MOODY’S ANALYTICS INSURANCE COSTS TRENDS BECOMING A HEADACHE FOR THE CRE MARKET

1

CRE

Insurance costs trends becoming a headache

for the CRE market

Summary

Insurance coverage cost and availability has become an increasing pain point for commercial

real estate (CRE) market participants. Property insurance expenses traditionally inflate by

roughly two to three percent per year, which is a typical expense budgeting target of

underwriters, lenders and asset managers. However, year-over-year insurance cost growth has

spiked to over 17% in some markets in recent years. We found that on average nationally, CRE

properties have seen about a 7.6% annual growth rate since 2017. The average cost of

insurance tends to be much higher for properties exposed to acute climate risks, but the

elevated insurance expense growth rate is largely ubiquitous across the country.

On top of this, some property owners are struggling to get coverage or maintain the requisite

coverage in their loan agreements, which leads to rippling implications for lenders.

Understanding the growing insurance expense trends and availability challenges provides an

important foundation from which to preemptively factor this into underwriting and

structuring deals around insurance requirements. Exploring the potential drivers of these

changes can also begin to indicate how these trends may evolve over time.

We reviewed the insurance costs trends of over 100,000 properties over the last 20 years. In

this report we summarized trends in insurance rates nationally and identified the markets with

the highest insurance costs and rate of cost inflation. We also differentiated properties and

their insurance costs where our modeling suggests the greatest potential damage and

business interruption due to acute climate-related hazards, such as hurricanes, floods and

wildfires.

REPORT

3 AUGUST, 2023

Authors

Kevin Fagan

Head of CRE Economic Analysis

Natalie Ambrosio Preudhomme

Associate Director

Caglar Demir

Assistant Director of Research

Contact Us

Americas

+1

.212.553.1658

clientservices@moodys.com

Europe

+44.20.7772.5454

clientservices.emea@moodys.com

Asia (Excluding Japan)

+85 2 2916 1121

clientservices.asia@moodys.com

Japan

+81 3 5408 4100

clientservices.japan@moodys.com

MOODY’S ANALYTICS INSURANCE COSTS TRENDS BECOMING A HEADACHE FOR THE CRE MARKET

2

Insurance Rates are Rising Nationally

Insurance rates are increasing nationwide, with a particular spike in the last five years. Overall insurance rates tend to increase

gradually over time, as we would expect given inflation. Our data shows that during times of economic downturn (ie 2009-2011)

prices decline gradually rather than increasing gradually. We also see that beginning around 2018 or 2019, depending on the

property type, the rate of increase in the past several years is noticeably higher than the gradual increase of previous years.

While different property types show moderately different rates of increase, the trend is consistent for all of them, as Figure 1

illustrates. This trend is also ubiquitous across geographies, supporting a more anecdotal theme heard repeatedly in the market

over the last year: the recent rapid increase in insurance premiums is proving challenging or prohibitive for some CRE transactions,

particularly for lenders that have long relied on insurance to offload most physical risks associated with properties.

Figure 1 Average annual insurance and rolling average annual growth in insurance by property type

Source: Moody’s Analytics CRE

0

100

200

300

400

500

600

-2%

0%

2%

4%

6%

8%

10%

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

Average Insurance Cost ($/unit)

Average Annual Growth Rate

Year

Multifamily

3-Yr Rolling Average Annual Growth Average Cost

0

0.05

0.1

0.15

0.2

0.25

0.3

0.35

0.4

0.45

0.5

-3%

-2%

-1%

0%

1%

2%

3%

4%

5%

6%

7%

8%

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

Average Cost ($/ sq ft)

Average Annual Growth Rate

Year

Office

3-Yr Rolling Average Annual Growth Average Cost

0

0.05

0.1

0.15

0.2

0.25

0.3

0.35

0.4

0.45

0.5

-4%

-2%

0%

2%

4%

6%

8%

10%

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

Average Cost ($/ sq ft)

Average Annual Growth Rate

Year

Retail

3 Yr Rolling Average Annual Growth Rate Average Cost

0

0.05

0.1

0.15

0.2

0.25

0.3

0.35

-4%

-2%

0%

2%

4%

6%

8%

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

Average Cost ($ / sq ft)

Average Annual Growth RAte

Year

Industrial

3-Yr Rolling Average Annual Growth Rate Average Cost

0

100

200

300

400

500

600

700

-4%

-2%

0%

2%

4%

6%

8%

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

Average Cost ($/unit)

Average Annual Growth Rate

Year

Hotel

3-Yr Average Annual Growth Mean Insurance Cost

MOODY’S ANALYTICS INSURANCE COSTS TRENDS BECOMING A HEADACHE FOR THE CRE MARKET

3

Looking Past the Averages, Cost Increases Skew High

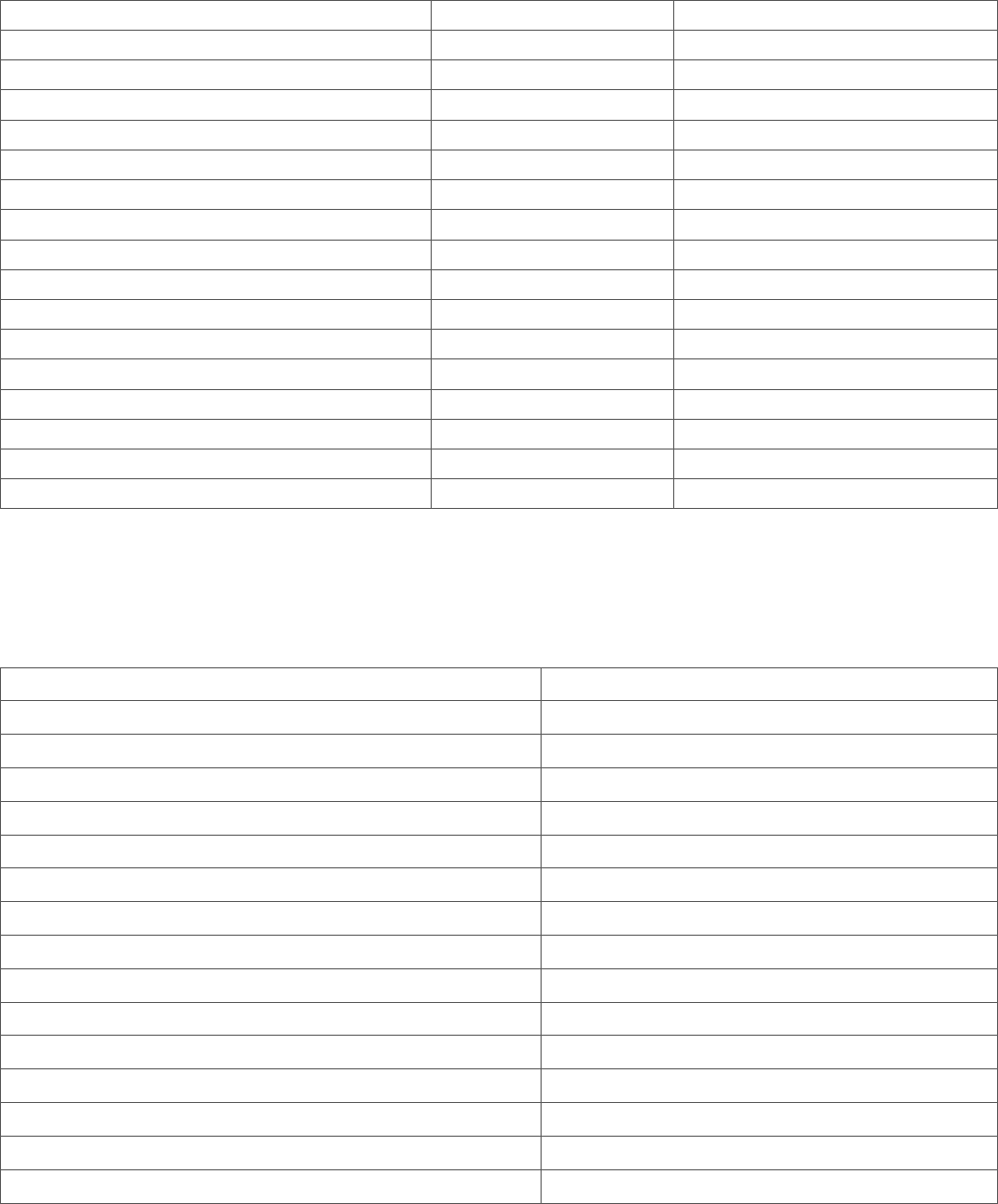

There is a wide distribution of insurance cost growth around the national average. There is a significant share of properties that

have maintained historically normal insurance inflation, but the distribution does skew toward the higher-than-average expense

increases. The cost growth is not isolated to a small handful of properties or markets.

Among all properties we examined, the biggest share of them experienced insurance cost compound annual growth rates (CAGRs)

above 10% from 2017 through 2022, as Figure 2 shows. This was the case across all CRE property types. Additionally, the majority

of properties across each property type saw insurance premium CAGRs over 5% over the last five years.

The bottom line is that, if these trends continue, most properties are likely to see well-above historical average insurance expense

growth. One of the differentiators is that some markets’ insurance costs are growing at higher rates than others, which we’ll dive

into in the next section.

Figure 2 Distribution of insurance expense CAGR (2017-2022) across properties

1

Source: Moody’s Analytics CRE.

Note:

1

National average CAGR shown in middle of charts.

Some Metros Are Trending Much Worse than Others

Insurance expenses are trending higher than prior to 2017 in the vast majority of markets, but some metros are feeling the pain

much worse than others, with many having average annual growth rates above 10%. There isn’t an obvious relationship between

region of metros and insurance cost growth, but Texas, Sunbelt, Northeastern and California metros tended to be among the

metros with highest growth rates.

We also noted that the property type with the most metros having >10% annual insurance cost growth rates since 2017 was

multifamily. Therefore, in the remainder of this section, we’ve focused on multifamily metros and their insurance trends. Similar

metro trend data for the other property types is provided in the Appendix.

MOODY’S ANALYTICS INSURANCE COSTS TRENDS BECOMING A HEADACHE FOR THE CRE MARKET

4

Metros with the highest median rate of insurance increase are spread across the country, with 25% of the top 20 metros for

multifamily located in Texas. Multifamily properties have the highest median CAGRs. Table 1 shows insurance expense CAGR

alongside rent CAGR for additional context for “real” expense growth, inasmuch as expenses are impacting the bottom-line

property net operating income (NOI).

Table 1. Top (left) and bottom (right) metros for 2017-2022 insurance expense and rent CAGR for multifamily

1,2

METRO INSURANCE CAGR RENT CAGR METRO INSURANCE CAGR RENT CAGR

Colorado Springs 17.3% 6.3% District of Columbia 3.4% 2.5%

Tulsa 14.9% 4.3% Chicago 5.0% 5.6%

San Antonio 14.8% 4.7% Minneapolis 5.1% 3.5%

Dallas 14.4% 6.1% New York Metro 5.2% 3.8%

Oklahoma City 14.3% 4.1% Northern New Jersey 5.6% 4.7%

Memphis 14.3% 6.8% Long Island 5.9% 4.4%

Fort Worth 14.2% 5.2% Pittsburgh 6.1% 4.8%

Raleigh-Durham 13.7% 6.6% Cleveland 6.2% 6.4%

Nashville 13.4% 4.0% Hartford 6.4% 4.7%

Kansas City 13.3% 5.2% Buffalo 6.5% 4.9%

Austin 13.2% 5.9% Philadelphia 6.7% 5.7%

Salt Lake City 13.2% 6.4% Detroit 7.0% 4.9%

Los Angeles 13.0% 4.8% Westchester 7.0% 5.7%

Knoxville 13.0% 6.8% San Diego 7.8% 5.8%

Orlando 12.9% 7.7% Oakland-East Bay 7.9% 4.0%

Columbia 12.8% 2.8% Norfolk/Hampton Roads 8.0% 5.8%

Fort Lauderdale 12.7% 7.7% Milwaukee 8.3% 5.1%

Houston 12.6% 4.1% Suburban Virginia 8.4% 2.8%

Charlotte 12.6% 6.9% San Jose 8.5% 2.4%

Jacksonville 12.4% 7.6% Rochester 8.6% 6.0%

Source: Moody’s Analytics CRE

Notes:

1

To obtain the median CAGR by metro we calculated the CAGR for each property with an insurance value in 2017 and 2022 and then took the median of that sample. See the

Appendix for the highest and lowest CAGRs and insurance prices for the other four property types.

2

To obtain rent CAGR we used average metro level rent growth from 2017 through

2022.

Higher rates of increase of insurance expenses do not appear to be isolated to metros with the highest CAGR for rent, meaning

insurance expenses are exceeding general metro-level rent inflation in most cases. However, it is noteworthy that Florida metros,

many of which have some of the highest insurance cost CAGRs also have seen some of the highest growth in rents. Florida metros

have experienced both high general inflation on top of having insurability issues stemming from hurricane risk. These metros

exemplify that a mix of factors can drive insurance rates, which we’ll discuss more in the next section.

When it comes to the level of property insurance cost, rather than rate of change, we see different metros on top, with a wide

range around the average (see Table 2). Many of the metros with the highest median insurance expense are in Florida and

California. These metros tend to have higher value properties per unit, and many are also in states that have been experiencing

repeated climate-related disasters, namely hurricanes and wildfires.

Table 2. Top (left) and bottom (right) multifamily metros by 2022 insurance cost

1

METRO INSURANCE ($/UNIT) METRO INSURANCE ($/UNIT)

San Francisco 1086.83 Tucson 249.01

New Orleans 1019.74 Phoenix 252.03

MOODY’S ANALYTICS INSURANCE COSTS TRENDS BECOMING A HEADACHE FOR THE CRE MARKET

5

Miami

1004.06

San Bernardino/Riverside

310.84

New York Metro

1002.45

Cleveland

312.23

Westchester

889.96

Columbus

313.84

Palm Beach

861.22

Las Vegas

316.93

Fort Lauderdale

814.41

Salt Lake City

329.44

Long Island

706.34

Richmond

329.85

Houston

690.86

Albuquerque

339.95

Northern New Jersey

669.25

Greensboro/Winston-Salem

341.38

Boston

614.14

Orange County

342.73

Oklahoma City

609.64

Charlotte

356.71

Tampa-St. Petersburg

607.17

Pittsburgh

361.10

Memphis

585.88

Milwaukee

365.74

Oakland-East Bay

581.49

Sacramento

366.71

Fort Worth

580.47

Dayton

367.66

Central New Jersey

566.90

Knoxville

370.56

Jacksonville

554.86

Suburban Virginia

379.06

Dallas

551.76

Indianapolis

379.61

Tulsa

545.95

Detroit

380.93

Source: Moody’s Analytics CRE.

Note:

1

Median insurance cost per unit for metro.

A Variety of Factors Drive Insurance Trends

We know that many factors affect the insurance market, interacting to drive insurance premiums. Among others, these factors

include general inflation, social inflation, litigation, increasing frequency and severity of natural catastrophes, liquidity in the

insurance capital markets, and the responses of reinsurers and regulators to these factors.

Firstly, general inflation has been affecting many aspects of the US economy, as prices continue to increase. However, as RMS

explains, the impact of inflation on insurance premiums is driven by more nuanced factors than the price of general goods typically

captured by the Consumer Price Index. A more informative metric might be something like the Producer Price Index which shows

that residential construction costs have generally been rising faster than the general inflation. However, this index is also highly

volatile, reflecting the nuanced supply chain challenges and demand fluctuations specific to construction materials. As inflation of

construction materials leads to higher insurance payouts, this is likely to affect insurance pricing over time. Although it’s unclear

how year-over-year fluctuations of a construction index like the Producer Price Index will take hold on a long-term basis. This type

of inflation also affects insurers through its impact on reinsurers, potentially leading to a lag time for it to thoroughly get priced in

by primary insurers.

Another factor influencing rising insurance premiums is social inflation, which refers to the way in which insurers’ costs rise above

the rate of economic inflation. For example, in Florida, there was a “25 percent rule” which mandated that if 25% or more of a roof

is deemed damaged, the entire roof must be replaced. While the rule has since been amended, it did contribute to “loss creep,” in

which insurance payouts end up being higher than one would expect purely looking at storm damage. However, rules like this also

pave the way for a bustling litigation landscape. In fact, Florida’s Office of Insurance Regulation points to insurance fraud as a key

driver of rising insurance premiums. The state only has about 9% of insurance claims in the nation, but has over 76% of property

insurance lawsuits. From outright fraud, such as claiming a roof is storm damaged when it's really just aging, to more nuanced

litigation around proving whether or not 25% of a roof has been storm damaged, these issues play a large role in the Florida

insurance market. Detailed analysis of various risk drivers can start to parse out the impact of social inflation on increasing insurers’

loss ratios and in turn rising premiums.

Accelerating growth in claims from climate-related hazards is also contributing to this rise in insurance premiums, and the ramp

up in insurance costs does appear to follow closely with the cost of billion-dollar-plus loss events in the US (see Figure 3). The

impact on insurance costs appears particularly acute in states like California and Florida with substantial exposure to repeated

MOODY’S ANALYTICS INSURANCE COSTS TRENDS BECOMING A HEADACHE FOR THE CRE MARKET

6

extreme events. These states’ five-year average loss ratios for homeowners insurance are 117% and 80% respectively. In California,

property & casualty insurers and their reinsurers had $36 billion in losses from the 2017 and 2018 wildfires, with their 2017 loss

ratio over 200%. Insurers are also pulling out of these highly exposed areas, further complicating the market. For example, State

Farm will no longer write new home or business property insurance policies, and Allstate stopped selling new homeowners

insurance policies in 2022. These challenges around insurance availability are interacting with other factors like affordability and

local amenities which drive migration and development to certain areas, which in some cases continue to have a growing demand

that has not yet significantly been curbed by these growing challenges.

Figure 3 Multifamily insurance costs and US natural disasters

Sources: NOAA National Centers for Environmental Information (NCEI), Moody’s Analytics CRE, Moody’s Analytics CMBS.

The structure of an insurance market also influences the availability and affordability of insurance, interacting with the impacts of

extreme events. For example, much of the Florida insurance market is composed of small, non-diversified insurance companies.

From April 2022 through May 2023, seven of Florida’s local property insurers went insolvent, and 24 are on the regulatory

watchlist. These local companies face substantial loss when a major hurricane hits, given the concentration of their business

activities. They in turn rely heavily on reinsurance, which is facing similar challenges and are also increasing their premiums

accordingly, which in turn further challenges the primary insurers. Due to current market conditions, some reinsurers may have

large unrealized losses on their fixed income investments as interest rates rise. This can present liquidity risk if severe catastrophes

do occur.

Moody’s Investors Service summarizes these various pressure points for insurers, writing that “Weak sector profitability in recent

years from above average catastrophe losses, inflationary pressures, a focus on the impact of climate change on catastrophe event

frequency, strong demand from ceding companies and tight supply conditions in the collateralized retrocessional market all point

to higher pricing in the months ahead.”

Unpacking One Driver of Rising Premiums: Climate Hazard Exposure

Leveraging the expertise and analytical tools of Moody’s RMS for catastrophe modeling and climate data (see box regarding data

and methodologies), we dug deeper into the relationship between acute climate risk exposure and insurance expenses. As

discussed above, there is ample anecdotal evidence to support such a relationship, but given the multitude of factors driving

insurance costs, it is not a clear-cut relationship. This final section of our report examines the relationship between climate hazard

risk and both the level and the growth rate of insurance expenses for property owners.

0

5

10

15

20

25

200

250

300

350

400

450

500

550

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Count of $1B+ Natural Disasters in the US

Average Multifamily Insurance Cost/Unit

MOODY’S ANALYTICS INSURANCE COSTS TRENDS BECOMING A HEADACHE FOR THE CRE MARKET

7

We overlayed the data on properties’ insurance premiums with data on the estimated damage from their modeled exposure to

acute climate-related hazards (floods, hurricanes and wildfires). We did not see an obvious correlation between the growth rate of

insurance premiums since 2017 and the estimated acute climate risk. However, we did find that the properties with the highest

insurance premiums tend to have higher estimated damage from climate hazards (see Figure 4). We show only trends for retail

properties here, but this trend holds for all property types. See the Appendix for equivalent charts for the other core property

types.

Figure 4 Median insurance premium by year for retail properties grouped by their acute climate risk

1

Sources: Moody’s Analytics CRE, Moody’s Analytics RMS.

Note: 1 We grouped properties into quintiles based on the sum of their Moody’s RMS Climate on Demand (CoD) average annualized damage (AAD) scores for hurricanes, wildfires and

floods. To see equivalent charts for the other four property types, refer to the Appendix.

This trend also persists when we normalize for property value (as proxied by gross revenue of the property). Figure 5 shows the

median insurance expense as a share of gross property revenue. While the insurance expense as a share of revenue fluctuated over

the last five years by climate risk group, it remained substantially higher for the group of properties with the highest exposure to

acute climate hazards.

Insurance premiums are often sized by the value and revenue of a CRE property, and higher value and revenue CRE properties are

often located in coastal areas with higher acute climate risk. However, insurance costs have also been consistently higher as a

share of revenue for the highest climate risk properties.

Figure 5 Median insurance premium as share of gross revenue for retail properties grouped by their acute climate risk

1

Sou

rces: Moody’s Analytics CRE, Moody’s Analytics RMS.

MOODY’S ANALYTICS INSURANCE COSTS TRENDS BECOMING A HEADACHE FOR THE CRE MARKET

8

Note:

1

We grouped properties into quintiles based on the sum of their Moody’s RMS Climate on Demand (CoD) average annualized damage (AAD) scores for hurricanes, wildfires and

floods. To see equivalent charts for the other four property types, refer to the Appendix.

When we unpack the relationship between type of acute hazard exposure and insurance premiums, we find that hurricane

exposure has the clearest relationship to insurance expense. In most property types when we bucket properties by their

hurricane average annual damage (AAD) estimates, those properties in the highest bucket show the highest insurance expenses

consistently for the past five years. Figure 6 illustrates this trend for the hotel sector.

Figure 6 Median insurance premium by year for hotel properties grouped by their hurricane risk

1

Sources: Moody’s Analytics CRE, Moody’s Analytics RMS.

Note:

1

We grouped properties into quintiles based on the sum of their Moody’s RMS Climate on Demand (CoD) average annualized damage (AAD) scores for hurricanes. To see equivalent

charts for the other four property types, refer to the Appendix.

Once again, this trend holds even when normalizing for value, by looking at the insurance expense as a share of revenue in Figure

6. Anecdotal evidence suggests that hurricane exposure is a driving force behind increasing insurance premiums along the Gulf

Coast, as discussed previously. Figure 6 does show substantial volatility in insurance premiums’ share of revenue, and it isn’t

consistently trending upward as one would expect. This reflects that both insurance markets and property markets are in flux and

do not

necessarily change in pace with one another.

Figure 7 Median insurance premium as a share of gross revenue for hotel properties grouped by their hurricane risk

1

Sources: Moody’s Analytics CRE, Moody’s Analytics RMS.

Note:

1

We grouped properties into quintiles based on the sum of their Moody’s RMS Climate on Demand (CoD) average annualized damage (AAD) scores for hurricanes. To see equivalent

charts for other property types, refer to the Appendix.

The trends for multifamily follow a similar pattern but are not quite as clear cut. When looking at both median insurance premium

(Figure 8) and median insurance premium as a share of revenue (Figure 9) those properties with no modeled hurricane risk are in

the bottom of the insurance expense, but those in the highest hurricane risk only appear on top when normalizing for value by

looking at insurance cost as a share of revenue.

MOODY’S ANALYTICS INSURANCE COSTS TRENDS BECOMING A HEADACHE FOR THE CRE MARKET

9

Figure 8 Median insurance premium by year for multifamily properties grouped by their hurricane risk

1

Sources: Moody’s Analytics CRE, Moody’s Analytics RMS.

Note:

1

We grouped properties into quintiles based on the sum of their Moody’s RMS Climate on Demand (CoD) average annualized damage (AAD) scores for hurricanes. To see equivalent

charts for other property types, refer to the Appendix.Median insurance premium as share of gross revenue for multifamily properties grouped by their hurricane risk

1

Figure 9 Median insurance premium as share of gross revenue for multifamily properties grouped by their hurricane risk

1

Sources: Moody’s Analytics CRE, Moody’s Analytics RMS.

Note:

1

We grouped properties into quintiles based on the sum of their Moody’s RMS Climate on Demand (CoD) average annualized damage (AAD) scores for hurricanes, wildfires and

floods. To see equivalent charts for other property types, refer to the Appendix.

For hotels, office and retail we find that the metro with the highest median hurricane AAD has the highest median insurance

expense in 2022 (see Table 3). For retail this is true of the several top metros. The top metros for both insurance expense and AAD

occur in Florida.

Table 3. Metros / property type combinations with the highest average insurance costs in 2022

PROPERTY TYPE

METRO

MEDIAN INSURANCE EXPENSE

MEDIAN HURRICANE AAD

Retail Miami 1.64 ($/ sq ft) $5,082

Office Fort Lauderdale 1.61 ($/sq ft) $4,628

Hotel Fort Lauderdale 1435.86 ($/unit) $5,072

Source: Moody’s Analytics CRE.

Takeaways

This nascent research into property insurance trends demonstrates that insurance premiums are increasing, faster than years prior.

The rate of increase skews higher for most properties, and some metros are experiencing insurance expense increases much

MOODY’S ANALYTICS INSURANCE COSTS TRENDS BECOMING A HEADACHE FOR THE CRE MARKET

10

greater than their average rent growth. We also see that, while there are many factors at play driving these trends, higher climate

risk generally equivocates to higher insurance cost per square foot or per unit. We also found that hurricane risk exposure was the

strongest differentiator of insurance costs among acute climate risks.

Many questions remain and this lays the groundwork for further research including exploring the time horizon that insurers may be

factoring climate risk into underwriting, separating catastrophe insurance out from other insurance, assessing the relationship with

NOI and conducting more detailed state level analysis relative to state insurance legislature policies. This also underscores the

need for solutions in the insurance industry, that best manage the desire for development with the reality that much of this

development is in areas that will be repeatedly hit by devastating hazards. This is an area of active exploration in the market and is

a topic we’ll continue to monitor closely.

Appendix

Table 4. Top (left) and bottom (right) metros for 2017-2022 insurance expense and rent CAGR for Retail

1,2

METRO INSURANCE CAGR RENT CAGR METRO INSURANCE CAGR RENT CAGR

Austin

11.9%

0.8%

Cleveland

2.6%

0.3%

Suburban Maryland

11.1%

0.9%

Detroit

3.3%

0.5%

San Antonio

11.0%

1.3%

San Diego

3.6%

0.7%

Dallas

10.8%

0.7%

Chicago

4.8%

0.8%

Palm Beach

10.5%

1.2%

Tampa-St. Petersburg

4.9%

0.4%

Methodology

Insurance Data

Moody’s collects CMBS property income, expense, reserve and capital expenditure data in CRE Financial Council Investor

Reporting Package format. The dataset contains more than 114,000 loans and 123,000 properties spanning back to the early

1990s. This dataset provides one data point covering all of a property’s insurance expenses. Thus, while this analysis focuses on

factors related to property and casualty insurance we are not able to parse out different types of insurance coverages.

For this analysis we focused on the past 20 years and looked specifically at multifamily, hotel, office, retail, and industrial

(which includes self-storage and warehouses) properties. We cleaned the dataset by removing outliers and adjusting for

incomplete data. This included annualizing statements that do not cover a full year using respective statement start & end dates.

We cleaned overlapping statement periods to construct property-level annual insurance expense series (at a monthly frequency),

interpolating as needed. We calculated national insurance expense indices for each property type by averaging these property-

level series. For metro level analysis we only included metros with at least twenty properties in our database with data for both

2017 and 2022 so as not to skew the results with outliers.

Climate Data

For the climate risk portion of our analyses, we used data from Moody’s Climate on Demand. Climate on Demand characterizes

physical climate risk through exposure scores for six climate hazards that are the most common climate-related hazards that can

result in significant business risk: flooding, heat stress, hurricanes & typhoons, sea level rise, water stress and wildfires. Climate on

Demand includes Average Annualized Damage (AAD), an estimate of the long-term damage, including physical damage,

downtime, increased operating costs and reduced productivity, that an asset faces due to each climate hazard. To inform the

Climate on Demand AAD estimate users can input replacement cost of the building and its contents combined with a measure

of net annual revenue. For this analysis, since we don’t have this detailed data for each property, we used $1 million of property

replacement cost as the exposed value to enable comparisons between assets in relative terms. Thus, in this report AAD is in

units of dollars, assuming a million dollars of exposure, with exposure defined as the combination of replacement cost and net

annual revenue for the site. We focused on the AAD values for acute climate hazards most likely to influence insurance costs in

the near term, including floods, wildfires and hurricanes. Climate on Demand offers RCP 4.5 and 8.5 and several time horizons

including 2020, 2030, 2040, 2050, 2075 and 2100. For this analysis we used RCP 8.5 and 2050.

MOODY’S ANALYTICS INSURANCE COSTS TRENDS BECOMING A HEADACHE FOR THE CRE MARKET

11

Fort Worth

9.9%

0.4%

Baltimore

5.5%

1.1%

St. Louis

9.8%

Raleigh-Durham

5.7%

1.1%

Suburban Virginia

9.4%

0.3%

Charlotte

5.8%

1.1%

Fort Lauderdale

9.1%

0.4%

Phoenix

6.0%

0.6%

Denver

9.0%

0.4%

Fresno

6.2%

-0.1%

Columbus 9.0% 0.7% Atlanta 6.2% 0.7%

Greenville 8.9% 0.3% Las Vegas 6.4% 0.6%

Orlando

8.6%

1.0%

Oakland-East Bay

6.4%

0.9%

Pittsburgh

8.6%

0.8%

Kansas City

6.6%

0.2%

Norfolk/Hampton Roads

8.5%

0.5%

Indianapolis

6.8%

0.3%

Houston

8.4%

1.1%

Orange County

6.8%

0.6%

Los Angeles

8.2%

0.9%

Philadelphia

7.1%

0.5%

Boston

8.1%

0.7%

New Orleans

7.4%

0.3%

San Bernardino/Riverside

8.0%

0.1%

Birmingham

7.4%

0.6%

New York Metro

7.8%

Miami

7.5%

1.4%

Source: Moody’s Analytics CRE

Notes:

1

To obtain the median CAGR by metro we calculated the CAGR for each property with an insurance value in 2017 and 2022 and then took the median of that sample. See the

Appendix for the highest and lowest CAGRs and insurance prices for the other four property types.

2

To obtain rent CAGR we used average metro level rent growth from 2017 through

2022.

Table 5. Top (left)and bottom (right) retail metros for 2022 insurance cost

1

METRO INSURANCE ($/SQ FT) METRO INSURANCE ($/SQ FT)

Miami

1.64

Cleveland

0.21

Palm Beach 1.33 Detroit 0.25

Fort Lauderdale

1.32

Columbus

0.26

New York Metro

1.23

Raleigh-Durham

0.27

New Orleans

1.17

Charlotte

0.29

Tampa-St. Petersburg

0.87

Phoenix

0.30

Orlando

0.81

Pittsburgh

0.30

Houston

0.73

Suburban Virginia

0.32

Northern New Jersey 0.70 Greenville 0.32

San Antonio

0.62

Birmingham

0.34

Dallas

0.56

Atlanta

0.34

Denver

0.54

Indianapolis

0.35

Oakland-East Bay

0.54

Fresno

0.36

Los Angeles

0.52

Baltimore

0.36

Boston 0.51 Kansas City 0.37

Fort Worth 0.50 Las Vegas 0.39

Philadelphia

0.50

Chicago

0.40

Austin

0.49

San Diego

0.40

San Bernardino/Riverside

0.48

Norfolk/Hampton Roads

0.42

Orange County

0.46

Suburban Maryland

0.44

MOODY’S ANALYTICS INSURANCE COSTS TRENDS BECOMING A HEADACHE FOR THE CRE MARKET

12

Source: Moody’s Analytics CRE.

Note:

1

Median insurance cost per square foot for metro.

Table 6. Metros in descending order of 2017-2022 insurance expense and rent CAGR for industrial

1, 2, 3

METRO

INSURANCE CAGR

RENT CAGR

Las Vegas

12.0%

4.9%

Dallas

11.3%

4.0%

Oakland-East Bay

11.1%

4.8%

Philadelphia

9.7%

4.5%

New York Metro

9.7%

2.0%

Houston

9.6%

4.3%

San Bernardino/Riverside

8.7%

12.8%

Denver

8.6%

3.8%

San Antonio 8.5% 2.8%

Chicago 8.2% 3.4%

Orange County

7.5%

5.3%

Tampa-St. Petersburg

6.3%

3.6%

San Diego

5.8%

4.8%

Los Angeles

5.7%

8.3%

Atlanta

2.0%

4.3%

Detroit

1.8%

3.3%

Source: Moody’s Analytics CRE

Notes:

1

To obtain the median CAGR by metro we calculated the CAGR for each property with an insurance value in 2017 and 2022 and then took the median of that sample. See the

Appendix for the highest and lowest CAGRs and insurance prices for the other four property types.

2

To obtain rent CAGR we used average metro level rent growth from 2017 through

2022.

3

For industrial properties there is not substantially more than 20 metros that have 20 or more properties in the Moody’s Analytics CRE database, so rather than showing top and

bottom twenty metros we show them all in descending order.

Table 7. Industrial metros in descending order of 2022 insurance cost

1, 2

METRO INSURANCE ($/SQ FT)

New York Metro

0.59

Tampa-St. Petersburg

0.47

Orange County

0.36

Houston

0.35

Dallas

0.32

San Diego

0.27

San Antonio

0.26

Denver

0.26

Los Angeles 0.25

Oakland-East Bay 0.24

San Bernardino/Riverside

0.23

Detroit

0.23

Las Vegas

0.21

Chicago

0.17

Philadelphia

0.15

MOODY’S ANALYTICS INSURANCE COSTS TRENDS BECOMING A HEADACHE FOR THE CRE MARKET

13

Atlanta

0.13

Source: Moody’s Analytics CRE.

Notes:

1

Median insurance cost per square foot for metro.

2

For industrial properties there is not substantially more than 20 metros that have 20 or more properties in the Moody’s

Analytics CRE database, so rather than showing top and bottom twenty metros we show them all in descending order.

Table 8. Metros in descending order of 2017-2022 insurance expense and rent CAGR for office

1

METROS

INSURANCE CAGR

RENT CAGR

Dallas

9.0%

2.1%

Los Angeles

8.6%

2.2%

Orange County 7.7% 1.1%

Pittsburgh

7.6%

1.2%

New York Metro

7.4%

0.8%

Houston

7.3%

0.3%

Central New Jersey

6.9%

1.1%

Suburban Virginia

6.7%

1.3%

San Jose

6.6%

2.5%

Fort Lauderdale

6.6%

1.7%

Philadelphia

6.6%

1.3%

Indianapolis 6.5% 1.6%

Atlanta

6.5%

2.3%

San Diego 6.2% 2.1%

Denver

6.0%

2.1%

Detroit

6.0%

1.0%

Phoenix

5.9%

2.2%

Chicago

5.4%

1.1%

San Francisco

5.4%

1.8%

Northern New Jersey

4.5%

0.8%

Source: Moody’s Analytics CRE

Note:

1

For office properties there is not substantially more than 20 metros that have 20 or more properties in the Moody’s Analytics CRE database, so rather than showing top and

bottom twenty metros we show them all in descending order.

Table 9. Office metros in descending order of 2022 insurance cost

1,2

METRO

INSURANCE ($/SQ FT)

Fort Lauderdale

1.61

San Francisco

1.06

San Jose 0.98

New York Metro

0.82

Houston

0.54

Los Angeles

0.53

Orange County

0.44

San Diego

0.40

Northern New Jersey

0.38

Chicago

0.36

MOODY’S ANALYTICS INSURANCE COSTS TRENDS BECOMING A HEADACHE FOR THE CRE MARKET

14

Philadelphia

0.34

Pittsburgh

0.34

Suburban Virginia

0.33

Denver

0.33

Central New Jersey 0.31

Las Vegas

0.29

Detroit

0.27

Seattle

0.27

Indianapolis

0.25

Dallas

0.25

Atlanta 0.24

Phoenix

0.23

Cleveland

0.22

Source: Moody’s Analytics CRE.

Notes:

1

Median insurance cost per square foot for metro

2

For office properties there is not substantially more than 20 metros that have 20 or more properties in the Moody’s Analytics

CRE database, so rather than showing top and bottom twenty metros we show them all in descending order.

Table 10. Metros in descending order of 2017-2022 insurance expense and rent CAGR for hotel

1,2

METROS

INSURANCE CAGR

ROOM RATE CAGR

Minneapolis

12.0%

1.2%

Phoenix

11.6%

5.5%

San Diego

10.3%

4.8%

San Jose

10.0%

-3.9%

Orlando

8.5%

4.0%

Los Angeles 8.5% 2.2%

Raleigh 8.4% 2.5%

Fort Lauderdale

8.1%

3.7%

District of Columbia

7.6%

Chicago

7.5%

1.6%

Indianapolis

7.3%

1.9%

Nashville

7.2%

3.3%

Anaheim

7.2%

5.1%

New York Metro

6.5%

1.6%

Atlanta

6.2%

1.9%

Fort Worth 6.1% 2.6%

Seattle

6.0%

0.3%

Detroit

5.6%

1.3%

MOODY’S ANALYTICS INSURANCE COSTS TRENDS BECOMING A HEADACHE FOR THE CRE MARKET

15

Virginia Beach

5.3%

4.3%

Dallas

5.1%

2.0%

Houston

4.0%

-1.0%

Philadelphia

3.1%

2.4%

Charlotte

1.5%

1.7%

Source: Moody’s Analytics CRE

Notes:

1

For hotel properties there is not substantially more than 20 metros that have 20 or more properties in the Moody’s Analytics CRE database, so rather than showing top and

bottom twenty metros we show them all in descending order.

2

Room rate is not available for every metro.

Table 11. Hotel metros in descending order of 2022 insurance cost

1,2

METRO

INSURANCE ($/UNIT)

Fort Lauderdale

1435.86

Los Angeles

1018.29

New York Metro 1003.77

Anaheim

893.73

Seattle

780.44

Orlando

780.21

San Jose 727.21

Houston

624.38

San Diego

605.36

Philadelphia

597.42

Fort Worth 583.87

Phoenix

563.73

Dallas

518.28

Chicago

453.75

Nashville 449.89

Virginia Beach

443.50

District of Columbia

430.85

Indianapolis

422.57

Minneapolis 404.78

Atlanta

393.53

Detroit

329.59

Raleigh

313.21

Charlotte 309.13

Source: Moody’s Analytics CRE.

Notes:

1

Median insurance cost per unit for metro.

2

For hotel properties there is not substantially more than 20 metros that have 20 or more properties in the Moody’s Analytics CRE

database, so rather than showing top and bottom twenty metros we show them all in descending order.

MOODY’S ANALYTICS INSURANCE COSTS TRENDS BECOMING A HEADACHE FOR THE CRE MARKET

16

Figure 10 Median insurance premium by year for hotel properties grouped by their acute climate risk

1

Sources: Moody’s Analytics CRE, Moody’s Analytics RMS.

Note:

1

We grouped properties into quintiles based on the sum of their Moody’s RMS Climate on Demand (CoD) average annualized damage (AAD) scores for hurricanes, wildfires and

floods.

Figure 11 Median insurance premium by year for multifamily properties grouped by their acute climate risk

1

Sources: Moody’s Analytics CRE, Moody’s Analytics RMS.

Note:

1

We grouped properties into quintiles based on the sum of their Moody’s RMS Climate on Demand (CoD) average annualized damage (AAD) scores for hurricanes, wildfires and

floods.

Figure 12 Median insurance premium by year for industrial properties grouped by their acute climate risk

1

Sources: Moody’s Analytics CRE, Moody’s Analytics RMS.

Note:

1

We grouped properties into quintiles based on the sum of their Moody’s RMS Climate on Demand (CoD) average annualized damage (AAD) scores for hurricanes, wildfires and

floods.

MOODY’S ANALYTICS INSURANCE COSTS TRENDS BECOMING A HEADACHE FOR THE CRE MARKET

17

Figure 13 Median insurance premium by year for office properties grouped by their acute climate risk

1

Sources: Moody’s Analytics CRE, Moody’s Analytics RMS.

Note:

1

We grouped properties into quintiles based on the sum of their Moody’s RMS Climate on Demand (CoD) average annualized damage (AAD) scores for hurricanes, wildfires and

floods.

Figure 14 Median insurance premium by year for retail properties grouped by their hurricane risk

1

Sources: Moody’s Analytics CRE, Moody’s Analytics RMS.

Note:

1

We grouped properties into quintiles based on the sum of their Moody’s RMS Climate on Demand (CoD) average annualized damage (AAD) scores for hurricanes.

Figure 15 Median insurance premium by year for industrial properties grouped by their hurricane risk

1

Sources: Moody’s Analytics CRE, Moody’s Analytics RMS.

Note:

1

We grouped properties into quintiles based on the sum of their Moody’s RMS Climate on Demand (CoD) average annualized damage (AAD) scores for hurricanes.

MOODY’S ANALYTICS INSURANCE COSTS TRENDS BECOMING A HEADACHE FOR THE CRE MARKET

18

Figure 16 Median insurance premium by year for office properties grouped by their hurricane risk

1

Sources: Moody’s Analytics CRE, Moody’s Analytics RMS.

Note:

1

We grouped properties into quintiles based on the sum of their Moody’s RMS Climate on Demand (CoD) average annualized damage (AAD) scores for hurricanes.

MOODY’S ANALYTICS INSURANCE COSTS TRENDS BECOMING A HEADACHE FOR THE CRE MARKET

BX19737

© 2023 Moody’s Corporation, Moody’s Investors Service, Inc., Moody’s Analytics, Inc. and/or their licensors and affiliates (collectively, “MOODY’S”). All rights reserved.

CREDIT RATINGS ISSUED BY MOODY'S CREDIT RATINGS AFFILIATES ARE THEIR CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT

COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES, AND MATERIALS, PRODUCTS, SERVICES AND INFORMATION PUBLISHED BY MOODY’S (COLLECTIVELY, “PUBLICATIONS”)

MAY INCLUDE SUCH CURRENT OPINIONS. MOODY’S DEFINES CREDIT RISK AS THE RISK THAT AN ENTITY MAY NOT MEET ITS CONTRACTUAL FINANCIAL OBLIGATIONS AS

THEY COME DUE AND ANY ESTIMATED FINANCIAL LOSS IN THE EVENT OF DEFAULT OR IMPAIRMENT. SEE APPLICABLE MOODY’S RATING SYMBOLS AND DEFINITIONS

PUBLICATION FOR INFORMATION ON THE TYPES OF CONTRACTUAL FINANCIAL OBLIGATIONS ADDRESSED BY MOODY’S CREDIT RATINGS. CREDIT RATINGS DO NOT

ADDRESS ANY OTHER RISK, INCLUDING BUT NOT LIMITED TO: LIQUIDITY RISK, MARKET VALUE RISK, OR PRICE VOLATILITY. CREDIT RATINGS, NON-CREDIT ASSESSMENTS

(“ASSESSMENTS”), AND OTHER OPINIONS INCLUDED IN MOODY’S PUBLICATIONS ARE NOT STATEMENTS OF CURRENT OR HISTORICAL FACT. MOODY’S PUBLICATIONS MAY

ALSO INCLUDE QUANTITATIVE MODEL-BASED ESTIMATES OF CREDIT RISK AND RELATED OPINIONS OR COMMENTARY PUBLISHED BY MOODY’S ANALYTICS, INC. AND/OR ITS

AFFILIATES. MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND PUBLICATIONS DO NOT CONSTITUTE OR PROVIDE INVESTMENT OR FINANCIAL ADVICE, AND

MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND PUBLICATIONS ARE NOT AND DO NOT PROVIDE RECOMMENDATIONS TO PURCHASE, SELL, OR HOLD

PARTICULAR SECURITIES. MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND PUBLICATIONS DO NOT COMMENT ON THE SUITABILITY OF AN INVESTMENT

FOR ANY PARTICULAR INVESTOR. MOODY’S ISSUES ITS CREDIT RATINGS, ASSESSMENTS AND OTHER OPINIONS AND PUBLISHES ITS PUBLICATIONS WITH THE EXPECTATION

AND UNDERSTANDING THAT EACH INVESTOR WILL, WITH DUE CARE, MAKE ITS OWN STUDY AND EVALUATION OF EACH SECURITY THAT IS UNDER CONSIDERATION FOR

PURCHASE, HOLDING, OR SALE.

MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS, AND PUBLICATIONS ARE NOT INTENDED FOR USE BY RETAIL INVESTORS AND IT WOULD BE RECKLESS AND

INAPPROPRIATE FOR RETAIL INVESTORS TO USE MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS OR PUBLICATIONS WHEN MAKING AN INVESTMENT

DECISION. IF IN DOUBT YOU SHOULD CONTACT YOUR FINANCIAL OR OTHER PROFESSIONAL ADVISER.

ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY LAW, INCLUDING BUT NOT LIMITED TO, COPYRIGHT LAW, AND NONE OF SUCH INFORMATION MAY BE COPIED

OR OTHERWISE REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE FOR

ANY SUCH PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODY’S PRIOR WRITTEN

CONSENT.

MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND PUBLICATIONS ARE NOT INTENDED FOR USE BY ANY PERSON AS A BENCHMARK AS THAT TERM IS

DEFINED FOR REGULATORY PURPOSES AND MUST NOT BE USED IN ANY WAY THAT COULD RESULT IN THEM BEING CONSIDERED A BENCHMARK.

All information contained herein is obtained by MOODY’S from sources believed by it to be accurate and reliable. Because of the possibility of human or mechanical error as well as

other factors, however, all information contained herein is provided “AS IS” without warranty of any kind. MOODY'S adopts all necessary measures so that the information it uses in

assigning a credit rating is of sufficient quality and from sources MOODY'S considers to be reliable including, when appropriate, independent third-party sources. However, MOODY’S

is not an auditor and cannot in every instance independently verify or validate information received in the credit rating process or in preparing its Publications.

To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability to any person or entity for any

indirect, special, consequential, or incidental losses or damages whatsoever arising from or in connection with the information contained herein or the use of or inability to use any

such information, even if MOODY’S or any of its directors, officers, employees, agents, representatives, licensors or suppliers is advised in advance of the possibility of such losses or

damages, including but not limited to: (a) any loss of present or prospective profits or (b) any loss or damage arising where the relevant financial instrument is not the subject of a

particular credit rating assigned by MOODY’S.

To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability for any direct or compensatory

losses or damages caused to any person or entity, including but not limited to by any negligence (but excluding fraud, willful misconduct or any other type of liability that, for the

avoidance of doubt, by law cannot be excluded) on the part of, or any contingency within or beyond the control of, MOODY’S or any of its directors, officers, employees, agents,

representatives, licensors or suppliers, arising from or in connection with the information contained herein or the use of or inability to use any such information.

NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY CREDIT

RATING, ASSESSMENT, OTHER OPINION OR INFORMATION IS GIVEN OR MADE BY MOODY’S IN ANY FORM OR MANNER WHATSOEVER.

Moody’s Investors Service, Inc., a wholly-owned credit rating agency subsidiary of Moody’s Corporation (“MCO”), hereby discloses that most issuers of debt securities (including

corporate and municipal bonds, debentures, notes and commercial paper) and preferred stock rated by Moody’s Investors Service, Inc. have, prior to assignment of any credit rating,

agreed to pay to Moody’s Investors Service, Inc. for credit ratings opinions and services rendered by it fees ranging from $1,000 to approximately $5,000,000. MCO and Moody’s

Investors Service also maintain policies and procedures to address the independence of Moody’s Investors Service credit ratings and credit rating processes. Information regarding

certain affiliations that may exist between directors of MCO and rated entities, and between entities who hold credit ratings from Moody’s Investors Service, Inc. and have also

publicly reported to the SEC an ownership interest in MCO of more than 5%, is posted annually at www.moodys.com under the heading “Investor Relations — Corporate Governance

— Charter Documents - Director and Shareholder Affiliation Policy.”

Additional terms for Australia only: Any publication into Australia of this document is pursuant to the Australian Financial Services License of MOODY’S affiliate, Moody’s Investors

Service Pty Limited ABN 61 003 399 657AFSL 336969 and/or Moody’s Analytics Australia Pty Ltd ABN 94 105 136 972 AFSL 383569 (as applicable). This document is intended to be

provided only to “wholesale clients” within the meaning of section 761G of the Corporations Act 2001. By continuing to access this document from within Australia, you represent to

MOODY’S that you are, or are accessing the document as a representative of, a “wholesale client” and that neither you nor the entity you represent will directly or indirectly

disseminate this document or its contents to “retail clients” within the meaning of section 761G of the Corporations Act 2001. MOODY’S credit rating is an opinion as to the

creditworthiness of a debt obligation of the issuer, not on the equity securities of the issuer or any form of security that is available to retail investors.

Additional terms for Japan only: Moody's Japan K.K. (“MJKK”) is a wholly-owned credit rating agency subsidiary of Moody's Group Japan G.K., which is wholly-owned by Moody’s

Overseas Holdings Inc., a wholly-owned subsidiary of MCO. Moody’s SF Japan K.K. (“MSFJ”) is a wholly-owned credit rating agency subsidiary of MJKK. MSFJ is not a Nationally

Recognized Statistical Rating Organization (“NRSRO”). Therefore, credit ratings assigned by MSFJ are Non-NRSRO Credit Ratings. Non-NRSRO Credit Ratings are assigned by an

entity that is not a NRSRO and, consequently, the rated obligation will not qualify for certain types of treatment under U.S. laws. MJKK and MSFJ are credit rating agencies registered

with the Japan Financial Services Agency and their registration numbers are FSA Commissioner (Ratings) No. 2 and 3 respectively.

MJKK or MSFJ (as applicable) hereby disclose that most issuers of debt securities (including corporate and municipal bonds, debentures, notes and commercial paper) and preferred

stock rated by MJKK or MSFJ (as applicable) have, prior to assignment of any credit rating, agreed to pay to MJKK or MSFJ (as applicable) for credit ratings opinions and services

rendered by it fees ranging from JPY100,000 to approximately JPY550,000,000.

MJKK and MSFJ also maintain policies and procedures to address Japanese regulatory requirements.