Energy Policy Review

Spain 2021

The IEA examines the

full spectrum

of energy issues

including oil, gas and

coal supply and

demand, renewable

energy technologies,

electricity markets,

energy efficiency,

access to energy,

demand side

management and

much more. Through

its work, the IEA

advocates policies

that will enhance the

reliability, affordability

and sustainability of

energy in its

30 member countries,

8 association

countries and beyond.

Please note that this

publication is subject to

specific restrictions that limit

its use and distribution. The

terms and conditions are

available online at

www.iea.org/t&c/

This publication and any

map included herein are

without prejudice to the

status of or sovereignty over

any territory, to the

delimitation of international

frontiers and boundaries and

to the name of any territory,

city or area.

Source: IEA. All rights

reserved.

International Energy Agency

Website: www.iea.org

IEA member

countries:

Australia

Austria

Belgium

Canada

Czech Republic

Denmark

Estonia

Finland

France

Germany

Greece

Hungary

Ireland

Italy

Japan

Korea

Luxembourg

Mexico

Netherlands

New Zealand

Norway

Poland

Portugal

Slovak Republic

Spain

Sweden

Switzerland

Turkey

United Kingdom

United States

The European

Commission also

participates in the

work of the IEA

IEA association

countries:

Brazil

China

India

Indonesia

Morocco

Singapore

South Africa

Thailand

INTERNATIONAL ENERGY

AGENCY

3

FOREWORD

Foreword

The International Energy Agency (IEA) has conducted in-depth peer reviews of its member

countries’ energy policies since 1976. This process supports energy policy development and

encourages the exchange of and learning from international best practices. By seeing what

has worked – or not – in the “real world”, these reviews help to identify policies that deliver

concrete results. Since 2017, the IEA has modernised the reviews by focusing on the key

challenges in today’s rapidly changing energy markets.

Spain has shown important leadership on clean energy transitions, including through support

for key IEA initiatives. I am especially grateful to Teresa Ribera – Fourth Vice President of

the Spanish Government and Minister for the Ecological Transition and the Demographic

Challenge – for her longstanding dedication to action on climate change and ensuring fair

and equitable energy transitions. She has played an invaluable role in the Global

Commission for Urgent Action on Energy Efficiency and the Global Commission on People-

Centred Clean Energy Transitions, two high-level groups of leading international figures that

I convened in recent years to bring greater attention and policy action in these critical areas.

Since the last IEA review in 2015, Spain has solved a long-standing problem of electricity

and gas tariffs not covering costs, and has closed all of its coal mines, allowing it to prioritise

the energy transition in its policy agenda. Spain has emphasised the concept of a just

transition by ensuring that communities in traditional energy sectors, notably coal mining,

are not left behind.

The Spanish framework for energy and climate is based on a 2050 objective of national

climate neutrality and 97% renewable energy in the total energy mix. As such, it is centred

on the massive development of renewable energy, energy efficiency, electrification and

renewable hydrogen. Notwithstanding its considerable progress to date on decarbonising

and increasing the share of renewables in the electricity sector, Spain’s total energy mix is

still heavily dominated by fossil fuels. The transport, industry and buildings sectors all have

considerable work ahead of them to meet the country’s targets for increasing the share of

renewables and reducing emissions.

When all of Spain’s plans and strategies are implemented, a completely different energy

sector will emerge, where fossil fuels are no longer dominant and end-user sectors are

mostly electrified. Such a transformation will bring new challenges in the form of energy

security, as fluctuating renewable generation will require new forms of back-up and flexibility.

The changes will also bring opportunities, particularly in areas such as energy system

integration. Importantly, Spain’s plans to recover from the COVID-19-induced economic

crisis present a major opportunity to frontload its planned investments in its clean energy

transition over the upcoming three years.

I sincerely hope that the recommendations proposed in this report will help Spain navigate

its energy system transformation as it seeks to build momentum towards achieving climate

neutrality and a renewables-based energy system by 2050.

Dr. Fatih Birol

Executive Director

International Energy Agency

All rights reserved.

TABLE OF CONTENTS

5

TABLE OF CONTENTS

ENERGY INSIGHTS

1. Executive summary .....................................................................................................11

Overview ............................................................................................................................11

Climate change policies.....................................................................................................12

Energy efficiency ...............................................................................................................13

Electricity transition ............................................................................................................13

Energy system transformation ...........................................................................................14

Energy security ..................................................................................................................14

Key recommendations .......................................................................................................15

2. General energy policy .................................................................................................17

Country overview ...............................................................................................................17

Supply and demand ...........................................................................................................19

Institutions ..........................................................................................................................23

General energy policy overview ........................................................................................25

Energy security ..................................................................................................................30

Pricing and taxation ...........................................................................................................31

Assessment .......................................................................................................................32

Recommendations .............................................................................................................37

ENERGY SYSTEM TRANSFORMATION

3. Energy and climate change ........................................................................................39

Overview ............................................................................................................................39

Energy-related CO

2

emissions ..........................................................................................40

Carbon intensity .................................................................................................................42

Institutional responsibilities ................................................................................................43

Emission targets and strategy ...........................................................................................44

Adaptation to climate change ............................................................................................49

Assessment .......................................................................................................................50

Recommendations .............................................................................................................52

4. Energy efficiency .........................................................................................................55

Energy intensity .................................................................................................................55

Energy consumption by sector ..........................................................................................57

Institutional responsibilities ................................................................................................61

All rights reserved.

TABLE OF CONTENTS

6

Energy efficiency targets and strategies ...........................................................................61

Assessment .......................................................................................................................72

Recommendations .............................................................................................................75

5. Renewable energy .......................................................................................................77

Renewable energy in total final energy consumption .......................................................77

Renewable energy in electricity .........................................................................................80

Institutional responsibilities ................................................................................................81

Renewable energy policy ..................................................................................................82

Assessment .......................................................................................................................91

Recommendations .............................................................................................................93

6. Energy research, development and innovation .......................................................95

Overview ............................................................................................................................95

Energy innovation priorities and guiding documents ........................................................97

Key actors in Spain’s energy innovation ecosystem .........................................................99

Resource push ............................................................................................................... 100

Knowledge management ................................................................................................ 103

Market pull ...................................................................................................................... 104

Socio-political support .................................................................................................... 105

Assessment .................................................................................................................... 107

Recommendations .......................................................................................................... 108

ENERGY SECURITY

7. Electricity................................................................................................................... 111

Overview ......................................................................................................................... 111

Electricity supply and demand ........................................................................................ 112

Electricity market structure ............................................................................................. 114

Trade and interconnections ............................................................................................ 119

Electricity prices .............................................................................................................. 121

Electricity market regulation ........................................................................................... 123

Electricity market policies ............................................................................................... 126

Electricity security ........................................................................................................... 131

Assessment .................................................................................................................... 134

Recommendations .......................................................................................................... 137

8. Nuclear ....................................................................................................................... 139

Overview ......................................................................................................................... 139

All rights reserved.

TABLE OF CONTENTS

7

TABLE OF CONTENTS

Nuclear policy ................................................................................................................. 140

Nuclear power plant operation ....................................................................................... 142

Nuclear fuel supply ......................................................................................................... 144

Decommissioning and radioactive waste management ................................................. 144

Research and development ........................................................................................... 149

Assessment .................................................................................................................... 149

Recommendations .......................................................................................................... 151

9. Coal ............................................................................................................................ 153

Overview ......................................................................................................................... 153

Supply and demand ........................................................................................................ 154

Coal policy ...................................................................................................................... 156

Assessment .................................................................................................................... 158

Recommendation ........................................................................................................... 159

10. Natural gas .............................................................................................................. 161

Overview ......................................................................................................................... 161

Supply and demand ........................................................................................................ 162

Gas prices ....................................................................................................................... 164

Institutions ....................................................................................................................... 166

Natural gas industry structure ........................................................................................ 167

Natural gas regulation .................................................................................................... 168

Natural gas market operation ......................................................................................... 170

Natural gas policy ........................................................................................................... 172

Natural gas infrastructure ............................................................................................... 174

Natural gas security of supply ........................................................................................ 177

Assessment .................................................................................................................... 180

Recommendations .......................................................................................................... 182

11. Oil ............................................................................................................................. 185

Overview ......................................................................................................................... 185

Supply and demand ........................................................................................................ 186

Oil market structure ........................................................................................................ 190

Oil market policies .......................................................................................................... 190

Prices and taxation ......................................................................................................... 192

Oil infrastructure ............................................................................................................. 194

Oil emergency policies and organisation ....................................................................... 196

Emergency oil stocks ...................................................................................................... 198

Assessment .................................................................................................................... 199

Recommendations .......................................................................................................... 201

All rights reserved.

TABLE OF CONTENTS

8

ANNEXES

ANNEX A: Organisations visited .................................................................................... 203

ANNEX B: Energy balances and key statistical data ..................................................... 206

ANNEX C: International Energy Agency’s “Shared Goals” ............................................ 210

ANNEX D: Glossary and list of abbreviations ................................................................ 212

LIST OF FIGURES, TABLES AND BOXES

Figures

Figure 2.1 Map of Spain ..................................................................................................19

Figure 2.2 Overview of Spain’s energy system by fuel and sector, 2019.......................20

Figure 2.3 Spain’s total energy supply by source, 2000-19 ............................................21

Figure 2.4 Spain’s energy production by source, 2000-19 .............................................21

Figure 2.5 Spain’s production/total energy supply by energy source, 2000-19 .............22

Figure 2.6 Spain’s total final consumption by sector, 2000-19 .......................................22

Figure 2.7 Spain’s total final consumption by source and sector, 2019 .........................23

Figure 3.1 Greenhouse gas emissions in Spain by sector, 1990-2018 ..........................40

Figure 3.2 Energy-related CO

2

emissions in Spain by sector, 2000-19 .........................41

Figure 3.3 Energy-related CO

2

emissions in Spain by energy source, 2000-19 ............41

Figure 3.4 Energy-related CO

2

emissions and key drivers in Spain, 2000-19 ...............42

Figure 3.5 CO

2

intensity in Spain and selected IEA member countries, 2000-19 ..........43

Figure 3.6 CO

2

intensity of electricity and heat generation in Spain and selected

IEA member countries, 2000-19 ....................................................................43

Figure 4.1 Energy consumption and drivers in Spain, 2000-19 .....................................56

Figure 4.2 Energy intensity in select IEA member countries, 2000-19...........................56

Figure 4.3 Energy consumption in Spain by sector, 2000-19 .........................................57

Figure 4.4 Energy consumption in transport in Spain by fuel, 2000-19 .........................58

Figure 4.5 Energy consumption in industry in Spain by fuel type, 2000-19 ...................58

Figure 4.6 Energy consumption in the residential sector in Spain by fuel, 2000-19 ......59

Figure 4.7 Breakdown of energy consumption in the residential sector in Spain

by use, 2018...................................................................................................60

Figure 4.8 Energy consumption in the services sector in Spain by fuel, 2000-19..........61

Figure 4.9. Spain’s cumulative final energy savings projected for 2021-30 ....................62

Figure 5.1 Renewable energy in total final energy consumption in Spain, 2019 ...........78

Figure 5.2 Renewable energy in total final energy consumption in Spain, 2000-19 ......79

Figure 5.3 Renewable energy as share of total final energy consumption

in IEA countries, 2018 ....................................................................................79

Figure 5.4 Renewable energy in electricity generation in Spain, 2000-19 .....................81

Figure 5.5 Renewable energy as a share of total electricity generatio

in IEA countries, 2019 ....................................................................................81

Figure 6.1 The IEA’s four functions of a successful innovation ecosystem for energy ..96

Figure 6.2 Energy-related public RD&D spending per GDP in IEA countries, 2018 ... 101

Figure 6.3 Energy-related public RD&D spending in Spain by category, 2000-18 ..... 101

Figure 6.4 Spain’s gross domestic expenditure on total R&D, 2000-18 ...................... 102

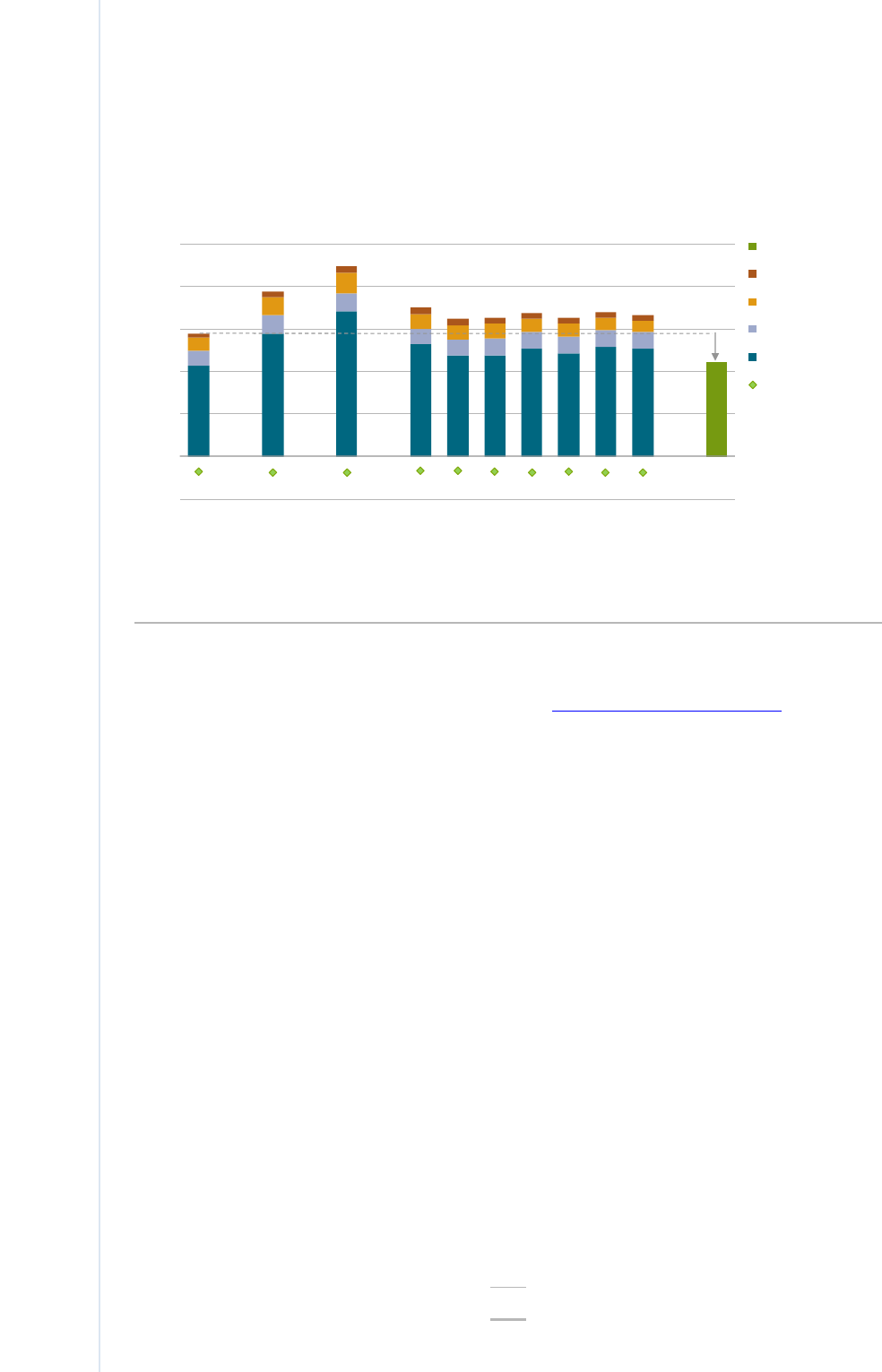

Figure 7.1 Spain’s electricity supply by source, 2000-19 ............................................ 113

Figure 7.2 Electricity generation by source in IEA member countries, 2019 ............... 113

All rights reserved.

TABLE OF CONTENTS

9

TABLE OF CONTENTS

Figure 7.3 Electricity consumption in Spain by consuming sector, 2000-19 ............... 114

Figure 7.4 Spain’s current interconnections with neighbouring countries ................... 119

Figure 7.5 Spain’s electricity trade by country, 2000-19 .............................................. 120

Figure 7.6 Electricity price for industry in IEA member countries, 2019 ...................... 122

Figure 7.7 Electricity prices for households in IEA member countries, 2019 .............. 122

Figure 7.8 Electricity prices in Spain and selected IEA member countries, 2000-19 .. 123

Figure 7.9 Spain’s electricity system tariff balances, 2000-18 .................................... 124

Figure 7.10 Installed power capacity in Spain’s NECP’s target scenario ...................... 127

Figure 8.1 Final shutdown schedule of nuclear power plants in Spain according

to the NECP ................................................................................................ 140

Figure 8.2 Institutional structure of nuclear energy in Spain ....................................... 141

Figure 8.3 Capacity factors of nuclear power plants in Spain and the world .............. 143

Figure 8.4 The funding system for decommissioning of nuclear facilities and

radioactive waste management .................................................................. 148

Figure 9.1 Share of coal in different energy supplies in Spain, 2000-19 ..................... 153

Figure 9.2 Spain’s coal supply by source, 2000-19 ..................................................... 154

Figure 9.3 Spain’s coal net imports by country, 2000-19 ............................................ 155

Figure 9.4 Coal consumption in Spain by sector, 2000-19 .......................................... 155

Figure 10.1 Natural gas in energy production, total energy supply, electricity and

total final consumption in Spain, 2000-19................................................... 162

Figure 10.2 Natural gas consumption in Spain by sector, 2000-19 ............................... 163

Figure 10.3 Spain’s natural gas net imports, 2000-19 ................................................... 164

Figure 10.4 IEA comparison of industry and household gas prices, 2019 .................... 165

Figure 10.5 Natural gas prices in industry and households in selected IEA countries,

2000-19 ....................................................................................................... 166

Figure 10.6 Map of Spain’s natural gas infrastructure ................................................... 175

Figure 11.1 Share of oil in energy production, total energy supply, electricity and

total final consumption in Spain, 2000-19................................................... 186

Figure 11.2 Oil consumption in Spain by sector, 2000-19 ............................................. 187

Figure 11.3 Spain’s crude oil net imports, 2000-19 ....................................................... 188

Figure 11.4 Spain’s oil products imports and exports by country, 2000-19 .................. 188

Figure 11.5 Spain’s oil refinery output and demand, 2019 ............................................ 189

Figure 11.6 Spain’s oil refinery output, 2000-19 ............................................................ 189

Figure 11.7 Price comparison for automotive diesel in the IEA, Q3 2020 ..................... 194

Figure 11.8 Price comparison for unleaded gasoline in the IEA, Q3 2020 ................... 194

Figure 11.9 Price comparison for light fuel oil in the IEA, Q3 2020 ............................... 194

Figure 11.10 Map of the Spanish oil infrastructure ........................................................ 196

Figure 11.11 Spanish oil stocks, as of end November 2020 ......................................... 199

Tables

Table 5.1 Renewables auction results in Spain .............................................................84

Table 5.2 Spain’s renewable energy auction calendar ..................................................85

Table 8.1 Operating nuclear power plants in Spain in 2020....................................... 142

Table 8.2 The cost structure of nuclear power generation in Endesa ........................ 144

Table 8.3 Status of the decommissioning process of nuclear power plants

in Spain, 2020 ............................................................................................. 145

Table 8.4 Phases to implement the deep geological repository proposed in the draft

7th GRWP ................................................................................................... 147

All rights reserved.

TABLE OF CONTENTS

10

Table 10.1 Technical capacity (firm and interruptible) of international interconnections

(GWh/day) ................................................................................................... 176

Table 10.2 Spanish liquefied natural gas import terminals (operating facilities) .......... 176

Boxes

Box 6.1 IEA framework for energy innovation policies ...............................................96

All rights reserved.

11

ENERGY INSIGHTS

1. Executive summary

Overview

Since the last International Energy Agency (IEA) in-depth review in 2015, Spain has solved

a long-standing issue of tariff deficits in its electricity and gas sectors and closed all of its

coal mines, which has allowed it to prioritise the issue of climate change on its national

agenda and align its goals with European Union (EU) objectives and ambitions. In doing

so, Spain has placed the energy transition at the forefront of its energy and climate change

policies.

The current Spanish framework for energy and climate is based on the 2050 objectives of

national climate neutrality, 100% renewable energy in the electricity mix and 97%

renewable energy in the total energy mix. As such, it is centred on the massive

development of renewable energy, particularly solar and wind; energy efficiency;

electrification; and renewable hydrogen. This is seen as an opportunity to stimulate the

economy; create jobs; modernise industry; enhance competitiveness; support vulnerable

groups; improve energy security; and support research, development and innovation.

Notwithstanding its considerable progress to date on decarbonising and increasing the

share of renewables in the electricity sector, Spain’s total energy mix is still heavily

dominated by fossil fuels. Notably, the transport, industry and buildings sectors all have

considerably more work ahead of them to meet the country’s targets for renewables

penetration and decarbonisation.

Moreover, under Spain’s decentralised system of government, regional administrations

have considerable authority over energy policy development and implementation, making

effective co-ordination between the centre and the regions even more critical to successful

enactment of energy strategies in Spain.

When all of Spain’s plans and strategies are implemented, a completely different energy

sector will emerge, where fossil fuels are no longer dominant and end-user sectors are

mostly electrified. Such a transformed energy landscape will come with new challenges

and will provide new opportunities.

The challenges include energy security. The current system is backed up by massive

stocks of oil, gas and coal that can be dispatched in a flexible way; the new system, with

a large share of variable renewable generation, will require other forms of longer term

backup, on top of short-term flexibility. New vulnerabilities will also arise, as electrification

goes hand-in-hand with smartening of the system and digitalisation.

The opportunities are with energy system integration. The new energy system can be

much more efficient than the current one, as end-use sectors can be coupled with higher

electrification, the use of residual heat, waste to energy, but also using electricity to

All rights reserved.

1. EXECUTIVE SUMMARY

12

produce renewable gases like hydrogen, among others. It will be important for Spain to

adapt the policy and regulatory framework, where needed, to gradually shape such a new

integrated energy system.

The current post-COVID-19 recovery context presents Spain with an important opportunity

to frontload its planned energy transition investments to the upcoming three years. Spain

is currently working on its green recovery plan, as it will be one of the key beneficiaries of

EU recovery funds. The main areas defined in the initial draft of Spain’s Recovery and

Resilience Plan for the energy transition are efficiency, sustainable mobility, renewable

energies, electricity infrastructure, storage and flexibility, and green hydrogen. Spain

should capitalise on this opportunity to jumpstart actions outlined in its National Energy

and Climate Plan (NECP).

Climate change policies

A

s a member of the European Union (EU), Spain is bound by EU targets for energy and

climate change as part of the Energy Union.

Toward this end, the central strategy document guiding Spain’s energy and climate policies

over the coming decade is its NECP for the period 2021-30. It outlines a number of policy

actions in various sectors that will support the country’s climate targets, including in the

areas of energy efficiency, renewables and transport. Its 2030 objectives include: a 23%

reduction in greenhouse gas emissions from 1990 levles; a 42% share of renewables in

energy end use; a 39.5% improvement in energy efficiency; and a 74% share of

renewables in electricity generation. Policies include increasing renewable power

installations and boosting the use of renewable gases in the power sector, modal shifts

and electrification in the transport sector, refurbishments and increasing the use of

renewable heating in the residential and commercial sectors, promoting energy efficiency

and fuel switching in the industry sector, and energy efficiency improvements in the

agricultural sector. The government anticipates that investments of EUR 241 billion will be

needed to enact the measures outlined in the NECP, out of which 80% is estimated to

come from the private sector.

Domestically, the Climate Change and Energy Transition Bill places the fight against

climate change and the need for an energy transition at the centre of the economy and

society. Its main targets are similar to those in the NECP, also placing renewable energy

and energy efficiency at the centre of the energy transition.

Notably, Spain has emphasised the concept of a just transition to ensure that communities

in traditional energy sectors, notably coal mining, are not left behind. To this end, Spain’s

Just Transition Strategy includes measures to promote employment opportunities in the

energy transition, supported by a framework of vocational training, active labour policies,

support measures to the most vulnerable and economic stimulus plans for those regions

most affected by the energy transition. These are executed through “just transition

agreements” between the government, unions and businesses, which can serve as an

example to other countries facing similar issues.

All rights reserved.

1. EXECUTIVE SUMMARY

13

ENERGY INSIGHTS

Energy efficiency

S

pain’s overall energy strategy employs an “efficiency first” principle. In all sectors, Spain’s

energy transition objectives hinge heavily on reducing consumption. Already, Spain has

begun to decouple economic growth from energy consumption; energy intensity, the ratio

of total consumption to gross domestic product, fell by 18% between 2008 and 2019. Still,

more reductions will be needed across all sectors.

The Bill on Climate Change and the Energy Transition as well as the NECP outline a

number of measures to improve efficiency and reduce consumption in all economic

sectors, including transport, buildings and industry. The policy plans are extensive and can

achieve strong results, but will need to be accompanied by a predictable, long-term

regulatory framework; sufficient incentives to mobilise private investments; and adequate

public financing to underpin all the programmes over the coming decade.

In addition, under Spain’s decentralised system of government, the implementation of a

number of efficiency measures for transport, buildings and industry will fall on regional and

local governments, making co-ordination between the central government and

regional/local administrations as well as skills capacity at all levels of government essential

to success.

Electricity transition

Spain is progressing toward its 2030 targets, notably in the electricity sector. After a slump

in investments between 2013 and 2018 due to a lack of financial means to promote

renewables, investments took off again in 2019. The share of renewables (including

non-renewable waste) in the national electricity mix grew from 24% in 2009 to 38%

in 2019. As such, Spain is well on track to meet its 2020 target to source 42% of its

electricity from renewables.

Though Spain’s progress on ramping up renewables in its electricity mix is commendable,

the future trajectory of its power mix warrants careful consideration to ensure a smooth

transition. To start, Spain plans to phase out both coal and nuclear power generation. The

coal phase-out appears well on track, with coal only providing around 5% of electricity

generation in 2019 and even less in 2020. Nuclear power, which accounted for 22% of

power generation in 2019 (and an important source of low-carbon generation), will begin

shutting down from 2027. Four of Spain’s seven nuclear reactors are scheduled to close

by the end of 2030, representing around 4 gigawatts of capacity. Natural gas

combined-cycle plants provide around one-third of power generation, and will be crucial to

balancing out a power system that is heavily dependent on variable renewables once coal

and nuclear have left the market. As such, the government will need to pay special

attention to prevent natural gas generation capacity from simultaneously exiting the

system. In this regard, the government should thoroughly assess the cost implications for

consumers of the expedited phase-out of both coal and nuclear generation.

Spain’s targets also foresee a sizeable buildout of new renewables capacity to reach 74%

of electricity generation by 2030, notably wind and solar. As such, a stable, long-term

remuneration framework for supporting the growth of renewables, including for storage,

will be essential. Spain’s updated auction mechanisms are a step in the right direction, and

investor sentiment and availability of financing appears on track. Additional help could

All rights reserved.

1. EXECUTIVE SUMMARY

14

come in the form of expedited permitting and timely issuance of auction schedules and

terms to improve investment clarity.

Moreover, the trajectory will require a concerted focus on system integration of variable

renewables in the coming years. The government’s strategy is centred on

interconnections, storage, demand-side management and digitalisation. Public

consultations and regulatory proceedings are underway in all of these areas, though timely

issuance of a regulatory framework will be crucial to mobilising investments, including in

next-generation technologies such as biogas and hydrogen. Co-operation with

neighbouring governments on interconnection capacity will also be a key element of

utilising Spain’s full production capacity on renewables, notably with France to expand

connection of the Iberian peninsula with the rest of continental Europe.

Energy system transformation

Beyond the electricity sector, the government plans to expand self-consumption of

renewables and distributed generation, as well as promote the use of renewables in the

industry and heating sectors. It also has plans to support the production of advanced

biofuels and renewable gases, as well as hydrogen.

Overall, Spain plans to move toward a full energy system transformation, the foundations

of which will be laid in the coming decade. The Long-Term Strategy projects that the

electrification of the economy will be over 50% by 2050.

In order to integrate more renewables into other sectors of the economy, the government

has a four-pronged strategy: 1) energy efficiency first; 2) renewables-based electrification;

3) storage; and 4) indirect electrification through renewable gases, mainly hydrogen. The

promotion of renewable gases is a critical measure outlined in Spain’s NECP, with uses

planned in mobility, industry, seasonal storage and synthetic fuels.

To this end, the government has several initiatives in place or underway to jumpstart plans

and investments in the 2030 time frame, including a Hydrogen Roadmap, a Biogas

Roadmap, an Offshore Wind Roadmap, a self-consumption strategy public consultation

and a smart meter evolution public consultation.

As Spain looks to a future of increased electrification of end-use sectors and sector

coupling – an essential element to achieve an energy transition – the competitiveness of

electricity against fossil fuels will be a critical element to achieving the desired results. As

such, Spain should consider changes to its taxation system, notably to incorporate the cost

of carbon into end-use prices, to reduce barriers to increased uptake of clean electricity in

more end uses.

Energy security

From an energy security perspective, although Spain continues to be heavily dependent

(73% dependency) on foreign sources for its energy, its sources for oil and gas are

relatively well diversified and the government has robust emergency response frameworks

in place in the case of a disruption.

All rights reserved.

1. EXECUTIVE SUMMARY

15

ENERGY INSIGHTS

Though the new policies and increased electrification will reduce Spain’s import

dependency, the rapid closure of coal and nuclear facilities over the coming decade bears

watching, as it could increase the country’s call on natural gas, especially if new

renewables capacity cannot be built as quickly as planned.

Interconnectivity with other European countries is also a critical element for Spain to

improve security of supply. While electricity projects with Portugal are progressing, existing

interconnection with France is often congested and new projects have been delayed,

causing Spain to fall short of its EU interconnectivity targets of 10% by 2020 and putting

at risk its 15% target by 2030.

Key recommendations

The government of Spain should:

Ensure that the National Recovery and Resilience Plan supports achieving the NECP’s

targets

.

I

mprove co-ordination with regional authorities and municipalities to implement t

he

N

ECP’s measures, especially on energy efficiency, more effectively.

Reinforce efforts to create more flexibility in the electricity market and to ensure proper

price signals for investments in generation, through increased interconnectivity,

continued integration of regional markets, and the development of demand-sid

e

r

esponse and storage.

Review taxation to avoid excess charges and distortionary impacts on electricit

y

r

elative to oil and gas consumption to promote electrification. Consider additional

carbon-based taxation as well as other mechanisms to progressively redistribute

electricity charges among all actors in the energy system.

All rights reserved.

17

ENERGY INSIGHTS

2. General energy policy

Key data

(2019)

T

otal energy supply (TES): 121.4 Mtoe (oil 42.4%, gas 25.4%, nuclear 12.5%, bioenergy

and waste 6.6

%, coal 4.0%, wind 3.9%, solar 2.8%, hydro 1.7%, electricity imports 0.5%), -

4.5

% since 2009

TES per capita:

2.6 toe/cap (IEA average* 3.7 toe/cap, IEA median 3.5 toe/cap)

TES per unit of GDP

:* 68 toe/USD million (IEA average* 85 toe/USD million, IEA median

79

toe/USD million PPP)

T

otal final consumption (TFC): 85.5 Mtoe (oil 50.8%, electricity 23.8%, natural gas 17.1%,

bioenergy and waste 6

.9%, solar 0.4%, coal 1.0%), -12.1% since 2008

TFC per capita

: 1.8 toe/cap (IEA average* 2.8 toe/cap, IEA median 2.4 toe/cap)

TFC per unit of GDP

:** 48 toe/USD million (IEA average* 62 toe/USD million PPP, IEA

median 62 toe/USD million PPP)

Energy producti

on: 34.0 Mtoe (nuclear 44.8%, biofuels and waste 24.5%, wind 14.1%,

solar

9.9%, hydro 6.2%, natural gas 0.3%, oil 0.1%), +11.9% since 2009

*

Weighted average of IEA member countries in 2018.

**

GDP data are expressed in 2015 prices and purchasing power parity (PPP).

Country overview

S

pain has a population of around 47 million and an area of 505 000 km

2

. It covers most of

the Iberian peninsula and also includes the Canary Islands, Balearic Islands and the

autonomous cities of Ceuta and Melilla in North Africa. Due to its size and geography, the

country’s climate can vary substantially by region.

Spain’s population has been stable since 2008, after increasing in previous years due to

immigration. The Spanish economy grew by 4.5% between 2008 and 2018, as the financial

crisis in 2008 strongly affected the industry, services and transport sectors. After

decreasing by 9% between 2008 and 2013, the economy rebounded by 14% between

2013 and 2018. This successful recovery has been guided by structural reforms, robust

employment growth and gains in competitiveness, allowing Spain’s economic growth to be

consistently higher than that of the euro area between 2014 and 2018 (OECD, 2018).

However, unemployment rates remain higher than the OECD average, with youth

unemployment close to 40%.

All rights reserved.

2. GENERAL ENERGY POLICY

18

In 2020, Spain was hit hard by the COVID-19 pandemic. OECD projections forecast

Spain’s economy to contract by 14.4% in 2020, or by 11.1%. The rebound for 2021 is

predicted to be between 5% and 7% (OECD, 2020).

The services sector accounted for almost three-quarters of gross domestic product (GDP)

in 2018, industry for almost one-quarter and the agricultural sector for the remaining 3%.

All shares are close to the OECD average. Tourism is particularly important, and Spain’s

tourism industry was the second-largest in the world in terms of financial receipts and the

fourth-largest in terms of arrivals. The impact of COVID-19 on the tourism sector was very

strong, as Spain closed its borders for nearly four months due to the pandemic between

February and June 2020.

Since 1978, Spain has been a parliamentary monarchy, and the king has a limited role in

day-to-day politics. The government is led by Prime Minister Pedro Sánchez of the Spanish

Socialist Workers’ Party (PSOE), who took over on 1 June 2018 after seven years under

a government led by Mariano Rajoy of the People’s Party. Sánchez called an early general

election in April 2018, but did not form a government, leading to another election in

November 2019. The PSOE and Unidas Podemos formed the first Spanish coalition

government since 1978, and Sánchez was renominated as Prime Minister on 13 January

2020.

A fairly decentralised country, Spain is divided into 17 autonomous communities, each with

its own parliament, plus 2 autonomous cities (Ceuta and Melilla). In the energy sector, the

autonomous regions are responsible for areas such as authorising certain power plants

and energy networks. Spain joined the European Union (EU) in 1986 and adopted the euro

as its currency in 2002.

All rights reserved.

2. GENERAL ENERGY POLICY

19

ENERGY INSIGHTS

Figure 2.1 Map of Spain

IEA. All rights reserved.

Supply and demand

Most of Spain’s energy supply and demand is met with fossil fuels, which accounted for

72% of total energy supply (TES)

1

and 68% of total final consumption (TFC)

2

in 2019

(Figure 2.2). Only one-quarter of TES was produced domestically in 2019; the remainder

was imported.

Domestic production consists mostly of nuclear energy (45% of total production) as well

as bioenergy and waste and other renewables, notably wind and solar. Production of

1

TES is made up of production + imports – exports – international marine and aviation bunkers ± stock changes. This

equals the total supply of energy that is consumed domestically, either in transformation (e.g. power generation and

refining) or in final use. Nuclear energy supply in TES includes losses. The primary energy equivalent of nuclear

electricity is calculated from the gross electricity generation by assuming a 33% conversion efficiency.

2

TFC is the final energy consumption (electricity, heat and fuel, such as natural gas and oil products) by end users,

not including the transformation sector (e.g. power generation and refining).

All rights reserved.

2. GENERAL ENERGY POLICY

20

renewable energy increased by 47% between 2009 and 2019 to cover more than half of

total domestic production in 2019 (55%).

TES is dominated by oil and gas, which accounted for 42% and 25% of TES, respectively,

in 2019. TES was 121 million tonnes of oil equivalent (Mtoe) in 2019, with an additional

12 Mtoe of oil products used in international marine bunkers and aviation. However, the

share of renewables significantly increased between 2009 and 2019, reaching 15% of TES

in 2019 compared with 11% in 2009.

Transport and industry are the highest energy-consuming sectors, accounting for 38% and

29% of TFC, respectively, followed by the residential (17%) and services (16%) sectors. TFC

was 86 Mtoe in 2019, with high shares of oil (51%) and gas (17%). Electricity, on the other

hand, was largely used in the services (53%) and residential (43%) sectors. Bioenergy and

waste were also a significant source of energy for residential consumption in 2019,

accounting for 18% of TFC in the sector.

Figure 2.2 Overview of Spain’s energy system by fuel and sector, 2019

While producing renewables and nuclear energy, Spain relies on imports of fossil fuels, which

accounted for almost three-quarters of total supply and TFC in 2019.

* Total energy supply + international bunker fuels.

**Other renewables includes wind, hydro, solar and a small amount of geothermal.

Notes: Mtoe = million tonnes of oil equivalent. TFC = total final consumption.

Source: IEA (2021), IEA World Energy Statistics and Balances (database), www.iea.org/statistics

.

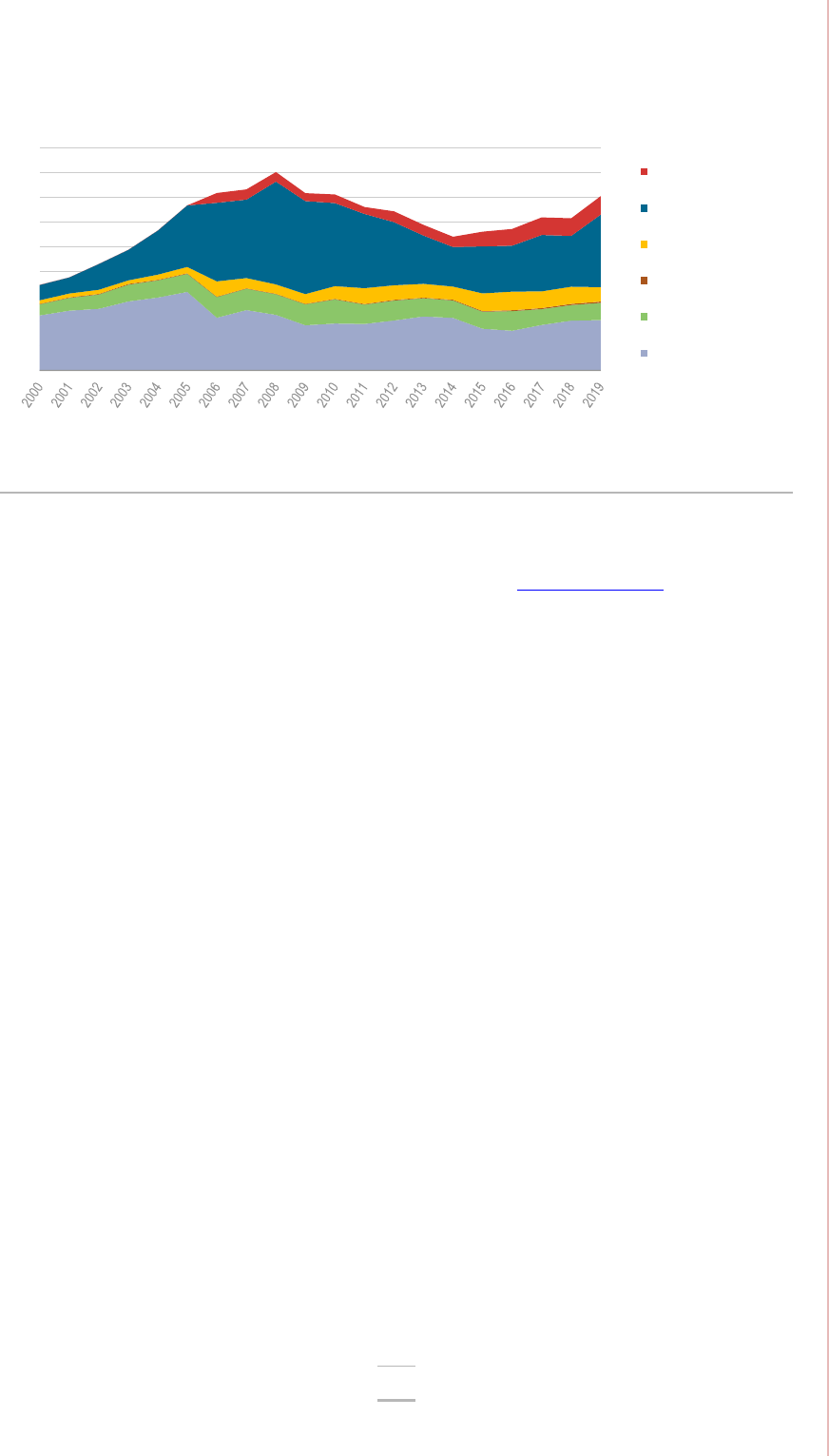

Total energy supply

TES in Spain peaked in 2007, before dropping in the following years as a consequence of

the financial crisis, which led to a decrease in supply to match cuts in the

energy-consuming sectors (Figure 2.3). Between 2014 and 2017, however, TES started

to increase again, rebounding by 10% in three years, to compensate for half of the 20%

drop experienced between 2007 and 2014. In 2019, TES again fell to 121 Mtoe from

126 Mtoe in 2017. Natural gas, oil, and bioenergy and waste were the main sources

supporting this increase, while energy from solar and wind remained flat between 2014

and 2018, due to a decline in investor confidence after a major overhaul of the renewables

support mechanism. Compared with other International Energy Agency (IEA) member

countries, Spain ranks 20th for its share of fossil fuels in TES, which in 2018 accounted

for 74% of total supply.

0

20

40

60

80

100

120

140

Production Total supply* TFC (by fuel) TFC (sector demand)

Mtoe

Bunker oil

District heat

Electricity

Other renewables**

Bioenergy and waste

Natural gas

Oil

Coal

Nuclear

Imports

Transformation and losses

Residential

Transport

Industry

Services

IEA. All rights reserved.

All rights reserved.

2. GENERAL ENERGY POLICY

21

ENERGY INSIGHTS

Figure 2.3 Spain’s total energy supply by source, 2000-19

TES in Spain peaked in 2007 and fell afterwards as an effect of the financial crisis. Between

2014 and 2018, total supply started to increase again, though fell again in 2019.

Notes: Mtoe = million tonnes of oil equivalent. The share of geothermal is not visible at this scale.

Source: IEA (2021), IEA World Energy Statistics and Balances (database), www.iea.org/statistics

.

Energy production and import dependency

As opposed to TES, domestic energy production increased by 12% in Spain between 2009

and 2019 (Figure 2.4). Nuclear energy consistently provided around 15 Mtoe per year, while

energy from coal decreased by almost 80% between 2008 and 2018; production ceased

entirely in 2019. In contrast, energy production from bioenergy and waste, wind, and solar

experienced a steady upward trend in the same decade (46% growth), leading to an increase

in energy production from renewables and waste of 54% of total production in 2019.

Figure 2.4 Spain’s energy production by source, 2000-19

Total domestic energy production did not change significantly between 2010 and 2019, but

the share of coal has significantly decreased, balanced by increased renewables.

Note: Mtoe = million tonnes of oil equivalent.

Source: IEA (2021), IEA World Energy Statistics and Balances (database), www.iea.org/statistics

.

Spain’s domestic production covers about one-quarter of TES (Figure 2.5), though the

country completely relies on imports for oil and gas. Internal production

0

20

40

60

80

100

120

140

Mtoe

Heat

Electricity imports

Bioenergy and waste

Solar

Geothermal

Wind

Hydro

Nuclear

Natural gas

Oil

Coal

IEA. All rights reserved.

0

5

10

15

20

25

30

Mtoe

Geothermal

Solar

Wind

Hydro

Bioenergy and waste

Natural gas

Oil

Coal

Nuclear

IEA. All rights reserved.

All rights reserved.

2. GENERAL ENERGY POLICY

22

of coal covered up to 40% of total energy supply in 2010, but since fell to less than 10%

self-sufficiency in 2018 and 0% in 2019.

Figure 2.5 Spain’s production/total energy supply by energy source, 2000-19

Three-quarters of total supply are imported, with high dependency on imported fossil fuels.

Note: Domestic energy production as a share of total energy supply + international bunker fuels (oil).

Source: IEA (2021), IEA World Energy Statistics Balances (database), www.iea.org/statistics

.

Energy consumption

After peaking in 2007, TFC decreased in Spain as a consequence of the economic crisis,

until 2014, when it started to increase again to reach 86 Mtoe in 2019 (Figure 2.6). Most

of these changes were guided by the transport and industry sectors, which saw outsized

impacts on consumption from the crisis in 2008.

Figure 2.6 Spain’s total final consumption by sector, 2000-19

Total final consumption peaked in 2010, after which it fell until 2014, then increased again

until 2019. Most of the energy is used in the transport and industry sectors.

* Industry includes non-energy consumption.

** Services/other includes commercial and public services, and agriculture and forestry.

Note: Mtoe = million tonnes of oil equivalent.

Source: IEA (2021), IEA World Energy Statistics and Balances (database), www.iea.org/statistics

.

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

Total energy

Coal

Oil

Natural gas

IEA. All rights reserved

0

20

40

60

80

100

Mtoe

Industry*

Transport

Residential

Services/other**

IEA. All rights reserved.

All rights reserved.

2. GENERAL ENERGY POLICY

23

ENERGY INSIGHTS

The transport sector was the largest energy-consuming sector in 2019, with final

consumption of 33 Mtoe. More than 90% of transport consumption constituted oil

(Figure 2.7), with a small share of biofuels. Industry was the second-largest sector in TFC,

consuming 25 Mtoe in 2019. Final consumption in the industry sector is almost equally

provided by gas, oil and electricity. The residential and services sectors used 15 Mtoe and

13 Mtoe in 2019, respectively. Electricity is the first energy carrier used in these sectors,

followed by oil and gas. Bioenergy has an important role in residential consumption,

covering 18% of the sector’s demand.

Figure 2.7 Spain’s total final consumption by source and sector, 2019

Oil covered half of total final consumption in 2019. The transport and industry sectors are

dominated by fossil fuels, but electricity is significant in the residential and services sectors.

* Industry includes non-energy consumption.

** Services/others includes commercial and public services, and agriculture and forestry.

*** Other renewables includes geothermal and solar thermal.

Source: IEA (2021), IEA World Energy Statistics and Balances (database), www.iea.org/statistics

.

COVID-19 impacts on energy demand

Spain declared a state of emergency between 14 March 2020 and 20 June 2020 due to

the COVID-19 pandemic. During this time, total electricity demand fell by 12.7% relative to

the same period in 2019, hitting an 18% decline during the period of total confinement

between 30 March and 12 April, led by the industry and services sector. Natural gas

demand during the emergency period fell by 15.5% while petroleum products demand fell

more significantly, by 60% for gasoline, 43% for diesel and 88% for aviation fuels.

Institutions

In the energy sector, the Ministry for the Ecological Transition and the Demographic

Challenge – currently led by Teresa Ribera Rodríguez – holds the basic competencies on

energy, which are focused at the national level, and leads on energy policy formulation.

The main responsibilities of the ministry include:

regulations concerning energy and mining matters, which are shared with other ministries

for evaluation

51%

26%

16%

93%

31%

17%

19%

21%

1%

36%

1%

1%

1%

7%

2%

18%

5%

6%

1%

2%

24%

53%

43%

1%

26%

0% 20% 40% 60% 80% 100%

Total

Services/other**

Residential

Transport

Industry*

Oil

Natural gas

Coal

Bioenergy and waste

Other renewables***

Electricity

Heat

IEA. All rights reserved.

All rights reserved.

2. GENERAL ENERGY POLICY

24

legislation overseeing the tariff structure, prices of energy products, and levies and tolls

(though the regulator sets the rates)

legislation to save energy, promote renewable energy, and support new energy and mining

technologies

legislation of measures to ensure energy supply

legislation and actions related to the demographic challenge.

The Secretary of State for Energy falls under this ministry, while the Directorate General

for Energy Policy and Mining falls under the Secretary of State for Energy. Also under the

Secretary of State for Energy are several institutions that hold competencies in various

areas of energy policy, including:

The Just Transition Institute, which oversees the economic transition of regions where coal

mines and coal power plants are closing.

The Institute for Energy Diversification and Savings (IDAE), which oversees research

programmes on electrification, mobility, energy efficiency and renewable energy, among

others. Its activities include increasing public knowledge and awareness, technical advice,

and project financing of technology innovations.

The Corporation of Strategic Reserves of Oil Products (CORES), which is the stockholding

agency in charge of maintaining stocks of oil products and monitoring industry obligations

to hold stocks of oil products, liquefied petroleum gas and natural gas. CORES also verifies

operators’ obligations to diversify their natural gas supplies.

The City of Energy Foundation, which is focused on the execution of research and

innovation programmes related to energy and the environment and contributing to

economic development.

The National Radioactive Waste Company (Enresa), which is focused on the management

of radioactive waste.

The Secretary of State for Environment also falls under the Ministry for the Ecological

Transition and the Demographic Challenge. Within the Secretary of State for Environment

are the Spanish Office for Climate Change, which provides advice to different bodies of

government on climate change, as well as the National Climate Council, which

co-ordinates the development and monitoring of climate change policies and measures of

the central government. The National Climate Council promotes information gathering,

analysis, preparation and implementation actions.

The National Commission of Markets and Competition (CNMC) is an independent

regulatory body that reports directly to the Spanish parliament. Its authorities on energy

include supervising and controlling the proper operation of energy markets and calculating

network access tariffs according to transmission and distribution costs. The CNMC also

supervises access to cross-border interconnections. At the EU level, the CNMC

co-operates with other regulators through the Council of European Energy Regulators and

the Agency for the Co-operation of Energy Regulators on developing network codes and

implementing the internal electricity market.

The Nuclear Safety Council (CSN) has authority over matters of nuclear safety and

radiation protection. It is directly accountable to the Spanish parliament and formally

independent from the administration.

All rights reserved.

2. GENERAL ENERGY POLICY

25

ENERGY INSIGHTS

The National Statistics Institute publishes statistical information on various fields such as

the economy, society and the environment, among others, in order to facilitate

decision making.

Other relevant ministries and bodies in the energy sector that co-ordinate policies with the

Ministry for the Ecological Transition and the Demographic Challenge are:

The Ministry of Agriculture, Fishing and Food is responsible for several energy-related

policies, such as air pollution and climate change.

The Ministry of Economic Affairs and Digital Transformation is in charge of the proposal

and execution of the government’s policies on economic issues and reforms to improve

competitiveness, industrial development, telecommunications and the information society,

development of the Digital Agenda, and other competencies and powers conferred by the

legal system.

The Ministry of Science and Innovation is responsible for the execution of the government's

policy regarding scientific and technical research, technological development and

innovation in all sectors, including the management of international relations in this area

and Spanish representation in programmes, forums and international organisations,

including the European Union.

The Ministry of Industry, Trade and Tourism develops and implements government policy

in the areas of industry, trade and tourism.

The Ministry of Transport, Mobility and Urban Agenda oversees land, aviation and maritime

infrastructure; the control, management and administrative regulation of transport services;

as well as access to housing, building, urban planning, land and architecture.

The autonomous communities have legal competencies related to energy, primarily in

authorising power plants of less than 50 megawatts (MW), and distribution networks of

electricity and natural gas. They are also heavily involved in designing and implementing

climate change, energy efficiency and renewable energy policies at the regional level.

General energy policy overview

Spain has built a stable, long-term strategy to transform the Spanish economy to a more

sustainable one, providing investment signals to guide its industrial composition toward

one where future competitive advantages are focused on greater innovation, better

efficiency and zero environmental footprint.

One of the major changes in Spain’s energy system since the last in-depth review has

been addressing the so-called tariff deficit, or a major imbalance between regulated costs

and revenues of the electricity and gas systems. In recent years, Spain has made

considerable headway in managing the tariff deficit in its electricity system, in part caused

by significant subsidies for renewables, which peaked at EUR 6.3 billion in 2008. Since

reforms enacted in 2013, system costs have been balanced with revenues, and a small

surplus was even recorded in 2014-18. A small deficit is expected for 2019, though

surpluses from previous years will cover it. The gas sector tariff deficit has similarly been

erased.

The current Spanish framework for energy and climate is based on the 2050 objectives of

national climate neutrality, 100% renewable energy in the electricity mix and 97%

renewable energy in the total energy mix. As such, it is centred on the massive

All rights reserved.

2. GENERAL ENERGY POLICY

26

development of renewable energy, particularly solar and wind; energy efficiency;

electrification; and renewable hydrogen. This is seen as an opportunity to stimulate the

economy; create jobs; modernise industry; enhance competitiveness; support vulnerable

groups; improve energy security; and support research, development and innovation.

As a member of the EU, Spain is bound by European targets for energy and climate

change as part of the Energy Union, which for 2020 include: a 20% reduction in

greenhouse gas (GHG) emissions, 20% of energy from renewable sources, a 20%

improvement in energy efficiency and a 10% electricity interconnection target. For 2030,

the level of ambition will grow to: a minimum 40% reduction in GHG emissions, a minimum

32% share of renewable energy, a minimum 32.5% improvement in energy efficiency and

a 15% interconnection target. The EU is currently finalising plans to further strengthen the

2030 targets; notably the GHG emissions reduction target is planned to increase from 40%

to 55%.

To achieve these targets, the central strategy document guiding Spain’s energy and

climate policies over the coming decade is its National Energy and Climate Plan (NECP)

for the period 2021-30, which Spain submitted to the European Commission in early 2020.

The document outlines a number of policy actions in various sectors that will support the

country’s climate targets, including in the areas of energy efficiency, renewables and

transport. Its 2030 objectives include: a 23% reduction in GHG emissions from 1990 levels;

a 42% share of renewables in energy end use; a 39.5% improvement in energy efficiency;

and a 74% share of renewables in electricity generation. Policies include increasing

renewable power installations and boosting the use of renewable gases in the power

sector, modal shifts and electrification in the transport sector, refurbishments and

increasing the use of renewable heating in the residential and commercial sectors,

promoting energy efficiency and fuel switching in the industry sector, and energy efficiency

improvements in the agricultural sector.

The government anticipates that investments of EUR 241 billion will be needed to enact

the measures outlined in the NECP, out of which 80% is estimated to come from the private

sector. It expects that as a result of the NECP’s measures, Spain will create up to 350 000

jobs annually, increase its GDP as much as EUR 25.7 billion, and avoid 2 400 premature

deaths.

Domestically, the Spanish government issued the Climate Emergency Declaration in

January 2020, which outlined 30 action areas to reach the climate neutrality goal by 2050,

with its three pillars being: 1) the Climate Change and Energy Transition Law; 2) the Just

Transition Strategy; and 3) the Long-Term Strategy. A supplemental National Energy

Poverty Strategy was also issued.

The Climate Change and Energy Transition Bill, approved by the government in May 2020

to be discussed in parliament, places the fight against climate change and the need for an

energy transition at the centre of the economy and society. Enshrining the principle of

carbon neutrality by 2050, it is the framework that will facilitate the co-ordination of policies

among different fields with coherence (see the section on climate change for more details).

Its main targets are similar to those of the NECP and include achieving at least 70% of

renewables in electricity by 2030 and 100% by 2050, at least 35% renewables in final

energy consumption by 2030, and to reduce primary energy consumption by at least 35%.

In this regard, it places renewable energy and energy efficiency at the centre of the energy

transition.

All rights reserved.

2. GENERAL ENERGY POLICY

27

ENERGY INSIGHTS

The Just Transition Strategy includes measures to promote employment opportunities in

the energy transition, supported by a framework of vocational training, active labour

policies, support measures to the most vulnerable and economic stimulus plans for those

regions the most affected by the energy transition.

In line with Paris Agreement commitments and the European Green Deal, Spain’s Long-

Term Strategy (LTS) anticipates and plans the transition towards climate neutrality in the

2050 horizon, with a reduction of at least 90% in total GHG emissions by 2050 compared

to 1990. The document includes interim milestones for 2030 and 2040, seizing the benefits

derived from the energy transition and bolstering the transformation and competitiveness

of the economy. The LTS defines the path that will enable an almost completely

renewables-based energy system (including in the transport, buildings and economic

sectors). Following an initial public consultation in April 2019 and a draft presentation in

July 2020, the LTS went through a second public consultation from July to September

2020, and was adopted by the Council of Ministers in November 2020. It will be reviewed

every five years.

The National Energy Poverty Strategy 2019-2024 was approved in 2019 as the instrument

to approach and analyse the energy poverty concept from a comprehensive perspective

for the medium and long term. This strategy includes a definition of energy poverty and

uses four indicators to measure the degree of energy poverty and its evolution:

1) percentage of households in which energy expenditure (as a share of household

income) is more than double the national average; 2) percentage of households in which

absolute energy expenditure is less than half the national average; 3) inability to maintain

dwellings at adequate temperatures; and 4) delays in energy bill payments.

Post-COVID-19 recovery

Given that Spain was hit hard by the COVID-19 pandemic and associated lockdowns, the

government has already approved energy-related measures to help stimulate the

economy. In particular, Royal Decree-Law 23/2020 from June 2020 includes measures to

advance energy storage, promote aggregation services in the electricity market,

encourage the formation of renewable energy communities, facilitate regulatory

sandboxes, stimulate demand management and sector coupling, as well as expand

electric vehicle charging infrastructure.

In the current post-COVID-19 context, the NECPs are expected to serve as the guiding

tool to direct the EU recovery plan’s actions, by frontloading the investments outlined in

the plan in the upcoming three years. In July 2020, EU leaders agreed to EUR 750 billion

in funding for recovery efforts. In order to receive support from the Recovery and

Resilience Facility, member states must prepare national recovery and resilience plans,

setting out their reform and investment agendas over the period 2021-26; funds must be

invested in the green and digital transformation.

Spain is currently working on its green recovery plan, as it will be one of the key

beneficiaries of EU recovery funds. Spain’s prime minister presented his government’s

plans for spending the EU recovery funds in early October. The Spanish government

expects to receive up to EUR 140 billion worth of grants and loans from the recovery funds,

out of which it plans to spend EUR 72 billion in the first three years (2021-23); of this

amount, over 37% is targeted for green investments. This will be supplemented by

EUR 27 billion from Spain’s national 2021 budget.

All rights reserved.

2. GENERAL ENERGY POLICY

28

The main areas defined in the initial draft of Spain’s Recovery and Resilience Plan for the

energy transition are efficiency, sustainable mobility, renewable energies, electricity

infrastructure, storage and flexibility, green hydrogen, and the just transition.

Energy efficiency

Spain’s overall energy strategy employs an “efficiency first” principle. Its energy efficiency

objectives are aligned with EU Energy Efficiency Directives, which establish a common

framework of measures to promote energy efficiency within the European Union, with

EU-wide targets of a 20% improvement in 2020 and 32.5% in 2030 (relative to 2005

levels). Spain assumes these objectives and establishes, in the NECP, a national guideline

for energy efficiency of 24.2% (excluding non-energy uses) by 2020, and by 2030, a

national indicative energy efficiency target of 39.5%. The reduction in primary energy

consumption proposed in the NECP is equivalent to 1.9% every year since 2017, which

when linked to an expected increase in GDP in the same period of around 1.7% will result

in an improvement in the primary energy intensity of the economy of 3.5% per year until

2030, which would be well above the IEA average over the last decade.

The National Energy Efficiency Fund was created in 2014 and is the main instrument to

implement measures for financial and economic support, technical assistance, training and

information, and other measures to increase energy efficiency across all sectors. It is

mainly financed by contributions from wholesale petroleum operators as well as natural

gas and electricity trading companies.

The NECP proposes 17 measures to meet the targets, 10 of which were designed along

a sectoral approach. Allocation of targets and funding for energy efficiency is granted

proportionally to the energy consumption of each sector, with transport receiving the

largest share. As such, the transport sector stands out in the NECP, with four measures,

followed by the industrial and residential sectors. The tertiary and agriculture and fishing

sectors represent the lowest contributions.

Given that the transport sector is the largest energy-consuming sector in Spain, accounting

for 38% of final consumption in 2019, the government has placed a particular focus on

reducing fuel consumption in the sector through a range of policies, including: promoting

modal shifts from road to rail and to bicycles, walking, public transit and shared vehicles;

increasing the use of advanced biofuels; renewing the vehicle fleet; and putting 5 million

electric vehicles on the road by 2030 (supported by a buildout of electric charging

infrastructure). The NECP establishes a target to source 28% of transport fuels from

renewables, which will mainly consist of biofuels and renewable electricity, well above the

14% required by the EU for 2030.

Electricity transition

Renewables

Spain’s renewable energy policy is aligned with EU 2020 targets, which set a binding

national target for renewable energy equal to 20% of gross final consumption of energy

(including 10% in transport). Spain’s targets on renewable energy for 2020 and the policies

and measures to meet them were initially laid out in the National Renewable Energy Action

Plan 2011-2020, which set a national 2020 target of 20.8% of renewable energy in gross

final energy consumption. Spain expects to reach a 20% share of renewables in gross final

energy consumption in 2020, up from 18.4% in 2019.

All rights reserved.

2. GENERAL ENERGY POLICY

29

ENERGY INSIGHTS

Spain is now focused on its 2030 targets. Overall, Spain’s NECP expects to achieve a

42% share of renewables in total end use of energy by 2030. This level will be led by the

power sector, where the plan projects the installation of nearly 60 gigawatts (GW) of new

renewable generation through 2030, led by wind and solar, amounting to 74% of total

electricity generation that year. This will put Spain on a pathway toward achieving its 2050