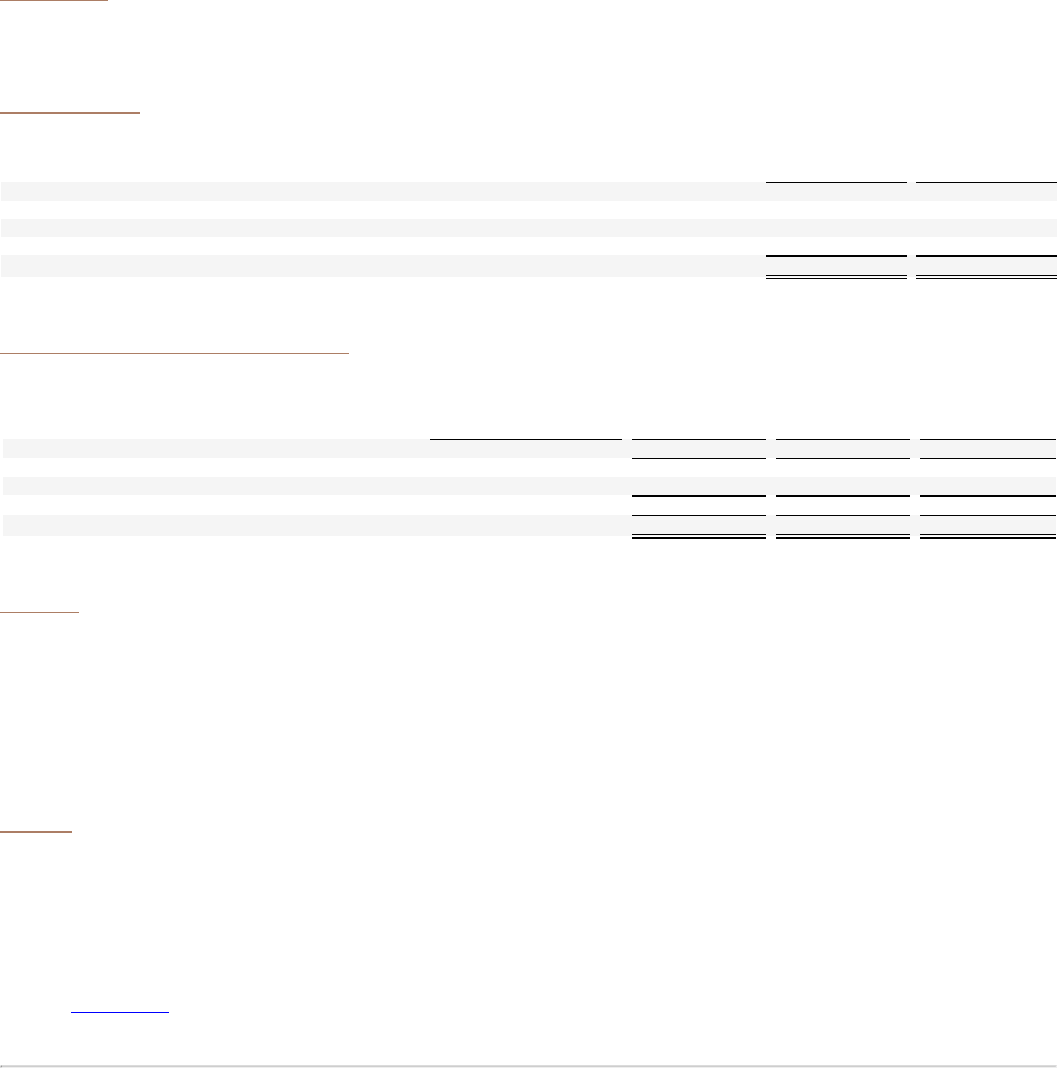

Abercrombie & Fitch (ANF) Historical Annual Reports 2002-2024

Year Report Size

2024

Abercrombie & Fitch (ANF) 10-K Annual Report - Apr 1st, 2024

1.1mb

2022

Abercrombie & Fitch (ANF) 10-K Annual Report - Mar 28th, 2022

788kb

2021

Abercrombie & Fitch (ANF) 10-K Annual Report - Mar 29th, 2021

860kb

2020

Abercrombie & Fitch (ANF) 10-K Annual Report - Mar 31st, 2020

1.1mb

2019

Abercrombie & Fitch (ANF) 10-K Annual Report - Apr 1st, 2019

1.1mb

2018

Abercrombie & Fitch (ANF) 10-K Annual Report - Apr 2nd, 2018

1.3mb

2017

Abercrombie & Fitch (ANF) 10-K Annual Report - Mar 27th, 2017

999kb

2016

Abercrombie & Fitch (ANF) 10-K Annual Report - Mar 28th, 2016

854kb

2015

Abercrombie & Fitch (ANF) 10-K Annual Report - Mar 30th, 2015

871kb

2014

Abercrombie & Fitch (ANF) 10-K Annual Report - Mar 31st, 2014

838kb

2013

Abercrombie & Fitch (ANF) 10-K Annual Report - Apr 2nd, 2013

820kb

2012

Abercrombie & Fitch (ANF) 10-K Annual Report - Mar 27th, 2012

573kb

2011

Abercrombie & Fitch (ANF) 10-K Annual Report - Mar 29th, 2011

626kb

2010

Abercrombie & Fitch (ANF) 10-K Annual Report - Mar 29th, 2010

591kb

2009

Abercrombie & Fitch (ANF) 10-K Annual Report - Mar 27th, 2009

568kb

2008

Abercrombie & Fitch (ANF) 10-K Annual Report - Mar 28th, 2008

459kb

2007

Abercrombie & Fitch (ANF) 10-K Annual Report - Mar 30th, 2007

446kb

2006

Abercrombie & Fitch (ANF) 10-K Annual Report - Apr 7th, 2006

446kb

2005

Abercrombie & Fitch (ANF) 10-K Annual Report - Apr 14th, 2005

389kb

2005

Abercrombie & Fitch (ANF) 10-K Annual Report - Apr 12th, 2005

376kb

2004

Abercrombie & Fitch (ANF) 10-K Annual Report - Apr 14th, 2004

345kb

2003

Abercrombie & Fitch (ANF) 10-K Annual Report - Apr 17th, 2003

301kb

2002

Abercrombie & Fitch (ANF) 10-K Annual Report - Apr 17th, 2002

253kb

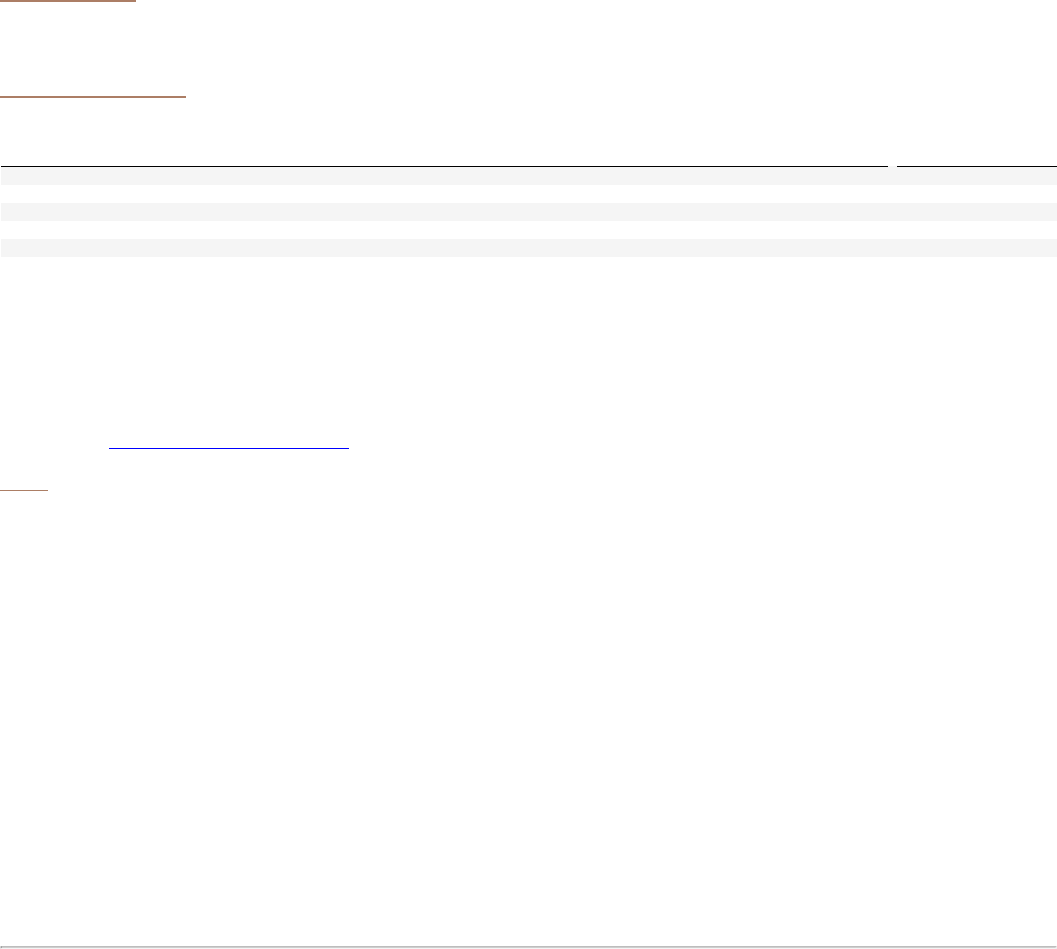

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended January 28, 2023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-12107

Abercrombie & Fitch Co.

(Exact name of registrant as specified in its charter)

Delaware 31-1469076

(State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.)

6301 Fitch Path New Albany Ohio 43054

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (614) 283-6500

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Trading Symbol(s) Name of each exchange on which registered

Class A Common Stock, $0.01 Par Value ANF New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. x Yes ¨ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the

preceding 12 months (or for such shorter period that the registrant was required to submit such files). x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer

x

Accelerated filer

¨

Non-accelerated filer

¨

Smaller reporting company

☐

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting

under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of

an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s

executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes x No

Aggregate market value of the registrant’s Class A Common Stock (the only outstanding common equity of the registrant) held by non-affiliates of the registrant (for this purpose,

executive officers and directors of the registrant are considered affiliates) as of July 29, 2022: $857,460,259. Number of shares outstanding of the registrant’s common stock as of

March 24, 2023: 49,218,719 shares of Class A Common Stock.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the registrant’s definitive proxy statement for the 2023 Annual Meeting of Stockholders, are incorporated by reference into Part III of this Annual Report on Form 10-K. The

registrant expects to file such definitive proxy statement with the Securities and Exchange Commission within 120 days of its fiscal year ended January 28, 2023.

Table of Contents

Table of Contents

PART I

Item 1. Business 4

Item 1A. Risk Factors 12

Item 1B. Unresolved Staff Comments 24

Item 2. Properties 24

Item 3. Legal Proceedings 24

Item 4. Mine Safety Disclosures 24

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities 25

Item 6. [Reserved] 26

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations 27

Item 7A. Quantitative and Qualitative Disclosures About Market Risk 41

Item 8. Financial Statements and Supplementary Data 42

Consolidated Statements of Operations and Comprehensive (loss) Income 42

Consolidated Balance Sheets 43

Consolidated Statements of Stockholders’ Equity 44

Consolidated Statements of Cash Flows 45

Index for Notes to Consolidated Financial Statements 46

Notes to Consolidated Financial Statements 47

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure 76

Item 9A. Controls and Procedures 76

Item 9B. Other Information 76

Item 9C. Disclosure Regarding Foreign Jurisdictions that Prevent Inspections 77

PART III

Item 10. Directors, Executive Officers and Corporate Governance 78

Item 11. Executive Compensation 79

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters 79

Item 13. Certain Relationships and Related Transactions, and Director Independence 79

Item 14. Principal Accountant Fees and Services 79

PART IV

Item 15. Exhibits and Financial Statement Schedules 80

Item 16. Form 10-K Summary 80

Index to Exhibits 81

Signatures 84

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this Annual Report on Form 10-K may constitute forward-looking statements (as such term is defined in the Private Securities Litigation Reform

Act of 1995) that involve risks and uncertainties and are subject to change based on various important factors, many of which may be beyond our control. Words such

as “estimate,” “project,” “plan,” “believe,” “expect,” “anticipate,” “intend,” “should,” “are confident,” “will,” “could”, “outlook,” or the negative versions of those words or

other comparable words and similar expressions may identify forward-looking statements. Future economic and industry trends that could potentially impact revenue

and profitability are difficult to predict. Therefore, there can be no assurance that the forward-looking statements included in this Annual Report on Form 10-K will

prove to be accurate. Factors that could cause results to differ from those expressed in the forward-looking statements include, but are not limited to, the risks

described or referenced in “ITEM 1A. RISK FACTORS ,” of this Annual Report on Form 10-K and otherwise in our reports and filings with the SEC, as well as the

following:

• risks related to changes in global economic and financial conditions, including volatility in the financial markets as a result of the failure, or rumored failure, of

financial institutions, and the resulting impact on consumer confidence and consumer spending, as well as other changes in consumer discretionary

spending habits;

• risks related to recent inflationary pressures with respect to labor and raw materials and global supply chain constraints that have, and could continue to,

affect freight, transit and other costs;

• risks and uncertainty related to the ongoing COVID-19 pandemic and any other adverse public health developments;

• risks related to geopolitical conflict, including the on-going hostilities in Ukraine, acts of terrorism, mass casualty events, social unrest, civil disturbance or

disobedience;

• risks related to natural disasters and other unforeseen catastrophic events;

• risks related to our failure to engage our customers, anticipate customer demand and changing fashion trends, and manage our inventory;

• risks related to our ability to successfully invest in and execute on our customer, digital and omnichannel initiatives;

• risks related to the effects of seasonal fluctuations on our sales and our performance during the back-to-school and holiday selling seasons;

• risks related to fluctuations in foreign currency exchange rates;

• risks related to fluctuations in our tax obligations and effective tax rate, including as a result of earnings and losses generated from our international

operations;

• risks related to our ability to execute on our strategic initiatives, including those outlined in our Always Forward Plan

• risks related to international operations, including changes in the economic or political conditions where we sell or source our products or changes in import

tariffs or trade restrictions;

• risks related to cybersecurity threats and privacy or data security breaches;

• risks related to the potential loss or disruption of our information systems;

• risks related to the continued validity of our trademarks and our ability to protect our intellectual property;

• risks associated with climate change and other corporate responsibility issues; and

• uncertainties related to future legislation, regulatory reform, policy changes, or interpretive guidance on existing legislation.

In light of the significant uncertainties in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation

by us, or any other person, that our objectives will be achieved. The forward-looking statements included herein are based on information presently available to our

management and speak only as of the date on which such statements are made. Except as may be required by applicable law, we assume no obligation to publicly

update or revise our forward-looking statements, including any financial targets and estimates, whether as a result of new information, future events, or otherwise. As

used herein, “Abercrombie & Fitch Co.,” “the Company,” “we,” “us,” “our,” and similar terms include Abercrombie & Fitch Co. and its subsidiaries, unless the context

indicates otherwise.

Abercrombie & Fitch Co. 3 2022 Form 10-K

Table of Contents

PART I

Item 1. Business

GENERAL

Abercrombie & Fitch Co. (“A&F”), a company incorporated in Delaware in 1996, through its subsidiaries (collectively, A&F and its subsidiaries are referred to as the

“Company,” “we,” “us,” and “our”), is a global, digitally-led omnichannel retailer. The Company offers a broad assortment of apparel, personal care products and

accessories for men, women and kids, which are sold primarily through its digital channels and Company-owned stores, as well as through various third-party

arrangements. The Company’s two brand-based operating segments are Hollister, which includes the Company’s Hollister, Gilly Hicks and Social Tourist brands, and

Abercrombie, which includes the Company’s Abercrombie & Fitch and abercrombie kids brands. These five brands share a commitment to offering unique products of

enduring quality and exceptional comfort that allow customers around the world to express their own individuality and style. The Company operates primarily in North

America, Europe, Middle East and Asia.

The Company’s fiscal year ends on the Saturday closest to January 31. This typically results in a fifty-two-week year, but occasionally gives rise to an additional

week, resulting in a fifty-three-week year. Fiscal years are designated in the Consolidated Financial Statements and Notes thereto, as well as the remainder of this

Annual Report on Form 10-K, by the calendar year in which the fiscal year commenced. All references herein to the Company’s fiscal years are as follows:

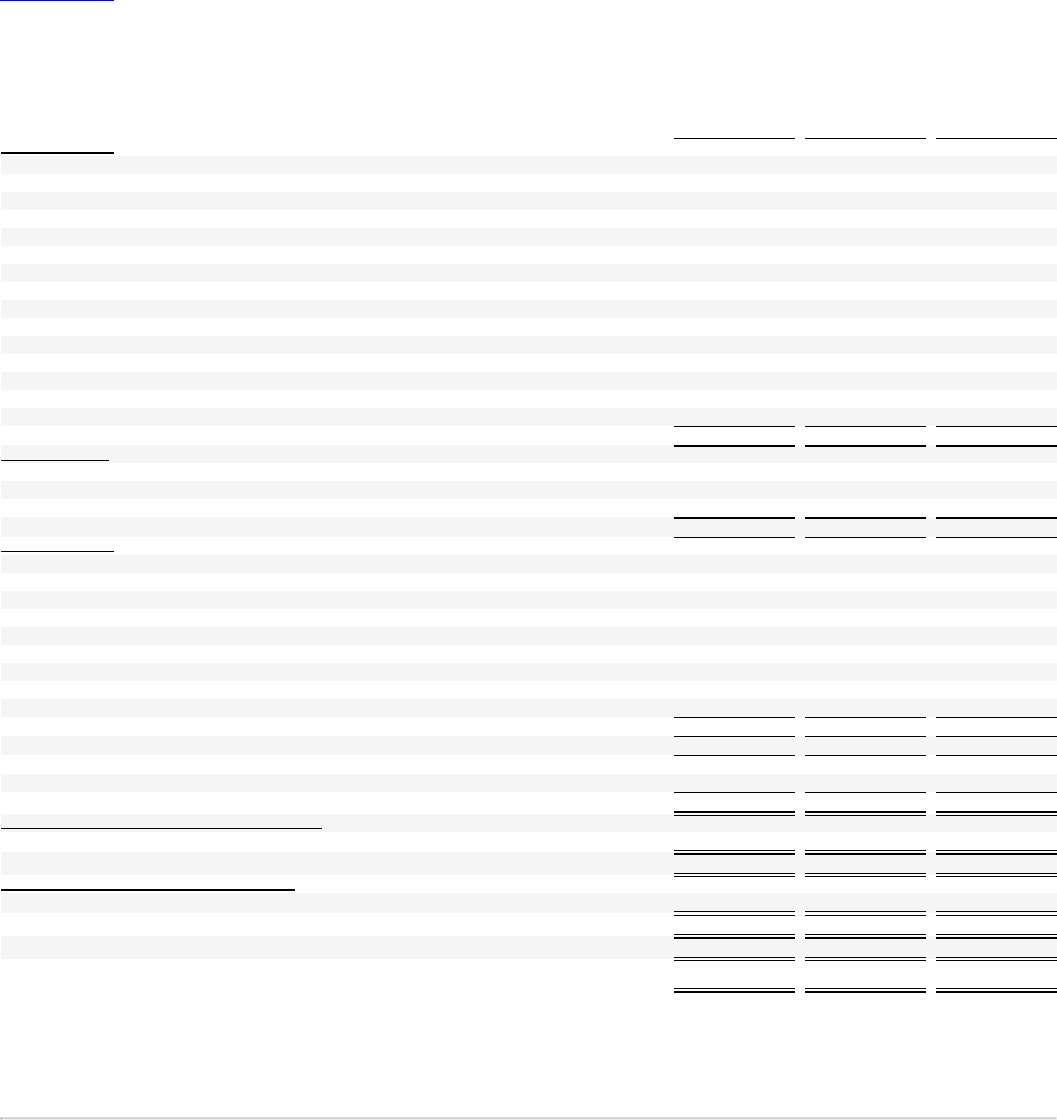

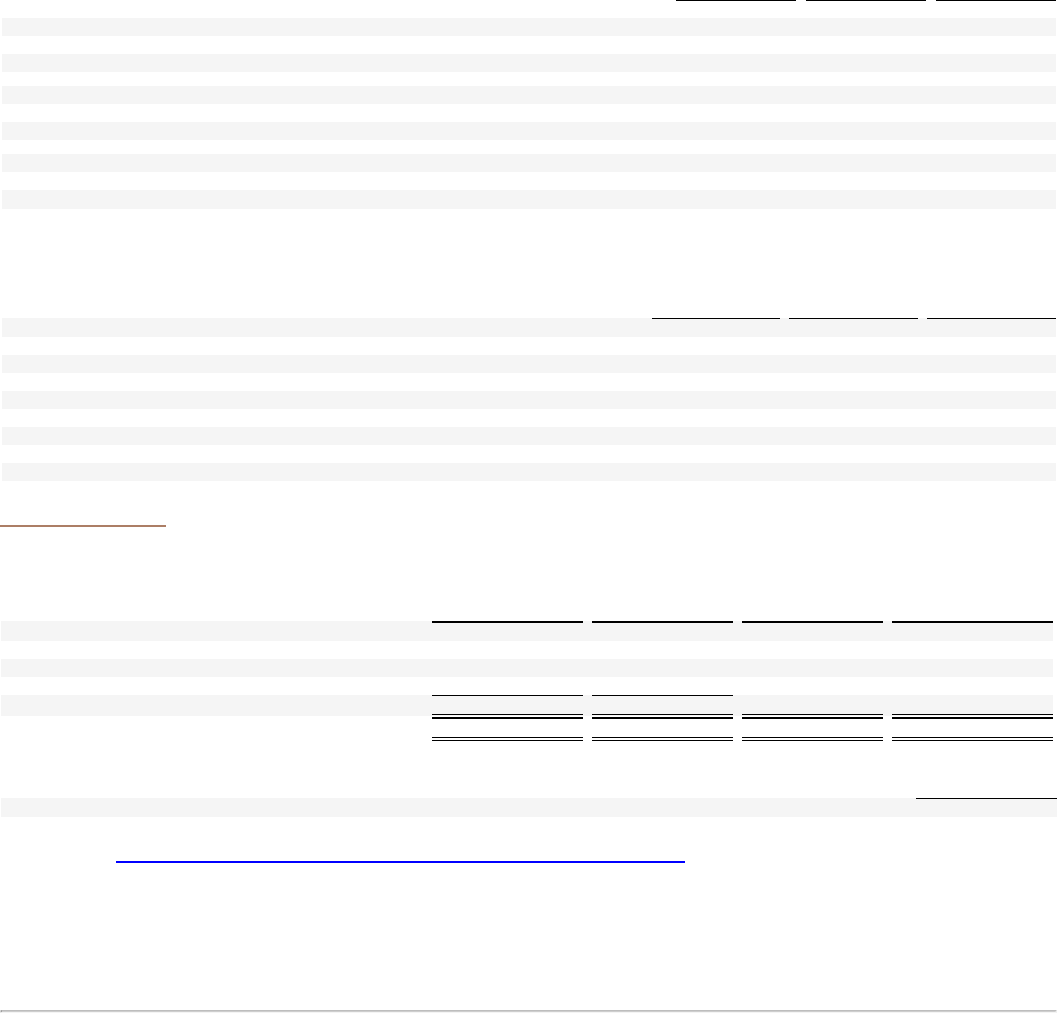

Fiscal year Year ended / ending Number of weeks

Fiscal 2020 January 30, 2021 52

Fiscal 2021 January 29, 2022 52

Fiscal 2022 January 28, 2023 52

Fiscal 2023 February 3, 2024 53

For additional information about the Company’s business, see “ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS,” as well as “ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA,” of this Annual Report on Form 10-K.

Current Economic Environment

The current economic environment remained challenging in Fiscal 2022. The COVID-19 pandemic and its effects on the global economy continued to impact the

Company’s operations in Fiscal 2022, including through temporary store closures. While trends in the severity of new cases of COVID-19 in the U.S. improved

throughout Fiscal 2022, caseloads have periodically increased in certain global regions, most notably, in the Asia-Pacific Region (“APAC”) in conjunction with the

easing of strict lockdowns and zero-tolerance policy shutdowns in China.

In addition, while the direct impacts of the COVID-19 pandemic have shown signs of abatement, the Company has experienced various other adverse impacts in the

current economic environment, including supply chain disruptions, inflationary pressures including higher freight and labor costs, labor shortages, and weak store

traffic.

The adverse consequences of the pandemic and of the current economic environment continue to impact the Company and may persist for some time. The Company

will continue to assess impacts on its operations and financial condition, and will respond as it deems appropriate.

For further information about COVID-19, refer to “ITEM 1A. RISK FACTORS ,” and “ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS," of this Annual Report on Form 10-K.

Table of Contents

BRANDS AND SEGMENT INFORMATION

The Company’s brands are as follows:

Brand Description

Hollister The quintessential apparel brand of the global teen consumer, Hollister Co. believes in liberating the spirit of an endless summer inside

everyone. At Hollister, summer isn’t just a season, it’s a state of mind. Hollister creates carefree style designed to make all teens feel

celebrated and comfortable in their own skin, so they can live in a summer mindset all year long, whatever the season.

Gilly Hicks At Gilly Hicks, we know that 10 minutes of activity a day can lead to a happier life. That's why we offer active lifestyle products to help Gen Z

customers create happiness through movement.

Social Tourist Social Tourist is the creative vision of Hollister and social media personalities Dixie and Charli D’Amelio. The lifestyle brand creates trend-

forward apparel that allows brand lovers to experiment with their style, while exploring the duality of who they are both on social media and in

real life.

Abercrombie & Fitch Abercrombie & Fitch believes that every day should feel as exceptional as the start of the long weekend. Since 1892, the brand has been a

specialty retailer of quality apparel, outerwear and fragrance - designed to inspire our global customers to feel confident, be comfortable and

face their Fierce.

abercrombie kids A global specialty retailer of quality, comfortable, made-to-play favorites, abercrombie kids sees the world through kids’ eyes, where play is life

and every day is an opportunity to be anything and better everything.

The Company determines its segments after taking into consideration a variety of factors, including its organizational structure and the basis that it uses to allocate

resources and assess performance. The Company’s two operating segments as of January 28, 2023 are brand-based: Hollister, which includes the Company’s

Hollister, Gilly Hicks and Social Tourist brands, and Abercrombie, which includes the Company’s Abercrombie & Fitch and abercrombie kids brands. These operating

segments have similar economic characteristics, classes of consumers, products, and production and distribution methods, operate in the same regulatory

environments, and have been aggregated into one reportable segment. Additional information concerning the Company’s segment and geographic information is

contained in Note 17, “SEGMENT REPORTING” of the Notes to Consolidated Financial Statements included in “ITEM 8. FINANCIAL STATEMENTS AND

SUPPLEMENTARY DATA” of this Annual Report on Form 10-K.

STRATEGY AND KEY BUSINESS PRIORITIES

The Company remains committed to, and confident in, its long-term vision of being a leading digitally-led omnichannel global apparel retailer. The Company continues

to evaluate opportunities to make progress toward initiatives that support this vision, while balancing the near-term challenges and the continued global uncertainty

presented by the changing macroeconomic and geopolitical environment.

Always Forward Plan

During the second quarter of Fiscal 2022, the Company announced its 2025 Always Forward Plan, which outlines the Company’s long-term strategy and goals,

including growing shareholder value. The Always Forward Plan is anchored on three strategic growth principles, which are to:

• Execute focused brand growth plans;

• Accelerate an enterprise-wide digital revolution; and

• Operate with financial discipline.

The following focus areas for Fiscal 2023 serve as a framework for the Company’s goal of achieving sustainable long-term growth and progressing toward the Always

Forward Plan:

• Execute brand growth plans

• Drive Abercrombie brands through marketing and store investment;

• Optimize the Hollister product and brand voice to enable second half growth; and

• Support Gilly Hicks growth with an evolved assortment mix

• Execute an enterprise-wide digital revolution

• Complete the current phase of our modernization efforts around key data platforms;

• Continue to progress on our multi-year ERP transformation and cloud migration journey; and

• Improve our digital and app experience across key parts of the customer journey

• Operate with financial discipline

• Maintain appropriately lean inventory levels that put Abercrombie and Hollister in a position to chase inventory throughout the year; and

• Properly balance investments, inflation and efficiency efforts to improve profitability

Table of Contents

OVERVIEW OF OPERATIONS

Omnichannel Initiatives

As customer shopping preferences continue to shift and customers increasingly shop across multiple channels, the Company aims to create best-in-class customer

experiences and grow total company profitability by delivering improvements through a continuous test-and-learn approach. With the impact of the COVID-19

pandemic in Fiscal 2020, the Company experienced an acceleration in sales fulfilled through digital channels. Despite, this acceleration in the shift towards digital

channels, stores continue to be an important part of the customers’ omnichannel experience and the Company believes that the customers’ experience is improved by

its offering of omnichannel capabilities, which include:

• Purchase-Online-Pickup-in-Store, allowing customers to purchase merchandise through one of the Company’s websites or mobile apps and pick-up the

merchandise in store, which often drives incremental in-store sales;

• Curbside pickup at a majority of U.S. locations;

• Same-day delivery service across its entire U.S. store fleet. Each brand’s website features a “Get It Fast” filter to easily find products that are available, or

shoppers can choose the same-day delivery option for available items at checkout;

• Order-in-Store, allowing customers to shop the brands’ in-store and online offerings while in-store;

• Reserve-in-Store, allowing customers to reserve merchandise online and try it on in-store before purchasing;

• Ship-from-Store, which allows the Company to ship in-store merchandise to customers and increases inventory productivity; and

• Cross-channel returns, allowing customers to return merchandise purchased through one channel to a different channel.

The Company also believes that its loyalty programs, Hollister House Rewards and Abercrombie’s myAbercrombie , are important enablers of its omnichannel

strategy as the Company aims to seamlessly interact and connect with customers across all touchpoints through members-only offers, items and experiences. Under

these programs, customers accumulate points primarily based on purchase activity and earn rewards as points are converted at certain thresholds. These rewards

can be redeemed for merchandise discounts either in-store or online. The loyalty programs continue to provide timely customer insights, and the Company believes

these programs contribute to higher average transaction value.

Digital Operations

In order to create a more seamless shopping experience for its customers, the Company continues to invest in its digital infrastructure. The Company has the

capability to ship merchandise to customers in more than 110 countries and process transactions in 26 currencies and through 25 forms of payment globally. The

Company operates desktop and mobile websites for its brands globally, which are available in various local languages, and four mobile apps. In the third quarter of

Fiscal 2022 the Company launched Share2Pay , a new payment feature in the Company’s mobile apps that allows customers to easily share their digital shopping

bags with a purchaser to complete the purchase. Initially available exclusively in the Hollister mobile app, as of the first quarter of Fiscal 2023, Share2Pay is

available across each of the Company’s mobile apps. The Company continues to develop its mobile capabilities as mobile engagement continues to grow, with over

83% of the Company’s digital traffic generated from mobile devices in Fiscal 2022. In addition, in its efforts to expand its international brand reach, the Company also

partners with certain third-party e-commerce platforms.

Store Operations

The Company continues to thoughtfully open new stores and invest in smaller omni-enabled store experiences that align with local customer shopping preferences.

New store formats are designed to provide the opportunity for higher productivity through a smaller footprint. During Fiscal 2022, the Company opened 59 new store

locations, remodeled one store location and right-sized an additional eight store locations. These stores are designed to be open and inviting, and include

accommodating features such as innovative fitting rooms and omnichannel capabilities. Also included in our new store openings for Fiscal 2022 are 14 Gilly Hicks

stand-alone locations. These stores are tailored to reflect the personality of each brand, with unique furniture, fixtures, music and scent adding to a rich brand

experience. The Company’s stores continue to play an essential role in creating brand awareness and serving as physical gateways to the brands. Stores also serve

as local hubs for online engagement as the Company continues to grow its omnichannel capabilities to create seamless shopping experiences.

The Company continues to evaluate and manage its store fleet through its ongoing global store network optimization initiative and has taken actions to optimize store

productivity by remodeling, right-sizing or relocating stores to smaller square footage locations, and closing legacy stores. As part of this initiative, the Company

closed 26 stores during Fiscal 2022. The actions taken in Fiscal 2022 continued to transform the Company's operating model and reposition the Company for the

future as the Company continues to focus on aligning store square footage with digital penetration.

® ®

TM

TM

Table of Contents

As of January 28, 2023, all of the retail stores operated by the Company are located in leased facilities, primarily in shopping centers. These leases generally have

initial terms of between five and ten years. Certain leases also include early termination options, which can be exercised under specific conditions. The leases expire

at various dates between Fiscal 2023 and Fiscal 2033.

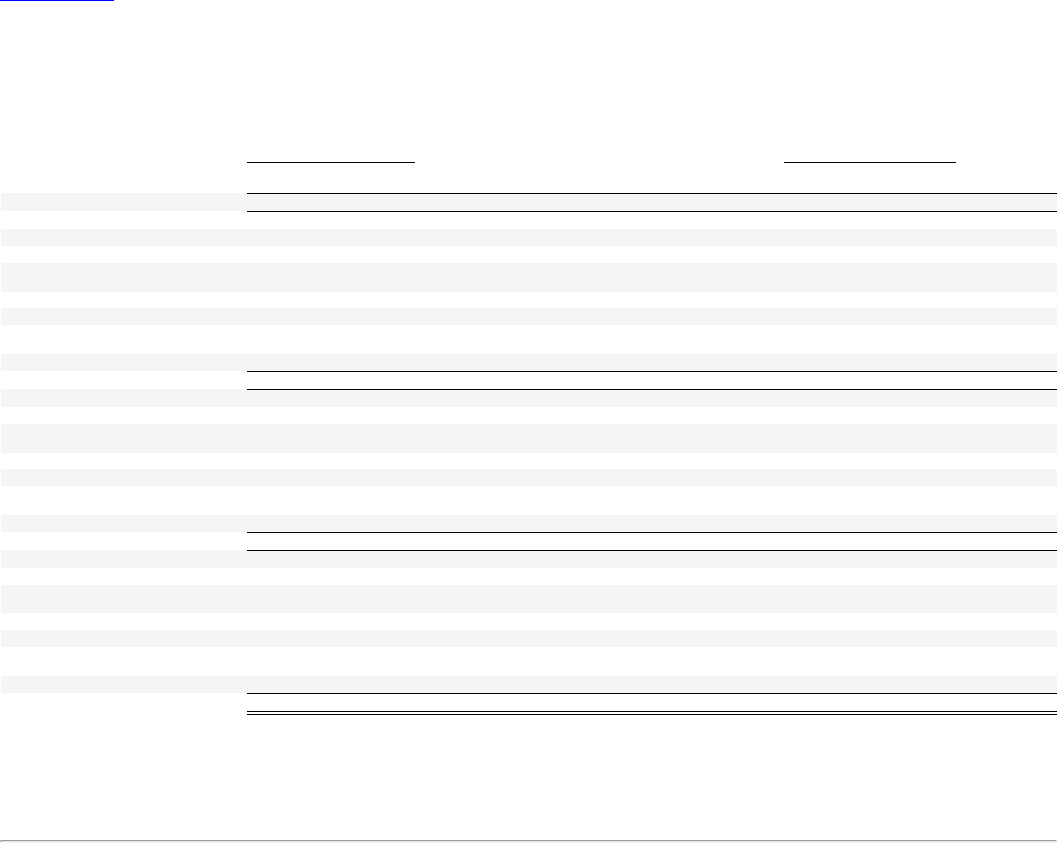

As of January 28, 2023, the Company operated 762 retail stores as detailed in the table below:

Hollister Abercrombie Total

Europe 107 20 127

Asia 28 20 48

Canada 9 4 13

Middle East 5 9 14

International 149 53 202

United States 380 180 560

Total

529 233 762

Includes the Hollister and Gilly Hicks brands. Locations with Gilly Hicks carveouts within Hollister stores are represented as a single store count. Excludes 12 international franchise stores and 16

U.S. Company-operated temporary stores as of January 28, 2023.

Includes Abercrombie & Fitch and abercrombie kids brands. Locations with abercrombie kids carveouts within Abercrombie & Fitch stores are represented as a single store count. Excludes 23

international franchise stores and three U.S. Company-operated temporary stores as of January 28, 2023.

This store count excludes one international third-party operated multi-brand outlet store as of January 28, 2023.

For store count and gross square footage by brand and geographic region as of January 28, 2023 and January 29, 2022, refer to “ITEM 7. MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.”

Third-Party Operations

The Company seeks to expand its international brand reach, create brand awareness and develop local presence through various wholesale, franchise, and licensing

arrangements. As of January 28, 2023, the Company had ten wholesale partnerships, primarily internationally. As of January 28, 2023, the Company’s franchisees

operated 35 international franchise stores across the Company’s brands located in Mexico, Qatar and Saudi Arabia.

SOURCING OF MERCHANDISE INVENTORY

The Company works with its network of third-party vendors to supply compelling, high-quality product assortments to its customers. These vendors are expected to

operate in compliance with the laws of their respective countries and all other applicable laws, rules, and regulations and have committed to follow the standards set

forth in the Company’s Vendor Code of Conduct, regarding human rights, labor rights, environmental responsibility and workplace safety.

The Company sourced merchandise through approximately 119 vendors located in 16 countries, including the U.S., during Fiscal 2022. The Company’s largest

vendor accounted for approximately 12% of merchandise sourced in Fiscal 2022, based on the cost of sourced merchandise. The Company believes its product

sourcing is appropriately distributed among vendors.

Refer to Note 5, “INVENTORIES,” of the Notes to Consolidated Financial Statements included in “ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY

DATA” of this Annual Report on Form 10-K for a summary of inventory sourced based on vendor location and dollar cost of merchandise receipts during Fiscal 2022.

DISTRIBUTION OF MERCHANDISE INVENTORY

The Company’s distribution network is built to deliver inventory to Company-operated and international franchise stores and fulfill digital and wholesale orders with

speed and efficiency. Generally, merchandise is shipped directly from vendors to the Company’s distribution centers, where it is received and inspected before being

shipped to the Company’s stores or its digital or wholesale customers.

(1) (2) (3)

(1)

(2)

(3)

Table of Contents

The Company relies on both Company-owned and third-party distribution centers to manage the receipt, storage, sorting, packing and distribution of its merchandise.

Additional information pertaining to certain of the Company’s distribution centers as of January 28, 2023 follows:

Location Company-owned or third-party

New Albany, Ohio (Primarily serves store and digital operations) Company-owned

New Albany, Ohio (Serves only digital operations) Company-owned

Bergen op Zoom, Netherlands Third-party

Shanghai, China Third-party

Goodyear, Arizona (Serves only digital operations) Third-party

The Company primarily used seven contract carriers to ship merchandise and related materials to its North American customers, and several contract carriers for its

international customers during Fiscal 2022.

COMPETITION

The Company operates in a rapidly evolving and highly competitive retail business environment. Competitors include: individual and chain specialty apparel retailers;

local, regional, national and international department stores; discount stores; and digitally-native brands and online-exclusive businesses. Additionally, the Company

competes for consumers’ discretionary spend with businesses in other product and experiential categories such as technology, restaurants, travel and media content.

The Company competes primarily on the basis of differentiating its brands from those of its competition through product, providing higher quality and increased

newness; brand voice, amplifying and consolidating brand messaging; and experience, investing in immersive, participatory omnichannel shopping environments.

Operating in a highly competitive industry environment can cause the Company to engage in greater than expected promotional activity, which would result in

pressure on average unit retail and gross profit. Refer to “ITEM 1A. RISK FACTORS - Our failure to operate in a highly competitive and constantly evolving industry

could have a material adverse impact on our business” of this Annual Report on Form 10-K for further discussion of the potential impacts competition may have on

the Company.

SEASONAL BUSINESS

Historically, the Company’s operations have been seasonal in nature and consist of two principal selling seasons: the spring season, which includes the first and

second fiscal quarters (“Spring”) and the fall season, which includes the third and fourth fiscal quarters (“Fall”). The Company experiences its greatest sales activity

during Fall, due to back-to-school and holiday sales periods. Refer to “ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS” of this Annual Report on Form 10-K for further discussion.

TRADEMARKS

The trademarks Abercrombie & Fitch , abercrombie , Hollister , Gilly Hicks , Social Tourist and the “Moose” and “Seagull” logos are registered with the U.S. Patent

and Trademark Office and registered, or the Company has applications for registration pending, with the registries of countries in key markets within the Company’s

sales and distribution channels. In addition, these trademarks are either registered, or the Company has applications for registration pending, with the registries of

many of the foreign countries in which the manufacturers of the Company’s products are located. The Company has also registered, or has applied to register, certain

other trademarks in the U.S. and around the world. The Company believes its products are identified by its trademarks and, therefore, its trademarks are of significant

value. Each registered trademark has a duration of 10 to 20 years, depending on the date it was registered, and the country in which it is registered, and is subject to

an indefinite number of renewals for a like period upon continued use and appropriate application. The Company intends to continue using its core trademarks and to

timely renew each of its registered trademarks that remain in use.

INFORMATION TECHNOLOGY SYSTEMS

The Company’s owned and third-party-operated management information technology systems consist of a full range of retail, merchandising, human resource and

financial systems. These systems include applications related to point-of-sale, digital operations, inventory management, supply chain, planning, sourcing,

merchandising, payroll, scheduling and financial reporting. The Company continues to invest in technology to upgrade its core systems to enhance reporting and

analytics, create efficiencies and to support its digital operations, omnichannel capabilities, customer relationship management tools and loyalty programs.

® ® ® ® ®

Table of Contents

WORKING CAPITAL

Refer to “ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS ” of this Annual Report on Form

10-K for a discussion of the Company’s cash requirements and sources of cash available for working capital needs and investment opportunities.

HUMAN CAPITAL MANAGEMENT

The Company strives to create a culture that not only drives strategic and key business priorities forward, but is welcoming, inclusive, diverse and encourages

associates to create a positive impact in their global communities. The Company believes that the strength of its unique culture is a competitive advantage, and

intends to continue building upon that culture to improve performance across its business.

Therefore, the Company believes that the attraction, retention, and management of qualified talent representing diverse backgrounds, experiences, and skill sets - and

fostering a diverse, equitable and inclusive work environment - are integral to its success.Highlights of our key human capital management programs and efforts

include the following:

• Living a corporate purpose of “Being here for you on the journey to being and becoming who you are.” The Company’s corporate purpose was developed

after conducting listening sessions with its associates and its customers, and by weaving in key themes from each of the brand purposes.

• Offering competitive compensation and benefits, to help the Company attract, motivate, and retain the key talent necessary to achieve outstanding

business and financial results. The Company’s compensation offerings includes cash-based and equity-based incentive awards in order to align the interests

of associates and stockholders, and in the second half of Fiscal 2021, the Company expanded the pool of associates eligible to receive cash-based incentive

awards by extending eligibility to additional associates across various job levels. In addition, the Company continues to evolve its approach to work flexibility,

including supporting remote work arrangements for key roles and “work from anywhere days and weeks” for our corporate home office associates where

feasible. We also support our associates and their families beyond our competitive compensation and comprehensive benefits offerings, providing eligible

associates with paid parental leave in the United States and internationally based on local law, and in 2022 we started offering adoption and fertility support

benefits for eligible associates globally.

• Improving associate engagement through open communication channels with a focus on development. The Company regularly holds all-company

meetings to communicate with its associates. The Company also collects feedback through various engagement surveys to better understand associate

experience and drive improvements, with the most recent organization-wide survey conducted in August 2022.

• Fostering associate development by providing a wide variety of growth and development opportunities throughout associates’ careers. This includes

stretch assignments, internal career pathing, self-awareness exercises, and active coaching. The Company also uses leadership standards to help

associates identify the core behaviors essential for their career growth, as well as personal growth, on their journey at the Company. In Fiscal 2022, the

Company launched the internal job board, which empowers associates to apply for open roles and/or to seek advancement opportunities within the

Company.

• Embracing inclusion and diversity in all forms, including gender, race, ethnicity, disability, nationality, religion, age, veteran status, LGBTQIA+ status, and

other factors. The Company continuously reviews metrics including representation, retention, pay, and promotionamong associates from diverse

backgrounds, including those in leadership positions. The Company also encourages associates to enhance their understanding of inclusion and diversity

through participating in the Company’s various associate resource groups, which allow associates from different business functions around the world to have

discussions, attend activities, and receive materials focused on allyship, community, celebration, and education. Additionally, the Company invests in

inclusion and diversity learning and development opportunities for associates on topics including bias, allyship, and advocacy, conducting roundtable

discussions, trainings and workshops.

• Encouraging community involvement of its associates by promoting various charitable, philanthropic, and social awareness programs, which the

Company believes fosters a collaborative and rewarding work environment. The Company provides support to global organizations in the form of cash

donations, volunteerism and in-kind support. In partnership with its vendor partners, customers and associates, the Company is proud to support community

partners serving youth, teens, and young adults with a focus on mental health and wellness, empowerment, and inclusion and diversity. The Company offers

its associates a paid volunteer day each year for eligible volunteer work.

• Focusing on the health and safety of its associates by investing in various wellness programs that are designed to enhance the physical, financial, and

mental well-being of its associates globally. The Company provides benefits-eligible associates and their families with access to free and confidential

counseling through our Employee Assistance Program, as well as free access to Headspace, a mediation and mindfulness app. The Company also provides

regular programming on financial planning and mental health.

Table of Contents

Associates

The Company employed approximately29,600 associates globally as of January 28, 2023, of whom approximately 22,400 were part-time associates. As of

January 28, 2023, the Company employed approximately22,400associates in the U.S., and employed approximately7,200associates outside of the U.S. The

Company employs temporary, seasonal associates at times, particularly during Fall, when it experiences its greatest sales activity due to back-to-school and holiday

sales periods.

The proportion of associates represented by works councils and unions is not significant and is generally limited to associates in the Company’s European stores.

Board Oversight

A&F’s Board of Directors (the “Board of Directors”) and its committees oversee human capital issues. The Compensation and Human Capital Committee of the Board

of Directors oversees the Company’s overall compensation structure, policies and programs, as well as administration of our cash-based and equity-based

performance award programs. Members of the Board of Directors also review succession plans for the Company’s executive officers and discuss with senior

leadership the Company’s human capital management strategies, programs, policies and practices, including those relating to organizational structure and key

reporting relationships, along with development of strategies and practices relating to recruitment, retention and development of the Company’s associates as needed.

Additionally, the Environmental, Social and Governance Committee of the Board of Directors oversees the Company’s strategies, policies and practices regarding

social issues and trends, including inclusion and diversity initiatives, health and safety, and philanthropy and community investment matters.

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

The Company’s executive officers serve at the pleasure of the Board of Directors. Set forth below is certain information regarding the executive officers of the

Company as of March 24, 2023:

Fran Horowitz, Chief Executive Officer and Director

Age: 59

Executive Roles:

• Chief Executive Officer, Principal Executive Officer and Director (February 2017 to present)

• Former President and Chief Merchandising Officer for all brands of the Company (December 2015 to February 2017), former member of

the Office of the Chairman of the Company (December 2014 to February 2017) and former Brand President of Hollister (October 2014 to

December 2015)

• Former President of Ann Taylor Loft, a division of Ascena Retail Group, Inc., the parent company of specialty retail fashion brands in

North America (October 2013 to October 2014)

• Formerly held various roles at Express, Inc., a specialty apparel and accessories retailer of women’s and men’s merchandise (February

2005 to November 2012), including Executive Vice President of Women’s Merchandising and Design (May 2010 to November 2012)

• Formerly held various merchandising roles at Bloomingdale’s and various positions at Bergdorf Goodman, Bonwit Teller and Saks Fifth

Avenue

Other Leadership Roles:

• Member of the Board of Directors of Conagra Brands, Inc. (NYSE: CAG), one of North America’s leading branded food companies (July

2021 to present)

• Member of the Board of Directors of SeriousFun Children’s Network, Inc., a non-profit corporation that provides specially-adapted camp

experiences for children with serious illnesses and their families, free of charge (since March 2017)

• Member of the Board of Directors of Chief Executives for Corporate Purpose (CECP), a CEO-led coalition that helps companies

transform their social strategy by providing customized resources (October 2019 to present)

Scott D. Lipesky, Executive Vice President and Chief Financial Officer

Age: 48

Executive Roles:

• Executive Vice President and Chief Financial Officer of the Company, as well as Principal Financial Officer and Principal Accounting

Officer of the Company (April 2021 to present)

• Senior Vice President and Chief Financial Officer of the Company, as well as Principal Financial Officer and Principal Accounting Officer

of the Company (October 2017 to April 2021)

• Prior to rejoining the Company, formerly served as Chief Financial Officer of American Signature, Inc., a privately-held home furnishings

company (October 2016 to October 2017)

• Formerly held various leadership roles and finance positions with the Company (November 2007 to October 2016) including: Chief

Financial Officer, Hollister Brand (September 2014 to October 2016); Vice President, Merchandise Finance (March 2013 to September

2014); Vice President, Financial Planning and Analysis (November 2012 to March 2013); and Senior Director, Financial Planning and

Analysis (November 2010 to November 2012)

• Former Corporate Finance Director with FTI Consulting Inc., a global financial services advisory firm

• Former Director of Corporate Business Development with The Goodyear Tire & Rubber Company

• Formerly held position as a Certified Public Accountant with PricewaterhouseCoopers LLP

Table of Contents

Kristin Scott, President, Global Brands

Age: 55

Executive Roles:

• President, Global Brands of the Company (November 2018 to present)

• Former Brand President of Hollister (August 2016 to November 2018)

• Formerly held senior positions at Victoria’s Secret, a specialty retailer of women’s intimate and other apparel which sells products at

Victoria’s Secret stores and online (December 2007 to April 2016), including: Executive Vice President, General Merchandise Manager

(March 2013 to April 2016); Senior Vice President, General Merchandise Manager (March 2009 to March 2013); and Senior Vice

President, General Merchandise Manager - Stores (December 2007 to March 2009)

• Formerly held various planning and merchandising positions at Gap Inc., Target, and Marshall Fields

Samir Desai, Executive Vice President, Chief Digital Technology Officer

Age: 42

Executive Roles:

• Executive Vice President and Chief Digital and Technology Officer of the Company (July 2021 to present)

• Formerly held various leadership and technology positions at Equinox Group, a luxury fitness company that operates several lifestyle

brands (October 2005 to June 2021), including: Chief Technology Officer (April 2016 to June 2021), Vice President, Technology (April

2013 to April 2016), Senior Director Technology (April 2011 to April 2013), Director Technology (October 2005 to April 2011)

• Formerly held technology roles at Intertex Apparel Group, a manufacturer and importer of branded and private label apparel (July 2002

to October 2005), including Director, Information Technology

Gregory J. Henchel, Executive Vice President, General Counsel and Corporate Secretary

Age: 55

Executive Roles:

• Executive Vice President, General Counsel and Corporate Secretary of the Company (October 2021 to present)

• Senior Vice President, General Counsel and Corporate Secretary of the Company (October 2018 to October 2021)

• Former Executive Vice President, Chief Legal Officer and Secretary of HSN, Inc., a $3+ billion multi-channel retailer (February 2010 to

December 2017)

• Former Senior Vice President and General Counsel of Tween Brands, Inc., a specialty retailer (October 2005 to February 2010) and

Secretary (August 2008 to February 2010)

• Formerly held various roles at Cardinal Health, Inc., a global medical device, pharmaceutical and healthcare technology company,

including Assistant General Counsel (2001 to October 2005), and Senior Litigation Counsel (May 1998 to 2001)

• Formerly held position as a litigation associate with the law firm of Jones Day (September 1993 to May 1998)

GOVERNMENT REGULATIONS

As a global organization, the Company is subject to the laws and regulations of the U.S. and multiple foreign jurisdictions in which it operates. These laws and

regulations include, but are not limited to: trade, transportation and logistic laws, including tariffs and import and export regulations; tax laws and regulations; product

and consumer safety laws; anti-bribery and corruption laws; employment and labor laws; antitrust or competition laws; data privacy laws; and environmental

regulations.

Inflation Reduction Act of 2022

On August 16, 2022, the Inflation Reduction Act was signed into law, with tax provisions primarily focused on implementing a 15% corporate minimum tax on global

adjusted financial statement income, expected to become applicable to the Company beginning in Fiscal 2023, and a 1% excise tax on share repurchases in tax years

beginning after December 31, 2022. The Company does not currently expect that the Inflation Reduction Act will have a material impact on its income taxes.

Laws and regulations have had, and may continue to have, a material impact on the Company’s operations as described further within “ITEM 7. MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS" of this Annual Report on Form 10-K.

Refer to “ITEM 1A. RISK FACTORS ,” of this Annual Report on Form 10-K for a discussion of the potential impacts regulatory matters may have on the Company in

the future, including those related to environmental matters. Compliance with government laws and regulations has not had a material effect on the Company’s

capital expenditures, earnings or competitive position.

Table of Contents

OTHER INFORMATION

A&F makes available free of charge on its website, corporate.abercrombie.com, under the “Investors – Financials/SEC Filings” section, its annual reports on Form 10-

K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or Section 15(d) of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), as soon as reasonably practicable after A&F electronically files such material with, or furnishes it

to, the Securities and Exchange Commission (the “SEC”). A&F also makes available free of charge in the same section of its website its definitive proxy materials filed

pursuant to Section 14 of the Exchange Act, as soon as reasonably practicable after A&F electronically files such proxy materials with the SEC. The SEC maintains a

website that contains electronic filings by A&F and other issuers at www.sec.gov.

A&F has included certain of its website addresses throughout this filing as textual references only. Information on the A&F websites shall not be deemed incorporated

by reference into, and do not form any part of, this Annual report on Form 10-K or any other report or document that A&F files with or furnishes to the SEC.

Item 1A. Risk Factors

Investing in our securities involves risk. The following risk factors should be read carefully in connection with evaluating our business and the forward-looking

statements contained in this Annual Report on Form 10-K. Any of these risk factors could lead to material adverse effects on our business, operating results and

financial condition. Additional risks and uncertainties not currently known to us or that we currently do not view as material may also become materially adverse our

business in future periods or if circumstances change.

MACROECONOMIC AND INDUSTRY RISKS.

Changes in global economic and financial conditions could have a material adverse impact on our business.

Uncertainty as to the state of the global economy and global financial condition could have an adverse effect on our operating results and business. Our business is

subject to factors that affect worldwide economic conditions, including rising inflation (which has occurred and is occurring), unemployment levels, consumer credit

availability, consumer debt levels, reductions in consumer net worth based on declines in the financial, residential real estate and mortgage markets, recent bank

failures, sales and personal income tax rates, fuel and energy prices, global food supplies, interest rates, consumer confidence in future economic and political

conditions, consumer perceptions of personal well-being and security, the value of the U.S. dollar versus foreign currencies, geopolitical conflicts, and other

macroeconomic factors. Actual events involving limited liquidity, defaults, non-performance or other adverse developments that affect financial institutions or other

companies in the financial services industry or the financial services industry generally, or concerns or rumors about any events of these kinds, have in the past and

may in the future lead to market-wide liquidity problems and volatility, such as the events in March 2023 wherein certain financial institutions were placed into

receivership. Changes in global economic and financial conditions could impact our ability to fund growth and our ability to access external financing in the credit and

capital markets.

The economic conditions and factors described above could adversely impact our results of operations, liquidity and capital resources, and may exacerbate other

risks within this section of “ITEM 1A. RISK FACTORS”.

Consumer confidence and spending could be materially impacted by economic conditions, which could adversely impact our results of operations.

Our business depends on consumer demand for our merchandise. Consumer confidence and discretionary spending habits, including purchases of our merchandise,

can be adversely impacted by recessionary periods, inflation and other macroeconomic conditions adversely impacting levels of disposable income. We may not be

able to accurately anticipate or predict consumer demand and behavior, such as taste and purchasing trends, in response to adverse economic conditions, which

could result in lower sales, excess inventories and increased mark-downs, all of which could negatively impact our ability to achieve or maintain profitability. In the

event that the U.S. and global economy worsens, or if there is a decline in consumer spending levels or other unfavorable conditions, we could experience lower than

expected revenues, which could force us to delay or slow the implementation of our growth strategies and adversely impact our results of operations.

Failure to engage our customers, anticipate customer demand and changing fashion trends, and manage our inventory commensurately could have a material

adverse impact on our business.

Our success largely depends on our ability to anticipate and gauge the fashion preferences of our customers and provide merchandise that satisfies constantly

shifting demands in a timely manner. Because we may enter into agreements for the manufacture and purchase of merchandise well in advance of the applicable

selling season, we are vulnerable to changes in consumer preferences and demand, pricing shifts, and the sub-optimal selection and timing of merchandise

purchases.

Table of Contents

Moreover, there can be no assurance that we will continue to anticipate consumer demands and accurately plan inventory successfully in the future. Changing

consumer preferences and fashion trends, and our ability to anticipate, identify and respond to them, could adversely impact our sales. Inventory levels for certain

merchandise styles no longer considered to be “on trend” may increase, leading to higher markdowns to sell through excess inventory and, therefore, lower than

planned margins. Conversely, if we underestimate consumer demand for our merchandise, or if our manufacturers fail to supply quality products in a timely manner,

we may experience inventory shortages, which may negatively impact customer relationships, diminish brand loyalty and result in lost sales.

We could also be at a competitive disadvantage if we are unable to leverage data analytics to retrieve timely, customer insights to appropriately respond to customer

demands and improve customer engagement. Any of these events could significantly harm our operating results and financial condition.

We are also vulnerable to factors affecting inventory flow that are outside our control, such as natural disasters or other unforeseen events that may significantly

impact anticipated customer demand. If we are not able to adjust appropriately to such factors, our inventory management may be negatively affected, which could

adversely impact our performance and our reputation.

Our failure to operate effectively in a highly competitive and constantly evolving industry could have a material adverse impact on our business.

The sale of apparel, personal care products and accessories for men, women and kids is a highly competitive business with numerous participants, including

individual and chain specialty apparel retailers, local, regional, national and international department stores, discount stores and online-exclusive businesses.

Proliferation of the digital channel within the last few years has encouraged the entry of many new competitors and an increase in competition from established

companies. These increases in competition could reduce our ability to retain and grow sales, resulting in an adverse impact to our operating results and business.

We face a variety of challenges in the highly competitive and constantly evolving retail industry, including:

• Anticipating and quickly responding to changing consumer shopping preferences better than our competitors;

• Maintaining favorable brand recognition;

• Effectively marketing our products to consumers across diverse demographic markets, including through social media platforms which have become

increasingly important in order to stay connected to our customers, as our digital sales penetration has increased.

• Retaining customers, including our loyalty club members, and the resulting increased marketing costs to acquire new customers;

• Developing innovative, high-quality merchandise in styles that appeal to consumers and in ways that favorably distinguish us from our competitors;

• Countering the aggressive pricing and promotional activities of many of our competitors without diminishing the aspirational nature of our brands and brand

equity; and

• Identifying and assessing disruptive innovation, by existing or new competitors, that could alter the competitive landscape by: improving the customer

experience and heightening customer expectations; transforming supply chain and corporate operations through digital technologies and artificial intelligence;

and enhancing management decision-making through use of data analytics to develop new, consumer insights.

In addition, in order to compete in this highly competitive and constantly evolving industry, at times, we may launch and/or acquire new brands to expand our portfolio.

This could result in significant financial and operational investments that do not provide the anticipated benefits or desired rates of return and there can be no

guarantee that pursuing these investments will result in improved operating results.

In light of the competitive challenges we face, we may not be able to compete successfully in the future.

The impact of war, acts of terrorism, mass casualty events, social unrest, civil disturbance or disobedience could have a material adverse impact on our business

In the past, the impact of war, acts of terrorism, mass casualty events, social unrest, civil disturbance or disobedience and the associated heightened security

measures taken in response to these events have disrupted commerce. Further events of this nature, domestic or abroad, including international and domestic unrest

and the ongoing conflict in Ukraine, may disrupt commerce and undermine consumer confidence and consumer spending by causing a decline in traffic, store

closures and a decrease in digital demand adversely affecting our operating results.

Furthermore, the existence or threat of any other unforeseen interruption of commerce, could negatively impact our business by interfering with the availability of raw

materials or our ability to obtain merchandise from foreign manufacturers. With a substantial portion of our merchandise being imported from foreign countries, failure

to obtain merchandise from our foreign manufacturers or substitute other manufacturers, at similar costs and in a timely manner, could adversely affect our operating

results and financial condition.

Table of Contents

Fluctuations in foreign currency exchange rates and our ability to mitigate the effects of such volatility and our ability to mitigate the effects of such volatility could have

a material adverse impact on our business.

Due to our international operations, we are exposed to foreign currency exchange rate risk with respect to our sales, profits, assets and liabilities denominated

in currencies other than the U.S. dollar. In addition, certain of our subsidiaries transact in currencies other than their functional currency, including intercompany

transactions, which results in foreign currency transaction gains or losses. Furthermore, we purchase substantially all of our inventory in U.S. dollars. As a result, our

sales, gross profit and gross profit rate from international operations will be negatively impacted during periods of a strengthened U.S. dollar relative to the functional

currencies of our foreign subsidiaries. Additionally, changes in the effectiveness of our hedging instruments may negatively impact our ability to mitigate the risks

associated with fluctuations in foreign currency exchange rates. For example, changes in inventory purchase assumptions have resulted in changes in the

effectiveness to certain of our hedging instruments, and we could see similar impacts in future periods.

Fluctuations in foreign currency exchange rates could adversely impact consumer spending, delay or prevent successful penetration into new markets or adversely

affect the profitability of our international operations. Certain events, such as the on-going conflict in Ukraine, the ongoing impact of the COVID-19 pandemic, and

uncertainty with respect to trade policies, tariffs and government regulations and actions affecting trade between the U.S. and other countries, have increased global

economic and political uncertainty in recent years and could result in volatility of foreign currency exchange rates as these events develop.

Pandemics, epidemics, or other public health crises such as the COVID

‐

19 pandemic may continue to materially adversely impact and cause disruption to our

business.

The COVID-19 pandemic has had a material adverse effect on our business, including our financial performance and condition, operating results and cash flows, and

may continue to materially adversely impact and cause disruption to our business in the future. Adverse impacts of the COVID-19 pandemic experienced by the

Company to date include supply chain disruptions, inflationary pressures including higher freight and labor costs, labor shortages, weak store traffic, temporary store

closures and reclosures of factories in certain regions. Despite the availability of COVID-19 vaccines, the pandemic continues to evolve, with resurgences and

outbreaks occurring in various parts of the world, including those resulting from variants of the virus.

A pandemic or other public health crisis, including the emergence of new COVID-19 variants, poses the risk that we or our employees, customers, vendors and

manufacturers may be prevented from conducting business activities for an indefinite period of time, including due to the spread of the disease or shutdowns

requested or mandated by governmental authorities. The impact of regulations imposed in the future in response to the COVID-19 pandemic or other public health

crises, could, among other things, require that we close our stores or distribution centers or otherwise make it difficult or impossible to operate our business.

Other factors that would negatively impact our ability to successfully operate during the ongoing COVID-19 pandemic include, but are not limited to:

• Our ability to keep our stores open if there is a re-emergence or increase in infection rate;

• Our ability to attract customers to our stores, given the risks, or perceived risks, of gathering in public places;

• Supply chain delays due to closed factories, reduced workforces, scarcity of raw materials and scrutiny, as well as carrier constraints due to an increase in

digital sales;

• Delays in, or our ability to complete, planned store openings on the expected terms or timing, or at all based on shortages in labor and materials and delays

in the production and delivery of materials;

• Associates, whether our own or those of our third-party vendors, working offsite through work from home arrangements may rely on residential

communication networks and internet providers and may be more susceptible to service interruptions and cyberattacks, and, this could result in an increase

in phishing and other scams, fraud, money laundering, theft and other criminal activity;

• Our ability to preserve liquidity to be able to take advantage of market conditions during periods of temporary store closures; and

• Difficulty accessing debt and equity capital on attractive terms, or at all, and a severe disruption and instability in the global financial markets or deterioration

in credit and financing conditions may affect our access to capital necessary to fund business operations or address maturing liabilities.

The factors described above may exacerbate other risks within this section of “ITEM 1A. RISK FACTORS”. Any future outbreak of any other highly infectious or

contagious disease could also have a material adverse impact on our business.

Our ability to attract customers to our stores depends, in part, on the success of the shopping malls or area attractions that our stores are located in or around.

Table of Contents

Our stores are primarily located in shopping malls and other shopping centers. Our sales at these stores, as well as sales at our flagship locations, are partially

dependent upon the volume of traffic in those shopping centers and the surrounding area which, for some centers, has been in decline. Our stores may benefit from

the ability of a shopping center’s other tenants and area attractions to generate consumer traffic in the vicinity of our stores and the continuing popularity of the

shopping center. We cannot control the loss of a significant tenant in a shopping mall or area attraction, the development of new shopping malls in the U.S. or around

the world, the availability or cost of appropriate locations or the success of individual shopping malls and there is competition with other retailers for prominent

locations.

Prior to the onset of the COVID-19 pandemic, the retail industry generally was facing declines in shopping mall traffic, and if the popularity of shopping malls declines

among our customers, our sales may decline, and it may be appropriate to exit leases earlier than originally anticipated.

While U.S. Company-operated stores have been fully reopened for in-store service following widespread temporary store closures due to the COVID-19 pandemic,

we may see additional temporary closures in certain geographic areas as outbreaks of COVID-19 cases could continue to occur and localized responses remain

unpredictable. Furthermore, declines in store traffic beyond our current expectations could result in additional impairment charges. While we were successful in

obtaining certain rent abatements and landlord concessions of rent payable as a result of COVID-19 store closures, we may be limited in our ability to obtain rent

abatements or landlord concessions of rent otherwise payable going forward.

All of these factors may impact our ability to meet our productivity or our growth objectives for our stores and could have a material adverse impact on our financial

condition or results of operations. Part of our future growth is dependent on our ability to operate stores in desirable locations, with capital investment and lease costs

providing the opportunity to earn a reasonable return. We cannot be sure when or whether such desirable locations will become available at reasonable costs.

The impact of natural disasters, negative climate patterns, public health crises, political crises and other unexpected and catastrophic events could result in

interruptions to our operations, as well as to the operations of our third-party partners, and have a material adverse impact on our business.

Our retail stores, corporate offices, distribution centers, infrastructure projects and digital operations, as well as the operations of our vendors and manufacturers, are

vulnerable to disruption from natural disasters, such as hurricanes, tornadoes, floods, earthquakes, extreme cold events and other adverse weather events; negative

climate patterns, such as those in domestic and global water-stressed regions; public health crises, such as pandemics and epidemics (including the ongoing COVID-

19 pandemic); political crises, such as terrorists attacks, war, labor, unrest and other political instability; significant power interruptions or outages; and other

unexpected, catastrophic events. These events could disrupt the operations of our corporate offices, global stores and supply chain and those of our third-party

partners, including our vendors and manufacturers. In addition to immediate impacts on global operations, these events could result in a reduction in the availability

and quality of raw materials used to manufacture our merchandise, delays in merchandise fulfillment and deliveries, loss of customers and revenues due to store

closures and inability to respond to customer demand, increased costs to meet consumer demand (which we may not be able to pass on to customers), reduced

consumer confidence or changes in consumers’ discretionary spending habits.

Historically, our operations have been seasonal, and natural disasters or unseasonable weather conditions, may diminish demand for our seasonal merchandise and

could also influence consumer preferences and fashion trends, consumer traffic and shopping habits. In addition, to the extent natural disasters cause physical losses

to our stores, distribution centers or offices, we may incur costs that exceed our applicable insurance coverage for any necessary repairs to damages or business

disruption.

STRATEGIC RISKS.

Our failure to successfully execute on our Always Forward Plan.

In 2022 we introduced our Always Forward Plan as our long-term strategic plan, as described in “ITEM 1. BUSINESS.” Our ability to successfully execute on our

Always Forward Plan is subject to various risks and uncertainties as described herein.

We believe that our Always Forward Plan will lead to long-term revenue growth and increased profitability, however, there is no assurance regarding the extent to

which we will realize the anticipated objectives, if at all, or regarding the timing of such anticipated benefits. Our failure to realize the anticipated objectives, which may

be due to our inability to execute on the various elements of our Always Forward Plan, changes in consumer demand, competition, macroeconomic conditions

(including inflation), retention of key talent, and other risks described herein, could have a material adverse effect on our business.

If the execution of our Always Forward Plan is not successful, or we do not realize the objectives to the extent or in the timeline that we anticipate, our financial

condition and reputation could be adversely affected.

Failure to continue to successfully manage the complexities of our customers’ omnichannel shopping experience, or failure to continue to successfully invest in

customer, digital and omnichannel initiatives could have a material adverse impact on our business.

Table of Contents

As omnichannel retailing continues to evolve, our customers increasingly interact with our brands through a variety of media and expect seamless integration across

all touchpoints. As our success depends on our ability to effectively manage the complexities of our customers’ omnichannel shopping experience, including our

ability to respond to shifting consumer traffic patterns and engage our customers, we have made significant investments and operational changes to develop our

digital and omnichannel capabilities globally, including the development of localized fulfillment, shipping and customer service operations, investments in digital media

to attract new customers and the rollout of omnichannel capabilities listed in “ITEM 1. BUSINESS.”

While we must keep up to date with technology trends in the retail environment in order to manage our successful omnichannel shopping experience, it is possible

these initiatives may not provide the anticipated benefits or desired rates of return. For example, we could be at a competitive disadvantage if we are unable to

leverage data analytics to retrieve timely, customer insights to appropriately respond to customer demands and improve customer engagement across channels or if

innovative digital products and features we develop are not utilized or received by customers as anticipated.

In addition, digital operations are subject to numerous risks, including reliance on third-party computer hardware/software and service providers, data breaches, the

increased rate of merchandise returns, violations of evolving laws and regulations, including those relating to online privacy, credit card fraud, telecommunication

failures, electronic break-ins and similar compromises, and disruption of internet service. Changes in foreign governmental regulations may also negatively impact our

ability to deliver product to our customers. Failure to successfully respond to these risks may adversely affect sales as well as damage the reputation of our brands.

Our failure to optimize our global store network could have a material adverse impact on our business.

With the evolution of digital and omnichannel capabilities, customer expectations have shifted and there has been greater pressure for a seamless omnichannel

experience across all channels. As a result, global store network optimization is an important part of our business and failure to optimize our global store network

could have an adverse impact on our results of operations.

The ability to open new stores experiences and modify existing leases requires partnership with our landlords. If our partnerships with our landlords were to

deteriorate, this could adversely affect the pace of opening new store experiences and/or lead to an increase in store closures. In addition, if there is an increase in

events such as landlord bankruptcies, or mall foreclosures, competition between retailers could increase for remaining suitable store locations. Pursuing the wrong

opportunities and any delays, cost increases, disruptions or other uncertainties related to those opportunities could adversely affect our results of operations. If our

investments in new stores or remodeling and right-sizing existing stores do not achieve appropriate returns, our financial condition and results of operations could be

adversely affected.

Although we attempt to open new stores in prominent locations, it is possible that locations which were prominent when we opened our stores may lose favor over

time.

Our inability to effectively conduct business in international markets, including as a result of legal, tax, regulatory, political and economic risks could have a material

adverse impact on our business.

We operate on a global basis and are subject to risks associated with international operations that could have a material adverse effect on our reputation, business

and results of operations if we fail to address them.

Such risks include, but are not limited to, the following:

• addressing the different operational requirements present in each country in which we operate, including those related to employment and labor,

transportation, logistics, real estate, lease provisions and local reporting or legal requirements;

• supporting global growth by successfully implementing local customer and product-facing teams and certain corporate support functions at our regional

headquarters located in Shanghai, China and London, United Kingdom;

• hiring, training and retaining qualified personnel;