WORKING PAPER SERIES

Determinants of Losses on Construction Loans:

Bad Loans, Bad Banks, or Bad Markets?

Emily Johnston Ross

Federal Deposit Insurance Corporation

Joseph B. Nichols

Board of Governors of the Federal Reserve System

Lynn Shibut

Federal Deposit Insurance Corporation

August 2021

FDIC CFR WP 2021-07

fdic.gov/cfr

The Center for Financial Research (CFR) Working Paper Series allows CFR staff and their coauthors to circulate

preliminary research findings to stimulate discussion and critical comment. Views and opinions expressed in CFR Working

Papers reflect those of the authors and do not necessarily reflect those of the FDIC or the United States. Comments and

suggestions are welcome and should be directed to the authors. References should cite this research as a “FDIC CFR

Working Paper” and should note that findings and conclusions in working papers may be preliminary and subject to

revision.

1

Determinants of Losses on Construction Loans:

Bad Loans, Bad Banks, or Bad Markets?

Emily Johnston Ross

1

Federal Deposit Insurance Corporation

Joseph B. Nichols

2

Board of Governors of the Federal Reserve System

Lynn Shibut

3

Federal Deposit Insurance Corporation

August 2021

Abstract

Construction loan portfolios have experienced notoriously high loss rates during economic

downturns and are a key factor in many bank failures. Yet there has been little research on what

drives losses on construction loans and how to mitigate those losses, due to a lack of data. Using

proprietary loan-level data from more than 15,000 defaulted construction loans at over 275 banks

that failed between 2008 and 2013, we explore the extent to which observed losses during a

severe downturn are driven by the characteristics of the loans, the originating banks, and the

local markets. We find close ties between loss rates and certain loan characteristics as well as

market conditions both at and after origination, while institution-level differences across banks

appear less important. We find that the risk of higher losses on construction loans is influenced

not only by the originating bank’s behavior but also by the behavior of other local lenders in the

market. This finding has important implications for how lenders and regulators manage risk

through the real estate cycle. We also find support for existing regulatory guidance regarding

higher capital requirements for construction loans, specifically for land and lot development

loans.

JEL Classification Codes: R31, R33, G21

Keywords: ADC, Construction Loan, LGD, CRE.

The views and opinions expressed in this paper reflect the views of the authors and not

necessarily those of the FDIC, the Board of Governors of the Federal Reserve System, or the

United States. The authors wish to thank Lily Freedman, A.J. Michelli, and Michael Pessin for

research assistance; Suzi Gardner, Derek Johnson, Michael McCann, and Ken Redline for expert

advice; and Domenic Barbato, Rosalind Bennett, Mike Brennan, Kayla Freeman, Lisa Garcia,

Peter Martino, Ajay Palvia, Smith Williams, and Mary Zaki for useful comments. All errors and

omissions are our own.

1

550 17

th

St NW, Washington, DC 20429, [email protected]

2

20

th

and C St NW, Washington, DC 20551, joseph.b.nichols@frb.gov

3

550 17

th

St NW, Washington, DC 20429, [email protected]

2

1. Introduction

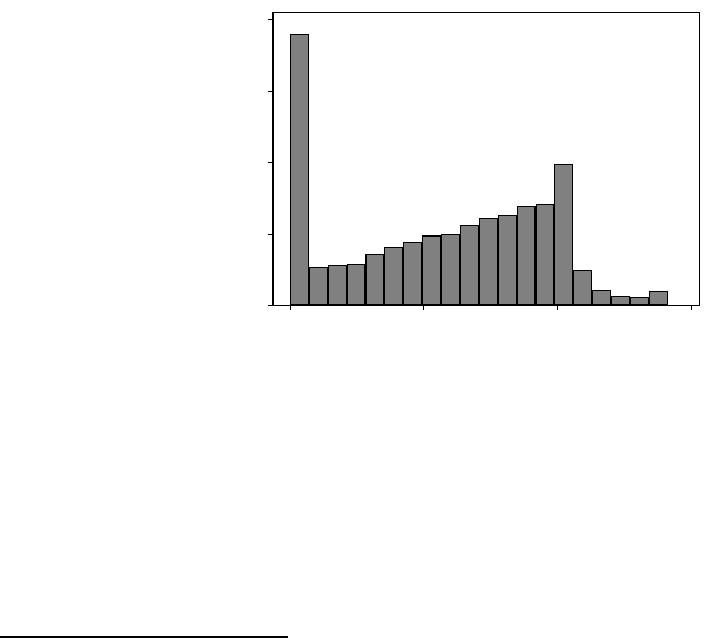

The construction sector of the economy is inherently cyclical. Figure 1 presents residential and

nonresidential construction investment in the United States from 1960 to 2020 and reveals a

series of large swings for both types of collateral. The bust was especially strong in the Great

Recession, with a peak-to-trough decline of 79 percent for residential investment and 51 percent

for nonresidential and multifamily investment.

4

An important contributor to this high degree of

cyclicality in the construction sector is the stickiness of construction spending, caused by the

time required to plan, finance, and construct a project. Many commercial projects take three or

more years to complete, making it difficult to quickly adjust the level of investment in response

to demand shocks.

5

Figure 1: Level of Investment in Construction from 1960 to 2020

It is not surprising, then, that construction loans have often played a significant role in

weakening bank balance sheets and contributing to bank failures during periods of financial

distress.

6

Noncurrent loan rates for acquisition, development, and construction (ADC) loans at

U.S. banks were more than double the noncurrent rates of other types of mortgages during both

4

Residential investment peak is 2005Q4 and trough is 2009Q2, while for nonresidential investment the peak is

2008Q2 and the trough is 2011Q1.

5

For example, see Grenadier (1995) and Wheaton (2014).

6

We include in our analysis not only loans for the construction of the actual buildings but also loans to acquire the

land itself and loans to develop the lots before the actual building construction (i.e., putting in curbs and pipes, etc.)

For the remainder of the paper, construction loans refer to the subset of loans that finance the construction of the

actual buildings.

3

the Great Recession and the 1980 to 1994 banking crisis.

7

Researchers have also found that

banks with heavy exposures to ADC loans were more likely to fail during both crises.

8

More

broadly, periods of real estate speculation have frequently contributed to financial crises around

the world.

9

Thus bankers need to approach ADC loans with appropriate caution and expertise,

and banking regulators need to set policies and procedures that suitably address the risk.

Unfortunately, there is much less information in the literature about what triggers losses for ADC

loans than for retail loans, corporate loans, or mortgages on existing residential and commercial

properties. Other types of loans often use nonbank financing, such as public debt markets or

securitization, that provide publicly available loan performance data for empirical studies.

10

ADC loans instead have, until recently, been limited to bank financing. As a result, data

availability has severely restricted research on ADC loan performance. In fact, we are unaware

of any empirical research that focuses on loss given default (LGD) for ADC loans, despite its

critical importance to the losses of this high-risk asset class.

This paper fills this hole in the literature by using a unique and proprietary set of loan-level data.

The goal of this paper is to learn about the factors that drive distressed LGD for ADC loans and

to explore the implications for lenders and regulators. We decompose LGD on ADC loans into

components that can inform bankers, investors, and regulators about risk exposures in actionable

ways. We then group the explanatory variables into loan, bank, and market characteristics, and

we examine the sensitivity of LGD to each group. Losses due to poor underwriting or poor bank

management can be mitigated through changes in lending policies and supervisory oversight.

Other factors that are not under direct control of the lender, such as losses tied to changes in

market conditions post-origination, are best addressed by loss reserves or capital requirements.

We analyze LGD for a sample of more than 15,000 loans from over 275 failed banks that were

resolved by the FDIC from 2008 to 2013. Most of these loans were originated during the boom

period in the mid-2000s, defaulted during the Great Recession, and were worked out during and

after the Great Recession. We acknowledge that this sample is hardly random: clearly we are

oversampling bad loans at bad banks during a very bad time.

11

However, we feel that this is

7

Author calculations using Call Report data. From 2008 through 2013, the noncurrent rate for ADC loans peaked at

16.8 percent, single-family peaked at 8.1 percent, and the others (C&I, multifamily, and other CRE) peaked below 5

percent. From 1991 to 1994, ADC loans peaked at 14.1, and the next highest loan type (other CRE) peaked at 5.5

percent. Data are not available for most loan types before 1991.

8

See GAO (2013) and Friend, Glenos, and Nichols (2013) for analysis of the Great Recession. See Fenn and Cole

(2008) and Collier, Forbush, and Nuxoll (2003) for analysis of the 1980 to 1994 crisis.

9

Both Kindleberger (2000) and Reinhart and Rogoff (2011) cite speculation in various forms of construction and

real estate as an underlying cause for many historical financial crises.

10

See, for example, Altman, Resti, and Sironi (2004) and Downs and Xu (2015).

11

We perform a benchmarking exercise in Appendix B, comparing our data against losses on construction loans

from a separate and independent supervisory data collection for large banks. We find differences between the two

samples, but we also find credible explanations for these difference that relate to the composition of the sample

4

precisely the sample one would want to work with to explore the drivers of ADC loan risk. It is

losses on bad loans during bad times that account for the majority of ADC losses at banks and

are the most damaging to the banking industry. And it is the drivers of distressed LGDs that is

what is interesting, as aggregate losses on construction loans during benign periods have

historically been negligible.

One of our key findings is that banks exert no direct control over some factors that heavily

influence distressed LGD. More specifically, we find two factors related to local markets at the

time of default: the share of noncurrent ADC loans held by local lenders when the loan defaults,

and the change in the local ratio of ADC loans to total loans between origination and default.

Higher local noncurrent rates for ADC loans at the time of default are an indication of markets

that are experiencing distress. At the same time, an increase in local ADC lending between

origination and default shows the extent to which other lenders are leaning into the market. If a

local area has both strongly increasing ADC lending and relatively high local noncurrent rates at

the same time, the local market may be unstable or overheating. We would expect to observe

higher losses on loans defaulting in these markets. We believe that the sensitivity of losses for

ADC loans to changes in these local market factors post-origination provides a strong argument

supporting the use of higher capital requirements and lower loan-to-value (LTV) limits than for

less cyclically sensitive loans.

12

We document the importance of market conditions at loan origination as well. The bank’s

decisions regarding when and where to make ADC loans are not exogenous: they reflect a bank’s

ability to properly assess and manage risk based on information available when the lending

decision is made. We find that loans originated in markets with higher proportions of ADC loans

to total loans are associated with higher losses, and loans originated in markets with higher ADC

lending growth in the period leading up to origination also have higher losses. Local markets

with outsized ADC lending exposure and faster ADC loan growth at origination may contribute

to higher losses through multiple channels, such as less experienced lending officers and

builders, weaker loan covenants, and less focus on risk exposures. In highly competitive markets,

lenders are well aware that they can originate loans only if their loan terms and covenants are

competitive. They may pay insufficient attention to increases in the supply of homes and

buildings (including the extent of new inventory that will or may soon arrive), optimistic

construction budgets or real estate appraisals, or environmental or other construction risks. Given

the time delay required to complete construction and the inability to adjust investment quickly, a

risk of oversupply under such conditions may be heightened.

(such as size and geography) and variable definitions, increasing our confidence in the representativeness of the

FDIC loan data.

12

The noncurrent rate for ADC loans, as reported in the Call Report, soared from 0.8 percent as of year-end 2006 to

16.8 percent as of March 31, 2010. The peak rate for ADC loans was more than double the peak rate for other loan

types.

5

We find that loan characteristics also explain a large share of the variation in LGD. Loans for

projects earlier in the development cycle, specifically those to purchase land and develop lots,

had significantly higher losses than loans for the actual construction of either single-family or

commercial buildings (“vertical” construction). This supports tighter capital and LTV guidance

for these loans. We find that smaller loans in our sample also have higher loss rates. The location

of the project matters, with loans outside of the originating bank’s footprint or in a judicial

foreclosure state

13

having higher losses as well. We do not observe a significant difference in

LGD between single-family and commercial construction loans.

We examine several loan-level characteristics based on the observed performance of the

mortgages post-origination. This includes the timing of the default (specifically the age of the

loan at default) and whether the loan defaulted at the expected maturity of the loan (a “maturity

default”). We also include the share of the committed balance that has been drawn at the time of

default and whether the bank allowed the borrower to draw more than what was originally

committed (an “overage”). These loan-level variables at default reflect a combination of

borrower/builder performance and the monitoring function of the lender. From a collateral

perspective, these variables may reflect the extent of progress made in creating collateral value

through construction.

In contrast to market and loan characteristics, bank-level factors seem to explain much less of the

variation in LGD. These include broad measures that are readily comparable across banks, such

as asset size or portfolio growth, which may, for example, reflect institutional differences in

specialization or in how loans are originated or monitored. We find that larger banks tend to

suffer lower losses in default. We also observe that LGD is higher when the bank had high ADC

loan growth leading up to origination and when it spent a longer time in distress before failure.

But overall, the impact of bank-level characteristics on LGD appears much smaller than loan-

level or market-level characteristics.

Our results have important implications to both bankers and regulators. When the demand (or

speculative demand) for new homes and buildings triggers a sustained strong increase in ADC

lending, the conditions for overbuilding—followed by high ADC defaults and high LGD on

defaulted loans—strengthen. Banks would be well served by astute credit risk functions that are

well informed about the risks that ADC loans pose during periods of distress, and how those

risks are exacerbated when the local market experiences a sustained period of new construction

and high levels of competition. While good underwriting and loan monitoring processes within

the originating bank will mitigate losses during periods of distress, the actions of other local

lenders and builders may contribute to oversupply in the market. Bank examiners should look for

evidence that banks understand these risks, have the appropriate levels of loss reserves, actively

13

That is, a state where a court order is required for foreclosures.

6

monitor for potential overbuilding, and do—or stand ready to—pull back their lending or

promptly take other actions to reduce their exposures as risks increase.

The rest of the paper is organized as follows. Because lending related to construction has unique

traits that influence LGD, Section 2 provides institutional background information that informs

our analysis. Section 3 discusses the FDIC Loss Share Administration program and the data used

for our analysis. Section 4 lays out the methodology, Section 5 provides the results, and Section

6 discusses the implications of those results. Section 7 concludes.

2. Institutional Background

Several unique aspects of ADC loans set them apart from other mortgages. The most significant

difference from the perspective of modeling losses is that a large share of the collateral that

backs ADC loans is created during the loan term. There is no cash flow from rents available to

service the debt. There is no rental history upon which to base a valuation, merely a speculative

estimate of value based on market conditions as of the expected completion date. This is a

foundational difference that influences the loan origination and servicing processes, the loan

terms, and the lender’s risk exposure. Section 2.1 begins by explaining the processes involved in

originating and managing these loans and the loan terms. Section 2.2 discusses the lender’s risks

from ADC loans and how they relate to the nature of the collateral, the loan administration

processes, and the loan terms. In both sections, ADC loans are compared with other, more

familiar, types of real estate loans,

14

and relevant academic literature is discussed.

2.1 Loan Processes and Terms

This section begins with a discussion of the typical loan origination process and loan terms,

followed by sections on the collateral valuation at origination, the monitoring process, default,

and the loan workout process.

15

2.1.1 Loan Origination and Loan Terms

Investors frequently form a Limited Liability Corporation (LLC) for each specific project. The

LLC acts as the official borrower, who hires a builder to do the construction; sometimes the

builder is the investor. The investor normally purchases the property and places it in the LLC (if

any), designs the construction project, hires the builders, and completes the entitlement process

16

before origination.

The term to maturity for ADC loans is relatively short, and larger projects usually involve

multiple loans. For example, for a single-family housing development, the borrower might obtain

a land development loan to put in curbs, underground pipes, and electrical service and a separate

14

Specifically, to a typical first lien for a single-family home or commercial real estate loan (CRE) loan.

15

This section is based on anecdotal information from discussions with bankers, examiners, and other experts.

16

That is, the process of obtaining the zoning changes and other regulatory approvals that are required before

construction begins.

7

construction loan to build the houses. Even single construction loans are often structured in

tranches, with the next segment of the committed balance being issued to the borrower only if

certain thresholds are met. For larger office/retail complexes, there may be separate loans or loan

tranches for each phase of development. Many ADC loans include a “permanent” (that is, long-

term) financing phase once construction is complete and other thresholds are met.

17

A large

share of the profits come from fees at origination. The loan structures for other types of

mortgages are more permanent and less complex, with interest income comprising a larger share

of the lender’s profit.

ADC projects rarely produce income for the borrower until construction is complete and the

property is either leased to tenants or sold. Therefore, the loans are normally structured with an

interest reserve with no payments due directly from the borrower until maturity (or, in the case of

single-family developments, as homes are sold). With an interest reserve, the total amount of the

loan includes funds disbursed to the borrower and undisbursed funds that are used to cover

interest expenses during the loan term. This structure contrasts with other types of mortgages,

where regular payments are due throughout the loan term (and which serve as a key measure in

determining default).

The payment stream to the borrower also differs markedly from other mortgages. For single-

family residential (SFR) and commercial real estate (CRE) mortgages, the full loan amount is

normally disbursed at origination. For ADC loans, the loan documents set forth a pre-defined

schedule, where new disbursements are made as various phases of construction (or in some cases

sales or leases) are completed. The requirements for each tranche of the loan to be disbursed are

spelled out in the loan covenants. Disbursements are often relatively modest during the early part

of the loan term.

One other significant difference between ADC loans and other mortgages is the prevalence of

recourse. Lenders frequently require borrowers to provide personal guarantees to back ADC

loans. These guarantees, or recourse, provide some “skin-in-the-game” on the part of the

borrower, if the value of the raw land or partially built project that is pledged as collateral is not

sufficient. Recourse is less frequently used for other types of mortgages, where the equity share

of the existing property pledged as collateral provides the “skin-in-the-game.” Glancy, et al.

(2021) find that recourse in transitional loans (defined as construction and redevelopment loans)

is correlated with unobserved risks, as transitional loans with recourse have higher spreads at

origination and worse performance during the COVID pandemic, however they are looking at

the impact of recourse on default and not recovery rates.

17

For example, for a multifamily loan, a specified share of the apartments might have to be leased.

8

2.1.2 Valuation at Origination

Banks must decide whether to originate an ADC loan based on the potential value of the project,

which is by definition unobserved. Third-party certified appraisers are hired during the loan

approval process and must adhere to well-developed standards that govern estimation methods

and the products they produce.

18

Loan commitments often occur before the appraisal is

complete—and are often conditional on the appraised value—but loan originations always occur

after the appraisal. Appraisals for construction projects are by their nature more speculative than

for existing buildings, where historical rental cash flows are available.

Banks normally request both an “as is” appraised value and one or more “as will be” appraised

value(s). There are two standard “as will be” measures of value. The first, known as “as

stabilized” value, represents the value for the finished project when the appraiser assumes that

the property is already built and leases have stabilized or finished lots or homes have been sold

as of the appraisal date. The second, known as the bulk value, represents a value based on a

discounted cash flow approach when the appraiser develops assumptions about the time needed

for building, the time needed for lease stabilization or asset sale(s), the future value of the

finished project, and then discounted the estimated future value to the appraisal date. Finished

product values are invariably higher, and banks used them more often—and relied on them more

heavily—during boom periods. We expect that, especially when markets are shifting, the

appraisals are significantly less reliable for construction projects than for other real estate.

2.1.3 Loan Monitoring

The monitoring process for ADC loans is much more labor intensive than for other mortgages

and often requires detailed knowledge of construction, the local regulatory approval process, the

loan contract details, the local market, and the title insurance process. Over the term of the loan,

the lender monitors the progress of the construction, including items such as the receipt of

materials, payments to suppliers, progress on the building(s), and associated regulatory

approvals. Based on the status of the construction and the loan covenants, the lender determines

when draws can be made, the size of the allowed draws, whether and how the loan terms should

be adjusted (if construction problems arise or markets shift), and when payments are due.

Adjustments are commonplace as the construction progresses and may arise because of issues

such as changing prices for labor or materials, delays in receiving materials, subcontractor

availability, environmental problems, poor quality construction, or changes in local demand.

2.1.4 Loan Default

The timing of loan default falls into two categories: term defaults and maturity defaults. Maturity

defaults occur when the borrower is unable to sell the collateral at an adequate price, or, for

commercial properties, when the borrower cannot obtain sufficient permanent financing to pay

18

See Appraisal Standards Board (2017) for details.

9

off the ADC loan in full.

19

Because the borrower does not make regular payments, term

defaults

20

are almost always determined by the lender (or in some cases bank examiners); they

are frequently based on an evaluation of the local market conditions and anticipated demand, or

on the borrower being unable to meet performance covenants. This contrasts sharply with other

types of mortgages, where borrowers make regular payments and default is simply determined

by payment delinquency.

21

Because loan default involves judgment on the part of the bank, the

timing may be less consistent across banks for ADC loans.

22

2.1.5 Loan Workout

The workout process for ADC loans is more complex and the lender’s negotiating position is

weaker than in the other types of mortgages, for two reasons. First, the investor’s equity position

is more likely to be deeply negative, especially during a severe crisis.

23

Thus investors may be

unwilling or unable to bring additional capital to the project or monitor the building process.

Second, and more importantly, the builder has considerable scope to influence the outcome and

incentives that rarely align with those of the lender. The construction industry is highly cyclical,

and during distress periods builders are retrenching and desperate for cash to pay staff and fund

operations. With no new construction projects available, builders aggressively seek additional

draws from existing loans to survive. They rarely have any reason to cut back on existing

projects, regardless of whether demand exists for the finished project. All the loan participants

are well aware of the high cost of changing builders in the middle of a project and the significant

discount to market value for an incomplete building, and builders and investors can use that

knowledge at the lender’s expense during negotiations.

2.2 Risks

We now link some of the institutional aspects of ADC lending to specific risks that can help

drive losses. We divide these risks into four separate, but often interrelated, topics: construction

risks, the opacity of ADC loans, the option value of land, and sensitivity to real estate cycles.

Both construction risks and opacity contribute to the higher level of idiosyncratic risk of

construction loans, while the option value of land and the sensitivity to real estate cycles

contribute to the higher level of cyclical risks for ADC loans. We provide a summary of risks in

Appendix A.

19

In some cases, this takes the form of being unable to meet the lender’s requirements for a conversion to permanent

financing (that is a conversion to a CRE loan).

20

Term defaults occur before the maturity of the loan. We define maturity defaults as defaults that occur within 90

days of maturity or after maturity. All other defaults are term defaults.

21

In some cases, lenders may place CRE loans into nonaccrual status even when payments are current, because the

value of the collateral has dropped and the lender no longer expects full repayment of the loan at maturity. This is

common in the commercial mortgage-backed securities (CMBS) market, where the master servicer will transfer

such a loan to the special servicer to begin the loan workout process even if the loan is still current.

22

However, banks have some scope to restructure other types of troubled loans in ways that minimize reported

defaults, known as “evergreening.” This type of restructuring is less likely to occur for single-family mortgages

because most of them have standard terms.

23

In some cases, solvency may be uncertain or positive but the investor is illiquid.

10

2.2.1 Construction Risks

Cost overruns for construction projects are commonplace. Problems often begin with the budget

itself, which may suffer from optimism bias, inadequate feasibility analysis, omissions of

required items, or simplistic assumptions that do not adequately consider risks or entrepreneurial

profit. Other problems can include bad weather; delays in the availability of subcontractors, staff,

materials, or government inspectors; design changes and scope creep; cost increases for labor or

materials; unexpected underground conditions and other environmental problems; inexperienced

builders; or foul play and corruption.

24

The potential for these challenges to arise results in the

need for ongoing, and costly, monitoring of ADC loans by the lender.

2.2.2 Opacity

As discussed in Section 2.1, the lending function for ADC loans involves more complicated

terms and conditions than for other types of mortgages. The loan monitoring process is more

complex, and determining whether the loan is in default is more ambiguous. The loan workout

process is more likely to depend on stakeholders with incentives that differ markedly from the

lender. Loan guarantees are used more frequently, and the value of these guarantees are not

readily discernable. The appraisal process requires more estimation that introduces more

opportunities for error, and the construction process involves numerous potential pitfalls that are

not immediately obvious. Taken as a whole, these characteristics support a conclusion that ADC

loans are more opaque than other mortgage types. This opacity explains why there is no

standardized underwriting process and why banks usually retain ADC loans in their portfolios. It

also may magnify the scope for lender myopia or overconfidence.

2.2.3 Option Value of Land

A wide range of research exists on the option value of land, from Quigg (1993) to Munneke and

Womack (2020). The underlying theory is that all land, both developed and undeveloped, is

valued based on its highest and best use. Geltner et al. (2014) documented how the highest and

best use may change over time in response to changes in the local market and demand for space.

Property whose highest and best use was as a farm may instead now have a highest and best use

as single-family residences. Once the option value of developing the land (or redeveloping it to

change the property type) reaches a certain threshold, the project becomes viable and can acquire

investment and financing.

One aspect of the option value of land that is relevant to thinking about potential loss on

construction loans is the limited reversibility of investment. When the project starts, the highest

and best use might be single-family residential. However, once the project reaches completion,

the highest and best use may have shifted due to market developments and is now retail. The

24

See Ahiaga-Dagbui and Smith (2014) for additional discussion.

11

physical aspects of the project are difficult to reverse: for example, the street plan for a housing

development would not serve an office park.

But zoning restrictions can often be even more difficult to reverse. Before loan origination,

builders must obtain local approvals to construct the building(s) and, for single-family

developments, break the property into separate lots for future sale, which is often time-

consuming and politically challenging. This process can add substantial value to the project: on a

per-acre basis, the value of timberland or farmland is often a fraction of the value of the same

acreage (in the same condition and location) that has been approved for homes or a retail

shopping center. But it also represents a stickiness in terms of optimal land use. For example, if

agricultural land had been re-zoned as residential, it could be costly—or politically impossible—

to transition it to another higher best use. The option value of the land is “spent” once the project

has begun. A shift in demand during a project’s lifetime could lead to higher losses on the ADC

loan.

2.2.4 Sensitivity to Real Estate Cycles

LGD for ADC loans is far more sensitive to real estate price changes than other types of

mortgages, for several reasons. First, substantial time elapses between the date the lender

commits to the loan and completion of the construction. This lag is caused by the time to build,

which is often longer than the original estimate because of time lost to address supply problems

and subcontractor schedules, longer-than expected regulatory approvals (such as demolition,

environmental impact, various stages of construction, and sometimes zoning), and investor and

lender decisions associated with change requests, and lender inspections and approvals for

draws. Major market shifts can occur between the loan commitment date and the completion of

construction.

25

The potential for losses relating to the time delay between origination and

completion is compounded by two additional factors: (a) strong incentives for builders to

continue building during periods of distress regardless of the declining value of the finished

product, and (b) potential weaknesses in appraisals, such as reliance on “as stabilized”

valuations.

Second, most construction projects end with empty buildings, and the borrower’s ability to repay

the loan is generally contingent on finding buyers or tenants for the finished product.

26

Relocation costs, and the transaction costs for purchasing real estate, are substantial and may

hinder sales or leases. Relatively few ADC loans are backed by owner-occupied buildings or

projects with significant levels of pre-leasing or pre-sale contracts in place at the time of loan

commitment. During periods of serious distress, pre-leasing and pre-sale agreements can fall

25

See Grenadier (1995) and Wheaton (1999) for additional discussion. Both authors cite this time lapse as a

contributing factor to real estate cycles.

26

Or, for horizontal construction, approval of a new loan for the next phase of construction.

12

through. On the other hand, many commercial leases are long-term. These phenomena mitigate

losses for other types of residential and commercial mortgages but amplify the sensitivity to

business cycles for ADC loans.

27

Third, while all loan types are affected by heightened competition during boom periods, ADC

loans tend to be more strongly affected. ADC loan growth was much stronger than other loan

types during the boom before the Great Recession: from year-end 2003 to year-end 2007, ADC

loans held by banks increased 131 percent, but other types of mortgages held by banks increased

45 percent.

28

Lenders with a stronger appetite for growth—and thus a higher willingness to take

on risk—gravitated to ADC loans, most likely because it was easier for them to gain market

share.

29

For example, as of year-end 2007, the median ratio of ADC loans to total loans held by

de novo banks was 17 percent; the ratio was only 5 percent for banks that were ten years old or

older and had the strongest CAMELS composite rating.

30

During boom periods, lenders may feel

pressure to grow quickly, and the benefits of monitoring (including tight loan covenants)

diminish while the costs remain constant.

31

In addition, the average experience levels of lending

officers and builders declines. New builders are more likely to make mistakes, both in the cost

estimation process and the construction itself. New lending officers have less knowledge of and

skill in all aspects of the loan origination process, and they lack memories of the high costs

associated with real estate downturns. Lusht and Leidenberger (1979) found empirical evidence

that both builder and lending officer experience reduced the probability of default for

construction loans; there is good reason to expect the same for LGD.

32

3. Data

This section introduces the FDIC Loss Share Administration data that are the primary data used

in the paper. We then discuss the construction of our LGD measure, including a decomposition

of the loss into different components. The decomposition supports the comparison of our LGDs

with those from other sources that may contain different components. We then provide a range of

27

See Grenadier (1995) for additional discussion.

28

Percentages derived from bank Call Reports. See Rajan (1994) for additional discussion and evidence that

heightened competition results in looser bank lending policies (such as relaxed underwriting criteria and less

stringent monitoring).

29

According to bank Call Reports, as of year-end 2006 (at the height of the boom), de novo banks, banks with high

loan growth rates, and banks that relied heavily on brokered deposits all had higher concentrations of ADC loans

and higher ADC loan growth rates than other banks. Yom (2005) discusses the incentives for de novo banks to grow

quickly.

30

Data from bank Call Reports and examinations. De novo is defined as eight years old or younger. For the second

group, only banks with a CAMELS composite rating of 1 are included in the calculation. CAMELS ratings are

supervisory designations of bank condition and range from 1 (very strong) to 5 (very weak).

31

At least as long as the boom continues. See Rajan (1994) and Levitin and Wachter (2013) for evidence and

discussion on pressure for earnings and asset growth during boom times. See Ruckes (2004) for an analysis of the

net benefit of loan monitoring across the cycle.

32

There is substantial evidence of the same phenomenon for lending more generally. See, for example, Berger and

Udell (2003) and Rötheli (2012).

13

descriptive statistics about our loss data, both overall and across different regions and property

types.

33

We end with a brief discussion of potential concerns about our data.

3.1 FDIC Loss Share Administration Data

In this study, we use LGD data from banks that failed and were resolved by the FDIC in the

aftermath of the 2008 financial crisis. Loan portfolios held by failed banks oversample the upper

end of the credit loss distribution of ADC loans, and they should incur higher default rates than

portfolios at healthy banks. The nature of this sample selection works to our benefit. A signi-

ficant driver of losses to a bank will depend on the performance of the worst-performing loans in

their portfolio. A lending institution’s solvency is not dependent on the performance of the

median loan, but by the performance and losses in the upper tail of the credit loss distribution.

34

The FDIC has a loss share program to help dispose of assets from failed banks. From 2008

through 2013, the FDIC sold $39 billion in ADC loans from 289 failed banks to 144 bank

acquirers with loss share coverage. Most of the FDIC loss share agreements provided the

acquirers with 80 percent indemnification from credit losses for five years for assets covered

under the agreement (thus acquirers would absorb just 20 percent of the losses).

35

To manage its

risk exposure and support program administration, the FDIC collected information from the

failed banks as of the sale date (that is, the date the bank failed) and through detailed quarterly

reporting requirements from the acquiring banks after the sale date. Note that when we refer to

bank characteristics in this paper, we are referring to the characteristics of the failed bank that

originated the loan and not the acquiring bank that serviced the loan. The dataset contains data

from the inception of the program in 2008 through year-end 2015.

36

One of the unique aspects of the loss share program data is its detail on the components of the

losses. As we discuss further in Section 3.2, most existing LGD data in the literature do not have

this level of detail. Loss share LGD components include

• Charge-offs (net of recoveries);

• Loss on sale of asset (loan or other real estate owned (ORE));

• Expenses (legal fees, foreclosure expenses, appraisals, property maintenance costs, etc.)

paid to third parties related to the asset, except servicing fees; and

• Up to 90 days of accrued interest.

33

Given that the loan level data we use are by definition drawn from failed banks, Appendix B provides a

benchmarking exercise with a separate and independent set of data on defaulted construction loans from the Federal

Reserve’s FR Y-14Q Schedule H.2.

34

Compared with surviving banks, failed banks had higher ratios of ADC loan exposure to capital and higher loan

default rates during the Great Recession. This does not necessarily mean that they had higher LGDs. We tested

whether the individual bank’s loan default rate influenced LGD for our sample, and we found that the relationship

between LGD and the bank’s default rate was insignificant in most specifications.

35

For an additional three years, the acquirer was required to continue reporting all losses and recoveries, and to

continue to share recoveries (net of certain collection expenses) with the FDIC. However, most of the loss share

transactions were terminated shortly before or after the full indemnification period ended.

36

As of year-end 2015, either the loss share agreements had been terminated or the loss-sharing period had expired

for 243 of the 289 agreements. Only $860 million (2 percent) of the ADC loan portfolio was still active.

14

For loans foreclosed under the loss share program, the FDIC was entitled to share in any income

earned from the collateral. Losses from bulk loan sales were covered by the FDIC, but only if the

acquirer could demonstrate that a bulk loan sale was more cost-effective than loan-level (or

borrower-level) workout strategies. Therefore, bulk loan sales were rare.

The loans in our sample were originated by banks that failed. When the originating bank failed,

the loan underwent an ownership change during the loan term or workout period. This is not a

random sample of all defaulted ADC loans in the United States during the relevant time horizon.

To address concerns that our sample may not be representative of defaulted ADC loans at

privately held banks, we note that almost all of these loans were originated when the originating

banks were healthy and when there was substantial industry-wide growth in ADC loans. In

addition, Shibut and Singer (2015) compared LGD using similar data for commercial real estate

(CRE) loans backed by completed buildings from the FDIC’s loss share program to LGDs

reported in studies that relied on public sources (i.e., not failed banks). After presenting results

from multiple studies, they concluded that “the LGDs in this sample are generally consistent

with other studies that focus on periods of distress.”

37

We also compare our sample to a group of

distressed ADC loans at large banks and conclude that the FDIC data seem consistent with the

Y-14 data in several ways (see Appendix B).

We considered the possibility that the FDIC indemnification under the loss share program might

weaken the incentives of acquirers to work out assets effectively when compared with assets that

lack indemnification coverage. The FDIC took several actions to mitigate the potential effects.

First, it required that acquirers work out covered assets in the same way that they work out their

own assets. Second, it required regular standardized reporting, adequate workpapers, and

evidence that the loans were worked out effectively. Third, it reviewed loss claims and

performed on-site compliance reviews at least once a year. The FDIC had the right to demand

program improvements, reverse loss claims or, in the case of a serious contract breach, abrogate

the loss share coverage altogether.

38

These factors help mitigate any bias due to the incentive

created by the loss sharing agreement.

We drop loans from the sample for several reasons. Loans are dropped if the asset had not yet

been extinguished (that is, the asset is sold, paid off, or written off in full) when the loss share

37

Shibut and Singer (2015), p. 11, with additional discussion on p. 10. The authors note that close comparisons are

not available, but they include LGDs calculated from defaulted commercial mortgage-backed securities and CRE

loans held by life insurance companies.

38

These are just some of the FDIC’s options to manage its exposure. Acquirers have the right to contest any FDIC

action. For more details about the loss share program, see www.fdic.gov

. All agreements are posted in the failed

bank section. See also FDIC (2010) for details about the data collected from acquirers and FDIC Office of Inspector

General (2013) for additional discussion about the FDIC’s monitoring program and its effectiveness.

15

agreement was terminated or at the end of sample period (right-censoring),

39

or because of data

problems associated with loans that defaulted before the bank failed. Loans that defaulted well

before failure are omitted from the sample.

40

Loans are also dropped if they are from a U.S.

territory (primarily Puerto Rico) or a foreign country, if they had very small outstanding loan

balances at default ($100 or less), or because of other missing data.

41

3.2 Key Definitions

Our definition of LGD is based on a combination of the guidance on LGD for the Basel 2

Advanced Approach models and data availability. The definition is as follows:

= ( − + )/

EAD is the exposure at default, defined as the total drawn and undrawn balance committed on

the loan at the time of default; REC is the discounted net principal recovery on the loan; EXP are

the discounted expenses consisting of legal fees, foreclosure expenses, appraisal fees, property

preservation costs, property taxes, and so on, plus up to 90 days of accrued interest at the time of

default. Acquirers do not report all the cash inflows under the loss share program, but they report

principal losses and expenses. Therefore, we back out the discounted principal recovery REC as

the exposure at default EAD minus charge-offs CO (net of recoveries) and any loss on sale of the

asset LOSALE, all discounted as of the default date at the interest rate on the loan: =

− − .

42

Like many studies, our definition excludes two items that are included

in the definition in the Basel 2 framework: servicing costs

43

and unpaid fee income. To guard

39

The notion of “resolution bias” suggests defaulted loans that are extinguished quickly tend to have lower losses,

so an exclusion of longer workouts outside our sample period would tend to bias LGD downward. However, failed

bank acquirers had strong incentives to complete the workout for defaulted loans before the loss share coverage

terminated, particularly for defaults with larger anticipated losses. We therefore do not believe that resolution bias is

likely to be an issue in our sample.

40

Some banks retain data on charge-offs in their loan servicing system for only a year after charge-offs are taken.

Thus, loans that defaulted more than a year before failure are omitted because we are uncertain that the historical

charge-off information is complete.

41

Specifically, observations were also dropped if (a) the asset type was uncertain, (b) there were math errors in the

acquirer’s loss submissions or the FDIC’s corrections of those submissions, (c) the ADC loan was combined with

other types of loans during the workout process, or; (d) data for explanatory variables (or data needed to calculate

explanatory variables, such as location of the collateral) were missing or incoherent. Also, note that some items were

estimated, notably the type of collateral and stage of development (which were estimated using heuristic methods

applied to relevant text data fields).

42

The Basel 2 framework requires discounting to the default date using a market rate. There is no strong consensus

on the appropriate interest rate, but the loan rate is frequently used. See Maclachlan (2004) for additional discussion

and a survey of discounting methods used in academic research on loan losses.

43

The Financial Crisis Inquiry Commission noted that a special servicer that handles problem loans “typically earns

a management fee of 25 to 50 basis points on the outstanding principal balance of a loan in default as well as 75

basis points to one percent of the new recovery of funds.” See Financial Crisis Inquiry Commission (2010), p 44.

The Commission

discussed servicing arrangements for loans that collateralize CMBSs. Servicing costs for

construction loans might be different.

16

against potential reporting errors, we winsorize observed LGD in our sample at the 99

th

percentile.

A key aspect of any LGD definition is how defaults are measured. In our study, we define

default as occurring the first time that we observe any of the following:

• The loan became 90 days or more delinquent,

• The loan was placed in non-accrual status,

• The loan was classified as being in foreclosure or bankruptcy, or

• A charge-off was taken on the loan, or any claim was made under the loss share program.

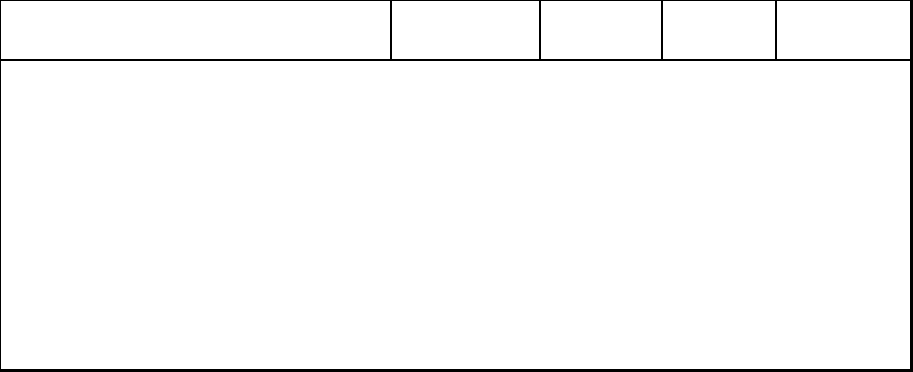

Figure 2 shows our sample distribution of LGD. Only 16 percent of the defaulted loans avoid

losses altogether, and 15 percent have losses of 100 percent or more. Had we constrained LGD to

be no higher than 100 percent, Figure 2 would look similar to the “U” shape seen in many

studies of realized losses.

44

We observe in our sample many loans with losses exceeding 100

percent. LDGs above 100 percent typically occur when expenses are significant and principal

recoveries are small. Such loans tend to be small (median EAD of $87,000, versus $260,000 for

the others), are more likely to be foreclosed (56 percent, versus 44 percent for the others), and

have longer workout periods (median of 11 quarters, versus 7 quarters for the others).

Figure 2: Sample Distribution of LGD

One contribution of our paper is that it uses a detailed measure of LGD that captures nearly the

full range of costs a lender would incur in resolving a defaulted ADC loan. Many studies of

losses on CRE mortgages are limited in their data on the composition of losses, and are limited to

comparing market price reactions to default announcements for CMBS securities or the

subsequent sales price of the property to loan exposure at default. We show in Figure 3 the

decomposition of LGD across different buckets of LGD losses. This breakdown shows how

expenses, the top (dark blue) segment in each column, account for a significant share of total

losses across the loss distribution. For loans with very small positive LGDs, expenses comprise

44

See Araten et al. (2004) and Asarnow and Edwards (1995) for examples of realized loss distributions.

0

1000

2000

3000 4000

Frequency

0 .5 1 1.5

LGD

17

more than 20 percent of losses. Charge-offs (COs) occasionally reflect the impact of successful

downstream recoveries. In some cases, they even offset some of the losses from expenses and

discounting, which is noticeable in the negative values for owned real estate charge-offs (ORE

COs) in the first three bars of Figure 3. For the segment with losses greater than 100 percent, the

share of expenses is approximately 17 percent of the total losses, highlighting the importance of

using loss measures that include expenses. The share of losses associated with charge-offs after

the bank has assumed ownership of the property—the ORE COs—increases as losses approach

and exceed 100 percent. ORE COs represents another 15 percent of the total losses for high LGD

loans in our sample, indicating that a significant portion of the total loss is being recognized later

in the workout process. LGD estimates that do not consider expenses related to assets in default,

or subsequent charge-offs for ORE assets, later in the workout are likely to underestimate the

extent of true losses incurred.

Figure 3: Decomposition of Net Losses by LGD Category

3.3 Descriptive Statistics

This section begins with basic descriptive statistics across the full sample. We then provide

additional detail on key variables and a breakdown of the sample based on geography and type of

collateral.

3.3.1 Full sample characteristics

As shown in Figure 4a, most of our loan originations occurred between 2005 and 2010, with 25

percent occurring in 2007 and 63 percent occurring between 2006 and 2008.

45

One interesting

aspect of the origination dates is that it includes a non-trivial share of construction loans

originated during the financial crisis, when overall construction lending dropped significantly.

Most defaults occurred between 2009 and 2011, with 33 percent in 2009, 29 percent in 2010, and

15 percent in 2011. This is clearly a sample of loans that defaulted during a period of severe

45

Observations where either the origination date or the default date are missing are excluded.

-20%

0%

20%

40%

60%

80%

100%

10

20 30 40

50 60 70 80

90 100 130

LGD Category *

Expenses

Discounting

Loss on Sale

Net ORE COs

Net Loan COs

* 10 includes 1% < LGD =< 10%, 20 includes 10% < LGD =< 20%, etc. CO stands for charge-offs, net

of recoveries.

Source: FDIC

loss share and failed bank data.

18

distress, which is exactly when losses on construction loans are of greatest concern for lenders

and the broader economy.

Figure 4b shows the distribution of the term to maturity at origination. The mean term to

maturity is 4 years, and the mean age at default is 3.2 years.

46

In addition, 60 percent of the loans

are maturity defaults.

47

Assuming the project has progressed as expected, a default occurring at

maturity would suggest that a bank would have a complete or nearly complete project to seize as

collateral, instead of a partially complete project with greatly reduced value.

Figure 4a: Distribution of Origination and Default Date Figure 4b: Distribution of Term to Maturity

Figure 5 reports the distribution by asset size. The distribution is strongly skewed, with a large

number of smaller assets that relate to construction of individual single-family properties, and is

not dominated by large construction loans for single-family developments or large commercial

projects. This is due in part to the nature of the crisis itself, which was strongly associated with a

boom-bust cycle in single-family lending. It is also due in part to the nature of failed banks,

many of which were smaller institutions specializing in smaller single-family and commercial

construction projects rather than larger residential or commercial developments. It is possible, for

example, that the experience of builders or the structure of financing for those large-scale

projects could differ in certain ways from most of the defaulted loans in our sample. Our results

from this crisis should be interpreted with this in mind.

46

The average length of the loan is significantly longer than the time it takes to complete a single residential unit,

which is 7.8 months. The difference between the loan term and typical construction period reflects the additional

time built into the loan for preparation before vertical construction, the construction of multiple buildings financed

by the same loan, the construction of buildings with more than a single unit (where the average time to build is 17.4

months), and time required to sell the completed properties.

47

A maturity default is defined as a default that occurs within 90 days of the scheduled maturity or after maturity.

19

Figure 5: Sample Distribution of Asset Size

Table 1 reports descriptive statistics for the full sample. The first section of the table provides

data on the characteristics of the loans. The mean LGD is 56.7 percent, and the median is 62.4

percent. Defaulted loans with a positive loss for the lender make up 84.4 percent of the sample,

while 15.6 percent of the defaults resolve with no loss. As shown in Figure 5, the distribution of

the size of the loans is heavily skewed: although the mean exposure at default is $1.06 million,

the median is only $230,000. The median interest rate is 6 percent. And as mentioned previously,

the mean term to maturity at origination is four years, and the median is three years. The mean

age of the loan at default is about three years, and 60 percent are maturity defaults. About 37

percent of the sample was already in default when the originating bank failed, and 46 percent of

the loans were foreclosed during the workout period. The mean workout period is 25 months,

and it varies substantially across the sample. The legal process for foreclosure influences the

ability of lenders to seize assets and may be relevant to explain loan loss, so we look at whether

loans are in judicial foreclosure states (41 percent).

48

Construction lending is also an

informationally intensive business, where knowledge of local market conditions are important,

so we track whether loans are made outside of Core-Based Statistical Areas (CBSAs) in which

the originating bank has a branch presence (“out-of-territory”). About 25 percent of the loans

were made based on collateral located outside of the lender’s CBSA footprint; these are not

distributed evenly across regions or banks. For 9 percent of the loans, the outstanding loan

balance exceeded the initial loan amount at some point during the loss share period (thus

indicating that the acquiring bank authorized additional funds to minimize losses).

48

In judicial foreclosure states, foreclosure requires a court order.

20

Table 1: Descriptive Statistics for the Sample

The next section of the table looks at the characteristics of the banks in our sample. Growth in

the originating banks’ ADC portfolios was strong during the period leading up to origination: on

average, it was 36 percent in the previous year and 167 percent in the previous three years. The

mean CAMELS rating at origination is 2.49, and the median is 2. The mean size of the failed

banks at origination is $3.4 billion, and the median is somewhat less than $1 billion. We also

track the time the originating bank spends in distress (defined as having a CAMELS composite

rating of 4 or 5). If a bank is closed shortly after it begins to experience distress, then the loans

are more quickly transferred to a healthier institution, which may result in lower losses. In our

sample, the average time spent by the originating bank in distress is just over 1.5 years.

Variable

No. of

Obs

10th

Percentile

Median

90th

Percentile

Mean

Standard

Deviation

Basel LGD based on discounted loss share cash flows 19,427 0 0.624 1.015 0.567 0.383

1 if basel LGD has a nonzero loss 19,427 0 1 1 0.844 0.363

Loan Characteristics

Outstanding balance at default ($1,000) 19,427 31 230 2,658 1,056 2,598

Interest Rate 19,427 4.0 6.0 8.5 6.3 2.3

Term to maturity (years) 18,658 1.0 3.0 7.0 4.0 3.84

Age at default (years) 18,780 0.93 2.82 5.69 3.17 2.12

Maturity default* 18,661 0 1 1 0.60 0.49

In default when the bank failed 18,639 0 0 1 0.37 0.48

Foreclosed 19,427 0 0 1 0.46 0.50

Workout period (months) 19,427 3.5 23.5 50.4 25.3 17.9

Ratio of balance drawn to total exposure ** 19,427 1 1 1 0.95 0.14

Land development loan 9,286 0 1 1 0.89 0.32

Judicial foreclosure state 18,493 0 0 1 0.42 0.49

Out of territory loan (CBSA) 17,775 0 0 1 0.25 0.43

Overage (Asset bal > init exposure at any time) 19,427 0 0 0 0.09 0.29

Bank Characteristics

Bank 3-yr ADC loan growth rate at loan origination 19,427

0

1.25 4.00 1.67 1.42

CAMELS rating at origination 18,549 2 2 4 2.49 1.05

Asset size of failed bank at loan origination ($ millions) +

18,714 3,389 6,574

Failed bank time spent in distress (years) 19,427 0.45 1.18 2.10 1.27 0.66

Market Characteristics

Local ratio of ADC to total lending at origination 18,487 0.063 0.117 0.190 0.123 0.051

Local NC rate for ADC loans at origination 18,481 0.002 0.013 0.153 0.048 0.064

Local 3-yr change in ADC to total lending at origination 18,481 -0.026 0.025 0.075 0.024 0.042

Local 3-yr change in brokered to total deposits at orig 18,481 -0.020 0.022 0.058 0.020 0.041

One year pct point chg in SFR permits/total stock at orig 18,472 -0.004 -0.002 0.001 -0.002 0.002

Local average vacancy rate for CRE at orig 18,449 0.056 0.081 0.106 0.081 0.020

Local change in ADC to total lending (orig to def) 16,287 -0.090 -0.032 0.004 -0.037 0.038

Local NC rate for ADC loans at default 18,501 0.084 0.168 0.223 0.162 0.057

Change in local ratio of NC ADC to total loans 18,481 0.012 0.119 0.205 0.114 0.076

* Default was within 90 days of scheduled maturity or after maturity

** Capped at 100%

+ Percentile items omitted for privacy reasons

NC stands for noncurrent (including nonaccrual). SFR stands for single family residential.

21

A key focus of our paper is the degree to which local market characteristics can explain ADC

loan loss rates. The last section of Table 1 reports several market-level measures calculated from

the balance sheets of all banks with branches located in the CBSA where the loan’s collateral

resides. These measures are meant to reflect the general climate of ADC lending with respect to

other local lenders competing in that market space. Geographic allocations for loans from local

banks are based on CBSA-level branch shares as reported in the FDIC Summary of Deposits

(SOD).

Our sample is heavily weighted toward markets that experienced significant construction lending

growth. The average local ratio of ADC loans to total loans at origination is 12 percent, and the

average percentage point increase in this ratio over the three years before loan origination was 2

percent.

49

Interestingly, a significant share of the loans—22 percent— was originated when the

three-year change in the ratio of ADC loans to total loans was declining.

50

These loans also were

originated in areas where banks were aggressively seeking new sources of deposits, with the

ratio of brokered to total deposits increasing 2 percentage points, on average, during the three

years before loan origination. We interpret these local lending measures as a proxy for how

aggressive the competition may be from other local banks in the market and as a reflection of

local supply conditions.

We look at other measures of market conditions that relate new ADC lending to existing stock.

We use the one-year regional change in single-family permits to total stock at origination, which

averages -0.2 percent. A negative value is a forward-looking indication that growth in single-

family stock is slowing, while a positive value is a forward-looking indication that single-family

stock is increasing. A higher positive value at origination reflects markets in which the supply of

single-family housing is increasing more dramatically. The slower adjustment of construction

sector investment (arising from the time required to build) could exacerbate the mismatch

between demand and supply if demand decreases sharply post-origination, contributing to higher

losses in default. We also include the local vacancy rate by commercial property type at

origination, which averages 8.1 percent.

51

These rates show how much supply exists in the

market relative to demand for finished commercial properties when the loan is made. ADC loan

originations where vacancy rates are already high may be a sign of lenders originating into

markets with a lower capacity for future absorption when construction is complete, increasing

the losses in default should there be a negative shock to demand.

49

For context, contrast levels and changes of ADC lending for the Atlanta and Boston CBSAs during the period

leading up to the crisis. In Atlanta, the peak ratio of ADC loans to total loans was 19.3 percent; in Boston, it was 4.9

percent. In Atlanta, the average three-year percentage point increase in that ratio exceeded 3 percentage points from

March 2005 to September 2008, with a maximum of nine percentage points in March 2007; in Boston, it never

reached two percentage points.

50

About 40 percent of the loans were originated when the one-year percentage point change in ADC loans to total

loans was negative.

51

State-level data were used for loans outside a CBSA designation.

22

We also look at what happens in the local market between origination of the loan and default.

These variables relate to the risk ADC lenders face that local market conditions may change after

originating the loan and before construction is complete. The average change in the ratio of ADC

loans to total loans from origination to default is -3.7 percentage points. A decline in this ratio

indicates that lenders may be reducing exposures because they recognize markets are shifting

and they are adapting their lending volume to that risk. On the other hand, when this ratio is

increasing dramatically between the time of loan origination and default, there is a greater

chance that default is occurring in an overzealous or glutted market, and recoveries may suffer as

a result. Therefore, we expect higher losses in our sample if this measure is increasing between

origination and default. This variable differs from our inclusion of the local three-year change in

ADC lending to total lending in the lead up to origination in terms of when the information is

available to lenders. The three-year percentage point change in ADC lending before origination

could be considered part of the lender’s available information set when the loan is made.

However, the change in ADC lending between origination and default is a measure of the change

in ADC lending after loan origination, and would not be observable to lenders at origination.

While the former variable is tied to the extent to which lenders are managing their risk exposure

from excessive market growth, the latter highlights the risk faced by lenders in fast-growing

markets after origination, before the property may be completed and sold. We also look at the

ratio of noncurrent ADC loans to total loans at the time of default to get a sense of distress in the

local market. If a large share of local projects are in distress when the loan defaults, we expect

that the value of the collateral for a defaulted loan will be lower and the losses will be higher.

3.3.2 Segmented sample characteristics

We take a deeper dive into the data by looking at the sample segmented across different regions

and property types. Figure 6 provides a map of loan location counts by state, and Table 2

provides a breakdown of the sample by collateral type and location.

52

The sample is not highly

concentrated by bank. The largest bank (in terms of sample size) held 10.8 percent of the loans;

the top five held 24.7 percent.

52

We also report separately loans where, due to data quality issues, we could not identify the type of project.

23

Figure 6: Sample Location by State

Table 2: Sample Breakout by Collateral Location and Type

The sample is heavily concentrated both in the South and in loans collateralized by single-family

properties. Loans from the South comprise 61 percent of the sample, whereas those from the

Northeast comprise a mere 2 percent. At 28 percent of the sample, Georgia is the most heavily

represented, even though it accounted for only 3 percent of the U.S. population in 2007.

53

Several factors contribute to this feature of the sample. First, at the onset of the crisis, FDIC-

insured banks headquartered in the South were more heavily invested in ADC loans: as of year-

end 2007, institutions headquartered in the South held 40 percent of the total balance of ADC

53

FDIC loss share data and Census data.

Land/Dev Home Unknown

Multi-

family

Retail

Other/

Unknown

By State

Georgia 5,106 27.6% 1,704 463 1,263 67% 30 55 386 9% 1,205 24%

Florida 3,552 19.2% 1,911 54 529 70% 52 37 237 9% 732 21%

Illinois 1,490 8.1% 183 55 194 29% 353 31 276 44% 398 27%

California 1,226 6.6% 229 78 344 53% 140 45 84 22% 306 25%

Washington 986 5.3% 418 68 99 59% 63 33 51 15% 254 26%

All Other 6,140 33.2% 2,041 306 1,600 64% 137 180 473 13% 1,403 23%

By Region*

Northeast and Midwest 3,603 19.5% 691 155 722 44% 435 166 511 31% 923 26%

South 11,273 60.9% 4,568 611 2,585 69% 116 105 807 9% 2,481 22%

West 3,624

19.6%

1,227 258

722

61% 224

110

189 14% 894

25%

Total 18,500 100.0% 6,486 1,024 4,029 62% 775 381 1,507 14% 4,298 23%

Pct of Total 35% 6% 22% 4% 2% 8% 23%

No. of Obs

Pct of

Total for

Location

No. of

Obs

Pct of

Total for

Location

* The Northeast region is made up of Connecticut, Delaware, Massachusetts, Maine, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, and

Vermont; the Midwest region is made up of Iowa, North Dakota, South Dakota, Illinois, Indiana, Michigan, Minnesota, Missouri, Nebraska, Ohio, Wisconsin, Kansas,

Oklahoma, and Texas; the South Region is made up of Alabama, Arkansas, Florida, Georgia, Kentucky, Louisiana, Maryland, Mississippi, North Carolina, South

Carolina, Tennessee, Virginia, District of Columbia, and West Virginia; the West region is made up of Arizona, California, Colorado, Idaho, Montana, New Mexico,

Nevada, Oregon, Utah, Washington, Wyoming, Alaska, and Hawaii. Northeast and Midwest regions are combined for privacy reasons.

Full Sample

Collateral Type

No. of

Obs

Pct of

Total

Sample

Single Family

Commercial

Unknown

No. of Obs

Pct of

Total for

Location

24

loans but only 28 percent of industry assets.

54

Second, institutions from the South and the West

failed and were resolved using the loss share program more often (South, 6.6 percent; West, 6.8

percent), whereas only 1.9 percent of banks in the Midwest and 0.9 percent of banks in the

Northeast failed and were placed into the loss share program.

55

In total, 47 percent of the banks

placed under the FDIC’s loss share program were headquartered in the South, 28 percent in the

Midwest, 22 percent in the West, and 3 percent in the Northeast. Moreover, the failed banks in

the Northeast had lower concentrations of ADC loans than those in other regions, and those in

the South had the highest concentrations.

56

Table 3 reports loan, bank, and market characteristics by region. Mean LGD is highest in the

South: 61 percent, versus 48 percent to 50 percent for the other regions. Loan sizes are much

smaller in the South, with a median value ($177,000) less than half that of loans in other regions

($326,000 to $500,000). The difference in loan size may reflect the higher share of loans in the

South that are collateralized by single-family properties. In most regions, maturity defaults

account for roughly 60 percent of all defaults, but in the Northeast they account for only 47

percent. However, the average draw rates suggest most of these projects drew almost all of their

committed balances even if they defaulted before maturity. Median interest rates on the loans are

slightly higher in the Midwest and West. Few states in the West are judicial foreclosure states,

while most states in the Northeast are. The share of loans where the asset balance at some point

exceeded the original committed balance is fairly consistent across regions, with a slightly higher

frequency observed in the South and the West.

There are strong regional patterns associated with out-of-territory lending by banks in our

sample. Loans collateralized by properties in the Midwest were the least likely to be out-of-

territory (13 percent), where there were a significant number of local bank failures but no boom

preceding the crisis. A strikingly large share of the loans in the Northeast were out-of-territory

(77 percent). There could be several reasons for this difference. First, there was no significant

real estate boom or bust there in the Northeast, and few local ADC lenders from that region

failed; thus, in our sample, lenders with loans in the Northeast tended to have higher shares of

out-of-territory loans than average. Second, construction may be more heavily constrained in the

Northeast because of zoning or less availability of suitable land for new development.

The originating failed banks in all four regions of our sample had high ADC loan growth at

origination, especially in the Northeast and West. When the sample loans were originated, the

54

Call Report data.

55

FDIC failure and Call Report data.

Failure rates are calculated as total failures placed under the loss share program

from 2008 through 2013 divided by total number of institutions as of year-end 2007. Puerto Rico banks had even

higher failure rates than what is reported for any of the regions reported here, but Puerto Rico is omitted because

loans from Puerto Rico are excluded from the sample.

56

Call Reports as of the quarter immediately before failure. The mean ADC concentrations were 13.2 percent for the

Northeast, 18.1 percent for the Midwest, 21.2 percent for the West, and 23.2 percent for the South.

25

Table 3: Sample Breakout by Region

lenders’ mean three-year ADC loan growth rate ranges from 146 percent in the South to 194

percent in the Northeast. All these rates exceed total industry growth: the industry’s peak three-

year growth rate for ADC loans during this period was 108 percent.

57

Banks that originated loans in the South were larger than in the other regions, with average assets

of $3.8 billion compared with $2.3 billion in the Northeast and $2.7 billion in the West and

Midwest. Banks that originated loans in the West spent the shortest average time in distress, just

over a year on average, while banks in the Midwest were in distress for 1.4 years on average.

The geographical pattern of loans in our sample reflects the conventional wisdom that