Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

OPERATING

GUIDE

powered by

Bidvest Merchant Services

1. Some Basic Rules - Page 4

-You Must

-You Cannot

-Record Keeping

-Storage of Cardholder Information

2. Things You Need to Know Before You Accept

Card Payments - Page 5

2.1 Payment Card Recognition - Page 5

-Visa

-Visa Credit Cards

-Visa Electron

-Visa Prepaid

-Visa and Visa Electron Mini Cards

-MasterCard

-MasterCard Credit Card and

Debit MasterCard

-Maestro

2.2 Commercial Cards - Page 8

-Business Card

-Corporate Card

-Purchasing Card

2.3 How To Guard Against Fraud - Page 9

-Preventing and Detecting Fraudulent Card

Not Present Transactions

-Preventing and Detecting Fraudulent Card

Present Transactions

-Counterfeit Cards

-Delivery Warning Signals

-Instruct Your Courier

-Returning Wanted or Recovered Cards

-Other Important Fraud Considerations

2.4 Card Scheme Requirements - Page 13

-Payment Card Industry Data

Security Standard (PCI DSS)

-What is PCI DSS?

-Why Comply with the PCI Security Standard?

-Secure Data Storage

-PCI DSS Requirements

3. Accepting Card Transactions - Page 15

3.1 Card Present Transactions - Page 15

-Using Your Point of Sale Terminal

-Manual Entry for Card Present Transactions

-Terminal Fallback

-Contactless Transactions

-What is a Contactless Transaction?

-Accepting Contactless Card Payments

-Authorisation and Code 10 Calls

-Definition of Authorisation

-Referrals

-Code 10 Calls for Card Present Transactions

-Purchase with Cashback

3.2 Card Not Present Transactions - Page 18

-Definition of Card Not Present

-Card Not Present Transactions

-Card Verification Value

-How You Must Treat the Card

Verification Value

-Pre-Authorisation

-Rules for Card Not Present Transactions

-Recurring Transaction

3.3 Internet Card Transactions - Page 21

-Applying to Take Internet Card Transactions

-Website Requirements

-Payment Page (check-out)

-Verified by Visa and MasterCard SecureCode

-Payment Service Provider

-Receipt Requirements

-Website Content

-Merchant Details

-Products and Pricing

-Placing an Order

-Payments and Refunds

-Recurring Payments

-Delivery and Guarantees

CONTENTS

OPERATING

GUIDE

Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

powered by

Bidvest Merchant Services

3.4 Refund Process - Page 25

4. General Procedures and Banking - Page 26

4.1 Everyday Procedures - Page 26

-Banking Procedures

4.2 Exceptional Procedures - Page 26

-Can I Pass Charges to My Customer?

-Minimum Charging

-Split Sales and Transactions

-Alteration of Amounts

5. Chargebacks and Retrieval Requests

- Page 27

-Why Chargebacks Occur

-Chargeback Reversal Procedure

-Common Causes for Chargebacks

-Retrieval Requests

-To Help Reduce the Risk of Chargebacks

6. Vehicle Rental Reservation Service - Page 30

-Telephone Reservations

-Fax or Mail Reservations

-Internet Reservations

-Reservation Confirmation

-Your Cancellation Policy

-Vehicle Collection

-Estimated Authorisation

-Pre-Authorisation

-Delayed Charges

-Accident or Collision

-Accepting Split Sales

-Refund Policy

-Extended Hire

-Disputed Transactions

7. Hotels, Lodging and Accommodation

- Page 35

-Advance Reservations

-Telephone Reservations

-Fax or Mail Reservations

-Internet Reservations

-Advanced Deposits

-Cancellation Policy

-Guest Arrivals/Check-In

-Pre-Authorisation

-Departures/Check-Out

-Express/Priority Check-Out

-Extended Stays

-Disputed Transactions

-Requests for Information and Notification

of Chargebacks

8. Keeping Your Point of Sale Terminal

Device Safe - Page 39

9. Changes to Your Business - Page 40

-Change of Bank and/or Branch

-Change of Address

-Closure or Change of Ownership

-Change of Business or Trading Name

-Change of Legal Entity

-Change of Products or Services Sold or

Other Details

-Changing Your Trading Terms

-Other Changes Affecting Your Business

-Changing Method of Taking Cards

10. Voicing Your Concerns - Page 42

11. Additional Information - Page 43

-Point of Sale and Display Materia

12. Useful Contact Information - Page 44

-Authorisation Centre

-Merchant Support Service

-Bidvest Merchant Services Global Leasing

13. Glossary - Page 45

CONTENTS CONTINUED

OPERATING

GUIDE

†

Telephone calls may be recorded for security purposes and monitored as part of our quality control process.

3 Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

powered by

Bidvest Merchant Services

1. SOME BASIC RULES

To get the most out of your service, it is important to follow some basic procedures

that are strictly enforced by VISA

®

and MasterCard

®

.

You Must

• Clearly display Card acceptance logos for your customers to see, for example VISA and MasterCard

window decals.

• Ensure that any charges in respect of Credit Cards do not exceed your cash prices.

• Provide a Sales Receipt for the Cardholder, to indicate that you have debited their credit or

debit card.

• Include any VAT taxes in the amount charged on Card Transactions, they may not be collected by

you in cash.

• Validate compliance with the Payment Card Industry Data Security Standard (PCI DSS). Please see

Section 2.4 for further information.

• Notify us of any changes to your business.

You Cannot

• Levy charges in respect of the acceptance of Credit or Debit Cards.

• Indicate that VISA and MasterCard or any other Association endorses your goods and services.

• Establish procedures that discourage, favour or discriminate against the use of any particular Card.

• Ask the Cardholder to supply any personal information, for example home or business telephone

number, home or business address, or drivers licence number specifically for the payment card

transaction, unless instructed by Bidvest Merchant Services.

• Submit a Card Transaction or sale that has been previously subject to Chargeback.

• Accept any direct payments from Cardholders e.g. cash/cheque for credit of the Card account. Only

the card-issuing bank is authorised to receive such payments.

• Accept Card Transactions on behalf of third parties.

• Manually key payment Card Transactions into a Point of Sale Terminal when the Card details have

been provided via an internet shopping cart.

• Process Card Not Present Transactions without prior notice from the Cardholder.

• Process Internet Card Transactions without prior agreement and designated internet facility.

• Store sensitive card data.

• Require, or indicate that you require, a minimum transaction amount to accept a valid and properly

presented Card.

Record Keeping

In order to help us to defend potential retrieval requests and Chargebacks on your behalf, please

retain and, if requested, provide copies of Card Transaction documents for a minimum of 36 months

after completion of each Card Transaction.

A Card Transaction is only completed on the final delivery of goods or services.

• Please supply all Sales Receipts and Refund Receipts requested by us within 14 calendar days.

Strict time limits for the supply of this information are enforced by each of the Card Schemes.

• When we request a copy of a Sales Voucher, the Card Issuer may only supply us with the Card

Transaction date and Card Number. It is important that you store your Sales Receipts carefully and

in date order, followed by the Card Number, to ease the retrieval process.

SECTION 1: SOME BASIC RULES

4 Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

powered by

Bidvest Merchant Services

In addition to major currencies such as the United States Dollar, British Pound and Euro,

the multi-currency World Currency Card

™

offers the following currency purses:

Storage of Cardholder Information

Do not store the following under any circumstances:

- Full contents of any data from the magnetic stripe or chip

- Card Verification Value (CVV) – the three digit value printed on the signature panel of the Card

• Store only the portion of the customer’s account information that is essential i.e. name, account

number and expiry date.

• Store all material containing this information in a secure area in accordance with the PCI DSS

Please see Section 2.4.

• You are responsible for retaining and providing copies of Sales Receipts and any Refund Receipts

for a minimum of 36 months from the original Card Transaction date. After such time, destroy or

purge all media containing obsolete transaction data with Cardholder Information.

• PCI DSS rules apply if you (or your agent) store data electronically. Please see Section 2.4.

SECTION 1: SOME BASIC RULES

2.1 PAYMENT CARD RECOGNITION

Visa

All Visa Cards have a Visa logo,

holographic feature, ultraviolet feature

and Card Security Code (CSC)

Not all Visa Cards are embossed or have a

full account number or Cardholder name.

Visa Credit Cards

SECTION 2: THINGS YOU NEED TO KNOW BEFORE YOU ACCEPT CARD PAYMENTS

1. Visa Logo

Always appears on the front of the Card, usually on

the right-hand side.

2. Account Number

Usually 16 digits and can be embossed or flat

printed.

3. Holographic feature

Features either a single dove or series of repeated

doves in flight.

4. Ultraviolet feature

Appears as a “V” or dove under ultraviolet light.

5. CVV

Always appears on the reverse of the Card either

on the signature panel or to the side. This security

feature should be used to confirm online and

telephone payments.

6. Cardholder name

May appear as a name, generic identifier e.g. airline

passenger or may be left blank.

7. Optional Chip

Works together with the Cardholder’s PIN or

signature to create more secure payment. Not all

Visa Cards have a chip but you can accept them as

normal using the magnetic stripe.

8. Issuer Identification

This area is available for each Card Issuer to brand

their cards.

8 Issuer Identification

8 Issuer Identification

8 Issuer Identification

5 Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

powered by

Bidvest Merchant Services

Visa Electron

1. Visa Electron Logo

Always appears on the Card, usually on the

right-hand side.

2. Account Number

Usually appears as a 16 digit and can be embossed

or flat printed.

3. Holographic feature

Features either a single dove or series of repeated

doves in flight.

4. Ultraviolet feature

Appears as a “V” of dove under ultraviolet light.

5. CVV

The CVV always appears on the reverse of the Card

either on the signature panel or to the side. This

security feature should be used to confirm online

and telephone payments.

6. Cardholder name

May appear as a name, generic identifier e.g. airline

passenger or may be left blank.

7. Optional Chip

Works together with the Cardholder’s PIN or signature

to create more secure payment. Not all Visa cards

have a chip but you can accept them as normal using

the magnetic stripe.

8. ELECTRONIC USE ONLY

A legend denoting ELECTRONIC USE ONLY appears

on the front or back of the Card.

9. Issuer Identification

This area is available for each Card Issuer to brand

their Cards.

SECTION 2: THINGS YOU NEED TO KNOW BEFORE YOU ACCEPT CARD PAYMENTS

Visa Prepaid

Visa issue prepaid cards. These are loaded with funds and often given as gifts. They are not always

personalised with a specific Cardholder name, but you can still accept them as you would any other

Visa Card.

Visa and Visa Electron Mini Cards

These are miniature Visa and Visa Electron Cards, which carry the logos in a reduced size, positioned

in either the bottom or top right of the Card.

A Visa mini dove hologram will feature on the back or front of the Visa Mini Card. However, this is

optional on Visa Electron Mini Cards.

Other features include:

• Signature Panel

a signature panel will appear on the back of the Card.

• Magnetic Stripe

The magnetic strip will appear on the back of the Card.

9 Issuer Identification

9 Issuer Identification

9 Issuer Identification

6 Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

powered by

Bidvest Merchant Services

• Card Verification Value

A three-digit Card Verification Value will be displayed on the back of the Card, either in the white

area next to the signature panel or directly onto the signature panel.

• Cardholder Photograph and Signature

A photograph of the Cardholder may appear either on the front or the back of the Card.

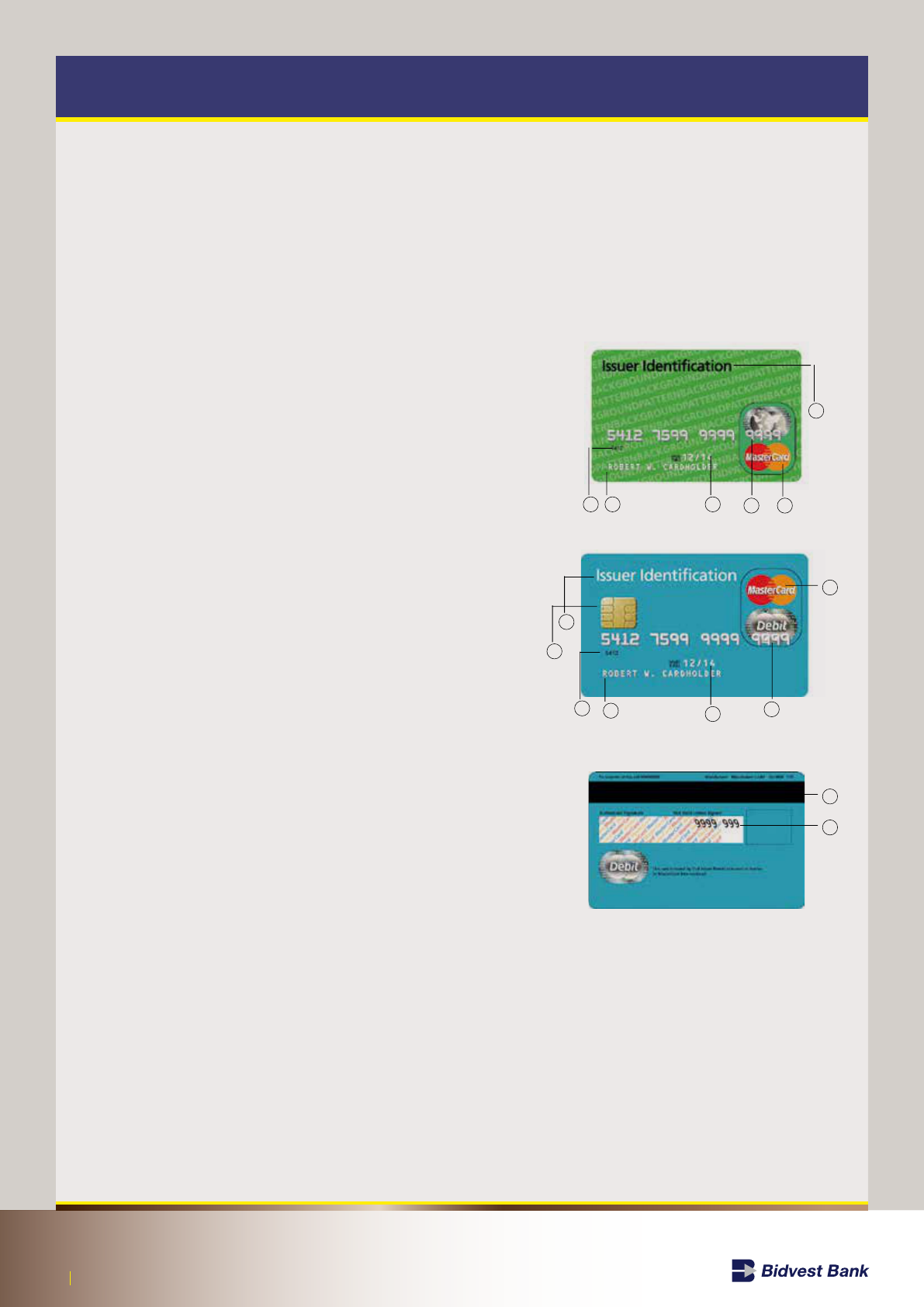

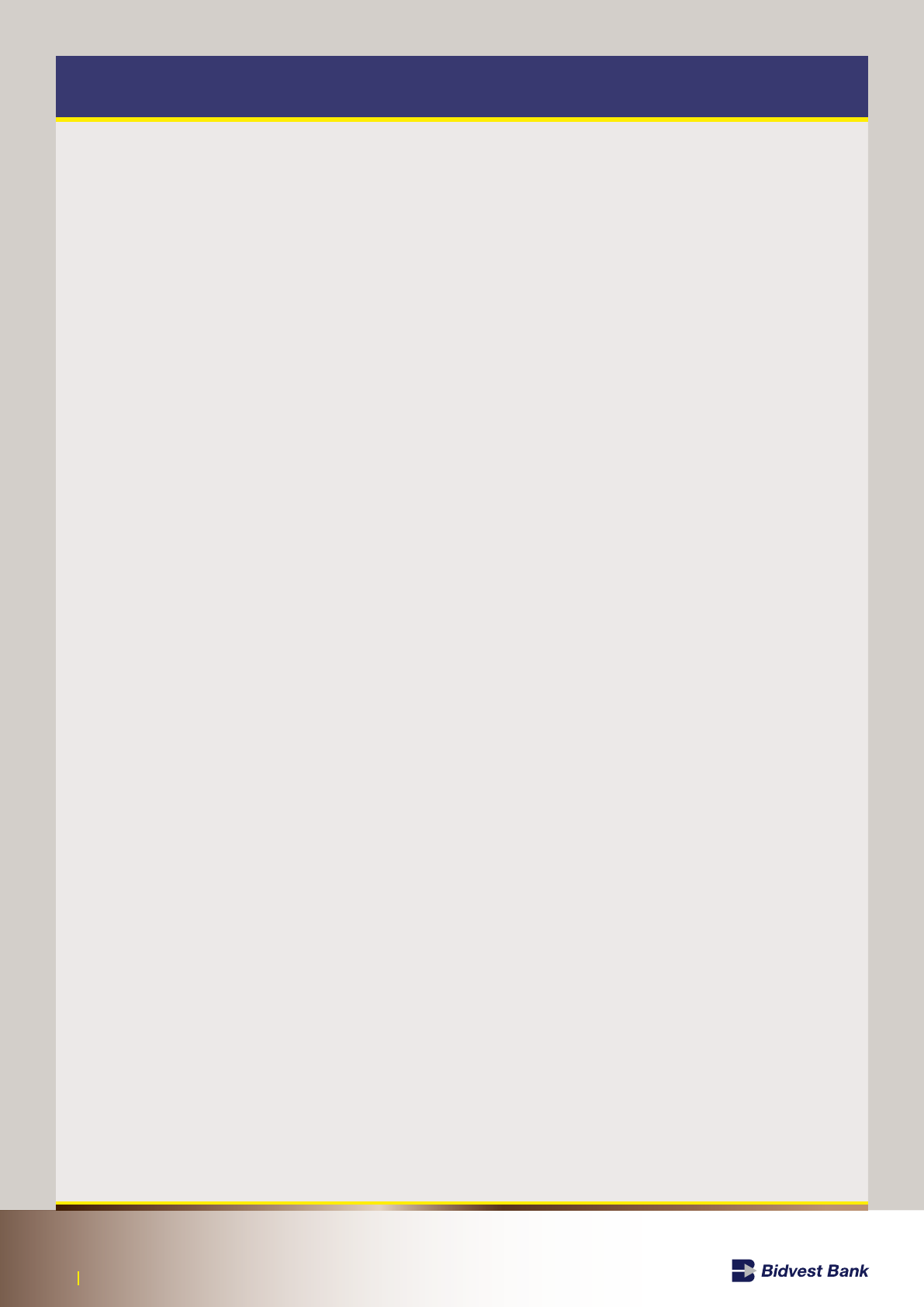

MasterCard™

MasterCard Cards are produced in many different designs

and each Card identifies the Card Issuer.

MasterCard Credit Card & Debit MasterCard

All MasterCard Cards have the following security features:

1. MasterCard Logo

The MasterCard symbol of two interlocking globes and the

MasterCard hologram together, surrounded by a retaining

line, on the front of the Card.

2. Chip

Most Cards will carry an embedded chip, which works

together with the Cardholders PIN or signature to create

more secure payment.

3. Expiry Date

Every MasterCard must have an expiry date. Some may also

include an optional ‘Valid From’ date.

4. Cardholder name

May appear as a name, generic identifier e.g. airline

passenger or may be left blank.

5. Embossed or printed account number

Embossed or flat printed, the account number

can be up to 19 digits and the first digit is always the number 5.

6. Printed Bank Identification Number (BIN)

The four digit printed BIN number must appear below the

account number and must match the first four digits of the

embossed or printed account number. You must always check

these numbers carefully to ensure they are the same.

7. Issuer Identification

This area is available for each Card Issuer to brand their Cards.

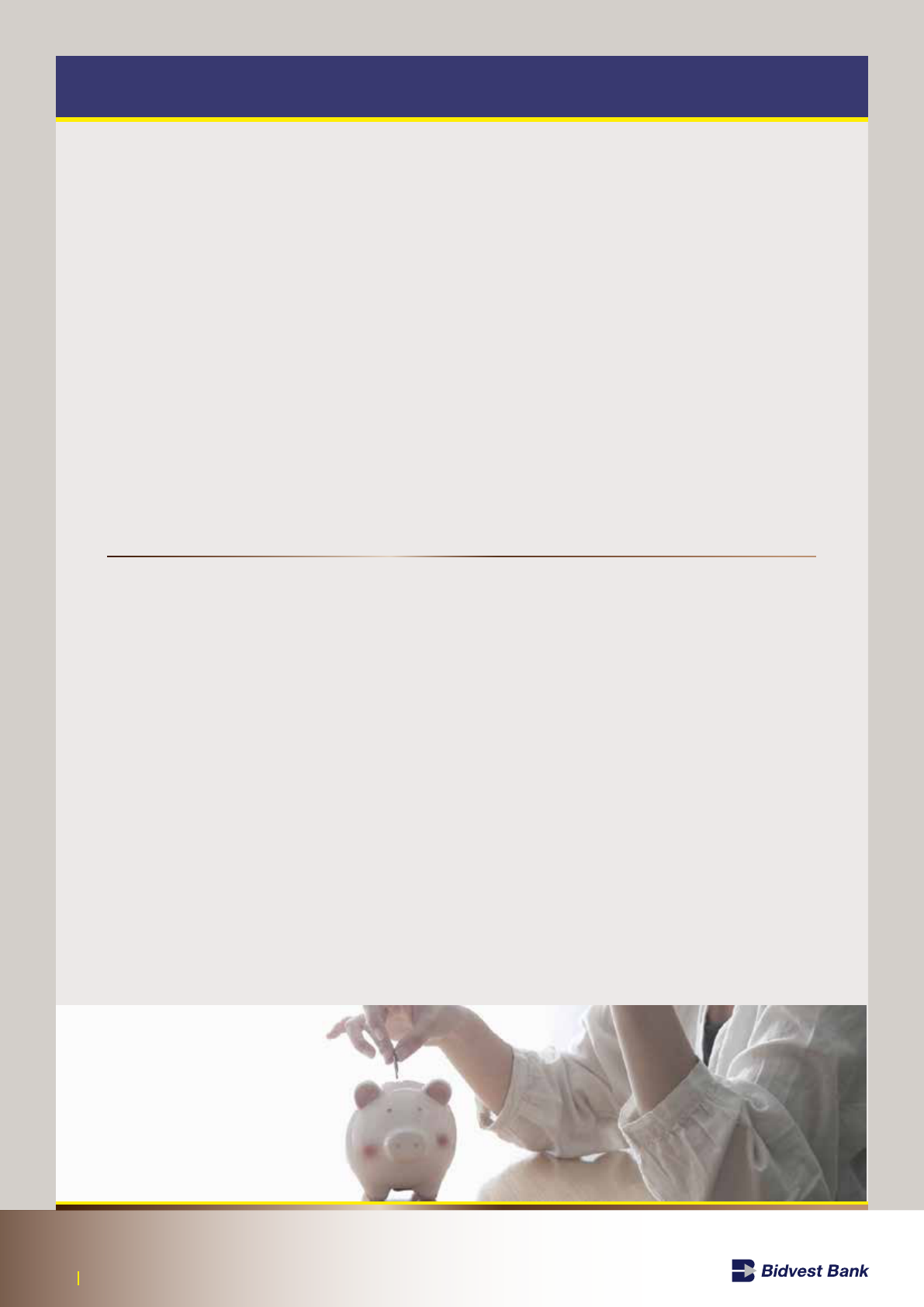

8. Magnetic stripe

The magnetic stripe holds information about the card and

appears on the back of all Cards.

9. CVV

The Card Number or last 4 digits of the Card Number is printed on the signature strip on the back of

the Card followed by the CVV (Card Verification Value) which is a 3-digit number designed to provide

extra security when conducting Card Not Present Transactions.

SECTION 2: THINGS YOU NEED TO KNOW BEFORE YOU ACCEPT CARD PAYMENTS

1

1

8

9

3

3

7

7

2

6

6

4

4

5

5

7 Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

powered by

Bidvest Merchant Services

Maestro™

Maestro is a Debit Card brand owned by MasterCard.

Usually, Maestro Cards will carry the following details:

1. Maestro Logo

The blue and red interlocking circles with the word

“Maestro” printed across the centre in white.

2. Cardholder Number

This can be between 12 and 19 digits long.

3. Cardholder Name

4. Expiry date

5. Signature Panel

A signature panel will appear on the back of the Card.

6. Magnetic Stripe

The magnetic strip will appear on the back of the Card. This may be printed with the word ‘Maestro’ in

repeat pattern and may contain the last four digits of the Card Number, followed by the CVV.

Some may also contain the following:

• Chip

• Hologram

• Cardholders title (for example, Mr, Mrs, Miss)

• Start date

• Card issue number

This is the sequential number used to identify cards issued on the same account.

It will be one or two digits only.

If you accept Internet Card Transactions, you must be registered for MasterCard SecureCode, please

refer to Section 3.3, before you can accept any International Maestro Cards.

2.2 Commercial Cards

Commercial Cards bring specific benefits to business-to-business sales transactions. They look like

any other Visa or MasterCard Card, although many have the description of the card’s function on the

front of the Card, for example ‘Purchasing Card’.

There are three main types of Commercial Cards:

Business Card

• Suitable for paying everything a small business needs for example stationery, office supplies, travel

expenses etc.

• Provides small businesses with a business payment method, an expense control mechanism and a

cash management tool.

• Available as charge and credit cards.

Corporate Card

• Suitable for mid-sized to large companies for travel and entertainment expenses.

• Provides management with the information to control expenditure and manage business expenses.

• Enables companies to streamline the administration of expenses, saving time and money by

reducing the cash handling and paper-based payments.

SECTION 2: THINGS YOU NEED TO KNOW BEFORE YOU ACCEPT CARD PAYMENTS

1

23

8 Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

powered by

Bidvest Merchant Services

Purchasing Card

Purchasing Cards can be used to settle transactions in the usual way, however, they can also

automate the paper invoice system and satisfy VAT reporting requirements.

• Used by government departments, public sector bodies and large businesses.

• Enables control and monitoring of expenditure and the provision of data and information to help

improve cost management.

• Allows reporting of reduced VAT rates.

• Removes paper-based processes through electronic invoicing and provides a detailed breakdown of

expenditure.

2.3 HOW TO GUARD AGAINST FRAUD

Preventing and Detecting Fraudulent Card Not Present (CNP) Transactions

• Authorisation is not a guarantee of payment, it only confirms there are enough funds to pay for the

goods and that the Card has not been blocked at the time of the transaction.

• Fraudulent CNP Transactions are your liability as they are likely to be charged back to you.

• Goods relating to a CNP Transaction should not be collected by the Cardholder. If the Cardholder

wishes to collect the goods, then they must present the Card for payment at the time of collection.

You should then cancel the CNP order and complete a Card Present Transaction.

• Never dispatch goods to a third party, such as a friend, taxi driver, hotel or other temporary

accommodation (except for goods such as flowers, as these are generally expected to be delivered

to an address other than that of the Cardholder).

• Be wary if the delivery/customer is overseas and products purchased are readily available in the

customers’ local market.

• Be aware of ‘social engineering’. Fraudsters may spend time building up credibility and then place

a large order or make a request for goods or services outside of your usual trade, such as money

transfers.

Ask yourself the following questions before the transaction.

• Why has this customer come to me?

• Is the sale almost too easy; is the customer disinterested in price and details of the goods?

• Are the goods of high value, ordered in bulk or easily re-saleable?

• How does the sale compare with your average transaction, is the customer ordering

multiple items, does the spending pattern fit with your usual customers?

• Is this a new customer, does the caller match the Card, is the customer having problems

remembering the address, or seem to be reading from notes, or is the customer being prompted by

a third party?

• Does the customer offer other Card Numbers if a transaction is declined?

• Is the customer unwilling to provide a landline number?

• What is the geographical location of the Card compared to the delivery address?

Has the Card been issued overseas with the goods to go locally and vice versa?

For example, if the billing address is an overseas address whilst the delivery

address is in the South Africa.

• Are you delivering multiple orders to the same address?

SECTION 2: THINGS YOU NEED TO KNOW BEFORE YOU ACCEPT CARD PAYMENTS

9 Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

powered by

Bidvest Merchant Services

Assess your risk and perform extra checks to reduce the risks of fraud.

• Employ CVV checking (please refer to Section 3.2).

• Register and implement 3D Secure (please refer to Section 3.3).

• Validate private telephone numbers through Directory Enquires and call customers back to confirm

orders (not necessarily straight away).

• Check business customers against business directories or internet search engines.

• Validate private addresses against the Electoral Register, telephone directory or internet

map searches.

• Avoid orders to overseas addresses unless you are confident that it is genuine. In the case of fraud,

you will lose your goods and the shipping costs.

• Employ velocity checking; how often would you expect the same customer or the same card to be

genuinely used over a specified period? Validate anything outside of these norms.

SECTION 2: THINGS YOU NEED TO KNOW BEFORE YOU ACCEPT CARD PAYMENTS

10 Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

powered by

Bidvest Merchant Services

Preventing and Detecting Fraudulent Card Present Transactions

Please make sure that all staff accepting payment by Credit/Debit Cards on your behalf have read and

understood the following guidelines in order to reduce the possibility of fraud.

Remember, these suggestions could help you in preventing fraudulent Card Transactions that could

result in a Chargeback to you.

• If the appearance of the Card being presented or the behaviour of the person presenting the

Card raises suspicion, you must immediately call the Authorisation Centre on 0801 414 881 and

state “This is a Code 10 Authorisation”. Answer all of the operator’s questions and follow their

instructions.

• Ask yourself; does the customer appear nervous/agitated/hurried?

• Are they making indiscriminate purchases? For example, not interested in the price of the item.

• The customer makes an order substantially greater than your usual sale e.g. your average Card

Transaction is R400, but this Card Transaction is for R4000.

• The customer purchases more than one of the same item (i.e. items that may be easily re-sold

such as jewellery, video equipment, stereo equipment, computer games).

• The customer insists upon taking the goods immediately, for example, they are not interested in

free delivery, alteration or if it is difficult to handle.

• The customer takes an unusual amount of time to sign and refers to the signature on the back of

the Card.

• The customer takes the Card from a pocket instead of a wallet.

• The customer repeatedly returns to make additional orders in a short period of time causing an

unusual sudden increase in the number and average sales Card Transactions value over a 1 to 3

day period.

• The customer tells you that he/she has been having problems with his/her Card for payment where

multiple Card Transactions are subsequently declined but eventually an Authorisation is obtained

for a lower amount. (Most genuine Cardholders know how much available credit they have.)

• Card Transactions are subsequently declined but eventually an Authorisation is obtained for a lower

amount. (Most genuine Cardholders know how much available credit they have.)

• A fraudster may present more than 1 Card, often to find a Card that will be successfully authorised.

If thishappens, take particular care and also look out for Cards presented, issued by the same Card

Issuer, where the Card Numbers are sequential or very similar. When in doubt, make a ‘Code 10’

Authorisation call to the Authorisation Centre.

• If you have an electronic Terminal and wish to reduce exposure to fraud you may request a

reduction to your Terminal Floor Limit. Not only will this reduce fraud but it may also reduce

Chargebacks due to invalid Cards. Please contact the Merchant Support Centre on 0860 11 14 41

†

to arrange this reduction.

Never accept an Authorisation Code from a customer. Authorisation must always be

obtained via the correct procedures.

Counterfeit Cards

Most cases of counterfeit fraud involves ‘skimming’ or ‘cloning’, this is where the genuine data in

the magnetic strip on one Card is electronically copied onto another Card without the legitimate

Cardholder’s knowledge. This type of fraud can be identified by checking that the Card Number printed

on the voucher is the same as that embossed on the front of the Card. If these numbers differ, call the

Authorisation Centre immediately on 0801 414 881 stating “This is a Code 10 Authorisation”.

The introduction of Chip Cards (Cards which contain a small micro chip) means that genuine Cards are

less likely to fail at the Point of Sale, so the need to manually key enter Card details is reduced.

SECTION 2: THINGS YOU NEED TO KNOW BEFORE YOU ACCEPT CARD PAYMENTS

11 Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

powered by

Bidvest Merchant Services

Delivery Warning Signals

Here are some danger signs to look out for when arranging delivery of goods.

• Goods should not be released to third parties such as friends of the Cardholder, taxi drivers,

chauffeurs, couriers or messengers. However, third party delivery of relatively low value goods

such as flowers is appropriate.

• Insist that goods may only be delivered to the Cardholder’s permanent address. If you agree to

send goods to a different address, take extra care and always keep a written record of the delivery

address with your copy of the Card Transaction details.

• Goods are to be delivered abroad.

• Don’t send goods to hotels or other temporary accommodation. Only send goods by registered

post or a reputable courier and insist on a signed and dated delivery note.

Instruct your Courier

Make sure the goods are delivered to the specified address and not given to someone who ‘just

happens to be waiting outside’. Instruct your courier to return with the goods if they are unable to

effect delivery to the agreed person/address.

Do not deliver to an address, which is obviously vacant.

Obtain signed proof of delivery, preferably the Cardholder’s signature.

If you have your own delivery service, consider training your driver to check the Card. If you

wish to do this please contact the Fraud Department by phoning the Merchant Support Centre on

0860 11 14 41

†

for more details.

Always be particularly wary of:

• Demands for next day delivery.

• Alterations of delivery address at short notice.

• Phone calls on the day of delivery asking what time, exactly, the goods are due to be delivered.

Returning Wanted or Recovered Cards

Please keep the Card safely at your premises until the end of business on the day when the Card

was found. If the Cardholder returns to claim the Card, obtain the claimant’s signature and compare

this signature with that on the Card. If you are suspicious that the claimant is not the Cardholder,

telephone the Authorisation Centre on 0801 414 881 and state “This is a Code 10 Authorisation”. Only

release the Card if you are satisfied that the claimant is the Cardholder.

Unclaimed Cards should be cut across the bottom left hand corner of the front of the Card and both

parts attached to a letter. Please complete the form and send it to:

Bidvest Merchant Services

PO Box 1314

Witkoppen

2068

Johannesburg

South Africa

A financial reward is not given in these circumstances.

SECTION 2: THINGS YOU NEED TO KNOW BEFORE YOU ACCEPT CARD PAYMENTS

12 Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

powered by

Bidvest Merchant Services

Other Important Fraud Considerations

Remember – An Authorisation Code only indicates the availability of a Cardholder’s credit and that

the Card has not been blocked at the time of the Card Transaction. It does not guarantee that the

person using the Card is the rightful Cardholder.

Do not, under any circumstances, process Card Transactions for any business other than your own.

Some fraudsters offer commission to process Card Transactions while they are awaiting their own

Credit Card facilities. If you process Card Transactions on behalf of any other business/person, you

will be liable for any Chargebacks, will be in breach of your Merchant Agreement and will put your

own Bidvest Merchant Services service at risk.

Your Card Transactions must not involve any Card Issued in:

• Your name or your account.

• Or the partner in, or director or other officer of your business.

• Or the spouse or any member of the immediate family or household of any such person

detailed above.

Doing so will put your Bidvest Merchant Services service at risk and, in addition, Bidvest Merchant

Services will have the right to process an entry to cancel the Card Transaction

without notification.

2.4 CARD SCHEME REQUIREMENTS

Payment Card Industry Data Security Standard (PCI DSS)

What is PCI DSS?

The Payment Card Industry Data Security Standard (PCI DSS) is a set of standards specified by the

PCI Security Standards Council aligning Visa’s Account Information Security (AIS) and MasterCard’s

Site Data Protection (SDP) programme.

Compliance with the standards will ensure that certain Card data is stored securely by your

business and by any third party, which stores, transmits or processes such Card data on your behalf.

Why Comply with the PCI Security Standards?

Compliance with the PCI DSS helps prevent security breaches and theft of Card data. Data

compromise can lead to financial penalties and will have a negative impact on the reputation of your

business. Complying with the PCI DSS means that your systems are secure and customers can trust

you with their sensitive Card data.

Secure Data Storage

Any data that is necessary to process Card Transactions must be securely stored, regardless of how

it is recorded, be it electronically, on paper, audio/voice recording or otherwise. This includes, but is

not limited to, the following:

• Any data that is used to authenticate a Card payment including the Card Number, expiry date,

passwords, pass phrases and any other unique data supplied as part of the Card payment

• Any data that may identify individual Cardholders and their purchases. This includes name,

address, purchase description, amount and other details of the Card payment

Certain data must not be stored at any time, examples include:

• The Card Verification Value (CVV) contained in the magnetic strip

• The contents of the magnetic strip, also known as Track 2 Data

• The Card Verification Value contained in a chip known as iCVV

• The Card Verification Value (CVV), also known as CVV2 printed on the back of the Card in or next

to the signature panel

• The PIN Verification Value (PVV), which is contained in the magnetic strip

SECTION 2: THINGS YOU NEED TO KNOW BEFORE YOU ACCEPT CARD PAYMENTS

13 Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

powered by

Bidvest Merchant Services

PCI DSS Requirements

PCI DSS sets out a number of requirements, which you must comply with to ensure that

Cardholder data is handled securely.

Further information is available from the PCI Security Standards Council website at

www.pcisecuritystandards.org

Goals PCI DSS Requirements – Validated by Self or

Outside Assessment

Build and Maintain a Secure

Network

1. Install and maintain a firewall configuration to protect

Cardholder data

2. Do not use vendor-supplied defaults for system pass-

words and other security parameters

Protect Cardholder Data 3. Protect stored data

4. Encrypt transmission of Cardholder data across open,

public networks

Maintain a Vulnerability

Management Program

5. Use and regularly update anti-virus software or

programs

6. Develop and maintain secure systems and applications

Implement Strong Access

Control Measures

7. Restrict access to Cardholder data by business

need-to-know

8. Assign a unique ID to each person with computer access

9. Restrict physical access to Cardholder data

Regularly Monitor and Test

Networks

10. Track and monitor all access to network resources and

Cardholder data

11. Regularly test security systems and processes

Maintain an Information

Security Policy

12. Maintain a policy that addresses information security for

all personnel

SECTION 2: THINGS YOU NEED TO KNOW BEFORE YOU ACCEPT CARD PAYMENTS

14 Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

powered by

Bidvest Merchant Services

3.1 CARD PRESENT TRANSACTIONS

Using Your Point of Sale (POS) Terminal

Always follow the instructions shown in

your Terminal User Guide supplied with your

Terminal.

Although Chip and PIN Cards are the most

common in the South Africa, you must

continue to accept all types of MasterCard

and Visa Cards.

Some customers may not have a Chip and

PIN Card e.g. customers from overseas and

some customers with disabilities.

You should not attempt to guess whether the

customer’s Card is a Chip and PIN Card or

requires a PIN or signature, simply process

the card in the terminal and follow the

prompts on the screen.

Manual Entry for Card Present Transactions

A vast majority of your Card Transactions

will be chip read or swiped through your

POS Terminal. You will find that Chip and PIN

Card will not usually fail. If you key enter or

revert to the magnetic strip on a Chip and

PIN Card, it is possible that the issuer will

decline the transaction. Specifically face-

to-face transactions taken on a Debit Card

must not be key entered. The issuer will

decline the transaction. If the transaction is

declined, follow the terminal prompts, which

may direct you to speak to our Authorisation

Centre. You should follow their instructions

and only return the Card to the customer if

you are not asked to retain it.

Terminal Fallback

You should contact your Terminal supplier

helpdesk immediately to report any faults. A

representative will endeavour to resolve the

problem remotely, or failing this, will arrange

for a new electronic terminal to be sent

to your premises on the next working day,

provided the fault is reported prior to 16:00.

This does not include premises situated in the

Highlands and Islands where replacement

may take 2 to 4 working days.

SECTION 3: ACCEPTING CARD TRANSACTIONS

Check that the customer agrees

with the transaction total

When prompted, remove the card

from the reader

Make sure the customer has

their receipt and card at the

end of the sale

Insert or Swipe the card in

the reader

Follow the prompts on

the screen

Ask the customer to enter their

PIN or sign the receipt

If the customer signs the receipt,

compare the signature with that

on the card

Perform other card checks

1 2

2

3

3

4

15 Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

powered by

Bidvest Merchant Services

Contactless Transactions

What is a Contactless Transaction?

Otherwise known as Visa PayWave and MasterCard PayPass, it is a contactless transaction process

that uses radio waves to exchange data between a reader and an electronic tag attached to an

object. This allows Cardholders to wave their Card in front of contactless payment terminals without

the need to physically swipe or insert the Card into a POS device.

Accepting Contactless Card Payments

Sales - The value of any single transaction is limited to R100.

Refund – These are not permitted. All refunds must be carried out as a Chip and PIN Transaction.

Failed transactions – if you are unable to process a contactless transaction, revert to standard

transaction acceptance, i.e. Chip and PIN.

Security – on occasion, you may be requested to process a contactless transaction as Chip and PIN.

This is a security measure to ensure the genuine Cardholder is in possession of the Card.

AUTHORISATION AND CODE 10 CALLS

Authorisation

Authorisation is a check that is undertaken with the Card Issuer to confirm if they will approve the

transaction. Authorisation from the Card Issuer is not a guarantee of payment. Authorisation must

be obtained at the time of the transaction. If you have an electronic POS device, an Authorisation

request should be automatically generated. You should not proceed with the Transaction when

your request for Authorisation is declined. It is your responsibility to ensure that all Transactions

are authorised.

Referrals

Sometimes you may be prompted by your Terminal to call for Authorisation. This is called a referral.

A referral is when a Card Issuer requests that Bidvest Merchant Services contact them prior to

providing a response to an Authorisation request. This may be prompted by an unusual spending

pattern for the Cardholder or a large value that triggers the issuer’s fraud detection process.

Generally, it will be necessary for the Cardholder to come to the telephone. You should follow the

instructions given by the authorisation operator. At the end of the call, a decision will be provided to you.

For Authorisation, please telephone: 0801 414 881. Lines open 24-hours a day, 7 days a week

SECTION 3: ACCEPTING CARD TRANSACTIONS

Card Type

Revert to CHIP

and signature

Revert to

Magnetic Strip

Comments

Maestro and Visa Electron &

Electronic Use only Cards

Unable to read magnetic strip

N/A N/A

Seek alternative

payment method

All Other Card types Chip Cards

PIN not enabled. Unable to read chip

N/A

3

All Other Card types Chip & PIN

enabled Cards. Pin Pad fault.

Unable to accept PIN entry

3

X

All Other Card types Magnetic

strip Cards only. Unable to read

Magnetic strip

N/A N/A

16 Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

powered by

Bidvest Merchant Services

SECTION 3: ACCEPTING CARD TRANSACTIONS

Code 10 Calls for Card Present

If you suspect something is wrong, or the Card checks you make show inconsistencies, then you

must telephone the Authorisation Centre on 0801 414 881 PRIOR to swiping to swiping the Card

through the Terminal and state that

“This is a Code 10 Authorisation”. Then follow their instructions.

‘Code 10’ Authorisation applies in the following circumstances:

• The Card Number embossed on the front of the Card is different from the one printed on the

signature strip on the back of the Card

• The Cardholder’s signature differs from that on the Card

• The title on the Card does not match the customer

• The signed name is not the same as that embossed on the front of the Card

• The word ‘void’ is visible on the signature strip or there is any indication that the strip has been

tampered with

• There has been any attempt to disguise or amend the signature

• The Card is unsigned

• There is no ‘flying V’ or ‘offset MC’ on the Card being presented

• The hologram is damaged or missing

• The Card has been mutilated in any way

• You have a reason to be suspicious about the sale, the Card or the customer

• The amount of the Card Transaction is significantly higher than normal for your business

• Your Terminal requests that you call the Authorisation Centre

Hold on to the Card and goods and telephone the Authorisation Centre immediately on 0801 414 881

- you should not call the Police unless instructed to do so by the Authorisation Centre.

When you make a ‘Code 10’ Authorisation call, have the following details ready:

• The Cardholder Number

• The Card issue number (if applicable)

• Your Bidvest Merchant Services number

• The exact amount of the Card Transaction, in Rand

• The Card expiry date

Say to the Operator: “This is a Code 10 Authorisation”

This will alert the Authorisation Centre and you will be asked the relevant questions, most of which

will require “Yes” or “No” answers (to avoid difficulty or embarrassment if the customer is waiting

close by). The operator may instruct you to call the Police or advise you that the Police have been

notified. Police involvement is not always necessary – please do not contact the Police unless

instructed to do so.

Purchase with Cashback

You must have received written notification from Bidvest Merchant Services that you are permitted

to offer “Purchase with Cashback”. Cashback may only be offered where the customer receives

goods or services as well as cash.

Here are some simple tips for dispensing Cashback:

1. Not every customer is eligible to receive Cashback with their Card – it is a service on the Cards

and it depends on whether the customer’s bank permits this service. Do not attempt to guess

whether the customer’s bank permits this, simply process the Card through your Terminal and

follow the prompts on the screen.

2. Only dispense Cashback when using an electronic terminal, not a manual imprint machine.

17 Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

powered by

Bidvest Merchant Services

SECTION 3: ACCEPTING CARD TRANSACTIONS

3. Only dispense Cashback to customers who make a purchase with their Card.

4. Only dispense up to the maximum Cashback amount confirmed in your written notification from

Bidvest Merchant Services.

5. Key in the purchase and Cashback separately.

6. Follow the prompts on the screen, it will tell you whether the purchase with Cashback has been

approved. Depending on your POS facilities, either you or your customer will handle the Card.

3.2 CARD NOT PRESENT TRANSACTIONS

Card Not Present

A Card Not Present Transaction is when a Card is not presented at the point of sale. Examples

of Card Not Present Transactions include mail order/ telephone order, internet and recurring

payments.

Card Not Present Transactions

Provided you have received written notification from Bidvest Merchant Services, you may accept a

Card Not Present Transaction from a Cardholder who wishes to pay using VISA, MasterCard and

Maestro.

When accepting a Card Not Present Transaction, please take extra care to ensure it is the

genuine Cardholder who placed the order. Record in writing, all details of the Card Not Present

Transaction and if conducted by telephone the time and date of the conversation. You may be asked

to produce this or the Cardholder’s authority for a Card Not Present Transaction if the Card Not

Present Transaction is disputed at a later date. If feasible, you should obtain and keep a copy of the

Cardholder’s signature on file authorising you to process the Card Not Present Transaction.

• Key in the purchase and cash

back amounts separately

• When prompted remove the

card from the reader

• Make sure the customer has

their receipt, card and cash

at the end of the sale

• You may initial the cash back

amount on the cardholder’s

receipt before you give it

to them. This may help in the

case of a dispute

• Insert or swipe the card

in the reader

• Follow the prompts on

the screen

• Ask the customer to enter

their PIN or sign the receipt

• If the customer signs the receipt,

compare the signature on the

receipt with that on the car

d

• Perf

orm other card checks

as appropriate

1 2 3

31

4

18 Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

powered by

Bidvest Merchant Services

SECTION 3: ACCEPTING CARD TRANSACTIONS

Important

Under no circumstances can goods paid by mail or telephone be handed over the counter to, or

collected by, your customer.

If a Cardholder wishes to collect the goods, then he/she must attend your premises in person and

produce his/her Card. You should cancel the Card Not Present Transaction and perform a new Card

Present Transaction. You must not release goods to a third party or anyone who suggests they have

been sent by the Cardholder to collect the goods. For example, a taxi driver.

To process a Card Not Present Transaction, you must obtain the following information:

• Card Number

• Expiry date

• Card Verification Value

• Cardholder’s full name and address

• Transaction amount

• Delivery address if different to the Cardholder’s address

You must obtain authorisation for the transaction. Please note: Authorisation from the Card Issuer is

not a guarantee of payment.

There are increased risks of Chargeback for Card Not Present Transaction as the Cardholder and

Card are not present. Please note: If you choose to deliver goods to an address other than the

Cardholders address, you are taking additional risk.

Card Verification Value (CVV)

All businesses that accept payment by Credit and Debit Cards must follow the procedures set out by

the Card Schemes, Bidvest Merchant Services as your Acquirer and the Payment Card Industry Data

Security Standard (PCI DSS). These standards exist to protect you and your customers from Card

fraud.

All customer and payment card information must be handled in a secure manner. You must ensure

you know how to treat payment Cards and data appropriately.

A key piece of information on any Credit or Debit Card is the Card Verification Value (CVV). The CVV

is printed on the reverse of the Card within the signature strip, after the Card Number and is used

as a fraud prevention tool. For all MasterCard and Visa Cards, the code is the 3 digit number that

follows directly after the Card Number as indicated. For American Express Cards the CVV is a 4 digit

number and appears above the embossed Card Number on the front of the Card, in the near future

those 4 digits will be moved to the signature strip on the reverse of the Card.

Your Terminal is designed to ensure the CVV is not retained.

If a customer sends Card details by email, you must ensure the email is securely deleted. Card

Numbers and the CVV are valuable data and you must never write them down. You must not request

or accept photocopies of the front or back of the Card, for any reason.

How You Must Treat the Card Verification Value

There are only two scenarios in which you will need to request the CVV:

1. During a Card Not Present Transaction

For example, if you are accepting payments over the telephone or via email for an advance

booking prepayment or deposit.

2. The Card is present, however your Terminal cannot read the Card details. In this scenario, you will

need to follow the prompts on the Terminal, which may require input of the CVV.

Once the transaction has been authorised, you must not keep a record of the CVV.

A complete refund of a guests, deposit is required if a reservation is cancelled before the deadline

specified in your bookings terms and conditions (please see Hotels section for further information).

19 Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

powered by

Bidvest Merchant Services

SECTION 3: ACCEPTING CARD TRANSACTIONS

Charges after check-out: the CVV is not required.

This is when a guest is billed for additional charges discovered after they have checked out, for

example, room service or bar charges. Provided your guest signs your terms and conditions of

booking, the CVV is not required when processing these extra charges.

Pre-Authorisation

This is only permitted in certain circumstances. Visa and MasterCard allow pre-authorisation for

car rental, hotel, internet and mail/telephone order merchants only. More information about pre-

authorisation for car rental and hotels can be found in Sections 6 and 7.

Rules for Card Not Present Transactions

For goods to be delivered by mail/telephone order or through an eCommerce Merchant should

obtain authorisation on the day the Cardholder contacts them to place the order. When the goods or

services are ready to be delivered, the transaction should be processed.

If shipping goods more than 7 days after the original Authorisation request, a second Authorisation

should be obtained.

Recurring Transaction

If you and a Cardholder agree that more than one transaction is to be made on a regular basis for

the cost of goods or services, then the transaction is a Recurring Transaction.

You must make an application to take Recurring Transactions with Bidvest Merchant Services, even

if you have an existing Merchant Agreement.

To take Recurring Transactions, the following must be adhered to:

• Use a dedicated Merchant Number exclusively for Recurring Transaction business. No other

transactions should be processed on this Merchant Number

• All Recurring Transactions must be flagged Card Not Present and must also have a recurring

indicator as defined by the Payment Association of South Africa (PASA) and the Schemes.

Please note Recurring Transactions are not permitted on Maestro Cards.

The initial transaction in which the Cardholder provides their Card details for recurring payments

must be undertaken on the standard Merchant Number for your business. All subsequent

transactions must be submitted on a Recurring Transaction Merchant Number.

Where the Cardholder initially provides their Card details over the Internet, you must submit the first

transaction as an Internet Card Transaction and all subsequent transactions will be authorised with

a recurring indicator as specified.

You may use an existing E Commerce (Internet Card Transaction) Merchant Number for the initial

transaction and you don’t need to have a specific E Commerce Merchant Number purely for the

initial transaction of a recurring payment.

All subsequent transactions must be submitted on a Recurring Transaction Merchant Number.

You may use an existing Recurring Transaction Merchant Number for subsequent Recurring

Transactions initiated over the internet and do not need to have a specific Recurring Transaction

Merchant Number purely for subsequent transactions initiated over the Internet.

Written permission from the Cardholder is required to undertake Recurring Transactions. This can

be submitted in writing or electronically to allow periodic billing to their account for recurring goods

or services over a period of time (no more than one year can be between each transaction). The

written request must at least specify:

• The transaction amounts or unspecific amount

• The frequency of recurring charges

• The duration of time for which the Cardholder’s permission is granted.

Examples of business types where Recurring Transactions are appropriate are:

• Insurance

20 Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

powered by

Bidvest Merchant Services

SECTION 3: ACCEPTING CARD TRANSACTIONS

• Membership

• Subscriptions

You must ensure:

• The Cardholder understands the ongoing nature of the commitment they have undertaken

• The Cardholder will always know at least 14 days before the event how much is due to be debited

from their account and when

To comply with the requirement you must comply with the following guidance on Advance Notice:

1. Where you are using a Recurring Transaction authority or acknowledgement which does not

specify both the due date of any debit and the amount to be debited, you are required to give

individual advance notice to your customers of:

- The amount to be debited from their account

- The date when the amount due will be debited from that account

2. Advance notice must be given in all cases when the amount and/or date of the debit are to change.

Please note when advising a Cardholder of the amount and date of their first payment, it is

acceptable to advise them that no fu rther advance notice will be given if the amount due to be

debited changes solely because of the alteration in the application rate of any statutory levy, such as

VAT or insurance premium tax.

3. Advance notice will not be required when a direct action by the Cardholder requires you to initiate

a specific claim on their account. This action must provide sufficient information to determine the

amount and date of the debit.

4. Where the amount due is to be debited infrequently, i.e. at intervals longer than one year, you are

required to notify the Cardholder at least 14 days before the debit is due.

You must ensure that debits made comply with the terms of the authority given by the Cardholder

and are timed to ensure that the debit appears on their account no later that 7 Business Days after

the agreed date.

When received, you must ensure that instructions to cancel are actioned immediately to ensure that

no more debits are made after receipt. You should note statutory notice, such as is published on the

appointment of a liquidator or receiver, is deemed to be constructive advice of cancellation.

If Bidvest Merchant Services request a copy of the Recurring Transaction, you must respond to this

request within 10 days of the request being received. Failure to supply a copy upon request may

result in a debit being disallowed and charged back.

Please note such requests may be originated up to six years after the last debit is made.

3.3 INTERNET CARD TRANSACTIONS

All Internet Card Transactions are regarded as “Card Not Present Transactions” and are taken

at your own risk. In the case of a dispute we retain the right under the Merchant Agreement to

Chargeback any Internet Card Transactions irrespective of whether an Authorisation Code is

obtained.

Applying to Take Internet Card Transactions

You must make an application to take Internet Card Transactions with Bidvest Merchant Services,

even if you have an existing Merchant Agreement.

On approval a new Bidvest Merchant Services Merchant number will be issued, this is solely for

the purpose of acceptance of Internet Card Transactions for the business described within the new

application.

21 Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

powered by

Bidvest Merchant Services

SECTION 3: ACCEPTING CARD TRANSACTIONS

Website Requirements

Order page (basket)

The order page on your Website, whether provided by a third party or created by you, must be PCI

(Payment Card Industry) compliant and collect at least the following details:

• Cardholders’ full name;

• Cardholders’ email address;

• Cardholders’ billing address and postcode;

• Delivery address.

Payment Page (checkout)

Bidvest Merchant Services is able to accept and process, on your behalf, Internet Card Transactions

made with the following Card types:

• Visa;

• MasterCard;

The payment page on your Website, whether provided by a third party or created by you must be PCI

DSS compliant and collect at least the following details:

• Transaction amount;

• Card type box, (for those Card types detailed in your Merchant Agreement, e.g. Visa);

• Customers’ Card Number;

• Card expiry date;

Verified by Visa and MasterCard SecureCode

These are industry wide initiatives introduced to combat Internet fraud, commonly known as

3D Secure. Cardholders who register for this service will be required to use a personal PIN or

password at the time of the Transaction to confirm they are the genuine Cardholder. Verified by Visa

and MasterCard SecureCode operate on your Website and interact with both the customer and their

Card Issuer. The Cardholder signs up for the extra security features with their Card Issuer.

Note – MasterCard Secure Code and Verified by Visa must be present on your website in order to

accept Internet Card Transactions by Visa, MasterCard and Maestro Cards.

• When shopping online, the Cardholder selects their goods/services and proceeds to the payment

page.

• The Cardholder enters their Card number. If registered for Verified by Visa or MasterCard

SecureCode, the Cardholder will see a pop-up screen from their Card issuer asking for their

password or one time PIN from their issuer as displayed on their mobile phone.

• The Card issuer verifies the password.

• The Transaction is completed, having verified the identity of both the Merchant and Cardholder.

For further information on these services, contact the Merchant Support Centre on 0860 11 14 41†.

Payment Services Provider (PSP)

To take Internet Card Transactions you will need to use a PSP. Bidvest Merchant Services require

that you use a fully hosted solution by your chosen PSP. This means having your card payment

application hosted on the PSP’s secure servers. If you choose the secure hosted option, the Payment

Card Industry Data Security Standard (PCI DSS) validation requirements for eCommerce merchants

are greatly reduced.

PCI DSS is a set of requirements, endorsed by the Card Schemes, Visa, MasterCard and American

Express, governing the safekeeping of account information and applies to all merchants that store,

processes or transmits Cardholder data.

22 Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

powered by

Bidvest Merchant Services

SECTION 3: ACCEPTING CARD TRANSACTIONS

The PSP you choose must be PCI compliant and be accredited with Bidvest Merchant Services to

submit Internet Card Transactions to us. Your chosen PSP will be able to advise you of relevant

costs, set up times and how their systems integrate with your Website.

Details of PSPs currently submitting Internet Card Transactions to us can be provided on request.

Any fees charged by the PSP will be in addition to the Business solutions Charge (MSC) on your

Internet Merchant Number.

Receipt Requirements

You must provide a Cardholder receipt and it must contain at least the following information:

• Concealed Cardholder Account Number; For Internet Card Transactions, the Cardholder account

number, Card Verification Value (CVV) and expiry date must not appear on the transaction receipt.

This is a PCI DSS requirement to ensure that Card details are protected from compromise;

• Unique Transaction Identifier; To assist in dispute resolution between the Cardholder and

Merchant, you should assign a unique identification number to the transaction and display it

clearly on the transaction receipt;

• Cardholder name;

• Transaction date;

• Transaction amount;

• Transaction currency;

• Authorisation Code;

• Description of merchandise or services;

• Merchant name;

• Website address.

You can choose to send a separate email message to the Cardholder containing this required

information, or send a physical receipt in the mail or both. To minimise Cardholder enquiries, you

are encouraged to send an online acknowledgement of the Internet Card Transaction. When this

online acknowledgement is sent, you should include a statement encouraging the Cardholder to

either print or save this document for their own records.

Website Content

Set out below are details that should be included in the content of your Website.

The details below should not be considered as a comprehensive list of the information which you

may be required to provide on your Website under applicable legal requirements and should not

be seen as a form of legal advice. You should obtain your own legal advice on the content of and

activities carried out on your Website.

You should ensure that your Website, its content and any activities related to it, such as marketing,

are in accordance with all local legal requirements and regulations.

You must also comply with the requirements of all data protection legislation, and where you

process Personal Data on your Website, include a Privacy Policy that Cardholders are required to

agree to before providing any personal data on your Website.

Merchant Details

Full details about your company should be provided on your Website, these should include:

• The registered company or LLP name and address, registration number and VAT number (if

applicable). If you are not a company or LLP you must indicate that you are a sole trader or a

partnership and the address where the business is located;

23 Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

powered by

Bidvest Merchant Services

SECTION 3: ACCEPTING CARD TRANSACTIONS

• Details of any trade register or similar register available to the public in which you are registered

and details of any professional body with which you are registered together with a reference to

the applicable professional rules and means to access them. You should make sure you have

determined what details are required to be given under relevant regulations;

• A correspondence and email address, as well as a customer services contact, i.e. telephone and

fax numbers;

• The physical location of your business, (including your country of domicile);

• A statement detailing under which legal jurisdiction your business operates.

Products and Pricing

• All products or services on offer should be clearly described/illustrated so that the Cardholder

has a good idea of what is on offer;

• Any limits to product availability should be clearly stated. This includes all costs, such as taxes,

including import duty, packaging and delivery charges;

• If appropriate and wherever possible, the Cardholder should be provided with the order details

and the total cost of purchase, including any additional charges as noted above. The Cardholder

should also be informed of the period for which the offer remains valid.

Placing an Order

Where a Cardholder places an order through your Website you must (unless the recipient is a

business and you have both opted out of these requirements):

• Provide details of the different technical steps to conclude the contract and whether the contract

will be kept by you and accessible to the Cardholder;

• Acknowledge receipt of the order to the Cardholder without undue delay and by electronic means;

• Make available to the Cardholder appropriate, effective and accessible, technical means allowing

him to identify and correct errors prior to placing the order;

• Provide information on any relevant codes of conduct to which you subscribe and how these can

be consulted; and

• Make available to the Cardholder any applicable terms and conditions in a way that allows him to

store and reproduce them.

Payments and Refunds

• The Cardholder should be provided with clear information on all payment options and clear

instructions on how to pay;

• The Cardholder should be informed of their cancellation rights and their rights to a refund, and/or

replacements at the time of purchase/and the conditions for exercising the cancellation rights;

• A refund information page should also be provided with clear contact details;

• Receipts should be provided with the goods on delivery;

• The Cardholder should be provided with details of how and to whom a complaint can be made

including an address.

Recurring Payments

Internet Merchants are able to accept an electronic record (such as email) from a Cardholder

with permission enclosed for the Merchant to periodically charge the Cardholder for Recurring

Transactions. This record can be retained for the duration of the services. A copy of the record must

be provided to the Card Issuer/Card Acquirer upon request. The phrase “recurring transaction”,

details of the frequency of debits and the period for which debits are agreed, must be included on

the receipt issued to the Cardholder.

24 Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

powered by

Bidvest Merchant Services

SECTION 3: ACCEPTING CARD TRANSACTIONS

If you are considering offering an online sign-up for Recurring Transactions, you must provide an

easy online cancellation procedure to the Cardholder. Such procedures must be as simple and as

accessible as those of the original sign-up process.

Delivery and Guarantees

• Delivery dates/times should be clearly stated and agreed with the Cardholder. If it is not possible

to deliver on the agreed date/time, another delivery should be arranged. If this is not possible, the

Cardholder should be offered a refund;

• You should capture both billing address details and delivery address details, where these differ;

• In the event of non-delivery, it is the Merchant’s responsibility to prove receipt of the goods by the

Cardholder;

• Guarantee terms and details should be clearly stated. The Cardholder needs to be aware that

this will in no way effect their statutory rights. The name and address of any insurer backing the

guarantee should be provided.

Apart from deposits, full payment for goods and services must not be debited from a Cardholder’s

Account until the goods have been dispatched or the service provided. Should you wish to be able to

take deposits on goods and services, you must get agreement from Bidvest Merchant Services for

this before any deposits are taken.

3.4 REFUND PROCESS

1. If you wish to provide a Refund, the Refund Card Transaction must be completed using the same

Card as that used for the original sale.

2. You should never make a Refund to a Card where the original sale was made by cash or cheque.

3. You should never make a Refund to a Card where there has been no sale transaction.

4. Failure to observe the procedures in this section could lead to your funds being withheld pending

further investigation.

5. You must enter the Card into the Chip Card reader, PIN Entry Device or swipe it. If your Terminal is

unable to read the card you must manually key enter the Card Number.

6. Where the original Transaction was PIN verified, you may need the Cardholder to enter their PIN

in order to process the Refund. This will depend on the type of Terminal you use; please refer to

your Terminal User Guide, otherwise you should sign the Terminal Sales Receipt, and make a note

of the exchange and/or return of any items.

7. If Authorisation was obtained for the original Card Transaction, or your Terminal indicates that

manual Authorisation is required, you must telephone the Authorisation Centre on 0801 414 881.

Maestro Card Transactions will make an automated Refund Authorisation call based on the same

parameters that were used for the sale, so a manual call is not required.

8. You may only perform a Refund agreed on the telephone or in correspondence if you are able to

manually key enter Card Transactions. Please refer to the manual key entry procedures in your

Terminal User Guide.

9. You must not perform a refund on a Maestro or Visa Electron transaction.

25 Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

powered by

Bidvest Merchant Services

SECTION 4: GENERAL PROCEDURES AND BANKING

4.1 EVERYDAY PROCEDURES

Banking Procedures

Please follow the end-to-end banking procedures detailed in your Terminal Operating Guide to

ensure you receive payment for all transactions. It is essential that all transactions are submitted

for payment within 2 working days of being accepted.

Please note that if a transaction is submitted after 2 working days, the Card Issuer may reject the

transaction, resulting in it being charged back.

4.2 EXCEPTIONAL PROCEDURES

Can I Pass Charges to My Customer?

In South Africa a merchant is not permitted to pass charges on to a Cardholder and the merchants’

cash prices must apply.

Minimum Charging

You must not set a minimum transaction limit on Credit and Debit Card Transactions if your

customer has a valid and properly presented Card.

Split Sales and Transactions

There may be occasions when a Cardholder will request to split payments between several Cards,

or between a Card and cash or cheque.

It is important for you to understand when you can and cannot split a transaction.

1. If several Cardholders wish to split the transaction amount into small amounts in order to pay

a proportion of a bill, this is permitted; for example, in a restaurant when individuals pay their

own bill or a proportion of the total bill. You are permitted to split the total bill between each

Cardholder. To prevent future disputes, ensure each Cardholder agrees to the amount they will

pay and process separate transactions for each Card. Each transaction must be verified by the

Cardholders PIN or signature, as prompted by the terminal. Please provide each Cardholder with

a copy of the transaction receipt applicable to the agreed amount (which may or may not include

gratuity) by the Cardholder.

2. If one Cardholder requests you to split a transaction amount between several Cards (perhaps

issued by different Card Issuers) you may proceed as follows:

- Only conduct the transaction if you are not suspicious of the transaction or the person

presenting the Card

- Ensure all Cards presented are issued with the same Cardholder name

- Follow the normal Card acceptance procedures as details in Section 3.

This type of request may occur when accepting a large value transaction where the Cardholder

may not have sufficient funds on one Card. Bidvest Merchant Services recommend you only split a

transaction over more than one Card when:

- It is a Card Present Transaction.

- You ensure each Card presented is either issued by a different bank or is a different Card type

from the same bank. It is unlikely that the Cardholder would have more than one Card issued by

the same bank and the same Card type

- You process each transaction by either chip-read or magnetic strip (as per Terminal prompts)

- Each transaction is verified by either Chip and PIN or signature (as requested by the Terminal)

- Each transaction is authorised

- The Cardholder agreed to the amount charged to each Card and is given a receipt for each

transaction, which shows the amount charged to each Card.

26 Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

powered by

Bidvest Merchant Services

SECTION 4: GENERAL PROCEDURES AND BANKING

3. You must not split transaction amounts for the same Cardholder into smaller amounts. For

example, if Authorisation is declined on a transaction, do not split it into smaller amounts in an

attempt to gain Authorisation.

If you attempt to split a sale, any transaction may be charged back. Bidvest Merchant Services will

not be able to defend you from such Chargebacks.

Alteration of Amounts

• You must not alter the transaction amount without the Cardholder’s consent.

• If you have a gratuity facility on your terminal, you must ensure the Cardholder has agreed for any

gratuity to be added to the bill.

SECTION 5: CHARGEBACKS AND RETRIEVAL REQUESTS

Why Chargebacks Occur

A Chargeback is an unpaid Card Transaction returned to us by the Card Issuer. The following

section describes the procedures which you should follow together with suggestions which will help

you reduce the risk of Chargebacks being debited to your Merchant Account. Remember you may be

liable for a Chargeback in some circumstances even if you obtained Authorisation for a

Card Transaction.

A Cardholder or the Card Issuer has the right to question/dispute a Card Transaction. Such requests

can be received up to 180 days after the Card Transaction has been debited to the Cardholder’s

Account and in some circumstances, beyond 180 days.

One of the main reasons a Cardholder disputes a transaction is because they do not recognise the

description on their Card statement, as it may not match the name of your business.

It is a Visa and MasterCard requirement that if you are predominantly trading as a mail or telephone

order business, a contact telephone number rather than location must be included in the transaction

description; for example The Mail Order Shop 021 123 4567. This provides the Cardholder with the

ability to verify the transaction with you, rather than disputing with the Card issuer.

The same applies to Internet Card Transactions; the transaction description should include

reference to your website address and a contact telephone number or email address.

You can change the description that appears on the Cardholder statements by contacting our

Merchant Support Centre on 0860 11 14 41†.

Chargeback Reversal Procedure

When a Chargeback is received from a Card Issuer we will normally debit your Merchant Account

and advise you accordingly, with details of the Card Transaction together with the information/

documentation required from you. We will also tell you the latest date by which you must reply with

the information/documentation required. If the information provided is:

- sufficient to warrant a reversal of the Chargeback; and

- within the applicable timeframe;

We will defend (reverse) the Chargeback if possible but reversal is contingent upon acceptance

by the Card Issuer under Visa/MasterCard guidelines. A reversal is not a guarantee that the

Chargeback has been resolved in your favour. If the Chargeback is reversed, the Card Issuer has the

right to present the Chargeback a second time and your Merchant Account will be debited again if

you have not complied fully with the terms of your Merchant Conditions and this Operating Guide.

27

Bidvest Merchant Services (Pty) Ltd (Reg No 2006/027329/07).

powered by

Bidvest Merchant Services

SECTION 5: CHARGEBACKS AND RETRIEVAL REQUESTS

We will do our best to help you to defend a Chargeback. However, due to the short timeframes and

the supporting documentation necessary to successfully (and permanently) reverse a Chargeback in

your favour, we strongly recommend the following:

• Ensure Card Transactions are completed in accordance with the terms of your Merchant

Conditions and this Operating Guide

• If you do receive a Chargeback, investigate and send in the appropriate documentation within the

required timeframe

• Whenever possible, contact the Cardholder directly to resolve the inquiry/dispute but still comply

with the request for information in case this does not fully resolve the matter.

Common Causes of Chargebacks

The most common causes for Chargebacks are:

• A fraudulent mail, telephone or Internet Card Transaction. Please refer to Section 2.3 for further

information

• You did not respond in time to a request for a copy of the transaction (retrieval request)