Indiana Journal of Global Legal Indiana Journal of Global Legal

Studies Studies

Volume 25 Issue 1 Article 21

2-15-2018

After the European Commission Ordered Apple to Pay Back Taxes After the European Commission Ordered Apple to Pay Back Taxes

to Ireland: Ireland's Future in the New Global Tax Environment to Ireland: Ireland's Future in the New Global Tax Environment

Boyu Wang

Indiana University Maurer School of Law

Follow this and additional works at: https://www.repository.law.indiana.edu/ijgls

Part of the Comparative and Foreign Law Commons, Taxation-Transnational Commons, and the Tax

Law Commons

Recommended Citation Recommended Citation

Wang, Boyu (2018) "After the European Commission Ordered Apple to Pay Back Taxes to Ireland: Ireland's

Future in the New Global Tax Environment,"

Indiana Journal of Global Legal Studies

: Vol. 25: Iss. 1, Article

21.

Available at: https://www.repository.law.indiana.edu/ijgls/vol25/iss1/21

This Note is brought to you for free and open access by

the Maurer Law Journals at Digital Repository @ Maurer

Law. It has been accepted for inclusion in Indiana Journal

of Global Legal Studies by an authorized editor of Digital

Repository @ Maurer Law. For more information, please

contact [email protected].

After

the

European

Comnmission

Ordered

Apple

to

Pay

Back

Taxes

to

Ireland:

Ireland's

Future

in

the

New

Global

Tax

Environment

BoYU

WANG*

ABSTRACT

On

August

30,

2016,

the

European

Commission

ordered

Ireland

to

collect

$14.5

billion

plus

interest

in

unpaid

taxes

between

2003

and

2014

from

Apple

Inc.

The

European

Union

suggested

that

Ireland

made

"sweetheart

deals"

with

Apple

in

exchange

for

bringing

more

jobs

into

the

country

and

concluded

that

these

deals

constituted

illegal

tax

benefits,

contrary

to

the

European

Union's

prohibitions

against

"state

aid."

Profit

shifting

and

transfer

pricing

manipulation

dominate

the

analysis

of the

corporate

tax

structure

in

Ireland

and

its

position

in

the

context

of

global

tax

policy.

This

note

explains

the

European

Commission's

Apple

decision

and

analyzes

how

this

decision

will

affect

Ireland's

international

relations

and

its

law

reform,

so

that

Ireland

could

comply

with

the

European

Union

and

international

tax

law.

The

European

Commission's

Apple

decision

helped

the

United

States,

the

European

Union,

and

Ireland

start

a

conversation

on how

to

work

together

to

regulate

tax

evasion

on

a

global

scale.

I

conclude

that

tax

system

reforms

on

an international

scale

will

happen

in

the

future

to

combat

"illegal

deals"

between

multinational

companies

and

specific

countries.

Boyu

Wang

is

a

Managing

Editor

for

the

Indiana Journal

of

Global

Legal

Studies,

Volume

25.

She

is

a

Juris

Doctor

Candidate

at

Indiana

University

Maurer

School

of

Law

and

received

her

Bachelor

of

Arts

degree

from

China

University

of

Political

Science

and

Law

in

2013

and

Master

of

Laws

degrees

from

Montreal

University

in

2014

and

from

Indiana

University

in

2015.

Boyu

is

immensely

grateful

to

her

family,

friends,

and

advisors

for

their

unyielding

support.

Indiana

Journal

of

Global

Legal

Studies

Vol.

25

#1

(Spring

2018)

@

Indiana

University

Maurer

School of

Law

539

INDIANA

JOURNAL

OF

GLOBAL

LEGAL

STUDIES

25:1

INTRODUCTION

On

August

30,

2016,

the

European

Commission

(EC)

ordered

Ireland

to

collect

$14.5

billion

plus

interest

in

unpaid

taxes

between

2003

and

2014

from

Apple

Inc.

1

After

massive

media

coverage

of

the

European

Commission's

ruling,

the

public

became

aware

of

the

corporate

tax

avoidance

issue

on

a

global scale.

2

The

European

Commission's

ruling

focuses

on

Apple's

structure

in

Ireland;

the question

at

the

heart

of

the

dispute

is

whether

Apple's

tax

agreements

constitute

"state

aid." Apple

based

a

major

international

division,

Apple

Sales

International,

in

an

office

in

Cork,

Ireland.

In

2011,

this

division

generated

more

than

C16

billion

($22

billion)

in

pretax

profit

but

paid

Ireland

less

than

£10

million

in

income

taxes,

which

represents

an

effective

tax

rate

of

0.05

percent

and

is well

below

Ireland's

12.5

percent

corporate

tax

rate.

3

How

did

Apple

manage

to

pay

such

a

low

tax?

Apple

made

two

agreements

with the

Irish

Revenue

Commissioners

in

1991,

updated

in

2007,

concerning

profits

allocation

among

Apple's

subsidiaries

in

Ireland.

4

According

to

these

agreements,

only

C50

million

of

the

£16

billion

pretax

profits

in

2011

were

considered

taxable

in

Ireland.

The

European

Commission

concluded

that

these

two

tax

agreements

constituted

illegal

tax

benefits,

contrary

to

the

European

Union's

prohibitions

against

"state

aid."

5

The

European

Union

suggested

that

Ireland

made

"sweetheart

deals"

with

Apple

in

exchange

for

bringing

more

jobs

into

the

country.

6

This

note

explains

the

European

Commission's

Apple

decision

and

analyzes

how

this

decision

will

affect

Ireland's

international

relations

1.

James

Kanter

&

Mark

Scott,

Apple

Owes

$14.5

Billion

in

Back

Taxes

to

Ireland,

E.

U.

Says,

N.Y.

TIMEs

(Oct.

30,

2017),

http://www.nytimes.com/2016/08/31/technology/

apple-tax-eu-ireland.html;

Letter

from

European

Commission

to

the

Republic

of

Ireland,

State

Aid

SA.

38373

(2014/C)

(ex 2014/NN)

(ex 2014/CP)

-

Ireland

Alleged

Aid

to

Apple,

21-22

(June

11,

2014)

(discussing

unpaid

taxes

Ireland

had

not

collected

from

Apple),

http://ec.europa.eulcompetition/state-aid/cases/253200/253200_1582634_87_2.pdf

[hereinafter

Letter

from

EC

to

Ireland].

2.

Kanter

&

Scott,

supra

note

1;

Letter

from

European

Commission

to

the

Republic

of

Ireland,

supra

note

1.

3.

Stu

Woo &

Sam

Schechner, At

Issue

in

Apple-EU

Tax

Case:

Did

Ireland

Take

Enough?,

WALL

ST.

J.

(Aug.

30,

2016,

1:09 PM),

http://www.wsj.comlarticles/at-issue-in-

apple-eu-tax-case-did-ireland-take-enough-1472576989.

4.

Id.;

Letter

from

European

Commission

to

the

Republic

of

Ireland,

supra

note

1,

at

2.

5.

Woo

&

Schechner,

supra

note

3.

6.

Natalia

Drozdiak,

Viktoria

Dendrinou

&

Sam

Schechner,

EU

Set

to

Rule

Apple

Tax

Deal

with

Ireland

Illegal,

WALL

ST.

J.

(Aug.

30,

2016, 12:39

AM),

http://www.wsj.com

/articles/eu-set-to-rule-as-soon-as-tuesday-apple-tax-deals-with-ireland-illegal-1472494231?mod

-whatnext&cx

navSource=cx

picks&cx-tag-contextual&cx

artPos-3#cxrecss.

540

AFTER

THE

EUROPEAN

COMMISSION

ORDERED APPLE

and

its

law

reform,

so

that

Ireland

could comply

with

the European

Union

and

international

tax

law.

7

Profit

shifting

and

transfer

pricing

manipulation

dominate

the analysis

of

the

corporate

tax structure

in

Ireland

and

its

position

in the

context

of global

tax

policy.

8

Although

bilateral

and

multilateral

tax

treaties

address

some

issues

of

the

sovereignty

of

tax

policies

in

the

context

of

an

increasingly

globalized

and

cross-jurisdictional

economic

system,

9

loopholes

between

the

various systems

provide

corporations

with

abundant

opportunities

to

minimize

their

tax

liability.1

0

Part

II

of

this

paper

explains

how

tax

evasion

became

a

global

issue

due

to

technological

developments

that

enhanced

international

mobility.

The

section

lays

out

some of

the

benefits

for

choosing

Ireland,

instead

of

a

corporation's

home

country,

as

the

state

of

incorporation.

Part

III

explains

the

"double

Irish"

structure

used

by

some

multinational

corporations

to

lower

their

corporate

tax

liability,

some

basic

tax

rules,

and

Apple's

structure

in

Ireland.

Part

IV

introduces

the

European

Commission's

decision

by

explaining

the

basis

of

the European

Commission's

ruling and

why

the European

Commission

has

the

authority

to

regulate tax

arrangements

between

Apple

Inc.

and

the

Irish

Government.

Specifically,

the European

7.

In

the

customary

method

of

the study

of

international

relations

and

international

law,

the

stress

is

on

the

state

or

nation

factor.

PHILIP

C.

JESSUP,

TRANSNATIONAL

LAW

11

(1956).

8.

See

E.

U.'s

Apple

Ruling

Is

No

Precedent

for

Future

Tax

Cases,

FORTUNE

(Sept.

26,

2016),

http://fortune.com/2016/09/26/apple-no-precedent-tax-cases/;

see

also

Stephen

C.

Loomis,

The

Double

Irish

Sandwich:

Reforming

Overseas

Tax Havens,

43

ST.

MARY'S

L.J.

825,

826

(2012);

Tom

Fairless,

EU

Regulators

to

Require

Starbucks,

Fiat

Pay

Millions

of

Euros in

Back

Taxes,

WALL

ST.

J.

(Oct.

21,

2015,

12:41

PM),

http://www.wsj.com/articles

/eu-rules-that-starbucks-fiat-benefited-from-illegal-tax-deals-1445419279;

Simon

Bowers,

Starbucks

and

Fiat

Sweetheart

Tax

Deals

with

EU

Nations

Ruled

Unlawful,

GUARDIAN

(Oct.

21,

2015),

https://www.theguardian.comlbusiness/2015/oct/21/starbucks-and-fiat-tax-

deals-with-eu-nations-ruled-unlawful.

9.

United

States

and

Ireland

have

bilateral

treaties.

See,

e.g.,

Convention

for

the

Avoidance

of Double

Taxation and

the

Prevention

of

Fiscal

Evasion

with

Respect

to

Taxes

on

Income

and

Capital

Gains,

U.S.-Ir.

Sept.

24,

1997,

39

U.S.T.

112;

see

also

Nelson

D.

Schwartz

&

Charles

Duhigg,

Billions

in

Taxes Avoided

by

Apple,

U.S.

Inquiry

Finds,

N.Y.

TIMES,

May

21,

2013,

at

Al

(discussing

the

Congressional

hearings

held

to uncover

the

scope

of

the

tax

avoidance

schemes

employed

by

Apple,

as

well

as

numerous

other

multinational

companies).

10.

For

example,

Google

has

created

four

separate

subsidiaries

and

has

used

conflicting

tax

codes,

as

well

as

bilateral

tax

agreements

to

avoid

paying

almost

any

U.S.

taxes.

Starbucks

has

for

years

made

Amsterdam

the

heart

of

its

European

operations.

See

Jesse

Drucker,

Google

2.4%

Rate

Shows

How

$60

Billion

Lost

to

Tax

Loopholes,

WASH.

POST

(Oct.

21,

2010,

6:00

AM),

http://www.washingtonpost.comlwp-dyn/content/article

/2010/10/22/AR2010102203253.html;

ERNST

&

YOUNG

LLP,

COMMON

CONSOLIDATED

CORPORATE

TAx

BASE:

A

STUDY

ON

THE

IMPACT

OF

THE

COMMON

CONSOLIDATED

CORPORATE

TAx

BASE

PROPOSALS

ON

EUROPEAN

BUSINESS

TAXPAYERS,

7-12

(2011),

http://taxinstitute.ie/Portals//EY%20CCTB.pdf.

541

INDIANA

JOURNAL

OF

GLOBAL

LEGAL

STUDIES

25:1

Commission

stated

that

its

decision

was

not

based

on

the

general

"double

Irish"

structure

or

the

lower

Irish

corporate

tax

rate,

but

rather,

it

was

about

Apple's

"illegal

deals"

with

the

Irish

government,

which

allowed

Apple

to

pay

virtually

nothing

on

its

European

business

for

years."

Part

V

analyzes

the

European

Union's

position

in

intervening

in

Apple's

tax

arrangements

with

Ireland

and

the

ramifications

of

the

European

Commission's

decision

to

Ireland.

Ireland's

governmental

representatives

expressed

that

they

were

going to

support

Apple

and

appeal

the

decision.12

This

position

is

not

surprising

since

Ireland

would

like

to

maintain

its reputation

as

being

tax

friendly

and

keep

attracting

significant

foreign

investment.

However,

with

the

global

awareness

of

tax

evasion

problems,

especially

after

the

Apple

decision,

Ireland

has

to

be

more

cautious

when

entering

into

private

deals

with

multinational

corporations

because

the

private

arrangements

could

be

investigated

by

the

European

Commission,

which

might

affect

Ireland's

reputation

as

being

tax

friendly.

I

conclude

that

tax

system

reforms

on

an

international

scale

will

happen

in

the

future

to

combat

"illegal

deals"

between

multinational

companies

and

specific

countries,

like

Ireland

in

Europe.

13

The

European

Commission's

Apple

decision

helped

the

United

States,

the

European

Union,

and Ireland

start

a

conversation

on

how

to

work

together

to

regulate

tax

evasion

on

a

global

scale. The

Organization

for

Economic

Cooperation

and

Development

(OECD)

also

tried

to

implement

projects

to combat

the

global

tax

evasion

problem.

While

Ireland

will

have

to

pay

close

attention

to

internationally

agreed

upon

standards

established

by

the

OECD,

Ireland

will

try

to

stay

competitive

and attractive

in

the

global

market

by

maintaining

its

lower

tax

rate

and

supporting

foreign

companies

in establishing

business

in

Ireland.

11.

Kanter

&

Scott,

supra

note

1.

12.

Ireland

to

Change

Company

Tax

Laws,

but

12.5%

Corporation

Tax

Rate

to

Stay,

RTE

NEWS

(Oct.

15,

2013,

7:01

PM), http://www.rte.ie/news/business/2013/1015/480547-

government-committed-to-12-5-corporation-tax-rate/;

Andrew

P.

Kummer,

Pro-Business

but

Anti-Economy?:

Why

Ireland's

Staunch

Protection

of its

Corporate

Tax

Regime

is

Preventing

a

Celtic

Phoenix From

Rising From

the Ashes

of

the

Celtic Tiger,

9

BROOK

J.

CORP.

FIN.

&

COM.

L.

284,

301-02

(2014).

13.

See

Jerald

David August,

Update

on

OECD

Base

Erosion

and

Profit

Shifting

Project,

KOSTEIANETZ

&

FINK,

LLP

(Aug.

17,

2016),

http://www.kflaw.com/update-on-oecd

base

erosion-and_profit-shifting-project.

542

AFTER

THE

EUROPEAN

COMMISSION

ORDERED

APPLE

I.

BACKGROUND

A.

Global

Economy

and

Scale

According

to

one

theory,

"[t]he

modern

state

is based

on

the

assumption

that

law

operates

on

a

single scale,

the

scale

of

the state."

14

"[Tihe

fixed

location

of

tangible

property

tend[s]

to

restrict

corporate

wealth

and

identity

to

fairly

defined

boundaries."

15

Thus,

for

a

long

time, corporations

have

primarily

been

linked

to

their

home

countries.

16

However,

with

increased

mobility

of

capital,

labor,

and

property,

political

barriers

continued

to

decline

and

multinational

corporations

inevitably

began

to

emerge.

17

With

the

explosion

of

globalization,

global

companies

tend

to

take

advantages

of

different

countries'

political

economies,

laws,

and

governments

to

achieve

wealth

concentration.

18

From

the

tax

perspective,

multinational

companies

have

a

financial

incentive

to

allocate

as much

profit

as

possible

to

low

tax

jurisdictions

by

taking

advantages

of

the

inconsistencies

of

the

international

taxation

rules.'

9

This

problem

is

further

emphasized

in

the

"case

of

global

technology

companies," whose

"primary

asset

and

source

of

income

is

intellectual

property

that

may

be

easily shifted

to

tax-friendly

countries."

20

B.

Benefits

for

Multinational

Corporations

to

Establish

Business

in

Ireland

Historically,

cities

became

places

where

people

of

different

origins

clustered

together

on

a

semi-permanent

basis out

of

mutual

interest.

2

1

Beginning

in

the

1980s,

the

Irish

government played

an

active

role

in

14.

Boaventura

de

Sousa Santos,

Law:

A

Map

of

Misreading.

Toward

a

Postmodern

Conception

of Law,

14

J.L.

&

SoC'Y,

279,

287

(1987).

15.

Steven

A.

Bank,

The

Globalization

of Corporate

Tax

Reform,

40

PEPP.

L.

REV.

1307,

1307

(2013).

16.

Id.

17.

Id.

at

1308.

18.

See

SASKIA

SASSEN, EXPULSIONS: BRUTALITY

AND

COMPLEXITY

IN

THE

GLOBAL

ECONOMY

14-15

(2014).

19.

See

CHARLES

H.

GUSTAFSON

ET

AL.,

TAXATION

OF INTERNATIONAL

TRANSACTIONS:

MATERIALS,

TAX

AND

PROBLEMS

710

(4th

ed.

2011)

(describing

the

setting

of

prices

on

all

types of

transactions

between

related

parties);

see

also

Brian

Mistler,

Taking

Action

Against

Base

Erosion

Profit

Shifting,

32

ARIZ.

J.

IN'L

&

COMP.

L.

903,

904

(2015).

20.

Bank,

supra

note

15,

at

1310.

21.

GREG

CLARK,

GLOBAL

CITIES

12

(2016).

543

INDIANA

JOURNAL

OF

GLOBAL

LEGAL

STUDIES

25:1

promoting

foreign

direct

investment

(FDI)

from

large

multinational

corporations.

22

Ireland's

economy

developed

tremendously

ever

since.

One

of

the

reasons

that

foreign

corporations

chose

to

locate

in

Ireland

is

the

12.5

percent

corporate

tax

rate,

23

which

is

one

of

the

lowest

corporate

tax

rate

regimes

in

the

world.

24

By

comparison,

the

United

States

has

a

much higher

corporate

tax

rate

of

35

percent.

25

This

means

that

when

a

company

generates

$10

million

in

profit,

it

needs

to

pay

$3.5

million

U.S.

tax

if

the

company

were

built

in

the

United

States,

while

it

only

pays

$1.25

million

if

the

factory

were

built

in

Ireland.

In

addition

to

the

12.5

percent

tax

rate,

Ireland

provides

tax

subsidies

for

research

and

development

and

other

activities.

26

However,

it

is

22.

Foreign

direct

investment

has

long

been

regarded

as

a key

component

in

Ireland's

economic

development.

Since

the late

1950s,

the

government

moved

away

from

import

substitution

strategies,

protectionism,

and

foreign

ownership

restriction

to

allow

nearly

unrestricted

access

to

the

Irish

economy.

Org.

for Econ.

Co-Operation

and

Dev.

[OECD],

OECD

REVIEWS

OF

FOREIGN

DIREcT

INVESTMENT:

IRELAND,

at

7-10

(1994),

https://www.oecd.org/ireland/34383945.pdf;

see

also

Michael

Mikiciuk,

Foreign

Direct

Investment

Success

in

Ireland-

Can

Poland

Duplicate

Ireland's

Economic Success

Based

on

Foreign

Direct

Investment

Policies?,

14

U.

MIAMI

INT'L

&

COMP.

L.

REV.

65,

95

(2006);

Apple

Tax

Case:

Why

is

Ireland

Refusing

Billions?,

BBC

(Sept.

7,

2016),

http://www.bbc.

com/news/world-europe-37299430.

23.

See

Ireland

Corporate

Tax

Rate

1981-2016,

TRADING

EcON.,

http://www.tradingeconomics.com/ireland/corporate-tax-rate

(last

updated

Oct.

2017);

CORPORATE

TAX

RATES

TABLE,

KPMG,

https://home.kpmg.com/xx/en/home/services/tax/

tax-tools-and-resources/tax-rates-online/corporate-tax-rates-table.html

(last

visited

Oct.

30,

2017);

Conor

O'Brien,

Is Ireland's

Corporation

Tax

Regime

Fit

for

Purpose?,

IRISH

TIMES

(June

11,

2013,

1:00 AM),

http://www.irishtimes.comlbusiness/economy/is-ireland-s-

corpbration-tax-regime-fit-for-purpose-1.1423602.

24.

According

to

a

corporate

tax

rate table

published

by

KPMG,

the

tax rate

of

some

other

countries

in

Europe

is

as

follows:

Belgium:

33.99%;

France:

33.3%;

Germany:

29.72%;

Iceland:

20%;

Italy:

31.4%;

Netherlands:

25%.

See

CORPORATE

TAX

RATES

TABLE,

supra

note

23;

Vincent

Boland,

Dublin

Ditches

Double

Irish

to

Save

Low

Tax

Regime,

FIN.

TIMES

(Oct.

14,

2014),

https://www.ft.com/content/1f740b46-539b-11e4-929b-00144feab7de.

25.

I.R.C.

§

11(b)(1)

(2016);

CORPORATE

TAX

RATE

SCHEDULE

2014,

TAX

POLIcY

CENTER

(Jan.

20,

2015),

http://www.taxpolicycenter.org/sites/default/fileslegacy/taxfacts/

content/pdf/corporaterates.pdf-

Anton

Aurenius, How

the

U.S.

Corporate

Tax Rate

Compares

to

the

Rest

of

the

World,

TAX

FOUNDATION

(Aug.

22,

2016),

http://taxfoundation.org/blog/how-us-corporate-tax-rate-compares-rest-world.

Effective

as

of

December

21,

2017,

the

United

States

changed

Section

11

of

the

Internal

Revenue

Code,

and

the

new

corporate

tax

rate

is

twenty-one percent.

I.R.C.

§

11

(2017).

This

note

only

discusses the

effects

and

implications

of

the

Apple

decision

in

the

context

of

previous

tax

structures

in

the

United

States

and in

Europe.

26.

"Ireland

has an

R&D

[Research

and

Development]

Tax

Credit

scheme since

2004.

Qualifying

R&D

expenditure generates

a

25%

tax

credit

for

offset

against

corporation

tax,

in

addition

to

the

tax

deduction

. . .

."

IDA

IRELAND,

TAXATION

IN

IRELAND

2016

(2016),

http://www.idaireland.com/docs/publications/Taxation_2016.pdf;

Kummer,

supra

note

12.

544

AFTER

THE

EUROPEAN

COMMISSION

ORDERED

APPLE

generally

asserted

that

no

preferential

treatment

exists

under

Ireland's

corporate

tax

structure.

27

Other

factors

that

help

a

corporation

decide

whether

to

establish

business

in

Ireland

include

the

quality

and

flexibility

of

the

English-

speaking

workforce,

availability

of

a

multilingual

labor

force,

cooperative

labor

relations,

political

stability,

pro-business

government

policies

and

regulators,

a

transparent

judicial

system,

transportation

links,

proximity

to

the

United

States

and

Europe,

and

the

drawing

power

of

existing

companies

operating

successfully

in

Ireland.

28

II.

THE

DOUBLE

IRISH

PROBLEM

AND

APPLE'S

STRUCTURE

IN

IRELAND

The

setting

of

prices

for

the

transfer

of goods

or

services

from

one

company

to

another

is

called

"transfer

pricing"

and

is

used

to

reduce

tax

liabilities

in

relatively

high-tax

countries.

29

The

problem

of

transfer

pricing

is

that

it

gives

an

advantage

to

a

company

if

it

can

artificially

allocate

profits

between

associate

companies

in

different

jurisdictions.

30

Lenient

U.S.

transfer

pricing

rules

allow

Irish

factories

to

generate

excessive

profits

that

should

have

been

taxed

in

the

United

States.

For

example,

if

a

company

generates

$30

million

profits,

when

it

shifts

$20

million

of

the

$30

million

profit

from

the

United

States

to

Ireland,

it

reduces

its

U.S.

tax

by

$7

million.

31

27.

Rashid

Raiyan,

What

the

Apple

Tax

Dispute

Means

for

the

EU-US

Relationship,

MKT.

MOGUL

(Sept.

6,

2016),

http://themarketmogul.com/what-the-apple-tax-dispute-

means-for-the-eu-us-relationship/.

But

there

are

special

deals

for

certain

companies

on

an

individualized

basis.

O'Brien,

supra

note

23.

28.

A

survey

released

by

Ernst

&

Young

in

2010

stated

that

the

best

way

for

states

to

stimulate

future

European

attractiveness

is:

(1)

whether

they

support

small

and

medium-

sized

enterprises;

(2)

whether

they

support

high-tech

industries

and

innovation;

and

(3)

whether

they

can

reduce

taxation

and increase

flexibility.

See

Jim

Stewart,

Low

Corporate

Tax

Rates

and

Economic

Development,

in

ENACTING

GLOBALIZATION:

MULTIDISCIPLINARY

PERSPECTIVES

ON

INTERNATIONAL

INTEGRATION

6-7

(Louis

Brennan

ed.,

2014);

BUREAU

OF

ECON.

&

Bus.

AFF.,

U.S.

DEP'T

OF

ST.,

2016

INVESTMENT

CLIMATE

STATEMENTS:

IRELAND

(2016),

http://www.state.gov/e/eb/rls/othr/ics/2016/eur/254375.htm;

Landon

Thomas

Jr.

&

Eric

Pfanner,

Even

Before

Apple

Tax

Breaks,

Ireland's

Policy

Had

Its

Critics,

CNBC

(May

22,

2013,

4:59

AM),

http://www.cnbc.com/id/100756298.

29.

DENNIS

CAPLAN,

MANAGEMENT

ACCOUNTING

CONCEPTS

AND

TECHNIQUES,

ch.

23

(2010).

30.

See

E.

U.'s

Apple

Ruling Is

No

Precedent

for

Future

Tax

Cases,

supra

note

8.

31.

See

Martin

Sullivan,

If

Ireland Is

Not

a

Tax

Haven,

What

Is

It?,

FORBES

(Nov.

6,

2013,

9:57

AM),

http://www.forbes.com/sites/taxanalysts/2013/1

106/if-ireland-is-not-a-tax-

haven-what-is-it/;

Michael

Hennigan,

How

Apple

Found

a

Bigger Tax

Loophole

than

the

Double

Irish,

FINFACTS

(Aug.

17,

2016),

http://www.finfacts.ie/Irishfinance-news/article

Detail.php?How-Apple-found-a-bigger-tax-loophole-than-the-Double-Irish-681.

545

INDIANA

JOURNAL

OF

GLOBAL

LEGAL

STUDIES

25:1

A.

The

Double

Irish

Structure

The

common

arrangement

in

Ireland

is

a

structure

called

"Double

Irish."

32

It

is

developed

by

using

a

twist

in

Irish

law

by

sending

royalty

payments

for

intellectual

property

from

one

Irish-registered

subsidiary

to

another

that

resides

in

a "tax

haven."

33

Apple

Inc.

used

the

legal

loophole

created

by

the

difference

between

the

U.S.

and

Irish

tax

laws

to

determine

the

basis

of

taxation,

and

developed

a

unique

structure

that

is

similar

to

the

double

Irish

scheme to

lower

its

tax.3

The

purpose

of

the

structure

is

to

trigger the deferral

provisions

of

the

U.S.

tax

code

for

profits

earned

outside

the

United

States.

35

The

earnings

of

foreign

corporations

will

not

be

taxed

in

the United

States

until

the

foreign

corporation

repatriates

its

earnings

through

the

distribution

of

dividends.

36

This

deferral

is

maintained

as

long

as

the

profits are

retained

in

the

non-U.S.

incorporated

affiliates

and

not

repatriated

to

the

U.S.

parent.

37

32.

See

Loomis,

supra

note

8,

at

828;

Vanessa

Houlder,

Q&A-

What

is

The

Double

Irish?

European

Commission

Has

Threatened

to

Launch

a

Formal

Investigation,

FIN.

TIMES

(Oct.

9,

2014),

https://www.ft.com/content/f7a2b958-4fc8-11e4-908e-00144feab7de.

33.

See

Scott DeAngelis,

If

You

Can't

Beat

Them,

Join

Them:

The

U.S.

Solution

to

the

Issue

of

Corporate

Inversions,

48

VAND.

J.

TRANSNAT'L

L.

1353,

1369 (2015);

see

also

Sam

Schechner,

Ireland

to Close

"Double

Irish"

Tax

Loophole:

Change

to

Come

Slowly,

Particularly

Affecting

U.S.

Tech

Firms

Like

Google

and

Facebook,

N.Y.

TIMES

(Oct.

14,

2014,

4:48

PM),

http://www.wsj.com/articles/ireland-to-close-double-irish-tax-loophole-

1413295755.

34.

See

EU

Releases

World

Tax

Havens

Blacklist,

EUBUSINESS

(June

18,

2015,

9:53

CET),

http://www.eubusiness.com/news-euleconomy-politics.

120n;

see

also

Enzo Miraslov

et

al.,

Apple

Inc's

Dubious

Tax

Evasion

Strategy:

Double

Irish

with

a

Dutch

Sandwich,

YONSEI

UNDERWOOD

GItNIES

L.

REV.

(May

15,

2016),

https://yonseiuiclawreview.wordpress

.com/2016/05/15/apple-incs-ingenious-tax-evasion-strategy-double-irish-with-a-dutch-

sandwich/.

35.

Seamus

Coffey,

Exaggerating

the

Irish-US

Economic

Relationship,

ECON.

INCENTIVES

(Mar.

5,

2015),

http://economic-incentives.blogspot.com/2015/03/exaggerating-

irish-us-economic.htmL

36.

Andrew

Mitchel

&

Ryan

E.

Dunn,

Subpart

F

Income,

INT'L

TAX

BLOG

(Nov.

14,

2011),

http://intltax.typepad.com/intltax-blog/2011/11/subpart-f-income.html.

37.

Coffey,

supra

note

35.

From the

U.S.

perspective,

the

operating

subsidiary

is

disregarded

under

the

check-the-box regime

so

that

the

cash

flowing

into

the

holding

company

does

not

trigger

subpart

F

inclusions

to

the

U.S.

parent.

Joseph

P.

Brothers,

Featured

Perspectives:

From

the

Double

Irish

to

the

Bermuda

Triangle,

TAX ANALYSTS

2014,

at

687

(Nov. 24,

2014),

http://www.sven-giegold.de/wp-content/uploads/2015/03/

From-Double-Irish-to-Bermuda-Triangle-2014.pdf.

The

subpart

F

rules

attempt

to

prevent

deflection

of

income,

either

from

the

United

States

or

from

the

foreign

country

in

which

earned,

into

another

jurisdiction

which

is

a

tax

haven

or

which

has

a

preferential

tax

regime

for

certain types

of income.

OFF.

OF

TAX

POL'Y,

DEP'T

OF

THE

TREASURY,

THE

DEFERRAL

OF

INCOME

EARNED

THROUGH

U.S.

CONTROLLED

FOREIGN

CORPORATIONS:

A

546

AFTER

THE

EUROPEAN

COMISSION

ORDERED

APPLE

The

"double

Irish"

structure

needs

at

least

three

companies

to

work.

38

The

first

company

is

a

U.S.

company

(U.S.

Co.),

which

licenses

its

intellectual

property

(IP)

to

a

subsidiary

based

in

Ireland

(Irish

Co.

1).39

Irish

Co.

1

then

licenses

the

patent

rights

to

a

second

Irish

company

(Irish

Co.

2),

which receives

income

from

Irish

Co.

1,

but

has

to

pay

royalties

and

fees

to

Irish

Co.

1.40

Thus,

Irish

Co.

2's

taxes

are

lower

because

the

royalties

and

fees

paid

to

Irish

Co.1.

are

deductible

expenses.

The

U.S.

company

doesn't

pay

any federal

taxes

on

the

income

from

the

Irish

companies

because

the

earnings

were

not

made

in

the

United

States.

41

The

combined

company's

global

profits

are

reported

in

Ireland,

regardless

of

where

they

are

earned.

4

2

B.

Inconsistence

of

Taxation

System

in

Ireland

and

in

the

United

States

There

are

two

major

types

of

taxation

systems

for

taxing

international

income:

the

territorial

system

and

the

worldwide

system.

43

Under

a

territorial

tax

system,

only income

derived

within

the

country

would

be

taxed,"

and

most

or

all

foreign

income

would

be

exempted.

45

POLICY

STUDY,

at

xii

(2000),

https://www.treasury.gov/resource-center/tax-policy/Docu

ments/Report-SubpartF-2000.pdf

38.

Daniel

Wesley,

Double

Irish

Deception:

How

Google-Apple-Facebook

Avoid

Paying

Taxes,

CREDITLOAN

(Mar.

15,

2017),

https://visualeconomics.creditloan.com/double-

irish-deception-how-google-apple-facebook-avoid-paying-taxes/.

39.

Charles

Duhigg

&

David

Kocieniewski,

How

Apple

Sidesteps

Billions

in

Taxes,

N.Y.

TIMIES

(April

28,

2012),

http://www.nytimes.com/2012/04/29/business/apples-tax-

strategy-aims-at-low-tax-states-and-nations.html;

Jeffrey

L.

Rubinger

&

Summer

Ayers

Lepree,

Death

of

the

'Double

Irish

Dutch

Sandwich"?

Not

so

Fast,

BILZIN

SUMBERG'S

TAXES

WITHOUT

BORDERS

(Oct.

23,

2014),

http://www.taxeswithoutbordersblog.com/2014

/10/death-of-the-double-irish-dutch-sandwich-not-so-fast/.

40.

Wesley,

supra

note

38.

41.

Id.;

see

also

Harriet

Taylor,

How

Apple

Managed

to

Pay

a

0.005

Percent

Tax

Rate

in

2014,

CNBC

(Aug.

30,

2016,

7:24

PM),

http://www.cnbc.com/2016/08/30/how-apples-

irish-subsidiaries-paid-a-0005-percent-tax-rate-in-2014.html.

42.

David

Jolly,

Ireland,

Home

to

U.S.

Inversions,'

Sees

Huge

Growth

in

G.D.P.,

N.Y.

TIMES

(July

12,

2016),

http://www.nytimes.com/2016/07/13/business/dealbooklireland-us-

tax-inversion.html?action=cick&contentCollection=Technology&module=RelatedCover

age®ion=Marginalia&pgtype=article.

43.

See

RESTATEMENT

(THIRD)

OF

FOREIGN

RELATIONS

LAW OF

THE

UNITED

STATES

§

411

(1987)

(explaining

the

main

ways

that

people

and

corporations

are

subject

to

tax in

the United States).

44.

John

T.

VanDenburgh,

Closing

International

Loopholes:

Changing

the

Corporate

Tax

Base

to

Effectively

Combat

Tax

Avoidance,

47

VAL.

U.L.

REV.

313,

321 (2012);

see

also

HUGH

J.

AULT

&

BRIAN

J.

ARNOLD,

COMPARATIVE

INCOME

TAXATION:

A

STRUCTURAL

ANALYSIS

347-49

(2d

ed.

2004)

(discussing

how

various

jurisdictions

determine

residency

status

for

taxing).

45.

See

I.R.C.

§

861(a)

(2016);

I.R.C.

§

862(a)

(2016). To

prevent

erosion

of

the

tax

base,

a

territorial

system

could cover

income

from

financial

assets

held

by

a

foreign

547

INDIANA

JOURNAL

OF GLOBAL

LEGAL

STUDIES

25:1

Under

a

worldwide

system,

a

corporation

is

taxed

on

its

worldwide

income,

regardless

of

the

source

of

their

income.

46

The

United

States

employs

a

system

that

combines

both the

territorial

and

the

worldwide

tax

system.

47

When

operations

are

carried

out

through

a

foreign

subsidiary,

the

income

generally

will

not

be

subject

to

the

U.S.

taxation

(except

when

distributed

through

dividends

or

other

financial

alternatives).

48

Ireland

also

employs a

mix

system:

Corporations

in

Ireland

are taxed

on

their

income

wherever

it

derives

from,

like

a

worldwide

tax

system;

49

Ireland

will

not

tax

the

earnings

of

a

nonresident

corporation

(except

on

its

Irish

source

earnings),

like

a

territorial

tax

system.so

The concept of

"resident"

is

very

important

under

the

worldwide

system

because

a

corporation

will

only

be

taxed

when

it

is

a

"resident"

of

that

particular

country.

51

While

the

United

States

uses

the

place

of

incorporation

and

the

principle

place

of

business

as

the

test

for

corporate

residence,

52

Ireland

uses

"manage

and

control"

for

subsidiary

that

could

easily

be

held

by

the

U.S.

company.

Territorial

vs.

Worldwide

Taxation,

SENATE

REPUBLICAN

POLICY

COMM.

(Sept.

19,

2012),

http://www.rpc.senate

.gov/policy-papers/territorial-vs-worldwide-taxation.

46.

Hugh

J.

Ault

&

David

F.

Bradford,

Taxing

International

Income:

An

Analysis

of

the

U.S.

System

and

Its

Economic

Premises

1

(Nat'1

Bureau

of

Econ.

Research,

Working

Paper

No.

3056,

1989),

http://www.nber.org/papers/w3056.pdf

47.

MICHAEL

J.

GRAETZ,

FOUNDATIONS

OF

INTERNATIONAL

INCOME

TAXATION

157-62

(2003)

(explaining

that

the United

States

tax

system

is

referred

to

by

most

as

a

worldwide

system,

because

the

United

States

taxes

foreign

source

income

even

though

it

is

not

quite

a

pure

system).

48.

See

Ault

&

Bradford,

supra

note

46,

at

1-2.

49.

AIDAN

WALSH

&

CHRIS

SANGER,

THE

HISTORICAL

DEVELOPMENT

AND

INTERNATIONAL

CONTEXT

OF

TBE

IRISH

CORPORATE

TAX

SYSTEM

3

(2014),

http://www.budget.gov.ie/Budgets/2015/Documents/EYHistoricalDevInternationalCon

textIrish_%20CorporationTax.pdf

50.

ERNST

&

YOUNG,

WORLDWIDE

CORPORATE

TAX

GUIDE

2013,

at

589

(2013),

http://www.ey.com/Publication/vwLUAssets/EY-worldwide-corporate-tax-guide-

2013/$FILE/EY-worldwide-corporate-tax-guide-2013.pdf (noting

that

only

"[a]

company

resident

in

Ireland

is

subject

to

corporation

tax

on

its

worldwide

profits"

while

"[a]

company

not

resident

in

Ireland

is

subject

to

corporation

tax

if

it

carries

on a

trade

in

Ireland

through a

branch

or agency"

and,

in

that

case,

tax

is

assessed

only on

"trading

profits

of

the

branch

or

agency")

(emphasis

added).

51.

Daniel

Shaviro,

The

Rising

Tax-Electivity

of

U.S.

Corporate

Residence,

64

TAX

L.

REV.

377,

383

(2011)

("A

corporation

is

a

U.S.

resident

if

and

only

if

it

is

'created

or

organized

in

the

United

States

or

under

the

law

of

the

United

States

or of

any State."').

52.

28

U.S.C.

§

1332(c)(1) (2017).

In Hertz,

the

Supreme

Court

developed

the

nerve

center

test

to

determine

the

citizenship

for

diversity

jurisdiction,

which

is

the

place where

the

corporation

has

an

"office

from

which

its

business

was

directed

and

controlled,"

usually

the headquarters.

Hertz

Corp.

v.

Friend,

559

U.S. 77,

89-90

(2010).

548

AFTER

THE

EUROPEAN

COMMISSION

ORDERED

APPLE

determination

of

residency.

53

This inconsistency

gives

rise

to

the

"nowhere

residence"

problem,M

which

arises

when

companies

do

not

need to

pay

U.S.

taxes

because

a

subsidiary

in

Ireland

earned

the

profits,

while

this

same

subsidiary

claims

that

it

is

not

managed

or

controlled

in

Ireland,

so

the

corporation

doesn't

need

to

pay

the

Irish

tax

either.

5

5

C.

Apple's

Structure

in

Ireland

Beginning

in

the

late

1980s,

Apple

started

to

create

subsidiaries

in

Ireland.

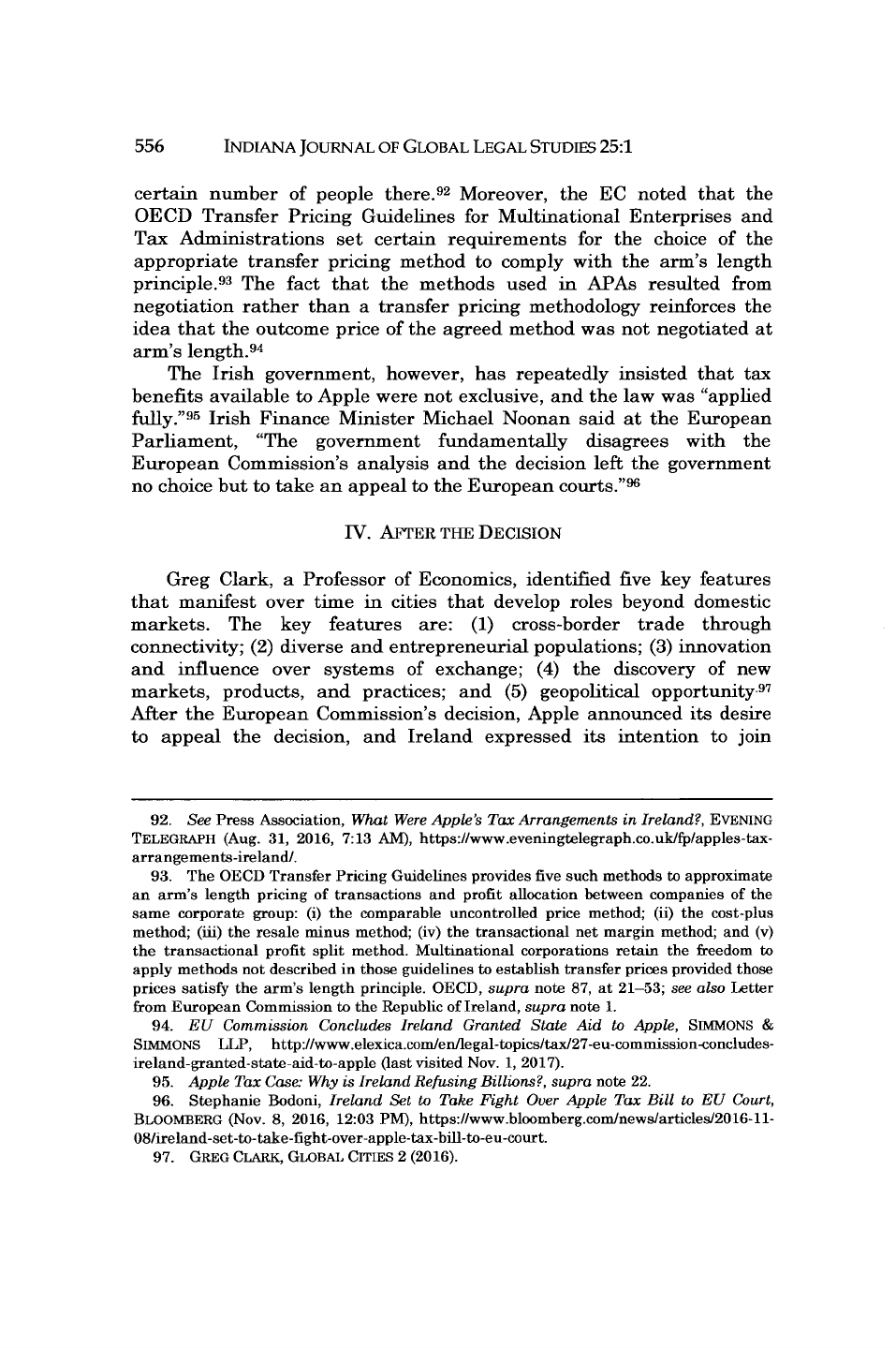

56

Apple's

companies

incorporated

in

Ireland

are

represented

in

the

chart

below.

Apple

Apple~~~

App

e

Apleaes

Aplcea

Opershons

Operado~ns'

Distrhuio,,

ktmEwpe

Holding*

*iih

tax

rsIen

company

Chart

from

European

Conunission

Decision

of

State

Aid

SA.

38373

(2014/C)

(ex

2014/NN)

(ex

2014/CP)

Ireland:

Alleged

Aid

to

Apple,

C

(2014)

3606

final of

June

11,

2014.

Among

the

companies

on

the

chart,

Apple

Inc.

is

incorporated

in

the

United

States

and

all

other

companies

are

incorporated

in

Ireland.

In

compliance

with the

U.S.

transfer

pricing

rules,

Apple

Inc.

entered

into

a

Research

and

Development

Cost

Sharing

Agreement

57

with

its

53.

See

Corporation

Tax

(CT):

Company

Residency

Rules,

REVENUE:

IRISH

TAX

AND

CUSTOMS

(June

22,

2017)

http://www.revenue.ie/en/companies-and-charities/corporation-

tax-for-companies/corporation-tax/company-residency-rules.aspx.

54.

See

DeAngelis,

supra

note

33.

55.

See

Wesley,

supra

note

38.

56.

Schwartz

&

Duhigg,

supra

note

9.

57.

A

cost

sharing

agreement

is

an

agreement

between

companies

of

one

group

to

share

costs

and benefits

of

developing

intangible

assets;

it

is

a

form

of

a cost

contribution

arrangement

described

in

Chapter

VIII

of

the

OECD

Guidelines.

Letter

from

European

Commission

to

the

Republic

of

Ireland,

supra

note

1,

at

8

n.

13;

Cost

Sharing

Agreements:

An

Effective

Tax

Planning

Tool,

VALUATION

RES.

CORP.

(Sept.

2008),

549

INDIANA

JOURNAL

OF

GLOBAL

LEGAL

STUDIES

25:1

subsidiaries,

Apple

Operations

Europe

(AOE)

and

Apple

Sales

International

(ASI),

who

are

also

parties

to

this

agreement.

According

to

the

agreement,

Apple,

AOE,

and

ASI

share

research

and

development

costs

and

risks

for

developing

certain

Apple

products

5 8

as

well

as

the

ownership

of

the

IP

rights

to

Apple

goods

sold

offshore.

59

Thus,

the

Irish

subsidiaries

were

allowed

to

receive

all

of

the

profits

from

exploiting

Apple

Inc.'s

IP

rights

abroad

without

paying

U.S.

taxes.co

For

sales

of

Apple

products,

ASI

signs

a

contract

with

an

independent

third-party

manufacturer

in

China

to

assemble

the

Apple

products

and

then

resells

the

products

to

Apple

Distribution

International

for

sales

in

Europe,

the

Middle

East,

Africa,

and

India

(and

to

Apple

Singapore

for

sales

in

Asia

and

the

Pacific

region).

6

'

In

the

end,

about

90

percent

of

Apple's

foreign

profits

are

earned

by

Irish

subsidiaries.

62

Apple

levied

a

big

part

of

the

profits

earned

elsewhere

in

Europe

to

account

for

IP and

used

it

to reduce

the

Irish

tax

on

its

earnings

from

Europe.

63

Unlike

most

other

multinational

corporations

that

use the

double

Irish

structure,

Apple

did

not

put

its

IP

used

in

Europe

and

other

non-U.S.

markets

in

separate

companies.

64

Instead,

ASI

was

split

http://www.valuationresearch.com/sites/default

/files/kb/4_CostSharing.pdf.

The

bigger

advantage

was

that

the

arrangement

allowed

Apple

to

send

royalties

on

patents

developed

in

California

to

Ireland.

The

transfer

was

internal,

and

simply

moved

funds

from

one

part

of

the

company

to

a

subsidiary

overseas.

Duhigg

&

Kocieniewski,

supra

note

39.

58.

Letter

from

European

Commission

to

the

Republic

of

Ireland,

supra

note

1,

at

8

n.13.

59.

Walter

Hickey,

Apple

Avoids

Paying

$17

Million

in

Taxes

Every

Day Through

a

Ballsy

but

Genius

Tax

Avoidance

Scheme,

BuS.

INSIDER

(May

21,

2013,

4:16

PM),

http://www.businessinsider.comlhow-apple-reduces-what-it-pays-in-taxes-2013-5.

60.

Miraslov,

supra

note

34.

Joseph

Stiglitz,

an

economist

from

Columbia

University,

made

the

following

comments:

"The

[U.S.]

tax

law

right

now

says

we

can

keep

that

in

Ireland

or

we

can

bring

it

back

...

we're

not

going

to

bring

it

back

until

there's

a

fair

rate.

There's

no

debate

about

it.

Is

that

legal

to

do

or

not

legal

to

do?

It

is

legal

to

do.

It

is

the

current

tax

law.

It's

not a

matter

of

being

patriotic

or

not

patriotic.

It

doesn't

go

that

the

more

you

pay,

the

more

patriotic

you

are."

Hennigan,

supra

note

31.

61.

Offshore

Profit

Shifting

and

the

U.S.

Tax

Code-Part

2

(Apple

Inc.):

Hearing

Before

the

Permanent

Subcomm.

on

Investigations

of

the

Comm.

on

Homeland

Sec.

&

Governmental Affairs

U.S.

Senate,

113th

Cong.

3

(2013)

(statement

of

Sen.

Carl

Levin,

Chair,

S.

Armed

Serv.'s

Comm.),

https://www.gpo.gov/fdsys/pkg/CHRG-113shrg81657/

pdflCHRG-113shrg81657.pdf

[hereinafter

Statement

of

Sen.

Carl

Levin].

62.

Vanessa

Houlder,

Alex

Barker,

&

Arthur

Beesley,

Apple's

EU

Tax Dispute

Explained,

FIN.

TIMEs

(Aug.

30,

2016),

https://www.ft.comlcontent/3eOl72aO-6elb-11e6-

9acl-1055824ca907.

63.

Cliff

Taylor,

Apple's

Irish

Company

Structure

Key

to

EU

Tax

Finding,

IRISH

TIMES

(Sept.

2,

2016),

http://www.irishtimes.com/business/economy/apple-s-irish-company-struc

ture-key-to-eu-tax-finding-1.2775684.

64.

Id.

550

AFTER

THE

EUROPEAN

COMMISSION

ORDERED

APPLE

into

an

Irish

branch

and

an

offshore

head

office.

65

All

strategic

decisions

taken

by

ASI,

including

in

relation

to

the

IP,

are

taken

outside

Ireland.

66

This

allows

for

the

profits

derived

on

the

IP

rights

held

by

the

Irish

subsidiaries

to

be

transferred

to

the

offshore

head

office.

Thus,

the

profits

are

subject

to

virtually

no

tax

burden

pursuant

to

the

offshore

island's

tax

laws.

6 7

ASI

is

able

to

claim

that

it

is

managed

and

controlled

outside

of

Ireland

and

thus,

was

not

a

tax

resident

in

Ireland.

68

At

the

same

time,

the

United

States

will

not

treat

the

holding

companies

established

under

the

laws

of

Ireland

as

their

residents

because

for

U.S.

tax

purposes,

residency

is

determined

by

the

"place

of

incorporation"

doctrine.

69

This

results

in

a

nowhere

resident

entity,

and

earnings

of

the

Irish

holding

companies

that

are

a

non-Irish

source

will

be

untaxed.

D.

Apple's

"Special

Arrangements"

With

Ireland

Apple

entered

into

two

agreements

with

the

Revenue

Commissioners

that

allowed

Apple

to

allocate

profits

between

the

Irish

branch

and

the

headquarters

of

ASI.

These

arrangements

were

the

center

of

the

European

Commission's

decision.

One

of

the

advance

transfer

pricing

arrangements

between

Apple

and

Ireland

is

for

Apple

Operations

Europe

(AOE).

In

1991,

Apple

and

the

Irish

Revenue

agreed

that

the

basis

for

determining

its

net

profit

would

be

calculated

as

65

percent

of

operating

expenses

up

to

an

annual

amount

of

sixty

to

seventy

million

dollars

and

20

percent

of

operating

expenses

in

excess

of

sixty

to

seventy

million

dollars.

7

0

Operating

expenses

included

in the

formula

were

all

operating

expenses

incurred

by

AOE's

Irish

branch,

including

depreciation,

but

excluding

materials

for

resale

and

cost-share

for

intangibles

charged

from

Apple-affiliated

companies.

71

In

2007,

a

revised

approach

for

remunerating

the

Irish

branch

of

AOE

was

agreed

which

was

based

on

a

10

to

20

percent

65.

See

id.;

see

also

Doron

Narotzki,

Corporate

Social

Responsibility

and

Taxation:

The

Next

Step

of the

Evolution,

16

Hous.

Bus.

&

TAX

L.J.

167,

189

(2016).

66.

See

generally

Statement

of

Sen.

Carl

Levin,

supra

note

61

(discussing

strategic

decisions

to

evade

tax

liability).

67.

See

id.

68.

The

Apple

Operations

International

(AOI)

has

no

physical

presence

and

has

not

had

any

employees

for

thirty-three

years.

It

has

two

directors

and

one

officer.

Most

of

the

AOI

board

meetings

were

held

in

Cupertino

rather

than

Cork.

Hickey,

supra

note

59;

see

also

Statement

of

Sen.

Carl

Levin,

supra

note

61;

Narotzki,

supra

note

65,

at

189.

69.

ERNST

&

YOUNG,

supra

note

50,

at

1421.

70.

This

was

subject

to

the

provision

that

if

the

overall

profit

from

the

Irish

operations

was

less

than

the

figure

resulting

from

this

formula,

that

lower

figure

would

be

used

for

determining

net

profits.

71.

Letter

from

European

Commission

to

the

Republic

of

Ireland,

supra

note

1,

at

29.

551

INDIANA

JOURNAL

OF

GLOBAL

LEGAL

STUDIES

25:1

margin

on

branch

operating

costs,

excluding

costs

not

attributable

to

the

Irish

branch,

and

an

IP

return

of

1

to

9

percent

of

branch

turnover

with

respect

to

the

accumulated

manufacturing

process

technology

of

the

Irish

branch.

As

for

ASI,

Apple

and

the

Irish

government

agreed

in

1991

that

the

net

profit

attributable

to

the

ASI

branch

would

be

calculated

as

12.5

percent

of

all

branch

operating

costs,

excluding

material

for

resale.

A

modified

basis was

agreed

in

2007

with

an eight

to

eighteen

percent

margin

on

branch

operating

costs,

excluding

costs

not

attributable

to

the

Irish

branch.

72

III.

Tm

EUROPEAN

COMMISSION'S

DECISION

Tax

agreements

between governments

and

companies

are

certainly

not unique

to

Ireland

and

Apple.

7

8

For

many

years,

Competition

Commissioner

Margrethe

Vestager

74

analyzed

and

criticized

"sweetheart

deals"

between

specific

European

Union

(EU)

countries

and

multinational

corporations.

75

On

June

11,

2014,

EU

regulators

opened

a

formal

investigation

into

corporate

tax

regimes

in

Ireland,

Luxembourg,

and

the

Netherlands.

This

investigation

was

prompted

by

concerns

that

several

major

multinational

corporations-Apple,

Amazon,

Google,

and

Starbucks-were

receiving

beneficial

tax

deals

greater

than

what

is

allowed

under

EU

law.

7 6

Vestager

argued

that

it

is

a

competition

issue

because

smaller

companies suffer

when

corporations

like

Apple

get

special

treatment.77

A

Why

Agreements

Between Apple

and

the

Irish

Government

are

Problematic

and

Why

the

European

Union

has

the

Authority

to

Regulate

Ireland's

Tax

Decisions

Given

the

multinational

nature

of

the

corporate

income

tax

problem,

it

is

not

surprising

that

the

search

for

a

solution

has taken

place

on

a

multinational

level.

Although

no

treaty

specifically

provides

the

EU

72.

Id.

73.

See

Taylor,

supra

note

41.

74.

Margrethe

Vestager

is a

member of

Denmark's

social

liberal

party.

See Dan

Bobkoff,

What

Just

Happened

to

Apple,

Explained,

Bus.

INSIDER

(Aug.

30,

2016,

5:28

PM),