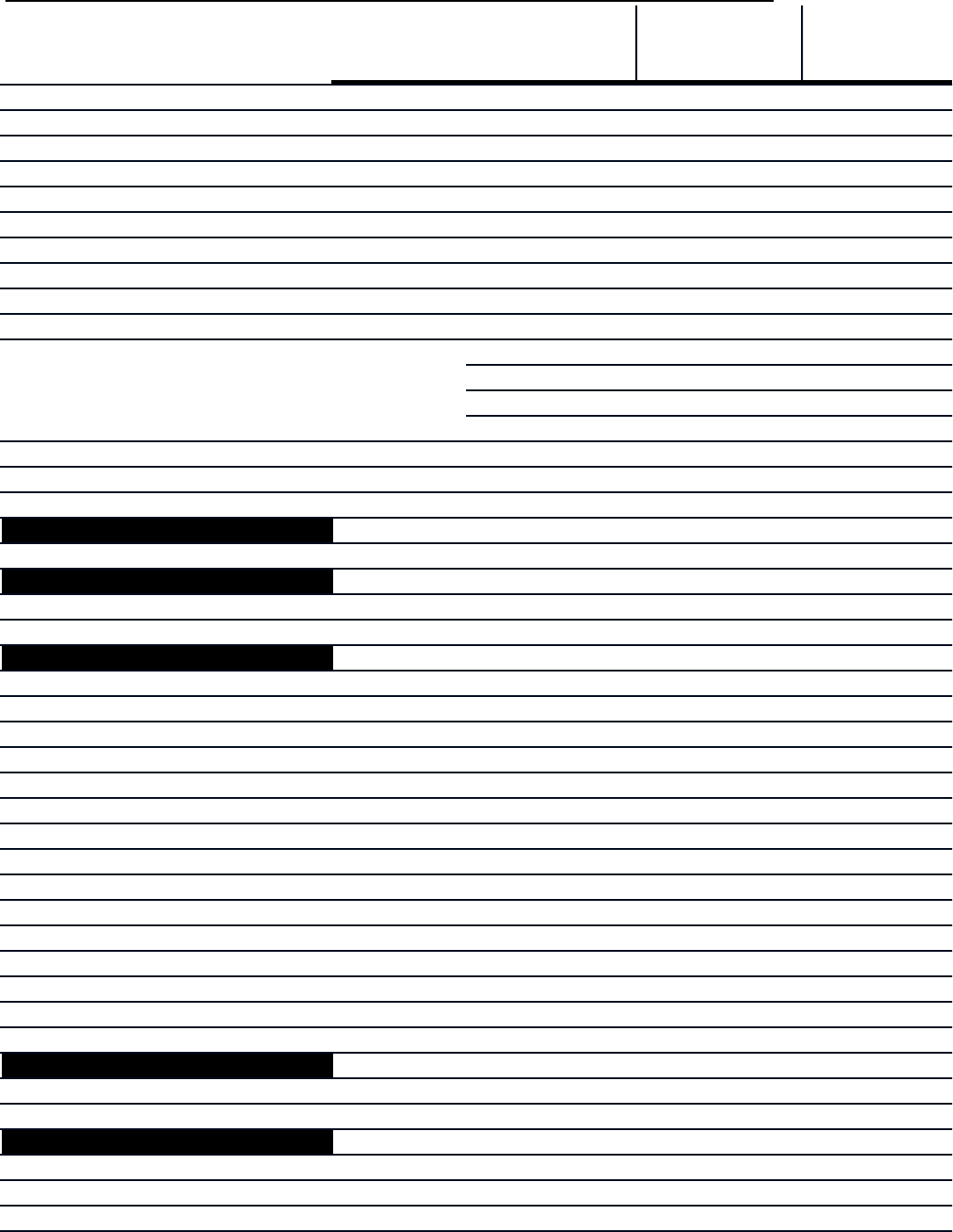

California City Documentary and Property Transfer Tax Rates

Governance: Per $1000 Rev&Tax Code Per $1000

General Law PropertyValue Sec 11911-11929 PropertyValue

or Chartered Cit

y

Rate Count

y

Rate Total

ALAMEDA COUNTY $ 1.10 $ 1.10

ALAMEDA Chartered $ 12.00 $ 1.10 $ 13.10

ALBANY Chartered $ 15.00 $ 1.10 $ 16.10

BERKELEY Chartered

1.5% for up to

$1.5M value

$ 1.10 $ 16.10

2.5% properties

over $2.5M

$ 1.10 $ 26.10

DUBLIN General Law $ 0.55 $ 0.55 $ 1.10

EMERYVILLE Chartered $ 12.00 $ 1.10 $ 13.10

FREMONT General Law $ 0.55 $ 0.55 $ 1.10

HAYWARD Chartered $ 8.50 $ 1.10 $ 9.60

LIVERMORE General Law $ 0.55 $ 0.55 $ 1.10

NEWARK General Law $ 0.55 $ 0.55 $ 1.10

OAKLAND Chartered 1% up to $300k $ 1.10 $ 11.10

1.5% $300k-$2M $ 1.10 $ 16.10

1.75% $2M–$5M $ 1.10 $ 18.60

2.5% over $5M $ 1.10 $ 26.10

PIEDMONT Chartered $ 13.00 $ 1.10 $ 14.10

PLEASANTON General Law $ 0.55 $ 0.55 $ 1.10

SAN LEANDRO Chartered $ 11.00 $ 1.10 $ 12.10

UNION CITY General Law $ 0.55 $ 0.55 $ 1.10

ALPINE COUNTY $ 1.10 $ 1.10

AMADOR COUNTY $ 1.10 $ 1.10

AMADOR General Law $ 0.55 $ 0.55 $ 1.10

IONE General Law $ 0.55 $ 0.55 $ 1.10

JACKSON General Law $ 0.55 $ 0.55 $ 1.10

PLYMOUTH General Law $ 0.55 $ 0.55 $ 1.10

SUTTER CREEK General Law $ 0.55 $ 0.55 $ 1.10

BUTTE COUNTY $ 1.10 $ 1.10

BIGGS General Law $ 0.55 $ 0.55 $ 1.10

CHICO Chartered $ 0.55 $ 0.55 $ 1.10

GRIDLEY General Law $ 0.55 $ 0.55 $ 1.10

OROVILLE Chartered $ 0.55 $ 0.55 $ 1.10

PARADISE General Law $ 0.55 $ 0.55 $ 1.10

CALAVERAS COUNTY $ 1.10 $ 1.10

ANGELS CAMP General Law $ 0.55 $ 0.55 $ 1.10

COLUSA COUNTY $ 1.10 $ 1.10

COLUSA General Law $ 0.55 $ 0.55 $ 1.10

WILLIAMS General Law $ 0.55 $ 0.55 $ 1.10

CONTRA COSTA COUNTY $ 1.10 $ 1.10

ANTIOCH General Law $ 0.55 $ 0.55 $ 1.10

BRENTWOOD General Law $ 0.55 $ 0.55 $ 1.10

CLAYTON General Law $ 0.55 $ 0.55 $ 1.10

CONCORD General Law $ 0.55 $ 0.55 $ 1.10

DANVILLE General Law $ 0.55 $ 0.55 $ 1.10

mjgc rev22March2022

Calif ornia Ci tyFinance.com

page 1 of 13

California City Documentary and Property Transfer Tax Rates

Governance: Per $1000 Rev&Tax Code Per $1000

General Law PropertyValue Sec 11911-11929 PropertyValue

or Chartered Cit

y

Rate Count

y

Rate Total

EL CERRITO Chartered $ 12.00 $ 1.10 $ 13.10

HERCULES General Law $ 0.55 $ 0.55 $ 1.10

LAFAYETTE General Law $ 0.55 $ 0.55 $ 1.10

MARTINEZ General Law $ 0.55 $ 0.55 $ 1.10

MORAGA General Law $ 0.55 $ 0.55 $ 1.10

OAKLEY General Law $ 0.55 $ 0.55 $ 1.10

ORINDA General Law $ 0.55 $ 0.55 $ 1.10

PINOLE General Law $ 0.55 $ 0.55 $ 1.10

PITTSBURG General Law $ 0.55 $ 0.55 $ 1.10

PLEASANT HILL General Law $ 0.55 $ 0.55 $ 1.10

RICHMOND Chartered

0.7% under $1M

$ 1.10 $ 8.10

1.25% $1M-$3M

$ 1.10 $ 13.60

2.5% $3M-$10M

$ 1.10 $ 26.10

3% ov er $10m

$ 1.10 $ 31.10

SAN PABLO General Law $ 0.55 $ 0.55 $ 1.10

SAN RAMON Chartered $ 0.55 $ 0.55 $ 1.10

WALNUT CREEK General Law $ 0.55 $ 0.55 $ 1.10

DEL NORTE COUNTY $ 1.10 $ 1.10

CRESCENT CITY General Law $ 0.55 $ 0.55 $ 1.10

EL DORADO COUNTY $ 1.10 $ 1.10

PLACERVILLE General Law $ 0.55 $ 0.55 $ 1.10

SOUTH LAKE TAHOE General Law $ 0.55 $ 0.55 $ 1.10

FRESNO COUNTY $ 1.10 $ 1.10

CLOVIS General Law $ 0.55 $ 0.55 $ 1.10

COALINGA General Law $ 0.55 $ 0.55 $ 1.10

FIREBAUGH General Law $ 0.55 $ 0.55 $ 1.10

FOWLER General Law $ 0.55 $ 0.55 $ 1.10

FRESNO Chartered $ 0.55 $ 0.55 $ 1.10

HURON General Law $ 0.55 $ 0.55 $ 1.10

KERMAN General Law $ 0.55 $ 0.55 $ 1.10

KINGSBURG Chartered $ 0.55 $ 0.55 $ 1.10

MENDOTA General Law $ 0.55 $ 0.55 $ 1.10

ORANGE COVE General Law $ 0.55 $ 0.55 $ 1.10

PARLIER General Law $ 0.55 $ 0.55 $ 1.10

REEDLEY General Law $ 0.55 $ 0.55 $ 1.10

SANGER General Law $ 0.55 $ 0.55 $ 1.10

SAN JOAQUIN General Law $ 0.55 $ 0.55 $ 1.10

SELMA General Law $ 0.55 $ 0.55 $ 1.10

GLENN COUNTY $ 1.10 $ 1.10

ORLAND General Law $ 0.55 $ 0.55 $ 1.10

WILLOWS General Law $ 0.55 $ 0.55 $ 1.10

HUMBOLDT COUNTY $ 1.10 $ 1.10

ARCATA General Law $ 0.55 $ 0.55 $ 1.10

BLUE LAKE General Law $ 0.55 $ 0.55 $ 1.10

EUREKA Chartered $ 0.55 $ 0.55 $ 1.10

mjgc rev22March2022

Calif ornia Ci tyFinance.com

page 2 of 13

California City Documentary and Property Transfer Tax Rates

Governance: Per $1000 Rev&Tax Code Per $1000

General Law PropertyValue Sec 11911-11929 PropertyValue

or Chartered Cit

y

Rate Count

y

Rate Total

FERNDALE General Law $ 0.55 $ 0.55 $ 1.10

FORTUNA Chartered $ 0.55 $ 0.55 $ 1.10

RIO DELL General Law $ 0.55 $ 0.55 $ 1.10

TRINIDAD General Law $ 0.55 $ 0.55 $ 1.10

IMPERIAL COUNTY $ 1.10 $ 1.10

BRAWLEY General Law $ 0.55 $ 0.55 $ 1.10

CALEXICO General Law $ 0.55 $ 0.55 $ 1.10

CALIPATRIA General Law $ 0.55 $ 0.55 $ 1.10

EL CENTRO Chartered $ 0.55 $ 0.55 $ 1.10

HOLTVILLE General Law $ 0.55 $ 0.55 $ 1.10

IMPERIAL General Law $ 0.55 $ 0.55 $ 1.10

WESTMORLAND General Law $ 0.55 $ 0.55 $ 1.10

INYO COUNTY $ 1.10 $ 1.10

BISHOP General Law $ 0.55 $ 0.55 $ 1.10

KERN COUNTY $ 1.10 $ 1.10

ARVIN General Law $ 0.55 $ 0.55 $ 1.10

BAKERSFIELD Chartered $ 0.55 $ 0.55 $ 1.10

CALIFORNIA CITY General Law $ 0.55 $ 0.55 $ 1.10

DELANO General Law $ 0.55 $ 0.55 $ 1.10

MARICOPA General Law $ 0.55 $ 0.55 $ 1.10

MCFARLAND General Law $ 0.55 $ 0.55 $ 1.10

RIDGECREST General Law $ 0.55 $ 0.55 $ 1.10

SHAFTER Chartered $ 0.55 $ 0.55 $ 1.10

TAFT General Law $ 0.55 $ 0.55 $ 1.10

TEHACHAPI General Law $ 0.55 $ 0.55 $ 1.10

WASCO General Law $ 0.55 $ 0.55 $ 1.10

KINGS COUNTY $ 1.10 $ 1.10

AVENAL General Law $ 0.55 $ 0.55 $ 1.10

CORCORAN General Law $ 0.55 $ 0.55 $ 1.10

HANFORD General Law $ 0.55 $ 0.55 $ 1.10

LEMOORE Chartered $ 0.55 $ 0.55 $ 1.10

LAKE COUNTY $ 1.10 $ 1.10

CLEARLAKE General Law $ 0.55 $ 0.55 $ 1.10

LAKEPORT General Law $ 0.55 $ 0.55 $ 1.10

LASSEN COUNTY $ 1.10 $ 1.10

SUSANVILLE General Law $ 0.55 $ 0.55 $ 1.10

LOS ANGELES COUNTY $ 1.10 $ 1.10

AGOURA HILLS General Law $ 0.55 $ 0.55 $ 1.10

ALHAMBRA Chartered $ 0.55 $ 0.55 $ 1.10

ARCADIA Chartered $ 0.55 $ 0.55 $ 1.10

ARTESIA General Law $ 0.55 $ 0.55 $ 1.10

AVALON General Law $ 0.55 $ 0.55 $ 1.10

AZUSA General Law $ 0.55 $ 0.55 $ 1.10

BALDWIN PARK General Law $ 0.55 $ 0.55 $ 1.10

BELL Chartered $ 0.55 $ 0.55 $ 1.10

mjgc rev22March2022

Calif ornia Ci tyFinance.com

page 3 of 13

California City Documentary and Property Transfer Tax Rates

Governance: Per $1000 Rev&Tax Code Per $1000

General Law PropertyValue Sec 11911-11929 PropertyValue

or Chartered Cit

y

Rate Count

y

Rate Total

BELLFLOWER General Law $ 0.55 $ 0.55 $ 1.10

BELL GARDENS General Law $ 0.55 $ 0.55 $ 1.10

BEVERLY HILLS General Law $ 0.55 $ 0.55 $ 1.10

BRADBURY General Law $ 0.55 $ 0.55 $ 1.10

BURBANK Chartered $ 0.55 $ 0.55 $ 1.10

CALABASAS General Law $ 0.55 $ 0.55 $ 1.10

CARSON General Law $ 0.55 $ 0.55 $ 1.10

CERRITOS Chartered $ 0.55 $ 0.55 $ 1.10

CLAREMONT General Law $ 0.55 $ 0.55 $ 1.10

COMMERCE General Law $ 0.55 $ 0.55 $ 1.10

COMPTON Chartered $ 0.55 $ 0.55 $ 1.10

COVINA General Law $ 0.55 $ 0.55 $ 1.10

CUDAHY General Law $ 0.55 $ 0.55 $ 1.10

CULVER CITY Chartered

<$1.5m AV: 0.45%

$ 1.10 $ 5.60

$2M-$3M: 1.95%

$ 1.10 $ 20.60

$3M-$10M: 3.45%

$ 1.10 $ 35.60

=<$10M: 4.45%

$ 1.10 $ 45.60

DIAMOND BAR General Law $ 0.55 $ 0.55 $ 1.10

DOWNEY Chartered $ 0.55 $ 0.55 $ 1.10

DUARTE General Law $ 0.55 $ 0.55 $ 1.10

EL MONTE General Law $ 0.55 $ 0.55 $ 1.10

EL SEGUNDO General Law $ 0.55 $ 0.55 $ 1.10

GARDENA General Law $ 0.55 $ 0.55 $ 1.10

GLENDALE Chartered $ 0.55 $ 0.55 $ 1.10

GLENDORA General Law $ 0.55 $ 0.55 $ 1.10

HAWAIIAN GARDENS General Law $ 0.55 $ 0.55 $ 1.10

HAWTHORNE General Law $ 0.55 $ 0.55 $ 1.10

HERMOSA BEACH General Law $ 0.55 $ 0.55 $ 1.10

HIDDEN HILLS General Law $ 0.55 $ 0.55 $ 1.10

HUNT INGTON PARK General Law $ 0.55 $ 0.55 $ 1.10

INDUST RY Chartered $ 0.55 $ 0.55 $ 1.10

INGLEWOOD Chartered $ 0.55 $ 0.55 $ 1.10

IRWINDALE Chartered $ 0.55 $ 0.55 $ 1.10

LA CANADA FLINTRIDGE General Law $ 0.55 $ 0.55 $ 1.10

LA HABRA HEIGHTS General Law $ 0.55 $ 0.55 $ 1.10

LAKEWOOD General Law $ 0.55 $ 0.55 $ 1.10

LA MIRADA General Law $ 0.55 $ 0.55 $ 1.10

LANCASTER Chartered $ 0.55 $ 0.55 $ 1.10

LA PUENTE General Law $ 0.55 $ 0.55 $ 1.10

LA VERNE General Law $ 0.55 $ 0.55 $ 1.10

LAWNDALE General Law $ 0.55 $ 0.55 $ 1.10

LOMITA General Law $ 0.55 $ 0.55 $ 1.10

LONG BEACH Chartered $ 0.55 $ 0.55 $ 1.10

LOS ANGELES Chartered $ 4.50 $ 1.10 $ 5.60

LYNWOOD General Law $ 0.55 $ 0.55 $ 1.10

mjgc rev22March2022

Calif ornia Ci tyFinance.com

page 4 of 13

California City Documentary and Property Transfer Tax Rates

Governance: Per $1000 Rev&Tax Code Per $1000

General Law PropertyValue Sec 11911-11929 PropertyValue

or Chartered Cit

y

Rate Count

y

Rate Total

MALIBU General Law $ 0.55 $ 0.55 $ 1.10

MANHATTAN BEACH General Law $ 0.55 $ 0.55 $ 1.10

MAYWOOD General Law $ 0.55 $ 0.55 $ 1.10

MONROVIA General Law $ 0.55 $ 0.55 $ 1.10

MONTEBELLO General Law $ 0.55 $ 0.55 $ 1.10

MONTEREY PARK General Law $ 0.55 $ 0.55 $ 1.10

NORWALK General Law $ 0.55 $ 0.55 $ 1.10

PALMDALE Chartered $ 0.55 $ 0.55 $ 1.10

PALOS VERDES ESTATES General Law $ 0.55 $ 0.55 $ 1.10

PARAMOUNT General Law $ 0.55 $ 0.55 $ 1.10

PASADENA Chartered $ 0.55 $ 0.55 $ 1.10

PICO RIVERA General Law $ 0.55 $ 0.55 $ 1.10

POMONA Chartered $ 2.20 $ 1.10 $ 3.30

RANCHO PALOS VERDES General Law $ 0.55 $ 0.55 $ 1.10

REDONDO BEACH Chartered $ 2.20 $ 1.10 $ 3.30

ROLLING HILLS General Law $ 0.55 $ 0.55 $ 1.10

ROLLING HILLS ESTATES General Law $ 0.55 $ 0.55 $ 1.10

ROSEMEAD General Law $ 0.55 $ 0.55 $ 1.10

SAN DIMAS General Law $ 0.55 $ 0.55 $ 1.10

SAN FERNANDO General Law $ 0.55 $ 0.55 $ 1.10

SAN GABRIEL General Law $ 0.55 $ 0.55 $ 1.10

SAN MARINO General Law $ 0.55 $ 0.55 $ 1.10

SANTA CLARITA General Law $ 0.55 $ 0.55 $ 1.10

SANTA FE SPRINGS General Law $ 0.55 $ 0.55 $ 1.10

SANTA MONICA Chartered <$5m AV: $3.00 $ 1.10 $ 4.10

$5m+ AV: $6.00 $ 1.10 $ 7.10

SIERRA MADRE General Law $ 0.55 $ 0.55 $ 1.10

SIGNAL HILL Chartered $ 0.55 $ 0.55 $ 1.10

SOUTH EL MONTE General Law $ 0.55 $ 0.55 $ 1.10

SOUTH GATE General Law $ 0.55 $ 0.55 $ 1.10

SOUTH PASADENA General Law $ 0.55 $ 0.55 $ 1.10

TEMPLE CITY Chartered $ 0.55 $ 0.55 $ 1.10

TORRANCE Chartered $ 0.55 $ 0.55 $ 1.10

VERNON Chartered $ 0.55 $ 0.55 $ 1.10

WALNUT General Law $ 0.55 $ 0.55 $ 1.10

WEST COVINA General Law $ 0.55 $ 0.55 $ 1.10

WEST HOLLYWOOD General Law $ 0.55 $ 0.55 $ 1.10

WESTLAKE VILLAGE General Law $ 0.55 $ 0.55 $ 1.10

WHITTIER Chartered $ 0.55 $ 0.55 $ 1.10

MADERA COUNTY $ 1.10 $ 1.10

CHOWCHILLA General Law $ 0.55 $ 0.55 $ 1.10

MADERA General Law $ 0.55 $ 0.55 $ 1.10

MARIN COUNTY $ 1.10 $ 1.10

BELVEDERE General Law $ 0.55 $ 0.55 $ 1.10

CORTE MADERA General Law $ 0.55 $ 0.55 $ 1.10

mjgc rev22March2022

Calif ornia Ci tyFinance.com

page 5 of 13

California City Documentary and Property Transfer Tax Rates

Governance: Per $1000 Rev&Tax Code Per $1000

General Law PropertyValue Sec 11911-11929 PropertyValue

or Chartered Cit

y

Rate Count

y

Rate Total

FAIRFAX General Law $ 0.55 $ 0.55 $ 1.10

LARKSPUR General Law $ 0.55 $ 0.55 $ 1.10

MILL VALLEY General Law $ 0.55 $ 0.55 $ 1.10

NOVATO General Law $ 0.55 $ 0.55 $ 1.10

ROSS General Law $ 0.55 $ 0.55 $ 1.10

SAN ANSELMO General Law $ 0.55 $ 0.55 $ 1.10

SAN RAFAEL Chartered $ 2.00 $ 1.10 $ 3.10

SAUSALITO General Law $ 0.55 $ 0.55 $ 1.10

TIBURON General Law $ 0.55 $ 0.55 $ 1.10

MARIPOSA COUNTY $ 1.10 $ 1.10

MENDOCINO COUNTY $ 1.10 $ 1.10

FORT BRAGG General Law $ 0.55 $ 0.55 $ 1.10

POINT ARENA General Law $ 0.55 $ 0.55 $ 1.10

UKIAH General Law $ 0.55 $ 0.55 $ 1.10

WILLITS General Law $ 0.55 $ 0.55 $ 1.10

MERCED COUNTY $ 1.10 $ 1.10

ATWATER General Law $ 0.55 $ 0.55 $ 1.10

DOS PALOS General Law $ 0.55 $ 0.55 $ 1.10

GUSTINE General Law $ 0.55 $ 0.55 $ 1.10

LIVINGSTON General Law $ 0.55 $ 0.55 $ 1.10

LOS BANOS General Law $ 0.55 $ 0.55 $ 1.10

MERCED Chartered $ 0.55 $ 0.55 $ 1.10

MODOC COUNTY $ 1.10 $ 1.10

ALTURAS General Law $ 0.55 $ 0.55 $ 1.10

MONO COUNTY $ 1.10 $ 1.10

MAMMOTH LAKES General Law $ 0.55 $ 0.55 $ 1.10

MONTEREY COUNTY $ 1.10 $ 1.10

CARMEL-BY-THE-SEA General Law $ 0.55 $ 0.55 $ 1.10

DEL REY OAKS General Law $ 0.55 $ 0.55 $ 1.10

GONZALES General Law $ 0.55 $ 0.55 $ 1.10

GREENFIELD General Law $ 0.55 $ 0.55 $ 1.10

KING CITY Chartered $ 0.55 $ 0.55 $ 1.10

MARINA Chartered $ 0.55 $ 0.55 $ 1.10

MONTEREY Chartered $ 0.55 $ 0.55 $ 1.10

PACIFIC GROVE Chartered $ 0.55 $ 0.55 $ 1.10

SALINAS Chartered $ 0.55 $ 0.55 $ 1.10

SAND CITY Chartered $ 0.55 $ 0.55 $ 1.10

SEASIDE General Law $ 0.55 $ 0.55 $ 1.10

SOLEDAD General Law $ 0.55 $ 0.55 $ 1.10

NAPA COUNTY $ 1.10 $ 1.10

AMERICAN CANYON General Law $ 0.55 $ 0.55 $ 1.10

CALISTOGA General Law $ 0.55 $ 0.55 $ 1.10

NAPA Chartered $ 0.55 $ 0.55 $ 1.10

SAINT HELENA General Law $ 0.55 $ 0.55 $ 1.10

YOUNTVILLE General Law $ 0.55 $ 0.55 $ 1.10

mjgc rev22March2022

Calif ornia Ci tyFinance.com

page 6 of 13

California City Documentary and Property Transfer Tax Rates

Governance: Per $1000 Rev&Tax Code Per $1000

General Law PropertyValue Sec 11911-11929 PropertyValue

or Chartered Cit

y

Rate Count

y

Rate Total

NEVADA COUNTY $ 1.10 $ 1.10

GRASS VALLEY Chartered $ 0.55 $ 0.55 $ 1.10

NEVADA CITY General Law $ 0.55 $ 0.55 $ 1.10

TRUCKEE Chartered $ 0.55 $ 0.55 $ 1.10

ORANGE COUNTY $ 1.10 $ 1.10

ALISO VIEJO General Law $ 0.55 $ 0.55 $ 1.10

ANAHEIM Chartered $ 0.55 $ 0.55 $ 1.10

BREA General Law $ 0.55 $ 0.55 $ 1.10

BUENA PARK Chartered $ 0.55 $ 0.55 $ 1.10

COSTA MESA General Law $ 0.55 $ 0.55 $ 1.10

CYPRESS Chartered $ 0.55 $ 0.55 $ 1.10

DANA POINT General Law $ 0.55 $ 0.55 $ 1.10

FOUNTAIN VALLEY General Law $ 0.55 $ 0.55 $ 1.10

FULLERTON General Law $ 0.55 $ 0.55 $ 1.10

GARDEN GROVE General Law $ 0.55 $ 0.55 $ 1.10

HUNT INGTON BEACH Chartered $ 0.55 $ 0.55 $ 1.10

IRVINE Chartered $ 0.55 $ 0.55 $ 1.10

LAGUNA BEACH General Law $ 0.55 $ 0.55 $ 1.10

LAGUNA HILLS General Law $ 0.55 $ 0.55 $ 1.10

LAGUNA NIGUEL General Law $ 0.55 $ 0.55 $ 1.10

LA HABRA General Law $ 0.55 $ 0.55 $ 1.10

LAKE FOREST General Law $ 0.55 $ 0.55 $ 1.10

LA PALMA General Law $ 0.55 $ 0.55 $ 1.10

LOS ALAMITOS Chartered $ 0.55 $ 0.55 $ 1.10

MISSION VIEJO General Law $ 0.55 $ 0.55 $ 1.10

NEWPORT BEACH Chartered $ 0.55 $ 0.55 $ 1.10

ORANGE General Law $ 0.55 $ 0.55 $ 1.10

PLACENTIA Chartered $ 0.55 $ 0.55 $ 1.10

RANCHO SANTA MARGARITA General Law $ 0.55 $ 0.55 $ 1.10

SAN CLEMENTE General Law $ 0.55 $ 0.55 $ 1.10

SAN JUAN CAPISTRANO General Law $ 0.55 $ 0.55 $ 1.10

SANTA ANA Chartered $ 0.55 $ 0.55 $ 1.10

SEAL BEACH Chartered $ 0.55 $ 0.55 $ 1.10

STANTON General Law $ 0.55 $ 0.55 $ 1.10

TUSTIN General Law $ 0.55 $ 0.55 $ 1.10

VILLA PARK General Law $ 0.55 $ 0.55 $ 1.10

WESTMINSTER General Law $ 0.55 $ 0.55 $ 1.10

YORBA LINDA General Law $ 0.55 $ 0.55 $ 1.10

PLACER COUNTY $ 1.10 $ 1.10

AUBURN General Law $ 0.55 $ 0.55 $ 1.10

COLFAX General Law $ 0.55 $ 0.55 $ 1.10

LINCOLN General Law $ 0.55 $ 0.55 $ 1.10

LOOMIS General Law $ 0.55 $ 0.55 $ 1.10

ROCKLIN General Law $ 0.55 $ 0.55 $ 1.10

ROSEVILLE Chartered $ 0.55 $ 0.55 $ 1.10

mjgc rev22March2022

Calif ornia Ci tyFinance.com

page 7 of 13

California City Documentary and Property Transfer Tax Rates

Governance: Per $1000 Rev&Tax Code Per $1000

General Law PropertyValue Sec 11911-11929 PropertyValue

or Chartered Cit

y

Rate Count

y

Rate Total

PLUMAS COUNTY $ 1.10 $ 1.10

PORTOLA General Law $ 0.55 $ 0.55 $ 1.10

RIVERSIDE COUNTY $ 1.10 $ 1.10

BANNING General Law $ 0.55 $ 0.55 $ 1.10

BEAUMONT General Law $ 0.55 $ 0.55 $ 1.10

BLYTHE General Law $ 0.55 $ 0.55 $ 1.10

CALIMESA General Law $ 0.55 $ 0.55 $ 1.10

CANYON LAKE General Law $ 0.55 $ 0.55 $ 1.10

CATHEDRAL CITY General Law $ 0.55 $ 0.55 $ 1.10

COACHELLA General Law $ 0.55 $ 0.55 $ 1.10

CORONA General Law $ 0.55 $ 0.55 $ 1.10

DESERT HOT SPRINGS Chartered $ 0.55 $ 0.55 $ 1.10

EASTVALE General Law $ 0.55 $ 0.55 $ 1.10

HEMET General Law $ 0.55 $ 0.55 $ 1.10

INDIAN WELLS Chartered $ 0.55 $ 0.55 $ 1.10

INDIO General Law $ 0.55 $ 0.55 $ 1.10

JURUPA VALLEY General Law $ 0.55 $ 0.55 $ 1.10

LAKE ELSINORE General Law $ 0.55 $ 0.55 $ 1.10

LA QUINTA Chartered $ 0.55 $ 0.55 $ 1.10

MENIFEE General Law $ 0.55 $ 0.55 $ 1.10

MORENO VALLEY General Law $ 0.55 $ 0.55 $ 1.10

MURRIETA General Law $ 0.55 $ 0.55 $ 1.10

NORCO Chartered $ 0.55 $ 0.55 $ 1.10

PALM DESERT Chartered $ 0.55 $ 0.55 $ 1.10

PALM SPRINGS Chartered $ 0.55 $ 0.55 $ 1.10

PERRIS General Law $ 0.55 $ 0.55 $ 1.10

RANCHO MIRAGE Chartered $ 0.55 $ 0.55 $ 1.10

RIVERSIDE Chartered $ 1.10 $ 1.10 $ 2.20

SAN JACINTO General Law $ 0.55 $ 0.55 $ 1.10

TEMECULA General Law $ 0.55 $ 0.55 $ 1.10

WILDOMAR General Law $ 0.55 $ 0.55 $ 1.10

SACRAMENTO COUNTY $ 1.10 $ 1.10

CITRUS HEIGHTS General Law $ 0.55 $ 0.55 $ 1.10

ELK GROVE General Law $ 0.55 $ 0.55 $ 1.10

FOLSOM Chartered $ 0.55 $ 0.55 $ 1.10

GALT General Law $ 0.55 $ 0.55 $ 1.10

ISLETON General Law $ 0.55 $ 0.55 $ 1.10

RANCHO CORDOVA General Law $ 0.55 $ 0.55 $ 1.10

SACRAMENTO Chartered $ 2.75 $ 1.10 $ 3.85

SAN BENITO COUNTY $ 1.10 $ 1.10

HOLLISTER General Law $ 0.55 $ 0.55 $ 1.10

SAN JUAN BAUTISTA General Law $ 0.55 $ 0.55 $ 1.10

SAN BERNARDINO COUNTY $ 1.10 $ 1.10

ADELANTO Chartered $ 0.55 $ 0.55 $ 1.10

APPLE VALLEY General Law $ 0.55 $ 0.55 $ 1.10

mjgc rev22March2022

Calif ornia Ci tyFinance.com

page 8 of 13

California City Documentary and Property Transfer Tax Rates

Governance: Per $1000 Rev&Tax Code Per $1000

General Law PropertyValue Sec 11911-11929 PropertyValue

or Chartered Cit

y

Rate Count

y

Rate Total

BARSTOW General Law $ 0.55 $ 0.55 $ 1.10

BIG BEAR LAKE Chartered $ 0.55 $ 0.55 $ 1.10

CHINO General Law $ 0.55 $ 0.55 $ 1.10

CHINO HILLS General Law $ 0.55 $ 0.55 $ 1.10

COLTON General Law $ 0.55 $ 0.55 $ 1.10

FONTANA General Law $ 0.55 $ 0.55 $ 1.10

GRAND TERRACE General Law $ 0.55 $ 0.55 $ 1.10

HESPERIA General Law $ 0.55 $ 0.55 $ 1.10

HIGHLAND General Law $ 0.55 $ 0.55 $ 1.10

LOMA LINDA Chartered $ 0.55 $ 0.55 $ 1.10

MONTCLAIR General Law $ 0.55 $ 0.55 $ 1.10

NEEDLES Chartered $ 0.55 $ 0.55 $ 1.10

ONTARIO General Law $ 0.55 $ 0.55 $ 1.10

RANCHO CUCAMONGA General Law $ 0.55 $ 0.55 $ 1.10

REDLANDS General Law $ 0.55 $ 0.55 $ 1.10

RIALTO General Law $ 0.55 $ 0.55 $ 1.10

SAN BERNARDINO Chartered $ 0.55 $ 0.55 $ 1.10

TWENTYNINE PALMS General Law $ 0.55 $ 0.55 $ 1.10

LAGUNA WOODS General Law $ 0.55 $ 0.55 $ 1.10

UPLAND General Law $ 0.55 $ 0.55 $ 1.10

VICTORVILLE Chartered $ 0.55 $ 0.55 $ 1.10

YUCAIPA General Law $ 0.55 $ 0.55 $ 1.10

YUCCA VALLEY General Law $ 0.55 $ 0.55 $ 1.10

SAN DIEGO COUNTY $ 1.10 $ 1.10

CARLSBAD Chartered $ 0.55 $ 0.55 $ 1.10

CHULA VIST A Chartered $ 0.55 $ 0.55 $ 1.10

CORONADO General Law $ 0.55 $ 0.55 $ 1.10

DEL MAR Chartered $ 0.55 $ 0.55 $ 1.10

EL CAJON Chartered $ 0.55 $ 0.55 $ 1.10

ENCINITAS General Law $ 0.55 $ 0.55 $ 1.10

ESCONDIDO General Law $ 0.55 $ 0.55 $ 1.10

IMPERIAL BEACH General Law $ 0.55 $ 0.55 $ 1.10

LA MESA General Law $ 0.55 $ 0.55 $ 1.10

LEMON GROVE General Law $ 0.55 $ 0.55 $ 1.10

NATIONAL CITY General Law $ 0.55 $ 0.55 $ 1.10

OCEANSIDE Chartered $ 0.55 $ 0.55 $ 1.10

POWAY General Law $ 0.55 $ 0.55 $ 1.10

SAN DIEGO Chartered $ 0.55 $ 0.55 $ 1.10

SAN MARCOS Chartered $ 0.55 $ 0.55 $ 1.10

SANTEE Chartered $ 0.55 $ 0.55 $ 1.10

SOLANA BEACH General Law $ 0.55 $ 0.55 $ 1.10

VISTA Chartered $ 0.55 $ 0.55 $ 1.10

SAN FRANCISCO COUNTY

SAN FRANCISCO Chartered

Over $100,000 AV => 0.5%, Over $250,000 AV => 0.68%

Over $1 million AV => 0.75%, Over $5 million AV => 2.25%

Over $10 million AV => 5.50%, over $25 million => 6.00%

Discounts for certain solar & seismic improvments.

mjgc rev22March2022

Calif ornia Ci tyFinance.com

page 9 of 13

California City Documentary and Property Transfer Tax Rates

Governance: Per $1000 Rev&Tax Code Per $1000

General Law PropertyValue Sec 11911-11929 PropertyValue

or Chartered Cit

y

Rate Count

y

Rate Total

SAN JOAQUIN COUNTY $ 1.10 $ 1.10

ESCALON General Law $ 0.55 $ 0.55 $ 1.10

LATHROP General Law $ 0.55 $ 0.55 $ 1.10

LODI General Law $ 0.55 $ 0.55 $ 1.10

MANTECA General Law $ 0.55 $ 0.55 $ 1.10

RIPON General Law $ 0.55 $ 0.55 $ 1.10

STOCKTON Chartered $ 0.55 $ 0.55 $ 1.10

TRACY General Law $ 0.55 $ 0.55 $ 1.10

SAN LUIS OBISPO COUNTY $ 1.10 $ 1.10

ARROYO GRANDE General Law $ 0.55 $ 0.55 $ 1.10

ATASCADERO General Law $ 0.55 $ 0.55 $ 1.10

EL PASO DE ROBLES General Law $ 0.55 $ 0.55 $ 1.10

GROVER BEACH General Law $ 0.55 $ 0.55 $ 1.10

MORRO BAY General Law $ 0.55 $ 0.55 $ 1.10

PISMO BEACH General Law $ 0.55 $ 0.55 $ 1.10

SAN LUIS OBISPO Chartered $ 0.55 $ 0.55 $ 1.10

SAN MATEO COUNTY $ 1.10 $ 1.10

ATHERTON General Law $ 0.55 $ 0.55 $ 1.10

BELMONT General Law $ 0.55 $ 0.55 $ 1.10

BRISBANE General Law $ 0.55 $ 0.55 $ 1.10

BURLINGAME General Law $ 0.55 $ 0.55 $ 1.10

COLMA General Law $ 0.55 $ 0.55 $ 1.10

DALY CITY General Law $ 0.55 $ 0.55 $ 1.10

EAST PALO ALTO General Law $ 0.55 $ 0.55 $ 1.10

FOSTER CITY General Law $ 0.55 $ 0.55 $ 1.10

HALF MOON BAY General Law $ 0.55 $ 0.55 $ 1.10

HILLSBOROUGH General Law $ 0.55 $ 0.55 $ 1.10

MENLO PARK General Law $ 0.55 $ 0.55 $ 1.10

MILLBRAE General Law $ 0.55 $ 0.55 $ 1.10

PACIFICA General Law $ 0.55 $ 0.55 $ 1.10

PORTOLA VALLEY General Law $ 0.55 $ 0.55 $ 1.10

REDWOOD CITY Chartered $ 0.55 $ 0.55 $ 1.10

SAN BRUNO General Law $ 0.55 $ 0.55 $ 1.10

SAN CARLOS General Law $ 0.55 $ 0.55 $ 1.10

SAN MATEO Chartered 0.5% of value $ 1.10 $ 6.10

SOUTH SAN FRANCISCO General Law $ 0.55 $ 0.55 $ 1.10

WOODSIDE General Law $ 0.55 $ 0.55 $ 1.10

SANTA BARBARA COUNTY $ 1.10 $ 1.10

BUELLTON General Law $ 0.55 $ 0.55 $ 1.10

CARPINTERIA General Law $ 0.55 $ 0.55 $ 1.10

GOLETA General Law $ 0.55 $ 0.55 $ 1.10

GUADALUPE General Law $ 0.55 $ 0.55 $ 1.10

LOMPOC General Law $ 0.55 $ 0.55 $ 1.10

SANTA BARBARA Chartered $ 0.55 $ 0.55 $ 1.10

SANTA MARIA Chartered $ 0.55 $ 0.55 $ 1.10

mjgc rev22March2022

Calif ornia Ci tyFinance.com

page 10 of 13

California City Documentary and Property Transfer Tax Rates

Governance: Per $1000 Rev&Tax Code Per $1000

General Law PropertyValue Sec 11911-11929 PropertyValue

or Chartered Cit

y

Rate Count

y

Rate Total

SOLVANG Chartered $ 0.55 $ 0.55 $ 1.10

SANTA CLARA COUNTY $ 1.10 $ 1.10

CAMPBELL General Law $ 0.55 $ 0.55 $ 1.10

CUPERTINO General Law $ 0.55 $ 0.55 $ 1.10

GILROY Chartered $ 0.55 $ 0.55 $ 1.10

LOS ALTOS General Law $ 0.55 $ 0.55 $ 1.10

LOS ALTOS HILLS General Law $ 0.55 $ 0.55 $ 1.10

LOS GATOS General Law $ 0.55 $ 0.55 $ 1.10

MILPITAS General Law $ 0.55 $ 0.55 $ 1.10

MONTE SERENO General Law $ 0.55 $ 0.55 $ 1.10

MORGAN HILL General Law $ 0.55 $ 0.55 $ 1.10

MOUNTAIN VIEW Chartered $ 3.30 $ 1.10 $ 4.40

PALO ALTO Chartered $ 3.30 $ 1.10 $ 4.40

SAN JOSE Chartered

$2m AV: $3.30

$ 1.10 $ 4.40

$2M-$5M: $3.30+0.75%

$ 1.10 $ 11.90

$5M-$10M: $3.30+1.0%

$ 1.10 $ 14.40

ov er $10m: $3.30+1.5%

$ 1.10 $ 19.40

SANTA CLARA Chartered $ 0.55 $ 0.55 $ 1.10

SARATOGA General Law $ 0.55 $ 0.55 $ 1.10

SUNNYVALE Chartered $ 0.55 $ 0.55 $ 1.10

SANTA CRUZ COUNTY $ 1.10 $ 1.10

CAPITOLA General Law $ 0.55 $ 0.55 $ 1.10

SANTA CRUZ Chartered $ 0.55 $ 0.55 $ 1.10

SCOTTS VALLEY General Law $ 0.55 $ 0.55 $ 1.10

WATSONVILLE Chartered $ 0.55 $ 0.55 $ 1.10

SHASTA COUNTY $ 1.10 $ 1.10

ANDERSON General Law $ 0.55 $ 0.55 $ 1.10

REDDING General Law $ 0.55 $ 0.55 $ 1.10

SHASTA LAKE General Law $ 0.55 $ 0.55 $ 1.10

SIERRA COUNTY $ 1.10 $ 1.10

LOYALTON General Law $ 0.55 $ 0.55 $ 1.10

SISKIYOU COUNTY $ 1.10 $ 1.10

DORRIS General Law $ 0.55 $ 0.55 $ 1.10

DUNSMUIR General Law $ 0.55 $ 0.55 $ 1.10

ETNA General Law $ 0.55 $ 0.55 $ 1.10

FORT JONES General Law $ 0.55 $ 0.55 $ 1.10

MONTAGUE General Law $ 0.55 $ 0.55 $ 1.10

MOUNT SHASTA General Law $ 0.55 $ 0.55 $ 1.10

TULELAKE General Law $ 0.55 $ 0.55 $ 1.10

WEED General Law $ 0.55 $ 0.55 $ 1.10

YREKA General Law $ 0.55 $ 0.55 $ 1.10

SOLANO COUNTY $ 1.10 $ 1.10

BENICIA General Law $ 0.55 $ 0.55 $ 1.10

DIXON General Law $ 0.55 $ 0.55 $ 1.10

FAIRFIELD General Law $ 0.55 $ 0.55 $ 1.10

mjgc rev22March2022

Calif ornia Ci tyFinance.com

page 11 of 13

California City Documentary and Property Transfer Tax Rates

Governance: Per $1000 Rev&Tax Code Per $1000

General Law PropertyValue Sec 11911-11929 PropertyValue

or Chartered Cit

y

Rate Count

y

Rate Total

RIO VISTA General Law $ 0.55 $ 0.55 $ 1.10

SUISUN CITY General Law $ 0.55 $ 0.55 $ 1.10

VACAVILLE General Law $ 0.55 $ 0.55 $ 1.10

VALLEJO Chartered $ 3.30 $ 1.10 $ 4.40

SONOMA COUNTY $ 1.10 $ 1.10

CLOVERDALE General Law $ 0.55 $ 0.55 $ 1.10

COTATI General Law $ 0.55 $ 0.55 $ 1.10

HEALDSBURG General Law $ 0.55 $ 0.55 $ 1.10

PETALUMA Chartered $ 2.00 $ 1.10 $ 3.10

ROHNERT PARK General Law $ 0.55 $ 0.55 $ 1.10

SANTA ROSA Chartered $ 2.00 $ 1.10 $ 3.10

SEBASTOPOL General Law $ 0.55 $ 0.55 $ 1.10

SONOMA General Law $ 0.55 $ 0.55 $ 1.10

WINDSOR General Law $ 0.55 $ 0.55 $ 1.10

STANISLAUS COUNTY $ 1.10 $ 1.10

CERES General Law $ 0.55 $ 0.55 $ 1.10

HUGHSON General Law $ 0.55 $ 0.55 $ 1.10

MODESTO Chartered $ 0.55 $ 0.55 $ 1.10

NEWMAN General Law $ 0.55 $ 0.55 $ 1.10

OAKDALE General Law $ 0.55 $ 0.55 $ 1.10

PATTERSON General Law $ 0.55 $ 0.55 $ 1.10

RIVERBANK General Law $ 0.55 $ 0.55 $ 1.10

TURLOCK General Law $ 0.55 $ 0.55 $ 1.10

WATERFORD General Law $ 0.55 $ 0.55 $ 1.10

SUTTER COUNTY $ 1.10 $ 1.10

LIVE OAK General Law $ 0.55 $ 0.55 $ 1.10

YUBA CITY General Law $ 0.55 $ 0.55 $ 1.10

TEHAMA COUNTY $ 1.10 $ 1.10

CORNING General Law $ 0.55 $ 0.55 $ 1.10

RED BLUFF General Law $ 0.55 $ 0.55 $ 1.10

TEHAMA General Law $ 0.55 $ 0.55 $ 1.10

TRINITY COUNTY $ 1.10 $ 1.10

TULARE COUNTY $ 1.10 $ 1.10

DINUBA Chartered $ 0.55 $ 0.55 $ 1.10

EXETER Chartered $ 0.55 $ 0.55 $ 1.10

FARMERSVILLE General Law $ 0.55 $ 0.55 $ 1.10

LINDSAY Chartered $ 0.55 $ 0.55 $ 1.10

PORTERVILLE Chartered $ 0.55 $ 0.55 $ 1.10

TULARE Chartered $ 0.55 $ 0.55 $ 1.10

VISALIA Chartered $ 0.55 $ 0.55 $ 1.10

WOODLAKE Chartered $ 0.55 $ 0.55 $ 1.10

TUOLUMNE COUNTY $ 1.10 $ 1.10

SONORA General Law $ 0.55 $ 0.55 $ 1.10

VENTURA COUNTY $ 1.10 $ 1.10

CAMARILLO General Law $ 0.55 $ 0.55 $ 1.10

mjgc rev22March2022

Calif ornia Ci tyFinance.com

page 12 of 13

California City Documentary and Property Transfer Tax Rates

Governance: Per $1000 Rev&Tax Code Per $1000

General Law PropertyValue Sec 11911-11929 PropertyValue

or Chartered Cit

y

Rate Count

y

Rate Total

FILLMORE General Law $ 0.55 $ 0.55 $ 1.10

MOORPARK General Law $ 0.55 $ 0.55 $ 1.10

OJAI General Law $ 0.55 $ 0.55 $ 1.10

OXNARD General Law $ 0.55 $ 0.55 $ 1.10

PORT HUENEME Chartered $ 0.55 $ 0.55 $ 1.10

SAN BUENAVENTURA Chartered $ 0.55 $ 0.55 $ 1.10

SANTA PAULA General Law $ 0.55 $ 0.55 $ 1.10

SIMI VALLEY General Law $ 0.55 $ 0.55 $ 1.10

THOUSAND OAKS General Law $ 0.55 $ 0.55 $ 1.10

YOLO COUNTY $ 1.10 $ 1.10

DAVIS General Law $ 0.55 $ 0.55 $ 1.10

WEST SACRAMENTO General Law $ 0.55 $ 0.55 $ 1.10

WINTERS General Law $ 0.55 $ 0.55 $ 1.10

WOODLAND General Law $ 0.55 $ 0.55 $ 1.10

YUBA COUNTY $ 1.10 $ 1.10

MARYSVILLE Chartered $ 0.55 $ 0.55 $ 1.10

WHEATLAND General Law $ 0.55 $ 0.55 $ 1.10

Source: CaliforniaCit

y

Finance.com

mjgc rev22March2022

Calif ornia Ci tyFinance.com

page 13 of 13