This Key Information Memorandum (KIM) sets forth the information, which a prospective investor ought to know before investing. For further details of the scheme/Mutual

Fund, due diligence certificate by the AMC, Key Personnel, investors’ rights & services, risk factors, penalties & pending litigations etc. investors should, before investment,

refer to the Scheme Information Document and Statement of Additional Information available free of cost at any of the Investor Service Centers or distributors or from the

website www.axismf.com.

The Scheme particulars have been prepared in accordance with Securities and Exchange Board of India (Mutual Funds) Regulations 1996, as amended till date, and filed with

Securities and Exchange Board of India (SEBI). The units being offered for public subscription have not been approved or disapproved by SEBI, nor has SEBI certified the

accuracy or adequacy of this KIM.

The Units of the Scheme will not be available for Subscription / Switch-in after the closure of NFO period. The Units of the Scheme will be listed on the BSE/ any other Stock

Exchange. Investors can purchase / sell Units on a continuous basis on the Stock Exchange(s) on which the Units are listed. As the Units are listed on the Stock Exchange, the

Scheme will not provide redemption facility until the date of Maturity.

The Mutual Fund or AMC and its empaneled brokers have not given and shall not give any indicative portfolio and indicative yield in any communication, in any manner

whatsoever. Investors are advised not rely on any communication regarding indicative yield/portfolio with regard to the scheme.

BSE Disclaimer: It is to be distinctly understood that the permission given by BSE Ltd. should not in any way be deemed or construed that the Scheme Information Document has

been cleared or approved by BSE Ltd. nor does it certify the correctness or completeness of any of the contents of the Scheme Information Document. The investors are advised

to refer to the Scheme Information Document for the full text of Disclaimer Clause of BSE Ltd.

The date of this Key Information Memorandum is December 26, 2023.

Name of scheme AXIS FIXED TERM PLAN - SERIES 119 (71 DAYS) A Close ended debt scheme; A Moderate Interest Rate Risk and Moderate Credit Risk.

Scheme Code AXIS/C/D/FTP/23/09/0082

Investment Objective The Scheme will endeavour to generate returns through a portfolio of debt & money market instruments that are maturing on or before the maturity

of the scheme. However, there is no assurance that the investment objective of the Scheme will be achieved. The Scheme does not assure or

guarantee any returns.

Maturity of the Scheme 71 days from the date of allotment (including the date of allotment.) If the maturity / pay out date falls on a non business day, the maturity / pay out

date shall be the next business day.

Asset Allocation Pattern For Scheme(s) having maturity up to 400 days.

of the Scheme

Under normal circumstances the asset allocation will be:

Instruments Indicative Allocation (% of Net Assets)

Minimum Maximum

Debt * and Money Market Instruments 0% 100%

*securitized debt up to 40% of the debt portfolio. The Scheme shall not invest in foreign securitized debt.

Investment in Derivatives - up to 50% of the debt portfolio. Investment in derivatives shall be for hedging. The cumulative gross exposure

through debt (including money market instruments) and derivative positions shall not exceed 100% of the net assets of the scheme. Cash or cash

equivalents with residual maturity of less than 91 days shall be treated as not creating any exposure. SEBI vide letter dated November 3, 2021,

has clarified that Cash Equivalent shall consist of Government Securities, T-Bills and Repo on Government Securities having residual maturity of

less than 91 days.

Investment in Repo in Corporate Debt Securities: The Scheme may undertake repo transactions in corporate debt securities in accordance with

the directions issued by RBI and SEBI from time to time. The gross exposure of the Scheme to repo transactions in corporate debt securities shall

not be more than 10% of the net assets of the Scheme or such higher limit as may be specified by SEBI. Further investment shall be made subject

to the guidelines which may be prescribed by the Board of Directors of the Asset Management Company and Trustee Company.

Credit Enhancement / Structured Obligations: In accordance with the Para 12.3 of Master Circular for Mutual Funds, the investment by the

Scheme in the following instruments shall not exceed 10% of the debt portfolio of the scheme and the group exposure in such instruments shall

not exceed 5% of the debt portfolio of the scheme:

Axis Asset Management Company Limited (Investment Manager)

KEY INFORMATION MEMORANDUM AND APPLICATION FORM

AXIS FIXED TERM PLAN - SERIES 119 (71 DAYS)

(A Close ended debt scheme; A Moderate Interest Rate Risk and Moderate Credit Risk)

Offer of Units of Rs. 10 each during the New Fund Offer

NEW FUND OFFER OPENS ON: JANUARY 03, 2024

NEW FUND OFFER CLOSES ON: JANUARY 09, 2024

(The product labelling assigned during the New Fund Offer is based on internal assessment of the Scheme Characteristics or model portfolio and the same may vary post

NFO when actual investments are made)

This product is suitable for investors

who are seeking*

• Optimal returns over 71 Days

• Investment in debt & money market

instruments maturing on or before

the maturity of the scheme.

*Investors should consult their financial

advisers if in doubt about whether the

product is suitable for them.

Product Labelling

Product Riskometer Benchmark Riskometer

CRISIL Liquid Debt Index

Fund Name & Benchmark

AXIS FIXED TERM PLAN - SERIES 119 (71 DAYS) (A Close ended debt scheme; A Moderate Interest Rate Risk and

Moderate Credit Risk)

Benchmark: CRISIL Liquid Debt Index

Potential Risk Class Matrix

Relatively

Low

(Class A)

Moderate

(Class B)

Relatively

High

(Class C)

Relatively Low

(Class I)

Moderate

(Class II)

Relatively High

(Class III)

Credit Risk

Interest Rate

Risk

B-II

-1-

High

Moderately

High

Moderate

Low to

Moderate

Low

Very High

RISKOMETER

Investors understand that their principal

will be at low to moderate risk

High

Moderately

High

Moderate

Low to

Moderate

Low

Very High

RISKOMETER

a. Unsupported rating of debt instruments (i.e. without factoring-in credit enhancements) is below investment grade and

b. Supported rating of debt instruments (i.e. after factoring-in credit enhancement) is above investment grade.

These limits shall not be applicable on investments in securitized debt instruments, as defined in SEBI (Public Offer and Listing of Securitized

Debt Instruments) Regulations 2008. The Scheme shall invest in abovementioned securities within such limits as may be revised by SEBI from

time to time.

Investment in Mutual Fund units: The Scheme may seek exposure in Mutual Fund units of debt schemes subject to applicable Regulations. Such

investment shall not exceed 5% of the net assets of the Scheme.

The scheme will not invest in unrated debt instruments, Credit default Swaps (CDS), securities covered under under Para 12.2 of Master circular

for Mutual Fund Scheme , REITs / InvITs, foreign Securities. The Scheme will not engage in short selling and securities lending.

The scheme retains the flexibility to invest across all the securities in the debt, Money Markets Instruments and units of mutual funds. The fund

manager can use Derivative instruments to protect the downside risk.

Investment in Short Term Deposits: Pending deployment of the funds in securities in terms of investment objective of the Scheme, the AMC may

in terms of Para 12.16 of Master Circular for Mutual Fund may be amended from time to time as may be amended from time to time, park the

funds of the Scheme in short term deposits of the Scheduled Commercial Bank

The net assets of the Scheme will be invested in Debt & Money market instruments maturing on or before the maturity date of the scheme.

Investment Strategy The fund manager will invest in debt & money market instruments maturing on or before the maturity date of the scheme(s) with the objective of

of the Scheme limiting interest rate volatility.

The fund manager will allocate assets of the scheme(s) between various fixed income securities (which mature on or before the maturity of the

scheme) with an endeavor to achieve optimal risk adjusted returns.

The Scheme does not assure or guarantee any returns.

Credit evaluation policy: The investment team of the AMC will carry out rigorous in depth credit evaluation of the money market and debt

instruments proposed to be invested in. The credit evaluation will essentially be a bottom up approach and include a study of the operating

environment of the issuer, the past track record as well as the future prospects of the issuer and the short term / long term financial health of the

issuer.

List of sectors the fund would not be investing

Aviation and gems & jewelry.

Floors and ceilings within a range of 5% of the intended allocation (in %) against each sub asset class/rating

As per the regulations, the scheme is allowed to invest within a range of 5% of the intended allocation (floor and cap) against each sub asset

class/credit rating..

Instruments Credit Rating

AAA A1+ AA A BBB Not applicable

Cds -- 35%-40% -- -- -- --

CPs -- 60%-65% -- -- -- --

NCDs/ Bonds -- -- -- – – –

Securitized Debt -- -- -- – – –

Government of India dated Securities/ State Government Securities -- -- -- -- -- 0-5%

Tri Party Repos, T-Bills, Cash Management Bill, Repos -- -- -- -- -- 0-5%

1. In Securities with rating A and AA shall include A+ and A- & AA+ and AA- respectively.

2. Positive variation in investment towards higher credit rating in the same instrument shall be allowed.

3. In case of non-availability of and taking into account the risk-reward analysis of CPs, NCDs (including securitized debt), the Scheme may

invest in CDs and CBLO having equivalent or higher ratings.

4. At the time of building up the portfolio post NFO and towards the maturity of the Scheme, there may be a higher allocation to cash and cash

equivalents.

5. Subsequent to the initial portfolio construction, during the tenure of the Scheme, the allocation of the scheme may vary due to instances like

(i) coupon inflow; (ii) the instrument is called or bought back by the issuer; (iii) in anticipation of any adverse credit event, etc.

6. All investment shall be made based on the rating prevalent at the time of investment. Further, in case of an instrument having dual ratings,

the most conservative publicly available rating would be considered.

7. Disclosures with respect to investment in unrated securities, derivatives, etc. if any.

8. In the event of any deviations from the floor and ceiling of credit ratings specified for any instrument, the same shall be rebalanced within 30

calendar days from the date of the said deviation.

Risk Profile of the Scheme Mutual Fund Units involve investment risks including the possible loss of principal. Please read the SID carefully for details on risk factors before

investment. Scheme specific Risk Factors are summarized below:

The scheme carries risks associated with investing in debt and money market securities.

Investment in mutual fund units involves investment risks such as trading volumes, settlement risk, liquidity risk and default risk. Trading volume

may restrict liquidity. The AMC may choose to invest in unlisted securities which may increase the risk on the portfolio. Also, the value of the

Scheme investments may be affected by changes in law/policies of the government, taxation laws and political, economic or other developments.

Investments in debt and money market instruments are subject to interest rate risk, re-investment risk, basis risk, credit risk, spread risk,

prepayment risk, creation of segregated portfolio, investment in debt instruments having credit enhancement, etc.

Listing of the units of the fund does not necessarily guarantee their liquidity and there can be no assurance that an active secondary market for

the units will develop or be maintained. Consequently, the Fund may quote below its face value / NAV.

Please refer to the SID for further details.

Risk Management Interest rate risk is managed by a meticulous determination of the modified duration of the portfolio. Extensive analysis of macro-economic

conditions is done to form a view on future interest rates and to position the portfolio accordingly. Credit risk is managed by in-depth analysis of

issuer (financial/operating performance) with the help of internal and external research. Liquidity risk is addressed by maintaining exposure to

cash/cash equivalents and highly liquid instruments.

Creation of Segregated In case of credit event, the Scheme may create segregated portfolio of debt and money market instruments in terms of applicable SEBI

Portfolio regulations/ circulars.

Plans and Options Axis Fixed Term Plan - Series - 119 (71 Days) offers the following Plans:

1. Axis Fixed Term Plan - Series 119 (71 Days) - Regular Plan

2. Axis Fixed Term Plan - Series 119 (71 Days) - Direct Plan

Regular Plan: Regular Plan is available for all type of investors investing through Distributor.

Direct Plan: Direct Plan is only for investors who purchase /subscribe Units in a Scheme directly with the Fund and is not available for investors

who route their investments through a Distributor.

-2-

-3-

All the Plans will have common portfolio.

The Scheme offers the following options under each plans:

Options Sub-options

Growth Nil

Income Distribution cum Capital Withdrawal (IDCW) Quarterly IDCW Payout

Scheme(s) having maturity ranging up to 12 months will offer Quarterly IDCW option (payout facility) in addition to Growth option.

IDCW may or may not be declared under this option at the discretion of the Trustee.

In case of Units held in dematerialized mode, the Depositories (NSDL/CDSL) will give the list of demat account holders and the number of Units

held by them in electronic form on the Record date to the Registrars and Transfer Agent of the Mutual Fund.

Default Plan/Option : The investor must clearly specify his choice of plan/ option. In the absence of such clear instruction, it will be assumed that

the investor has opted for ‘default’ plan/ option and the application will be processed accordingly.

Investors subscribing under Direct Plan of a Scheme will have to indicate “Direct Plan” against the Scheme name in the application form e.g. “Axis

Fixed Term Plan - Series 119 (71 Days) - Direct Plan”. Investors should also indicate “Direct” in the ARN column of the application form.

The investors may refer to the following table for applicability of Direct Plan/ Regular Plan under different scenario:

Scenario Broker Code mentioned by the investor Plan mentioned by the investor Default Plan to be captured

1 Not mentioned Not mentioned Direct Plan

2 Not mentioned Direct Direct Plan

3 Not mentioned Regular Direct Plan

4 Mentioned Direct Direct Plan

5 Direct Not Mentioned Direct Plan

6 Direct Regular Direct Plan

7 Mentioned Regular Regular Plan

8 Mentioned Not Mentioned Regular Plan

In cases of wrong/ invalid/ incomplete ARN codes mentioned on the application form, the application shall be processed under Regular Plan. The

AMC shall contact and obtain the correct ARN code within 30 calendar days of the receipt of the application form from the investor/ distributor.

In case, the correct code is not received within 30 calendar days, the AMC shall reprocess the transaction under Direct Plan from the date of

application without any exit load.

Default option: Growth

Applicable NAV Being a close ended Scheme, Investors can subscribe to the Units of the scheme during the New Fund Offer Period only.

After close of NFO Period, the Fund will not provide facility for subscription / redemption /switches, and hence cut-off timing and applicable NAV

provisions do not apply.

In case of switch-out proposed for investing the redemption proceeds in another scheme of the Fund, the switch-out request will be accepted up

to 3.00 p.m. on the Maturity Date.

Minimum Application Purchase Additional Purchase Repurchase

Amount/ Number of Units ` 5,000 and in multiples of ` 10/- thereafter Not applicable Not applicable

Non CTS / Outstation Cheques/Demand Drafts will not be accepted.

Application in NFO will be processed through Direct Credit mode(Transfer / NEFT / RTGS) only. Switch-in requests from equity and hybrid

schemes will be accepted up to January 08, 2024 till the cut-off time applicable for switches. Switch-in requests from debt schemes will be

accepted up to January 09, 2024, till the cut-off time applicable for switches.

Despatch of Repurchase As the Scheme is closed ended scheme, investors will not be able to redeem their units during the tenor of the scheme. Units under the scheme

(Redemption) Request will be compulsorily and without any further act by the Unit holder(s) redeemed on the Maturity Date of the scheme.

The redemption proceeds shall be dispatched to the unit holders within three (3) working days from the Maturity Date of the scheme.

Benchmark Index CRISIL Liquid Debt Index

IDCW Policy The Trustee will endeavor to declare the IDCW as specified, subject to availability of distributable surplus calculated in accordance with the

Regulations. The actual declaration of IDCW and frequency will inter-alia, depend on availability of distributable surplus calculated in

accordance with SEBI (MF) Regulations and the decisions of the Trustee shall be final in this regard. There is no assurance or guarantee to the

Unit holders as to the rate of IDCW nor that will the IDCW be paid regularly.

Name of the Fund Manager Mr. Sachin Jain (Since Inception)

Tenure of Managing the Tenure is applicable from the date of inception of the Scheme

Scheme as Fund Manager

Scheme’s portfolio Not applicable as the scheme is a new fund to be launched

holdings

Fund allocation towards Not applicable as the scheme is a new fund to be launched

various Sectors

Website link for Please visit www.axismf.com to obtain Scheme’s latest fortnightly / monthly portfolio holding statement.

Fortnightly / Monthly

Portfolio Holding

Portfolio Turnover Portfolio turnover ratio: Not applicable as the scheme is a new fund to be launched.

Name of the Trustee Axis Mutual Fund Trustee Limited

Company

Performance of This Scheme is a new scheme and does not have any performance track record.

the scheme

Expenses of the Scheme (i) Load Structure

Entry load: Not applicable

Para 10.4 of Master Circular for Mutual Funds has decided that there shall be no Entry Load for all Mutual Fund schemes.

The upfront commission on investment made by the investor, if any, shall be paid to the ARN Holder (AMFI registered Distributor) directly by

the investor, based on the investor’s assessment of various factors including service rendered by the ARN Holder.

Exit load : Nil

(ii) Recurring expenses

All fees and expenses charged in a Direct Plan (in percentage terms) under various heads including the investment and advisory fee shall not

exceed the fees and expenses charged under such heads in other than Direct Plan. **Direct Plan shall have a lower expense ratio excluding

distribution expenses, commission, etc. and no commission for distribution of Units will be paid / charged under Direct Plan.

Mutual Fund/AMCs may charge GST on investment and advisory service fees (‘AMC fees’) in addition to the maximum limit as prescribed in

regulation 52 of the SEBI Regulations.

The expenses towards Investment Management and Advisory Fees under Regulation 52 (2) and the various sub-heads of recurring

expenses mentioned under Regulation 52 (4) of SEBI (MF) Regulations can be apportioned under various expense heads/ sub heads without

any sub limit, as permitted under the applicable regulations. Thus, there shall be no internal sub-limits within the expense ratio for expense

heads mentioned under Regulation 52 (2) and (4) respectively.

These estimates have been made in good faith as per the information available to the Investment Manager and are subject to change inter-se

or in total subject to prevailing Regulations.

The AMC will charge the Scheme such actual expenses incurred, subject to the statutory limit prescribed in the Regulations.

The recurring expenses of the Scheme (including the Investment Management and Advisory Fees) shall be as per the limits prescribed under

the SEBI (MF) Regulations.

The total expenses of the Scheme including the investment management and advisory fee shall not exceed the limit stated in Regulation

52(6) of the SEBI (MF) Regulations and amendments thereto.

Expenses charged to the Scheme:

A. In addition to the limits as specified in Regulation 52(6) of SEBI MF Regulations or the Total Recurring Expenses (Total Expense Limit) as

specified above, the following costs or expenses may be charged to the Scheme namely-

Additional expenses for gross new inflows from specified cities

a) expenses not exceeding of 0.30 per cent of daily net assets, if the new inflows from such cities as specified by SEBI/AMFI from

time to time are at least -

i. 30 per cent of gross new inflows in the Scheme, or;

ii. 15 per cent of the average assets under management (year to date) of the Scheme, whichever is higher:

Provided that if inflows from such cities is less than the higher of sub-clause (i) or sub- clause (ii), such expenses on daily net assets

of the Scheme shall be charged on proportionate basis.

Provided further that, expenses charged under this clause shall be utilised for distribution expenses incurred for bringing inflows

from such cities.

Provided further that amount incurred as expense on account of inflows from such cities shall be credited back to the Scheme in

case the said inflows are redeemed within a period of one year from the date of investment.

Note: Pursuant to SEBI letter dated February 24, 2023 read with AMFI communication dated March 02, 2023, w.e.f March 01,

2023 no additional expense shall be charged on the new inflows received on or after March 01, 2023 from specified cities as per

Regulation 52 (6A) (b) till any further guidance is received from SEBI in this regard.

This sub clause (a) shall be applicable for inflows received during the NFO period.

b) GST payable on investment and advisory service fees (‘AMC fees’) charged by Axis Asset Management Company Ltd.;

Brokerage and transaction cost incurred for the purpose of execution shall be charged to the schemes as provided under

Regulation 52 (6A) (a) upto 12 bps and 5 bps for cash market transactions and derivatives transactions respectively. Any payment

towards brokerage & transaction costs, over and above the said 12 bps and 5 bps for cash market transactions and derivatives

transactions respectively within the maximum limit of Total Expense Ratio (TER) as prescribed under Regulation 52 of the

Regulations

B. Within the Total Expense Limit chargeable to the scheme, following will be charged to the Scheme:

(a) GST on other than investment and advisory fees, if any, (including on brokerage and transaction costs on execution of trades) shall

be borne by the Scheme

(b) Investor education and awareness initiative fees of at least 2 basis points on daily net assets of respective Scheme.

C. AMC fees charged by Axis AMC to the scheme will be within the Total Expense Limit as prescribed by SEBI Regulations, as amended

from time to time.

Expenses over and above the prescribed limit shall be charged / borne in accordance with the Regulations prevailing from time to time.

The mutual fund would update the current expense ratios on its website (www.axismf.com) atleast three working days prior to the effective

date of the change. Investors can refer ‘Total Expense Ratio of Mutual Fund Schemes’ section on https://www.axismf.com/total-expense-

ratio for Total Expense Ratio (TER) details.

Transaction charge In terms of Para 10.5 of Master Circular of Mutual Funds, as amended from time to time, Transaction Charge per subscription of Rs.10, 000/ –

and above shall be charged from the investors and shall be payable to the distributors/ brokers (who have opted in for charging the

transaction charge) in respect of applications routed through distributor/ broker relating to Purchases / subscription / new inflows only (lump

sum). The transaction charge (based on the type of the product), if any shall be deducted by AMC from the subscription amount and paid to the

distributor; and the balance shall be invested and accordingly units allotted. The statement of account shall clearly state the net investment

as gross subscription less transaction charge. The charge is, subject to the following:

• For Existing / New investors: Rs.100 / Rs.150 as applicable per subscription of 10,000/ – and above

• There shall be no transaction charge on subscription below Rs. 10,000/-.

• There shall be no transaction charges on direct investments.

• There shall be no transaction charges for transaction other than purchases/subscriptions relating to new inflows such as Switches, etc.

• Transactions carried out through the Stock Exchange platforms for mutual funds shall not be subject to transaction charges.

Further, the Investors are requested to note that the requirement of Minimum Application Amount for investment shall not be applicable if

the investment amount falls below the minimum requirement due to deduction of Transaction Charge from the subscription amount.

The Transaction Charge as mentioned above shall be deducted by the AMC from the subscription amount of the unit holder and paid to the

distributor. The balance amount shall be invested in the Scheme.

Waiver of Load for Not applicable

Direct Applications

Tax treatment for the Investors are advised to refer to the paragraph on Taxation in the “Statement of Additional Information” and to consult their own tax advisors

Investors (Unitholders) with respect to the specific amount of tax and other implications arising out of their participation in the scheme.

Daily Net Asset Value The NAV will be declared on all business days. NAV can also be viewed on www.axismf.com and www.amfiindia.com [You can also telephone

(NAV) Publication us at 1800 221 322.]

-4-

For Investor Grievances Name and Address of Registrar Name, address, telephone number, fax number, e-mail I.D. of the Mutual Fund

please contact KFin Technologies Ltd. Mr. C P Shivkumar Nair

Unit - Axis Mutual Fund Axis Asset Management Company Ltd.

Tower B, Plot number 31 & 32, Axis House", 1st Floor, C-2, Wadia International Centre, Pandurang Budhkar Marg,

Financial District, Gachibowli, Worli, Mumbai – 400025. Phone no.: 022 4325 4123 Fax No: 022 4325 5199

Hyderabad - 500008 Toll Free: 1800-3000-3300 e-mail: customerservice@axismf.com

Tel : 040 33211000

For any grievances with respect to transactions through BSE StAR and / or NSE MFSS, the investors / Unit Holders should approach either the

stock broker or the investor grievance cell of the respective stock exchange.

Unitholders’ Information Account Statements:

• On acceptance of the application for subscription, an allotment confirmation specifying the number of units allotted by way of email and/or

SMS within 5 business days from the date of receipt of transaction request will be sent to the Unit Holders registered email address and/or

mobile number.

• In case of Unit Holders holding units in the dematerialized mode, the Fund will not send the account statement to the Unit Holders. The

statement provided by the Depository Participant will be equivalent to the account statement.

• For those Unit holders who have provided an e-mail address, the AMC will send the account statement by e-mail.

• Unit holders will be required to download and print the documents after receiving e-mail from the Mutual Fund. Should the Unit holder

experience any difficulty in accessing the electronically delivered documents, the Unit holder shall promptly advise the Mutual Fund to

enable the Mutual Fund to make the delivery through alternate means. It is deemed that the Unit holder is aware of all security risks including

possible third party interception of the documents and contents of the documents becoming known to third parties.

• The Unit holder may request for a physical account statement by writing/calling the AMC/ISC/Registrar. In case of specific request received

from the Unit Holders, the AMC/Fund will provide the Account Statement to the Investors within 5 business days from the receipt of such

request.

Consolidated Account Statement (CAS) : CAS is an account statement detailing all the transactions and holding at the end of the month including

transaction charges paid to the distributor, across all schemes of all mutual funds. CAS issued to investors shall also provide the total purchase

value/cost of investment in each scheme.

Further, CAS issued for the half-year (September/ March) shall also provide

a. The amount of actual commission paid by AMC/Mutual Fund to distributors (in absolute terms) during the half-year period against the

concerned investor’s total investments in each scheme.

b. The scheme’s average Total Expense Ratio (in percentage terms) along with the break up between Investment and Advisory fees,

Commission paid to the distributor and Other expenses for the period for each scheme’s applicable plan (regular or direct or both) where the

concerned investor has actually invested in.

The amounts can be distributed out of investors capital (Equalization Reserve), which is part of sale price that represents realized gains.

The word transaction will include purchase, redemption, switch, IDCW payout, IDCW reinvestment, systematic investment plan, systematic

withdrawal plan and systematic transfer plan.

a) For Unitholders not holding Demat Account:

CAS for each calendar month shall be issued, on or before 15th day of succeeding month by the AMC.

The AMC shall ensure that a CAS for every half yearly (September/ March) is issued, on or before 21st day of succeeding month, detailing

holding at the end of the six month, across all schemes of all mutual funds, to all such investors in whose folios no transaction has taken place

during that period.

The AMC shall identify common investors across fund houses by their Permanent Account Number (PAN) for the purposes of sending CAS.

In the event the account has more than one registered holder, the first named Unit Holder shall receive the Account Statement.

The AMC will send statement of accounts by e-mail where the Investor has provided the e-mail id. Additionally, the AMC may at its discretion

send Account Statements individually to the investors.

b) For Unitholders holding Demat Account:

SEBI vide its circular no. CIR/MRD/DP/31/2014 dated November 12, 2014 read with other applicable circulars issued by SEBI from time to

time, to enable a single consolidated view of all the investments of an investor in Mutual Fund and securities held in demat form with

Depositories, has required Depositories to generate and dispatch a single CAS for investors having mutual fund investments and holding

demat accounts.

In view of the aforesaid requirement, for investors who hold demat account, for transactions in the schemes of Axis Mutual Fund, a CAS,

based on PAN of the holders, will be sent by Depositories to investors holding demat account, for each calendar month within 15th day of the

succeeding month to the investors in whose folios transactions have taken place during that month.

CAS will be sent by Depositories every half yearly (September/March), on or before 21st day of succeeding month, detailing holding at the

end of the six month, to all such investors in whose folios and demat accounts there have been no transactions during that period.

CAS sent by Depositories is a statement containing details relating to all financial transactions made by an investor across all mutual funds

viz. purchase, redemption, switch, IDCW payout, IDCW reinvestment, systematic investment plan, systematic withdrawal plan, systematic

transfer plan (including transaction charges paid to the distributor) and transaction in dematerialized securities across demat accounts of

the investors and holding at the end of the month.

In case of demat accounts with nil balance and no transactions in securities and in mutual fund folios, the depository shall send account

statement in terms of regulations applicable to the depositories. Investors whose folio(s)/ demat account(s) are not updated with PAN shall

not receive CAS.

Consolidation of account statement is done on the basis of PAN. Investors are therefore requested to ensure that their folio(s)/ demat

account(s) are updated with PAN. In case of multiple holding, it shall be PAN of the first holder and pattern of holding.

For Unit Holders who have provided an e-mail address to the Mutual Fund or in KYC records, the CAS is sent by e-mail. However, where an

investor does not wish to receive CAS through email, option is given to the investor to receive the CAS in physical form at the address

registered in the Depository system.

Investors who do not wish to receive CAS sent by depositories have an option to indicate their negative consent. Such investors may contact

the depositories to opt out. Investors who do not hold demat account continue to receive CAS sent by RTA/AMC, based on the PAN, covering

transactions across all mutual funds as per the current practice.

In case an investor has multiple accounts across two depositories; the depository with whom the account has been opened earlier will be the

default depository.

The dispatches of CAS by the depositories constitute compliance by the AMC/ the Fund with the requirement under Regulation 36(4) of SEBI

(Mutual Funds) Regulations. However, the AMC reserves the right to furnish the account statement in addition to the CAS, if deemed fit in

the interest of investor(s).

Investors whose folio(s)/demat account(s) are not updated with PAN shall not receive CAS. Investors are therefore requested to ensure that

their folio(s)/demat account(s) are updated with PAN.

-5-

-6-

For folios not included in the CAS (due to non-availability of PAN), the AMC shall issue monthly account statement to such Unit holder(s), for

any financial transaction undertaken during the month on or before 15th of succeeding month by mail or email.

For folios not eligible to receive CAS (due to non-availability of PAN), the AMC shall issue an account statement detailing holding across all

schemes at the end of every six months (i.e. September/March), on or before 21st day of succeeding month, to all such Unit holders in whose

folios no transaction has taken place during that period shall be sent by mail/e-mail.

Option to hold units in dematerialized (demat) form

Investors shall have an option to receive allotment of Mutual Fund units in their demat account while subscribing to the Scheme in terms of

the guidelines/ procedural requirements as laid by the Depositories (NSDL/CDSL) from time to time.

Investors desirous of having the Units of the Scheme in dematerialized form should contact the ISCs of the AMC/Registrar.

Where units are held by investor in dematerialized form, the demat statement issued by the Depository Participant would be deemed

adequate compliance with the requirements in respect of dispatch of statements of account.

In case investors desire to convert their existing physical units (represented by statement of account) into dematerialized form or vice versa,

the request for conversion of units held in physical form into Demat (electronic) form or vice versa should be submitted along with a

Demat/Remat Request Form to their Depository Participants. In case the units are desired to be held by investor in dematerialized form, the

KYC performed by Depository Participant shall be considered compliance of the applicable SEBI norms.

Further, demat option shall also be available for SIP transactions. Units will be allotted based on the applicable NAV as per Scheme

Information Document and will be credited to investors Demat Account on weekly basis on realization of funds.

Units held in Demat form are freely transferable in accordance with the provisions of SEBI (Depositories and Participants) Regulations, as

may be amended from time to time. Transfer can be made only in favor of transferees who are capable of holding units and having a Demat

Account. The delivery instructions for transfer of units will have to be lodged with the Depository Participant in requisite form as may be

required from time to time and transfer will be affected in accordance with such rules / regulations as may be in force governing transfer of

securities in dematerialized mode.

For details, Investors may contact any of the Investor Service Centers of the AMC.

Annual Report:

The Scheme wise annual report or an abridged summary thereof shall be e-mailed to the registered e-mail address of the unitholders not later

than four months (or such other period as may be specified by SEBI from time to time) from the date of closure of the relevant accounting year (i.e.

31st March each year). AMC shall provide physical copy of the abridged summary of annual report, without charging any cost, on specific request

received from a unitholder. Full annual report shall be available for inspection at the Head Office of the Mutual Fund and a copy shall be made

available to the Unit holders on request on payment of nominal fees, if any. Scheme wise annual report shall also be displayed on the website of

the AMC (www.axismf.com) and Association of Mutual Funds in India (www.amfiindia.com).

Mutual Fund shall also publish an advertisement every year, in an all India edition of one national English daily newspaper and in one Hindi

newspaper, disclosing the hosting of the scheme wise annual report on the website of the Mutual Fund and AMFI and the modes through which a

unitholder can submit a request for a physical or electronic copy of the annual report or abridged summary thereof.

Fortnightly/Monthly and Half yearly disclosures

The AMC will disclose the portfolio of the Scheme (along with ISIN) on fortnightly, monthly and half yearly basis on the website of the Mutual

Fund and AMFI within 5 days of every fortnight, 10 days from close of each month and within 10 days from the close of each half year (i.e. 31st

March and 30th September) respectively in a user-friendly and downloadable spreadsheet format. Further, AMC shall publish an advertisement

in an all India edition of one national English daily newspaper and one Hindi newspaper, every half year, disclosing the hosting of the half-yearly

statement of its schemes’ portfolio on the website of the Mutual Fund and AMFI and the modes through which unitholder(s) can submit a request

for a physical or electronic copy of the statement of scheme portfolio.

The AMC will also provide a dashboard, in a comparable, downloadable (spreadsheet) and machine readable format, providing performance and

key disclosures like Scheme’s AUM, investment objective, expense ratios, portfolio details, scheme’s past performance etc. on website..

Riskometer The AMC shall review Riskometers on a monthly basis based on evaluation of risk level of Scheme’s month end portfolios. Changes in

Riskometers, if any, shall be communicated by way of Notice cum Addendum. Investors may also refer to the website/portfolio disclosure for the

latest Riskometers.

Scheme Summary The AMC has provided on its website Scheme summary document which is a standalone scheme document for all the Schemes which contains all

document the details of the Scheme viz. Scheme features, Fund Manager details, investment details, investment objective, expense ratios, portfolio details,

etc.

Disclosure of Potential Pursuant to the provisions of Para 17.5 of Master Circular for Mutual Funds, all debt schemes are required to be classified in terms of a Potential

Risk Class (PRC) Matrix Risk Class matrix consisting of parameters based on maximum interest rate risk (measured by Macaulay Duration (MD) of the scheme) and

maximum credit risk (measured by Credit Risk Value (CRV) of the scheme). Mutual Funds are required to disclose the PRC matrix (i.e. maximum

risk that a fund manager can take in a Scheme) along with the mark for the cell in which the Scheme resides on the front page of initial offering

application form, SID, KIM, common application form and scheme advertisements in the manner as prescribed in the said circular. The scheme

would have the flexibility to take interest rate risk and credit risk below the maximum risk as stated in the PRC matrix. Subsequently, once a PRC

cell selection is done by the Scheme, any change in the positioning of the Scheme into a cell resulting in a risk (in terms of credit risk or duration

risk) which is higher than the maximum risk specified for the chosen PRC cell, shall be considered as a fundamental attribute change of the

Scheme in terms of Regulation 18(15A) of SEBI (Mutual Fund) Regulations, 1996.

The Mutual Funds shall be required to inform the unitholders about the PRC classification and subsequent changes, if any, through SMS and by

providing a link on their website referring to the said change.

The Mutual Fund/ AMC shall also publish the PRC Matrix in the scheme wise Annual Reports and Abridged summary.

Further as stated in Para 3.5 of Master Circular for Mutual Funds the positioning of the Index Fund in the Potential Risk Class (PRC) matrix shall

be in the same cell as that of positioning of the index in the PRC matrix.

Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to `1 Lakh). Trustee: Axis

Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC). Risk Factors: The sponsor is not liable or responsible for any loss or shortfall

resulting from the operation of the scheme. Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Axis Asset Management Company Limited (Investment Manager)

APPLICATION FORM

AXIS FIXED TERM PLAN - SERIES 119 (71 DAYS)

(A Close ended debt scheme; A Moderate Interest Rate Risk and Moderate Credit Risk)

Offer of Units of Rs. 10 each during the New Fund Offer

NEW FUND OFFER OPENS ON: JANUARY 03, 2024

NEW FUND OFFER CLOSES ON: JANUARY 09, 2024

(The product labelling assigned during the New Fund Offer is based on internal assessment of the Scheme Characteristics or model portfolio and the same may vary post

NFO when actual investments are made)

This product is suitable for investors

who are seeking*

• Optimal returns over 71 Days

• Investment in debt & money market

instruments maturing on or before

the maturity of the scheme.

*Investors should consult their financial

advisers if in doubt about whether the

product is suitable for them.

Product Labelling

Product Riskometer Benchmark Riskometer

CRISIL Liquid Debt Index

Fund Name & Benchmark

AXIS FIXED TERM PLAN - SERIES 119 (71 DAYS) (A Close ended debt scheme; A Moderate Interest Rate Risk and

Moderate Credit Risk)

Benchmark: CRISIL Liquid Debt Index

Potential Risk Class Matrix

Relatively

Low

(Class A)

Moderate

(Class B)

Relatively

High

(Class C)

Relatively Low

(Class I)

Moderate

(Class II)

Relatively High

(Class III)

Credit Risk

Interest Rate

Risk

B-II

High

Moderately

High

Moderate

Low to

Moderate

Low

Very High

RISKOMETER

Investors understand that their principal

will be at low to moderate risk

High

Moderately

High

Moderate

Low to

Moderate

Low

Very High

RISKOMETER

TRANSACTION CHARGES FOR APPLICATIONS THROUGH DISTRIBUTORS ONLY (Refer Instruction No. 17)

I confirm that I am a first time investor across Mutual Funds.

In case the subscription amount is ` 10,000 or more and your Distributor has opted to receive Transaction Charges, the same are deductible as

applicable from the purchase/subscription amount and payable to the Distributor. Units will be issued against the balance amount invested.

You/ Sole Applicant /Guardian Second Applicant Third Applicant Power of Attorney Holder

I/We hereby confirm that the EUIN box has been intentionally left blank by me/us as this transaction is executed without any interaction or advice by the employee/ relationship manager/sales

person of the above distributor/sub broker or notwithstanding the advice of in-appropriateness, if any, provided by the employee/relationship manager/sales person of the distributor/sub broker.

Distributor

ARN

(PLEASE READ THE INSTRUCTIONS BEFORE FILLING UP THE FORM. ALL SECTIONS TO BE COMPLETED IN ENGLISH IN BLACK/BLUE COLOURED INK & IN BLOCK LETTERS)

FOR FIRST TIME INVESTORS FOR LUMPSUM INVESTMENTS / SIP INVESTMENTS.

Upfront commission shall be paid directly by the investor to the AMFI registered distributor based on the investor's assessment of various factors including the service rendered by the distributor. ^I/We, have invested in the

scheme(s) of Axis Mutual Fund under Direct Plan. I/We hereby give my/our consent to share/provide the transactions data feed/portfolio holdings/ NAV etc. in respect of my/our investments under Direct Plan of all schemes of

Axis Mutual Fund, to the above mentioned SEBI Registered Investment Adviser. ^^I/We, have invested in the scheme(s) of Axis Mutual Fund under Direct Plan. I/We hereby give my/our consent to share/provide the

transactions data feed/portfolio holdings/ NAV etc. in respect of my/our investments under Direct Plan of all schemes of Axis Mutual Fund, to the above mentioned SEBI Registered Portfolio Manager.

PMR (Portfolio Manager's

Registration) Number ^^

SUB-Distributor

ARN

Internal

SUB-Broker/Sol ID

EUIN

Employee

Code

RIA

CODE^

Serial No., Date

& Time Stamp

OR

I confirm that I am an existing investor across Mutual Funds.

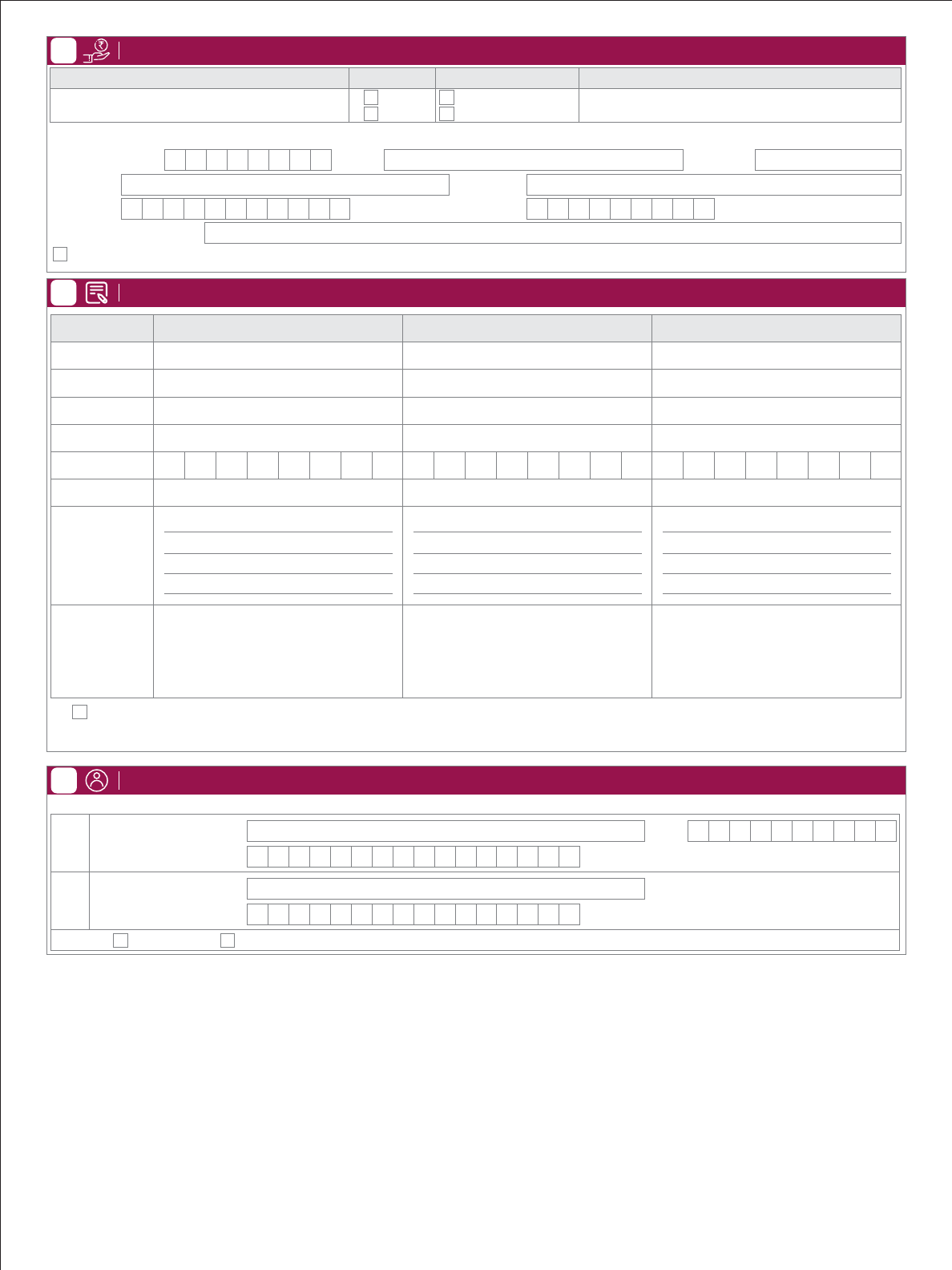

01 MY DETAILS

(To be filled in Block Letters. Please provide the following details in full)

My Name (Should match with PAN Card)

PAN/PEKRN (1st Applicant) KYC

My Guardian’s Name (if minor)/POA/Contact Person (For Non-individuals)

PAN/PEKRN (Guardian/POA)

KYC

On behalf of Minor (*Attach Mandatory Documents as per instructions)

Guardian named is

Date of Birth Minor’s

D

D M M Y Y Y Y

Date of Birth Proof attached*

Father Mother Court Appointed

Guardian named is

JOINT APPLICANTS (IF ANY) DETAILS

2nd Applicant Name (Should match with PAN Card)

PAN/PEKRN (Second applicant) KYC

3rd Applicant Name (Should match with PAN Card)

PAN/PEKRN (Third applicant)

KYC

(In case of investment "On behalf of minor", Please refer instruction No. 11)

Mode of Operation

Single Joint Either or Survivor(s) [Default]

MY CONTACT DETAILS

(For electronic communication, Please refer instruction No. 14)

(As per KYC records. To be filled in Block Letters)

Address

City

Pin Code

State

Address Type (Mandatory) Residential & Business Residential Business Registered Office

Email ID

(CAPITAL

letters only)

Email ID and Mobile number should pertain to First Holder only.

Mobile

No.

Tel

No.

02

03

Existing folio number

Add overseas address (Mandatory for NRI / FII Applicants)

I/ We want to create new Folio (Instruction No. 26)

City

Pin Code

Country

(Joint applicant details not to be filled in case of minor investments).

BANK ACCOUNT DETAILS

(Please note that as per SEBI Regulations it is mandatory for

investors to provide their bank account details. Refer Instruction No. 6)

(Avail Multiple Bank Registration Facility)

Branch Address

City

Pin Code

State

IFSC code: (11 digit)

My Bank Name

Bank A/C No. A/C Type

Savings Current NRE NRO FCNR Others

BANK

MICR code (9 digit)

(This is a 9 digit number next to your cheque number)

04

Valid up to

Note: LEI code mandatory to provide if transaction value is

equal to or exceeds ` 50 crore limit, with LEI proof.

LEI Code

D

D M M Y Y Y Y

Unit Holding Option

Physical Mode Demat Mode

(in case of Demat, please fill sec 7)

I declare that provided in this form belongs to (tick any one): Email address

I declare that provided in this form belongs to (tick any one)Mobile Number

Spouse

Dependent Children

Dependent Siblings

Dependent Parents

Guardian

PMS

and approve for usage of these contact details for any communication with Axis Mutual Fund.

Self

Spouse

Dependent Children

Dependent Siblings

Dependent Parents

Guardian

PMS

and approve for usage of these contact details for any communication with Axis Mutual Fund.

Self

I wish to receive Scheme : Account Statement along with Annual Report & Abridged Summary

(Choose online mode to help us save paper & contribute

towards a greener & cleaner environment.)

Online (Preferred & Default) Physical Copy

If above any option is not ticked (P) or selected then (Self) option is considered as a default.

APPLICATION NO.

APPLICATION FORM FOR

AXIS FIXED TERM PLAN - SERIES 119 (71 DAYS)

(A Close ended debt scheme; A Moderate Interest Rate Risk and Moderate Credit Risk)

NFO OPENS : NFO CLOSES : JANUARY 03, 2024 AND JANUARY 09, 2024

MFD / EUIN holder/ sub-distributor is not related to the 1st holder.

If yes, declare that joint holders details provided in this form belongs to (tick any one):

Spouse

Children

Siblings

Parents

MY INVESTMENT DETAILS

(For investments, Please refer instruction No. 1 & 19)

Bank Name

Payment Details

First Cheque Date M M Y Y Y YD D

05

NOMINATION DETAILS

(For nomination, Please refer instruction No. 15)

06

DEPOSITORY ACCOUNT DETAILS

(For DEMAT details Please refer instruction No. 16)

07

(Optional. To be filled if investor wishes to hold the units in Demat mode).

Beneficiary Ac No.

I N

NSDL:

Beneficiary Ac No.

CDSL:

(Please ensure that the sequence of names as mentioned in the application form matches with that of the A/c held with the depository participant) Refer Instruction No. 19.

Enclosed

Client Master

Transaction / Statement Copy / DIS Copy

Depository Participant Name

DP ID:

Depository Participant Name

If source of payment bank is same as above bank details tick here.

Account No.

IFSC Code MICR Code

Amount

Cheque No.

RTGS/ NEFT/ Funds Transfer

OR I / We hereby confirm that I / We do not wish to appoint any nominee(s) for my mutual fund units held in my / our mutual fund folio and understand the issues involved

in non-appointment of nominee(s) and further are aware that in case of death of all the account holder(s), my / our legal heirs would need to submit all the requisite documents

issued by Court or other such competent authority, based on the value of assets held in the mutual fund folio.

Nominee Name

Details

PAN

Allocation (%)

Relationship

with Investor

Guardian Name

(in case of Minor)

Nominee/Guardian

Signature

Nominee date

of birth

Nominee Address

NOMINEE 1 NOMINEE 2 NOMINEE 3

M M Y Y Y YD D M M Y Y Y YD D M M Y Y Y YD D

Amount

Scheme Name Plan

Regular

Direct

Option

AXIS FIXED TERM PLAN - SERIES 119 (71 DAYS)

Growth

(Default Option)

Quarterly IDCW Payout

ACKNOWLEDGEMENT SLIP

APPLICATION NO.

Stamp & Signature

Received from

Scheme Name

Amount

Bank & Branch details

Plan

Option

Cheque/DD No.

D

D M M Y Y Y Y

Date

KNOW YOUR CUSTOMER (KYC) DETAILS

(For KYC details. Refer Instruction No. 8)

(Mandatory. Please Tick/ Specify. The application is liable to get rejected

if details not filled.)

08

Tax Status details for

Resident Individual

NRI/PIO/OCI

Sole Proprietorship

Minor through Guardian

Non Individual

1st Applicant

2nd Applicant

3rd Applicant

Guardian

Company Body Corporate Partnership

Trust Society HUF

AOP

FI

FPI

Others (Please specify)

Gross Annual Income Range (in `)

Below 1 lac

5-10 lac

25 lac- 1 cr

5 - 10 cr

OR Networth in `

(Mandatory for Non

Individual) (not older

than 1 year)

as on as on as on as on

D D M M Y Y D D M M Y Y D D M M Y Y D D M M Y Y

Occupation details for

Private Sector

1st Applicant

2nd Applicant

3rd Applicant

Guardian

Public Sector

Government Service

Business

Professional

Agriculturist

Retired

Housewife

Student

Others (Please specify)

Politically Exposed Person (PEP) details

1st Applicant

Is a PEP

Related to PEP

Not Applicable

2nd Applicant

3rd Applicant

Guardian

Authorised Signatories

Promoters

Partners

Karta

Whole-time Directors/Turstee

Bank

FII

ADDITIONAL INFORMATION

(For additional information Please refer instruction No. 8A)

Applicant

First Applicant

Second Applicant

Third Applicant

Guardian or POA^

KIN No. (If KYC done via CKYC)

#

Date of Birth

M M Y Y Y YD D

Gender

Male Female

#

Date of Birth - Mandatory if CKYC ID mentioned. ^G: Guardian; POA: Power Of Attorney

M M Y Y Y YD D

M M Y Y Y YD D

M M Y Y Y YD D

Male Female

Male Female

Male Female

Details

Mobile No.

Email Id.

Second Applicant

Third Applicant

G or POA

9

Relationship with

Investor

DEBIT MANDATE

(For Debit mandate Please refer instruction No. 5 & 19)

(Only for Axis Bank Account holders: Now you don't have to issue a cheque if you hold

an Axis Bank Account). To be processed in CMS software under client code "AXISMF"

10

Account type

I/ We

N a m e o f t h e a cc o u n t h o ld e r ( s )

Specify

Amount

(in Figures)

to pay for the purchase of

authorise you to debit my/our account no.

(in words)

Signature of

First Account Holder

Signature of

Second Account Holder

Signature of

Third Account Holder

APPLICATION NO.

Savings

NRO

CurrentNRE FCNR

Others

M M Y Y Y YD D

Date*

*Date is mandatory

I declare that provided in this form belongs to (tick any one): Email address

I declare that provided in this form belongs to (tick any one)Mobile Number

Spouse

Dependent Children

Dependent Siblings

Dependent Parents

Guardian

PMS

and approve for usage of these contact details for any communication with Axis Mutual Fund.

Self

Spouse

Dependent Children

Dependent Siblings

Dependent Parents

Guardian

PMS

and approve for usage of these contact details for any communication with Axis Mutual Fund.

Self

If above any option is not ticked (P) or selected then (Self) option is considered as a default.

Scheme Name

OR

Axis MF Multiple Schemes

In case of Non-Profit Entity (refer point no 21)

1-5 lac

10-25 lac

1 -5 cr

> 10 cr

We are falling under “Non-Profit Organization” [NPO] which has been constituted

for religious or charitable purposes referred to in clause (15) of section 2 of the

Income-tax Act, 1961 (43 of 1961), and is registered as a trust or a society under the

Societies Registration Act, 1860 (21 of 1860) or any similar State legislation or a

Company registered under the section 8 of the Companies Act, 2013 (18 of 2013).

If yes, please quote Registration No. of Darpan portal of Niti Aayog. (refer point no 21)

YES

NO

AXIS FIXED TERM PLAN - SERIES 119 (71 DAYS)

To stay up to date with your

mutual fund investments,

connect with us on our

WhatsApp number.

Sent us a 'Hi' on 7506771113

from your registered mobile

number to have your queries

answered.

WhatsApp

Follow

Us on

https://ifaconnect.

axismf.com/#/home

WEBSITE

Axis MF

www.axismf.com

https://www.axismf.com/

corporate/Login.aspx

App

Axis MF

DECLARATION AND SIGNATURE

(For declaration and signature, please refer point number 4)

13

Having read and understood the content of the SID / KIM of the scheme and SAI of the Axis Mutual

Fund (The Fund), I/we hereby apply for units of the scheme. I have read and understood the terms,

conditions, details, rules and regulations governing the scheme. I/We hereby declare that the amount

invested in the scheme is through legitimate source only and does not involve designed for the purpose

of the contravention of any Act, Rules, Regulations, Notifications or Directives of the provisions of the

Income Tax Act, Anti Money Laundering Laws, Anti Corruption Laws or any other applicable laws

enacted by the Government of India from time to time. I/we have not received nor have been induced

by any rebate or gifts, directly or indirectly in making this investment. I/We confirm that the funds

invested in the Scheme, legally belongs to me/us. In event “Know Your Customer” process is not

completed by me/us to the satisfaction of the Mutual Fund, (I/we hereby authorize the Mutual Fund, to

redeem the funds invested in the Scheme, in favour of the applicant, at the applicable NAV prevailing on

the date of such redemption and undertake such other action with such funds that may be required by

the law.) The ARN holder has disclosed to me/us all the commissions (trail commission or any other

mode), payable to him for the different competing Schemes of various Mutual Funds amongst which

the Scheme is being recommended to me/ us. I / we give my / our consent to collect personal data or

information as prescribed in the privacy policy which is available on the website of the AMC / Fund.

I/We hereby give consent to the Company or its Authorized Agents and third party service providers to

use information/data provided by me to contact me through any channel of communication including

but not limited to email, telephone, sms, etc. and further authorise the disclosure of the information

contained herein to its affiliates/group companies or their Authorized Agents or Third Party Service

Providers in order to provide information and updates to me on various financial and investment

products and offering of other services. I/We agree that all personal or transactional related

information collected/provided by me can be shared/transferred and disclosed with the above

mentioned parties including with any regulatory, statutory or judicial authorities for compliance with

any law or regulation in accordance with privacy policy as available at the website of the Company.

You/ Sole Applicant /Guardian Second Applicant Third Applicant

Power of Attorney Holder

M M Y Y Y YD D

Date Place

QUICK CHECKLIST

14

KYC acknowledgement letter (Compulsory for MICRO Investments) Self attested PAN card copy Plan / Option / Sub Option name mentioned in addition to

scheme name Multiple Bank Accounts Registration form (if you want to register multiple bank accounts so that future payments can be made from any of the accounts)

Email id and mobile number provided for online transaction facility SIP Registration Form for SIP investments Relationship proof between guardian and minor (if

application is in the name of a minor) FATCA Declaration Additional documents attached for Third Party payments. Refer instruction No. 7.

FATCA AND CRS DETAILS

(Including Sole Proprietor. Refer Instruction No. 20)

Details

11

For Individuals (Mandatory). Non Individual investors including HUF should

mandatorily fill separate FATCA/CRS/UBO details form

Sole/ 1st Applicant 2nd Applicant 3rd Applicant

Guardian/POA

Place & Country of Birth

Nationality

Are you a tax resident of

any country other than

India?

If Yes: Mandatory to enclose FATCA /CRS Annexure

Yes No Yes No Yes No Yes No

I/We confirm that I/We do not have any existing Micro SIP/Lumpsum investments which together with

the current application will result in aggregate investments exceeding ` 50,000 in a year (Applicable

for Micro investment only.) with your fund house. For NRIs only - I / We confirm that I am/ we are Non

Residents of Indian nationality/origin and that I/We have remitted funds from abroad through

approved banking channels or from funds in my/ our Non Resident External / Non Resident Ordinary /

FCNR account. I/We confirm that details provided by me/us are true and correct.

I/ We give my consent to Axis Asset Management Company Limited and its agents to contact me over

phone, SMS, email or any other mode to address my investment related queries and/or receive

communication pertaining to transactions/ non-commercial transactions/ promotional/ potential

investments and other communication/ material irrespective of my blocking preferences with the

Customer Preference Registration Facility.

I/ We hereby provide my/our consent in accordance with Aadhaar Act, 2016 and regulations made

thereunder, for (i) collecting, storing and usage (ii) validating/authenticating and (ii) updating my/ our

Aadhaar number(s) (if provided) in accordance with the Aadhaar Act, 2016 (and regulations made

thereunder) and PMLA. I/ We hereby provide my/our consent for sharing/disclosing of the Aadhaar

number(s) including demographic information with the asset management companies of SEBI

registered mutual fund (s)and their Registrar and Transfer Agent (RTA) for the purpose of updating the

same in my/our folios with my PAN.

CERTIFICATION: I / We have understood the information requirements of this Form (read along with

the FATCA & CRS Instructions) and hereby confirm that the information provided by me/us on this

Form is true, correct, and complete. I / We also confirm that I / We have read and understood the FATCA

& CRS Terms and Conditions below and hereby accept the same.

I/We have read and understood the instructions on nomination given below/overleaf and I/We hereby

undertake to abide by the same. The instructions contained herein supercedes all previous

nominations made by me/us in respect of the folio(s) mentioned above.

Switch to Scheme Name

Plan Option

If an investor fails to specify the Plan / Option he will be allotted units under the default Plan / Option / Sub Option of the scheme.

Proceeds to be dispatched /

Credit to bank A/c

(As may be applicable).

I / We would like to switch all units from the schemes on its maturity. Investor can opt for having the payout on maturity at his / her designed bank account and the redemption

or repurchase proceeds. The same shall be dispatched to the unitholders within 3 Business Days from the date of redemption or repurchase.

AUTO SWITCH ON MATURITY

12

(Refer Instruction No. 21)

INSTRUCTIONS FOR COMPLETING THE APPLICATION FORM

(Please read the SID carefully before signing the application form and tendering payment.)

1. GENERAL INSTRUCTIONS

a. The application form should be completed in ENGLISH and in BLOCK LETTERS.

b. All cheques, demand drafts and pay orders should be crossed “Account Payee

only” and made in favour of “Scheme Name A/c First Investor Name” or “Scheme

Name A/c Permanent Account No.”.

c. If the Scheme name on the application form and on the payment instrument are

different, the application may be processed and units allotted at applicable NAV

of the scheme mentioned in the application / transaction slip duly signed by

investor(s).

d. Any over-writing / changes made while filling the form must be authenticated by

canceling the original entry, re-entering correct details and ensuring that all

applicants counter-sign against each correction.

e. Application forms along with supporting documents can be submitted to ISCs /

OPAs, contact details of which are available on www.axismf.com.

f. Investors must write the application form number / folio number on the reverse

of the cheque / demand draft.

g. Investors are requested to check contents of the account statement on receipt.

Any discrepancy should be reported to the AMC / Registrar within 7 calendar

days of the receipt of the statement; else contents of the statement would be

presumed to be correct and binding. The AMC may modify any discrepancy at its

discretion.

h. Units will be allotted subject to realization of payment proceeds.

i. Unitholder / Guardian name should be same as per PAN / KYC records. Please

note that AMC at discretion may replace the name as per KRA.

j. FATCA Declaration: Individual investors, please fill in FATCA / CRS annexure and

attach along with Application form. Non-Individual investors, please fill in UBO

form along with FATCA / CRS annexure and attach along with Application form

available on our website www.axismf.com

2. DIRECT INVESTMENTS

Investors subscribing under Direct Plan of the scheme will have to indicate “Direct

Plan” against the scheme name in the application form e.g. “Axis Arbitrage Fund -

Direct Plan”. Investors should also indicate “Direct” in the ARN column of the

application form. However, in case Distributor code is mentioned in the application

form, but“Direct Plan” is indicated against the scheme name, the application will be

processed under Direct Plan. Further, where application is received for Regular Plan

without Distributor code or “Direct” mentioned in the ARN Column, the application

will be processed under Direct Plan.

Note: Direct Plan investment not applicable for ETF schemes.

3. EMPLOYEE UNIQUE IDENTIFICATION NUMBER (EUIN)

Investor investing through distributor shall mention EUIN on the application form, if

he/she has been advised by Sales Person/ Employee/ Relationship Manager of the

distributor this would assist in addressing any instance of mis-selling. If left blank,

applicant(s) need to tick and sign the following declaration “I/We hereby confirm

that the EUIN box has been intentionally left blank by me/us as this transaction is

executed without any interaction or advice by the employee/relationship

manager/sales person of the above distributor/sub broker or notwithstanding the

advice of in-appropriateness, if any, provided by the employee/relationship

manager/sales person of the distributor/sub broker.” on the form. SEBI has made it

mandatory to obtain EUIN no. for every employee/ relationship manager/ sales

person of the distributor for selling mutual fund products.

4. DECLARATION AND SIGNATURES

a. Thumb impressions must be attested by a Magistrate / Notary Public under his /

her official seal.

b. In case of HUF, the Karta needs to sign on behalf of the HUF.

c. Applications by minors should be signed by their guardian.

d. For Corporates, signature of the Authorised Signatory (from the Authorised

Signatory List (ASL)) is required.

5. PAYMENTS

a. The AMC intends using electronic payment services (NEFT, RTGS, ECS (Credit),

Direct Credit, etc.) to the extent possible for dividends / redemptions for faster

realization of proceeds to investors. In case an investor wishes to receive

payments vide cheques / demand drafts to be sent using a postal / courier

service, please provide appropriate written instructions to the AMC / Registrar

for the same.

b. Please enclose a cancelled cheque leaf (or copy thereof) in case your investment

instrument (pay-in) is not from the same bank account as mentioned under bank

account details.

c. Any communication, dispatch of redemption / dividend payments / account

statements etc. would be made by the Registrar / AMC as per reasonable

standards of servicing.

d. The Debit Mandate is an additional facility available to Axis Bank account

holders only.

6. BANK DETAILS

It is mandatory for investors to mention bank account details on the form as per

directives issued by SEBI. Applications without this information are liable to be

rejected. The Mutual Fund / AMC reserve the right to hold redemption proceeds in

case requisite bank details are not submitted.

Option to register multiple bank accounts

The AMC / Mutual Fund has also provided a facility to investors to register multiple

bank accounts. By registering multiple bank accounts, investors can use any of their

registered bank accounts to receive redemption / dividend proceeds. Any request

for a change in bank mandate requires 10 days for validation and verification.

Further, these account details will be used by the AMC / Mutual Fund / R&T for

verification of instruments (like cheques/DDs/POs) received at the time of

subscription / purchase applications to ensure that subscription payments are

received only from one of the registered bank accounts. Payments from non-

registered bank accounts (called third party payments) will not be accepted (except

where permitted as per SEBI regulations). Investors are requested to avail of this

facility by filling in the application form for registration of multiple bank accounts

available at any of our ISCs / OPAs or on our website www.axismf.com.

Cheques submitted at the time of purchase should be from the beneficiary investors

account or from an account mentioned in your Multiple Bank Accounts Registration

form (except for minors for amounts less than ` 50,000 and Corporates / non-

individuals).

Demand drafts submitted at the time of subscription should be accompanied by a

banker’s certificate clearly stating the investor’s name and PAN as well as

mentioning that the demand draft has been issued by debiting the investor’s own

bank account. Pre-funded instruments issued by the bank against cash shall not be

accepted for investments of `50,000 or more. This pre-funded instrument should

also be accompanied by a certificate from the banker giving the investor’s name,

address and PAN.

Payments made through RTGS/NEFT/NECS should be accompanied by a banker’s

certificate stating that the RTGS/NEFT/NECS payment has been made by debiting

the investor’s own bank account along with mention of the investor’s name and

PAN.

7. THIRD PARTY PAYMENTS

When payment is made through instruments issued from a bank account other than

that of the investor, the same is referred to as a Third Party payment. Where an

investor has opted to register multiple bank accounts (using the ‘Multiple Bank

Accounts Registration Form’), and purchase payment is made from an account

different from what is registered, any one of the following documents need to be

provided as proof along with the payment instrument.

• Banker’s certificate stating that the investment is from the investor’s own bank

account along with mention of his name and PAN

• Bank account passbook or statement mentioning the investor’s name / PAN

Restriction on acceptance of Third Party payments for subscriptions, and

exceptions thereto

a. In case of payments from a joint bank account, one of the joint holders of the

bank account must be the first account holder under the investment application.

b. The Asset Management Company shall not accept subscriptions with Third

Party payments except in the following situations:

1. Where payment is made by parents/grand parents/related persons on

behalf of a minor in consideration of natural love and affection or as gift for a

value not exceeding ` 50,000

(each regular purchase or per SIP installment). However this restriction will

not be applicable for payment made by a guardian whose name is registered

in the records of Mutual Fund in that folio.

2. Where payment is made by an employer on behalf of an employee under

Systematic Investment Plans through payroll deductions.

3. Custodian on behalf of an FII or a client.

Documents to be submitted for exceptional cases

1. KYC is mandatory for all investors (guardian in case of minor) and the person

making the payment i.e. the third party. Investors and the person making the

payment should attach their valid KYC acknowledgement letter to the

application form.

2. Submission of a separate, complete and valid ‘Third Party Payment

Declaration Form' from the investors (guardian in case of minor) and the

person making the payment i.e. third party. The said Declaration Form shall,

inter-alia, contain the details of the bank account from which the payment is

made and the relationship with the investor(s). Please contact the nearest

OPA/ISC of Axis Mutual Fund or visit our website www.axismf.com for the

declaration form.

8. KYC

All Applicants (including POAs and Guardians) are required to be KYC compliant

irrespective of the amount of investment. In case you are not KYC certified, please

fill in the KYC form (individual or Non-Individual). A KYC acknowledgement letter

should be submitted along with application for opening a folio or making an

investment. Each holder in the folio must be KYC compliant.

Investors may kindly note that new SEBI Circular issued regarding uniformity in the

KYC process was effective from January 1, 2012.

1. SEBI has introduced a common KYC Application Form for all the SEBI registered

intermediaries, new Investors are therefore requested to use the common KYC

Application Form and carry out the KYC process including In-Person

Verification (IPV) with any SEBI registered intermediaries including mutual

funds. The KYC Application Forms are available on our website

www.axismf.com.

2. The Mutual Fund shall perform the initial KYC of its new investors and shall also

accept the details change form for investors who have done their KYC prior to

31st Dec11.

3. It is mandatory to carry out In-Person Verification(IPV) for processing the KYC

of its new / existing investors from January 1, 2012.

4. Once the KYC and IPV-In Person Verification has been done with any SEBI

registered intermediary, the investor need not undergo the same process again

with any another intermediary including mutual funds. However, the Mutual

Fund reserves the right to carry out fresh KYC/additional KYC of the investor.

5. Existing KYC compliant investors of the Mutual Fund can continue to invest as

per the current practice.

6. Non-individual investors will have to do a fresh KYC due to significant changes in

KYC requirements.

7. In accordance with SEBI Circular No. CIR/MIRSD/13/2013 dated December 26,

2013, the additional details viz. Occupation details, Gross Annual

Income/networth and Politically Exposed Person (PEP)* status mentioned

under section 2 & 3 which was forming part of uniform KYC form will now be