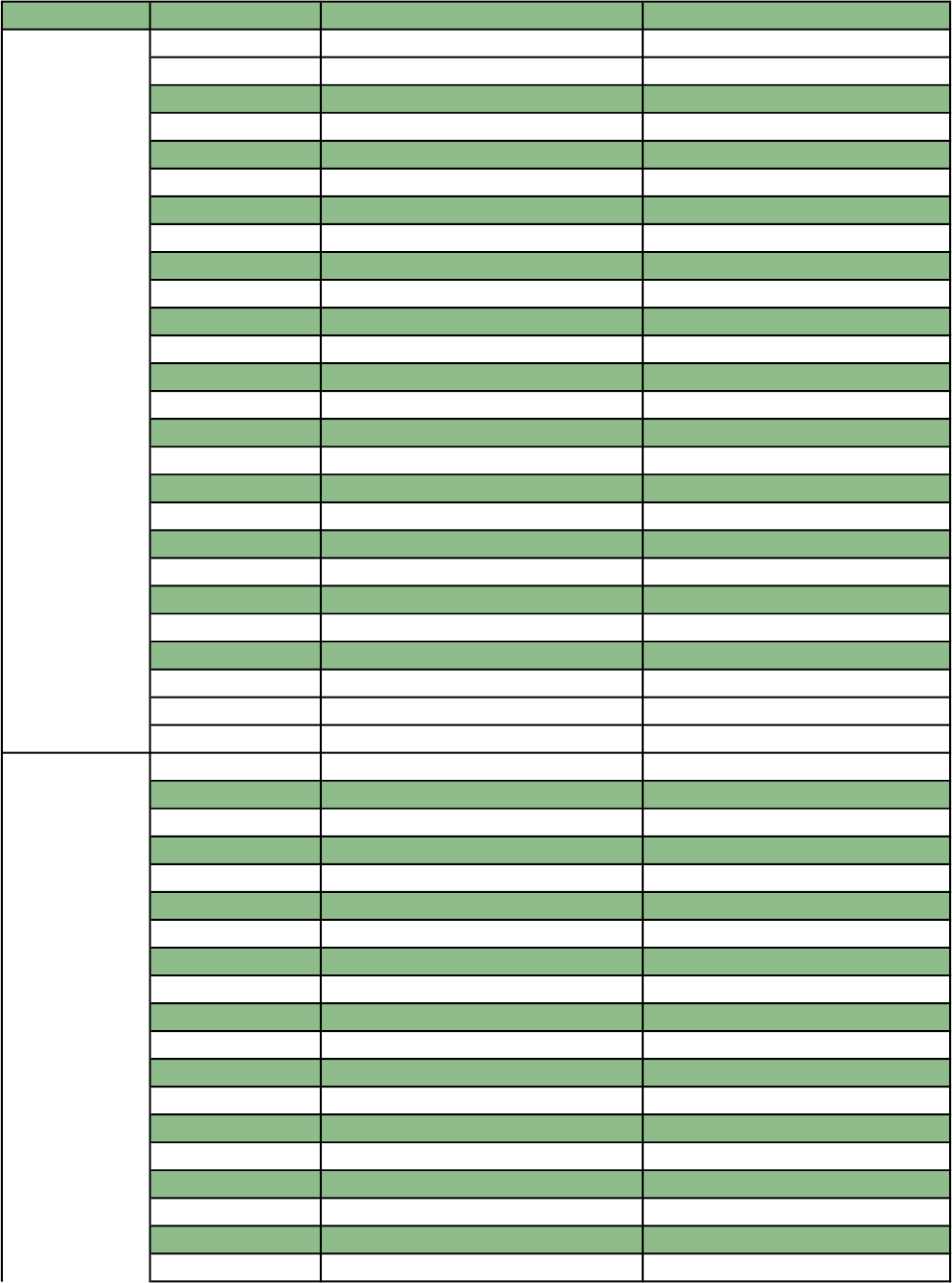

District Code District Name Average Tax Bill

ATLANTIC COUNTY

01 ABSECON CITY $5,679

02 ATLANTIC CITY $4,369

03 BRIGANTINE CITY $7,050

04 BUENA BORO $5,834

05 BUENA VISTA TWP $6,062

06 CORBIN CITY $4,087

07 EGG HARBOR CITY $6,513

08 EGG HARBOR TWP $7,053

09 ESTELL MANOR CITY $5,199

10 FOLSOM BORO $4,402

11 GALLOWAY TWP $5,590

12 HAMILTON TWP $5,608

13 HAMMONTON TOWN $6,044

14 LINWOOD CITY $11,145

15 LONGPORT BORO $12,496

16 MARGATE CITY $9,373

17 MULLICA TWP $6,552

18 NORTHFIELD CITY $7,734

19 PLEASANTVILLE CITY $5,182

20 PORT REPUBLIC CITY $7,167

21 SOMERS POINT CITY $7,320

22 VENTNOR CITY $8,412

23 WEYMOUTH TWP $5,270

ATLANTIC COUNTY

$6,632

BERGEN COUNTY

01 ALLENDALE BORO $16,952

02 ALPINE BORO $21,722

03 BERGENFIELD BORO $11,427

04 BOGOTA BORO $11,363

05 CARLSTADT BORO $7,942

06 CLIFFSIDE PARK BORO $9,984

07 CLOSTER BORO $17,649

08 CRESSKILL BORO $18,541

09 DEMAREST BORO $23,475

10 DUMONT BORO $12,237

11 ELMWOOD PARK BORO $10,004

12 EAST RUTHERFORD BORO $7,510

13 EDGEWATER BORO $10,022

14 EMERSON BORO $14,319

15 ENGLEWOOD CITY $14,054

16 ENGLEWOOD CLIFFS BORO $15,178

17 FAIRLAWN BORO $11,766

18 FAIRVIEW BORO $10,557

Taxation - Local Property Tax

MOD IV- Average Residential Tax Report

TaxYear - 2023

01

02

Taxation - Local Property Tax

MOD IV- Average Residential Tax Report

TaxYear - 2023

19 FORT LEE BORO $11,827

20 FRANKLIN LAKES BORO $18,575

21 GARFIELD CITY $9,393

22 GLEN ROCK BORO $18,391

23 HACKENSACK CITY $9,214

24 HARRINGTON PARK BORO $16,426

25 HASBROUCK HEIGHTS BORO $12,709

26 HAWORTH BORO $19,520

27 HILLSDALE BORO $14,641

28 HOHOKUS BORO $18,266

29 LEONIA BORO $14,779

30 LITTLE FERRY BORO $10,315

31 LODI BORO $10,503

32 LYNDHURST TWP $10,265

33 MAHWAH TWP $9,777

34 MAYWOOD BORO $10,638

35 MIDLAND PARK BORO $13,563

36 MONTVALE BORO $13,847

37 MOONACHIE BORO $8,603

38 NEW MILFORD BORO $12,989

39 NORTH ARLINGTON BORO $10,517

40 NORTHVALE BORO $12,134

41 NORWOOD BORO $14,765

42 OAKLAND BORO $13,090

43 OLD TAPPAN BORO $17,276

44 ORADELL BORO $16,731

45 PALISADES PARK BORO $10,701

46 PARAMUS BORO $11,600

47 PARK RIDGE BORO $15,100

48 RAMSEY BORO $14,591

49 RIDGEFIELD BORO $10,456

50 RIDGEFIELD PARK VILLAGE $11,913

51 RIDGEWOOD VILLAGE $19,838

52 RIVER EDGE BORO $15,283

53 RIVER VALE TWP $16,245

54 ROCHELLE PARK TWP $9,285

55 ROCKLEIGH BORO $12,641

56 RUTHERFORD BORO $13,260

57 SADDLE BROOK TWP $10,152

58 SADDLE RIVER BORO $19,306

59 SOUTH HACKENSACK TWP $10,783

60 TEANECK TWP $12,904

61 TENAFLY BORO $23,036

62 TETERBORO BORO $2,110

63 UPPER SADDLE RIVER BORO $19,020

64 WALDWICK BORO $12,341

65 WALLINGTON BORO $10,375

Taxation - Local Property Tax

MOD IV- Average Residential Tax Report

TaxYear - 2023

66 WASHINGTON TWP $12,675

67 WESTWOOD BORO $11,390

68 WOODCLIFF LAKE BORO $18,558

69 WOOD-RIDGE BORO $10,596

70 WYCKOFF TWP $15,204

BERGEN COUNTY

$13,136

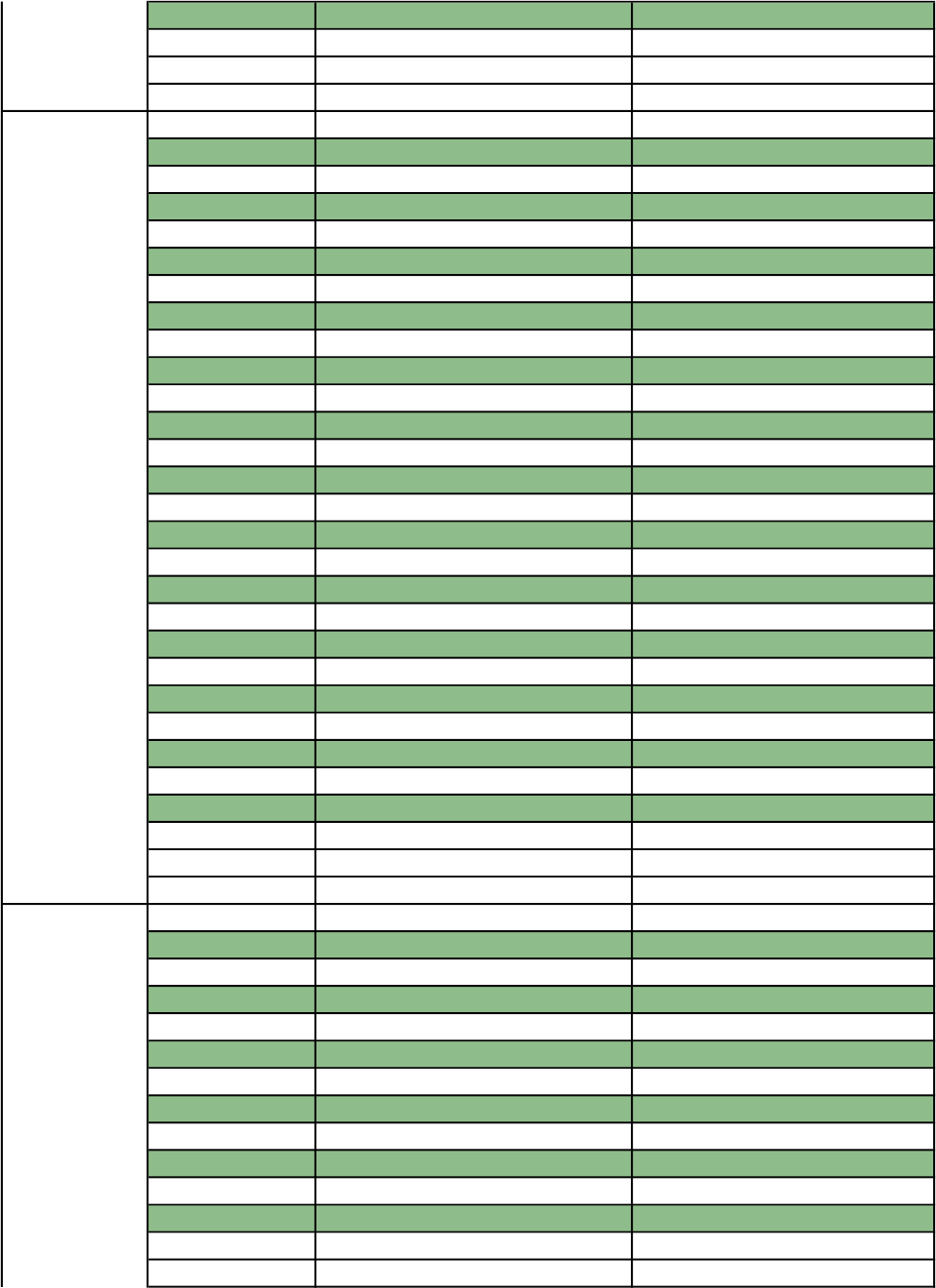

BURLINGTON COUNTY

01 BASS RIVER TWP $4,790

02 BEVERLY CITY $6,117

03 BORDENTOWN CITY $7,243

04 BORDENTOWN TWP $7,514

05 BURLINGTON CITY $5,932

06 BURLINGTON TWP $6,794

07 CHESTERFIELD TWP $12,155

08 CINNAMINSON TWP $8,194

09 DELANCO TWP $6,678

10 DELRAN TWP $7,952

11 EASTAMPTON TWP $7,488

12 EDGEWATER PARK TWP $6,122

13 EVESHAM TWP $8,223

14 FIELDSBORO BORO $5,945

15 FLORENCE TWP $5,323

16 HAINESPORT TWP $7,161

17 LUMBERTON TWP $7,506

18 MANSFIELD TWP $8,226

19 MAPLE SHADE TWP $5,939

20 MEDFORD TWP $10,904

21 MEDFORD LAKES BORO $10,383

22 MOORESTOWN TWP $12,211

23 MOUNT HOLLY TWP $5,461

24 MOUNT LAUREL TWP $6,679

25 NEW HANOVER TWP $5,048

26 NORTH HANOVER TWP $6,920

27 PALMYRA BORO $6,294

28 PEMBERTON BORO $4,775

29 PEMBERTON TWP $4,736

30 RIVERSIDE TWP $5,846

31 RIVERTON BORO $9,269

32 SHAMONG TWP $9,231

33 SOUTHAMPTON TWP $6,007

34 SPRINGFIELD TWP $8,545

35 TABERNACLE TWP $8,349

36 WASHINGTON TWP $3,795

37 WESTAMPTON TWP $6,519

38 WILLINGBORO TWP $6,871

39 WOODLAND TWP $7,100

03

Taxation - Local Property Tax

MOD IV- Average Residential Tax Report

TaxYear - 2023

40 WRIGHTSTOWN BORO $5,108

BURLINGTON COUNTY

$7,475

CAMDEN COUNTY

01 AUDUBON BORO $7,936

02 AUDUBON PARK BORO $0

03 BARRINGTON BORO $8,954

04 BELLMAWR BORO $6,338

05 BERLIN BORO $7,977

06 BERLIN TWP $7,192

07 BROOKLAWN BORO $4,510

08 CAMDEN CITY $1,994

09 CHERRY HILL TWP $8,851

10 CHESILHURST BORO $6,450

11 CLEMENTON BORO $5,319

12 COLLINGSWOOD BORO $8,889

13 GIBBSBORO BORO $9,497

14 GLOUCESTER CITY $5,450

15 GLOUCESTER TWP $7,530

16 HADDON TWP $8,892

17 HADDONFIELD BORO $16,672

18 HADDON HEIGHTS BORO $10,002

19 HI-NELLA BORO $8,408

20 LAUREL SPRINGS BORO $8,854

21 LAWNSIDE BORO $6,255

22 LINDENWOLD BORO $5,310

23 MAGNOLIA BORO $6,965

24 MERCHANTVILLE BORO $9,574

25 MOUNT EPHRAIM BORO $7,545

26 OAKLYN BORO $8,412

27 PENNSAUKEN TWP $5,784

28 PINE HILL BORO $6,033

30 RUNNEMEDE BORO $6,499

31 SOMERDALE BORO $6,398

32 STRATFORD BORO $7,296

33 TAVISTOCK BORO $38,209

34 VOORHEES TWP $11,084

35 WATERFORD TWP $7,495

36 WINSLOW TWP $6,245

37 WOODLYNNE BORO $5,500

CAMDEN COUNTY

$7,222

CAPE MAY COUNTY

01 AVALON BORO $10,465

02 CAPE MAY CITY $7,221

03 CAPE MAY POINT BORO $5,292

04 DENNIS TWP $3,377

04

05

Taxation - Local Property Tax

MOD IV- Average Residential Tax Report

TaxYear - 2023

05 LOWER TWP $4,553

06 MIDDLE TWP $4,952

07 NORTH WILDWOOD CITY $4,740

08 OCEAN CITY $6,811

09 SEA ISLE CITY $5,963

10 STONE HARBOR BORO $11,977

11 UPPER TWP $5,960

12 WEST CAPE MAY BORO $7,338

13 WEST WILDWOOD BORO $4,857

14 WILDWOOD CITY $6,013

15 WILDWOOD CREST BORO $5,397

16 WOODBINE BORO $2,071

CAPE MAY COUNTY

$6,048

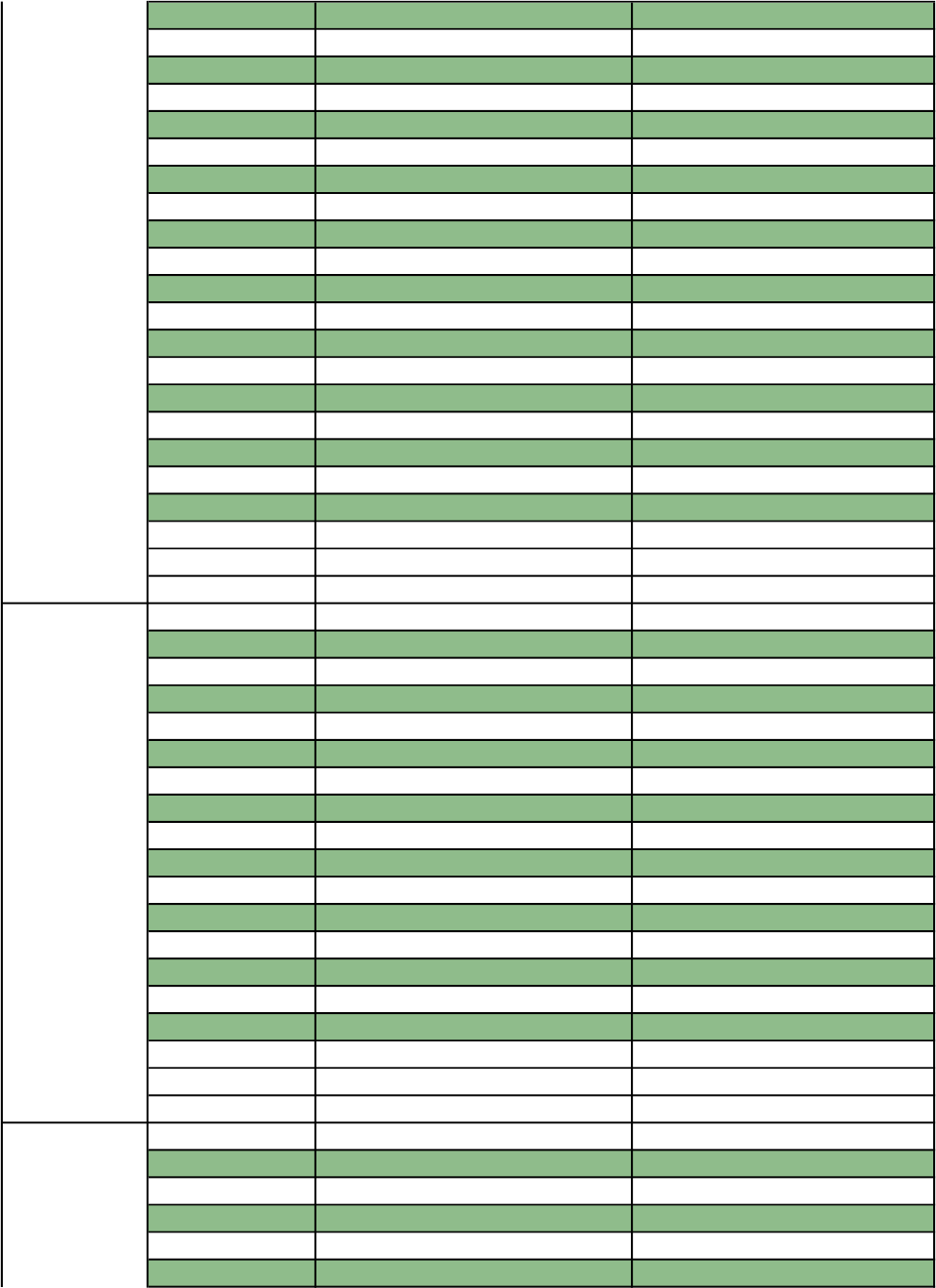

CUMBERLAND COUNTY

01 BRIDGETON CITY $3,648

02 COMMERCIAL TWP $2,793

03 DEERFIELD TWP $5,202

04 DOWNE TWP $3,551

05 FAIRFIELD TWP $4,234

06 GREENWICH TWP $6,214

07 HOPEWELL TWP $5,417

08 LAWRENCE TWP $4,930

09 MAURICE RIVER TWP $4,693

10 MILLVILLE CITY $4,874

11 SHILOH BORO $4,740

12 STOW CREEK TWP $5,877

13 UPPER DEERFIELD TWP $5,867

14 VINELAND CITY $5,101

CUMBERLAND COUNTY

$4,770

ESSEX COUNTY

01 BELLEVILLE TWP $10,911

02 BLOOMFIELD TWP $11,564

03 CALDWELL BORO TWP $13,199

04 CEDAR GROVE TWP $12,015

05 EAST ORANGE CITY $10,205

06 ESSEX FELLS TWP $20,335

07 FAIRFIELD TWP $10,864

08 GLEN RIDGE BORO TWP $22,609

09 IRVINGTON TWP $9,014

10 LIVINGSTON TWP $16,892

11 MAPLEWOOD TWP $18,269

12 MILLBURN TWP $24,952

13 MONTCLAIR TWP $21,416

14 NEWARK CITY $7,070

15 NORTH CALDWELL BORO $17,597

06

07

Taxation - Local Property Tax

MOD IV- Average Residential Tax Report

TaxYear - 2023

16 NUTLEY TWP $12,650

17 CITY OF ORANGE TWP $11,763

18 ROSELAND BORO $10,889

19 SOUTH ORANGE VILLAGE TWP $21,289

20 VERONA TWP $13,259

21 WEST CALDWELL TWP $12,070

22 WEST ORANGE TWP $15,476

ESSEX COUNTY

$13,283

GLOUCESTER COUNTY

01 CLAYTON BORO $6,283

02 DEPTFORD TWP $5,971

03 EAST GREENWICH TWP $9,212

04 ELK TWP $7,671

05 FRANKLIN TWP $6,729

06 GLASSBORO BORO $6,710

07 GREENWICH TWP $5,353

08 HARRISON TWP $10,837

09 LOGAN TWP $4,309

10 MANTUA TWP $7,682

11 MONROE TWP $7,499

12 NATIONAL PARK BORO $6,556

13 NEWFIELD BORO $6,914

14 PAULSBORO BORO $4,620

15 PITMAN BORO $8,101

16 SOUTH HARRISON TWP $10,038

17 SWEDESBORO BORO $7,299

18 WASHINGTON TWP $7,949

19 WENONAH BORO $10,979

20 WEST DEPTFORD TWP $6,921

21 WESTVILLE BORO $6,380

22 WOODBURY CITY $7,090

23 WOODBURY HEIGHTS BORO $8,485

24 WOOLWICH TWP $10,637

GLOUCESTER COUNTY

$7,466

HUDSON COUNTY

01 BAYONNE CITY $10,781

02 EAST NEWARK BORO $7,605

03 GUTTENBERG TOWN $9,993

04 HARRISON TOWN $10,457

05 HOBOKEN CITY $8,582

06 JERSEY CITY $10,560

07 KEARNY TOWN $10,387

08 NORTH BERGEN TWP $7,874

09 SECAUCUS TOWN $7,069

10 UNION CITY $9,340

09

08

Taxation - Local Property Tax

MOD IV- Average Residential Tax Report

TaxYear - 2023

11 WEEHAWKEN TWP $14,336

12 WEST NEW YORK TOWN $7,745

HUDSON COUNTY

$9,762

HUNTERDON COUNTY

01 ALEXANDRIA TWP $10,769

02 BETHLEHEM TWP $11,187

03 BLOOMSBURY BORO $7,261

04 CALIFON BORO $12,137

05 CLINTON TOWN $12,132

06 CLINTON TWP $11,539

07 DELAWARE TWP $10,707

08 EAST AMWELL TWP $9,410

09 FLEMINGTON BORO $9,125

10 FRANKLIN TWP $11,748

11 FRENCHTOWN BORO $10,589

12 GLEN GARDNER BORO $6,966

13 HAMPTON BORO $9,264

14 HIGH BRIDGE BORO $10,297

15 HOLLAND TWP $8,893

16 KINGWOOD TWP $9,263

17 LAMBERTVILLE CITY $9,294

18 LEBANON BORO $7,231

19 LEBANON TWP $10,096

20 MILFORD BORO $9,022

21 RARITAN TWP $11,036

22 READINGTON TWP $11,712

23 STOCKTON BORO $9,396

24 TEWKSBURY TWP $14,945

25 UNION TWP $10,321

26 WEST AMWELL TWP $10,859

HUNTERDON COUNTY

$10,795

MERCER COUNTY

01 EAST WINDSOR TWP $8,828

02 EWING TWP $7,590

03 HAMILTON TWP $7,146

04 HIGHTSTOWN BORO $10,471

05 HOPEWELL BORO $13,219

06 HOPEWELL TWP $13,946

07 LAWRENCE TWP $8,646

08 PENNINGTON BORO $14,624

11 TRENTON CITY $3,524

12 ROBBINSVILLE TWP $11,823

13 WEST WINDSOR TWP $15,396

14 PRINCETON $21,320

MERCER COUNTY

$9,043

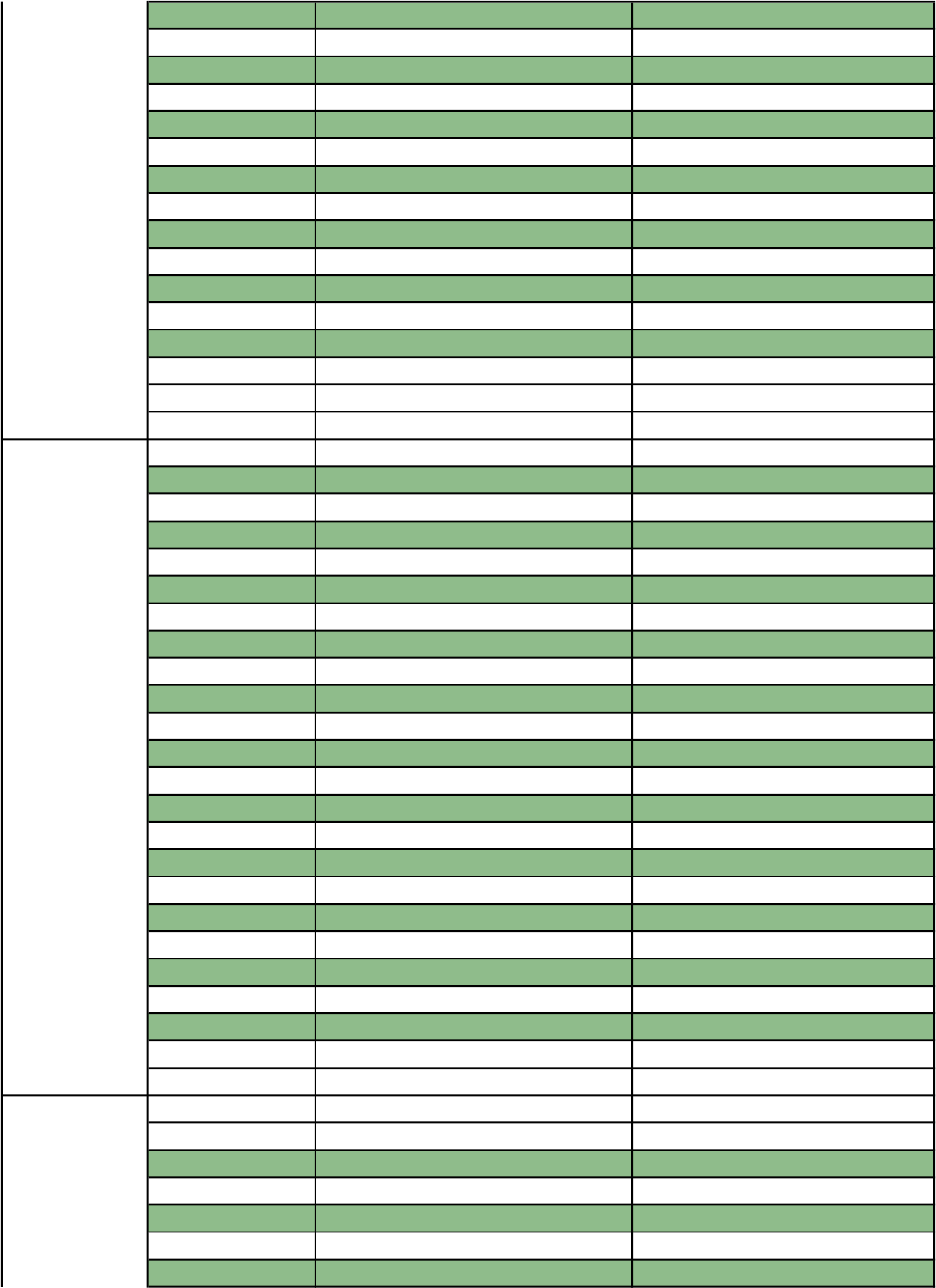

10

11

Taxation - Local Property Tax

MOD IV- Average Residential Tax Report

TaxYear - 2023

MIDDLESEX COUNTY

01 CARTERET BORO $7,590

02 CRANBURY TWP $10,967

03 DUNELLEN BORO $10,502

04 EAST BRUNSWICK TWP $10,940

05 EDISON TWP $10,403

06 HELMETTA BORO $6,787

07 HIGHLAND PARK BORO $11,990

08 JAMESBURG BORO $8,023

09 METUCHEN BORO $12,730

10 MIDDLESEX BORO $9,357

11 MILLTOWN BORO $10,822

12 MONROE TWP $8,503

13 NEW BRUNSWICK CITY $6,658

14 NORTH BRUNSWICK TWP $10,001

15 OLD BRIDGE TWP $8,250

16 PERTH AMBOY CITY $7,414

17 PISCATAWAY TWP $8,388

18 PLAINSBORO TWP $11,424

19 SAYREVILLE BORO $8,648

20 SOUTH AMBOY CITY $8,465

21 SOUTH BRUNSWICK TWP $10,082

22 SOUTH PLAINFIELD BORO $8,288

23 SOUTH RIVER BORO $7,230

24 SPOTSWOOD BORO $9,231

25 WOODBRIDGE TWP $9,002

MIDDLESEX COUNTY

$9,251

MONMOUTH COUNTY

01 ABERDEEN TWP $8,182

02 ALLENHURST BORO $18,414

03 ALLENTOWN BORO $8,435

04 ASBURY PARK CITY $8,076

05 ATLANTIC HIGHLANDS BORO $9,934

06 AVON BY THE SEA BORO $11,068

07 BELMAR BORO $8,217

08 BRADLEY BEACH BORO $9,169

09 BRIELLE BORO $13,263

10 COLTS NECK TOWNSHIP $15,990

11 DEAL BORO $21,748

12 EATONTOWN BORO $9,933

13 ENGLISHTOWN BORO $8,413

14 FAIR HAVEN BORO $17,456

15 FARMINGDALE BORO $7,810

16 FREEHOLD BORO $7,913

17 FREEHOLD TWP $10,317

12

13

Taxation - Local Property Tax

MOD IV- Average Residential Tax Report

TaxYear - 2023

18 HAZLET TWP $9,409

19 HIGHLANDS BORO $8,042

20 HOLMDEL TWP $14,732

21 HOWELL TWP $8,766

22 INTERLAKEN BORO $10,443

23 KEANSBURG BORO $6,680

24 KEYPORT BORO $8,545

25 LITTLE SILVER BORO $14,973

26 LOCH ARBOUR VILLAGE $11,084

27 LONG BRANCH CITY $10,843

28 MANALAPAN TWP $9,928

29 MANASQUAN BORO $10,823

30 MARLBORO TWP $11,624

31 MATAWAN BORO $10,730

32 MIDDLETOWN TWP $10,220

33 MILLSTONE TWP $12,810

34 MONMOUTH BEACH BORO $10,332

35 NEPTUNE TWP $8,401

36 NEPTUNE CITY BORO $7,855

37 OCEAN TWP $11,510

38 OCEANPORT BORO $12,027

39 RED BANK BORO $9,635

40 ROOSEVELT BORO $9,126

41 RUMSON BORO $22,476

42 SEA BRIGHT BORO $8,789

43 SEA GIRT BORO $14,219

44 SHREWSBURY BORO $13,576

45 SHREWSBURY TWP $4,672

46 LAKE COMO BORO $7,551

47 SPRING LAKE BORO $14,611

48 SPRING LAKE HEIGHTS BORO $8,178

49 TINTON FALLS BORO $7,532

50 UNION BEACH BORO $8,496

51 UPPER FREEHOLD TWP $13,255

52 WALL TWP $9,691

53 WEST LONG BRANCH BORO $12,174

MONMOUTH COUNTY

$10,445

MORRIS COUNTY

01 BOONTON TOWN $11,904

02 BOONTON TWP $13,081

03 BUTLER BORO $10,110

04 CHATHAM BORO $15,423

05 CHATHAM TWP $16,560

06 CHESTER BORO $14,137

07 CHESTER TWP $16,619

08 DENVILLE TWP $10,848

14

Taxation - Local Property Tax

MOD IV- Average Residential Tax Report

TaxYear - 2023

09 DOVER TOWN $7,588

10 EAST HANOVER TWP $9,157

11 FLORHAM PARK BORO $10,645

12 HANOVER TWP $8,569

13 HARDING TWP $14,335

14 JEFFERSON TWP $9,238

15 KINNELON BORO $16,390

16 LINCOLN PARK BORO $9,867

17 MADISON BORO $14,305

18 MENDHAM BORO $16,420

19 MENDHAM TWP $19,807

20 MINE HILL TWP $7,848

21 MONTVILLE TWP $13,654

22 MORRIS TWP $11,371

23 MORRIS PLAINS BORO $11,071

24 MORRISTOWN TOWN $10,415

25 MOUNTAIN LAKES BORO $22,443

26 MOUNT ARLINGTON BORO $8,105

27 MOUNT OLIVE TWP $10,339

28 NETCONG BORO $9,170

29 PARSIPPANY-TROY HILLS TWP $10,369

30 LONG HILL TWP $12,992

31 PEQUANNOCK TWP $9,743

32 RANDOLPH TWP $13,533

33 RIVERDALE BORO $6,813

34 ROCKAWAY BORO $9,848

35 ROCKAWAY TWP $10,744

36 ROXBURY TWP $9,285

37 VICTORY GARDENS BORO $5,436

38 WASHINGTON TWP $12,392

39 WHARTON BORO $9,394

MORRIS COUNTY

$11,460

OCEAN COUNTY

01 BARNEGAT TWP $7,158

02 BARNEGAT LIGHT BORO $7,333

03 BAY HEAD BORO $15,710

04 BEACH HAVEN BORO $10,241

05 BEACHWOOD BORO $5,680

06 BERKELEY TWP $4,815

07 BRICK TWP $7,253

08 TOMS RIVER TWP $7,470

09 EAGLESWOOD TWP $6,920

10 HARVEY CEDARS BORO $10,658

11 ISLAND HEIGHTS BORO $8,585

12 JACKSON TWP $8,188

13 LACEY TWP $6,766

15

Taxation - Local Property Tax

MOD IV- Average Residential Tax Report

TaxYear - 2023

14 LAKEHURST BORO $5,385

15 LAKEWOOD TWP $7,908

16 LAVALLETTE BORO $8,170

17 LITTLE EGG HARBOR TWP $5,685

18 LONG BEACH TWP $11,238

19 MANCHESTER TWP $4,693

20 MANTOLOKING BORO $23,048

21 OCEAN TWP $6,322

22 OCEAN GATE BORO $6,315

23 PINE BEACH BORO $7,210

24 PLUMSTED TWP $7,228

25 POINT PLEASANT BORO $8,700

26 PT PLEASANT BEACH BORO $9,527

27 SEASIDE HEIGHTS BORO $6,614

28 SEASIDE PARK BORO $9,150

29 SHIP BOTTOM BORO $7,772

30 SOUTH TOMS RIVER BORO $5,361

31 STAFFORD TWP $7,162

32 SURF CITY BORO $8,995

33 TUCKERTON BORO $6,354

OCEAN COUNTY

$7,205

PASSAIC COUNTY

01 BLOOMINGDALE BORO $11,507

02 CLIFTON CITY $10,402

03 HALEDON BORO $12,023

04 HAWTHORNE BORO $11,431

05 LITTLE FALLS TWP $10,397

06 NORTH HALEDON BORO $11,298

07 PASSAIC CITY $10,994

08 PATERSON CITY $9,579

09 POMPTON LAKES BORO $10,700

10 PROSPECT PARK BORO $11,734

11 RINGWOOD BORO $12,177

12 TOTOWA BORO $10,431

13 WANAQUE BORO $9,716

14 WAYNE TWP $13,139

15 WEST MILFORD TWP $9,590

16 WOODLAND PARK BORO $11,398

PASSAIC COUNTY

$10,862

SALEM COUNTY

01 ALLOWAY TWP $6,472

02 CARNEYS POINT TOWNSHIP $5,180

03 ELMER BORO $6,590

04 ELSINBORO TWP $5,293

05 LOWER ALLOWAY CREEK TWP $2,190

16

17

Taxation - Local Property Tax

MOD IV- Average Residential Tax Report

TaxYear - 2023

06 MANNINGTON TWP $5,962

07 OLDMANS TWP $5,345

08 PENNS GROVE BORO $4,622

09 PENNSVILLE TWP $7,549

10 PILESGROVE TWP $10,157

11 PITTSGROVE TWP $7,363

12 QUINTON TWP $5,316

13 SALEM CITY $3,605

14 UPPER PITTSGROVE TWP $6,982

15 WOODSTOWN BORO $8,283

SALEM COUNTY

$6,441

SOMERSET COUNTY

01 BEDMINSTER TWP $5,584

02 BERNARDS TWP $13,589

03 BERNARDSVILLE BORO $16,203

04 BOUND BROOK BORO $9,214

05 BRANCHBURG TWP $9,862

06 BRIDGEWATER TWP $10,122

07 FAR HILLS BORO $12,190

08 FRANKLIN TWP $8,161

09 GREEN BROOK TWP $13,796

10 HILLSBOROUGH TWP $10,394

11 MANVILLE BORO $7,981

12 MILLSTONE BORO $7,012

13 MONTGOMERY TWP $17,022

14 NORTH PLAINFIELD BORO $9,577

15 PEAPACK GLADSTONE BORO $13,498

16 RARITAN BORO $9,187

17 ROCKY HILL BORO $11,389

18 SOMERVILLE BORO $10,628

19 SOUTH BOUND BROOK BORO $9,150

20 WARREN TWP $15,993

21 WATCHUNG BORO $16,383

SOMERSET COUNTY

$10,918

SUSSEX COUNTY

01 ANDOVER BORO $7,719

02 ANDOVER TWP $10,289

03 BRANCHVILLE BORO $6,190

04 BYRAM TWP $9,622

05 FRANKFORD TWP $7,730

06 FRANKLIN BORO $7,484

07 FREDON TWP $9,925

08 GREEN TWP $12,088

09 HAMBURG BORO $7,543

10 HAMPTON TWP $7,208

19

18

Taxation - Local Property Tax

MOD IV- Average Residential Tax Report

TaxYear - 2023

11 HARDYSTON TWP $7,188

12 HOPATCONG BORO $7,584

13 LAFAYETTE TWP $8,858

14 MONTAGUE TWP $4,511

15 NEWTON TOWN $8,347

16 OGDENSBURG BORO $8,765

17 SANDYSTON TWP $6,505

18 SPARTA TWP $12,943

19 STANHOPE BORO $8,586

20 STILLWATER TWP $7,264

21 SUSSEX BORO $6,394

22 VERNON TWP $6,810

23 WALPACK TWP $416

24 WANTAGE TWP $7,497

SUSSEX COUNTY

$8,380

UNION COUNTY

01 BERKELEY HEIGHTS TWP $13,382

02 CLARK TWP $11,411

03 CRANFORD TWP $12,478

04 ELIZABETH CITY $10,964

05 FANWOOD BORO $13,349

06 GARWOOD BORO $10,958

07 HILLSIDE TWP $9,864

08 KENILWORTH BORO $10,581

09 LINDEN CITY $9,157

10 MOUNTAINSIDE BORO $12,437

11 NEW PROVIDENCE BORO $15,267

12 PLAINFIELD CITY $9,366

13 RAHWAY CITY $9,752

14 ROSELLE BORO $10,370

15 ROSELLE PARK BORO $10,910

16 SCOTCH PLAINS TWP $14,412

17 SPRINGFIELD TWP $12,501

18 SUMMIT CITY $18,658

19 UNION TWP $10,055

20 WESTFIELD TWP $17,931

21 WINFIELD TWP $4,058

UNION COUNTY

$11,915

WARREN COUNTY

01 ALLAMUCHY TWP $7,283

02 ALPHA BORO $6,349

03 BELVIDERE TWP $7,396

04 BLAIRSTOWN TWP $8,439

05 FRANKLIN TWP $9,444

06 FRELINGHUYSEN TWP $8,443

20

21

Taxation - Local Property Tax

MOD IV- Average Residential Tax Report

TaxYear - 2023

07 GREENWICH TWP $9,845

08 HACKETTSTOWN TOWN $9,352

09 HARDWICK TWP $8,575

10 HARMONY TWP $5,340

11 HOPE TWP $7,887

12 INDEPENDENCE TWP $8,272

13 KNOWLTON TWP $8,093

14 LIBERTY TWP $7,508

15 LOPATCONG TWP $6,682

16 MANSFIELD TWP $8,372

17 OXFORD TWP $7,401

19 PHILLIPSBURG TOWN $4,687

20 POHATCONG TWP $7,333

21 WASHINGTON BORO $7,432

22 WASHINGTON TWP $9,724

23 WHITE TWP $6,190

WARREN COUNTY

$7,528

STATE AVERAGE:

$9,569