- 1 -

Axis Fixed Term Plan - Series 120 (91 Days)

SCHEME INFORMATION DOCUMENT

AXIS FIXED TERM PLAN - SERIES 120 (91 Days)

A Close ended debt scheme; A Moderate Interest Rate Risk and Moderate Credit Risk

Offer of Units of Rs. 10 each during the New Fund Offer,

For Series with Tenure up to 1100 days with at least 65% portfolio exposure in AAA/ A1+ rated

securities;

This product is

suitable for

investors who are

seeking*:

Product Riskometer

Axis Fixed Term Plan – Series

120 (91 Days)

Benchmark

Riskometer

CRISIL Liquid Debt

Index

Potential Risk Class

• Optimal

returns over

91 Days.

• Investment in

debt &

money

market

instruments

maturing on

or before the

maturity of

the scheme.

POTENTIAL RISK CLASS

Credit

Risk

Rela

tivel

y

Low

(Cla

ss A)

Moder

ate

(Class

B)

Relativel

y High

(Class C)

Interest

Rate

Risk

Relative

ly Low

(Class I)

Modera

te

(Class II)

B - II

Relative

ly High

(Class

III)

*Investors should consult their financial advisers if in doubt about whether the product is

suitable for them.

(The product labelling including PRC will be assigned during the New Fund Offer is based on

internal assessment of the Scheme Characteristics or model portfolio and the same may vary

post NFO when actual investments are made)

New Fund Offer Opens on: January 18, 2024

New Fund Offer Closes on: January 23, 2024

Name of Mutual Fund

:

Axis Mutual Fund

Name of Asset Management

Company

:

Axis Asset Management Company Limited

Name of Trustee Company

:

Axis Mutual Fund Trustee Limited

Addresses, Website of the entities

:

Axis House, 1

st

Floor, C-2, Wadia International

Centre, Pandurang Budhkar Marg, Worli, Mumbai -

400 025 www.axismf.com

Name of Sponsor

:

Axis Bank Ltd.

The particulars of the Scheme have been prepared in accordance with the Securities and

Exchange Board of India (Mutual Funds) Regulations, 1996, (herein after referred to as SEBI

(MF) Regulations or the Regulations) as amended till date, and filed with SEBI, along with a

Due Diligence Certificate from the Asset Management Company (AMC). The Units being

- 2 -

Axis Fixed Term Plan - Series 120 (91 Days)

offered for public subscription have not been approved or recommended by SEBI nor has

SEBI certified the accuracy or adequacy of the Scheme Information Document.

The Scheme Information Document sets forth concisely the information about the Scheme

that a prospective investor ought to know before investing. Before investing, investors should

also ascertain about any further changes to this Scheme Information Document after the

date of this Document from the Mutual Fund / Investor Service Centres / Website / Distributors

or Brokers.

The investors are advised to refer to the Statement of Additional Information (SAI) for details of

Axis Mutual Fund, Tax and Legal issues and general information on www.axismf.com.

SAI is incorporated by reference (is legally a part of the Scheme Information Document). For

a free copy of the current SAI, please contact your nearest Investor Service Centre or log on

to our website.

The Scheme Information Document should be read in conjunction with the SAI and not in

isolation.

The Mutual Fund or AMC and its empaneled brokers have not given and shall not give any

indicative portfolio and indicative yield in any communication, in any manner whatsoever.

Investors are advised not rely on any communication regarding indicative yield/portfolio with

regard to the scheme.

This Scheme Information Document is dated January 09, 2024.

- 3 -

Axis Fixed Term Plan - Series 120 (91 Days)

DISCLAIMER:

BSE Limited has vide its letter number LO/IPO/AH/MF/IP/028/2023-24 dated July 24, 2023 given

its permission to Axis Mutual Fund to use the Exchange’s name in the SID of Axis Fixed Term

Plan - Series 120 (91 Days) as one of the Stock Exchanges on which this Mutual Fund’s Units

are proposed to be listed. The Exchange has scrutinized this SID for its limited internal purpose

of deciding on the matter of granting the aforesaid permission to Axis Mutual Fund. The

Exchange does not in any manner: -

i) warrant, certify or endorse the correctness or completeness of any of the contents of this

SID; or

ii) warrant that this scheme’s unit will be listed or will continue to be listed on the Exchange;

or

iii) take any responsibility for the financial or other soundness of this Mutual Fund, its

promoters, its management or any scheme or project of this Mutual Fund.

and it should not for any reason be deemed or construed that this SID has been cleared or

approved by the Exchange. Every person who desires to apply for or otherwise acquires any

unit of Axis Fixed Term Plan - Series 120 (91 Days) of this Mutual Fund may do so pursuant to

independent inquiry, investigation and analysis and shall not have any claim against the

Exchange whatsoever by reason of any loss which may be suffered by such person

consequent to or in connection with such subscription/acquisition whether by reason of

anything stated or omitted to be stated herein or for any other reason whatsoever.

- 4 -

Axis Fixed Term Plan - Series 120 (91 Days)

TABLE OF CONTENTS

Index

HIGHLIGHTS/ SUMMARY OF THE SCHEME .................................................................................... 5

I. INTRODUCTION ......................................................................................................................... 9

A. RISK FACTORS ............................................................................................................................. 9

B. REQUIREMENT OF MINIMUM INVESTORS IN THE SCHEME ..................................................... 13

C. SPECIAL CONSIDERATIONS, if any ......................................................................................... 13

D. DEFINITIONS .............................................................................................................................. 14

E. DUE DILIGENCE BY THE ASSET MANAGEMENT COMPANY ................................................... 17

II. INFORMATION ABOUT THE SCHEME ............................................................................................. 19

A. TYPE OF THE SCHEME(S) .......................................................................................................... 19

B. WHAT IS THE INVESTMENT OBJECTIVE OF THE SCHEME(S)? .................................................. 19

C.HOW WILL THE SCHEME(S) ALLOCATE ITS ASSETS? ................................................................ 19

D.WHERE WILL THE SCHEME(S) INVEST? ...................................................................................... 21

E. WHAT ARE THE INVESTMENT STRATEGIES? .............................................................................. 27

F: FUNDAMENTAL ATTRIBUTES ...................................................................................................... 33

G. HOW WILL THE SCHEME(S) BENCHMARK ITS PERFORMANCE? ........................................... 34

H. WHO MANAGES THE SCHEME(S)?......................................................................................... 34

I. WHAT ARE THE INVESTMENT RESTRICTIONS? ........................................................................... 35

J. CREATION OF SEGREGATED PORTFOLIO ............................................................................... 41

K. HOW HAS THE SCHEME PERFORMED? ................................................................................... 45

L. ADDITIONAL SCHEME RELATED DISCLOSURES .............................................................................. 45

III. UNITS AND OFFER ............................................................................................................................ 47

A. NEW FUND OFFER (NFO) ......................................................................................................... 47

B. ONGOING OFFER DETAILS ....................................................................................................... 68

C. PERIODIC DISCLOSURES.......................................................................................................... 76

D. COMPUTATION OF NAV.......................................................................................................... 81

IV. FEES AND EXPENSES ....................................................................................................................... 83

A. NEW FUND OFFER (NFO) EXPENSES ........................................................................................ 83

B. ANNUAL SCHEME RECURRING EXPENSES .............................................................................. 83

C. LOAD STRUCTURE .................................................................................................................... 86

D. WAIVER OF LOAD FOR DIRECT APPLICATIONS ..................................................................... 87

V. RIGHTS OF UNITHOLDERS ................................................................................................................ 88

VI. PENALTIES, PENDING LITIGATION OR PROCEEDINGS, FINDINGS OF INSPECTIONS OR

INVESTIGATIONS FOR WHICH ACTION MAY HAVE BEEN TAKEN OR IS IN THE PROCESS OF BEING

TAKEN BY ANY REGULATORY AUTHORITY .......................................................................................... 89

- 5 -

Axis Fixed Term Plan - Series 120 (91 Days)

HIGHLIGHTS/ SUMMARY OF THE SCHEME

Scheme Code: AXIS/C/D/FTP/23/09/0083

Investment objective

The Scheme will endeavour to generate returns through a portfolio of debt & money market

instruments that are maturing on or before the maturity of the Scheme. However, there is no

assurance that the investment objective of the Scheme will be achieved. The Scheme does

not assure or guarantee any returns.

Tenure

Tenure of the Scheme(s) is – 91 days from the date of allotment (including the date of

allotment.) If the maturity / pay out date falls on a non-business day, the maturity / pay out

date shall be the next business day.

Units of respective schemes(s) will be redeemed only on the Maturity Date of the respective

scheme(s)

Liquidity

The Units of the Scheme cannot be redeemed by the Unit holder directly with the Fund until

the Maturity Date.

The Units of the Scheme will be listed on the capital market segment of the BSE and/ or any

other Stock Exchange. Unit holders can purchase / sell Units on a continuous basis on BSE

and/or any other Stock Exchange(s) on which the Units are listed. The Units can be

purchased / sold during the trading hours of the Stock Exchange(s) like any other publicly

traded stock. The trading of Units on BSE and/or any other Stock Exchange(s) on which the

Units are listed will automatically get suspended one Business Day prior to the record date for

redemption of Units on Maturity Date/ Final Redemption Date. No separate notice will be

issued by the AMC informing about Maturity Record Date or Suspension of trading by the

stock exchange. However, the Fund reserves the right to change the record date for maturity

by issue of suitable notice. The Unit holders whose name(s) appear on the list of beneficial

owners as per the Depositories (NSDL/CDSL) on records date shall be entitled to receive

redemption proceeds of Units.

The price of the Units on the Stock Exchange(s) will depend on demand and supply at that

point of time and underlying NAV. There is no minimum investment limit, although Units are

normally traded in round lots of 1 Unit.

Please refer to para “Settlement of purchase / sale of Units of the Scheme on BSE” and

“Rolling Settlement” under the section “Cut off timing for subscriptions/ redemption/

switches” for further details.

Dematerialization of Units

The Unit holders are given an Option to hold the units by way of an Account Statement

(Physical form) or in Dematerialized (‘Demat’) form. Mode of holding shall be clearly

specified in the KIM cum application form. Unit holders holding the units in physical form will

not be able to trade or transfer their units till such units are dematerialized.

- 6 -

Axis Fixed Term Plan - Series 120 (91 Days)

Unit holders opting to hold the units in demat form must provide their Demat Account details

in the specified section of the application form. The Unit holder intending to hold the units in

Demat form are required to have a beneficiary account with the Depository Participant (DP)

(registered with NSDL/ CDSL as may be indicated by the Fund at the time of launch) and will

be required to indicate in the application the DP’s name, DP ID Number and the beneficiary

account number of the applicant with the DP. In case Unit holders do not provide their

Demat Account details, an Account Statement shall be sent to them. Such investors will not

be able to trade on the stock exchange till the holdings are converted in to demat form.

Transfer of Units

Units held in Demat form are freely transferable in accordance with the provisions of SEBI

(Depositories and Participants) Regulations, as may be amended from time to time. Transfer

can be made only in favor of transferees who are capable of holding units and having a

Demat Account. The delivery instructions for transfer of units will have to be lodged with the

DP in requisite form as may be required from time to time and transfer will be affected in

accordance with such rules / regulations as may be in force governing transfer of securities in

dematerialized mode.

Payment of redemption proceeds

The AMC shall dispatch the Redemption proceeds within three (3) working Days from the

maturity date.

Benchmark

CRISIL Liquid Debt Index

Transparency/NAV Disclosure

The AMC will calculate and disclose the first NAV of the Scheme within a period of 5 business

days from the date of allotment. Subsequently, the AMC will calculate and disclose the NAVs

on all Business Days. The AMC shall update the NAVs on website of the Association of Mutual

Funds in India - AMFI (www.amfiindia.com) before 11.00 p.m. on every Business Day and shall

also update the NAVs on the website of AMC (www.axismf.com). If the NAVs are not

available before the commencement of Business Hours on the following day due to any

reason, the Mutual Fund shall issue a press release giving reasons and explaining when the

Mutual Fund would be able to publish the NAV.

The AMC will disclose the portfolio of the Scheme (along with ISIN) on fortnightly, monthly and

half yearly basis on the website of the Mutual Fund and AMFI within 5 days of every fortnight,

10 days from close of each month and within 10 days from the close of each half year (i.e.

31

st

March and 30

th

September) respectively in a user-friendly and downloadable

spreadsheet format. Further, AMC shall publish an advertisement, in an all India edition of

one national English daily newspaper and in one Hindi newspaper, every half year disclosing

the hosting of the half-yearly statement of its schemes portfolio on the website of the Mutual

Fund and AMFI and the modes through which unitholder can submit a request for a physical

or electronic copy of the statement of scheme portfolios.

The AMC will also provide a dashboard, in a comparable, downloadable (spreadsheet) and

machine readable format, providing performance and key disclosures like Scheme’s AUM,

investment objective, expense ratios, portfolio details, scheme’s past performance etc. on its

website.

The AMC will make available the Annual Report of the Scheme within four months of the end

of the financial year on its website and on the website of AMFI along with a link.

- 7 -

Axis Fixed Term Plan - Series 120 (91 Days)

Loads

Entry Load: Not Applicable

Para 10.4 of Master Circular for Mutual Funds has decided that there shall be no Entry Load

for all Mutual Fund schemes.

Exit Load: Nil

Units under the scheme cannot be redeemed directly with the Fund as the Units of the

Scheme will be listed on the Stock Exchange(s). These units can be sold on a continuous basis

on the stock exchange(s) where the units will be listed during the trading hours on all trading

days. For more details on load structure, please refer paragraph ‘Load Structure’.

Minimum Application Amount (for purchase and switch in)

Rs. 5,000 and in multiples of Rs. 10/- thereafter

Non CTS / Outstation Cheques/Demand Drafts will not be accepted.

Application in NFO will be processed through Direct Credit mode(Transfer / NEFT / RTGS) only.

Switch-in requests from equity and hybrid schemes will be accepted up to January 22, 2024

till the cut-off time applicable for switches. Switch-in requests from debt schemes will be

accepted up to January 23, 2024, till the cut-off time applicable for switches.

Plans and Options under the Scheme

Plans

- Axis Fixed Term Plan - Series 120 (91 Days) - Regular Plan

- Axis Fixed Term Plan - Series 120 (91 Days) - Direct Plan

Each Plan offers the following option

- Growth

- Income Distribution cum Capital Withdrawal (IDCW)

Options

Sub-options

Growth

Nil

Income

Distribution

cum Capital

Withdrawal

(IDCW)

Quarterly IDCW Payout

Scheme(s) having maturity ranging up to 12 months will offer Quarterly IDCW option (payout

facility) in addition to Growth option.

IDCW may or may not be declared under this option at the discretion of the Trustee.

Direct Plan

Direct Plan is only for investors who purchase /subscribe Units in a Scheme directly with the

Fund and is not available for investors who route their investments through a Distributor.

All the Plans will have common portfolio.

- 8 -

Axis Fixed Term Plan - Series 120 (91 Days)

Default Plan/Option

The investor must clearly specify his choice of plan/ option. In the absence of such clear

instruction, it will be assumed that the investor has opted for ‘default’ plan/ option and the

application will be processed accordingly as mentioned in the table for applicability of

Direct Plan/ Regular Plan under different scenarios mentioned underneath.

Investors subscribing under Direct Plan of a Scheme will have to indicate “Direct Plan”

against the Scheme name in the application form e.g. “Axis Fixed Term Plan - Series 120 (91

Days) - Direct Plan”. Investors should also indicate “Direct” in the ARN column of the

application form.

The investors may refer to the following table for applicability of Direct Plan/ Regular Plan

under different scenario: -

Scenario

Broker Code mentioned by

the investor

Plan mentioned by the

investor

Default Plan to be

captured

1

Not mentioned

Not mentioned

Direct Plan

2

Not mentioned

Direct

Direct Plan

3

Not mentioned

Regular

Direct Plan

4

Mentioned

Direct

Direct Plan

5

Direct

Not Mentioned

Direct Plan

6

Direct

Regular

Direct Plan

7

Mentioned

Regular

Regular Plan

8

Mentioned

Not Mentioned

Regular Plan

In cases of wrong/ invalid/ incomplete ARN codes mentioned on the application form, the

application shall be processed under Regular Plan. The AMC shall contact and obtain the

correct ARN code within 30 calendar days of the receipt of the application form from the

investor/ distributor. In case, the correct code is not received within 30 calendar days, the

AMC shall reprocess the transaction under Direct Plan from the date of application without

any exit load.

Default option – Growth

- 9 -

Axis Fixed Term Plan - Series 120 (91 Days)

I. INTRODUCTION

A. RISK FACTORS

i. Standard Risk Factors:

• Investment in mutual fund Units involves investment risks such as trading volumes,

settlement risk, liquidity risk, default risk including the possible loss of principal.

• As the price / value / interest rates of the securities in which the Scheme invests

fluctuates, the value of your investment in the Scheme may go up or down.

• Past performance of the Sponsor/AMC/Mutual Fund does not guarantee future

performance of the Scheme.

• The name of the Scheme does not in any manner indicate either the quality of the

Scheme or its future prospects and returns.

• The sponsor is not responsible or liable for any loss resulting from the operation of the

Scheme beyond the initial contribution of Rs. 1 lac made by it towards setting up the

Fund.

• The Scheme is not a guaranteed or assured return scheme.

ii. Scheme Specific Risk Factors

Risks associated with investments in Fixed Income Securities

Interest-Rate Risk: Fixed income securities such as government bonds, corporate bonds,

money market instruments and derivatives run price-risk or interest-rate risk. Generally, when

interest rates rise, prices of existing fixed income securities fall and when interest rates drop,

such prices increase. The extent of fall or rise in the prices depends upon the coupon and

maturity of the security. It also depends upon the yield level at which the security is being

traded.

Re-investment Risk: Investments in fixed income securities carry re-investment risk as interest

rates prevailing on the coupon payment or maturity dates may differ from the original

coupon of the bond.

Basis Risk: The underlying benchmark of a floating rate security or a swap might become less

active or may cease to exist and thus may not be able to capture the exact interest rate

movements, leading to loss of value of the portfolio.

Spread Risk: In a floating rate security the coupon is expressed in terms of a spread or mark

up over the benchmark rate. In the life of the security this spread may move adversely

leading to loss in value of the portfolio. The yield of the underlying benchmark might not

change, but the spread of the security over the underlying benchmark might increase

leading to loss in value of the security.

Liquidity Risk: The liquidity of a bond may change, depending on market conditions leading

to changes in the liquidity premium attached to the price of the bond. At the time of selling

the security, the security can become illiquid, leading to loss in value of the portfolio.

Liquidity Risk on account of unlisted securities: The liquidity and valuation of the Schemes’

investments due to their holdings of unlisted securities may be affected if they have to be

sold prior to their target date of divestment. The unlisted security can go down in value

before the divestment date and selling of these securities before the divestment date can

lead to losses in the portfolio.

- 10 -

Axis Fixed Term Plan - Series 120 (91 Days)

Credit Risk: This is the risk associated with the issuer of a debenture/bond or a Money Market

Instrument defaulting on coupon payments or in paying back the principal amount on

maturity. Even when there is no default, the price of a security may change with expected

changes in the credit rating of the issuer. It is to be noted here that a Government Security is

a sovereign security and is the safest. Corporate bonds carry a higher amount of credit risk

than Government Securities. Within corporate bonds also there are different levels of safety

and a bond rated higher by a particular rating agency is safer than a bond rated lower by

the same rating agency.

Settlement Risk: Fixed income securities run the risk of settlement which can adversely affect

the ability of the fund house to swiftly execute trading strategies which can lead to adverse

movements in NAV

Risk associated with Securitized Debt

The Scheme may invest in domestic securitized debt such as Asset Backed Securities (ABS) or

Mortgage Backed Securities (MBS). ABS are securitized debts where the underlying assets are

receivables arising from various loans including automobile loans, personal loans, loans

against consumer durables, etc. MBS are securitized debts where the underlying assets are

receivables arising from loans backed by mortgage of residential / commercial properties.

At present in Indian market, following types of loans are securitized:

1. Auto Loans (cars / commercial vehicles /two wheelers)

2. Residential Mortgages or Housing Loans

3. Consumer Durable Loans

4. Personal Loans

5. Corporate Loans

In terms of specific risks attached to securitization, each asset class would have different

underlying risks. Residential Mortgages generally have lower default rates than other asset

classes, but repossession becomes difficult. On the other hand, repossession and subsequent

recovery of commercial vehicles and other auto assets is fairly easier and better compared

to mortgages. Asset classes like personal loans, credit card receivables are unsecured and in

an economic downturn may witness higher default. A corporate loan/receivable, depend

upon the nature of the underlying security for the loan or the nature of the receivable and

the risks correspondingly fluctuate.

The rating agencies define margins, over collateralization and guarantees to bring risk in line

with similar AAA rated securities. The factors typically analyzed for any pool are as follows:

a. Assets securitized and Size of the loan: This indicates the kind of assets financed with the

loan and the average ticket size of the loan. A very low ticket size might mean more costs

in originating and servicing of the assets.

b. Diversification: Diversification across geographical boundaries and ticket sizes might result

in lower delinquency

c. Loan to Value Ratio: Indicates how much % value of the asset is financed by borrower’s

own equity. The lower this value the better it is. This suggests that where the borrowers

own contribution of the asset cost is high; the chances of default are lower.

d. Average seasoning of the pool: This indicates whether borrowers have already displayed

repayment discipline. The higher the number, the more superior it is.

The other main risks pertaining to Securitized debt are as follows:

- 11 -

Axis Fixed Term Plan - Series 120 (91 Days)

Prepayment Risk: This arises when the borrower pays off the loan sooner than expected.

When interest rates decline, borrowers tend to pay off high interest loans with money

borrowed at a lower interest rate, which shortens the average maturity of ABSs. However,

there is some prepayment risk even if interest rates rise, such as when an owner pays off a

mortgage when the house is sold or an auto loan is paid off when the car is sold.

Reinvestment Risk: Since prepayment risk increases when interest rates decline, this also

introduces reinvestment risk, which is the risk that the principal can only be reinvested at a

lower rate.

Risks associated with investment in Derivatives Transactions

Credit Risk: The credit risk is the risk that the counter party will default in its obligations and is

generally small as in a Derivative transaction there is generally no exchange of the principal

amount.

Interest rate risk: Derivatives carry the risk of adverse changes in the price due to change in

interest rates.

Basis Risk: When a bond is hedged using a derivative, the change in price of the bond and

the change in price of the Derivative may not be fully correlated leading to basis risk in the

portfolio.

Liquidity risk: During the life of the derivative, the benchmark might become illiquid and

might not be fully capturing the interest rate changes in the market, or the selling, unwinding

prices might not reflect the underlying assets, rates and indices, leading to loss of value of the

portfolio.

Model Risk: The risk of mis–pricing or improper valuation of Derivatives.

Trade Execution: Risk where the final execution price is different from the screen price leading

to dilution in the spreads and hence impacting the profitability of the reverse arbitrage

strategy.

Systemic Risk: For Derivatives, especially OTC ones the failure of one Counter Party can put

the whole system at risk and the whole system can come to a halt.

Derivative products are leveraged instruments and can provide disproportionate gains as

well as disproportionate losses to the Investor. Execution of such strategies depends upon the

ability of the fund manager to identify such opportunities. Identification and execution of the

strategies to be pursued by the fund manager involve uncertainty and decision of fund

manager may not always be profitable. No assurance can be given that the fund manager

will be able to identify or execute such strategies.

The risks associated with the use of Derivatives are different from or possibly greater than, the

risks associated with investing directly in securities and other traditional investments.

Risks associated with Repo transactions in Corporate Bonds

The Scheme may be exposed to counter party risk in case of repo lending transactions in the

event of the counterparty failing to honor the repurchase agreement. However, in repo

transactions, the collateral may be sold and a loss is realized only if the sale price is less than

the repo amount. The risk is further mitigated through over-collateralization (the value of the

collateral being more than the repo amount).

- 12 -

Axis Fixed Term Plan - Series 120 (91 Days)

Risks associated with segregated portfolio

1. Investor holding units of segregated portfolio may not able to liquidate their holding till

the time recovery of money from the issuer.

2. Security comprises of segregated portfolio may not realise any value.

3. Listing of units of segregated portfolio on recognised stock exchange does not

necessarily guarantee their liquidity. There may not be active trading of units in the stock

market. Further trading price of units on the stock market may be significantly lower than

the prevailing NAV.

Risk Factor associated with debt instruments having credit enhancement:

The Scheme may invest in debt instruments having credit enhancement backed by equity

shares/guarantees or other any assets as collateral. The profile of these issuers tend to be

relatively weak and there may be a pledge of shares of a related party to enhance credit

quality or guarantees provided or any other asset provided as security acceptable to

lenders.

Where equity shares are provided as collateral there is the risk of sharp price volatility of

underlying securities which may lead to erosion in value of collateral which may affect the

ability of the fund to enforce collateral and recover capital and interest obligations. Also

there is a possibility of guarantor going insolvent which also can impact the recovery value of

exposure. In case of credit enhanced structures backed by equity share the liquidity of the

underlying shares may be low leading to a lower recovery and a higher impact cost of

liquidation. In case of other assets provided recovery value and enforce ability of asset can

also be a risk factor which can lower the recovery value.

Risks related to Listing of Mutual Fund units

Listing of the units of the fund does not necessarily guarantee their liquidity and there can be

no assurance that an active secondary market for the units will develop or be maintained.

Consequently, the Fund may quote below its face value / NAV.

Trading in Units of the scheme on the Exchange may be halted because of market

conditions or for reasons that in view of Exchange Authorities or SEBI, trading in Units of the

scheme is not advisable. In addition, trading in Units of the Scheme is subject to trading halts

caused by extraordinary market volatility and pursuant to Exchange and SEBI 'circuit filter'

rules. There can be no assurance that the requirements of Exchange necessary to maintain

the listing of Units of the scheme will continue to be met or will remain unchanged. Any

changes in trading regulations by the Stock Exchange(s) or SEBI may inter-alia result in wider

premium/ discount to NAV. The Units of the scheme(s) may trade above or below their NAV.

The NAV of the scheme will fluctuate with changes in the market value of scheme’s holdings.

The trading prices of Units of the scheme will fluctuate in accordance with changes in their

NAV as well as market supply and demand for the Units of the scheme(s). The Units will be

issued in demat form through depositories. The records of the depository are final with respect

to the number of Units available to the credit of Unit holder. Settlement of trades, repurchase

of Units by the Mutual Fund on the maturity date will depend upon the confirmations to be

received from depository(ies) on which the Mutual Fund has no control.

The market price of the Units of the scheme(s), like any other listed security, is largely

dependent on two factors, viz., (1) the intrinsic value of the Unit (or NAV), and (2) demand

and supply of Units in the market. Sizeable demand or supply of the Units in the Exchange

may lead to market price of the Units to quote at premium or discount to NAV. As the Units

- 13 -

Axis Fixed Term Plan - Series 120 (91 Days)

allotted under the Scheme will be listed on the Exchange, the Mutual Fund shall not provide

for redemption / repurchase of Units prior to maturity date of the Scheme.

Risk Factor associated with Close-ended Schemes

Investing in close-ended Schemes is more appropriate for seasoned investors. A close-ended

Scheme endeavors to achieve the desired returns only at the scheduled maturity of the

Scheme. Investors who wish to exit/redeem before the scheduled maturity date may do so

through the stock exchange mode, if they have opted to hold Units in a demat form, by

mentioning their demat details on the NFO application form. For the units listed on the

exchange, it is possible that the market price at which the units are traded may be at a

discount to the NAV of such Units. Hence, Unit Holders who sell their Units in a Scheme prior to

maturity may not get the desired returns.

B. REQUIREMENT OF MINIMUM INVESTORS IN THE SCHEME

The Scheme/Series shall have a minimum of 20 investors and no single investor shall account

for more than 25% of the corpus of the Scheme/Series. These conditions will be complied with

immediately after the close of the NFO itself i.e. at the time of allotment. In case of non-

fulfillment with the condition of minimum 20 investors, the Scheme/Series shall be wound up in

accordance with Regulation 39(2)(c) of SEBI (MF) Regulations automatically without any

reference from SEBI. In case of non-fulfillment with the condition of 25% holding by a single

investor on the date of allotment, the application to the extent of exposure in excess of the

stipulated 25% limit would be liable to be rejected and the allotment would be effective only

to the extent of 25% of the corpus collected. Consequently, such exposure over 25% limits will

lead to refund within 5 business days from the date of closure of the New Fund Offer.

C. SPECIAL CONSIDERATIONS, if any

• Prospective investors should study this Scheme Information Document and Statement of

Additional Information carefully in its entirety and should not construe the contents

hereof as advise relating to legal, taxation, financial, investment or any other matters and

are advised to consult their legal, tax, financial and other professional advisors to

determine possible legal, tax, financial or other considerations of subscribing to or

redeeming Units, before making a decision to invest/redeem/hold Units.

• The Scheme related documents i.e. SID/ KIM/ SAI or the units of the Fund are not

registered in any jurisdiction including the United States of America nor in any provincial/

territorial jurisdiction in Canada. The distribution of the Scheme related document in

certain jurisdictions may be restricted or subject to registration requirements and,

accordingly, persons who come into possession of the Scheme related documents are

required to inform themselves about, and to observe any such restrictions. No persons

receiving a copy of this Scheme related documents or any accompanying application

form in such jurisdiction may treat these Scheme related documents or such application

form as constituting an invitation to them to subscribe for units, nor should they in any

event use any such application form, unless in the relevant jurisdiction such an invitation

could lawfully be made to them and such application form could lawfully be used

without compliance with any registration or other legal requirements. Accordingly, the

Scheme related documents do not constitute an offer or solicitation by anyone in any

jurisdiction in which such offer or solicitation is not lawful or in which the person making

such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to

make such offer or solicitation as per applicable law.

- 14 -

Axis Fixed Term Plan - Series 120 (91 Days)

• The AMC, Trustee or the Mutual Fund have not authorized any person to issue any

advertisement or to give any information or to make any representations, either oral or

written, other than that contained in this Scheme Information Document or the Statement

of Additional Information or as provided by the AMC in connection with this offering.

Prospective investors are advised not to rely upon any information or representation not

incorporated in the Scheme Information Document or Statement of Additional

Information or as provided by the AMC as having been authorized by the Mutual Fund,

the AMC or the Trustee.

• Redemption due to change in the fundamental attributes of the Scheme or due to any

other reasons may entail tax consequences. The Trustee, AMC, Mutual Fund, their

directors or their employees shall not be liable for any such tax consequences that may

arise due to such redemptions.

• The Trustee, AMC, Mutual Fund, their directors or their employees shall not be liable for

any of the tax consequences that may arise, in the event that the Scheme/Plan(s) is

wound up for the reasons and in the manner provided in ‘Statement of Additional

Information.

• The tax benefits described in this Scheme Information Document and Statement of

Additional Information are as available under the present taxation laws and are available

subject to relevant conditions. The information given is included only for general purpose

and is based on advise received by the AMC regarding the law and practice currently in

force in India as on the date of this Scheme Information Document and the Unit holders

should be aware that the relevant fiscal rules or their interpretation may change. As is the

case with any investment, there can be no guarantee that the tax position or the

proposed tax position prevailing at the time of an investment in the Scheme will endure

indefinitely. In view of the individual nature of tax consequences, each Unit holder is

advised to consult his / her own professional tax advisor.

• The Mutual Fund may disclose details of the investor’s account and transactions there

under to those intermediaries whose stamp appears on the application form or who have

been designated as such by the investor. In addition, the Mutual Fund may disclose such

details to the bankers, as may be necessary for the purpose of effecting payments to the

investor. The Fund may also disclose such details to regulatory and statutory

authorities/bodies as may be required or necessary.

• Pursuant to the provisions of Prevention of Money Laundering Act, 2002, if after due

diligence, the AMC believes that any transaction is suspicious in nature as regards money

laundering, on failure to provide required documentation, information, etc. by the unit

holder the AMC shall have absolute discretion to report such suspicious transactions to

FIU-IND and/or to freeze the folios of the investor(s), reject any application(s) / allotment

of units.

D. DEFINITIONS

"AMC" or "Asset

Management

Company" or

"Investment

Manager

Axis Asset Management Company Limited incorporated under the provisions of

the Companies Act, 1956 and approved by Securities and Exchange Board of

India to act as the Asset Management Company for the scheme(s) of Axis

Mutual Fund.

“Business Day”

A day other than:

(i) Saturday and Sunday;

(ii) A day on which the banks in Mumbai and /or RBI are closed for business

/clearing;

(iii) A day on which the National Stock Exchange of India Limited and/or BSE

Ltd., Mumbai are closed;

(iv) A day which is a public and /or bank Holiday at an Investor Service

- 15 -

Axis Fixed Term Plan - Series 120 (91 Days)

Centre/Official Point of Acceptance where the application is received;

(v) A day on which Sale / Redemption / Switching of Units is suspended by the

AMC;

(vi) A day on which normal business cannot be transacted due to storms, floods,

bandhs, strikes or such other events as the AMC may specify from time to

time.

Further, the day(s) on which the money markets and/or debt markets are closed

/ not accessible, may not be treated as Business Day(s).

The AMC reserves the right to declare any day as a Business Day or otherwise at

any or all Investor Service Centers/Official Points of Acceptance.

"Business Hours"

Presently 9.30 a.m. to 5.30 p.m. on any Business Day or such other time as may be

applicable from time to time.

"Custodian"

A person who has been granted a certificate of registration to carry on the

business of custodian of securities under the Securities and Exchange Board of

India (Custodian) Regulations 1996, which for the time being is Deutsche Bank

AG.

"Depository"

Depository as defined in the Depositories Act, 1996 (22 of 1996).

"Derivative"

Derivative includes (i) a security derived from a debt instrument, share, loan

whether secured or unsecured, risk instrument or contract for differences or any

other form of security; (ii) a contract which derives its value from the prices, or

index of prices, or underlying securities.

"Exit Load"

Load on Redemption / Switch out of Units.

“Foreign Portfolio

Investor” or (“FPI”)

A person who satisfies the eligibility criteria prescribed under regulation 4 of

Securities and Exchange Board of India (Foreign Portfolio Investors) Regulations,

2019 and has been registered under Chapter II of these regulations, which shall

be deemed to be an intermediary in terms of the provisions of the Act.

"Floating Rate

Debt Instruments"

Floating rate debt instruments are debt securities issued by Central and / or State

Government, corporates or PSUs with interest rates that are reset periodically. The

periodicity of the interest reset could be daily, monthly, quarterly, half-yearly,

annually or any other periodicity that may be mutually agreed with the issuer

and the Fund. The interest on the instruments could also be in the nature of fixed

basis points over the benchmark gilt yields.

"Gilts" or

"Government

Securities"

Securities created and issued by the Central Government and/or a State

Government (including Treasury Bills) or Government Securities as defined in the

Government Securities Act, 2006,, as amended or re-enacted from time to time.

“GOI”

Government of India

“Holiday”

Holiday means the day(s) on which the banks (including the Reserve Bank of

India)are closed for business or clearing in Mumbai or their functioning is affected

due to a strike / bandh call made at any part of the country or due to any other

reason.

"Investment

Management

Agreement"

The agreement dated June 27, 2009 entered into between Axis Mutual Fund

Trustee Limited and Axis Asset Management Company Limited, as amended

from time to time.

"Investor Service

Centres" or "ISCs"

Offices of Axis Asset Management Company Limited or such other centers /

offices as may be designated by the AMC from time to time.

"Load"

In the case of Redemption / Switch out of a Unit, the sum of money deducted

from the Applicable NAV on the Redemption / Switch out (Exit Load) and in the

case of Sale / Switch in of a Unit, a sum of money to be paid by the prospective

investor on the Sale / Switch in of a Unit (Entry Load) in addition to the Applicable

NAV. Presently, entry load cannot be charged by mutual fund schemes.

"Money Market

Includes commercial papers, commercial bills, treasury bills, Government

- 16 -

Axis Fixed Term Plan - Series 120 (91 Days)

Instruments"

securities having an unexpired maturity up to one year, call or notice money,

certificate of deposit, usance bills and any other like instruments as specified by

the Reserve Bank of India from time to time.

"Mutual Fund" or

"the Fund"

Axis Mutual Fund, a trust set up under the provisions of the Indian Trusts Act, 1882.

"Net Asset Value"

or "NAV"

Net Asset Value per Unit of the Scheme(s), calculated in the manner described in

this Scheme Information Document or as may be prescribed by the SEBI (MF)

Regulations from time to time.

"NRI"

A Non-Resident Indian or a Person of Indian Origin residing outside India.

"Official Points of

Acceptance"

Any location, as may be defined by the Asset Management Company from time

to time, where investors can tender the request for subscription (during the new

fund offer period for a close ended scheme), redemption or switching of units,

etc.

“Overseas Citizen

of India” or “OCI”

Means a person registered as an Overseas Citizen of India Cardholder by the

Central Government under section 7A of The Citizenship Act, 1955.

"Person of Indian

Origin"

A citizen of any country other than Bangladesh or Pakistan, if (a) he at any time

held an Indian passport; or (b) he or either of his parents or any of his

grandparents was a citizen of India by virtue of Constitution of India or the

Citizenship Act, 1955 (57 of 1955); or (c) the person is a spouse of an Indian citizen

or person referred to in sub-clause (a) or (b).

"Rating"

Rating means an opinion regarding securities, expressed in the form of standard

symbols or in any other standardized manner, assigned by a credit rating agency

and used by the issuer of such securities, to comply with any requirement of the

SEBI (Credit Rating Agencies) Regulations, 1999 as amended from time to time.

"RBI"

Reserve Bank of India, established under the Reserve Bank of India Act, 1934, (2

of 1934)

"Registrar and

Transfer Agent" or

“Registrar”

KFin Technologies Limited, Hyderabad, currently acting as registrar to the

Scheme, or any other Registrar appointed by the AMC from time to time.

"Redemption” or

“Repurchase"

Redemption of Units of the Scheme, where permitted.

“Regulatory

Agency”

GOI, SEBI, RBI or any other authority or agency entitled to issue or give any

directions, instructions or guidelines to the Mutual Fund

“Repo”

Sale/Repurchase of Securities with simultaneous agreement to repurchase / resell

them at a later date.

"Statement of

Additional

Information" or

"SAI"

The document issued by Axis Mutual Fund containing details of Axis Mutual Fund,

its constitution, and certain tax, legal and general information. SAI is legally a

part of the Scheme Information Document.

"Sale or

Subscription"

Sale or allotment of Units to the Unit holder upon subscription by the Investor /

applicant under the respective plans of the scheme.

"Scheme"

Axis Fixed Term Plan - Series 120 (91 Days) and each of the Plans launched there

under including the Options offered under such Plans referred to individually as

the Plan and collectively as the Plans or the Scheme in this Scheme Information

Document.

Each such Plan being a distinct entity is of the nature of a scheme under the SEBI

(MF) Regulations.

“Scheme

Information

Document”

This document issued by Axis Mutual Fund, offering Units of scheme(s) for

subscription.

"SEBI"

Securities and Exchange Board of India, established under the Securities and

Exchange Board of India Act, 1992.

- 17 -

Axis Fixed Term Plan - Series 120 (91 Days)

"SEBI (MF)

Regulations" or

"Regulations"

Securities and Exchange Board of India (Mutual Funds) Regulations, 1996, as

amended from time to time.

"Sponsor"

Axis Bank Limited

"Switch"

Redemption of a unit in any scheme (including the plans and options therein) of

the Mutual Fund against purchase of a unit in another scheme (including the

plans and options therein) of the Mutual Fund, subject to completion of Lock-in

Period, if any.

"Deed of Trust"

The Deed of Trust dated June 27, 2009 made by and between Axis Bank Limited

and Axis Mutual Fund Trustee Limited thereby establishing an irrevocable trust,

called Axis Mutual Fund.

“Tri Party Repo”

Tri Party Repo Dealing System (TREPS) facilitates borrowing and lending of funds,

in Triparty Repo arrangement.

“Trustee” or

“Trustee

Company”

Axis Mutual Fund Trustee Limited incorporated under the provisions of the

Companies Act, 1956 and approved by SEBI to act as the Trustee to the

Scheme(s) of the Axis Mutual Fund.

"Unit"

The interest of the Unit holder which consists of each Unit representing one

undivided share in the assets of the Scheme.

"Unit holder" or

"Investor"

A person holding Unit in the Scheme of Axis Mutual Fund offered under this

Scheme Information Document.

INTERPRETATION

For all purposes of this Scheme Information Document, except as otherwise expressly

provided or unless the context otherwise requires:

• all references to the masculine shall include the feminine and all references, to the

singular shall include the plural and vice-versa.

• all references to "dollars" or "$" refer to United States Dollars and "Rs" refer to Indian

Rupees. A "crore" means "ten million" and a "lakh" means a "hundred thousand".

• all references to timings relate to Indian Standard Time (IST).

• References to a day are to a calendar day including a non-Business Day.

E. DUE DILIGENCE BY THE ASSET MANAGEMENT COMPANY

It is confirmed that:

(i) The Scheme Information Document forwarded to SEBI is in accordance with the

SEBI (Mutual Funds) Regulations, 1996 and the guidelines and directives issued by

SEBI from time to time.

(ii) All legal requirements connected with the launching of the Scheme as also the

guidelines, instructions, etc., issued by the Government and any other competent

authority in this behalf, have been duly complied with.

(iii) The disclosures made in the Scheme Information Document are true, fair and

adequate to enable the investors to make a well informed decision regarding

investment in the Scheme.

(iv) The intermediaries named in the Scheme Information Document and Statement

of Additional Information are registered with SEBI and their registration is valid, as

on date.

(v) There are no deviations from the regulations and no subjective interpretations

have been applied to the provisions of the regulations unless specified.

(vi) The contents of Scheme Information Document including figures, data, yields, etc.

have been checked and are factually correct.

- 18 -

Axis Fixed Term Plan - Series 120 (91 Days)

(vii) AMC has complied with the set of checklist applicable for Scheme Information

Documents.

Place: Mumbai

Signed: Sd/-

Date: January 10, 2024

Name: Darshan Kapadia

Designation: Compliance Officer

- 19 -

Axis Fixed Term Plan - Series 120 (91 Days)

II. INFORMATION ABOUT THE SCHEME

A. TYPE OF THE SCHEME(S)

A Close ended debt scheme, A Moderate Interest Rate Risk and Moderate Credit Risk.

B. WHAT IS THE INVESTMENT OBJECTIVE OF THE SCHEME(S)?

The Scheme will endeavour to generate returns through a portfolio of debt & money market

instruments that are maturing on or before the maturity of the scheme. However, there is no

assurance that the investment objective of the Scheme will be achieved. The Scheme does

not assure or guarantee any returns.

C.HOW WILL THE SCHEME(S) ALLOCATE ITS ASSETS?

Under normal circumstances, the asset allocation will be:

For scheme(s) having maturity up to 400 days

Instruments

Indicative Allocation

(% of net assets)

Risk Profile

Debt * and Money Market Instruments

0 - 100%

Low to Moderate

*securitized debt up to 40% of the debt portfolio. The Scheme shall not invest in foreign

securitized debt.

Investment in Derivatives - up to 50% of the debt portfolio. Investment in derivatives shall be

for hedging. The cumulative gross exposure through debt (including money market

instruments) and derivative positions shall not exceed 100% of the net assets of the scheme.

Cash or cash equivalents with residual maturity of less than 91 days shall be treated as not

creating any exposure. SEBI vide letter dated November 3, 2021, has clarified that Cash

Equivalent shall consist of Government Securities, T-Bills and Repo on Government Securities

having residual maturity of less than 91 days.

Investment in Repo in Corporate Debt Securities

The Scheme may undertake repo transactions in corporate debt securities in accordance

with the directions issued by RBI and SEBI from time to time. The gross exposure of the Scheme

to repo transactions in corporate debt securities shall not be more than 10% of the net assets

of the Scheme or such higher limit as may be specified by SEBI. Further investment shall be

made subject to the guidelines which may be prescribed by the Board of Directors of the

Asset Management Company and Trustee Company.

Credit Enhancement / Structured Obligations:

In accordance with the Para 12.3 of Master Circular for Mutual Funds, the investment by the

Scheme in the following instruments shall not exceed 10% of the debt portfolio of the scheme

and the group exposure in such instruments shall not exceed 5% of the debt portfolio of the

scheme:

a. Unsupported rating of debt instruments (i.e. without factoring-in credit enhancements) is

below investment grade and

b. Supported rating of debt instruments (i.e. after factoring-in credit enhancement) is above

investment grade.

- 20 -

Axis Fixed Term Plan - Series 120 (91 Days)

These limits shall not be applicable on investments in securitized debt instruments, as defined

in SEBI (Public Offer and Listing of Securitized Debt Instruments) Regulations 2008. The Scheme

shall invest in abovementioned securities within such limits as may be revised by SEBI from

time to time.

Investment in Mutual Fund units

The Scheme may seek exposure in Mutual Fund units of debt schemes subject to applicable

Regulations. Such investment shall not exceed 5% of the net assets of the Scheme.

The scheme will not invest in unrated debt instruments, Credit default Swaps (CDS), securities

covered under under Para 12.2 of Master circular for Mutual Fund Scheme , REITs / InvITs,

foreign Securities. The Scheme will not engage in short selling and securities lending.

The scheme retains the flexibility to invest across all the securities in the debt, Money Markets

Instruments and units of mutual funds. The fund manager can use Derivative instruments to

protect the downside risk.

Investment in Short Term Deposits

Pending deployment of the funds in securities in terms of investment objective of the Scheme,

the AMC may in terms of Para 12.16 of Master Circular for Mutual Fund may be amended

from time to time as may be amended from time to time, park the funds of the Scheme in

short term deposits of the Scheduled Commercial Bank

The net assets of the Scheme will be invested in Debt & Money market instruments maturing

on or before the maturity date of the scheme.

Due to market conditions, the AMC may invest beyond the range set out in the

asset allocation. Such deviations shall normally be for a short term and defensive

considerations as per Para 2.9 of Master Circular for Mutual Funds, and the fund manager will

rebalance the portfolio within 30 calendar days from the date of deviation.

Further, as per Para 2.9 of Master Circular for Mutual Funds , as may be amended from time

to time, in the event of deviation from mandated asset allocation due to passive breaches

(occurrence of instances not arising out of omission and commission of the AMC), the fund

manager shall rebalance the portfolio of the Scheme within 30 Business Days. In case the

portfolio of the Scheme is not rebalanced within the period of 30 Business Days, justification in

writing, including details of efforts taken to rebalance the portfolio shall be placed before the

Investment Committee of the AMC. The Investment Committee, if it so desires, can extend

the timeline for rebalancing up to sixty (60) Business Days from the date of completion of

mandated rebalancing period. Further, in case the portfolio is not rebalanced within the

aforementioned mandated plus extended timelines the AMC shall comply with the

prescribed restrictions, the reporting and disclosure requirements as specified in under Para

2.9 of Master circular for Mutual Fund Scheme.

- 21 -

Axis Fixed Term Plan - Series 120 (91 Days)

D.WHERE WILL THE SCHEME(S) INVEST?

The corpus of the scheme will be invested in Debt Instruments, Money Market Instruments and

other permitted securities which will include but not limited to:

Debt Instruments, and Money Market Instruments:

Certificate of Deposit (CD)

Certificate of Deposit is a negotiable money market instrument issued by scheduled

commercial banks and select all-India Financial Institutions that have been permitted by the

RBI to raise short term resources. The maturity period of CDs issued by the Banks is between 7

days to one year, whereas, in case of FIs, maturity is one year to 3 years from the date of

issue.

Commercial Paper (CP)

Commercial Paper is an unsecured negotiable money market instrument issued in the form of

a promissory note, generally issued by the corporates, primary dealers and all India Financial

Institutions as an alternative source of short term borrowings. CP is traded in secondary

market and can be freely bought and sold before maturity.

Treasury Bill (T-Bills)

Treasury Bills are issued by the Government of India to meet their short term borrowing

requirements. T-Bills are issued for maturities of 14 days, 91 days, 182 days and 364 days.

The Scheme may also invest in Cash Management Bill (CMB) issued by the Government of

India to meet their short term borrowing requirements. CMB are generally issued for maturities

of less than 91 days.

Commercial Usance Bills

Bill (bills of exchange/ promissory notes of public sector and private sector corporate entities)

Rediscounting, usance bills and commercial bills.

Repos

Repo (Repurchase Agreement) or Reverse Repo is a transaction in which two parties agree

to sell and purchase the same security with an agreement to purchase or sell the same

security at a mutually decided future date and price. The transaction results in collateralized

borrowing or lending of funds. Presently in India, corporate debt securities, G-Secs, State

Government securities and T-Bills are eligible for Repo/Reverse Repo.

Tri-party repo means a repo contract where a third entity (apart from the borrower and

lender), called a Tri-Party Agent, acts as an intermediary between the two parties to the repo

to facilitate services like collateral selection, payment and settlement, custody and

management during the life of the transaction.

The Scheme may undertake repo or reverse repo transactions accordance with the

directions issued by RBI and SEBI from time to time. Such investment shall be made subject to

the guidelines which may be prescribed by the Board of Directors of the Asset Management

Company and Trustee Company.

Securities created and issued by the Central and State Governments as may be permitted by

RBI

- 22 -

Axis Fixed Term Plan - Series 120 (91 Days)

These securities guaranteed by the Central and State Governments (including but not limited

to coupon bearing bonds, zero coupon bonds and treasury bills). State Government

securities (popularly known as State Development Loans or SDLs) are issued by the respective

State Government in co-ordination with the RBI.

Non-Convertible Debentures and Bonds

Non-convertible debentures as well as bonds are securities issued by companies / institutions

promoted / owned by the Central or State Governments and statutory bodies which may or

may not carry a Central/State Government guarantee, Public and private sector banks, all

India Financial Institutions and Private Sector Companies. These instruments may have fixed

or floating rate coupon. These instruments may be secured or unsecured against the assets

of the Company and generally issued to meet the short term and long term fund

requirements.

The Scheme may also invest in the non-convertible part of convertible debt securities.

Securitized Assets

Securitization is a structured finance process which involves pooling and repackaging of cash

flow producing financial assets into securities that are then sold to investors. They are termed

as Asset Backed Securities (ABS) or Mortgage Backed Securities (MBS). ABS are backed by

other assets such as credit card, automobile or consumer loan receivables, retail installment

loans or participations in pools of leases. Credit support for these securities may be based on

the underlying assets and/or provided through credit enhancements by a third party. MBS is

an asset backed security whose cash flows are backed by the principal and interest

payments of a set of mortgage loans. Such Mortgage could be either residential or

commercial properties. ABS/MBS instrument reflect the undivided interest in the underlying

assets and do not represent the obligation of the issuer of ABS/MBS or the originator of

underlying receivables. Securitization often utilizes the services of SPV.

Pass through Certificate (PTC)

(Pay through or other Participation Certificates) represents beneficial interest in an underlying

pool of cash flows. These cash flows represent dues against single or multiple loans originated

by the sellers of these loans. These loans are given by banks or financial institutions to

corporates. PTCs may be backed, but not exclusively, by receivables of personal loans, car

loans, two wheeler loans and other assets subject to applicable regulations.

The following are certain additional disclosures w.r.t. investment in securitized debt:

1. How the risk profile of securitized debt fits into the risk appetite of the Scheme?

Securitized debt is a form of conversion of normally non-tradable loans to transferable

securities. This is done by assigning the loans to a special purpose vehicle (a trust), which in

turn issues Pass-Through-Certificates (PTCs). These PTCs are transferable securities with fixed

income characteristics. The risk of investing in securitized debt is similar to investing in debt

securities. However, it differs in two respects.

Typically, the liquidity of securitized debt is less than similar debt securities. For certain types of

securitized debt (backed by mortgages, personal loans, credit card debt, etc.), there is an

additional pre-payment risk. Pre-payment risk refers to the possibility that loans are repaid

before they are due, which may reduce returns if the re-investment rates are lower than

initially envisaged.

- 23 -

Axis Fixed Term Plan - Series 120 (91 Days)

Because of these additional risks, securitized debt typically offers higher yields than debt

securities of similar credit rating and maturity. If the fund manager judges that the additional

risks are suitably compensated by the higher returns, he may invest in securitized debt up to

the limits specified in the asset allocation table above.

2. Policy relating to originators based on nature of originator, track record, NPAs, losses in

earlier securitized debt, etc.

The originator is the person who has initially given the loan. The originator is also usually

responsible for servicing the loan (i.e. collecting the interest and principal payments). An

analysis of the originator is especially important in case of retail loans as this affects the credit

quality and servicing of the PTC. The key risk is that of the underlying assets and not of the

originator. For example, losses or performance of earlier issuances does not indicate quality

of current series. However, such past performance may be used as a guide to evaluate the

loan standards, servicing capability and performance of the originator.

Originators may be: Banks, Non-Banking Finance Companies, Housing Finance Companies,

etc. The fund manager / credit analyst evaluates originators based on the following

parameters

• Track record

• Willingness to pay, through credit enhancement facilities etc.

• Ability to pay

• Business risk assessment, wherein following factors are considered:

- Outlook for the economy (domestic and global)

- Outlook for the industry

- Company specific factors

In addition, a detailed review and assessment of rating rationale is done including

interactions with the originator as well as the credit rating agency.

The following additional evaluation parameters are used as applicable for the originator /

underlying issuer for pool loan and single loan securitization transactions:

• Default track record/ frequent alteration of redemption conditions / covenants

• High leverage ratios of the ultimate borrower (for single-sell downs) – both on a

standalone basis as well on a consolidated level/ group level

• Higher proportion of reschedulement of underlying assets of the pool or loan, as the

case may be

• Higher proportion of overdue assets of the pool or the underlying loan, as the case

may be

• Poor reputation in market

• Insufficient track record of servicing of the pool or the loan, as the case may be.

3. Risk mitigation strategies for investments with each kind of originator

An analysis of the originator is especially important in case of retail loans as the size and

reach affects the credit quality and servicing of the PTC. In addition, the quality of the

collection process, infrastructure and follow-up mechanism; quality of MIS; and credit

enhancement mechanism are key risk mitigants for the better originators / servicers.

In case of securitization involving single loans or a small pool of loans, the credit risk of the

underlying borrower is analyzed. In case of diversified pools of loans, the overall characteristic

of the loans is analyzed to determine the credit risk. The credit analyst looks at ageing (i.e.

- 24 -

Axis Fixed Term Plan - Series 120 (91 Days)

how long the loan has been with the originator before securitization) as one way of

evaluating the performance potential of the PTC. Securitization transactions may include

some risk mitigants (to reduce credit risk). These may include interest subvention (difference in

interest rates on the underlying loans and the PTC serving as margin against defaults),

overcollateralization (issue of PTCs of lesser value than the underlying loans, thus even if some

loans default, the PTC continues to remain protected), presence of an equity / subordinate

tranche (issue of PTCs of differing seniority when it comes to repayment - the senior tranches

get paid before the junior tranche) and / or guarantees.

4. The level of diversification with respect to the underlying assets, and risk mitigation

measures for less diversified investments

In case of securitization involving single loans or a small pool of loans, the credit risk of the

borrower is analyzed. In case of diversified pools of loans, the overall characteristic of the

loans is analyzed to determine the credit risk.

The credit analyst looks at ageing (i.e. how long the loan has been with the originator before

securitization) as one way of judging the performance potential of the PTC. Additional risk

mitigants may include interest subvention, over collateralization, presence of an equity /

subordinate tranche and / or guarantees. The credit analyst also uses analysis by credit rating

agencies on the risk profile of the securitized debt.

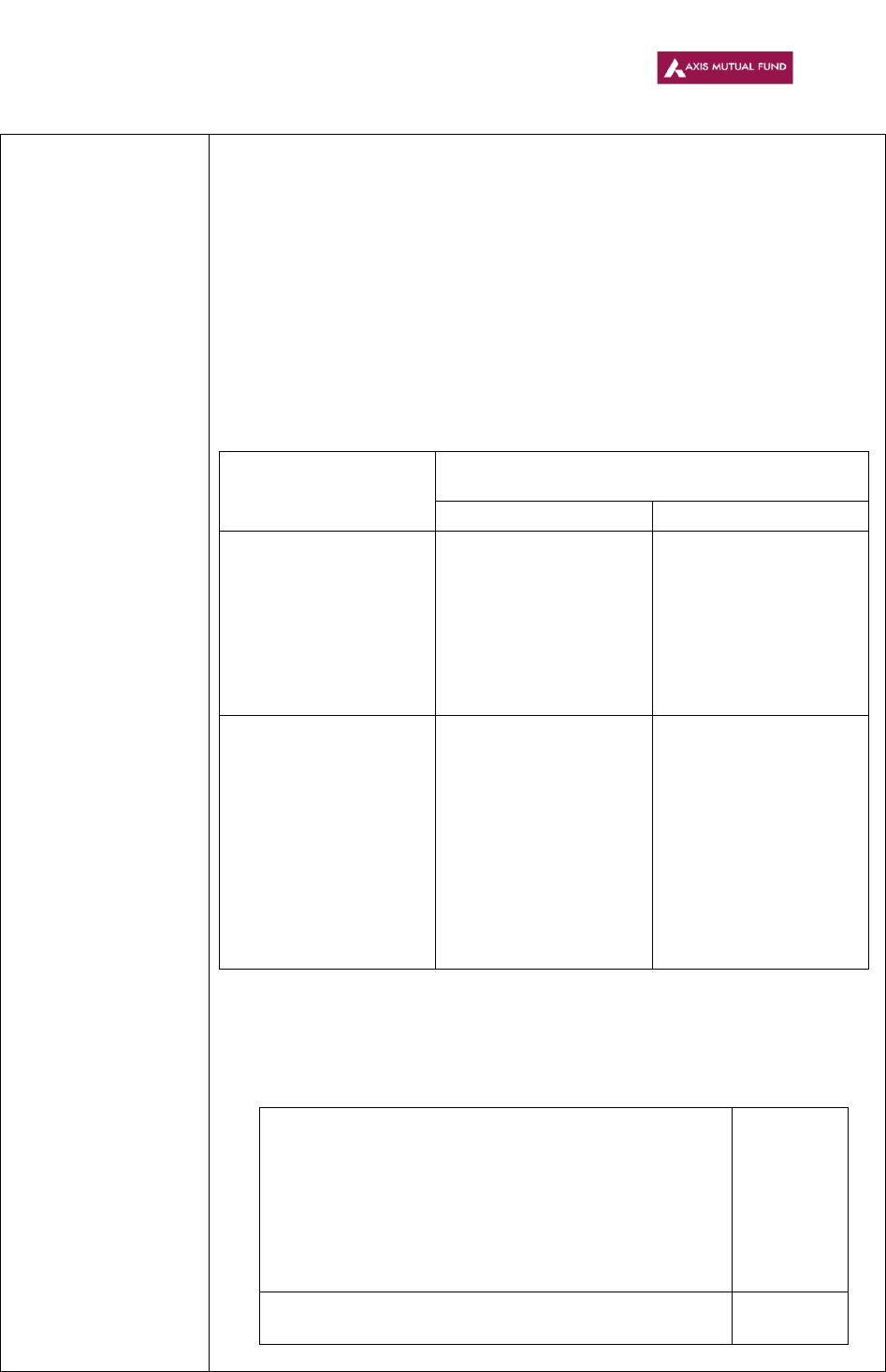

Currently, the following parameters are used while evaluating investment decision relating to

a pool securitization transaction. The Investment Review Committee may revise the

parameters from time to time.

Characteristics/Type

of Pool

Mortgage

Loan

Commercial

Vehicle and

Construction

Equipment

CAR

2

wheelers

Micro

Finance

Pools *

Personal

Loans *

Single

Sell

Downs

Others

Approximate

Average maturity (in

Months)

Up to 10

years

Up to 3

years

Up to 3

years

Up to 3

years

NA

NA

Refer

Note

1

Refer

Note

2

Collateral margin

(including cash,

guarantees, excess

interest spread,

subordinate

tranche)

>10%

>10%

>10%

>10%

NA

NA

“

“

Average Loan to

Value Ratio

<90%

<80%

<80%

<80%

NA

NA

“

“

Average seasoning

of the Pool

>3

months

>3 months

>3

months

>3

months

NA

NA

“

“

Maximum single

exposure range

<1%

<1%

<1%

<1%

NA

NA

“

“

Average single

exposure range %

<1%

<1%

<1%

<1%

NA

NA

“

“

* Currently, the Scheme will not invest in these types of securitized debt

Note 1: In case of securitization involving single loans or a small pool of loans, the credit risk of

the borrower is analyzed. The investment limits applicable to the underlying borrower are

applied to the single loan sell-down.

2: Other investments will be decided on a case-to-case basis

- 25 -

Axis Fixed Term Plan - Series 120 (91 Days)

The credit analyst may consider the following risk mitigating measures in his analysis of the

securitized debt:

• Size of the loan

• Average original maturity of the pool

• Loan to Value Ratio

• Average seasoning of the pool

• Default rate distribution

• Geographical Distribution

• Credit enhancement facility

• Liquid facility

• Structure of the pool

5. Minimum retention period of the debt by originator prior to securitization

Issuance of securitized debt is governed by the Reserve Bank of India. RBI norms cover the

"true sale" criteria including credit enhancement and liquidity enhancements. In addition, RBI

has proposed minimum holding period of between nine and twelve months for assets before

they can be securitized. The minimum holding period depends on the tenor of the

securitization transaction. The Fund will invest in securitized debts that are compliant with the

laws and regulations.

6. Minimum retention percentage by originator of debts to be securitized

Issuance of securitized debt is governed by the Reserve Bank of India. RBI norms cover the

"true sale" criteria including credit enhancement and liquidity enhancements, including

maximum exposure by the originator in the PTCs. In addition, RBI has proposed minimum

retention requirement of between five and ten percent of the book value of the loans by the

originator. The minimum retention requirement depends on the tenor and structure of the

securitization transaction. The Fund will invest in securitized debts that are compliant with the

laws and regulations.

7. The mechanism to tackle conflict of interest when the mutual fund invests in securitized

debt of an originator and the originator in turn makes investments in that particular

scheme of the fund

The key risk is securitized debt relates to the underlying borrowers and not the originator. In a

securitization transaction, the originator is the seller of the debt(s) and the fund is the buyer.

However, the originator is also usually responsible for servicing the loan (i.e. collecting the

interest and principal payments). As the originators may also invest in the scheme, the fund

manager shall ensure that the investment decision is based on parameters as set by the

Investment Review Committee (IRC) of the Asset Management Company and IRC shall

review the same at regular interval.

8. The resources and mechanism of individual risk assessment with the AMC for monitoring

investment in securitized debt

The fund management team including the credit analyst has the experience to analyze

securitized debt. In addition, credit research agencies provide analysis of individual

instruments and pools. On an on-going basis (typically monthly) the servicer provides reports

regarding the performance of the pool. These reports would form the base for ongoing

- 26 -

Axis Fixed Term Plan - Series 120 (91 Days)

evaluation where applicable. In addition, rating reports indicating rating changes would be

monitored for changes in rating agency opinion of the credit risk.

Short Term Deposits

Pending deployment of the funds in securities in terms of investment objective of the Scheme,

the AMC may in terms of Para 12.16 of Master Circular for Mutual Fund as may be amended

from time to time, park the funds of the Scheme in short term deposits of the Scheduled

Commercial Bank

Units of Mutual Fund schemes

The Scheme may invest in other schemes managed by the AMC or in the schemes of any

other mutual funds in conformity with the investment objective of the Scheme and in terms of

the prevailing SEBI (MF) Regulations.

The securities / instruments mentioned above and such other securities the Scheme is

permitted to invest in could be listed, privately placed, secured, unsecured, rated or unrated

and of any maturity (within the investment objective of the scheme).

The securities may be acquired through Initial Public Offering (IPOs), secondary market,

private placement, rights offer, negotiated deals, etc. Further investments in debentures,

bonds and other fixed income securities will be in instruments which have been assigned