Page 1 of 18

California’s Solar Consumer Protection Guide

July 2019

Putting solar on your home is an important financial decision.

Don’t sign a contract until you read this document! [graphic to go here]

• In many areas of California, you cannot connect a rooftop solar system to the electric grid

until you read, initial, and sign this document.

➢ To see if you qualify for low-income solar programs, go to page 9.

➢ This guide is also available in Spanish, Chinese, Vietnamese, Korean, and Tagalog. See this

link or call XXX-XXX-XXXX.

➢ For visually impaired individuals, or for anyone who prefers to hear this guide read aloud,

an audio recording is available at XXX-XXX-XXXX.

The California Public Utilities Commission (CPUC) created this guide to provide information

to homeowners interested in rooftop solar. The CPUC is a government agency that

oversees the solar programs of privately-owned electric utilities.

For more information on this guide, please visit: link to CPUC webpage

Customer Initial Here ___________ (1/4)

Before Going Solar:

Take your time. [graphic to go here]

Beware of scams. See the next page. [graphic to go here]

Make sure the solar provider has a valid license. See page 4. [graphic to go here]

Page 2 of 18

If you are considering signing a contract for a rooftop solar system,

make sure to read at least the next 3 pages.

1) Beware of Solar Scams

There are many honest and fair Solar Providers in California. However, there are also scams and misleading

advertising that you should watch out for. See below for some common scams.

Scam: A salesperson promises you free rooftop solar energy at no cost to you.

The Truth: Rooftop solar energy is almost never free. An honest company will be up front about all

the costs you will pay over time.

o There is one exception: some government-funded solar programs offer free or low-

cost solar to low-income households. See page 9 for more details.

Scam: A salesperson tells you that you will never pay an electricity bill ever

again after you install a solar system.

The Truth: You will still receive an electricity bill from your utility after going solar. Most rooftop

solar customers still pay at least a small electricity bill every month, with a larger

payment due to the utility at the end of a 12-month cycle.

o Customers who take out a solar loan or sign a lease or power purchase agreement

will also receive a monthly bill from a loan company or solar provider. If you use

PACE financing, your payments will be due once or twice a year with your property

taxes or monthly with your mortgage payment.

Scam: A salesperson insists that you sign an agreement on an electronic tablet

without showing you the contract terms.

The Truth: California law requires that a salesperson show you the contract terms before you sign.

An honest salesperson would never rush you to sign anything, especially on a tablet,

without giving you the time to review all the paperwork.

o By law, the contract must be written in the same language the salesperson used to

sell you solar.

If you think you have been a victim of solar fraud, report the incident to the Contractors State License Board

(CSLB) at XXX-XXX-XXXX or at this link.

Customer Initial Here ___________ (2/4)

Page 3 of 18

2) Know Your Rights [graphic to go here]

YOU HAVE THE RIGHT to a 3-day cancellation period after signing a contract.

You have three business days to cancel your contract for any reason. You may cancel the contract by emailing,

mailing, faxing or delivering a notice to your solar provider by midnight of the third business day after you

received a signed, dated copy of the contract.

➢ If your solar provider refuses to cancel the contract, report them to the Contractors State License Board

(CSLB) at this link.

YOU HAVE THE RIGHT to a Solar Disclosure Document from your solar provider.

By law, a solar provider must provide a Solar Energy System Disclosure Document created by the CSLB and

California Public Utilities Commission. This document provides you with information about your solar system,

such as total costs. See this document at this link and learn more on page 15.

YOU HAVE THE RIGHT to read this entire 18-page guide before signing a contract.

If you are a PG&E, SCE, or SDG&E customer, a solar provider must give you the time to read and sign this guide

before you sign a contract for solar. If they do not allow you to read this document, they cannot interconnect

your solar system to the electric grid.

YOU HAVE THE RIGHT [placeholder]

[This right is a placeholder until after AB 1070 (Gonzalez Fletcher, 2017) Section 3 is implemented through

CPUC’s R.14-07-002 stakeholder process]

Customer Initial Here ___________ (3/4)

Page 4 of 18

3) Ask a Solar Provider These Questions Before You Sign a Contract.

What is your Contractors State License Board (CSLB) license number?

o Ask for a proof of the license. You can check the license to make sure it is valid by going to this link

or calling XXX-XXX-XXXX.

▪ CSLB License Number is: _____________________.

o If your solar provider does not have a valid license, do not sign a contract with them.

What is the total amount of payments I will make over the entire contract

period for solar?

o If you are considering a solar loan, lease, or power purchase agreement, ask if there is a down

payment, how you much you will pay per month, when these payments will increase, and by how

much.

o If you are considering PACE financing, ask how much you will pay once or twice a year with your

property taxes or monthly with your mortgage. Ask how many years you will pay this amount.

How will a solar system impact the sale or refinancing of my home?

o Ask your solar provider to show you where in the contract it describes what happens when you sell

your home.

For more questions to ask a solar provider, go to page 7 of this guide.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

OK, I read these 3 pages. Now what?

➢ For a step-by-step guide for how to go solar, proceed to the next page. This is

recommended, even if you’ve already started the solar process!

➢ If you want to skip to the “Before You Sign” checklist, please go to page 17 of this guide.

Customer Initial Here ___________ (4/4)

[pop out box]

Make sure to get 3 bids from different

solar providers before you sign a

contract. See page 7 of this guide for

more details.

Page 5 of 18

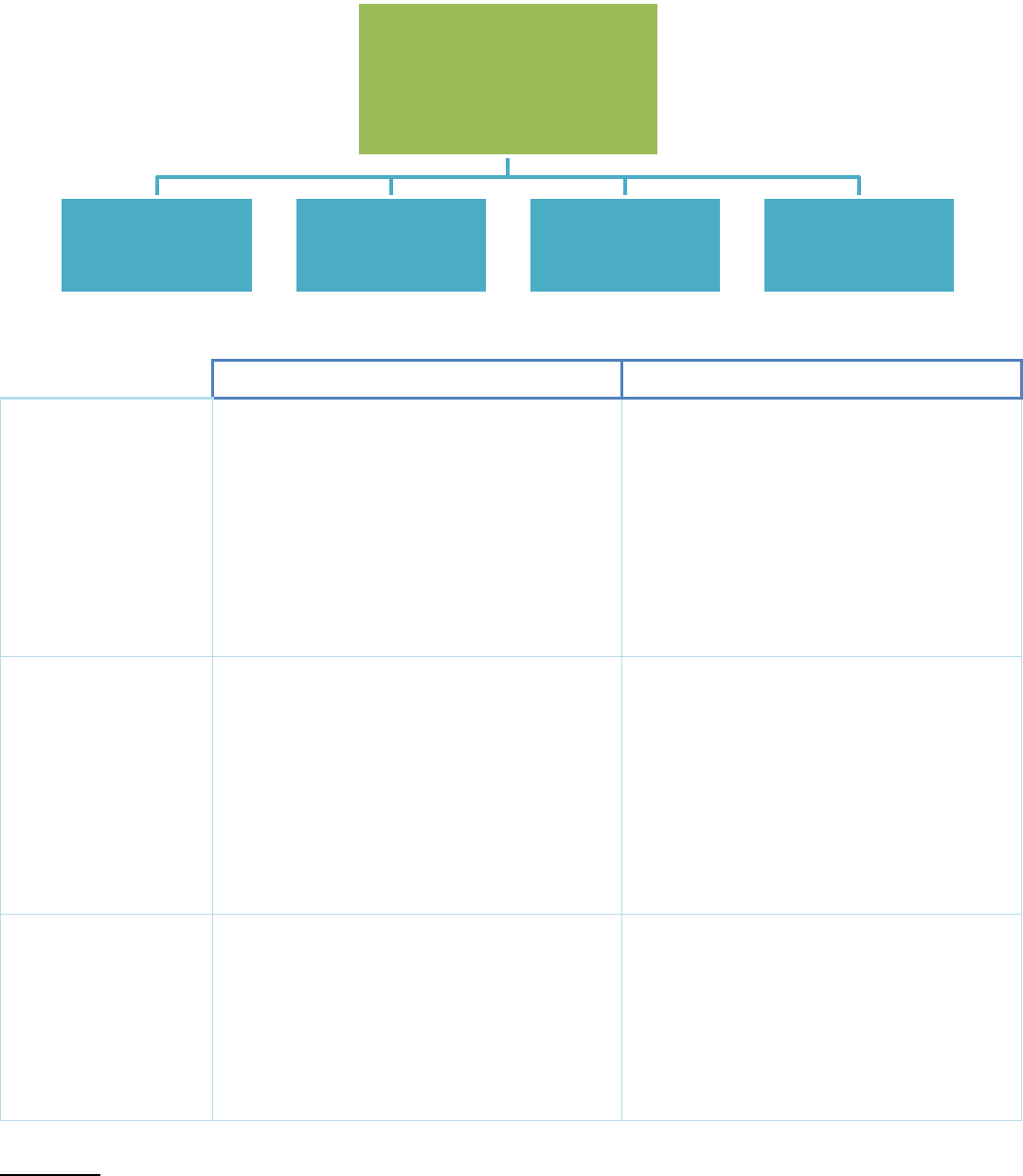

Roadmap for Rooftop Solar

The information below will be a graphic similar to this:

Step 1: Decide if Rooftop Solar Is Right for You

Step 2: Understand Roles and the Rooftop Solar Process

Step 3: Find a Qualified Contractor

Step 4: Compare Financing Options

Step 5: Learn About Electricity Bill Savings

Step 6: Carefully Read All Paperwork

Step 7: Check Off the “Before You Sign” Checklist

Step 8: Sign This Guide

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Step 1: Is Rooftop Solar the Right Choice for Me?

Rooftop solar photovoltaic panels capture sunlight on your roof and convert it into electricity.

This electricity powers the needs of your home, like lights and appliances.

1

[graphic to go here]

Before you consider getting rooftop solar, ask yourself:

• Have I made my home energy efficient first?

o Making your home energy efficient before going solar can decrease your overall energy use and

reduce the size of the solar system you need, potentially saving you thousands of dollars. Call your

utility or check their website for energy efficiency tips and advice on how to get an in-person home

energy assessment.

• Do I qualify for low-income solar programs?

o If you think you might qualify for a low-income solar program, go straight to page 9 of this guide.

There are rooftop solar and community solar programs available for qualifying low-income PG&E,

SCE, and SDG&E customers that could save you more money with no financial risk.

• Have I considered community solar?

o If you are a PG&E, SCE, or SDG&E customer, you can sign up for a community solar program and

receive 50-100% of your electricity from solar projects located across California. This could be a

good option for you if your roof is heavily shaded or isn’t in great condition. Check out this link.

1

Note that solar panels can also be ground-mounted on your property.

Page 6 of 18

Step 2: Understand Roles and the Rooftop Solar Process

Solar Providers are the companies that sell you solar and send

installers to your home. Sometimes they provide financing.

[Question for stakeholders: should we use the term “Solar

Company” throughout the guide instead?]

Salespeople work for Solar Providers and may call you or

knock on your door. Similar to Solar Providers and

Installers, they must be registered. Check their “HIS

registration” at link or by calling XXX-XXX-XXXX.

Installers are sent by Solar Providers to your home to conduct

site visits and install the solar system.

Lenders or Financers provide you with financing if you have a

solar loan or PACE financed system.

Electric Utilities interconnect your rooftop solar system to the

electric grid and send you electricity bills that may include

solar bill credits.

Program Administrators manage PACE financing programs.

They must be licensed. Check their license at this link.

Manufacturers are the companies you would contact about

equipment warranties if you own a solar system.

City/County Inspectors come to your home to make sure the

system is up to code in order to get a permit.

Overview of a Sample Rooftop Solar Process

Before you sign a contract

1) You………………………… get a home energy assessment to make your home more energy efficient

2) You……………………….. research Solar Providers and compare 3-6 bids

3) Solar Provider……….. provides a Solar Disclosure Document based on your roof and energy use

4) You……………………….. review the Solar Disclosure Document with Solar Provider and ask questions

5) Solar Provider……….. writes up solar contract

6) You……………………….. qualify for financing (if needed)

7) Lender/Financer……. writes up financing agreement (if needed)

8) You……………………….. go through checklist on p. 17 of this guide

9) You………………..…….. sign this guide, Solar Disclosure Document, solar contract, and financing agreement

After you sign a contract

1) Installer………………… performs a home site visit to confirm assumptions and check roof/electric conditions

2) Solar Provider……….. applies for building permit with city or county agency

3) Installer……….… …….. installs the solar system (only after receiving city/county permit)

4) City/County Inspector inspects home for building permit compliance

5) Solar Provider………… submits application to utility to interconnect solar system to grid

6) Solar Provider……….. submits city/county inspection approval to utility

7) You……………………….. turn on system only after receiving written approval from utility

8) Electric Utility… …….. sends you your first electricity bill with solar/net energy metering credits (see page 13)

9) Lender/Solar Provider sends you first bill for solar system or solar energy

Rooftop

Solar

Solar

Provider

Lender or

Financer

Program

Admiinistrator

Manufacturer

Installer

Electric

Utility

City or

County

Inspector

Sales-

person

Page 7 of 18

Step 3: Find a Qualified Solar Provider

Find Solar Providers that Serve Your Neighborhood

• Go to www.CaliforniaDGStats.ca.gov, a government-funded website, to enter your zip code and see a list of

Solar Providers and their recent installation costs.

• Refer to the Contractors State License Board (CSLB) List of Solar Providers at this link.

• Check to see if your county has a County Contractor’s Association with Solar Providers.

• Research solar panel brands and search manufacturer website for Solar Providers that sell them near you.

• Ask a community-based group, or friends and neighbors, for Solar Providers they recommend and why.

Narrow Down the List to Qualified Solar Providers

• First, make sure Solar Providers you consider have a valid license from the Contractors State License Board

(CSLB). It is illegal for Solar Providers and their Installers to conduct business without a license.

o Go the CSLB website at link or call XXX-XXX-XXX to see if the Solar Provider and Installer licenses are

current and valid. The licenses must be in the category C-10, C-46, A or B.

• Find out how long the company has been in business and how many installations they have done.

• Check out customer review websites online. Since some websites may not be neutral, check a few different

websites to make sure reviews are consistent.

• It’s a good sign if companies employ installers certified by the North American Board of Certified Energy

Practitioners (NABCEP), a high standard in the industry.

Get Bids From 3 to 6 Qualified Solar Providers and Ask Questions

• After you narrow down the list of Solar Providers, ask for a bid or price quote.

o Note that the best option for you is not necessarily the cheapest bid. A very low bid may indicate that a

Solar Provider is trying to cut corners.

• Don’t hesitate to ask Solar Providers lots of questions up front. A qualified company will be happy to answer all

of them. A sample list of questions is below.

Sample Questions to Ask a Solar Provider

Company Background

What is your company’s license number from the Contractors State License Board (CSLB)? What is

your Installer’s license number?

Will you subcontract to another company to install the solar system? If so, what is their CSLB number?

How long have you been in business and how many systems have you installed?

Can you provide me with three customer references to call?

Design and Roof

Why did you choose this specific design and size?

▪ Note that a system sized to cover all of your energy use isn’t necessarily the best investment.

Typically, a system is sized to around 80% of your electricity use from the previous year.

Does my roof need to be replaced before installing solar panels?

▪ If yes, how much will that cost, who will do it/what is their license #, and is there a roof warranty?

What steps will you take to ensure my roof won’t leak?

How much will it cost to remove and re-install the panels if I need to replace my roof down the road,

including inspection fees?

Continued on next page

Page 8 of 18

Sample Questions to Ask A Solar Provider, Continued

Estimated Electric Bill Savings

Please beware of a solar provider that tells you solar is free—it is not. See page 2 for info on solar scams.

This bullet is a placeholder until AB 1070 implemented through CPUC’s R.14-07-002 stakeholder process.

What electricity rate do you recommend I switch to and why?

How long will I be on that rate, and how can I compare or change rates on my utility website?

Warranties and Performance of Solar System

Are there warranties for the panels and inverters?

▪ If yes, how long do they last and who do I contact to replace these components?

▪ If equipment such as the inverter fails after the warranty period, how much will it cost to replace?

Are there warranties for labor/construction?

Are repairs and maintenance included in the contract? If yes, who should I contact for repairs?

Will I be able to monitor the performance of the system once it’s installed? If so, how?

Does the solar provider offer a minimum energy guarantee (common with leases/power purchase

agreements)?

▪ If yes, how will I be paid if the system does not produce as much energy as promised in the contract?

Is there an insurance policy that comes with the solar system, or do I need to take out additional

homeowner’s insurance? Note that this is especially important if you live in fire-prone areas.

What are my obligations in the contract if my solar system stops working due to a disaster like an

earthquake or a fire?

Who has the right to claim the environmental benefits of the power generated by my system?

Impacts on Future Sale of Your Home

How will a solar system impact the home sale and refinancing of my property?

For leases, power purchase agreements (PPAs), and PACE financed systems:

What happens if the home buyer doesn’t want the solar system or doesn’t qualify to take on my

lease, PPA or PACE financed system?

Are there fees if I need to terminate the contract early to sell my house?

Are there fees for transferring the lease, PPA, or PACE financing to a new homeowner?

Timeline

When do you propose to start and finish installing solar on my roof?

After installation is complete, how long do you estimate it will take for my utility to interconnect my

system to the grid?

Want to know questions to ask a lender or financer? Keep reading because those are in the next sections!

Page 9 of 18

Step 4: Compare Your Financing Options

There are many financing options for rooftop solar. Before you invest time researching those options, STOP!

First check to see if you qualify for any low-income solar programs below. If you qualify, these solar programs

will save you more money without any financial risk.

Low-Income Solar Programs available to PG&E, SCE, and SDG&E eligible customers

If you currently receive a discounted electricity bill through the CARE or FERA program, you may qualify for

one of these programs.

You may also qualify for one of these programs if you live in a disadvantaged community (DAC). A DAC is a

neighborhood vulnerable to multiple sources of pollution. To find out if you live in a qualified DAC, check out

the map at this link.

If you are not a PG&E, SCE or SDG&E customer, call your electric utility-- or check their website-- to see if any

low-income solar options are available to you.

SASH Program and DAC-SASH Program

The SASH Program provides discounted rooftop solar for qualifying low-income homeowners who

live in affordable single-family housing. If you qualify, your family can get assistance installing solar at

a low cost.

The DAC-SASH program is designed for CARE or FERA eligible homeowners that live in a

disadvantaged community (DAC). Homeowners do not need to live in a home defined as affordable

to qualify but must live in a qualified DAC.

➢ See this link or call XXX-XXX-XXXX for more information on eligibility and how to sign up.

DAC-Green Tariff Program

The DAC-Green Tariff Program is designed for CARE or FERA eligible households that live in a

disadvantaged community (DAC). Participants can have 100% of their electricity offset by solar

generation and receive 20% discount on their electricity bills.

In this program, you do not have to install solar on your roof. The solar is installed elsewhere and the

bill credits are assigned to you.

➢ See this link or call XXX-XXX-XXXX for more information on eligibility and how to sign up.

Community Solar Green Tariff Program

The Community Solar Green Tariff Program allows households in a disadvantaged community to

subscribe to a solar array within 5 miles of their neighborhood and receive a 20% discount on their

electricity bills.

➢ See this link or call XXX-XXX-XXXX for more information on eligibility and how to sign up.

Page 10 of 18

Side-By-Side Quick Financial Comparison

Pros

Cons

Purchase

• Typically greater return on investment.

• May increase value of home.

• You can directly receive tax credits and

deductions.

• You are responsible for repairs and

maintenance, which may involve

contacting different manufacturers, who

could go out of business during the 10-

20 year component lifecycles.

• Some solar loans place a lien on your

property. If you do not make your

payments, this could result in

foreclosure or complicate home

sale/refinancing.

PACE Financing

• Little or no upfront costs.

• May have a longer repayment period

than typical home improvement loan.

• You can directly receive tax credits and

deductions.

• PACE financing results in a first-priority

lien on your property. If you do not

make your payments, this could result in

foreclosure or complicate home

sale/refinancing.

• You are responsible for repairs and

maintenance, which may involve

contacting different manufacturers, who

could go out of business during the 10-

20 year component lifecycles.

Lease and PPA

• Little or no upfront costs.

• Solar Provider is responsible for all

monitoring, maintenance and repairs.

• Minimum energy production often

guaranteed.

• Selling home is more complicated than

with a purchased system, since new

owner must agree to take on the

lease/agreement or you must buy out

the lease/agreement, which could be

thousands of dollars.

• Solar Provider could go out of business

during the contract period.

Purchase

You can purchase a solar system from a Solar Provider or Manufacturer with a solar loan or cash. In this

approach, you own the installed system. Types of loans include:

Most Common

Rooftop Solar

Financing Options

Purchase

(Cash or Loan)

PACE Financing Lease

Power Purchase

Agreement

(PPA)

Page 11 of 18

• Secured loans: these require an asset that will serve as collateral for the loan – in most cases, that

asset is your home, similar to a home equity loan.

• Unsecured loans: these do not require any collateral other than the solar panel system.

Typically, a secured loan is preferred because it is tax deductible and has lower interest rates.

Many Solar Providers work with lenders that offer solar loans, but you should check with banks and credit

unions as well. Compare offers to make sure you are being offered a reasonable interest rate.

If you purchase and begin construction on a solar system before December 31, 2021, you can deduct between

22% and 30% of the cost of installing solar from with a federal solar tax credit (ITC). If you have questions

about the ITC or whether a loan is tax deductible, speak to a Certified Public Accountant (CPA) for tax advice.

Since you will be responsible for any maintenance and repairs, make sure you save the equipment warranties,

particularly for the inverter, which may need to be replaced sooner than other equipment. If you sell your

home, look for real estate agents and appraisers with experience selling homes with solar. You may include

the system in the house sale just like any other major home component.

PACE (Property Assessed Clean Energy)

PACE is a financing option that is available in some areas of California. In a PACE financing arrangement, a

PACE Program Administrator finances the upfront costs of a solar system, which you then pay through an

assessment on your property tax bill. With PACE financing, you own the solar system.

PACE financing lasts for a fixed term, typically around 10-20 years, and it is attached to your house. If you sell

your house before you have fully paid the PACE assessment, a buyer may require you to repay the assessment,

which could be thousands of dollars. Some mortgage lenders will not loan money to buyers to purchase

properties with PACE liens unless the full assessment is paid.

Unlike Leases and Power Purchase Agreements that require monthly payments, PACE assessments are

typically due once or twice a year with your property taxes. Given this unique arrangement, it’s important to

understand how much you will owe and when, so that you can set aside enough money throughout the year

to cover the amount.

If your house is mortgaged and you typically pay your taxes with an escrow or impound account, your

mortgage company may increase the amount you must pay monthly to cover the anticipated increase to your

property tax bill. Discuss how PACE will affect your monthly mortgage payment before you sign an agreement.

Questions to Ask a Lender About the Purchase of a Solar System with a Loan:

What is the total cost of the loan over the entire course of the contract?

How much will I pay up front, how much over time, and for how long?

What is my interest rate?

Who do I contact if I have questions about my loan payments?

How does a solar loan affect the ability to sell or refinance my home?

Page 12 of 18

Lease and Power Purchase Agreement

With a Lease, the Solar Provider owns the system on your property and “rents” it to you for a set period of

time. A Solar Provider will install the solar system on your home, and you will make scheduled monthly

payments in exchange for all the electricity the system produces. A typical Lease contract period is 15-25

years.

In a Power Purchase Agreement (PPA), the Solar Provider owns the system on your property and sells you the

electricity it generates. PPAs are similar to Leases, except that instead of making a fixed monthly payment for

the system, you pay for every unit of energy the solar system generates (a fixed per-kilowatt-hour rate). The

contract will specify the kilowatt hour rate you pay in the first year and every year after that. This rate should

be lower than your current utility rate. A typical PPA contract period is 10-25 years.

➢ If you sell your house before the Lease or PPA contract is over, you will have to pay the Solar Provider the

remainder of the value of the Lease or PPA or transfer the contract to the new property owner. Make sure

you understand the specific contract terms, since buying out a Lease or PPA can cost thousands of dollars.

➢ Payments for both Leases and PPAs will typically increase by a specified amount every year based on an

“escalation clause” or “escalator.” Escalators are typically in the range of a 1% to 3% increase above the

rate you paid in the previous year. Be cautious of entering into a contract with an escalator higher than

that.

➢ There are different ways to arrange Leases and PPAs, such as paying more up front to reduce your monthly

payments.

Questions to Ask a PACE Program Administrator About a PACE financed System:

What is the total cost of the financing over the entire course of the contract?

How much will I owe for PACE financing when I pay my mortgage or property taxes?

How many times a year will I owe this PACE payment?

What happens if I want to sell or refinance my home? Is there anything I have to do with the

mortgage company?

What are the penalties for failing to pay the assessment on time?

Who do I contact if I have problems making my PACE payments?

Questions to Ask a Lender or Solar Provider About a Lease or PPA:

What is the total cost of the solar system or solar energy over the entire course of the

contract?

How much will I pay up front, how much over time, and for how long?

Will my payments increase over time? How much will they increase, and how

frequently?

Is there an option to make a down payment to reduce my monthly payments (for a

Lease) or kilowatt hour rate (for a PPA)?

What happens if I wish to end the Lease or Power Purchase Agreement early?

Will I owe a balloon payment and/or an early termination fee? If so, how much will I

owe?

How does a Lease or PPA affect the ability to sell or refinance my home?

Page 13 of 18

Step 5: Learn About Electricity Bill Savings

Electricity Bill Savings Estimates—What You Need to Know

[After AB 1070 implemented through CPUC’s R.14-07-002 stakeholder process, additional text will go here]

How Electricity Bill Savings Work

There is a special arrangement with your utility that is called Net Energy Metering (NEM). NEM allows you to

get a financial credit on your electricity bill when your rooftop solar system sends electricity back to the grid

after first powering electricity needs at your house. Usually this credit is approximately equal to the retail rate

of energy. This means that you are credited on your bill about the same amount that your utility would have

charged you for electricity during that time.

NEM and Your Electricity Bill

Since the sun isn’t always shining, solar customers also rely on electricity from their utility. After your solar

system is interconnected to the grid, your monthly electricity bill will summarize how much electricity you

drew or “consumed,” from the utility, and how much your solar system sent to the grid or “exported.”

If you drew in more than you sent out to the grid in any given month, you will see an overall charge on your

bill. If you sent out more than you drew in, you will see an overall credit. Typically, you will be able to carry

forward credits to the next month’s bill, and electricity usage charges will not be due until the end of a 12-

month period. Note that many utilities require solar customers to pay a monthly minimum bill each month

just like other utility customers.

Electricity Bill Savings Estimates Do Not Guarantee Savings

An electricity bill savings estimate is an educated guess about how much you could save with rooftop solar.

Here are some reasons why it’s possible that your savings could be lower than the estimate:

• Electricity bill savings estimates are based on several uncertain factors. For example, the estimates

include a forecast of your electricity use based on your previous usage. If your family grows or you

decide to turn up your Air Conditioning in the summer, your energy usage will go up, and your overall

savings could go down.

• Electricity rates can change over time. Your utility may require you to switch to a different rate in the

future, which would change how much you save.

• If you sell your home, you could incur additional costs. For example, if a buyer doesn’t want to take on a

Lease or Power Purchase Agreement, you might have to buy out the contract, which could be thousands

of dollars.

Before you sign a contract, ask yourself: if the savings end up being lower than the estimated monthly or

yearly savings, does getting rooftop solar still make sense to me?

Page 14 of 18

12 Month “True Up” Bill

At the end of a 12-month period, you will receive a “True Up” bill that reconciles all the credits and charges.

Even though going solar can reduce your electricity costs, most customers still owe some money to their utility

at the end of the 12 months. Some utilities give you the option to pay your bills monthly instead of annually. If

you choose this option, you won’t have to worry about paying for one potentially large bill at the end of the

year.

Though it’s rare, if you have an electricity credit balance at the end of the 12-month period, you are eligible to

be paid “net surplus compensation,” which is around 2 to 3 cents per kilowatt hour. Because this rate is lower

than the retail rate, it is generally not in your financial interest to install a solar system that produces more

energy than you would use over the course of a year.

Customers in PG&E, SCE, and SDG&E territories are guaranteed NEM for 20 years from the time their solar

system starts operating. Your electricity rate, however, is subject to change. See this CPUC link for more

details.

Getting Environmental Credit for Going Green [pop out box #1]

When a rooftop solar system produces electricity, the system is assigned Renewable Energy Certificates, or

“RECs,” which are certificates that represent the renewable energy that is generated. If you purchase a

solar system, you can make the claim that you’re avoiding emissions of greenhouse gases by going solar.

However, if you enter a Lease or PPA, the contract may state that the Solar Provider or Lender owns the

RECs, and therefore you cannot claim the environmental benefit. And with PACE financing, a local

jurisdiction may own the RECs. If owning the RECs is important to you, ask your solar provider who will own

the RECs, and check the contract fine print.

Combining Solar with Storage [pop out box #2]

When you install battery storage with your solar system, you can store excess solar electricity produced by

your panels for use in the evening when the sun goes down. The software that comes with battery storage

automatically determines whether to store the extra energy or export it to the grid to maximize cost

savings. Battery storage can also provide limited backup power.

The state-funded Self-Generation Incentive Program (SGIP) provides financial incentives to install storage.

See this link for details on the SGIP program.

Page 15 of 18

Step 6: Carefully Read All Paperwork

[Visual of the three sample documents described below, side-by-side, to go here]

The Solar Energy System Disclosure Document

• [This section is a placeholder until supporting information for the Solar Energy System Disclosure

Document is produced at the CSLB’s discretion in collaboration with the CPUC pursuant to sub

paragraph (c) of Business and Professions Code section 7169. It will be a brief description of the

document’s purpose and key information it contains].

Contract

• The solar contract—not the Solar Energy System Disclosure Document—is the legally binding

document between you and the Solar Provider. Make sure to read it carefully.

• If you saw important information in the Solar Energy System Disclosure Document that is not

referenced in the contract, ask the Solar Provider to include it.

• Make sure everything you were promised is written in the contract, such as answers to questions

on p. 7 and 8 of this guide.

• By law, any contract for rooftop solar must include:

o Contractor information, including business address and license numbers

o Description of the project, including equipment installed and materials used

o Contract price, plus finance charge and/or down payment if applicable

o Approximate start and end date

o Notice of a 3-day right to cancel the contract

• Ask the Solar Provider what situations would allow you to be released from the contract. For

example, if your Solar Provider discovers on a site visit that your roof is shaded in a way that wasn’t

expected, that could void the contract.

Financing Agreement

• If you are purchasing a system with a solar loan or PACE financing, you will be asked to sign a

financing agreement. A financing agreement is typically given to you by your Solar Provider on

behalf of a financing institution or PACE Administrator.

• Make sure everything you were promised is written into the agreement, such as answers to

questions on pages 11 and 12 of this guide.

Page 16 of 18

Additional Resources

Utility Solar Program Resources:

PG&E: Phone # PG&E Solar Call Center

PG&E’s Guide to Going Solar link

Solar program link

Solar checklist link

SCE: Phone # SCE Solar Call Center

Solar program link

SCE solar videos

SDG&E: Phone # SDG&E Solar Call Center

Solar program link

SDG&E Let’s Go Solar…Together Guide link

➢ If another utility supplies you with electricity, call them or check website for details on their solar programs.

Low-Income Solar Programs:

• SASH Program phone #s and links

• DAC GT Program phone #s and links

• Community Solar GT Program phone #s and links

➢ If another utility supplies you with electricity, please see their website for low-income solar options.

Contractors State License Board (CSLB) Resources:

• “Check a License” tool to confirm status of Solar Provider and Installer’s license

• Check an HIS Registration status

• CSLB Solar Energy System Disclosure Documents

• CSLB customer help phone number

• CSLB “Solar Smart” link

Department of Business of Oversight (DBO) Resources (for PACE financing):

[placeholder for DBO PACE guides when available]

Net Energy Metering (NEM) Resources Solar Financing Guides

• CPUC NEM website link CESA Homeowner’s Guide to Solar Financing in English

• PG&E NEM link + NEM sample bill link CESA Homeowner’s Guide to Solar Financing in Spanish

• SCE NEM link + NEM sample bill link CESA/GW video Financing 101

• SDG&E NEM link + NEM sample bill link

Other Solar Guides

• Solar Energy Industries Association (SEIA) Residential Consumer Guide to Solar Power link

• Interstate Renewable Energy Council (IREC) consumer checklist link

• CESA/GW How to Choose An Installer video link

• EnergySage “Solar 101” page link

means available

in video format

Page 17 of 18

Step 7: “Before You Sign” Checklist

Before you sign any documents, make sure you have completed these items! Remember, take your time and

don’t feel pressured to sign a contract.

Consider making your home more energy efficient before getting solar. This could save you money.

See page 5.

Check to see if you qualify for a low-income solar program, which has strong protections for

consumers. See page 9.

Get at least 3 bids for rooftop solar. See page 7.

Check to make sure the Solar Provider’s license is current and valid with the Contractors State License

Board. See page 4.

Ask the Solar Provider for 3 customer references.

Ask the Solar Provider the contract questions on page 7 and 8 so you understand the terms of the

solar contract.

If you are financing your system, ask the lender, Solar Provider or PACE Program Administrator the

finance questions on page 11 or 12, so you understand the terms of your financing arrangement.

Read the critical information about electricity bill savings estimates on page 13.

Carefully read all the documents that the Solar Provider is asking you to sign. These usually include: 1)

Solar Energy System Disclosure Document, 2) contract, and 3) financing agreement. See page 15.

Understand what happens after you sign a contract for solar. See page 6.

Save copies of all the documents after you sign. The information will be useful if you sell your home,

need to replace your roof, or have any repair/maintenance issues.

Page 18 of 18

Step 8: Sign This Guide

Have you read at least the first 4 pages of this guide?

The first 4 pages of California’s Solar Consumer Protection Guide contain important

information on how to avoid solar scams and your rights.

The California Public Utilities Commission recommends that you take 48 hours

to read and understand this entire 18-page guide.

Customer

I read and initialed the first 4 pages of the California’s Solar Consumer Protection Guide.

The solar provider asking me to sign this page gave me the time to read the 18-page guide.

I have not yet entered into a contract for solar with the solar provider signing below.

Customer Printed Name Customer Signature Date

Solar Provider

2

I printed out the 18-page guide for the customer signing above, unless customer already had a copy.

I gave the customer the time to read the entire 18-page California’s Solar Consumer Protection Guide.

The customer initialed the first 4 pages of the guide.

The customer signed above before entering into a contract with my company for a purchase, lease,

power purchase agreement, or PACE financing of a solar system or solar energy.

Employee Name/Title Employee Signature Date

Company Name Company and Employee Email Company Phone

2

A solar provider is defined in California Public Utilities Commissioner Decision (D.) 18-09-044 [link to be inserted] as a vendor, contractor, installer, or financing entity

that enters into a contract for a power purchase agreement, lease, or purchased solar system. Pacific Gas and Electric (PG&E), Southern California Edison (SCE), and

San Diego Gas & Electric (SDG&E) require solar providers to upload a signed copy of this page with a wet signature to their interconnection portals before

interconnecting residential customers in single-family homes to the electric grid. This requirement does not apply to new home construction.