Contents

Section 1 – Introduction .........................................................................................................

5

Section 2 – Types of Debt ......................................................................................................

6

a. Bonds ...........................................................................................................................

7

b. Notes ............................................................................................................................

8

c. Financing Leases ...........................................................................................................

8

d. Loan Agreements ..........................................................................................................

9

Section 3 – Types of Issuers ..................................................................................................

10

a. Cities .............................................................................................................................

11

b. Counties........................................................................................................................

11

c. Metropolitan Governments ...........................................................................................

11

d. Health, Educational, and Housing Facility Boards .........................................................

11

e. Housing Authorities ......................................................................................................

11

f. Special School Districts .................................................................................................

11

g. Industrial Development Boards ....................................................................................

11

h. Public Building Authorities ...........................................................................................

11

i. Hospital Authorities ......................................................................................................

11

j. Municipal Energy Authorities .......................................................................................

11

k. Water and Wastewater Treatment Authorities ...............................................................

12

l. Utility Districts ..............................................................................................................

12

m. Emergency Communication Districts ...........................................................................

12

n. Local Government Authorities .....................................................................................

12

i. Airport Authorities ................................................................................................

12

ii. Convention Center Authorities ..............................................................................

12

iii. Port Authorities .....................................................................................................

12

iv. Parking Authorities ................................................................................................

12

v. Sports Authorities ..................................................................................................

12

Section 4 – Types of Security for Local Government Debt .................................................

13

a. General Obligation and Limited Tax Debt ....................................................................

13

b. Revenue Debt ...............................................................................................................

14

Section 5 – Types of Sales of Local Government Debt ........................................................

15

Section 6 – Comptroller Oversight of Short-Term Obligations ..........................................

17

a. Short-Term Obligations Requiring Approval by the Comptroller of the Treasury .........

17

b. Bond Anticipation Notes ..............................................................................................

21

c. Capital Outlay Notes .....................................................................................................

23

d. Grant Anticipation Notes .............................................................................................

27

e. Revenue Anticipation Notes .........................................................................................

29

f. Tax and Revenue Anticipation Notes ............................................................................

31

g. Summary Grid of Notes Authorized Under Title 9, Chapter 21, Tenn. Code Ann. .......

33

h. Financing Leases ...........................................................................................................

34

Section 7 – Other Comptroller Oversight .............................................................................

37

a. Plans of Refunding .......................................................................................................

37

b. State Law Reissuance ....................................................................................................

42

c. Utility and E-911 Plans of Financing .............................................................................

43

d. Balloon Debt ................................................................................................................

43

e. Pledge of Non-Tax Revenues........................................................................................

44

f. Debt Reporting .............................................................................................................

45

g. Default Reporting .........................................................................................................

45

h. Debt Management Policies............................................................................................

45

Section 8 – Federal Oversight of Municipal Bonds .............................................................

46

a. Internal Revenue Service and Tax-Exempt Status .........................................................

46

b. Federal Securities Laws .................................................................................................

48

Section 9 – Best Practices and Other Resources .................................................................

51

a. Seven Keys ...................................................................................................................

51

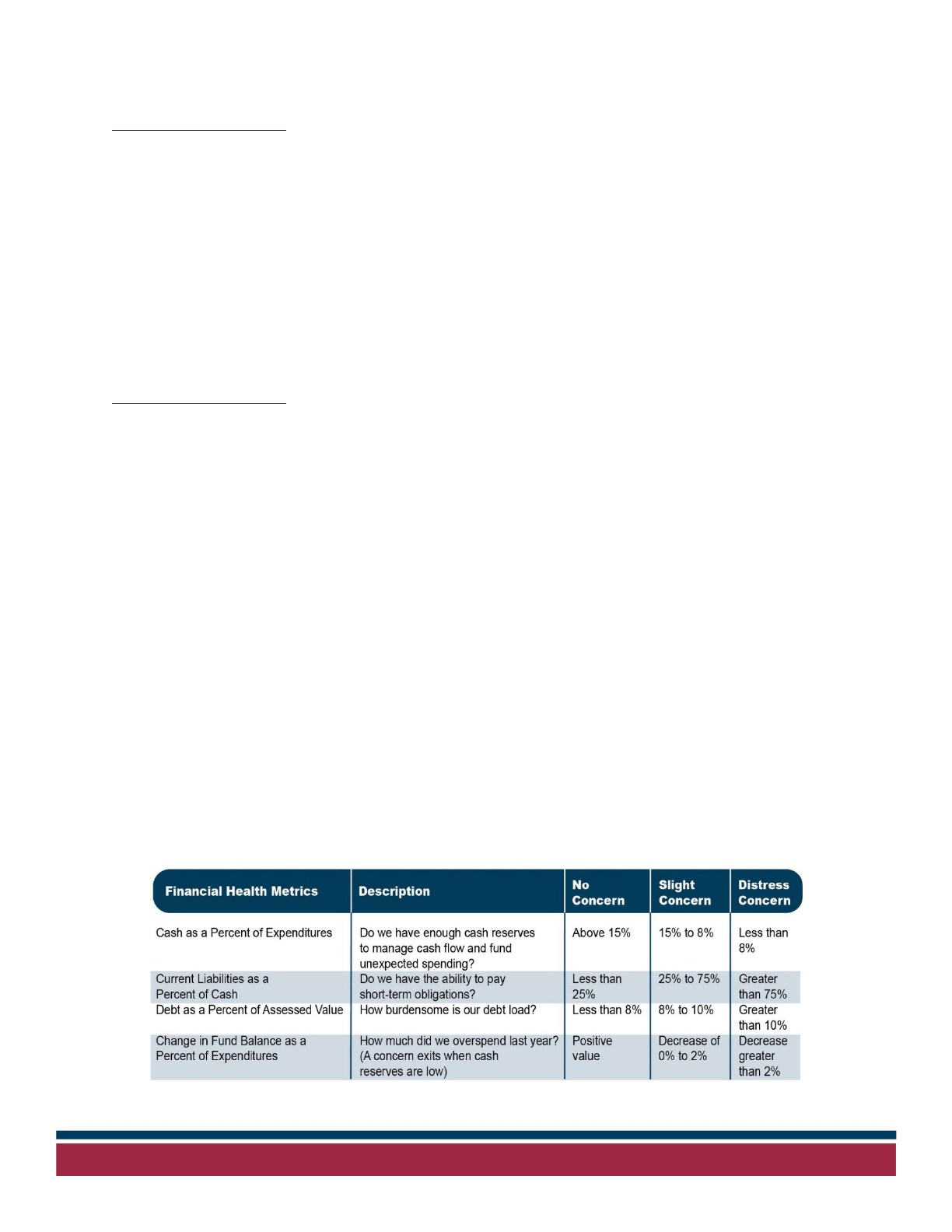

b. Financial Health Metrics ...............................................................................................

52

c. Technical Assistance Services ........................................................................................

53

d. Debt Coverage ..............................................................................................................

53

e. Rating Agencies ............................................................................................................

54

Appendix .................................................................................................................................

55

1. Bond Anticipation Note Resolution ..............................................................................

56

2. Capital Outlay Note Resolution ....................................................................................

62

3. Grant Anticipation Note Resolution .............................................................................

68

4. Tax Anticipation Note Resolution ................................................................................

74

5. Informal Bid Form .......................................................................................................

79

6. Balloon Debt Law Flowchart ........................................................................................

81

5

Section 1 – Introduction

The purpose of this Tennessee Debt Manual for Local Governments (this “Manual”) is to provide

general information to local government issuers in Tennessee relating to the issuance of debt. This

manual also provides for specific forms and procedures, as is authorized by Tenn. Code Ann. § 4-3-

305, that should be complied with by local government entities to which those forms and procedures

are applicable.

Specifically, this Manual contains the following:

• Sections 2–5 provide general information relating to the issuance of local government debt in

Tennessee.

• Section 6 provides uniform procedures for the issuance of notes by Tennessee’s counties,

metropolitan governments, municipalities, and other local governments authorized to issue

notes pursuant to Title 9, Chapter 21, of Tennessee Code Annotated.

• Section 7 provides refunding and state law reissuance guidance as well as brief descriptions of

other reporting and approval requirements related to local government debt issuance.

• Section 8 provides a brief overview of federal oversight of local government debt.

• Section 9 provides local governments with an introduction to other resources related to best

practices for the issuance of debt.

This Manual, as approved by the State Funding Board on June 27, 2023, is the second edition issued

pursuant to Tenn. Code Ann. § 4-3-305.

This Manual provides general information and is not intended to offer specific financial or legal advice

for local government issuers. If local government issuers have questions regarding matters discussed

in this Manual or the application of this Manual to particular situations, local government issuers

should contact the Division of Local Government Finance in the Comptroller’s Office and/or consult

with the issuer’s legal and financial advisors.

6

Section 2 – Types of Debt

In general, debt refers to borrowing money and repaying it with interest over a period of time. In

Tennessee, the debt of local government entities can be issued for a very short term, such as a few

months, but certain types of debt of local government entities can have a term of up to 40 years.

Local government entities typically issue long-term debt to finance capital projects, such as schools,

courthouses, safety facilities, and other public assets, that will last for many years and may be too

expensive to pay for at the time of construction with current funds. By repaying the debt over a longer

period of time, the cost of the project is spread over its life. Local government entities often issue

short-term debt to finance equipment that has a shorter life when the cost of the equipment needs to

be spread over multiple fiscal years.

If authorized at all, local government entities are generally allowed to borrow for the payment of

operating expenses on a short-term basis, which is usually less than a year. Only in rare circumstances

can local government entities borrow funds to finance or refinance the payment of operating expenses

on a long-term basis.

Like comparable provisions in many other states, Article II, Section 29 of the Tennessee Constitution

prohibits cities and counties from lending their credit for the benefit of private enterprises unless an

election is first held and three-fourths of the votes cast in the election are in favor of the proposal.

Tennessee courts have generally interpreted this provision so that it only applies when a debt is actually

incurred and only when a city or county secures the debt with its taxing power, and not with other

available revenues.

In some states, a local government entity may obtain a court ruling to validate the issuance of a debt

obligation. Validation proceedings are rare in Tennessee, and almost all local government debt is

issued in Tennessee without validation. If a debt obligation is not legally issued by certain local

government entities, the Comptroller’s Office is permitted to work with the local government entity

to bring the obligation into conformity with applicable laws. Sometimes compliance is accomplished

through a corrective action plan, but in some cases, it is necessary for the nonconforming obligation

to be retired early. See Tenn. Code Ann. § 9-21-406.

7

The most common types of debt instruments in Tennessee are the following:

a. Bonds

Bonds are typically long-term debt instruments, although many Tennessee statutes do not provide a

clear distinction between the term of bonds and the term of other debt obligations. Like other debt

obligations, a bond is the issuer’s promise to repay a set amount of money, plus periodic interest, on

a specific date. When bonds are issued by cities, counties, metropolitan governments, and other local

government entities that have strong credit, those bonds are often sold to the public. Typical features

of municipal bonds sold to the public are as follows:

• Such bonds typically have serial maturity dates with a maturity in each year and a

different interest rate for each maturity.

• Such bonds are typically sold in $5,000 denominations so that they can be sold to many

investors.

• Interest on such bonds is typically paid semi-annually.

• Such bonds often cannot be prepaid for a period of time (typically 10 years).

*Please note that not all bond transactions in Tennessee involve a trustee or an underwriter.

8

b. Notes

Notes are typically short-term debt instruments. As with a bond, the issuer of a note promises to

repay the amount of principal borrowed, plus interest, on a certain date.

Notes issued by local government issuers in Tennessee may take many forms. Types of notes issued

by counties, cities, and metropolitan governments include the following:

• Bond anticipation notes, which are notes typically used to fund the construction phase

of a capital project until long-term bonds are issued. Bond anticipation notes are

sometimes issued in a commercial paper format.

• Grant anticipation notes, which are issued to fund initial spending that is later

reimbursed through a grant.

• Tax and revenue anticipation notes, which are issued to provide operating funds until

other taxes or other revenues are collected. Such notes generally must be repaid by

fiscal-year end.

• Capital outlay notes, which are typically issued to finance the purchase of capital assets

that have a shorter economic life, such as vehicles or equipment. Capital outlay notes

may remain outstanding for up to 12 years.

Notes, as listed above, may be issued as internal loans pursuant to Tenn. Code Ann. § 9-21-408. The

Division of Local Government Finance must approve the internal loans listed above (the process is

described below). Electric department interdivisional loans authorized under Tenn. Code Ann. § 7-

52-603, do not require Comptroller approval.

c. Financing Leases

After recent accounting rule changes, most leases will be shown as a liability and an asset on a local

government entity’s balance sheet. The distinction between financing leases and operating leases (or

true leases) has largely been eliminated for accounting purposes.

However, the notion of a financing lease, as opposed to an operating lease, is still a relevant concept

under federal tax law. Under federal tax law, a financing lease typically provides for periodic rent

payments that are effectively principal and interest payments, with the interest component specifically

identified, and further provides for a bargain purchase option by the lessee at the end of the lease.

Financing leases are often marketed to local governments in connection with the sale of equipment,

such as energy savings equipment.

Certain types of local government entities in Tennessee are authorized to enter into financing leases.

A local government entity should confirm with its legal counsel whether it has the legal authority to

enter into a financing lease.

In addition, any financing leases entered into by certain local government entities that are not classified

as exempt under the “Uniformity in Local Government Lease Financing Act of 2021,” must be

reviewed and approved by the Comptroller’s Office prior to approval by the local governing body.

See Section 6h on page 30 for further detail.

9

d. Loan Agreements

In Tennessee, certain local government entities are authorized to borrow funds pursuant to a loan

agreement, in which case the issuance of a bond or note may not be required. As its name suggests,

a loan agreement is an agreement under which an entity agrees to borrow funds from a lender.

In Tennessee, certain types of local government entities can borrow funds through a loan agreement

with another type of local government entity known as a public building authority (also known as a

PBA). PBAs were first authorized in state law in 1971 and were intended to help governments

construct, operate, and maintain public buildings. PBAs are public corporations that are legally

separate from the government or governments that create the PBA (a county or city (or both) is

authorized to create a PBA).

PBAs issue debt to finance capital projects and typically loan the debt proceeds to another local

government entity, such as a city or county. Although PBAs issue revenue debt, the loan agreement

with a county or city may be a general obligation of the county or city. As a result, PBA debt often

has the same credit quality as general obligation bonds issued by the local government borrower from

the PBA.

10

Section 3 – Types of Issuers

Tennessee law authorizes many types of local government entities to issue debt. A list of most local

government entities that have the authority to issue debt in Tennessee follows:

11

*These districts are not legal entities which are authorized to directly issue debt, but they are areas in

which a special assessment or increment tax revenue stream is designated to be available for payment

of debt service by a local government entity. In most cases, such debt would be issued by another

local government entity, such as a city, county, PBA, or industrial development board, depending on

the relevant statutes.

The following is a brief description of some of the local government entities in Tennessee that have

the legal authority to issue debt. Each of these entity types have the authority to issue debt, usually

to finance (either directly or through a loan to a third party) capital projects constructed to further

the purpose for which the entity was formed.

a. Cities—Cities can be created in Tennessee under certain general statutes or by private act.

Most cities have the power to impose property taxes, although not all cities in Tennessee do

impose taxes. If a city forfeits its charter and it has debt outstanding, then the county is

authorized to levy a special tax for the area of the city to repay the debt (Tenn. Code Ann. §

6-52-304).

b. Counties—Counties are created by the Tennessee legislature and are subdivisions of the state.

c. Metropolitan Governments—Tennessee statutes allow for the merger of the city and county

government function into one metropolitan government if approved at a referendum.

d. Health, Educational, and Housing Facility Boards (HEHFB)—HEHFBs are created by

a city and/or county to facilitate growth of health and educational facilities as well as housing.

e. Housing Authorities—Housing authorities are created by cities and/or counties to facilitate

the creation of housing in the area served. Housing authorities may also undertake tax

increment financing (TIF) to assist redevelopment projects.

f. Special School Districts—Special school districts are created by private act of the Tennessee

legislature to provide education to residents of the area of incorporation.

g. Industrial Development Boards (IDB)— IDBs are created by a city and/or county to

provide for industrial development and other commercial and public projects in the area

served by the IDB. IDBs may also undertake tax increment financing for certain economic

development purposes.

h. Public Building Authorities (PBA)—PBAs are created by cities and/or counties to finance,

construct, and maintain public buildings. PBAs also have the legal authority to function as a

lender to other local government entities.

i. Hospital Authorities—Hospital authorities are created by private act or certain general

statutes. Hospital authorities generally operate hospital facilities within their service area.

j. Municipal Energy Authorities—Municipal energy authorities are created by cities and/or

counties to operate, separate from the authorizing city or county, an electric system or other

utility systems.

12

k. Water and Wastewater Treatment Authorities—Water and wastewater treatment

authorities are created by cities, counties, and/or metropolitan governments or by private act

to provide water or sewer services to rate payers in the service area.

l. Utility Districts—Utility districts, which are common in Tennessee, are generally created by

one or more counties with new utility districts being subject to approval by the Tennessee

Board of Utility Regulation (TBOUR). Utility districts generally provide water, sewer, gas, or

fire protection services to the rate payers in their service area.

m. Emergency Communications Districts—Emergency communications districts are created

by cities and/or counties (and may be approved by voter referendum) to provide emergency

communication services (911 calls and dispatch of emergency responders) in the authorized

area.

n. Local Government Authorities

i. Airport Authorities—Various types of airport authorities can be created by cities

and/or counties to own and operate airport facilities.

ii. Convention Center Authorities—Convention center authorities can be created by a

city and/or county to develop tourism, convention, and employment.

iii. Port Authorities—Port authorities can be created by cities and/or counties to

develop ports and the related infrastructure to encourage commerce.

iv. Parking Authorities—Parking authorities can be created by cities and/or counties to

finance, construct, and maintain parking structures and related infrastructure.

v. Sports Authorities—Sports authorities can be created by cities and/or counties to

construct and maintain sports facilities.

13

Section 4 – Types of Security for

Local Government Debt

a. General Obligation and Limited Tax Debt

In Tennessee, local government debt that is secured by a commitment to impose property taxes, to

the extent necessary, to pay such debt is typically referred to as general obligation debt. Because

counties, metropolitan governments, and cities are generally the only local government entities that

have the legal authority to impose property taxes, essentially all general obligation debt issued by local

government entities in Tennessee is issued by counties, metropolitan governments, and cities. General

obligation debt is often described in Tennessee as being backed by the “full faith and credit” of the

county, metropolitan government, or city that is issuing the debt.

General obligation debt is secured by the unlimited taxing power of the local government. Therefore,

notwithstanding any local charter limitations to the contrary, the local government is required to

impose a property tax in whatever amount is necessary to pay the debt. If the local government fails

to do so, the holders of the debt can force the local government, through a court proceeding, to raise

taxes in an amount sufficient to pay the debt service on the general obligation debt.

Certain special school districts in Tennessee, which have been created by private act, are allowed to

collect property taxes imposed by the state legislature, but the amount of that property tax that can be

imposed is typically limited. Debt issued by such special school districts is considered to be secured

by a limited tax commitment because the property tax cannot be imposed in an unlimited amount if

the taxes collected are not sufficient to pay debt payable from such taxes.

Another type of local government debt secured by limited taxes is special assessment debt. While

commonly used in some states, special assessment debt has rarely been issued in Tennessee. However,

as is noted in the Types of Issuers chart on page 6, a few statutes authorize the issuance of special

assessment debt in Tennessee. Under those statutes, a special assessment, which is essentially a type

of limited property tax, can be imposed on a specific district or area, and these assessments are typically

collected by the city or county in which the special assessment district is created. The special

assessments are sometimes used to pay for additional public services with the designated district or

area, but such assessments can also be used to pay debt service on debt incurred to make capital

improvements in the district or area. Because the amount of the special assessment is typically

specified and limited, the debt payable from such special assessments is not typically a general

obligation of the city or county and is more accurately characterized as a limited tax obligation.

14

b. Revenue Debt

Revenue debt is essentially all local government debt that is not payable from property taxes. Revenue

debt can be generally subdivided into two categories—direct revenue debt and conduit revenue debt.

Direct revenue debt is debt payable from revenues created by the local government entity that issues

the debt. Conduit revenue debt is debt issued by a governmental entity on behalf of a third party and

payable by the.

The most common type of direct revenue debt in Tennessee is debt issued by local government entities

that provide utilities and similar public services. Cities frequently issue debt payable from the revenues

of their electric, water, sewer, stormwater, and gas systems. Utility districts and energy authorities are

also frequent issuers of direct revenue debt in Tennessee. This type of direct revenue debt is usually

issued under a bond resolution of the local government issuer under which the issuer pledges the

revenues of the particular utility system (frequently after the payment of operating expenses) to the

payment of the debt being issued to provide improvements to the utility system.

Another common type of direct revenue debt in Tennessee is tax increment debt. In Tennessee tax

increment debt (which is also sometimes called tax increment financing or “TIF”) is generally issued

by housing authorities, to promote redevelopment, or by industrial development boards, to promote

economic development. Tax increment debt is generally payable from the incremental increase in

property taxes from a base year (generally the year before the tax increment plan is approved by the

local governments) and each tax year for which the calculation of the increment is made (less certain

deductions required by state statutes).

The most common issuers of conduit revenue debt in Tennessee are industrial development boards;

health, education, and housing facility boards; and public building authorities. Industrial development

boards and health, education, and housing facility boards frequently are requested to issue bonds to

finance projects for private parties, such as projects for charitable “501(c)(3)” organizations, low-

income housing projects, small manufacturing projects, and solid waste projects, and to loan the

proceeds of those bonds to the private party to finance the particular project. This financing method

is typically used to permit the private party to realize the benefit of tax-exempt financing as is described

in Section 8 of this manual. In this type of financing, the industrial development board or health,

education, and housing facility board has no obligation to pay the issued bonds except from loan

repayments by the private party, so the financing is non-recourse to the local government issuer.

As is discussed in Section 2d on page 5, another common type of conduit revenue debt in Tennessee

is debt issued by public building authorities or PBAs. As with industrial development boards and

health, education, and housing facility boards, debt issued by PBAs is generally only payable from the

loan repayments made to the PBA by another party, which, in this case, would be the local government

entity that borrows the proceeds of debt issued by the PBA. Therefore, the financing is typically non-

recourse to the PBA. However, the underlying loan to the other local government entity may be a

general obligation of the local government that borrows from the PBA, or such underlying loan may

be payable only from specified revenues of that local government entity.

15

Section 5 – Types of Sales of

Local Government Debt

There are generally two methods of sale of local government debt—competitive sale and negotiated

sale. With a competitive sale, parties that are interested in purchasing a local government entity’s debt

compete to offer the lowest interest rate for the debt. With a negotiated sale, a local government

entity negotiates with a single purchaser in an effort to obtain the most favorable terms. General

obligation debt and highly-rated direct revenue debt is usually well suited for competitive sales, while

other types of debt are better suited for negotiated sales.

When a local government entity sells debt using a competitive sale method, the local government

entity will typically publicly advertise the sale through a notice of sale and request bidders to submit

bids to purchase the debt being sold by a specified time. The notice of sale will specify the parameters

for the sale, such as the maturities, maximum principal amount, and maximum interest rate. Once the

bids are submitted, the local government will then award the bonds to the bidder that provides the

lowest interest rate. In most cases, the bidders for the bonds are typically underwriters who resell the

bonds to their customers.

For capital outlay notes (see Section 6c on page 19) issued by cities and counties that do not exceed

$5 million in principal, a modified form of competitive sale, known as the informal bid process, can

be used. Under this alternative, a city or county can seek quotes from financial institutions to purchase

a capital outlay note instead of selling the capital outlay note through a publicly advertised competitive

sale.

Negotiated sales generally take two forms—public underwritings and private placements. With a

public underwriting, a local government entity selects an underwriter and then negotiates the terms

for the sale of the debt of the local government entity, such as interest rates, call provisions, and

purchase price, among other things, with the underwriter. The local government entity and the

underwriter enter into a bond purchase agreement or similar agreement to memorialize these terms

and to provide for the sale of the debt. The underwriter will then typically reoffer the debt, which is

usually in the form of bonds, to its customers.

With a private placement (also sometimes called a direct placement), the purchaser of the debt of the

local government entity is typically a bank or other financial institution, and the debt of the local

government entity is not reoffered to the public but is held by the purchaser of the debt as a loan or

investment. In some cases, the purchaser of the debt may be required to hold the debt until it matures

or may be subject to other restrictions regarding the transfer of the debt. The terms of the debt are

negotiated directly by the local government entity and the purchaser of the debt.

16

The permitted method of sale for local government debt will generally be established by the statutes

that authorize the issuance of the debt. Most general obligation debt in Tennessee is required to be

sold by public competitive sale, and the State of Tennessee through its State Funding Board prefers

to issue its general obligation debt for larger capital projects by competitive sale.

17

Section 6 – Comptroller Oversight

of Short-Term Obligations

a. Short-Term Obligations Requiring Approval by the Comptroller of the Treasury

Types of Obligations

Statute

Bond Anticipation Notes

T.C.A. §§ 9-21-501 et seq.

Capital Outlay Notes

T.C.A. §§ 9-21-601 et seq.

Financing Leases

T.C.A. §§ 9-24-101 et seq.

Grant Anticipation Notes

T.C.A. §§ 9-21-701 et seq.

Revenue Anticipation Notes – Health Care

T.C.A. §§ 9-21-1101 et seq.

Revenue Anticipation Notes – Utilities, Other

T.C.A. §§ 7-34-111; 7-36-113; 7-82-501

Tax and Revenue Anticipation Notes

T.C.A. §§ 9-21-801 et seq.

i. General Requirements for Notes

Limits on Indebtedness

Except for Tax Anticipation Notes, there is no limit on indebtedness imposed on local

governments in the “Local Government Public Obligations Act of 1986” (the “Act”).

Local Government Powers

Local governments have the following powers under the Act: (a) contract debts in

order to make grants, donations, reimbursements or loans to one (1) or more local

governments, local government instrumentalities, or utility districts for the

construction of any public works project; (b) Borrow money for the construction of

any public works project; or (c) Issue bonds or notes to finance such construction,

grant, donation, reimbursement or loan for the construction of any public works

project.

In addition, local governments may pledge the full faith, credit, and unlimited taxing

power of the local government as to all taxable property in the local government or a

portion of the local government, if applicable, to the punctual payment of the principal

of and interest on the bonds or notes issued to finance any public works project, except

bonds or notes and the interest thereon payable exclusively from revenues of a public

works project.

18

Local governments may assess, levy, and collect ad valorem taxes on all taxable

property within the local government or a portion of the local government, if

applicable, sufficient to pay the principal of and interest on the bonds or notes issued

to finance any public works project, except bonds or notes and the interest thereon

payable exclusively from revenues of a public works project.

Tenn. Code Ann. § 9-21-107

Tax-Exemption

Any bonds or notes issued by a local government pursuant to the provisions of the

Act and the income therefrom shall be exempt from all state, county and municipal

taxation except for inheritance, transfer and estate taxes, and except as otherwise

provided in the Tennessee Code Annotated.

Tenn. Code Ann. § 9-21-117

ii. Remedies for Noteholders

Any holder of notes issued pursuant to the Act has the right, in addition to all

other rights:

By mandamus or other suit, action or proceeding in any court of competent

jurisdiction to enforce such holder's rights against the local government, the

governing body of the local government and any officer, agent, or employee

of the local government, including, but not limited to, the right to require the

local government, the governing body and any proper officer, agent or

employee of the local government to assess, levy and collect taxes, and to fix

and collect fees, rents, tolls, or other charges adequate to carry out any

agreement as to, or pledge of, such taxes, fees, rents, tolls, or other charges,

and to require the local government, the governing body of the local

government and any officer, agent or employee of the local government to

carry out any other covenants and agreements, and to perform its and their

duties under this chapter. No holder or holders of notes payable exclusively

from the revenues of a public works project shall ever have the right to compel

the levying and collection of taxes to pay such notes and the interest thereon.

By action or suit in equity to enjoin any acts or things which may be unlawful

or a violation of the rights of such holder or holders of notes.

Tenn. Code Ann. § 9-21-407

19

iii. Public Works Projects Defined by Tenn. Code Ann. § 9-21-105

The following list is a summary and grouping of all public works projects authorized

by Tenn. Code Ann. § 9-21-105:

GENERAL GOVERNMENT

• City and town halls

• Convention and event centers

• Courthouses

• Equipment (including vehicles, technology equipment, and related software) used for

local government purposes

• Facilities for the indigent

• Fire alarm systems

• Local government stables or garages

• Public buildings

• Plazas

• Parking facilities

• Memorials

• Voting machines

PUBLIC SAFETY

• Ambulances

• Corrective, detention, and penal facilities, including, but not limited to, jails and

transition centers

• Fire department equipment and buildings

• Law enforcement and emergency services equipment

HEALTH

• Dispensaries

• Facilities for persons with disabilities

• Health centers and clinics, including medical and mental health centers and clinics

• Hospitals

• Nursing homes

PUBLIC RECREATION

• Acquisitions of land for the purpose of providing or preserving open land

• Auditoriums

• Expositions

• Fairgrounds and fairground facilities

• Greenways

• Museums

• Parks

• Playgrounds

• Public art

20

• Preserves

• Recreation centers and facilities

• Stadiums

• Swimming pools

• Zoos

PUBLIC WORKS

• Facilities for the storage and maintenance of any items of equipment that constitute

public works projects

• Flood control

• Levees

• Reclamation of land

SOLID WASTE

• Garbage collection and disposal systems

• Incinerators

EDUCATION

• Libraries

• Schools

• Transportation equipment for schools

• Technology equipment and related software

TRANSPORTATION

• Airports

• Alleys

• Bridges

• Curbs

• Harbor and riverfront improvements

• Highways

• Highway and street equipment

• Parkways

• Port facilities

• Railroads, including railway beltlines and switches

• Rights-of-way

• River and navigation improvements and roads

• Ship canals

• Sidewalks

• Streets

• Tunnels

• Urban transit facilities

• Wharves

UTILITIES

• Culverts

• Drainage systems, including storm water sewers and drains

21

• Electric plants and systems

• Gas and natural gas systems and storage facilities

• Heat plants and systems

• Reservoirs

• Sewers

• Sewage and wastewater systems, including, but not limited to, collection, drainage,

treatment, and disposal systems

• Thermal transfer generating plants and/or distribution systems

• Viaducts

• Water treatment distribution and storage systems

ECONOMIC DEVELOPMENT

Hotels and supporting or incidental facilities built by local governments which are built

adjacent to, and as a supporting facility of, civic or convention centers located in

municipalities which have created a central business improvement district under the

provisions of the “Central Business Improvement District Act of 1971,” compiled in

Tenn. Code Ann. Title 7, Chapter 84

Improvements made pursuant to a plan of improvement for a central business

improvement district created pursuant to the “Central Business Improvement District

Act of 1971,” compiled in Tenn. Code Ann. Title 7, Chapter 84

• Markets

• Business parks

• Industrial parks

• Urban renewal projects

b. Bond Anticipation Notes

The authority for the issuance of Bond Anticipation Notes (BANs) is found in Title 9, Chapter

21, Part 5 of the Tennessee Code Annotated. BANs are issued for the express purpose of

providing funds in anticipation of the sale of bonds. Pursuant to Tenn. Code Ann. § 9-21-

505, BANs must first be approved by the Comptroller’s Office. See the template BAN

resolution in the Appendix. Template resolutions can also be found on the Comptroller of

the Treasury’s website at tncot.cc/debt – select the “Note Resolutions” tab.

STEP ONE – Submission Requirements for Approval – BAN

Local governments seeking approval to issue BANs shall submit the following information

electronically to the Division of Local Government Finance in the Comptroller’s Office at

1. Request Letter

The letter requesting approval to issue the BANs shall be from and signed by the local

government’s Chief Executive Officer or designee.

22

2. Adopted Initial Bond Resolution

A certified copy of the signed and adopted initial bond resolution authorizing the

issuance of general obligation bonds revenue bonds.

3. Statement Regarding Publication of Initial Bond Resolution and Protest Period

• For general obligation bonds, certification of compliance with Tenn. Code

Ann. § 9-21-206 that (a) the initial bond resolution authorizing the issuance of

general obligation bonds has been published in a newspaper of general

circulation; and (b) no protest was made against the initial resolution for

general obligation bonds during the 20-day protest period.

• For revenue bonds, certification of compliance with Tenn. Code Ann. § 9-21-

304 that the initial bond resolution authorizing the issuance of revenue bonds

has been published in full once in a newspaper of general circulation.

4. Adopted Resolution

The resolution shall authorize the issuance of BANs and shall be certified. The

resolution should include the following key elements:

• Clear description of public works project(s) that meet(s) the definition in Tenn.

Code Ann. § 9-21-105, Title 9, Ch 11 or Title 49, Ch 3, Pt 10;

• Not to exceed dollar amount;

• Name of the note;

• Life and term of the note does not exceed 2 years;

o Entity may request subsequent approval to extend BANs for two

additional 2-year periods – Tenn. Code Ann. § 9-21-505.

• Planned amortization of the notes that meets statutory requirements;

o After the first 2-year period, a minimum of 1/20 of the original

principal shall be retired annually.

o The entity may request subsequent waiver of the principal retirement

when requesting BAN Extension – Tenn. Code Ann. § 9-21-505.

• Disclosure of any recurring fees included in the interest rate;

• Not to exceed interest rate that is less than the state usury maximum (Tenn.

Code Ann. § 47-14-103);

• If it is an internal loan, and the entity is lending restricted monies (e.g., money

from the water and sewer fund), then the entity is paying interest – Tenn. Code

Ann. § 9-21-408.

o Interest should be the highest rate currently being earned on other

investments, excluding pension investments.

o If there are no applicable investments, the interest rate is the amount

that could be earned for deposits in the Local Government Investment

Pool administered by the Tennessee State Treasurer.

• Method of sale – competitive or negotiated;

• Security – Tenn. Code Ann. § 9-21-504 – general obligation or revenue;

• Date of approval by governing body; and

• Relevant signatures and certification.

23

5. Statement of Monthly Cash Flow Analysis

This requirement only applies for interfund BANs. A monthly cash flow analysis is

required for the lending fund(s). A monthly cash flow analysis Microsoft Excel

template is available on the Comptroller of the Treasury’s website at tncot.cc/debt –

select the “Tools” tab.

STEP TWO – Approval by the Comptroller’s Office – BAN

1. The request will be reviewed within 10 days of receipt by the Division of Local

Government Finance in the Comptroller’s Office. If the submission is incomplete,

the 10-day review period will not begin until the needed information is received.

2. Once the review process is complete, the local government will receive a letter via e-

mail from the Division of Local Government Finance indicating approval or non-

approval.

3. The approval is valid for six months after the date of the letter. If the BANs are not

issued within that time, a new note resolution must be passed and submitted to the

Comptroller’s Office for approval. Please notify [email protected] as soon as possible

if a decision is made not to issue the BANs.

STEP THREE – Submission Requirements after Approval – BAN

1. Debt Report

Pursuant to Tenn. Code Ann. § 9-21-134, a Debt Report shall be completed and filed

with the governing body of the local government no later than 45 days after the

issuance of the BANs and a copy (including attachments, if any) shall be filed with the

Division of Local Government Finance in the Comptroller’s Office. The form should

be completed using the Comptroller’s online application located at tncot.cc/debt-

report. An additional Debt Report will need to be filed once the long-term bonds are

issued.

2. Annual Budget Approval

Within 15 days of adoption, the local government’s annual budget, including

supporting schedules, shall be submitted to the Division of Local Government

Finance in the Comptroller’s Office at [email protected].

c. Capital Outlay Notes

Capital Outlay Notes require the approval of the Comptroller’s Office. The authority for

issuance of Capital Outlay Notes (CONs) is found in Tenn. Code Ann. Title 9 Chapter 21 Part

6. See the template CON resolution in the Appendix. Template resolutions can also be found

on the Comptroller of the Treasury’s website at tncot.cc/debt under the “Note Resolutions”

tab.

24

STEP ONE – Submission Requirements for Approval – CON

Local governments seeking approval to issue CONs shall submit the following information

electronically to the Division of Local Government Finance in the Comptroller’s Office at

1. Request Letter

The letter requesting approval to issue the CONs shall be from and signed by the local

government’s Chief Executive Officer or designee.

The request must state that the proposed sale is feasible and in the best interest of the

local government and that the entity is able to repay the proposed indebtedness

together with all other obligations of the local government.

2. Resolution

The signed and certified authorizing resolution, and draft note. The resolution should

include the following key elements:

• Clearly described municipal project(s) that meet(s) the definition in Tenn.

Code Ann. § 9-21-105.

• Not to exceed dollar amount.

• Economic life of the project(s) that is reasonable based upon the nature of the

project.

• Method of sale (competitive sale, negotiated, informal bid process, or

interfund). The proposed type of sale must comply with Tenn. Code Ann. §

9-21-607:

o Up to 3 years & any amount = Competitive public sale or private

negotiated sale.

o >3 and up to 12 years & up to $5,000,000 = Competitive (can be local)

or informal bid.

o >3 and up to 12 years & >$5,000,000 = Competitive public sale only.

o Land acquisition notes can be sold to the seller of land in a private

negotiated sale in addition to other permitted methods of sale.

o Interfund loans are not subject to the method of sale requirements in

Tenn. Code Ann. § 9-21-607.

• Name of the note.

• Life/term of the note does not exceed:

o Economic life of the project(s) or 12 years, whichever is less – Tenn.

Code Ann. § 9-21-602(a).

o Economic life of the project(s) or 20 years, whichever is less, for

interfund CON lent from proceeds from the sale of a Tennessee

private act hospital – T.C.A. § 9-21-604(b).

o 10 years for a land purchase (Tenn. Code Ann. § 9-21-607).

o 12 years for interfund loans (Tenn. Code Ann. § 9-21-408 & Title 9,

Chapter 21, Part 6)

25

• Planned repayment begins after the first fiscal year the notes are issued and are

repaid, either by maturity or by mandatory redemption. The amortization of

the notes meets statutory requirements of Tenn. Code Ann. § 9-21-604.

o Level debt service payments (specifically, principal and interest does

not exceed any prior year by more than 5%).

o An equal amount of principal in each fiscal year.

o As otherwise approved by the Comptroller’s Office.

o Interfund CON from Tennessee Private Act Hospital sale proceeds—

not less than 1/20 of the original principal amount of the notes.

o The Comptroller’s Office may waive periodic retirement requirement.

• Disclosure of any recurring fees included in the interest rate.

• Not to exceed interest rate that is less than the state usury maximum (Tenn.

Code Ann. § 47-14-103).

• If this is an internal loan and the entity is lending restricted monies (e.g., money

from the water and sewer fund), the entity is paying interest – Tenn. Code

Ann. § 9-21-408).

o Interest should be the highest rate currently being earned on other

investments, excluding pension investments.

o If there are no applicable investments, the interest rate is the amount

that could be earned for deposits in the Local Government Investment

Pool administered by the Tennessee State Treasurer.

o The fixed interest rate may be set on the day of issuance or locked in

up to 60 days prior to the day of issuance, but not prior to the decision

by the local government to execute the project.

• Security – Tenn. Code Ann. § 9-21-603

o Notes shall be direct general obligations of entity; taxing power

pledged.

o If for an income-producing public works (e.g., water utility fund), a

secondary security/pledge payable from revenues of the public works

may be added.

• Placeholder for the date of approval by governing body.

• Placeholders for relevant signatures and certification.

• Interfund CON from the Tennessee Private Act Hospital sale proceeds – the

authorizing resolution may provide that the notes must be subject to

redemption prior to maturity at the option of the local government.

3. Informal Bid Attachment

If seeking informal bid approval, the CON must be for $5 million or less. Tenn. Code

Ann. § 9-21-609. See the sample informal bid form in the Appendix.

4. Statement of Monthly Cash Flow Analysis

This requirement only applies for interfund CONs. A monthly cash flow analysis is

required for the lending fund(s) to demonstrate the lending of fund will not adversely

impact the cash flow/working capital needs of the lending fund

. A monthly cash flow

26

analysis Microsoft Excel template is available on the Comptroller of the Treasury’s

website at tncot.cc/debt – select the “Tools” tab.

5. Copy of Proposed Disclosure Statement, if any

6. Schedule of Estimated Annual Principal and Interest Requirements

7. Detailed Estimated Costs of Issuance

This must include all amounts required to be reported under Tenn. Code Ann. § 9-21-

134, if applicable.

8. List of Projects to be Financed

Please include a detailed list of all proposed projects, including the estimated life of

those projects. A weighted average life calculator is available on the Comptroller of

the Treasury’s website at tncot.cc/debt – select the “Tools” tab.

STEP TWO – Approval by the Comptroller’s Office – CON

1. The request will be reviewed within 10 days of receipt by the Division of Local

Government Finance in the Comptroller’s Office. If the submission is incomplete,

the 10-day review period will not begin until the needed information is received.

2. Approval can only be granted if the issuance of the CONs, as compared to the issuance

of GO bonds, is in the best interest of the local government pursuant to Tenn. Code

Ann. § 9-21-601(b)(4).

• When making this determination, the Comptroller’s Office will consider

whether the life of the project materially exceeds the life of the CON.

• For example, if school construction is being financed for 12 years, and it is

apparent that the entity will not be able to repay the CON within that period

and will need to refund the CON in order to extend maturity to a later date,

then the request cannot be approved.

3. Once the review process is complete, your local government will receive a letter via e-

mail from the Division of Local Government Finance indicating approval or non-

approval.

4. The approval is valid for six months after the date of the letter. If the CONs are not

issued within that time, a new draft note resolution must be prepared and submitted

to the Comptroller’s Office for approval. Please notify [email protected] as soon as

possible if a decision is made not to issue the CONs.

STEP THREE – Submission Requirements after Approval – CON

1. Debt Report

Pursuant to Tenn. Code Ann. § 9-21-134, a Debt Report shall be completed and filed

with the governing body of the local government no later than 45 days after the

27

issuance of the CONs and a copy (including attachments, if any) shall be filed with the

Division of Local Government Finance in the Comptroller’s Office. The form should

be completed using the Comptroller’s online application located at tncot.cc/debt-

report.

2. Annual Budget Approval

Within 15 days of adoption, the local government’s annual budget, including

supporting schedules, shall be submitted to the Division of Local Government

Finance in the Comptroller’s Office at [email protected].

d. Grant Anticipation Notes

Grant Anticipation Notes require the approval of the Comptroller’s Office. The authority for

issuance of Grant Anticipation Notes (GANs) is found in Tenn. Code Ann. Title 9, Chapter

21, Part 7. See the template GAN resolution in the Appendix. Template resolutions can also

be found on the Comptroller of the Treasury’s website at tncot.cc/debt under the “Note

Resolutions” tab.

A local government may issue capital outlay notes or bond anticipation notes for the matching

portion of public works grants, as well as grant anticipation notes issued under Tenn. Code

Ann. Title 9 Chapter 21 Part 7, provided that the proceeds from the sale of any such capital

outlay notes or bond anticipation notes shall not be applied to the payment of such grant

anticipation notes.

STEP ONE – Submission Requirements for Approval – GAN

Local governments seeking approval to issue GANs shall submit the following information

electronically to the Division of Local Government Finance in the Comptroller’s Office at

1. Request Letter

The letter requesting approval to issue the GANs shall be from and signed by the local

government’s Chief Executive Officer or designee.

2. Adopted Resolution

The resolution shall authorize the issuance of GANs and shall be certified as well as

include the draft note. The resolution should include the following key elements:

• Not to exceed dollar amount.

• Name of the note.

• Life/term of the note does not exceed 3 years from the date of issuance, unless

requesting initial Comptroller approval to extend – Tenn. Code Ann. § 9-21-

705.

• Disclosure of any recurring fees included in the interest rate.

28

• Not to exceed interest rate that is less than the state usury maximum (Tenn.

Code Ann. § 47-14-103).

• Security – Tenn. Code Ann. § 9-21-704.

o Notes shall not be direct general obligations of entity.

o Pledge to repay principal shall be solely from a state or federal grant

contract/agreement.

o Pledge for interest payment may be from ad valorem taxes.

• Date of approval by governing body.

• Relevant signatures and certification.

• If this is an internal loan and the entity is lending restricted monies (e.g., money

from the water and sewer fund), the entity is paying interest – Tenn. Code

Ann. § 9-21-408.

o Interest should be the highest rate currently being earned on other

investments, excluding pension investments.

o If there are no applicable investments, the interest rate is the amount

that could be earned for deposits in the Local Government Investment

Pool administered by the Tennessee State Treasurer.

3. Copy of Signed Contract and Notice to Proceed with Project Letter

The fully executed contract or agreement between the state or federal agency and the

local government pledging the funds for the public works project and documentation

indicating that a notice to proceed with the project or the equivalent has been received.

4. Statement of Monthly Cash Flow Analysis

This requirement only applies for interfund GANs. A monthly cash flow analysis is

required for the lending fund(s). A monthly cash flow analysis Microsoft Excel

template is available on the Comptroller of the Treasury’s website at tncot.cc/debt

under the “Tools” tab.

STEP TWO – Approval by the Comptroller’s Office – GAN

1. The request will be reviewed within 10 days of receipt by the Division of Local

Government Finance in the Comptroller’s Office. If the submission is incomplete,

the 10-day review period will not begin until the needed information is received.

2. Once the review process is complete, the local government will receive a letter via e-

mail from the Division of Local Government Finance indicating approval or non-

approval.

3. The approval is valid for six months after the date of the letter. If the GANs are

not issued within that time, a new note resolution must be passed and submitted to

the Comptroller’s Office for approval. Please notify [email protected] as soon as

possible if a decision is made not to issue the GANs.

29

STEP THREE – Submission Requirements after Approval – GAN

1. Debt Report

Pursuant to Tenn. Code Ann. § 9-21-134, a Debt Report shall be completed and filed

with the governing body of the local government no later than 45 days after the

issuance of the GANs and a copy (including attachments, if any) shall be filed with the

Division of Local Government Finance in the Comptroller’s Office. The form should

be completed using the Comptroller’s online application located at tncot.cc/debt-

report.

2. Annual Budget Approval

Within 15 days of adoption, the local government’s annual budget, including

supporting schedules, shall be submitted to the Division of Local Government

Finance in the Comptroller’s Office at [email protected].

e. Revenue Anticipation Notes

Pursuant to Tenn. Code Ann. §§ 7-34-111, 7-36-113, and 7-82-501, cities and counties as well

as energy authorities and utility districts can issue certain utility Revenue Anticipation Notes

(RANs), which require the approval of the Comptroller’s Office.

STEP ONE – Submission Requirements for Approval – RAN

Local governments seeking approval to issue RANs shall submit the following information

electronically to the Division of Local Government Finance in the Comptroller’s Office at

1. Request Letter

The letter requesting approval to issue the RANs shall be from and signed by the local

government’s Chief Executive Officer or designee.

2. Adopted Resolution

The resolution shall authorize the issuance of RANs and shall be certified as well as

include the draft note. The resolution should include the following key elements:

• Name of the note.

• Not to exceed dollar amount.

• The next two requirements only apply to RANs issued for construction, etc.

of public works systems pursuant to Tenn. Code Ann. § 7-34-111 (a)-(b):

o Economic life of the project(s) that is reasonable based upon the

nature of the project.

o Life/term of the note does not exceed economic life of the project(s)

and does not exceed 5-years.

• Planned amortization of the notes that meets statutory requirements.

30

o Maximum 12 months for gas and/or power purchases – Tenn. Code

Ann. §§ 7-34-111(d), 7-36-113(d), and 7-82-501. Note: The 12-month

period does not have to mirror the entity’s fiscal year.

o Maximum 5 years for construction-related – Tenn. Code Ann. § 7-34-

111(a)-(b).

• Not to exceed interest rate that is less than the state usury maximum (Tenn.

Code Ann. § 47-14-103).

• Date of approval by the governing body.

• Relevant signatures and certification.

3. Copy of Budget

For RANs issued to fund gas and/or power purchases, budget showing amount of

budgeted electric power or gas purchases that will be used to calculate the 60%

limitation – Tenn. Code Ann. §§ 7-34-111(d), 7-36-113(d), and 7-82-501.

STEP TWO – Approval by the Comptroller’s Office – RAN

1. The request will be reviewed within 10 days of receipt by the Division of Local

Government Finance in the Comptroller’s Office. If the submission is incomplete,

the 10-day review period will not begin until the needed information is received.

2. RANs issued for gas/power purchases must comply with the following requirements:

• The amount requested for approval is 60% or less than the total budgeted for

the purchase of gas or electricity – Tenn. Code Ann. §§ 7-34-111(d), 7-36-

113(d), and 7-82-501.

• The entity has a positive ending net position for the last fiscal year audit and a

positive change in net position in one of the last three fiscal years.

• Revenue projections in the budget appear realistic in that the RANs may be

retired within 12-months after issuance.

3. Once the review process is complete, the local government will receive a letter via e-

mail from Division of Local Government Finance indicating approval or non-

approval.

4. The approval is valid for six months after the date of the letter. If the RANs are not

issued within that time, a new note resolution must be passed and submitted to the

Comptroller’s Office for approval. Please notify [email protected] as soon as possible

if a decision is made not to issue the RANs.

STEP THREE – Submission Requirements after Approval – RAN

1. Debt Report

Pursuant to Tenn. Code Ann. § 9-21-134, a Debt Report shall be completed and filed

with the governing body of the local government no later than 45 days after the

issuance of the RANs and a copy (including attachments, if any) shall be filed with the

31

Division of Local Government Finance in the Comptroller’s Office. The form should

be completed using the Comptroller’s online application located at tncot.cc/debt-

report.

2. Annual Budget Approval

Within 15 days of adoption, the local government’s annual budget, including

supporting schedules, shall be submitted to the Division of Local Government

Finance in the Comptroller’s Office at [email protected].

f. Tax and Revenue Anticipation Notes

Tax and Revenue Anticipation Notes (TRANs) require the approval of the Comptroller’s

Office. The authority for issuance of TRANs is found in Tenn. Code Ann. Title 9, Chapter

21, Part 8. See the template TRAN resolution in the Appendix. Template resolutions can also

be found on the Comptroller of the Treasury’s website at tncot.cc/debt – select the “Note

Resolutions” tab.

STEP ONE – Submission Requirements for Approval – TRAN

Local governments seeking approval to issue TRANs shall submit the following information

electronically to the Division of Local Government Finance in the Comptroller’s Office at

1. Request Letter

The letter requesting approval to issue the TRANs shall be from and signed by the

local government’s Chief Executive Officer or designee. It must identify the amount

of the TRAN and whether it is an internal or external loan.

2. Adopted Resolution

The resolution shall authorize the issuance of TRANs and shall be certified as well as

include the draft note. The resolution should include the following key elements:

• Approved and certified resolution and draft note.

• Not to exceed dollar amount.

• Borrowing Fund.

• Life/term of the note does not exceed beyond appropriation fiscal year.

• Name of the note.

• Not to exceed interest rate that is less than the state usury maximum (Tenn.

Code Ann. § 47-14-103).

• Date of approval by the governing body.

• Relevant signatures and certification.

3. Statement of Monthly Cash Flow Analysis for the Borrowing Fund

A monthly cash flow analysis is required for the borrowing fund (the fund anticipating

the future tax or other revenue). A monthly cash flow analysis Microsoft Excel

32

template is available on the Comptroller of the Treasury’s website at tncot.cc/debt –

select the “Tools” tab.

4. Statement of Monthly Cash Flow Analysis for the Lending Fund (for Internal Loans)

This requirement only applies for interfund TRANs. A monthly cash flow analysis is

required for the lending fund(s). A monthly cash flow analysis Microsoft Excel

template is available on the Comptroller of the Treasury’s website at tncot.cc/debt –

select the “Tools” tab.

STEP TWO – Approval by the Comptroller’s Office – TRAN

1. The request will be reviewed within 10 days of receipt by the Division of Local

Government Finance in the Comptroller’s Office. If the submission is incomplete,

the 10-day review period will not begin until the needed information is received.

2. Approval can only be granted if the following requirements are met:

• The amount requested for approval is 60% or less than the total budgeted

appropriations for the fund – Tenn. Code Ann. § 9-21-801.

• Any prior year TRANs have been repaid and the entity sent proof to the

Division of Local Government Finance in the Comptroller’s Office at

• The cash flow for the borrowing fund: (1) appears reasonable/realistic; (2)

demonstrates need; and (3) demonstrates ability to repay.

3. Once the review process is complete, the local government will receive a letter via e-

mail from the Division of Local Government Finance indicating approval or non-

approval.

4. The approval is valid through the end of the fiscal year identified in our approval letter.

STEP THREE – Submission Requirements after Approval – TRAN

1. Debt Report

Pursuant to Tenn. Code Ann. § 9-21-134, a Debt Report shall be completed and filed

with the governing body of the local government no later than 45 days after the

issuance of the TRANs and a copy (including attachments, if any) shall be filed with

the Division of Local Government Finance in the Comptroller’s Office. The form

should be completed using the Comptroller’s online application located at

tncot.cc/debt-report.

2. Annual Budget Approval

Within 15 days of adoption, the local government’s annual budget, including

supporting schedules, shall be submitted to the Division of Local Government

Finance in the Comptroller’s Office at [email protected].

33

3. Repayment Requirement

The local government must repay the TRANs no later than June 30 of the fiscal year

of borrowing and provide the Division of Local Government Finance in the

Comptroller’s Office at [email protected] with documentation within 15 days of, but

not later than June 30 of the fiscal year of, borrowing.

g. Summary Grid of Notes Authorized Under Tenn. Code Ann. Title 9,

Chapter 21

34

h. Financing Leases

Lease financing agreements meeting certain criteria must be approved by the Comptroller’s

Office. Tenn. Code Ann. § 9-24-101 et seq. This approval requirement applies to individual

lease financing agreements with principal amounts greater than $100,000 and to individual

lease financing agreements that are $100,000 or less if the principal amount, together with the

principal amount of all exempt lease financings issued by the public entity in the same fiscal

year exceeds $100,000. A lease is defined as an agreement for the use of property under which

a public entity is the lessee, and a lease financing includes one of the following elements: (a)

rental payments include an identifiable interest component; or (b) the local government has

the right to purchase the property that is subject to the lease at a price that is not based upon

the fair market value of the property at the time of the purchase.

STEP ONE – Submission Requirements for Approval – Financing Lease

Local governments seeking approval to enter into Financing Leases shall submit the following

information electronically to the Division of Local Government Finance in the Comptroller’s

Office at [email protected]:

1. Request Letter

The letter requesting approval to enter into a Financing Lease shall be from and signed

by the local government’s chief executive officer or designee.

2. Plan of Lease Financing

The Plan of Lease Financing is a certified copy of the draft lease agreement that

includes the following key elements:

Lease information summary sheet available on our website: tncot.cc/debt.

• Not to exceed dollar amount.

• Schedule of estimated annual principal and interest requirements.

• Detailed estimated costs of issuance, including one-time fees and recurring

administrative or similar fees paid over the life of the lease.

• Lease terms that are reasonable and comparable to debt being issued in the

current markets.

Interest rates and other borrowing costs from two additional lenders for the

same amount and maturity of the proposed lease financing.

• A weighted average maturity of the lease principal payments that does not

exceed the estimated weighted average life of the property being financed –

Tenn. Code Ann. § 9-24-104(a)(2). A weighted average life calculator is

available on the Comptroller of the Treasury’s website at tncot.cc/debt – select

the “Tools” tab.

• A lease term that does not exceed the maximum term of debt that could be

issued by the public entity to finance the proposed project – Tenn. Code Ann.

§ 9-24-104(a)(3).

• Description of the project(s) to be financed with the following minimum

information:

o Estimated useful life (or lives).

35

o Authorizing law to incur indebtedness for the project [Tenn. Code

Ann. § 9-24-104(a)(3)].

• The lease is payable from all or any portion of the revenues of the public entity,

pursuant to applicable law [Tenn. Code Ann. § 9-24-104(a)(4)].

• Not to exceed interest rate that is less than the state usury maximum (Tenn.

Code Ann. § 47-14-103).

3. Initial Resolution

If the lease is payable from or secured by property taxes, and the term of the lease

exceeds the maximum term of a capital outlay note that may be issued for the same

project, the entity must adopt and publish an initial resolution with respect to the lease

financing consistent with Tenn. Code Ann. Title 9, Ch. 21, Pt. 2, as applicable with

respect to the type of property that is being financed [Tenn. Code Ann. § 9-24-

104(a)(5)]. A statement that the local government complied with this provision, as

applicable, should be included in the request letter.

4. Balloon Indebtedness

Is the lease considered balloon indebtedness as defined in Tenn. Code Ann. § 9-21-

133?

• If it is balloon indebtedness, a separate request to issue balloon debt is required

pursuant to “State Funding Board Guidelines for Comptroller Approval of

Balloon Indebtedness.”

• If it is not balloon indebtedness because it meets an exception, please include

the nature of the exception.

STEP TWO – Approval by the Comptroller’s Office – Financing Lease

1. The request will be reviewed within 15 days of receipt by the Division of Local

Government Finance in the Comptroller’s Office. If the submission is incomplete,

the 15-day review period will not begin until the needed information is received.

2. Approval can only be granted if the issuance of the lease, as compared to debt being

issued in the current markets, is in the best interest of the local government pursuant

to Tenn. Code Ann. § 9-24-104. When making this determination, the Comptroller’s

Office will consider the following:

• Do the lease terms appear reasonable and comparable to debt being issued in

the current markets?

• Does the weighted average maturity of the lease principal payments exceed the

estimated weighted average life of the property being financed? Tenn. Code

Ann. § 9-24-104(a)(2).

• Does the term of the lease not exceed the maximum term of debt that could

be issued by the public entity to finance the proposed project? Tenn. Code

Ann. § 9-24-104(a)(3).

36

3. Once the review process is complete, the local government will receive a letter via e-

mail from the Division of Local Government Finance indicating approval or non-

approval.

4. The approval is valid for six months after the date of the letter. If the Financing Lease

is not issued within that time, a new plan of lease financing must be prepared and

as soon as possible if a decision is made not to issue the Financing Lease.

STEP THREE – Submission Requirements after Approval – Financing Lease

1. Debt Report

Pursuant to Tenn. Code Ann. § 9-21-134, a Debt Report shall be completed and filed

with the governing body of the local government no later than 45 days after the

issuance of the Financing Lease and a copy (including attachments, if any) shall be

filed with the Division of Local Government Finance in the Comptroller’s Office. The

form should be completed using the Comptroller’s online application located at

tncot.cc/debt-report.

2. Annual Budget Approval

Within 15 days of adoption, the local government’s annual budget, including

supporting schedules, shall be submitted to the Division of Local Government

Finance in the Comptroller’s Office at.

37

Section 7 – Other Comptroller Oversight

a. Plans of Refunding

Requirements for a Plan of Refunding

Tennessee statutes require local governments to submit a plan of refunding (the “Plan”) to

the Comptroller’s Office for review prior to the adoption of a resolution authorizing the

issuance of refunding bonds. The Comptroller’s Office may present the local government

with a report on the Plan (“Refunding Report”) that must be submitted to the governing body

and reviewed at the public meeting during which the refunding bond authorizing resolution is

considered for adoption.

A fillable and downloadable form of a Refunding Plan can be found on the

Comptroller’s website at tncot.cc/debt. Please contact the Comptroller’s Office with

any questions about this online form.

Statutory Sections Requiring Plans

The following Plans are required to be filed with our office:

• Tenn. Code Ann. § 9-21-612—To issue Capital Outlay Notes (CONs) to refund

CONs;

• Tenn. Code Ann. § 9-21-903—To issue General Obligation Bonds to refund General

Obligation and/or Revenue debt;

• Tenn. Code Ann. § 9-21-1003—To issue Revenue Refunding Bonds to refund

Revenue debt; and

• Tenn. Code Ann. § 12-10-116—To issue Public Building Authority Loans to refund

any General Obligation and/or Revenue Debt.

Developing the Plan

Write the Plan to communicate the narrative of the refunding in easy-to-understand language.