ALASKA PUBLIC

OFFICES COMMISSION

TRAINING MATERIAL:

PUBLIC & LEGISLATIVE

OFFICIAL FINANCIAL

DISCLOSURE

The purpose of this training material is to provide filers with a general familiarity with the reasons for filing and basic instructions on how

to fill out the required forms. The contents of this booklet are NOT intended to serve as a precise statement of the statutes and regulations

of the State of Alaska relating to public official financial disclosure. The statutes and regulations governing financial disclosure are

enclosed for reference. If you have specific question not readily covered in the materials please call APOC staff.

ELECTRONIC FILING

Contact Information

Public & Legislative

Official Financial

Disclosure

2016

ElectronicTraining

Training Presentation

POFD/LFD Statutes

POFD/LFD Regulations

Procedural Regulations

Alaska Public Offices Commission Resources

Contact Information

APOC Anchorage

(Campaign/Financial Disclosure)

APOC Juneau

(Lobbying/Legislative)

Physical/Mailing Address:

2221 E. Northern Lights, Room 128

Anchorage, AK 99508-4149

Phone: (907) 276-4176

Toll-Free: 1-800-478-4176

Fax: (907) 276-7018

General Email: apoc@alaska.gov

Reports:doa.apoc.reports@alaska.gov

Physical Address: 240 Main St. #500

Mailing Address: PO Box 110222

Juneau, AK 99811

Phone: (907) 465-4864

Toll-Free: 1-866-465-4864

Fax: (907) 465-4832

General Email: apocjnu@alaska.gov

Useful Links

Name

Website

APOC Website:

http://doa.alaska.gov/apoc/home.html

MyAlaska

https://my.alaska.gov

Searching Reports

http://aws.state.ak.us/ApocReports/Home.aspx

THE PURPOSE OF THIS BRIEF SET OF INSTRUCTIONS IS TO

PROVIDE INFORMATION REGARDING:

WHO NEEDS TO FILE A POFD;

WHY; AND,

WHEN.

AND

HOW TO CREATE AND LOG IN TO A MYALASKA ACCOUNT

INTRODUCTION

Do I have to file Public Official

Financial Disclosure Report?

Why do I need to file a Public Official Financial

Disclosure?

AS 39.50.010 states that a public office is a public trust

that should be free from the danger of a conflict of

interest. As a result public officials, legislators, judicial

officers, and many municipal officials are required to file

a POFD. This is not about anyone getting into your

financial life, it is about transparency to the public at

large.

Part 1

Why, Who, When

Do I need to file a POFD?

WHO—State Level (AS 39.50.200 (a)(1), (6), (9))

At the state level—YES if you are any of the following;

1. Governor, Lt. Governor, or a special assistant, executive assistant, administrative

assistant, press assistant, or employed in these offices as a policy making employee;

2. A judicial officer—a judge or magistrate, or a judge pro tem working more than 30

days in a calendar year;

3. The head of a department—i.e. a commissioner or deputy commissioner;

4. The director or deputy director of a division;

5. A special assistant to a commissioner;

6. A legislative liaison for department;

7. A state investment officer or the state comptroller in the Dept. of Revenue;

8. The Chief Procurement officer as appointed under AS 36.30.010;

9. The executive director of the Alaska Workforce Investment Board;

10.A member of the board of trustees, the executive director, and the investment

officer of the Alaska Permanent Fund Corporation;

11. A member of or the chair of a state commission or board (see AS 39.50.200(b) for

a list of boards and commissions required to report);

12. A member of the state senate of house, a legislative director, or a public member

of the legislative ethics committee (see AS 24.60.200 - .260 and .990).

Do I need to file a POFD?

WHO—Municipal Level (AS 39.50.200(8))

At the municipal level--YES if you are (this assumes that the

municipality has not opted out of filing POFDs):

1. A borough or city mayor;

2. Member of a borough assembly;

3. City council member;

4. School board member;

5. Elected utility board member;

6. City or borough manager;

7. Member of a municipal planning and zoning commission;

8. A candidate for any of the above listed elective offices—

even if you are an incumbent official.

When do I need to file a POFD?

Every March 15 if you are in a position that is required to

report—your annual report;

Within 30 days of taking a position that is required to report—

your initial report (even if you were just elected after filing a

candidate POFD);

Within 90 days of leaving a position that is required to report—

your final report (the final report covers anything not covered

on a report already submitted);

With your candidate registration/declaration of candidacy if you

are a candidate even if you are in incumbent (incumbent

legislators not subject to this paragraph).

I don’t want to file my POFD electronically

In some cases you don’t have to file electronically. AS

39.50.050(a)—”The commission shall require that the

information required under this chapter be submitted

electronically but may, when circumstances warrant an

exception, accept any information required under this

chapter that is typed in clear and legible black typeface or

hand-printed in dark ink on paper in a format approved by

the commission or on forms provided by the commission

and that is filed with the commission. A municipal officer

for a municipality with a population of less than 15,000

shall submit information required under this chapter either

electronically or typed or hand-printed in the manner

described in this subsection.”

Part 2

Setting up an account to file electronically

In this section you will learn how to set up an account

in myAlaska to be able to file your POFD

electronically.

Where do I start?

First, go to myAlaska

myAlaska Log in

If you already have a myAlaska account sign in to it.

If you don’t have a myAlaska account follow the

instructions provided on the web site to create one and

then sign in. See the process that follows.

If you don’t have a myAlaska account

Click here to

register for

an account.

You will be brought to this page

You will

be

required

to fill in

all the

boxes

here.

You will be

using myAlaska

to file your

forms in the

future. It is

best if you

write down

your

username

and

password. If

you forget

them, APOPC

cannot help

you retrieve

them.

When done,

check this

button and

then the “Start

Registration”

button.

And then to this page…

A confirmation email with instructions for

continuing the registration process will arrive at the

email address you provided.

Please check your email and follow the instructions

provided there. If the confirmation email fails to

appear in your inbox, please check your

spam/junkmail.

You have 24 hours to complete the steps outlined in

that email or you will have to restart the registration

process.

You’ll get an e-mail as below

You’ll need to open

this e-mail to

proceed.

Click this

link and it

will take

you here

Here enter your username

and password and then click

the “Click Here to Continue”.

You’ll end up here

select “View

Your Services”

here.

You an

select

“Services”

here, or

You’ll be brought here

Here, select

APOC

Disclosure

Forms

Here is the start of the filing process

The first time

you go to fill

out a form

you’ll see this.

Read the

privacy

agreement,

click the “I

accept” box,

and then click

“continue”

You’ll end up here. Click on the first link under “Welcome to

APOC Forms Online”

This is

where

you will

go to

start

your

POFD.

If you have filed POFDs before you’ll see something like this. If you haven’t filed

before there will be nothing listed under the forms area. Here you get information

about the differences between copying and amending.

If you have not

filed a POFD

before this page

will be blank. If

this is the case

click on the red

“Start new

form” button so

you can start a

new form.

What these things mean

Start

Resume

Copy- helpful when filing a

report that doesn’t differ much

from an earlier report

Amend

Delete

For a first time filer you

will need to click on Start

New Form

Part 3

Starting a New POFD

In this section you will learn how to begin a new

POFD.

Let’s start a new form, click the red button

Important deadlines and instructions here.

When ready click the blue “Start” button

As stated in

AS 39.50.020

It’s important to start correctly!

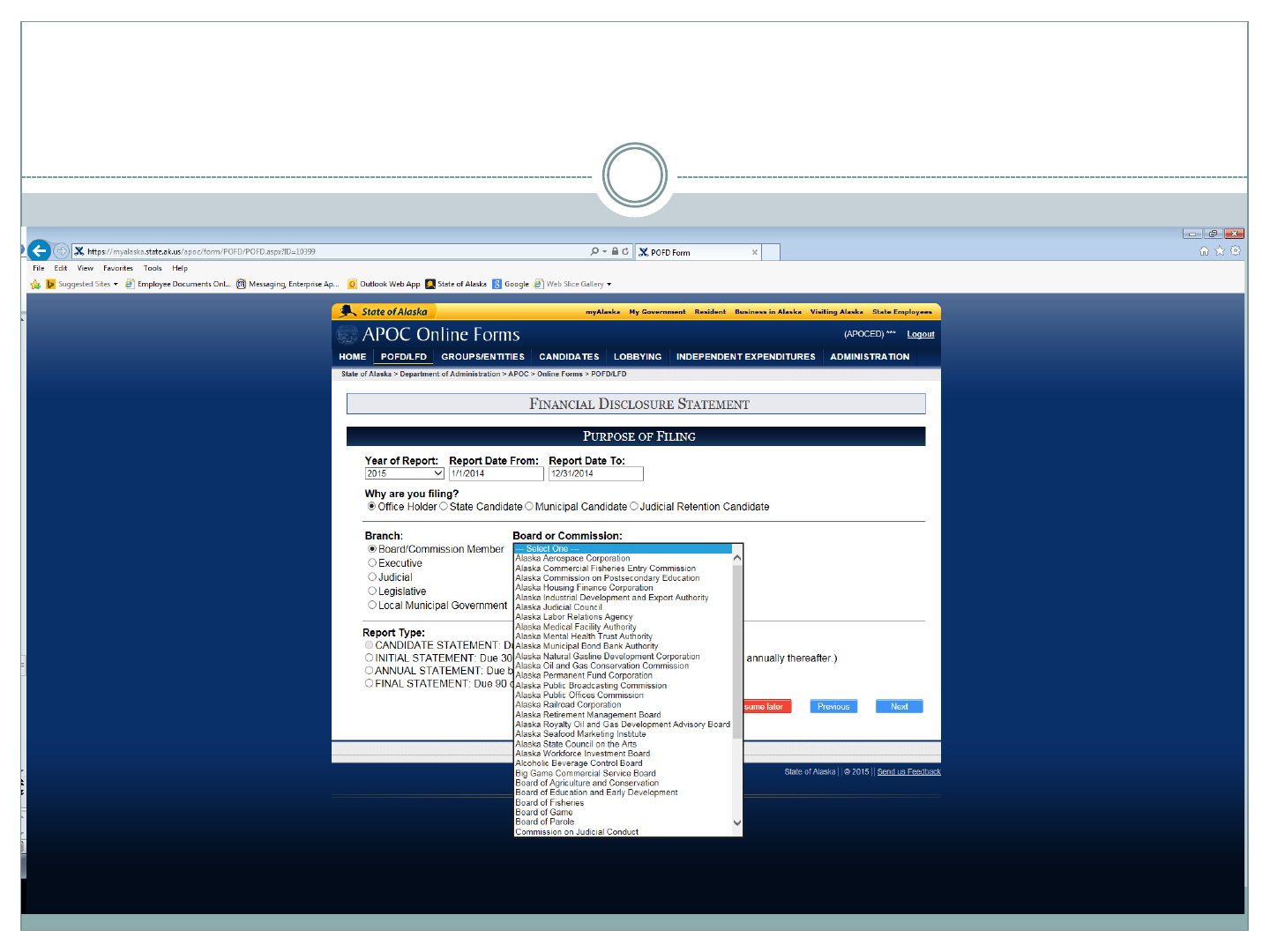

The Year of Report is the year you are reporting in; the Report date from and to is

the previous year unless this is a final POFD (we’ll deal with finals in a little bit).

“Why are you filing” is self-explanatory—each will bring you a menu to choose

from. The report type is important so that you appear in the right place. When

done hit the blue next button. You can come back and make changes later.

IMPORTANT

FACT—

members of

local

municipal

planning and

zoning

commissions

are local

municipal

government.

Why are you filing?

Boards and Commissions

If you select

Board/Commission

Member go to the

drop down box and

select the board or

commission you are

on. Not every state

board or

commission is

required to file a

financial disclosure.

If you don’t see the

board you are on

listed you may not

have to report. Call

APOC.

IMPORTANT

FACT—members

of local municipal

planning and

zoning

commissions are

local municipal

government

Why are you filing?

Executive Branch

If you are filing

as a member of

the executive

branch there are

two drop downs

for you to

choose from.

Please choose

from each

before trying to

proceed.

Why are you filing?

Judicial Branch

Another

brief drop

down box.

Why are you filing?

Legislative Branch

Pick your

position

from the

drop

down

box.

Why are you filing?

Local Municipal Government

Again, there is a

drop box for you to

select the

municipality from.

Please choose one

since there may be

other people with

your name and this

is one way to

differentiate the

Tom Jones from

North Pole from

the Tom Jones in

Anchorage.

Pick the type of report

Here you pick if

this is an initial,

annual, final or

candidate filing.

This is another

way that staff can

match reports file

to reports

expected. If you

don’t choose the

correct reason for

filing staff may

not be able to

find your report.

If you are an incumbent and need to file a candidate POFD don’t amend your

annual, copy your annual and change the reason for filing.

The information on page 2 of the form is more

important to you than you might think. It allows

APOC staff to ensure that you have filed on time. We

match what you put on page 2 to a set of expectations.

When the information on page 2 does not match the

expectations staff can’t always see your report. So, if

you are filing for the election for the state senate, but

on page 2 you say you’re running for a council seat in

Wasilla, staff or others won’t see your report and

assume that you haven’t reported.

Help us help you!

You’ve already logged in and entered the reasons you’re reporting. Page 3

is where you enter your contact information.

It helps to be

consistent. If

your name is

William, but

you go by Bill,

use Bill as

your first

name here,

but use it

whenever you

file.

It will be

helpful for you

and for APOC if

you provide an

e-mail address

and phone

number you use

regularly. If

your address or

phone changes

you can amend

your report.

This is how it would look filled out

Mr. Flintstone

should always

file as Fred in

the future.

Filing as

Frederick

could cause

identification

issues in the

future

When

done, click

on the blue

NEXT

button.

If you run out of time you can always

Save & Resume later

THIS PART OF THE PRESENTATION COVERS

ENTERING THE REQUIRED INFORMATION

FOR PAGES 4 THROUGH 19

Part 4

Entering Information into your

POFD filing

Now we start entering income information

Here is information

that will answer

most questions. If

you received four

checks from the

same employer for

$400 each, then you

received $1,200 in

wages and must

report it. But if you

received four checks

at $400 each from

four different

employers you are

not required to

report them since

each is under

$1,000.

Here is what adding a source of income looks like

You don’t

need your

tax

information

to fill this

out. The

income is

listed in a

range, not a

precise

number.

Remember

you have to

list income

for you,

your

spouse (if

you have

one) and

your

children (if

they live

with you).

AS 39.50.030

You must “Add

Income” before

moving on.

And after pressing the blue Add Income button

You can keep

adding

salaried

employment

as needed just

click here.

When done

click on next.

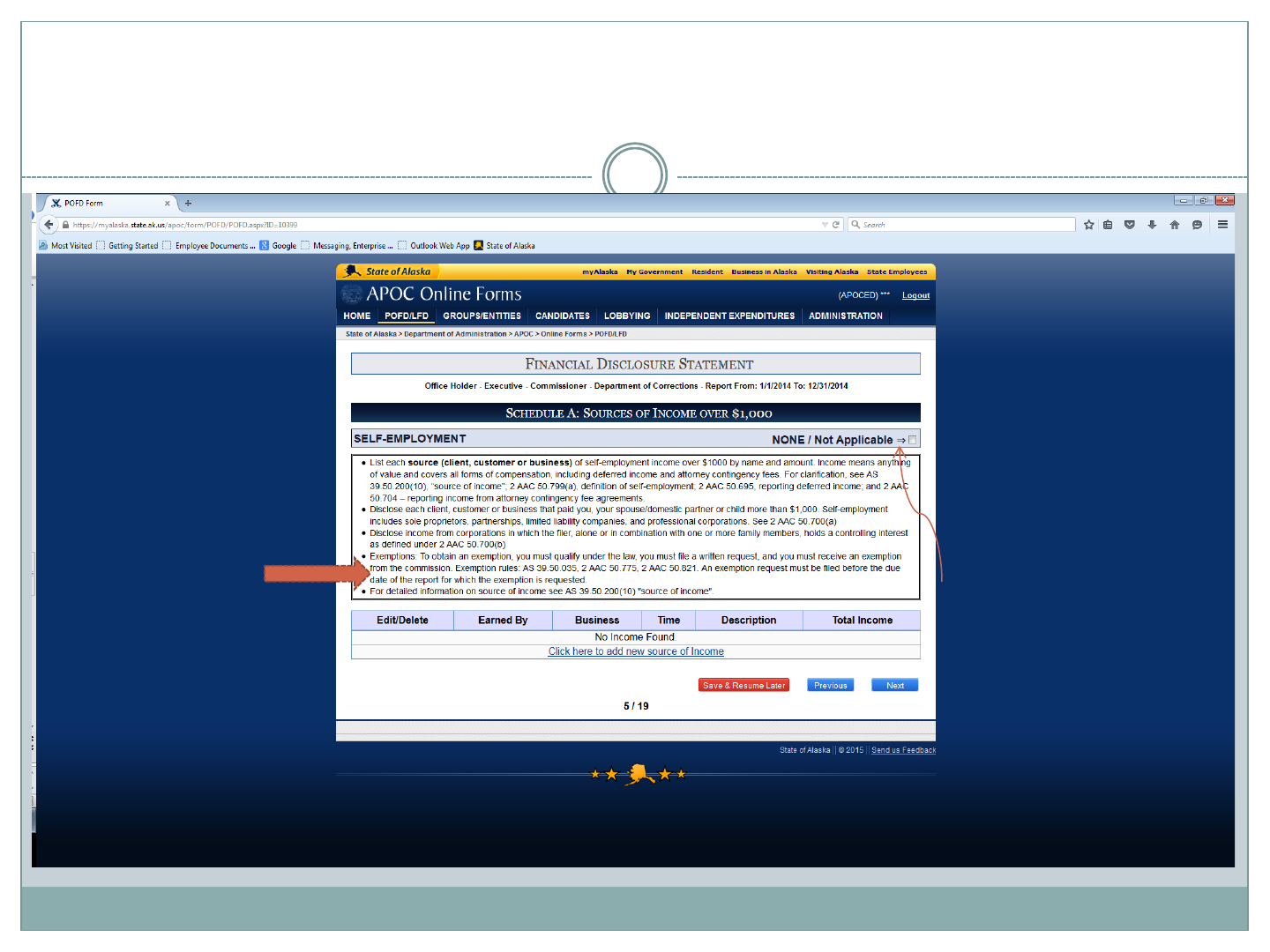

Income from Self-Employment

If you, your

spouse, or any

children DID

NOT receive

any income

from self-

employment

click here and

press next.

Physicians,

attorneys, and

others are not

automatically

exempt from

reporting clients.

Please see the

exemption

information on

this page. See

also 2 AAC

50.690 for a good

faith effort to get

the information.

More self employment:

You can add clients one at a time as below

Or you can keep your clients on a spreadsheet and

import the information

APOC has a

template

available

that you can

download.

See the

template on

the next

slide.

Template for uploading client information

Uploading will give you something like this

When finished uploading and

updating income you get this.

Rental Income

If you own property that you rent to others you will need to fill this out.

This box is

available on

most of the

following pages.

If the type of

income does

not apply to you

click here and

move on.

Rental 2

If you have a renter this is what it looks like

After entering

the renter,

click “Add

Income”.

Once you

have entered

all your

renters you’ll

click next on

the rental

page.

Dividends, Interest, and other Earnings

This works

just like the

rental

income

page. See

slides 43

and 44.

Gifts

If you have

no gifts to

report click

here.

If you have

gifts to report

click here to

report them.

Adding a Gift

To Whom

From Whom

What is it

Value of

gift

When done

click here to

add the gift.

Other Income

Sell your

house, car,

cash out your

retirement

account? That

information

goes on this

page.

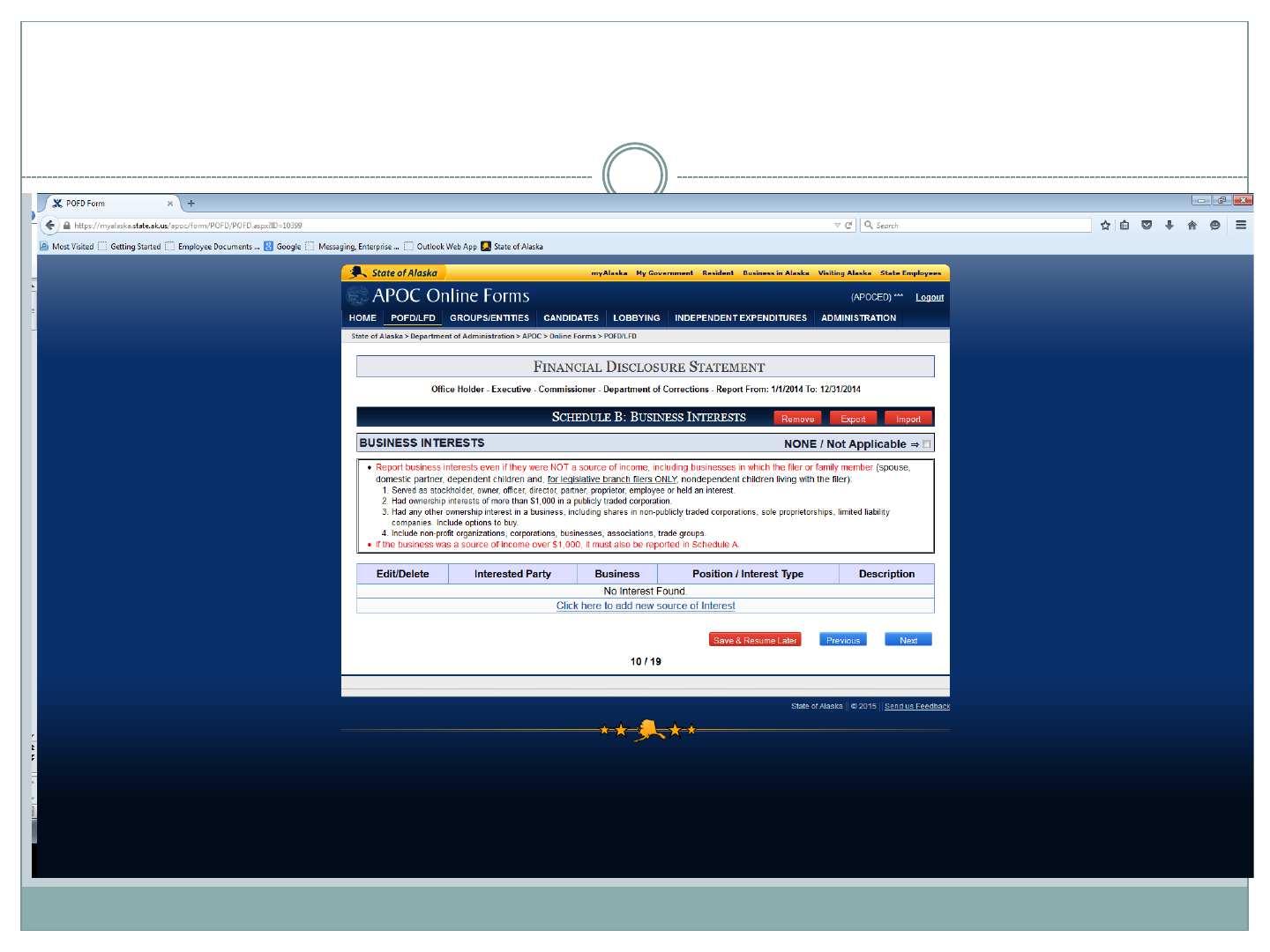

Disclosing Business Interests

As in other areas, you can import the information via a

spreadsheet. Even if you didn’t receive income you need to list

your business interests here.

Adding a business interest

To add

business

interests

one at a

time fill in

the blank

areas.

After you enter an interest the page will look like this

Real Property Interests

What are

Real Property

Interests?

Primary residence and recreational property

identification

Your primary

residence and

one

recreational

property

need only be

identified by

zip code. All

others need a

more precise

description.

Beneficial Interests

This point can

make your filing

much easier. If

an account is

managed by a

company you

can simplify

your report.

Here you don’t need to have

received income, report if the

value is over $1,000.

Beneficial interests

This account is

managed by

another so it

does not

require detail.

But the filer

manages this

one so it needs

to be detailed.

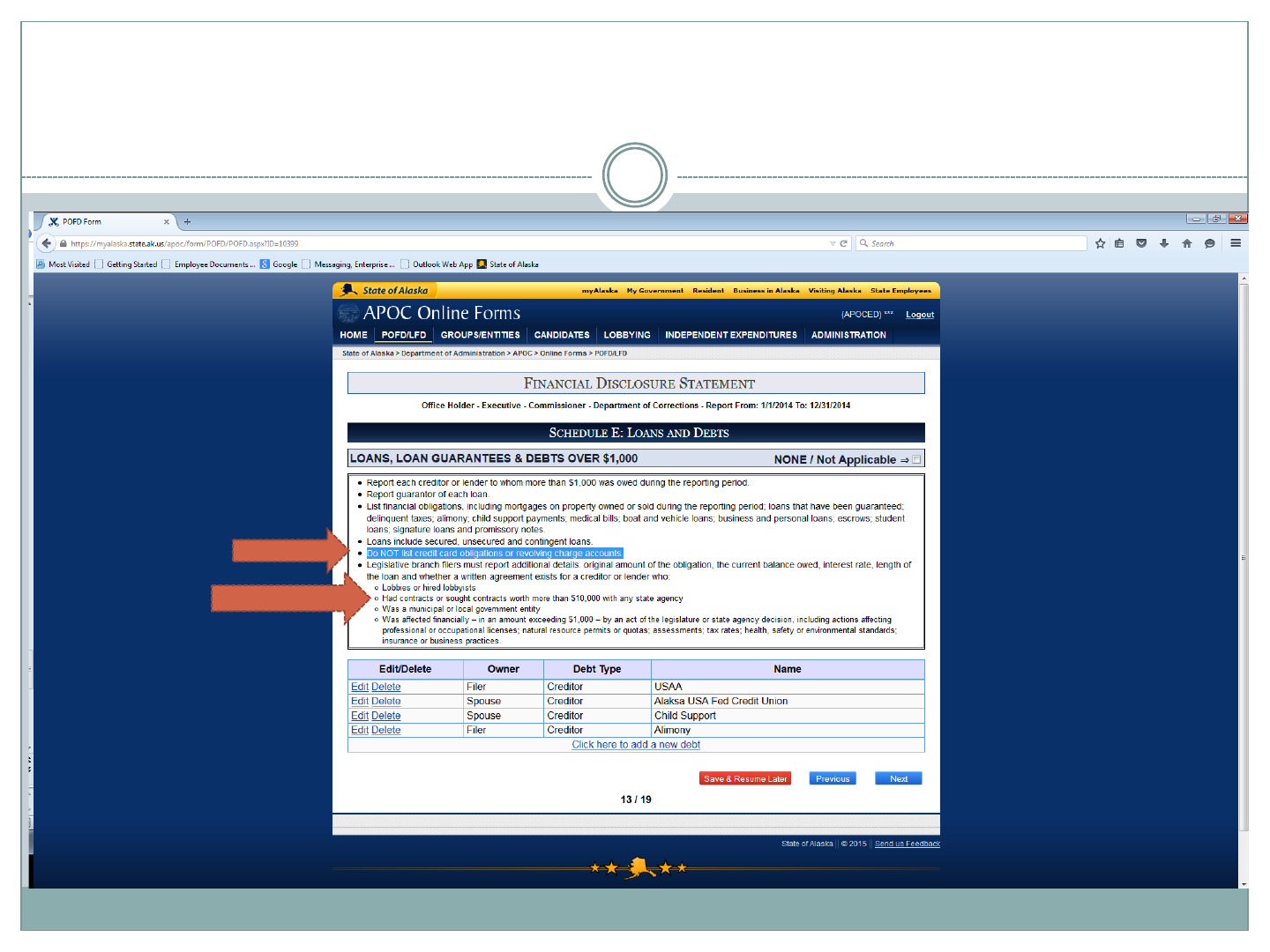

Loans and Debts

Who do you owe

money to

What to report on

this page

This page

works like

earlier pages

For most filers loans and debts will look like this

This will make

your reporting

easier!

Legislative

filers please

take note.

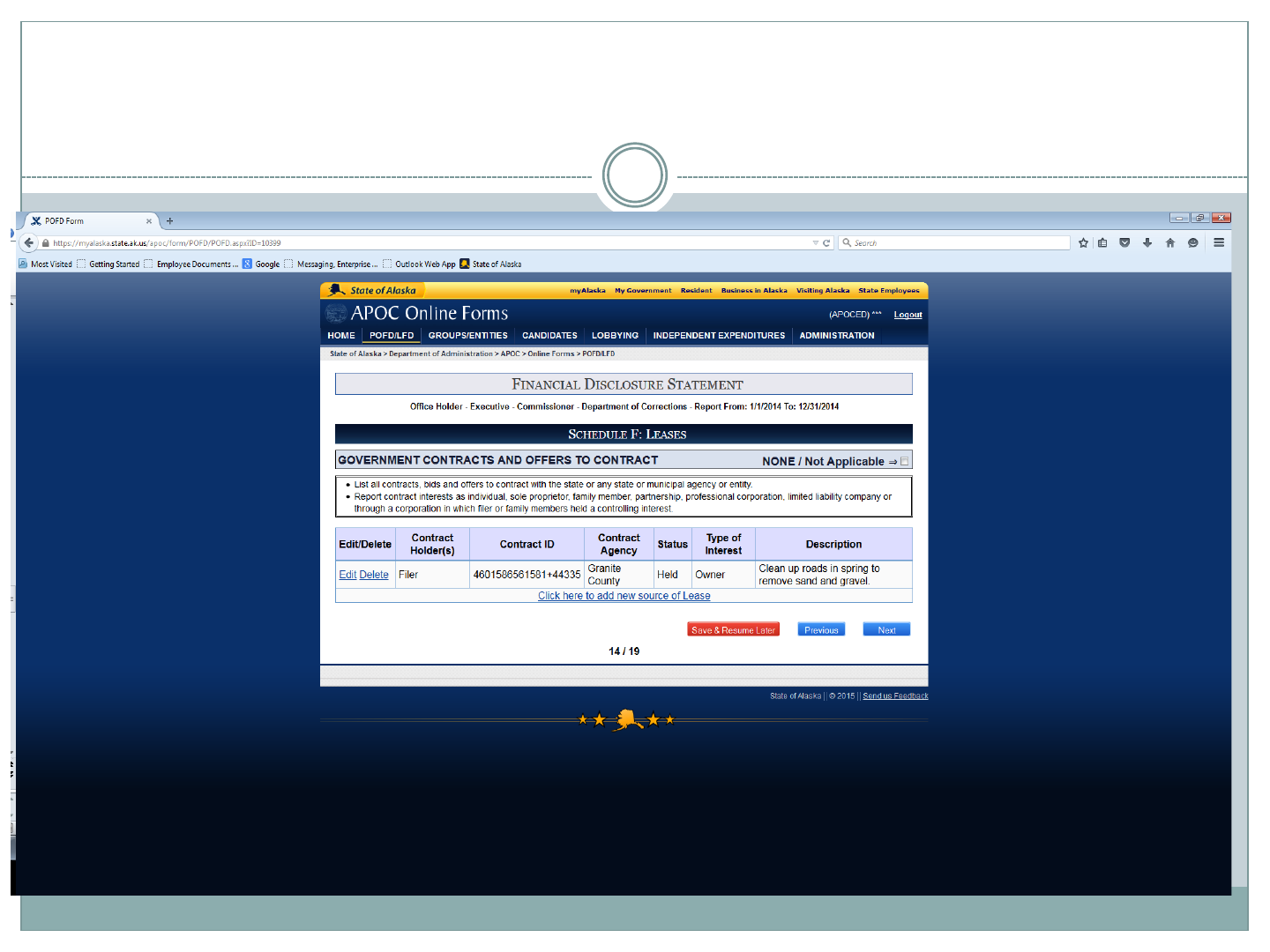

Government Contracts and Leases

What to

report

A contract would look like this

Not many people

have this to

report. Notice

this contract is

with a county and

not the state.

Even contracts

with

municipalities

need to be

reported.

Natural Resource Leases

What to report

Close Economic Associations

Many filers

won’t have

to report

anything

here. But,

make sure

you are

reporting if

you are

required to

do so.

Lobbyist Reporting

Who has to

report anything

on this page.

Municipal

Officials and

members of

Boards and

Commissions

need not report

here.

Almost There!

This is

the

review

point and

what your

filing will

look like

after you

check it

and then

submit it.

“Incomplete”

does not mean

you’ve missed a

step. It means

you need to

review and

certify before

you have

completed the

process.

Review and make sure you’re satisfied with the information

Typos show

Anything

missing?

How about

the PFD for

the filer

and

spouse?

Keep checking

More typos

Don’t worry

about how

the words

break in the

fields. It is a

function of

the program.

If there are

errors you want

to fix you can

save and resume

later, or go to

previous pages

and fix it now. If

it is as you want

it click next.

Okay, now you’re ready to certify

Certify here—and You’re Done!

Here is

where you

certify your

report. By

typing in

your

password

and hitting

the “Sign

and Submit”

button you

certify that

the report is

complete

and correct.

You are

now

done!

Part 5

Other Things

Saving and Resuming an incomplete report

Deleting an incomplete report

Viewing a report

Printing a report

Amending a report

Copying a report

Saving and resuming a report

You can save an incomplete

report on any page of the filing

and come back to it later.

You resume

from here.

Deleting Reports

You can only delete

incomplete reports.

If you want to view or print a report you have filed

By

clicking

here

you can

view

and

print a

report

you

have

filed.

Amending a Report

You can only

amend

reports you

have already

filed. Go to

the report

you want to

amend and

click

“Amend”.

Navigate to

the

information

you want to

change, make

the changes,

and then go

to the end

and certify.

Your original

report will be

available, but

will show as

amended.

Copy last year’s report for this year

You’ve filed

electronically for last

year. Nothing has

changed for this year.

Make things easy for

yourself. Copy last

year’s report—this

creates a duplicate of

the report—change the

year, and other dates

and then verify. You’ll

save yourself

considerable time.

Remember, income is

in ranges, if you

remain in the range, no

need to change

anything other than

the date.