Federal Communications Commission FCC 20-188

Before the

Federal Communications Commission

Washington, D.C. 20554

In the Matter of

Communications Marketplace Report

)

)

)

GN Docket No. 20-60

2020 COMMUNICATIONS MARKETPLACE REPORT

Adopted: December 31, 2020 Released: December 31, 2020

By the Commission: Commissioner Carr approving in part, concurring in part and issuing a statement;

Commissioner Rosenworcel concurring and issuing a statement; Commissioner Starks approving in part,

dissenting in part and issuing a statement.

TABLE OF CONTENTS

Heading Paragraph #

I. INTRODUCTION .................................................................................................................................. 1

II. ASSESSMENT OF THE STATE OF COMPETITION ........................................................................ 4

A. The Mobile Wireless Marketplace ................................................................................................... 6

1. Overview of the Mobile Wireless Marketplace ......................................................................... 9

a. Service Providers ................................................................................................................ 9

b. Connections/Subscribers and Connections Market Share ................................................ 20

c. Churn ................................................................................................................................ 26

d. Data Usage ........................................................................................................................ 27

2. Mobile Wireless Spectrum and Service Providers’ Spectrum Holdings ................................. 29

3. Wireless Infrastructure ............................................................................................................ 34

4. Pricing Levels and Trends ....................................................................................................... 37

a. Postpaid Service ................................................................................................................ 38

b. Prepaid Service ................................................................................................................. 41

c. Price Indicators for Mobile Wireless Services .................................................................. 44

5. Non-Price Competition ............................................................................................................ 50

a. Investment ......................................................................................................................... 50

b. Innovation and Technological Change ............................................................................. 52

c. Mobile Wireless Devices, Services, and Advertising ....................................................... 58

d. Speed of Service ............................................................................................................... 62

6. Network Coverage ................................................................................................................... 66

a. FCC Form 477 .................................................................................................................. 67

b. Mobile Wireless Coverage Estimates ............................................................................... 72

B. The Fixed Broadband Services Marketplace ................................................................................. 82

1. Overview of the Fixed Broadband Marketplace ..................................................................... 83

a. Technologies Deployed .................................................................................................... 85

b. Service Providers .............................................................................................................. 92

c. Connections/Subscribers ................................................................................................... 99

d. Adoption Rates ............................................................................................................... 101

2. Competition in Fixed Broadband .......................................................................................... 105

a. Investment Trends ........................................................................................................... 106

Federal Communications Commission FCC 20-188

2

b. Pricing ............................................................................................................................. 109

c. Speed ............................................................................................................................... 115

d. Access to Multiple Providers .......................................................................................... 125

3. Competition between Fixed and Mobile Broadband Service ................................................ 130

C. Voice Telephone Services ............................................................................................................ 143

D. The Video Marketplace ................................................................................................................ 150

1. Overview of the Video Programming Marketplace .............................................................. 150

2. Multichannel Video Programming Distributors .................................................................... 154

a. Providers and Subscribers ............................................................................................... 154

b. Channel Packages and Bundling ..................................................................................... 160

c. Pricing ............................................................................................................................. 163

d. Video Revenue ................................................................................................................ 167

e. Content Ownership ......................................................................................................... 168

f. Commercial Availability of Equipment Used to Access MVPD Programming and

Services ........................................................................................................................... 170

3. Online Video Distributors ..................................................................................................... 176

a. OVD Service Offerings .................................................................................................. 177

b. Original Content and Content Ownership ....................................................................... 189

c. OVD Usage, Subscribers, and Revenue ......................................................................... 193

4. Broadcast Television Stations ............................................................................................... 201

a. Station Licensing and Ownership ................................................................................... 202

b. Distribution and Delivery ............................................................................................... 205

c. Programming and Content Ownership ............................................................................ 208

d. Broadcast Television Revenue ........................................................................................ 213

5. Competition in Video ............................................................................................................ 218

6. Report on Cable Industry Prices ............................................................................................ 233

E. The Audio Market ........................................................................................................................ 240

1. Overview of the Audio Programming Market ....................................................................... 241

2. Terrestrial Radio Broadcasters .............................................................................................. 245

3. Satellite Radio ....................................................................................................................... 255

4. Online Audio Providers ......................................................................................................... 259

5. Competition in Audio Programming ..................................................................................... 265

III. ASSESSMENT OF BROADBAND DEPLOYMENT ...................................................................... 275

A. Access to Advanced Telecommunications Capability ................................................................. 276

1. Broadband Deployment Estimates ........................................................................................ 281

a. Deployment of Fixed Advanced Telecommunications Capability ................................. 282

b. Deployment of Mobile 4G LTE ...................................................................................... 283

c. Deployment of Fixed Services and Mobile 4G LTE ...................................................... 284

d. Additional Deployment Estimates .................................................................................. 287

B. Demographic Data ....................................................................................................................... 288

1. Tribal Lands Data .................................................................................................................. 292

C. International Broadband Data Report .......................................................................................... 294

1. Broadband Speed and Performance Comparison .................................................................. 296

2. Broadband Price Comparison ................................................................................................ 299

3. Broadband Deployment Comparison with Europe ................................................................ 302

4. Demographics ........................................................................................................................ 305

5. International Regulatory Developments ................................................................................ 306

IV. ENTRY AND EXPANSION CONDITIONS IN THE COMMUNICATIONS

MARKETPLACE .............................................................................................................................. 319

A. The Mobile Wireless Communications Marketplace ................................................................... 320

B. The Fixed Communications Marketplace .................................................................................... 327

1. Fixed Terrestrial .................................................................................................................... 327

2. Satellite .................................................................................................................................. 332

Federal Communications Commission FCC 20-188

3

C. The Video and Audio Communications Marketplace .................................................................. 336

V. COMMISSION ACTIONS ALREADY TAKEN TO CLOSE DIGITAL DIVIDE,

ENHANCE COMPETITION, AND ENCOURAGE DEPLOYMENT OF

COMMUNICATIONS SERVICES ................................................................................................... 351

A. The Mobile Wireless Communications Marketplace ................................................................... 352

1. Universal Service Support ..................................................................................................... 352

2. Spectrum Challenges ............................................................................................................. 354

3. Wireless Infrastructure Siting ................................................................................................ 366

B. The Fixed Communications Marketplace .................................................................................... 371

1. Enhancing Competition, Removing Barriers to Investment, and Encouraging

Deployment ........................................................................................................................... 371

2. Universal Service Support ..................................................................................................... 387

3. Satellite .................................................................................................................................. 404

C. The Video and Audio Communications Marketplace .................................................................. 409

D. Efforts To Ensure and Improve Connectivity During the COVID-19 Pandemic ........................ 419

VI. COMMISSION AGENDA TO FURTHER ENCOURAGE INVESTMENT, INNOVATION,

DEPLOYMENT, AND COMPETITION .......................................................................................... 433

A. The Mobile Wireless Communications Marketplace ................................................................... 434

B. The Fixed Communications Marketplace .................................................................................... 442

C. The Video and Audio Communications Marketplace .................................................................. 446

VII. PROCEDURAL MATTERS ............................................................................................................. 451

APPENDIX A: List of Commenters

APPENDIX B: Mobile Wireless Communications Market

APPENDIX C: Fixed Communications Market

APPENDIX D: 9

th

and 10

th

Fixed Measuring Broadband America Reports

APPENDIX E: Cable Industry Prices Report

APPENDIX F: Broadband Deployment and Advanced Telecommunications Capability

APPENDIX G: International Broadband Deployment Report

I. INTRODUCTION

1. Every two years, the Commission is required to publish a Communications Marketplace

Report that, among other things, assesses generally the state of competition across the broader

communications marketplace, including competition to deliver voice, video, audio, and data services

among providers of telecommunications, providers of commercial mobile service, multichannel video

programming distributors, broadcast stations, providers of satellite communications, Internet service

providers, and other providers of communications services.

1

The Commission must consider all forms of

competition, including “the effect of intermodal competition, facilities-based competition, and

competition from new and emergent communications services.”

2

The Commission also must assess

whether laws, regulations, regulatory practices—whether federal, state, local, Tribal, or foreign—or

marketplace practices pose a barrier to competitive entry into the communications marketplace or to the

competitive expansion of existing providers of communications service.

3

1

47 U.S.C. §§ 163(a), (b)(1); see also Section 401 of the Repack Airwaves Yielding Better Access for Users of

Modern Services Act of 2018 (RAY BAUM’S Act of 2018), Pub. L. No. 115-141, 132 Stat. 1087 (codified at 47

U.S.C. § 163) (RAY BAUM’S Act of 2018).

2

47 U.S.C. § 163(d)(1).

3

47 U.S.C. § 163(b)(3). In assessing the state of competition under subsection (b)(1) and regulatory barriers under

subsection (b)(3) of the Act, the Commission must also “consider market entry barriers for entrepreneurs and other

small businesses in the communications marketplace in accordance with the national policy under section 257(b).”

(continued….)

Federal Communications Commission FCC 20-188

4

2. In December 2018, the Commission adopted the first Communications Marketplace

Report, providing a comprehensive evaluation of the state of the communications marketplace (as of year-

end 2017).

4

In February 2020, the Commission updated certain figures, maps and tables contained in the

2018 Communications Marketplace Report, to reflect the most recent data available as of year-end

2018.

5

On February 27, 2020, the Commission adopted a Public Notice seeking input on the state of the

communications marketplace to inform its assessment of competition in the communications marketplace

in its second Communications Marketplace Report (2020 Communications Marketplace Report) to

Congress.

6

3. With this second 2020 Communications Marketplace Report, the Commission fulfills the

requirement set forth in RAY BAUM’S Act of 2018 to provide a comprehensive evaluation of the state of

competition in the communications marketplace in the United States. As required, this Report assesses

the state of all forms of competition in the communications marketplace; the state of deployment of

communications capabilities; barriers to competitive entry, including market entry barriers for

entrepreneurs and other small businesses. Further, this Report describes the actions taken by the

Commission in the previous two years to address challenges and opportunities in the communications

marketplace. It also discusses the actions taken by the Commission to help Americans in the face of the

unprecedented COVID-19 pandemic. Finally, this Report discusses the Commission’s agenda for

continuing to address the challenges and opportunities in front of us over the next two years.

II. ASSESSMENT OF THE STATE OF COMPETITION

4. RAY BAUM’S Act of 2018 requires the Commission to assess the state of competition in

the communications marketplace. We first assess the state of competition separately within several

specific components of the broader communications marketplace, including the mobile wireless

marketplace, the fixed broadband marketplace, the voice services marketplace, the video marketplace

including cable industry prices, and the audio marketplace.

5. In assessing the state of competition, we report on several economic indicators. These

include indirect measures of competition—such as the number of providers along with barometers of

market concentration—that are recognized as being associated with the level of competition. We also

report, among other things, prices and product offerings. This entails looking at the major factors that

affect prices, including inputs such as spectrum, infrastructure, or video content, as well as the quality of

the service being offered to consumers and quality enhancing investment. The Report further recognizes

that some markets are interrelated, and so assesses competition between some of these markets, such as

between fixed and mobile broadband and between multichannel video programming distributors

(MVPDs), online video distributors (OVDs), and broadcast television stations.

47 U.S.C. § 163(d)(3). The Commission must include the International Broadband Data Report required by section

103(b)(1) of the Broadband Data Improvement Act as part of the Communications Marketplace Report. See RAY

BAUM’S Act of 2018 § 402(c), 132 Stat. at 1089; 47 U.S.C. § 163; 47 U.S.C. § 1303(b)(1).

4

Communications Marketplace Report et al., GN Docket No. 18-231 et al., Report, 33 FCC Rcd 12558 (2018)

(2018 Communications Marketplace Report).

5

FCC Releases Certain Data Updated as of December 31, 2018 for the Communications Marketplace Report, GN

Docket No. 18-231, Public Notice, 35 FCC Rcd 1479 (OEA 2020) (CMR Updated Data Public Notice); FCC, 2018

Communications Marketplace Report – Updates, https://www.fcc.gov/communications-marketplace-report-updates

(last visited Oct. 27, 2020).

6

See generally Office of Economics and Analytics Seeks Comment On The State Of Competition In The

Communications Marketplace, GN Docket No. 20-60, Public Notice, 35 FCC Rcd 1577 (OEA 2020) (2020 Public

Notice). The comment period was scheduled to end on April 13, 2020, and the reply comment period was scheduled

to end on May 13, 2020. These deadlines were extended on April 10, 2020, due to the COVID-19 pandemic, and

community and business efforts to respond to this public safety crisis. The revised comment date was April 27,

2020, and the revised reply comment date was May 28, 2020. Appx. A of this Report provides a list of all parties

who filed in this proceeding.

Federal Communications Commission FCC 20-188

5

A. The Mobile Wireless Marketplace

6. We assess competition among mobile wireless service providers and discuss the resulting

pricing, quality, and other related outcomes. In addition to the three facilities-based nationwide mobile

wireless service providers, the mobile wireless marketplace consists of numerous regional and local

facilities-based providers, mobile virtual network operators (MVNOs) who purchase mobile wireless

services wholesale, cable providers that rely on a hybrid wholesale/hotspot arrangement to offer service,

and mobile satellite providers who currently primarily focus on niche services like tracking services for

aircraft and ships and operations in remote locations. Additionally, as a condition following the merger of

T-Mobile and Sprint, DISH has committed to building its own independent fifth-generation (5G) mobile

network. Mobile wireless services are an important and increasingly prevalent part of Americans’ daily

lives, and competition in the provision of mobile wireless services drives innovation and investment to

the ultimate benefit of the American people and economy. In this section, we present and review

available 2019 data for all mobile wireless services, including voice, messaging, and broadband, and we

also present certain information as of mid-2020.

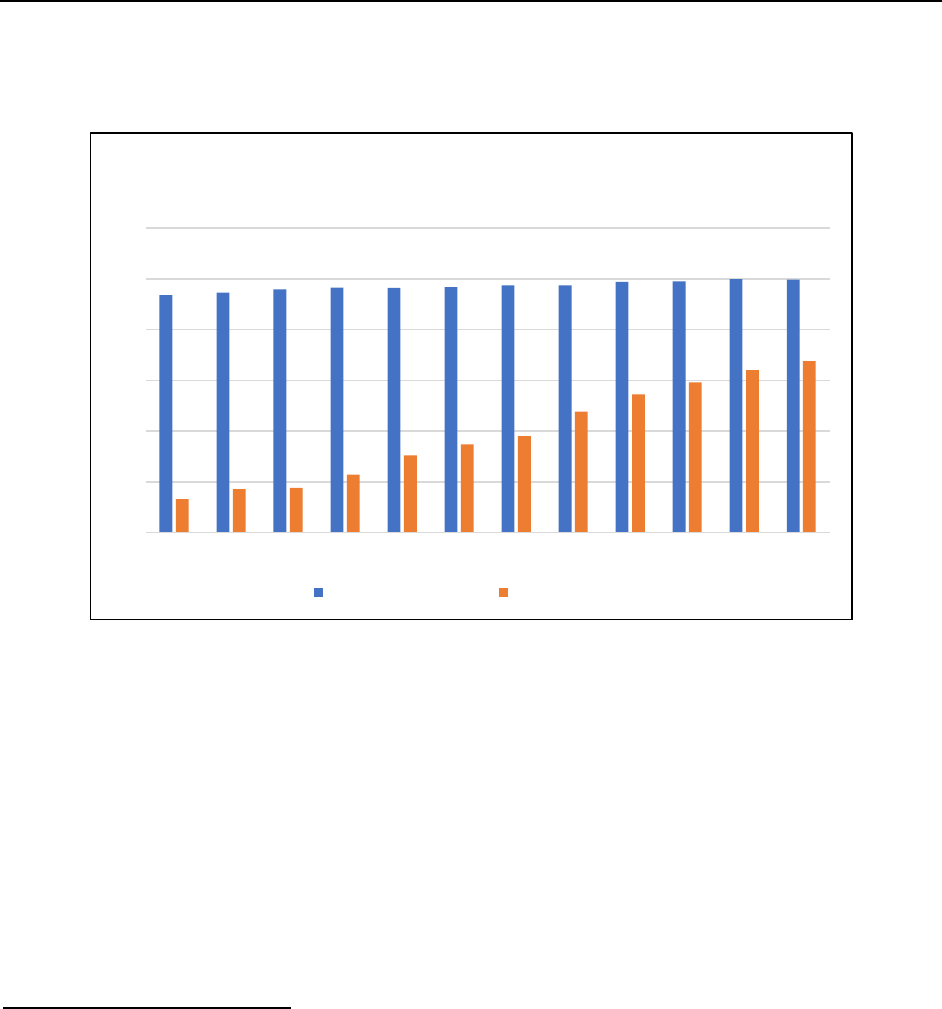

7. Mobile wireless service connections have grown by 2 to 5% per year since year-end

2017, while data usage has continued to grow substantially faster, rising to 9.2 GB per subscriber per

month at year-end 2019, an increase of approximately 39% from year-end 2018. Growing consumption is

made possible by the increasing availability of unlimited data plans from both postpaid and prepaid

mobile wireless brands as well as the increased speeds offered by nationwide service providers. For

instance, nationwide Long Term Evolution (LTE) download speeds increased from 16 Mbps in the

second half of 2017 to 26.2 Mbps in the second half of 2019, an increase of approximately 64%.

8. The wireless industry is currently undertaking the implementation and construction of 5G

mobile wireless networks that are expected to deliver even faster download speeds, reduced latency, and

better security to users than 4G LTE networks. This has entailed increased deployment of small cells and

Distributed Antenna Systems (DAS) to fill local coverage gaps, densify networks, and increase local

capacity. At the same time, the Commission has made available significant amounts of mid-band

spectrum as well as nearly 12 gigahertz of licensed and unlicensed millimeter wave (mmW) spectrum to

meet service needs. In addition to the quality improvements that this investment and access to spectrum

allow, CTIA data indicate that industry prices declined, with ARPU decreasing from roughly $39 in 2017

to approximately $37 in 2019, an indicator of strong competition in the mobile wireless marketplace.

1. Overview of the Mobile Wireless Marketplace

a. Service Providers

9. Facilities-Based Service Providers. Following the completed merger of T-Mobile and

Sprint on April 1, 2020,

7

there are three facilities-based mobile wireless service providers in the United

States that this Report terms “nationwide service providers”: AT&T, T-Mobile, and Verizon Wireless.

Although none of these three nationwide service providers has a network that is truly ubiquitous, the three

service providers each have networks that they report cover a substantial majority of the country—at least

98% of the U.S. population and at least 84% of U.S. road miles—with their 4G LTE networks.

8

7

The Commission approved the transaction between T-Mobile and Sprint, subject to certain conditions, on October

16, 2019. See generally Applications of T-Mobile US, Inc., and Sprint Corporation For Consent to Transfer Control

of Licenses and Authorizations; Applications of American H Block Wireless L.L.C, DBSD Corporation, Gamma

Acquisition L.L.C., and Manifest Wireless L.L.C. for Extension of Time, WT Docket No. 18-197, Memorandum

Opinion and Order, Declaratory Ruling, and Order of Proposed Modification, 34 FCC Rcd 10578 (2019) (T-Mobile-

Sprint Order). In this Report, we present and review data for year-end 2019, and as such, T-Mobile and Sprint data

are, for the most part, reported separately. See also Press Release, T-Mobile, T-Mobile Completes Merger with

Sprint to Create the New T-Mobile (Apr. 1, 2020), https://www.t-mobile.com/news/un-carrier/t-mobile-sprint-one-

company.

8

See infra section II.A.6.

Federal Communications Commission FCC 20-188

6

Collectively, these three service providers account for over 400 million connections.

9

U.S. Cellular,

currently the fourth largest facilities-based service provider in the United States, is best characterized as a

multi-regional service provider, and has developed wireless networks and customer service operations in

portions of 20 states.

10

As of December 31, 2019, U.S. Cellular accounted for approximately five million

connections.

11

Two other larger regional service providers include C Spire, which provides service to

nearly one million subscribers in the Southeastern United States,

12

and Claro, which provides service to

approximately 920,000 subscribers in Puerto Rico.

13

There are also dozens of other facilities-based

mobile wireless service providers throughout the United States, many of which provide service in a

single, often rural, geographic area.

14

These non-nationwide facilities-based service providers increase

choices for consumers and help make facilities-based service more widely available in rural areas.

15

10. T-Mobile-Sprint Transaction. In April 2018, T-Mobile and Sprint announced their intent

to merge. T-Mobile and Sprint claimed that the merger would represent a total implied enterprise value

of approximately $146 billion and would rapidly allow them to create a nationwide 5G network with a

combined company that would have lower costs and better quality than the standalone competitors.

16

In

its initial filing to the Commission, T-Mobile emphasized that the proposed merger would spur 5G

network deployment nationally, improve rural coverage, and permit the combined companies to compete

with wired broadband providers through a new in-home fixed broadband service offering.

17

11. This transaction involved the transfer of multiple spectrum licenses and authorizations,

and was subject to Commission review to determine whether the transaction would serve the public

interest, convenience, and necessity.

18

Accordingly, we assessed the extent to which this merger of two

firms that compete in many of the same geographic and product markets might lessen some elements of

competition, and whether any potential harms would be counterbalanced by the potential benefits of the

transaction. In response to Commission staff’s concerns about certain aspects of the proposed transaction,

in May 2019, T-Mobile made several commitments to the Commission—including a pledge to divest

Sprint’s Boost Mobile business and various 5G deployment commitments.

19

On October 16, 2019, the

9

See infra Fig. II.A.1.

10

United States Cellular Corp., 2019 SEC Form 10-K at 1 (filed Feb. 25, 2020). U.S. Cellular is a majority-owned

(82%) subsidiary of Telephone and Data Systems, Inc. Id.

11

See id.

12

C Spire, About C Spire, C Spire Celebrates 30 Years of Customer Inspiration This Month (Feb. 13, 2018),

https://www.cspire.com/company_info/about/news_detail.jsp?entryId=29600003.

13

América Móvil, América Móvil's Second Quarter of 2020 Financial and Operating Report at 23 (July 14, 2020),

https://www.americamovil.com/investors/reports-and-filings/quarterly-results/default.aspx.

14

Examples of regional facilities-based service providers include Appalachian Wireless, Carolina West Wireless,

Cellcom, Choice Wireless, GCI, Nex-Tech Wireless, and Sagebrush Cellular. Annual Report and Analysis of

Competitive Market Conditions With Respect to Mobile Wireless, Including Commercial Mobile Services, WT

Docket No. 17-126, Twentieth Report, 32 FCC Rcd 8968, 8975, para. 14 & n.50 (2017) (Twentieth Wireless

Competition Report).

15

Policies Regarding Mobile Spectrum Holdings Expanding the Economic and Innovation Opportunities of

Spectrum Through Incentive Auctions, Report and Order, 29 FCC Rcd 6133, 6207, paras. 179-80 (2014) (Mobile

Spectrum Holdings Report and Order).

16

Press Release, T-Mobile, T-Mobile and Sprint to Combine, Accelerating 5G Innovation & Increasing Competition

(Apr. 29, 2018), https://www.t-mobile.com/news/press/5gforall.

17

See generally Applications of T-Mobile USA, Inc., and Sprint Corporation for Consent To Transfer Control of

Licenses and Authorizations, ULS File No. 0008224209 (Lead Application) (filed June 18, 2018, amended July 5,

2018), Exh. 1—Description of the Transaction, Public Interest Statement, and Related Demonstrations at 2.

18

47 U.S.C. §§ 214(a), 310(d).

19

See T-Mobile-Sprint Order, 34 FCC Rcd at 10801-28, Appx. G.

Federal Communications Commission FCC 20-188

7

Commission adopted the T-Mobile-Sprint Order, which required, “as a condition of our approval, that the

Applicants fulfill a series of commitments to address the potential for lost price competition, such as the

divestiture of Boost Mobile.”

20

12. Mobile Virtual Network Operators. MVNOs do not own any network facilities, but

instead they purchase mobile wireless services wholesale from facilities-based service providers and

resell these services to consumers.

21

In 2019, TracFone, an América Móvil subsidiary,

22

was the largest

MVNO, with approximately 21 million subscribers.

23

In 2015, Google launched “Project Fi,” an MVNO

in partnership with T-Mobile and Sprint whereby Google Fi subscribers switched between Wi-Fi

networks and these two service providers’ 4G LTE networks.

24

13. Cable providers have also begun entering the mobile wireless market through MVNO

arrangements. These products rely on combining the mobile networks of facilities-based partners with

hotspot or small-cell networks that send traffic through the cable provider’s infrastructure.

25

In 2016,

20

T-Mobile-Sprint Order, 34 FCC Rcd at 10582, para. 11.

21

Twentieth Wireless Competition Report, 32 FCC Rcd at 8976, para. 15. The Commission is not able to provide an

exact figure of the number of MVNOs that currently offer services. This is partly because, as resellers of service

offered by facilities-based service providers, MVNOs are not licensees and typically do not file section 214

applications. Furthermore, as the Commission has found in prior competition reports, “[c]omprehensive data on

MVNO subscribers are generally not reported by either MVNOs or facilities-based providers that host

MVNOs. Estimates of the number of MVNOs operating in the United States vary considerably. Many MVNOs are

privately-held companies that do not publicly report financial or subscriber data.” Implementation of Section

6002(b) of the Omnibus Budget Reconciliation Act of 1993; Annual Report and Analysis of Competitive Market

Conditions With Respect to Mobile Wireless, Including Commercial Mobile Services, Sixteenth Report, 28 FCC Rcd

3700, 3739, para. 32 (2013) (Sixteenth Wireless Competition Report).

22

Verizon announced that it has entered into an agreement with América Móvil to acquire TracFone Wireless, Inc.,

the leading pre-paid and value mobile provider in the United States. The consideration for the transaction will

include $3.125 billion in cash and $3.125 billion in Verizon common stock, subject to customary adjustments, at

closing. The agreement also includes up to an additional $650 million in future cash consideration related to the

achievement of certain performance measures and other commercial arrangements. Verizon expects the transaction

to close in the second half of 2021. See Verizon Wireless, Verizon to acquire TracFone Wireless (Sept. 14, 2020),

https://www.verizon.com/about/news/verizon-to-acquire-tracfone.

23

TracFone, TracFone Home, http://www.tracfone.com/ (last visited Oct. 27, 2020); BestMVNO, For the First

Time Straight Talk Has More Subscribers Than All Other Tracfone Brands Combined (Feb. 24, 2020),

https://bestmvno.com/straight-talk/for-the-first-time-straight-talk-has-more-subscribers-than-all-other-tracfone-

brands-combined/.

24

FierceWireless, Google Unveils “Project Fi” MVNO with Sprint and T-Mobile as Partners (Apr. 22, 2015),

http://www.fiercewireless.com/story/google-unveils-project-fi-mvno-sprint-and-t-mobile-partners/2015-04-22. In

June 2016, Google added U.S. Cellular as a partner. FierceWireless, Google’s Project Fi to Add U.S. Cellular to

Partner Network (June 8, 2016), http://www.fiercewireless.com/story/googles-project-fi-add-us-cellular-partner-

network/2016-06-08. Similar Wi-Fi service is also provided by two other MVNOs: FreedomPop, FreedomPop

Home, https://www.freedompop.com/ (last visited Oct. 27, 2020) and Republic Wireless, Republic Wireless FAQ,

https://republicwireless.com/faqs (last visited Oct. 27, 2020).

25

Chris Mills and Fiona Armstrong, Tutela, Special Report: State of MVNOs at 18 (Oct. 2019) (“The most

immediate solution for wireless traffic offload are the networks of public or semi-public hotspots operated by the

cable companies. Comcast . . . claims to operate a network of 18 million ‘xfinitywifi’hotspots nationwide”); see

also id. at 21. (“Altice Mobile is also well positioned to exploit future technology improvements and spectrum

deployments to embrace the ‘hybrid MVNO’ model. Altice operates the core network, device SIMs, and in some

cases has infrastructure agreements in place with Sprint for small cells.”),

https://www.tutela.com/hubfs/Assets/USA%20State%20of%20MVNOs%20Report%20-%20October%202019.pdf.

Federal Communications Commission FCC 20-188

8

both Comcast

26

and Charter,

27

the nation’s two largest cable providers, activated MVNO options they held

with Verizon Wireless. Comcast launched its Xfinity Mobile wireless service in the spring of 2017,

which has since grown to more than 2 million subscribers by year-end 2019.

28

Charter began offering its

service in the summer of 2018 and has grown to approximately 1.1 million customers by year-end 2019.

29

Altice,

30

another cable provider, launched an MVNO service on Sprint’s network in September 2019, and

it had 69,000 subscribers by the end of 2019.

31

14. DISH. As a condition of the T-Mobile-Sprint transaction,

32

DISH entered into an

agreement with T-Mobile to provide mobile wireless service.

33

On July 1, 2020, DISH acquired the

Boost Mobile brand and its approximately 9 million customers from T-Mobile,

34

as a result of the

required divestiture by the Commission and Department of Justice in approving the T-Mobile-Sprint

merger.

35

Initially this offering will be an MVNO,

36

which would make it the second largest in the nation

behind TracFone. The MVNO agreement between T-Mobile and DISH allows DISH to use T-Mobile’s

wireless network to provide service to its customers, offers DISH the option to construct and use its own

network, and requires T-Mobile to interconnect with DISH’s network.

37

Unlike traditional MVNOs,

however, DISH has committed to building its own independent 5G network,

38

using its AWS-4, Lower

26

FierceWireless, Comcast to Launch Wireless Service in 2017 with Verizon MVNO, 15M Wi-Fi Hotpots (Sept. 20,

2016), http://www.fiercewireless.com/wireless/comcast-to-launch-wireless-service-2017-verizon-mvno-15m-wi-fi-

hotspots.

27

FierceCable, Rutledge: Charter Has Asked Verizon to Activate MVNO Agreement (Sept. 21, 2016),

http://www.fiercecable.com/cable/rutledge-charter-has-asked-verizon-to-activate-mvno-agreement.

28

FierceWireless, Comcast Adds 261,000 Wireless Subscribers in Q4, Its Largest Gain Yet (Jan. 23, 2020),

https://www.fiercewireless.com/wireless/comcast-adds-261-000-wireless-subscribers-q4-its-largest-gain-yet.

29

FierceWireless, Charter’s Mobile Service Crosses 1M Subscriber Mark (Feb. 3, 2020),

https://www.fiercewireless.com/operators/charter-s-mobile-service-crosses-1-million-subscriber-mark.

30

Altice describes itself as an “infrastructure-based Mobile Virtual Network Operator,” as it operates its own core

network infrastructure to provide wireline broadband, though it does not have its own radio access network for its

mobile offering. The distinction in Altice’s ability to leverage its own facilities has allowed it to obtain numbers

directly under waiver. See Numbering Policies for Modern Communications; Number Resource Optimization, WC

Docket No. 13-97; CC Docket No. 99-200, Order, 33 FCC Rcd 12501 (WCB 2018).

31

FierceWireless, Altice Mobile Raises Prices by $10 for New Customers (Feb. 13, 2020),

https://www.fiercewireless.com/operators/altice-mobile-raises-price-by-10-for-new-customers.

32

T-Mobile-Sprint Order, 34 FCC Rcd at 10591-3, paras. 34-36; see also United States et al. v. Deutsche Telekom

AG, T-Mobile US, Inc. Softbank Group Corp. and Sprint Corp., Competitive Impact Statement, No. 1:19-cv-02232,

at 8 & n.2 (D.D.C.) (filed July 30, 2019).

33

See Letter from Charles Mathias and Catherine Matraves, FCC, to Kathleen O’Brien Ham, Counsel to T-Mobile,

DA 20-421, 35 FCC Rcd 3556 (filed Apr. 16, 2020) (Mathias and Matraves Letter).

34

DISH, DISH Enters Retail Wireless Market with Close of Boost Mobile, Advances Build of the Nation’s First

Standalone 5G Network (July 1, 2020), http://about.dish.com/2020-07-01-DISH-enters-retail-wireless-market-with-

close-of-Boost-Mobile-advances-build-of-the-nations-first-standalone-5G-network.

35

T-Mobile-Sprint Order, 34 FCC Rcd at 10591-92, 10661, paras. 33-34, 189; see also DISH, DISH to Become

National Facilities-based Wireless Carrier (July 26, 2019), http://about.dish.com/2019-07-26-DISH-to-Become-

National-Facilities-based-Wireless-Carrier.

36

T-Mobile-Sprint Order, 34 FCC Rcd at 10591-92, paras. 33-34.

37

Id. at 10592-3, para. 34; see also Mathias and Matraves Letter at 1-2.

38

T-Mobile-Sprint Order, 34 FCC Rcd at 10594, 10740, paras. 37, 369; see also DISH, DISH Enters Retail Wireless

Market with Close of Boost Mobile, Advances Build of the Nation’s First Standalone 5G Network (July 1, 2020),

http://about.dish.com/2020-07-01-DISH-enters-retail-wireless-market-with-close-of-Boost-Mobile-advances-build-

of-the-nations-first-standalone-5G-network.

Federal Communications Commission FCC 20-188

9

700 MHz, and H Block spectrum licenses.

39

As DISH expands its network, it will operate as a hybrid of a

facilities-based operator and an MVNO, and ultimately the Commission expects it to become a standalone

facilities-based operator.

40

15. In its second 2020 quarterly earnings call, DISH stated it intends to cover 20% of the

U.S. population by mid-2022 and deploy over 15,000 cell sites by mid-2023, with an eventual nationwide

network of 50,000 cell sites with a $10 billion investment cost.

41

DISH spent more than $900 million for

5,492 licenses for 5G-capable mid-band spectrum in Auction 105, the second largest amount of any

winning bidder.

42

Further, we note that DISH has already made arrangements with suppliers, including

Fujitsu for radios, VMWare for cloud networking, and Altiostar and Mavenir for software.

43

16. Mobile Satellite Providers. In the United States, and globally, satellites provide

telecommunications infrastructure for communications, including voice, video, audio, and data services.

44

Mobile satellite service (MSS)

45

generally involves transmitting and receiving communications signals

from mobile earth stations located on land, on sea, or on airplanes.

46

MSS operates in a 70 megahertz

range of spectrum allocated in the L-band, in a 40 megahertz range in the 2 GHz MSS band, in a 33

megahertz range in the Big LEO band, and in a 4 megahertz range in the Little LEO band.

47

Voice and

39

See T-Mobile-Sprint Order, 34 FCC Rcd at 10829-41, Appx. H.

40

See id. at 10594, 10741-45, 10829-41, paras. 37, 372-38, Appx. H.

41

CitiResearch, DISH Network Corp (DISH), Wireless Outlook Needs to Pivot Beyond Tech to the TAM, at 1 and 3

(Aug. 9, 2020); J.P. Morgan, DISH Network, Strong Video Trends as Focus Shifts to Wireless Execution; Boost

Likely Loses Subs from Here, at 1 (Aug. 7, 2020).

42

Auction of Priority Access Licenses in the 3550-3650 MHz Band; Winning Bidders Announced for Auction 105,

AU Docket No. 19-244, Public Notice, DA 20-1009, Exh. A, at 1,

https://auctionfiling.fcc.gov/form175/search175/index.htm, (OEA, WTB Sept. 2, 2020) (3.5 GHz Public Notice).

43

DISH, DISH Selects Mavenir to Deliver Cloud-Native OpenRAN Software for Nation's First Virtual 5G Wireless

Broadband Network (Apr. 23 , 2020), http://about.dish.com/2020-04-23-DISH-Selects-Mavenir-to-Deliver-Cloud-

Native-OpenRAN-Software-for-Nations-First-Virtual-5G-Wireless-Broadband-Network; DISH, DISH advances O-

RAN network, Selects Fujitsu for 5G radio units and Altiostar for virtualized RAN software solution (June. 30,

2020), https://about.dish.com/2020-06-30-DISH-advances-O-RAN-network-Selects-Fujitsu-for-5G-radio-units-and-

Altiostar-for-virtualized-RAN-software-solution; VMWare, DISH Selects VMware to Help Build the Most

Advanced, Automated, End-to-End 5G Network in the U.S., https://www.vmware.com/company/news/releases/vmw-

newsfeed.DISH-Selects-VMware-to-Help-Build-the-Most-Advanced-Automated-End-to-End-5G-Network-in-the-

U.S.459a7317-5c39-48ec-a2c1-fef8509d4075.html (last visited Oct. 27, 2020).

44

Satellites function as relay stations in space that receive signals from an earth station and then re-transmit the

signal to a distant point located often thousands of miles from the point of signal origination. An earth station is a

station located either on the Earth’s surface or within the major portion of the Earth's atmosphere and intended for

communication: (1) With one or more space stations; or (2) With one or more stations of the same kind by means of

one or more reflecting satellites or other objects in space. 47 CFR § 25.103. The Commission’s definition is

identical to the definition established by the International Telecommunication Union (ITU). ITU, Radio

Regulations—Articles (ed. 2016), at 13 (Article 1, 1.63),

http://search.itu.int/history/HistoryDigitalCollectionDocLibrary/1.43.48.en.101.pdf (ITU Radio Regulations) (last

visited Oct. 27, 2020).

45

MSS generally refers to services provided to mobile earth stations using MSS frequency bands. The newer

ESIMs, discussed below, refer to services provided to mobile earth stations using the FSS frequency bands.

46

47 CFR § 25.103.

47

There are MSS allocations in the 1525-1559 MHz (space-to-Earth) band and the 1626.5-1660.5 MHz (Earth-to-

space) band of the L-band, and in the 2000-2020 MHz and 2180-2200 MHz bands of the 2 GHz band. Other

frequency bands with MSS allocations have been given specific labels in the Commission rules: the Big LEO bands

(1610-1626.5 MHz and 2483.5-2500 MHz) and the Little LEO bands (137-138 MHz, 400.15-401 MHz, and 148-

150.5 MHz). 47 CFR § 25.103. Due to encumbrances, not all of the allocated spectrum is available for use by MSS

providers.

Federal Communications Commission FCC 20-188

10

data services are conducted in the L-band, Big LEO band, and 2 GHz bands, while the Little LEO band is

limited to non-voice services.

48

Examples of MSS applications include voice, low-speed data, and

tracking services for aircraft and ships, as well as handsets operating in remote locations on land.

17. Currently, five satellite operators provide MSS in the United States: Inmarsat, Ligado

(formerly known as LightSquared),

49

Iridium, Globalstar, and ORBCOMM.

50

Due to technological

differences, MSS services vary significantly in characteristics, such as cost, geographic availability,

required customer equipment, data bandwidth and allowances, two-way capabilities, latency, network

reliability, and ease of use.

51

Inmarsat, the largest MSS operator, provides extensive voice, video, and

data communications services to mobile earth stations using GSO satellites, five of which have been

granted access to the U.S. market.

52

In 2019, MSS generated approximately $700 million in U.S.

revenues.

53

18. Over the last ten years, the Commission also has allowed the operation of Earth Stations

in Motion (ESIMs) within the spectrum bands allocated to fixed satellite services (FSS).

54

Earth Stations

on Vessels, Vehicle-Mounted Earth Stations, and Earth Stations Aboard Aircraft—collectively designated

as ESIMs

55

—are mobile in nature, but nevertheless operate in FSS spectrum because at any point in time,

their emissions have the same characteristics as those of a fixed earth station transmitting from the same

location. Given that ESIMs have access to a significant amount of FSS spectrum and they use directional

48

See, e.g., Terrestrial Use of the 2473-2495 MHz Band for Low-Power Mobile Broadband Networks; Amendments

to Rules for the Ancillary Terrestrial Component of Mobile Satellite Service Systems, IB Docket No. 13-213, RM-

11685, Report and Order, 31 FCC Rcd 13801, 13802 & n.2 (2016) (noting distinction between Big LEO systems,

which operate with voice and higher data-rate capabilities, and Little LEO systems, which do not provide voice

service and generally operate with lower data-rate capabilities).

49

Ligado Amendment to License Modification Applications IBFS File Nos. SES-MOD-20151231-00981, SAT-MOD-

20151231-00090, and SAT-MOD-20151231-00091 et al., IB Docket No. 11-109, Order and Authorization, 35 FCC

Rcd 3772 (2020).

50

See Inmarsat, Our Satellites, https://www.inmarsat.com/about-us/our-technology/our-satellites/ (last visited Oct.

27, 2020); Ligado, Covering a Continent with the Ligado SkyTerra 1 Satellite, https://ligado.com/wp-

content/uploads/SkyTerra1_InfoSheet_0819.pdf (last visited Oct. 27, 2020); Iridium, Iridium Global Network,

https://www.iridium.com/network/globalnetwork/ (last visited Oct. 27, 2020); Globalstar, Our Technology,

https://www.globalstar.com/en-us/corporate/about/our-technology (last visited Oct. 27, 2020); ORBCOMM,

Satellite IoT and M2M Networks, https://www.orbcomm.com/en/networks/satellite (last visited Oct. 27, 2020).

51

Inmarsat Plc, 2018 Annual Report and Financial Statements at 1, https://www.inmarsat.com/wp-

content/uploads/2019/12/Inmarsat-Group-Limited-Annual-Report-2018.pdf (last visited Oct. 27, 2020); Iridium

Communications, Inc., 2019 SEC Form 10-K at 2-5 (filed Feb. 25, 2020); Globalstar, 2019 SEC Form 10-K at 3-9

(filed Feb. 28, 2020).

52

FCC, Space Station Approval List, https://www.fcc.gov/approved-space-station-list. (last visited Oct. 27, 2020).

53

Mobile satellite 2019 revenues totaled $0.7 billion in both 2018 and 2019, approximately 1% of total U.S. satellite

services revenue. SIA Comments at 5, SIA Ex Parte. For total mobile satellite revenues from 2013 through 2017,

see 2018 Communications Marketplace Report, 33 FCC Rcd at 12673, Fig. F-1.

54

See generally Procedures to Govern the Use of Satellite Earth Stations on Board Vessels in the 5925-6425

MHz/3700-4200 MHz Bands and 14.0-14.5 GHz/11.7-12.2 GHz Bands, IB Docket No. 02-10, Report and Order, 20

FCC Rcd 674 (2005); see also Amendment of Parts 2 and 25 of the Commission’s Rules to Allocate Spectrum and

Adopt Service Rules and Procedures to Govern the Use of Vehicle-Mounted Earth Stations in Certain Frequency

Bands Allocated to the Fixed-Satellite Service, IB Docket No. 07-101, Report and Order, 24 FCC Rcd 10414 (2009).

55

O3b Limited; Request for Modification of U.S. Market Access for O3b Limited's Non-Geostationary Satellite Orbit

System in the Fixed-Satellite Service and in the Mobile-Satellite Service, Order and Declaratory Ruling, 33 FCC Rcd

5508, 5516, para. 21 & n.59 (2018) (O3b Modification Order).

Federal Communications Commission FCC 20-188

11

antennas that enhance throughput,

56

ESIMs are able to transmit and receive very high data-rate broadband

communications while in motion.

57

Licensees increasingly use ESIMs to deliver broadband to ships,

vehicles, trains, and aircraft using the same frequency bands, hardware, satellites, transponder beams, and

gateways used to serve earth stations at fixed locations.

58

19. FSS operators provide broadband services to aircraft and maritime vessels, which include

government organizations, commercial entities, and individual clients.

59

For example, Intelsat and Telesat

offer broadband services for maritime vessels (including maritime enterprise VSAT services

60

and

broadband connectivity for cruise ships), as well as broadband connectivity for in-flight entertainment and

Wi-Fi services for the aeronautical industry.

61

SES and ViaSat provide broadband service on commercial

airlines and cruise ships.

62

Hughes/Echostar also provides broadband service on commercial airlines.

63

56

The use of directional antennas required for FSS spectrum use means that FSS spectrum can be re-used

repeatedly, for each satellite spot beam, unlike MSS services which traditionally use non-directional antennas,

preventing the reuse of spectrum. O3b Modification Order, 33 FCC Rcd at 5516, para. 21 & n.59.

57

O3b Modification Order, 33 FCC Rcd at 5516, para. 21 & n.59. ESIMs enable the provision of very high data rate

broadband communications, navigational, situational awareness, and other services to mobile platforms that often

cannot be served using other communications technologies. See Amendment of Parts 2 and 25 of the Commission’s

Rules to Facilitate the Use of Earth Stations in Motion Communicating with Geostationary Orbit Space Stations in

Frequency Bands Allocated to the Fixed Satellite Service, IB Docket No. 17-95, Report and Order and Further

Notice of Proposed Rulemaking, 33 FCC Rcd 9327, 9328-29, para. 3 (2018) (ESIMs Order). The Commission

continues to distinguish ESIMs, which operate in FSS spectrum, from mobile earth stations, which operate in MSS

spectrum. ESIMs Order 33 FCC Rcd at 9328-30, paras. 3-4, 10 (defining ESIMs to collectively designate the three

types of FSS earth stations that the Commission authorizes to transmit while in motion: Earth Stations on Vessels

(ESVs), Vehicle-Mounted Earth Stations (VMESs), and Earth Stations Aboard Aircraft (ESAAs)); 47 CFR § 25.103

(Mobile Earth Station) (defining mobile earth station as “[a]n earth station in the Mobile-Satellite Service intended

to be used while in motion or during halts at unspecified points.”).

58

ESIMs Order, 33 FCC Rcd at 9328, para. 2.

59

“Satellites are playing an increasingly profitable role in the aviation industry. A $1B market today, the London

School of Economics projects that airline broadband will encompass a $30B market by 2035. Connected aircraft

could also save airlines $15B annually in operating costs, according to the same study.” SIA Comments at 8-9. See

also Grous, Alexander, Sky High Economics. Department of Media and Communications, London School of

Economics and Political Science (2017), http://eprints.lse.ac.uk/87438/1/Grous_Sky%20High_Author.pdf.

60

Vessels can connect to the global communications network with VSAT technology, which provides crew and

passengers with high-speed Internet access and phone service. iDirect, ViaSatellite, The Coming Wave of Maritime

VSAT Growth, https://www.satellitetoday.com//long-form-stories/maritime-vsat/ (last visited Oct. 27, 2020).

61

See Intelsat, 2019 SEC Form 10-K, at 11 (filed Feb. 20, 2020) (Intelsat 2019 SEC Form 10-K); Telesat Canada,

2019 SEC Form 20-F at 34 (filed Feb. 27, 2020) (Telesat Canada 2019 SEC Form 20-F). For example, Telesat has a

long-term contract with Panasonic Avionics Corporation (Panasonic) to provide satellite capacity to support

Panasonic’s in-flight entertainment and communications systems. See Telesat, Panasonic Signs Long Term

Contract For Multiple Transponders on Telesat Satellites to Expand Aeronautical Broadband Service Over Latin

America (Nov. 14, 2012), www.telesat.com/news-events/panasonic-signs-long-term-contract-multiple-transponders-

telesat-satellites-expand. Likewise, Intelsat leases transponder capacity to GoGo for aviation. Intelsat, Gogo Adds

Intelsat 29e Services to Provide Broadband Connectivity for Aircraft Crossing the North Atlantic (Nov. 17, 2016),

http://www.intelsat.com/news/press-release/gogo-adds-intelsat-29e-services-to-provide-broadband-connectivity-for-

aircraft-crossing-the-north-atlantic/.

62

SES plans to launch SES-17 in 2021 to provide aviation service over the Americas and Atlantic. SES, 2019

Annual Report at 36, 41, https://www.ses.com/sites/default/files/2020-

04/SES_Annual_Report_2019_HighRes_1.pdf (SES 2019 Annual Report) (last visited Oct. 27, 2020); ViaSat, 2019

SEC Form 10-K at 3-4 (filed May 28, 2020) (ViaSat 2019 SEC Form 10-K).

63

Hughes, Thales and SES Select Hughes for Next-Generation Aviation Connectivity Network to Provide Increased

Capacity, Coverage and Redundancy over the Americas (Mar. 8, 2017), https://www.hughes.com/resources/press-

(continued….)

Federal Communications Commission FCC 20-188

12

b. Connections/Subscribers and Connections Market Share

20. To estimate the number of mobile wireless subscribers/connections, this Report uses

Numbering Resource Utilization/Forecast (NRUF) data,

64

which track how many phone numbers have

been assigned to mobile wireless devices,

65

and CTIA data.

66

As shown in Figure II.A.1 below,

67

NRUF

estimates of mobile wireless connections at year-end 2018 were approximately 422 million, an increase of

around 3% from year-end 2017, and at year-end 2019 were approximately 430 million, an increase of

around 2% from year-end 2018. CTIA estimates of mobile wireless connections at year-end 2018 were

approximately 422 million, an increase of around 5% from year-end 2017, and at year-end 2019 were

approximately 442 million, an increase of approximately 5% from year-end 2018.

releases/thales-and-ses-select-hughes-next-generation-aviation-connectivity-network; Hughes, Aeronautical

Broadband Solutions, https://www.hughes.com/what-we-do/by-industry/aeronautical-broadband-solutions (last

visited Oct. 27, 2020).

64

NRUF data indicate the number of assigned phone numbers that a wireless service provider has in a particular rate

center (there are approximately 18,000 rate centers in the country). Rate centers are geographic areas used by local

exchange carriers for a variety of reasons, including the determination of toll rates. Harry Newton, Newton’s

Telecom Dictionary: 19

th

Expanded & Updated Edition at 660 (July 2003). All mobile wireless service providers

must report to the Commission the quantity of their phone numbers that have been assigned to end users, thereby

permitting the Commission to calculate the total number of mobile wireless subscribers. For purposes of

geographical analysis, the rate center data can be associated with a geographic point, and all of those points that fall

within a county boundary can be aggregated together and associated with much larger geographic areas based on

counties. We note that the aggregation to larger geographic areas reduces the level of inaccuracy inherent in

combining non-coterminous areas, such as rate center areas and counties.

65

While NRUF provides a measure of the number of mobile wireless connections or connected devices that have

assigned telephone numbers, the data have limitations, like providing only the quantity of mobile wireless

connections that have a telephone number, rather than the number of consumers subscribed to mobile broadband or

voice service. Twentieth Wireless Competition Report, 32 FCC Rcd at 8977-78, n.65. If a mobile broadband or

voice subscriber uses a device that does not have a telephone number assigned to it (e.g., a tablet), then that

subscriber will not be recorded. See Modernizing the FCC Form 477 Data Program, WC Docket No. 11-10,

Further Notice of Proposed Rulemaking, 32 FCC Rcd 6329, 6337, para. 26 & n.38 (2017) (2017 Data Collection

Improvement FNPRM). These data also do not reflect when consumers move to a different state and retain the same

telephone number. See Establishing the Digital Opportunity Data Collection et al., WC Docket No. 19-195, Report

and Order and Second Further Notice of Proposed Rulemaking, 34 FCC Rcd 7505, 7530-31, para. 60 (2019)

(Digital Opportunity Data Collection Order and Second Further Notice).

66

Different sources refer to their data as connections or subscribers, and when discussing the different data, we will

use the terminology most currently used by the source and, where possible, provide a definition of this term. For

example, CTIA explains its use of the terms “subscribers” and “connections” as follows: “Traditionally, the term

‘subscribers’ was used as a term of art, reflecting the number of revenue-generating units, equally describable as

‘wireless connections’—the equivalent of wired telephone ‘lines.’ The terms ‘subscriber’ does not indicate a unique

individual person. Indeed, the growing number and variety of non-traditional devices and machine-to-machine

applications mean that the term ‘subscribers’ is increasingly less descriptive of a growing share of the universe of

active units.” CTIA, CTIA’s Wireless Industry Indices Report, Year-End 2019 Results at 16 (CTIA Year-End 2019

Wireless Industry Indices Report).

67

For details of total mobile wireless connections over time, see Appx. B.1 of this Report.

Federal Communications Commission FCC 20-188

13

Source: NRUF, CTIA Year-End 2019 Wireless Industry Indices Report.

21. Figure II.A.2 presents data on total connections by service segment, based on UBS

Investment Research data. It shows that, in 2019, the postpaid segment accounted for approximately 59%

of all connections, while the prepaid segment accounted for approximately 15% of all connections. Most

notably, Internet connected devices surpassed prepaid connections in the middle of 2018 and is now the

second-largest segment by volume, accounting for approximately 22% of all wireless connections.

68

68

These wireless connections are “composed almost entirely of data-capable devices, with web-capable devices,

smartphones, tablets/laptops and wireless broadband modems composing the vast majority of all wireless-connected

devices.” In addition, the number of data-only devices—such as connected cars, IoT devices and wearables—

increased to approximately 175 million in 2019. CTIA Year-End 2019 Wireless Industry Indices Report at 6.

Federal Communications Commission FCC 20-188

14

Source: UBS Investment Research. UBS Data 2017-2019. Published with permission from UBS.

22. Figure II.A.3 presents data on total mobile wireless connections for the largest publicly

traded service providers operating in the United States, including an estimate of their respective market

shares as of year-end 2019.

69

As of the end of 2019, the market shares for Verizon Wireless and AT&T

were each greater than the next three largest providers, T-Mobile, Sprint, and U.S. Cellular, combined.

Fig II.A.3

Estimated Total Connections for Publicly Traded Facilities–Based Mobile

Wireless Service Providers (in thousands): 2016–2019

Service

Providers

EOY 2016

EOY 2017

EOY 2018

EOY 2019

EOY 2019

(% Connection

Market Share)

Verizon

Wireless

145,859

151,978

155,798

169,602

35.4

AT&T

134,875

146,847

157,095

163,388

34.1

T-Mobile

71,455

74,040

79,651

86,046

18.0

Sprint

59,515

54,683

54,495

54,165

11.3

U.S. Cellular

5,079

5,063

5,041

4,948

1.0

Top 5 Service

Providers

Total

416,783

432,611

452,080

479,149

Source: UBS Investment Research. UBS Data 2016-2019. Published with permission from UBS. Total estimated

connections figure includes data only for the service providers reported in this table.

23. Estimates of the number of net additions in 2018 and 2019 vary, likely due to differences

in the way in which connections are measured. As shown in Figure II.A.4, for 2018, there were

approximately 12.3 million net additions based on NRUF data, compared with 4.3 million based on CTIA

data. Mobile voice subscriber data as reported by service providers on FCC Form 477 show that for

69

The size of a company, typically measured by service revenues or subscribers, relative to the total size of the

industry determines its market share. See, e.g., The MIT Dictionary of Modern Economics at 268 (4

th

ed. 1992).

417.6

418.3

420.4

427.3

432.5

438.3

444.7

452.1

457.3

464.2

470.2

478.1

0

50

100

150

200

250

300

350

400

450

500

1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19

Total Connections (Millions

)

Quarter, Year

Fig. II.A.2

Quarterly Total Mobile Wireless Connections by Service Segment

2017-2019

Postpaid Prepaid Wholesale Connected Devices

Federal Communications Commission FCC 20-188

15

2018, net subscriber additions totaled approximately 8.1 million. In 2019, NRUF showed 11.0 million

additions, CTIA showed 21.6 million additions, and preliminary figures from FCC Form 477 showed 7.8

million additions.

70

Source: NRUF, CTIA Year-End 2019 Wireless Industry Indices Report, FCC Form 477.

24. Figure II.A.5 below shows that in both 2018 and 2019, a substantial majority of wireless

additions were connected devices, accounting for approximately 69% and 75% of all wireless additions in

those two years, respectively. Additionally, wholesale additions surpassed postpaid additions in 2018,

perhaps in part due to the entry of cable providers into the wireless market. Lastly, prepaid connections

declined in each of the last three years. Figure II.A.6 shows net subscriber additions by the four

nationwide service providers from 2016 through 2019.

70

Based on FCC Form 477 data, the preliminary total number of mobile voice telephone subscriptions at year-end

2019 was 356 million, as compared to 348 million at year-end 2018. We again note that the year-end FCC Form

477 data are preliminary only, are subject to corrections as appropriate by the service provider, and the final data

will be published in due course by the agency. See, e.g., FCC, Wireline Competition Bureau, Voice Telephone

Services: Status as of December 31, 2018 (Mar. 6, 2020), https://www.fcc.gov/voice-telephone-services-report.

These data do not include non-voice devices.

20.2

12.3 12.3

11.0

18.0

4.3 4.3

21.6

6.1

1.9

8.1

7.8

0

5

10

15

20

25

2016 2017 2018 2019

Net Additions (Millions)

Year

Fig. II.A.4

Total Mobile Wireless Connections Annual Net Additions

(2016-2019)

NRUF

CTIA

Form 477

Federal Communications Commission FCC 20-188

16

Source: UBS Investment Research. UBS Data 2016-2019. Published with permission of UBS.

Source: UBS Investment Research. UBS Data 2016-2019. Published with permission of UBS.

2016 2017 2018 2019

Verizon

4,955 5,222 6,069 6,392

AT&T

6,196 9,474 11,581 13,804

Sprint

2,411 1,173 129 (330)

T-Mobile

8,173 5,658 7,044 7,011

(2,000)

-

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

Net Subscriber Additions (Thousands

)

Fig. II.A.6

Annual Net Additions by Service Provider: 2016-2019

Federal Communications Commission FCC 20-188

17

25. Market Concentration. High market concentration levels in any market may raise some

concern that a market is not competitive, although it is not necessarily the case.

71

To measure mobile

wireless market concentration, the Commission employs the Herfindahl-Hirschman Index (HHI), widely

used in competition analysis.

72

The HHI is calculated by summing the squared market shares of all firms

in the given market. In this Report, we calculate HHIs based on the NRUF data by Economic Area (EA)

to maintain continuity with past reports and to ensure that we do not compromise the confidential

information found in the NRUF data. As of year-end 2017, the weighted average HHI (weighted by

population across the 172 EAs in the United States) for mobile wireless services was 3,106.

73

As of year-

end 2019, taking into account the transaction between T-Mobile and Sprint, the weighted average HHI for

mobile wireless services by EA was 3,622.

74

c. Churn

26. Churn measures the percentage of connections that are disconnected from mobile

wireless service during a given time period.

75

A service provider’s churn rate depends on many factors,

such as the distribution of its customers between postpaid and prepaid service plans, customer satisfaction

with their service provider, and switching costs.

76

High levels of industry churn can indicate that

consumers are not only willing but are also able to easily switch between service providers. For 2019,

CTIA reported an annual industry-wide churn rate of 19.5%, and a monthly rate of 1.6%.

77

Figure II.A.7

shows the industry weighted churn rates, according to UBS, for the nationwide providers by quarter. At

the end of 2019, stronger wireless competition among the top four providers and new competition from

cable MVNOs resulted in a slight increase in churn rates.

78

71

It is well understood that we can observe intense competition even with a small number of firms in the market.

See, e.g., Ernest Gellhorn, Antitrust Law and Economics 117 (4

th

ed. 1994) (stating “[m]arket shares are not

synonymous with market power; they should mark the beginning for careful analysis, not the end of it.”); Michael

Whinston, Antitrust Policy toward Horizontal Mergers, Handbook of Industrial Organization, Vol. 3, (eds. Mark

Armstrong and Robert Porter 2007); John Sutton, Sunk Costs and Market Structure (1991); Joseph Farrell and Carl

Shapiro, Antitrust Evaluation of Horizontal Mergers: An Economic Alternative to Market Definition, 10(1) The

B.E. Journal of Theoretical Economics 1 (2010); Gregory J. Werden and Luke M. Froeb, Unilateral Competitive

Effects of Horizontal Mergers, Handbook of Antitrust Economics (ed. Paolo Buccirossi 2008).

72

To the extent that this section uses the term “markets,” we do not intend it to be interpreted as synonymous with

the antitrust concept of the “relevant market,” which the Commission defines in the context of secondary market

transactions review. See, e.g., T-Mobile-Sprint Order, 34 FCC Rcd at 10601, para. 55.

73

2018 Communications Marketplace Report, 33 FCC Rcd at 12582-83, para. 30.

74

Antitrust authorities in the United States generally classify markets into three types: Unconcentrated (HHI <

1500), Moderately Concentrated (1500 < HHI < 2500), and Highly Concentrated (HHI > 2500). U.S. Department of

Justice and the Federal Trade Commission, Horizontal Merger Guidelines (Aug. 19, 2010),

http://www.justice.gov/atr/public/guidelines/hmg-2010.pdf.

75

CTIA defines churn as “a measure of the number of subscribers disconnecting from service during the period.”

CTIA Year-End 2019 Wireless Industry Indices Report at 35. Churn is calculated by dividing the aggregate number

of wireless connections that canceled service during a time period by the total number of wireless connections at the

beginning of that time period. For an annual calculation, if a service provider has an average monthly churn rate of

2%, the service provider would lose 24% of its subscribers over the course of a year. Service providers publish their

monthly churn rate information as part of their quarterly filings with the SEC.

76

2018 Communications Marketplace Report, 33 FCC Rcd at 12567, para. 11.

77

CTIA Year-End 2019 Wireless Industry Indices Report at 37. For prepaid services, CTIA reported an annual

industry-wide churn rate of 47.2% and a monthly churn rate of 4.45%. Id. at Appx. C, 14.

78

Instinet, LLC, Equity Research, Churn Return: 2020 to Interrupt Years of Progress at 3 (2020); Bevin Fletcher,

Sprint sheds subscribers as churn climbs (Jan. 27, 2020), https://www.fiercewireless.com/financial/sprint-sheds-

subscribers-as-churn-climbs.

Federal Communications Commission FCC 20-188

18

Source: UBS Investment Research. UBS Data 2017-2020. Published with permission of UBS.

d. Data Usage

27. As shown in Figure II.A.8, monthly data usage per smartphone subscriber rose to an

average of 9.2 GB per subscriber per month,

an increase of approximately 39% from year-end 2018 to

year-end 2019.

79

Figure II.A.9 further shows that total network annual data usage increased by

approximately 30% from 2018 to 2019, with a commensurate increase in total annual minutes of voice

use (MOUs) of approximately 29%,

80

while total messaging traffic experienced a much smaller increase

of approximately 3%.

81

79

CTIA Year-End 2019 Wireless Industry Indices Report at 15.

80

Id. at 13.

81

Id. This provider-reported messaging traffic does not include traffic from over-the-top messaging applications

and services, which would only appear in the total data traffic figures, thereby contributing to the total MB of data

traffic. See id.

1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19

AT&T

1.5% 1.3% 1.3% 1.4% 1.2% 1.2% 1.3% 1.4% 1.2% 1.1% 1.2% 1.3%

Verizon Wireless

1.4% 1.2% 1.2% 1.2% 1.3% 1.2% 1.2% 1.2% 1.3% 1.2% 1.2% 1.3%

Sprint

1.9% 1.9% 2.0% 1.8% 1.8% 1.6% 1.8% 1.9% 1.8% 1.7% 1.9% 2.0%

T-Mobile

1.7% 1.7% 2.0% 1.8% 1.7% 1.6% 1.7% 1.6% 1.5% 1.3% 1.7% 1.5%

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

Churn Rate

Fig. II.A.7

Quarterly Churn Rate for Nationwide Mobile Wireless Providers

1st Quarter 2017- 4th Quarter 2019

Federal Communications Commission FCC 20-188

19

Source: CTIA Year-End Wireless Industry Indices Report at 15, Chart 4.

Source: CTIA Year-End Wireless Industry Indices Report at 13, Chart 2.

28. This growth in data usage is primarily driven by increasing data demanded per device.

According to a 2019 Pew survey, smartphone and tablet ownership were 81% and 52%, respectively,

largely unchanged from the 77% and 53% ownership figures reported in 2018.

82

Pew reported that 17%

of American adults are “smartphone-only” Internet users—they own a smartphone, but do not have

traditional fixed home broadband service—a 3-point decrease from a year earlier.

83

Comparatively, the

U.S. Census Bureau’s American Community Survey (ACS) found that, as of 2019, approximately 10% of

total U.S. households subscribed to a cellular data plan with no other type of Internet subscription.

84

82

Pew Research Center, Mobile Fact Sheet (June 12, 2019), http://www.pewinternet.org/fact-sheet/mobile/ (Pew

Mobile Fact Sheet).

83

See Pew Mobile Fact Sheet.

84

U.S. Census Bureau, 2019 American Community Survey 1-Year Estimates, Types of Computers and Internet

Subscriptions,

https://data.census.gov/cedsci/table?q=S2801%3A%20TYPES%20OF%20COMPUTERS%20AND%20INTERNET

%20SUBSCRIPTIONS&tid=ACSST1Y2019.S2801&hidePreview=true (last visited Oct. 27, 2020). We note that

(continued….)

0.1

0.3

0.4

0.8

1.0

2.2

2.9

3.3

5.8

7.1

0.3

0.5

0.8

1.2

1.4

2.9

3.9

5.1

6.6

9.2

0.0

2.0

4.0

6.0

8.0

10.0

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Average Monthly GB per Average

Data Capable Unit

Fig. II.A.8

Mobile Data Usage per Subscriber

2010 - 2019

Data Capable Unit Smartphone

2,241

2,296 2,300

2,618

2,455

2,881

2,751

2,180

2,389

3,078

2,108

2,356

2,264

2,006

2,073

2,108

1,939

1,768

2,046

2,098

388

867

1,468

3,230

4,061

9,650

13,719

15,687

28,585

37,060

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

45,000

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Billions of MOUs / Messages / MB

Fig. II.A.9

Annual Minutes, Messages, and Megabytes of Wireless Traffic

MOUs Messages MB of Data Usage

3.1 trillion

2.1 trillion text

messages

37.1 trillion

MBs

Federal Communications Commission FCC 20-188

20

Many consumers also choose to depend on some combination of fixed and mobile broadband access,

while discontinuing their landline telephone services. In fact, according to preliminary data from the

Centers for Disease Control and Prevention, as of June 2019, the percentage of U.S. adults living in

households that were identified as having wireless-only telephone service (no landline telephone service)

was approximately 59%.

85

2. Mobile Wireless Spectrum and Service Providers’ Spectrum Holdings

29. Spectrum is a critical input in the provision of mobile wireless services.

86

It can affect

whether, when, and where existing service providers and potential entrants will be able to expand

capacity or deploy networks.

87

Incumbent service providers may need additional spectrum to increase

their coverage or capacity, while new entrants need access to spectrum to enter a geographic area at all.

Spectrum bands vary in breadth and in their propagation characteristics, and these variations have

implications for how spectrum is deployed.

88