University of Nebraska - Lincoln University of Nebraska - Lincoln

DigitalCommons@University of Nebraska - Lincoln DigitalCommons@University of Nebraska - Lincoln

Honors Theses Honors Program

5-2024

Delta Air Lines Strategic Audit Delta Air Lines Strategic Audit

Victoria Diersen

University of Nebraska-Lincoln

Rebecca Koppelman

University of Nebraska-Lincoln

Nicholas Lauver

University of Nebraska-Lincoln

Aaryan Naik

University of Nebraska-Lincoln

Drake Vorderstrasse

University of Nebraska-Lincoln

Follow this and additional works at: https://digitalcommons.unl.edu/honorstheses

Part of the Business Administration, Management, and Operations Commons, Gifted Education

Commons, Higher Education Commons, and the Management Sciences and Quantitative Methods

Commons

Diersen, Victoria; Koppelman, Rebecca; Lauver, Nicholas; Naik, Aaryan; and Vorderstrasse, Drake, "Delta

Air Lines Strategic Audit" (2024).

Honors Theses

. 703.

https://digitalcommons.unl.edu/honorstheses/703

This Thesis is brought to you for free and open access by the Honors Program at DigitalCommons@University of

Nebraska - Lincoln. It has been accepted for inclusion in Honors Theses by an authorized administrator of

DigitalCommons@University of Nebraska - Lincoln.

Delta Air Lines Strategic Audit

An Undergraduate Honors Thesis

Submitted in Partial Fulfillment of

University Honors Program Requirements

University of Nebraska-Lincoln

by

Victoria Diersen, BS

Economics

College of Business

Rebecca Koppelman, BS

Economics, Supply Chain Management

College of Business

Nicholas Lauver, BS

Actuarial Science, Finance

College of Business

Aaryan Naik, BS

Economics

College of Business

Drake Vorderstrasse, BS

Finance

College of Business

May 1, 2024

Faculty Mentor:

Tammy E. Beck, PhD, Management

Delta Air Lines Strategic Audit Page 2

Abstract

This case study focuses on Delta Air Lines, a prominent company in the airline industry. We

conducted a strategic audit utilizing theories and principles central to strategic management to

complete the case study. Our research used publicly available information that included the

company’s website, SEC filings, news articles, and industry analysis. The goal of this case

study is to collect and analyze data, apply strategic management concepts to a contemporary

organization, and evaluate the firm’s potential for competitive advantage.

We looked at many factors for Delta Air Lines, including firm analysis, industry analysis, external

analysis, internal analysis, performance analysis, competitive dynamics, business level strategy,

corporate level strategy, and strategic decision making. Using these factors, we created a

comprehensive audit that focuses on Delta Air Lines’ core competencies and evaluates the

company on how well it leverages its strengths. Our competitive analysis also focused on the

company’s key competitor, American Airlines. This strategic audit of Delta Air Lines covers its

overall strategy and industry-specific methods for success. Information about the broad

business environment and industry-specific insights are used to create a comprehensive

understanding of the firm. Our audit has found that Delta Air Lines’ operational excellence,

brand strength, competitive advantage, and financial performance have well-positioned the firm

in the industry to continue its success and increase its profitability in the coming years.

Key Words: Delta Air Lines, Airline Industry, Domestic Airlines, Strategic Management, Strategic

Audit, Case Study

Delta Air Lines Strategic Audit Page 3

Table of Contents

Executive Summary .................................................................................................................. 5

Industry and Firm Overview ..................................................................................................... 6

History ................................................................................................................................... 6

Business Preview .................................................................................................................. 7

Mission, Vision, Values, and Ethics ....................................................................................... 7

Leadership ............................................................................................................................ 7

Company Outlook ................................................................................................................. 8

External Analysis ...................................................................................................................... 9

General Environment ............................................................................................................ 9

Political ............................................................................................................................ 9

Economical ...................................................................................................................... 9

Social ............................................................................................................................ 10

Technological ................................................................................................................ 10

Environmental ............................................................................................................... 10

Legal ............................................................................................................................. 10

Industry Environment .......................................................................................................... 11

Porter’s Five Forces ............................................................................................................ 12

Threat of New Entry: ...................................................................................................... 12

Threat of Substitutes: .................................................................................................... 12

Power of Suppliers: ....................................................................................................... 12

Power of Buyers: ........................................................................................................... 12

Intensity of Competitive Rivalry:..................................................................................... 13

Industry Concentration ........................................................................................................ 13

Internal Analysis ..................................................................................................................... 14

Resources and Capabilities ................................................................................................. 14

Hub and Spoke Model: .................................................................................................. 14

Labor Relations: ............................................................................................................ 14

Aircraft Fleet: ................................................................................................................. 15

Strategic Alliances and Partnerships: ............................................................................ 15

Competitive Positioning ....................................................................................................... 15

Core Competencies............................................................................................................. 16

SWOT Analysis ................................................................................................................... 16

Performance Analysis ............................................................................................................ 17

Firm Performance ............................................................................................................... 17

Key Performance Indicators ................................................................................................ 18

Employee Satisfaction ................................................................................................... 18

Employee Engagement ........................................................................................... 18

Turnover Rates ........................................................................................................ 18

Customer Satisfaction ................................................................................................... 19

Delta Air Lines Strategic Audit Page 4

Competitive Advantage ....................................................................................................... 19

Financial Compensation ...................................................................................................... 19

Competitive Dynamics ............................................................................................................ 20

Key Competitor: American Airlines ...................................................................................... 20

Competitor Mission and Values ..................................................................................... 20

Competitor Resources ................................................................................................... 20

Product and Geographic Market .................................................................................... 21

Performance Relative to Industry ................................................................................... 21

Performance Relative to Delta ....................................................................................... 22

Competitive Strategic Actions .............................................................................................. 22

Delta Pilot Recruitment .................................................................................................. 22

American Airlines Winter Capacity ................................................................................. 22

Business Level Strategy ......................................................................................................... 23

Market Approach ................................................................................................................. 23

Broad Differentiation............................................................................................................ 23

Strengths and Weaknesses of Broad Differentiation ...................................................... 24

Corporate Level Strategy........................................................................................................ 24

Vertical Integration .............................................................................................................. 24

Corporate Diversification ..................................................................................................... 25

Mergers and Acquisitions .................................................................................................... 26

Corporate Governance ........................................................................................................... 27

Board of Directors Structure ................................................................................................ 27

Large Stockholders and Employee Ownership .................................................................... 27

Recent Shareholder Votes .................................................................................................. 27

Current Organizational Structure ......................................................................................... 28

Control Systems .................................................................................................................. 28

Recent Strategic Decision Analysis ...................................................................................... 29

Appendices ............................................................................................................................. 30

Appendix A: Leadership Committee Bios ............................................................................ 30

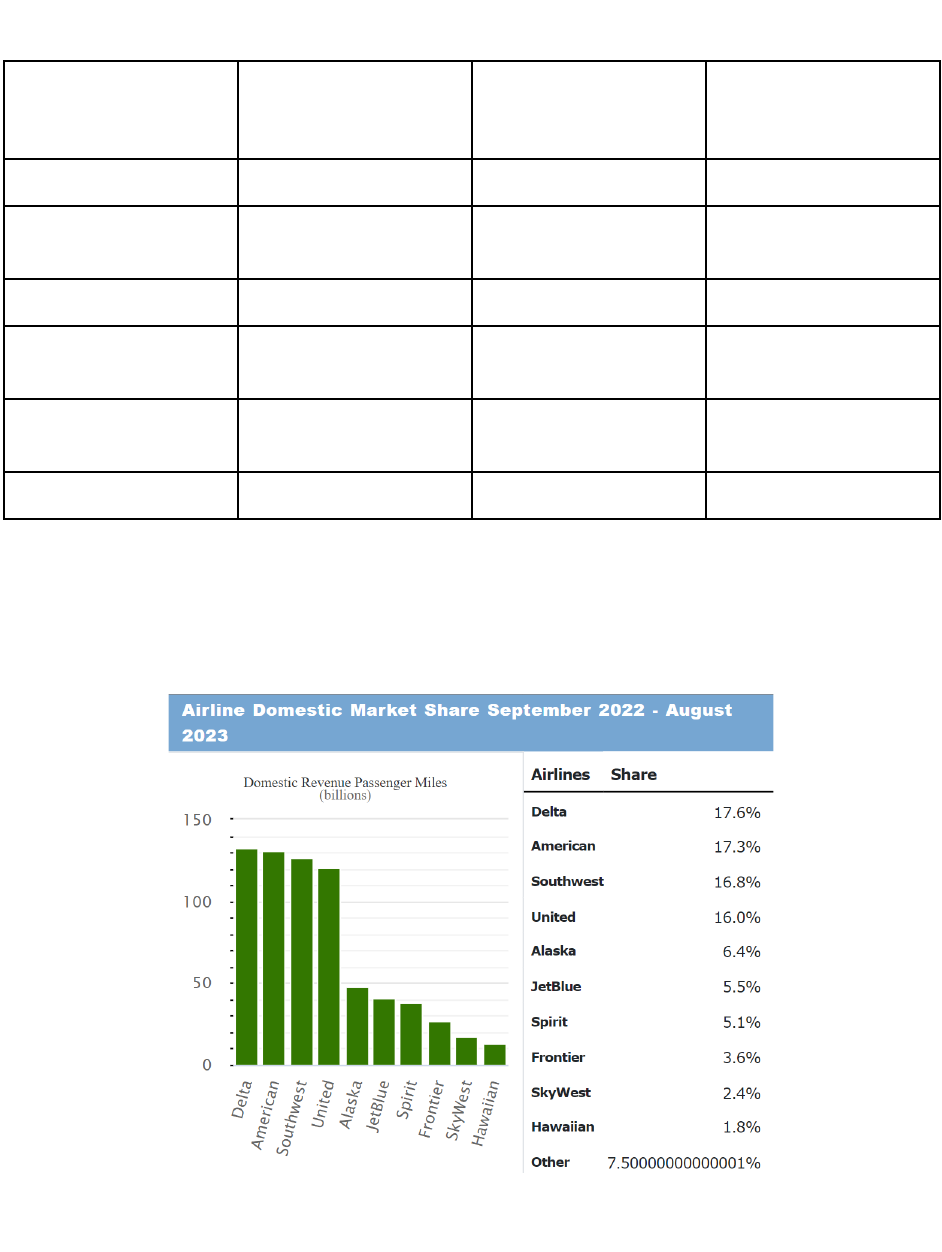

Appendix B: 2022 Industry Revenue Split and Market Share .............................................. 31

Appendix C: North American Carriers’ 2022 On-Time Performance .................................... 32

Appendix D: Delta U.S. Customer Satisfaction % from 1995 to 2021 .................................. 33

Appendix E: Delta Stock Returns & Earnings Per Share ..................................................... 34

Appendix F: 2021 Compensation Mix .................................................................................. 35

Appendix G: VRIO Analysis Grid ......................................................................................... 36

Appendix H: Vertical Value Chain........................................................................................ 37

Appendix I: Board of Directors Committee Structure ........................................................... 38

Appendix J: Largest Stockholders ....................................................................................... 39

Appendix K: Domestic Organizational Structure .................................................................. 40

References .............................................................................................................................. 41

Delta Air Lines Strategic Audit Page 5

Executive Summary

Delta Airlines, founded in 1925 as a local crop dusting service, became an industry leader

despite challenges and transformations. The company's trajectory, from its small beginnings to

its current position as one of the world's largest airlines, reflects a commitment to growth,

innovation, and adaptation to industry dynamics.

Delta adopts a mechanistic organizational process focusing on specialization, formulation,

centralization, and hierarchy, ensuring a top-down approach to uphold consistency and quality.

The company's functional organizational structure domestically enhances operational efficiency

and resource optimization in a cost-sensitive industry. This high-level organizational framework

aligns with the company's differentiation strategy and enables the company to navigate the

challenges of the airline industry effectively.

Delta Airlines strategically targets high-value consumers by enhancing amenities to attract

premium fare-paying passengers, especially business travelers who contribute significantly to

airline profits. It employs a broad differentiation strategy, offering unique products and services,

a premium in-flight experience, a reliable route network, strategic partnerships, and exceptional

customer service. Its diversification strategy involves maintaining a geographically diverse

business, utilizing joint ventures and partnerships, and offering various services like

maintenance, repair, overhaul operations, vacation packages, co-branded credit cards, and

cargo services.

Despite financial challenges, Delta achieved a 13% premium revenue increase and a record 8.5

million loyalty program member growth in 2022. Committed to ESG, Delta emphasized

sustainability with fleet advancements. High operational efficiency, a 98.6% trip completion rate,

and significant workforce recruitment contributed to success. Key indicators highlight a focus on

employee and customer satisfaction, with engagement scores surpassing benchmarks. Delta's

on-time performance (84.1%) and customer satisfaction scores reflect a dedication to service

quality. Leading in market cap, Delta maintains a robust financial compensation structure

aligning executive interests with company performance.

Delta is confident in its three-year plan, focusing on operational excellence, brand strength,

competitive advantage, and financial performance. The company's long-term strategic priorities

include running the world's best airline, unlocking the value of its trusted brand, transforming

through digital means, and delivering long-term shareholder value. As an audit team, we believe

Delta is poised to ride the resurgence of travel and increase profitability through the coming

years. Its investment in SAF allows it to cater to climate-conscious consumers and stay ahead

of ESG requirements.

Delta Air Lines Strategic Audit Page 6

Industry and Firm Overview

History

Delta Airlines was founded in 1925 in Georgia as a small, local crop dusting service. Originally

named Huff Daland Dusters, the company began to expand its services into mail carrying and

small passenger flights. After gaining more success in the space, the headquarters, originally

located in Macon, Georgia, was relocated to Monroe, Louisiana in 1929. It was here where the

company changed its name to Delta Air Corporation. In 1930, the passenger services of Delta’s

business became the most profitable sector and the company ramped up services, offering

flights between Dallas, Texas, and Jackson, Mississippi from Shreveport and Monroe,

Louisiana. In the next decade, it expanded its route network to include various cities in the

southeastern United States.

During World War II, Delta contributed transportation and cargo services to the US military. This

led to the monetization of the aircraft fleet and an increase in expansion in the 1950s.

Throughout the 1960s, Delta began offering many luxury services to passengers and expanded

its fleet of pressurized planes that were first introduced in the 50s. Alongside this, they began

acquiring more regional airlines to expand their network. Throughout the next two decades,

Delta invested in the hub-and-spoke system.This concentrated flights and operations in select

cities with major airports, such as Atlanta, helping to improve overall efficiency. During this time,

Delta acquired Northeast Airlines for about $25 million in 1971 (Walker, 1971).

Delta continued to grow throughout the 1990s and 2000s. It established partnerships with

various international airlines and expanded its global reach, becoming a member of the

SkyTeam Alliance. The acquisition of Pan Am's transatlantic routes in 1991 further solidified its

position as a major global carrier. Despite this, Delta faced financial hardship in the mid-2000s

and filed for bankruptcy in 2005. It emerged from bankruptcy in 2007 and subsequently merged

with Northwest Airlines, creating one of the world's largest airlines. This period saw significant

changes in Delta's fleet and operations.

The 2010s were an age of innovation and investment in the customer experience. It introduced

new cabin classes, upgraded its fleet with more fuel-efficient aircraft, and expanded its

international routes. The airline also focused on sustainability and environmental initiatives. Like

the entire airline industry, Delta faced challenges during the COVID-19 pandemic due to travel

restrictions. It implemented various safety measures and adjusted its operations to navigate the

crisis while also focusing on cargo and repatriation flights.

Delta Air Lines has consistently ranked among the world's largest and most prominent airlines,

serving millions of passengers each year and playing a crucial role in both domestic and

international travel. Its history is marked by growth, innovation, and adaptation to changing

industry dynamics (Delta Airlines, 2023-h).

Delta Air Lines Strategic Audit Page 7

Business Preview

Delta defines its principal business model as “connecting customers across our expansive

global network,” or, in other terms, consumer air travel (United States Securities and Exchange

Commission, 2022-b). Delta considers its staff and training the most significant contributors to

its success. The company also relies on customer retention; this is precisely why Delta boasts a

robust loyalty portfolio. Programs like SkyMiles create an appealing convenience that keeps

frequent fliers returning to Delta. Delta’s loyalty programs have proven to be quite lucrative,

although they rarely share its financials on this aspect of their operations. However, in their 10K,

it was revealed that Delta made nearly $5.5 through its partnership with American Express and

sold $5.7 billion in SkyMiles (Leff, 2023).

Companies like Southwest or Frontier attract low-budget fliers, whereas Delta targets corporate

travelers. Delta targets this demographic by enhancing the level of comfort available to

passengers willing to pay extra or established customers. The higher margins inherent with

business professionals prime this market as a reliable demographic for Delta (C, 2015).

Mission, Vision, Values, and Ethics

Mission: We—Delta's employees, customers, and community partners together form a force for

positive local and global change, dedicated to bettering standards of living and the environment

where we and our customers live and work.

Vision: To be the World's Most Trusted Airline.

Values: Honesty, Integrity, Respect, Perseverance, Servant Leadership

Delta Airlines has four primary guides for each respective segment of its business operations.

Rules of the Road outlines the company’s principles and expectations of modeling leadership,

The Way We Fly sets forth basic expectations of employees, Delta’s Code of Ethics and

Business Conduct focuses on business conducted around the world, and the Annual Flight Plan

sets corporate goals for the year. Delta’s mission statement and business model work

cohesively, as the mission focuses on connecting its customers worldwide, and the business

model invests in the working and living environment of its employees and customers (Delta Air

Lines, 2016).

Leadership

In May 2016, Ed Bastian was named to lead Delta Air Lines as Chief Executive Officer. Bastian

has been with the company since 1998 when he joined as Vice President of Finance and

Controller. He has helped to steer the company through challenges such as 9/11, the Great

Recession, and COVID-19 using a values-based leadership approach and placing empathy,

humanity, and devotion to service as his top pillars. His leadership has assisted Delta in

becoming the world’s most reliable and most awarded airline. Bastian was recently named Chief

Executive magazine’s 2023 Chief Executive of the Year.

In May 2016, Glen Hauenstein was named President of Delta Air Lines. Hauenstein joined Delta

in 2005, and his leadership helped Delta transition from focusing on domestic transportation to a

Delta Air Lines Strategic Audit Page 8

nearly even split of domestic and international service. Before joining Delta, Hauenstein worked

as Chief Commercial Officer and Chief Operating Officer at Alitalia - an airline based in Italy

whose revenue grew almost 20% in his time there.

In 2021, Alain Bellemare joined Delta as President - International. Bellemare comes in with

strong international aerospace experience. He previously served as President and Chief

Executive Officer of Bombardier - a business jet manufacturer based in Montreal. In his time

there, he led the company through intense certification through the European Aviation Safety

Agency (EASA) and the Federal Aviation Agency (FAA) for their first commercial aircraft.

Bellemare has extensive experience in the creation of aerospace systems.

Dan Janki is the Chief Financial Officer of Delta. Before joining the company in 2021, Janki was

President and Chief Executive Officer at General Electric Power Portfolio. He has over 25 years

of executive leadership experience and works closely with Bastian to form Delta’s strategy and

vision. Outside of these four leaders, Delta has a strong leadership committee consisting of

talented chief executives and senior/executive vice presidents who have a wide range of

experience, which can be viewed in Appendix A (Delta Air Lines, 2023-b).

Company Outlook

Delta claimed to be “executing well against [the] three-year plan.” Delta highlighted joint

ventures, service, operations, brand, and customer service as key elements of their industry

leadership. Delta projected confidence in expected demand, expecting earnings per share

(EPS) to grow to $5.00 - $6.00 in 2023 and above $7.00 in 2024.

On Capital Markets Day, Delta set out to do the following four things:

1. Run best-in-class operations. Delta is a leader in reliability and projects non-fuel unit

costs to decline 5% to 7% YOY in 2023.

2. Strengthen brand and customer experience. Delta is experiencing a significant growth in

premium seating margin and NPS.

3. Extend competitive advantage. Delta invested in new facilities in four major airports and

formed new partnerships.

4. Restore financial performance. In June 2023, Delta announced that the company is

expected to meet the top end of its original earnings per share guidance for fiscal year

2023 at $6 per share.

In the report, Delta detailed how the company delivered on its long-term commercial strategy,

which is split into the four following areas (Delta Air Lines, 2022 -b):

1. Deepen Network Advantages. Delta maintains 4 core and 4 coastal hubs, with growth

targeted in the core hubs. However, the coastal hubs help lead JVs and expand

international market share.

2. Expand Premium Revenue. Delta expects premium seating mix to grow 30% by 2024.

3. Grow Loyalty Ecosystem. Delta forecasts strong growth among loyalty customers, going

from $4b AmEx Remuneration in 2021 to an expected $6.5b in 2023.

Delta Air Lines Strategic Audit Page 9

4. Increase Revenue Diversification. Delta expects premium and non-ticket revenue growth

to be 80% of the revenue growth for the company.

Delta outlined its four long-term strategic priorities: run the world’s best airline, unlock value of

Delta’s trusted brand, transform through digital, and deliver long-term shareholder value. Delta

is showing commitment to these priorities in a few ways. Delta is aiming to migrate to the cloud

by 2024 and deploy mainline free in-flight wifi by the end of 2023. Additionally, Delta generated

positive free cash flow in 2022 and increased the weight of free cash flow in executive

compensation plans. Finally, Delta is investing in next-generation aircraft that are 15-25% more

fuel efficient (Delta Air Lines, 2023-e). Overall, Delta is looking to grow its topline revenue

primarily by offering best-in-class experiences for customers and incentivizing loyalty. Delta is in

a financial position to invest in digital, people, and aircraft, which will help drive cost-effective

and high-quality operations for years to come.

External Analysis

General Environment

The government heavily regulates the domestic airline industry, but the industry also receives

high assistance from government and non-governmental support. According to the IBISWorld

Report, domestic trips by US residents and corporate profit are expected to increase over the

next five years. Higher revenue is expected for the industry as airlines offset the higher oil prices

by increasing airfare and passing costs to consumers.

Political

Delta and other airlines face political factors that present opportunities and challenges in

operating in different regions. The factors include government regulations on safety, security,

finances, and environment, aviation policies set by the Federal Aviation Administration (FAA),

and navigating the political stability of other countries where the airlines operate. Delta has 120

Open Skies agreements, and the agreements eliminate government interference in commercial

decisions of routes, capacity, and pricing (U.S. DoS, 2017). All airlines operating in the US are

subject to following FAA regulations and staying current with any changes set forth by the

administration. The war in Ukraine has created political instability and has had the global impact

of increasing flight times, airspace closures, and carbon dioxide emissions (ITF, 2022).

Increased regulatory environments are meant to improve customer safety while allowing airlines

to set pricing, routes, and capacity.

Economical

The factors from the global economy that have impacted Delta’s financial performance include

rising interest rates and increased fuel prices. One way the rising interest rates affect Delta is

the increased cost of debt and the eventual increase in lease rates for aircraft (KPMG, 2023).

Delta Air Lines Strategic Audit Page 10

Rising interest rates can influence consumer spending and overall economic conditions that

decrease passenger demand for air travel. Increased fuel prices have had a negative effect on

Delta’s operating costs. Fuel prices reached a 14-year high in 2022, rising 70% in the first six

months because of the war in Ukraine (Flightworx, 2023). The increase is felt substantially

because fuel costs account for 18-20% of Delta’s costs (Gupta, 2023).

Social

Evolving customer expectations for travel preferences, including flight amenities and

environmental sustainability, provide an opportunity for Delta Air Lines. Consumers have a

growing demand for on-board Wi-Fi, and Delta has spent more than $1 billion in upgrades. The

upgrades will include free Wi–Fi for customers on over 1,200 planes by 2024 (Black, 2023). Wi-

Fi has been on airplanes for decades, but the speed and reliability vary from one aircraft to the

next and from airline to airline. A survey by McKinsey found that almost 40% of global travelers

are willing to pay 2% extra for carbon-neutral tickets to reduce their climate impact (Ahmed et

al., 2022). Preferences for selecting carbon-neutral flights vary across regions, but the trend's

popularity is increasing. Delta Air Lines purchases carbon offset carbon emissions for each

flight, allowing passengers to fly carbon-neutral (Delta Air Lines, 2023-g).

Technological

Advancements in technological innovations protect against potential threats and provide

opportunities. Delta has safeguards to protect data and privacy from cybersecurity risks and

potential Artificial Intelligence (AI)-related threats (Delta Air Lines, 2022-d). The airline is subject

to federal laws regarding the privacy of customer and employee data. AI is also used in helpful

ways to streamline the carrier’s baggage system and identify weather patterns on the ground

and at high altitudes. The usage of AI shows baggage transfer drivers the sequence of gates

they have to deliver or transfer bags to (Hines, 2023). AI can identify potential aircraft

maintenance issues before they occur, improving safety and reducing downtime for the aircraft.

Environmental

The airline industry is feeling public pressure to reduce its environmental impact. Delta is

lowering its impact by investing in alternative fuel sources for reduced carbon emissions and

developing waste reduction and recycling programs. The company has committed to replacing

10% of fuel with sustainable aviation fuel (SAF) by 2030 (Delta Air Lines, 2022-c). Additionally,

Delta is committed to net zero carbon emissions by 2050. The company executes sustainable

fuel agreements with corporate customers to support sustainable business travel. Delta

continues to reduce waste by eliminating single-use plastics aboard flights, and it has resumed

recycling and production donation programs to promote sustainability (Delta Air Lines, 2023-g).

Legal

legislation and regulations continue to threaten Delta and other airlines' operating environments.

The company faces ongoing legal cases of lawsuits and class actions. Delta was hit with a

Delta Air Lines Strategic Audit Page 11

lawsuit regarding its carbon-neutral claims in May of 2023 for $1 billion (Newburger, 2023).

Delta is also facing a consumer antitrust class action of US airfares over accusations of driving

up costs by reducing available seats (Stempel, 2023). Airlines sit in a heavily regulated industry

and face additional challenges related to labor disputes, contractual obligations, or customer

claims. Delta must maintain a solid legal framework to have a compliant operation.

Industry Environment

The domestic airline industry is a vital component of the global transportation sector, serving as

a primary mode of travel for millions of passengers each year.

One of the fundamental drivers of the domestic airline industry's profit potential is the state of

the economy. A robust and growing economy tends to translate into increased business and

leisure travel, which, in turn, can bolster airline revenues. Conversely, during economic

downturns or recessions, people and businesses may cut back on travel expenditures, affecting

the airlines' bottom line. Therefore, a proper domestic analysis of the economy is required.

Throughout 2023, the airline industry has made significant strides in recovery following the

COVID-19 pandemic. The industry faced a large loss in profit as travel restrictions and

quarantine mandates forced many potential flyers to utilize other means of transportation or not

travel at all. As the pandemic subsided, airlines such as Delta began offering lower priced

tickets to spur potential travelers to take advantage of the discounted rates. Now, travel is

becoming more expensive as significant global supply issues have caused inflation to rise

domestically (Woodyard, 2020). This contributed to weaker revenue growth following the initial

hit of the pandemic, as rising costs of living have led to lower disposable income. This trend has

prevented consumers from taking leisure trips, causing revenue to weaken. After the post

pandemic recovery, the domestic airline industry has slowly declined amidst pricing issues.

Because of this, the profit potential could go either way in terms of macroeconomic trends. The

industry faces challenges that could decrease profitability. The Federal Reserve's decision to

raise interest rates to combat the high inflation will increase borrowing costs for airlines,

affecting expansion plans and limiting the amount of aircraft they can purchase. Elevated

inflation could also drive up the prices of equipment, which airlines may pass on to consumers,

potentially curbing consumer spending on flights. Labor costs are expected to rise due to crew

shortages and wage increases, adding to the industry's expenses. Low-cost airlines continue to

pose a threat, particularly as consumers become more price-conscious in the wake of high

inflation and pandemic-related losses. Despite these challenges, the future outlook for business

travel remains relatively positive, with both businesses and consumers gradually returning to

pre-pandemic travel patterns, though this recovery will depend on various factors, including cost

considerations and evolving travel preferences (Caputo, 2023).

On the positive side, airlines are poised to benefit from a recovering economy. As the economy

strengthens, rising disposable income will likely lead to industry growth, enabling more

customers to purchase plane tickets and premium services like first-class seats and extra

baggage. Additionally, the expected expansion in corporate profits is set to drive sales of

Delta Air Lines Strategic Audit Page 12

business-class tickets for business-related activities, creating opportunities for higher profit

margins (Caputo, 2023). This economic upturn may also limit competition from low-cost airlines,

allowing legacy carriers to maintain their pricing power.

Porter’s Five Forces

Threat of New Entry:

New airline industry entrants are unlikely to succeed due to the significant upfront costs and the

ubiquity of established airlines. These barriers are particularly troubling when considering the

paper-thing margins in the airline industry. The International Air Transport Association estimates

that industry net profits will reach $9.8 billion in 2023, or 1.2% net margin (International Air

Transport Association, 2023). Costs like fuel, airport gates, and new technology keep just

staying in the black, a challenge for even industry giants. Consequently, volume is the name of

the game in the airline industry, instituting a significant barrier to entry for prospective airlines.

Passengers are unlikely to alter their air travel choices, as many airlines are profiting on higher

margins on their loyalty programs than their actual travel services (Singh, 2023-b).

Threat of Substitutes:

The airline industry faces an array of potential substitutes: car travel, Amtrak, or water travel.

However, the convenience of air travel is unrivaled. Traveling by plane is faster and easier than

any alternative, but regulation does prompt some intriguing questions about the airline industry's

future. The environmental complications of air travel are a hot-button subject and prompt action

from legislators. Specifically, President Joe Biden's proposal for Amtrak expansion created

some initial tension in the airline industry, but progress has slowed substantially. Even if Amtrak

improves its presence in the United States, Amtrak travel is more time-consuming, similarly

priced, and more likely to be delayed (Amtrak Guide, 2020).

Power of Suppliers:

Domestic airlines use many suppliers with varying degrees of power. The COVID-19 pandemic

caused significant implications on the strength of suppliers for domestic airlines - specifically

with ordering new aircrafts. Airbus and Boeing have rapidly dropped production levels and are

only projected to deliver roughly 75% of orders in 2023. Removing the current backlog is

estimated to take up to ten years (ING, 2023). This forces airlines to use older airplanes for

longer and delays growth in the number of flights airlines can offer.

Power of Buyers:

Due to the nature of domestic airlines, the power of buyers is high. If an airline can not fill (or

mostly fill) a flight, it will be hard to recoup the lost maintenance, personnel, fuel, and airport

space expenses. Today, airlines use highly sophisticated systems and algorithms to track what

consumers will spend on tickets. They adjust based on past bookings, capacity, and average

demand to make as much revenue as possible for the company (Chitty, 2018). Airlines will fail

Delta Air Lines Strategic Audit Page 13

to sell tickets if they start pricing above what consumers are willing to pay. Therefore, they must

keep an eye on the market. Airlines are at the mercy of events such as COVID-19, natural

disasters, and significant events that may impact demand at any given point.

Intensity of Competitive Rivalry:

The competitive rivalry between domestic airlines is high. A few major players compete for the

same consumers, resembling an oligopoly. Airlines must differentiate by cost, experience,

and/or reliability to gain a competitive advantage. Maintaining this advantage and continuing to

innovate and grow is expensive - which allows safety from new entrants but raises the

competition between rivals. Antitrust controversy has occurred over high-profile mergers in the

past few years (JetBlue & Spirit). Therefore, the most successful way to grow and maintain a

position as a major player is to increase the strength of your own company with costly projects.

The nature of competition can be seen as cutthroat. Additionally, low-cost airlines pose a major

threat to general ticket sales. If consumers become more price-sensitive, these cost leading

airlines may take away customers from brands like Delta who often charge on the higher end.

The airline industry is expensive to enter and also expensive to exit. The fixed cost of buying

planes, hiring staff, and managing logistics causes the firms in the industry to fully commit to do

their best, creating a high level of rivalry.

In sum, the biggest threat for domestic airlines is the power of their suppliers and the intensity of

the competitive rivalry. Both of these forces can decrease profit margins on an airline’s services.

If suppliers decide to raise their prices, there are not many alternatives for airlines to source

from. Additionally, if competitors begin to lower prices, others will have to follow suit to not lose

market share. These high pressures guide many executive team’s decisions to maintain a high

competitive advantage.

Airline industry profitability is slim today; consequently, increased pressure from external threats

produces negative outlooks for airline companies. Environmental regulations and attitudes force

airlines to invest heavily in the research and development of sustainable travel. Committing

significant capital to a relatively young field puts airlines in a precarious situation. However, if a

competing airline can achieve a practical recipe for sustainable aviation fuel or another

environmental breakthrough, it puts itself in a durable position as regulations continue to tighten.

Industry Concentration

Delta leads domestic airlines in revenue, market capitalization, and passenger miles, which can

be viewed in more detail in Appendix B. From September 2022 to August 2023, Delta led the

industry with a 17.6% share of the market (measured by domestic revenue passenger miles).

The four largest carriers made up 67.4% of all miles flown domestically during this period

(Bureau of Transportation Statistics, 2023-a).

The total industry revenue was $185.5 billion in 2022 (Burns, 2023). Delta led the industry with a

27.2% share of the market by total revenue in 2022. The industry is highly concentrated among

the top firms, with the three largest domestic carriers generating 78% of the total revenue.

Delta Air Lines Strategic Audit Page 14

Among these carriers, Delta held 35% market share (measured by total revenue) in 2022. Delta

generated over twice the revenue of the fourth largest US airline, Southwest, and over five times

the fifth largest US airline, Alaskan Air (Yahoo Finance, 2023 a-e).

This market share concentration among the largest airlines demonstrates the high industry

competitiveness and barriers to growth and scaling. Like American and United, Delta leverages

its volume and hub-and-spoke model to stay competitive. Operationally, Delta leads the four

largest domestic carriers in on-time departures, as seen in Appendix C (Airoldi, 2022).

Internal Analysis

Resources and Capabilities

There are many resources Delta Airlines employs to remain an industry leader. It employs

tangible and intangible resources to remain competitive in the domestic airline business.

Although many resources are used for domestic airline companies, there are a few that make

Delta unique and are key to its strategic positioning.

Hub and Spoke Model:

The hub-and-spoke model is an important operational resource for Delta. Delta establishes hub

airports such as the Hartsfield-Jackson Atlanta International Airport in this model, where many

flights meet and connect to other destinations. This model increases efficiency when routing

passengers, optimizing flight schedules, and maximizing connectivity between flights. Delta's

hub-and-spoke system is a critical resource and capability because it allows the airline to

efficiently transport passengers and goods to a wide range of destinations with minimal

layovers. It enhances Delta's competitiveness by providing convenient and comprehensive

travel options. Having Hub airports in major airports also helps take customers from other

airlines whose cheapest option is to use Delta.

Labor Relations:

Labor relations between Delta and its employee unions and workforce is another important

resource it uses. It encompasses negotiations, contracts, and the overall relationship between

the company and its employees, including pilots, flight attendants, ground crew, and other

personnel. Effective labor relations are what make Delta's operations smooth. Maintaining

positive relations helps prevent disruptions due to strikes or labor disputes, ensuring that flights

are on schedule and customer service remains consistent. In recent history, there have been

many transportation-related strikes that have impacted the airline industry. By avoiding these

conflicts, Delta can continue to provide great service to customers and not face any labor

related disputes. It's also essential for workforce management, including hiring, training, and

retaining skilled personnel.

Delta Air Lines Strategic Audit Page 15

Aircraft Fleet:

Delta's fleet includes many different planes, from smaller regional jets to large, long-distance

aircraft. These assets are essential for providing air travel services to customers and are used

more efficiently than many other airline companies. The average age of an aircraft in its fleet is

seventeen years, significantly older than all other domestic competitors. By investing in proper

maintenance, Delta spends less on acquiring new planes and, through its technical operations

team, is dedicated to maintaining a smarter, lower-cost fleet without sacrificing any operational

integrity. The composition and size of the aircraft fleet are strategic decisions that impact Delta's

route network, capacity, and competitiveness. Having a mix of planes for various routes and

demands allows Delta to offer services to changing customer needs and optimize its operations

for efficiency (Baldanza, 2019).

Strategic Alliances and Partnerships:

Delta has formed many strategic alliances and partnerships with other domestic and

international airlines, many of which fall under the SkyTeam.These relationships involve code-

sharing agreements, joint ventures, and coordinated schedules to increase efficiency and

incentivize international travelers to fly Delta when visiting the US. Alongside this, it allows Delta

to offer more destinations and connections to customers by sharing costs with the partner

airlines. These partnerships are a primary reason for Delta's global expansion and

competitiveness in the domestic airline industry (Routes News, 2018).

Delta's specific resources are vital to its overall business strategy, helping the company provide

efficient and convenient air travel services, maintain positive labor relations, build customer

loyalty, and expand its network.

Competitive Positioning

Delta holds a firm position in the airline industry, likely due to the array of resources at its

disposal. To better understand Delta’s competitive edge, it is crucial to evaluate the company’s

strengths through a Value, Rarity, Inimitable, and Organized (VRIO) analysis. Each resource

contributes to Delta's success, but its labor relations and hub-and-spoke model may provide the

most comprehensive benefit to the company. Delta has kept unionization low in a historically

high-unionization industry, a task that keeps workforce negotiations brief and low-cost.

Additionally, its hub-and-spoke model reduces the number of flights the average traveler must

take to reach their desired destination. Delta’s additional resources hold their value proposition

but do not hold the same unique quality or pragmatic barriers that Delta’s labor relations have.

Delta continues to renew its aging fleet, which sits around the industry average of 14 years

(Wyman, 2023), but its fleet does not stand out among key competitors. Delta’s partnership with

SkyTeam may also open up significant opportunities related to cost and international travel, but

its partnership does not hold a significant competitive edge compared to similar industry

alliances. For a more in-depth analysis of these resources, please refer to Appendix G.

Delta Air Lines Strategic Audit Page 16

Core Competencies

Delta repeatedly referenced its people and culture as a core competency for the firm that helps

it stay competitive in the market. People and culture were highlighted in the four key

presentation takeaways and five competitive building blocks of competitive advantage, with the

presentation stating, “Delta People Are The Foundation Of Our Success And Future.” Delta

measures net promoter score (NPS) as a measure of customer satisfaction and loyalty.

According to the presentation, 50% of NPS created by the company is a direct result of the

company’s people and service. Delta hired 25,000 new employees in 2022, a very large

investment that underscores the complexity of running best-in-class operations and maintaining

a high quality culture. According to Delta’s 10-K, “Forbes recognized Delta as No. 6 on its list of

the World’s Best Employers for 2022, making it the highest-ranked airline on the list (Delta Air

Lines, 2023-e).

SWOT Analysis

As the domestic airline industry continues to recover from the pandemic, fears of a recession

have been high. Despite high inflation and high interest rates, consumers have proven that they

are determined to make up for lost time. International travel has become more trendy for

consumers - a movement that Delta should capitalize on. It can be costly to invest in new

destinations; however, Delta can continue strategically utilizing its partnerships with other

airlines. Currently, Delta has partnerships with AirFrance, KLM, Virgin Atlantic, China Eastern,

Korean Air, Aeromexico, Latam, WestJet, and more (Quvein, Lee & Kartashova, 2023). With

these partnerships, Delta can share resources, customers, and routes. Domestic Delta

consumers may purchase a ticket on any of these airlines through the Delta ecosystem,

providing a seamless transition for international travel. By leveraging these partnerships, Delta

can continue offering its consumers more international choices without adding enormous costs.

A major threat to Delta’s success is its dependence on the strength of the US economy. When

the economy is growing and wages are increasing, consumers are more likely to spend on

discretionary travel. Additionally, more business travel is completed, and more discretionary

income can be spent on upgrades. However, when the economy is struggling and inflation is

high, consumers start to decrease their travel budgets.

To help mitigate this threat, Delta can continue expanding its debit and credit card programs.

Partnering with American Express, Delta expects to have earned up to $7 billion from its credit

card program within four years. Banks often pay a fixed cost per mile to the airline as a

customer reward. Additionally, American Express often also hosts incentives for Delta to sign up

more customers. This allows Delta to earn money from consumers when they are buying

groceries, paying rent, or placing any other charges on their Delta account - even if they aren’t

buying plane tickets, providing Delta an added level of security even during economic

downturns (Sumers, 2019).

Delta is heavily dependent on domestic flights, Atlanta and London in particular, according to

Cirium (2023). About 20% of Delta’s flights touch Atlanta, whereas other main airlines' biggest

Delta Air Lines Strategic Audit Page 17

hubs account for 11-15%. Delta’s most revenue-generating international flight flies from Atlanta

to the Heathrow Airport in London. Delta can expand its international presence by flying to other

airport hubs in Europe, diversifying its flight offerings while simultaneously branching into its

opportunity of international flights.

Delta had a high turnover of employees in 2022 of 30% (Airoldi, 2023). Delta has recently

signed a new contract with the pilot labor union that will cost the company an additional $7

billion to pay out to pilots over the next four years. If there is decreased employee turnover,

Delta will not be losing employees to its other main competitors and will save money during the

onboarding process by needing to onboard fewer employees.

Delta is offsetting its carbon emissions by purchasing carbon offsets. If the company were

instead to start investing in the development and production of Sustainable Aviation Fuel, the

potential of fuel price fluctuations would not affect revenue costs, and the company would reach

Carbon Zero goals by emitting less carbon instead of spending extra capital on carbon offsets,

which should strengthen the firm’s financial position and future regulatory compliance.

Performance Analysis

Firm Performance

Like the rest of the airline industry, Delta spent the years since 2020 struggling to return to its

pre-pandemic functionality. Delta is returning to the basics, specifically focusing on deepening

its presence on the coast. In 2022, Delta solidified its presence in its Boston and Los Angeles

hubs, two areas with great international flight potential. Delta also boasted a variety of awards

for its outstanding service to corporate travelers in 2022.

Delta still feels the financial aftermath of COVID-19, but the airline is beginning to see significant

improvements that once seemed out of reach. Despite economic conditions, travel demand

continued to rise, and in Q4 of 2022, Delta’s premium revenue exceeded 2019 by 13%. Delta’s

loyalty program also saw an 8.5 million member increase, a record year for the program.

(Souza, 2023)

Delta has made a systematic effort to tie its performance to its commitment to ESG

(Environmental and Social Governance). The airline is taking measures to become more

environmentally friendly through fuel efficiency, fleet improvements, and carbon offsets. Delta’s

fleet has already seen significant advancements in sustainability practices, such as introducing

its most fuel-efficient aircraft, the A321 (Delta Air Lines, 2022-a).

This year sparked some optimism after a dark period in the travel industry. Delta credits its

operational durability and culture as its primary catalysts for success. Delta’s trip completion

rate of 98.6% is certainly indicative of an efficient travel channel (Bureau of Transport Statistics,

2023-c). Additionally, although air travel turnover stays high, Delta’s ability to recruit high

volumes of staff, 25,000 in 2022, ensures a strong workforce at the airline’s disposal (Delta Air

Lines, 2023-d).

Delta Air Lines Strategic Audit Page 18

Key Performance Indicators

Delta Air Lines, like many large corporations, uses a balanced approach when evaluating its

performance, considering various stakeholders and metrics. While financial metrics are

undoubtedly important, Delta primarily focuses on employee and customer satisfaction.

Employee Satisfaction

Delta has a strong focus on employee satisfaction. In 2020, CEO Ed Bastian stated, "We

believe taking care of our people first and then taking care of our customers, and then taking

care of our brand, is a virtuous circle. Our employees are the foundation of everything we do”

(Business Roundtable, 2020). This emphasis on employee well-being represents Delta’s high

value on the satisfaction and engagement of its workforce. Its core mission highly depends on

the relations it forges with employees. Through its emphasis on employee satisfaction, Delta

has been able to evade many labor disputes other airlines face, which has undoubtedly helped

its bottom line. Two numerical key performance indicators prove its emphasis on employee

satisfaction: Employee Engagement and Employee Turnover Rates.

Employee Engagement

Employee engagement at Delta has been on the rise. In 2022, Delta reported that the average

engagement score for survey participants was 79. This is higher than the overall US industry

benchmark (Delta Air Lines, 2023-a) and industry competitor American Airlines, which had a

score of 77. They continue to leverage this information by providing resources to improve

engagement across departments and issue the survey annually to track progress. This led to a

corresponding increase in employees who viewed Delta as a favorable place to work.

Turnover Rates

Similarly, turnover rates offer a unique insight into how a company is for the well-being of

employees by analyzing how quickly individuals in their respective fields enter and exit their

positions. In Delta’s case, its employee turnover rate is 2%, which by many industry standards is

considered incredibly low (Fortune, 2023). On average, the rest of the domestic airline industry

experiences anywhere between 18% and 20% in a given year. Throughout the pandemic, Delta

was still able to retain staff. The firm had a motivated base of core employees who decided to

stay with the company due to Delta’s ongoing efforts to invest in the company culture and

provide a wealth of resources to employees.

Customer Satisfaction

Likewise, Delta places an emphasis on customer satisfaction. In a statement by CEO Ed

Bastian, he stated, "Our top priority is to deliver the safest, most reliable, and most caring

service to our customers” (Ignatius, 2022). This dedication to customers reflects Delta's core

mission, where customer happiness is the center of its success. Just as it highly values its

employees, it recognizes that satisfied passengers lead to the most successful outcomes

financially. By focusing on customer satisfaction, it consistently provides exceptional service,

Delta Air Lines Strategic Audit Page 19

strong customer loyalty, and positive relationships with consumers. Two key performance

indicators that prove this are customer satisfaction scores and on-time performance.

On-Time Performance:

On-Time Performance tracks the percentage of flights that depart and arrive on time. This

metric is key as airlines with lower on-time performance rates, did not have high customer

approval rates. In Delta’s case, its on-time rate is 84.1% in 2022, making it the most punctual

airline in the US (Airoldi, 2022).

Customer Satisfaction Scores:

Surveys and feedback from passengers help assess the airline's performance in terms of

service quality and overall experience. Delta consistently ranks highly in customer satisfaction

surveys and awards. For example, in the American Customer Satisfaction Index (ACSI), Delta

has continuously improved its scores over the last decade as seen in Appendix D. In recent

years, customer satisfaction scores show a stark difference in leadership and a continued

commitment to the customer experience (ACSI, 2023). This is evident in Delta's mission

statement, which focuses on "making the travel experience even more enjoyable."

Competitive Advantage

Delta Airlines is currently the leading airline in market cap at $25.53B and leads the next

domestic airline by more than $9B, as seen in Appendix B. Delta also has the highest market

share within the United States, measured by total passenger miles over the last twelve months

(see Appendix B). The company has maintained its positioning since pre-pandemic levels.

Based on stock returns (see Appendix E), Delta Airlines generally outperforms airline indices

and the S&P 500.

Financial Compensation

According to the 2022 proxy statement, seven named executives own roughly 2.5 million shares

of common stock (currently valued at roughly $92 million), with the CEO owning 1.5 million

shares. The company enforces minimum stock ownership for executive officers (based on a

multiple of base salary), which helps align their financial interests with the company’s financial

performance. The proxy statement disclosed details of the 2021 executive compensation plan,

which was in place for five named executives and consisted of both an annual plan and a long-

term incentive plan. From 2020 to 2021, the number of performance measures were reduced in

both plans. The company also frontloaded the vesting plan and promised incentive plan payouts

in cash, rather than stock. These plan changes showed Delta’s commitment to a strong

executive compensation program that could better weather economic downturns like the

COVID-19 pandemic.

Compensation is structured in a manner that puts roughly 90% of compensation “at-risk”, or

subject to meeting incentive goals, for executives (see Appendix F). The annual incentive

performance measures are related to short-term business goals. In 2021, these measures were

Delta Air Lines Strategic Audit Page 20

pre-tax income and operational performance (a combination of operational metrics such as

NPS, on-time arrival, and flight completion). The long-term incentive performance measures are

related to long-term business goals. In 2021, these measures were total revenue per available

seat mile (TRASM), customer service (NPS), and free cash flow. In 2021, 93.75% of the annual

target awards were achieved by the executives and 88.75% of the long-term target awards were

achieved (United States Securities and Exchange Commission, 2022-a).

Competitive Dynamics

Key Competitor: American Airlines

American Airlines is the competitor in the domestic airline industry with the closest operational

similarity and the next highest market share to Delta. Founded in 1926, American now has

destinations all over the United States and internationally. They employ similar rewards

programs and strategies to maintain a high market share and remain profitable.

Competitor Mission and Values

Delta and American Airlines have both similarities and differences. One example is their

contrasting mission statements. American Airlines’s mission statement is “committed to provide

every citizen of the world with the best service of air travel to the extensive selection of

destinations possible” (Mission Statement, 2021). While both mention their commitment to

providing value, American’s mission statement is focused on business operations, whereas

Delta has an overarching mission to offer bounding benefits beyond its operations. Similarly, the

vision statement for American is “To be the world's most reliable, affordable, and profitable

airline” (Mission Statement, 2021). This mirrors the mission statement and is more operational.

Its mission and vision statements show Delta’s overall simplification and dedication to

customers.

Competitor Resources

American Airlines shares many essential resources and capabilities that play integral roles in

their respective operations. American also employs the hub-and-spoke model for ease of

operations. The hubs for American are primarily concentrated in the northeastern and southern

regions of the U.S., leaving room for growth and improvement in the middle and northwest

areas of the country (American Airlines, 2023-a). Alongside this, American has a vast aircraft

fleet; however, the average age is 12.8 years, showing a need for more commitment to

maintaining aircraft for extended use (Airfleets, 2023). American also employs various strategic

alliances and rewards programs to promote customer loyalty and maintain an international

presence. Like Delta’s SkyTeam, OneWorld Alliance comprises some of the world’s leading

airlines, serving over 900 locations. The AAdvantage program offers similar rewards to Delta

SkyMiles and the same lounge benefits and perks for loyal customers (American Airlines, 2023-

c). The one significant resource that American has yet to replicate is Delta’s strong labor

relations. Delta’s strategic labor negotiations (detailed in Appendix G) keeps it a step ahead of

the competition, driving its workforce satisfaction up.

Delta Air Lines Strategic Audit Page 21

Product and Geographic Market

Delta and American Airlines compete to be the top domestic airline in the United States,

leveraging alliance partners, credit cards, and reward programs to differentiate themselves.

Through American Airlines alliances, consumers can fly to over 900 destinations in 170

countries. Delta’s partners have flights landing in over 1,000 locations in 180 countries. Both

companies are trying to leverage consumer demand and reach as many locations around the

globe as possible.

Additionally, both companies extend credit lines to consumers - strengthening their connection

with their customers. American Airlines currently offers seven personal credit cards and two

business cards. Delta offers four different personal credit cards. Customers can build higher

status with the airlines through these credit lines and receive various perks. Additionally, credit

cards prove to be highly profitable for these companies. Through AAdvantage and SkyMiles,

customers also enjoy rewards based on flight miles and purchases with each airline (Coates &

Quebin, 2023). Given how competitive both companies are in each of these categories, they are

considered direct competitors. They are attempting to differentiate themselves from each other

and other competitors in the airline space.

Performance Relative to Industry

As noted in Appendix B, American Airlines has the second highest share of the domestic airline

industry at 17.3%, just below Delta at 17.6%. Despite this high market share, American Airlines

ranks third in the number of passengers and departures in August 2023. Delta ranked second in

both metrics, with Southwest coming in first. American Airlines is set back by its on-time

percentage. Only 75% of their flights departed on time in 2023, ranking American 11th in the

industry. Additionally, American Airlines has canceled 1.37% of their flights this year, ranking at

fifth. Meanwhile, Delta places seventh for on-time departures and fourth for cancellations

(Bureau of Transportation Statistics, 2023-a).

While American struggles with some in-flight operations, their rewards program is quite

successful. The company was the second airline in the world to launch a rewards program in

1981. AAdvantage is the largest airline reward program, with over 115 million members in 2021

(American, 2021). Their rewards program can be seen as less advantageous than most airline

rewards because miles expire after 24 months, and each mile costs roughly 1.7 cents (Etzel,

2023). Regardless, American Airlines has built a loyal base of customers.

Performance Relative to Delta

American Airlines is among the most prolific competitors in the domestic airline industry and

performs similarly to Delta financially. In 2022, American Airlines Group saw $48.97 billion in

revenue compared to Delta’s $50.58 (Appendix A). Their operation models are quite similar:

both are domestic titans in the airline industry with international ties supported by their

respective alliances. Delta Airlines travels to approximately 280 locations internationally, while

American offers flights to 350 destinations (American Airlines, 2023-b). However, Delta’s

alliance, SkyTeam, is more well-established with a wider network, boasting a market share of

Delta Air Lines Strategic Audit Page 22

13.7% compared to American’s, Oneworld Alliance, of 11.9% (Placek, 2023). Delta is

attempting to compete with American’s expansive network via its alliance. Still, Delta’s reliance

on the SkyTeam reduces their payoff, as they must share much of their revenues with the

partnered airlines. Delta’s robust investment in luxurious rewards perks is beneficial in attracting

frequent fliers. While American’s rewards program technically has more members, its member

activity rate is relatively low at only 18% (American, 2021). However, American Airlines can

reach a broader customer volume due to its impressive number of destinations, driving up its

market share.

Competitive Strategic Actions

Delta Pilot Recruitment

In November 2022, Delta Airlines announced a significant change in its pilot recruiting strategy.

The airline will offer jobs to “full-time, active-duty U.S. military pilots up to two years before their

retirement” and conditional job offers six months out for pilots in the Active Guard Reserve (Staff

Writer, 2022). This is one element of Delta’s multi-prong approach to acquiring talent, including

partnerships with HBCUs and other organizations. The major airlines focus on attracting pilots

because experts believe airlines in North America will be short 30,000 pilots by 2032 as

retirements outpace new pilot supply (Koenig, 2023). In response to this move by Delta, United

Airlines announced the launch of its own military pilot program in September of 2023. United

candidates do not need to hold an Airline Transport Pilot Certificate when applying. They only

need it to start the position. United has also launched United Aviate Academy, a flight school

that aims to have at least half of the individuals being women or people of color (United Airlines,

2023).

American Airlines Winter Capacity

American Airlines is expanding its winter capacity in the Caribbean and Latin America. This

expansion allows for more flight options in the countries, including increased capacity on ten

routes (Garbuno, 2023). The firm announced its largest-ever flight capacity for the season after

recent expansion announcements of Delta and United Airlines. American Airlines has

historically had the most significant presence out of the domestic carriers in the area. Latin

America has emerged as a dynamic region in the airline industry, and Delta is attempting to

capture more market share by entering a joint venture with LATAM Airlines Group, a Brazilian

airline holding company. American Airlines had 27% of passenger revenue share in 2022 for

flights between South America and the United States, while 18% was split between Delta and

LATAM as the two work to increase their share by expanding flight offerings (Reed, 2023).

Business Level Strategy

Delta Airlines improves its amenities to appeal to the high-value consumer. Quality meals,

luxurious airport lounges, and attentive in-flight service await those willing to pay the premium of

Delta airfare. Professionals appreciate the benefits of the robust rewards programs, a vital

Delta Air Lines Strategic Audit Page 23

element of the Delta business model. Business travelers make up nearly 75% of airline profits

(Brock, 2022). Therefore, Delta strives to incentivize loyalty. If Delta takes a larger piece of the

“corporate pie,” it will likely see an overall market share improvement. Delta decreases its

overhead by utilizing partnered airlines to travel to destinations out of its network and focuses

on improving the actual travel experience. Personalizing the travel process with various

amenities gives Delta the edge among airlines for meeting professionals’ high expectations.

Delta does not use a cost-leadership position to give itself an advantage in the domestic airline

industry. That said, the airline industry has small margins - from 2018 to 2023, the industry profit

margin was only 3.7% (Burns, 2023). In order to remain successful, Delta has to keep a close

eye on costs, especially as fuel and labor become more expensive. In the second half of 2023

alone, Delta’s fuel costs are estimated to rise by $400 million, causing Delta to lay off some of

its corporate workers (Kaur & Shetti, 2023).

Market Approach

Delta Air Lines has a broad approach to the market by offering a wide range of destinations and

appeals to various customer segments. The key customer segments for airlines that Delta

targets are business and leisure travelers, frequent flyers, families, and international travelers.

For business travelers, Delta Air Lines offers priority boarding and access to airport lounges.

Leisure travelers enjoy in-flight options, comfortable seating, and a variety of destination

choices. Frequent flyers have loyalty programs and exclusive perks with the Delta SkyMiles

Loyalty Program (Delta Air Lines, 2023-c). Families benefit from in-flight Wi-Fi and flight

amenities. International travelers have access to expanding flight destination options, including

the expanding Latin American market (Staff Writer, 2023-a).

Broad Differentiation

Delta Airlines employs a broad differentiation business strategy in the highly competitive airline

industry. It offers a range of unique and distinct products and services compared to its

competitors. This strategy is driven by a commitment to delivering superior value to their

customers.

Delta leverages value drivers that align with its differentiation strategy. By evolving to meet the

needs to appeal to a wide range of customers, for example, with its mobility-impaired seat

design (Street, 2023) and an expanded menu for those with dietary restrictions (Woods, 2023),

Delta shows its commitment to being the airline of choice for a broad base of customers.

Similarly, Delta has built an extensive and reliable route network that ensures customers can

quickly reach various destinations. This not only provides convenience but also appeals to

business travelers and tourists seeking diverse travel options. Additionally, its strategic

partnerships with other airlines and the SkyMiles loyalty program offer added value to frequent

flyers.

Customer service is another crucial component of Delta's differentiation strategy. It aims to

provide exceptional customer service throughout the travel experience, from booking to

Delta Air Lines Strategic Audit Page 24

disembarkation. This commitment to superior service appeals to customers who value a hassle-

free and pleasant journey.

Delta Airlines' focus on these value drivers aligns with its differentiation strategy, making it an

appealing choice for travelers who prioritize a premium travel experience. Their ability to

consistently deliver on these drivers has helped them maintain a strong position in the market.

Strengths and Weaknesses of Broad Differentiation

The differentiation aspect of Delta’s strategy leads the company to garner strong brand loyalty

and achieve higher profit margins. However, Delta would be more prone to financial

underperformance in market downturns when demand for premium seating decreases.

Additionally, Delta must continually invest in activities and resources to outpace the

differentiation efforts of other firms pursuing a similar strategy.

To achieve the broad aspect of its strategy, Delta offers customers many different seating

options and auxiliary services. However, this complexity can lead to higher operational costs

and difficulty meeting the various demands of customers. Additionally, board resource allocation

can be a challenge for managers pursuing a broad strategy.

Corporate Level Strategy

Vertical Integration

Delta Airlines has slowly become more vertically integrated. In a 2014 interview with Harvard

Business Review, then CEO, Richard H. Anderson, detailed multiple steps towards adding more

stages of the value chain to Delta’s operations. The company had reclaimed its reservation

system, becoming the only major US airline carrier to own this process. Additionally, Delta

acquired an oil refinery, allowing better fuel cost management. These steps allow Delta better

visibility of the current environment.

Delta’s refinery is based in Trainer, Pennsylvania. Recently, the plant has begun processing

biofuel - greatly improving Delta’s environmental impact (Sanicola & Kearney, 2022). By having

ownership of the process, Delta was able to leverage the resource to best meet their needs

which would not have been possible through a third party.

Delta’s in-house reservation system is based in Atlanta, Georgia. While the system normally