CYBER INSURANCE

Insurers and

Policyholders Face

Challenges in an

Evolving Market

Report to Congressional Committees

May 2021

GAO-21-477

United States Government Accountability Office

United States Government Accountability Office

Highlights of GAO-21-477, a report to

congressional committees

May 2021

CYBER INSURANCE

Insurers and Policyholders Face Challenges in an

Evolving Market

What GAO Found

Key trends in the current market for cyber insurance include the following:

• Increasing take-up. Data from a global insurance broker indicate its clients’

take-up rate (proportion of existing clients electing coverage) for cyber

insurance rose from 26 percent in 2016 to 47 percent in 2020 (see figure).

• Price increases. Industry sources said higher prices have coincided with

increased demand and higher insurer costs from more frequent and severe

cyberattacks. In a recent survey of insurance brokers, more than half of

respondents’ clients saw prices go up 10–30 percent in late 2020.

• Lower coverage limits. Industry representatives told GAO the growing

number of cyberattacks led insurers to reduce coverage limits for some

industry sectors, such as healthcare and education.

• Cyber-specific policies. Insurers increasingly have offered policies specific

to cyber risk, rather than including that risk in packages with other coverage.

This shift reflects a desire for more clarity on what is covered and for higher

cyber-specific coverage limits.

Cyber Insurance Take-up Rates for a Selected Large Broker’s Clients, 2016–2020

The cyber insurance industry faces multiple challenges; industry stakeholders

have proposed options to help address these challenges.

• Limited historical data on losses. Without comprehensive, high-quality

data on cyber losses, it can be difficult to estimate potential losses from

cyberattacks and price policies accordingly. Some industry participants said

federal and state governments and industry could collaborate to collect and

share incident data to assess risk and develop cyber insurance products.

• Cyber policies lack common definitions. Industry stakeholders noted that

differing definitions for policy terms, such as “cyberterrorism,” can lead to a

lack of clarity on what is covered. They suggested that federal and state

governments and the insurance industry could work collaboratively to

advance common definitions.

View GAO-21-477. For more information,

contact

John Pendleton at (202) 512-8678 or

.

Why GAO Did This Study

Malicious cyber activity poses

significant risk to the federal

government and the nation’s

businesses and critical infrastructure,

and it costs the U.S. billions of dollars

each year. Threat actors are becoming

increasingly capable of carrying out

attacks,

highlighting the need for a

stable cyber insurance market.

The National Defense Authorization

Act for Fiscal Year 2021 includes a

provision for GAO to study the U.S.

cyber insurance market. This report

describes (1) key trends in the current

market for c

yber insurance, and (2)

identified challenges faced by the

cyber insurance market and options to

address them.

To conduct this work, GAO analyzed

industry data on cyber insurance

policies; reviewed reports on cyber risk

and cyber insurance from researchers,

think tanks, and the insurance industry;

and interviewed Treasury officials.

GAO also interviewed

two industry

associations representing cyber

insurance providers, an organization

providing policy language services to

insurers, and one large cyber

insu

rance provider.

Page i GAO-21-477 Cyber Security Insurance

Letter 1

Background 3

Cyber Insurance Coverage Varies by Industry and Entity Size, but

Growing Cyber Risk Creates Uncertainty in Evolving Market 5

Cyber Insurance Industry Faces Multiple Challenges, but Options

Have Been Proposed to Address Them 13

Agency Comments 20

Appendix I GAO Contact and Staff Acknowledgments 21

Figures

Figure 1: Cyber Insurance Take-up Rates for a Selected Large

Broker’s Clients, 2016–2020 5

Figure 2: Cyber Insurance Take-up Rates for a Selected Large

Broker’s Clients, by Industry, 2016–2020 7

Figure 3: Direct Written Premiums and Policies in Force for Cyber

Insurance, 2016–2019 9

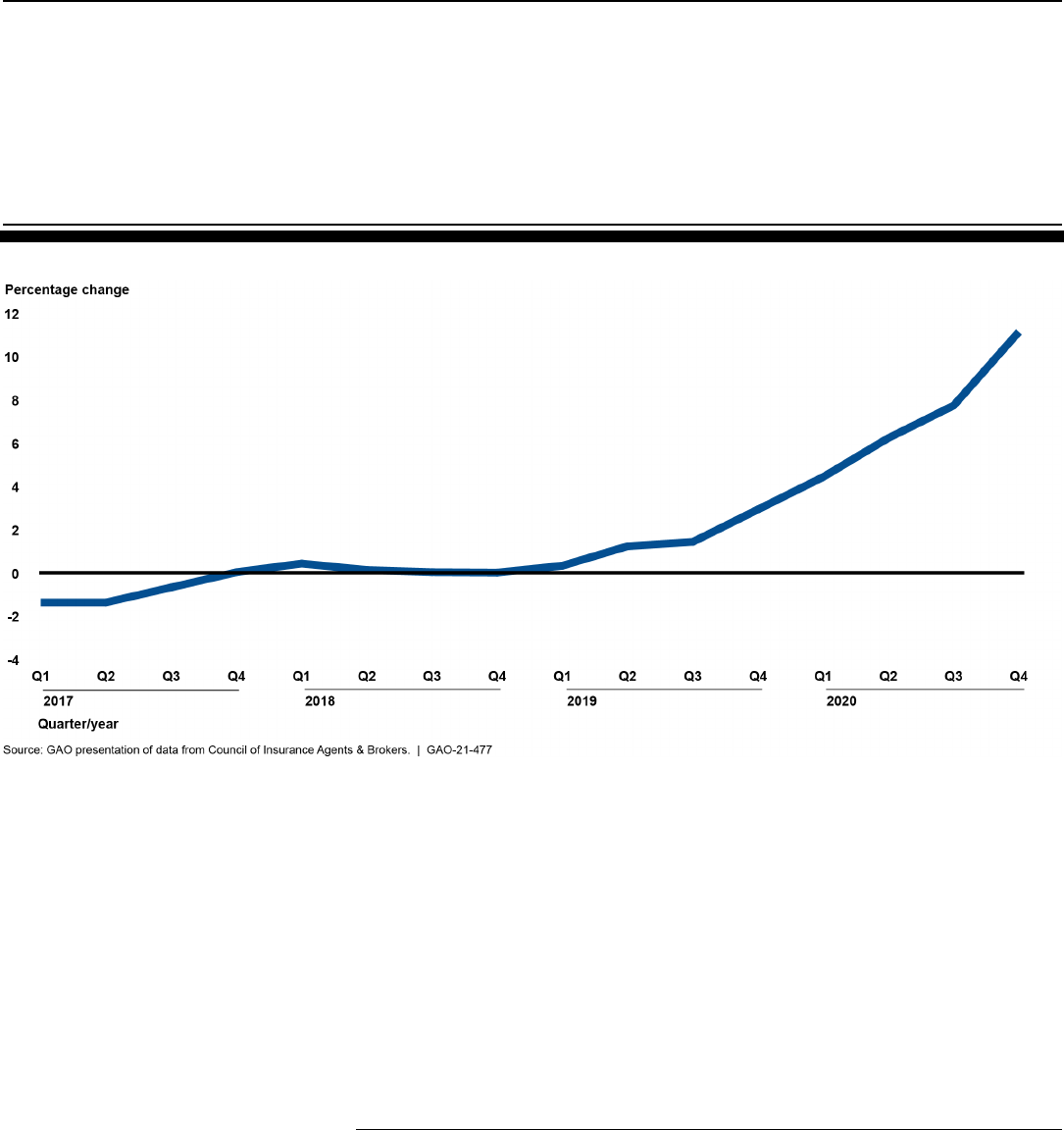

Figure 4: Change in Cyber Insurance Premiums, 2017–2020 11

Contents

Page ii GAO-21-477 Cyber Security Insurance

Abbreviations

NAIC National Association of Insurance Commissioners

Treasury Department of the Treasury

TRIA Terrorism Risk Insurance Act

TRIP Terrorism Risk Insurance Program

This is a work of the U.S. government and is not subject to copyright protection in the

United States. The published product may be reproduced and distributed in its entirety

without further permission from GAO. However, because this work may contain

copyrighted images or other material, permission from the copyright holder may be

necessary if you wish to reproduce this material separately.

Page 1 GAO-21-477 Cyber Security Insurance

441 G St. N.W.

Washington, DC 20548

May 20, 2021

The Honorable Jack Reed

Chairman

The Honorable James M. Inhofe

Ranking Member

Committee on Armed Services

United States Senate

The Honorable Adam Smith

Chairman

The Honorable Mike Rogers

Ranking Member

Committee on Armed Services

House of Representatives

The cost of malicious cyber activity to the U.S. economy was between

$57 billion and $109 billion in 2016, according to the White House Council

of Economic Advisers.

1

Since 1997, we have designated cybersecurity as

a government-wide high-risk area, and U.S. businesses and other entities

continue to face significant cybersecurity risks with the potential for large

losses.

2

Some members of Congress and others have raised questions

about the availability, affordability, and stability of the cyber insurance

market. Cyber insurance is a broad term for policies that cover liability

and property losses from events adversely affecting electronic activities

and systems.

3

The National Defense Authorization Act for Fiscal Year 2021 includes a

provision for us to review the state and availability of insurance coverage

in the United States for cybersecurity risks.

4

This report addresses (1) the

1

Council of Economic Advisers, The Cost of Malicious Cyber Activity to the U.S. Economy

(Washington, D.C.: February 2018).

2

GAO, High Risk Series: Dedicated Leadership Needed to Address Limited Progress in

Most High-Risk Areas, GAO-21-119SP (Washington, D.C: Mar. 2, 2021).

3

More specifically, cyber insurance generally refers to policies that address first-party

losses to a policyholder and third-party losses to a policyholder’s client or customer as a

result of an event that jeopardizes the confidentiality, integrity, and availability of an

information system

.

4

William M. (Mac) Thornberry National Defense Authorization Act for Fiscal Year 2021,

Pub. L. No. 116-283, § 9005, 134 Stat. 3388, 4777 (2021).

Letter

Page 2 GAO-21-477 Cyber Security Insurance

state of coverage and key trends in the current market for cyber

insurance, and (2) identified challenges faced by the cyber insurance

market and potential options to address them. The focus of this report is

cyber insurance provided to businesses and other entities and not to

individual consumers.

To describe the current market for cyber insurance, we reviewed publicly

available data from the National Association of Insurance Commissioners

(NAIC), including on premiums and policies in force. We evaluated the

reliability of the data by comparing NAIC’s reported aggregate figures for

domestic insurers to a S&P Global Market Intelligence database of cyber

supplement data submitted by individual domestic insurers, and assessed

NAIC’s methods for estimating premiums when they were not reported.

5

We also determined what cyber coverage might not be reported,

evaluated premium and policy data on surplus line insurers domiciled

outside the United States, interviewed staff from NAIC and industry

stakeholders, and performed electronic tests. We found the data, after

adjustment to the 2016 estimate of nonreported package policy

premiums, sufficiently reliable for reporting aggregate market trends. We

also reviewed data on take-up rates (the proportion of entities electing

coverage) from Marsh McLennan, a global insurance broker and risk-

management firm. We reviewed reports from the Department of the

Treasury (Treasury) and NAIC on the markets for cyber insurance and

terrorism risk insurance. We interviewed industry participants and

reviewed industry market reports, including from Marsh McLennan; A.M.

Best, a global credit rating agency specializing in the insurance industry;

the Council of Insurance Agents and Brokers, an association of large

commercial insurance and employee benefits brokerages; and the

Insurance Information Institute, an online provider of insurance

information to consumers. We also interviewed staff from Treasury and

NAIC.

To identify key challenges the market faces and potential options to

address them, we reviewed reports and statements from federal and state

officials, including Treasury, NAIC, the Department of Homeland

Security’s insurance industry working sessions, and the U.S.

5

In 2015, state insurance regulators, through NAIC, developed the Cybersecurity and

Identity Theft Coverage Supplement for insurers’ annual financial statements, which

requires insurers providing this coverage to report to NAIC data including policies in force,

premiums, claims, and losses.

Page 3 GAO-21-477 Cyber Security Insurance

Cybersecurity Solarium Commission.

6

We also reviewed reports and

statements and interviewed industry participants to obtain their

perspectives on challenges in the market and options for addressing

them. These industry participants included Marsh McLennan and A.M.

Best, two industry associations that represent cyber insurance providers,

a company that provides insurers with sample policy forms and

standardized policy language, and one large cyber insurance provider.

7

We also reviewed reports from researchers and academics, including

from an international think tank, an independent nongovernmental

organization, and a professional organization representing actuaries. The

information we obtained from these industry participants and researchers

may not represent the views and practices of all industry participants or

researchers.

We conducted this performance audit from January 2021 to May 2021 in

accordance with generally accepted government auditing standards.

Those standards require that we plan and perform the audit to obtain

sufficient, appropriate evidence to provide a reasonable basis for our

findings and conclusions based on our audit objectives. We believe that

the evidence obtained provides a reasonable basis for our findings and

conclusions based on our audit objectives.

A cyber incident is defined as a cyber event that jeopardizes the

cybersecurity of an information system or the information the system

processes, stores, or transmits; or an event that violates security policies,

procedures, or acceptable use policies, whether resulting from malicious

activity or not.

8

Cyber incidents, including cyberattacks, can damage

information technology assets, create losses related to business

disruption and theft, release sensitive information, and expose entities to

liability from customers, suppliers, employees, and shareholders.

6

U.S. Cyberspace Solarium Commission, U.S. Cyberspace Solarium Commission Final

Report (Washington, D.C.: March 2020). The commission is a bipartisan,

intergovernmental body, created by statute to develop a strategic approach to defense

against significant U.S. cyberattacks. Department of Homeland Security, National

Protection and Programs Directorate, Insurance Industry Working Session Readout

Report: Insurance for Cyber-Related Critical Infrastructure Loss: Key Issues (Washington,

D.C.: July 2014).

7

The industry associations were the Council for Insurance Agents and Brokers and

American Property Casualty Insurance Association.

8

Financial Stability Board, Cyber Lexicon (Nov. 12, 2018).

Background

Page 4 GAO-21-477 Cyber Security Insurance

Some private insurance companies offer businesses and other entities

cyber insurance to protect against first-party (policyholder) and third-party

losses (policyholder’s clients or customers) from an event that

jeopardizes the confidentiality, integrity, and availability of an information

system. The insurance can be provided through a standalone policy that

provides only cyber insurance coverage or as a part of a package policy

that provides multiple types of coverage, such as a general commercial

liability insurance policy.

States regulate the private insurance market, including for cyber

insurance. The regulators seek to ensure that insurance policy provisions

comply with state law, are reasonable and fair, and do not contain major

gaps in coverage that might be misunderstood by consumers and leave

them unprotected. States generally do not establish minimum standards

for cyber insurance policy coverage; they largely have focused on the

solvency of cyber insurers, according to NAIC.

9

Some states and NAIC

have promoted cybersecurity and data protections for insurers.

10

The Federal Insurance Office in Treasury administers the Terrorism Risk

Insurance Program (TRIP), which requires the federal government to

share some losses with private insurers in the event of a certified act of

terrorism. Losses from cyberattacks might be reimbursed under TRIP if

the attacks met certain certification criteria specified by the program. We

will be issuing a report later in 2021 that examines (1) the risks and costs

of cyberattacks on U.S. critical infrastructure; (2) insurance coverage that

is available for losses related to cyber risk, including cyberterrorism; and

(3) the extent to which TRIP, under the Terrorism Risk Insurance Act

(TRIA), is structured to respond to cyberattacks and cyberterrorism.

9

In February 2021, the State of New York issued a Cyber Insurance Risk Framework that

directs insurers to take steps to improve and enhance their cybersecurity strategy to

include educating policyholders about cybersecurity and reducing the risk of cyber

incidents.

10

In 2017, NAIC adopted the Insurance Data Security Model Law to update state

insurance regulatory requirements relating to data security, investigations of cyber events,

and notification to state insurance commissioners of cybersecurity events at regulated

entities.

Page 5 GAO-21-477 Cyber Security Insurance

One way of assessing the extent of coverage among businesses is

through take-up rates. Insurance take-up rates refer to the percentage of

entities eligible for coverage that elect to take it. According to Marsh

McLennan, its clients’ cyber insurance take-up rates rose from 26 percent

in 2016 to 47 percent in 2020 (see fig. 1).

11

Figure 1: Cyber Insurance Take-up Rates for a Selected Large Broker’s Clients,

2016–2020

11

Marsh McLennan is the largest commercial insurance broker of U.S. business, by

revenues, according to the Insurance Information Institute’s 2021 Insurance Fact Book.

Cyber Insurance

Coverage Varies by

Industry and Entity

Size, but Growing

Cyber Risk Creates

Uncertainty in

Evolving Market

Cyber Coverage Varies by

Industry and Entity Size

Page 6 GAO-21-477 Cyber Security Insurance

Note: Insurance take-up rate refers to the percentage of entities eligible for coverage that elect to take

it. These figures represent take-up rates of Marsh McLennan clients that used Marsh McLennan as

their broker to obtain cyber coverage. Take-up rates for Marsh McLennan clients overall may be

higher because some clients may use another broker to obtain coverage.

Industry sources, including Marsh McLennan, also have reported that

take-up rates for small and mid-size entities lag those of larger entities.

12

According to industry representatives and reports, a combination of

factors likely contributed to lower take-up rates for small and mid-size

entities: underestimation of cyber risks, difficulty understanding

coverages, belief that current coverage is adequate, and affordability

concerns.

Take-up rates also vary by industry. According to Marsh McLennan,

among its clients, the industry sectors with the highest take-up rates in

2016–2020 included education and health care, which collect, maintain,

and use significant amounts of personally identifiable information or

protected health information (see fig. 2). Sectors experiencing significant

growth in take-up in that period included the hospitality and retail sectors,

which commonly collect payment card information. The manufacturing

sector’s take-up rate also grew significantly, as that industry became

increasingly aware of potential cyberattack risks, according to industry

sources.

12

No uniform standard exists for defining the size of an entity for insurance purposes,

although number of employees and annual revenue are frequently used as proxies. For

example, the Insurance Information Institute notes that small businesses are typically

those with fewer than 50 employees, although common small business policies are

available for businesses with fewer than 100 employees. According to Marsh McLennan,

entities with revenues of $250 million or less are generally considered part of the small

and mid-size market and businesses with revenue up to $1 billion are generally

considered mid-size. The Insurance Information Institute also generally considers

businesses with 50–1,000 employees and revenues from $10 million to $1 billion to be

mid-size.

Page 7 GAO-21-477 Cyber Security Insurance

Figure 2: Cyber Insurance Take-up Rates for a Selected Large Broker’s Clients, by Industry, 2016–2020

Note: Insurance take-up rate refers to the percentage of entities eligible for coverage that elect to take

it. Figures do not include Marsh McLennan clients that did not also use the company as their

insurance broker to obtain cyber coverage.

Various industry sources described their opinions on the availability and

affordability of cyber insurance. The Council of Insurance Agents and

Brokers told us coverage has been available and affordable since at least

2016 for the majority of entities of various sizes and across industries.

NAIC officials agreed that cyber insurance is generally currently available

and affordable, but noted this varies based on business size. Small

businesses may purchase cyber insurance less often if they perceive their

risks to be minimal or policies too costly. Representatives from the

Page 8 GAO-21-477 Cyber Security Insurance

Insurance Information Institute identified several factors such as industry

type and a business’s use of data that may affect the cost and

affordability of coverage.

The extent to which cyber insurance will continue to be generally

available and affordable remains uncertain. Despite the upward trend in

take-up rates to date, insurer appetite and capacity for underwriting cyber

risk has contracted more recently, especially in certain high-risk industry

sectors such as health care and education and for public-sector entities,

according to the Council of Insurance Agents and Brokers, Marsh

McLennan, and A.M. Best.

13

These sources noted the contraction has

resulted from factors that include increasing losses from cyberattacks, the

threat of future attacks, and overall insurance market conditions.

According to industry representatives and reports, underwriters have

been more carefully scrutinizing the risks posed by all entities, regardless

of size or sector, which could affect future cyber insurance availability and

affordability. They noted that insurers have become more selective in

extending coverage to high-risk entities and industries and increasing

prices of coverage they offer. This caution has been in response to the

increasing frequency, severity, and cost of cyberattacks and uncertainty

about the type, scope, and targets of future attacks.

Recent trends in the cyber insurance market include increasing demand,

higher premiums, a growing number of industry participants, and more

restrictive policy terms and coverage limits.

Increasing demand. The demand for cyber insurance has increased as

entities better understand and respond to increasing cyber risks.

According to our analysis of data from S&P Market Intelligence and NAIC,

the number of cyber insurance policies in force increased by about 60

percent in 2016–2019, from about 2.2 million policies to more than 3.6

million policies (see fig. 3).

14

The amount of total direct written premiums

13

Capacity is the maximum amount of insurance an insurer can underwrite and remain

financially solvent.

14

Policies in force are those that are active and for which premiums have been paid or are

being paid.

Growing Risks Have

Created Uncertainty in

Evolving Cyber Insurance

Market

Page 9 GAO-21-477 Cyber Security Insurance

increased by about 50 percent during this period, from $2.1 billion to $3.1

billion.

15

Figure 3: Direct Written Premiums and Policies in Force for Cyber Insurance, 2016–

2019

Note: Data include standalone and package cyber insurance premiums and policies in force reported

by both U.S. domiciled insurers and non-U.S. surplus lines insurers and reflect estimates for

unreported amounts. As of April 2021, complete data for 2020 were not available. The completeness,

consistency, and comparability of data may be limited due to insurers’ difficulty estimating premiums

for cyber coverage included in package policies with other property and liability coverages. Direct

written premiums for 2016 reflect GAO adjustments to NAIC’s estimate of package policy premiums

not reported by insurers.

According to one industry survey, more than 60 percent of brokers

surveyed reported that the top two drivers of new or increased sales of

cyber insurance were clients experiencing a cyberattack or hearing that

15

Direct written premiums are the dollar value of premiums an insurer receives on a policy

without any adjustment for any portion of premiums ceded to reinsurers. Because insurers

record written premiums as of the effective date of a policy contract, the recorded amount

may include premiums earned in a different period.

Page 10 GAO-21-477 Cyber Security Insurance

others suffered losses from an attack.

16

Another survey noted that that 75

percent of responding agents and brokers reported an increase in

demand for cyber coverage in the fourth quarter of 2020.

17

Higher premiums. After holding relatively steady in 2017 and 2018,

cyber insurance premiums increased markedly in 2020, as shown in

figure 4. Moreover, more than half of brokers recently surveyed reported

that their clients experienced a 10–30 percent price increase in cyber

insurance premiums from the third to the fourth quarter of 2020. Only 15

percent of these brokers reported no change in premium price during this

period.

18

Higher prices for cyber insurance have coincided with increased

demand for the product and higher insurer losses from increasingly

frequent and severe cyberattacks (particularly ransomware attacks that

block users from accessing systems or data until a ransom is paid),

according to A.M. Best, the Council of Insurance Agents and Brokers, and

NAIC.

19

16

Advisen and PartnerRe, Cyber Insurance–The Market’s View (September 2020).

17

The Council of Insurance Agents & Brokers, Commercial Property/Casualty Market

Index, Q4/2020 (Washington, D.C.: Feb. 17, 2021).

18

Commercial Property/Casualty Market Index, Q4/2020.

19

Losses and related claims defense costs paid as a percent of direct written premiums

(direct loss and loss cost ratio) rose from 16 percent in 2016 to 33 percent in 2019 for

standalone cyber policies. Fitch Ratings stated that it believes that cyber underwriting

performance will continue to deteriorate as underwriting exposure grows, coverage

broadens, and the nature of cyber claims evolves.

Page 11 GAO-21-477 Cyber Security Insurance

Figure 4: Change in Cyber Insurance Premiums, 2017–2020

Factors that can affect the extent of premium increases include the size of

a company, its industry, and the extent to which it has strong cyber

controls. For example, brokers specializing in cyber insurance for small

and mid-size entities told us that average premiums for cyber policies

currently range from about $1,400 to about $3,000 per million of limit for

small entities that have strong cyber controls and are in low-risk

industries. Premiums can be many times that amount depending on entity

and industry risk factors.

20

These same brokers told us premium

increases in 2021 were expected to be larger for high-risk industries and

mid-size and larger entities than for smaller entities, where premium

20

One broker told us that minimum premiums for high-risk industries with revenues up to

$5 million can range from $2,000 to $3,500 per million of limit, while other brokers said

premiums on policies that target mid-size entities with revenues from less than $100

million to $250 million can average from about $5,000 to more than $10,000 per million of

limit. In addition to entity and industry risk factors, premiums can differ based on the

amount of a deductible or other self-insured amount, which the brokers told us had

minimums from $1,000 to $5,000 for policies with a $1 million total limit. These same risk

factors also can result in lower coverage limits for certain perils, such as $250,000 for

social engineering and wire transfer attacks on a policy with a $1 million total limit.

Page 12 GAO-21-477 Cyber Security Insurance

increases are expected by one broker to be more in the range of 5–10

percent for those with strong cyber controls.

More industry participants in a concentrated market. The number of

insurers offering cyber coverage increased by about 35 percent between

2016 and 2019, according to our analysis of NAIC’s cyber supplement

data. However, new market participants (insurers entering the cyber

market after 2016) represented only about 9 percent of total premiums

written in 2019. The cyber insurance market is more concentrated than

the property and casualty insurance market as a whole. Our analysis of

S&P Market Intelligence Market Share Report and cyber supplement data

showed that 10 U.S. insurance groups wrote nearly 70 percent of cyber

insurance premiums in 2019, but represented 18 percent of total property

and casualty insurance premiums in 2019.

More cyber-specific policies. Insurers offer affirmative cyber

coverage—that is, coverage specific to cyber risk. This insurance is

offered through standalone cyber policies, package policies that combine

cyber coverage with professional liability coverages, and, less frequently,

through an affirmative cyber endorsement to other lines of coverage.

21

Industry sources have noted that the increase in cyber-specific policies

may reflect a desire for coverage of losses related to the confidentiality,

integrity or availability of data and systems and clarity about what is

covered, which in turn may help reduce claims disputes and litigation in

the event of a cyberattack. Standalone policies also provide policyholders

with a greater potential for higher cyber-specific limits.

22

Reduced coverage limits for certain sectors. According to industry

representatives and reports, the continually increasing frequency and

severity of cyberattacks, especially ransomware attacks, have led

insurers to reduce cyber coverage limits for certain riskier industry

21

Standalone policies cover specific types of risk, such as cyber risk. Other property and

casualty policies, such as those for commercial multi-peril, offer broad coverage for a

number of risks. Package policies combine property and liability coverages (such as by

adding an endorsement for cyber risk) into a single insurance contract.

22

Almost 60 percent of brokers responding to a recent industry survey stated their clients

sought to switch from an endorsement to a standalone policy to obtain a dedicated limit,

while almost 40 percent said the motivation to switch was a desire to obtain a higher limit

offered through a standalone policy. Cyber Insurance–The Market’s View.

Page 13 GAO-21-477 Cyber Security Insurance

sectors, such as health care and education, and for public entities and to

add specific limits on ransomware coverage.

Tighter terms and more exclusions. Industry participants have noted

that insurers have been tightening policy terms and conditions for cyber-

specific policies. They also have been adding exclusions to traditional

lines of coverage and package policies with cyber endorsements to avoid

any ambiguity that coverages would overlap with cyber policies. These

restrictions seek to eliminate coverage of “silent” cyber risks that could

damage multiple businesses and result in insurers accumulating

significant unforeseen losses that could pose a risk to their solvency.

23

A.M. Best representatives said that “silent” cyber is unlikely to be

eliminated in the short term, but continued movement towards standalone

cyber and clarification of policy language could help.

Key challenges facing the cyber insurance market include data

limitations, limited awareness of cybersecurity risks by businesses, and

the risk of aggregated losses from a cyberattack, according to

insurers, brokers, and other industry members we interviewed and

literature we reviewed. Several potential options have been proposed for

federal and state governments and the insurance industry to address

some of these challenges.

One challenge facing the cyber insurance industry is limited availability of

historical loss and cyber event data, according to industry reports and

experts we interviewed. Insurance companies use historical loss data to

quantify risk and set premium rates for insurance products. However,

according to reports by industry participants and a government entity,

historical data on cyber losses are very limited, incomplete, or of poor

quality.

24

According to a report by the Deloitte Center for Financial

Services, these limitations make it difficult to build the predictive models

23

Silent risk refers to coverage that is not explicitly granted or excluded in insurance

policies (“non-affirmative” risk).

24

Reasons for data limitations include the relative newness of the cyber insurance market,

the fact that most cyberattacks go unreported or undetected, and the lack of a centralized

source for information about cyber events.

Cyber Insurance

Industry Faces

Multiple Challenges,

but Options Have

Been Proposed to

Address Them

Limited Historical Data

Exist on Cyber Losses and

Events

Page 14 GAO-21-477 Cyber Security Insurance

that help assess the probability of loss from a cyberattack.

25

That report

also noted no comprehensive, centralized source of information about

cyber events exists for insurers to access.

26

In addition, a 2020 report by

the International Association of Insurance Supervisors noted that

incomplete or inaccurate historical data on cyber incidents decreases the

reliability of actuarial models, leading to increases in uncertainty around

loss estimates.

27

Without access to such data, some industry participants

and researchers are concerned that current prices for cyber policies may

not accurately reflect risk. According to NAIC, if a product is priced too

low, an insurer may not have the financial means to pay claims to the

policyholder, which could lead to insolvency. If priced too high, few

businesses and consumers might be able to afford the coverage.

Opportunities exist for improving the nation’s capacity for collecting cyber

event and loss data and for coordinating industry-wide efforts to collect

and share that information. According to a recent report by the U.S.

Cyberspace Solarium Commission, Congress could establish an entity to

collect data to better understand cyber risk and help the insurance

industry create better risk models.

28

The commission also suggested that

a public-private working group could be established at the Department of

25

Deloitte Center for Financial Services, Demystifying Cyber Insurance Coverage:

Clearing Obstacles in a Problematic but Promising Growth Market (Deloitte University

Press, 2017).

26

Historical loss data are used to build predictive models about expected costs, which are

part of the ratemaking process. These models are partly based on what the estimated loss

will be from specific events, such as data breaches or ransomware attacks. According to

Marsh McLennan, because there is no precedent for insurable cyber catastrophic events,

the insurance industry has drawn parallels or made assumptions based on lessons

learned from other lines of business and “near misses” in the cyber line of business, or

both. Deloitte and the U.S. Cyberspace Solarium Commission suggest that access to data

on cyber events would facilitate decision-making for insurers as it relates to modeling and

pricing.

27

International Association of Insurance Supervisors, Cyber Risk Underwriting: Identified

Challenges and Supervisory Considerations for Sustainable Market Development (Basel,

Switzerland: December 2020).

28

The commission’s report also includes recommendations to enact a national cyber

incident reporting law requiring critical infrastructure agencies to report cyber incidents to

the federal government, where the data would be anonymized and shared with a new

entity charged with collecting and providing cybersecurity data to inform policymaking and

government programs. The report recommends that the data entity act as a statistical

agency that collects, processes, analyzes, and disseminates essential data on

cybersecurity and cyber incidents to the public, Congress, federal agencies, state and

local government, and the private sector.

Page 15 GAO-21-477 Cyber Security Insurance

Homeland Security to convene insurance companies and cyber risk

modeling companies to collaborate on pooling available data that could

inform innovations in cyber risk modelling.

Support for better data collection dates back several years. During

Department of Homeland Security working sessions of the Cyber Incident

Data and Analysis Working Group, industry participants suggested that

an anonymized cyber incident data repository could foster voluntary data

sharing about attacks, data breaches, and business interruptions.

Participants suggested that a repository to share, store, aggregate, and

analyze sensitive cyber event data would help promote greater

understanding of the financial and operational effects of cyber events.

29

Our review of several reports on the industry by a U.S. agency and

researchers indicates that terms commonly used in cyber policies are not

consistently defined. Representatives from the Insurance Services Office,

a company that has produced widely used sample policy forms and

standardized policy language, said that the language used in cyber

policies with more than $5 million in coverage varies greatly.

30

They noted

that carriers may use slightly different language in their definitions. A

report by the Congressional Research Service found a lack of consensus

on what defines a cyberattack.

31

Similarly, a report by the Geneva

Association noted that neither “cyber war” nor “cyberterrorism” have a

29

On May 12, 2021, the president issued an Executive Order on cybersecurity that directs

federal contractors providing technology services to share information and data related to

cyber threats and incidents with the Cybersecurity and Infrastructure Security Agency

(CISA) and agencies with which they have contracted. The Executive Order further directs

CISA to centrally collect and manage this information. As part of the implementation of this

order, the Secretary of Defense acting through the Director of the National Security

Agency, the Attorney General, the Secretary of Homeland Security, and the Director of

National Intelligence is directed to develop procedures for ensuring that cyber incident

reports are promptly and appropriately shared among agencies. Executive Order on

Improving the Nation’s Cybersecurity (May 12, 2021).

30

The Insurance Services Office representatives told us they have noticed that policies

with more than $5 million in coverage are typically more specialized and customized to

each client.

31

Congressional Research Service, Cyberwarfare and Cyberterrorism: In Brief, R43955

(Washington, D.C.: Mar. 27, 2015).

Cyber Policies Lack

Common Definitions

Page 16 GAO-21-477 Cyber Security Insurance

common definition in the insurance market.

32

It also noted that no global

consensus exists on the exact behavior or criteria that define a cyber

event as either terrorism or warfare.

33

Finally, representatives from the

Council of Insurance Agents and Brokers told us insurers may define

ransomware attacks in different ways.

Staff from NAIC also told us that inconsistent policy language, which

includes the definition of key policy terms, might present challenges for

the insurance industry. They explained that if the industry does not use

consistent definitions for key policy terms, it will not be clear which perils

are covered and which are excluded, making it difficult to move toward

greater policy standardization.

34

In addition, this ambiguity can result in

misunderstandings and litigation between insurers and policyholders.

35

According to the Geneva Association, common terminology could lead to

a more sustainable cyber market in which insurers could make informed

choices about the levels of coverage and policyholders could understand

their insurance protection. Some industry stakeholders recommended

increased clarity and transparency in insurance language, including

uniform definitions for key insurance terms.

32

The Geneva Association is an international organization that conducts research in

different areas of the insurance industry, including cyber. The Geneva Association

reported that the definitions and understanding of cyberterrorism and cyberwarfare may

differ depending on the way they are applied in different settings, such as military or

political. The use of these insurance terms has varied between jurisdictions, companies,

and lines of business. The Geneva Association, Cyber War and Terrorism: Towards a

common language to promote insurability (July 2020).

33

The Geneva Association introduced “hostile cyber activity” as a potential term for the

insurance industry to mitigate the ambiguity surrounding policy wording in the context of

war and terrorism.

34

The Council of Insurance Agents and Brokers also stated that it is challenging to

determine which events are considered “cyberterrorism” because this is not an official

industry term.

35

In June 2017, Russian cyber operators launched destructive malware adapted from

vulnerabilities common to unpatched Windows operating systems, which quickly spread

worldwide. The NotPetya attack exposed some of the ambiguities in policy treatment of

certain cyber incidents. Several companies affected by this attack filed multiple claims with

their property and casualty insurers. Some of the insurers paid out the NotPetya claims

and others denied the claims by invoking a “war exclusion,” which is common in some

policies but had not been applied to cyber incidents. The companies sued the insurance

companies that denied the claim and the case remains in litigation.

Page 17 GAO-21-477 Cyber Security Insurance

Several industry associations, regulators, and participants said that many

entities, particularly smaller businesses, may underestimate their cyber

risks and the cyber coverage needed to mitigate those risks. According to

Marsh McLennan, insurance with inadequate limits and insufficient

coverage can lead to protection gaps, which increases a company’s

financial exposure.

36

According to the Geneva Association, the annual

global economic cost of cyber incidents may be almost twice the average

annual amount of natural disaster losses. A survey by the Better Business

Bureau found 87 percent of small business respondents believed they

were vulnerable to cyberattacks.

37

However, industry participants and a

regulator have stated that smaller entities may not fully appreciate the

magnitude of the cyber risk they face and the potential effects and costs

to their business of a cyberattack. Reports by several industry

researchers also indicate that some businesses are hesitant to purchase

cyber insurance because they do not see its value, believe it will not

provide for recovery from a cyberattack, or believe the coverage includes

too many exclusions.

38

The Council of Insurance Agents and Brokers has suggested that the

insurance industry, including insurance agents and brokers, can help

companies understand the risk, impact, and cost of a cyberattack on their

operations. They also advise that customers evaluate their cyber risk and

understand the coverage they purchase and its limits. NAIC

representatives told us the industry may offer additional cyber services to

help policyholders manage their cyber risk. But they added that some

small and mid-size businesses have limited technical resources or staff

with cybersecurity expertise and are not taking full advantage of these

services.

36

The Geneva Association defines insurance protection gaps as the difference between

the amount of insurance that is economically beneficial and the amount of coverage

actually purchased.

37

Better Business Bureau, 2017 State of Cybersecurity among Small Businesses in North

America (Arlington, Va.: 2017).

38

For example: Jon Bateman, War, Terrorism, and Catastrophe in Cyber Insurance:

Understanding and Reforming Exclusions, Carnegie Endowment for International Peace

Working Paper (Washington, D.C.: October 2020); and Organisation for Economic Co-

operation and Development, Enhancing the Role of Insurance in Cyber Risk Management

(2017).

Some Businesses Have

Limited Awareness of

Cyber Risks and

Coverage

Page 18 GAO-21-477 Cyber Security Insurance

Some industry participants and a regulatory agency said they were

unsure about the likelihood of Treasury certifying cyberattacks as acts of

terrorism, because the department has never certified any event under

TRIA and cyberattack characteristics may not readily meet the act’s

certification requirements. For Treasury to certify an act of terrorism under

TRIA, the act must be violent or dangerous to human life, property, or

infrastructure, generally result in losses in the United States, and be part

of an effort to coerce the civilian population of the United States or affect

the conduct of the U.S. government by coercion. However, cyberattacks

may not be violent, or they may cause losses to computer servers located

outside the United States. In addition, cyberattacks could be conducted

for financial ransom, rather than to coerce the government or population

of the United States. The Centers for Better Insurance noted that if TRIA

were to more openly encompass cyberattacks, Congress could amend

the statute to revise the certification criteria to include acts that involve

losses associated with electronic data and infrastructure, extend the

geographic parameters of the program beyond damage in the United

States, and broaden the scope of intent underlying the cyberattack

beyond coercion. However, the Insurance Information Institute suggested

that expanding TRIA coverage could have implications for the insurance

market and that insurers might pull back on the property and liability

insurance they offer if they felt they could not assume those levels of risk.

Some industry participants also have expressed two additional concerns.

First, they noted the possibility of an extremely large cyberattack, such as

to the electrical grid, exceeding the TRIA cap of $100 billion, leaving

losses above the cap uninsured. TRIA’s coverage cap has not been

adjusted since Congress passed TRIA. Second, some participants

expressed concerns about the increased level of risk borne by private-

sector insurers. Congressional reauthorizations of TRIA generally shifted

exposure from the federal government to the private sector.

39

In a May

2020 report, Treasury’s Advisory Committee on Risk Sharing

Mechanisms found that because of the shift in loss exposures, TRIP may

no longer be as effective a framework for insurance industry stability as it

39

According to our analysis of Treasury data on insurer direct-earned premiums, federal

losses following a terrorist event under the loss-sharing provision in effect in 2020 would

be smaller than they would have been for a similar event under the loss-sharing provision

in effect in 2015, across all event sizes and subsets of insurers. See GAO, Terrorism Risk

Insurance: Program Changes Have Reduced Federal Fiscal Exposure, GAO-20-348

(Washington, D.C.: Apr. 20, 2020).

Industry Stakeholders Cite

Concerns about TRIA’s

Applicability for

Cyberattacks

Page 19 GAO-21-477 Cyber Security Insurance

previously was, and recommended that Treasury review the potential

implications of changing the cap.

Cyber risk continues to evolve as technology and the methods of

cyberattack change, making it difficult for insurers to underwrite coverage.

The Federal Reserve Bank of Chicago has stated that the growing

sophistication and agility of threat actors has increased insurers’ cyber

risk exposure. Fitch has noted that underwriting cyber insurance policies

is challenging as technology advances and the connectivity of digital

devices to the internet or the cloud increases. Similarly, a recent study by

Deloitte found existing cyber exposures continue to change and new ones

arise.

40

It noted that even as insurers collect more data and hone

predictive models based on prior cyber threats, the underlying exposure

keeps changing. This makes it difficult to create a reliable predictive

model when it is not clear what new objective, strategy, or technique

cyber threat actors may deploy.

In addition, a single cyberattack could damage multiple businesses and

result in significant losses. NAIC staff told us that cyberattacks have the

potential for aggregated losses—that is, the possibility that many

businesses may simultaneously make claims.

41

Aggregated losses could

financially challenge insurers, even posing solvency risks. The Cambridge

Centre for Risk Studies similarly noted that cyberattacks can spread

quickly and cause aggregated losses, which according to its 2016 report,

was cited by most insurers as a primary reason for not expanding their

capacity to offer cyber insurance.

42

One example of how losses can quickly aggregate is the 2017 NotPetya

malware attack that originated in Russia, struck the Ukraine, and quickly

spread around the world, resulting in at least $10 billion in damages. The

U.S. Cybersecurity Solarium Commission reported that the malware

spread from targeted Ukrainian banks, payment systems, and federal

40

Deloitte Center for Financial Services, Demystifying Cyber Insurance Coverage:

Clearing Obstacles in a Problematic but Promising Growth Market (2017). Cyber

exposures are vulnerabilities associated with computers or network technology that create

potential losses for a business.

41

Aggregation risk refers to the fact that a single cyberattack could damage multiple

businesses, span connected systems, cover wide geographies, and result in aggregated

losses from the accumulation of exposures.

42

University of Cambridge Centre for Risk Studies, Managing Cyber Insurance

Accumulation Risk (2016).

Cyber Risks Are Evolving

and Could Involve

Aggregated Losses

Page 20 GAO-21-477 Cyber Security Insurance

agencies to power plants, hospitals, and other life-critical systems

worldwide. According to a 2020 report published by the Carnegie

Endowment for International Peace, cyber risk presents a high potential

for aggregated losses, and a single cyber event may result in claims from

multiple sources at once.

43

Concerns about the systemic risks and

potential for aggregated losses posed by such attacks have led insurers,

according to Marsh McLennan, to seek loss modeling beyond that for

known, non-catastrophic portfolio losses to include modeling for the

impact of catastrophic cyber events. Marsh McLennan said that it expects

insurers will rely more heavily on data and analytics to inform underwriting

strategy, product pricing, and reinsurance purchasing as cyber portfolios

continue to grow and modeling matures.

We provided a draft of this report to Treasury and NAIC for review and

comment. Treasury and NAIC provided technical comments, which we

incorporated as appropriate.

We are sending copies of this report to the appropriate congressional

committees, the Secretary of the Treasury, and other interested parties.

In addition, the report is available at no charge on the GAO website at

https://www.gao.gov.

If you or your staff have any questions about this report, please contact

me at (202) 512-8678 or [email protected]. Contact points for our

Offices of Congressional Relations and Public Affairs may be found on

the last page of this report. GAO staff who made key contributions to this

report are listed in appendix I.

John H. Pendleton

Director, Financial Markets and Community Investment

43

Jon Bateman, War, Terrorism, and Catastrophe in Cyber Insurance: Understanding and

Reforming Exclusions.

Agency Comments

Appendix I: GAO Contact and Staff

Acknowledgments

Page 21 GAO-21-477 Cyber Security Insurance

In addition to the contact named above, Winnie Tsen (Assistant Director),

Nathan Gottfried (Analyst in Charge), Evelyn Calderon, Scott McNulty,

Barbara Roesmann, Stephen Ruszczyk, Jessica Sandler, Jena Sinkfield,

and Andrew Stavisky made significant contributions to this report.

Appendix I: GAO Contact and Staff

Acknowledgments

GAO Contact

Staff

Acknowledgments

(104726)

The Government Accountability Office, the audit, evaluation, and investigative

arm of Congress, exists to support Congress in meeting its constitutional

responsibilities and to help improve the performance and accountability of the

federal government for the American people. GAO examines the use of public

funds; evaluates federal programs and policies; and provides analyses,

recommendations, and other assistance to help Congress make informed

oversight, policy, and funding decisions. GAO’s commitment to good government

is reflected in its core values of accountability, integrity, and reliability.

The fastest and easiest way to obtain copies of GAO documents at no cost is

through our website. Each weekday afternoon, GAO posts on its website newly

released reports, testimony, and correspondence. You can also subscribe to

GAO’s email updates to receive notification of newly posted products.

The price of each GAO publication reflects GAO’s actual cost of production and

distribution and depends on the number of pages in the publication and whether

the publication is printed in color or black and white. Pricing and ordering

information is posted on GAO’s website, https://www.gao.gov/ordering.htm.

Place orders by calling (202) 512-6000, toll free (866) 801-7077, or

TDD (202) 512-2537.

Orders may be paid for using American Express, Discover Card, MasterCard,

Visa, check, or money order. Call for additional information.

Connect with GAO on Facebook, Flickr, Twitter, and YouTube.

Subscribe to our RSS Feeds or Email Updates. Listen to our Podcasts.

Visit GAO on the web at https://www.gao.gov.

Contact FraudNet:

Website: https://www.gao.gov/fraudnet/fraudnet.htm

Automated answering system: (800) 424-5454 or (202) 512-7700

Orice Williams Brown, Managing Director, WilliamsO@gao.gov, (202) 512-4400,

U.S. Government Accountability Office, 441 G Street NW, Room 7125,

Washington, DC 20548

Chuck Young, Managing Director, young[email protected], (202) 512-4800

U.S. Government Accountability Office, 441 G Street NW, Room 7149

Washington, DC 20548

Stephen J. Sanford, Acting Managing Director, [email protected], (202) 512-4707

U.S. Government Accountability Office, 441 G Street NW, Room 7814,

Washington, DC 20548

GAO’s Mission

Obtaining Copies of

GAO Reports and

Testimony

Order by Phone

Connect with GAO

To Report Fraud,

Waste, and Abuse in

Federal Programs

Congressional

Relations

Public Affairs

Strategic Planning and

External Liaison

Please Print on Recycled Paper.