CREDIT CARD

INSURANCES.

Product Disclosure Statement

and Information Booklet

1 March 2018

About this Product Disclosure Statement and

Information Booklet

This booklet sets out:

• The terms and conditions of the International Travel Insurance

and other covers provided to you automatically as a cardholder.

• The Product Disclosure Statement (PDS) for Activated and

Upgrade Policies offered to cardholders in respect of the

additional benefits and options available under the International

Travel Insurance. The PDS is made up of the information

contained in Part 1 of this booklet (“General Information”) and the

information set out in the Activated Policy Terms and Conditions

(see pages 44 to 58) and the Upgrade Policy Terms and

Conditions (see pages 59 to 70). A PDS is a document required by

the Corporations Act 2001 (Cth) and contains information designed

to help you decide whether to obtain these policies and to compare

them with other products you may be considering.

The Insurer and the Product Issuer

Commonwealth Bank is not the issuer of these insurance covers

or policies referred to in this booklet and neither Commonwealth

Bank, nor any of its related corporations, guarantee or are liable

to pay any of the benefits under these covers.

The Insurer and the Product Issuer, Allianz Australia Insurance Limited,

ABN 15 000 122 850, AFS Licence No. 234708, of 2 Market Street,

Sydney, NSW 2000 (Allianz) underwrites the covers described in

this booklet.

AWP Australia Pty Ltd, ABN 52 097 227 177, AFS Licence No. 245631,

of 74 High Street, Toowong, QLD 4066 (Allianz Global Assistance),

issues and manages the covers described in this booklet on behalf

of Allianz.

The covers provided under the complimentary covers are provided

at no additional cost to you. The Commonwealth Bank does

not receive any commission in relation to cover issued under the

complimentary covers.

The covers provided under the Upgrade Policy may be subject

to the payment of an additional premium by the cardholder. The

Commonwealth Bank will receive a commission in relation to cover

issued under the Upgrade Policy. Ask the Commonwealth Bank

for details. Neither Commonwealth Bank nor any of its related

corporations are authorised representatives of Allianz (the Insurer

and the Product Issuer), Allianz Global Assistance or any of their

related companies.

Allianz Global Assistance is remunerated by Allianz for providing

services on behalf of Allianz. This is a percentage (exclusive of GST)

of the premium that you pay for an insurance policy and is only paid if

you buy a policy. Employees of Allianz Global Assistance receive an

annual salary.

The above remuneration is included in any premium the

cardholder pays.

If you would like more information about the remuneration that

employees and representatives of Allianz Global Assistance receive

please ask us.

(In the remainder of this booklet, Allianz Global Assistance may be

expressed as Allianz Global Assistance, ‘we’, ‘us’ or ‘our’).

Contents

What you need to know about your Commonwealth

Bank Complimentary Credit Card Insurances............1

About this booklet ........................................................5

Enquiries ........................................................................5

Part 1 - General Information

The Insurance Covers....................................................................6

Maximum period of cover - International Travel Insurance .......... 7

Cruising in Australian waters - International Travel Insurance .....8

Special conditions and restrictions which apply

for persons aged 80 years or over - International

Travel Insurance ............................................................................. 8

Pre-existing medical conditions for persons aged

79 years and under - International Travel Insurance ....................9

Medical support and emergency assistance

while overseas - International Travel Insurance .......................... 11

Medical and hospital cover in Australia ...................................... 11

Definitions and interpretations ....................................................12

Policy exclusions - what is not covered ...................................... 22

Sanctions .....................................................................................27

General Insurance Code of Practice ........................................... 27

Financial claims scheme .............................................................27

Jurisdiction and choice of law .....................................................27

Privacy..........................................................................................27

Complaints and dispute resolution process ...............................29

Claims - assisting us with claims ................................................29

Excess - what you contribute to a claim ..................................... 30

Safety of your belongings............................................................31

Reporting lost, stolen or wilfully damaged belongings ..............31

Repairing or replacing your belongings ...................................... 31

Claims ..........................................................................................32

Part 2 - Base Cover International Travel

Insurance Terms and Conditions .................37

Part A - Important matters you should know

Who is eligible for the Base Cover International

Travel Insurance? .................................................................... 37

Special conditions and restrictions for persons

aged 80 years or over ............................................................. 37

Pre-existing medical conditions for persons aged

79 years and under ................................................................. 38

Maximum period of cover ....................................................... 38

Part B - Table of benefits and cover limits .................................. 39

Part C - Benefits and cover .........................................................40

Part 3 - Activated Policy Terms and Conditions ....... 44

Taking out your Activated Policy .................................................44

Cancellation of Cover ..................................................................44

Part A - Important matters you should know

Who is eligible for an Activated Policy? ................................... 44

When does cover start under an Activated Policy? ................. 44

Special conditions and restrictions for persons

aged 80 years or over at the time of Activation ....................... 45

Pre-existing medical conditions for persons aged

79 years and under at the time of Activation ........................... 45

Maximum period of cover ....................................................... 45

Part B - Table of benefits and cover limits .................................. 46

Part C - Benefits and cover .........................................................48

Part 4 - Upgrade Policy Terms and Conditions ........59

Applying for an Upgrade Policy ..................................................59

About your premium .................................................................... 59

Cooling-off period .......................................................................59

Duty of Disclosure .......................................................................60

Part A - Important matters you should know

Who is eligible for an Upgrade Policy? .................................... 61

Part B - Upgrade options, benefits and limits

Medical cover for persons aged 80 years or over ................... 61

Pre-existing medical conditions for persons aged

79 years and under ................................................................. 62

Extension of period of cover ................................................... 63

Increased rental vehicle insurance excess .............................. 63

Snow Pack (additional benefits relating to snow

sport activities) ........................................................................ 64

Cruise Pack (additional benefits relating to cruise activities) ... 68

Adventure Pack .......................................................................

Part 5 - Base Cover Other Insurances

Terms and Conditions ...................................71

Purchase Security Insurance ......................................................71

Extended Warranty Insurance.....................................................73

Interstate Flight Inconvenience Insurance

(only available to Diamond and Platinum cardholders

travelling domestically) ..................................................................75

Transit Accident Insurance (only available to Diamond

and Platinum cardholders travelling internationally) ......................77

Guaranteed Pricing Scheme (only available to Diamond

and Platinum cardholders) ............................................................ 79

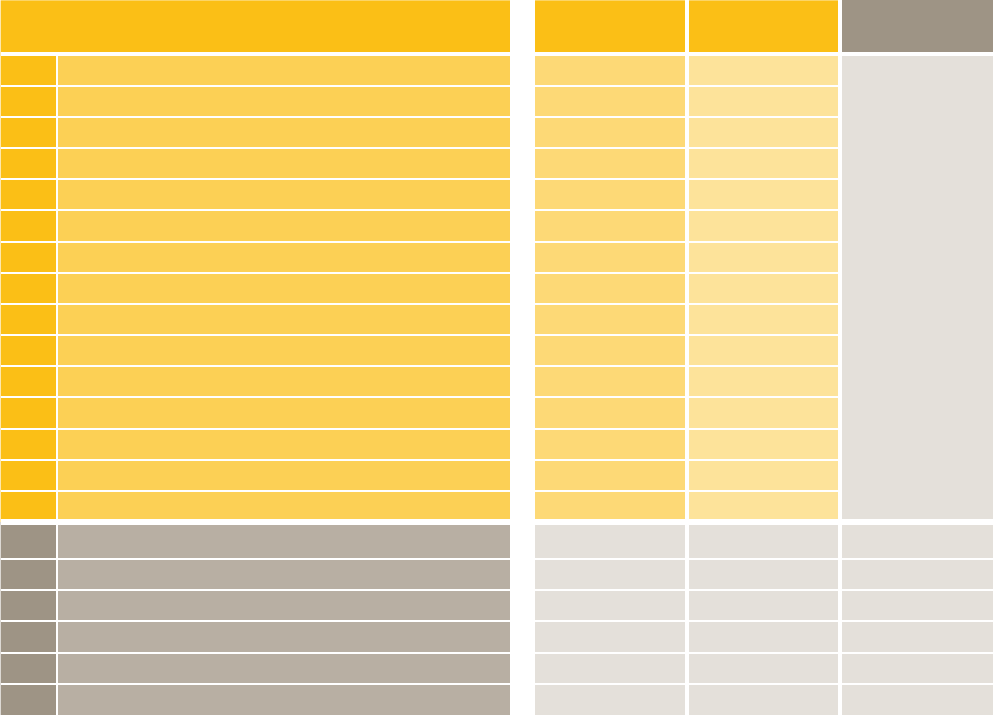

1 2

Cover/policy type

International

Travel Insurance

Base Cover Activated Policy Upgrade Policy

How do I get it?

Cover is automatic Log-in to NetBank or the

CommBank App and follow the

prompts

While you’re ‘Activating’ and

based on what you’ve told us, we’ll

show you what Upgrade options

are available.

Is it complimentary?

Yes Yes No, you pay for any additional

upgrades you wish to add. We’ll show

you what the cost is first so you can

choose whether or not to proceed.

What do I get

Overseas Emergency Medical

Assistance

Overseas Emergency Medical

and Hospital Expenses

Personal Liability

Note: For persons aged 80

years or over, restrictions apply

Full details on pages 37 to 43.

International Travel

Insurance cover, including

cover for cancellations and

rearrangement expenses, trip

disruption, loss of luggage and

personal items. Also includes

cover for a domestic cruise in

Australian waters.

Note: for persons aged 80 years

or over, certain restrictions apply

to Benefit 4 - Cancellation Fees

& Lost Deposits.

See the full list of benefits on

pages 46 to 58.

Upgrade options:

• Approved pre-existing medical

conditions not automatically

covered if you’re aged 79 years

or under

• Any travel days over and above

your complimentary journey

period

• Certain benefits relating to snow

sport activities

• Certain benefits relating to

Cruising

• Increased Rental Vehicle Insurance

Excess

• If you’re 80 years or over, you can

apply to include medical cover,

subject to our approval

• For full details on Upgrades,

please see pages 59 to 70.

Other need to know information:

• An Activated Policy also covers your spouse and

dependent children travelling with you.

• You must Activate before each trip you take – activating

once doesn’t mean you’re covered for all trips taken.

• Your complimentary journey period varies based on the

type of credit card you hold, so make sure you refer to

the definition of journey on page 17 to see what you’re

entitled to.

• There are some terms and conditions and restrictions for

those aged 80 years or older. Please make sure you read

the sections of the document relevant to you.

Your Base Cover is what you receive just by being a cardholder

and includes cover for Overseas Emergency Medical Assistance and

Overseas Emergency Medical & Hospital Expenses. Please note that if

you or your spouse are aged 80 years or older restrictions apply, but

you can find the full details on page 8.

Your Activated Policy incorporates all the remaining Travel Insurance

benefits, but may only be accessed by ‘Activation’ which is done

online, via NetBank or the CommBank App, and requires you to

answer some questions about your trip. You can find the full list of

Activated Policy benefits on pages 46 to 58.

We also understand the travel needs of our customers vary greatly,

which is why we also have a range of added extras (which we term

Upgrades) that you may choose to add to your cover.

As a Commonwealth Bank Gold, Platinum or Diamond

cardholder you are entitled to certain travel insurance benefits

at no additional cost.

There are important terms and conditions which we’ve summarised

for you below. Most importantly, you need to be aware that in order

to access the majority of your comprehensive travel insurance cover,

you need to complete an online Activation process.

The levels of complimentary cover available to you are called Base

Cover and Activated Policy.

What you need to know about

your Commonwealth Bank

Complimentary Credit Card

Insurances

3 4

Benefits & Upgrade Options Base Cover

Activated

Policy

Upgrade

Policy

1* Overseas Emergency Medical Assistance

9

9

All benefits

available under

the Activated

Policy apply to the

Upgrade Policy

2* Overseas Emergency Medical & Hospital Expenses

9

9

3 Personal Liability

9

9

4* Cancellation Fees & Lost Deposits

8

9

5* Travel Service Provider Insolvency

8

9

6* Resumption of Journey

8

9

7* Accidental Death

8

9

8* Loss of Income

8

9

9* Travel Documents, Transaction Cards, Travellers Cheques & Cash

8

9

10* Lost or Damaged Luggage & Personal Goods

8

9

11* Luggage Delay Expenses

8

9

12* Travel Delay

8

9

13 Alternative Transport Expenses

8

9

14 Rental Vehicle Insurance Excess

8

9

15* Kidnap & Hijack

8

9

16* ^ Snow Pack

8

8

9

17* ^ Cruise Pack

8

8

9

^ Medical Cover for 80 years+

8

8

9

^ Pre-existing Medical Conditions (79 years & under)

8

8

9

^ Extension of Period of Cover

8

8

9

^ Increased Rental Vehicle Insurance Excess

8

8

9

* sub-limits apply

^ available on application - an additional cost may apply

The travel insurance benefits available to you under the Base Cover,

Activated Policy and Upgrade Policy are summarised in the

table below.

Please note this table only provides a summary of the benefits.

You need to read this booklet carefully for details of what is covered and

what is not covered. Importantly, note that exclusions do apply as well as

limits to cover.

65

About this booklet

This booklet contains five parts, as follows:

• Part 1 - General Information

The General Information provides details of information which

applies to one or more of the covers.

• Part 2 - Base Cover International Travel Insurance Terms

and Conditions

The Base Cover International Travel Insurance Terms

and Conditions provides information about the Base Cover

International Travel Insurance provided automatically to you.

The cover provided under the Base Cover International Travel

Insurance Terms and Conditions is automatically available

without any actions being taken to accept any of the cover.

• Part 3 - Activated Policy Terms and Conditions

The Activated Policy Terms and Conditions provides

information about the additional complimentary insurance policy

covers available in relation to the International Travel Insurance

that will be issued to a cardholder after the cardholder has

completed Activation.

• Part 4 - Upgrade Policy Terms and Conditions

The Upgrade Policy Terms and Conditions provides information

about the additional insurance policy available in relation to the

International Travel Insurance that a cardholder can apply

for once they have completed Activation and been issued an

Activated Policy. Please note the covers available under the

Upgrade Policy are not complimentary to you.

• Part 5 - Base Cover Other Insurances Terms and Conditions

The Base Cover Other Insurances Terms and Conditions

provides information about the Base Cover Other Insurances

Terms and Conditions provided automatically to you.

The covers provided under the Base Cover Other Insurances

Terms and Conditions is automatically available without any

actions being taken to accept any of them.

Please read this booklet carefully and keep it in a safe place.

The preparation date of this PDS and booklet is: 1 March, 2018.

Enquiries

For 24 hour, 7 days a week emergency assistance, please call Allianz

Global Assistance on:

From Overseas: Reverse charge +61 7 3305 7499

Within Australia: 1800 010 075

For Activation, claims or other enquiries about your complimentary

cover, please call Allianz Global Assistance on:

From Overseas: +61 7 3377 3988

- select from available options

Within Australia: 1800 837 177

Please note that any recommendation or statement of opinion contained

in this booklet are of a general nature only and do not take into account

your objectives, financial situation or needs.

The Insurance Covers

Base Cover

The Base Cover is provided under a Group Policy issued to

Commonwealth Bank of Australia, ABN 481 23 123 124 of Level 1, 48

Martin Place, Sydney, NSW 2000 (Commonwealth Bank) by Allianz.

You have no right to cancel or vary the Group Policy (or any of them)

or the cover provided under the Group Policy (or any of them) – only

the Commonwealth Bank (as the Insured under the Group Policy)

and Allianz can do this. If Allianz cancels or varies the Group Policy

(or any of them) or their cover, neither Allianz nor the Commonwealth

Bank need to obtain your consent to do so.

Allianz does not provide any notices in relation to this cover described in

this booklet to you. Allianz only sends notices to the Commonwealth

Bank which is the only entity that Allianz has contractual obligations to

under the Group Policy.

Neither Allianz Global Assistance, Allianz or the Commonwealth

Bank hold anything on trust for, or for the benefit or on behalf of, you in

relation to this insurance arrangement. The Commonwealth Bank:

• does not act on behalf of Allianz Global Assistance, Allianz or

you in relation to the cover provided under the Base Cover;

• is not authorised by Allianz Global Assistance or Allianz to

provide any financial product advice, recommendations or opinions

about the insurance; and

• does not receive any remuneration or other benefits from Allianz

Global Assistance or Allianz, in respect of the Base Cover.

The Commonwealth Bank may terminate or vary the Group Policy

providing the Base Cover described in this booklet at any time.

In such a case, the Commonwealth Bank will either:

a] give the cardholder a written notice of the variation or

termination; or

b] advise the cardholder that a variation or termination to a cover is

to occur.

In these circumstances the Commonwealth Bank will not provide the

cardholder with a copy of the actual changes made to the cover but

will direct the cardholder to the relevant Commonwealth Bank URL

for the details of the variation or termination and inform the cardholder

that they can call the Commonwealth Bank and request a paper copy

of the actual changes be sent to the cardholder.

This booklet will be said to have been amended by these changes to

the cover.

Purchases made in accordance with the existing Base Cover before the

Base Cover is terminated or varied will still be eligible for that cover.

Part 1 - General Information

7 8

Activated Policy and Upgrade Policy

If Allianz changes the terms of either the Activated Policy or Upgrade

Policy, where required by law, Allianz will issue a new Product

Disclosure Statement or a supplementary Product Disclosure

Statement (in respect of the relevant policy), except in the case that the

relevant change(s) is not a materially adverse change. This booklet will

be updated to reflect the relevant change.

In the case that the relevant change is not a materially adverse change,

this information may be updated from time to time. In such a case, this

information will be available by contacting the Commonwealth

Bank and, on request, a paper copy will be provided to a person

without charge.

Confirmation of cover

To confirm any policy transaction, call Allianz Global Assistance.

Maximum period of cover - International

Travel Insurance

You are only covered for incidents that occur in the period of cover.

If you find that your return to Australia has been delayed because of

one or more of the following reasons and you return home as soon as

possible, your period of cover may be automatically extended at no

additional cost:

• your scheduled transport back to Australia is delayed for reasons

beyond your control; or

• the delay is due to an event for which you can claim under the

International Travel Insurance.

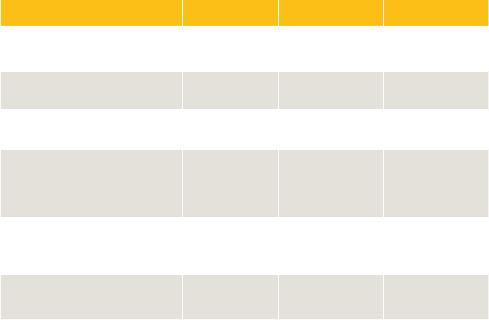

Cover Gold Platinum Diamond

International Travel

Insurance

Available Available Available

Purchase Security

Insurance

Available Available Available

Extended Warranty

Insurance

Available Available Available

Interstate Flight

Inconvenience

Insurance

Not available Available Available

Transit Accident

Insurance (international

travel only)

Not available Available Available

Guaranteed Pricing

Scheme

Not available Available Available

If, for any other reason other than as stated above, your overseas travel

is for a period longer than the period of cover, you will not be covered

after the end of that period of cover unless the cardholder has

applied for an extension to the period of cover.

The cardholder will need to complete Activation and then apply

under the Upgrade Policy for ‘Extension to period of cover’. If the

cardholder’s application for an upgrade is accepted, an additional

premium will apply.

Please refer to the Activated Policy Terms and Conditions for details

on Activation and the Upgrade Policy Terms and Conditions for

details of how to apply for this upgrade.

Cruising in Australian waters - International

Travel Insurance

The International Travel Insurance also includes cover if you

are travelling on a domestic cruise in Australian waters and the

cardholder has completed Activation. If your domestic cruise is not

part of an international journey, please ensure you choose ‘Pacific’ as

your destination during Activation.

Please refer to the Activated Policy Terms and Conditions for details

on Activation.

Special conditions and restrictions which

apply for persons aged 80 years or over -

International Travel Insurance

Please note that under the International Travel Insurance, the

following benefits are not available to persons who are aged 80

years or over at the time they commence their journey (Base Cover

International Travel Insurance) or at the time of Activation:

Benefit 1 - Overseas Emergency Medical Assistance

Benefit 2 - Overseas Emergency Medical and Hospital Expenses

Benefit 4 - Cancellation Fees & Lost Deposits

(where the cause of the claim is the death, sickness or injury of a

cardholder or spouse if they were aged 80 years or over at the time

of Activation).

However, the cardholder may be able to include cover under the

above benefits (including for their spouse if applicable) by completing

Activation and then applying for ‘Medical cover for persons aged

80 years and over’ under an Upgrade Policy. If we accept the

application for medical cover, the cardholder will need to pay an

additional premium.

Please refer to the Activated Policy Terms and Conditions for

details on Activation and the section ‘Medical cover for persons aged

80 years or over’ on page 61 of the Upgrade Policy Terms and

Conditions for details of how to apply for an Upgrade Policy.

Any purchases made after the termination or variation of the Base

Cover will not be eligible for the existing cover.

For the avoidance of doubt any notification required to be provided, as

mentioned above, will be sent to the cardholder.

The following table sets out the covers that apply to you depending on

the card held by the cardholder. You are not entitled to any cover that

does not apply to the eligible card.

9 10

Pre-existing medical conditions for

persons aged 79 years and under -

International Travel Insurance

The International Travel Insurance only provides cover for

emergency overseas medical events that are unforeseen. Cover is

not provided for pre-existing medical conditions except for those

described in the section ‘Pre-existing medical conditions which are

covered (some restrictions apply)’ below and on page 10.

If you have a pre-existing medical condition that is not covered,

we will not pay any claims arising from, related to or associated with

that condition. This means that you may have to pay for an overseas

medical emergency and any associated costs, which can be prohibitive

in some countries.

Blood thinning prescription medication

Please note we will not pay any claims arising from, related to or

associated with you taking a blood-thinning prescription medication

such as Warfarin or similar, other than under Benefit 1.1 a] and 1.1 b] in

‘Part C - Benefits and cover’ on page 40.

Pre-existing medical conditions which are covered

(some restrictions apply)

This section outlines the pre-existing medical conditions which

are covered.

You have cover if your pre-existing medical condition is listed

below, provided that you have not been hospitalised (including day

surgery or emergency department attendance) for that condition in the

24 months prior to you commencing your journey:

1. acne;

2. asthma, provided:

• you are under 60 years of age, and

• you have no other lung disease;

3. bunions;

4. carpal tunnel syndrome;

5. cataracts;

6. cleft palate;

7. cochlear implant;

8. coeliac disease;

9. congenital adrenal hyperplasia;

10. congenital blindness;

11. congenital deafness;

12. conjunctivitis;

13. dengue fever;

14. *Diabetes (type 1 or type 2), or glucose intolerance provided:

• you were first diagnosed over 6 months ago; and

• you had no complications in the last 12 months; and

• you had no kidney, eye or neuropathy complications or

cardiovascular disease; and

• you are under 50 years of age;

15. dry eye syndrome;

16. Dupuytrens contracture;

17. ear grommets, if no current infection;

18. eczema;

19. gastric reflux (GORD);

20. glaucoma;

21. gout;

22. hay fever;

23. hiatus hernia, if no surgery planned;

24. hormone replacement therapy;

25. *hypercholesterolaemia (high cholesterol), provided no

cardiovascular disease and/or no diabetes;

26. *hyperlipidaemia (high blood lipids), provided no cardiovascular

disease and/or no diabetes;

27. *hypertension, provided no cardiovascular disease and/or

no diabetes;

28. hypothyroidism, including Hashimoto’s disease;

29. lipoma;

30. macular degeneration;

31. Meniere’s disease;

32. rhinitis;

33. rosacea;

34. sinusitis;

35. tinnitus; or

36. single uncomplicated pregnancy, up to and including 23 weeks,

not arising from services or treatment associated with an

assisted reproduction program including but not limited to, in vitro

fertilisation (IVF).

* Diabetes (type I and type 2) , hypertension, hypercholesterolaemia

and hyperlipidaemia are risk factors for cardiovascular disease. If

you have a history of cardiovascular disease, and it is a pre-existing

medical condition, cover for these conditions is also excluded.

However, if your pre-existing medical condition is not described in

the above list or is a condition:

• for which you have been hospitalised (including day surgery or

emergency department attendance) in the 24 months prior to

either your period of cover (Base Cover International Travel

Insurance) or Activation; or

• was for surgery involving any joints, the back, spine, brain or

abdomen requiring at least an overnight stay in hospital at any time

prior to either your period of cover (Base Cover International

Travel Insurance) or Activation;

we will not provide any cover for any claims arising from, related to or

associated with that condition other than under Benefit 1.1 a] and 1.1 b] in

‘Part C - Benefits and cover’ on page 40.

11 12

If you require cover for any other pre-existing medical conditions,

you will need to apply for ‘Pre-existing medical conditions’ cover

under an Upgrade Policy. If we accept your application for cover of

pre-existing medical conditions, an additional premium may apply.

Please refer to the Activated Policy Terms and Conditions for details

on Activation and the Upgrade Policy Terms and Conditions for

details of how to apply for this upgrade.

Medical support and emergency assistance

while overseas - International Travel Insurance

Medical support and emergency assistance is automatically provided to

persons aged 79 years and under.

It will also be available to persons who are aged 80 years and over at the

time of Activation if they have applied and been approved for ‘Medical

cover for persons aged 80 years or over’ in the Upgrade Policy and

have paid the relevant additional premium.

In the event that you require medical support or you require any other

non-medical emergency assistance while overseas, Allianz Global

Assistance is only a telephone call away.

The team will help with medical problems, locating nearest medical

facilities, your evacuation home, locating nearest embassies and

consulates, as well as keeping you in touch with your family and work in

an emergency.

If you are hospitalised, you, or a member of your travelling party,

MUST contact us as soon as possible. If you do not, then to the

extent permitted by law, we will not pay for these expenses or for any

evacuation or airfares that have not been approved or arranged by us.

If you are not hospitalised but you are being treated as an outpatient

and the total cost of such treatment is likely to exceed $2,000, you

MUST contact us.

Medical and hospital cover in Australia

We do not pay for any medical or hospital expenses incurred in

Australia, unless you are not eligible for Medicare.

However, cover is available for medical or hospital expenses incurred

while you are travelling on a domestic cruise in Australian waters.

If you meet the above criteria, we will pay the medical or hospital

expenses as outlined in ‘Part C - Benefits and cover’ on pages 40 to 42.

For the purposes of this cover:

• travel from Tasmania or mainland Australia to Norfolk Island,

Christmas Island, Lord Howe Island or Cocos Island will be

considered to be overseas and will be covered under the

International Travel Insurance, however, there is no cover for

medical transfers/evacuations, or medical and hospital expenses;

• travel from Norfolk Island, Christmas Island, Lord Howe Island or

Cocos Island to Tasmania or mainland Australia will be considered

to be overseas and will be covered under the International

Travel Insurance, however, there is no cover for medical transfers/

evacuations, or medical and hospital expenses.

Definitions and interpretations

When the following words and phrases appear in bold throughout this

booklet, they have the meanings given below. The use of the singular

shall also include the use of the plural and vice versa.

accident means

a] in regard to the Transit Accident Insurance, any sudden and

unexpected physical force, which occurs on a trip and causes an

injury that is described in the Schedule of Benefits contained in the

Transit Accident Insurance cover; or

b] for all over covers, an unexpected event caused by something

external and visible.

Activation

means the process of activating an Activated Policy, as described in

the Activated Policy Terms and Conditions.

Activated Policy

means the insurance policy described in the Activated Policy

Terms and Conditions and the cardholder’s current Certificate

of Insurance.

Activated Policy Terms and Conditions

means the terms and conditions for an Activated Policy described in

Part 3 of this booklet, and incorporating the “General Information” in

Part 1 of this booklet.

AICD/ICD

means an implantable cardioverter-defibrillator (ICD), also known as an

automated implantable cardioverter-defibrillator (AICD).

Allianz

means Allianz Australia Insurance Limited (ABN 15 000 122 850,

AFSL 234708).

Allianz Global Assistance

means AWP Australia Pty Ltd (ABN 52 097 227 177, AFSL 245631).

Australia

means the area enclosed by the territorial waters of the Commonwealth

of Australia where Medicare benefits are payable. Australian has a

corresponding meaning.

Australian warranty

means the manufacturer’s expressed written warranty, that is applicable

and able to be fulfilled within Australia and which has been properly

registered with the manufacturer.

backcountry

means ungroomed and unmarked slopes or pistes, or unmarked or

unpatrolled areas inside or outside of a ski resort’s boundaries.

Base Cover

means the cover described in the Base Cover International Travel

Insurance Terms and Conditions and in the Base Cover Other

Insurances Terms and Conditions and each of them.

Base Cover International Travel Insurance

means the cover described in the Base Cover International Travel

Insurance Terms and Conditions.

13 14

Base Cover International Travel Insurance Terms and Conditions

means the terms and conditions described in Part 2 of this booklet, and

incorporating the “General Information” in Part 1 of this booklet.

Base Cover Other Insurances Terms and Conditions

means the terms and conditions described in Part 5 of this booklet,

and incorporating the “General Information” in Part 1 of this booklet.

booklet

means this Product Disclosure Statement and Information Booklet.

business items

(cover for business items only applies to eligible business Gold and

business Platinum cardholders)

means all new business property acquired for use by the business, but

does not include the following:

• items with an original purchase price in excess of A$3,000;

• items acquired for the purpose of re-supply/re-sale;

• items acquired for transformation in a business;

• animals or plant material;

• computer software, information stored on electronic devices,

electronic applications or non-tangible items;

• cash, bullion, negotiable instruments, trading cards, lottery tickets

or other gambling related items, tickets of any description, travellers

cheques, or collections such as stamps, coins and cards;

• consumable or perishable items (including but not limited to food,

drugs, fuel or oil);

• boats, automobiles, motor boats, airplanes or any other motorised

vehicles and their integral parts and installed accessories;

• second-hand items, including antiques;

• items of contraband;

• personal goods; or

• real estate and movable fixtures or fittings including but not limited

to dishwashers and fixed air conditioners) which are, or are intended

to form, part of any office, home or real estate.

cardholder

means a person residing in Australia to whom the Commonwealth

Bank has issued an eligible credit card. Persons residing in

Australia must have either an:

a] Australian Medicare card; or

b] Australian issued Temporary Work (skilled) Visa (subclass 457); or

c] Australian Visa which:

• authorises them to live and work in Australia; and

• requires them to maintain a minimum level of health

insurance coverage as required by the Department of

Immigration and Citizenship.

If a family is travelling together, only one person can claim the benefits

payable to the cardholder. The others can only claim as a spouse or

dependent child.

carrier

means an aircraft, vehicle, train, tram, vessel or other scheduled transport

operated under a licence for the purpose of transporting passengers.

However, it does not mean a taxi, limousine or similar service.

Certificate of Insurance (this definition only applies to an Activated

Policy and Upgrade Policy)

means the document which is provided to a cardholder when they are

issued an Activated Policy and, if applicable, an Upgrade Policy and

sets out details of the cover provided.

chronic

means a persistent and lasting condition. It may have a pattern of

relapse and remission.

Commonwealth Bank

means Commonwealth Bank of Australia (ABN 48 123 123 124).

complimentary cover

means Base Cover and cover under an Activated Policy.

concealed storage compartment

means a boot, trunk, glove box, enclosed centre console, or concealed

cargo area of a motor vehicle.

covered breakdown

means the failure of personal goods or business items to operate for

the purpose for which they were designed as a result of a breakdown or

defect, provided the breakdown or defect is covered by the terms of the

Australian warranty.

dependent child/children means at the time eligibility for

cover is satisfied:

a] all unmarried children up to and including the age of 18, who the

cardholder has sole custody of and who live with the cardholder;

b] all unmarried children up to and including the age of 18 who the

cardholder has shared custody of;

c] all unmarried children from the age of 19, to and including the age of

21, who are full-time students attending an accredited institution of

higher learning in Australia and who the cardholder has/had sole

or shared custody of, and who are dependent upon the cardholder

for their maintenance and financial support; or

d] all unmarried persons who are physically or mentally incapable of

self-support who the cardholder has custody of and who live with

the cardholder,

however, dependent child/children never means an infant born on

the journey.

domestic cruise means a voyage on a foreign-registered cruise ship

from a port in Australia to another port or ports in Australia without

any stopover at a port outside of Australia.

eligible credit card

means, unless otherwise specified, a current and valid personal or

business Gold, personal or business Platinum, or personal Diamond

credit card issued by the Commonwealth Bank (An eligible credit card

that is currently cancelled or suspended is not current and valid).

eligible credit card account

means, unless otherwise specified, a current and valid personal or

business Gold, personal or business Platinum, or personal Diamond

credit card facility with the Commonwealth Bank (An eligible credit

card account that is currently cancelled or suspended is not current

and valid).

15 16

epidemic

means a sudden development and rapid spreading of a contagious

disease in a region where it developed in a simply endemic state or

within a previously unscathed community.

Extended Warranty Insurance

means Extended Warranty Insurance described in the Base Cover

Other Insurances Terms and Conditions.

excess

means the deduction Allianz Global Assistance will make from the

amount otherwise payable under the applicable cover for each claimable

incident or event made by you.

formal wear

means dinner suit, dress shirt, bowtie, evening gown, cocktail dress

or other items of clothing which are required attire for formal dining/

functions. This includes wedding attire but does not include jewellery.

funeral expenses means:

a] for an Activated Policy and Upgrade Policy, the costs charged

by a funeral director for arranging your funeral service and by a

cemetery for your burial or a crematorium for your cremation. It

does not include the cost of memorialisation; or

b] for Interstate Flight Inconvenience Insurance:

• the costs of returning your remains or ashes to your home

town/city in Australia; and/or

• the costs of the funeral or cremation.

Group Policy

means the group policies issued by Allianz to the Commonwealth

Bank, in relation to the Base Cover.

Guaranteed Pricing Scheme

means Guaranteed Pricing Scheme described in the Base Cover

Other Insurances Terms and Conditions.

heli-skiing

means downhill skiing or snowboarding from locations only accessible

by helicopter.

home

means the place where you normally live in Australia.

hospital

means an established hospital registered under any legislation that

applies to it, that provides in-patient medical care.

income

means the amount of money you earn from personal exertion in a trade,

business, profession or occupation after the deduction of income tax.

injury or injured

means bodily injury caused solely and directly by violent, accidental,

visible and external means, which happens at a definite time and place

during the period of cover provided for your journey and does not

result from any illness, sickness or disease.

Together with the above, injury in relation to the Transit Accident

Insurance, with reference to hand or foot, means complete severance

through or above the wrist for the hand or above the ankle joint for

the foot and, as used with reference to an eye, means permanent

irrecoverable loss of the entire sight thereof.

insolvency or insolvent

means bankruptcy, provisional liquidation, liquidation, appointment

of a receiver, manager or administrator, entry into any official or

unofficial scheme of arrangement, statutory protection, restructuring

or composition with creditors, or the happening of anything of a similar

nature under the laws of any jurisdiction.

International Travel Insurance

means International Travel Insurance described in the Base Cover

International Travel Insurance Terms and Conditions, the

Activated Policy Terms and Conditions and Upgrade Policy

Terms and Conditions and each of them.

interstate flight

means travel on a registered and scheduled commercial passenger

airline from any Australian state or territory, to another Australian

state or territory.

Interstate Flight Inconvenience Insurance

means Interstate Flight Inconvenience Insurance described in the Base

Cover Other Insurances Terms and Conditions.

jewellery

means a form of personal adornment, such as brooches, rings,

necklaces, earrings, and bracelets. It does not include watches or

items of clothing.

journey means:

The journey starts when you leave your home or your place of

business to travel directly to the Australian air or sea terminal that is the

departure point for your journey.

The journey ends when the first of the following occurs:

a] for Base Cover, 3 months after the date of departure shown on a

Gold personal and business cardholder’s return overseas travel

ticket, (6 months for Platinum personal and business cardholders,

or 12 months for Diamond cardholders) or,

b] for any Activated Policy, the end date of the period of cover

shown on the Certificate of Insurance.

c] for any Upgrade Policy, the end date of the period of cover

shown on the Certificate of Insurance;

d] at midnight on the date when the cardholder’s scheduled

transport (as shown on their return overseas travel ticket) is due

to arrive in Australia;

e] when you return to your home, provided you travel directly there

from the Australian air or sea terminal where you landed; or

f] when the cardholder cancels their return overseas travel ticket.

legal costs

means fees, costs and expenses (including any applicable taxes and

charges) in connection with a legal action. It also means any costs which

you are ordered to pay by a court or arbitrator (other than any fine or

penalty, or aggravated, punitive, exemplary or liquidated damages) or

any other costs Allianz Global Assistance agree to pay.

17 18

medical adviser

means a doctor, a clinical psychologist or a dentist, who is not you, your

travel companion or a relative, or an employee of you, your travel

companion or a relative, holding the necessary certification in the

country in which they are currently practising and qualified to give the

diagnosis being provided.

mental illness

means any illness, condition or disorder listed in the current edition of the

Diagnostic and Statistical Manual of Mental Disorders.

moped or scooter

means any two-wheeled or three-wheeled motor vehicle with an engine

displacement of not greater than 50cc.

motorcycle

means any two-wheeled or three-wheeled motor vehicle with an engine

displacement greater than 50cc.

natural disaster

means any event or force of nature that has catastrophic consequences,

such as avalanche, earthquake, flood, bush fire, hurricane, tornado,

cyclone, tsunami and volcanic eruption, but not epidemics or

pandemics.

off-piste

means areas that are not:

a] groomed terrain,

b] marked slopes, or

c] trails that are open, maintained, monitored and patrolled by the

ski resort.

overseas

means outside Australia and its territories.

pandemic

means a form of an epidemic that extends throughout an

entire continent.

period of cover (this definition only applies to International

Travel Insurance)

means the time when you are covered under the International Travel

Insurance. The period of cover starts:

a] for Base Cover International Travel Insurance:

• for all benefits - at the commencement of the journey.

for an Activated Policy:

• Benefit 4 - Cancellation Fees & Lost Deposits - from the date

the cardholder completes Activation; and

• for all other benefits - the start date on the Certificate

of Insurance.

For an Upgrade Policy:

• for all benefits - the start date on the Certificate of Insurance.

b] and ends at the earliest of the following times:

• at the end of the journey; or

• when Allianz Global Assistance determines that you should

return to Australia for treatment.

personal goods includes all new personal property and valuables

acquired for personal domestic or household use, but does not include

the following:

• items with an original purchase price in excess of A$10,000

for Gold cardholders and A$20,000 for Diamond and

Platinum cardholders;

• items acquired for the purpose of re-supply/re-sale;

• items acquired for transformation in a business;

• business-owned or business-related items;

• items purchased in a business name;

• animals or plant material;

• computer software, information stored on electronic devices,

electronic applications or non-tangible items;

• cash, bullion, negotiable instruments, vouchers, gift cards, trading

cards, lottery tickets or other gambling-related items, tickets of any

description, travellers cheques, or collections such as stamps, coins

and cards;

• consumable or perishable items {including but not limited to food,

drugs, fuel or oil;

• boats, automobiles, motorboats, airplanes or any other motorised

vehicles and their integral parts and installed accessories;

• second-hand items, including antiques;

• items of contraband; or

• real estate and movable fixtures or fittings including but not limited

to dishwashers and fixed air conditioners which are, or are intended

to form, part of any home or real estate.

pre-existing medical condition

means a condition of which you were aware:

1. prior to the time you became eligible for the covers provided

in this booklet that involves:

a] your heart, brain, circulatory system/blood vessels; or

b] your lungs or chronic airways disease; or

c] cancer; or

d] back pain requiring prescribed pain relief medication; or

e] surgery involving any joints, the back, spine, brain or abdomen

requiring at least an overnight stay in hospital; or

f] Diabetes Mellitus (Type 1 or Type 2); or

g] your mental illness (including anxiety and depression); or

2. in the 2 years prior to the time you became eligible for the

covers provided in this booklet:

a] for which you have been in hospital or emergency department

or day surgery; or

b] for which you have been prescribed a new medication or had a

change to your medication regime; or

c] requiring prescription pain relief medication; or

19 20

3. prior to the time you became eligible for the covers provided

in this booklet that is:

a] pregnancy; or

b] connected with your current pregnancy or participation in an

IVF program; OR

4. for which, prior to the time you became eligible for the

covers provided in this booklet:

a] you have not yet sought a medical opinion regarding the

cause; or

b] you are currently under investigation to define a diagnosis; or

c] you are awaiting specialist opinion.

For the purposes of this definition ‘condition’ includes a dental condition

or mental illness. The above definition applies to you, your travel

companion, a relative or any other person.

premium

means the amount payable by you in relation to the covers described in

the Upgrade Policy Terms and Conditions.

professional sport

means training for, coaching or competing in any sporting event where

you are entitled to receive, or are eligible to receive, an appearance fee,

wage, salary or prize money in excess of $1,000.

public place

means any place that the public has access to, including but not limited

to planes, trains, cruise ships, taxis, buses, air or bus terminals, stations,

wharves, streets, shops, museums, galleries, hotels, hotel foyers and

grounds, beaches, restaurants, private car parks, public toilets and

general access areas.

Purchase Security Insurance

means Purchase Security Insurance described in the Base Cover

Other Insurances Terms and Conditions.

quad bike

means a motorised vehicle designed to travel on four or more

wheels, having a seat straddled by the operator and handlebars for

steering control.

reasonable means:

• in relation to medical and hospital expenses, the care obtained

should be at the standard level given in the country you are in

and not exceeding the level you would normally receive in

Australia; and

• in relation to unexpected travel and accommodation expenses,

the standard not exceeding the average standard of travel and

accommodation you had booked for the rest of your journey, or for

all other expenses, as determined by Allianz Global Assistance.

Reciprocal Healthcare Agreement

means an agreement between the Government of Australia and the

government of another country where Australian residents are provided

with subsidised essential medical treatment. (Please visit www.dfat.gov.au

for details of Reciprocal Healthcare Agreements with Australia).

redundant or redundancy

means loss of permanent paid full time employment (except voluntary

redundancy), after a continuous working period of two years with the

same employer.

relative

means a person who resides permanently in Australia, who is the

cardholder’s:

• spouse;

• parent, parent-in-law, step-parent, guardian;

• grandparent;

• child, grandchild, stepchild;

• brother, brother-in-law, sister, sister-in-law;

• daughter, daughter-in-law, son, son-in-law;

• fiancé, fiancée;

• uncle, aunt;

• half-brother, half-sister; or

• niece, nephew.

rental vehicle

means a campervan/motorhome that does not exceed 4.5 tonnes, a

sedan, coupe, hatchback, station wagon, SUV, four-wheel-drive or mini

bus/people mover rented from a licensed motor vehicle rental company

or agency.

return overseas travel ticket

means a return ticket from and returning to Australia.

sick or sickness

means a medical condition (including a mental illness), not being an

injury, the symptoms of which first occur or manifest during the period

of cover provided for your journey.

snow sport activities

means snow based activities conducted on groomed ski slopes within

ski resort boundaries.

snow sport equipment

means skis, poles, boots, bindings, snowboards or ice skates.

sporting equipment

means equipment needed and used to participate in a particular sport

and which can be carried about with you.

spouse

means the partner of the cardholder who is permanently living with the

cardholder at the time the journey starts (or the trip in respect of the

Transit Accident Insurance) or the time the interstate travel starts.

transaction card

means a debit card, credit card or travel money card.

Transit Accident Insurance

means Transit Accident Insurance described in the Base Cover Other

Insurances Terms and Conditions.

21 22

travel companion means:

• in regard to the International Travel Insurance, a person whom,

before the journey began, arranged to accompany you on your

journey for at least 50% of the time of your journey.

• in regard to the Interstate Flight Inconvenience Insurance, a

person who is accompanying you for at least 50% of the time of

your interstate travel.

travel services provider

means any scheduled service airline, hotel and resort operator,

accommodation provider, motor vehicle rental or hire agency, bus line,

shipping line or railway company.

trip

(this definition only applies to the Transit Accident Insurance)

means an international passage taken by the cardholder and their

spouse and/or dependent children if applicable, as a paying

passenger (not as a pilot, driver or crew member etc.) in a licensed

plane, tourist bus, train, ferry or other conveyance authorised pursuant

to any statute, regulation, by-law or the equivalent thereof for the

transportation of passengers for hire, provided that before the passage

commenced the cost of the passage was charged to the cardholder’s

eligible credit card account.

unattended

means when your possessions are not under your or your travel

companion’s observation, (i.e. when your possessions are in a

position where neither you nor your travel companion can observe

any attempt by anyone to interfere with them) and/or your possessions

can be taken without you or your travel companion being able to

prevent them from being taken. This includes if you are asleep and your

possessions are taken without your knowing.

Upgrade Policy

means the insurance policy described in the Upgrade Policy Terms

and Conditions and the cardholder’s current Certificate of

Insurance and any other document we tell you forms part of your policy.

Upgrade Policy Terms and Conditions

means the terms and conditions for an Upgrade Policy described in

Part 4 of this booklet, and incorporating the “General Information” in

Part 1 of this booklet.

valuables

means jewellery, watches, precious metals or semi precious stones/

precious stones and items made of or containing precious metals or

semi precious stones/precious stones, furs, binoculars, telescopes, any

kind of photographic, audio, video, computer, television, fax and phone

equipment (including mobile phones), tablets, MP3/4 players and PDAs.

you or your

means any of the following if they are eligible for the cover:

• the cardholder; and

• the cardholder’s spouse and/or dependent children.

Policy exclusions - what is not covered

The following exclusions apply to all the covers described in this

booklet. As well as these exclusions, there are also specific exclusions

applying to certain covers.

To the extent permitted by law:

1. we do not insure you for any event that arises directly or indirectly

from, or is in any way connected with, any pre-existing medical

condition of any person including you, your travel companion

or a relative other than as provided in ‘Part C - Benefits and cover’

of the Activated Policy under Benefit 4.1 f] on page 49 and Benefit

6.1.b] on page 52.

This exclusion will not apply:

• if you satisfy the provisions as set out under the heading

‘Pre-existing medical conditions which are covered (some

restrictions apply) in the section ‘Pre-existing medical

conditions for persons aged 79 years and under - International

Travel Insurance’ on pages 9 to 11 of “Part 1 - General

Information”, or under the heading ‘Pre-existing medical

conditions which may be covered with no additional premium

payable’ in ‘Part B - Upgrade options, benefits and limits’ of

the Upgrade Policy; or

• as provided in your Medical Terms of Cover letter and from the

time any additional premium that applies has been received by

us for pre-existing medical conditions for which you must

apply for cover and for which approval has been given by us.

Special conditions, limits and excesses may apply if we notify

you in writing.

2. we do not insure you for any event that arises from, is related to or

associated with any physical or mental signs or symptoms that you

were aware of before the commencement of any cover described in

this booklet commenced, but:

• you had not yet sought a medical opinion regarding the cause; or

• you were currently under investigation to define a diagnosis; or

• you were awaiting specialist opinion.

3. we do not insure you for any event involving the cost of medication

in use at the time the journey began or the cost for maintaining a

course of treatment you were on prior to the start of the journey.

4. we do not insure you for any expenses that arise directly or

indirectly out of pregnancy, childbirth or related complications

unless it is a single, uncomplicated pregnancy (up to and including

23 weeks) or we have agreed in writing to provide cover.

In any event we will not pay medical expenses for:

• regular antenatal care;

• childbirth at any gestation; or

• care of the newborn child.

5. we do not insure you for any travel that:

• you book or take against the advice of a medical adviser; or

• you take for the purpose of obtaining medical treatment

or advice.

23 24

6. we do not insure you for any event that arises, or is a consequence

of complications from medical, surgical or dental procedures or

treatments that are not for an injury or sickness that would be

otherwise be covered by this policy.

7. we do not insure you for any event that:

• arises directly or indirectly from, or is in any way connected with,

you being under the influence of any intoxicating liquor or drugs

except a drug prescribed to you by a medical adviser, and

taken in accordance with their instruction; or

• involves a hospital or clinic where you are being treated for

addiction to drugs or alcohol, or are using it as a nursing,

convalescent or rehabilitation place.

8. we will not pay any claim arising directly or indirectly from or in any

way connected with drug, substance or alcohol abuse or addiction.

9. we do not insure you for any event that is intentionally caused by

you or by a person acting with your consent (including suicide or

self-destruction or any attempt at suicide or self-destruction while

sane or insane).

10. we do not insure you for any event that arises directly or indirectly

from, or is in any way connected with, a sexually transmitted disease

or virus, unless we have agreed in writing to provide cover as set

out in your Medical Terms of Cover letter and you have paid any

additional premium that applies.

11. we will not pay for any expenses if, despite the advice given

following your call to Allianz Global Assistance, you received

private hospital or medical treatment where public funded

services or care is available in Australia or under any Reciprocal

Healthcare Agreement between the Government of Australia

and the government of any other country.

12. we do not insure you for any event that arises from any medical

procedures in relation to AICD/ICD insertion during overseas

travel. If you require this procedure, due to sudden and acute

onset which occurs for the first time during your journey and not

directly or indirectly related to a pre-existing medical condition,

we will exercise our right based on medical advice, to organise a

repatriation to Australia for this procedure to be completed.

13. we will not pay for any expense which arises from, or is in any way

related to or associated with any loss, damage, liability, event,

occurrence, injury or sickness where providing such cover would

result in us contravening the Health Insurance Act 1973 (Cth), the

Private Health Insurance Act 2007 (Cth) or the National Health Act

1953 (Cth) or where Allianz does not have the necessary licenses

or authority to provide such cover.

14. we will not pay for any expenses which are recoverable by

compensation under any workers compensation or transport

accident laws or by any government sponsored fund, plan, or

medical benefit scheme, or any other similar type legislation required

to be effected by or under a law.

15. we will not pay for loss of or damage:

• to any item that you post or otherwise pay to be transported,

and that is not part of your accompanying baggage;

• to any item that is brittle or fragile (except photographic or video

equipment), unless the loss or damage is caused by thieves,

burglars, fire, or an accident involving the means of transport in

which you are travelling);

• to sporting equipment while it is being used; or

• to valuables which are lost, stolen or damaged while in:

– unattended motor vehicles; or

– checked-in baggage/luggage; or

– baggage/luggage, unless the baggage/luggage is

directly under your personal supervision or that of your

travel companion.

• if you do not take all adequate precautions (considering the

value of the items) to protect your business items/property/

personal goods or if the business items/property/personal

goods are left:

– unattended in a public place;

– unattended in an unlocked motor vehicle;

– unattended in a motor vehicle in view of someone looking

into the motor vehicle;

– unattended in a motor vehicle overnight;

– behind, forgotten or misplaced in a public place; or

– with a person who steals or deliberately damages them.

• for the disappearance of the business items/property/

personal goods in circumstances which cannot be explained

to our reasonable satisfaction.

• as a result of non-receipt of the business items/property/

personal goods that you have purchased and which is/are

being transported to you.

• caused by laundering (including washing, ironing and dry

cleaning) whether by professional persons or otherwise.

• arising out of additional damage caused while an item is being

serviced or repaired, unless we have authorised the work.

16. we will not pay for loss of or damage to:

• items that you buy to resell or re-supply in your business;

• items acquired for transformation in a business;

• commercial samples;

• items you take to sell while overseas;

• securities, stamps, manuscripts or books of account;

• computer software, information stored on electronic devices,

electronic applications or non-tangible items; or

• works of art and antiques.

17. we will not pay for loss or damage caused by any of the following:

• an electrical or mechanical fault or breakdown unless covered

under the Extended Warranty Insurance;

• vermin or insects;

• mildew, atmospheric or climatic conditions, or flood;

25 26

• deterioration, normal wear and tear, or damage arising

from inherent defects in the business items/property/

personal goods;

• any defective item or any defect in an item, unless covered

under the Extended Warranty Insurance;

• any process of repairing or restoring the item unless we have

given prior approval; or

• your failure to comply with the recommended security

guidelines for the use of bank or currency notes, cheques,

credit card, postal or money orders or petrol coupons.

18. we do not insure you for any event that is caused by or arises from

any of the following:

• any government prohibition or restrictions or government

authorities delaying you or seizing or keeping your belongings;

• any person, organisation, government or government authority

who lawfully destroys or removes your ownership or control of

any business items/property/personal goods;

• travel to countries or parts of a country for which:

1. a] an advice or warning has been released by the Australian

Government Department of Foreign Affairs and Trade or

any other government or official body, and

b] the advice or warning risk rating is ‘Reconsider your need

to travel’ or ‘Do not travel’ (or words to that effect) or the

advice or warnings advise against all non-essential travel

to or in that location or advise against specific transport

arrangements or participation in specific events or

activities, or

2. the mass media has indicated the existence or potential

existence of circumstances (including circumstances referred

to in 1 a] and 1 b] above) that may affect your travel;

and

3. you did not take appropriate action to avoid or minimise any

potential claim under your policy (including delay of travel to

the country or part of the country referred to in the relevant

advice(s), warning(s) and/or mass media statement(s) ).

Circumstances, in this case, include but are not limited to strike,

riot, weather event, civil protest or contagious disease (including

an epidemic or pandemic).

• an actual or likely epidemic or pandemic; or the threat of an

epidemic or pandemic.

Refer to www.who.int and www.smartraveller.gov.au for further

information on epidemics and pandemics.

• any war or war like activities. whether war has been formally

declared or not, any hostilities, rebellion or revolution, or civil

war, military coup, or overthrow/attempted overthrow of a

government/military power.

• radioactivity, or the use, existence or escape of any nuclear fuel,

nuclear material or nuclear waste.

• biological and/or chemical materials, substances, compounds

or the like used directly or indirectly for the purpose to harm or

to destroy human life and/or create public fear.

• illegal activities, fraud or abuse.

• consequential loss or damage, punitive damages or any

fines or penalties, including punitive, exemplary, liquidated or

aggravated damages.

• changes in currency rates.

• you do not doing everything you can to reduce your loss as

much as possible.

• you intentionally or recklessly act in a way that would

reasonably pose a risk to your safety or the safety of your

business items/personal goods, except in an attempt to

protect the safety of a person or to protect property.

• you not observing all safety warnings and advice about adverse

weather and terrain conditions.

• your or your travel companion’s employment or work

(whether paid or unpaid or voluntary) either in Australia or

overseas (other than where you or your travel companion

have been made unexpectedly redundant or as stated in

Benefit 4.2 l] of the Activated Policy), including not being able

to take leave from that employment.

• your underwater activities that involve using artificial breathing

equipment (unless you have an open water diving licence and

are diving with another person, or are diving with a qualified and

registered diving instructor.

• your mountaineering (involving the use of climbing equipment.

ropes or guides), rock climbing (involving the use of climbing

equipment, ropes or guides), white water rafting, white water

boating, abseiling, parasailing, skydiving, hang-gliding, base

jumping, wingsuiting, bungy jumping, pot holing, canyoning,

caving, fire walking, running with the bulls, rodeo riding, polo

playing, water skiing, jet skiing, tobogganing, off-piste snow

skiing, off-piste snowboarding and snow mobiling.

• your racing (other than on foot).

• you or your travel companion participating in professional

sport of any kind.

• your travel in any air supported device other than as a

passenger in a fully licensed aircraft operated by an airline or

charter company, or regulated or licensed ballooning.

• any activities involving hunting equipment or projectiles (e.g.

shooting and archery).

• you:

– driving a motor vehicle or riding a moped or scooter

without a current Australian drivers licence or drivers

licence valid for the country you are driving or riding in. This

applies even if you are not required by law to hold a licence

in the country you are driving or riding in;

– riding a motorcycle without a current Australian

motorcycle licence or motorcycle licence valid for the

country you are riding in. This applies even if you are not

required to hold a motorcycle licence because you hold a

drivers licence, or a motorcycle licence is not required by

law in the country you are riding in;

27 28

– riding or travelling as a passenger on a motorcycle with an

engine capacity greater than 250cc;

– travelling as a passenger on a motorcycle, moped or

scooter that is in the control of a person who does not

hold a current motorcycle or drivers licence valid for the

vehicle being ridden and for the country you are riding in;

– riding, or travelling as a passenger, on a motorcycle,

moped or scooter without wearing a helmet;

– riding, or travelling as a passenger, on a quad bike.

• you not wearing the appropriate protective clothing and head

protection for the sport or activity you are participating in.

• the conduct of someone who enters your accommodation with

your consent, or whose accommodation you choose to enter.

Sanctions

Notwithstanding any other terms, we shall not be deemed to provide

coverage or will make any payments or provide any service or benefit

to any person or other party to the extent that such cover, payment,

service, benefit and/or any business or activity of the person would

violate any applicable trade or economic sanctions law or regulation.

General Insurance Code of Practice

Allianz and Allianz Global Assistance proudly support the General

Insurance Code of Practice.

The Code sets out the minimum standards of practice in the general

insurance industry. For more information on the Code please call Allianz

Global Assistance.

Financial claims scheme

In the unlikely event Allianz were to become insolvent and could not

meet its obligations under insurance covers described in this booklet, a

person entitled to claim may be entitled to payment under the Financial

Claims Scheme.

Access to the Scheme is subject to eligibility criteria. For more

information visit www.fcs.gov.au.

Jurisdiction and choice of law

All insurance covers are governed by and construed in accordance with

the law of New South Wales, Australia and you agree to submit to the

exclusive jurisdiction of the courts of New South Wales. You agree that it

is your intention that this Jurisdiction and Choice of Law clause applies.

Privacy

To arrange and manage your Base Cover, Activated Policy and

Upgrade Policy (in this Privacy Notice together “covers”) (as relevant),

we (in this Privacy Notice “we”, “our” and “us” includes AWP Australia

Pty Ltd trading as Allianz Global Assistance and its duly authorised

representatives) collect personal information including sensitive

information from you and those authorised by you such as your family

members, travel companions, your doctors, hospitals, as well as

from others we consider necessary, including our agents.

Any personal information provided to us is used by us to evaluate

and arrange your cover. We also use it to administer and provide the

insurance services and manage your and our rights and obligations in

relation to those insurance services, including managing, processing

and investigating claims. We also collect, use and disclose it for

product development, marketing, conducting research and analytics

in relation to all of our products and services, IT systems maintenance

and development, recovery against third parties, the detection and

investigation of suspected fraud and for other purposes with your

consent or where authorised by law.

This personal information is disclosed to third parties we engage

or who assist us carry out the above functions or processes, such

as travel agents and consultants, travel insurance providers and

intermediaries, authorised representatives, other insurers, reinsurers,

claims handlers and investigators, cost containment providers, medical

and health service providers, overseas data storage and data handling

providers, legal and other professional advisers, your agents, the

Commonwealth Bank and its related and group companies, and our

related and group companies including Allianz. Some of these third

parties may be located in other countries such as Thailand, France and

India to name a few. You agree that while those parties will often be

subject to confidentiality or privacy obligations, they may not always

follow the particular requirements of Australian privacy laws.

Unless you opt out, we may contact you on an ongoing basis by

telephone, mail, electronic messages (including email), online and via

other means with promotional material and offers of products or services

that we consider may be relevant and of interest to you (including

financial and insurance products and roadside assistance services). If

you do not want to receive such offers from us (including product or