Washington Apple Health (Medicaid)

ProviderOne

billing and

resource guide

June 2024

2 | PROVIDERONE BILLING AND RESOURCE GUIDE

Table of contents

About this guide ................................................................................................................................ 6

Current updates ............................................................................................................................. 6

Introduction ......................................................................................................................................... 7

Purpose ............................................................................................................................................. 7

Guide topics .................................................................................................................................... 8

Apple Health (Medicaid) overview ............................................................................................ 9

Apple Health ................................................................................................................................... 9

Washington Apple Health clients .......................................................................................... 9

Apple Health comparison ...................................................................................................... 10

Apple Health compared to Medicare ............................................................................... 10

Apple Health clients identified ............................................................................................ 10

Apple Health clients as consumers of healthcare services ..................................... 11

Provider enrollment ...................................................................................................................... 12

Benefits for enrolled providers ............................................................................................ 12

Enrolling as an Apple Health provider ............................................................................. 12

Requirements to enroll ........................................................................................................... 12

Eligible provider types ............................................................................................................. 13

Providers required to enroll .................................................................................................. 13

Provider enrollment policies................................................................................................. 13

Policies regarding documentation and paper claims ................................................ 14

Out-of-state bordering cities ............................................................................................... 14

Resources ...................................................................................................................................... 15

Important contacts.................................................................................................................... 18

Eligibility, Benefit Service Packages, and service limits ................................................ 19

Getting paid for eligible Apple Health services ........................................................... 19

Verifying Apple Health coverage ....................................................................................... 19

Verifying primary payer and program type ................................................................... 23

Client with managed care ...................................................................................................... 25

Integrated managed care ....................................................................................................... 25

Health Home program ............................................................................................................ 26

Behavioral health services ..................................................................................................... 27

State-only programs ................................................................................................................ 27

Primary Care Case Management (PCCM) ....................................................................... 27

Clients with Medicare .............................................................................................................. 28

Commercial insurance, Medicare Part C/D, or military benefits .......................... 28

3 | PROVIDERONE BILLING AND RESOURCE GUIDE

Restricted client information ................................................................................................ 31

Hospice services ......................................................................................................................... 31

Developmental Disabilities Administration (DDA) ..................................................... 32

Children with Special Health Care Needs (CSHCN).................................................... 32

Medicaid suspension ................................................................................................................ 32

Benefit Service Package .......................................................................................................... 33

Spenddown ................................................................................................................................... 33

Spenddown FAQ ........................................................................................................................ 33

Medical records for clients in Foster Care ...................................................................... 34

Covered services and prior authorization....................................................................... 38

Procedure codes and fee schedules .................................................................................. 39

Covered procedures ................................................................................................................. 39

Prior authorization requirement ......................................................................................... 40

Claim payments – professional services .......................................................................... 41

Claim payments – institutional services .......................................................................... 42

Claim payments – inpatient hospital services ............................................................... 42

Provider preventable conditions (PPCs) .......................................................................... 42

Client service limits ................................................................................................................... 44

Submitting fee for service claims ............................................................................................ 48

Timely and accurate payments ............................................................................................ 48

Claim submission method ..................................................................................................... 49

Claim backup ............................................................................................................................... 49

Submitting new claims and backup .................................................................................. 51

Direct Data Entry (DDE) .......................................................................................................... 52

Submitting backup for a DDE claim .................................................................................. 58

Submitting backup through a clearinghouse ............................................................... 61

Resolving DDE claim errors ................................................................................................... 61

Entering commercial insurance information ................................................................. 62

Saving a DDE claim ................................................................................................................... 64

Submitting online batch claims .......................................................................................... 65

Special Claim Indicators (SCI)............................................................................................... 66

Submitting Medicare crossover claims ............................................................................ 67

Overview of Medicare crossover process ....................................................................... 68

Medicare Part B professional services .............................................................................. 69

Part B only (no Part A), or Part A exhausted prior to stay ...................................... 70

Medicare begins during hospital stay, or Part A exhausts during stay............. 71

Medicare Advantage plans (Part C) ................................................................................... 72

4 | PROVIDERONE BILLING AND RESOURCE GUIDE

QMB – Medicare Only clients ............................................................................................... 74

Claim status .................................................................................................................................. 76

Timeliness ...................................................................................................................................... 77

Adjusting, resubmitting, or voiding a claim .................................................................. 77

Adjusting or Voiding DDE claims ....................................................................................... 80

Resubmitting denied or voided DDE claims .................................................................. 82

Claim templates .......................................................................................................................... 83

Submitting a template claim or batch of template claims ..................................... 86

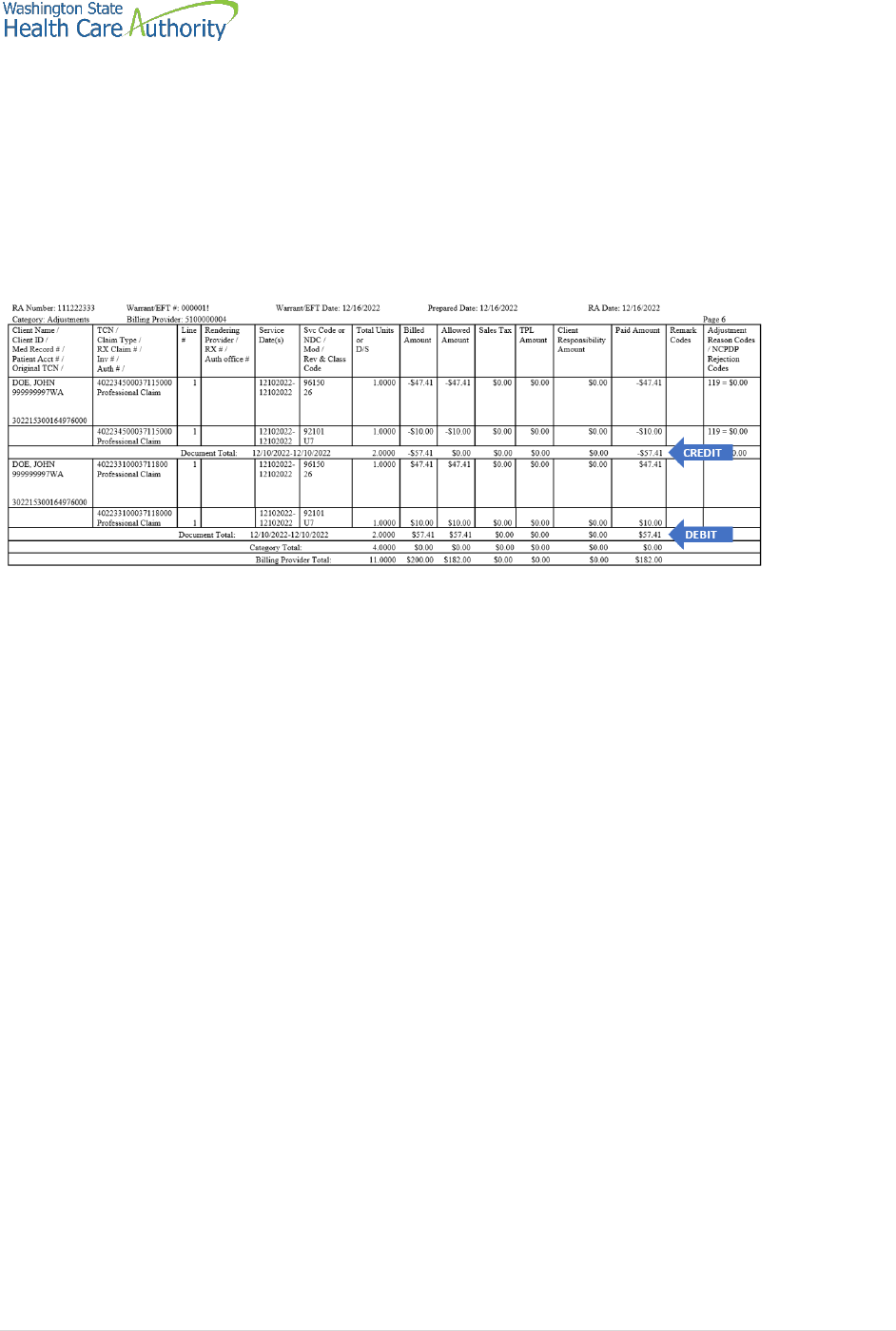

The remittance advice .................................................................................................................. 89

Understanding claim status .................................................................................................. 89

Retrieving the RA ....................................................................................................................... 89

Adjustment types ....................................................................................................................... 91

Reviewing paid claims ............................................................................................................. 95

Reviewing denied claims ........................................................................................................ 96

Reviewing adjusted claims .................................................................................................... 97

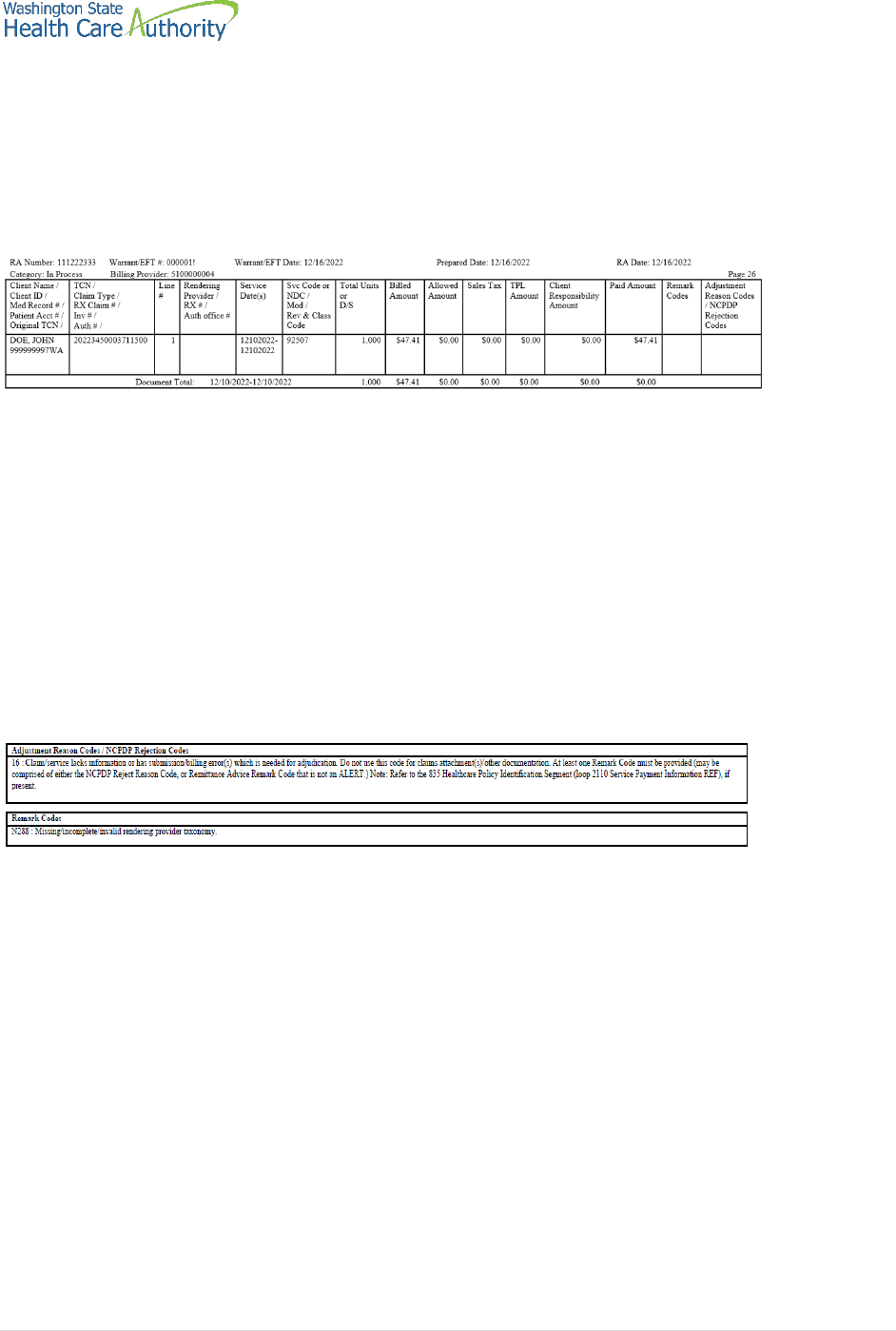

Reviewing in process claims ................................................................................................. 98

Reviewing EOB codes ............................................................................................................... 98

Requesting prior authorization ................................................................................................ 99

The authorization intake process ....................................................................................... 99

DDE prior authorization intake process ........................................................................ 100

General Information for Authorization form, HCA 13-835 ................................... 100

Submitting backup for DDE authorizations ................................................................. 100

Submitting backup for faxed authorizations (no x-rays) ...................................... 101

Checking PA status ................................................................................................................. 101

Additional documentation requests ............................................................................... 102

Cover sheet tips ........................................................................................................................ 103

For more information ............................................................................................................ 103

Appendix A: Verify eligibility with IVR................................................................................ 105

Appendix B: Verify eligibility with magnetic card readers ........................................ 106

Appendix C: Managed care organizations ........................................................................ 107

Appendix D: Casualty and health insurance claims ...................................................... 108

Appendix E: Benefit service packages ................................................................................. 109

ACES program codes .............................................................................................................. 112

Appendix F: Prior authorization process ........................................................................... 118

Appendix G: Authorization status using the IVR ........................................................... 119

Checking authorization status using Interactive Voice Response (IVR) ......... 119

Checking authorization status using ProviderOne ................................................... 120

5 | PROVIDERONE BILLING AND RESOURCE GUIDE

Appendix H: Cover sheets for backup documentation ............................................... 122

Appendix I: Taxonomy and ProviderOne .......................................................................... 124

Appendix J: Medicare crossover claim payment methodology .............................. 125

Professional services .............................................................................................................. 125

Institutional services ............................................................................................................... 126

Appendix K: Checking claim status using the IVR ......................................................... 127

Appendix L: Checking warrants using the IVR ................................................................ 129

6 | PROVIDERONE BILLING AND RESOURCE GUIDE

About this guide

This guide supersedes all previously published agency ProviderOne Billing and

Resource Guides.

Current updates

Reason for change

Page number

Subject

Change

New program

addition – Appendix

E

109, 112, and

115

Apple Health

Expansion (AHE)

AHE description

addition and 2 new

ACES program

codes

HCA accepts only electronic claims for Apple Health (Medicaid) services, except

under limited circumstances. Providers may seek approval to submit paper claims

if they are in a temporary or long-term situation outside of their control that

precludes submission of claims electronically. Go to the ProviderOne Billing and

Resource Guide webpage and go to paperless billing at HCA for more

information.

7 | PROVIDERONE BILLING AND RESOURCE GUIDE

Introduction

This guide provides a step-by-step resource to help providers and billing staff

understand the processes of ensuring clients are eligible for services and to

receive timely and accurate payments for covered services.

Disclaimer

A contract, known as the Core Provider Agreement (CPA), governs the

relationship between HCA and Apple Health (Medicaid) providers. The CPA’s

terms and conditions incorporate federal laws, rules and regulations, state law,

agency rules and regulations, and agency program policies, provider notices, and

provider guides, including this guide. Providers must submit a claim in

accordance with agency rules, policies, provider notices, and provider billing

guides in effect for the date of service.

HCA does not assume responsibility for informing providers of national coding

rules. ProviderOne will deny claims billed in conflict with national coding rules.

Consult the appropriate coding resources.

Purpose

This guide serves as a resource for providers and billing staff whose duties are to:

• Maintain provider records.

• Schedule client appointments or check in patients on the day they receive

services.

• Submit fee for service (FFS) claims to HCA.

• Post and reconcile payments.

This guide assumes familiarity with standard medical billing practices and coding.

Note: This guide does not include billing information for the

pharmacy point-of-sale (POS) system. See the Pharmacy

information webpage for more information on the POS system

or see the Prescription Drug Program provider guide for more

information. DSHS social service billers should refer to the

ProviderOne for social services webpage for training resources.

8 | PROVIDERONE BILLING AND RESOURCE GUIDE

Guide topics

This guide consists of the following six sections:

Apple Health (Medicaid) overview

This section explains the Apple Health (Medicaid) programs provided by HCA,

how Apple Health compares to other payers, how Medicaid differs from

Medicare, how to identify Apple Health clients, the ProviderOne services card,

requirements for becoming an Apple Health provider, and links to important

policy documents and resources.

Provider enrollment

This section is for general information about becoming an Apple Health provider.

Visit the Enroll as a provider webpage for more information.

Client eligibility, Benefit Service Packages, and coverage limits

This section explains how to determine if a client is eligible for Apple Health

(Medicaid) services using ProviderOne, if the service you plan to deliver is

covered under their Benefit Service Package (BSP), and when prior authorization

is needed.

This section also explains how to determine if a client:

• Has enrolled in a managed care plan.

• Has any restriction to a select number of health care providers.

• Has a spenddown balance that may affect eligibility.

Submitting fee for service (FFS) claims

This section prepares you to submit fee for service claims using the ProviderOne

Direct Data Entry (DDE) feature, submit electronic backup documentation, check

on the progress of a claim, and process Medicare crossover claims. This section

also outlines how to resolve errors, submit adjustments, resubmit denied claims,

or void a paid claim.

The Remittance Advice (RA)

This section explains how to obtain your Remittance Advice (RA), determine

which claims were paid or denied, review claims still in process, and determine

the reason for a claim denial.

Requesting prior authorization

This section explains how to determine if a procedure requires authorization and

what steps are needed to complete that process.

9 | PROVIDERONE BILLING AND RESOURCE GUIDE

Apple Health (Medicaid) overview

Apple Health

Medical assistance is the general name for Washington Apple Health programs

administered by the Health Care Authority (HCA).

Washington Apple Health includes Medicaid, mental health programs, chemical

dependency and prevention treatment programs, the Children’s Health Insurance

Program (CHIP), family planning programs, and other state-funded children’s

healthcare programs. Medicaid is the federal entitlement program financed and

operated jointly by the states and the federal government.

HCA provides healthcare coverage for low-income residents who meet certain

eligibility requirements. Examples of these requirements include age, pregnancy,

disability, and blindness. Special rules exist for those living in a nursing home or

for those who receive home and community-based services.

Clients receive healthcare services either through enrollment in a managed care

program or on a fee for service basis. For managed care, the agency contracts

with licensed health insurance carriers to provide a defined set of services to

enrolled members. Fee for service care is delivered by licensed or certified health

care providers who have a contract with the agency and receive payment through

ProviderOne.

Washington Apple Health clients

Washington’s Apple Health programs provide healthcare coverage for our most

vulnerable residents. Approximately 1.5 million Washington residents, nearly two-

thirds of them children, depend on Apple Health (Medicaid) programs for their

healthcare.

Apple Health covers one in three children living in Washington State including:

• Children enrolled in foster care.

• Children of working parents unable to afford health care coverage.

• Disabled children

Other clients also include:

• Nursing home residents

• Elderly or disabled individuals

• Low-income pregnant women

The Health Benefit Exchange (HBE), the HCA Medical Eligibility Determination

Services (MEDS), as well as the Department of Social and Health Services

determine eligibility for medical assistance depending on the client’s

circumstances.

10 | PROVIDERONE BILLING AND RESOURCE GUIDE

Apple Health comparison

Washington State has several programs dedicated to providing healthcare

coverage to low-income residents. Washington Apple Health is the largest single

source for this coverage. However, some Apple Health programs have limited

benefits compared to commercial carriers. See Appendix E for more details.

In many ways, Apple Health is like other payers. There are some distinct

differences between Apple Health and commercial insurance plans and Medicare.

These differences include:

Specific rules a contracted provider must follow regarding billing a client. See

WAC 182-502-0160 and form 13-879 for details.

Apple Health is almost always the payer of last resort, which means Medicare and

commercial private insurance companies are billed first. For more information on

general conditions of payment see WAC 182-502-0100.

Apple Health compared to Medicare

Apple Health and Medicare are very different programs. Medicare is an

entitlement program funded entirely at the federal level. It is a health insurance

program for people 65 or older, people 65 and younger with certain disabilities,

and people of all ages with end stage renal disease.

The Medicare Program provides:

• Medicare Part A, which covers inpatient hospital services.

• Medicare Part B, which covers professional, and vendor services.

• Medicare Part C, which is a managed care version of Medicare, also called a

Medicare Advantage Plan, and offered through private insurance companies.

• Medicare Part D, which covers prescription drugs.

Apple Health (Medicaid) is a needs-based program with eligibility determined by

income and covers a wider range of healthcare services than Medicare (i.e.,

dental). Some individuals are eligible for both Medicaid and Medicare. These

clients are referred to as “dual-eligible” clients.

For more information on Medicare, you can find extensive material at the Centers

for Medicare and Medicaid Services (CMS) website.

Apple Health clients identified

Each Apple Health client receives a plastic services card. The services card is

permanent, and each eligible family member receives a separate card with a

client identifier assigned for each client. The card contains only the following

information about the client:

• First name

• Last name

• ProviderOne client identification number (9 digits followed by WA)

• Date card was issued.

Using the ProviderOne client ID displayed on the front of the card is one way to

access a client’s eligibility information. The card also features a magnetic strip on

11 | PROVIDERONE BILLING AND RESOURCE GUIDE

the back and providers may use a magnetic swipe card reader to obtain the most

current eligibility information. There are many other ways to verify a client’s

eligibility if you do not have access to the client’s services card. See the eligibility,

benefit service packages, and coverage limits section for more information.

Example of a services card:

Apple Health clients as consumers of healthcare

services

The agency encourages Medicaid clients to be responsible consumers of

healthcare services. New clients receive information to use when obtaining

services that cover topics such as:

• Verifying if a provider is contracted to bill Apple Health before obtaining

services from a doctor, dentist, clinic, pharmacy, or other provider. Non-

contracted providers can bill clients directly.

• How to help the healthcare provider by bringing the services card to all

appointments. Clients should always carry the services card with them in case

of emergencies.

• Being courteous about appointments and call their provider’s office if an

appointment will be missed.

• Informing their provider if they have commercial or other medical insurance

besides Apple Health.

12 | PROVIDERONE BILLING AND RESOURCE GUIDE

Provider enrollment

Benefits for enrolled providers

Some benefits for Apple Health providers include:

• ProviderOne pays claims promptly when billed according to agency rules and

regulations.

• Providers may determine how many Apple Health patients to allow according

to their business needs.

• ProviderOne offers Electronic Funds Transfer (EFT) payments as a convenience.

• Enhanced payments are available for dental providers who provide Access to

Baby and Child Dentistry (ABCD) services.

• The satisfaction that Washington’s most vulnerable population is receiving

healthcare services.

Enrolling as an Apple Health provider

You can enroll as an Apple Health provider using the electronic enrollment

option in the ProviderOne system. See the Enroll as a provider webpage for more

information.

For enrollment questions contact the Provider Enrollment office at 1-800-562-

3022, extension 16137.

Requirements to enroll

To enroll as a provider with the agency, a healthcare professional, healthcare

entity, supplier or contractor of a service must, on the date of application:

• Be licensed, certified, accredited, or registered according to Washington State

laws and rules.

• Meet the conditions in Chapter 182-502 WAC and other chapters regulating

the specific type of provider, program, and/or service.

• To enroll, an eligible provider must sign a Core Provider Agreement (CPA)

with the agency according to WAC 182-502-0005.

• Enrollment of a provider applicant is effective no earlier than the date of

approval of the provider application.

• The agency does not pay for services provided to clients during the core

provider agreement (CPA) application process, regardless of whether the CPA

is later approved or denied.

Note: There is an application fee for institutional provider

enrollment applications. This fee does not apply to providers

enrolled with Apple Health prior to June 1, 2016. The provider

enrollment application fee is only required for provider types in

the institutional setting. Providers that are required to pay the

application fee will receive notification of the cost by mail.

13 | PROVIDERONE BILLING AND RESOURCE GUIDE

For additional information about federal and state regulations

related to the provider enrollment application fee, see 42 CFR

455, Subpart E, 42 CFR 455.460 and WAC 182-502-0010 (k).

For questions related to the enrollment application fee, email

providerenrollment@hca.wa.gov or call 800-562-3022 and use

extension 16137.

Eligible provider types

There are specific rules on who may enroll:

• All performing providers of services to an Apple Health client must be

enrolled under the billing provider’s CPA.

• The agency does not enroll licensed or unlicensed practitioners not specifically

addressed in WAC 182-502-0002, and ineligible providers as listed in WAC

182-502-0003.

• For a list of providers who are eligible to enroll with Apple Health, see WAC

182-502-0002.

• All dental servicing providers must be enrolled in ProviderOne under the

dental billing provider NPI (effective July 1, 2014).

Providers required to enroll

See 42 CFR 455.410:

• Any referring, ordering, or prescribing provider must be enrolled with HCA as

a fee for service provider.

• The National Provider Identifier (NPI) number of any referring, ordering, or

prescribing provider must be listed on any claims for services, supplies, tests,

etc. ordered, referred, or prescribed by that provider.

• To comply with the National Uniform Billing Committee (NUBC) guidelines all

NPI numbers of attending, operating, and “other” providers must be reported

on institutional claims.

• All providers reported on the institutional claim must be enrolled as a

Washington State Medicaid Provider.

Provider enrollment policies

Specific policies regarding provider enrollment include:

• You must notify HCA in writing within seven calendar days of ownership or

control changes of any kind (see WAC 182-502-0018).

• You may voluntarily terminate your provider agreement by contacting

Provider Enrollment at ProviderEnrollm[email protected] (see WAC 182-502-

0040).

• In some situations, the agency may immediately terminate your

enrollment/CPA (see WAC 182-502-0030).

• There are a few exceptions to the enrollment effective date (see WAC 182-

502-0005).

14 | PROVIDERONE BILLING AND RESOURCE GUIDE

• See the full text of Chapter 182-502 WAC for additional provider enrollment

information.

• To continue to provide services for eligible clients and be paid for services, a

provider must:

o Provide all services without discriminating on the grounds of race, creed,

color, age, sex, sexual orientation, religion, national origin, marital status,

the presence of any sensory, mental, or physical handicap, or the use of a

trained dog guide or service animal by a person with a disability.

o Provide all services according to federal and state laws and rules, Medicaid

agency billing instructions, numbered memoranda issued by the agency,

and other written directives from the agency.

o See the full text of Chapter 182-502-0016 for additional detail on these

requirements.

Policies regarding documentation and paper claims

Specific policies regarding documentation and paper claims include:

• The complete list of Healthcare Record Requirements can be found in WAC

182-502-0020.

• Charts and records must be available to the agency, its contractors or

designees, and the US Department of Health and Human Services upon

request for six years from the date of service, or longer if required specifically

by federal or state law regulation.

• As of October 1, 2016, the agency will only accept electronic claims for Apple

Health (Medicaid) services, except under limited circumstances. Providers may

seek approval to submit paper claims if they are in a temporary or long-term

situation outside of their control that precludes submission of claims

electronically. See the ProviderOne Billing and Resource Guide webpage for

more information.

Out-of-state bordering cities

WAC 182-501-0175

All eligible Washington residents may receive medical care in a recognized out-

of-state bordering city on the same basis as in-state care. The only Washington

recognized bordering cities are:

• Idaho: Coeur d’Alene, Lewiston, Priest River, Moscow, and Sandpoint

• Oregon: Astoria, Hermiston, Hood River, Milton-Freewater, Portland, Rainier,

and The Dalles

Note: Washington Apple Health does not cover services

provided outside Washington under the Involuntary Treatment

Act (ITA) (Chapter 71.05 RCW and Chapter 388-865 WAC),

including designated bordering cities.

15 | PROVIDERONE BILLING AND RESOURCE GUIDE

Out-of-state providers must have a contract with HCA for payment of out-of-

state emergency services and may request retroactive enrollment when

necessary.

For nonemergency services, use the Out of State Medical Services Request form,

HCA 13-787.

Resources

Topic

Contact or link

Where can I find provider guides

that explain program-specific

billing guidelines, coverage, and

limitations?

See the Provider billing guides and fee

schedules webpage.

Where can I find fee schedules?

See the Provider billing guides and fee

schedules webpage.

Where can I find hospital rates?

See the Hospital reimbursement webpage.

Who do I contact if I have

questions about payments,

denials, general questions

regarding claims processing, or

managed care plans?

The Medical Assistance Customer Service

Center (MACSC) provider line is available

Monday through Friday 7 a.m. to 4:30 p.m.

daily (claims line open 8 a.m. – noon, closed

noon – 1:30 p.m., and open 1:30 to 3:30 p.m.).

The interactive voice response (IVR) phone

system is available 24 hours a day, 7 days a

week.

• 1-800-562-3022

• Email MACSC using the Contact Us link.

Note: Providers may use HCA's toll free lines

for questions regarding its programs;

however, HCA's response is based solely on

the information provided to the

representative at the time of the call or

inquiry, and in no way exempts a provider

from following the rules and regulations that

govern HCA's programs (see Chapter 182-502

WAC).

Where can I get information

about becoming an Apple

Health provider, submitting a

change of address, submitting a

change of ownership, or to ask

questions about the status of an

application?

See the Enroll as a provider webpage.

Provider enrollment hours are 7 a.m. to 4:30

p.m. (closed noon to 1 p.m.) Tuesday and

Thursday.

Closed Mondays, Wednesdays, and Fridays.

• 1-800-562-3022 ext. 16137

• Fax: 360-725-2144

16 | PROVIDERONE BILLING AND RESOURCE GUIDE

Topic

Contact or link

• Email providerenrollme[email protected]

Where can I find information

about HCA’s current rule making

activity?

See HCA’s Rulemaking webpage.

Where do I find all Washington

Administrative Codes (WAC)?

See the Washington Administrative Code

(WAC) webpage.

What is the Apple Health web

address?

See the Washington Apple Health (Medicaid)

coverage webpage.

Where can I find the Washington

State Confidentiality Toolkit for

Providers?

See the Toolkit and webpage announcement.

Where can I ask questions about

private insurance or third-party

liability?

For private insurance claims, submit a Contact

us email. Choose Medical Provider and use

Private Commercial Insurance on the Select

Topic dropdown.

For casualty-related claims or third-party

liability, call the toll free number at 1-800-

562-3022 M – F from 8 a.m. – 4:30 p.m.

Where do I ask questions about

nonemergency transportation

services?

HCA provides access to nonemergency

transportation services for clients who need

help with transportation to and from their

healthcare appointments.

For more information, see the Transportation

services (nonemergency) webpage or email

HCA Transportation.

Where do I ask questions about

interpreter services?

For spoken language access providers (LAP),

register through Universal Language. Visit the

spoken language access provider webpage for

more details.

For sign language interpretation, visit the sign

language interpretation webpage for more

details.

E-mail: HCA Interpreter Services

Where do I obtain HCA’s forms?

See HCA’s forms and publications webpage.

Where can I find locations of

DSHS Community Service Offices

(CSO)?

For more information, see the Online

Community Services Office (CSO) webpage on

the DSHS website.

17 | PROVIDERONE BILLING AND RESOURCE GUIDE

Topic

Contact or link

Where do I find locations of

DSHS Home and Community

Services (HCS)?

For more information, see the Home and

Community Services Information for

Professionals webpage on the DSHS website.

How do I find out what is

included in the nursing facility

per diem or general rate?

Contact the DSHS Aging and Long Term

Support Administration (ALTSA) website or

call 1-800-422-3263.

How do I request authorization?

Visit the Prior authorization webpage for

complete step by step instructions on

entering prior authorization requests through

the direct data entry feature of ProviderOne.

Call 1-800-562-3022 using an extension listed

below:

• Durable medical equipment and supplies,

prosthetics and orthotics, and oxygen:

15466

• Dental: 15468

• Pharmacy: 15483

• Medical – Surgical: 52018

• All other medical services/enteral nutrition:

15471

See the program specific billing guide located

on the provider billing guides and fee

schedules webpage for information on

requesting authorization. See Appendix F for

instructions on completing the General

Authorization Request form, HCA 13-835.

• Authorization forms can only be sent by

fax to 1-866-668-1214

If you are faxing supporting documentation

without the original authorization request

form, a cover sheet is required. See Appendix

H for more information on cover sheets.

Where can I access provider

training materials?

See the ProviderOne resources webpage.

How do I submit backup

documentation for electronic

claims?

Heath Care Authority

RE: Cover sheets and backup documentation

PO Box 45535

Olympia, WA 98504-5535

Backup documentation must include a cover

sheet as the first page and can be faxed to 1-

866-668-1214.

See Appendix H for more information on

cover sheets.

18 | PROVIDERONE BILLING AND RESOURCE GUIDE

Important contacts

Section

Contact

Disability Insurance

1-800-562-6074

Fraud Hotline

1-833-794-2345

Home Health/Plan of Treatment

1-360-586-1471

Foster Care

1-800-562-3022 ext. 15480

Hospice Notification

1-360-725-1965 (fax only)

Medical Eligibility Determination

Services (MEDS)

1-800-562-3022

Medicare Unit Fax Line

1-360-664-2186

Patient Review and Coordination

1-800-562-3022 ext. 15606

TAKE CHARGE questions

1-800-562-3022

Telecommunication Relay Services

(TRS)

711

Managed care plan managers

HIPAA help desk

19 | PROVIDERONE BILLING AND RESOURCE GUIDE

Eligibility, Benefit Service Packages, and

service limits

Getting paid for eligible Apple Health services

HCA denies many claims because the client was not eligible for Apple Health on

the date of service. To prevent billing denials, always check the client’s eligibility

and confirm plan enrollment prior to providing any services. Checking eligibility

and coverage takes less time and effort than resolving a denied claim.

Some procedures may require the satisfaction of certain conditions before

reimbursement for a service, such as determining whether a service requires prior

authorization. Researching these requirements before providing a service will

help prevent denied claims.

If the service is not covered and the client chooses to receive and pay for a

specific service, providers may be able to bill the client. See the billing a client

WAC 182-502-0160 and Agreement to Pay for Healthcare Services form 13-879

for rules on billing a client. For training materials on this topic, see our webinars

page.

This section shows how to determine:

• If the client has Apple Health.

• If a service is covered under the client’s Benefit Service Package.

• If the client is enrolled in a managed care plan or if they are fee for service.

• If a client has commercial insurance as their primary payer.

• When prior authorization is required.

• When and if a waiver can be used to bill a client.

• If the client has a spenddown balance that may affect eligibility.

• Any special limitations or restrictions.

• If the client has reached their maximum for services with limitations.

Disclaimer

A contract, known as the Core Provider Agreement (CPA), governs the

relationship between HCA and Washington Apple Health providers. The CPA’s

terms and conditions incorporate federal laws, rules and regulations, state law,

HCA’s rules and regulations, and HCA’s program policies, provider notices, and

provider guides, including this guide. Providers must submit a claim in

accordance with HCA’s rules, policies, provider notices, and provider guides in

effect at the time they provided the service.

Verifying Apple Health coverage

It is your responsibility to verify whether the client has Apple Health coverage for

the date of service, and if so, to check the limitations of the client’s medical

program. Verification helps prevent providing a service that the agency will not

pay for. When making an appointment for a client it is important to check

20 | PROVIDERONE BILLING AND RESOURCE GUIDE

eligibility to determine if the client needs interpreter services for the

appointment.

There are many methods to check client eligibility. Most of these methods involve

using the ProviderOne system. Use ProviderOne to submit an eligibility inquiry

using one of these methods:

• Search for eligibility information using ProviderOne.

• Submit an electronic individual or batch 270/271 inquiry to ProviderOne.

• Swipe the client services card using a magnetic card reader (see Appendix B).

• Use a medical eligibility vendor to access information on your behalf (see

Appendix B).

• Call the interactive ProviderOne voice response (IVR) (see Appendix A).

• Submit a request through the Contact Us email link.

• If the client’s appointment is within 48 hours, call a customer service

representative at 1-800-562-3022.

To search for eligibility information in ProviderOne, log into ProviderOne and

select the EXT Provider Eligibility Checker or EXT Provider Super User profile to

verify client’s eligibility for Apple Health (Medicaid):

Select the Benefit Inquiry hyperlink from the provider portal home page menu:

Search by any one of the many combinations available. The inquiry start date will

default to the current date. When searching for other dates of service, make sure

to enter only the current date or previous dates as ProviderOne cannot search

21 | PROVIDERONE BILLING AND RESOURCE GUIDE

future eligibility. Information displayed is only valid for the inquiry start and end

date. A client’s eligibility segment may change if a different date of service is

used. The maximum date span for an eligibility inquiry is 2 years.

Note: If you aren’t sure how to spell the client’s name,

ProviderOne allows a client eligibility search by using the first 5

letters of the last name and the first 3 letters of the first name.

However, if using the name search feature, the date of birth or

SSN is required.

If your search was successful, the system then displays the selection criteria you

entered, followed by the demographic information. If the demographic

information is blank, review the System Response Information to see why

ProviderOne could not find the client.

Basic client detail is returned including client ID, gender, and DOB. The eligibility

information can be printed out using the Printer Friendly Version link in blue.

22 | PROVIDERONE BILLING AND RESOURCE GUIDE

Below the Client Demographic Information, successful client searches will display

the Client Eligibility Spans with detail on what kind of coverage the client has

during the date span you searched:

Each column is described below:

• Insurance type code – the type of coverage for the client

• Recipient aid category (RAC)

• Name of Benefit service package (BSP) acronym

• Eligibility start date - start date for this eligibility segment.

• Eligibility end date - if there is no end date, ProviderOne defaults to

12/31/2999.

• Review end date - the date a client may terminate if they don’t renew their

coverage (renewal notices are sent the month before). If there is no end date,

it does not apply to their coverage type.

• ACES coverage group - code assigned when eligibility is determined.

• ACES case number – case number assigned to client.

• Retro eligibility - this reflects the three calendar months before the month

the client applied for services (WAC 182-502-0150).

• Delayed certification - in some cases the determination of eligibility is

delayed. If approved, the delayed certification date will be displayed in this

location. The agency can accept claims up to one year past this date (WAC

182-502-0150).

Note: Some providers may need to use the Recipient aid

category (RAC) for specific billing purposes or to further

determine a client’s eligibility in a program. Please reference the

applicable program specific provider guide for further details.

If the eligibility inquiry is unsuccessful, the system will display an error message

under system response information:

23 | PROVIDERONE BILLING AND RESOURCE GUIDE

Note: If your search returns an error, check how you entered the

information and correct as needed.

Pitfalls:

• Relying on eligibility information obtained before the date of service. HCA

recommends that providers always verify eligibility the day the service occurs.

• Failing to verify the identity of the cardholder. Apple Health coverage is not

transferable. If you suspect that a client has presented a services card

belonging to someone else, request to see a photo ID or another form of

identification.

Verifying primary payer and program type

Apple Health is almost always the payer of last resort (for exceptions, see WAC

182-502-0100). The agency will not pay claims as primary if there is another payer

(such as Medicare or commercial insurance). Most Apple Health clients will be in

a managed care plan where the agency pays a monthly premium to that plan for

the client’s medical needs. If there is no managed care segment on the client’s

file, they are considered fee for service clients and all billing will be submitted

directly to ProviderOne, or through the agency’s pharmacy POS (point of sale)

system for prescription benefits.

Note: Effective for claims with dates of service on and after

January 1, 2017, the Health Care Authority changed the process

for managing Apple Health (Medicaid) benefits for clients with

other primary health insurance. See the Apple Health Medicaid

provider alert dated 11/16/2016 10:09 AM PST.

• Providers billing for fee for service clients with a private commercial insurance,

bill ProviderOne as secondary.

• Providers do not have to be part of the client’s MCO network to bill for

secondary coverage. However, to bill the client’s MCO, providers must follow

the MCO’s billing requirements.

24 | PROVIDERONE BILLING AND RESOURCE GUIDE

• After billing a client’s primary health insurance for a covered service, providers

must then bill the MCO or the MCO’s pharmacy benefit manager (PBM) to

coordinate benefits for copays, deductibles, or other remaining balances.

Providers must not bill copays, deductibles, or other remaining balances to

the client.

• If a provider bills the client’s MCO as a secondary payer, the MCO does not

require prior authorization. However, if the client’s primary health insurance

does not cover the service, the provider must follow the Apple Health MCO

requirements, including prior authorization if necessary.

To avoid turning away an individual at check-in, determine the client’s primary

payer when making an appointment. Some of the reasons a provider might turn

clients away include:

• The provider does not accept their managed care plan.

• The provider is not an enrolled Medicare provider.

• The provider is not an enrolled provider with their commercial private

insurance.

Client eligibility may change over time, and the primary payer may change as

well. For example, a client may enroll in an Apple Health managed care plan.

Nursing home providers must review the Institutional Award Letter. The award

letter explains client income and participation amount, medical care eligibility,

effective date for care, care level, and other information.

This does not apply to clients with Alternative benefits plan (ABP) benefits, as this

population has nursing home coverage without cost sharing, so the institutional

award letter is unnecessary.

All other providers that are not nursing homes can follow the instructions below.

This section covers the following:

• How to determine the client is enrolled in an Apple Health managed care

plan.

• How to determine the client is eligible for behavioral health services (mental

health and substance use disorders).

• Whether or not the client is enrolled with a Primary care case management

(PCCM) provider.

• Verifying the client is Medicare eligible.

• How to determine if the client has commercial private insurance, Medicare

Part C or D, or military.

• How to verify a client receives services from specific providers.

• Verifying a client is receiving services through a hospice agency.

• How to determine an individual is a client of the Developmental Disabilities

Administration (DDA).

• How to verify a client is participating with the Department of Health’s Children

with Special Health Care Needs (CSHCN) program.

25 | PROVIDERONE BILLING AND RESOURCE GUIDE

Client with managed care

If the client is enrolled in a Managed Care Organization (MCO), the following

segment will be displayed as part of the client benefit inquiry. HCA does not

process or pay claims for clients enrolled in an MCO for services provided under

the plan’s contract. If the service is covered by the MCO, do not bill HCA as a

secondary payer. If there is no managed care segment, or there are end dates

noted for the managed care plan and the dates you are billing for, the client is

fee for service, and you should bill ProviderOne directly.

Note: The benefit inquiry response does not return the primary

care provider (PCP) information but does return the PCP clinic

name when the information is available.

Contact the managed care plan with any questions regarding authorization and

billing. See Appendix C for MCO contact information.

Note: Already saw a client enrolled in an MCO and the provider

is not the assigned primary care provider (PCP), or the client

does not have a referral? Contact the PCP to get a referral and

then call the MCO to see if authorization is required or can be

obtained for the service provided. If the office is not contracted

with the MCO, call the MCO to see if they have an allowance for

a noncontracted provider treating the client.

When a client is enrolled in an MCO upon admit to a hospital stay, then disenrolls

from the plan and becomes fee for service (FFS) during the stay, the entire stay

and physician services are the responsibility of the plan until the client is

discharged.

Integrated managed care

Integrated managed care (IMC) was implemented in 2016 and includes physical

and mental health services, and drug and alcohol treatment, all in one health

plan. It is now available in all regions of the state with the remaining areas of

Thurston-Mason, Great Rivers, and Salish implemented January 1, 2020.

For more information, view a map of the integrated managed care plans available

in each region. IMC is represented as fully integrated managed care (FIMC) in

ProviderOne:

26 | PROVIDERONE BILLING AND RESOURCE GUIDE

Clients enrolled in Apple Health Core Connections (AHCC) will have a Healthy

Options Foster Care (HOFC) segment for Coordinated Care listed in the managed

care section:

Note: Effective for claims with dates of service on and after

January 1, 2017, clients with other primary health insurance may

be enrolled into an Apple Health managed care plan as a

secondary insurance. Remember to always check for other

primary payers when verifying eligibility in ProviderOne. See the

Apple Health Medicaid provider alert dated 11/16/2016 10:09

AM PST.

If a client has a managed care plan as their secondary

insurance, all updates related to their primary payer

(terminations, etc.) must be reported through the managed

care plan not through the agency’s Coordination of Benefits

Unit.

Health Home program

The Health Home (HH) program provides patient-centered care coordination

services to support Medicaid and dual Medicaid/Medicare eligible clients in

accessing appropriate medical and social services. Care Coordinators (CC) work

with clients to support their overall health, wellbeing, and self-care. Participation

is optional and does not affect Medicaid coverage or other health care benefits

the client is currently receiving.

FFS clients enrolled in the HH program will have a segment for “Health Home

Only” listed in the managed care section:

A managed care client enrolled in the HH program will have a Health Home

eligibility segment on the benefit inquiry screen in ProviderOne.

27 | PROVIDERONE BILLING AND RESOURCE GUIDE

Behavioral health services

As of January 1, 2020, the state has fully transitioned all behavioral health

organizations into the integrated managed care program (IMC). All behavioral

health services (including substance use disorder [SUD]) will go through the

client’s managed care plan.

Clients who are dual eligible (Medicare as primary) or some clients who are fee

for service, will receive behavioral health services through Behavioral Health

Services Only program (BHSO).

Clients enrolled in a BHSO will have the following display:

Apple Health clients who are in a program that is not eligible for a BHSO should

be referred to the appropriate community resource in their county to see if there

are available funds for services.

For more information on IMC and BHSO programs, please visit the Behavioral

Health Care and Recovery webpage page.

State-only programs

Some provider groups rely on the ACES program codes to help them determine if

the client is on a state only (fee for service) program. Review the ACES Program

Codes for assistance.

Primary Care Case Management (PCCM)

Primary Care Case Management (PCCM) is an Apple Health (Medicaid) program

where an Indian Health Service (IHS) or tribal clinic serves as the primary care

provider (PCP) and manages the client’s health care needs, including specialty

care. To support coordination of the health care services the client is receiving,

the agency requires a referral from the client’s assigned PCP.

Clients enrolled in a PCCM will have the following display in the Managed Care

Information section:

• Clients who have a PCCM have Apple Health (Medicaid) coverage without a

managed care plan and all claims are billed to ProviderOne fee for service.

28 | PROVIDERONE BILLING AND RESOURCE GUIDE

• All clients with a PCCM must have a referral from their PCCM for health care

services to be paid to an outside provider.

• Bill all services for PCCM clients covered by the referral to Apple Health and

indicate the PCCM referral number on the claim.

• Women who have a PCCM provider do not need a referral for OB/GYN, or

family planning services provided outside of the PCCM.

The current PCCMs are:

• Lake Roosevelt Community Health Centers

• Inchelium Clinic

• Lower Elwha Health Clinic

• Puyallup Tribal Health Authority

• Seattle Indian Health Board

• Lummi Tribal Health Center

• Roger Saux Health Center - Medical

• Native Project

• Nooksack Community Clinic

• Tulalip Tribes

• Yakama Health Center

• David C Wynecoop Memorial Clinic

• Colville Indian Health Clinic

• Shoalwater Bay Tribal Clinic

• Quileute Health Clinic

Clients with Medicare

The Medicare Eligibility Information screen displays the following segments for

clients eligible for Medicare Part A or Part B:

You must bill Medicare as the primary payer if Medicare covers the service. The

client’s Medicare Beneficiary Identifier (MBI) will be returned on a ProviderOne

benefit inquiry screen for billing purposes.

Commercial insurance, Medicare Part C/D, or military

benefits

If the client has other coverage, ProviderOne displays the following segments in

the Coordination of Benefits Information section of the eligibility results:

29 | PROVIDERONE BILLING AND RESOURCE GUIDE

Note: If you know an Apple Health client has a commercial

insurance and you do not see a Coordination of Benefits

Information segment on their eligibility file in ProviderOne, you

must complete a Contact Us email. Choose “I am an Apple

Health (Medicaid) biller or provider,” then choose the Medical

Provider button. On the select topic dropdown, choose Private

Commercial Insurance. Enter the client’s insurance information

in the Other Comments section. The agency’s Coordination of

Benefits unit will update the client’s file using this information.

Check eligibility again in ProviderOne in 3 – 5 business days to

verify the update has been made. Only after verification of this

information in ProviderOne should you bill the claim to the

system.

• You must bill the commercial private insurance as primary. ProviderOne

should be billed only after verification of commercial insurance on the client’s

file in ProviderOne, and all other commercial insurance claims have been

processed.

• The insurance carrier code displayed under the Carrier Code column must be

used on the direct data entry (DDE) secondary insurance claims billed to

ProviderOne as the insurance company ID number.

• If the private insurance does not cover the service or has denied the service,

expand the Other Insurance Information area in the DDE screen and complete

all required fields, entering zeros for COB Payer Paid Amount. If you do not

have a specific Claim Adjustment Reason Code (CARC) to enter in the Claim

Level Adjustment area, you must attach the letter or EOB from the primary

payer. By entering the Other Insurance Information, the claim will be manually

reviewed with the backup submitted. For assistance submitting backup with

your DDE claim, review the submitting backup documentation for a DDE claim

section of this guide.

• You must bill the Medicare Part C plan as primary. Bill a secondary crossover

claim to the agency after the claim is processed and payment is made by the

plan. If the Part C plan did not make a payment, these claims would not be

considered crossover claims and will be processed as a standard medical claim

in ProviderOne. Include a copy of the Medicare EOB with the denied claim.

• ProviderOne may pay the client liability amount (deductible, co-insurance, or

co-pay) according to the agency’s payment policy.

• If ProviderOne indicates Medicare Part D (prescription drug coverage) in the

Coordination of Benefits section, see the Prescription Drug Program provider

guide for specific details.

30 | PROVIDERONE BILLING AND RESOURCE GUIDE

• Refer active-duty military clients who are eligible for benefits with the Civilian

Health and Medical Program of the Uniformed Services (CHAMPUS) to use

their local military facility. When a client is CHAMPUS eligible, the insurance

carrier code is either HI50 or HI00 (see example below).

• Individuals with Department of Veterans Affairs (VA) eligibility may seek care

through their VA primary insurance, but it is not required. When billing HCA

as secondary insurance, use the insurance carrier code VE02.

Note: If the client needs to locate a VA medical center, they may

call 1-800-827-1000 from any location in the United States and

the call routes automatically to the nearest VA regional office.

• Refer clients who have insurance through a commercial Health Maintenance

Organization (HMO) to their designated facility or provider. If a client’s

primary insurance is through an HMO, the insurance carrier code will be HM,

HI, or HO.

• Apple Health does not pay for services referred to a provider not contracted

with the primary HMO. This is the responsibility of the referring HMO. If the

HMO does not cover the service, the agency may be billed for those services if

they are covered by Apple Health.

Exception: If a client lives more than 25 miles or 45 minutes away from the

nearest primary HMO provider/facility, Apple Health will pay for nonemergency

services under the fee for service (per fee schedule) program. These cases are

generally determined on an individual basis.

You must complete a Contact Us email to our Coordination of Benefits Unit.

Choose the option “I am an Apple Health (Medicaid) biller or provider” and then

choose the Medical Provider button. On the select topic dropdown, choose

Private Commercial Insurance. Enter information relating to the issue in the

Other Comments section to include a reference to “out of area network review.”

The primary HMO may require notification of any emergency services before they

make any payment(s).

The Contact Us form can also be used to update a client’s file when the

commercial insurance is no longer active following the same steps as above. In

the Other Comments section enter the following detail:

• Termination date of the private insurance

• Date you spoke to the insurance agent to verify end date.

31 | PROVIDERONE BILLING AND RESOURCE GUIDE

The agency does not deny the following services for third party coverage unless

the third-party liability (TPL) carrier code is HM, HI, or HO:

• Outpatient preventative pediatric care

• Outpatient maternity-related services

• Accident-related claims, if the third party benefits are not available to pay the

claims at the time they are filed

Note: If it is determined that there is a possible casualty claim,

call the toll-free number at 1-800-562-3022 [e.g., motor vehicle

accident, Department of Labor and Industries (L&I) claim, injury

diagnosis]. See Appendix D for more information on casualty

claims.

Restricted client information

(WAC 182-501-0135)

Some clients are assigned to certain providers. ProviderOne displays the

following segment(s) in the Restricted Client Information screen when clients are

restricted to specific providers:

• The Patient Review and Coordination (PRC) program assists clients in using

medical services appropriately by assigning them a PCP, pharmacy, and/or a

hospital for nonemergency care. The PCP may make referrals for specialty

medical care. Some covered services that do not need a referral include, but

are not limited to, dental and medical equipment.

• Providers must bill PCP referred services with the PCP’s National Provider

Identifier (NPI) in the appropriate field on the claim. You may look up an NPI

at the National Plan & Provider Enumeration System (NPPES) Registry website.

For questions about the PRC program or to report a client for utilization

review, call 1-800-562-3022 ext. 15606.

Hospice services

(WAC 182-551-1210)

If the client receives services through a hospice agency, the following segment

will be displayed as part of the client benefit inquiry:

See the Hospice Services provider guide for more information.

32 | PROVIDERONE BILLING AND RESOURCE GUIDE

Developmental Disabilities Administration (DDA)

Clients of DDA will display the following segment in the Developmental Disability

Information section of the eligibility results:

Clients of DDA may be eligible for additional medical services. See the program

specific provider guides for those additional services.

Children with Special Health Care Needs (CSHCN)

If the client has special health care needs and is enrolled in the CSHCN program,

the system displays the following segment in the Children with Special Health

Care Needs Information section of the eligibility display:

Medicaid suspension

If an existing Apple Health client is incarcerated or committed to a state hospital,

their coverage with Apple Health will be suspended and no longer end dated in

ProviderOne. If you see the term “suspended when doing an eligibility check,

Apple Health would only be covering inpatient services for the time frame during

the suspension. All other services during the suspended timeframe would be

covered by the jail or state hospital. For more information, visit the Medicaid

Suspension webpage:

Pitfalls

• Failing to check the dates on a displayed segment. When reviewing the

eligibility record, always make sure the dates on a segment correspond with

the actual date of service.

• Billing the agency when there is a primary payer. This delays receipt of

payment increasing a provider’s workload. Commercial insurance must be

added to a client’s file prior to submitting a secondary claim to ProviderOne.

• Providing a service to a client who has chosen to obtain care with a PCCM

provider, and this provider is not the PCP, or the PCCM provider/PCP did not

refer the client. Contact the PCP for a referral.

33 | PROVIDERONE BILLING AND RESOURCE GUIDE

Benefit Service Package

Benefit Service Packages (BSP) do not cover all services and procedures. Providers

should always verify the service provided is a covered benefit under the client’s

BSP.

View additional information related to programs covered under a specific BSP

(e.g., physical therapy, dental, hospital) by clicking on the hyperlink under the

heading Benefit Service Package.

See Appendix E for an overview of Benefit Service Packages.

Spenddown

Spenddown is a type of client liability, like an insurance deductible. Spenddown

liability is the amount of medical expense a client must pay before Limited

Casualty Program/Medically Needy Program (LCP/MNP) coverage begins. When

the client has paid medical expenses equal to or greater than a predetermined

spenddown amount, the provider can submit a claim for the outstanding amount.

Medical coverage does not always begin on the first day of the month. A date of

service that is the same as the Medicaid eligibility start date may require the

claim to show a spenddown liability amount. See the Provider Spenddown step-

by-step fact sheet and Chapter 182-519 WAC for more information on

spenddown.

If the client has not accumulated enough financial obligation to obtain medical

benefits, the Benefit Service Package displays Pending Spenddown – No Medical:

Spenddown FAQ

Q - How do I find out if our claim was used to meet a client’s spenddown

liability? How do I find out how much of our claim was assigned to a client’s

spenddown liability?

A - Call the spenddown inquiry toll free number for providers 1-877-501-2233

and leave a message to request a call back from the specialized Spenddown Unit.

Q - How will my claim be processed if there is a spenddown amount applied to

my claim?

A - HCA will deduct the spenddown amount from HCA allowable amount. For

more information on provider payments, see WAC 182-519-0110.

Q - How do I know if a claim was denied for spenddown?

A - Check the remittance advice to find the denial code for the claim. Claims

34 | PROVIDERONE BILLING AND RESOURCE GUIDE

denied for spenddown will show adjustment reason code 125 and remark code

N58.

Q - What will happen if I submit a claim when ProviderOne indicates the client is

“pending spenddown”?

A - The claim will deny because the client is not eligible.

Q - Can I charge the client when some or my entire bill has been used to meet

the client’s spenddown liability?

A - Providers may charge the client no more than the spenddown amount that

was applied to the claim. See WAC 182-519-0110 for more information.

Q - How do I report spenddown on a claim?

A - See the Provider spenddown step-by-step fact sheet.

Q - What if I see an active Benefit Services Package, such as CNP effective for the

same date(s) as a pending spenddown segment?

A - Due to changes in the way eligibility is determined and displayed in

ProviderOne, some clients still show pending spenddown segments from the

benefit they had prior to Medicaid expansion on 1/1/14; these will not go away

until the end of their spenddown period, so until that happens providers will see

overlapping eligibility. It is important to note the active segment will always be

honored, so in these situations providers can ignore the pending spenddown

segment and bill according to the active segment.

Pitfalls

• Failing to check the client’s Benefit Service Package. This may result in

providing services that are not covered by HCA.

Medical records for clients in Foster Care

ProviderOne now gives the provider access to claims history for children in foster

care. The claims history (pharmacy, dental, medical, etc.) will be available when a

provider performs an eligibility check in ProviderOne.

Providers may benefit from knowing a foster care client’s claims history before

treating or prescribing medications for the client.

Log into ProviderOne and select the Benefit Inquiry hyperlink to conduct an

eligibility check for the client.

Enter the appropriate search criteria to locate the client’s eligibility information. If

the selected client’s medical records are available when the eligibility page

displays in ProviderOne, the following “Medical Records” button appears

at the top left of the screen:

35 | PROVIDERONE BILLING AND RESOURCE GUIDE

Note: The placement code (indicated by the arrow in the image

above) may allow an enhanced payment to providers for certain

E&M codes. See the EPSDT provider guide for the placement

code table, plus detailed information about how to bill for the

enhancement.

Select Medical Records to open the next screen which contains claims

information in three separate sections. These sections contain information about

paid claims obtained from the ProviderOne claims history database. Two years of

data will be returned by default, regardless of the eligibility search begin or end

dates.

The three sections include:

• Pharmacy services claims

• Medical services claims (including dental)

• Hospital services claims

The overall screen looks like the example below. Providers may need to use the

scroll bar on the right side of the page to see the bottom portion of the screen.

This is a “Printer Friendly Version”, so the content of this screen is printable by

clicking on the blue “Printer Friendly Version” hyperlink at the top center of the

screen.

36 | PROVIDERONE BILLING AND RESOURCE GUIDE

The first section contains the Pharmacy claim information:

Some fields could be empty or contain “zero (0)” as a value for the different

pharmacy claims if that information is not available for viewing.

Providers have the option to search the pharmacy list for specific dates of service

by using the “Filter By Period” option as seen in the segment below.

1. Pick the filter value name (all or a date range) using the drop-down

option.

2. If using a date range, in the next box indicate the filter value “from” date

of service.

3. Next in the date range, use the second filter box to enter the “to” date of

service (all dates entered in ProviderOne must be formatted as

mm/dd/ccyy).

37 | PROVIDERONE BILLING AND RESOURCE GUIDE

4. Click the Go button.

ProviderOne will return the paid claim(s) found for those filter values based on

the “from” date. Providers can sort the list of pharmacy claims using the up/down

triangles located under each blue column heading.

The system only sorts by one column heading at a time; however, it will sort the

whole list based on the column heading chosen.

• Clicking on the triangle (caret) on the left causes ProviderOne to sort the list

by the oldest, smallest, or in alphabetical order, according to the column

specified.

• Clicking on the caret on the right causes ProviderOne to sort the list by the

latest, largest, or in reverse alphabetical order, according to the column

specified.

Note: The search (Filter By) option and the column sort

functions work the same for each specific claim section on this

screen.

Providers should keep in mind that each claim history section may have multiple

pages. The buttons at the bottom of the page provide the ability to move to the

next page if they have black text. If there are no more pages to review, the Next

button will be greyed out. In the following screen example, the Next button

indicates that more than one page of claims is available to view.

The medical, including dental, services section look like the following segment:

38 | PROVIDERONE BILLING AND RESOURCE GUIDE

Some fields could be empty when viewing the different professional and dental

services because the information did not apply to the service indicated, or the

data may not be available. The “filter by” (search) and the column sort features

described above work the same on this screen.

The hospital care screen looks like this and is the last section on the page:

When viewing the hospital claims in this section, some fields may be empty

because the information does not apply, or the data is not available. The “filter

by” (search feature) and the column sort features work the same as described in

the previous section.

Note: If any one of the screens return the message No Records

Found! the client does not have any claims history for that

section.

Covered services and prior authorization

Apple Health does not cover all medical services and some covered services

require Prior Authorization (PA). The agency will not pay a claim if a provider fails

to obtain a required prior authorization. For additional information on prior

authorization, visit the Prior Authorization webpage.

This section describes how to identify a procedure code, how to use that

procedure code to determine if Apple Health covers the service, and how to

determine if PA is required (as identified in Apple Health’s program specific

provider guides).

PA indicates providers must obtain prior authorization before providing certain