1

Loan Guaranty Service

Quick Reference Document

For

Cash-Out Refinances

2

Contents

Introduction ................................................................................................................................................... 3

Appraisal Request for Cash-Out Refinance .................................................................................................. 3

Compliance Disclosures for Cash-Out Refinance Loans .............................................................................. 4

Issuing the Guaranty for Cash-Out Refinance Loans ................................................................................... 5

Cash-Out Refinance Loan Information Page ................................................................................................ 5

Veteran Information Page ............................................................................................................................. 7

Type 1 vs. Type 2 Cash-Out Refinance ........................................................................................................ 8

Initial Disclosure of New Loan ..................................................................................................................... 9

Comparison of Loan being Refinanced to New Loan ................................................................................. 13

Quick Reference Document for Cash-Out Refinances

3

Introduction

Procedures outlined in this Quick Reference Document (QRD), assists lenders with guaranteeing

cash-out refinance loans in WebLGY. This self-service functionality is available following the

WebLGY 19.3 software release.

The overview of the process:

• Lender Appraisal Processing Program (LAPP) or Independent (IND) Appraisal Request

• Upload the appropriate documents to appraisal correspondence

• Issue the Guaranty for the Cash-Out Refinance Loan

Appraisal Request for Cash-Out Refinance

WebLGYLoanRequest AppraisalSelect LAPP or IND Request Type

• Complete the required fields in the Appraisal Request form

4

•

Ensure 3G. “Sale or Refinance?” input is “Refinance Price” in the Property Information

Section of the appraisal request.

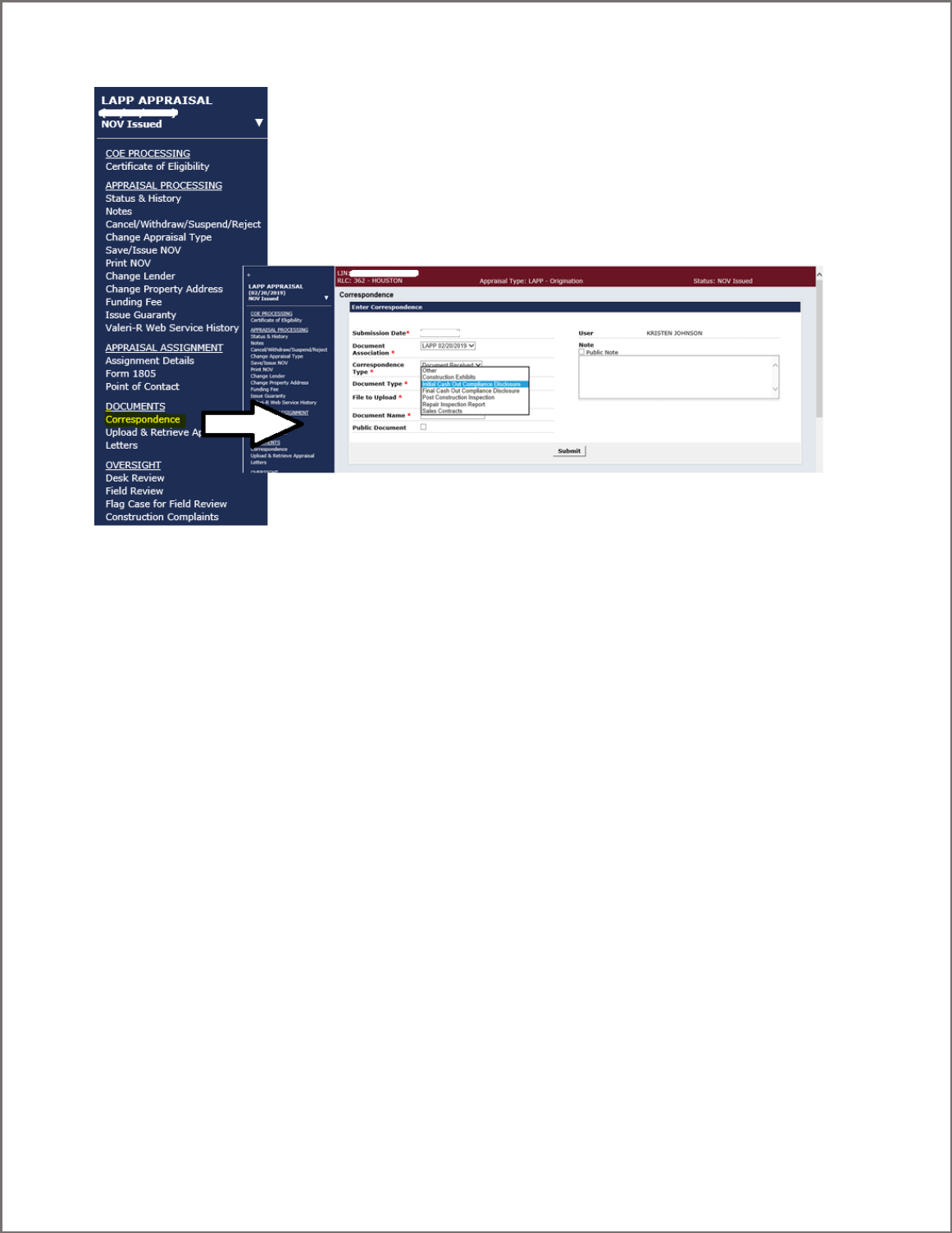

Compliance Disclosures for Cash-Out Refinance Loans

Upon successful creation of the appraisal request, upload the Initial Cash-Out Compliance

Disclosure and the Final Cash-Out Compliance Disclosure documents to the appraisal record.

WebLGY AppraisalDocumentsCorrespondence

Quick Reference Document for Cash-Out Refinances

5

With an original loan application date on, or after February 15, 2019, at least one of each of the

documents listed below are required for the guaranty issue of a Cash-Out refinance.

• Initial Cash-Out Compliance Disclosure

• Final Cash-Out Compliance Disclosure

Issuing the Guaranty for Cash-Out Refinance Loans

1. Loan being refinanced information is required

2. Initial Disclosure of new loan information is required

3. Auto-calculation to determine Type 1 versus Type 2 refinance

4. Auto-determination of net tangible benefit(s) to the Veteran for the refinance; at least 1

must be found.

5. Seasoning certification is required for all VA to VA refinances

6. Recoupment certification is required for all Type 1 VA to VA refinances

Cash-Out Refinance Loan Information Page

A guaranty is not allowed for a Cash-Out refinance if the compliance disclosures have not been

uploaded to appraisal correspondence for the Loan Identification Number (LIN). See

Compliance Disclosures for Cash-Out Refinance Loans for more information.

6

Once the appraisal is in the Notice of Value (NOV) Issued status, the Issue Guaranty link on the

left navigation menu of the appraisal is available. The user must have access to the Establish

New Loan functionality in order to access the Issue Guaranty link. For more information please

contact your Regional Loan Center (RLC) representative.

WebLGY AppraisalAppraisal ProcessingIssue Guaranty

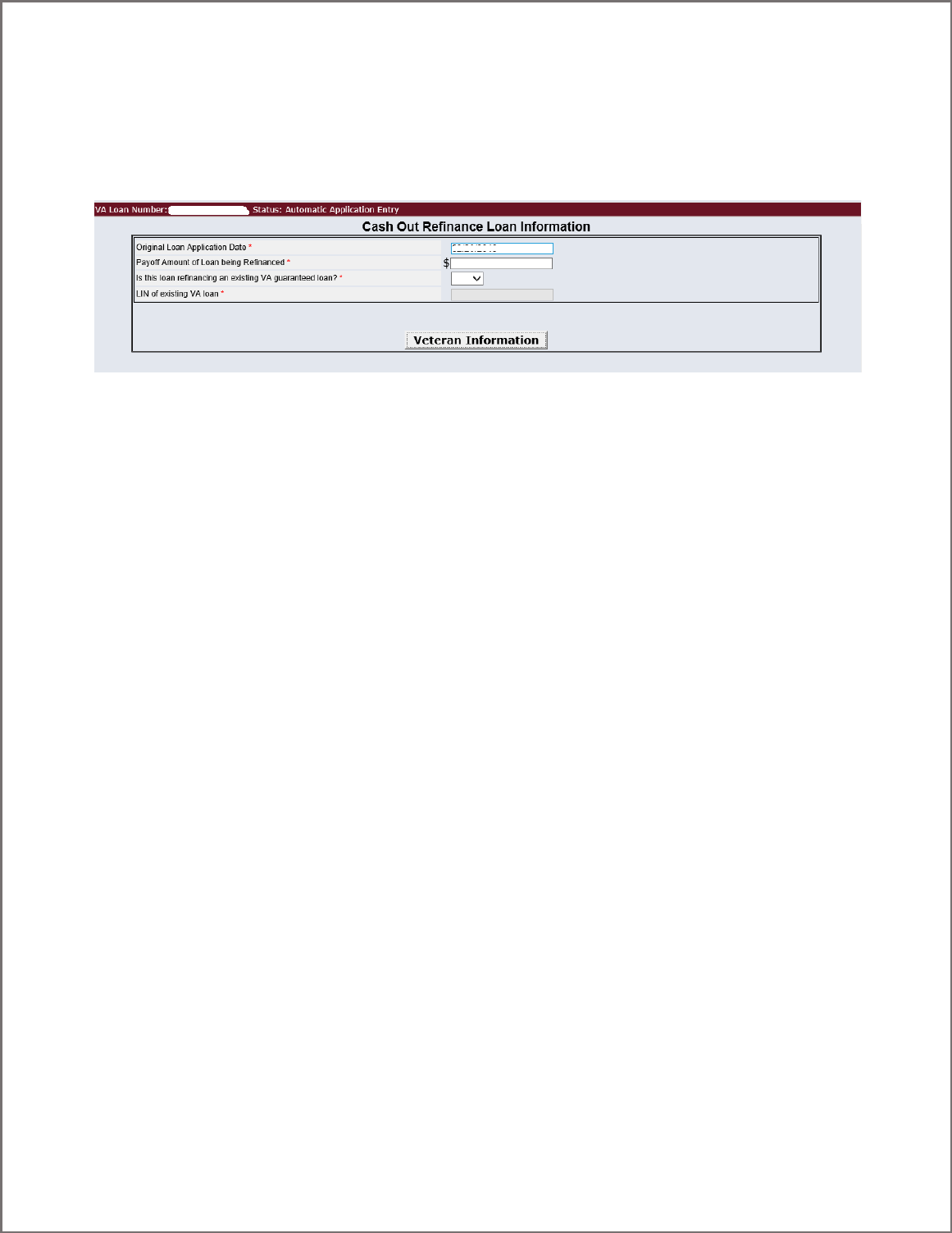

Selecting the Issue Guaranty link takes the user to the Cash-Out Refinance Loan Information

page to enter the Original Loan Application Date (MM/DD/YYYY).

Note: The original loan application date must be on, or before the date of the appraisal request.

For any loan with an original loan application date before February 15, 2019, the original

application date is the only required field. All other fields will be grayed. Selecting the Veteran

Information link will allow the user to proceed through to the standard issue guaranty process.

For loans with an original loan application date on, or after February 15, 2019, the following

additional information is required on the Cash-Out Refinance Loan Information page:

Quick Reference Document for Cash-Out Refinances

7

• Payoff amount of loan being refinanced

• Is this loan refinancing an existing VA-guaranteed loan? (Yes/No)

o If refinancing an existing VA-guaranteed loan, the LIN of the loan being

refinanced is required.

Note: When ‘Yes’ is selected for the question: “Is this loan refinancing an existing VA-

guaranteed loan?” and the LIN is entered, several validations are performed on the LIN.

• The LIN entered must be a valid, 12-digit VA loan ID number.

• The loan must be in 'Active' status.

• The Veteran Social Security Number (SSN) on the Funding Fee record for the LIN

must be the same as the Veteran SSN on the Funding Fee Record for the new loan. (The

primary obligor SSN is compared in the case that multiple obligors exist.)

• AND at least one of the following 2 validations must be true:

o The Office of Origination – Office of Jurisdiction (OO-OJ) Code (first 4 digits of

the LIN) must be the same as the OO-OJ code of the new loan.

o The city, state, county (all considered together) must be the same as the new loan.

Selecting the Veteran Information link after completing all required fields will direct the user to

proceed through to the new Loan Summary/Issue Guaranty page for Cash-Out Refinance Loans.

Veteran Information Page

In the case that the Veteran information is not complete, the Veteran information page is

presented to the user for updates. Required fields must be entered before the user is allowed to

proceed to the loan summary/issue guaranty page.

8

Type 1 vs. Type 2 Cash-Out Refinance

Based on the data entered about the loan being refinanced on the Cash-Out Loan Information

Page, the system will determine for the user if the new loan is a Type 1 or Type 2 cash-out

refinance.

A Type 1 cash-out refinance occurs when the loan amount of the new loan is less than or equal to

100 percent of the payoff amount of the loan being refinanced.

Requirements for Type 1 VA to VA Refinance:

• Seasoning Certification

• Fee Recoupment Period Certification

• At least one Net Tangible Benefit to the Veteran

• Document Type = Initial Cash-Out Disclosure uploaded to Appraisal Correspondence

• Document Type = Final Cash-Out Disclosure uploaded to Appraisal Correspondence

Requirements for Type 1 non-VA to VA Refinance:

• At least one Net Tangible Benefit to the Veteran

• Document Type = Initial Cash-Out Disclosure uploaded to Appraisal Correspondence

• Document Type = Final Cash-Out Disclosure uploaded to Appraisal Correspondence

A Type 2 cash-out refinance occurs when the loan amount of the new loan is greater than 100

percent of the payoff amount of the loan being refinanced.

Requirements for Type 2 VA to VA Refinance:

Quick Reference Document for Cash-Out Refinances

9

• Seasoning Certification

• At least one Net Tangible Benefit to the Veteran

• Document Type = Initial Cash-Out Disclosure uploaded to Appraisal Correspondence

• Document Type = Final Cash-Out Disclosure uploaded to Appraisal Correspondence

Requirements for Type 2 non-VA to VA Refinance:

• At least one Net Tangible Benefit to the Veteran

• Document Type = Initial Cash-Out Disclosure uploaded to Appraisal Correspondence

• Document Type = Final Cash-Out Disclosure uploaded to Appraisal Correspondence

All data for the new loan should be entered into the Loan Summary as usual. The inputs should

reflect what is in the final disclosure documents for the new loan. Where comparisons are made

with the loan being refinanced, the data will auto-fill and will not have to be entered twice.

Initial Disclosure of New Loan

The user is required to disclose data from the Initial Disclosure of the new loan on the Loan

Summary. The loan-to-value percentage and home equity will auto-calculate for the user in the

initial disclosure section. Although the data from the initial disclosure of the new loan is

displayed to the user in a comparison chart, the data from the initial disclosure is not used to

determine net tangible benefit(s).

Initial Disclosure of New Loan

Data Element

Data Definition

Loan Amount

Currency

- $1,234,567.89

10

Type of Mortgage

Drop

-Down

Lender must select from one of the same options available in WebLGY:

0

- Regular Fixed

1

- GPM Never Exceed Reasonable Value

2

- GPM Other

3

- GEM

4

- TMP Buyout

5

- Hybrid ARM

6

- ARM

Interest Rate

Numeric/Percentage

12.345%

Loan Term

Numeric/Month

- 3 digit

Monthly Principal, Interest

and PMI (if applicable)

Payment (Do not include

escrow for taxes, insurance

or HOA)

Currency

- $12,345.67

Total

payments the Veteran

will have paid after making

all remaining principal,

interest, and PMI (if

applicable) payments as

scheduled

Currency

- $1,234,567.89

Residual Income

Currency

- $12,345.67

Is this loan refinancing an

interim construction loan?

Checked = Yes

Quick Reference Document for Cash-Out Refinances

11

If the loan being refinanced was a VA loan, then several of the data elements about the loan will

be auto populated in the Initial Disclosure section and the Final Disclosure section. The loan-to-

value percentage and home equity will auto-calculate. The user must manually enter other

required data. Requirements for manually entered fields are listed below.

Loan being refinanced (VA)

Data Element Data Definition

Interest Rate

If interest rate entered does not equal what is currently on record for the

LIN, the following question is asked of the user: ‘Was the loan modified

or was it an ARM loan?’ Yes/No (Default = Blank)

If Yes, the user is allowed to proceed.

If No, then the following error message will display to the user: "The

interest rate that you have entered does not match our records. Please

correct what you have entered or contact your local RLC for assistance."

The user will not be allowed to issue the guaranty.

Total payments the

Veteran will have paid

after making all

remaining principal,

interest, and PMI (if

applicable) payments as

scheduled

Currency - $1,234,567.89

Residual Income Currency - $12,345.67

If the loan being refinanced was a non-VA loan, data about the loan is required. The payoff

amount will auto populate. The loan-to-value percentage and home equity will auto-calculate

once the required data is entered for the calculation. Requirements for manually entered fields

are listed below.

12

Loan being Refinanced (non-VA)

(All fields are required.)

Data Element

Data Definition

Type of Mortgage

Lender must select from one of the same options available in WebLGY:

0

- Regular Fixed

1

- GPM Never Exceed Reasonable Value

2

- GPM Other

3

- GEM

4

- TMP Buyout

5

- Hybrid ARM

6

- ARM

Interest Rate

Numeric/Percentage

Loan Term

Numeric/Month

- 3 digit

Monthly Principal,

Interest and PMI (if

applicable)

Payment

(Do not

include escrow for

taxes, insurance or

HOA)

Manually entered:

Currency

- $12,345.67

Amount of PMI

included in Monthly

Payment

Value must be entered.

‘0’ indicates there is no PMI.

Total payments the

Veteran will have

paid after making all

Currency

- $1,234,567.89

Quick Reference Document for Cash-Out Refinances

13

remaining principal,

interest, and PMI (if

applicable) payments

as scheduled

Residual Income

Currency

- $12,345.67

Is this loan

refinancing an interim

construction loan?

Checked = Yes

Comparison of Loan being Refinanced to New Loan

The net tangible benefit(s) to the Veteran are auto-determined based on the comparison of the

loan being refinanced to the new loan. At least one net tangible benefit must be met before the

guaranty will be issued.

VA to VA Refinance

14

Non-VA to VA Refinance

Net Tangible Benefit Criteria

Net Tangible Benefit (NTB) Criteria

Elimination of Monthly

Mortgage Insurance

If 'PMI Included in Monthly Payment' = Yes (Checked) for the

non

-

VA loan being refinanced then the criteria is met. If no, criteria

is

not met. If loan being refinanced is a VA loan, the question does

not apply, so the criteria is not met.

Decreased Loan Term

Compares the loan term of the loan being refinanced to the loan

term of the refinancing new loan. If the loan term of the

refinancing new loan is less

than the loan term of the loan being

refinanced then the criteria is met.

Decreased Monthly

Principal and Interest

Payment

Compares the

monthly P&I of the loan being refinanced to m

onthly

P&I of

refinancing new loan. If the monthly P&I of refinancing

the

new loan is less than the monthly P&I of the loan being

refinanced, then the criteria is met.

Quick Reference Document for Cash-Out Refinances

15

Reduced Interest Rate

Compare

s the interest rate of loan being refinanced to interest rate

of the

refinancing new loan. If interest rate of refinancing new lo

an

is less than interest rate on loan being refinanced, then the criteria

is met.

Maintained Loan

-to-

Value equal to or less

than 90%

If

loan-to-value percentage of refinancing new loan is equal to or

less than 90

percent, then the criteria is met.

Refinanced an Interim

Construction Loan

If 'Is this an interim construction loan?' = Yes on loan being

refinanced, then the criteria is met.

Increased Monthly

Residual Income

If residual income of refinancing new loan is more than the residual

income of

the loan being refinanced, criteria is met.

Refinanced from an

Adjustable Rate Loan to

a Fixed Rate Loan

If

the type of m

ortgage loan being refinanced is not a fixed rate and

the

type of mortgage of the refinancing new loan is fixed, then the

criteria is met.

• 0 - Regular Fixed - Fixed

• 1 - GPM Never Exceed Reasonable Value - Adjustable

• 2 - GPM Other - Adjustable

• 3 - GEM - Adjustable

• 4 - TMP Buydown/Buyout- Adjustable

• 5 - Hybrid ARM - Adjustable

• 6 - ARM - Adjustable

Seasoning Certification

For all cash-out refinances paying off an existing VA loan seasoning certification is required.

The number of days from closing of loan being refinanced and loan closing of new loan will

auto-calculate and cannot be less than 210 (days) or the guaranty will not be issued.

16

Recoupment Certification

For all Type 1 cash-out refinances paying off an existing VA loan the fee recoupment period is

required and it must be between 0 and 36 (months), or the guaranty will not be issued.

Note: The fee recoupment period must be between 0 and 36.

WARNING: In the case that the Issue Guaranty page is submitted and either no net tangible

benefit to the Veteran is found or no cash-out compliance documents have been uploaded to

appraisal correspondence, when the error message is returned to the user all data entered on the

page will be lost. The user will have to re-enter all of the data to issue the guaranty.