FEDERAL RESERVE SYSTEM PUBLICATION

The Fed Explained

What the Central Bank Does

PUBLIC EDUCATION & OUTREACH

FEDERAL RESERVE SYSTEM PUBLICATION

The Fed Explained

What the Central Bank Does

PUBLIC EDUCATION & OUTREACH

First Edition, May 1939

Second Edition, November 1947

Third Edition, April 1954

Fourth Edition, February 1961

Fifth Edition, December 1963

Sixth Edition, September 1974

Seventh Edition, December 1984

Eighth Edition, December 1994

Ninth Edition, June 2005

Tenth Edition, October 2016

Eleventh Edition, August 2021

ISSN: 0199-9729

DOI: 10.17016/0199-9729.11

This and other Federal Reserve publications are available

online in the Publications section of the Federal Reserve

Board’s website, https://www.federalreserve.gov. To order

copies of publications available in print, access the Federal

Reserve System Publication Order Form or contact:

Publications Fulfillment

(email) [email protected]

(ph) 202-452-3245

(fax) 202-728-5886

(mail) Mail Stop N-127

Board of Governors of the Federal Reserve System

20th Street and Constitution Avenue, NW

Washington, DC 20551

Contents

1 Overview of the Federal Reserve System ............................. vi

The U.S. Approach to Central Banking ..................................... 2

The Decentralized System Structure and Its Philosophy ........................ 3

The Reserve Banks: A Blend of Private and Governmental Characteristics ........... 4

2 The Three Key System Entities ...................................... 6

The Federal Reserve Board: Selection and Function ........................... 7

The Federal Reserve Banks: Structure and Function ........................... 8

The Federal Open Market Committee: Selection and Function .................... 12

Other Signicant Entities Contributing to Federal Reserve Functions ............... 13

3 Conducting Monetary Policy ........................................ 16

The Federal Reserve’s Monetary Policy Mandate and Strategy and Why It Matters ..... 21

The Conduct of Monetary Policy ......................................... 24

Monetary Policy Tools ................................................ 34

How Monetary Policy Is Implemented ..................................... 39

4 Promoting Financial System Stability ................................ 46

What Is Financial Stability? ............................................ 47

Monitoring Risk across the Financial System ................................ 48

Macroprudential Supervision and Regulation of Large, Complex Financial Institutions ... 55

Domestic and International Cooperation and Coordination ...................... 57

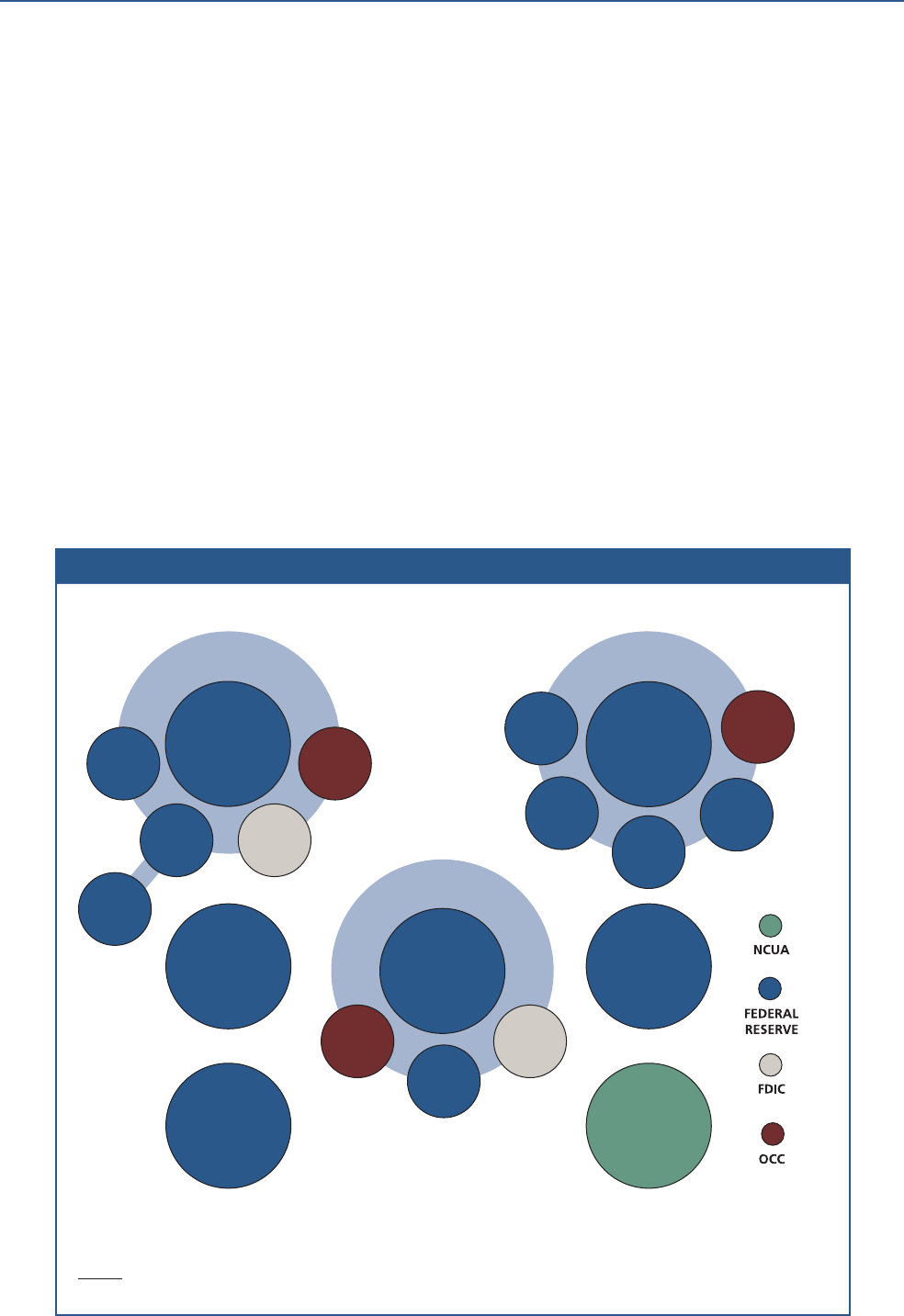

5 Supervising and Regulating Financial Institutions and Activities ......... 62

Overview of the Federal Reserve’s Financial Institution Oversight ................. 63

How the Federal Reserve Supervises Financial Institutions ...................... 69

How the Federal Reserve Regulates Financial Institutions ...................... 75

6 Fostering Payment and Settlement System Safety and Efciency ........ 84

Overview of Key Federal Reserve Payment System Functions .................... 86

Providing Services to Banks and the Federal Government ....................... 86

The U.S. Payment System Today and Reserve Bank Services .................... 88

Regulating and Supervising the Payment System ............................. 104

Providing Banking System Liquidity ....................................... 108

Exploring and Implementing Payment System Improvements ..................... 109

7 Promoting Consumer Protection and Community Development .......... 112

Consumer Protection Supervision and Examination ........................... 114

Administering Consumer Laws and Drafting Regulations ........................ 123

Research and Analysis of Emerging Consumer Issues ......................... 123

Community Economic Development Activities ............................... 125

vi The Fed Explained: What the Central Bank Does

1

Overview of the Federal

Reserve System

The Federal Reserve performs five key functions

in the public interest to promote the health of the

U.S. economy and the stability of the U.S. financial

system.

The U.S. Approach to Central Banking ......................2

The Decentralized System Structure and Its Philosophy ..........3

The Reserve Banks: A Blend of Private and

Governmental Characteristics ...........................4

Overview of the Federal Reserve System 1

The Federal Reserve System is the central bank of the United States. It performs five general

functions to promote the effective operation of the U.S. economy and, more generally, the public

interest. The Federal Reserve

• conducts the nation’s monetary policy to promote maximum employment and stable prices in

the U.S. economy;

• promotes the stability of the financial system and seeks to minimize and contain systemic

risks through active monitoring and engagement in the U.S. and abroad;

• promotes the safety and soundness of individual financial institutions and monitors their

impact on the financial system as a whole;

• fosters payment and settlement system safety and efficiency through services to the banking

industry and the U.S. government that facilitate U.S.-dollar transactions and payments; and

• promotes consumer protection and community development through consumer-focused

supervision and examination, research and analysis of emerging consumer issues and trends,

community economic development activities, and the administration of consumer laws and

regulations.

Figure 1.1. The Federal Reserve System

The Federal Reserve is unique among central banks. By statute, Congress provided for a central banking

system with public and private characteristics. The System performs five functions in the public interest.

The Federal

Reserve System

Federal

Reserve Board

of Governors

12 Federal

Reserve

Banks

1

U.S.

Central Bank

3

Key

Entities

5

Key

Functions

Conducting

the nation’s

monetary

policy

Helping

maintain the

stability of

the financial

system

Supervising

and regulating

financial

institutions

Fostering

payment and

settlement

system safety

and efficiency

Promoting

consumer

protection and

community

development

Federal

Open Market

Committee

2 The Fed Explained: What the Central Bank Does

The U.S. Approach to Central Banking

The framers of the Federal Reserve Act purposely rejected the concept of a single central bank.

Instead, they provided for a central banking “system” with three salient features: (1) a central

governing Board, (2) a decentralized operating structure of 12 Reserve Banks, and

(3) a combination of public and private characteristics.

Although parts of the Federal Reserve System share some characteristics with private-sector enti-

ties, the Federal Reserve was established to serve the public interest.

There are three key entities in the Federal Reserve System: the Federal Reserve Board of Gov-

ernors (Board of Governors), the Federal Reserve Banks (Reserve Banks), and the Federal Open

Market Committee (FOMC). The Board of Governors, an agency of the federal government that

reports to and is directly accountable to Congress (figure 1.2), provides general guidance for the

System and oversees the 12 Reserve Banks.

Within the System, certain responsibilities are shared between the Board of Governors in Wash-

ington, D.C., whose members are appointed by the President with the advice and consent of the

Senate, and the Reserve Banks and Branches, which constitute the System’s operating presence

around the country. While the Federal Reserve has frequent communication with executive branch

and congressional officials, its decisions are made independently.

Figure 1.2. Three key entities, serving the public interest

The framers of the Federal Reserve Act developed a central banking system that would broadly represent the public

interest.

CONGRESS

oversees the Federal Reserve System

and its entities.

BOARD OF GOVERNORS

is an independent agency of the

federal government.

FEDERAL RESERVE BANKS

are the operating arms of the

Federal Reserve System and are

supervised by the Board of Governors.

FEDERAL OPEN MARKET

COMMITTEE

consists of the members of the Board of

Governors and Reserve Bank presidents.

The Chair of the Board is the

FOMC Chair.

Overview of the Federal Reserve System 3

The Decentralized System Structure and Its Philosophy

In establishing the Federal Reserve System, the United States was divided geographically into 12

Districts, each with a separately incorporated Reserve Bank. District boundaries were based on

prevailing trade regions that existed in 1913 and related economic considerations, so they do not

necessarily coincide with state lines (figure 1.3).

As originally envisioned, each of the 12 Reserve Banks was intended to operate independently

from the other Reserve Banks. Variation was expected in discount rates—the interest rate that

commercial banks were charged for borrowing funds from a Reserve Bank. The setting of a sepa-

rately determined discount rate appropriate to each District was considered the most important

tool of monetary policy at that time. The concept of national economic policymaking was not well

developed, and the impact of open market operations—purchases and sales of U.S. government

securities—on policymaking was less significant.

As the nation’s economy became more integrated and more complex, through advances in tech-

nology, communications, transportation, and financial services, the effective conduct of monetary

Figure 1.3. Twelve Federal Reserve Districts operate independently but with supervision

Federal Reserve District boundaries are based on economic considerations; the Reserve Banks in each District

operate independently but under the supervision of the Federal Reserve Board of Governors.

Washington, D.C.

(Board of Governors)

2

San Francisco

12

Kansas City

10

11

Dallas

Minneapolis

9

Chicago

7

St. Louis

8

Cleveland

4

Richmond

5

New York

Boston

1

Philadelphia

3

Atlanta

6

Alaska

Hawaii

Puerto Rico

Virgin Islands

Guam

4 The Fed Explained: What the Central Bank Does

policy began to require increased collaboration and coordination throughout the System. This was

accomplished in part through revisions to the Federal Reserve Act in 1933 and 1935 that together

created the modern-day FOMC.

The Depository Institutions Deregulation and Monetary Control Act of 1980 (Monetary Control

Act) introduced an even greater degree of coordination among Reserve Banks with respect to the

pricing of financial services offered to depository institutions. There has also been a trend among

Reserve Banks to centralize or consolidate many of their financial services and support functions

and to standardize others. Reserve Banks have become more efficient by entering into intra-

System service agreements that allocate responsibilities for services and functions that are na-

tional in scope among each of the 12 Reserve Banks.

The Reserve Banks: A Blend of Private and Governmental

Characteristics

Pursuant to the Federal Reserve Act, each of the 12 Reserve Banks is separately incorporated

and has a nine-member board of directors.

Commercial banks that are members of the Federal Reserve System hold stock in their District’s

Reserve Bank and elect six of the Reserve Bank’s directors; three remaining directors are appoint-

ed by the Board of Governors. Most Reserve Banks have at least one Branch, and each Branch

has its own board of directors. Branch directors are appointed by either the Reserve Bank or the

Board of Governors.

Directors serve as a link between the Federal Reserve and the private sector. As a group, directors

bring to their duties a wide variety of experiences in the private sector, which gives them invaluable

insight into the economic conditions of their respective Federal Reserve Districts. Reserve Bank

head-office and Branch directors contribute to the System’s overall understanding of the economy.

The Federal Reserve is not funded by congressional appropriations. Its operations are financed

primarily from the interest earned on the securities it owns—securities acquired in the course of

the Federal Reserve’s open market operations. The fees received for priced services provided to

depository institutions—such as check clearing, funds transfers, and automated clearinghouse op-

erations—are another source of income; this income is used to cover the cost of those services.

After payment of expenses and transfers to surplus (limited to an aggregate of $6.785 billion), all

the net earnings of the Reserve Banks are transferred to the U.S. Treasury (figure 1.4).

Overview of the Federal Reserve System 5

Despite the need for coordination and consistency throughout the Federal Reserve System,

geographic distinctions remain important. Effective monetary policymaking requires knowledge

and input about regional differences. For example, two directors from the same industry may have

different opinions regarding the strength or weakness of that sector, depending on their regional

perspectives. The decentralized structure of the System and its blend of private and public charac-

teristics, envisioned by the System’s creators, therefore, remain important features today.

Figure 1.4. Federal Reserve net earnings are paid to the U.S. Treasury

The Federal Reserve transfers its net earnings to the U.S. Treasury.

$75.4

$88.4

$79.6

$96.9

$91.5

$80.6

$54.9

$86.9

$62.1

$3.2**

$97.7

$19.3*

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

$120

$100

$80

$60

$40

$20

$–

Earnings remittances

Transfer of capital surplus

Billions of

dollars

Source: Federal Reserve Board news release, January 11, 2021 (available in the News & Events section of the Federal Reserve

Board’s website, https://www.federalreserve.gov/newsevents.htm).

* The Reserve Banks transferred to the Treasury $19.3 billion from their capital surplus on December 28, 2015, which was the

amount necessary to reduce aggregate Reserve Bank surplus to the $10 billion surplus limitation in the Fixing America’s Surface

Transportation Act.

** The Reserve Banks transferred to the Treasury $3.175 billion from their capital surplus in 2018, of which $2.5 billion was the

amount necessary to reduce aggregate Reserve Bank surplus to the $7.5 billion surplus limitation in the Bipartisan Budget Act of

2018 and $675 million was the amount necessary to further reduce aggregate Reserve Bank surplus to the $6.825 billion surplus

limitation in the Economic Growth, Regulatory Relief, and Consumer Protection Act.

6 The Fed Explained: What the Central Bank Does

2

The Three Key System

Entities

The Board of Governors, the Federal Reserve

Banks, and the Federal Open Market Committee

work together to promote the health of the U.S.

economy and the stability of the U.S. financial

system.

The Federal Reserve Board: Selection and Function ............7

The Federal Reserve Banks: Structure and Function ............8

The Federal Open Market Committee: Selection and Function ....12

Other Significant Entities Contributing to Federal

Reserve Functions ..................................13

The Three Key System Entities 7

Three key Federal Reserve entities—the Federal Reserve Board of Governors (Board of Governors),

the Federal Reserve Banks (Reserve Banks), and the Federal Open Market Committee (FOMC)—

make decisions that help promote the health of the U.S. economy and the stability of the U.S.

financial system.

The Federal Reserve Board: Selection and Function

The Board of Governors—located in Washington, D.C.—is the governing body of the Federal Re-

serve System. It is run by seven members, or “governors,” who are nominated by the President of

the United States and confirmed in their positions by the Senate. The Board of Governors guides

the operation of the Federal Reserve System to promote the goals and fulfill the responsibilities

given to the Federal Reserve by the Federal Reserve Act.

Figure 2.1. How the Federal Reserve operates within the U.S. government framework

A statutory framework established by Congress guides the operation of the Federal Reserve System.

THE FEDERAL RESERVE ACT

creates the Federal Reserve System and

specifies how Board members and Reserve

Bank presidents are chosen.

BOARD OF GOVERNORS

Seven Board members guide all

aspects of the operation of the Federal

Reserve System and its five key functions.

SENATE

confirms Board members appointed by the

President to staggered 14-year terms, and

confirms the nominations of Board members to

be either Chair or Vice Chair.

FEDERAL RESERVE BANKS

12 Reserve Banks examine and supervise

financial institutions, act as lenders of last

resort, and provide U.S. payment system

services, among other things.

PRESIDENT

nominates members of the Board of Governors,

the chief governing body of the Federal Reserve

System, and nominates one Board member to be

Chair and one to be Vice Chair.

FEDERAL OPEN MARKET

COMMITTEE

Seven Board members and five Reserve

Bank presidents direct open market

operations that sets U.S. monetary policy to

promote maximum employment, stable

prices, and moderate long-term interest

rates in the U.S. economy.

8 The Fed Explained: What the Central Bank Does

All of the members of the Board serve on the FOMC, which is the body within the Federal Reserve

that sets monetary policy (see “The Federal Open Market Committee: Selection and Function” on

page 12). Each member of the Board of Governors is appointed for a 14-year term; the terms are

staggered so that one term expires on January 31 of each even-numbered year. After serving a full

14-year term, a Board member may not be reappointed. If a Board member leaves the Board be-

fore his or her term expires, however, the person nominated and confirmed to serve the remainder

of the term may later be appointed to a full 14-year term (figure 2.2).

The Chair and Vice Chair of the Board are also appointed by the President and confirmed by the

Senate, but serve only four-year terms. They may be reappointed to additional four-year terms. The

nominees to these posts must already be members of the Board or must be simultaneously ap-

pointed to the Board.

The Board oversees the operations of the 12 Reserve Banks and shares with them the respon-

sibility for supervising and regulating certain financial institutions and activities (see section 5,

“Supervising and Regulating Financial Institutions and Activities,” on page 62). The Board also

provides general guidance, direction, and oversight when the Reserve Banks lend to depository

institutions and when the Reserve Banks provide financial services to depository institutions and

the federal government. The Board also has broad oversight responsibility for the operations and

activities of the Reserve Banks (see section 6, “Fostering Payment and Settlement System Safety

and Efficiency,” on page 84). This authority includes oversight of the Reserve Banks’ services

to depository institutions and to the U.S. Treasury, and of the Reserve Banks’ examination and

supervision of various financial institutions. As part of this oversight, the Board reviews and ap-

proves the budgets of each of the Reserve Banks.

The Board also helps to ensure that the voices and concerns of consumers and communities are

heard at the central bank by conducting consumer-focused supervision, research, and policy analy-

sis, and, more generally, by promoting a fair and transparent consumer financial services market

(see section 7, “Promoting Consumer Protection and Community Development,” on page 112).

The Federal Reserve Banks: Structure and Function

The 12 Reserve Banks and their 24 Branches are the operating arms of the Federal Reserve

System. Each Reserve Bank operates within its own particular geographic area, or district, of the

United States.

Each Reserve Bank gathers data and other information about the businesses and the needs of

local communities in its region. That information is then factored into monetary policy decisions by

the FOMC and other decisions made by the Board of Governors.

The Three Key System Entities 9

Reserve Bank Leadership

As set forth in the Federal Reserve Act, each Reserve Bank is subject to “the supervision and

control of a board of directors.” Much like the boards of directors of private corporations, Reserve

Bank boards are responsible for overseeing their Bank’s administration and governance, reviewing

the Bank’s budget and overall performance, overseeing the Bank’s audit process, and developing

broad strategic goals and directions. However, unlike private corporations, Reserve Banks are not

operated in the interest of shareholders, but rather in the public interest.

Each year, the Board of Governors designates one chair and one deputy chair for each Reserve

Bank board from among its Class C directors. The Federal Reserve Act requires that the chair of a

Reserve Bank’s board be a person of “tested banking experience,” a term which has been inter-

preted as requiring familiarity with banking or financial services.

Each Reserve Bank board delegates responsibility for day-to-day operations to the president of

that Reserve Bank and his or her staff. Reserve Bank presidents act as chief executive officers

of their respective Banks and also serve, in rotation, as voting members of the FOMC. Presidents

are nominated by a Bank’s Class B and C directors and approved by the Board of Governors for

five-year terms.

Figure 2.2. Serving on the Board of Governors

The Federal Reserve’s governors serve staggered 14-year terms and may not be reappointed; all governors—

including the Chair and Vice Chair—are appointed by the President and confirmed by the Senate.

The member is nominated to be Chair or Vice Chair

by the President and confirmed by the Senate.

He or she may be reappointed as Chair or Vice

Chair for one or more additional four-year terms.

The member

leaves before his

or her term has expired.

He or she

is replaced.

The newly appointed member serves the remainder

of his or her predecessor’s term and may be

appointed to a full 14-year term.

The member

serves a

14-year term.

The member’s term ends

on January 31, and he or she

cannot be reappointed.

A Board member

is appointed and

confirmed.

10 The Fed Explained: What the Central Bank Does

Reserve Bank Branches also have boards of directors. Pursuant to policy established by the Board

of Governors, Branch boards must have either five or seven members. All Branch directors are

appointed: the majority of directors on a Branch board are appointed by the Reserve Bank, and

the remaining directors on the board are appointed by the Board of Governors. Each Branch board

selects a chair from among those directors appointed by the Board of Governors. Unlike Reserve

Bank directors, Branch directors are not divided into different classes. However, Branch directors

must meet different eligibility requirements, depending on whether they are appointed by the Re-

serve Bank or the Board of Governors.

Reserve Bank and Branch directors are elected or appointed for staggered three-year terms. When

a director does not serve a full term, his or her successor is elected or appointed to serve the

unexpired portion of that term.

Reserve Bank Responsibilities

The Reserve Banks carry out Federal Reserve core functions by

1. supervising and examining state member banks (state-chartered banks that have chosen to

become members of the Federal Reserve System), bank and thrift holding companies, and non-

Figure 2.3. Composition of Federal Reserve Bank boards of directors and selection of

Reserve Bank presidents

The boards of directors of the Reserve Banks represent a cross-section of banking, commercial, agricultural, and

industrial interests. Six of the nine members of each board of directors are chosen to represent the public interest;

those six board directors nominate their Bank’s president.

Class C directors

represent the public.

Federal Reserve

Board of Governors appoints

three Class C directors.

Chair and deputy chair

are designated by the

Board of Governors

from among Class C

directors.

Reserve Bank presidents are nominated

by Class B and C directors and approved

by the Board of Governors.

Class B directors

represent the public.

Federal Reserve member banks

elect three Class A directors and

three Class B directors.

Class A directors

represent District

member banks.

The Three Key System Entities 11

bank financial institutions that have been designated as systemically important under authority

delegated to them by the Board;

2. lending to depository institutions to ensure liquidity in the financial system;

3. providing key financial services that undergird the nation’s payment system, including distribut-

ing the nation’s currency and coin to depository institutions, clearing checks, operating the Fed-

Wire and automated clearinghouse (ACH) systems, and serving as a bank for the U.S. Treasury;

and

4. examining certain financial institutions to ensure and enforce compliance with federal consum-

er protection and fair lending laws, while also promoting local community development.

In its role providing key financial services, the Reserve Bank acts, essentially, as a financial institu-

tion for the banks, thrifts, and credit unions in its District—that is, each Reserve Bank acts as a

“bank for banks.” In that capacity, it offers (and charges for) services to these depository institu-

tions similar to those that ordinary banks provide their individual and business customers: the

equivalent of checking accounts; loans; coin and currency; safekeeping services; and payment

services (such as the processing of checks and the making of recurring and nonrecurring small-

and large-dollar payments) that help banks, and ultimately their customers, buy and sell goods,

services, and securities.

In addition, through their leaders and their con-

nections to, and interactions with, members of

their local communities, Reserve Banks

provide the Federal Reserve System with a

wealth of information on conditions in virtually

every part of the nation—information that is

vital to formulating a national monetary policy

that will help to maintain the health of the economy and the stability of the nation’s financial sys-

tem.

Certain information gathered by the Reserve Banks from Reserve Bank directors and other sourc-

es is also shared with the public prior to each FOMC meeting in a report commonly known as the

Beige Book. In addition, every two weeks, the board of each Reserve Bank recommends discount

rates (interest rates to be charged for loans to depository institutions made through that Bank’s

discount window); these interest rate recommendations are subject to review and determination

by the Board of Governors.

Want to learn more about Reserve Bank directors?

Reserve Bank and Branch directors play a number

of roles at their Banks. To learn more about director

responsibilities and requirements, see Roles and Re-

sponsibilities of Federal Reserve Directors in the About

the Fed section of the Board’s website, https://www.

federalreserve.gov/aboutthefed/directors/about.htm.

12 The Fed Explained: What the Central Bank Does

The Federal Open Market Committee:

Selection and Function

The FOMC is the body of the Federal Reserve System that sets national monetary policy (figure

2.4). The FOMC makes all decisions regarding the appropriate position or “stance” of monetary

policy to help move the economy toward the congressionally mandated goals of maximum em-

ployment and price stability. The Committee

raises and lowers its target range for the policy

rate, which is the federal funds rate (the rate

at which depository institutions lend to each

other), to achieve these dual objectives. At

times, as an additional policy measure, the

FOMC has used forward guidance about its policy rate to influence expectations about the future

course of monetary policy. In addition, the Committee sometimes leans on balance sheet policy,

where it adjusts the size and composition of the Federal Reserve’s asset holdings, to assist with

market functioning and help foster accommodative financial conditions. Congress enacted legisla-

tion that created the FOMC as part of the Federal Reserve System in 1933 and 1935.

FOMC Membership

The FOMC consists of 12 voting members—the 7 members of the Board of Governors; the presi-

dent of the Federal Reserve Bank of New York; and 4 of the remaining 11 Reserve Bank presi-

dents, who serve one-year terms on a rotating basis.

Want to learn more about the FOMC?

For more information about the FOMC, visit the About

the Fed section of the Board’s website, https://www.

federalrserve.gov/aboutthefed/structure-federal-open-

market-committee.htm.

Figure 2.4. Composition of the Federal Open Market Committee

The Federal Open Market Committee’s (FOMC) structure promotes the consideration of broad U.S. economic

perspectives and the public interest in key monetary policy decisions made by the U.S. central bank.

Board of Governors

(permanent FOMC

participants)

Federal Reserve Bank

of New York president

(permanent FOMC

participant)

Reserve Bank presidents

(serve one-year terms

on a rotating basis)

The Three Key System Entities 13

All 12 of the Reserve Bank presidents attend FOMC meetings and participate in FOMC discus-

sions, but only the presidents who are Committee members at the time may vote on policy deci-

sions.

By law, the FOMC determines its own internal organization and, by tradition, the FOMC elects the

Chair of the Board of Governors as its chair and the president of the Federal Reserve Bank of New

York as its vice chair. FOMC meetings are typically held eight times each year in Washington, D.C.,

and at other times as needed.

FOMC Responsibilities

Once the FOMC determines the appropriate stance of policy, it must then make sure this stance

is effectively transmitted to financial markets. The Board and FOMC have many monetary policy

implementation tools at their disposal. Key tools include the Federal Reserve’s administered inter-

est rates and open market purchases and sales of securities (see section 3, “Conducting Mon-

etary Policy,” on page 16). The FOMC also directs operations undertaken by the Federal Reserve in

foreign exchange markets and authorizes currency swap programs with foreign central banks.

Other Significant Entities Contributing to Federal Reserve

Functions

Two other groups play important roles in the Federal Reserve System’s core functions:

(1) depository institutions—banks, thrifts, and credit unions; and (2) Federal Reserve System

advisory committees, which make recommendations to the Board of Governors and to the Reserve

Banks regarding the System’s responsibilities.

Depository Institutions

Depository institutions offer transaction, or checking, accounts to the public and may maintain

accounts of their own at their local Reserve Banks. Depository institutions receive interest on

the reserve balances they hold in their Reserve Bank accounts. Interest on reserves is a key tool

for monetary policy implementation (see section 3, “Conducting Monetary Policy,” on page 16 for

more information about the conduct of monetary policy).

Advisory Councils

Five advisory committees assist and advise the Board on matters of public policy.

1. Federal Advisory Council (FAC). This council, established by the Federal Reserve Act, comprises

12 representatives of the banking industry. The FAC ordinarily meets with the Board four times

14 The Fed Explained: What the Central Bank Does

a year, as required by law. Annually, each Reserve Bank chooses one person to represent its

District on the FAC. FAC members customarily serve three one-year terms and elect their own

officers.

2. Community Depository Institutions Advisory Council (CDIAC). The CDIAC was originally estab-

lished by the Board of Governors to obtain information and views from thrift institutions (savings

and loan institutions and mutual savings banks) and credit unions. More recently, its member-

ship has expanded to include community banks. Like the FAC, the CDIAC provides the Board of

Governors with firsthand insight and information about the economy, lending conditions, and

other issues.

3. Model Validation Council. This council was

established by the Board of Governors in

2012 to provide expert and independent ad-

vice on its process to rigorously assess the

models used in stress tests of banking insti-

tutions. Stress tests are required under the

Dodd-Frank Wall Street Reform and Consumer Protection Act. The council is intended to improve

the quality of stress tests and thereby strengthen confidence in the stress testing program. (For

more information about stress tests, see “Capital Planning and Stress Testing” on page 77.)

4. Community Advisory Council (CAC). This council was formed by the Federal Reserve Board in

2015 to offer diverse perspectives on the economic circumstances and financial services needs

of consumers and communities, with a particular focus on the concerns of low- and moderate-

income populations. The CAC complements the FAC and CDIAC, whose members represent

depository institutions. The CAC meets semiannually with members of the Board of Governors.

The 15 CAC members serve staggered three-year terms and are selected by the Board through a

public nomination process.

5. Insurance Policy Advisory Committee (IPAC). This council was established at the Board of

Governors in 2018 by section 211(b) of the Economic Growth, Regulatory Relief, and Consumer

Protection Act. The IPAC provides information, advice, and recommendations to the Board on

international insurance capital standards and other insurance issues.

Reserve Banks also have their own advisory committees. Perhaps the most important of these are

committees that advise the Banks on agricultural, small business, and labor matters. The Federal

Reserve Board solicits the views of each of these committees biannually.

More on Federal Reserve Advisory Councils

For a current roster of Federal Reserve advisory coun-

cil members, visit the About the Fed section of the

Board’s public website at https://www.federalreserve.

gov/aboutthefed/advisorydefault.htm.

16 The Fed Explained: What the Central Bank Does

3

Conducting Monetary Policy

The Federal Reserve sets U.S. monetary policy to

promote maximum employment and stable prices

in the U.S. economy.

The Federal Reserve’s Monetary Policy Mandate and Strategy and

Why It Matters ....................................21

The Conduct of Monetary Policy ..........................24

Monetary Policy Tools .................................34

How Monetary Policy Is Implemented ......................39

Conducting Monetary Policy 21

What is monetary policy? It is the Federal Reserve’s actions, as a central bank, to achieve the

“dual mandate” goals specified by Congress: maximum employment and stable prices in the

United States.

The Federal Reserve conducts monetary policy by using a variety of tools to manage financial con-

ditions that encourage progress toward its dual mandate objectives. Monetary policy most directly

affects the current and expected future path of short-term interest rates; the anticipated path of

short-term interest rates then affects overall financial conditions including longer-term interest

rates, stock prices, the exchange value of the dollar, and many other asset prices. Through these

channels, monetary policy influences the decisions of households and businesses, thus affecting

overall spending, investment, production, employment, and inflation in the United States (figure 3.1).

Conducting monetary policy effectively involves a number of important elements including a basic

strategy that guides the adjustment of the stance of policy over time, a policy process involving

the coordinated actions of the Federal Reserve’s two decisionmaking bodies—the Board of Gover-

nors (Board) and the Federal Open Market Committee (FOMC)—a communications effort with the

public to describe the rationale for the Federal Reserve’s policy decisions, a range of tools used

to implement the desired stance of policy, and an institutional framework that involves appropri-

ate independence of the Federal Reserve in conducting policy while remaining fully accountable to

Congress and the American people for its actions.

The Federal Reserve’s Monetary Policy Mandate and

Strategy and Why It Matters

The Federal Reserve was created by Congress in 1913 to provide the nation with a safer, more

flexible, and more stable monetary and financial system. In 1977, Congress amended the Federal

Reserve Act (FRA) to provide greater clarity about the goals of monetary policy. The amended FRA

directs the Board of Governors and the FOMC to conduct monetary policy “so as to promote

Figure 3.1. The Fed’s statutory mandate: maximum employment and stable prices

The Federal Reserve conducts monetary policy in pursuit of the goals set for it by Congress. The mandated goals

are considered essential to a well-functioning economy for households and businesses.

FOMC monetary

policy decision

Affects current and

expected short-term

interest rates

Affects overall financial

conditions

Influences decisions

of households and

businesses

Progress toward

maximum

employment and

stable prices

%

%

22 The Fed Explained: What the Central Bank Does

Fed Chair on accountability and transparency

“We are committed to providing clear explanations about our policies and activities. Congress has given us an

important degree of independence so that we can effectively pursue our statutory goals based on objective analysis

and data. We appreciate that our independence brings with it an obligation for transparency so that you and the public

can hold us accountable.”

Chair Jerome Powell, July 11, 2019

https://www.federalreserve.gov/newsevents/testimony/powell20190710a.htm

effectively the goals of maximum employment, stable prices, and moderate long-term interest

rates.”

Because long-term interest rates remain mod-

erate in a stable economy with low expected

inflation, this set of goals is often referred to

as the dual mandate, comprising the coequal

objectives of maximum employment and price

stability. This dual mandate still exists today

and ties monetary policy to the broader goal of

fostering a productive and stable U.S. economy.

Though Congress specifies the goals for monetary policy, it established the Federal Reserve as

an independent agency to ensure that its decisions are based on facts and objective analysis and

serve the best interests of all Americans. Studies have shown that central bank independence is

an important factor that supports the ability of monetary policy to achieve solid economic perfor-

mance and stable prices over time. At the same time, the Federal Reserve must be accountable to

Congress and the American people for its actions. It does so by being transparent about its policy

deliberations and actions through a range of official communications.

Understanding How the Fed Interprets and Achieves Its Maximum

Employment and Price Stability Mandates

To promote public understanding of how the Federal Reserve interprets its statutory mandate,

the FOMC released its Statement on Longer-Run Goals and Monetary Policy Strategy for the first

time in January 2012. The statement, which was reaffirmed every January until 2020, lays out the

goals for monetary policy, articulates the policy framework the Committee uses, and serves as the

foundation for the Committee’s policy actions. It is also intended to enhance the transparency, ac-

countability, and effectiveness of monetary policy.

FOMC composition helps ensure broad perspective

The FOMC consists of the seven members of the

Board of Governors; the president of the Federal

Reserve Bank of New York; and 4 of the remaining 11

Reserve Bank presidents, who serve one-year terms

on a rotating basis. See section 1 on page vi for an

overview of the Federal Reserve System and the FOMC.

Conducting Monetary Policy 23

In August 2020, the Committee released a revised statement after conducting an 18-month review

of its strategic framework for monetary policy. The new statement reaffirmed many key aspects

of the previous statement but also included some innovations to reflect important changes in the

economy that have become apparent in recent years. In particular, the Committee acknowledged

that the level of the federal funds rate con-

sistent with maximum employment and price

stability over the longer run has declined rela-

tive to its historical average and so the federal

funds rate is likely to be constrained by its

effective lower bound more frequently than in

the past. Reflecting this possible outcome, the

Committee stated that it is prepared to use

its full range of tools to achieve its maximum

employment and price stability goals.

Employment. In the statement, the FOMC recognized that the maximum level of employment is a

broad-based and inclusive goal that is not directly measurable and changes over time for reasons

unrelated to monetary policy. Consequently, the Committee does not set a fixed goal for employ-

ment but bases its policy decisions on assessments of the shortfalls of employment from its max-

imum level. The Committee considers a wide range of indicators in making these assessments.

Inflation. In the statement, the Committee reaffirmed its judgment that inflation at the rate of 2

percent, as measured by the annual change in the price index for personal consumption expendi-

tures, is most consistent over the longer run with the Federal Reserve’s statutory mandate. The

Committee noted that longer-term inflation expectations that are well anchored at 2 percent foster

price stability and moderate long-term interest rates and enhance the Committee’s ability to pro-

mote maximum employment in the face of significant economic disturbances. In order to anchor

longer-term inflation expectations at this level, the Committee noted that it seeks to achieve infla-

tion that averages 2 percent over time.

Working toward the two goals. The statement noted that in setting monetary policy, the FOMC

seeks over time to mitigate short falls of employment from the Committee’s assessment of its

maximum level and deviations of inflation from its longer-run goal. Most of the time, the Federal

Reserve’s goals for employment and inflation are complementary. The FOMC could, however, face

situations where its goals are pulling policy in opposite directions. In these circumstances, the

Committee indicated that it will take into account the employment shortfalls and inflation devia-

tions as well as the potentially different time horizons over which employment and inflation are

projected to return to their desired levels.

A fresh look at the monetary policy framework

In 2019, the Fed launched a comprehensive and

public review of the monetary policy framework—the

strategy, tools, and communication practices—it em-

ploys to achieve its mandate. See the Board’s website

for more information on the process and results:

https://www.federalreserve.gov/monetarypolicy/

review-of-monetary-policy-strategy-tools-and-communi-

cations.htm.

24 The Fed Explained: What the Central Bank Does

The Conduct of Monetary Policy

Monetary policy affects the U.S. economy—and the achievement of the dual mandate—primarily

through its influence on interest rates and overall financial conditions. With this in mind, the FOMC

decides on the appropriate position or “stance” of monetary policy. Over time, the Committee has

raised and lowered its target range for the policy rate, which is the federal funds rate (figure 3.2).

When the FOMC changes the target range for the federal funds rate, other interest rates and finan-

cial conditions more broadly adjust in response, thus affecting household and business spending

decisions (see figure 3.1).

Short-term interest rates. Short-term interest rates—for example, the rate of return paid to hold-

ers of U.S. Treasury bills or commercial paper (a short-term debt security) issued by private com-

panies—are affected by changes in the target range for the federal funds rate. Short-term interest

rates would decline if the FOMC reduced its

target range for the federal funds rate, or if

unfolding events or Federal Reserve communi-

cations led the public to think that the FOMC

would soon reduce the target range for the

federal funds rate to a level lower than previ-

ously expected. Conversely, short-term interest

rates would rise if the FOMC increased the federal funds rate target range, or if unfolding events

or Federal Reserve communications prompted the public to believe that the target range for the

federal funds rate would soon be moved to a higher level than had been anticipated.

Longer-term interest rates and asset prices. Longer-term interest rates and the prices for a wide

range of financial and nonfinancial assets, including stocks, bonds, and real estate, respond to

changes in the current and expected path of the federal funds rate. That is, medium- and longer-

term interest rates are affected by how people expect the federal funds rate to change in the

future. For example, if borrowers and lenders think, today, that the FOMC is likely to lower its target

for the federal funds rate substantially over the next several years, medium- and longer-term inter-

est rates today will incorporate those expectations, and those rates then will be lower than would

otherwise be the case.

Generally speaking, the effect on short-term interest rates of a single change in the FOMC’s target

range for the federal funds rate will be somewhat larger than the effect on longer-term rates be-

cause long-term rates typically reflect the expected course of short-term rates over a long period.

Monetary policy: Easing and tightening defined

The FOMC changes monetary policy primarily by rais-

ing or lowering its target range for the federal funds

rate. Lowering the target range represents an “easing”

of monetary policy, while increasing the target range is

a “tightening” of policy.

Conducting Monetary Policy 25

However, the influence of a change in the FOMC’s target range for the federal funds rate on longer-

term interest rates can also be substantial if it has clear implications for the expected course of

short-term rates over a considerable period.

Effects on spending. The level of longer-term interest rates affects household and business

spending decisions, which in turn influence the level of economic output, employment, and infla-

tion. For example, lowering mortgage rates will make buying a house more affordable, encouraging

some individuals who were previously renters to purchase homes. As more individuals purchase

homes, employment rises among homebuilders and many other types of home-supply industries.

Lower mortgage rates may also allow some existing homeowners to refinance their mortgages

at lower rates and thus free up income for spending on many other types of goods and services.

In addition, lower interest rates on consumer loans may spur greater spending on durable goods

(long-lasting manufactured goods) such as televisions and automobiles. The increased demand for

all goods and services will boost employment across a variety of industries. Corresponding to the

increased demand and change in employment, prices will adjust.

Figure 3.2. The federal funds rate over time

The effective federal funds rate is the interest rate at which depository institutions—banks, savings institutions

(thrifts), and credit unions—and government-sponsored enterprises borrow from and lend to each other overnight

to meet short-term business needs. The target for the federal funds rate—which is set by the Federal Open Market

Committee—has varied widely over the years in response to prevailing economic conditions.

1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 2019

Percent

Effective federal funds rate

Target federal funds rate

Target federal funds range

8

7

6

5

4

3

2

1

0

26 The Fed Explained: What the Central Bank Does

Factors Affecting the Stance of Monetary Policy

In determining the appropriate stance of monetary policy, the FOMC assesses how a variety of

factors affect the current and projected path of the economy. These factors influence the FOMC’s

decisions regarding the appropriate stance of monetary policy.

Anticipated Factors

Many factors affect spending, output, employment, and inflation. Some of these factors can

be anticipated and factored into the FOMC’s deliberations. For example, the government influ-

ences demand in the economy through changes in taxes and spending programs, which are

often anticipated. Indeed, the economic effects of a tax cut may precede its actual implemen-

tation if businesses and households increase their spending in anticipation of lower taxes. In

addition, forward-looking financial markets may build anticipated fiscal events into the level

and structure of interest rates.

Demand Shocks

Other factors that affect spending on goods and services can come as a surprise and can influ-

ence the economy in unforeseen ways. Examples of these “demand shocks” include shifts in

consumer and business confidence or unexpected changes in the credit standards that banks

and other lenders apply when they consider making loans. Once a demand shock is identified,

the FOMC may seek to offset the effects of that shock on the economy by adjusting the stance of

monetary policy.

For instance, in 2020, the global economy was suddenly and severely hit with the coronavirus

(COVID-19) pandemic. This public health crisis disrupted economic activity, significantly affected

financial conditions, and posed risks to the economic outlook. In light of these developments, the

FOMC swiftly adjusted the stance of monetary policy, including using some nontraditional policy

measures. (See “2020 and Beyond: Taking Aggressive Action Amid the Global Pandemic” on page

34 for more discussion.)

Other times, however, because data and other information on the state of the economy are not

available immediately, it can take time before a demand shock is identified and the FOMC re-

sponds. Because traditional changes in the stance of monetary policy affect the economy with a

lag, policy actions today may take several quarters or more before their effects on spending and

inflation take hold. Thus, demand shocks can push the economy away from the Federal Reserve’s

goals of maximum employment and price stability for a time.

Conducting Monetary Policy 27

Supply Shocks

Other shocks can affect the production of goods and services and their prices by altering the

costs associated with production or the technology used in production. Examples of such “supply

shocks” include crop losses due to extreme weather and slowdowns in productivity growth relative

to what would have occurred otherwise—these sorts of adverse supply shocks tend to raise prices

and reduce output (and also employment). A disruption in the oil market that reduces the supply

of oil and increases its price substantially can also raise other prices and reduce output because

oil is an input to the production of many products.

In the face of these adverse supply shocks, policymakers can attempt to counter the loss of out-

put by easing monetary policy and making financial conditions more conducive to spending; alter-

natively, policymakers can attempt to counter the rise in prices by tightening policy. As discussed,

in these situations, the FOMC has indicated it would take into account the employment shortfalls

and inflation deviations in achieving its goals.

Of course, the economy can also experience beneficial supply shocks, such as technological

breakthroughs or reductions in the cost of important raw materials, and these beneficial supply

shocks can both lower prices and boost output.

How Monetary Policy Decisions Are Made: The Deliberative Process

How are monetary policy decisions made? The members of the Board of Governors and the presi-

dents of the 12 Federal Reserve Banks gather for eight regularly scheduled joint meetings of the

Board and FOMC each year to discuss economic and financial conditions and deliberate on mon-

etary policy. Normally, this meeting is held at the Board’s offices in Washington, D.C.; if necessary,

FOMC participants meet by video conference for these meetings or at other times.

FOMC Meetings: Assessing an Evolving U.S. and World Economy

At its meetings, the FOMC considers how the U.S. economy is likely to evolve in the near and

medium term, along with risks to the outlook for the economy. With this assessment, it then deter-

mines the appropriate monetary policy setting to help move the economy to the Federal Reserve’s

goals of maximum employment and 2 percent inflation over the longer run. The FOMC also consid-

ers how it can effectively communicate its expectations for the economy and its policy decisions to

the public. For a closer look at FOMC meeting deliberations, see box 3.1.

28 The Fed Explained: What the Central Bank Does

How the FOMC Determines the Appropriate Stance of Monetary Policy

During the FOMC meeting, policymakers discuss a broad range of information to help them assess

trends in the U.S. economy and to judge the appropriate stance of monetary policy. They analyze

the most up-to-date economic data; consider surveys of households, businesses, and financial

market participants; and review reports from the Federal Reserve staff and other sources.

Overall, while reviewing all the information and analysis, policymakers keep in mind the linkages

between the level of the federal funds rate, other short-term interest rates, broader financial condi-

Box 3.1. What Happens at an FOMC Meeting

In preparation for each Federal Open Market Committee (FOMC) meeting, policymakers analyze

economic and financial developments and evaluate the implications of these developments for the

economic outlook and risks to the outlook.

The materials that they and their staffs review include a wide range of U.S. and international economic

and financial data, statistical and judgmental economic forecasts, and analyses of alternative policy

approaches. Participants also consult business, consumer, and financial industry contacts to hear

their perspectives on economic and financial conditions and the outlook.

Reserve Bank input gathered. The staff of the Federal Reserve Banks collect and summarize infor-

mation on current economic conditions in their Districts. An overall summary, commonly known as

the Beige Book, is released to the public two weeks before the FOMC meeting. (The Beige Book is

available at https://w

ww. federalreserve.gov/monetarypolicy/beigebook/default.htm.) At about the

same time, the staff of the Federal Reserve Board distributes to all FOMC participants its analysis of

the economy, its economic forecasts, and an analysis of several policy options that span the range

of plausible monetary policy responses to the current and expected economic situation. Economic

research groups at the Reserve Banks separately brief their Bank presidents on relevant economic de-

velopments and policy choices. Using these materials, FOMC participants formulate their preliminary

views on the economic outlook and the appropriate policy response in preparation for their meeting in

Washington.

Economic situation: FOMC participants receive briefings and present their views. During the first

part of the meeting, the Federal Reserve governors and Reserve Bank presidents receive briefings that

review the operations of the System Open Market Desk at the Federal Reserve Bank of New York and

recent economic and financial developments in the United States and abroad. Each Bank president

around the table then takes a turn presenting their views on economic conditions in his or her District,

and both the presidents and governors offer their assessments of recent developments and the out-

look.

Monetary policy: FOMC participants briefed and discuss appropriate stance of policy; members

vote. After a staff presentation on options for monetary policy, participants again share their individual

judgments of how policy should be conducted over the period prior to the next FOMC meeting, how

they expect policy to evolve over the medium run, and how the Committee’s policy intentions should be

communicated to the public. While all participants are included in the discussions, the policy decision

rests with the voting members of the FOMC—the members of the Board of Governors, the president

of the Federal Reserve Bank of New York, and 4 of the remaining 11 Bank presidents (on a rotating

basis).

For more information on the FOMC and other key Federal Reserve entities, see section 2 on page 6.

For an in-depth look at what happens at an FOMC meeting, see the speech that former Federal Re-

serve Governor Elizabeth A. Duke delivered in October 2010, “Come with Me to the FOMC,” available

at https://www.federalreserve.gov/newsevents/speech/duke20101019a.htm.

Conducting Monetary Policy 29

tions, and the actions of households and businesses. They also take into account uncertainties

and risks in their analysis. The FOMC meeting concludes with a decision on the stance of policy.

FOMC Statement and Chair’s Press Conference

Starting in 1994, the Federal Reserve released a statement to the public when the FOMC made a

change in the stance of monetary policy. A few years thereafter, the Committee began to release

a statement after every meeting. The statement summarizes the Committee’s judgment about

recent economic developments and the economic outlook, states the FOMC’s policy decision, and

provides information about the factors that the FOMC will consider in setting policy as economic

and financial developments evolve.

At times, the statement provides “forward guid-

ance”—that is, information about the Commit-

tee’s intentions for the federal funds rate in

the future. The statement may also contain

information about policy actions that may af-

fect the size and composition of the Federal

Reserve’s balance sheet. Forward guidance

and balance sheet policies were important

tools used in the aftermath of both the 2007–09 financial crisis and the 2020 COVID-19 shock,

when short-term interest rates were near zero. The postmeeting statement concludes by noting

which FOMC members voted for an action, and which members, if any, dissented from it.

Beginning in 2011, the Chair held press conferences immediately following the conclusion of four

FOMC meetings during the year. Then, starting in 2019, the Chair started holding press conferenc-

es after each FOMC meeting. Each press conference begins with the Chair presenting an opening

statement and then taking questions from members of the media. These press conferences allow

the Chair to explain the rationale behind the policy decision and how it relates to the Committee’s

dual mandate.

Communicating Policy Regularly and Clearly

The Federal Reserve has a long-standing commitment to communicate regularly with the public

and Congress concerning its monetary policy activities and the pursuit of its dual mandate. While

some communications are required by statute, most represent an effort by the Federal Reserve to

increase the transparency and accountability of its policy decisions and operations. The Federal

Reserve also engages in significant outreach to the public in order to enhance its understanding

of economic issues and the effects of its policies.

Besides the regular FOMC postmeeting statements and the Chair’s press conferences that explain

the FOMC’s decisions, there are many other avenues for communications. Some of these com-

Learn more about the context for monetary policy

decisions

The release of postmeeting communications provides

the broad context for FOMC policy decisions. Visit the

Board’s website to view postmeeting releases and oth-

er communications that provide the context for each

FOMC meeting at https://www.federalreserve.gov

/monetarypolicy/fomccalendars.htm.

30 The Fed Explained: What the Central Bank Does

munications are tied to FOMC meetings and

released on set dates. Other communications

are associated with unanticipated events and

released at the times of the events.

FOMC meeting minutes. Detailed minutes of

FOMC meetings are released three weeks after

each meeting. The minutes cover all policy-

related topics that receive a significant amount

of attention during the meeting. They describe

the views expressed by the participants, the

risks and uncertainties attending the outlook,

and the reasons for the Committee’s deci-

sions. The minutes can help the public interpret economic and financial developments and better

understand the Committee’s decisions. As an official record of the meeting, the minutes identify

all attendees and include votes on all authorized policy operations.

Summary of Economic Projections. Beginning in late 2007, the Federal Reserve began publishing

a summary of the economic projections of individual FOMC participants four times each year in

the “Summary of Economic Projections.” The FOMC publishes these projections at the same time

it releases its policy statement after its regularly scheduled meetings. The projections are partici-

pants’ individual assessments of the most likely outcomes for real gross domestic product (GDP)

growth, the unemployment rate, and inflation consistent with each participant’s assessment of the

appropriate setting of the federal funds rate over the medium term and over the longer run. Also

included are measures of participants’ assessment of the uncertainty and risks associated with

their outlooks for these variables. Participants base their respective projections on assumptions

about the factors likely to affect economic outcomes.

Testimonies to Congress, speeches, and transcripts. The FOMC’s communication of its policy ac-

tions and intentions extends well beyond the postmeeting statements, minutes, and press confer-

ences. By statute, the Federal Reserve Chair testifies twice each year on economic developments

and monetary policy before the congressional committees that oversee the Federal Reserve. At

those times, the Board of Governors delivers the semiannual Monetary Policy Report to Congress

that discusses the conduct of monetary policy and economic developments and prospects for

the future. In addition, the Chair and other Board members appear frequently before Congress to

report and answer questions on economic and financial market developments and on monetary

and regulatory policy. Many Federal Reserve policymakers regularly give public speeches. And a

The Fed’s commitment to its goals

“Overall, our new Statement on Longer-Run Goals

and Monetary Policy Strategy conveys our continued

strong commitment to achieving our goals, given the

difficult challenges presented by the proximity of in-

terest rates to the effective lower bound. In conduct-

ing monetary policy, we will remain highly focused

on fostering as strong a labor market as possible for

the benefit of all Americans. And we will steadfastly

seek to achieve a 2 percent inflation rate over time.”

Chair Jerome Powell, August 27, 2020

https://www.federalreserve.gov/newsevents/

speech/powell20200827a.htm

Conducting Monetary Policy 31

wide range of documents, including transcripts of the FOMC meetings and staff analysis prepared

for each meeting, is made available after a five-year lag.

Committee policy statements. In addition to

the regular FOMC statements following every

meeting, the FOMC also issues statements

from time to time providing additional infor-

mation on specific topics. Three examples of

such statements discussed in this section are

the statement of the Committee’s longer-run

goals and monetary policy strategy, state-

ments regarding balance sheet normalization

principles and plans, as well as its statement

regarding monetary policy implementation in the longer-run.

Collecting information from the public. FOMC policymakers collect a vast amount of informa-

tion from the public to help inform them on the setting of the appropriate stance of monetary

policy. Reserve Bank presidents meet with contacts in their Districts before each FOMC meeting

to discuss District as well as national economic issues. The Federal Reserve conducts numerous

surveys at the District level and the national level that inform the Committee about financial and

economic conditions. In addition, the Federal Reserve publishes various financial and economic

data that are used by the FOMC as well as the public more broadly in evaluating the health of the

economy.

Monetary Policy Evolution in Recent Decades

Since the mid-1990s, the FOMC has focused on conducting monetary policy by adjusting the level

of short-term interest rates with the goal of influencing overall financial conditions in a way that

will promote the attainment of the Committee’s dual mandate objectives. This approach, which

is followed by many central banks, seeks to adjust policy in a systematic and transparent way in

response to the observed and expected paths for employment and inflation. Since 2007, with

extraordinary shocks hitting the global economy, the Federal Reserve has expanded its policy tools

to include some less-conventional policy measures as needed.

Monetary Policy during and after the 2007–09 Financial Crisis

The crisis in global financial markets that began during the summer of 2007 became particularly

severe during 2008. Early on, the Federal Reserve responded by expanding its lending to banks

that were experiencing shortages of liquidity through its standard discount window. In addition, the

Federal Reserve introduced several emergency lending programs that were designed to address

financial institutions’ needs for short-term liquidity, to help alleviate strains in many markets, and

Regular congressional testimony and reporting

promote accountability and transparency

The Board submits the Monetary Policy Report to Con-

gress semiannually. This report contains discussions

of the conduct of monetary policy and economic devel-

opments and prospects for the future. At the time this

report is released, the Chair testifies in front of the

Senate Committee on Banking, Housing, and Urban Af-

fairs and in front of the House Committee on Financial

Services. See the Board’s website at https://www.

federalreserve.gov/monetarypolicy/mpr_default.htm.

32 The Fed Explained: What the Central Bank Does

to support the flow of credit to households and

businesses. The Federal Reserve also estab-

lished dollar liquidity swap arrangements with

several foreign central banks to address global

dollar funding pressures.

Another way that the Federal Reserve respond-

ed to the crisis was through adjustments to its

traditional policy tool, the federal funds rate.

Beginning in the fall of 2007, the FOMC began

cutting its target for the federal funds rate and, by the end of 2008, the target had been reduced

from a level of 5¼ percent to a range of 0 to ¼ percentage point (see figure 3.2).

Although the Federal Reserve’s initial responses to the crisis helped financial markets to recover

and function more normally, the recession in the U.S. economy that began in December 2007 was

particularly severe and long-lasting. With the federal funds rate near zero, the FOMC turned to two

less-conventional policy measures—forward guidance and large-scale asset purchases—to provide

additional policy accommodation to support economic activity and stem disinflationary pressures.

The FOMC’s use of forward guidance influenced expectations about the future course of monetary

policy. Because households and businesses can use this information in making decisions about

spending and investment, forward guidance

about future monetary policy can influence

financial and economic conditions today. Over

the course of several years, the FOMC used

various forms of forward guidance and, by

December 2012, the FOMC’s statement was

pointing to the economic conditions that the

Committee expected to see before it would

begin to consider raising its target range for

the federal funds rate.

In terms of large-scale asset purchases, between late 2008 and October 2014, the Federal Re-

serve purchased longer-term securities through a series of programs with the aim of putting down-

ward pressure on longer-term interest rates, easing broader financial market conditions, and thus

supporting economic activity and job creation. These purchases reduced the cost and increased

the availability of credit for households and businesses.

Clear usage of forward guidance

In 2008, the FOMC lowered the target range for the

federal funds rate to the effective lower bound and

provided forward guidance that indicated the target

would likely be exceptionally low for some time. A

timeline of the FOMC’s setting of the policy rate and

use of forward guidance is available at https://www.

federalreserve.gov/monetarypolicy/timeline-forward-

guidance-about-the-federal-funds-rate.htm.

Unprecedented actions to foster maximum

employment and stable prices

The Federal Reserve responded aggressively to the

financial crisis that emerged in the summer of 2007,

including the implementation of a number of programs

designed to support the liquidity of financial institu-

tions and foster improved conditions in financial

markets.

For more on the monetary policy actions taken at that

time, see https://www.federalreserve.gov/monetary-

policy/bst_crisisresponse.htm.

Conducting Monetary Policy 33

Reflecting the FOMC’s multiyear asset purchase programs and decision to reinvest maturing and

prepaying securities, total assets of the Federal Reserve increased significantly by the end of

2014, from $870 billion in August 2007 to about $4.5 trillion, or 25 percent as a ratio to nominal GDP.

2015–19: Normalizing Monetary Policy in a Normalizing Economy

By 2015, the economic expansion had been ongoing for several years and unemployment had

declined noticeably. In addition, labor market conditions were projected to continue to improve,

and inflation was projected to move up to 2

percent. With this backdrop, the FOMC decided

that it would begin normalizing the stance of

monetary policy in order to continue to fos-

ter its macroeconomic objectives. The term

“normalization” refers to steps the FOMC took

to return both short-term interest rates as well

as the size and composition of the Federal Re-

serve’s balance sheet to more-normal levels.

To be transparent about this process and allow market participants to prepare for Federal Reserve

normalization actions, the FOMC made public its policy normalization principles and plans. In

particular, it announced the plan to first raise the federal funds rate from near zero and then to

normalize the size and composition of the balance sheet. To that end, the Committee gradually

raised its target range for the federal funds rate between December 2015 and December 2018.

By the end of 2018, the federal funds rate target range stood at 2¼ to 2½ percent.

In terms of balance sheet policy, the FOMC began reducing the size of its asset holdings in late

2017 by gradually phasing out the reinvestment of maturing and prepaying securities. By early

2019, the Federal Reserve’s balance sheet declined to a bit under 20 percent as a ratio of nomi-

nal GDP.

As in the period prior to the 2007–09 financial crisis, during this period, the FOMC normalized the

stance of policy by adjusting the level of short-term interest rates up in response to the observed

and expected future paths for the unemployment rate and inflation. However, after several years

of increasing the target range for the federal funds rate, the level of interest rates still remained

much lower than in the past. Many factors contributed to this lower level—well-anchored inflation

expectations, demographics, globalization, slower productivity growth, and greater demand for safe assets.

In this lower interest rate environment, the risk of shocks to the economy that can push the fed-

eral funds rate to the effective lower bound is much higher than before the financial crisis. And,

in fact, the FOMC found itself swiftly lowering the policy target range to the effective lower bound

Large-Scale Asset Purchase (LSAP) programs

supported credit for households and businesses

From the end of 2008 through October 2014, the

Federal Reserve greatly expanded its holding of longer-

term securities with the goal of putting downward pres-

sure on longer-term interest rates and thus supporting

economic activity and job creation by making financial

conditions more accommodative.

More information on LSAPs is available at https://

www.federalreserve.gov/monetarypolicy/bst_

openmarketops.htm.

34 The Fed Explained: What the Central Bank Does

in March 2020, at the onset of the COVID-19 pandemic, and turning to tested, additional policy

tools—forward guidance and balance sheet policy.

2020 and Beyond: Taking Aggressive Action Amid the Global Pandemic