Revised 10/2022 Effective Winter 2023 Page | 1

INSTRUCTIONS FOR COMPLETING A PETITION FOR

CHANGE IN CLASSIFICATION FOR TUITION PURPOSES

Submit the completed petition and all supporting documentation to the following address (faxes and emails are not

accepted):

University of Maryland-College Park

Office of the Registrar

Residency Reclassification Services

1130 Clarence M. Mitchell Jr. Building

College Park, MD 20742

IMPORTANT INFORMATION REGARDING PETITIONS:

● The petition below is based upon USM BOR VIII-2.70 Policy on Student Classification for Admission and Tuition Purposes

(“Policy”), which contains the requirements for establishing in-state classification and which is found at

https://www.usmd.edu/regents/bylaws/SectionVIII/VIII-2.70.pdf.

● This Petition must be completed by the Student.

● The petition submission deadline is the First day of classes for the semester/term for which you are seeking

in-state status.

● Read the petition carefully and complete ALL sections of the petition that apply to you. Petitions with incomplete applicable

sections, and petitions missing required supporting documentation will not be evaluated.

● If you cannot provide the required information, you must attach a separate sheet with an explanation or write your

explanation in the margins of the petition.

● Only one petition may be filed per semester/term.

● Petitions and requests for retroactive reclassification for tuition purposes are not granted.

● No materials or documentation will be returned after the petition is submitted.

● The review of the petition and an initial determination of the classification may take as long as six (6) weeks, not including

subsequent appeals. While petitions are under review, petitioners are required to make full tuition payment at the out-of-

state rate. If the University determines that the petitioner meets all of the requirements for in-state residency, the

petitioner’s classification will be changed and a refund or account credit will be issued as appropriate.

● If claiming financial dependence, the person upon whom the petitioner is dependent must sign the petition and have their

signature notarized. For your convenience there is a Notary Public at the Office of the Registrar. Please call ahead to

check for availability.

● Affidavits must be typed, dated, notarized, and contain information as specific as possible including dates, addresses,

amounts, etc.

● The petition refers to “the 12-month period prior to the last date to register for classes” which is defined as the twelve (12)

consecutive months immediately prior to and including the last date available to register for courses in the semester/term

for which the petitioner seeks in-state tuition classification.

Graduate Assistants who were admitted as out-of-state students are assessed tuition at the in-state rate only as a

benefit of their employment. All out-of-state graduate assistants who have met all residency requirements and wish

to change their classification to in-state must file a timely petition with the Residency Reclassification Services in

accordance with Policy requirements.

Revised 10/2022 Effective Winter 2023 Page | 2

University of Maryland – College Park

PETITION FOR CHANGE IN CLASSIFICATION FOR TUITION PURPOSES

DIRECTIONS: This petition is intended for use by students who seek a change in residency classification or by those whose

classification cannot be determined from the information submitted with the application for admission. Only one petition for change in

classification may be filed per semester. A petitioner is the student who wishes to have their residency classification changed. All

petitioners must complete Section 1 (Petitioner Information), Section 2 (Income, Support, and Expense Information of Petitioner),

Section 3 (Petitioner Residency Information), and Section 6 (Affirmation of Petitioner and Person Upon Whom Dependent). Petitioners

who claim financial dependence upon another person must have the person upon whom the petitioner is financially dependent complete

Section 4 (Residency Information for Person Upon Whom Petitioner is Financially Dependent) and Section 6 (Affirmation of Petitioner

and Person Upon Whom Dependent). Petitioners who raised the presumption that they are in the State of Maryland primarily for the

purpose of attending an educational institution and who wish to rebut this presumption will need to complete Section 5 (Rebuttal

Evidence) (see Section 5 for explanation). Provide documentation where required and supplement with documentation where

appropriate or helpful to your circumstances.

SECTION 1: PETITIONER INFORMATION (To be completed by Petitioner)

This section must be completed by the petitioner.

Program (Check one): Undergraduate Graduate/Professional

1) Are you currently registered? Yes No

2) Semester & Year Admitted: ______________

3) Current Class Status: Freshman Sophomore Junior Senior Graduate/Professional

4) Name: ______________________________________________ 5) University ID Number: ______________________

Last First MI

Address: _______________________________________________________ 6) Date of Birth (mm/dd/yyyy):__________________

Street

_________________________________________________ 7) Daytime/Cell Telephone: ____________________

City State Zip

8) University email address: _________________________________________

9) Semester/Term & Year of Petition (cannot be a past semester/year): ___________________

10) Have you filed a residency petition before? Yes No If Yes, indicate semester(s) and year(s): ________________

Revised 10/2022 Effective Winter 2023 Page | 3

SECTION 2: INCOME, SUPPORT, AND EXPENSE INFORMATION OF PETITIONER (To be completed by Petitioner)

This section must be completed by all petitioners. The documentation provided by the petitioner should evidence any employment and

earnings history through sources beyond those related to enrollment as a student in an educational institution, e.g., beyond support

provided by work study, scholarships, grants, stipends, aid, student loans, etc. The petitioner must list all employers for the past two (2)

years, with specific dates of employment.

1) Have you been employed within the past two years? Yes No

If Yes, list all employers (most recent first) for the past 2 years. Use a separate sheet if necessary.

Name of Employer

Address (City and State)

Dates of Employment

(month/year to month/year)

2) Income Tax Information: For the 12-month period prior to the last date to register for classes, including the most recent tax year,

did you file a state income tax return(s)? Yes No

If No, please attach an explanation.

If Yes, list the following information regarding state income taxes (if necessary, attach a supplemental sheet):

Income Tax Returns Tax Year(s) Filed for

State [indicate state(s)]: ___________ ________________

Attach:

• photocopies of your most recent paystub(s) from all employers listed, and

• signed and filed state income tax returns* with all attachments and W-2 forms or 1099(s) from all employers for

the tax year ending within the 12-month period prior to the last date to register for classes. (If you did not file

a Maryland state income tax return for that tax year, please attach an explanation. If you filed state income

tax returns in another state or more than one state, please attach all returns and an explanation.)

* For Maryland Income Tax returns, attach Maryland Comptroller’s certified copies of each Maryland tax return.

To obtain Maryland Comptroller’s certified copies, submit Form 129 to the Maryland Comptroller’s Office. Visit the

Maryland Comptroller’s Office web page to find Form 129)

3) Please check one:

I am financially independent. I provide 50% or more of my own living and educational expenses and I have not been

claimed as a dependent on another person's most recent income tax return.

I am financially dependent on another person who has claimed me as a dependent on their most recent income tax

returns. (Petitioners who claim financial dependence upon another person must have the person upon whom the

petitioner is financially dependent complete Section 4.)

Name of person upon whom you are dependent and relationship to you: ____________________________________

How long have you been dependent upon this person? _________________________________________________

Is the person a resident of Maryland? Yes No

Address of this person: ___________________________________________________________________________

I am not financially independent (I do not provide 50% or more of my own living and educational expenses),

but I have not been claimed as a dependent on another person’s most recent income tax returns, and I am not a ward

of the State of Maryland. (Petitioners who claim financial dependence upon another person must have the person

upon whom the petitioner is financially dependent complete Section 4.)

Name of person who provides you with financial support for more than 50% of your living and educational expenses,

and that person’s relationship to you: _______________________________________________________________

How long has this person been providing such financial support? _________________________________________

Is the person a resident of Maryland? Yes No

Address of this person: ___________________________________________________________________________

I am a ward of the State of Maryland. If a ward of the State of Maryland, please submit your court decree or

documentation from your social worker.

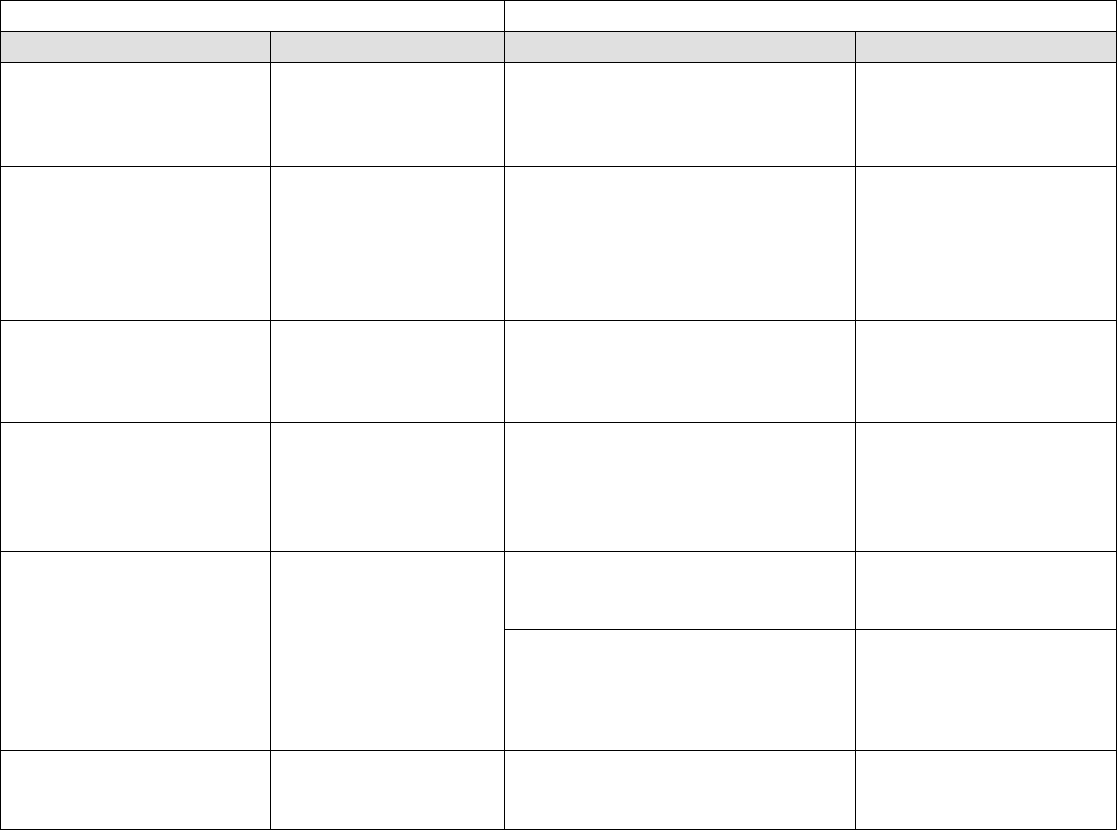

4) Complete the following chart below.

Revised 10/2022 Effective Winter 2023 Page | 4

Expense and Sources of Funds and other Financial Support

Information for Petitioner for the 12-Month Period Prior to Last Date to Register for Classes

Expenses

Sources of Funds and other Financial Support

Annual Amount

Annual Amount

Tuition and Fees

Income (including employment and

self-employment income)

• Attach paystub(s), W-2(s),

1099(s), and/or tax return(s)

Housing and Food (on-campus

or off-campus)

Contribution from another person (e.g.,

from family member or others, alimony,

child support)

• Attach statement(s) or

affidavit(s) evidencing source of

contribution.

Personal Expenses (e.g.,

Health Insurance and Medical

Expenses, Transportation,

Clothing)

Trust and/or Investment Funds

• Attach investment/portfolio

statement(s).

Books and Supplies (if

applicable)

Loans/Grants/Fellowships/Stipends/

Scholarships

• Attach your promissory note(s),

with disbursement dates listed,

for all loans.

Other

Savings and Checking Account Balances

• Attach your bank statement(s)

verifying these amounts.

Other

• Attach supporting

documentation.

TOTAL

TOTAL

Revised 10/2022 Effective Winter 2023 Page | 5

SECTION 3: PETITIONER RESIDENCY INFORMATION (To be completed by the Petitioner)

1) Have you ever lived outside the State of Maryland? Yes No

a. If Yes, did you move to Maryland primarily to attend an educational institution? Yes No

If No, attach a statement regarding the circumstances that brought you to the State of Maryland.

b. For the last 12 consecutive months, have you had the continuous intent to reside in Maryland indefinitely and for a

primary purpose other than that of attending an educational institution in Maryland? Yes No

2) a. Indicate name(s) and address(es) of high school(s) attended (if necessary, attach a supplemental sheet):

Name of High School: ____________________________________________________________________________________

Address: _______________________________________________________________________________________________

Street City State Zip

Dates Attended: From ____________ To ________________

2) b. If applicable, indicate name(s) and address(es) of all other previously attended higher education institution(s) (if necessary,

attach a supplemental sheet):

Name of Institution: _______________________________________________________________________________________

Address: _______________________________________________________________________________________________

Street City State Zip

Dates Attended: From ___________ To ________________

Were you assessed in-state or out-of-state tuition and fees while enrolled at that institution?

In-state Out-of-state Not Applicable

3) Did you occupy, own or rent living quarters in Maryland during the entire 12-month period prior to the last date to register for

classes? Yes No If No, please attach an explanation.

Attach, for the 12-month period prior to the last date to register for classes:

• a photocopy of deed(s) or lease agreement(s) (if your name does not appear on the deed or lease, then provide

a notarized statement from the deed or leaseholder specifying the address and dates of occupancy),

and

• if you provide a lease, also provide cancelled rent checks (front and back of checks) or evidence of payment

from your rental agent if cancelled rent checks are not available or applicable,

and

• a statement of your 12-month residence history.

List living quarters for the 12-month period prior to the last date to register for classes.

Address (Street Address, City and State)

Dates of Occupancy From (mm/dd/yyyy) To (mm/dd/yyyy)

4) Are all, or substantially all, of your personal property such as household effects, furniture, and pets in the State of Maryland?

Yes No If No, please attach an explanation.

5) Motor Vehicle Registration: Do you own/co-own or lease/co-lease or have you owned/co-owned or leased/co-leased any

vehicle(s) during the 12 months prior to the last date to register for classes? Yes No If Yes, complete the following

information (answer No if your name does not appear on the vehicle registration for the vehicle you use).

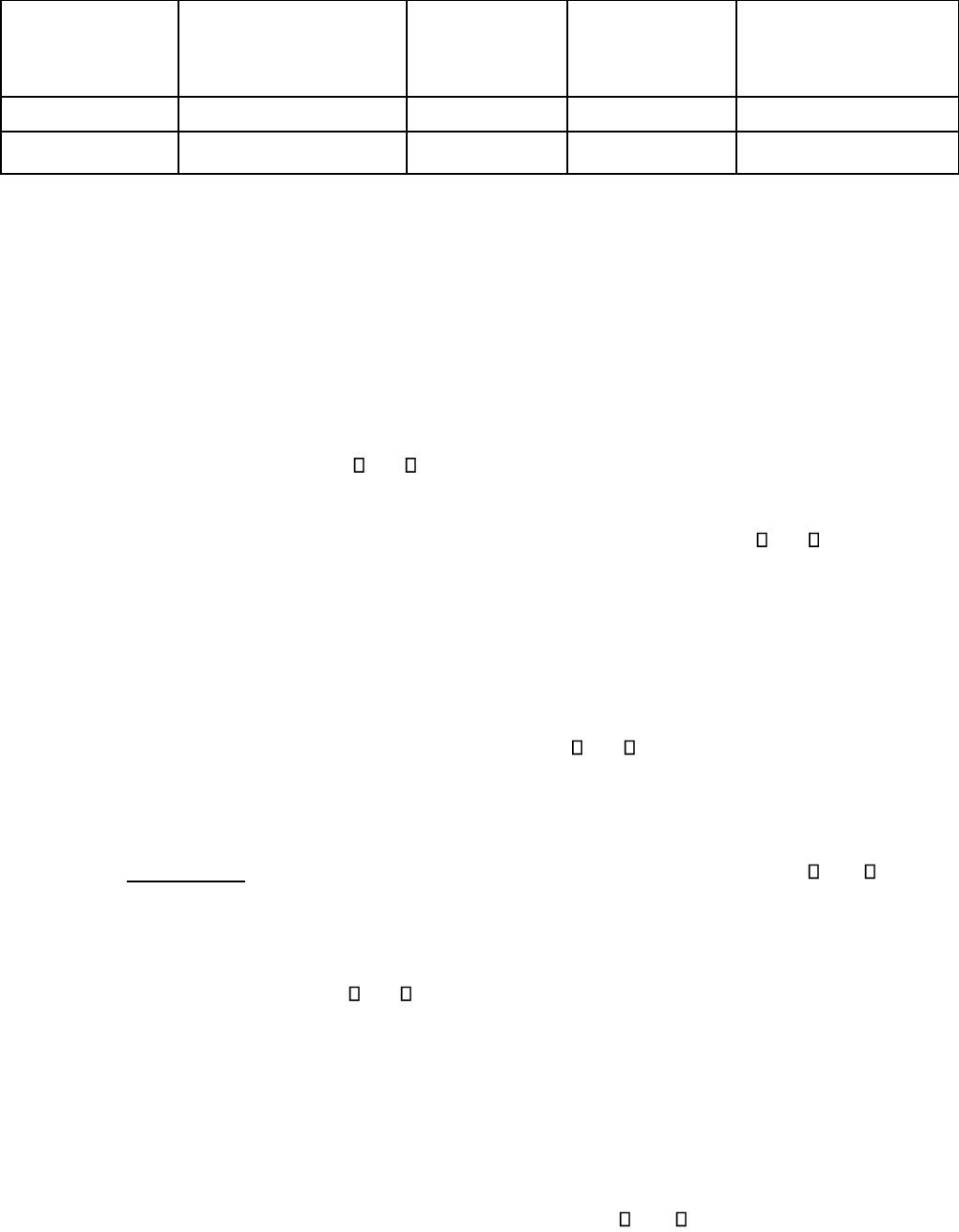

Revised 10/2022 Effective Winter 2023 Page | 6

Year, Vehicle Make

& Model

State(s) of Registration(s)

(For the 12-month period

prior to the last date to

register for classes)

Date(s) of Original

Registration &

Date(s) of

Renewal

Date of Vehicle

Purchase or Lease

Currently Owned or

Leased?

If not, date vehicle sold or

lease terminated

Attach:

• a photocopy of the current and previous registration(s) and title(s), or registration and lease agreement, of all

vehicles (if your current registration and title, or registration and lease agreement, were issued less than 12

months ago, provide a photocopy of previous registration(s) and title(s) of all vehicles listed),

and

• if vehicle was sold, provide a photocopy of the Bill of Sale,

and

• if the vehicle was purchased within the previous 12 consecutive months, provide a photocopy of Purchase

Order.

6) Motor Vehicle Operator’s License:

a) Do you possess a valid driver’s license? Yes No If Yes, in what state? ___________

b) If Maryland, what was the original date of issue? _______________

If you’ve renewed your license, what is the most recent date of issue (not expiration date): ________________

c) Have you possessed a driver’s license in a state other than Maryland within the last 12 months? Yes No

Attach:

• a photocopy of any driver’s license you currently possess,

and

• if issued or renewed during the 12-month period prior to the last date to register for classes, provide a

photocopy of previous license or an uncertified copy of your Maryland MVA driving record. Visit

https://mva.maryland.gov and search Uncertified Driving Record

7) Voter Registration

Are you currently or have been registered to vote in the last 12 months? Yes No

If Yes, in what state? ______________________

Attach:

• a photocopy of your most recent voter’s registration.

8) Do you receive NON-Maryland public assistance (i.e., housing assistance, Medicaid, or food vouchers)? Yes No

If Yes, attach a photocopy of source and type of assistance that covers the 12-month period prior to the last date to

register for classes.

9) Citizenship Status (Check all boxes that apply to fully detail your status during the applicable 12-month period)

a) Are you a citizen of the United States? Yes No (If No, complete b through g, as applicable).

If Yes, attach a photocopy of a document demonstrating current U.S. citizenship status that covers the 12-month

period prior to the last date to register for classes (e.g. copy of birth certificate or passport or naturalization

certificate) and skip to Section 4.

b) If not a U.S. citizen, what is your Country of Citizenship: __________________

c) If you have a Visa, what type? ____________________

• Attach a photocopy of visa for the 12-month period prior to the last date to register for classes.

d) If you do not have a Visa, are you a Permanent Resident of the U.S.? Yes No

• If yes, attach a copy of Permanent Resident Card (front and back) that covers the 12-month period prior to the

last date to register for classes.

Revised 10/2022 Effective Winter 2023 Page | 7

e) Are you an applicant for Permanent Residency and have filed the I-485 Application to Register Permanent Residence or

Adjust Status? Yes No

• If yes, attach a copy of I-485/I-797C document that covers the 12-month period prior to the last date to register

for classes.

f) Are you an applicant for Naturalization and have filed the N-400 Application for Naturalization? Yes No

• If yes, attach a copy of N-400 document that covers the 12-month period prior to the last date to register for

classes.

g) Other status (explain): _____________________________________________________________

• Attach a photocopy of current immigration documentation that covers the 12-month period prior to the last date

to register for classes.

SECTION 4: RESIDENCY INFORMATION FOR PERSON UPON WHOM PETITIONER IS FINANCIALLY DEPENDENT

(To be completed by the person who has financially supported or claimed the petitioner as a dependent on the most recent state income

tax return.)

1) Did you occupy, own or rent living quarters in Maryland for the 12-month period prior to the last date for the petitioner to

register for classes? Yes No If No, please attach an explanation.

List living quarters for the 12-month period prior to the last date to register for classes.

Address (Street Address, City and State)

Dates of Occupancy From (mm/dd/yyyy) To (mm/dd/yyyy)

Attach, for the 12-month period prior to the last date for the petitioner to register for classes:

• a photocopy of your deed(s) or lease agreement(s) (if your name does not appear on the deed or lease, then

provide a notarized statement from the deed or leaseholder specifying the address and dates of occupancy),

and

• if you provide a lease, also provide cancelled rent checks (front and back of checks) or evidence of payment

from your rental agent if cancelled rent checks are not available or applicable,

and

• a statement of your 12-month residence history.

2) Are all, or substantially all, of your personal property such as household effects, furniture, and pets in the State of Maryland?

Yes No If No, please attach an explanation.

3) Have you been employed within the past two years? Yes No

If Yes, list all employers (most recent first) for the past 2 years. Use a separate sheet if necessary.

Name of Employer

Address (City and State)

Dates of Employment

(month/year to month/year)

4) Will you claim or have you claimed the petitioner as your dependent on your state income tax returns for the tax year(s) during

the 12-month period prior to the last date for the petitioner to register for classes? Yes No

If No, please attach an explanation.

Attach:

Revised 10/2022 Effective Winter 2023 Page | 8

• photocopies of your most recent paystub(s) from all employers listed,

and

• signed and filed state income tax returns* with all attachments and W-2 forms or 1099(s) from all employers for

the tax year ending within the 12-month period prior to the last date to register for classes. (If you did not file

a Maryland state income tax return for that tax year, please attach an explanation. If you filed state income

tax returns in another state or more than one state, please attach all returns and an explanation.)

* For Maryland Income Tax returns, attach Maryland Comptroller’s certified copies of each Maryland tax return.

To obtain Maryland Comptroller’s certified copies, submit Form 129 to the Maryland Comptroller’s Office. Visit the

Maryland Comptroller’s Office web page to find Form 129)

SECTION 5: REBUTTAL EVIDENCE (To be completed by the Petitioner)

As provided in Section II.B of USM BOR VIII-2.70 Policy on Student Classification for Admission and Tuition Purposes, either of the following

circumstances raises a presumption that the student is residing in the State of Maryland primarily for the purpose of attending an educational

institution, and, therefore, does not qualify for in-state classification under the Policy:

• A student is attending school or living outside of Maryland at the time of application for admission to the USM institution; or

• A student is Financially Dependent on a person who is not a resident of Maryland. A Financially Dependent student is one who has

been claimed as a dependent on another person’s prior year tax returns or is a ward of the State of Maryland. A student will be

considered financially independent if the student provides 50% or more of his or her own living and educational expenses and has

not been claimed as a dependent on another person’s most recent tax returns.

If the information received by the institution has raised the presumption set forth above, the student bears the burden of rebutting the

presumption by presenting additional evidence of objectively verifiable conduct to rebut the presumption and show the requisite intent to

reside in Maryland indefinitely and for a primary purpose other than that of attending an educational institution in Maryland. Rebuttal evidence

of intent must be clear and convincing and will be evaluated not only by the amount presented but also based upon the reliability, authenticity,

credibility and relevance of the evidence and the totality of facts known to the institution. Evidence that does not document a period of at least

twelve (12) consecutive months immediately prior to and including the last date available to register for courses in the semester/term for

which the student seeks in-state tuition classification is generally considered an unfavorable factor under the Policy. The absence of objective,

relevant evidence is generally considered an unfavorable factor. A student's statement of intent to remain in Maryland in the future is

generally not considered to be objective evidence under the Policy.

For purposes of rebutting the presumption, additional evidence that will be considered includes, but is not limited to:

1) Source of financial support:

a. Maryland employment and earnings history through sources beyond those incident to enrollment as a student in an

educational institution (e.g., beyond support provided by work study, scholarships, grants, stipends, aid, student loans)

Tuition costs will be considered as a student expense only to the extent tuition exceeds the amount of any educational

scholarships, grants, student loans, etc., or

b. Evidence the student is Financially Dependent, for the previous 12 months, upon a person who is a resident of Maryland.

2) Substantial participation as a member of a professional, social, community, civic, political, athletic or religious organization in

Maryland, including professionally related school activities that demonstrate a commitment to the student's community or to the

State of Maryland.

• Attach signed statement(s) on letterhead from the professional, social, community, civic, political, athletic, or

religious organizations showing the activity and applicable dates.

3) Registration as a Maryland resident with the Selective Service, if applicable.

• Attach a copy of Selective Service registration.

4) Evidence that the student is married to a Maryland resident.

• Attach a copy of marriage certificate.

5) Evidence that the student attended schools in Maryland for grades K‐12.

• Attach a copy of transcripts with years of attendance.

Revised 10/2022 Effective Winter 2023 Page | 9

6) Evidence showing the student uses his or her Maryland address as his or her sole address of record for all purposes including on

health and auto insurance records, bank accounts, tax records, loan and scholarship records, school records, military records,

leases, etc.

• Attach evidence of your sole address of record for all purposes (including on health and auto insurance records,

bank accounts, tax records, loan and scholarship records, school records, military records, leases, etc.).

7) An affidavit from a person unrelated to the student that provides objective, relevant evidence of a student's conduct demonstrating

the student's intent to reside in Maryland primarily for a purpose other than that of attending an educational institution in Maryland.

• Attach notarized affidavit(s) from a person(s) unrelated to you that provides objective, relevant evidence of your

conduct demonstrating your intent to live permanently in Maryland.

8) Evidence of life and employment changes that caused the student to relocate to Maryland for reasons other than primarily

educational purposes (e.g., divorce, family relocation, taking care of a sick family member)

9) Attach evidence of life and employment changes (e.g., employment offer letter) and other documentation supporting the life

changes.

SECTION 6: AFFIRMATION OF PETITIONER AND PERSON UPON WHOM DEPENDENT (To be completed by the petitioner and/or

person upon whom the petitioner is financially dependent.)

I affirm that I have read USM BOR VIII-2.70 Policy on Student Classification for Admission and Tuition Purposes, which contains the

requirements for establishing in-state classification and which is found at https://www.usmd.edu/regents/bylaws/SectionVIII/VIII-

2.70.pdf.

I hereby swear and affirm that all information provided in this petition is accurate and complete, and that all documents attached hereto

are true and unaltered copies of the original documents requested. I understand that failure to include all requested documents will

render this petition invalid. If false or misleading information is submitted, the University may, at its discretion, revoke in-state

classification and take disciplinary action, including suspension or expulsion. I agree to notify the University, in writing, within fifteen (15)

days of any change of circumstances that may alter my eligibility for in-state classification.

Signature of Petitioner (notary not required) Date

Signature of person upon whom Petitioner is financially dependent Date

(Signature must be Notarized) (Petition will not be accepted without notarized signature.)

Sworn to and subscribed before me _________________________this day of _______________________ ________________

___________________________________________________________ My commission expires: _______________________

Signature of Notary Public Date

Attachments: Please be advised the University will be unable to accept your petition for in-state classification if photocopies of the

documents are not provided with your petition. Petitions not having the required documentation will not be evaluated.

Office of the Registrar

Residency Reclassification Services

Room 1130, Clarence Mitchell Building

College Park, MD 20742

TEL: 301.314.9596 | Fax: 301.314.7915

RESIDENCY RECLASSIFICATION PETITION STUDENT CHECKLIST

Petitioner Name: UID:

Print Clearly

Your petition will ONLY be accepted if accompanied by ALL supporting documents for the prior 12

consecutive months. The checklist provided below is designed as an aid and is not a substitute for the

requirements stated in the Petition. Additional documentation should be accompanied with the petition as

directed.

All Petitioners:

_ Are you registered for classes during the term for which you are petitioning?

_ Signed and completed Petition form, including all documents for Expense and Support Information chart. (The petition will not be

accepted if incomplete or without a signature.)

_ Copy of Maryland Comptroller’s Certified state income tax return* and documentation of all sources of income for the

last tax year. Include the following documents of income sources, if applicable:

W-2 forms totaling amount claimed on return for all individuals filing the return (only provide if a non-MD tax

return was filed)

1099 forms (only provide if a non-MD tax return was filed)

Most recent pay stubs showing a year-to-date income total for all individuals filing the return (If receiving

direct deposit, contact employer.)

Unemployment/Public Assistance Notice (if applicable)

Written statement/explanation why you did not file state income taxes (if applicable)

*Maryland Comptroller’s Certified Return (for tax returns filed in Maryland) is required at the time of petition

submission. Remove all Social Security Numbers, Employee Identification Numbers, and bank account numbers.

____ Did you select the correct petitioner type in Section 2, Question 3 (financial independent/financial dependent) on

the petition? Petitioners cannot select that they are financially independent if: their most recent certified tax return

is filed as a dependent taxpayer OR they were claimed as a dependent on another person’s most recent filed tax

return AND a certified return filed as an independent tax payer AND/OR a filed tax return that they are not

claimed as a dependent, is available at the time the petition is submitted. Petitioners must complete the petition

according to their tax filing status (Dependent or Independent) based on the most recent return filed.

____ If you filed state income tax returns in more one state, attach copies of all non- Maryland state returns (if applicable).

_

Statement/explanation (not to exceed one typed page) regarding the circumstances that brought you to the state of Maryland

and include your reasoning for seeking reclassification. Statement is required with petition.

Verificatio

n of living quarters covering the prior 12 consecutive months for the semester for which you are petitioning based on the

following:

2

Please visit http://registrar.umd.edu/resreclass.html for additional information regarding Residency Reclassificaiton

Updated 12/16/22

Copy of a deed or settlement papers showing property home ownership.* OR

Copy of lease agreement(s). The signed lease must include your name, address of residence, and term of

lease agreement.* AND proof of rental payments. (E.g. copies of electronic processed checks (front and

back), copies of money order receipts, copies of electronic bank statements with rental payments highlighted,

or printouts of rental transactions (ledger) from your rental agency with your name included.)

*Note: If you are not the deed holder, or if your name does not appear on the lease agreement, you will

need to submit the following along with the deed/lease:

A signed, notarized letter from the deed or lease holder you pay rent to or with whom you reside. The letter

must be dated and include: the address of the residence, the time period that you have resided with them, the

amount of rent paid, how the rental payments were made (check, cash, or money order), if rental payments are

current, and your relationship (e.g. landlord, family member) with the deed or lease holder. If the person with

whom you are residing with is the leaseholder, they will also need to provide verification of their rental

payments AND proof of rental payments of lease holder and petitioner. (E.g. copies of electronic processed

checks (front and back), copies of money order receipts, copies of electronic bank statements with rental

payments highlighted, or printouts of rental transactions (ledger) from the rental agency with your name

included).

If you did not occupy living quarters in Maryland during the entire 12 month period prior to the last day to register for

classes, please provide a statement to explain why. (if applicable).

_ If all of your personal property is not in the State of Maryland, please provide a written statement to explain the circumstances and

attach to the petition. (if applicable)

_ Copy of vehicle registration(s) and title(s) of all vehicles, if owned by the petitioner for the 12 month period prior to the last date to

register for classes.

If your current vehicle registration has been valid for less than the 12 months, please provide:

Copy of your previous registration and title (if unavailable, contact the

Department of Motor Vehicles for the state previously registered)

Purchase Order or applicable documentation proving acquisition of the vehicle (if vehicle was purchased less than 12 months

ago

_ Copy of driver’s license for the prior 12 month period prior to the last date to register for classes, if licensed to drive. If your current

driver’s license has been valid for less than 12 consecutive months, please provide:

Copy of your previous driver’s license OR

Copy of your Maryland driving record from the MVA (http://www.mva.maryland.gov/drivers/driving-record-

information)

_

Copy of voter registration card OR information printed from the Maryland Board of Elections

website (http://www.elections.state.md.us/voter_registration/).

3

Please visit http://registrar.umd.edu/resreclass.html for additional information regarding Residency Reclassificaiton

Updated 12/16/22

For Permanent Residents only, a copy of Permanent Resident Card

(front and back) valid for 12 consecutive months for

the semester in which you are petitioning. If current Permanent Resident Card is valid for less than 12 months, please

provide the previously issued Permanent Resident Card or a copy of immigration documentation such as I-485 or I-797 (if

applicable)

For visa holders only, provide a copy of your visa for the prior 12 consecutive months (if

applicable)

_

Copies of rebuttal evidence as listed on Section 5

of the Residency Petition.

If petitioner is a U.S. citizen, copy of birth certificate OR U.S. passport OR naturalization certificate

4

Please visit http://registrar.umd.edu/resreclass.html for additional information regarding Residency Reclassificaiton

Updated 12/16/22

Dependent Petitioners: In addition to the items listed for All Petitioners, provide the following for the person whom you are

dependent upon. (Financial dependency is defined as a student who has been claimed as a dependent on another person’s prior year tax

returns.)

_ Signed and notarized signature on the submitted completed petition of the person whom the petitioner is dependent upon.

(The Petition will not be accepted without a notarized signature.)

_ Verification of living quarters covering the prior 12 consecutive months for the semester for which you are petitioning.

Copy of a deed or settlement papers showing property home ownership.* OR

Copy of lease agreement(s). The signed lease must include your name, address of residence, and term of

lease agreement.* AND proof of rental payments. (E.g. copies of electronic processed checks (front and

back), copies of money order receipts, copies of electronic bank statements with rental payments highlighted,

or printouts of rental transactions (ledger) from your rental agency with your name included.)

*Note: If you are not the deed holder, or if your name does not appear on the lease agreement, you will

need to submit the following along with the deed/lease:

A signed, notarized letter from the deed or lease holder you pay rent to or with whom you reside. The letter

must be dated and include: the address of the residence, the time period that you have resided with them, the

amount of rent paid, how the rental payments were made (check, cash, or money order), if rental payments are

current, and your relationship (e.g. landlord, family member) with the deed or lease holder. If the person with

whom you are residing with is the leaseholder, they will also need to provide verification of their rental

payments AND proof of rental payments of lease holder and petitioner. (E.g. copies of electronic processed

checks (front and back), copies of money order receipts, copies of electronic bank statements with rental

payments highlighted, or printouts of rental transactions (ledger) from the rental agency with your name

included).

If you did not occupy living quarters in Maryland during the entire 12 month period prior to the last day to register for

classes, please provide a written statement to explain the circumstances and attach to the petition. (if applicable).

_ If all of your personal property is not in the State of Maryland, please provide a written statement to explain the circumstances and

attach to the petition. (if applicable).

_ Copy of Maryland Comptroller’s Certified state income tax return* and documentation of all sources of income for the

last tax year. Include the following documents of income sources, if applicable:

W-2 forms totaling amount claimed on return for all individuals filing the return (only provide if a non-MD tax

return was filed)

1099 forms (only provide if a non-MD tax return was filed)

Most recent pay stubs showing a year-to-date income total for all individuals filing the return (If receiving

direct deposit, contact employer.)

Unemployment/Public Assistance Notice (if applicable)

Written statement/explanation why you did not file state income taxes (if applicable).

5

Please visit http://registrar.umd.edu/resreclass.html for additional information regarding Residency Reclassificaiton

Updated 12/16/22

*Maryland Comptroller’s Certified Return (for tax returns filed in Maryland) is required at the time of petition

submission. Remove all Social Security Numbers, Employee Identification Numbers, and bank account numbers.

_ If you did not claim the petitioner as your dependent on your state income tax returns for the tax year(s)

during the 12 month period to the last date for the petitioner to register for classes, please attach a written

explanation to the petition. (if applicable).

Petitioners cannot select that they are financially independent if: their most recent certified tax return is filed as a

dependent taxpayer OR they were claimed as a dependent on another person’s most recent filed tax return AND a

certified return filed as an independent tax payer AND/OR a filed tax return that they are not claimed as a

dependent, is available at the time the petition is submitted. Petitioners must complete the petition according to their

tax filing status (Dependent or Independent) based on the most recent return filed.

Notes for additional items needed: