M O S T L I T I G A T E D

T A X I S S U E S

2 0 0 5 A N N U A L R E P O R T

◆

TA X P A Y E R A DVO CATE S E R V I C E

471

S E C T I O N

THREE

T H E M O S T L I T I G A T E D T A X I S S U E S

M O S T L I T I G A T E D I S S U E S : I N T R O D U C T I O N

Internal Revenue Code § 7803(c)(2)(B)(ii)(X) requires the National Taxpayer Advocate to

identify the ten tax issues most often litigated in the federal courts, classified by the type

of taxpayer affected. Through analysis of these issues, the National Taxpayer Advocate

will, if appropriate, make recommendations designed to mitigate disputes that result in

litigation. The recommendations included in this analysis could minimize some of the

litigation covered in this section.

1

Taxpayer Advocate Service (TAS) analysts utilized commercial legal research databases to

identify the ten most litigated issues (Most Litigated Issues) in federal courts during the

period of June 1, 2004 through May 31, 2005.

2

For purposes of the Most Litigated Issues

section of the report, the term “litigated” refers to cases in which the court issued an opin-

ion.

3

The ten Most Litigated Issues identified for this year are:

Collection Due Process hearings, under IRC §§ 6320 and 6330;

Gross income, under IRC § 61 and related Code sections;

Failure to file penalty, under IRC § 6651(a)(1);

Trade or business expenses;

Frivolous issues penalty, under IRC § 6673;

Negligence penalty, under IRC § 6662(b)(1);

Family status issues, under IRC §§ 2, 21, 24, 32 and 151;

Relief from joint and several liability for spouses, under IRC § 6015;

Summons enforcement, under IRC § 7604; and

Trust Fund Recovery Penalty, under IRC § 6672.

The top ten litigated issues are substantially similar to those identified in 2004,

4

with some

important exceptions. For the first time, summons enforcement is a Most Litigated Issue,

which may be due in part to the IRS’s increased emphasis on enforcement.

5

While the

1

For example, Collection Due Process (CDP) is again the number one most litigated issue this year. The

National Taxpayer Advocate is making a legislative recommendation to reform CDP legislation, designed

to increase the availability of review for some taxpayers while reducing the incentive to appeal solely

for the purpose of delaying collections. See Key Legislative Recommendation: Restructuring and Reform of

Collection Due Process Provisions, supra.

2

Federal tax cases are tried in the United States Tax Court, the United States district courts, the United

States Court of Federal Claims, the United States bankruptcy courts, United States Courts of Appeals and

the United States Supreme Court.

3

We recognize that many cases are resolved prior to the court issuing an opinion. Some taxpayers are able

to reach settlement with the IRS before trial while other taxpayers’ cases are dismissed for a variety of rea-

sons, including lack of jurisdiction and lack of prosecution. In addition, courts can also issue less formal

“bench opinions” which are not published or precedential. For example, bench opinions are issued by the

United States Tax Court pursuant to Tax Court Rule 152, wherein Tax Court Trial Judges or Special Trial

Judges read oral findings of fact or opinion into the trial transcript. We received copies of some bench

opinions for Collection Due Process cases, this year’s most litigated issue.

4

See National Taxpayer Advocate 2004 Annual Report to Congress 495.

5

Beginning in 2002, the IRS identified the increased use of summonses as a part of the overall shift in

audit priorities toward abusive schemes and promoter investigations. IRS News Release, IRS Sets New

Priorities, September 2002.

◆

◆

◆

◆

◆

◆

◆

◆

◆

◆

TH E MO ST LI TI GAT ED TA X I S S U E S

472

M O S T L I T I G AT E D

M O S T L I T I G A T E D

T A X I S S U E S

S E C T I O N

THREE

other issues remain substantially the same, there was a reordering of the top ten issues

caused by a decrease in litigation involving family status issues

6

and an increase in litigation

involving the failure-to-file penalty, the negligence penalty, and the frivolous issues penalty.

7

Once the ten issues were identified, TAS personnel provided analysis for each issue that

includes four sections: a summary of the findings, a description of the present law, analy-

sis of the litigated cases and a conclusion. We have listed each of the cases litigated, by

issue, in Appendix 3 of this report and have categorized the cases by type of taxpayer.

The case listings for each issue identify the specific citation of the case, the main issue(s),

whether the taxpayer was represented at trial or argued the case pro se, and the decision of

the court. We classify the “opinion” of the court as a decision for the taxpayer, the IRS,

or as a split decision. For purposes of this analysis, when identifying the decision of the

court we only considered the issue analyzed, and a split decision was defined as a partial

allowance of the specific issue litigated.

A N O V E R V I E W O F H O W TA X I S S U E S A R E L I T I G A T E D

Taxpayers generally have access to four different tribunals in which to initially litigate a

tax matter – the United States Tax Court, United States district courts, the United States

Court of Federal Claims, the United States bankruptcy courts. With limited exceptions,

taxpayers have an automatic right of appeal from decisions of the trial court.

8

The United States Tax Court is generally a “prepayment” forum in that taxpayers have

access to the Tax Court without having to pay the disputed tax in advance. The Tax Court

has jurisdiction over a variety of issues, to include deficiencies, certain declaratory judg-

ment actions, collection due process, and relief from joint and several liability.

9

The federal district courts and the Court of Federal Claims have concurrent jurisdiction over

tax matters in which (1) the tax has been assessed and paid in full,

10

and (2) the taxpayer has

filed an administrative claim for refund.

11

The federal district courts are the only forums in

which a taxpayer can receive a jury trial. Bankruptcy courts can adjudicate tax matters that

were not previously adjudicated before the initiation of a bankruptcy case.

12

6

There was a 60 percent decrease in Family Status related issues down from 72 litigated in 2004 to 45 liti-

gated in 2005.

7

There was also a 60 percent increase in failure-to-file penalty litigation and a 91 percent increase in litiga-

tion involving application of the frivolous issues penalty.

8

See IRC § 7482 (providing that the United States Courts of Appeals have jurisdiction to review the deci-

sions of the Tax Court). There are exceptions to this general rule. For example, IRC § 7463 provides

special procedures for small Tax Court cases (where the amount of the deficiency or claimed overpayment

totals $50,000 or less) from which appellate review is not available. See also 28 U.S.C. § 1294 (appeals from

district court are to the appropriate Court of Appeals); 28 U.S.C. § 1295 (appeals from Court of Federal

Claims are heard in the Federal Circuit Court).

9

IRC §§ 6214, 7476-7479, 6330, and 6015.

10

28 U.S.C. § 1346(a)(1). See Flora v. United States, 362 U.S. 145 (1960).

11

IRC § 7422(a).

12

See 11 U.S.C.A. §§ 505(a)(1) and (a)(2)(A).

2 0 0 5 A N N U A L R E P O R T

◆

TA X P A Y E R A DVO CATE S E R V I C E

473

M O S T L I T I G A T E D

T A X I S S U E S

S E C T I O N

THREE

L I T I G A T E D I S S U E S

A N A LY S I S O F

P R O S E

L I T I G A T I O N

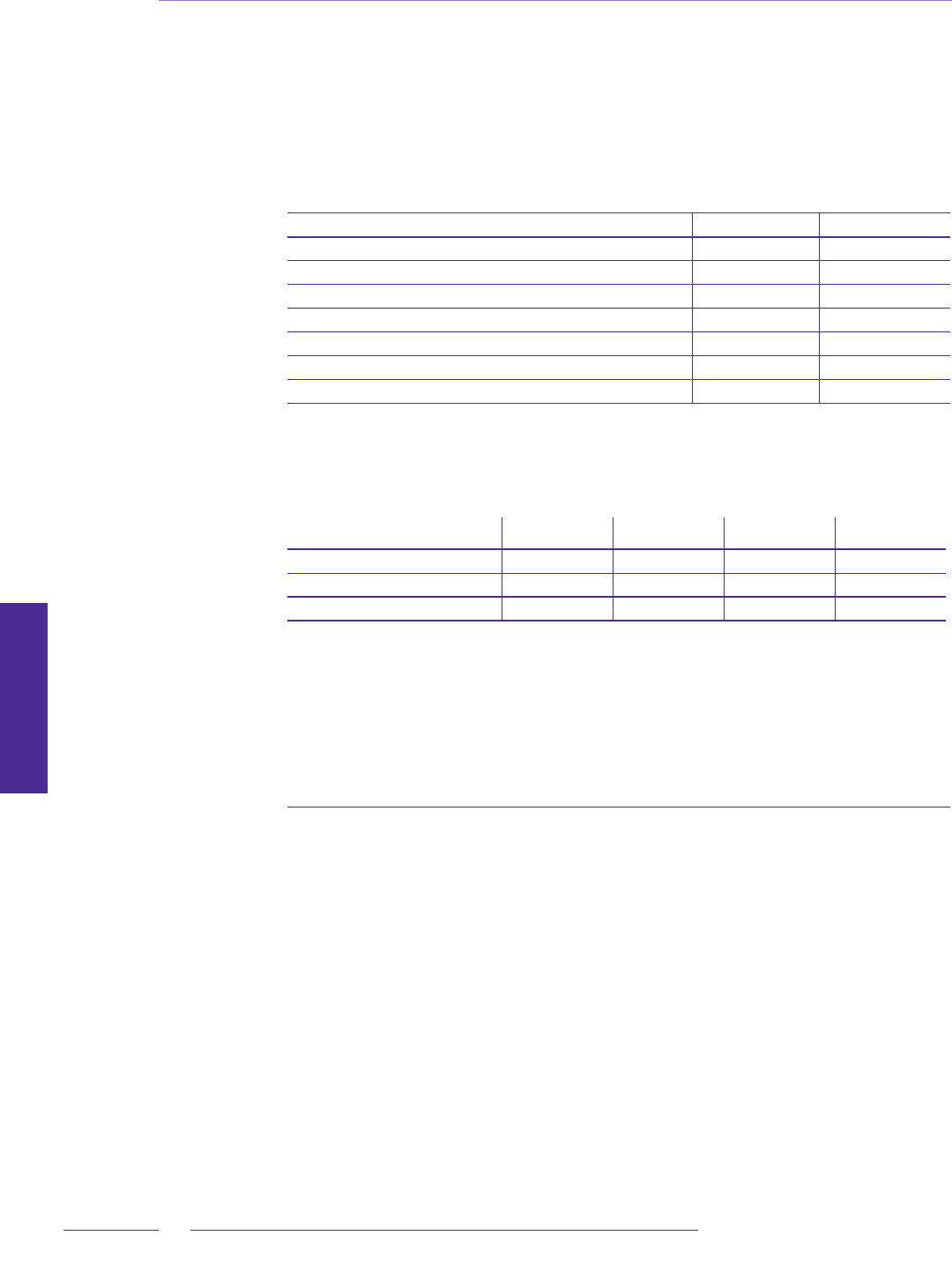

As in the previous two years our analysis indicated that many taxpayers represented them-

selves before the courts, pro se.

13

The following table (Table 3.I-01) lists the most litigated

tax issues for the period June 1, 2004, through May 31, 2005, and identifies the number

of cases in which taxpayers represented themselves before the court.

T A B L E 3 . I - 0 1 ,

P R O S E

C A S E S B Y I S S U E

Most L i t i g a t e d Issue

To t a l N u m b e r of L i t i g a t e d

Cases R e v i e w e d

Pro S e

Litigation

Percentage o f

Pro S e

C a s e s

Collection Due Process 209 165 79%

Gross Income 108 60 56%

Failure to File Penalty 75 58 77%

Trade or Business Expense 67 46 69%

Frivolous Issues Penalty 67 64 96%

Negligence Penalty 57 33 58%

Family Status Issues 45 39 87%

Joint and Several Liability 45 27 60%

Summons Enforcement 44 20 45%

Trust Fund Recovery Penalty 34 8 24%

Total 751 520 69%

Table 3.I-02 demonstrates that taxpayers have a higher chance of prevailing in litigation if

they are represented.

T A B L E 3 . I - 0 2 , O U T C O M E S F O R

P R O S E

A N D R E P R E S E N T E D TA X P AY E R S

Pro S e Ta x p a y e r s Repre s e n t e d Taxpa y e r s

Most L i t i g a t e d Issue

To t a l

Cases

Ta x p a y e r

Prevailed i n

whole o r in p a r t

Percent

To t a l

Cases

Ta x p a y e r

Prevailed i n

whole o r in p a r t

Percent

Collection Due Process 165 15 9% 44 9 20%

Gross Income 60 11 18% 48 14 29%

Failure to File Penalty 58 2 3% 17 3 18%

Trade or Business Expense 46 7 15% 21 9 43%

Frivolous Issues Penalty 64 17 27% 3 1 33%

Negligence Penalty 33 10 30% 24 8 33%

Family Status Issues 39 5 13% 6 2 33%

Joint and Several Liability 27 6 22% 18 6 33%

Summons Enforcement 20 0 0% 24 2 8%

Trust Fund Recovery Penalty 8 1 13% 26 12 46%

Totals 520 74 14% 231 66 29%

13

“Pro Se” means “for oneself; on one’s own behalf; without a lawyer.” Black’s Law Dictionary 1236-37 (7th

ed. 1999).

TH E MO ST LI TI GAT ED TA X I S S U E S

474

M O S T L I T I G AT E D

M O S T L I T I G A T E D

T A X I S S U E S

S E C T I O N

THREE

C O L L E C T I O N D U E P R O C E S S ( C D P ) H E A R I N G S I S S U E # 1

LI TI GAT ED

I S S U E # 1

A P P E A L S F R O M C O L L E C T I O N D U E P R O C E S S ( C D P ) H E A R I N G S U N D E R

I N T E R N A L R E V E N U E C O D E S E C T I O N S 6 3 2 0 A N D 6 3 3 0

S U M M A R Y

Collection Due Process (CDP) hearings, established by the IRS Restructuring and Reform

Act of 1998 (RRA 98), provide taxpayers an important opportunity for independent review

by the Office of Appeals (Appeals) of the IRS’s decision to file a lien or its proposal to

undertake a levy action.

1

At the CDP hearing, the taxpayer has the statutory right to raise

certain issues, including the appropriateness of collection actions, collection alternatives,

spousal defenses, and under certain limited circumstances, the underlying tax liability.

2

The taxpayer also has an automatic right to judicial review of Appeals’ determination,

provided that the taxpayer timely requests the CDP hearing and timely requests judicial

review.

3

Generally, collection action is stayed during the CDP hearing process and any

judicial review that may follow.

4

As was the case in 2003 and 2004, Collection Due Process is the most frequently litigated

tax issue in federal courts during the period analyzed for the Annual Report to Congress.

CDP rights are a dramatic departure from the post-deprivation hearings that characterized

IRS collection procedure utilized prior to RRA 98.

5

CDP has been criticized by many for

slowing down the collection process and allowing a forum for some taxpayers to expound

frivolous arguments. These critics contend that the costs of CDP are significant, while the

benefits of CDP are few.

6

However, other commentators note that CDP hearings bring

vital independent oversight to bear upon IRS tax collectors who are not infallible and

whose collection powers are considerable.

7

The CDP cases litigated in the federal courts

reflect that there is an element of truth to these competing points of view. On balance,

we believe that collection appeal rights with limited judicial review protect taxpayers from

arbitrary collection decisions. In the Key Legislative Recommendations section of this

report, the National Taxpayer Advocate proposes significant changes to CDP legislation.

8

1

Internal Revenue Service Restructuring and Reform Act of 1998, Pub.L. No. 105-206 § 3401, 112 Stat. 685.

2

IRC §§ 6320(c) and 6330(c).

3

IRC §§ 6320(a)(3)(B) and 6330(a)(3)(B) set forth the time requirements for requesting a CDP hearing and

IRC §§ 6320(c) and 6330(d) set forth the time requirements for obtaining judicial review of Appeals’ deter-

mination.

4

IRC § 6330(e)(1) provides that in general there is a suspension of levy actions during the CDP process (along

with a corresponding suspension in the running of the collection statute of limitations). However, IRC §

6330(e)(2) allows the IRS to resume levy actions during judicial review upon a showing of “good cause.”

5

Phillips v. Comm’r, 283 U.S. 589 (1931) (holding that where there is adequate opportunity for judicial deter-

mination after levy there is no right to pre-levy hearings).

6

Bryan T. Camp, Failure of Collection Due Process, Pt. 1: The Collection Context, 104 Tax Notes 969 (Aug. 30,

2004); Bryan T. Camp, The Failure of CDP, Part 2: Why it Adds No Value, 104 Tax Notes 1567 (Sept. 27,

2004); Bryan T. Camp, The Costs of CDP, 105 Tax Notes 1445 (Dec. 6, 2004).

7

Leslie Book, The Collection Due Process Rights: A Misstep or a Step in the Right Direction?, 41 Hous. L. Rev.

1145 (2004).

8

See Key Legislative Recommendation: Restructuring and Reform of Collection Due Process Provisions, supra.

M O S T L I T I G A T E D

T A X I S S U E S

2 0 0 5 A N N U A L R E P O R T

◆

TA X P A Y E R A DVO CATE S E R V I C E

475

L I T I G A T E D I S S U E S

S E C T I O N

THREE

P R E S E N T L A W

Current law provides taxpayers an opportunity for independent review of a lien

9

filed by

the IRS or a proposed levy action.

10

The purpose of CDP rights was to give taxpayers

adequate notice of collection activity and a meaningful hearing before the IRS deprives

them of property. The hearing allows the taxpayer an opportunity to raise issues germane

to the collection of the tax, including:

11

Appropriateness of collection actions;

12

Collection alternatives such as installment agreement, offer in compromise, posting a

bond or substitution of other assets;

13

Appropriate spousal defenses;

14

and

The existence or amount of the tax, but only if the taxpayer did not receive a notice

of deficiency or did not otherwise have an opportunity to dispute the tax liability.

15

A taxpayer may not reintroduce an issue that was raised and considered at a prior admin-

istrative or judicial hearing if the individual participated meaningfully in the prior hearing

or proceeding.

16

Procedurally, the IRS must provide notice to the taxpayer of the lien filing

17

and of its

intent to levy.

18

The Notice of Federal Tax Lien must be provided to the taxpayer not

more than five days after the day of the filing of the notice of the lien.

19

The Notice of

Intent to Levy must be provided to taxpayers at least 30 days before the day of the levy.

20

The IRS is also required to notify the taxpayer of his or her right to a CDP hearing after

the filing of the Notice of Federal Tax Lien (NFTL) and before any levy action can take

place. In the case of a lien, the CDP hearing notice must be provided to the taxpayer

not more than five days after the filing of the NFTL and must inform the taxpayer of his

9

IRC § 6320.

10

IRC § 6330.

11

Internal Revenue Service Restructuring and Reform Act of 1998, Pub. L. No. 105-206, § 3401, 112 Stat.

685; S. Rep. No. 105-174.

12

IRC §§ 6330(c)(2)(A)(ii) and 6320(c).

13

IRC §§ 6330(c)(2)(A)(iii) and 6320(c).

14

IRC §§ 6330(c)(2)(A)(i) and 6320(c).

15

IRC §§ 6330(c)(2)(B) and 6320(c).

16

IRC §§ 6330(c)(4) and 6320(c).

17

IRC § 6320(a).

18

IRC § 6331(d).

19

IRC § 6320(a)(2). The Notice of Federal Tax Lien can be provided to the taxpayer in person, left at the

taxpayer’s residence or dwelling, or can be sent by certified or registered mail to the taxpayer’s last known

address.

20

IRC § 6331(d)(2). The Notice of Intent to Levy can be provided to the taxpayer in person, left at the

taxpayer’s residence or dwelling, or can be sent by certified or registered mail to the taxpayer’s last known

address.

◆

◆

◆

◆

C O L L E C T I O N D U E P R O C E S S ( C D P ) H E A R I N G S I S S U E # 1

TH E MO ST LI TI GAT ED TA X I S S U E S

476

M O S T L I T I G AT E D

M O S T L I T I G A T E D

T A X I S S U E S

S E C T I O N

THREE

C O L L E C T I O N D U E P R O C E S S ( C D P ) H E A R I N G S I S S U E # 1

or her right to request a CDP hearing within the 30-day period that begins on the expira-

tion of the fifth day after the filing of the NFTL.

21

In the case of a levy, the CDP hearing

notice must be provided to the taxpayer no fewer than 30 days before the first levy and

must inform the taxpayer of his or her right to request a hearing 30 days from the date

that the notice is sent.

22

Under both lien and levy procedures, the taxpayer must return a signed, written request

for a CDP hearing within 30 days of the date of notice.

23

Taxpayers who request a CDP

hearing after the 30 days will receive an “equivalent hearing,” which is similar to a CDP

hearing except there is no judicial review of an equivalent hearing.

24

Proposed revisions

to the CDP regulations require the taxpayer to put the reasons for the CDP hearing in

writing (preferably using Form 12153, Request For A Collection Due Processs Hearing), and the

failure to provide the basis for hearing may result in a denial of a face-to-face hearing.

25

Proposed revisions also eliminate the availability for equivalent hearings if the taxpayer

does not make a request for a hearing within one year from the date of issuance of the

CDP Notice.

26

When a taxpayer requests CDP hearings with respect to both a lien and a proposed levy,

the IRS Appeals officer will attempt to conduct one hearing.

27

The IRS will suspend

collection action throughout the hearing process, unless it determines that the collection

of the tax is in jeopardy.

28

Collection activity is also suspended throughout any judicial

review of Appeals’ determination, unless the underlying tax liability is not at issue and the

IRS can demonstrate to the court good cause to resume collection activity.

29

Collection Due Process hearings are informal. The Office of Appeals presumptively

establishes telephonic CDP hearings, and it is incumbent on the taxpayer to request a

21

IRC § 6320(a)(2).

22

IRC § 6330(a)(2). The CDP hearing notice can be provided to the taxpayer in person, left at the taxpayer’s

residence or dwelling, or can be sent by certified or registered mail (return receipt requested) to the tax-

payer’s last known address.

23

IRC §§ 6330(a)(3)(B) and 6330(a)(3)(B); Treas. Reg. § 301.6320-1(c) and Treas. Reg. § 301.6330-1(c).

24

Treas. Reg. § 301.6330-(1)(i).

25

Prop. Treas. Reg. § 301.6320-1 and Prop. Treas. Reg. § 301.6330-1. The proposed regulations provide tax-

payers an opportunity to cure a failure to provide a basis for the CDP hearing.

26

Id.

27

IRC § 6320(b)(4).

28

IRC § 6330(e)(1) provides the general rule for suspending collection activity while IRC § 6330(f) provides

that if collection of the tax is deemed in jeopardy, section 6330 does not apply.

29

IRC§ 6330(e)(1) and 6330(e)(2). In Burke v. Comm’r, 124 T.C. 189 (2005), the Tax Court granted the IRS’s

motion to levy while the case was on appeal since the taxpayer was espousing only frivolous arguments;

see also Howard v. Comm’r, T.C. Memo. 2005-100, where the IRS moved for and obtained from the court

an order allowing resumption in levy activity on the taxpayer due to the taxpayer’s frivolous arguments

made solely for the purpose of delaying collection.

M O S T L I T I G A T E D

T A X I S S U E S

2 0 0 5 A N N U A L R E P O R T

◆

TA X P A Y E R A DVO CATE S E R V I C E

477

L I T I G A T E D I S S U E S

S E C T I O N

THREE

face-to-face hearing.

30

Courts have determined that, depending on the circumstances,

a CDP hearing need not be face-to-face with the Appeals officer,

31

but instead, can take

place by telephone,

32

or by an exchange of correspondence.

33

The hearing is to be held

by an impartial officer from the Appeals function of the IRS.

34

In addition to the issues

described above that the taxpayer is permitted to address, the Appeals officer must obtain

verification that the requirements of all laws and procedures have been satisfied for the

IRS to proceed with collection activity.

35

In making its determination, Appeals must

weigh the issues raised by the taxpayer and determine whether the proposed collection

action balances the need for efficient collection of taxes with the legitimate concern of the

taxpayer that any collection action be no more intrusive than necessary.

36

Within 30 days

of the Appeals determination, the taxpayer may petition the United States Tax Court or

where appropriate, the U.S. district court for judicial review of Appeals’ determination.

37

Where the validity of the tax liability is properly at issue in the CDP hearing, the amount

of the tax liability will be reviewed by the appropriate court on a de novo basis.

38

Where

the appropriateness of the collection action is at issue, the court will review the IRS’s

administrative determination for abuse of discretion.

39

A N A LY S I S O F L I T I G A T E D C A S E S

Collection Due Process was the most litigated tax issue in the federal court system

between June 1, 2004 and May 31, 2005. Two hundred and nine (209) CDP court deci-

30

Appeals Letter 3855. See also Treas. Reg. § 301.6320-1(d)(2) Q&A D6 and Treas. Reg. § 301.6320-1(d)(2)

Q&A D6 regarding the informality of CDP hearings.

31

For example, in Casey v. Comm’r, T.C. Memo. 2004-228, the Tax Court held that a face-to-face hearing was

not required where taxpayer had a reasonable opportunity for a hearing, but changed addresses and failed to

provide the IRS her new address. However, in Cavanaugh v. U.S., 93 A.F.T.R.2d (RIA) 2004-1522 (D. N.J.

2004), where the facts were disputed as to whether the taxpayer knew that phone conversations constituted

the taxpayer’s CDP hearing, the court remanded the case for Appeals to provide a face-to-face hearing.

32

In Whiting v. Comm’r, T.C. Memo. 2004-136, the Tax Court held that two phone conversations by the tax-

payer’s representative and the Appeals officer were sufficient to constitute a CDP hearing in the absence

of testimony regarding the content of the phone conversations.

33

Treas. Regs. §§ 301.6320-1(d)(2), Q&A-D6 and 301.6330-1(d)(2), Q&A-D6.

34

IRC §§ 6320(b)(1), 6320(b)(3), 6330(b)(1) and 6330(b)(3).

35

IRC § 6330(c)(1).

36

IRC § 6330(c)(3).

37

IRC §§ 6330(d)(1) and 6320(c).

38

The legislative history of RRA 98 addresses the standard of review courts should apply in reviewing the

IRS’s administrative CDP determinations. H.R. Rep. No.105-599 at 266 (Conf. Rep.). The term de novo

means anew. Black’s Law Dictionary, 447 (7th ed. 1999).

39

Robinette v. Comm’r, 123 T.C. 85 (2004), appeal docketed, No. 04-4081 (8th Cir. Dec. 16, 2004) (noting that

abuse of discretion means an adjudicator’s decision which is arbitrary, capricious, clearly unlawful or without

a sound basis in law or fact).

C O L L E C T I O N D U E P R O C E S S ( C D P ) H E A R I N G S I S S U E # 1

TH E MO ST LI TI GAT ED TA X I S S U E S

478

M O S T L I T I G AT E D

M O S T L I T I G A T E D

T A X I S S U E S

S E C T I O N

THREE

C O L L E C T I O N D U E P R O C E S S ( C D P ) H E A R I N G S I S S U E # 1

sions were reviewed.

40

Excluding unpublished bench opinions that were not included in

prior years’ statistics, this represents an eight percent increase from the 182 CDP cases

from last year’s analysis and a one percent decrease from the 199 CDP cases reported in

2003.

41

The 209 decided cases do not reflect the full measure of CDP litigation involv-

ing taxpayers and the IRS during the review period. Not all CDP cases result in decisions

for or against taxpayers. For example, from June 1, 2004 to May 31, 2005, taxpayers filed

approximately 1,098 CDP cases in the United States Tax Court and 114 cases in United

States district courts.

42

Some cases are resolved through negotiated settlements while

other taxpayers do not pursue their litigation after filing their petitions with the courts,

resulting in dismissal of the action. While these 209 decided cases may not provide the

full measure of all CDP litigation, they do provide useful insight into the costs and ben-

efits of CDP by shedding light on the situations of taxpayers utilizing CDP. Table 1 in

Appendix 3 provides a detailed listing of litigated CDP cases, including specific informa-

tion about the types of taxpayers involved.

Litigation Success Rate

Taxpayers prevailed in whole or in part in 24 of the 209 cases reviewed (or approximately

11 percent). In 16 of the 209 cases (approximately 8 percent), courts either remanded the

case to Appeals because issues of material fact remained, or ruled that the IRS abused its

discretion.

43

Of the remaining eight cases where taxpayers prevailed, four involved the

existence or amount of underlying liability or application of the relief from joint and sev-

eral liability provisions under IRC § 6015,

44

and four cases involved procedural rulings.

45

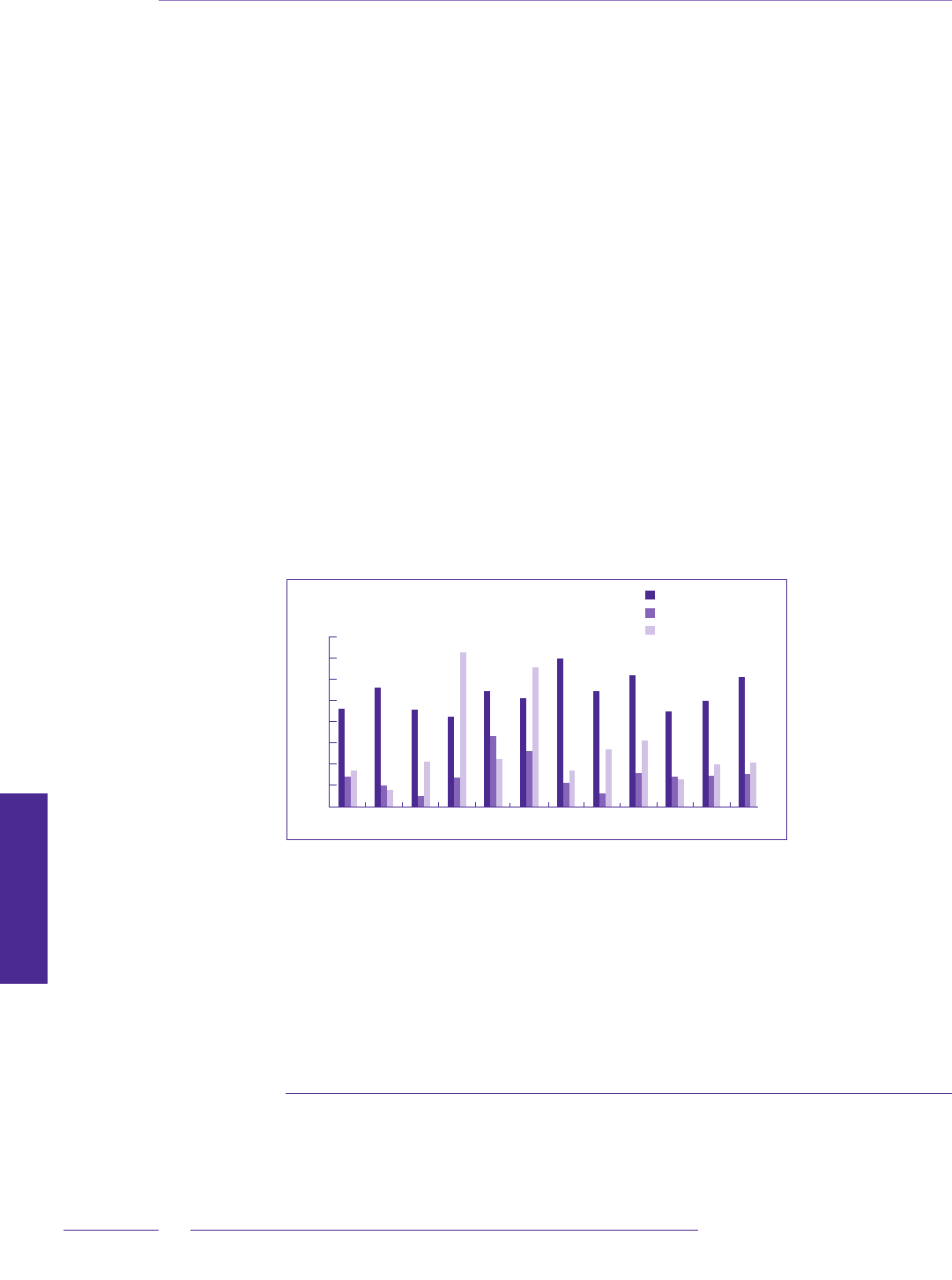

Table 3.1.1 below compares litigation success rates in CDP cases for the 2002, 2003, and

2004 Reports to Congress.

40

The cases reviewed for the Most Litigated Issues section of the report are those opinions that are pub-

lished through on-line legal research services. In addition, the 209 litigated CDP opinions include 12

bench opinions issued pursuant to United States Tax Court Rule 152, wherein Tax Court Trial Judges or

Special Trial Judges render oral findings of fact or opinion into the trial transcript. Bench opinions are not

available through on-line research services and we did not have access to all bench opinions or orders of

dismissal issued during this timeframe.

41

See National Taxpayer Advocate 2003 Annual Report to Congress 318; National Taxpayer Advocate 2004

Annual Report to Congress 498.

42

Statistics were provided by the Internal Revenue Service Office of Chief Counsel.

43

Berger v. Comm’r, No. 19535-02L (Dec. 15, 2004); Calderone v. Comm’r, T.C. Memo. 2004-240; Demus v.

Comm’r, No. 6636-04L (Dec. 15, 2004); Fowler v. Comm’r, T.C. Memo. 2004-163; Jackson v. Comm’r, T.C.

Summ. Op. 2005-12; Johnson v. Comm’r, T.C. Summ. Op. 2005-47; Karara v. Comm’r, No. 7748-02L (Dec.

15, 2004); Langer v. U.S., 95 A.F.T.R.2d (RIA) 894 (8th Cir. 2005); Parker v. Comm’r, T.C. Memo. 2004-226;

Pollack v. U.S., 327 F.Supp.2d 907 (W.D. Tenn. 2004); Robinette v. Comm’r, 123 T.C. 85 (2004), appeal dock-

eted, No. 04-4081 (8th Cir. Dec. 16, 2004); Skrizowski v. Comm’r, T.C. Memo. 2004-229; Thorpe v. Comm’r,

T.C. Summ. Op. 2004-98; Zapara v. Comm’r, 124 T.C. 223 (2005); Cox v. U.S., 345 F.Supp.2d 1215 (W.D.

Okla. 2004); Newstat v. Comm’r, T.C. Memo. 2004-208.

44

Hayes v. Comm’r, T.C. Memo. 2005-57; Hendricks v. Comm’r, T.C. Memo. 2005-72; Molina v. Comm’r, T.C.

Memo. 2004-258.

45

Beverly v. Comm’r, T.C. Memo. 2005-41; Klet v. Comm’r, T.C. Summ. Op. 2004-172; Smith v. Comm’r, 124

T.C. 36 (2005); Electro, Inc. v. Comm’r, 95 A.F.T.R.2d (RIA) 700 (D. Or. 2005).

M O S T L I T I G A T E D

T A X I S S U E S

2 0 0 5 A N N U A L R E P O R T

◆

TA X P A Y E R A DVO CATE S E R V I C E

479

L I T I G A T E D I S S U E S

S E C T I O N

THREE

T A B L E 3 . 1 . 1 , C D P L I T I G A T I O N S U C C E S S R A T E S

COURT

DECISIONS

2002

Percentage

2003

Percentage

2004

Percentage

2005

Percentage

Decided for IRS 90% 96% 95% 89%

Decided for Taxpayer 7% 1% 4% 8%

Split Decision

46

3% 3% 1% 3%

The increased litigation success rate for taxpayers in the 2004 - 2005 review period does

not likely suggest any particular trend.

46

Issues Litigated

In 2004, we focused on the numerous procedural problems that taxpayers experienced

with CDP hearings and judicial review of those hearings.

47

Taxpayers continued to expe-

rience these problems, and we discuss that issue further below. However, this year we

focused more on the substantive issues raised by taxpayers in an effort to determine how

useful CDP was for litigants and for tax administration. As was described above, taxpay-

ers are able to raise a variety of issues at CDP hearings. It is essential for taxpayers to raise

all relevant issues with Appeals so that the issue is preserved in the event it is necessary

to pursue judicial review.

48

If the issue is not raised in the CDP hearing, it may not be

raised on judicial review.

49

Table 3.1.2 below demonstrates the different issues raised by

taxpayers and the frequency of success for each issue.

50

46

A "split" decision refers to a case with multiple issues where both the IRS and the taxpayer prevail on one

or more substantive issues.

47

National Taxpayer Advocate 2004 Annual Report to Congress 498.

48

Treas. Reg. § 301.6330-1(f) Q-AF5 provides:

Q-F5 What issue or issues may the taxpayer raise before the Tax Court or before a district court if the tax-

payer disagrees with the Notice of Determination?

A-F5 In seeking Tax Court or other district court review of Appeals’ Notice of Determination, the tax-

payer can only ask the court to consider an issue that was raised in the taxpayer’s CDP hearing.

49

Id.

50

The number of issues does not equal the number of cases reviewed for three reasons. First, for purposes

of identifying issues, we did not take into consideration issues considered by the courts to have been friv-

olous or raised solely for the purpose of delay. Second, other cases had multiple issues. Third, numerous

decisions addressed only threshold procedural questions and did not address the substantive issue raised

by the taxpayer.

C O L L E C T I O N D U E P R O C E S S ( C D P ) H E A R I N G S I S S U E # 1

TH E MO ST LI TI GAT ED TA X I S S U E S

480

M O S T L I T I G AT E D

M O S T L I T I G A T E D

T A X I S S U E S

S E C T I O N

THREE

C O L L E C T I O N D U E P R O C E S S ( C D P ) H E A R I N G S I S S U E # 1

T A B L E 3 . 1 . 2 , S U C C E S S O F L I T I G A N T S B Y I S S U E

51

Issue

No. C a s e s Issue

Argued

IRS

Prevailed

Ta x p a y e r

Prevailed

Collection Alternatives 40 35 5

Validity of Liability 39 33 6

Procedural Requirements 37 31 6

Abatement of Penalties 15 15 0

Payment of Liability

52

9 7 2

Bankruptcy Issues 6 3 3

Abatement of Interest 5 4 1

Collection Statute Expiration 4 4 0

Relief from Joint & Several 2 1 1

Total: 157 133 24

52

Collection Alternatives

Collection alternatives were litigated more than any other CDP issue. Taxpayers have

a statutory right to raise collection alternatives in their CDP hearings.

53

The two most

frequently litigated collection alternatives were offers in compromise

54

and installment

agreements.

55

Each of these collection alternatives requires current filing compliance on

the taxpayer’s part; offers in compromise additionally require that taxpayers remain in fil-

ing and payment compliance for an additional five years or until the liability is full paid,

whichever is longer, or else the offer will be defaulted and the tax reinstated.

56

Courts

review Appeals’ consideration of collection alternatives, such as offers in compromise uti-

lizing an abuse of discretion standard.

57

Five taxpayers were able to demonstrate that the IRS abused its discretion when considering

51

This count excludes numerous cases where taxpayers raised procedural issues that the courts deemed frivo-

lous or groundless. See e.g., Kubon v. Comm’r, T.C. Memo. 2005-71 (the Secretary or delegate may issue

collection notices, assessment was valid) Henderson v. Comm’r, T.C. Memo. 2004-157 (assessment was proper,

notice of balance due/Notice of Intent to Levy meet requirement for notice and demand for payment).

52

In these cases, taxpayers argued that previous payments, levies, or credits satisfied liabilities.

53

IRC §§ 6330(c)(2) and 6320(c).

54

Offers in compromise are provided for in IRC § 7122 and allow the IRS to compromise the taxpayer’s

liability based on doubt as to liability, doubt as to collectibility, and effective tax administration. Treas.

Reg. § 301.7122-1.

55

Installment agreements are provided for in IRC § 6159 and allow taxpayers who cannot immediately sat-

isfy the liability to full-pay the liability in installments.

56

See IRM § 5.14.1.5.1 for installment agreements; see § IRM 5.8.3.4.1 and IRS Form 656 for offers.

57

Robinette v. Comm’r, 123 T.C. 85 (2004), appeal docketed, No. 04-4081 (8th Cir. Dec. 16, 2004).

M O S T L I T I G A T E D

T A X I S S U E S

2 0 0 5 A N N U A L R E P O R T

◆

TA X P A Y E R A DVO CATE S E R V I C E

481

L I T I G A T E D I S S U E S

S E C T I O N

THREE

their collection alternatives.

58

While relatively few in number (taxpayers prevailed in 13 per-

cent of CDP cases in which collection alternatives were raised), these cases demonstrate the

importance of judicial review to CDP rights as a check against arbitrary collection actions.

For example, in Johnson v. Commissioner, Appeals rejected the proposed installment agree-

ment of an individual who alleged that he was homeless (living in a temporary shelter), and

Appeals determined to let levy action proceed against the taxpayer because he had failed

to file two tax returns, although the taxpayer had given evidence that his income was insuf-

ficient to require the filing of those returns.

59

In Fowler v. Commissioner, the court held that

the IRS abused its discretion in denying a taxpayer’s offer in compromise proposal based on

the Appeals officer’s use of national expense standards to compute the taxpayer’s expenses

when the taxpayer’s actual expenses were available.

60

In Robinette v. Commissioner, the Tax

Court held that it was an abuse of discretion to default the taxpayer’s offer in compromise

(which requires that the taxpayer remain in compliance for five years) for the late filing of

a tax return when the taxpayer’s representative testified that he mailed the return and when

the return reflected that the taxpayer was entitled to a refund.

61

These cases are examples of

how judicial review can improve IRS collection policy by helping to instill more flexibility

and common sense to its resolution practices.

Validity of the Underlying Liability

The next largest category of issues raised by taxpayers on judicial review was the validity

of the taxpayer’s underlying liability.

62

Taxpayers are able to argue the underlying liabil-

ity in the CDP hearing and in de novo proceedings before the Tax Court if they did not

receive a notice of deficiency or have a previous opportunity to argue the issue prior to

the hearing.

63

In 26 of the 39 cases where the underlying liability was raised, courts found

that the taxpayers had received a notice of deficiency or had had another opportunity

to argue the underlying liability.

64

In three cases, however, courts made pre-trial rulings

allowing taxpayers to argue the underlying liability where it appeared that the taxpayers

58

Skrizowski v. Comm’r, T.C. Memo. 2004-229 (holding it was an abuse of discretion to not fully investigate

the OIC before rejecting it and not basing rejection on taxpayer’s income, assets and allowable expenses

and ability to pay. The court found that the taxpayer did not receive $5 million in business income

reported on taxpayer’s return when taxpayer was intoxicated when he submitted the delinquent return

after allegedly being told by an IRS collections officer that he could go to jail if he did not file the return,

and further noted that the Appeals officer did not believe the reported income was valid); Cox v. U.S., 345

F.Supp.2d 1215 (W.D. Okla. 2004) (holding it was abuse of discretion to conclude that taxpayer could

not make installment agreement payments when the company had been making payments on the tax);

Robinette v. Comm’r, 123 T.C. 85 (2004), appeal docketed, No. 04-4081 (8th Cir. Dec. 16, 2004); Fowler v.

Comm’r, T.C. Memo. 2004-163; Johnson v. Comm’r, T.C. Summ. Op. 2005-47.

59

Johnson v. Comm’r, T.C. Summ. Op. 2005-47.

60

Fowler v. Comm’r, T.C. Memo. 2004-163.

61

Robinette v. Comm’r, 123 T.C. 85 (2004), appeal docketed, No. 04-4081 (8th Cir. Dec. 16, 2004).

62

See Key Legislative Recommendation, Restructuring and Reform of Collection Due Process Provisions, supra, pro-

posing elimination of de novo judicial review of the underlying liability in CDP cases.

63

IRC §§ 6320(c) and 6330(c)(2)(B); H.R. Rep. No. 105-599 at 266 (1998) (Conf. Rep.).

64

See Table 1 in Appendix 3 for a list of cases where the court found the taxpayer was not entitled to argue

the underlying liability.

C O L L E C T I O N D U E P R O C E S S ( C D P ) H E A R I N G S I S S U E # 1

TH E MO ST LI TI GAT ED TA X I S S U E S

482

M O S T L I T I G AT E D

M O S T L I T I G A T E D

T A X I S S U E S

S E C T I O N

THREE

C O L L E C T I O N D U E P R O C E S S ( C D P ) H E A R I N G S I S S U E # 1

may have been denied an earlier opportunity to do so.

65

In three other cases, taxpayers

successfully raised and prevailed on the issue of the underlying liability.

66

Satisfaction of Procedural Requirements

The third largest category of CDP cases were taxpayers who argued that Appeals

failed to follow all procedural requirements in offering and conducting the CDP

hearing. In making its determination, Appeals is required to consider all issues

raised by the taxpayer, and obtain verification that all laws and procedures have

been followed to take the proposed collection action. In making its determination,

Appeals must balance the need for efficient tax collection with the taxpayer’s legiti-

mate concern that any proposed collection alternative be no more intrusive than

necessary.

67

The CDP statute and Treasury Regulations also impose notice and hear-

ing procedural requirements on the IRS.

68

Five taxpayers prevailed in their arguments that the IRS failed to follow all required

procedural steps.

69

In Cox v. Commissioner, the court stressed the importance of CDP’s

procedural requirements, holding that the taxpayer was entitled to prior notice of the

CDP hearing and that the taxpayer did not receive prior notice or any notice that two

phone conversations constituted the CDP hearing.

70

The court emphasized the impor-

tant role that adequate notice plays in the provision of CDP rights: Finally, although it is

true that the Act does not import all federal due process protections into its requirements,

it is also true that the opportunity to be heard at a meaningful time and in a meaning-

ful manner is a bedrock principle of federal due process. See Armstrong v. Manzo, 380

U.S. 545, 552, 85 S.Ct. 1187, 14 L.Ed.2d 62 (1965) (a fundamental requirement of due

65

Berger v. Comm’r, No. 19535-02L (Dec. 15. 2004) (finding that taxpayer’s signature signing for notice of

deficiency appeared to be forged); Calderone v. Comm’r, T.C. Memo. 2004-240 (holding that taxpayer’s repre-

sentative may not have informed taxpayer about the notice of deficiency); Newstat v. Comm’r, T.C. Memo.

2004-208 (finding that there was no apparent record of a notice of deficiency for one year at issue).

66

Molina v. Comm’r, T.C. Memo. 2004-258 (holding that distribution from retirement plan was not taxable

in 2000); Zelaya v. Comm’r, T.C. Summ. Op. 2004-163 (holding that liability stemming from issuance of

second refund check was invalid since evidence showed that check had been forged); Langer v. U.S., 95

A.F.T.R.2d (RIA) 894 (8th Cir. 2005) (holding taxpayer not collaterally estopped from raising FICA tax

issues in district court after improperly raising the issue in Tax Court).

67

IRC § 6330(c)(3).

68

See IRC §§ 6320(a) and 6330(a) governing notice requirements; see also Treas. Reg. §§ 301.6320 et seq. and

301.6330 et seq. governing the hearing procedure.

69

Demus v. Comm’r, 6636-04L (Dec. 15, 2004) (remanding the case to Appeals to consider and address in the

Notice of Determination all issues raised by taxpayer); Karara v. Comm’r, No. 7748-02L (Dec. 15, 2004)

(holding taxpayer did not receive adequate CDP notice for tax year); Parker v. Comm’r, T.C. Memo. 2004-

226 (when taxpayer requests face-to-face hearing, Appeals was required to hold hearing in closest Appeals

office to taxpayer); Pollack v. U.S., 327 F.Supp.2d 907 (W.D. Tenn. 2004), reconsidered at 95 A.F.T.R.2d 1191

(W.D.Tenn. 2004) (holding procedure not followed when Appeals Officer did not properly complete form

prior to giving it to taxpayer in accordance with IRM; upon reconsideration, the court found that the notice

of deficiency mailed to wrong address and the taxpayer could contest underlying liability); Cox v. U.S., 345

F.Supp.2d 1215 (W.D. Okla. 2004) (holding notice of CDP hearing was inadequate).

70

Cox v. U.S., 345 F.Supp.2d 1218 (W.D. Okla. 2004).

M O S T L I T I G A T E D

T A X I S S U E S

2 0 0 5 A N N U A L R E P O R T

◆

TA X P A Y E R A DVO CATE S E R V I C E

483

L I T I G A T E D I S S U E S

S E C T I O N

THREE

process is the opportunity to be heard, granted at a meaningful time and in a meaningful

manner). Inadequacy of notice of the hearing required by § 6330 inevitably impairs the

protections which are explicitly provided for in that section.

Last year we reported numerous cases where taxpayers had objected to Appeals’ refusal

to allow them to record their CDP hearings notwithstanding the holding in Keene v.

Commissioner, which recognized taxpayers’ right to record hearings. Taxpayers continued

to use this argument in an attempt to invalidate Appeals’ determination; however, courts

have demonstrated little inclination to remand a case on this basis where the taxpayer has

failed to make other substantive arguments in the CDP process.

71

The IRS has changed

its procedures to permit recording of CDP hearings when the hearing is face-to-face if

certain requirements are met.

72

Taxpayers also continue to make similar arguments about

the right to a face-to-face hearing, but courts have recognized there is no absolute right to

a face-to-face hearing and are unwilling to remand the case back to Appeals on this basis

where the taxpayer makes no other substantive arguments.

73

Most taxpayers raising the argument of noncompliance with CDP procedures argued in

general fashion that the IRS failed to adequately complete the verification requirements

of IRC § 6330(c)(1). None of these taxpayers prevailed.

74

Taxpayers continued to demonstrate confusion with procedural aspects of CDP. Appeals

from CDP hearings relating to income taxes are appealed to the Tax Court, while employ-

ment taxes and certain penalty appeals, such as the IRC § 6702 frivolous return penalty,

are made to the appropriate district court.

75

At least ten of the taxpayers filed their

appeals in the wrong court.

76

As we described in last year’s report, judicial review would

be greatly simplified if jurisdiction was consolidated in the Tax Court.

77

71

Borchardt v. Comm’r, 338 F.Supp.2d 1040 (D. Minn. 2004).

72

IRM § 8.6.1.2.5

73

Casey v. Comm’r, T.C. Memo. 2004-228; Chandler v. Comm’r, T.C. Memo. 2005-99; Gardner v. Comm’r, 95

A.F.T.R.2d (RIA) 2023 (D. N.J. 2005); Quigley v. Comm’r, 358 F.Supp.2d 427 (E.D. Pa. 2004). See also, Treas.

Reg. § 601.106(b), providing in part “the appeal procedures do not extend to cases involving solely the

failure or refusal to comply with the tax laws because of moral, religious, political, constitutional, consci-

entious, or similar grounds.”

74

See Table 1, Appendix 3 for cases where this argument was made. Additionally, many of the taxpayers

whose arguments were deemed “frivolous” or made solely for the purpose of delay also raised the verifica-

tion argument.

75

IRC §§ 6330(d)(1) and 6320(c).

76

Israel v. U.S., 93 A.F.T.R.2d (RIA) 2044 (S.D. Iowa 2005); Kupcho v. Comm’r, 95 A.F.T.R.2d (RIA) 1439

(D. N.J. 2005); Mackinnon v. Fredrickson, 95 A.F.T.R.2d (RIA) 1973 (D. Or. 2005); Peterson v. Kreidich, 95

A.F.T.R.2d (RIA) 2416 (11th Cir. 2005); Rustam v. Comm’r, T.C. Memo. 2005-42; Torczon v. Lucas, 95

A.F.T.R.2d (RIA) 681 (9th Cir. 2005); Updegrave v. U.S., 94 A.F.T.R.2d (RIA) 6155 (D. Or. 2005); Burns v.

U.S., 95 A.F.T.R.2d (RIA) 1160 (M.D. Tenn. 2005); Canaday v. U.S., 94 A.F.T.R.2d (RIA) 6311 (S.D. W.Va.

2004); Cobin v. Comm’r, A.F.T.R.2d (RIA) 717 (D. S.C. 2005).

77

National Taxpayer Advocate 2004 Annual Report to Congress 502; see also Key Legislative

Recommendation: Restructuring and Reform of Collection Due Process Provisions, supra.

C O L L E C T I O N D U E P R O C E S S ( C D P ) H E A R I N G S I S S U E # 1

TH E MO ST LI TI GAT ED TA X I S S U E S

484

M O S T L I T I G AT E D

M O S T L I T I G A T E D

T A X I S S U E S

S E C T I O N

THREE

C O L L E C T I O N D U E P R O C E S S ( C D P ) H E A R I N G S I S S U E # 1

Penalty Abatement

Taxpayers can request the abatement of penalties in CDP hearings provided that the

taxpayer has not previously had an opportunity to raise the issue.

78

The most frequently

litigated penalties that taxpayers sought to abate through CDP hearings were:

IRC § 6651: The penalty for failure to file a timely tax return penalty pursuant to

IRC § 6651 can be abated by demonstrating that the failure to file was due to rea-

sonable cause, and courts review the issue on a de novo standard.

79

Jurisdiction for

judicial review from CDP hearings pertaining to the failure to file penalty applicable

to income tax returns is with the Tax Court.

80

In cases where taxpayers sought abate-

ment of the failure to file penalty, the issue was raised in conjunction with other

issues, and none of the taxpayers were able to demonstrate reasonable cause.

81

IRC § 6702: The frivolous return penalty under IRC § 6702 is assessed against tax-

payers who file a tax return that does not contain substantially correct information

due to a position taken by the taxpayer that is frivolous or is based on a desire to

impede or delay the administration of federal taxes.

82

Jurisdiction for judicial review

from CDP hearings pertaining to the frivolous income tax return penalty is with

the appropriate United States district court.

83

The reviewed decisions reflected a

disagreement among the courts about the standard of review for this type of penalty

(i.e. de novo or abuse of discretion).

84

All of the taxpayers assessed these penalties

had filed returns showing zeroes in the boxes where taxable income is reported, and

none of these taxpayers raised meritorious issues on appeal.

85

78

IRC §§ 6320(c) and 6330(c)(4) provide that taxpayers are precluded from raising issues in a CDP hearing

if the issue was raised in any other administrative or judicial proceeding, provided that the person mean-

ingfully participated in the proceeding.

79

Goza v. Comm’r, 114 T.C. 176 (2000).

80

IRC § 6330(d)(1)(A) and (B).

81

Most of these taxpayers failed to offer any evidence on reasonable cause. See Conner v. Comm’r, T.C.

Summ. Op. 2005-27; Seavey v. Comm’r, T.C. Summ. Op. 2005-8; but see Jackson v. Comm’r, T.C. Summ.

Op. 2005-12 (holding that taxpayers failed to prove that the IRS agreed to abate penalties).

82

IRC § 6702(a)(1)-(2).

83

IRC § 6330(d)(1)(A) and (B); see Hoffman v. U.S., 209 F.Supp.2d 1089 (W.D. Wash. 2002).

84

Le Doux v. U.S., 375 F.Supp.2d 1242 (D. N.M. 2005). In Le Doux, the court noted that some courts have

held that a frivolous penalty is reviewed on a de novo standard, citing Lemieux v. U.S., 230 F.Supp.2d 1143

(D. Nev. 2002), while other courts have held that the standard is abuse of discretion, citing Carroll v. U.S.,

217 F.Supp.2d 852 (W.D. Tenn. 2002). The court in Le Doux held that under either standard the taxpayers

had filed a frivolous return.

85

Gardner v. U.S., 95 A.F.T.R.2d (RIA) 2023 (D. N.J. 2005); Herip v. U.S., 95 A.F.T.R.2d (RIA) 537 (6th Cir.

2004); Holmes v. U.S., 351 F.Supp.2d 526 (W.D. La. 2004); McCurdy v. U.S., 95 A.F.T.R.2d (RIA) 2776 (D.

Mass. 2005); Meyer v. Comm’r, 95 A.F.T.R.2d (RIA) 2471 (W.D. WI 2005)(incurring additional Rule 11

sanctions for making frivolous arguments); Quigely v. U.S., 358 F.Supp.2d 427 (E.D. PA 2004); Ray v. U.S.,

94 A.F.T.R.2d (RIA) 5925 (W.D. Mo. 2004); Schultz v. U.S., 95 A.F.T.R.2d (RIA) 1977 (W.D. MI 2005);

Sergio v. U.S., 95 A.F.T.R.2d (RIA) 1174 (2005); Turner v. U.S., 372 F.Supp.2d 1053 (S.D. Ohio 2005);

Updegrave v. U.S., 94 A.F.T.R.2d (RIA) 6155 (D. Or. 2004).

◆

◆

M O S T L I T I G A T E D

T A X I S S U E S

2 0 0 5 A N N U A L R E P O R T

◆

TA X P A Y E R A DVO CATE S E R V I C E

485

L I T I G A T E D I S S U E S

S E C T I O N

THREE

Application of Payments

Taxpayers also argued that payments, levies, or credits satisfied all or part of the outstand-

ing liabilities and the IRS misapplied their payments. Taxpayers prevailed on this issue

in two of six cases. In Hayes v. Commissioner, the taxpayers and the IRS disagreed about

whether the disputed liability had been paid. Before trial, however, the IRS’s counsel

discovered that the IRS had misapplied the taxpayer’s payment to a different year and

disclosed this fact to the court.

86

In Zapara v. Commissioner, the Tax Court held that

pursuant to IRC § 6335(f)

87

taxpayers were entitled to a credit for the value of stock

accounts, which had been seized, as of the date which the IRS was required to sell the

stock, having been requested to do so by the taxpayers.

88

Bankruptcy

Some CDP cases raised the automatic stay provisions and discharge provisions of the

Bankruptcy Code. When a taxpayer files a petition in bankruptcy court, there is an

automatic stay on the commencement or continuation of any judicial or administrative

proceeding against the debtor that was or could have been started before the commence-

ment of the bankruptcy case.

89

Over the past year, the Tax Court dealt with different

scenarios involving the interaction of taxpayers’ CDP cases and their bankruptcy peti-

tions. In Smith v. Commissioner, the Tax Court found that it did not have jurisdiction,

holding that Appeals’ Notice of Determination was issued in violation of the automatic

stay where the taxpayer filed his bankruptcy petition after his CDP hearing but before

Appeals’ determination, thus invalidating the determination.

90

The automatic stay

worked to the taxpayer’s disadvantage in Prevo v. Commissioner, where the Tax Court held

that it had no jurisdiction when the taxpayer filed a bankruptcy petition after the Notice

of Determination was issued, but before petitioning the Tax Court. The Court stated that

this was a “trap for the unwary,” noting the absence of a tolling provision in IRC §§ 6320

or 6330 comparable to IRC § 6213(f).

91

The National Taxpayer Advocate recommended

a legislative change in the 2004 Annual Report

92

to fix this unintended result.

In general, tax liabilities for taxable years in which a return was due, including exten-

sions, within three years of the date of the filing of the bankruptcy petition may not be

86

Hayes v. Comm’r, T.C. Memo. 2005-57.

87

IRC § 6335(f) requires the IRS to sell seized property within 60 days of the request by taxpayers.

88

Zapara v. Comm’r, 124 T.C. 223 (2005).

89

11 U.S.C.A. § 362(a).

90

Smith v. Comm’r, 124 T.C. 36 (2005); see also Beverly v. Comm’r, T.C. Memo. 2005-41 (invalidating the IRS’s

Notice of Intent to Levy where it was issued after the filing of taxpayer’s bankruptcy petition).

91

Prevo v. Comm’r, 123 T.C. 326 (2004). Other taxpayers were unsuccessful in attempting to use the automat-

ic stay to shield them from collection actions. Meadows v. Comm’r, 405 F.3d 949 (11th Cir. 2005) (holding

that application of wife’s $10,000 offer-in-compromise payment to debt that was later discharged in bank-

ruptcy was not a violation of the automatic stay from taxpayer’s previous bankruptcy filing).

92

National Taxpayer Advocate 2004 Annual Report to Congress 490.

C O L L E C T I O N D U E P R O C E S S ( C D P ) H E A R I N G S I S S U E # 1

TH E MO ST LI TI GAT ED TA X I S S U E S

486

M O S T L I T I G AT E D

M O S T L I T I G A T E D

T A X I S S U E S

S E C T I O N

THREE

C O L L E C T I O N D U E P R O C E S S ( C D P ) H E A R I N G S I S S U E # 1

discharged in bankruptcy.

93

One taxpayer unsuccessfully argued that his liabilities were

discharged, but the Tax Court determined that the taxes were not discharged and were not

dischargeable. The court determined that the tax liabilities for several years at issue were

liabilities for which returns were due (including extensions) within three years of the fil-

ing of the bankruptcy petition and thus, were not dischargeable. The tax liability for the

remaining year was not dischargeable because the due date for the return (including exten-

sions) for the year at issue was after the date that the bankruptcy petition was filed.

94

Interest Abatement

In CDP hearings, taxpayers may raise the issue of abatement of interest from the liability

pursuant to IRC § 6404(e), which allows the IRS to abate interest attributable to unrea-

sonable error or delay resulting from a ministerial or managerial act.

95

Courts review

the Appeals’ determination on abatement of interest utilizing an abuse of discretion

standard.

96

In one case, the taxpayer was able to demonstrate that the IRS unreasonably

delayed in providing the taxpayer an escrow demand letter, which the taxpayer needed so

that he could finance the repayment of the tax liability.

97

Collection Statute Expiration

Generally, the IRS has ten years from the date of assessment to collect a tax.

98

The run-

ning of the ten-year collection period is suspended on the occurrence of certain events,

including the filing of a CDP hearing request

99

and the submission by taxpayers of

offers-in-compromise or installment agreements.

100

Four taxpayers raised the expiration

of the statute of limitations as a defense to the imposition of collection action; none pre-

vailed.

101

93

11 U.S.C.A. §§ 523(a)(1)(A) and 507(a)(8)(A)(i).

94

Klet v. Comm’r, T.C. Summ. Op. 2004-172.

95

IRC § 6404(e); Treas. Reg. § 1.6404-2(a)(2).

96

Woodral v. Comm’r, 112 T.C. 19 (1999).

97

Jackson v. Comm’r, T.C. Summ. Op. 2005-12 (holding in a split decision that some of the accrued interest

was attributable to the IRS’s delay in providing taxpayer an escrow demand letter and also holding that

Appeals had not abused its discretion in refusing to abate penalties).

98

IRC § 6502(a)(1).

99

When a CDP hearing is elected, the suspension of the collection statute exists until the hearing and any

related appeals are concluded. IRC § 6330(e)(1).

100

The collection statute is suspended while offers-in-compromise and installment agreements are pending.

IRC § 6331(i)(5) and (k)(1)-(2).

101

Van Dyke v. Comm’r, T.C. Summ. Op. 2005-5; Griffith v. Comm’r, T.C. Memo. 2004-267; Picchiottino v.

Comm’r, T.C. Memo. 2004-231; Picchiottino v. Comm’r, T.C. Memo. 2004-232.

M O S T L I T I G A T E D

T A X I S S U E S

2 0 0 5 A N N U A L R E P O R T

◆

TA X P A Y E R A DVO CATE S E R V I C E

487

L I T I G A T E D I S S U E S

S E C T I O N

THREE

Relief From Joint and Several Liability On Joint Returns

Relief from joint and several liability on joint returns pursuant to IRC § 6015 is also a

Most Litigated Issue for this year’s report. Taxpayers have the option to raise these issues

in CDP hearings.

102

Two taxpayers litigated the Appeals determination on IRC § 6015

issues in CDP hearings, with one taxpayer prevailing.

103

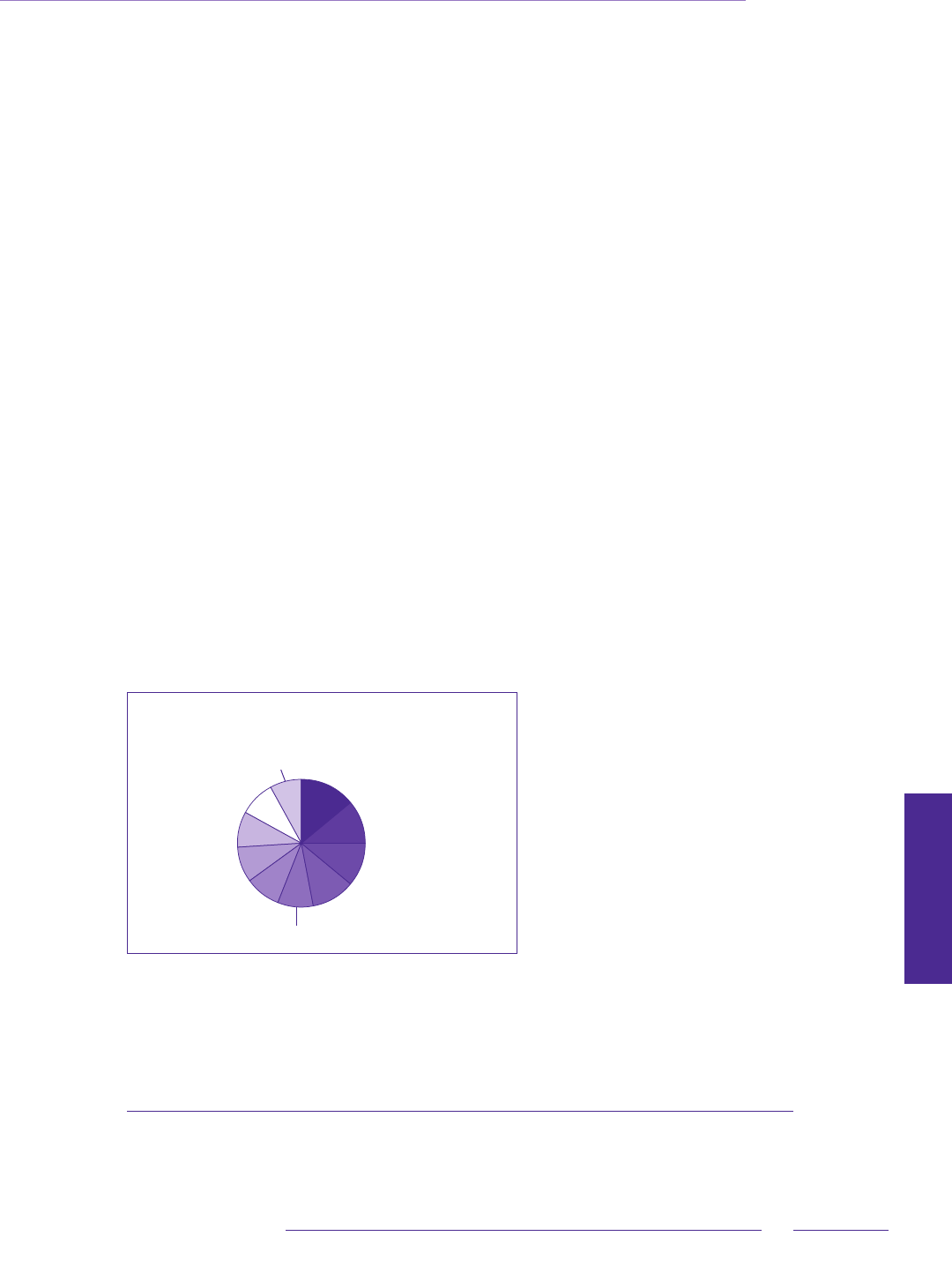

Pro Se Analysis

One hundred and sixty-five (or 79 percent) of the 209 cases litigated were brought before

the courts by the taxpayer, pro se, without benefit of counsel. This is a modest increase

from 74 percent in the previous year.

104

Table 3.1.3 shows the breakdown of pro se and

represented taxpayers and the decisions rendered by the court, indicating that approxi-

mately nine percent of pro se taxpayers receive some relief on judicial review while 20

percent of represented taxpayers received full or partial relief from their CDP appeals.

T A B L E 3 . 1 . 3 , S U C C E S S R A T E S A N D R E P R E S E N TA T I O N

Court D e c i s i o n s

Ta xpaye r Pro Se Repre s e n t a t i o n

Vo l u m e Percentage o f Tot a l Vo l u m e Pe r c e n t a g e O f To t a l

Decided for IRS 150 91% 35 80%

Decided for Taxpayer 10 6% 8 18%

Split Decision 5 3% 1 2%

Totals: 165 100% 44 100%

C O N C L U S I O N

CDP continues to be the most litigated issue in federal tax courts. This volume is due in

part to the breadth of issues that can be raised in CDP hearings. Despite weaknesses in

the CDP legislation, we think CDP and judicial oversight of the collection process serves

as an important check on the IRS and balances the taxpayers’ concerns about collection

action with the government’s need to collect taxes. We have attempted to address these

weaknesses in a Key Legislative Recommendation in this year’s report so that the value of

CDP is preserved.

102

IRC § 6330(c)(2)(A)(i).

103

Zachry v. Comm’r, T.C. Summ. Op. 2005-55; Hendricks v. Comm’r, T.C. Memo. 2005-72.

104

National Taxpayer Advocate 2004 Annual Report to Congress 509.

C O L L E C T I O N D U E P R O C E S S ( C D P ) H E A R I N G S I S S U E # 1

TH E MO ST LI TI GAT ED TA X I S S U E S

488

M O S T L I T I G AT E D

M O S T L I T I G A T E D

T A X I S S U E S

S E C T I O N

THREE

G R O S S I N C O M E I S S U E # 2

LI TI GAT ED

I S S U E # 2

G R O S S I N C O M E U N D E R I N T E R N A L R E V E N U E C O D E S E C T I O N 6 1

A N D R E L A T E D C O D E S E C T I O N S

S U M M A R Y

Gross income is the starting point for computing taxable income and the amount of tax

that must be paid. The issue of what constitutes gross income under IRC § 61 is once

again a most litigated issue, as it has been in each of the National Taxpayer Advocate’s

Annual Reports to Congress. The cases reviewed for this report involved whether income

was includible in taxable gross income, whether the Internal Revenue Code (IRC) specifi-

cally excluded an item of income, and whether taxpayers reported the correct amount of

income. While the cases touched on a variety of issues, the four most prevalent were:

Awards and settlements;

Disability and Social Security benefits;

Constructive dividends; and

Unreported income.

P R E S E N T L A W

IRC § 61 broadly defines gross income as “all income from whatever source derived.”

1

The courts also construe this provision broadly, categorizing income as “any accession to

wealth.”

2

However, the Code excludes many specific items from gross income,

3

and the

courts construe these exclusions narrowly.

4

A N A LY S I S O F L I T I G A T E D C A S E S

This analysis covers cases involving gross income that were decided in the federal court

system between June 1, 2004, and May 31, 2005.

5

The detailed analysis of cases is limited

to certain categories with a high volume of cases, and to a follow-up of issues identi-

fied in the Annual Report to Congress for fiscal years 2002, 2003 and 2004.

6

Table 2 in

Appendix 3 provides a detailed listing of the cases analyzed for this report.

1

IRC § 61(a).

2

Comm’r v. Glenshaw Glass Co., 348 U.S. 426, 430 (1955).

3

See e.g., IRC §§ 104, 105, and 108.

4

Comm’r v. Schleier, 515 U.S. 323 (1995).

5

The methodology used to identify income cases was based on a review of federal cases involving IRC § 61.

6

National Taxpayer Advocate 2002 Annual Report to Congress 260-271; National Taxpayer Advocate 2003

Annual Report to Congress 332-351; and National Taxpayer Advocate 2004 Annual Report to Congress

511-523.

◆

◆

◆

◆

M O S T L I T I G A T E D

T A X I S S U E S

2 0 0 5 A N N U A L R E P O R T

◆

TA X P A Y E R A DVO CATE S E R V I C E

489

L I T I G A T E D I S S U E S

S E C T I O N

THREE

A W A R D S A N D S E T T L E M E N T S

Taxation of settlements and judgments remains a frequently litigated issue. Taxpayers

disagree with the IRS over whether the award or a portion of the award qualifies for exclu-

sion from gross income as an amount “received on account of personal physical injuries

or physical sickness”

7

and whether the attorney fee portion of the award or settlement is

includible in gross income.

The Supreme Court’s decision in Commissioner v. Banks clarifies the tax treatment of con-

tingent attorney fees only, holding that generally, when a litigant’s recovery of damages

constitutes income, contingent attorney’s fees should be included in the taxpayer’s gross

income.

8

In 2004, Congress passed legislation addressing the deductibility of attorneys’ fees and

court costs in discrimination suits, effective for awards received after October 22, 2004.

9

The new provision allows an “above the line” deduction not to exceed the amount of

the judgment or settlement. This means that attorney fees in discrimination cases are

generally deducted from gross income when computing adjusted gross income.

10

For

contingent fee awards in discrimination cases received on or before October 22, 2004, the

taxpayer must include the fee in gross income and deduct it as a miscellaneous itemized

deduction, subject to a reduction by two percent of the taxpayer’s adjusted gross income

and Alternative Minimum Tax (AMT).

11

I R C § 1 0 4 ( a ) ( 2 )

Under IRC § 104(a)(2), the award (other than punitive damages) is excluded from gross

income if the judgment or settlement is “on account of personal physical injuries or phys-

ical sickness.”

12

This exclusion can lead taxpayers to structure judgments or settlements

to reflect compensation for physical injuries, rather than other forms of damages not eli-

gible for the exclusion. Nine opinions were issued this year on whether an award was “on

7

IRC § 104(a)(2) excludes from gross income damages (other than punitive damages) received “on account

of personal physical injuries or physical sickness.”

8

Comm’r v. Banks, 543 U.S. 426, 125 S. Ct. 826 (2005).

9

On October 22, 2004, the President signed into law H. R. 4520, the American Jobs Creation Act of

2004. Section 703, Civil Rights Tax Relief, provides relief from the double taxation of attorneys’ fees and

court costs awarded to plaintiffs in lawsuits for unlawful discrimination. The new law allows an “above

the line” deduction of these amounts for adjusted gross income (AGI), thus effectively subtracting these

amounts for purposes of the taxable income of the plaintiff.

10

IRC § 62(a)(19).

11

Comm’r v. Banks, 543 U.S. 426, 125 S. Ct. 826, 830-31 (2005); IRC § 67– limitation on miscellaneous

itemized deductions. See description of contingent attorney fees, infra for more analysis of Banks and its

implications.

12

IRC § 104(a)(2).

G R O S S I N C O M E I S S U E # 2

TH E MO ST LI TI GAT ED TA X I S S U E S

490

M O S T L I T I G AT E D

M O S T L I T I G A T E D

T A X I S S U E S

S E C T I O N

THREE

G R O S S I N C O M E I S S U E # 2

account of personal physical injuries or physical sickness.”

13

Taxpayers lost all nine cases.

Courts interpret § 104(a)(2) very narrowly.

14

In Vincent v. Commissioner, the taxpayer

received a settlement in a wrongful termination suit. The taxpayer alleged she missed

work due to an ulcer, and the settlement agreement allocated $240,000 of the settlement

award for “personal injuries and emotional distress.” The court looked to the underlying

claim, and held that despite the wording of the settlement agreement, the award was really

for discrimination and not “personal physical injuries” and the award was includible in

gross income.

15

In Murphy v. IRS, the taxpayer sued the New York National Guard for employment

discrimination. The taxpayer offered medical testimony that she experienced physical

injuries, including teeth grinding, due to the discrimination. The taxpayer later settled the

case, and the agreement allocated $45,000 of the award to “mental pain and anguish.”

16

The court held this award did not qualify for the § 104(a)(2) exclusion, as “mental pain

and anguish” is not a physical injury even when it leads to a physical injury, and hence

the award was fully taxable.

17

Contingent Attorneys’ Fees

For those awards not excludable under IRC § 104(a)(2), the issue has arisen as to whether

the attorney fees portion of a taxable award is also includible in gross income. In

Commissioner v. Banks, the Supreme Court held that generally, when a plaintiff’s settle-

ment or judgment constituted income, the plaintiff’s income includes the portion of

the judgment or settlement allocated to attorney fees as a contingent fee. The court did

not address the issue of claims brought under federal statutes that authorize fee awards

to attorneys, stating that because the attorney’s fees in Banks were paid on the basis of

a contingent fee contract, it was unnecessary to address the taxation of attorneys’ fees

that could have been awarded under federal statute.

18

Before the Supreme Court deci-

sion in Banks, the lower courts were split on the tax treatment of attorney fees.

19

The

Fifth, Sixth, and Eleventh Circuits held that the contingent fee portion of a judgment or

settlement should not be included in plaintiff’s gross income. Six other circuits held that

such fees are includible in gross income, with some circuits relying on state law property

13

Bolden v. Comm’r, T.C. Summ. Op. 2004-114; Brooks v. U.S., 383 F.3d 521 (6th Cir. 2004); Henderson v.

Comm’r, 94 A.F.T.R.2d 5246 (9th Cir. 2004); Kidd v. Comm’r, T.C. Memo. 2004-135; Murphy v IRS, 362

F.Supp. 2d 206 (D.D.C. 2005); Ndirika v. Comm’r, T.C. Memo. 2004-250; Valia v. Comm’r, T.C. Summ.

Op. 2005-17; Vincent v. Comm’r, T.C. Memo. 2005-95.

14

Kidd v. Comm’r, T.C. Memo. 2004-135.

15

Vincent v. Comm’r, T.C. Memo. 2005-95.

16

Murphy v. IRS, 362 F.Supp.2d 206, 210 (D.D.C. 2005).

17

Id.

18

Comm’r v. Banks, 543 U.S. 426, 125 S. Ct. 826 (2005).

19

Id.

M O S T L I T I G A T E D

T A X I S S U E S

2 0 0 5 A N N U A L R E P O R T

◆

TA X P A Y E R A DVO CATE S E R V I C E

491

L I T I G A T E D I S S U E S

S E C T I O N

THREE

interests while others disregarded state law.

20

In Banks, the Supreme Court held that the

contingent attorneys' fees portion of the settlement was taxable income to the plaintiff

under the anticipatory assignment of income doctrine.

21

Inclusion in gross income of contingent attorney fees that the individual plaintiff never

receives can cause inequitable results because of the way the Internal Revenue Code

deals with the corresponding deduction of the fees. While taxpayers can deduct the

full amount of attorney fees they are required to take into income, many taxpayers are

adversely affected because the deductions are treated as miscellaneous itemized deduc-

tions.

22

Miscellaneous itemized deductions are deductible only if the taxpayer itemizes,

and are subject to a two percent floor under IRC § 67. More importantly, miscellaneous

itemized deductions are not taken into account for purposes of computing the AMT.

23

Therefore, the taxpayer may end up paying more in taxes than the amount of the award

settlement he or she actually received for awards received on or before October 22,

2004.

24

In Banks and its companion case, Commissioner v. Banaitis, the taxpayers received settle-

ment awards and their attorneys received portions of the awards under contingent fee

arrangements.

25

The taxpayers argued that because applicable state law granted the attor-

ney a property interest in the contingent fee portion of the award, the taxpayer should

not have to include the contingent fee in gross income. The Supreme Court rejected that

argument, holding that amounts representing the contingent attorney fee portions of the

awards are includible in the plaintiff’s gross income because the fee arrangement was an

“anticipatory assignment of income.” The Court reasoned that “income should be taxed

to the party who earns the income and enjoys the consequent benefits.”

26

State property

laws do not change the fundamental principal-agent nature of the attorney-client relation-

ship, and are thus irrelevant.

27

The Supreme Court decision in Banks requires that if the settlement or judgment consti-

tutes income, i.e. the award does not fall under the exclusion under IRC § 104(a)(2) for

20

Comm’r v. Banks, 543 U.S. 426, 125 S. Ct. 826 (2005).

21

Id. at 830-31.

22

Biehl v. Comm’r, 351 F.3d 982, 984 (9th Cir. 2003).

23

IRC § 56(b)(1)(A)(i).

24

See National Taxpayer Advocate’s 2004 Annual Report to Congress 517, footnote 47, citing David G.

Savage, A Win-Lose Situation, 90 A.B.A.J., 18 (Nov. 2004), discussing Spina v. Forest Preserve District of

Cook County, 207 F.Supp.2d 764 (N.D. Ill. 2002) where the taxpayer received a $300,000 award and her

attorneys received $1 million in fees, all of which was taxed to the taxpayer, resulting in a tax liability that

exceeded her award by $99,000.

25

Comm’r v. Banks, 125 S. Ct. at 829-30; Banaitis v. Comm’r, 340 F.3d 1074 (9th Cir. 2003). In Banitis v.

Commissioner, an Oregon case, the court ruled that the state law afforded a property interest in the settle-

ment and therefore portion of the settlement paid directly for attorney fees was excluded from income.

26

Comm’r v. Banks, 125 S. Ct. at 830.

27

Id.

G R O S S I N C O M E I S S U E # 2

TH E MO ST LI TI GAT ED TA X I S S U E S

492

M O S T L I T I G AT E D

M O S T L I T I G A T E D

T A X I S S U E S

S E C T I O N

THREE

G R O S S I N C O M E I S S U E # 2

personal physical injury or physical sickness or the exclusion under IRC § 62(a)(19) for

claims involving unlawful discrimination paid after October 22, 2004, taxpayers report as

gross income the contingent attorney fee portion of these awards, even in cases in which the

taxpayer never actually receives that amount or is legally entitled to receive it.

28

The Tax

Court relied on the Banks decision in deciding two subsequent contingent fee cases.

29

D I S A B I L I T Y A N D S O C I A L S E C U R I T Y B E N E F I T S

As workers age and retire, wage income is often replaced by other forms of income, such

as disability benefits, Social Security, and tax-advantaged retirement income. Because

these forms of income can be wholly or partially excludible from gross income, taxpay-

ers and the IRS frequently litigate the characterization of certain of these payments. This

year, courts issued 26 opinions, compared with 11 last year.

30

Disability Income

We reviewed six cases in which taxpayers claimed that some sort of disability benefits were

excludible from income under IRC §§ 104 or 105.

31

Two cases involving military pension

income illustrate how narrowly courts interpret the statutory exclusions for disability pay-

ments.

32

In Hintz v. Commissioner, the taxpayer, a retired U.S. Army infantryman, claimed

he should be able to exclude his disability pension income from the Department of

Defense. The Tax Court held for the IRS, as there was no evidence the taxpayer’s disabil-

ity stemmed from combat, a requirement for the exclusion under IRC § 104(b)(2)(C).

33

28

In response to the pending litigation, the American Jobs Creation Act of 2004, § 703, Pub. L. No. 108-357,

118 Stat. 1418, 1546 (2004), enacted IRC § 62(a)(19) to allow an “above-the line” deduction for attorney