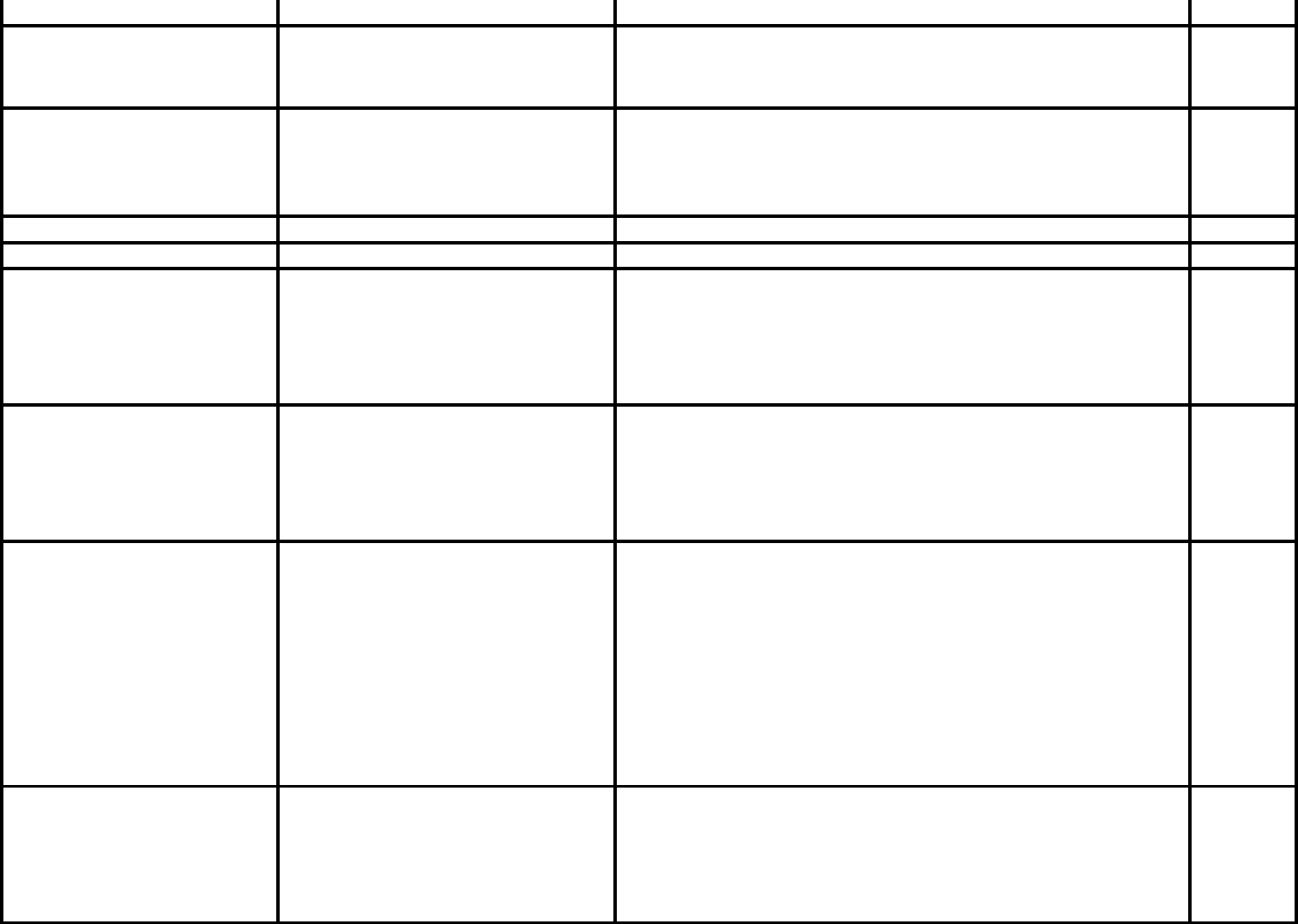

Effective January 1, 2024

SERFF Type Of Insurance SERFF Sub-Type of Insurance Description

NAIC

Annual

Statement

Line

01.0 Property

Coverage protecting the insured against loss or damage to real or personal

property from a variety of perils, includingbut not limited tofire,

lightening, business interruption, loss of rents, glass breakage, tornado,

windstorm, hail, water damage, explosion, riot, civil commotion, rain, or

damage from aircraft or vehicles.

0102.1

01.0001 Commercial Property (Fire and

Allied Lines)

Property insurance coverage sold to commercial ventures.

0102.1

01.0002 Personal Property (Fire and Allied

Lines)

Property insurance coverage sold for personal, family or household

purposes.

0102.1

02.1 Crop 02.1000 Crop - Hail Sub-TOI Combinations

Coverage protecting the insured against loss or damage to crops from a

variety of perils, including but not limited to fire, lightening, loss of revenue,

tornado, windstorm, hail, flood, rain, or damage by insects.

02.2 or 02.4

02.1001 Crop - Hail Non-Federally

Reinsured Only

Private market coverage for crop insurance and agricultural-related

protection, such as hail and fire, and is not reinsured by the FCIC.

2.4

02.1002 Crop - Hail Federally Reinsured

Only

Crop insurance coverage that is either wholly or in part reinsured by the

Federal Crop Insurance Corporation (FCIC) under the Standard

Reinsurance Agreement (SRA). This includes the following products:

Multiple Peril Crop Insurance (MPCI); Catastrophic Insurance, Crop

Revenue Coverage (CRC); Income Protection and Revenue Assurance.

2.2

02.3 Flood

Coverage protecting the insured against loss or damage to real or personal

property from flood. (Note: If coverage for flood is offered as an additional

peril on a property insurance policy, file it under the applicable property

insurance filing code.)

02.3 or 02.5

02.3001 Commercial Flood

Separate flood insurance policy sold to commercial ventures for primary

coverage.

02.3 or 02.5

02.3002 Personal Flood

Separate flood insurance policy sold for personal, family or household

purposes for primary coverage.

02.3 or 02.5

UNIFORM PROPERTY & CASUALTY PRODUCT CODING MATRIX

Page 1 of 21

Effective January 1, 2024

2.3003 Commercial Excess Flood

Separate flood insurance policy sold to commercial ventures for excess

coverage.

02.3 or 02.5

2.3004 Personal Excess Flood

Separate flood insurance policy sold for personal, family or household

purposes for excess coverage.

02.3 or 02.5

03.0 Personal Farmowners 03.0000 Personal Farmowners

Farmowners insurance sold for personal, family or household purposes.

This package policy is similar to a homeowners policy, in that it has been

developed for farms and ranches and includes both property and liability

coverage for personal and business losses. Coverage includes farm

dwellings and their contents, barns, stables, other farm structures and farm

inland marine, such as mobile equipment and livestock.

3

04.0 Homeowners

04.0000 Homeowners Sub-TOI

Combinations

A package policy combining real and personal property coverage with

personal liability coverage. Coverage applicable to the dwelling,

appurtenant structures, unscheduled personal property and additional living

expense are typical. Includes mobile homes at a fixed location.

4

04.0001 Condominium Homeowners

Homeowners insurance sold to condominium owners occupying the

described property.

4

04.0002 Mobile Homeowners

Homeowners insurance sold to owners occupying the described mobile

home.

4

04.0003 Owner Occupied Homeowners

Homeowners insurance sold to owners occupying the described property. 4

04.0004 Tenant Homeowners

Homeowners insurance sold to tenants occupying the described property. 4

04.0005 Other Homeowners

All other Homeowners insurance products. 4

05.0 CMP Liability and Non-Liability 05.0000 CMP Sub-TOI Combinations

The policy packages two or more insurance coverages protecting an

enterprise from various property and/or liability risk exposures. Frequently

includes fire, allied lines, various other coverages (e.g., difference in

conditions) and liability coverage. Such coverages would be included in

other annual statement lines, if written individually. Include under this type

of insurance multi-peril policies (other than farmowners, homeowners and

automobile policies) that include coverage for liability other than auto.

5.1,

5.2,

17

05.1 CMP Non-Liability Portion

Only

05.1000 CMP Sub-TOI Combinations

Coverage for non-liability commercial multiple peril contracts. 5.1

05.2 CMP Liability Portion Only 05.2000 CMP Sub-TOI Combinations

Coverage for liability commercial multiple peril contracts. 5.2, 17

Page 2 of 21

Effective January 1, 2024

05.0001 Builders Risk

05.1001 Builders Risk

05.2001 Builders Risk

Typically written on a reporting or completed value form, this coverage

insures against loss to buildings in the course of construction. The

coverage also includes machinery and equipment used in the course of

construction and to materials incidental to construction.

5.1

05.0002 Businessowners

05.1002 Businessowners

05.2002 Businessowners

The Businessowners (BOP) provides a broad package of property and

liability coverages for small and medium sized apartment buildings, offices,

and retail stores.

05.1—05.2

05.0003 Commercial Package

05.1003 Commercial Package

05.2003 Commercial Package

The Commercial Package Policy (CPP) provides a broad package of

property and liability coverages for commercial ventures other than those

provided insurance through a businessowners policy. (The older special

multi peril programs (SMP) also use this code.)

05.1—05.2

05.0004 Manufacturers Output

05.1004 Manufacturers Output

05.2004 Manufacturers Output

Provides broad form all risks coverage of personal property of an insured

manufacturer that is located away from the premises of the manufacturer

at the time of a claim.

5.1

05.0005 CMP E-Commerce

05.1005 CMP E-Commerce

05.2005 CMP E-Commerce

Coverage for all aspects of E-Commerce Business. 5.1

05.0006 Commercial Farm and Ranch

05.1006 Commercial Farm and Ranch

05.2006 Commercial Farm and Ranch

A commercial package policy for farming and ranching risks that includes

both property and liability coverage. Coverage includes barns, stables,

other farm structures and farm inland marine, such as mobile equipment

and livestock.

3

05.0007Other CMP

05.1007 Other CMP

05.2007 Other CMP

All other commercial multiple peril (CMP) insurance products. 05.1—05.2

06.0 Mortgage Guaranty 06.0000 MG Sub-TOI Combinations

Insurance that indemnifies a lender for loss upon foreclosure if a borrower

fails to meet required mortgage payments.

6

06.0001 Fixed Rate MG

The type of loan in which the interest rate will not change for the entire term

of the loan.

6

06.0002 Trust/Pool MG

Insure pools of loans secured by instruments constituting a first lien on real

estate and evidenced by pass-through certificates or other instruments.

6

06.0003 Variable Rate MG

The type of loan in which the interest rate may vary or float periodically

throughout the term of the loan based on an interest rate index.

6

06.0004 Other MG

All other mortgage guaranty products. 6

Page 3 of 21

Effective January 1, 2024

08.0 Ocean Marine 08.0000 Ocean Marine

Coverage for ocean and inland water transportation exposures; goods or

cargoes; ships or hulls; earnings; and liability.

8

09.0 Inland Marine

09.0000 Inland Marine Sub-TOI

Combinations

Coverage for property that may be in transit, held by a bailee, at a fixed

location, or movable goods that are often at different locations (e.g., off-

road constructions equipment), or scheduled property (e.g., Homeowners

Personal Property Floater) including items such as live animals, property

with antique or collector’s value, etc. These lines also include

instrumentalities of transportation and communication, such as bridges,

tunnels, piers, wharves, docks, pipelines, power and phone lines, and radio

and television towers. This does not include motor vehicles licensed for use

on public roads.

9

09.0001 Animal Mortality

Coverage that provides a death benefit to the owner of a policy in the event

of the death of the insured livestock.

9

09.0002 Difference in Conditions (DIC)

DIC is a special form of open-peril coverage written in conjunction with

basic fire coverage and designed to provide protection against losses not

reimbursed under the standard fire forms.

5

09.0003 Electronic Data Processing (EDP)

Coverage to protect against losses arising out of damage to or destruction

of electronic data processing equipment and its software.

9

09.0004 Pet Insurance Plans

Veterinary care plan insurance policy providing care for a pet animal (e.g.,

dog or cat) of the insured owner in the event of its illness or accident.

9

09.0005 Other Commercial Inland Marine

All other inland marine coverage that is sold to commercial ventures,

including coverage on property rented/leased by the named insured to

others. (Also see 28.2003)

9

09.0006 Other Personal Inland Marine

All other inland marine coverage that is sold for personal, family or

household purposes.

9

9.0007 Communication Equipment (Cellular

Telephones)

Provides insured subscribers of Communications Equipment Service

Provider replacement coverage for loss of and damage, theft or

mechanical breakdown to communications equipment. Communications

equipment means wireless telephones and pagers, and any other devices

incorporating wireless phone and pager capabilities, including but not

limited to personal digital assistants (PDA) and wireless aircards.

9

Page 4 of 21

Effective January 1, 2024

9.0008 Event Cancellation

Coverage for financial loss because of the cancellation or postponement of

a specific event due to weather or other unexpected cause beyond the

control of the insured.

9

9.0009 Travel Coverage

Covers financial loss due to trip cancellation/interruption; lost or damaged

baggage; trip or baggage delays; missed connections and/or changes in

itinerary; and casualty losses due to rental vehicle damage.

9

9.0010 Boatowners/Personal Watercraft

Covers damage to pleasure boats, motors, trailers, boating equipment and

personal watercraft as well as bodily injury and property damage liability to

others.

9

10.0 Financial Guaranty 10.0000 Financial Guaranty

A surety bond, insurance policy, or an indemnity contract (when issued by

an insurer), or similar guaranty types under which loss is payable upon

proof of occurrence of financial loss to an insured claimant, obligee or

indemnitee as a result of failure to perform a financial obligation or any

other permissible product that is defined as or determined to be financial

guaranty insurance.

10

11.0 Med Mal - Claims Made and

Occurrence

11.0000 Med Mal Sub-TOI Combinations

Insurance coverage protecting a licensed health care provider or health

care facility against legal liability resulting from the death or injury of any

person due to the insured’s misconduct, negligence, or incompetence, in

rendering or failure to render professional services.

11

11.1 Med Mal - Occurrence Only 11.1000 Med Mal Sub-TOI Combinations

These policies cover insured events that occur within the effective dates of

the policy regardless of when they are reported to the reporting entity.

11.1

11.2 Med Mal - Claims Made Only 11.2000 Med Mal Sub-TOI Combinations

These policies cover insured events that are reported (as defined in the

policy) within the effective dates of the policy, subject to retroactive dates

and extended reporting periods when applicable.

11.2

11.0001 Acupuncture

11.1001 Acupuncture

11.2001 Acupuncture

Medical malpractice for acupuncture procedures. 11

11.0002 Ambulance Services

11.1002 Ambulance Services

11.2002 Ambulance Services

Medical malpractice for an ambulance service. 11

11.0003 Chiropractic

11.1003 Chiropractic

11.2003 Chiropractic

Medical malpractice for a chiropractor. 11

Page 5 of 21

Effective January 1, 2024

11.0004 Community Health Centers

11.1004 Community Health Centers

11.2004 Community Health Centers

Medical malpractice for a community health center. 11

11.0005 Dental Hygienists

11.1005 Dental Hygienists

11.2005 Dental Hygienists

Medical malpractice for a dental hygienist. 11

11.0006 Dentists - General Practice

11.1006 Dentists - General Practice

11.2006 Dentists - General Practice

Medical malpractice for a general practice dentist. 11

11.0007 Dentists - Oral Surgeons

11.1007 Dentists - Oral Surgeons

11.2007 Dentists - Oral Surgeons

Medical malpractice for an oral surgeon dentist. 11

11.0008 Home Care Service Agencies

11.1008 Home Care Service Agencies

11.2008 Home Care Service Agencies

Medical malpractice for a home care service agency. 11

11.0009 Hospitals

11.1009 Hospitals

11.2009 Hospitals

Medical malpractice for a hospital. 11

11.0010 Nurse - Anesthetists

11.1010 Nurse - Anesthetists

11.2010 Nurse - Anesthetists

Medical malpractice for a nurse anesthetist. 11

11.0011 Nurse - Licensed Practical

11.1011 Nurse - Licensed Practical

11.2011 Nurse - Licensed Practical

Medical malpractice for a licensed practical nurse. 11

11.0012 Nurse - Midwife

11.1012 Nurse - Midwife

11.2012 Nurse - Midwife

Medical malpractice for a nurse midwife. 11

11.0013 Nurse - Practitioners

11.1013 Nurse - Practitioners

11.2013 Nurse - Practitioners

Medical malpractice for a nurse practitioner. 11

11.0014 Nurse - Private Duty

11.1014 Nurse - Private Duty

11.2014 Nurse - Private Duty

Medical malpractice for a private duty nurse. 11

Page 6 of 21

Effective January 1, 2024

11.0015 Nurse - Registered

11.1015 Nurse - Registered

11.2015 Nurse - Registered

Medical malpractice for a registered nurse. 11

11.0016 Nursing Homes

11.1016 Nursing Homes

11.2016 Nursing Homes

Medical malpractice for a nursing home. 11

11.0017 Occupational Therapy

11.1017 Occupational Therapy

11.2017 Occupational Therapy

Medical malpractice for an occupational therapist. 11

11.0018 Ophthalmic Dispensing

11.1018 Ophthalmic Dispensing

11.2018 Ophthalmic Dispensing

Medical malpractice for ophthalmic dispensing. 11

11.0019 Optometry

11.1019 Optometry

11.2019 Optometry

Medical malpractice for an optometrist. 11

11.0020 Osteopathy

11.1020 Osteopathy

11.2020 Osteopathy

Medical malpractice for an osteopathic physician. 11

11.0021 Pharmacy

11.1021 Pharmacy

11.2021 Pharmacy

Medical malpractice for a pharmacist. 11

11.0022 Physical Therapy

11.1022 Physical Therapy

11.2022 Physical Therapy

Medical malpractice for a physical therapist. 11

11.0023 Physicians & Surgeons

11.1023 Physicians & Surgeons

11.2023 Physicians & Surgeons

Medical malpractice for a physician or surgeon. 11

11.0024 Physicians Assistants

11.1024 Physicians Assistants

11.2024 Physicians Assistants

Medical malpractice for a physicians’ assistant. 11

11.0025 Podiatry

11.1025 Podiatry

11.2025 Podiatry

Medical Malpractice for a podiatrist. 11

Page 7 of 21

Effective January 1, 2024

11.0026 Psychiatry

11.1026 Psychiatry

11.2026 Psychiatry

Medical malpractice for a psychiatrist. 11

11.0027 Psychology

11.1027 Psychology

11.2027 Psychology

Medical malpractice for a psychologist. 11

11.0028 Speech Pathology

11.1028 Speech Pathology

11.2028 Speech Pathology

Medical malpractice for a speech pathologist. 11

11.0029 Other

11.1029 Other

11.2029 Other

Medical malpractice not specifically described above. 11

11.0030 Dentist

11.1030 Dentist

11.2030 Dentist

Medical malpractice for a dentist. 11

11.0031 Anesthetist

11.1031 Anesthetist

11.2031 Anesthetist

Medical malpractice for an anesthetist. 11

11.0032 Professional Nurses

11.1032 Professional Nurses

11.2032 Professional Nurses

Medical malpractice for any professional nurse. 11

11.0033 Assisted Living Facility

11.1033 Assisted Living Facility

11.2033 Assisted Living Facility

Medical malpractice for an assisted living facility. 11

12.0 Earthquake

Property coverage for losses resulting from a sudden trembling or shaking

of the earth, including that caused by volcanic eruption.

12

12.0001 Commercial Earthquake

Earthquake property coverage for commercial ventures. 12

12.0002 Personal Earthquake

Earthquake property coverage for personal, family or household purposes. 12

16.0 Workers Compensation 16.0000 WC Sub-TOI Combinations

Insurance that covers an employer’s liability for injuries, disability or death

to persons in their employment, without regard to fault, as prescribed by

state or federal workers’ compensation laws and other statutes. Includes

employer’s liability coverage.

16

Page 8 of 21

Effective January 1, 2024

16.0001 Alternative WC

Other than standard workers’ compensation coverage, employer’s liability

and excess workers’ compensation (e.g., large deductible, managed care).

16

16.0002 Employers Liability WC

Employers’ liability coverage for the legal liability of employers arising out of

injuries to employees. This code should be used when coverage is issued

as an endorsement, or as part of a statutory workers’ compensation policy.

When coverage is issued as a stand-alone policy, or as an endorsement a

package policy, the appropriate “Other Liability” code should be used (i.e.,

17.0009, 17.1009, or 17.2009).

16

16.0003 Excess WC

Either specific and/or aggregate excess workers’ compensation insurance

written above an attachment point or self-insured retention.

17

16.0004 Standard WC

Insurance that covers an employer’s liability for injuries, disability or death

to persons in their employment, without regard to fault, as prescribed by

state or federal workers’ compensation laws and includes within the basic

policy employer’s liability coverage.

16

16.0005 Occupational Accident WC

Insurance that covers occupational accident to include comparable

workers' compensation.

16

17.0 Other Liability - Occ/Claims

Made

17.0000 Other Liability Sub-TOI

Combinations

Coverage protecting the insured against legal liability resulting from

negligence, carelessness, or a failure to act resulting in property damage or

personal injury to others.

17

17.1 Other Liability - Occ Only

17.1000 Other Liability Sub-TOI

Combinations

These policies cover insured events that occur within the effective dates of

the policy regardless of when they are reported to the reporting entity.

17.1

17.2 Other Liability - Claims Made

Only

17.2000 Other Liability Sub-TOI

Combinations

These policies cover insured events that are reported (as defined in the

policy) within the effective dates of the policy, subject to retroactive dates

and extended reporting periods when applicable.

17.2

17.0001 Commercial General Liability

17.1001 Commercial General Liability

17.2001 Commercial General Liability

Flexible & broad commercial liability coverage with two major sub-lines:

premises/operations sub-line and products/completed operations sub-line.

For general professional liability see 17.0019.

17

17.0002 Completed Operations

17.1002 Completed Operations

17.2002 Completed Operations

Policies provided to contractors covering liability to persons who have

incurred bodily injury or property damage from defective work or operations

completed or abandoned by or for the insured, away from the insured’s

premises.

17

Page 9 of 21

Effective January 1, 2024

17.0003 Comprehensive Personal Liability

17.1003 Comprehensive Personal Liability

17.2003 Comprehensive Personal Liability

Comprehensive liability coverage for exposures arising out of the residence

premises and activities of individuals and family members. (Non-business

liability exposure protection for individuals.)

17

17.0004 Contractual Liability

17.1004 Contractual Liability

17.2004 Contractual Liability

Liability coverage of an insured who has assumed the legal liability of

another party by written or oral contract. Incudes a contractual liability

policy providing coverage for all obligations and liability incurred by a

service contract or other contract provider under the terms of contracts

issued by the provider.

17

17.0005 Day Care Centers

17.1005 Day Care Centers

17.2005 Day Care Centers

Liability coverage for day care centers. 17

17.0006 Directors & Officers Liability

17.1006 Directors & Officers Liability

17.2006 Directors & Officers Liability

Liability coverage protecting directors or officers of a corporation from

liability arising out of the performance of their professional duties on behalf

of the corporation.

17

17.0007 Elevators and Escalators Liability

17.1007 Elevators and Escalators Liability

17.2007 Elevators and Escalators Liability

Liability coverage for bodily injury or property damage arising from the use

of elevators or escalators operated, maintained or controlled by the

insured.

17

17.0008 Employee Benefit Liability

17.1008 Employee Benefit Liability

17.2008 Employee Benefit Liability

Liability protection for an employer for claims arising from provisions in an

employee benefit insurance plan provided for the economic and social

welfare of employees. Examples of items covered are pension plans, group

life insurance, group health insurance, group disability income insurance,

and accidental death and dismemberment. For fiduciary liability see

17.0029.

17

17.0009 Employers Liability

17.1009 Employers Liability

17.2009 Employers Liability

Employers’ liability coverage for the legal liability of employers arising out of

injuries to employees. This code should be used when coverage is issued

as a stand-alone policy, or as an endorsement to a package policy. When

this coverage is issued as an endorsement to a statutory workers’

compensation policy, the appropriate “Workers’ Compensation” code

should be used (i.e., Code 16.0002).

17

Page 10 of 21

Effective January 1, 2024

17.0010 Employment Practices Liability

17.1010 Employment Practices Liability

17.2010 Employment Practices Liability

Liability protection for an employer providing personal injury coverage

arising out of employment-related practices, personnel policies, acts, or

omissions. Examples of claims such policies respond to are refusal to

employ, termination, coercion, demotion, evaluation, reassignment,

discipline, defamation, harassment, humiliation, and discrimination.

17

17.0011 Environmental Pollution Liability

17.1011 Environmental Pollution Liability

17.2011 Environmental Pollution Liability

Liability coverage of an insured to persons who have incurred bodily injury

or property damage from acids, fumes, smoke, toxic chemicals, waste

materials or other pollutants.

17

17.0012 Fire Legal Liability

17.1012 Fire Legal Liability

17.2012 Fire Legal Liability

Coverage for property loss liability as the result of separate negligent acts

and/or omissions of the insured that allows a spreading fire to cause bodily

injury or property damage of others. An example is a tenant who, while

occupying another party’s property, through negligence causes fire damage

to the property.

17

17.0013 Kidnap & Ransom Liability

17.1013 Kidnap & Ransom Liability

17.2013 Kidnap & Ransom Liability

Liability coverage up to specific limits for payments demanded by

kidnappers for the release of an insured held against his or her will.

26

17.0014 Liquor Liability

17.1014 Liquor Liability

17.2014 Liquor Liability

Coverage for the liability of an entity involved in the retail or wholesale

sales of alcoholic beverages, or the serving of alcoholic beverages, to

persons who have incurred bodily injury or property damage arising from

an intoxicated person.

17

17.0015 Municipal Liability

17.1015 Municipal Liability

17.2015 Municipal Liability

Liability coverage for the acts of a municipality. 17

17.0016 Nuclear Energy Liability

17.1016 Nuclear Energy Liability

17.2016 Nuclear Energy Liability

Coverage for bodily injury and property damage liability resulting from the

nuclear energy material (whether or not radioactive) on the insured

business’s premises or in transit.

17

17.0017 Personal Injury Liability

17.1017 Personal Injury Liability

17.2017 Personal Injury Liability

Coverage for the liability of an insured for injury to persons, other than

bodily injury. Examples include discrimination, falsely arrest, illegal

detainment, libel, malicious prosecution, slander, suffering mental anguish,

and violation of privacy rights.

17

Page 11 of 21

Effective January 1, 2024

17.0018 Premises and Operations (OL&T

and M&C)

17.1018 Premises and Operations (OL&T

and M&C)

17.2018 Premises and Operations (OL&T

and M&C)

Policies covering the liability of an insured to persons who have incurred

bodily injury or property damage on an insured’s premises during normal

operations or routine maintenance, or from an insured’s business

operations either on or off of the insured’s premises.

17

17.0019 Professional Errors and Omissions

Liability

17.1019 Professional Errors and Omissions

Liability

17.2019 Professional Errors and Omissions

Liability

Coverage available to pay for liability arising out of the performance of

professional or business related duties, with coverage being tailored to the

needs of the specific profession. Examples include abstracters,

accountants, insurance adjusters, architects, engineers, insurance agents

and brokers, lawyers, real estate agents, stockbrokers.

17

17.0020 Commercial Umbrella and Excess

17.1020 Commercial Umbrella and Excess

17.2020 Commercial Umbrella and Excess

Coverage for the liability of a commercial venture above a specific amount

set forth in a basic policy issued by the primary insurer; or a self-insurer for

losses over a stated amount; or an insured or self-insurer for known or

unknown gaps in basic coverages or self-insured retentions. Note: Does

not include excess workers’ compensation insurance. Does include excess

directors and officers and excess errors and omissions products.

17

17.0021 Personal Umbrella and Excess

17.1021 Personal Umbrella and Excess

17.2021 Personal Umbrella and Excess

Non-business liability protection for individuals above a specific amount set

forth in a basic policy issued by the primary insurer; or a self-insurer for

losses over a stated amount; or an insured or self-insurer for known or

unknown gaps in basic coverages or self-insured retentions.

17

17.0022 Other

17.1022 Other

17.2022 Other

Other Liability not specifically described above. 17

17.0023 Veterinarian

17.1023 Veterinarian

17.2023 Veterinarian

Liability coverage for the acts of a veterinarian. 17

17.0024 Internet Liability

17.1024 Internet Liability

17.2024 Internet Liability

Liability arising out of claims for wrongful acts related to the content posted

on a website by the insured or the insured’s failure to maintain the security

of its computer systems.

17

Page 12 of 21

Effective January 1, 2024

17.0025 Provider Excess Stop Loss

17.1025 Provider Excess Stop Loss

17.2025 Provider Excess Stop Loss

An insurance policy that provides excess coverage to a health care

provider from catastrophic patient losses or adverse cash flow, including,

but not limited to, shortfalls from capitated payment agreements. A provider

may be, but is not limited to, a physician, hospital, group medical practice,

nurse, nursing home, or a pharmacy.

13 & 15

17.0026 Excess Stop Loss

17.1026 Excess Stop Loss

17.2026 Excess Stop Loss

Insurance coverage extended to a self-insured employer plan to insure

against the risk that any one claim will exceed a specific dollar amount or

that an entire plan’s losses will exceed a specific amount. For provider

excess stop loss, use 17.0025. For any other excess stop loss, use

17.0027. Does not include stop-gap/employer’s liability insurance.

13 & 15

17.0027 Other Excess Stop Loss

17.1027 Other Excess Stop Loss

17.2027 Other Excess Stop Loss

Insurance coverage extended to a health plan to insure against the risk that

any one claim will exceed a specific dollar amount or that an entire plan’s

losses will exceed a specific amount. For provider excess stop loss, use

17.0025. For self-insured employer plan excess stop loss, use 17.0026.

Does not include stop-gap/employer’s liability insurance.

13 & 15

17.0028 Cyber Liability

17.1028 Cyber Liability

17.2028 Cyber Liability

Stand-alone comprehensive coverage for liability arising out of claims

related to unauthorized access to or use of personally identifiable or

sensitive information due to events including but not limited to viruses,

malicious attacks or system errors or omissions. This coverage could also

include expense coverage for business interruption, breach management

and/or mitigation services. When cyber liability is provided as an

endorsement or as part of a multi-peril policy, as opposed to a stand-alone

policy, use the appropriate Sub-TOI of the product to which the coverage

will be attached.

17

Page 13 of 21

Effective January 1, 2024

17.0029 Fiduciary Liability

17.1029 Fiduciary Liability

17.2029 Fiduciary Liability

This type of insurance provides protection for fiduciaries against legal

liability for claims made against them for a wrongful act (defined as a

breach of fiduciary duty imposed by ERISA or similar common or statutory

law). It’ll respond to claims for damages arising out of improper

investments, plan and employee advice, insufficient funding and failure of

an insurer to perform.

Examples include failure to invest plan assets prudently or failure to select

a qualified service provider for a covered plan. Some fiduciary liability

policies may also provide coverage for negligent acts, as well as errors or

omissions in the administration of employee benefit plans.

17

18.0 Product Liability 18.0000 Product Liab - Occ/Claims Made

Coverage for losses or injuries caused by defect or malfunction of the

product.

18

18.0001 Product Liab - Occurrence Only

These policies cover insured events that occur within the effective dates of

the policy regardless of when they are reported to the reporting entity.

18.1

18.0002 Product Liab - Claims Made Only

These policies cover insured events that are reported (as defined in the

policy) within the effective dates of the policy, subject to retroactive dates

and extended reporting periods when applicable.

18.2

19.0 Personal Auto 19.0000 Personal Auto Combinations

Privately owned motor vehicles and trailersfor use on public roadsnot

owned or used for commercial purposes. This includes Personal Auto

Combinations of Private Passenger Auto, Motorcycle, Financial

Responsibility Bonds, Recreational Vehicles and/or Other Personal Auto.

19.1,

19.2,

21.1

19.0001 Private Passenger Auto (PPA)

PPA filings that include singularly or in any combination coverage such as

the following: Auto Liability, Personal Injury Protection (PIP), Medical

Payments (MP), Uninsured/Underinsured (UM/UIM); Specified Causes of

Loss, Comprehensive, and Collision.

19.1,

19.2,

21.1

19.0002 Motorcycle

Motorcycle filings that include singularly or in any combination coverage

such as in the following: Motorcycle Liability, PIP, MP, UM/UIM, Specified

Causes of Loss, Comprehensive, and Collision.

19.1,

19.2,

21.1

19.0003 Recreational Vehicle (RV)

RV filings (including filings for Golf Carts) which include singularly or in any

combination coverage such as the following: Auto Liability, PIP, MP,

Uninsured Motorist and/or Underinsured Motorists (UM/UIM); Specified

Causes of loss, Comprehensive, and Collision.

19.1,

19.2,

21.1

Page 14 of 21

Effective January 1, 2024

19.0004 Other

A catchall code for other than the previously presented auto coding used

for Personal Auto.

19.1,

19.2,

21.1

20.0 Commercial Auto 20.0000 Commercial Auto Combinations

Coverage for motor vehicles owned by a business engaged in commerce

that protects the insured against financial loss because of legal liability for

motor vehicle related injuries, or damage to the property of others caused

by accidents arising out of the ownership, maintenance, use, or care-

custody & control of a motor vehicle. This includes Commercial Auto

Combinations of Business Auto, Garage, Truckers and/or Other

Commercial Auto.

19.3,

19.4,

21.2

20.0001 Business Auto

Coverage for motor vehicles, other than those in the garage business,

engaged in commerce. Business Auto filings include singularly or in any

combination coverage such as the following: Auto Liability, PIP, MP,

Uninsured Motorist and/or Underinsured Motorists (UM/UIM); Specified

Causes of Loss, Comprehensive, and Collision.

19.3,

19.4,

21.2

20.0002 Garage

Garage auto filings pertaining to auto dealers and to auto non-dealers (auto

repair shops, auto service stations, parking garages, and similar risks).

Garage filings include singularly or in any combination coverage such as

the following: Garage Liability, Garagekeepers Legal Liability, PIP, MP,

UM/UIM; Specified Causes of Loss, Comprehensive, and Collision.

19.3,

19.4,

21.2

20.0003 Other

A catchall code for other than the previously presented automobile coding

used for Commercial Auto.

19.3,

19.4,

21.2

20.0004 Truckers

Coverage for persons or organizations engaged in the business of

transporting property by auto for hire, including coverage of the specialized

liability exposure created by trailer interchange agreements.

19.3,

19.4,

21.2

21.4 Mobile Homes under

Transport

21.0004 Mobile Homes under Transport

Mobile Homes while under transport for personal or commercial use.

21.1,

21.2

22.0 Aircraft 22.0000 Aircraft

Coverage for aircraft (hull) and their contents; aircraft owners’ and aircraft

manufacturers liability to passengers, airports and other third parties.

22

23.0 Fidelity 23.0000 Fidelity

A bond or policy covering an employer’s loss resulting from an employee’s

dishonest act (e.g., loss of cash, securities, valuables, etc.)

23

Page 15 of 21

Effective January 1, 2024

23.0/24.0 Fidelity and Surety 23.0000/24.0000 Fidelity and Surety

See Fidelity and Surety Above

24.0 Surety 24.0000 Surety

A three-party agreement where the insurer agrees to pay a second party

(the obligee) or make complete an obligation in response to the default,

acts, or omissions of a third party (the principal or obligor).

24

26.0 Burglary and Theft

Coverage for property taken or destroyed by break-in and entering the

insured’s premises; burglary or theft; forgery or counterfeiting; fraud; and

off-premises exposure. Includes Fidelity and Surety coverage written as

part of a Crime and Fidelity program.

26

26.0001 Commercial Burglary and Theft

Burglary and theft coverage for commercial enterprises. 26

26.0002 Personal Burglary and Theft

Burglary and theft coverage for personal or household risks. 26

27.0 Boiler & Machinery or

Equipment Breakdown

27.0000 Boiler & Machinery or Equipment

Breakdown

Coverage for the failure of boilers, machinery and other electrical

equipment. Benefits include (i) property of the insured, which has been

directly damaged by the accident; (ii) costs of temporary repairs and

expediting expenses; and (iii) liability for damage to the property of others.

Coverage also includes inspection of the equipment.

27

28.1 Credit - Credit Default 28.1000 Credit - Credit Default

Coverage purchased by manufacturers, merchants, educational

institutions, or other providers of goods and services extending credit, for

indemnification of losses or damages resulting from the nonpayment of

debts owed to them for goods or services provided in the normal course of

their business.

28

28.2 Credit - Personal Property

This section is for use where credit personal property is handled by the

property and casualty section of the state insurance department. Under

Code 28.2001 through Code 28.2003 credit insurance may be either

“single interest” or “dual interest”. Single interest means insurance that

protects only the creditor’s/lessor’s interest in the collateral securing a

debtor’s/lessee’s credit transaction. Dual interest (also commonly referred

to as “limited dual interest”) means insurance that protects the

creditor’s/lessor’s and the debtor’s/lessee’s interest in the collateral

securing the debtor’s/lessee’s credit/lease transaction.

28

28.2001 Creditor - Placed Home

Single interest or dual interest credit insurance purchased unilaterally by

the creditor, who is the named insured, subsequent to the date of the credit

transaction, providing coverage against loss to property that would either

impair a creditor’s interest or adversely affect the value of collateral on

homes, mobile homes, and other real estate.

28*

Page 16 of 21

Effective January 1, 2024

28.2002 Creditor - Placed Auto

Single interest or dual interest credit insurance that is purchased

unilaterally by the creditor/lessor, who is the named insured, subsequent to

the date of the credit/lease transaction, providing coverage against loss to

property that would either impair a creditor’s/lessor’s interest or adversely

affect the value of collateral on automobiles, boats, or other vehicles.

28*

28.2003 Personal Property

Single interest or dual interest credit insurance (where collateral is not a

motor vehicle, mobile home, or real estate) that covers perils to goods

purchased or used as collateral and that concerns a creditor’s/lessor’s

interest in the purchased/leased goods or pledged collateral either in whole

or in part; or covers perils to goods purchased/leased in connection with an

open-end credit/lease transaction.( Also see 9.0005)

28*

28.2004 Credit Involuntary Unemployment

Credit insurance that provides a monthly or lump sum benefit during an

unpaid leave of absence from employment resulting from specified causes,

such as layoff, business closure, strike, illness of a close relative and

adoption or birth of a child. This insurance is sometimes referred to as

Credit Family Leave.

28

28.2005 Personal GAP Insurance

Insurance that insures the excess of the outstanding indebtedness over the

primary property insurance benefits in the event of a total loss to a

collateral asset.

28*

28.2006 Other

Not specifically described above. 28

28.3 Credit - Commercial Property 28.3000 Credit - Commercial Property

Single or dual interest insurance purchased unilaterally by the creditor, who

is the named insured, subsequent to the credit transaction, providing loss

to property that would either impair a creditor’s interest or adversely affect

the value of collateral on commercial property

28*

30.0 Homeowner/ Auto

Combinations

30.0000 Homeowner/Auto Combinations

A special form of package policy composed of personal automobile and

homeowners insurance.

None

30.1 Dwelling Fire/Personal Liability 30.1000 Dwelling Fire/Personal Liability

A special form of package policy composed of dwelling fire and/or allied

lines, and personal liability insurance.

None

33.0 Other Lines of Business

Coverage not described under previous Lines of Insurance. 34

33.0001 Other Personal Lines

Coverage not described under previous Types or Sub-types of Insurance. 34

Page 17 of 21

Effective January 1, 2024

33.0002 Other Commercial Lines

Coverage not described under previous Types or Sub-types of Insurance. 34

33.0003 Mechanical Breakdown Insurance

An insurance policy , issued by an insurance company, which provides

repair or replacement serviceor indemnification for that servicefor the

operational or structural failure of property due to defects in materials or

workmanship, or normal wear and tear. (May cover motor vehicles, mobile

equipment, boats, appliances, electronics, residential structures, etc.)

30

33.0004 Service Contract

A contract or agreement given for consideration over and above the

purchase or lease price of the covered property and that undertakes to

perform or provide repair or replacement service, or reimbursement for that

service, for the operational or structural failure of covered property due to

defect in materials or workmanship or normal wear and tear, but does not

include mechanical breakdown insurance. (See 17.0004 for contractual

liability insurance issued to reimburse service contract providers for

liabilities assumed under service contracts.)

30

33.0005 Other Contracts

A contract or agreement regulated by the department of insurance (DOI)

and required to be submitted to the state in which the contract is delivered

which does not fall under 33.0004 Service Contracts. Such contracts,

include, but are not limited to, motor vehicle ancillary product protection

contracts , such as glass repair or paint-less dent removal, tire and wheel

road hazard or motor vehicle protection products, such as window etching.

Note: See 17.0004 for contractual liability insurance issued to reimburse

the contract provider for liability assumed under these contracts.

34 or None

33.0006 Tuition Reimbursement Plans

Product which reimburses for the tuition expenses of students who drop

out, are expelled, leave for medical reasons, etc.

34.0 Title 34.0000 Title

Coverage that guarantees the validity of a title to real and personal

property. Buyers of real and personal property and mortgage lenders rely

upon the coverage to protect them against losses from undiscovered

defects in existence when the policy is issued.

None

Page 18 of 21

Effective January 1, 2024

35.0 Interline Filings

35.0000 Personal/Commercial Interline

Filings

A Personal and Commercial filing consisting of one or more forms,

classification or territories that applies to more than one type of insurance

(e.g., cancellation provisions; declarations page; payment plan rule).

None

35.0001 Personal Interline Filings

A Personal filing consisting of one or more forms, classification or

territories that applies to more than one type of insurance (e.g.,

cancellation provisions; declarations page; payment plan rule).

None

35.0002 Commercial Interline Filings

A Commercial filing consisting of one or more forms, classification or

territories that applies to more than one type of insurance (e.g.,

cancellation provisions; declarations page; payment plan rule).

None

Since the first digit following the decimal for 11.2000 is the number 2, that number may be dropped down in lieu of the 0 for the first decimal in the acupuncture sub-code.

This would therefore change the acupuncture sub-code from 11.001 to 11.2001

, which would effectively designate its coverage as that of claims made acupuncture.

The claims made sub-code in the example is 11.2000. The acupuncture sub-code without designating whether it is occurrence or claims made is 11.0001.

The filing for claims made acupuncture coverage (located in the Type of Insurance for Medical Malpractice), as correctly entered under Sub-Type of Insurance of the

transmittal document.

**Filing codes for Sub-Type of Insurance with sub-codes that denote a 1 or 2 immediately following the decimal point are to be used to clarify a coverage sub-

code so that only one sub-code number is needed to file for a particular coverage, rather than two. An example, to correctly represent on the Uniform

Property & Casualty Transmittal Document, is as follows:

Placing Code 11.0000 (Medical Malpractice) under Type of Insurance on the transmittal document would denote the filing of all its sub-codes listed. If all of the sub-codes

represent occurrence coverage, then it is necessary to list the code 11.1000 (Occurrence) as a second code under Type of Insurance. If all of the sub-codes represent

claims made coverage, then it is necessary to list the code 11.2000 (Claims Made) as a second code under Type of Insurance. If the sub-codes under Code 11.000 vary

between occurrence and claims made coverage, then it will be necessary to list each sub-code as either occurrence or claims made by denoting a 1 or 2 immediately

following the sub-codes decimal point as explained in the following example.

*Filing codes for Type of Insurance that have all zeros after the decimal point include all listed sub-codes (if any), when this Type of Insurance code is listed

under Type of Insurance in the filing transmittal document. An example, to correctly represent on the Uniform Property & Casualty Transmittal Document, is

as follows:

Page 19 of 21

Effective January 1, 2024

Personal GAP (Guaranteed Asset Protection) Insurance

Credit insurance is generally issued in connection with the issuance of credit to an individual by a bank, retailer, finance company or other similar organization and

protects the organization for the unpaid balance of the loan and frequently for durations of less than 120 months. (Taken from SSAP No. 59, Credit Life and Accident

and Health Contracts.)

28*

Coverage purchased by consumers, manufacturers, merchants, educational institutions or other providers of goods and services extending credit, for indemnification of

losses or damages resulting from the nonpayment of debts owed to/from them for goods or services provided in the normal course of their business.

Because auto filings are either Private Passenger Auto or Commercial Auto and because most contain both liability and physical damage exposures, the codes for Private

Passenger Auto and Commercial Auto have been added to the table to accommodate these filings in SERFF. Hint:

The first digit after the decimal designates Private

Passenger (.1) or Commercial (.2). The last (fourth) digit after the decimal designates No-Fault/PIP (.X001) or Liability (.X0002).

When a filing contains more than one of the identified Sub-Types of Insurance, use the appropriate .0000 "Combinations" code. Example 1: If a Homeowners filing

includes both 4.0003 Owner Occupied Homeowners and 4.0004 Tenant Homeowners, use 4.0000 Homeowners Sub-TOI Combinations as the SERFF Sub-Type of

Insurance. Example 2: If a Medical Malpractice filing includes both occurrence and claims made coverage for Acupuncture, use code 11.0001. If it includes only claims

made coverage but for Acupuncture, Chiropractic and Optometry, use code 11.2000.

SERFF Notes: SERFF limits each filing to a single Type of Insurance (TOI) and Sub-Type of Insurance (Sub-TOI).

The same procedure is applicable to sub-codes where other double-asterisks appear, such as the following: Sub-codes 5.1000 (Non-Liability Portion for the Commercial

Multiple Peril Type of Insurance) and 5.2000 (Liability Portion for the Commercial Multiple Peril Type of Insurance); 17.1000 (Occurrence for the Other Liability Type of

Insurance) and 17.2000 (Claims Made for the Other Liability Type of Insurance).

Credit insurance that insures the excess of the outstanding indebtedness over the primary property insurance benefits in the event of a total loss to a collateral asset.

*States may require annual statement to be completed differently from the recommendation.

Credit insurance that provides a monthly or lump sum benefit during an unpaid leave of absence from employment resulting from specified causes, such as layoff,

business closure, strike, illness of a close relative and adoption or birth of a child. This insurance is sometimes referred to as Credit Family Leave.

Include all types of business that are “force-placed” or “lender-placed” in the same pre defined lines of business as business placed by borrower or creditor for the

same coverage.

Force-Placed Business:

Credit Involuntary Unemployment

Page 20 of 21

Effective January 1, 2024

Force-placed (also known as lender-placed and creditor-placed insurance) is insurance that is placed by the lender subsequent to the date of the credit transaction,

providing coverage against loss, expense or damage to collateralized property as a result of fire, theft, collision or other risks of loss that would either impair a

creditor’s interest or adversely affect the value of collateral covered by limited dual-interest insurance. It is purchased by the lender according to the terms of the

credit agreement as a result of the borrower’s failure to provide required insurance, with the cost of the coverage being charged to the borrower. It may be either

single-interest insurance or limited dual-interest insurance.

Page 21 of 21