MEDICARE SUPPLEMENT

MONTHLY PREMIUMS FOR

AS OF JULY 1, 2024

POLICIES

Monthly Premiums for

Medicare Supplement Insurance Policies

As of July 1, 2024

NOTE: This publication is updated twice a year for rates as of January 1 and July 1. For the most current list of participating insurance carriers, refer

to https://insurance.maryland.gov/Consumer/Documents/publicnew/medsupindpolicies.pdf.

Scope of Guide

This publication provides: (1) names, addresses, telephone numbers and websites of insurance carriers that sell Medicare Supplement insurance in Maryland,

(2) Plan

s A, B, C, D, F, high deductible F, G, high deductible G, K, L, M, and N monthly premiums for ages 65, 70, 75, 80 and 85 individuals, and (3) Plan

s A, C,

and D mo

nthly premiums for individuals under age 65 with a disability who are enrolled in Medicare Part B. Some insurance carriers sell other plan

s for

individual

s under age 65 with a disability who are enrolled in Medicare Part B. The plan options listed in this publication are for Standardized polic

ies

(and

certificates) first offered on or after June 1, 2010 except for Plan G with High Deductible. The plan options listed for Plan G with High Dedu

ctible are for

polici

es with an effective date for coverage on or after January 1, 2020. (Please note: Effective January 1, 2020, only applicants who are first eligib

le for

Medicare bef

ore year 2020 may purchase Plans C, F, and high deductible F.) The premiums are subject to change, and the informat

ion in this Guide is

for informatio

nal purposes only. For current premiums and more information about policies, contact your insurance producer (Insurance Produce

r or broker)

or insuran

ce carrie

r.

This pu

blication only provides the rate information filed with the MIA. For general information about Medicare and Medicare Supplement Policies, you can

view the MIA’s webinar, Medicare Supplement Insurance in Maryland at: https://tinyurl.com/ydcqnthw. You may also visit the website of the federal Centers for

Medicare and Medicaid Services (CMS), which administers the Medicare program and can answer your questions regarding the Medicare Program.

The CMS website at www.cms.gov contains valuable information regarding Medicare, including a handbook on Medicare entitled Medicare & You that provides

detailed information on Medicare program benefits, rights and obligations, and also a guide titled, Choosing a Medigap Policy: A Guide to Health Insurance for

People with Medicare. You also may contact CMS directly with your questions regarding the Medicare program by calling toll free 1-800-MEDICARE or visiting the

Medicare website at www.medicare.gov.

General Information

Medicare Suppleme

nt is private insurance and can only be purchased through an insurance carrier. It is not sponsored by either federal or state government.

An insurance carrier writes a policy based on issue age, attained age, or community rating.

Issue Age means that premiums are based on your age at the time you purchase the policy. While premiums may periodically increase

due to benefit changes, inflation, or increases in medical costs, they will not increase due to your advancing age.

Attained Age means that premiums are based on your age on the last policy anniversary date. Premiums are scheduled to increase

at predetermined intervals (for example, every year or every five years). These increases are in addition to premium increases

because of benefit changes, inflation, or increasing medical costs.

Community Rated means that premiums do not depend on your age, either at the time the policy is issued or upon renewal. Premiums

depend on other factors and may increase because of benefit changes or overall premium adjustments.

2

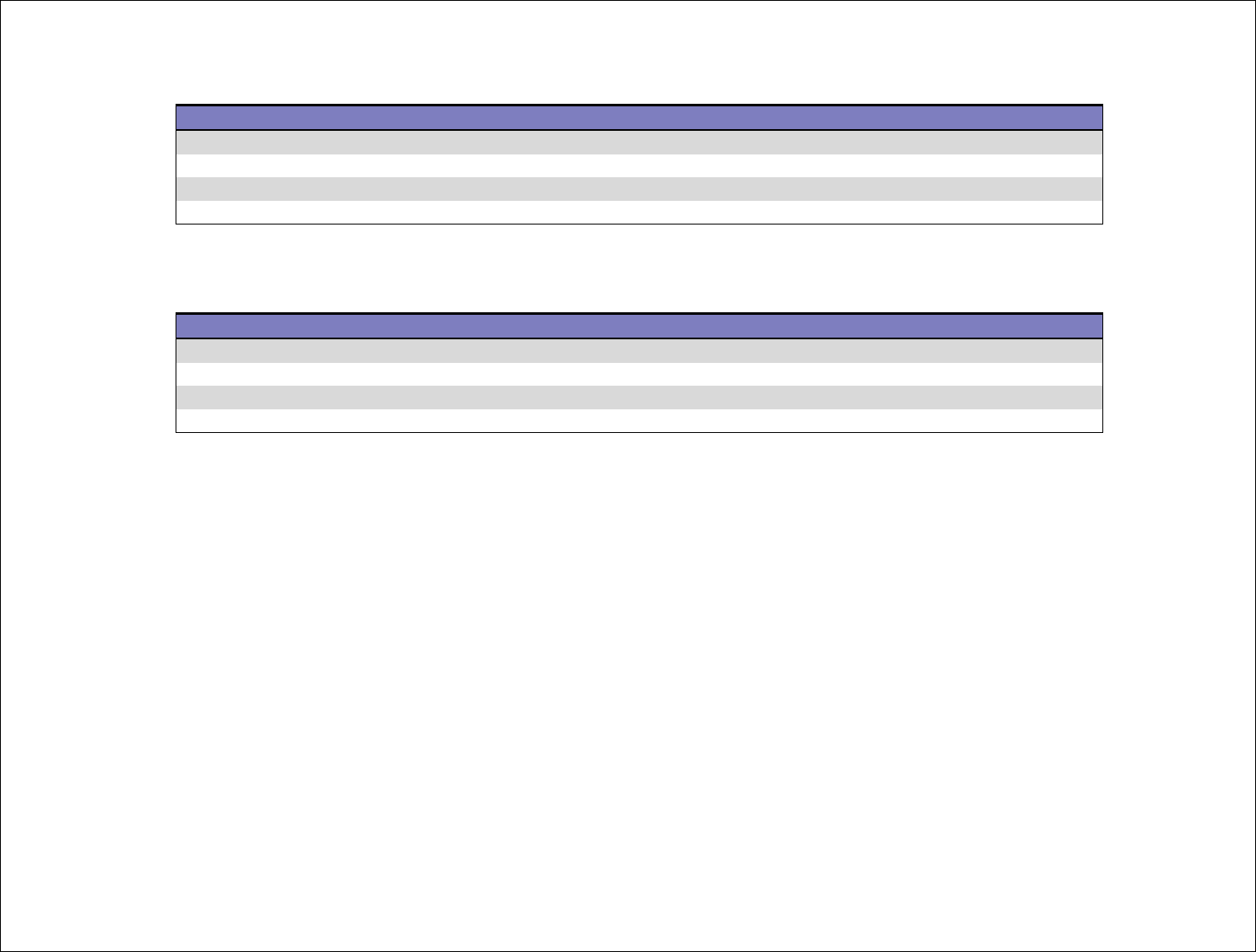

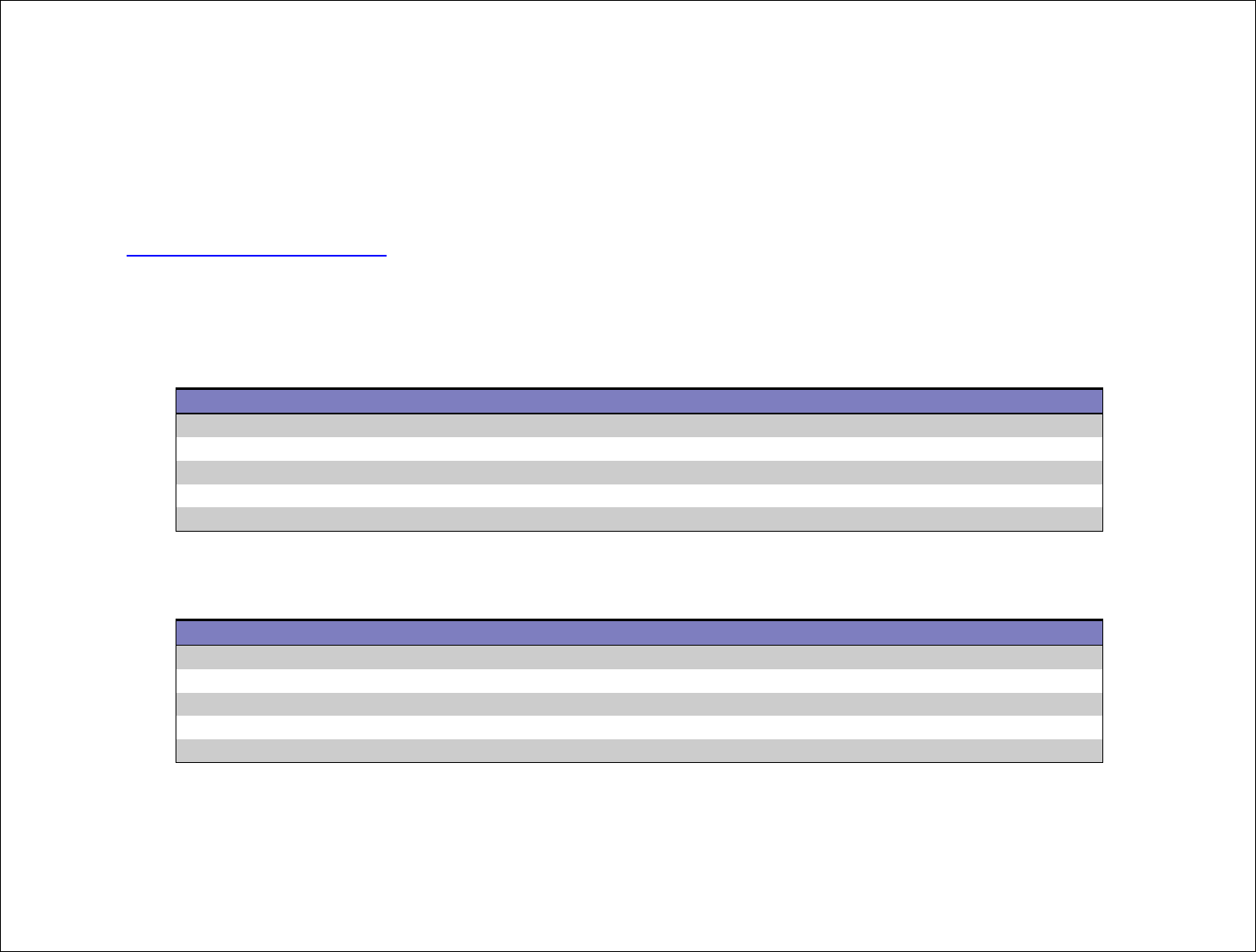

Individual Medicare Supplement Plan Choices – Plans A, B, C, D, F, High Deductible F, G, High Deductible G, K, L, M and N

Benefit Chart of Medicare Supplement Plans Sold on or After January 1, 2020.

This chart shows the benefits included in each of the standard Medicare Supplement plans. Some plans may not be available to all Original (Part A/Part B) Medicare

beneficiaries. Only applicants first eligible for Medicare before January 1, 2020 may purchase Plans C, F, and high deductible F.

Note: A means 100% of the benefit is paid.

1

Pl

ans F and G also have a high deductible option which require first paying a plan deductible before the plan begins to pay. Once the plan deductible is met, the plan pa

ys

10

0% of covered services for the rest of the calendar year. High deductible Plan G does not cover the Medicare Part B deductible.

2

Plans K and L pay 100% of covered services for the rest of the calendar year once you meet the out-of-pocket yearly limit.

3

Plan N pays 100% of the Part B coinsurance, except for a co-payment of up to $20 for some office visits and up to a $50 co-payment for emergency room visits that do

not result in an inpatient admission.

Benefits

Plans Available to All Applicants First eligible

for Me

dicare

before

1/1/2020 l

A

B

D

G

1

K

L

M

N

C

F

1

Medicare Part A coinsurance and

hospital coverage (up to an

additional 365 days after Medicare

benefits are used up)

Medicare Part B coinsurance or

Copayment

50% 75%

copays

apply

3

Blood (first three pints)

50% 75%

Part A hospice care coinsurance or

copayment

50% 75%

Skilled nursing facility coinsurance

50% 75%

Medicare Part A deductible

50% 75% 50%

Medicare Part B deductible

Medicare Part B excess charges

Foreign travel emergency (up to

plan limits)

Out

-of-pocket limit

$7,060

2

$3,530

2

3

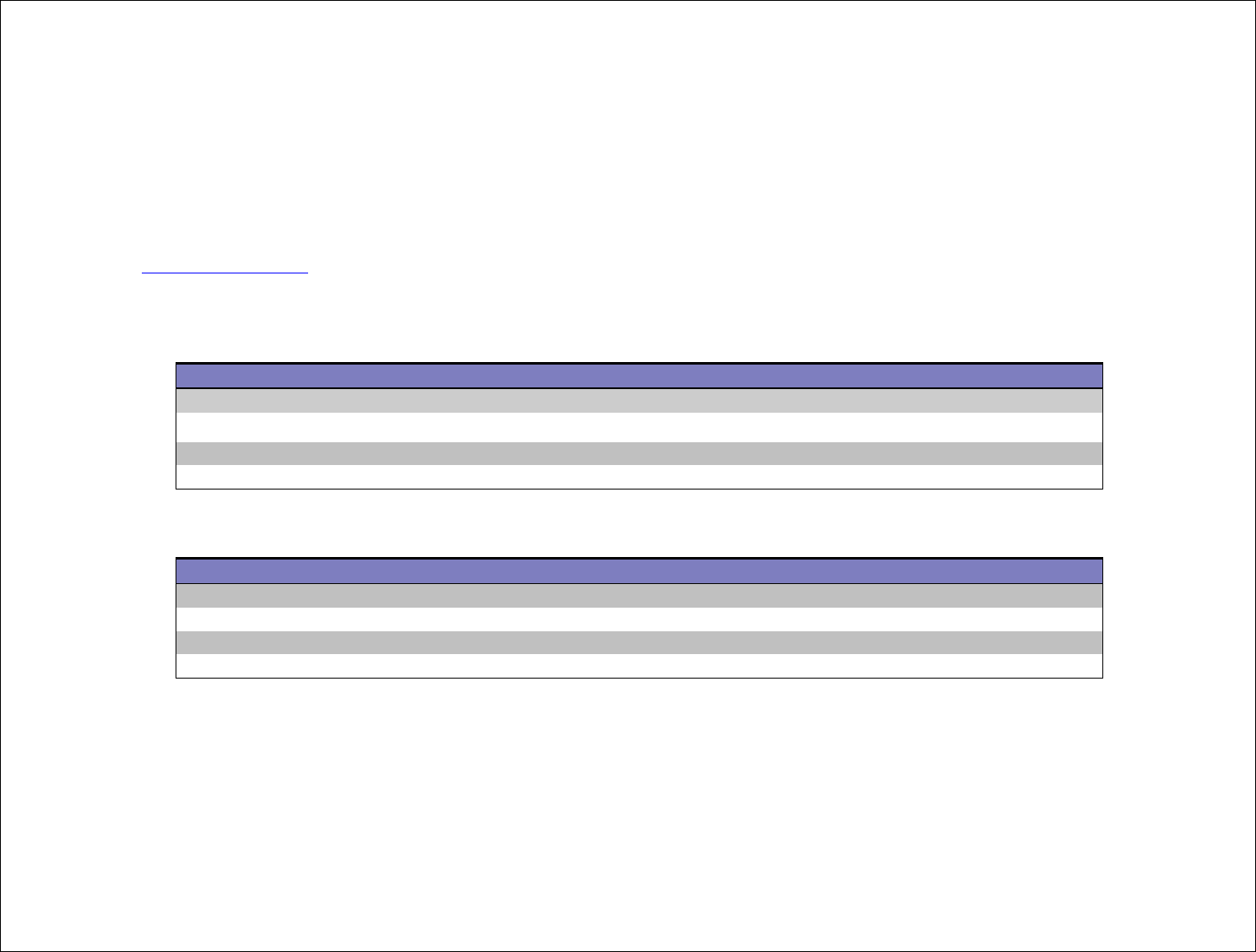

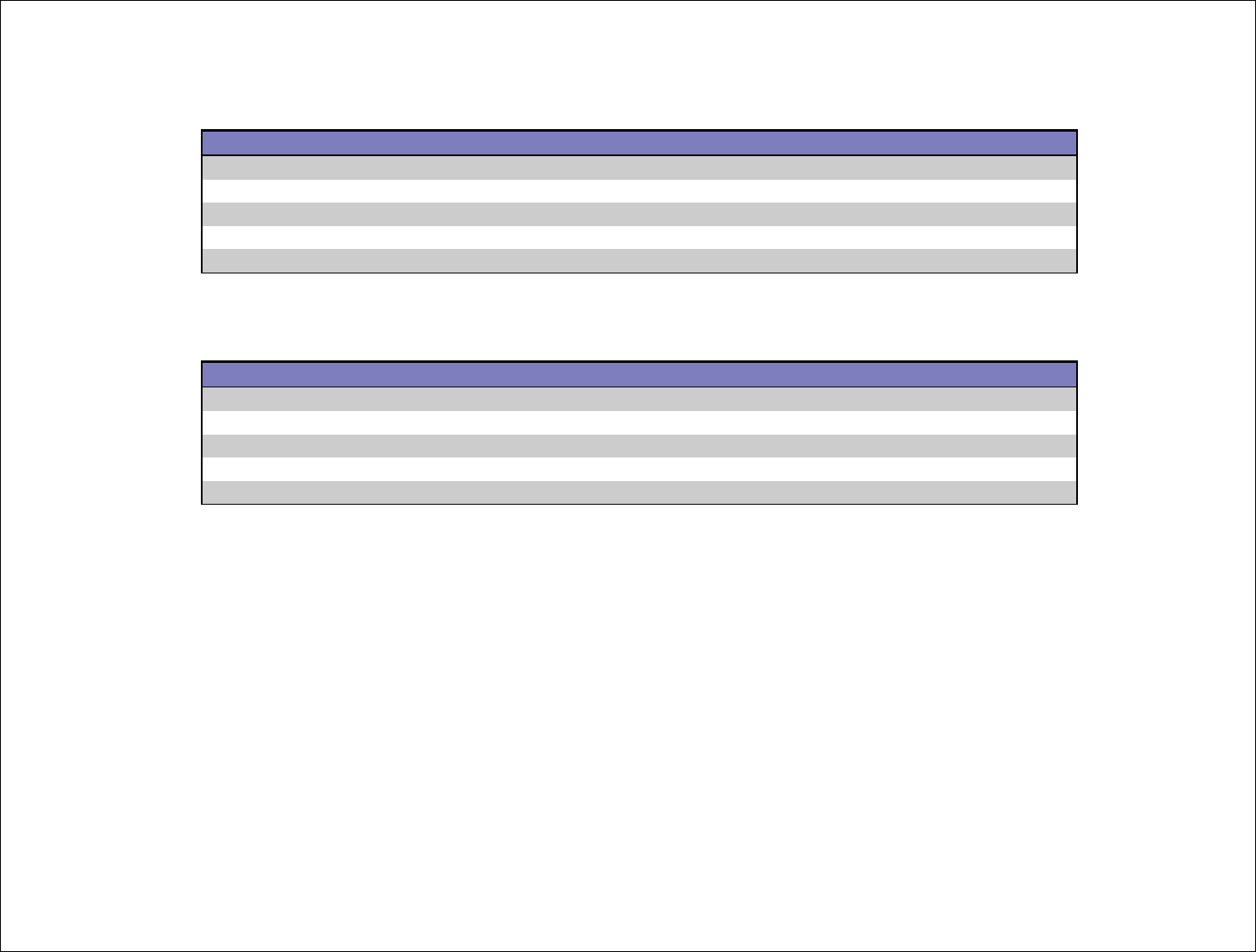

Medicare Supplement Birthday Rule

Starting on July 1, 2023, Medicare Supplement policyholders in Maryland will be granted a once-yearly Open Enrollment Period during the 30-day period

following the policyholder’s birthday. The Birthday Rule establishes a guaranteed issue period each year to allow a policyholder to change, without underwriting,

to a Medicare Supplement policy of equal or lesser benefits. “Without underwriting” means that a policyholder will be eligible for the lowest class of premiums and

may not be asked about tobacco usage or health status; or given a tobacco rate or a less preferred rate based on assumed tobacco/health status by the carrier.

Medicare Supplement policies are considered to have equal or lesser value unless:

the policy contains one or more significant benefits not included in the Medicare supplement policy being replaced; or

the policy contains the same significant benefits included in the Medicare supplement policy being replaced but it reduces the cost–sharing

responsibilities of the enrollee for the benefits

See equal or lesser value matrix below:

4

SHIP

Maryland’s State Health

Insurance Program

The State Health Insurance Program is a program that helps those on Medicare with personalized Medicare counseling, education, and access to

financial assistance resources.

SHIP offices help Medicare beneficiaries identify and understand programs and plans such as Medicare prescription drug coverage, Medicare

Advantage Plans, and Medicare supplemental insurance policies. SHIP can also help Medicare beneficiaries enroll in these plans. The services you

receive through SHIP offices are confidential and free.

Allegany – 301-783-1710

Harfor

d

–

410-638-3025

Anne Arundel

–

410-222-4257

Howar

d

–

410-313-7392

Baltimore City

–

410-396-2273

Ken

t

–

410-778-2564

Baltimore County

–

410-887-2059

Montgomery

–

301-255-4250

Calver

t

–

410-535-4606

Prince George’s

–

301-265-8471

Caroline

–

410-479-2535

Queen Anne’s

–

410-758-0848

Carroll

–

410-386-3800

Somerse

t

–

410-742-0505

Cecil

–

410-996-8174

St. Mary’s

–

301-475-4200 ext. 1064

Charles

–

301-934-9305

Talbo

t

–

410-822-2869 ext. 231

Dorcheste

r

–

410-376-3662

Washington

–

301-790-0275

Frederic

k

–

301-600-1234

Garrett – 301-334-9431

Wicomico – 410-742-0505

Worcester – 410-742-0505

5

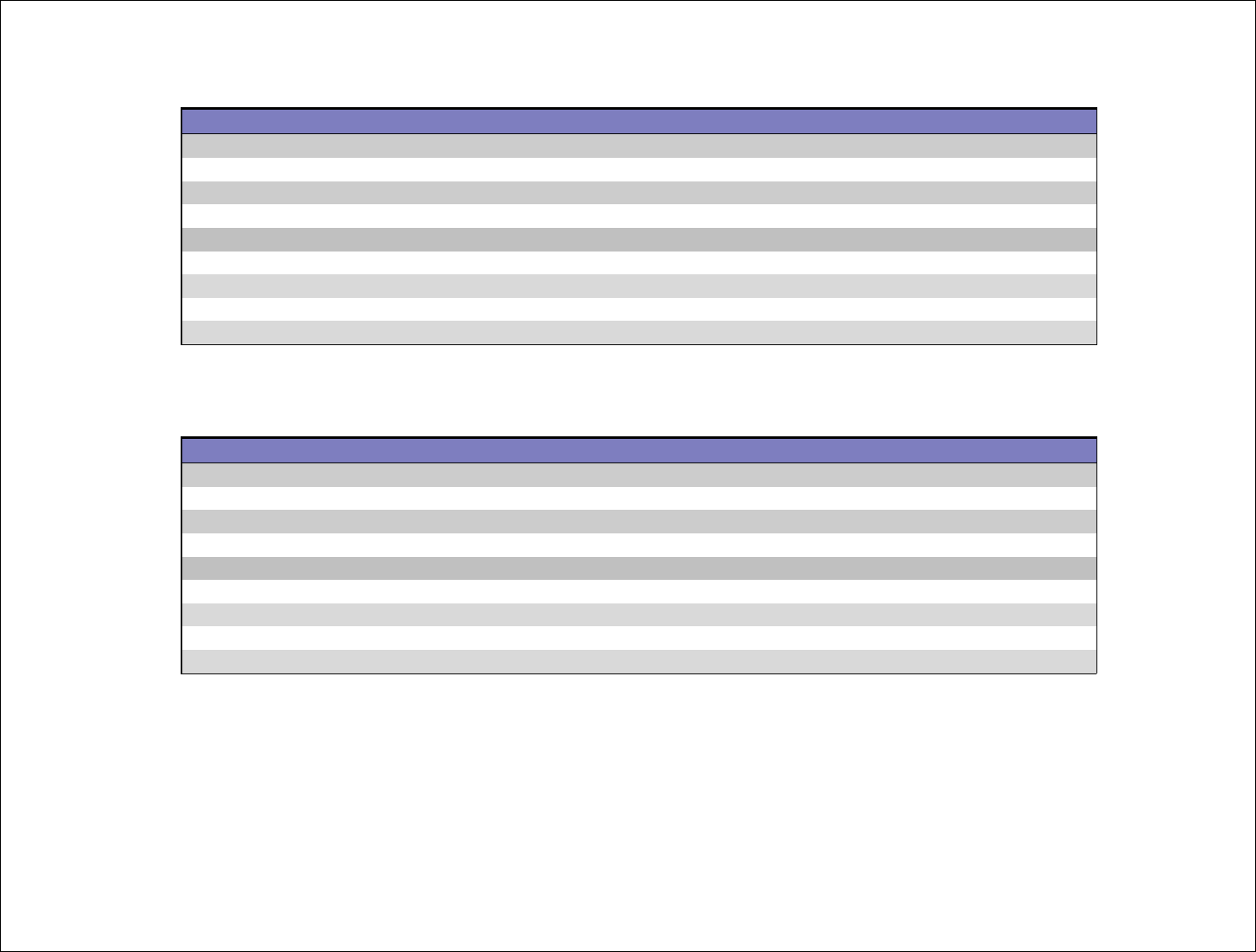

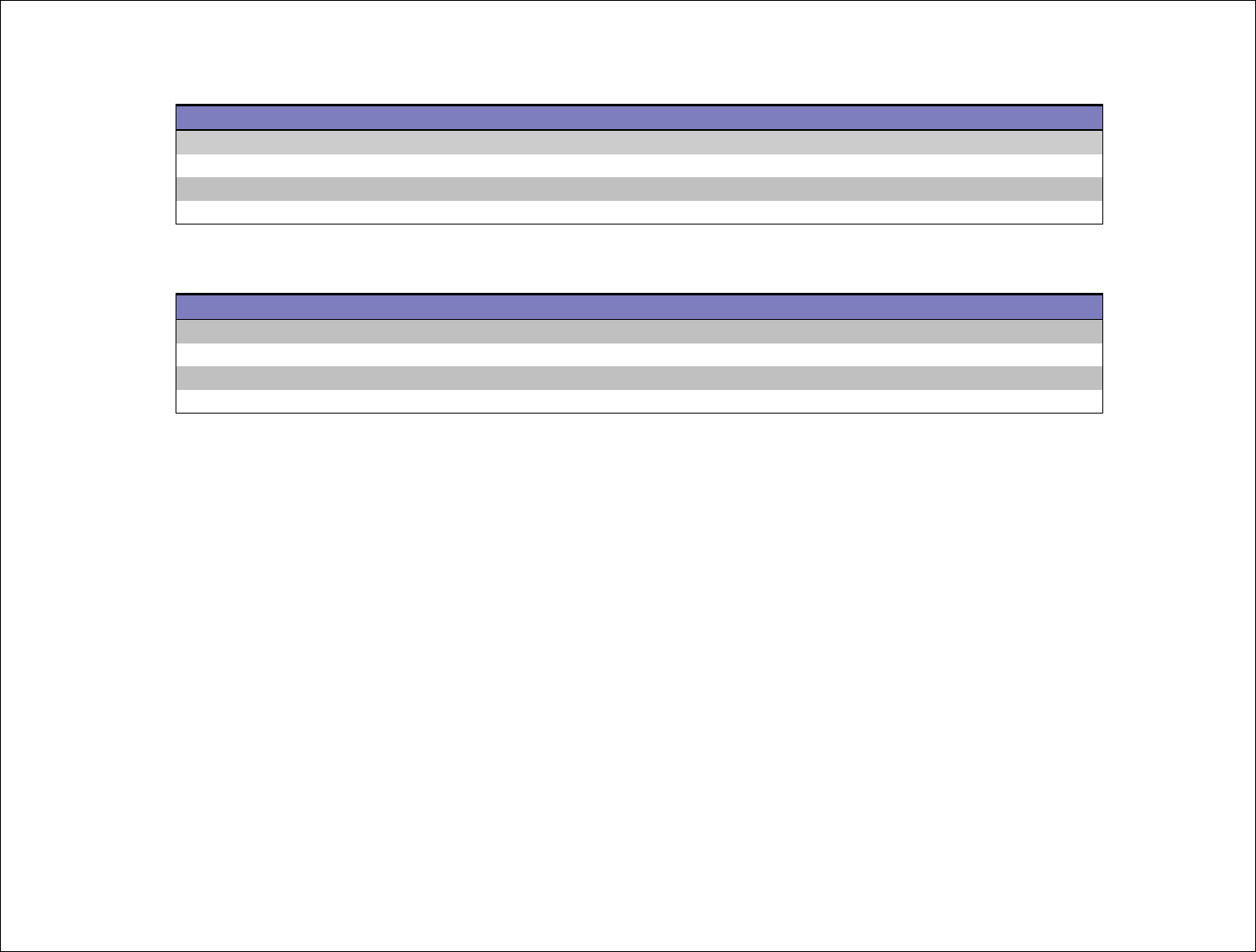

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

RATES FOR PLAN A, MEDICARE ELIGIBLE INDIVIDUALS DUE TO A DISABILITY

AS OF JULY 1, 2024

COMPANY_NAME

Male Non-Tobacco

or Male Preferred

Plan A < 65

Female Non-Tobacco

or Female Preferred

Plan A < 65

Male Tobacco or

Mal e S tandar d

Plan A < 65

Female Tobacco or

Femal e S tandard

Plan A < 65

ACE Property and Casualty Insurance Company $160 $142 $184 $163

Aetna Health Insurance Company $571 $497 N/A N/A

American Benefit Life Insurance Company $218 $190 $251 $218

American Financial Security Life Insurance Company $228 $198 $262 $228

American Home Life Insurance Company (The) $229 $199 $263 $229

Bankers Fidelity Assurance Company $174 $151 N/A N/A

Bankers Reserve Life Insurance Company of Wisconsin $474 $412 $545 $474

Cigna National Health Insurance Company $340 $306 $374 $337

EPIC Life Insurance Company (The) $274 $251 $274 $251

Erie Family Life Insurance Company $203 $176 $233 $203

Everence Association, Inc. $420 $382 $483 $439

Federal Life Insurance Company $258 $258 $297 $297

First Care, Inc. (dba CareFirst MedPlus) $948 $917 N/A N/A

First Health Life and Health Insurance Company $214 $196 $236 $216

Globe Life and Accident Insurance Company $261 $261 $261 $261

GPM Health and Life Insurance Company $385 $385 $442 $442

Guarantee Trust Life Insurance Company $287 $255 $358 $318

Heartland National Life Insurance Company $217 $189 $250 $217

Humana Benefit Plan of Illinois, Inc. $366 $324 $421 $373

LifeShield National Insurance Company $214 $186 $246 $214

Monitor Life Insurance Company of New York $226 $197 $260 $226

Mutual of Omaha Insurance Company $177 $154 $204 $177

Nassau Life Insurance Company of Kansas $246 $214 $282 $246

National Health Insurance Company $209 $185 $251 $222

Physicians Life Insurance Company $214 $193 $238 $215

State Farm Mutual Automobile Insurance Company $280 $280 $280 $280

Supreme Council of the Royal Arcanum $199 $173 $229 $199

Tier One Insurance Company $250 $217 $287 $250

6

Transamerica Life Insurance Company $231 $208 $254 $228

Unified Life Insurance Company $300 $260 $344 $300

United American Insurance Company $185 $161 N/A N/A

United Healthcare Insurance Company $463 $411 $509 $452

USAA Life Insurance Company $299 $299 $329 $329

Washington National Insurance Company $253 $253 $253 $253

7

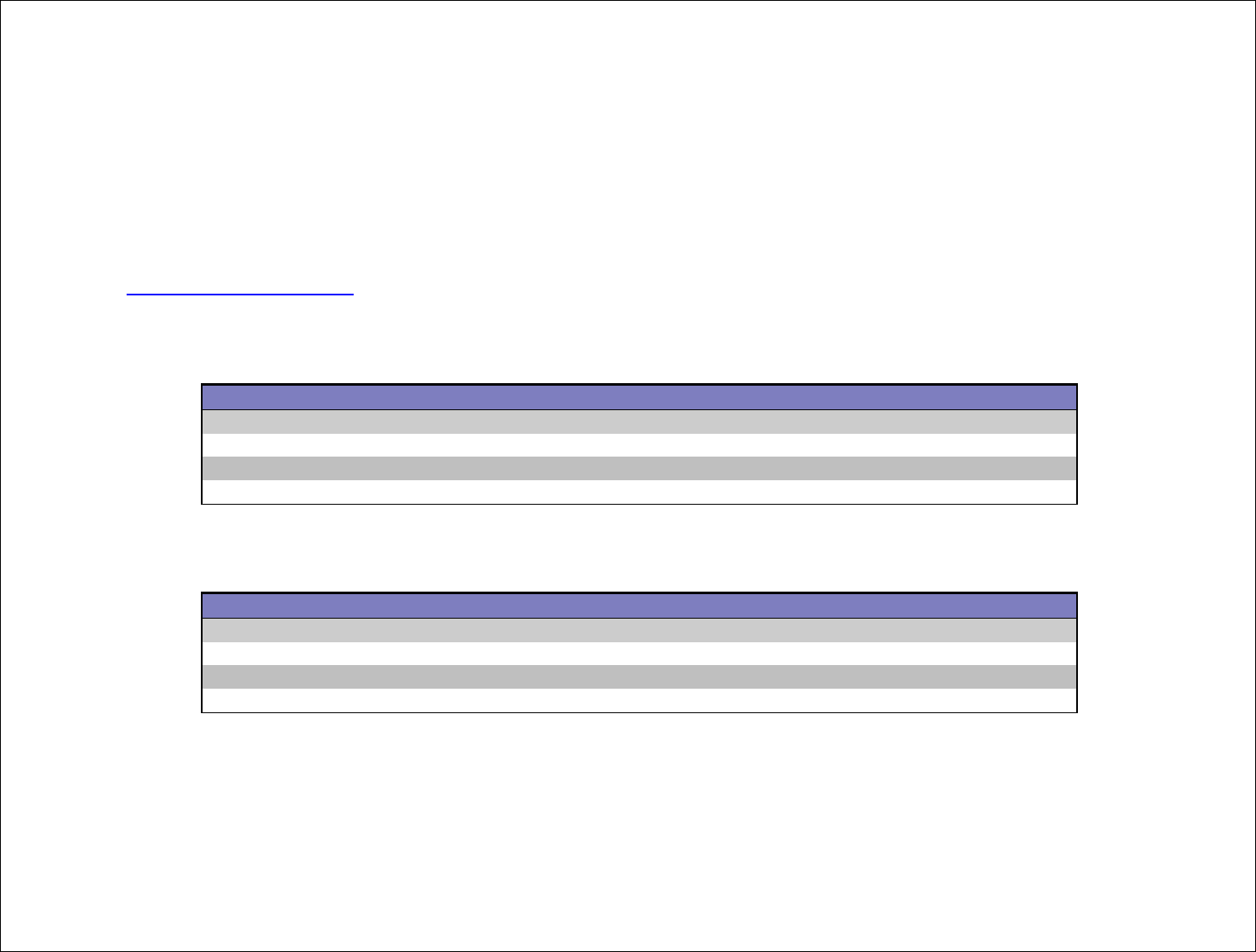

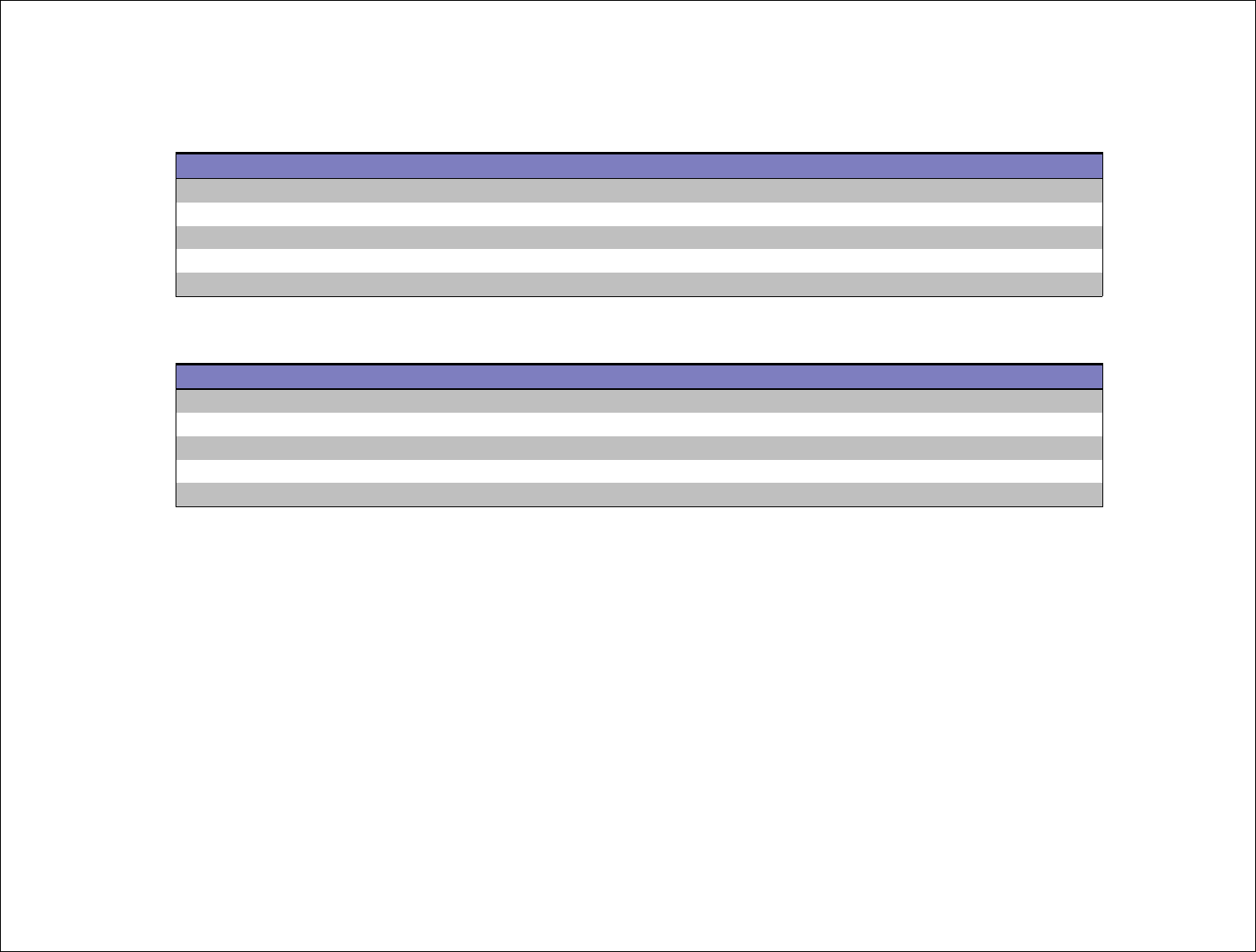

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

RATES FOR PLANS C AND D, MEDICARE ELIGIBLE INDIVIDUALS DUE TO A DISABILITY

AS OF JULY 1, 2024

COMPANY_NAME

Male Non-Tobacco

or Male Preferred

Plan C < 65

Female Non-Tobacco

or Female Preferred

Plan C < 65

Male Tobacco or

Mal e S tandar d

Plan C < 65

Female Tobacco or

Femal e S tandard

Plan C < 65

Heartland National Life Insurance Company $1,137 $989 $1,308 $1,137

State Farm Mutual Automobile Insurance Company $675 $675 $675 $675

United Healthcare Insurance Company $1,121 $994 $1,233 $1,093

COMPANY_NAME

Male Non-Tobacco

or Male Preferred

Plan D < 65

Female Non-Tobacco

or Female Preferred

Plan D < 65

Male Tobacco or

Mal e S tandar d

Plan D < 65

Female Tobacco or

Femal e S tandard

Plan D < 65

State Farm Mutual Automobile Insurance Company $657 $647 $657 $647

United American Insurance Company $729 $632 N/A N/A

8

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

AS OF JULY 1, 2024

ACE Property and Casualty Insurance Company Individual Market-Attained Age

Attn: Medicare Supplement Marketing Method: Insurance Producer Solicited

436 Walnut Street

Philadelphia, PA 19106

1-800-601-3372

Male Preferred

<65 65 70 75 80 85

A

$160 $157 $160 $190 $231 $288

F

$184 $200 $238 $289 $360

G

$158 $161 $192 $233 $290

High G

$ 63 $ 65 $ 77 $ 93 $116

N

$121 $126 $149 $181 $226

Female Preferred

<65 65 70 75 80 85

A

$142 $139 $142 $169 $205 $256

F

$163 $178 $211 $257 $320

G

$141 $143 $170 $207 $258

High G

$ 56 $ 57 $ 68 $ 83 $103

N

$108 $112 $133 $161 $201

A 7% household discount is available for applicants who qualify.

9

Male Standard*

<65 65 70 75 80 85

A

$184 $180 $184 $218 $265 $331

F

$211 $230 $273 $332 $414

G

$182 $186 $220 $268 $334

High G

$ 73 $ 74 $ 88 $107 $134

N

$139 $145 $172 $209 $260

Female Standard*

<65 65 70 75 80 85

A

$163 $160 $163 $194 $236 $294

F

$188 $205 $243 $296 $368

G

$162 $165 $196 $238 $297

High G

$ 65 $ 66 $ 78 $ 95 $119

N

$124 $129 $153 $186 $231

*Premiums listed above for Male Standard and Female Standard cannot be used if an application for a Medicare

supplement policy or certificate is submitted during the 6-month open enrollment period, or if an application

for an available Medicare supplement policy is submitted during the guaranteed issue period, or if the policy or

certificate is submitted during the 30-day annual open enrollment period triggered by a policyholder’s birthday.

A 7% household discount is available for applicants who qualify.

10

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

AS OF JULY 1, 2024

Aetna Health Insurance Company Individual Market-Attain

ed Age

800 Crescent Centre Drive

Marketing Method: Insurance Producer Solicited

Suite 200

Franklin, TN 37067

1-800-264-4000

www.aetnas

eniorproducts.com

Male Preferred

<65 65 70 75 80 85

A

$571 $354 $376 $441 $520 $608

B

$188 $199 $234 $276 $322

F

$228 $242 $284 $335 $391

G

$209 $222 $261 $307 $359

High G

$ 54 $ 57 $ 67 $ 79 $ 93

N

$135 $151 $178 $209 $244

Female Preferred

<65 65 70 75 80 85

A

$497 $308 $327 $384 $452 $528

B

$163 $173 $204 $240 $280

F

$198 $210 $247 $291 $340

G

$182 $193 $227 $267 $312

High G

$ 47 $ 50 $ 58 $ 69 $ 80

N

$117 $131 $155 $182 $213

A 7% Household Discount is available. In order to be eligible for the 7% Household Discount, an individual

must enroll for a Medicare Supplement plan at the same time as another Medicare eligible adult, or

the other Medicare eligible adult must currently be covered by an Aetna Medicare Supplement

policy issued in Maryland.

11

Male Standard*

<65 65 70 75 80 85

A

N/A $393 $417 $490 $578 $675

B

$209 $222 $260 $307 $358

F

$253 $269 $316 $372 $435

G

$232 $246 $290 $341 $398

High G

$ 60 $ 64 $ 75 $ 88 $103

N

$150 $168 $198 $232 $272

Female Standard*

<65 65 70 75 80 85

A

N/A $342 $363 $426 $503 $587

B

$181 $193 $226 $267 $311

F

$220 $234 $275 $324 $378

G

$202 $214 $252 $297 $346

High G

$ 52 $ 55 $ 65 $ 76 $ 89

N

$130 $146 $172 $202 $236

*Premiums listed above for Male Standard and Female Standard cannot be used if an application for a Medicare

supplement policy or certificate is submitted during the 6-month open enrollment period or if an application

for an available Medicare supplement policy is submitted during the guaranteed issue period, or if the policy or

certificate is submitted during the 30-day annual open enrollment period triggered by a policyholder’s birthday.

A 7% Household Discount is available. In order to be eligible for the 7% Household Discount, an individual

must enroll for a Medicare Supplement plan at the same time as another Medicare eligible adult or

the other Medicare eligible adult must currently be covered by an Aetna Medicare Supplement

policy issued in Maryland.

12

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

AS OF JULY 1, 2024

American Benefit Life Insurance Company Individual Market-Attained Age

1605 LBJ Freeway, Suite 7700 Marketing Method: Insurance Producer Solicited

Dallas, TX 75234

1-833-504-0331

www.lbig.com

Male Preferred

<65 65 70 75 80 85

A

$218 $179 $179 $203 $247 $320

F

$198 $207 $248 $300 $371

G

$163 $167 $204 $248 $322

N

$119 $130 $162 $203 $262

Female Preferred

<65 65 70 75 80 85

A

$190 $156 $156 $176 $215 $279

F

$173 $180 $216 $261 $323

G

$142 $146 $177 $216 $280

N

$103 $113 $141 $176 $228

A 10% Household Discount applies for eligible individuals.

13

Male Standard*

<65 65 70 75 80 85

A

$251 $206 $206 $233 $284 $368

F

$228 $238 $285 $345 $427

G

$187 $193 $234 $285 $370

N

$137 $149 $187 $233 $301

Female Standard*

<65 65 70 75 80 85

A

$218 $179 $179 $203 $247 $320

F

$198 $207 $248 $300 $371

G

$163 $167 $204 $248 $322

N

$119 $130 $162 $203 $262

*Premiums listed above for Male Standard and Female Standard cannot be used if an application for a

Medicare supplement policy or certificate is submitted during the 6-month open enrollment period or if an

application for an available Medicare supplement policy is submitted during the guaranteed issue period, or

if the policy or certificate is submitted during the 30-day annual open enrollment period triggered by a

policyholder’s birthday.

A 10% Household Discount applies for eligible individuals.

14

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

AS OF JULY 1, 2024

American Financial Security Life Insurance Company Individual Market-Attained Age

1021 Reams Fleming Boulevard Marketing Method: Insurance Producer Solicited

Franklin, TN 37064

1-866-951-0686

www.afslic.com

Male Preferred

<65 65 70 75 80 85

A

$228 $182 $182 $204 $253 $314

F

$188 $200 $234 $287 $372

G

$161 $173 $206 $254 $332

N

$121 $128 $158 $196 $255

Female Preferred

<65 65 70 75 80 85

A

$198 $159 $159 $178 $220 $273

F

$163 $174 $203 $250 $324

G

$140 $150 $179 $221 $289

N

$105 $111 $137 $170 $222

A 10% Household Discount applies for eligible individuals.

15

Male Standard*

<65 65 70 75 80 85

A

$262 $210 $210 $235 $291 $361

F

$216 $230 $269 $330 $428

G

$185 $199 $236 $293 $382

N

$139 $147 $181 $225 $294

Female Standard*

<65 65 70 75 80 85

A

$228 $182 $182 $204 $253 $314

F

$188 $200 $234 $287 $372

G

$161 $173 $206 $254 $332

N

$121 $128 $158 $196 $255

*Premiums listed above for Male Standard and Female Standard cannot be used if an application for a

Medicare supplement policy or certificate is submitted during the 6-month open enrollment period or if an

application for an available Medicare supplement policy is submitted during the guaranteed issue period, or

if the policy or certificate is submitted during the 30-day annual open enrollment period triggered by a

policyholder’s birthday.

A 10% Household Discount applies for eligible individuals.

16

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

AS OF JULY 1, 2024

American Home Life Insurance Company (The) Individual Market-Attained Age

400 S. Kansas Avenue Marketing Method: Insurance Producer Solicited

Topeka, KS 66601

1-833-504-0334

www.amhlifeco.com

Male Preferred

<65 65 70 75 80 85

A

$229 $175 $175 $202 $253 $316

F

$190 $196 $243 $301 $374

G

$158 $165 $203 $254 $317

N

$114 $129 $161 $199 $251

Female Preferred

<65 65 70 75 80 85

A

$199 $152 $152 $176 $220 $275

F

$165 $171 $211 $262 $325

G

$138 $143 $177 $221 $276

N

$100 $112 $140 $173 $218

A 7% Household Discount applies for eligible individuals.

17

Male Standard*

<65 65 70 75 80 85

A

$263 $202 $202 $232 $291 $363

F

$219 $226 $279 $347 $430

G

$182 $189 $234 $292 $365

N

$132 $148 $185 $229 $289

Female Standard*

<65 65 70 75 80 85

A

$229 $175 $175 $202 $253 $316

F

$190 $196 $243 $301 $374

G

$158 $165 $203 $254 $317

N

$114 $129 $161 $199 $251

*Premiums

listed above for Male

Standard and Female Standard cannot be used if an application for a

Medicare s

upplement policy or certificate is submitt

ed during the 6-month open enrollment period or if an

application for an available Medicare supplement polic

y

is submitted during the guaranteed issue period, or

if the polic

y or certificate is submitted during the 30-day annual open enrollment period triggered by

a

policyholder’s birthday.

A 7% Household Discount applies for eligible individuals.

18

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

AS OF JULY 1, 2024

Bankers Fidelity Assurance Company Individual Market-Attained Age

4370 Peachtree Road, NE Marketing Method: Insurance Producer Solicited

Atlanta, GA 30348-5185

1-866-458-7500

www.bankersfidelity.com

Male Preferred

<65 65 70 75 80 85

A

$174 $174 $180 $214 $253 $293

F

$174 $180 $214 $253 $293

G

$151 $157 $186 $221 $255

High G

$ 53 $ 54 $ 65 $ 77 $ 89

K

$ 89 $ 92 $110 $130 $150

N

$116 $120 $142 $169 $195

Female Preferred

<65 65 70 75 80 85

A

$151 $151 $157 $186 $221 $255

F

$151 $157 $186 $221 $255

G

$132 $136 $162 $192 $222

High G

$ 46 $ 48 $ 57 $ 67 $ 78

K

$ 78 $ 81 $ 96 $114 $131

N

$101 $104 $124 $147 $170

A household discount of 7% is available.

19

Male Standard*

<65 65 70 75 80 85

A

N/A $216 $224 $267 $316 $365

F

$217 $225 $267 $316 $366

G

$189 $195 $232 $275 $318

High G

$ 65 $ 68 $ 80 $ 95 $110

K

$111 $115 $137 $162 $187

N

$144 $149 $178 $210 $243

Female Standard*

<65 65 70 75 80 85

A

N/A $189 $195 $232 $275 $318

F

$189 $196 $232 $275 $319

G

$164 $170 $202 $240 $277

High G

$ 57 $ 59 $ 70 $ 83 $ 96

K

$ 97 $100 $119 $141 $163

N

$126 $130 $155 $183 $212

*Premiums listed above for Male Standard and Female Standard cannot be used if an application for a

Medicare supplement policy or certificate is submitted during the 6-month open enrollment period, or if an

application for an available Medicare supplement policy is submitted during the guaranteed issue period, or

if the policy or certificate is submitted during the 30-day annual open enrollment period triggered by a

policyholder’s birthday.

A household discount of 7% is available.

20

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

AS OF JULY 1, 2024

Bankers Reserve Life Insurance Company Individual Market-Attained Age

Of Wisconsin Marketing Method: Insurance Producer Solicited

P.O. Box 16895

Clearwater, FL 33766

1-833-441-1564

www.wellcare.com

Male Preferred

<65 65 70 75 80 85

A

$474 $302 $324 $375 $450 $527

F

$196 $208 $243 $300 $365

G

$170 $176 $210 $264 $325

N

$126 $138 $167 $210 $259

Female Preferred

<65 65 70 75 80 85

A

$412 $263 $281 $326 $392 $458

F

$170 $181 $211 $261 $318

G

$148 $153 $182 $230 $283

N

$109 $120 $145 $183 $225

A 10% Household Discount is available if the applicant has a household resident (at least one but no more than three),

with whom they have continuously resided with for the past 12 months.

21

Male Standard*

<65 65 70 75 80 85

A

$545 $347 $372 $431 $518 $606

F

$225 $239 $280 $345 $420

G

$196 $203 $241 $304 $374

N

$145 $158 $192 $242 $297

Female Standard*

<65 65 70 75 80 85

A

$474 $302 $324 $375 $450 $527

F

$196 $208 $243 $300 $365

G

$170 $176 $210 $264 $325

N

$126 $138 $167 $210 $259

*Premiums listed above for Male Standard and Female Standard cannot be used if an application for a Medicare

supplement policy or certificate is submitted during the 6-month open enrollment period, or if an application

for an available Medicare supplement policy is submitted during the guaranteed issue period, or if the policy

or certificate is submitted during the 30-day annual open enrollment period triggered by a policyholder’s

birthday.

A 10% Household Discount is available if the applicant has a household resident (at least one but no more than three),

with whom they have continuously resided with for the past 12 months.

22

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

AS OF JULY 1, 2024

Cigna National Health Insurance Company Individual Market-Attained Age

P.O. Box 5725 Marketing Method: Insurance Producer Solicited/Direct Response

Scranton, PA 18505-5725

1-866-459-4272

www.Cigna.com/Medicare

Male Preferred

<65 65 70 75 80 85

A

$340 $312 $340 $409 $498 $606

F

$192 $216 $260 $316 $385

G

$174 $190 $229 $278 $338

N

$123 $139 $167 $204 $248

Female Preferred

<65 65 70 75 80 85

A

$306 $281 $306 $369 $449 $546

F

$173 $194 $234 $285 $347

G

$157 $171 $206 $251 $305

N

$111 $125 $151 $183 $223

There is a 6% discount which will be applied to eligible new business on all underwriting classes when a policyholder resides in a

Household with another adult who is age 18 or older, which includes a legal spouse, civil union partner, or domestic partner. We may

request additional documentation to determine eligibility.

There is an additional 9% discount applied to eligible new business on all underwriting classes when more than one member of the

Household enrolls or is enrolled in a Medicare Supplement policy provided by or through an Affiliate of Cigna National Health Insurance

Company.

23

Male Standard*

<65 65 70 75 80 85

A

$374 $344 $374 $450 $548 $666

F

$211 $237 $286 $348 $423

G

$192 $209 $252 $306 $372

N

$136 $153 $184 $224 $273

Female Standard*

<65 65 70 75 80 85

A

$337 $310 $337 $406 $493 $600

F

$190 $214 $258 $314 $382

G

$173 $188 $227 $276 $335

N

$122 $138 $166 $202 $246

*Premiums listed above for Male Standard and Female Standard cannot be used if an application for

a Medicare supplement polic

y or certificate

is submitted during the 6-month open enrollment period,

or if an application for an available Medicare supplement polic

y

is submitted during the guaranteed

issue p

eriod, or if the policy or certificate is submitted during the 30-day an

nual open enrollment

period triggered by

a policyholder’s birthday.

There is a 6% discount which will be applied to eligible new business on all underwriting classes when a policyholder resides in a

Household with another adult who is age 18 or older, which includes a legal spouse, civil union partner, or domestic partner. We may

request additional documentation to determine eligibility.

There is an additional 9% discount applied to eligible new business on all underwriting classes when more than one member of the

Household enrolls or is enrolled in a Medicare Supplement policy provided by or through an Affiliate of Cigna National Health Insurance

Company.

24

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

AS OF JULY 1, 2024

EPIC Life Insurance Company (The) Individual Market-Attained Age

1717 W. Broadway Marketing Method: Insurance Producer Solicited

Madison, WI 53713

1-800-236-8809

www.mywpsmedicare.com

Male

<65 65 70 75 80 85

A

$274 $237 $283 $332 $379 $449

F

$238 $284 $333 $380 $451

G

$196 $234 $274 $313 $370

N

$176 $210 $246 $280 $332

Female

<65 65 70 75 80 85

A

$251 $216 $257 $302 $344 $408

F

$217 $259 $303 $346 $410

G

$178 $213 $249 $284 $337

N

$160 $191 $223 $255 $302

Two individuals living in the same household who each purchase a Medicare supplement policy

from EPIC will receive a 7% discount.

Members enrolled in ACH payments will receive a 2% discount from the displayed rates.

25

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

AS OF JULY 1, 2024

Erie Family Life Insurance Company Individual Market-Attained Age

100 Erie Insurance Place Marketing Method: Insurance Producer Solicited

Erie, PA 16530

1-800-458-0811

www.erieinsurance.com

Male Non-Tobacco

<65 65 70 75 80 85

A

$203 $180 $196 $230 $263 $298

F

$223 $248 $286 $335 $390

G

$183 $206 $242 $281 $327

N

$155 $172 $205 $239 $275

Female Non-Tobacco

<65 65 70 75 80 85

A

$176 $156 $171 $200 $229 $259

F

$194 $215 $248 $291 $339

G

$160 $179 $210 $244 $284

N

$135 $150 $178 $208 $239

A 5% household discount will be offered to applicants who (a) live in an eligible household

and (b) the applicant lives in the same household with another person who is over the age of 18

and is either the applicant’s spouse, someone with whom the applicant is in a civil union

partnership, or is a permanent resident in the applicant’s home and has resided there for a

minimum of 12 months.

26

Male Tobacco*

<65 65 70 75 80 85

A

$233 $207 $226 $265 $303 $342

F

$256 $285 $329 $385 $449

G

$211 $237 $278 $323 $376

N

$178 $198 $236 $275 $316

Female Tobacco*

<65 65 70 75 80 85

A

$203 $180 $196 $230 $263 $298

F

$223 $248 $286 $335 $390

G

$183 $206 $242 $281 $327

N

$155 $172 $205 $239 $275

*Premiums

listed above for Male T

obacco and Female Tobacco cannot be used if an application for

a Medicare

supplement policy or certificate is submi

tted during the 6-month open enrollment period,

or if an application for an availabl

e Medicare supplement policy

is submitted during the guaranteed

issue period, or if the policy or certificate is submitted during the 30-day annual open enrollment

period triggered b

y a policyholder’s birthday.

A 5% household discount will be offered to applicants who (a) live in an eligible household

a

nd (b) the applicant lives in the same household with another person who is over the age of 18

and is either the applicant’s spouse, someone with whom the applicant is in a civil union

partnership, or is a permanent resident in the applicant’s home and has resided there for a

minimum

of 12 months.

27

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

AS OF JULY 1, 2024

Everence Association, Inc. Individual Market-Issue Age/Attained Age

1110 N. Main Street Marketing Method: Members Only

P.O. Box 483 Insurance Producer Solicited/Direct Response

Goshen, IN 46527

1-800-348-7468

www.everence.com

Male Non-Tobacco

<65 65 70 75 80 85

A

$420 $398 $430 $451 $479 $500

F

$301 $326 $346 $374 $403

G

$218 $236 $251 $269 $280

L

$130 $142 $151 $164 $177

N

$144* $172* $195* $213* $229*

Female Non-Tobacco

<65 65 70 75 80 85

A

$382 $362 $391 $410 $435 $454

F

$273 $296 $314 $340 $367

G

$198 $214 $229 $244 $255

L

$118 $129 $138 $149 $161

N

$131* $157* $178* $194* $208*

*Plan N premiums are Attained Age

.

28

Male Tobacco**

<65 65 70 75 80 85

A

$483 $458 $495 $519 $551 $575

F

$346 $375 $397 $430 $464

G

$250 $271 $289 $309 $322

L

$149 $163 $174 $189 $203

N

$165* $198* $225* $245* $263*

Female Tobacco**

<65 65 70 75 80 85

A

$439 $416 $449 $472 $500 $522

F

$314 $341 $361 $391 $422

G

$228 $246 $263 $281 $293

L

$136 $148 $158 $172 $185

N

$150* $180* $204* $223* $239*

*Plan N premiums are Attained Age.

**Premiums listed above for Male Tobacco and Female Tobacco cannot be used if an application for

a Medicare supplement policy or certificate is submitted during the 6-month open enrollment period,

or if an application for an available Medicare supplement policy is submitted during the guaranteed

issue period, or if the policy or certificate is submitted during the 30-day annual open enrollment

period triggered by a policyholder’s birthday.

29

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

AS OF JULY 1, 2024

Federal Life Insurance Company Individual Market-Attained Age

3750 W. Deerfield Road Marketing Method: Insurance Producer Solicited

Riverwoods, IL 60015

1-888-747-3760

www.federallife.com

Male Non-Tobacco

<65 65 70 75 80 85

A

$258 $171 $189 $226 $261 $291

F

$198 $211 $257 $297 $331

G

$166 $183 $219 $252 $281

N

$119 $130 $157 $181 $202

Female Non-Tobacco

<65 65 70 75 80 85

A

$258 $153 $169 $202 $233 $259

F

$177 $189 $230 $265 $295

G

$148 $163 $195 $225 $251

N

$107 $116 $140 $162 $180

A discount of 7

% will be applied if for the past twelve months the certificate holder has resided with at least one, but no

more than three, other adults aged 60 or older, or if the certificate holder lives with another adult who is his or her legal

spouse or civil union partner.

30

Male Tobacco*

<65 65 70 75 80 85

A

$297 $197 $217 $260 $300 $334

F

$228 $243 $296 $341 $380

G

$190 $210 $251 $290 $323

N

$137 $150 $180 $208 $232

Female Tobacco*

<65 65 70 75 80 85

A

$297 $176 $194 $232 $268 $298

F

$203 $217 $264 $305 $339

G

$170 $188 $224 $259 $288

N

$123 $134 $161 $186 $207

*Premiums listed above for Male Tobacco and Female Tobacco cannot be used if an application for a Medicare

supplement policy or certificate is submitted during the 6-month open enrollment period, or if an application

for an available Medicare supplement policy is submitted during the guaranteed issue period, or if the policy

or certificate is submitted during the 30-day annual open enrollment period triggered by a policyholder’s

birthday.

A discount of 7% will be applied if for the past twelve months the certificate holder has resided with at least one, but no

more than three, other adults aged 60 or older, or if the certificate holder lives with another adult who is his or her legal

spouse or civil union partner.

31

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

AS OF JULY 1, 2024

FirstCare, Inc. (d.b.a. CareFirst MedPlus) Individual Market-Attained Age

10455 Mill Run Circle Marketing Method: Direct Response

Owings Mills, MD 21117-5559

1-800-275-3802

410-356-8123 (Local)

www.carefirst.com

Male Level 1 without Household Discount Baltimore Metro, D.C. Metro & Western MD*

<65 65 70 75 80 85

A

$948 $837 $1,058 $1,284 $1,522 $1,722

B

$220 $ 279 $ 338 $ 401 $ 453

F

$247 $ 313 $ 379 $ 449 $ 509

High F

$ 56 $ 71 $ 87 $ 103 $ 116

G

$202 $ 255 $ 310 $ 367 $ 415

High G

$ 56 $ 70 $ 85 $ 101 $ 114

L

$159 $ 201 $ 244 $ 290 $ 328

M

$242 $ 306 $ 371 $ 439 $ 497

N

$177 $ 224 $ 271 $ 322 $ 364

Female Level 1 without Household Discount Baltimore Metro, D.C. Metro & Western MD*

<65 65 70 75 80 85

A

$917 $786 $994 $1,205 $1,418 $1,545

B

$207 $262 $ 317 $ 373 $ 407

F

$232 $293 $ 356 $ 419 $ 456

High F

$ 53 $ 67 $ 81 $ 96 $ 104

G

$190 $240 $ 291 $ 342 $ 373

High G

$ 52 $ 66 $ 80 $ 94 $ 103

L

$150 $189 $ 229 $ 270 $ 294

M

$227 $287 $ 348 $ 409 $ 446

N

$166 $210 $ 255 $ 300 $ 326

*Level 1 rates apply if application is made during the 6-month open enrollment period, or during the

guaranteed issue period.

A 10% Household Discount is available if the policyholder resides with another person who is eligible and has

enrolled in a MedPlus Medicare Supplement plan with CareFirst.

32

Male Level 1 without Household Discount Eastern & Southern MD*

<65 65 70 75 80 85

A

$920 $812 $1,027 $1,246 $1,476 $1,670

B

$214 $ 270 $ 328 $ 389 $ 440

F

$240 $ 303 $ 368 $ 436 $ 493

High F

$ 55 $ 69 $ 84 $ 100 $ 113

G

$196 $ 248 $ 300 $ 356 $ 403

High G

$ 54 $ 68 $ 83 $ 98 $ 111

L

$155 $ 195 $ 237 $ 281 $ 318

M

$234 $ 296 $ 360 $ 426 $ 482

N

$172 $ 217 $ 263 $ 312 $ 353

Female Level 1 without Household Discount Eastern & Southern MD*

<65 65 70 75 80 85

A

$889 $762 $964 $1,169 $1,376 $1,499

B

$201 $254 $ 308 $ 362 $ 395

F

$225 $285 $ 345 $ 406 $ 443

High F

$ 51 $ 65 $ 79 $ 93 $ 101

G

$184 $232 $ 282 $ 332 $ 361

High G

$ 51 $ 64 $ 78 $ 91 $ 99

L

$145 $183 $ 222 $ 262 $ 285

M

$220 $278 $ 338 $ 397 $ 433

N

$161 $204 $ 247 $ 291 $ 317

*Level 1 rates apply if application is made during the 6-month open enrollment period, or during the guaranteed issue period.

A 10% Household Discount is available if the policyholder resides with another person who is eligible and has enr

olled in

a MedPlus Med

icare Supplement plan with

CareFirst.

33

Male Level 2 Non-Smoker without Household Discount Baltimore Metro, D.C. Metro & Western MD*

<65 65 70 75 80 85

A

$1,043 $1,046 $1,228 $1,412 $1,674 $1,894

B

$ 276 $ 323 $ 372 $ 441 $ 499

F

$ 309 $ 363 $ 417 $ 494 $ 559

High F

$ 71 $ 83 $ 95 $ 113 $ 128

G

$ 252 $ 296 $ 341 $ 404 $ 457

High G

$ 69 $ 81 $ 94 $ 111 $ 126

L

$ 199 $ 234 $ 269 $ 319 $ 360

M

$ 302 $ 354 $ 408 $ 483 $ 547

N

$ 221 $ 259 $ 298 $ 354 $ 400

Female Level 2 Non-Smoker without Household Discount Baltimore Metro, D.C. Metro & Western MD*

<65 65 70 75 80 85

A

$1,008 $982 $1,152 $1,326 $1,560 $1,699

B

$259 $ 303 $ 349 $ 411 $ 447

F

$290 $ 340 $ 392 $ 461 $ 502

High F

$ 66 $ 78 $ 89 $ 105 $ 115

G

$237 $ 278 $ 320 $ 376 $ 410

High G

$ 65 $ 76 $ 88 $ 104 $ 113

L

$187 $ 219 $ 252 $ 297 $ 323

M

$284 $ 333 $ 383 $ 450 $ 491

N

$208 $ 244 $ 280 $ 330 $ 359

*Premiums listed above for Male Level 2 Non-Smoker and Female Level 2 Non-Smoker cannot be used if an

application for a Medicare supplement policy or certificate is submitted during the 6-month open

enrollment period, or if an application for an available Medicare supplement policy is submitted during

the guaranteed issue period, or if the policy or certificate is submitted during the 30-day annual open enrollment

period triggered by a policyholder’s birthday. Premiums are for individuals who are required to go through medical

underwriting for coverage.

A 10% Household Discount is available if the policyholder resides with another person who is eligible and has enrolled in

a MedPlus Medicare Supplement plan with CareFirst.

34

Male Level 2 Smoker without Household Discount Baltimore Metro, D.C. Metro & Western MD*

<65 65 70 75 80 85

A

$1,303 $1,308 $1,534 $1,765 $2,092 $2,367

B

$ 344 $ 404 $ 465 $ 551 $ 623

F

$ 386 $ 453 $ 521 $ 618 $ 699

High F

$ 88 $ 104 $ 119 $ 141 $ 160

G

$ 315 $ 370 $ 426 $ 504 $ 571

High G

$ 87 $ 102 $ 117 $ 139 $ 157

L

$ 249 $ 292 $ 336 $ 398 $ 450

M

$ 378 $ 443 $ 510 $ 604 $ 683

N

$ 276 $ 324 $ 373 $ 442 $ 500

Female Level 2 Smoker without Household Discount Baltimore Metro, D.C. Metro & Western MD*

<65 65 70 75 80 85

A

$1,260 $1,228 $1,440 $1,657 $1,949 $2,124

B

$ 323 $ 379 $ 436 $ 513 $ 559

F

$ 363 $ 425 $ 489 $ 576 $ 627

High F

$ 83 $ 97 $ 112 $ 132 $ 143

G

$ 296 $ 347 $ 400 $ 470 $ 512

High G

$ 81 $ 96 $ 110 $ 129 $ 141

L

$ 234 $ 274 $ 315 $ 371 $ 404

M

$ 354 $ 416 $ 478 $ 563 $ 613

N

$ 259 $ 304 $ 350 $ 412 $ 449

*Premiums listed above for Male Level 2 Smoker and Female Level 2 Smoker cannot be used if an

application for a Medic

are supplement policy

or certificate is submitted during the 6-month open

enrollment period, or if an application for an available Medicare supplement polic

y

is submitted during

the guaranteed issue period, or if the polic

y or certificate is submitted during the 30-day an

nual open

enrollment period triggered b

y a policyholder’s birthday. Premiums are for individuals wh

o are required

to go through medical underw

ritin

g for coverage.

A 10% Household Discount is available if the policyholder resides with another person who is eligible and has enrolled in

a MedPlus Medicare Supplement plan with CareFirst.

35

Male Level 2 Non-Smoker without Household Discount Eastern & Southern MD*

<65 65 70 75 80 85

A

$1,012 $1,015 $1,191 $1,370 $1,624 $1,837

B

$ 267 $ 314 $ 361 $ 428 $ 484

F

$ 300 $ 352 $ 405 $ 480 $ 543

High F

$ 69 $ 80 $ 92 $ 110 $ 124

G

$ 245 $ 287 $ 330 $ 392 $ 443

High G

$ 67 $ 79 $ 91 $ 108 $ 122

L

$ 193 $ 227 $ 261 $ 309 $ 350

M

$ 293 $ 344 $ 396 $ 469 $ 531

N

$ 215 $ 252 $ 289 $ 343 $ 388

Female Level 2 Non-Smoker without Household Discount Eastern & Southern MD*

<65 65 70 75 80 85

A

$978 $953 $1,118 $1,286 $1,513 $1,649

B

$251 $ 294 $ 339 $ 398 $ 434

F

$281 $ 330 $ 380 $ 447 $ 487

High F

$ 64 $ 75 $ 87 $ 102 $ 111

G

$230 $ 270 $ 310 $ 365 $ 398

High G

$ 63 $ 74 $ 85 $ 100 $ 109

L

$181 $ 213 $ 245 $ 288 $ 314

M

$275 $ 323 $ 371 $ 437 $ 476

N

$201 $ 236 $ 272 $ 320 $ 348

*Premiums listed above for Male Level 2 Non-Smoker and Female Level 2 Non-Smoker cannot be used if an

application for a Medicare supplement policy or certificate is submitted during the 6-month open

enrollment period, or if an application for an available Medicare supplement policy is submitted during

the guaranteed issue period, or if the policy or certificate is submitted during the 30-day annual

open enrollment period triggered by a policyholder’s birthday. Premiums are for individuals

who are required to go through medical underwriting for coverage.

A 10% Household Discount is available if the policyholder resides with another person who is eligible and has enrolled in

a MedPlus Medicare Supplement plan with CareFirst.

36

Male Level 2 Smoker without Household Discount Eastern & Southern MD*

<65 65 70 75 80 85

A

$1,264 $1,269 $1,488 $1,712 $2,030 $2,296

B

$ 334 $ 392 $ 451 $ 534 $ 605

F

$ 375 $ 440 $ 506 $ 599 $ 678

High F

$ 86 $ 100 $ 116 $ 137 $ 155

G

$ 306 $ 359 $ 413 $ 489 $ 554

High G

$ 84 $ 99 $ 114 $ 135 $ 152

L

$ 241 $ 283 $ 326 $ 386 $ 437

M

$ 366 $ 430 $ 494 $ 586 $ 663

N

$ 268 $ 314 $ 362 $ 429 $ 485

Female Level 2 Smoker without Household Discount Eastern & Southern MD*

<65 65 70 75 80 85

A

$1,222 $1,191 $1,397 $1,607 $1,891 $2,060

B

$ 314 $ 368 $ 423 $ 498 $ 542

F

$ 352 $ 413 $ 475 $ 559 $ 608

High F

$ 80 $ 94 $ 108 $ 128 $ 139

G

$ 287 $ 337 $ 388 $ 456 $ 497

High G

$ 79 $ 93 $ 107 $ 126 $ 137

L

$ 227 $ 266 $ 306 $ 360 $ 392

M

$ 344 $ 403 $ 464 $ 546 $ 595

N

$ 252 $ 295 $ 340 $ 400 $ 435

*Premiums listed above for Male Level 2 Smoker and Female Level 2 Smoker cannot be used if an

application for a Medic

are supplement policy

or certificate is submitted during the 6-month open

enrollment period, or if an application for an available Medicare supplement polic

y

is submitted during

the guaranteed issue period, or if the polic

y or certificate is submitted during the 30-day an

nual

open enrollment period triggered b

y a policyholder’s birthday. Prem

iums are for individuals

w

ho are required to go through medical underwriting fo

r coverage.

A 10% Household Discount is available if the policyholder resides with another person who is eligible and has enrolled in

a MedPlus Medicare Supplement plan with CareFirst.

37

Male Level 3 Non-Smoker without Household Discount Baltimore Metro, D.C. Metro & Western MD*

<65 65 70 75 80 85

A

$1,517 $1,674 $1,905 $2,054 $2,435 $2,755

B

$ 441 $ 502 $ 541 $ 641 $ 725

F

$ 495 $ 563 $ 607 $ 719 $ 814

High F

$ 113 $ 129 $ 139 $ 164 $ 186

G

$ 404 $ 459 $ 495 $ 587 $ 664

High G

$ 111 $ 126 $ 136 $ 162 $ 183

L

$ 319 $ 362 $ 391 $ 463 $ 524

M

$ 483 $ 550 $ 593 $ 703 $ 795

N

$ 354 $ 402 $ 434 $ 514 $ 582

Female Level 3 Non-Smoker without Household Discount Baltimore Metro, D.C. Metro & Western MD*

<65 65 70 75 80 85

A

$1,466 $1,572 $1,788 $1,928 $2,269 $2,472

B

$ 414 $ 471 $ 508 $ 597 $ 651

F

$ 464 $ 528 $ 570 $ 670 $ 730

High F

$ 106 $ 121 $ 130 $ 153 $ 167

G

$ 379 $ 431 $ 465 $ 547 $ 596

High G

$ 104 $ 119 $ 128 $ 151 $ 164

L

$ 299 $ 340 $ 367 $ 432 $ 470

M

$ 454 $ 516 $ 557 $ 655 $ 714

N

$ 332 $ 378 $ 407 $ 479 $ 522

*Premiums listed above for Male Level 3 Non-Smoker and Female Level 3 Non-Smoker cannot be used

if an application for a Medicare supplement policy or certificate is submitted during the 6-month open

enrollment period, or if an application for an available Medicare supplement policy is submitted during

the guaranteed issue period, or if the policy or certificate is submitted during the 30-day annual

open enrollment period triggeredby a policyholder’s birthday. Premiums are for individuals who

are required to go through medical underwriting for coverage.

A 10% Household Discount is available if the policyholder resides with another person who is eligible and has enrolled

in a MedPlus Medicare Supplement plan with CareFirst.

38

Male Level 3 Smoker without Household Discount Baltimore Metro, D.C. Metro & Western MD*

<65 65 70 75 80 85

A

$1,896 $2,092 $2,381 $2,567 $3,043 $3,443

B

$ 551 $ 627 $ 676 $ 801 $ 906

F

$ 618 $ 703 $ 758 $ 899 $1,017

High F

$ 141 $ 161 $ 173 $ 205 $ 232

G

$ 505 $ 574 $ 619 $ 734 $ 830

High G

$ 139 $ 158 $ 170 $ 202 $ 229

L

$ 398 $ 453 $ 488 $ 579 $ 655

M

$ 604 $ 687 $ 741 $ 879 $ 994

N

$ 442 $ 503 $ 542 $ 643 $ 727

Female Level 3 Smoker without Household Discount Baltimore Metro, D.C. Metro & Western MD*

<65 65 70 75 80 85

A

$1,833 $1,964 $2,235 $2,410 $2,835 $3,089

B

$ 517 $ 588 $ 634 $ 746 $ 813

F

$ 580 $ 660 $ 712 $ 837 $ 912

High F

$ 133 $ 151 $ 163 $ 191 $ 208

G

$ 474 $ 539 $ 581 $ 684 $ 745

High G

$ 130 $ 148 $ 160 $ 188 $ 205

L

$ 374 $ 425 $ 459 $ 539 $ 588

M

$ 567 $ 645 $ 696 $ 819 $ 892

N

$ 415 $ 472 $ 509 $ 599 $ 653

*Premiums listed above for Male Level 3 Smoker and Female Level 3 Smoker cannot be used

if an application for a Medicare s

upplement policy or ce

rtificate is submitted during the 6-month open

enrollment period, or if an application for an available Medicare supplement polic

y

is submitted during

the guaranteed issue period, or if the polic

y or certificate is submitted during the 30-day an

nual

open enrollment period triggered b

y a policyholder’s birthday. Prem

iums are for individuals

w

ho are required to go through medical underwriting fo

r coverage.

A 10% Household Discount is available if the policyholder resides with another person who is eligible and has enrolled

in a MedPlus Medicare Supplement plan with CareFirst.

39

Male Level 3 Non-Smoker without Household Discount Eastern & Southern MD

<65 65 70 75 80 85

A

$1,472 $1,624 $1,848 $1,993 $2,362 $2,673

B

$ 428 $ 487 $ 525 $ 622 $ 704

F

$ 480 $ 546 $ 589 $ 698 $ 789

High F

$ 110 $ 125 $ 134 $ 159 $ 180

G

$ 392 $ 446 $ 481 $ 570 $ 644

High G

$ 108 $ 123 $ 132 $ 157 $ 177

L

$ 309 $ 352 $ 379 $ 449 $ 509

M

$ 469 $ 534 $ 575 $ 682 $ 772

N

$ 343 $ 390 $ 421 $ 499 $ 565

Female Level 3 Non-Smoker without Household Discount Eastern & Southern MD

<65 65 70 75 80 85

A

$1,423 $1,525 $1,735 $1,871 $2,201 $2,398

B

$ 401 $ 457 $ 493 $ 579 $ 631

F

$ 450 $ 512 $ 553 $ 650 $ 708

High F

$ 103 $ 117 $ 126 $ 149 $ 162

G

$ 368 $ 418 $ 451 $ 531 $ 578

High G

$ 101 $ 115 $ 124 $ 146 $ 159

L

$ 290 $ 330 $ 356 $ 419 $ 456

M

$ 440 $ 501 $ 540 $ 636 $ 692

N

$ 322 $ 367 $ 395 $ 465 $ 507

*Premiums listed above for Male Level 3 Non-Smoker and Female Level 3 Non-Smoker cannot be used

if an application for a Medicare supplement policy or certificate is submitted during the 6-month open

enrollment period, or if an application for an available Medicare supplement policy is submitted during

the guaranteed issue period, or if the policy or certificate is submitted during the 30-day annual

open enrollment period triggered by a policyholder’s birthday. Premiums are for individuals

who are required to go through medical underwriting for coverage.

A 10% Household Discount is available if the policyholder resides with another person who is eligible and has enrolled

in a MedPlus Medicare Supplement plan with CareFirst.

40

Male Level 3 Smoker without Household Discount Eastern & Southern MD

<65 65 70 75 80 85

A

$1,839 $2,030 $2,309 $2,490 $2,952 $3,340

B

$ 534 $ 608 $ 656 $ 777 $ 879

F

$ 600 $ 682 $ 736 $ 872 $ 987

High F

$ 137 $ 156 $ 168 $ 199 $ 225

G

$ 490 $ 557 $ 601 $ 712 $ 805

High G

$ 135 $ 153 $ 165 $ 196 $ 222

L

$ 386 $ 439 $ 474 $ 562 $ 635

M

$ 586 $ 667 $ 719 $ 852 $ 964

N

$ 429 $ 488 $ 526 $ 624 $ 706

Female Level 3 Smoker without Household Discount Eastern & Southern MD

<65 65 70 75 80 85

A

$1,778 $1,906 $2,168 $2,338 $2,751 $2,997

B

$ 502 $ 571 $ 616 $ 724 $ 789

F

$ 563 $ 640 $ 691 $ 812 $ 885

High F

$ 129 $ 146 $ 158 $ 186 $ 202

G

$ 460 $ 523 $ 564 $ 663 $ 723

High G

$ 126 $ 144 $ 155 $ 183 $ 199

L

$ 363 $ 413 $ 445 $ 523 $ 570

M

$ 550 $ 626 $ 675 $ 794 $ 865

N

$ 403 $ 458 $ 494 $ 581 $ 633

*Premiums listed above for Male Level 3 Smoker and Female Level 3 Smoker cannot be used

if an application for a Medicare supplement policy or certificate is submitted during the 6-month open

enrollment period, or if an application for an available Medicare supplement policy is submitted during

the guaranteed issue period, or if the policy or certificate is submitted during the 30-day annual open

enrollment period triggered by a policyholder’s birthday. Premiums are for individuals who are

required to go through medical underwriting for coverage.

A 10% Household Discount is available if the policyholder resides with another person who is eligible and has enrolled

in a MedPlus Medicare Supplement plan with CareFirst.

41

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

AS OF JULY 1, 2024

First Health Life and Health Insurance Company Individual Market-Attained Age

MEDICARE SUPPLEMENT ADMINISTRATIVE OFFICE Marketing Method: Direct Response

3200 Highland Avenue

Downers Grove, IL 60515

1-866-465-1023

www.aetnas

eniorproducts.com

Male Preferred

<65 65 70 75 80 85

A

$214 $173 $198 $220 $233 $242

B

$194 $227 $258 $284 $306

F

$211 $247 $284 $316 $345

G

$208 $245 $282 $316 $347

N

$121 $143 $166 $187 $208

Female Preferred

<65 65 70 75 80 85

A

$196 $159 $181 $202 $214 $222

B

$178 $208 $236 $260 $280

F

$194 $227 $261 $290 $317

G

$192 $226 $260 $291 $321

N

$112 $133 $154 $173 $192

42

Male Standard*

<65 65 70 75 80 85

A

$236 $190 $218 $242 $257 $267

B

$214 $249 $284 $313 $336

F

$232 $272 $312 $347 $379

G

$229 $269 $310 $347 $382

N

$133 $157 $182 $205 $228

Female Standard*

<65 65 70 75 80 85

A

$216 $174 $199 $222 $235 $244

B

$196 $228 $260 $286 $308

F

$213 $250 $287 $319 $349

G

$211 $249 $287 $321 $353

N

$123 $146 $169 $191 $212

*Premiums listed above for Male Standard and Female Standard cannot be used if an application for a Medicare

supplement polic

y or

certificate is submitted during the 6-month open enrollment period, or if an application

for an available Medicare supplement polic

y is submitted during the guaranteed issue period, or if the policy

or certificate is submitted during the 30-day annual open enrollment period triggered by a policyholde

r’s

birthday.

43

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

AS OF JULY 1, 2024

Globe Life and Accident Insurance Company Individual Market-Attained Age

3700 S. Stonebridge Drive Marketing Method: Direct Response

P.O. Box 8080

McKinney, TX 75070

1-800-801-6831

www.globecaremedsupp.com

Unisex

<65 65 70 75 80 85

A

$261* $184 $246 $263 $264 $264

B

$216 $272 $310 $314 $314

F

$256 $315 $370 $392 $392

High F

$ 34 $ 47 $ 56 $ 67 $ 67

G

$222 $277 $331 $351 $351

High G

$ 34 $ 47 $ 56 $ 67 $ 67

N

$161 $203 $245 $266 $266

* Plan A for Individuals

with a Disability is offered only during Open Enrollment/Guaranteed

Issue periods.

44

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

AS OF JULY 1, 2024

GPM Health and Life Insurance Company Individual Market-Attained Age

P.O. Box 2679

Marketing

Method: Insurance Producer Solicited

Omaha, NE 68103

1-866-242-7573

www.gp

mhealthandlife.com

Male Non-Tobacco

<65 65 70 75 80 85

A

$385 $274 $303 $362 $418 $466

F

$328 $362 $434 $500 $557

G

$274 $303 $362 $418 $465

N

$207 $229 $274 $316 $352

Female Non-Tobacco

<65 65 70 75 80 85

A

$385 $238 $263 $315 $364 $405

F

$285 $315 $377 $435 $485

G

$239 $263 $315 $363 $405

N

$180 $199 $238 $275 $306

A 7% Household Discount will be applied if for the past twelve months the policyholder has resided with at least one,

but no more than three, other adults aged 60 or older, or if the policyholder lives with another adult who is his

or her legal spouse or civil union partner.

45

Male Tobacco*

<65 65 70 75 80 85

A

$442 $315 $348 $417 $481 $535

F

$377 $416 $498 $575 $640

G

$315 $348 $416 $480 $535

N

$238 $263 $315 $363 $404

Female Tobacco*

<65 65 70 75 80 85

A

$442 $274 $303 $362 $418 $466

F

$328 $362 $433 $500 $557

G

$274 $303 $362 $418 $465

N

$207 $229 $274 $316 $351

*Premiums

listed above for Male T

obacco and Female Tobacco cannot be used if an application for

a Medicare

supplement policy or certificate is submi

tted during the 6-month open enrollment period,

or if an application for an availabl

e Medicare supplement policy

is submitted during the guaranteed

issue period, or if the polic

y or certificate is submitted during the 30-day annu

al open enrollment

period triggered by a policyholder’s birthday.

A 7% Household Discount will be applied if for the past twelve months the policyholder has resided with at least one,

but no more than three, other adults aged 60 or older, or if the policyholder lives with another adult who is his

or her legal spouse or civil union partner.

46

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

AS OF JULY 1, 2024

Guarantee Trust Life Insurance Company Individual Market-Attained Age

1275 Milwaukee Avenue Marketing Method: Insurance Producer Solicited

Glenview, IL 60025

1-800-338-7452

1-847-699-0600

www.gtlic.com

Male Preferred

<65 65 70 75 80 85

A

$287 $250 $266 $301 $350 $378

F

$323 $343 $408 $510 $574

High F

$ 73 $ 77 $ 92 $115 $129

G

$250 $266 $316 $395 $445

N

$209 $222 $264 $330 $372

Female Preferred

<65 65 70 75 80 85

A

$255 $223 $237 $267 $308 $334

F

$288 $306 $364 $455 $513

High F

$ 65 $ 69 $ 82 $102 $115

G

$223 $237 $282 $353 $397

N

$187 $198 $236 $295 $332

A household discount of 7% is available if two or more policyholders with an inforce Medicare Supplement

policy from the Company are currently residing together.

47

Male Standard*

<65 65 70 75 80 85

A

$358 $312 $332 $377 $437 $473

F

$404 $429 $510 $638 $718

High F

$ 91 $ 96 $115 $143 $161

G

$312 $332 $395 $494 $556

N

$262 $278 $330 $413 $465

Female Standard*

<65 65 70 75 80 85

A

$318 $279 $296 $333 $385 $417

F

$360 $383 $455 $569 $641

High F

$ 81 $ 86 $102 $128 $144

G

$279 $296 $352 $441 $496

N

$234 $248 $295 $369 $415

*Premiums

listed above for Male

Standard and Female Standard cannot be used if an application

for a Medic

are supplement policy

or certificate is submitted during the 6-month open enrollment

period, or if an application for an available Medicare supplement polic

y

is submitted during the

guaranteed issue period, or if the polic

y or certificate is submitted during the 30-day annu

al open

enrollment period triggered by a policyholder’s birthday.

A

household discount of 7% is available if two or more policyholders with an inforce Medicare Supplement

po

licy from the Company are currently residing together.

48

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

AS OF JULY 1, 2024

Heartland National Life Insurance Company Individual Market-Attained Age

P.O. Box 2878 Marketing Method: Insurance Producer Solicited

Salt Lake City, UT 84110-2878

1-888-6

16-0015

www.heartlandnational.net

Male Non-Tobacco

<65 65 70 75 80 85

A

$ 217 $183 $183 $222 $255 $286

C

$1,137 $236 $236 $282 $331 $381

G

$184 $184 $224 $268 $315

N

$148 $155 $189 $224 $263

Female Non-Tobacco

<65 65 70 75 80 85

A

$189 $160 $160 $193 $222 $248

C

$989 $205 $205 $246 $287 $331

G

$160 $160 $195 $233 $274

N

$129 $135 $164 $195 $229

A

7% Household Discount is available to those that qualify.

49

Male Tobacco*

<65 65 70 75 80 85

A

$ 250 $211 $211 $255 $293 $328

C

$1,308 $271 $271 $325 $380 $438

G

$212 $212 $258 $308 $363

N

$171 $178 $217 $258 $303

Female Tobacco*

<65 65 70 75 80 85

A

$ 217 $183 $183 $222 $255 $286

C

$1,137 $236 $236 $282 $331 $381

G

$184 $184 $224 $268 $315

N

$148 $155 $189 $224 $263

*Premiums

listed above for Male T

obacco and Female Tobacco cannot be used if an application for

a Medicare

supplement policy or certificate is submi

tted during the 6-month open enrollment period,

or if an application for an availabl

e Medicare supplement policy

is submitted during the guaranteed

issue period, or if the polic

y or certificate is submitted during the 30-day annu

al open enrollment

period triggered b

y a policyholder’s birthday.

A 7% Household Discount is available to those that qualify.

50

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

AS OF JULY 1, 2024

Humana Benefit Plan of Illinois, Inc. Individual Market-Attained Age

500 West Main Street Marketing Method: Insurance Producer Solicited

Louisville, KY 40202

1-800-984-9095

www.Humana-Medicare.com

Male Preferred

<65 65 70 75 80 85

A

$366 $335 $356 $420 $511 $599

F

$187 $198 $234 $285 $333

G

$160 $169 $200 $243 $285

High G

$ 58 $ 61 $ 72 $ 88 $103

N

$115 $130 $160 $192 $223

Female Preferred

<65 65 70 75 80 85

A

$324 $297 $315 $372 $453 $530

F

$165 $175 $207 $252 $295

G

$141 $150 $177 $215 $252

High G

$ 51 $ 54 $ 64 $ 78 $ 91

N

$102 $115 $141 $170 $197

A 12% household discount is available for applicants who qualify.

51

Male Standard*

<65 65 70 75 80 85

A

$421 $385 $409 $483 $588 $688

F

$215 $228 $269 $327 $383

G

$184 $195 $230 $280 $328

High G

$ 66 $ 71 $ 83 $101 $119

N

$133 $149 $183 $221 $256

Female Standard*

<65 65 70 75 80 85

A

$373 $341 $362 $428 $520 $609

F

$190 $201 $238 $290 $339

G

$162 $172 $204 $248 $290

High G

$ 59 $ 62 $ 74 $ 90 $105

N

$117 $132 $162 $196 $227

*Premiums listed above for Male Standard and Female Standard cannot be used if an application for a Medicare

supplement polic

y or

certificate is submitted during the 6-month open enrollment period, or if an application

for an available Medicare supplement polic

y is submitted during the guaranteed issue period, or if the policy

or certificate is submitted during the 30-day annual open enrollment period triggered by a policyholde

r’s

birthday.

A 12% household discount is available for applicants who qualify.

52

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

AS OF JULY 1, 2024

LifeShield National Insurance Company Individual Market-Attained Age

5500 N. Western Avenue Marketing Method: Insurance Producer Solicited

Suite 200

Oklahoma City, OK 73118

1-833-989-0033

www.lifeshieldnational.com

Male Preferred

<65 65 70 75 80 85

A

$214 $204 $204 $228 $265 $288

F

$188 $196 $235 $285 $350

G

$153 $159 $195 $240 $298

N

$114 $126 $158 $192 $231

Female Preferred

<65 65 70 75 80 85

A

$186 $177 $177 $198 $231 $250

F

$163 $170 $204 $248 $305

G

$133 $138 $170 $209 $259

N

$100 $109 $137 $167 $201

A 7% household discount is available for those who qualify.

53

Male Standard*

<65 65 70 75 80 85

A

$246 $234 $234 $262 $305 $331

F

$216 $225 $270 $328 $403

G

$176 $182 $224 $276 $343

N

$132 $144 $181 $221 $266

Female Standard*

<65 65 70 75 80 85

A

$214 $204 $204 $228 $265 $288

F

$188 $196 $235 $285 $350

G

$153 $159 $195 $240 $298

N

$114 $126 $158 $192 $231

*Premiums listed above for Male Standard and Female Standard cannot be used if an application

for a Medicare supplement policy or certificate is submitted during the 6-month open enrollment

period, or if an application for an available Medicare supplement policy is submitted during the

guaranteed issue period, or if the policy or certificate is submitted during the 30-day annual open

enrollment period triggered by a policyholder’s birthday.

A 7% household discount is available for those who qualify.

54

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

AS OF JULY 1, 2024

Monitor Life Insurance Company of New York Individual Market-Attained Age

305 Madison Avenue

Marketing

Method: Insurance Producer Solicited

Morristown, NJ 07962

1-877-759-5762

Male Preferred

<65 65 70 75 80 85

A

$226 $170 $170 $206 $258 $310

F

$209 $209 $248 $306 $374

G

$171 $171 $207 $260 $322

High G

$ 62 $ 62 $ 75 $ 93 $113

N

$132 $132 $164 $195 $228

Female Preferred

<65 65 70 75 80 85

A

$197 $148 $148 $179 $225 $270

F

$181 $181 $215 $266 $325

G

$149 $149 $180 $226 $280

High G

$ 54 $ 54 $ 65 $ 81 $ 98

N

$114 $114 $142 $169 $198

A 7% household discount is available for applicants who qualify.

55

Male Standard*

<65 65 70 75 80 85

A

$260 $196 $196 $237 $297 $357

F

$240 $240 $285 $352 $430

G

$197 $197 $238 $298 $371

High G

$ 72 $ 72 $ 86 $107 $130

N

$151 $151 $188 $224 $262

Female Standard*

<65 65 70 75 80 85

A

$226 $170 $170 $206 $258 $310

F

$209 $209 $248 $306 $374

G

$171 $171 $207 $260 $322

High G

$ 62 $ 62 $ 75 $ 93 $113

N

$132 $132 $164 $195 $228

*Premiums listed above for Male Standard and Female Standard cannot be used if an application for a Medicare

supplement polic

y or

certificate is submitted during the 6-month open enrollment period, or if an application

for an available Medicare supplement polic

y is submitted during the guaranteed issue period, or if the policy

or certificate is submitted during the 30-day annual open enrollment period triggered by a policyholde

r’s

birthday.

A 7% household discount is available for applicants who qualify.

56

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

AS OF JULY 1, 2024

Mutual of Omaha Insurance Company Individual Market-Attained Age

3300 Mutual of Omaha Plaza Marketing Method: Insurance Producer Solicited

Omaha, NE 68175

1-800-667-2937

www.mutualofomaha.com/states

Male Non-Tobacco

<65 65 70 75 80 85

A

$177 $177 $197 $236 $285 $341

F

$199 $214 $253 $306 $370

G

$173 $191 $229 $278 $332

High G

$ 50 $ 56 $ 67 $ 81 $ 97

N

$122 $135 $161 $195 $233

Female Non-Tobacco

<65 65 70 75 80 85

A

$154 $154 $171 $205 $248 $297

F

$173 $186 $220 $266 $322

G

$150 $166 $199 $241 $289

High G

$ 44 $ 49 $ 58 $ 71 $ 84

N

$106 $117 $140 $169 $203

A 12% household discount is available for applicants who qualify.

57

Male Tobacco*

<65 65 70 75 80 85

A

$204 $204 $226 $271 $328 $392

F

$229 $246 $291 $352 $426

G

$198 $220 $264 $319 $382

High G

$ 58 $ 64 $ 77 $ 93 $112

N

$141 $155 $185 $224 $268

Female Tobacco*

<65 65 70 75 80 85

A

$177 $177 $196 $236 $285 $341

F

$199 $214 $253 $306 $370

G

$173 $191 $229 $277 $332

High G

$ 50 $ 56 $ 67 $ 81 $ 97

N

$122 $135 $161 $195 $233

*Premiu

ms listed above for Male Tobacco and Female Tobacco cannot be used if an application for a Medica

re

supplem

ent policy or

certificate is submitted during the 6-month open enrollment period, or if an application

for an available Medicare supplement policy

is submitted during the guaranteed issue period, or if the policy

or certificate is submitted during the 30-da

y annual open enrollment period triggered by a polic

yholder’s

birthda

y.

A 12% household discount is available for applicants who qualify.

58

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

AS OF JULY 1, 2024

Nassau Life Insurance Company of Kansas

Individual

Market-Attained Age

1 American Row

Marketing

Method: Insurance Producer Solicited

Hartford, CT 06102

1-800-420-5382, Option 3

www.nfg.co

m

Male Preferred

<65 65 70 75 80 85

A

$246 $183 $196 $239 $278 $321

F

$194 $210 $252 $297 $379

G

$163 $174 $212 $252 $325

N

$124 $133 $163 $195 $251

Female Preferred

<65 65 70 75 80 85

A

$214 $159 $170 $208 $242 $279

F

$168 $182 $219 $258 $330

G

$141 $151 $185 $219 $282

N

$108 $115 $141 $169 $219

A 7% Household Discount is available if there are between 2 and 4 adults residing at the same residential address.

59

Male Standard*

<65 65 70 75 80 85

A

$282 $210 $225 $275 $320 $369

F

$223 $241 $289 $341 $436

G

$187 $200 $244 $290 $373

N

$143 $153 $187 $224 $289

Female Standard*

<65 65 70 75 80 85

A

$246 $183 $196 $239 $279 $321

F

$194 $210 $252 $297 $379

G

$163 $174 $212 $252 $325

N

$124 $133 $163 $195 $251

*Premiums listed above for Male Standard and Female Standard cannot be used if an application for a

Medicare supplement policy or certificate is submitted during the 6-month open enrollment period, or if an

application for an available Medicare supplement policy is submitted during the guaranteed issue period, or

if the policy or certificate is submitted during the 30-day annual open enrollment period triggered by a

policyholder’s birthday.

A 7% Household Discount is available if there are between 2 and 4 adults residing at the same residential address.

60

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

AS OF JULY 1, 2024

National Health Insurance Company

Individual Market-Attained Age

P.O. Box 3450 Marketing Method: Insurance Producer Solicited

Salt Lake City, UT 84110-3450

1-833-976-2628

Male Preferred II

<65 65 70 75 80 85

A

$209 $171 $176 $206 $250 $296

F

$224 $231 $270 $328 $388

High F

$ 67 $ 69 $ 81 $ 98 $116

G

$185 $191 $223 $271 $320

N

$134 $138 $161 $196 $232

Female Preferred II

<65 65 70 75 80 85

A

$185 $151 $156 $182 $222 $262

F

$198 $204 $239 $290 $343

High F

$ 60 $ 61 $ 72 $ 87 $103

G

$164 $169 $197 $240 $284

N

$119 $122 $143 $174 $205

A household discount of 7% is available.

61

Male Preferred

<65 65 70 75 80 85

A

$209 $171 $199 $231 $268 $309

F

$224 $261 $302 $350 $404

High F

$ 67 $ 78 $ 91 $105 $121

G

$185 $216 $250 $290 $334

N

$134 $156 $181 $210 $242

Female Preferred

<65 65 70 75 80 85

A

$185 $151 $176 $204 $237 $273

F

$198 $231 $268 $310 $358

High F

$ 60 $ 69 $ 80 $ 93 $107

G

$164 $191 $221 $256 $296

N

$119 $138 $160 $186 $214

A household discount of 7% is available.

62

Male Standard*

<65 65 70 75 80 85

A

$251 $205 $239 $277 $321 $370

F

$268 $313 $362 $420 $484

High F

$ 81 $ 94 $109 $126 $145

G

$222 $259 $300 $347 $400

N

$161 $187 $217 $252 $290

Female Standard*

<65 65 70 75 80 85

A

$222 $181 $211 $245 $284 $327

F

$237 $277 $321 $372 $429

High F

$ 71 $ 83 $ 96 $112 $129

G

$196 $229 $265 $307 $354

N

$142 $166 $192 $223 $257

*Premiums listed above for Male Standard and Female Standard cannot be used if an application

for a Medicare supplement policy or certificate is submitted during the 6-month open enrollment

period, or if an application for an available Medicare supplement policy is submitted during the

guaranteed issue period, or if the policy or certificate is submitted during the 30-day annual open

enrollment period triggered by a policyholder’s birthday.

A household discount of 7% is available.

63

MONTHLY PREMIUMS FOR MEDICARE SUPPLEMENT INSURANCE POLICIES

AS OF JULY 1, 2024

Physicians Life Insurance Company

Individual Market-Attained Age/Issue Age

2600 Dodge Street Marketing Method: Insurance Producer Solicited/Direct Response

Omaha, NE 68131 Issue Age rates are available for all plans

1-800-325-6300

www.physiciansmutual.com/web/medsupp

Male Non-Tobacco

<65 65 70 75 80 85

A*

$214* $214* $214* $214* $214* $214*

F

$232 $250 $290 $316 $325

High F

$ 73 $ 80 $100 $124 $155

G

$197 $213 $247 $269 $277

High G

$ 71 $ 77 $ 96 $120 $149

Female Non-Tobacco

<65 65 70 75 80 85

A*

$193* $193* $193* $193* $193* $193*

F

$210 $226 $263 $286 $294

High F

$ 66 $ 72 $ 90 $112 $140

G

$179 $193 $223 $244 $250

High G

$ 64 $ 70 $ 87 $108 $135

*Plan A is I

ssue Age. Other Plans are Attained Age.

An applicant who resides in a household either with a spouse, or with another person (but no more

than three) that is age 60 or older and has continuously resided with the applicant for the last 12 months,

is eligible for a 10% household discount.

All Medicare Supplement plans from Physicians Life Insurance Company except Plan A provide additional innovative

benefits for preventive care and hearing loss testing. We also offer a Deductible Discount Rider on Plans F and G that

applies the high deductible for only 2-3 years, with a premium discount off of the base plan that applies for

the life of the policy.

64

Male Tobacco**

<65 65 70 75 80 85

A*

$238* $238* $238* $238* $238* $238*

F

$258 $278 $322 $352 $361

High F

$ 81 $ 89 $111 $138 $172

G

$219 $237 $274 $299 $308

High G

$ 79 $ 86 $107 $133 $166

Female Tobacco**

<65 65 70 75 80 85

A*