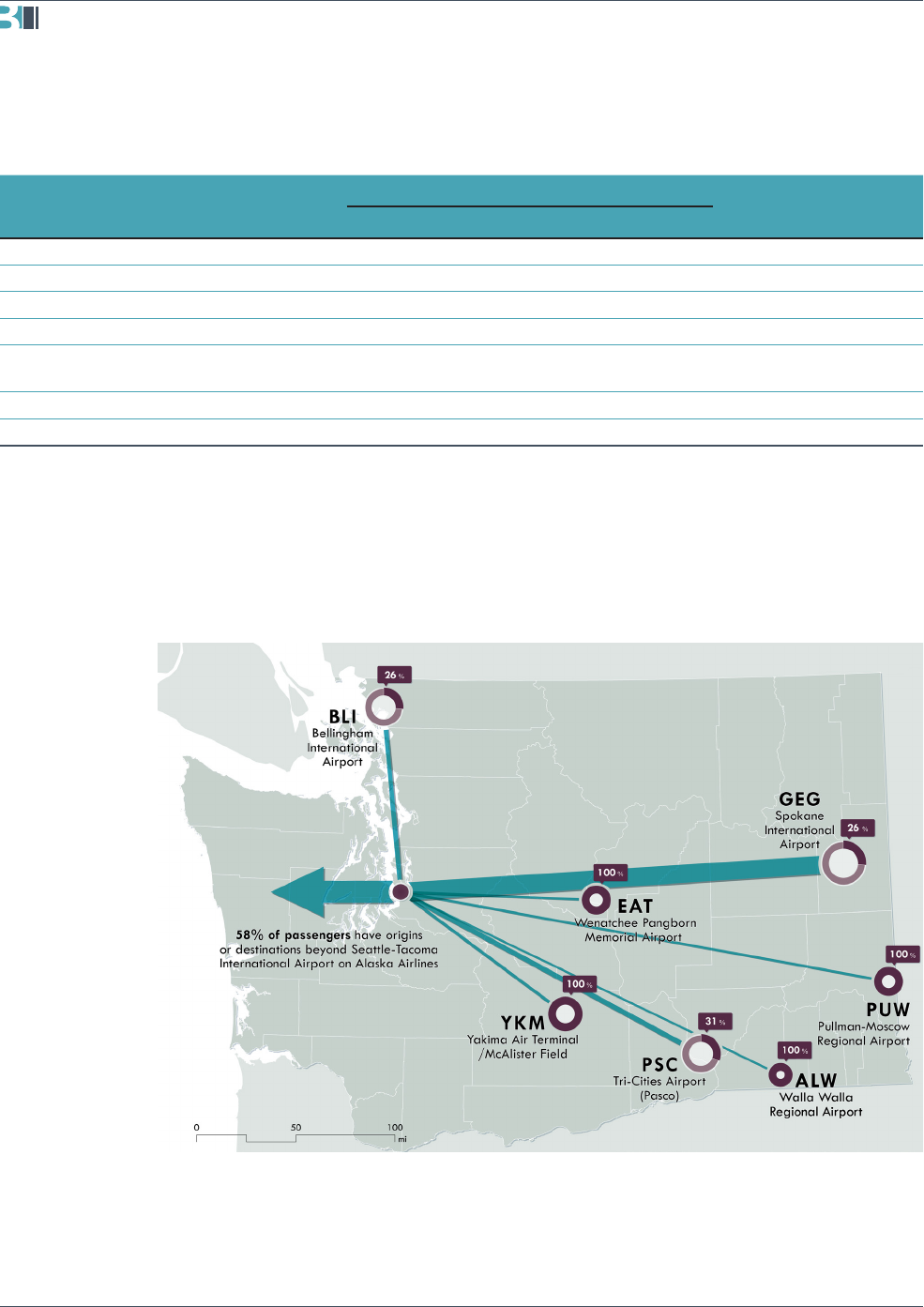

WASHINGTON STATE DESTINATIONS

Alaska Air Group companies also provide

hundreds of ights each day between

Washington cities. Within Washington state,

Alaska Airlines and Horizon Air provide

direct service to and from eight airports in

Washington. Regional service helps travelers

move around the state and increases

accessibility to smaller urban centers in

Washington state. This strengthens economies

in central and eastern Washington by linking

local businesses to larger markets and drawing

in regional, national, and international visitors

for trade and tourism across the state.

Exhibits 17 and 18 show passenger volumes

from Seattle to Washington state airports in

2017. Key conclusions from these statistics

include the following:

Seattle and Spokane are major regional

transportation hubs. Alaska Airlines

and Horizon Air support reliable service

from the Seattle hub to the seven

other Washington airports. Spokane

International Airport is a major destination

for mainline and regional service, with

about 842,000 of the passengers

traveling to and from Spokane in 2017

(over a quarter of total trafc) passing

through Sea-Tac.

Flights from other airports in Washington state connect to national and international

destinations. Although the trafc between Washington state airports and Sea-Tac helps

to link the state, about 58% of passengers come from different origins or continue to

other destinations through Sea-Tac. Sea-Tac provides a critical national and international

connection for airports across Washington state.

Alaska Airlines and Horizon Air are major service providers to eastern Washington.

As shown in Exhibits 17 and 18, Alaska Airlines and Horizon Air are responsible for all

major passenger service for Wenatchee, Yakima, Walla Walla, and Pullman-Moscow.

They also provide ights for over 30% of the passengers passing through the Tri-Cities

Airport.

WASHINGTON STATE

DESTINATIONS

Alaska Airlines and Horizon Air

provide services to eight regional

and international airports within

Washington state:

Bellingham International Airport

(BLI) (seasonal route)

Pasco/Kennewick/Richland Tri-

Cities Airport (PSC)

Pullman-Moscow Regional Airport

(PUW)

Seattle-Tacoma International

Airport (SEA)

Spokane International Airport

(GEG)

Walla Walla Regional Airport

(ALW)

Wenatchee Pangborn Memorial

Airport (EAT)

Yakima Air Terminal/McAlister

Field (YKM)

Note that Portland, Oregon also

provides service that supports cities

in southwest Washington, such as

Vancouver.

23

ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES · ALASKA AIRLINES

OCTOBER 2018 · PASSENGER TRAFFIC AND TRENDS

Exhibit 18 Statewide Alaska Airlines and Horizon Air passenger

volume touching Seattle, by origin or destination airport

and percent of total airport volume, 2017.

Source: Alaska Airlines, 2018; BERK, 2018.

Exhibit 17 Statewide Alaska Airlines and Horizon Air passenger volume

statistics for trips touching Seattle, 2017.

2017 PASSENGER VOLUME

% 2017

VOLUME

2016–2017

CHANGEORIGIN DESTINATION TOTAL

GEG Spokane International Airport 425,582 416,262 841,844 26% -6.2%

PSC Tri-Cities Airport (Pasco) 115,914 114,158 230,072 31% -4.0%

BLI Bellingham International Airport 106,907 98,751 205,658 26% -9.0%

YKM Yakima Air Terminal / McAlister Field 70,542 68,588 139,130 100% 0.8%

EAT Wenatchee Pangborn Memorial

Airport

60,731 59,044 119,775 100% 1.9%

PUW Pullman-Moscow Regional Airport 59,096 59,769 118,865 100% -3.7%

ALW Walla Walla Regional Airport 50,011 49,756 99,767 100% 4.9%

Source: Alaska Airlines, 2018; BERK, 2018.

ALASKA AIRLINES · ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES

PASSENGER TRAFFIC AND TRENDS · OCTOBER 201824

CARGO SERVICES

Alaska Airlines and Horizon Air provide cargo services through Alaska Air Cargo.

Historically, Alaska Airlines has served an important role carrying mail and freight between

Alaskan communities and the continental US via Sea-Tac International Airport. Today, Alaska

Air Cargo serves 93 destinations and transports over 170 million pounds of cargo annually,

which is the most extensive air cargo operation on the US West Coast through passenger

airlines.

Alaska Air Cargo recently added three Boeing 737–700Fs used as freighters to existing

freight service on the Alaska Airlines system. In June 2018, Alaska Airlines put 71 Airbus

aircraft from the Virgin America acquisition into use for cargo service. With these additional

aircraft, Alaska Air Cargo expanded its cargo lift capacity by 40% in the continental US.

The increased connections across the country mean that Alaska Airlines and Horizon Air will

provide even more frequent and reliable cargo delivery services for customers.

Although air cargo services provided by Alaska Airlines and Horizon Air in 2017 accounted

for about 7.8% of total freight from Sea-Tac International Airport, there is signicant

potential for future growth with the recent additions to the Alaska Air Cargo eet. This will

position Alaska Air Cargo as a larger competitor for cargo services across the West Coast

and can provide additional support for businesses within the state that rely on air freight

connections to deliver products to market.

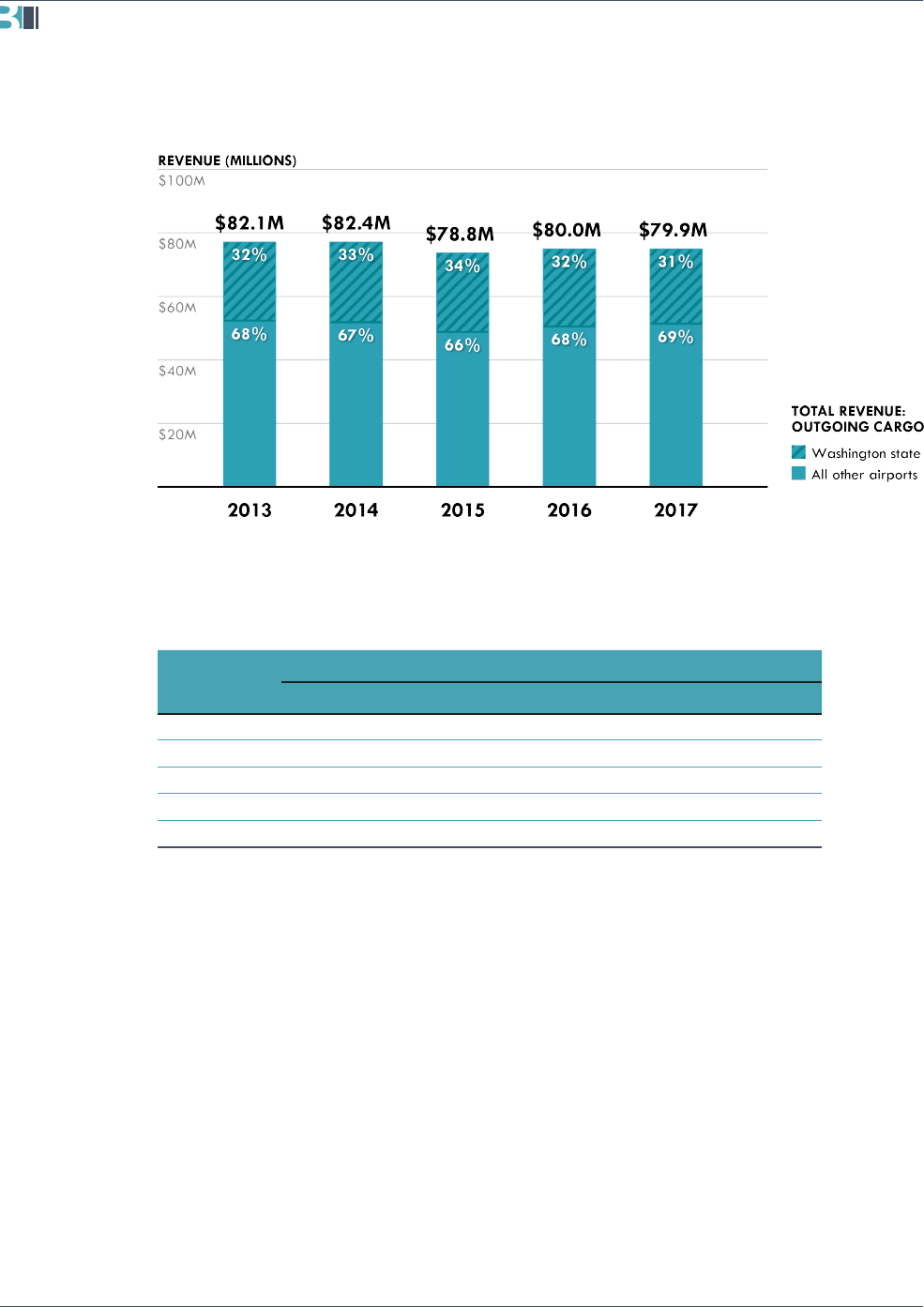

Exhibits 19 and 20 provide an overview of the revenue received from cargo transportation

from 2013–2017, with a focus on revenue from outgoing cargo from Washington state and

Seattle-Tacoma International Airport.

Key ndings for current cargo services by Alaska Air Cargo include the following:

Cargo operations have been consistent across all airports. Total revenue generated

from outgoing cargo across all airports has remained relatively steady, around $80

million per year from 2013 through 2017.

Washington state is a major origin point for cargo operations by Alaska Air Cargo.

Outgoing cargo from Washington airports comprises approximately one-third of all

cargo revenue across all airports. Revenue from outgoing cargo in Washington airports

has slightly decreased each year from 2013 to 2017, bringing in $26 million annually in

2013 and $24 million annually in 2017.

Almost all current cargo trafc originating from the state is from Sea-Tac

International Airport. Within Washington state, outgoing cargo from Seattle-Tacoma

International Airport has comprised 97% of the revenue generated from Washington

25

ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES · ALASKA AIRLINES

OCTOBER 2018

airports. The remaining 3% comes from Spokane (2%), Bellingham (0.2%), Pasco (0.2%),

Yakima (0.2%), and less than 0.1% each from Pullman, Walla Walla, Wenatchee, Paine

Field, and Boeing Field.

Signicant changes are expected to air cargo routes and capacity. These gures are

expected to change substantially after the introduction of Boeing 737–700F and former

Virgin America Airbus aircraft to the cargo eet, which has increased cargo capacity

and allowed for new routes for cargo services.

Exhibit 19 Summary of total revenue from Alaska Air Cargo operations, 2013–2017.

Source: Alaska Airlines, 2018; BERK, 2018.

Exhibit 20 Statistics for revenue from outgoing cargo, Alaska Air Cargo, 2013–2017.

YEAR

OUTGOING CARGO

ALL AIRPORTS WA AIRPORTS SEA-TAC AIRPORT

2013 $82.1 M $26.6 M $ 26.0 M

2014 $82.4 M $27.4 M $ 26.7 M

2015 $78.8 M $26.6 M $ 25.8 M

2016 $80.0 M $25.9 M $ 25.2 M

2017 $79.9 M $25.0 M $ 24.3 M

Source: Alaska Airlines, 2018; BERK, 2018.

Note: Non-Washington airports include both airports within and outside of the US.

ALASKA AIRLINES · ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES

CARGO SERVICES · OCTOBER 201826

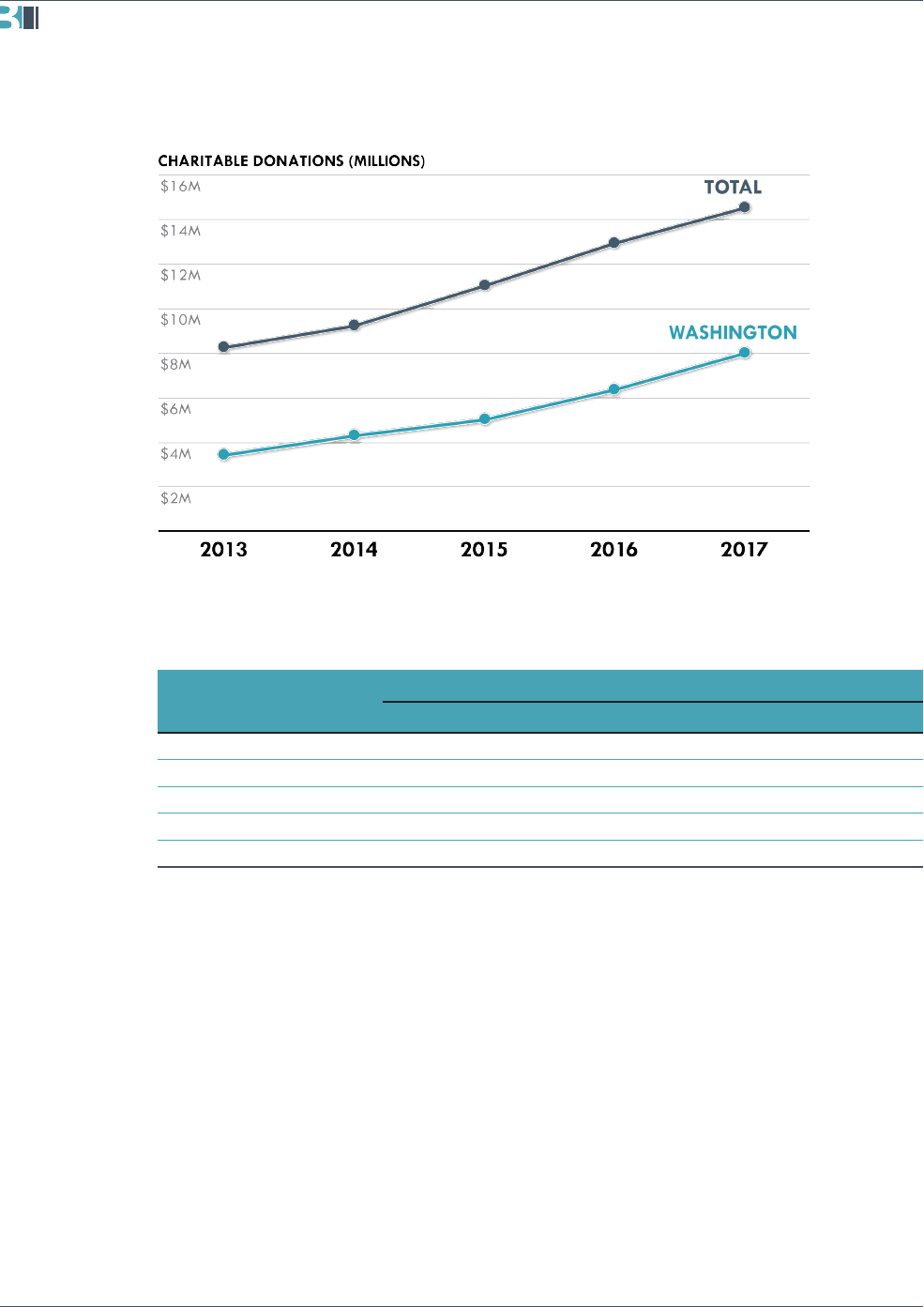

CHARITABLE GIVING

AAG companies contribute to a range of charitable organizations in Washington, Alaska,

and other locations. Recipients include hundreds of organizations working in education,

economic development, health, and other elds.

Exhibits 21 and 22 provide an overview of charitable giving by AAG companies. Giving

has increased steadily over the last ve years, and in 2017, AAG companies contributed

$14.5 million to charities in total. The greatest recipients of funding have been charitable

organizations in Washington state, with about $8 million contributed in 2017 and a strong

upward trend in local donations.

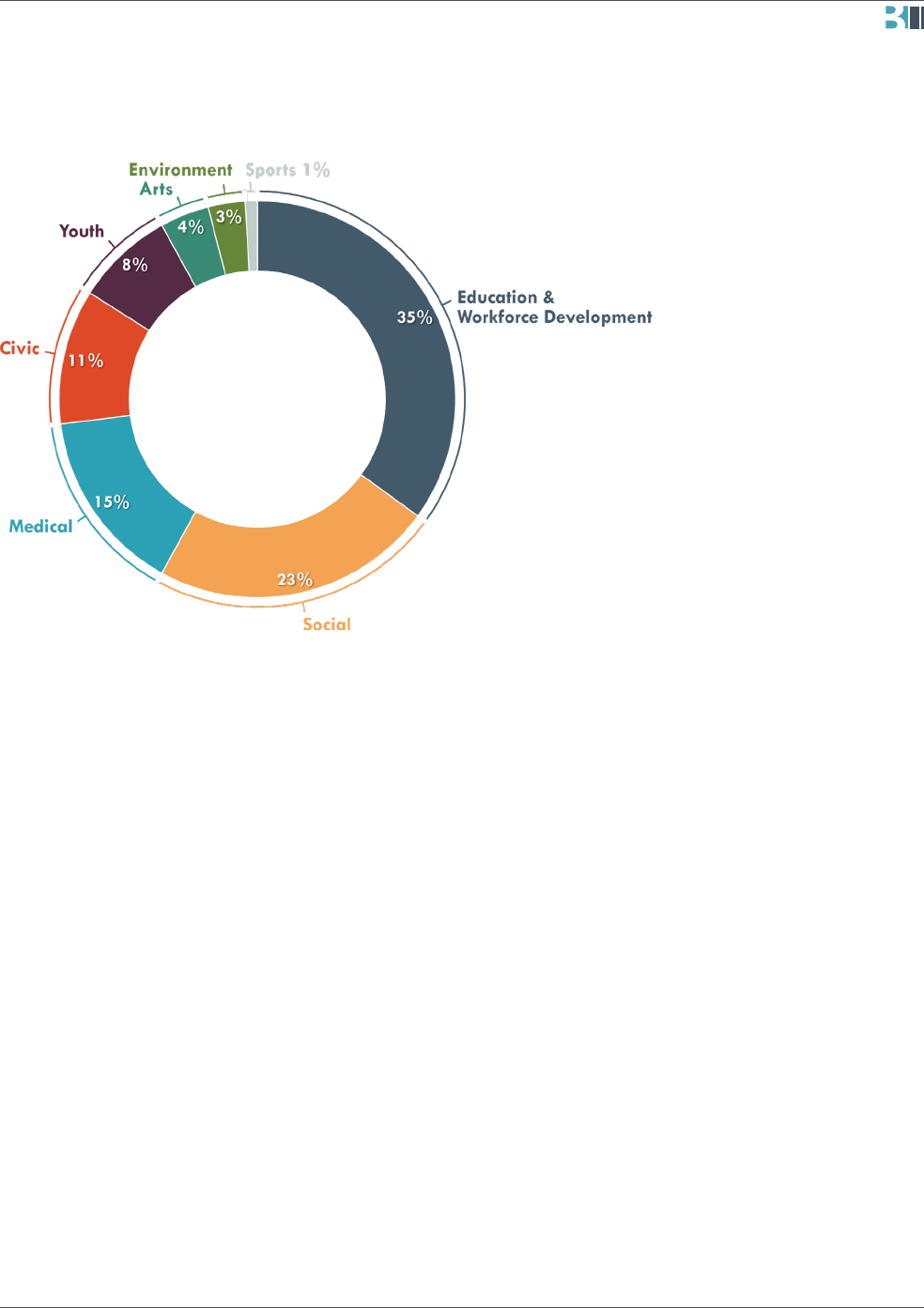

Exhibit 23 shows the breakdown of the charitable donations made by AAG companies in

2017 by category. The top recipients of charitable giving from AAG companies include

organizations in the following areas:

Education and workforce development, such as Highline School District, Mukilteo

Schools Foundation, and Highline Community College Foundation;

Social, such as Northwest Harvest, the United Way of King County, Southwest Youth and

Family Services, and the Seattle Goodwill;

Medical, such as the American Heart Association, the American Cancer Society, and the

Leukemia and Lymphoma Society;

Civic, such as Challenge Seattle and the Economic Development Council of Seattle &

King County;

Youth, such as the YMCA, the Boy Scouts of America, the Boys and Girls Club, and Girl

Scouts of Western Washington;

Environmental, such as the Woodland Park Zoo, the Seattle Audubon Society, and The

Nature Conservancy;

Arts, such as the 5th Avenue Theatre, the Seattle Art Museum, and the Pacic Northwest

Ballet; and

Sports, such as the Special Olympics and the SeaTac United Youth Academy.

In addition to direct giving, AAG companies provides charitable giving through Employee

Gift Match and Dollars for Doers:

Employee Match refers to the AAG program that provides donations to charities to

match employee contributions. AAG companies matc these employee contributions at

a 1:1 rate, up to $1,000 per year. In 2017, employees of AAG companies raised

$464,759 in funds that were matched for a total of $989,518.

27

ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES · ALASKA AIRLINES

OCTOBER 2018

Exhibit 21 Summary of charitable giving, AAG companies, 2013–2017.

Source: Alaska Airlines, 2018; BERK, 2018.

Exhibit 22 Charitable giving statistics, AAG companies, 2013–2017.

YEAR

CHARITABLE GIVING

2013 2014 2015 2016 2017

Washington $3.4 M $4.3 M $5.0 M $6.3 M $8.0 M

Alaska $2.6 M $2.5 M $3.5 M $3.6 M $3.5 M

Other locations $2.2 M $2.4 M $2.5 M $3.0 M $3.0 M

Total $8.3 M $9.2 M $11.0 M $12.9 M $14.5 M

Total (w/other giving) $8.5 M $9.7 M $11.7 M $13.5 M $15.5 M

Source: Alaska Airlines, 2018; BERK, 2018.

Note: “Other giving” includes grants and nancial support, in-kind travel, and employee volunteerism from

AAG companies, including Employee Match dollars and Dollars for Doers

ALASKA AIRLINES · ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES

CHARITABLE GIVING · OCTOBER 201828

Dollars for Doers is a program through which AAG companies provide grants to

nonprots where employees regularly volunteer. Employees are offered a grant of $10

per hour volunteered to that organization, up to $1,000 per employee each year. This

program encourages employees to spend their time volunteering for local causes. In

2017, these employees earned and donated $263,163 by providing 41,760 hours of

volunteer time.

Through these programs, Alaska Airlines invests in local community organizations working in

youth and education, arts and sciences, housing, and health and human services.

Alaska Airlines also contributes through charity miles, in-kind donations, and disaster relief.

Charity miles: In 2017, Alaska Airlines donated 52.3 million miles valued at $1.4 million

to support 10 organizations, including the Fred Hutchinson Cancer Research Center,

Make-A-Wish Foundation, and Angel Flight West.

In-kind donations: In 2017, Alaska Airlines provided airline tickets to over 1,300

nonprot organizations with $7 million in in-kind ticket donations.

Exhibit 23 Breakdown of charitable giving by type, 2013–2017.

Source: Alaska Airlines, 2018; BERK, 2018.

29

ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES · ALASKA AIRLINES

OCTOBER 2018 · CHARITABLE GIVING

Disaster relief: In 2017, Alaska Airlines donated over $375,000 (cash and in-kind) to

relief efforts for hurricanes, wildres, ooding, and an earthquake. Alaska Airlines has

waived travel fees for customers who are affected by natural disasters and added extra

ights to help evacuation from impacted areas.

This analysis of charitable giving highlights the following points:

Charitable donations by AAG companies has increased signicantly since 2013. In

2017, corporate donations amounted to about $15.5 million in cash grants and other

nancial support, in-kind travel, and employee volunteerism, an increase from $13.5

million in 2016. Overall, funding for charitable causes has increased by an average of

15% per year since 2013.

Growth in charitable donations is focused in Washington state. Washington state

charities received about $8 million in 2017, which has increased at an average of over

18% per year and more than doubled since 2013.

Charities working in education, social causes, and medical organizations were

the highest recipients of funds. For donations between 2013 and 2017, the highest

proportion of charitable funds were allocated to charities involving education and

workforce development (35%), social issues (23%), and medicine (15%).

ALASKA AIRLINES · ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES

CHARITABLE GIVING · OCTOBER 201830

CONCLUSIONS

Alaska Airlines provides a strong set of benets to the Seattle metropolitan region with its

major hub at Sea-Tac International Airport and its headquarters in the city of SeaTac. In

addition to providing access to regional, national, and international destinations, Alaska

Airlines supports economic activity within the state and region.

Major economic benets include the following:

Alaska Air Group companies had a local economic impact of about $7 billion in

2017. This impact has had an average of 5.9% yearly growth over the past ve years,

and a 12% increase from 2016.

The Sea-Tac International Airport and the Alaska Airlines headquarters in the city

of SeaTac are major centers of employment, and they are growing. Alaska Air

Group companies include 9,505 employees in the Seattle metropolitan area, including

employees with McGee Air Services. For Alaska Airlines and Horizon Air, employment at

the airport and Alaska Airlines SeaTac headquarters amounts to about 40% of the total

employment across both companies. With the addition of new employees from Virgin

America and McGee Air Services, employment with AAG companies has increased by

about 6.2% per year in the Seattle metropolitan area.

AAG companies supported about 23,561 jobs statewide in 2017, with 2.4 total

jobs created for every job with the companies. In addition to the 9,916 employees

statewide with Alaska Air Group companies, an additional 5,978 jobs are supported by

companies in the supply chain due to business operations, and 7,667 jobs are supported

by the earnings of employees from AAG companies and across the supply chain. This

amounts to a total of 2.4 jobs in the entire state economy for every job created with an

AAG company.

Using local suppliers provides increased benets to the region. AAG companies invest

in business with state and regional suppliers, which boosts the local economy. Purchases

of new aircraft from Boeing created $3.4 billion of economic activity in the region over

the past ve years and supported over 1,700 workers in 2017. The rate of growth

of other vendors has been signicant over the past several years, which has kept the

economic benets of vendor spending in the region and provided opportunities for

locally sourced food and beverage products to gain visibility with Alaska Airlines and

Horizon Air customers.

Alaska Airlines’ network links Seattle and Washington state to the world. Supporting

a world-class hub for national and international travel is essential to a growing region

like the Seattle metropolitan area. Ongoing efforts to expand this network with Alaska

31

ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES · ALASKA AIRLINES

OCTOBER 2018 · CONCLUSIONS

Global Partners means easier access to and from Seattle for business and tourism. This

is also true for other Washington cities, and as Washington airports depend on Alaska

Airlines, Horizon Air, and the Seattle hub for access to other destinations, the company is

an important component for economic development across the state.

Cargo services by Alaska Air Cargo have primarily served outgoing freight from

SeaTac Airport, but increased cargo capacity will change the nature of this business.

Cargo trafc and revenue from the state of Washington and the rest of the Alaska

Airlines network has been relatively stable over the past several years, with about $80

million in revenue per year, with $24 million originating from Washington state in 2017.

Recent additions to the Alaska Air Cargo eet have increased capacity and will have

signicant changes to the future of air cargo in the state.

Charitable donations from Alaska Airlines are increasing, with the largest proportion

of the company’s giving in Washington state. Charitable giving by Alaska Airlines

amounted to $14.5 million in 2017, with an additional $989,000 contributed through

grants and nancial support, in-kind travel, and employee volunteerism (Employee

Match dollars and Dollars for Doers). About $8 million of this was donated to causes in

Washington, an increase of more than 100% in just ve years.

ALASKA AIRLINES · ASSESSING THE ECONOMIC IMPACT OF ALASKA AIRLINES

CONCLUSIONS · OCTOBER 201832