A 2005 Report

U.S. INDIVIDUAL LIFE PERSISTENCY

UPDATE

A JOINT STUDY SPONSORED BY LIMRA INTERNATIONAL

AND THE SOCIETY OF ACTUARIES

Marianne Purushotham

Product Research

860-285-7794

© 2005, LIMRA International, Inc.®

300 Day Hill Road, Windsor, Connecticut 06095-4761, U.S.A.

350 Bloor Street East, 2nd Floor, Toronto, Ontario M4W 3W8, Canada

St. Martins House, 31-35 Clarendon Road, Watford WD17 1JA, United Kingdom

28 Wattle Valley Road, Canterbury, Melbourne VIC 3126, Australia

China Merchants Tower, Suite 917, 161 Lu Jia Zui East Road, Pudong, Shanghai 200120, China

This publication is a benefit of LIMRA International and the Society of Actuaries membership. No part may

be shared with other organizations or reproduced in any form without LIMRA and the Society of Actuaries’

written permission.

007108-0306-30-B94 Printed in U.S.A.

CONTENTS

Page

EXECUTIVE SUMMARY ..................................................................................................7

RECOMMENDATIONS .....................................................................................................9

METHODOLOGY...........................................................................................................10

SAMPLE DESCRIPTION.................................................................................................11

OVERALL RESULTS .....................................................................................................12

WHOLE LIFE INSURANCE............................................................................................14

Gender.........................................................................................................................16

Issue Age.....................................................................................................................16

Attained Age...............................................................................................................17

Premium Payment Mode.............................................................................................18

Risk Class ...................................................................................................................18

Smoking Status ...........................................................................................................19

Underwriting Method..................................................................................................20

Single Premium Whole Life .......................................................................................21

TERM LIFE INSURANCE...............................................................................................23

Gender.........................................................................................................................25

Issue Age.....................................................................................................................25

Attained Age...............................................................................................................26

Premium Payment Mode.............................................................................................27

Risk Class ...................................................................................................................27

Smoking Status ...........................................................................................................28

Underwriting Method..................................................................................................29

Page

UNIVERSAL LIFE INSURANCE......................................................................................30

Gender.........................................................................................................................32

Issue Age.....................................................................................................................33

Attained Age...............................................................................................................34

Risk Class ...................................................................................................................34

Smoking Status ...........................................................................................................35

Underwriting Method..................................................................................................35

Death Benefit Option..................................................................................................36

VARIABLE UNIVERSAL LIFE INSURANCE....................................................................37

Gender.........................................................................................................................39

Issue Age.....................................................................................................................40

Attained Age...............................................................................................................40

Risk Class ...................................................................................................................41

Smoking Status ...........................................................................................................41

PREMIUM PERSISTENCY EXPERIENCE FOR FLEXIBLE PREMIUM PRODUCTS............42

Premium Payment Ratio .............................................................................................42

Excess Premium Ratio................................................................................................44

Total Premium Collection Growth Ratio....................................................................46

PARTICIPATING COMPANIES.......................................................................................47

RELATED LINKS ..........................................................................................................48

FIGURES AND TABLES

Page

Figure 1 Individual Life Policy Lapse Rates....................................................................12

Figure 2 Individual Life Face Amount Lapse Rates.........................................................13

Figure 3 Individual Life versus Individual Disability and Long-Term Care

Insurance Lapse Experience..............................................................................13

Figure 4 Whole Life Policy Lapse Rates..........................................................................14

Figure 5 Whole Life Face Amount Lapse Rates ..............................................................15

Figure 6 Whole Life Lapse Rates by Policy Size.............................................................15

Figure 7 Whole Life Policy Lapse Rates by Gender........................................................16

Figure 8 Whole Life Policy Lapse Rates by Issue Age Group.........................................17

Figure 9 Whole Life Policy Lapse Rates by Attained Age Group...................................17

Figure 10 Whole Life Policy Lapse Rates by Premium Payment Mode..........................18

Figure 11 Whole Life Policy Lapse Rates by Risk Class.................................................19

Figure 12 Whole Life Policy Lapse Rates by Smoking Status.........................................19

Figure 13 Whole Life Policy Lapse Rates by Underwriting Method...............................20

Figure 14 Single Premium Whole Life Policy Lapse Rates.............................................21

Figure 15 Single Premium Whole Life Face Amount Lapse Rates..................................21

Figure 16 Single Premium Whole Life Policy Lapse Rates by Gender...........................22

Figure 17 Single Premium Whole Life Face Amount Lapse Rates by Gender................22

Figure 18 Term Life Policy Lapse Rates..........................................................................24

Figure 19 Term Life Face Amount Lapse Rates ..............................................................24

Figure 20 Term Life Policy Lapse Rates by Gender........................................................25

Figure 21 Term Life Policy Lapse Rates by Issue Age Group.........................................26

Figure 22 Term Life Policy Lapse Rates by Attained Age Group...................................26

Figure 23 Term Life Policy Lapse Rates by Premium Payment Mode............................27

Page

Figure 24 Term Life Policy Lapse Rates by Risk Classification .....................................28

Figure 25 Term Life Policy Lapse Rates by Smoking Status...........................................28

Figure 26 Term Life Policy Lapse Rates by Underwriting Method.................................29

Figure 27 Universal Life Policy Lapse Rates...................................................................31

Figure 28 Universal Life Face Amount Lapse Rates .......................................................31

Figure 29 Universal Life Lapse Rates by Policy Size......................................................32

Figure 30 Universal Life Policy Lapse Rates by Gender.................................................32

Figure 31 Universal Life Face Amount Lapse Rates by Gender......................................33

Figure 32 Universal Life Policy Lapse Rates by Issue Age Group..................................33

Figure 33 Universal Life Policy Lapse Rates by Attained Age Group ............................34

Figure 34 Universal Life Policy Lapse Rates by Risk Class............................................34

Figure 35 Universal Life Policy Lapse Rates by Smoking Status....................................35

Figure 36 Universal Life Policy Lapse Rates by Underwriting Method..........................35

Figure 37 Universal Life Policy Lapse Rates by Death Benefit Option...........................36

Figure 38 Universal Life Face Amount Lapse Rates by Death Benefit Option...............36

Figure 39 Variable Universal Life Policy Lapse Rates....................................................38

Figure 40 Variable Universal Life Face Amount Lapse Rates.........................................38

Figure 41 Variable Universal Life Policy Lapse Rates by Gender ..................................39

Figure 42 Variable Universal Life Face Amount Lapse Rates by Gender.......................39

Figure 43 Variable Universal Life Policy Lapse Rates by Issue Age Group...................40

Figure 44 Variable Universal Life Policy Lapse Rates by Attained Age Group..............40

Figure 45 Variable Universal Life Policy Lapse Rates by Underwriting Class...............41

Figure 46 Variable Universal Life Policy Lapse Rates by Smoking Status.....................41

Figure 47 Premium Payment Ratios.................................................................................43

Figure 48 Premium Payment Ratios — Males versus Females........................................43

Figure 49 Premium Payment Ratios — By Issue Age Group..........................................44

Page

Figure 50 Excess Premium Ratios....................................................................................45

Figure 51 Excess Premium Ratios — By Issue Age Group.............................................45

Figure 52 Total Premium Collection Growth Ratios........................................................46

Figure 53 Total Premium Collection Growth Ratios — By Issue Age Group.................46

• • • • •

Table 1 Study Sample — Number of Policies..................................................................11

Table 2 Study Sample — Face Amount...........................................................................11

Table 3 Whole Life Coverage Activity Reported During the Observation Period...........14

Table 4 Term Life Coverage Activity Reported During the Observation Period.............23

Table 5 Universal Life Coverage Activity Reported During

the Observation Period .......................................................................................30

Table 6 Variable Universal Life Coverage Activity Reported During

Observation Period .............................................................................................37

7

EXECUTIVE SUMMARY

For all individual life insurance products combined, lapse rates have increased from levels

observed in a previous LIMRA persistency study covering the mid-1990s experience period.

With the exception of the early years, policy lapse rates for the current study observation period

were higher across all durations. The overall lapse rate for the 2001-2002 observation period was

4.9% on a policy basis and 7.8% on a face amount basis.

Individual life insurance products experienced higher rates of lapse than either individual

disability income or individual long-term care insurance plans. And the difference is greatest for

policies in durations 5 through 10. In response to the poor performance of financial markets

during the observation period of the current study, many individual life carriers began to focus

new product development work on products with strong guarantees, including term, guaranteed

universal life, and even whole life. This resulted in replacement of both variable policies and

older, less competitive guaranteed products with more competitive newer products.

The overall lapse rate for whole life insurance plans was 3.9 on a policy basis and 5.8% on a face

amount basis. Policy lapse rates have increased slightly from the mid-1990 levels for all policy

years.

Total lapse rates for term insurance for all policy years combined were 10.2% on a policy basis

and 10.3% on a face amount basis. Experience has worsened slightly since the mid-1990s for

policies in years 11 and later; however, rates of lapsation have declined for policies in years 1

through 10. Some of the increase in lapses in the later years is attributable to shock lapses on

level premium term policies nearing the end of the level premium period.

Shock lapse rates (rates of lapse for policies near the end of the guaranteed level premium period)

for level-premium term plans included in the current study ranged from 30% to 50% and tended

to vary with the length of the guaranteed premium period.

The overall lapse rate for universal life (UL) products for all policy years combined was 5.3% on

both a policy basis and on a face amount basis. With the exception of policies in year 1, UL lapse

rates have increased from the levels seen in previous individual life persistency studies.

The overall lapse rate for variable universal life (VUL) plans covered by the current study was

8.5% on a policy basis and 8.8% on a face amount basis. Lapse rates have increased significantly

from levels observed during the mid-1990s. This is likely the result of the poor equity market

performance and continual volatility of returns over the observation period of the current study.

Many policyholders became disillusioned with variable products after seeing their cash values

shrink significantly. And, in the case of variable universal life plans, in many instances additional

unplanned premium payments were required to keep policies in force.

8

Premium persistency was also examined as part of this study. Premium payment ratios are

calculated as the ratio of actual premium paid (up to the planned or billed amount) to the planned

premium amount on policies that survive the observation period. Premium payment ratios have

increased slightly for policies in the first three years, but have decreased for policies that are in

duration 4 or later.

Excess premiums are defined as any amounts paid into universal life or variable universal life

policies greater than the planned premium for a given policy year. Excess premium ratios

(the ratio of amounts above the planned premium level to the planned premium amount) have

increased dramatically since the mid-1990s, especially for policies in their early years. Again,

during the observation period of the current study, the industry saw a good deal of replacement

of existing universal life and variable universal life policies with updated and more competitive

product designs. This may also explain some of the increased excess premium in early durations.

9

RECOMMENDATIONS

This report examines lapse experience on individual life products for a variety of policy and product

factors. The study can be used for industry benchmarking, as well as for background information for

the product development and planning process.

The data contained in this report can help companies identify factors that impact individual life

insurance persistency. However, since the participants in the current study do not represent the entire

industry and results for specific companies can vary, sometimes dramatically, these results should

be used only as a supplement to the experience of the individual carrier. Companies should carefully

consider underlying differences in distribution, product design, product development, and market

strategy between their own organizations and current study participants.

To aid the reader in interpreting the information contained in this report, an Excel spreadsheet, which

provides exposure information by lapse factor and data cell, is also available. The Excel file also

contains face amount lapse data for all policy factors discussed in this report.

10

METHODOLOGY

For purposes of this report, lapse includes termination for nonpayment of premium, insufficient cash

value, full surrender of a policy, transfer to reduced paid-up or extended term status, and terminations

for unknown reason. This is consistent with the definition of lapse applied for other LIMRA and

Society of Actuaries experience studies and allows for comparison of results over time.

Participants were asked to provide information on their entire in-force blocks and, except in cases

where a company’s volume of business was so large or its experience so different from that of other

participants that overall results would be unduly skewed, the lapse rates shown are based on 100% of

policies submitted by the company.

It should be noted that not all participants in the study contributed data for their entire in-force block

including all subsidiaries, product lines and policy years. In addition, several companies did not

provide data for all policy and product factors requested. Therefore, care should be taken in

interpreting results. The number of companies contributing to each lapse factor examined is indicated

in the appropriate report section.

Due to the scarcity of data provided, lapse experience could not be examined by distribution channel

for this or previous LIMRA persistency studies. We continue to work with participating companies to

try to increase the level of detail included in study data submissions.

The observation period for the study is calendar years 2001 and 2002. The data for this report was

collected on a policy level (seriatim) basis as this allows for a more detailed analysis of the factors

influencing lapse results than studies conducted on an aggregated data basis.

Lapse rates are calculated as follows:

Annualized Policy Lapse Rate = 100 x Number of Policies Lapsed During the Year

Number of Policies Exposed to Lapse During the Year

The number of policies exposed to lapse is based on the length of time the policy is exposed to the

risk of lapsation during the year. Lapses contribute exposure for the full 12 months. Terminations due

to death, expiry, maturity or conversion are not included in the amounts lapsing and contribute

exposure for only the fraction of the year they were in force.

Industry lapse rates are calculated as a weighted average of the experience of all contributing

companies, so companies with larger in-force blocks will affect the overall results more than

companies with smaller in-force blocks.

11

SAMPLE DESCRIPTION

Of the 22 companies participating in the study, 20 companies provided whole life data, 22 provided

term data, 12 provided universal life data, and six submitted variable universal life data. Tables 1 and

2 below show the number of exposure records and the associated face amount in force for each

product in the study sample. Some participants did not submit in force for all affiliated companies, all

product lines and observation years.

Table 1

Study Sample — Number of Policies

Issue year

Whole life

(20 cos.)

Term life

(22 cos.)

Universal life

(12 cos.)

Variable

universal life

(6 cos.)

Total

2001–2002 325,925 599,197 128,110 27,100 1,080,332

2000 604,479 738,210 115,910 26,041 1,484,640

1999 675,866 1,015,573 106,967 25,353 1,823,759

1998 678,666 892,267 93,594 32,916 1,697,443

1997 734,194 796,920 103,730 33,508 1,668,352

1994–1996 2,562,210 1,580,264 239,370 103,166 4,485,010

1989–1993 5,881,863 1,277,018 421,633 138,335 7,718,849

Pre 1989 35,911,304 1,515,596 870,354 79,071 38,376,325

Total 47,374,507 8,415,045 2,079,668 465,490 58,334,710

Table 2

Study Sample — Face Amount

In Millions

Issue year

Whole life

(20 cos.)

Term Life

(22 cos.)

Universal life

(12 cos.)

Variable

universal life

(6 cos.)

Total

2001–2002 31,640 207,102 42,052 12,226 293,020

2000 48,411 236,043 39,026 12,834 336,314

1999 54,585 224,375 35,325 9,302 323,587

1998 56,585 193,291 30,480 9,235 289,591

1997 64,890 162,262 25,644 8,237 261,033

1994–1996 208,075 314,462 46,989 18,918 588,444

1989–1993 442,773 235,133 56,466 18,945 753,317

Pre 1989 535,140 109,299 90,925 8,354 743,718

Total 1,442,099 1,681,967 366,907 98,051 3,589,024

12

OVERALL RESULTS

This report presents the results of a study of individual life insurance lapse experience in the United

States conducted jointly by LIMRA International and the Society of Actuaries. The study is based on

data provided by 22 individual life insurance companies and it presents lapse experience for whole

life, term life, universal life, and variable universal life plans traced through 2002. Premium

persistency under flexible premium payment products (universal life and variable universal life) is

also examined.

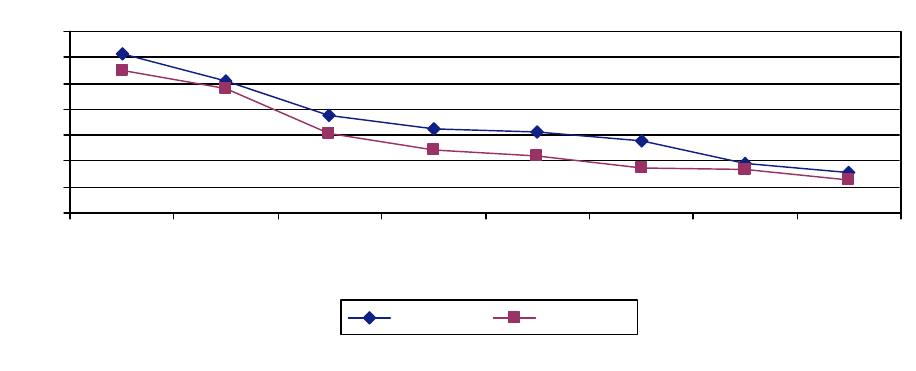

For all individual life insurance products combined, lapses have increased from mid-1990 levels.

This is consistent with industry-based policy lapse ratios calculated using annual statement data for

years 1995-1996 and 2001-2002. With the exception of the first two years, policy lapse rates for the

current study observation period were higher at all durations (Figure 1).

Figure 1

Individual Life Policy Lapse Rates

0%

2%

4%

6%

8%

10%

12%

1 2 3 4 5 6-10 11-20 21+

Policy Year

2001-2002 1994-1996

On a face amount basis, lapse rates emerged in a more level pattern by policy year with lower lapse

rates on a face amount basis for policies in the early years and higher lapse rates on a face amount

basis for policies in the later years (Figure 2).

13

Figure 2

Individual Life Face Amount Lapse Rates

0%

2%

4%

6%

8%

10%

12%

1 2 3 4 5 6-10 11-20 21+

Policy Face Amount

Individual life insurance products also experienced higher lapse rates than did either individual

disability income or individual long-term care insurance plans (Figure 3). During the observation

period of the current study, the financial markets were in significant turmoil as poor performance of

equity investments combined with all-time low interest rates. In response, many individual life

carriers began to focus new product development work on products with strong guarantees including

term, guaranteed universal life, and even whole life. This resulted in replacement of both variable

policies and older, less competitive guaranteed products with the newer more competitive options.

Figure 3

Individual Life versus Individual Disability and Long-Term Care Insurance

Lapse Experience

0%

2%

4%

6%

8%

10%

12%

1 2 3 4 5 6-10 11-20 21+

Policy Year

Individual Life Individual DI Individual LTC

14

WHOLE LIFE INSURANCE

This section of the report focuses on traditional whole life plans. However, the results include a small

number of graded premium life, interest-sensitive whole life, and modified life policies, as well.

Table 3 shows policy activity during the observation period for whole life plans.

Table 3

Whole Life Coverage Activity Reported During the Observation Period

Percentage of Policy Records Submitted

Coverage activity Percent of Policies

Lapse for full surrender or nonpayment of premium 3.3%

Death 1.2

Converted to another plan of insurance 0.4

Expiry/maturity 1.0

Remaining in force 94.1

Total 100.0%

The overall lapse rate for whole life insurance plans for all product designs and policy years

combined was 3.9% on a policy basis and 5.8% on a face amount basis. Figure 4 below shows policy

lapse rates by year for whole life plans from the 1994-1996 and 2001-2002 experience periods. Note

that lapse rates have increased slightly across all policy years. Some of this may be due to the

introduction of stronger no-lapse guarantees on some universal life plans. These newer universal life

products have become a source of competition for traditional whole life plans and may have led to

some replacement activity.

Figure 4

Whole Life Policy Lapse Rates

0%

2%

4%

6%

8%

10%

12%

14%

1 2 3 4 5 6-10 11-20 21+

Policy Year

2001-2002 1994-1996

15

On a face amount basis, whole life lapse rates tend to emerge in a more level pattern by policy year.

And, with the exception of the first year, face amount lapse rates have also increased at all durations

since the mid-1990s (Figure 5).

Figure 5

Whole Life Face Amount Lapse Rates

0%

2%

4%

6%

8%

10%

12%

14%

1 2 3 4 5 6-10 11-20 21+

Policy Year

2001-2002 1994-1996

And, as in past studies, during the first five years, smaller whole life policies were more likely to

lapse than larger policies (Figure 6).

Figure 6

Whole Life Lapse Rates by Policy Size

0%

2%

4%

6%

8%

10%

12%

14%

16%

123456-1011-2021+

Policy Year

Under $100,000 $100,000 and over

The remainder of the whole life section of this report looks at those policy and product features most

likely to affect lapse experience for whole life plans. These factors include gender, issue age, attained

age, premium payment mode, risk class, smoking status, and underwriting method.

16

GENDER

The whole life sample population is 60% male, 40% female on a policy basis and 75% male, 25%

female on a face amount basis. The average face amount for males is $40,000, while the average for

females is $26,000. Total policy lapse rates for females were slightly higher than for males with

differences seen in the early policy years (Figure 7).

Figure 7

Whole Life Policy Lapse Rates by Gender

Includes 19 Companies

0%

2%

4%

6%

8%

10%

12%

14%

1 2 3 4 5 6-10 11-20 21+

Policy Year

Males Females

ISSUE AGE

Lapse experience generally improves with increasing age at issue (Figure 8). The exception to this

is policies issued on individuals under the age of 20 whose lapse rates are closer to those of the age

30-39 and 40-49 issue age groups. This may be because premiums for these policies are paid by older

adult family members rather than the insureds themselves. So, the pattern of lapse may be more

closely tied to the age of the adult premium-payers.

17

Figure 8

Whole Life Policy Lapse Rates by Issue Age Group

Includes 18 Companies

0%

2%

4%

6%

8%

10%

12%

14%

16%

1 2 3 4 5 6-10 11-20 21+

Policy Year

Under 20 20-29 30-39 40-49 50-59 60 and older

ATTAINED AGE

Figure 9 shows policy lapse rates for various attained ages. Following a pattern very similar to the

data by issue age group, lapses decrease with increasing attained age. Again, the exception to this is

the case of policyholders under the age of 20.

Figure 9

Whole Life Policy Lapse Rates by Attained Age Group

Includes 17 Companies

0%

2%

4%

6%

8%

10%

12%

14%

16%

1 2 3 4 5 6-10 11-20 21+

Policy Year

Under 20 20-29 30-39 40-49 50-59 60 and older

18

PREMIUM PAYMENT MODE

As seen in previous studies of whole life persistency experience, lapse rates generally increase with

the number of premium payments made each year (Figure 10). Note that the exception to this rule is

policies paid on a monthly basis. This category includes policies billed on a direct basis, as well as

those paid through electronic fund transfer methods where the automatic nature of the transaction

tends to lead to improved policy persistency.

Figure 10

Whole Life Policy Lapse Rates by Premium Payment Mode

Includes 13 Companies

0%

5%

10%

15%

20%

25%

123456-1011-2021+

Policy Year

Annual Semiannual Quarterly Monthly

RISK CLASS

With the exception of the first policy year, where “buyer’s remorse” has the greatest impact on

lapsation, experience doesn’t vary significantly by risk class (Figure 11). The preferred classes

tended to have slightly better persistency than either the standard or substandard classes, especially

in the first policy year. At the latest policy durations, lapse levels are similar across the various risk

groups.

19

Figure 11

Whole Life Policy Lapse Rates by Risk Class

Includes 13 Companies

0%

2%

4%

6%

8%

10%

12%

14%

1 2 3 4 5 6-10 11-20 21+

Policy Year

Preferred Standard Substandard

SMOKING STATUS

Smokers and nonsmokers also exhibited similar rates of lapsation by policy year with nonsmokers

lapsing slightly more often than smokers in the early years and the opposite trend in later years

(Figure 12).

Figure 12

Whole Life Policy Lapse Rates by Smoking Status

Includes 17 Companies

0%

2%

4%

6%

8%

10%

12%

123456-1011+

Policy Year

NonSmokers Smokers

20

UNDERWRITING METHOD

Looking at results by the underwriting method used, policies issued with full medical underwriting or

on a paramedical basis exhibited the lowest rates of lapsation. Whole life policies issued on a

nonmedical basis (using a traditional nonmedical questionnaire with a complete set of medical

history questions) or on a simplified issue basis (with less than a full nonmedical screening)

experienced higher lapse rates for the first five policy years (Figure 13).

Figure 13

Whole Life Policy Lapse Rates by Underwriting Method

Includes 14 Companies

0%

5%

10%

15%

20%

1 2 3 4 5 6-10 11-20 21+

Policy Year

Medical Paramedical Non Medical Simplified Issue

21

SINGLE PREMIUM WHOLE LIFE

Six companies provided data on single premium whole life insurance plans. For these companies,

single premium products experienced significantly lower rates of lapse than recurring premium

products (Figure 14).

Figure 14

Single Premium Whole Life Policy Lapse Rates

0%

2%

4%

6%

8%

10%

12%

14%

1 2 3 4 5 6-10 11+

Policy Year

Single Premium Whole Life Recurring Premium Whole Life

And, single premium lapses are even lower on a face amount basis than on a policy count basis

(Figure 15).

Figure 15

Single Premium Whole Life Face Amount Lapse Rates

0%

1%

2%

3%

123456-1011+

Policy Year

Policy Lapse Rates Face Amount Lapse Rates

22

Overall lapse rates for single premium whole life plans were similar for males and females. However,

there was some variance in the results by duration on both a policy count and a face amount basis

(Figures 16 and 17).

Figure 16

Single Premium Whole Life Policy Lapse Rates by Gender

0%

1%

2%

3%

123456-1011+

Policy Year

Males Females

Figure 17

Single Premium Whole Life Face Amount Lapse Rates by Gender

0%

1%

2%

3%

123456-1011+

Policy Year

Males Females

23

TERM LIFE INSURANCE

This portion of the report contains experience for annually renewable term and level-premium term

plans combined. The exposure for early policy years is predominantly level-premium term, while the

exposure for policy years 15 and later consists of mostly annually renewable term policies.

Some participating company term data submissions included level term insurance that had reached

the end of the level premium period during the experience period of the study. Wherever possible,

these blocks were identified and policies that were near the end of the level-premium term period

were excluded for purposes of examining total term lapse rates. However, these policies were later

reviewed in an attempt to estimate end-of-guarantee period shock lapse rates for level-premium term

products.

Table 4 shows policy activity during the observation period for term insurance policies.

Table 4

Term Life Coverage Activity Reported During the Observation Period

Percentage of Policy Records Submitted

Termination activity Percent of Policies

Lapse for nonpayment of premium 9.5%

Death 0.2

Converted to another plan of insurance 0.9

Expiry/maturity 0.1

Remaining in force 89.3

Total 100.0%

Total lapse rates for term insurance products for all policy years combined was 10.2% on a policy

basis and 10.3% on a face amount basis. Figure 18 below shows policy lapse rates by year for term

life plans from the 1994-1996 and 2001-2002 experience periods. Experience has worsened slightly

for policies in years 11 and later; however, term rates of lapsation have decreased for policies in

years 1 through 10. The increase in term lapse rates seen in durations 11 and later is due at least in

part to shock lapses on level-premium term business as not all participating companies were able to

separately identify this business.

24

Figure 18

Term Life Policy Lapse Rates

0%

2%

4%

6%

8%

10%

12%

14%

123456-1011-2021+

Policy Year

2001-2002 1994-1996

The trend in experience is similar on a face amount basis, but lapse rates are lower in the first few

policy years (Figure 19).

Figure 19

Term Life Face Amount Lapse Rates

0%

2%

4%

6%

8%

10%

12%

14%

16%

1 2 3 4 5 6-10 11-20 21+

Policy Year

2001-2002 1994-1996

As with the whole life products, the remainder of the term insurance section of the report looks at

those policy and product features most likely to affect lapse experience for term life plans. These

factors include gender, issue age, attained age, premium payment mode, risk class, smoking status,

and underwriting method.

25

GENDER

The term sample is 40% female, 60% male by policy count and 25% female, 75% male by face

amount. The average face amount for females was $140,000 and the average face amount for males

was $240,000. For term insurance plans, females exhibited better persistency than males did across

all policy years (Figure 20).

Figure 20

Term Life Policy Lapse Rates by Gender

Includes 22 Companies

0%

2%

4%

6%

8%

10%

12%

14%

1 2 3 4 5 6-10 11-20 21+

Policy Year

Males Females

ISSUE AGE

Term insurance policy lapse rates do not vary as much by issue age group as permanent policies do

(Figure 21). Total lapse rates are highest at the youngest and oldest ages, including individuals under

30 and over 60 years of age at issue. Young and healthy policyholders were likely replacing their

existing policies at more competitive rates, while older policyholders may have been lapsing due to

less perceived need for life insurance protection combined with the fact that rates can become

prohibitively expensive at the higher ages. Lapse experience was very similar for issue ages between

30 and 60, with approximately 10% of policies lapsing each year for the first 10 to 20 years.

26

Figure 21

Term Life Policy Lapse Rates by Issue Age Group

Includes 21 Companies

0%

5%

10%

15%

20%

25%

123456-1011+

Policy Year

Under 30 30-39 40-49 50-59 60 and over

ATTAINED AGE

Figure 22 shows policy lapse rates for various attained ages and indicates that in a pattern very

similar to the experience by issue age, lapses are relatively level at around 10% until years 11 and

later. Again, the exception to this is individuals under the age of 30 who exhibited poorer persistency.

Figure 22

Term Life Policy Lapse Rates by Attained Age Group

Includes 19 Companies

0%

5%

10%

15%

20%

25%

123456-1011+

Policy Year

Under 30 30-39 40-49 50-59 60 and over

27

PREMIUM PAYMENT MODE

In a pattern similar to other individual life insurance products, lapse rates for term insurance

generally increase with the number of premium payments made each year (Figure 23). Again, as with

whole life insurance plans, the exception is policies paid on a monthly basis. This category includes

both policies billed on a direct basis and those paid through electronic fund transfer methods where

the automatic nature of the transaction can lead to improved policy persistency.

Figure 23

Term Life Policy Lapse Rates by Premium Payment Mode

Includes 18 Companies

0%

5%

10%

15%

20%

25%

1 2 3 4 5 6-10 11-20 21+

Policy Year

Annual Semiannual Quarterly Monthly

RISK CLASS

Term insurance policies that were classified as substandard risks at issue had higher rates of lapsation

than policies issued as standard or preferred risks for most policy years (Figure 24). In the later

policy years, lapse rates for substandard policies are significantly greater. This may be a data

anomaly as the sample size for durations 11 and later is relatively small, representing only 13% of

the total exposure for substandard cases.

28

Figure 24

Term Life Policy Lapse Rates by Risk Classification

Includes 18 Companies

0%

5%

10%

15%

20%

25%

30%

1 2 3 4 5 6-10 11-20 21+

Policy Year

Preferred Standard Substandard

SMOKING STATUS

Smokers lapsed more often than nonsmokers at all policy durations (Figure 25). For term insurance

buyers, price is often the key consideration in the purchase and retention of a policy. It is possible

that smokers either found their policies too expensive to maintain or they may have found more

competitive smoker rates through new product offerings.

Figure 25

Term Life Policy Lapse Rates by Smoking Status

Includes 21 Companies

0%

5%

10%

15%

20%

1 2 3 4 5 6-10 11-20 21+

Policy Year

NonSmokers Smokers

29

UNDERWRITING METHOD

Looking at results by the underwriting method used, like whole life insurance, term policies with

more rigorous underwriting requirements tended to have better persistency than those issued on a

nonmedical basis (using a traditional nonmedical questionnaire with a complete set of medical

history questions) (Figure 26). Again, this is likely the result of greater focus by term insurance

buyers on price. Generally, a more thorough underwriting process allows the life insurance carrier to

offer its healthy customers the lowest prices.

Figure 26

Term Life Policy Lapse Rates by Underwriting Method

Includes 12 Companies

0%

2%

4%

6%

8%

10%

12%

14%

16%

123456-1011-2021+

Policy Year

Medical Paramedical NonMedical

30

UNIVERSAL LIFE INSURANCE

This section examines lapse experience for universal life policies issued during 2002 and earlier. As

a result, the underlying data consists mostly of traditional current assumption universal life product

designs. However, a portion of the policies in the first three policy years during the study observation

period were issued with the strong no-lapse guarantees that have become popular in the universal life

marketplace over the past several years.

Table 5 shows policy activity during the observation period for universal life plans.

Table 5

Universal Life Coverage Activity Reported During the Observation Period

Percentage of Policy Records Submitted

Termination activity Percent of Policies

Lapse for full surrender or insufficient cash value 5.1%

Death 0.7

Converted to another plan of insurance 0.0

Expiry/maturity 0.0

Remaining in force 94.2

Total 100.0%

The overall lapse rate for universal life products for all policy years combined was 5.3% on both a

policy basis and on a face amount basis. Figure 27 below shows policy lapse rates by year for

universal life plans from the 1994-1996 and 2001-2002 experience periods. With the exception of

year 1, policy lapse rates have increased from the levels seen in the mid-1990s. This is likely related

both to the increased level of new product development in the universal life market, as well as the

continued low interest environment and its impact on universal life policy cash values.

31

Figure 27

Universal Life Policy Lapse Rates

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

1 2 3 4 5 6-10 11+

Policy Year

2001-2002 1994-1996

For policies in years 1 through 10, lapse rates are lower on a face amount basis than on a policy

basis, indicating that smaller policies tended to lapse more often than larger policies (Figures 28 and

29). However, for policies in years 11 and later, the trend reverses.

Figure 28

Universal Life Face Amount Lapse Rates

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

123456-1011+

Policy Year

2001-2002 1994-1996

32

Figure 29

Universal Life Lapse Rates by Policy Size

0%

2%

4%

6%

8%

10%

12%

123456-1011+

Policy Year

Under $100,000 $100,000 and over

GENDER

Universal life policies in the current sample are distributed 65% male and 35% female by policy

count and 70% male and 30% female by face amount. The average face amount for males is

$185,000, while the average for females is $155,000. On a policy basis, rates of lapsation for female

universal life policyholders are generally higher than those of males during the first 10 policy years

(Figure 30).

Figure 30

Universal Life Policy Lapse Rates by Gender

Includes 12 Companies

0%

2%

4%

6%

8%

10%

1 2 3 4 5 6-10 11+

Policy Year

Males Females

33

However, on a face amount basis, with female policyholder’s smaller average size, women generally

had lower lapse rates than their male counterparts (Figure 31).

Figure 31

Universal Life Face Amount Lapse Rates by Gender

Includes 12 Companies

0%

2%

4%

6%

8%

10%

123456-1011+

Policy Year

Males Females

ISSUE AGE

For universal life insurance products covered by the current study, lapse rates generally decrease with

increasing issue age across all policy years. In a pattern similar to other individual life insurance

products, the exception to this is the case where the policyholder is under age 20 at issue (Figure 32).

Figure 32

Universal Life Policy Lapse Rates by Issue Age Group

Includes 12 Companies

0%

2%

4%

6%

8%

10%

12%

14%

16%

123456-1011+

Policy Year

Under 20 20-29 30-39 40-49 50-59 60 and over

34

ATTAINED AGE

As with other individual life insurance products, lapse experience is very similar on an issue age

and an attained age basis (Figure 33). In general, older policyholders have significantly higher

persistency than younger policyholders, regardless of when the policy was issued.

Figure 33

Universal Life Policy Lapse Rates by Attained Age Group

Includes 12 Companies

0%

2%

4%

6%

8%

10%

12%

14%

16%

123456-1011+

Policy Year

Under 20 20-29 30-39 40-49 50-59 60 and over

RISK CLASS

For recently issued cases (in policy years 4 and earlier during the observation period of the study),

those issued on a preferred basis exhibited lower rates of lapsation than those issued on a standard

basis (Figure 34). The trend then reverses itself for policies in years 5 and later. Universal life

policies issued on a substandard basis generally had the most favorable persistency experience.

Figure 34

Universal Life Policy Lapse Rates by Risk Class

Includes 7 Companies

0%

2%

4%

6%

8%

10%

123456-1011+

Policy Year

Preferred Standard Substandard

35

SMOKING STATUS

The universal life sample for the current study is over 90% nonsmoker and lapse rates for smokers

are significantly higher than for nonsmokers on both a policy and a face amount basis (Figure 35).

Figure 35

Universal Life Policy Lapse Rates by Smoking Status

Includes 11 Companies

0%

2%

4%

6%

8%

10%

12%

14%

123456-1011+

Policy Year

Non Smokers Smokers

UNDERWRITING METHOD

As with whole life and term insurance, universal life insurance policies issued on a nonmedical basis

exhibited higher rates of lapse than policies that underwent a more rigorous underwriting process

(Figure 36). The nonmedical category includes policies sold at the worksite or through direct

response channels. It also includes a small sample of universal life policies that were converted from

term insurance plans.

Figure 36

Universal Life Policy Lapse Rates by Underwriting Method

Includes 7 Companies

0%

2%

4%

6%

8%

10%

12%

14%

123456-1011+

Policy Year

Medical Paramedical Non Medical

36

DEATH BENEFIT OPTION

The universal life policy sample for the study is split approximately 75% level death benefit and 25%

level net amount at risk. There is little difference in lapse experience by death benefit option;

however, on a policy basis, lapse rates tended to be slightly higher for policies that had elected the

level net amount at risk (Figure 37). Experience is very similar on a face amount basis (Figure 38).

Figure 37

Universal Life Policy Lapse Rates by Death Benefit Option

Includes 8 Companies

0%

2%

4%

6%

8%

10%

123456-1011+

Policy Year

Level Death Benefit Level Net Amount at Risk

Figure 38

Universal Life Face Amount Lapse Rates by Death Benefit Option

Includes 8 Companies

0%

2%

4%

6%

8%

10%

123456-1011+

Policy Year

Level Death Benefit Level Net Amount at Risk

37

VARIABLE UNIVERSAL LIFE INSURANCE

The variable universal life insurance portion of this report is based on data submitted by six VUL

carriers. Table 6 shows policy activity during the observation period for variable universal life plans.

Table 6

Variable Universal Life Coverage Activity Reported During Observation Period

Percentage of Policy Records Submitted

Termination activity Percent of Policies

Lapse for full surrender or insufficient cash value 8.2%

Death 0.3

Converted to another plan of insurance 0.0

Expiry/maturity 0.0

Remaining in force 91.5

Total 100.0%

The overall lapse rate for variable universal life plans covered by the current study was 8.5% on a

policy basis and 8.8% on a face amount basis. Figure 39 below shows policy lapse rates by year for

variable universal life plans from the 1994-1996 and 2001-2002 experience periods. Note that lapse

rates were significantly higher during the 2001-2002 period of observation. This is likely the result of

the poor equity market performance and continual volatility of returns over the observation period of

the current study. Many policyholders had become disillusioned with variable products after seeing

their account values plummet. And, in the case of variable universal life plans, in many instances,

additional unplanned premium payments were required to keep policies in force.

38

Figure 39

Variable Universal Life Policy Lapse Rates

0%

2%

4%

6%

8%

10%

12%

14%

123456-1011+

Policy Year

2001-2002 1994-1996

Rates of lapsation for variable universal life plans were generally lower on a face amount basis than

on a policy basis — indicating a tendency for smaller policies to lapse (Figure 40).

Figure 40

Variable Universal Life Face Amount Lapse Rates

0%

2%

4%

6%

8%

10%

12%

14%

123456-1011+

Policy Year

Policy Count Face Amount

39

GENDER

Variable universal life policies in the current sample are distributed 60% male and 40% female by

policy count and 66% male and 34% female by face amount. The average face amount for males is

$225,000, while the average for females is $180,000. In contrast to universal life insurance

experience, on a policy basis, rates of lapsation for male variable universal life policyholders are

generally higher than those of females for all policy years (Figure 41). And, with the exception of

policies in force for longer than 10 years, the same relationship is seen on a face amount basis

(Figure 42).

Figure 41

Variable Universal Life Policy Lapse Rates by Gender

Includes 6 Companies

0%

2%

4%

6%

8%

10%

12%

14%

123456-1011+

Policy Year

Males Females

Figure 42

Variable Universal Life Face Amount Lapse Rates by Gender

Includes 6 Companies

0%

2%

4%

6%

8%

10%

12%

14%

1 2 3 4 5 6-10 11+

Policy Year

Males Females

40

ISSUE AGE

As with other permanent individual life insurance products, variable universal life insurance lapse

rates are highest at issue ages 20-29 and lowest at issue ages over 60 (Figure 43).

Figure 43

Variable Universal Life Policy Lapse Rates by Issue Age Group

Includes 6 Companies

0%

5%

10%

15%

20%

123456-1011+

Policy Year

<20 20-29 30-39 40-49 50-59 60 and over

ATTAINED AGE

We see a similar pattern of lapse by policy year and attained age (Figure 44).

Figure 44

Variable Universal Life Policy Lapse Rates by Attained Age Group

Includes 4 Companies

0%

5%

10%

15%

20%

123456-1011+

Policy Year

<20 20-29 30-39 40-49 50-59 60 and over

41

RISK CLASS

The variable universal life policies in the current study are approximately 10% preferred and 90%

standard or substandard by underwriting category. Like universal life, lapse rates for variable

universal life insurance policies issued on a preferred basis are lower than lapse rates for policies

issued on a standard basis at most policy durations (Figure 45).

Figure 45

Variable Universal Life Policy Lapse Rates by Underwriting Class

Includes 6 Companies

0%

2%

4%

6%

8%

10%

12%

14%

16%

123456-1011+

Policy Year

Preferred Standard

SMOKING STATUS

Approximately 15% of variable universal life policies in the current study were issued with smoker

rates, while 85% were issued on a nonsmoker basis. Like traditional universal life insurance, for

variable universal life products, lapse rates for smokers are higher than nonsmokers (Figure 46).

Figure 46

Variable Universal Life Policy Lapse Rates by Smoking Status

Includes 5 Companies

0%

2%

4%

6%

8%

10%

12%

14%

16%

1 2 3 4 5 6-10 11+

Policy Year

Non Smokers Smoker

42

PREMIUM PERSISTENCY EXPERIENCE FOR

FLEXIBLE PREMIUM PRODUCTS

For universal life and variable universal life plans, which allow for flexible premium payments,

product profitability is impacted by both the rate of surrender or lapse, as well as the premium

persistency and cash flow patterns. Six participating carriers were able to provide data to support a

review of premium persistency for universal life and variable universal life products.

This section of the report will examine the following premium persistency measures for UL and VUL

plans:

• Premium Payment Ratio

• Excess Premium Ratio

• Total Premium Collections Growth Ratio

These measures are defined and discussed in detail in the LIMRA report Universal Life: A New

Approach to Measuring Premium Persistency (1985).

PREMIUM PAYMENT RATIO

The premium payment ratio measures the rate of premium payment up to the planned level on only

those policies that are in force at the end of the observation period. Premium payments are calculated

at the individual policy level and can be used to determine where lapses are likely to occur in order to

help companies design and focus their conservation efforts. Policies that pay smaller percentages of

the planned premium than in prior years may be close to lapse or surrender. The rates could either be

tracked for an entire block of business or at the individual policy level.

Premium payment ratios for flexible premium products are shown in Figure 47 below for both the

current study and an earlier study that LIMRA published in 2001. Note that premium payment ratios

have increased somewhat for business in the first three years, but have decreased overall for policies

that are in years 4 and later. This may be due at least in part to the fact that the majority of business

underlying both samples is universal life. This business includes some of the newer UL plans sold

with strong no lapse guarantees. In order to maintain the death benefit guarantee, policyholders are in

essence required to make payments at or above the no-lapse premium level. And, since the

guaranteed premium level is often higher than the minimum premium or billed amount, this may

have contributed to some of the increased funding in the early durations. In addition, it should be

noted that, since these two samples do not represent an identical group of contributing companies,

some differences are due to variations in individual carrier experience.

43

Figure 47

Premium Payment Ratios

Flexible Premium Products

0%

20%

40%

60%

80%

100%

123456-10

Policy Year

2001-2002 1995-1996

Males generally paid a greater portion of the planned premium than females did during the

observation period of the current study (Figure 48).

Figure 48

Premium Payment Ratios — Males versus Females

Flexible Premium Products

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

123456-10

Policy Year

Males Females Total

44

And, looking at all policy years combined, premium payment ratios increase with age at issue until

about age 55 when they begin to fall off again (Figure 49).

Figure 49

Premium Payment Ratios — By Issue Age Group

Flexible Premium Products

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

Under 20 20-29 30-39 40-49 50-59 60 and older

EXCESS PREMIUM RATIO

Excess premiums are defined as any amounts paid into a universal life or variable universal life

policy greater than the planned premium for a given policy year. For policies in their first year,

excess premiums often stem from cash value rollovers due to internal or external replacements. In

renewal years, policyholders may “dump in” additional premium in order to take advantage of

competitive credited rates or favorable market returns. Or, as in recent years, additional premium

payments may be required to keep the policy in force during market downturns. The excess premium

ratio is equal to the ratio of excess premiums collected for the given policy year to expected planned

premiums for that year.

Figure 50 shows excess premium ratios for flexible premium products in the current study, as

compared to rates experienced during the mid 1990s. Note that excess premium rates have increased

significantly, especially in the early policy years. And, as in past studies, the vast majority of excess

premium is paid during the first few policy years. As mentioned earlier, the majority of policies

underlying these results are universal life plans. And, during the observation period of the current

study, there was a good deal of replacement of existing universal life and variable universal life

policies with updated and more competitive product designs, which may explain some of the

increased excess premium in early durations.

45

Figure 50

Excess Premium Ratios

Flexible Premium Products

0%

20%

40%

60%

80%

100%

120%

140%

160%

1 2 3 4 5 6-10

Policy Year

2001-2002 1995-1996

For the policies underlying the current study, excess premium ratios increased significantly with

increasing age at issue (Figure 51). Although premium payment ratios fall off for issues ages over 50,

excess premium ratios continue to increase. This is due to the fact that calculations are made at the

individual policy level and then aggregated and the largest deposits of excess premium tend to be

made by older buyers likely through rollovers from existing plans.

Figure 51

Excess Premium Ratios — By Issue Age Group

Flexible Premium Products

0%

20%

40%

60%

80%

Under 20 20-29 30-39 40-49 50-59 60 and older

46

TOTAL PREMIUM COLLECTION GROWTH RATIO

The final cash flow measure to be discussed is the total premium collection growth ratio, defined

as the ratio of the premiums collected in the current policy year to the premiums collected in the

previous policy year. Note that, in line with experience on planned and excess premium payment

ratios, total premium collection ratios have increased since the mid-1990s (Figure 52). For the six

companies that provided data for the study of premium persistency experience, total premium

collection for the current year now exceeds amounts collected in the prior year for most policy

durations.

Figure 52

Total Premium Collection Growth Ratios

Flexible Premium Products

0%

20%

40%

60%

80%

100%

120%

140%

23456-10

2001-2002 1995-1996

Overall, year over year premium collections generally decrease with increasing age at issue and this

pattern is consistent across all policy years (Figure 53).

Figure 53

Total Premium Collection Growth Ratios — By Issue Age Group

Flexible Premium Products

0%

20%

40%

60%

80%

100%

120%

140%

160%

180%

Under 20 20-29 30-39 40-49 50-59 60 and older

47

PARTICIPATING COMPANIES

Amerus

CNA

Equitable Life Insurance Company

Farm Family Life

Federated Life

Government Personnel Mutual Life

Guardian Life Insurance Company of America

Hartford Life

Horace Mann

Liberty Mutual Life

Manulife

MassMutual

MetLife

MONY

New York Life

Northwestern Mutual Life

Phoenix Life

Prudential

SunLife

TIAA-CREF

Travelers Life and Annuity

USAA

48

RELATED LINKS

The following links are valid as of 12/31/05.

LIMRA

Individual Life Insurance Persistency (2001)

This study examines individual life insurance persistency experience for 13 participating U.S.

companies. The report provides lapse rates separately for traditional whole life, term, universal life,

and variable universal life products. Lapse results are reviewed for a variety of policy and product

features, which explains some of the variations in experience from one study period to the next.

http://www.limra.com/members/abstracts/3506.aspx

Finding New Customers: Who is Buying Individual Life and Why? (2005)

This report is the first in a series of reports exploring the attitudes and opinions of recent individual

life buyers. It defines the differences in the wants and needs of buyers of different age and income

groups. It explores why consumers from different backgrounds buy insurance, what they are looking

for in a policy and how this shapes the type of product they buy.

http://www.limra.com/members/abPdf/4909.pdf

A Universal Challenge: The Future of Flexible Premium Products (2005)

This report presents an overview of the market for universal life (UL) and variable universal life

(VUL) products based on data collected from 26 companies representing nearly 70% of the UL and

VUL sales in 2004 and supplemented by data from LIMRA's Individual life Insurance Sales survey.

Trends in product design, distribution, sales results, and producer compensation are examined.

http://www.limra.com/abstracts/4943.asp

US Individual Life Insurance Sales, 2005 3rd quarter (2005)

This report tracks individual life insurance sales results measured by annualized premiums, face

amount, and number of policies, with results reported separately for various distribution systems.

Contributors include 76 U.S. companies and their 83 subsidiaries. The study tracks separate data for

individual products such as universal life, term, variable life, variable universal life, survivorship life,

and whole life. The survey also tracks universal life interest-rate data.

http://www.limra.com/members/abPdf/4894.pdf

49

US Individual Life Insurance Sales Trends, 1975-2004 (2005)

This report provides industry estimates of individual life insurance sales results measured by

annualized premiums, face amount, and number of policies.

http://www.limra.com/members/abPdf/1746.pdf

US Long-Term Care Insurance Persistency Experience (2004)

This report represents the first study conducted jointly by LIMRA International and the Society of

Actuaries (SOA) Long-Term Care Experience Committee that focuses on long-term care insurance

(LTCI) persistency. The study examines voluntary lapse and total termination activity for calendar

years 2000 and 2001. Overall, the results indicate that LTCI persistency has continued to improve;

however, the current improvement seems to be coming from the individual lines of business rather

than the group lines.

http://www.limra.com/members/abPdf/4482.pdf

Individual Disability Income Insurance Lapse Experience (2004)

This report examines individual disability income lapse experience including both guaranteed

renewable and noncancelable business. Eight of the major individual DI writers submitted data

representing experience for years 1999 through 2001.

http://www.limra.com/members/abPdf/4661.pdf

Non-LIMRA

1984-2001 Long-Term Care Experience Committee’s Intercompany Study

Based on data from twelve participating companies, this report represents the first study of lapse

experience for Canadian Universal Life Level Cost of Insurance plans.

http://www.soa.org/ccm/content/areas-of-practice/special-interest-sections/long-term-care-

insurance/actuarial/papers-presentations-research-resources/1984-2001-long-term-care-experience-committees-

intercompany-study/