2023 Michigan Lottery Annual Comprehensive Financial Report.pdf 1 2/12/2024 9:34:47 AM2023 Michigan Lottery Annual Comprehensive Financial Report.pdf 1 2/12/2024 9:51:07 AM

BUREAU OF STATE LOTTERY

An Enterprise Fund of the State of Michigan

Annual Comprehensive Financial Report

For the Fiscal Years Ended September 30, 2023 and 2022

Prepared by Financial Gaming Services & Accounting Division

Bureau of State Lottery, State of Michigan

Annual Comprehensive Financial Report

for the fiscal years ended September 30, 2023 and 2022

TABLE OF CONTENTS

Page

INTRODUCTORY SECTION

Letter of Transmittal………………………………………………………………………….. 1

GFOA Certificate of Achievement………………………………………………….……..... 10

Organization Chart and Principal Officials…………………….…………………………... 11

FINANCIAL SECTION

Independent Auditors’ Report………………………………………………………….…… 12

Management’s Discussion and Analysis…………………………………………………... 15

Basic Financial Statements

Statement of Net Position.……………………………………………………………… 29

Statement of Revenues, Expenses and Changes in Net Position..….…………….. 30

Statement of Cash Flows……………………………………………………………..… 31

Notes to Financial Statements………………………………………………………..… 33

Required Supplemental Information

Schedule of Lottery’s Proportionate Share of Net Pension Liability………………… 73

Schedule of Lottery’s Pension Contributions………………………………………….. 74

Notes to Pension Required Supplemental Information Schedules………………….. 75

Schedule of Lottery’s Proportionate Share of Net OPEB Liability…………………… 76

Schedule of Lottery’s OPEB Contributions…………………………………………….. 77

Notes to OPEB Required Supplemental Information Schedules……………………. 78

Schedule of Lottery’s Proportionate Share of Total OPEB Liability…………………. 79

Other Supplemental Information

Supplementary Schedule of Revenues and Expenses September 2023……......... 80

Supplementary Schedule of Revenues and Expenses September 2022……......... 82

Supplementary Schedule of Other Operating Expenses……………………............. 84

STATISTICAL SECTION

Index………………………………………………………………………………………….... 85

Michigan Statistics

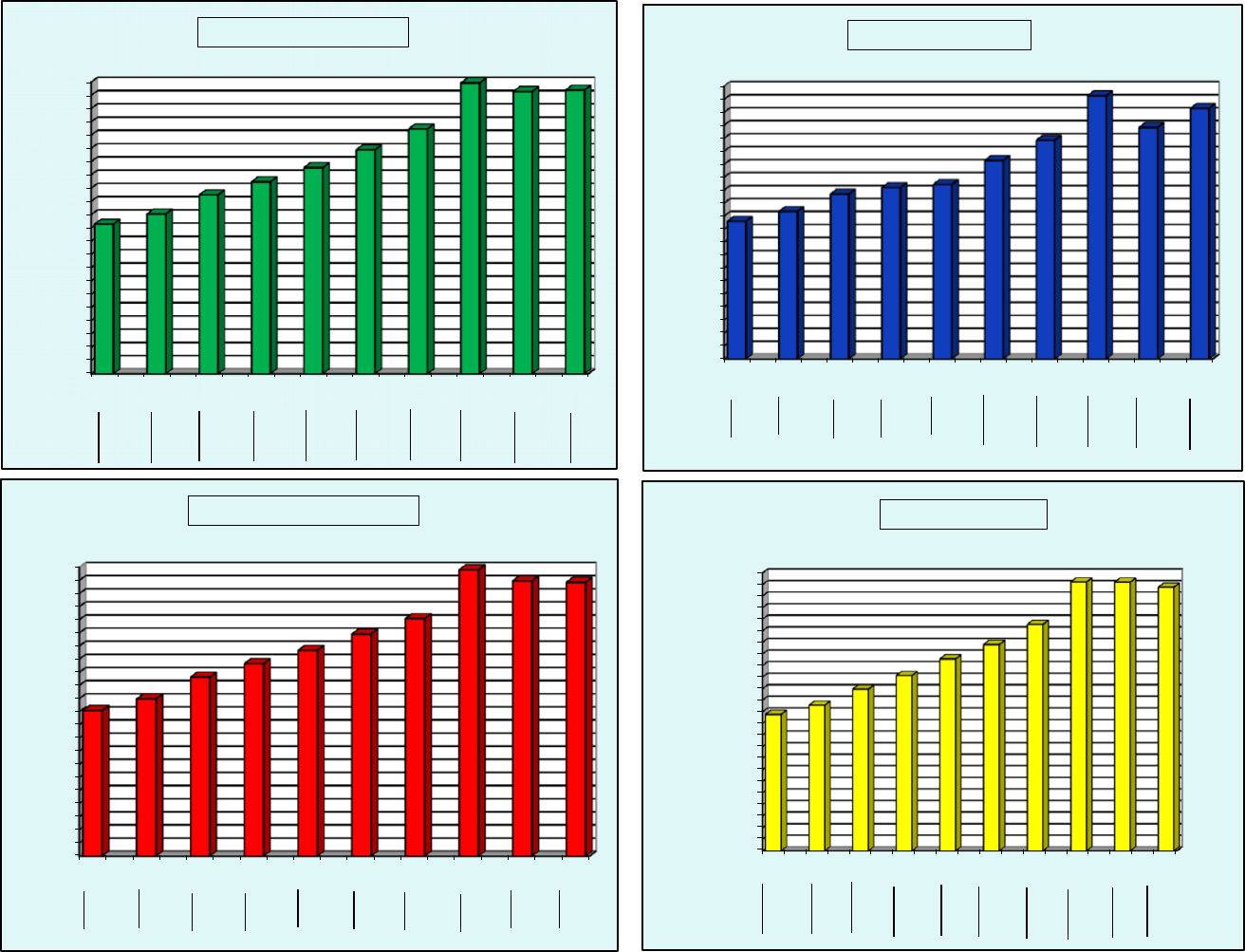

Financial Trends

Net position……………………………………………………………………………….. 86

Changes in net position…………………………………………………………………. 87

Chart of Financial Trends……………………...………………………………………... 88

Bureau of State Lottery, State of Michigan

Annual Comprehensive Financial Report

for the fiscal years ended September 30, 2023 and 2022

Revenue Capacity

Revenue from ticket sales.....………………………………………………..…............ 89

Chart of ticket sales…..………..…………………………………………….……….….. 90

Debt Capacity

Ratio of outstanding debt by type……………………………………………………..... 91

Ratio of Installment prize awards liability………………………………………………...92

Demographic and Economic Information

Demographic general tracking study…………………………………………………… 93

Charts of general tracking study……………………………………………………...… 94

Demographic and economic indicators……………………..………………………. 96

Operating Information

Operating Information.………………………………………………………………… 97

Expenses and disbursements………………………………………………………... 98

Chart of expenses and disbursements……………………………………………… 99

U.S. Lottery Statistics

Fiscal Year 2022 U.S. Lottery Sales, Prizes & Government

Transfers Measured by GDP………………………………………………………… 100

Fiscal Year 2022 U.S. Lottery Sales by Game…………………………………….. 101

Compliance Information

Independent Auditors’ Report on Internal Control……………………………….... 102

STATE OF MICHIGAN

BUREAU OF STATE LOTTERY

LANSING

January 19, 2024

The Honorable Gretchen Whitmer, Governor

Members of the Legislature

Citizens of the State of Michigan

We are pleased to present to you the Annual Comprehensive Financial Report (ACFR)

of the Bureau of State Lottery (Lottery) for the fiscal years ending September 30, 2023

and 2022. Lottery management is responsible for the accuracy of the financial data and

the completeness of the contents of this report.

The Lottery is an enterprise fund within the State of Michigan and its financial statements

are included in the State’s ACFR. This report presents only the activity of the Lottery as

a single enterprise fund and is an overview of the Lottery’s operations.

The mission statement of the Lottery is:

To maximize net revenues to supplement state K-12 public education programs;

To provide fun and entertaining games of chance;

To operate all games and bureau functions with nothing less than total integrity.

Within the financial section of this ACFR, the Lottery’s Management Discussion and

Analysis (MD&A) provides a detailed narrative of activities that occurred over this time

period. This letter of transmittal is intended to complement the MD&A and should be

read in conjunction with the MD&A.

The enabling legislation of the Lottery requires biannual and special post audits of all

accounts and transactions of the Lottery by the Auditor General or by an independent

public accounting firm appointed by the Auditor General. The Auditor General has

contracted with an independent public accounting firm for these audits. The financial

statements have been audited in accordance with auditing standards generally accepted

in the United States of America and the standards applicable to financial audits

contained in Government Auditing Standards, issued by the Comptroller General of the

United States.

- 1 -

The Michigan Lottery supports K-12 public education.

101 E. HILLSDALE

P.O. BOX 30023 LANSING, MICHIGAN 48909

www.michiganlottery.com

(517) 335-5600

GRETCHEN WHITMER

GOVERNOR

JESSICA WEARE

ACTING COMMISSIONER

- 2 -

Fiscal Year 2023 Highlights

Significant School Aid Fund Contributions. The Lottery contributed over

$1,351,900,00 to the School Aid Fund in fiscal year 2023 -- its second highest

contribution ever.

Sales and Prizes. Total sales in fiscal year 2023 were $4.9 billion. Prizes in fiscal year

2023 were $3.0 billion.

Retailer Commissions and Incentives. Lottery retailers, many of which are small,

family-owned businesses, received more than $354.6 million in commissions and

incentives.

Responsible Gaming Commitment. Michigan was the first State Lottery to receive

Internet Compliance Assessment Program certification from the National Council on

Problem Gambling and has continued to be certified since 2015. Lottery also maintains

its Responsible Gaming Verification from the North American Association of State and

Provincial Lotteries and the National Council on Problem Gambling and has continued to

be certified since 2017.

Profile of the Lottery

History

The Lottery was established under the authority of Public Act 239 of 1972 to generate

funds to support Michigan’s public school system. The first lottery game was called the

Green Ticket and went on sale November 13, 1972. On October 7, 1975, the Lottery

began selling instant games. Draw game sales began June 6, 1977 with the introduction

of the Daily 3. The first multi-jurisdictional draw game, called The Big Game, included 10

states, and went on sale August 31, 1996. The Lottery began selling lottery games over

the internet on August 11, 2014. Since the Lottery was established, it has contributed

more than $28.0 billion to the School Aid Fund.

Lottery Products

The Lottery offers a variety of games in several different styles of play, including Instant

Tickets, Pull Tabs, Draw Games, and Fast Cash. Digital versions of many games may

also be purchased online.

Instant Ticket Games

Instant games are played by scratching off the latex covering on each ticket to reveal

prize symbols. A variety of games with different themes, play styles, price points, and

prize structures are available with over 40 games released each year. The games are

priced between $1 and $50 and top prizes range from $1,000 to $6.0 million.

- 3 -

Pull Tabs

Pull Tab games are similar to instant tickets, but players pull a perforated tab instead of

scratching off a latex covering. A variety of different Pull Tab games are offered and

range in price from $0.50 to $5 with top prizes ranging from $50 to $30,000.

Draw Games

Draw game tickets are printed by a retailer terminal connected to a central gaming

system. Players can select their numbers or have numbers randomly selected. Drawings

are conducted to select winning numbers and players win based on how many numbers

they matched. The frequency of the drawings varies depending on the game. Draw

games currently offered are Mega Millions, Powerball, Lucky for Life, Lotto 47, Fantasy

5, Daily 3, Daily 4, Poker Lotto, Keno!, and Club Keno. Many draw games can also be

purchased online.

Mega Millions and Megaplier

Mega Millions is a multi-jurisdictional draw game with forty-seven participating

jurisdictions. Players select five of seventy white ball numbers and one of twenty-five

gold ball numbers for a chance to win a progressive jackpot prize. The jackpot starts at

$20 million. Players may win any of nine prizes including the jackpot and eight set prize

amounts ranging from $2 to $1 million. The Megaplier is an add-on wager that allows

players to increase their non-jackpot prize. Mega Millions drawings are conducted twice

a week on Tuesday and Friday.

Powerball and Power Play, and Double Play

Powerball is a multi-jurisdictional draw game with forty-eight participating jurisdictions.

Players select five of sixty-nine white ball numbers and one of twenty-six red ball

numbers for a chance to win a progressive jackpot prize. The jackpot starts at $20

million. Players may win any of nine prizes including the jackpot and eight set prize

amounts ranging from $4 to $1 million. Power Play is an add-on wager that allows

players to increase their non-jackpot prize. Double Play is an add-on game that was

launched in August 2021 and uses a player’s Powerball numbers for an additional draw

that takes place after the regular drawing. Powerball drawings are conducted three times

per week on Monday, Wednesday, and Saturday.

Lucky for Life

Lucky for Life is a multi-jurisdiction draw game with twenty-three participating

jurisdictions. Players select five of forty-eight white ball numbers and one of eighteen

yellow ball numbers for a chance to win lifetime prize payments. Players may win any of

ten prizes including the top prize of $1,000 a day for life, the second prize of $25,000 a

year for life, or one of eight set prize amounts ranging from $3 to $5,000. Lucky for Life

drawings are conducted daily.

- 4 -

Lotto 47, EZMatch, and Double Play

Lotto 47 is a draw game in which players select six of forty-seven numbers for a chance

to win a progressive jackpot prize. The jackpot starts at $1 million and is guaranteed to

increase by a minimum of $50,000 after each drawing if the jackpot is not won. Players

may win any of four prizes including the jackpot and three set prize amounts ranging

from $5 to $2,500. EZMatch is an add-on game that offers players a chance to win

instantly. Double Play is an add-on game that was launched in January 2019 and uses a

player’s Lotto 47 numbers for an additional draw that takes place after the regular

drawing. Lotto 47 drawings are conducted twice a week on Wednesday and Saturday.

Fantasy 5, EZMatch, and Double Play

Fantasy 5 is a draw game in which players select five of thirty-nine numbers for a

chance to win a progressive jackpot prize. The jackpot starts at $100,000 and increases

by a minimum of $5,000 after each drawing if the jackpot is not won. Players may win

any of four prizes including the jackpot and set prize amounts ranging from $1 to $100.

EZMatch is an add-on game that offers players a chance to win instantly. Double Play is

an add-on game that was launched in January 2019 and uses a player’s Fantasy 5

numbers for an additional draw that takes place after the regular drawing. Fantasy 5

drawings are conducted daily.

Daily 3 and Daily 4

The Daily 3 and Daily 4 are the Lottery’s longest running and most consistently popular

draw games. Players select three numbers ranging from zero to nine for the Daily 3 and

four numbers ranging from zero to nine for the Daily 4. Numerous wager options are

offered such as straight (match each number in order drawn), boxed (match numbers in

any order for a reduced prize), and wheeled (match numbers in any order for full prize).

Drawings for both games are conducted twice a day, every day of the week.

Poker Lotto

Poker Lotto offers players a chance to win instantly and again during a drawing. Players

randomly are assigned five of fifty-two cards at the time of purchase. If the player’s cards

form one of the eligible winning poker hands, the player instantly wins a prize of $2 to

$5,000. In addition to the instant game, the player’s cards are also eligible for a drawing.

Five cards are drawn and players may win prizes ranging from $3 to $100,000 based on

the number of cards matched. Poker Lotto drawings are conducted daily.

Keno!

Keno! is a draw game in which players select ten of eighty numbers. The Lottery draws

twenty-two numbers and players matching ten of those numbers win the jackpot prize of

$250,000. Players may win any of six prizes including the jackpot and lower-tier prizes

ranging from a free $1 instant ticket to $2,500. Keno! drawings are conducted daily.

- 5 -

Club Keno, Kicker, The Jack, and Extra

Club Keno is a draw game predominantly played in bars, restaurants, and bowling

facilities. Players select from one to ten of eighty numbers. The Lottery draws twenty

numbers. Prizes are based on how many numbers the player matches and the selected

ticket price. The Kicker is an add-on wager that allows players to multiply their prizes by

as much as ten times. The Jack is an add-on wager that allows players to participate in a

progressive jackpot starting at $10,000. Extra is an add-on wager where an additional

drawing takes place after each Club Keno drawing. Ten “Extra” numbers are drawn from

the remaining pool of sixty. Players can win in both drawings but cannot combine

numbers from both drawings. Club Keno and Extra drawings are conducted every 3.5

minutes, and the results are displayed both in-store and online.

Fast Cash

Fast Cash tickets print from the Lottery terminal and offer players instant-win

opportunities along with a progressive jackpot that can be won at any time. Games with

different themes are offered at price points of $1, $2, $5, $10, and $20. Players can win

set prizes ranging from $1 to $250,000. All Fast Cash games feature a progressive

jackpot that grows based on sales, so no game has a static top prize. Two of the $20

price point games offer a top prize of $250,000 plus the jackpot. Each game contributes

10% of sales to the jackpot and players can win either a share or the entire jackpot,

depending on the price of their ticket.

Budgetary System and Controls

The Lottery works with the Department of Technology, Management and Budget, the

State Budget Office, and the Legislature to create an annual appropriated budget for the

Lottery’s administrative costs. The Legislature reviews and approves the Lottery’s

budget each year. This approved budget becomes a spending cap for administrative

expenses and ticket revenues provide funding for operations.

Revenue and net income forecasts are prepared throughout the fiscal year comparing

estimates and forecasts to actual sales and expenses. This information is provided to

the State Budget Office and other state agencies in order to ensure Lottery projections

are reflected accurately in State budgetary planning.

- 6 -

Economic Condition and Financial Information

Local Economy

The University of Michigan Research Seminar in Quantitative Economics provides the

following highlights in its most recent Michigan forecast issued on November 17, 2023:

We project statewide employment to decrease by only 2,200 jobs in the

fourth quarter, as the UAW strike ended before it could affect the November

jobs report. Still, employment climbs by 65,900 jobs on a calendar year

basis in 2023 due to the strong gains so far this year. Job gains slow to

40,400 in 2024 as the national economy hits a soft patch. Gains nudge up to

42,400 jobs in 2025 as the national economy reaccelerates but Michigan’s

labor market runs up against labor supply constraints. We expect Michigan’s

payroll employment count to surpass its pre-pandemic level in the first

quarter of 2024. By the end of 2025, statewide employment climbs to 86,200

jobs (1.9 percent) above the pre-pandemic level, although it remains

169,100 jobs (3.6 percent) below its all-time peak from the second quarter of

2000.

We estimate that the UAW strike cost the U.S. economy 69,500 jobs in the

October jobs report, including 27,400 striking workers and 42,100 spin-off

job losses across the economy.

Michigan’s blue-collar industries have led the recovery from the pandemic

recession, and we estimate that they were the most heavily impacted by the

recent strike in the auto industry. We expect these industries to lose 7,300

jobs on a quarterly basis in the fourth quarter but to add 7,700 jobs back in

the first quarter of next year as the industry rebounds from the strike. Taking

a longer perspective, the state’s blue-collar industries’ job growth has

slowed significantly this year, and we expect slower growth for these

industries to be the norm over the next two years as well.

Our calculations suggest that the fallout from the UAW strike will increase

the state’s unemployment rate from 3.9 percent in September to 4.1 percent

in the fourth quarter of 2023. We anticipate that the unemployment rate will

tick up further to 4.2 percent in early 2024 amid a period of below-trend

growth for the national economy. We project that Michigan's unemployment

rate will hover at 4.2 percent during 2024 and the first half of 2025.

Personal income per capita in Michigan held steady at $57,000 in 2022, as

the large swings in nominal income associated with the pandemic era

became a thing of the past. We expect Michigan’s personal income per

capita to increase by 4.1 percent this year and 3.2 percent next year, as the

national economy hits a speed bump. As broad economic momentum picks

back up, Michigan personal income per capita increases by 4.1 percent in

2025. That growth would bring Michigan’s personal income per capita to

$63,800 in 2025, roughly 30 percent higher than in 2019.

Michigan's real disposable income per capita surged by 8.2 percent in 2020,

thanks to low inflation and federal support, and it edged up a further 1.3

percent in 2021.

- 7 -

In 2022, however, high inflation drove a decline of nearly 9 percent, sending

living standards back to 2019 levels. We expect Michigan’s real disposable

income largely to tread water until the national economy begins to pick up

speed in the second half of 2024. Our forecast calls for a gradual return to

modest growth in living standards in 2025, with real disposable income per

capita expected to exceed the 2019 average by just 1.3 percent.

The complete forecast and analysis from the University of Michigan Research Seminar

in Quantitative Economics is available at https://lsa.umich.edu/econ/rsqe.html.

In September 2023, Michigan’s seasonally adjusted unemployment rate increased by

two-tenths of a percentage point to 3.9 percent, while the national rate remained

unchanged at 3.8 percent. Statewide total employment rose by 13,000 and

unemployment advanced by 9,000 over the month. Michigan’s workforce rose by 23,000

during September. The national jobless rate remained unchanged at 3.8 percent during

September. Michigan’s rate was one-tenth of a percentage point larger than the U.S.

rate. The national unemployment rate increased by three-tenths of a percentage point

over the year. Michigan’s rate was reduced by four-tenths of a percentage point since

September 2022.

Michigan’s September 2023 employment level rose by 3.7 percent over the year, an

increase two full percentage points larger than the employment gain seen nationally (1.7

percent). Michigan’s quarterly average jobless rate remained unchanged at 3.7 percent

between the second and third quarter of 2023. According to the Department of

Technology, Management and Budget, fifteen Michigan labor market areas displayed

employment decreases over the month, with a median reduction of 0.9 percent. The

largest over-the-month decline occurred in the Northwest Lower Michigan region (-5.1

percent). The Detroit and Lansing metro areas both demonstrated employment

advances since August. Payroll jobs advanced by 56,000, or 1.3 percent, over the year.

Michigan not seasonally adjusted nonfarm jobs edged down by 2,000, or 0.1 percent,

over the month, resulting in a nonfarm employment total of 4,452,000 in September.

Decreases across most major industries in the state were partially offset by a large

seasonal increase in the government sector (+45,000).

Financial Information

The sale of Lottery tickets provides all funding for operations and the net income is

disbursed to the School Aid Fund for public education.

Operations involve the sale of paper and digital tickets, determination of winning tickets,

payment of prizes, compensation to retailers, and administrative functions. The Lottery

also provides $1 million a year to the Department of Health and Human Services for

responsible gaming programs.

The Lottery’s Commissioner is responsible to the Governor, Legislature, and the citizens

of the State for Lottery operations.

The Lottery’s goals and objectives ensure ongoing efforts to achieve operational

efficiencies and maximize contributions to the School Aid Fund. Operational results are

included in the Financial and Statistical Sections.

The Charitable Gaming Division’s net proceeds are dedicated to the state’s General

Fund. These activities are discussed in the MD&A.

- 8 -

Accounting Systems and Policies

As an enterprise fund of the State of Michigan, the Lottery operates as a business within

state government structure. The Lottery uses the accrual basis of accounting following

Generally Accepted Accounting Principles (GAAP) and Governmental Accounting

Standards Board (GASB) pronouncements.

The Lottery voluntarily follows the recommendations of the Government Finance Officers

Association of United States and Canada (GFOA) for the contents of government

financial reports and participates in GFOA’s review program for the Certificate of

Achievement for Excellence in Financial Reporting. The Lottery also adheres to financial

reporting policies and procedures issued by the Michigan Department of Technology,

Management and Budget.

Internal Controls

The Lottery and State of Michigan policies and procedures tightly control assets,

inventory, computer systems, drawings, and accounting. Separation of duties, internal

control structure, ongoing monitoring, and evaluation of information as well as stringent

employee, retailer, and contractor standards all minimize risk of loss or theft. All

employees, retailers, and contractor employees must pass a security background check

prior to being hired or licensed.

The system of internal controls has been designed to provide reasonable rather than

absolute assurance that the financial statements are free from material misstatement.

The concept of reasonable assurance recognizes that the cost of a control should not

exceed the benefits likely to be derived, and that the costs and benefits require

estimates and judgments by management.

Debt Administration

Long-term liabilities for the Lottery are for installment payments owed to certain prize

winners. These prize liabilities are funded by investments in U.S. Treasury zero-coupon

bonds and State of Michigan General Obligation Capital Appreciation Bonds, which are

held to maturity.

Long-Term Financial Planning

The Lottery continuously works to increase sales. Each year, a strategic marketing plan

is developed that identifies new product initiatives, promotions, and advertising

programs. Additionally, expenditures related to these product investments are

continuously reviewed and analyzed so that net return to the School Aid Fund is

maximized.

In the retail channel, the Lottery plans to introduce forty-eight new retail instant games,

twenty-five new Pull Tabs games, and several promotions for its Club Keno game in

fiscal year 2024. There are also some changes to Club Keno under consideration. The

proposed changes include modifying the Kicker, changing The Jack to a 9-spot,

replacing Extra with a new “Plus 3” add-on game and increasing the 10-spot top-prize to

$500,000. In fiscal year 2024, quarter 3, Cash Pop will launch as a new draw game.

Lottery’s digital gaming team plans to introduce around 40 new digital instant games,

with a total 250 running games, including new game themes and prize structures, that

will create a wider portfolio of compelling options for players. The main focus will be on

- 9 -

maximizing awareness of available products and jackpots to all players visiting Lottery's

website and mobile applications to drive sales. Retail and online integrations will

continue as part of a holistic player engagement strategy.

Awards and Acknowledgements

Awards

The Government Finance Officers Association of the United States and Canada (GFOA)

awarded the Lottery a Certificate of Achievement for Excellence in Financial Reporting

for its fiscal year 2022 ACFR. To receive this prestigious award, a government agency

must publish an easily readable and efficiently organized annual comprehensive

financial report that meets GAAP and applicable legal requirements. The Lottery is proud

to have received a Certificate of Achievement from the GFOA for 18 consecutive years

and will submit this report to the GFOA for consideration.

Acknowledgement

Preparation of this report would not be possible without the hard work and dedication of

Lottery’s Financial Gaming Services and Accounting division as well as the entire Lottery

team. Their tremendous efforts and teamwork make this informative document possible.

Respectfully submitted,

Kristi L.B. Thompson

Deputy Commissioner of Administration & CFO

Jessica Karbowski Weare

Acting Commissioner

Government Finance Officers Association

Certificate of

Achievement

for Excellence

in Financial

Reporting

Presented to

Michigan Lottery

For its Annual Comprehensive

Financial Report

For the Fiscal Year Ended

September 30, 2022

Executive Director/CEO

- 10 -

ACTING

COMMISSIONER

Jessica Weare

EXECUTIVE

DIVISION

ADMINISTRATION

Kristi Thompson

Cristina McDermott

CHARITABLE

GAMING

Ron Wells

TECHNOLOGY &

PLANNING

Laura Trayer

INFORMATION

SECUR

ITY

Scott Hall

PLAYER

RELATIONS

Jake Harris

FINANCIAL GAMING

SERVICES

Natalia Tiemann

DEPARTMENT

SERVICES

Julie Proux

PRODUCT

DEVELOPMENT

Lindsay Sands

DRAW CASH &

FAST CASH

GAMES

Amanda Miller

ADVERTISING &

PROMOT

IONS

Tim Shafer

DEPARTMENT OF TECHNOL

OGY,

MANAGEMENT & BUDGET

AGENCY SERVICES

APPLICATIONS &

PROGRAMMING

NETWORK AND

COMMUNI

CATIONS

SERVER TEAM 4

INTERNAL

AUDIT (DTMB)

Sherri Washabaugh

HUMAN

RESOURCES

(MCSC)

Lori Fedewa

REGIONAL

OFFICES

Bryan Torok

Pat Napoleon

RETAILER

SERVICES

Dina Woodward

ACCOUNTING

(Treasury)

DIGITAL

GAMING

Zac Stri

ckler

GAMING CONTROL

Trisha Townsend

LEGISLATIVE

LIAISON

Mike Gallagher

GAMES &

MARKETING

Vacant

SALES

DIVISION

William Griffin

DRAWING

CONTROL

Tim Ridderhoff

Michigan State Lottery

Organization Chart and Principal Officials

TECHNOLOGY &

GAMING OPERATIONS

Aaron Dickason

GAMING

INSPECTION

CHIEF DEPUTY

COMMISSIONER

William Griffin

TECHNOLOGY &

PLATFORMS

Sandeep Jain

SECURITY &

INVESTIGATIONS

Ben Vogel

COMPLIANCE &

LEGAL AFFAIR

S

Joe Froelich

DATA CENTER

OPERATIONS

Nick Rebh

DATA CENTER

OPERATIONS TEAM &

DRAWING

OPERATIONS

Vacant

- 11 -

Independent Auditor's Report

To

Ms. Jessica Weare, Acting Commissioner,

the Bureau of State Lottery, State of Michigan,

and Mr. Doug Ringler, CPA, CIA,

Auditor General, State of Michigan

Bureau of State Lottery, State of Michigan

Report on the Audits of the Financial Statements

Opinion

We

have audited

the financial statements of the

Bureau of State Lottery, State of Michigan

(the "

Lottery

"),

an

enterprise fund of the State of Michigan,

as of and for the six-month periods and years ended September 30,

2023 and 2022 and the related notes to the financial statements, which collectively comprise the

Lottery

's basic

financial statements, as listed in the table of contents.

In our opinion, the accompanying financial statements referred to above present fairly, in all material respects,

the financial position of the

Lottery

as of

September 30, 2023

and 2022

and the changes in its financial position

and its cash flows for the

six-month periods and years

then ended in accordance with accounting principles

generally accepted in the United States of America.

Basis for Opinion

We conducted our audit

s

in accordance with auditing standards generally accepted in the United States of

America (GAAS)

and the standards applicable to financial audits contained in

Government Auditing Standards

issued by the Comptroller General of the United States

. Our responsibilities under those standards are further

described in the Auditor's Responsibilities for the Audits of the Financial Statements section of our report. We

are

required to be

independent of the

Lottery

and to meet our other ethical responsibilities in accordance with

the relevant ethical requirements relating to our audit

s

. We believe that the audit evidence we have obtained is

sufficient and appropriate to provide a basis for our audit opinion.

Emphasis of Matter

We draw attention to Note 1, which explains that these financial statements present only the Bureau of State

Lottery, State of Michigan and do not purport to, and do not, present fairly the financial position of the State of

Michigan as of September 30, 2023 and 2022 or the changes in its financial position and the changes in its cash

flows thereof for the six-month periods then ended in conformity with accounting principles generally accepted in

the United States of America. Our opinion is not modified with respect to this matter.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance

with accounting principles generally accepted in the United States of America and for the design,

implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial

statements that are free from material misstatement, whether due to fraud or error.

Auditor’s Responsibilities for the Audits of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free

from material misstatement, whether due to fraud or error, and to issue an auditor's report that includes our

opinion

. Reasonable assurance is a high level of assurance but is not absolute assurance and, therefore, is not a

guarantee that audits conducted in accordance with GAAS

and

Government Auditing Standards

will always

detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from

fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions,

misrepresentations, or the override of internal control. Misstatements are considered material if there is a

substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a

reasonable user based on the financial statements.

- 12 -

To

Ms. Jessica Weare, Acting Commissioner,

the Bureau of State Lottery, State of Michigan,

and Mr. Doug Ringler, CPA, CIA,

Auditor General, State of Michigan

Bureau of State Lottery, State of Michigan

In performing audits in accordance with GAAS and Government Auditing Standards, we:

•

Exercise professional judgment and maintain professional skepticism throughout the audits.

•

Identify and assess the risks of material misstatement of the

financial statements, whether due to fraud or

error, and design and perform audit procedures responsive to those risks. Such procedures include examining,

on a test basis, evidence regarding the amounts and disclosures in the financial statements.

•

Obtain an understanding of internal control relevant to the audits in order to design audit procedures that are

appropriate in the circumstances but not for the purpose of expressing an opinion on the effectiveness of the

Lottery's internal control. Accordingly, no such opinion is expressed.

•

Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting

estimates made by management, as well as evaluate the overall presentation of the financial statements.

We are required to communicate with those charged with governance regarding, among other matters, the

planned scope and timing of the audits, significant audit findings, and certain internal control-related matters that

we identified during the audits.

Required Supplementary Information

Accounting principles generally accepted in the United States of America require that the

management's

discussion and analysis and required supplementary information, as identified in the table of contents,

be

presented to supplement the basic financial statements. Such information is the responsibility of management

and, although not a part of the basic financial statements, is required by the Governmental Accounting Standards

Board, which considers it to be an essential part of financial reporting for placing the basic financial statements in

an appropriate operational, economic, or historical context. We have applied certain limited procedures to the

required supplementary information in accordance with auditing standards generally accepted in the United

States of America, which consisted of inquiries of management about the methods of preparing the information

and comparing the information for consistency with management's responses to our inquiries, the basic financial

statements, and other knowledge we obtained during our audit of the basic financial statements. We do not

express an opinion or provide any assurance on the information because the limited procedures do not provide

us with sufficient evidence to express an opinion or provide any assurance.

Supplementary Information

Our audits were conducted for the purpose of forming an opinion on the financial statements that collectively

comprise the

Lottery

's

basic financial statements. The other supplementary information is presented for the

purpose of additional analysis and is not a required part of the basic financial statements. Such information is the

responsibility of management and was derived from and relates directly to the underlying accounting and other

records used to prepare the basic financial statements. The information has been subjected to the auditing

procedures applied in the audits of the basic financial statements and certain additional procedures, including

comparing and reconciling such information directly to the underlying accounting and other records used to

prepare the basic financial statements or to the basic financial statements themselves, and other additional

procedures in accordance with auditing standards generally accepted in the United States of America. In our

opinion, the

other supplementary information

is

fairly stated in all material respects in relation to the basic

financial statements as a whole.

Other Information

Management is responsible for the other information included in the Annual Comprehensive Financial Report.

The other information comprises the

introductory and statistical sections

but does not include the basic financial

statements and our auditor's report thereon. Our opinion on the basic financial statements does not cover the

other information, and we do not express an opinion or any form of assurance thereon.

- 13 -

To

Ms. Jessica Weare, Acting Commissioner,

the Bureau of State Lottery, State of Michigan,

and Mr. Doug Ringler, CPA, CIA,

Auditor General, State of Michigan

Bureau of State Lottery, State of Michigan

In connection with our audits of the basic financial statements, our responsibility is to read the other information

and consider whether a material inconsistency exists between the other information and the basic financial

statements or whether the other information otherwise appears to be materially misstated. If, based on the work

performed, we conclude that an uncorrected material misstatement of the other information exists, we are

required to describe it in our report.

Other Reporting Required by Government Auditing Standards

In accordance with Government Auditing Standards, we have also issued our report dated

January 19, 2024

on

our consideration of the

Lottery

's

internal control over financial reporting and on our tests of its compliance with

certain provisions of laws, regulations, contracts, grant agreements, and other matters. The purpose of that

report is solely to describe the scope of our testing of internal control over financial reporting and compliance and

the results of that testing, and not to provide an opinion on the effectiveness of the

Lottery

's

internal control over

financial reporting or on compliance. That report is an integral part of an audit performed in accordance with

Government Auditing Standards in considering the

Lottery

's

internal control over financial reporting and

compliance.

January 19, 2024

- 14 -

Bureau of State Lottery, State of Michigan

Management’s Discussion and Analysis

- 15 -

The following discussion provides an overview of the Lottery’s financial performance and

activities for the fiscal year ended September 30, 2023. Please read it in conjunction with the

financial statements, which begin on page 29.

Using This Report

The Lottery is accounted for as an enterprise fund, reporting on all of the activity’s assets and

liabilities using the accrual basis of accounting, much like a private business entity. As such, this

Annual Comprehensive Financial Report consists of a series of financial statements, along with

explanatory notes to the financial statements and supplementary schedules. The Statement of

Net Position on page 29 and the Statement of Revenues, Expenses and Changes in Net

Position on page 30, report the Lottery’s net position and its changes.

By law, the Lottery is required to deposit all of its net income each fiscal year into either the

State School Aid Fund (for income related to Lottery gaming activities) or the General Fund (for

income related to Charitable Gaming activities). The net position of the Lottery consists of

capital assets, unrealized gains or losses on investments held to fund annuitized prize

payments, as well as the change in pension and other postemployment benefits (OPEB)

liabilities, deferred inflows, and outflows related to pension and OPEB. To assess the Lottery’s

financial position and financial health, the reader of these statements should pay particular

attention to changes in the components of assets and liabilities as set forth in the Statement of

Net Position, and to changes in operating revenues, expenses, and disbursement expenses to

other funds as set forth in the Statement of Revenues, Expenses and Changes in Net Position.

In addition, the reader should also refer to the accompanying notes to the financial statements.

Financial Highlights

Compared to the fiscal year ended September 30, 2022:

Total revenues for all activities increased by $56.8 million, or 1.2%.

Operating revenues for Lottery gaming activities increased by $27.6 million, or 0.6%.

Non-operating revenues increased by $29.2 million, or 152.9%, primarily due to an

increase in common cash interest rates and decrease in unrealized loss on

investments.

Total expenses increased $41.5 million, or 0.8%.

Operating expenses decreased $63.8 million, or 1.7%, consisting of a decrease in

net prize awards of $80.2 million and an increase in direct game and administrative

expenses of $16.4 million.

Non-operating expenses increased by $105.3 million, or 8.4%, reflecting an increase

in disbursements to the School Aid Fund of $103.4 million, a decrease in prize

amortization of $0.2 million, and an increase in disbursements to the General Fund

of $2.1 million.

Bureau of State Lottery, State of Michigan

Management’s Discussion and Analysis

- 16 -

Net Position

A summary of the Lottery’s net position is presented below:

2023 2022 2021

Current and other assets 277.0$ 252.6$ 254.2$

Investments - non-current 108.4 120.0 148.7

Other assets 1.1 1.5 1.8

Capital assets

(net of accumulated depreciation) 1.3 1.7 0.8

Total assets 387.8 375.8 405.5

Deferred Outflows of Resources:

Deferred outflows related to pensions 3.1 2.9 2.9

Deferred outflows related to OPEB health 8.4 7.5 10.0

Deferred outflows related to OPEB life insurance 0.7 1.0 1.0

T

ota

l

d

e

f

erre

d

out

fl

ows o

f

resources

12

.

2

11

.

4

13

.

9

Current liabilities 272.3 245.5 241.6

Long-term liabilities 167.9 168.9 196.3

Total liabilities 440.2 414.4 437.9

Deferred Inflows of Resources:

Deferred inflows related to pensions 0.3 7.8 -

Deferred inflows related to OPEB health 14.0 16.9 14.7

Deferred inflows related to OPEB life insurance 2.1 0.9 0.6

Total deferred inflows of resources 16.4 25.6 15.3

Net position:

Net investment in capital assets 0.1 0.3 0.5

Unrestricted (deficit) (56.6) (53.1) (34.3)

Total net position (56.5)$ (52.8)$ (33.8)$

Table 1 - Net Position

(in millions)

September 30,

As shown in Table 1 above, the Lottery’s net position decreased from September 2022 to 2023

by $3.7 million and decreased from September 2021 to 2022 by $19.0 million. The decreases

noted above are primarily attributable to the unrealized losses on investments that the Lottery

holds to fund future payments due on annuitized Lottery prizes. Accounting principles dictate

that the Lottery record the gain or loss related to the change in market value of investments.

U.S. Treasury zero-coupon bonds and State of Michigan General Obligation Capital

Appreciation Bonds have been purchased for the payment of installment prize awards and are

generally held to maturity. The difference between the market value of these investments and

the amortized book value is considered a restriction for unrealized gains on investments and is

not available for disbursement to the School Aid Fund. Additional detailed information on

investments may be found in Note 3 in the accompanying financial statements.

Bureau of State Lottery, State of Michigan

Management’s Discussion and Analysis

- 17 -

As of September 30, 2023 and 2022, the Lottery recorded a deficit in the amount restricted for

the School Aid Fund, which resulted in a negative overall net position. This deficit amount has

been reported as unrestricted on the Statement of Net Position on page 29 in the financial

statements, as a negative balance cannot be considered restricted.

Capital assets consist of equipment and leasehold improvements, plus right of use assets under

lease arrangements. During fiscal year 2023, net capital assets decreased by $0.4 million.

Capital assets increased $0.9 million from September 2021 to 2022. Additional detailed

information on capital assets may be found in Note 5 in the accompanying financial statements.

A detail of the Lottery’s liabilities is presented in Table 2 below:

2023 2022 2021

Current:

Accounts payable and other liabilities 29.7 31.3 29.2

Due to other State agencies 32.0 14.3 28.3

Prize awards payable (net of discount) 210.6 199.9 184.1

Total current 272.3 245.5 241.6

Non-current:

Prize awards payable (net of discount) 117.5 126.6 135.0

Net pension liability 27.4 17.6 29.0

Net OPEB liability - health 16.5 16.6 25.0

Net OPEB liability - life insurance 4.1 5.8 6.1

Other non-current liabilities 1.2 1.3 0.3

Compensated absences 1.2 1.0 0.9

Total non-current 167.9 168.9 196.3

Total liabilities 440.2$ 414.4$ 437.9$

September 30,

Table 2 - Liabilities

(in millions)

Non-current liabilities consist of prize liability for prizes paid in installments over several years,

long-term pension recorded as a result of GASB 68, and long-term OPEB obligation allocation

recorded as a result of GASB 75. For the fiscal year ended September 2023, long-term prize

liability decreased $9.1 million, or 7.2%, from September 2022 and decreased by $8.4 million, or

6.2%, from September 2021 to September 2022. The decreases from September 2022 to

September 2023 and September 2021 to September 2022 are attributable to the maturing of

some long-term prize liabilities as well as minimal additions to the pool of annuitized installment

prizes. Refer to Note 7 in the accompanying financial statements for more information.

Bureau of State Lottery, State of Michigan

Management’s Discussion and Analysis

- 18 -

A summary of the Lottery’s change in net position is presented in Table 3 below:

2023 2022 2021

Operating revenues 4,939.1$ 4,911.5$ 5,058.0$

Operating expenses:

Prizes and direct game expenses

Prizes less unclaimed prizes (3,016.8) (3,097.0) (3,057.0)

Commissions and game related expenses (501.8) (491.6) (515.5)

Total prizes and direct game expenses (3,518.6) (3,588.6) (3,572.5)

Income before other operating

expenses 1,420.5 1,322.9 1,485.5

Other operating expenses (68.8) (62.6) (56.2)

Operating income 1,351.7 1,260.3 1,429.3

N

on-operat

i

ng revenues an

d

(

expenses

)

:

Investment and interest revenues (losses) 10.1 (19.1) (5.6)

Investment and interest expenses (5.0) (5.2) (6.2)

School Aid Fund disbursement expense (1,352.0) (1,248.6) (1,419.8)

General Fund disbursement expense (7.5) (5.4) (4.5)

Health & Human Services disbursement expense (1.0) (1.0) (1.0)

Net non-operating expense (1,355.4) (1,279.3) (1,437.1)

Change in net position (3.7) (19.0) (7.8)

Total net position beginning of period (52.8) (33.8) (26.0)

Total net position end of period (56.5)$ (52.8)$ (33.8)$

September 30,

Table 3 - Changes in Net Position

(in millions)

Because the Lottery is required by law to deposit all of its net income into the School Aid Fund

or General Fund, change in net position does not reflect the result of the Lottery’s operating

activities. The $1,352.0 million disbursement expense to the School Aid Fund reflects the

Lottery’s operating activities for the fiscal year ended September 2023. There was an increase

in disbursement expense of $103.3 million, or 8.3%, from September 2022. For the fiscal year

ended September 2022 there was a decrease of $171.2 million, or 12.0%, from September

2021. The disbursement expense to the General Fund reflects Charitable Gaming activities for

the fiscal year ended September 2023. Charitable Gaming activities experienced an increase in

net revenues for the fiscal year ended September 2022 compared to September 2021, as well

as for the fiscal year ended September 2023 compared to September 2022. The increases from

September 2021 to September 2022 and September 2022 to September 2023 are primarily due

to minimized operating costs, as well as the shift of Millionaire Party operating expenses to the

Michigan Gaming Control Board. Refer to Note 17 for further details. Charitable Gaming net

income is disbursed annually to the General Fund.

Bureau of State Lottery, State of Michigan

Management’s Discussion and Analysis

- 19 -

Disbursements to other funds are detailed in Table 4 below:

2023 2022 2021

School Aid Fund 1,352.0$ 1,248.6$ 1,419.8$

General Fund 7.5 5.4 4.5

Health & Human Services

1.0 1.0

1.0

Total Disbursements to Other Funds

1,360.5$

1,255.0$

1,425.3$

September 30,

Table 4 - Disbursements to Other Funds

(in millions)

Revenues

The following chart shows the major sources and the percentages of operating revenues for the

fiscal year ended September 30, 2023:

Instant Games 48.0%

iLottery instants, Net Win

3.7%

Daily Games 19.6%

Mega

Millions/Megaplier 4.6%

Powerball/Powerplay/

Powerball Double

Play 5.7%

Other Games 2.7%

Club Games 13.0%

Lucky for Life 0.7%

Fast Cash 1.7%

Charitable Gaming &

Other 0.3%

Total Operating Revenues

September 30, 2023

Bureau of State Lottery, State of Michigan

Management’s Discussion and Analysis

- 20 -

A detail of the Lottery’s revenues is presented in Table 5 below:

2023 2022 2021

Operating revenues:

Instant tickets 2,364.7$ 2,381.0$ 2,448.6$

iLottery Instants, Net Win 183.5 193.2 241.8

Daily games 967.8 1,070.7 1,170.0

Mega Millions/Megaplier 227.5 175.1 177.1

Powerball/Power Play/Powerball Double Play 281.5 169.4 151.1

Lucky for Life 36.8 36.6 23.6

Fast Cash 83.2 95.5 73.3

Club games 642.0 662.1 600.2

Other games and promotions 135.8 113.3 160.4

Other operating revenue 16.3 14.6 11.9

Total operating revenues 4,939.1 4,911.5 5,058.0

Non-operating revenues:

Unrealized gain (loss) on investments (5.8) (26.4) (12.2)

Amortization on bonds 5.6 5.8 6.2

Other income 10.3 1.5 0.4

Total non-operating revenue 10.1 (19.1) (5.6)

Total revenues 4,949.2$ 4,892.4$ 5,052.4$

September 30,

Table 5 - Revenues

(in millions)

Operating revenues, primarily Lottery ticket sales, for the fiscal year ended September 2023

increased from September 2022 by $27.6 million, or 0.6%, and decreased $146.5 million, or

2.8%, for the fiscal year ended September 2022 compared to September 2021.

Instant game ticket sales decreased by $16.3 million, or 0.7%, for the fiscal year ended

September 2023 compared to September 2022 and decreased by $67.6 million, or 2.7% for the

fiscal year ended September 2022 over September 2021. The sales decrease for the year

ended September 30, 2023 is primarily due to increased competition from casinos now offering

sports betting and online gaming (including significant marketing expenditures), as well as

reduction of disposable income caused by inflationary pressures.

iLottery instant ticket net win, as described in Note 8, decreased $9.7 million, or 5.0%, for the

fiscal year ended September 2023 compared to September 2022, and net win decreased $48.6

million, or 20.0%, for the fiscal year ended September 2022 compared to September 2021.

Refer to Note 8 in the accompanying financial statements.

The iLottery sales decrease for the fiscal year ended September 2023 is primaily due to

increased competition from casinos now offering sports betting and online gaming (including

significant marketing expenditures) reduction of disposable income caused by inflationary

pressures.

Bureau of State Lottery, State of Michigan

Management’s Discussion and Analysis

- 21 -

Daily Games sales, as shown in Table 5 above, includes Daily 3 and Daily 4. Daily games sales

for the fiscal year ended September 2023 decreased by $102.9 million, or 9.6%, from

September 2022. Sales for the fiscal year ended September 2022 decreased $99.3 million, or

8.4%, over September 2021. The sales decrease for the fiscal year ended September 2023 is

primarily due to a decrease in high tier prize payouts, direct competition from casinos now

offering sports betting and online gaming (including significant marketing expenditures), and

reduction of disposable income by inflationary pressures.

Mega Millions sales for the fiscal year ended September 2023 increased by $52.4 million, or

29.9%, compared to the fiscal year ended September 2022. Sales for the fiscal year ended

September 2022 decreased by $2.0 million, or 1.1%, compared to September 2021. The sales

increase for the fiscal year ended September 2023 compared to the fiscal year ended

September 2022 can be attributed to an increase in the number of jackpots over $100.0 million,

particularly a $1.3 billion jackpot that was won on January 13, 2023. The decrease in sales for

the fiscal year ended September 2022 over the fiscal year ended September 2021 can be

primarily attributed to a decrease in the number of jackpots over $100.0 million.

Powerball sales for the fiscal year ended September 2023 increased by $112.1 million, or

66.2%, over September 2022, and increased by $18.3 million, or 12.1%, for the fiscal year

ended September 2022 compared to September 2021. The sales increase from September

2023 to September 2022 is primarily due to an increase in the number of jackpots greater than

$100.0 million, with one world record jackpot of over $2.0 billion won in November 2022 and

another $1.1 billion won in July 2023. The increase in sales for the fiscal year ended September

2022 is primarily due having a full year of drawings three times per week and a full year of

Double-Play game sales, both of which began in August 2021.

Lucky for Life sales had a slight increase of $0.2 million, or 0.5%, for the fiscal year ended

September 2023 over September 2022, and an increase of $13.0 million, or 55.0%, for the fiscal

year ended September 2022 over September 2021. The sales increase for both fiscal years can

be primarily attributed having a full year of daily Lucky for Life drawings, which began in July

2021, and the addition of the Lucky for Life game to the iLottery platform in May 2020.

Fast Cash sales decreased by $12.3 million, or 12.9%, for the fiscal year ended September

2023 over September 2022, and sales increased by $22.2 million, or 30.2%, for the fiscal year

ended September 2022 compared to September 2021. The sales decrease from September

2023 to September 2022 is primarily due to the lack of jackpot growth, which is the main driver

for Fast Cash sales. The jackpot was $1,000,000 or higher only 7% of the days. Currently, there

are 11 Fast Cash games on sale, and the jackpot was hit on an average of once every twenty

days during this fiscal year ended September 2023. The sales increase for the fiscal year ended

September 2022 over September 2021 is primarily due to the increase in the odds of winning

the progressive jackpot in November of 2021 creating higher jackpots and driving sales.

Club games, as shown in Table 5 above, include Club Keno add-ons (Kicker, The Jack, and

Extra), and Pull-Tabs. Club Games sales for the fiscal year ended September 2023 decreased

by $20.1 million, or 3.0%, over September 2022. Sales for the fiscal year ended September

2022 increased by $61.9 million, or 10.3%, compared to September 2021. The sales decrease

for the year ended September 30, 2023 is primarily due to an increased competition from

casinos now offering sports betting and online gaming (including significant marketing

expenditures) and reduction of disposable income by increased inflationary pressures. The

sales increase for the fiscal year ended September 2022 over September 2021 can be

Bureau of State Lottery, State of Michigan

Management’s Discussion and Analysis

- 22 -

attributed to the re-opening and return to normal operations of Michigan bars and restaurants in

2021 through 2022 after temporary closures and capacity restrictions were imposed in 2020 due

to the COVID-19 pandemic, as well as the return of the Tripler Time promotion in June 2022.

Additionally, increased focus was placed on promoting the Pull-Tabs product to retailers who do

not currently sell it.

Other games consist of Lotto 47, Lotto 47 EZ Match, Lotto 47 Double Play, Fantasy 5, Fantasy

5 EZ Match, Fantasy 5 Double Play, Keno, Raffle, Poker Lotto, Online Game Cards, and

iLottery promotions. Other game sales for the fiscal year ended September 30, 2023 increased

by $22.5 million, or 19.9%, compared to September 2022, and sales decreased by $47.1

million, or 29.3%, for the fiscal year ended September 2022 over September 2021. The sales

increase for the fiscal year ended September 2023 over September 2022 can be primarily

attributed to a large Lotto 47 jackpot in August of 2023, as well as the new Raffle game

introduced on the digital platform in May of 2023. The sales decrease for the fiscal year ended

September 30, 2022 is primarily due to an absence of pandemic-related factors that increased

sales in the fiscal year 2021, increased competition from casinos now offering sports betting and

online gaming (including significant marketing expenditures), and reduction of disposable

income by inflationary pressures.

The increase in non-operating revenues for the fiscal year ended September 2023 compared to

September 2022 resulted primarily from an increase in common cash interest revenue and a

decrease in unrealized loss on investments. The decrease in non-operating revenues for the

fiscal year ended September 2022 compared to September 2021 resulted primarily from an

increase in the unrealized loss on investments. As previously discussed, the unrealized gain or

loss on investments is a reflection of the market value of the investments and does not impact

the disbursement to the School Aid Fund.

The decrease in bond amortization for the fiscal year ended September 2023 compared to

September 2022 and September 2021 is due to a decreasing bond portfolio from maturing

investments, as well as the fact that most prize winners have elected the cash option instead of

installment payments.

Other income increased for the fiscal year ended September 2023 compared to September

2022 and September 2021. The increases are due to changes in interest rates on common cash

investments. Additional detailed information on investments may be found in Note 3 in the

accompanying financial statements.

Bureau of State Lottery, State of Michigan

Management’s Discussion and Analysis

- 23 -

Expenses

The following chart shows prizes, game costs, and other operating expenses as a percentage of

total operating expenses for the fiscal year ended September 30, 2023:

Prize Awards 84.1%

Retailer and Vendor

Commissions 12.7%

Advertising 0.9%

Game Related Expense

1.3%

Other Operating

Expense 1.0%

Total Operating Expenses

September 30, 2023

Bureau of State Lottery, State of Michigan

Management’s Discussion and Analysis

- 24 -

A detail of the Lottery’s expenditures is presented in Table 6 below:

2023 2022 2021

Prizes:

Instant prizes 1,793.7$ 1,788.3$ 1,823.4$

Draw Game prizes 853.7 905.4 918.4

Club game prizes 426.5 438.7 393.3

Total prizes 3,073.9 3,132.4 3,135.1

Less: unclaimed prizes 57.1 35.4 78.1

Net prize awards 3,016.8 3,097.0 3,057.0

Direct game expenses:

Retailer commissions 354.7 356.6 370.9

Vendor commissions and other expenses 98.9 93.9 103.7

Game related expenses 48.2 41.1 40.9

Total direct game expenses 501.8 491.6 515.5

Other operating expenses:

Salaries, wages and benefits 25.6 17.5 21.6

Other professional services 5.4 8.8 7.7

Printing and supplies 2.5 1.8 1.5

Other general and administrative 3.5 3.4 2.6

Promotion and advertising 31.8 31.1 22.8

Total other operating expenses 68.8 62.6 56.2

Total operating expenses 3,587.4 3,651.2 3,628.7

Non-operating expenses:

Amortization of prize discount 5.0 5.2 6.2

School Aid Fund disbursement 1,352.0 1,248.6 1,419.8

General Fund disbursement 7.5 5.4 4.5

Health & Human Services disbursement 1.0 1.0 1.0

Total non-operating expenses 1,365.5 1,260.2 1,431.5

Total expenses 4,952.9$ 4,911.4$ 5,060.2$

September 30,

Table 6 - Expenses

(in millions)

Instant games overall payout for the fiscal year ended September 2023 increased to 75.9% from

75.1% at September 2022 and from 74.5% at September 2021. The games vary in payout

percentage depending on ticket price. Instant game prize payouts range from 60.0% for a $1

game to 79.9% for a $50 game for the fiscal year ended September 2023.

The combined Daily Games prize payout decreased overall for the fiscal year ended September

2023 compared to September 2022. Daily 3 prize payout decreased to 48.2% for the fiscal year

Bureau of State Lottery, State of Michigan

Management’s Discussion and Analysis

- 25 -

ended September 2023, compared to 52.5% for the fiscal year ended September 2022 and

50.1% at September 2021.

Daily 4 prize payout decreased to 43.9% for the fiscal year ended September 2023, compared

to 53.9% for the fiscal year ended September 2022 and 50.0% at September 2021. Daily games

are designed to yield an average prize payout of 50.0% and combined, the games averaged a

payout of 45.9% for the fiscal year ended September 2022.

The Club Games prize payout percentage increased to 66.4% for the fiscal year ended

September 2023, compared to 65.8% for the fiscal year ended September 2022 and 65.1% for

September 2021. The other draw games have an anticipated payout between 50.0% and

80.1%.

Retailer and vendor commissions have increased commensurate with higher overall sales. Total

overall increase of $3.1 million, or 0.7% for the fiscal year ended September 2023 compared to

September 2022 and decreased by $24.1 million, or 5.0%, for the fiscal year ended September

2022 compared to September 2021.

Other operating expenses have increased by $6.2 million, or 9.9%, for the fiscal year ended

September 2023 compared to September 2022 and increased by $6.4 million, or 11.3%, for the

fiscal year ended September 2022 compared to September 2021. Lessened closures and other

disruptions relating to the COVID-19 pandemic in 2020 through 2021, as well as overall

increase in sales, lead to an increase in advertising expenses for the fiscal years ended

September 2023 and September 2022 over September 2021. Increase in salaries, wages,

benefits, and printing costs, has also contributed to the increase for the fiscal year ended

September 2023 over September 2022.

Unclaimed Prizes

By law, Lottery prizes not claimed within one year of their drawing date are to be disbursed to

the State School Aid Fund.

The Lottery recognizes the value of unclaimed prizes using an allowance methodology. Under

this method, a 2-year historical average of retail game sales and actual unclaimed prizes are

utilized to estimate the amount of prizes awarded during the current year that will not be paid

out due to claims not being filed for those prizes. Refer to Note 1 for further details.

Unclaimed prizes for the fiscal year ended September 2023 increased by $21.7 million

compared to September 2022 and decreased by $42.7 million for the fiscal year ended

September 2022 compared to September 2021. The increase in unclaimed prizes for the fiscal

year ended September 2023 can be attributed to an expiration of several large instant games,

as well as one large Powerball prize. An increase in sales has also contributed to the increase

in the percentage used to estimate the annual allowance for unclaimed prizes. The large

decrease in unclaimed prizes for the fiscal year ended September 2022 compared to

September 2021 is primarily due to a revision to the unclaimed prize methodology effective in

October 2021. The historical average of sales used in the calculation was updated to make it

more consistent for Instant and Pull-Tab game sales. Also, all sales from the iLottery platform

were excluded from the historical average of sales due to a historically low amount of unclaimed

iLottery prizes.

Bureau of State Lottery, State of Michigan

Management’s Discussion and Analysis

- 26 -

Charitable Gaming

A detail of the Lottery’s charitable gaming revenues, expense, and net income for the fiscal

years ended September 30 are presented in Table 7 below:

2023 2022 2021

Gross revenue 13.1$ 13.2$ 10.9$

Operating expenses (5.6) (7.8) (6.4)

Net income 7.5$ 5.4$ 4.5$

September 30,

Table 7 - Charitable Gaming Revenue, Expense, and Net Income

(in millions)

The mission of the Charitable Gaming Division is to maintain the integrity of charitable gaming

activities. Revenues received through the issuance of licenses and from the distribution of

charity-game tickets cover the costs of oversight. Any revenue in excess of program costs is

disbursed annually to the State’s General Fund.

Charitable gaming activities overseen by the Lottery include the licensing and regulation of

qualifying nonprofit organizations to conduct bingos, raffles, charity game ticket sales, and other

charitable gaming events for fundraising purposes. The Lottery also oversees the distribution

and sale of charity-game tickets (also for fund-raising purposes) to licensed suppliers.

Charitable Gaming launched a program in February 2015 to sell charity tickets through

specialized vending machines at 20 different licensed non-profit organizations.

Each year, qualifying nonprofit organizations generate millions of dollars in revenue through

their charitable gaming activities. In FY 23, 437 nonprofit organizations were qualified by the

Charitable Gaming Division to engage in charitable gaming activities. 9,455 license applications

were processed and 9,063 licenses were issued, including 428 regular bingo licenses, 333

special bingo licenses, 4,925 large raffle licenses, 2,116 small raffle licenses, 633 combination

raffle licenses, 559 annual charity game ticket licenses, 20 special charity game ticket licenses,

31 hall licenses and 18 supplier licenses.

The Charitable Gaming Division conducted 984 inspections of qualified nonprofit organizations

and investigated 52 complaints. Inspections ensure proceeds are accounted for by the qualified

licensed nonprofit organizations and used for lawful purposes and assist qualified organizations

in maximizing proceeds for their charitable cause. Abuses encountered by the Charitable

Gaming Division include improper management of gaming proceeds and failure to obtain

appropriate charitable gaming licenses.

Executive Order 2012-4 (E.O. 2012-4), effective June 10, 2012, transferred the licensing and

regulation of Millionaire Party activities from the Lottery to the Michigan Gaming Control Board

(MGCB). MGCB Millionaire Party licensing and regulation was later codified pursuant to

Michigan Public Act 159 of 2019. According to E.O. 2012-4, Millionaire Party licensing revenue

shall be remitted to the Lottery and all necessary expenses up to $3.1 million shall be financed

by the Lottery. Effective fiscal year 2023, per Public Act 269 and Public Act 270, all expenses

related to Millionaire Party are being funded from the Internet Gaming Fund and are

administered by the Michigan Gaming Control Board.

Bureau of State Lottery, State of Michigan

Management’s Discussion and Analysis

- 27 -

Other Potentially Significant Factors Impacting Next Year

In the retail channel, the Lottery plans to introduce forty-eight new retail instant games in fiscal

year 2024, an increase of one game compared to the previous fiscal year. Of these forty-eight

games, 70% will consist of new titles and designs vetted by players in focus groups. The

remaining 30% will consist of reliably high-selling Bingo, Cashword and Wild Time games.

These games will continue to utilize unique themes, play styles, and new innovations, as well as

tailored prize structures that provide players with the best play experience. A new $50 game,

500X Money Maker will launch early Q1 and will have payouts of over $300,000,000 in total

cash prizes, over $38,000,000 in multiplied prizes, and no breakeven prizes. This game will

incorporate a payout of over 80% with $2,000,000 in second chance prizes. In FY24 the printed

products team will focus on having a balanced portfolio offering dependable core games and

families of games, as well as offering games designed for distinct player segments. Individual

games will be carefully chosen by exploring new themes, adapting high performing games

within the industry, and revisiting market tested player favorites.

On the draw games side, the Lottery is planning for two one-month long Club Keno Tripler Time

bonus promotions in Q2 and Q3 of fiscal year 2024. The Lottery is also considering some

changes to the game and add-ons in Q4 of FY24. The proposed changes include modifying the

Kicker, changing The Jack to a 9-spot, replacing Extra with a new “Plus 3” add-on game and

increasing the 10-spot top-prize to $500,000. In Q2 and Q4 of FY24, the Lottery will run Daily 3

& 4 bonus payout promotions. As always with Daily Game promotions, the objective will be to

stimulate winning experiences with short-term ratcheted payouts to increase excitement and

sales for the Daily 3 & 4. Promotions will only be implemented if natural payouts for the games

are lower than the designed 50% payout. The Lottery plans to launch a new first $30 Fast Cash

game in July and will have a Jackpot Slots playstyle offering players a chance to win 100% of

the progressive jackpot plus $1,000,000. In March of 2024, Lottery is planning to launch a new

draw game called Cash Pop. Cash Pop is a draw game that players can win by matching just

one number from one through 15. Players can play one number, multiple numbers – or all 15

numbers. The more numbers played the better their chance to win. The Lottery will draw one

number from 1- 15. Players can win by matching any of their numbers to the one number drawn

by the Lottery. Drawings are held every 14 minutes, and the results can be viewed on Club

Keno monitors, retail display screens, and online at michiganlottery.com. Cash prizes range

from five times up to 250 times the wager amount.

The Lottery will continue to conduct research on these new concepts. The goal of the research

is to evaluate the four concepts and determine which concept(s) offer the best opportunity to

increase player engagement, overall revenue, and provide a fun and rewarding play experience.

In FY24, Lottery will continue to add new game studios to allow for an increased launch

schedule and an expanded library of games. Lottery’s digital gaming team plans to introduce

around 40 new digital instant games, with a total 250 running games, in fiscal 2024. The main

focus will be on maximizing awareness of available products and jackpots to all players visiting

Lottery's website and mobile applications to drive sales. Additionally, the improved use of

communication channels, relevant promotions, and content personalization will increase player

engagement.

Management continuously reviews and explores new game concepts and features, promotions,

and opportunities to engage retailers.

Bureau of State Lottery, State of Michigan

Management’s Discussion and Analysis

- 28 -

Contacting the Lottery’s Financial Management

This financial report is designed to provide the Legislature and the executive branch of

government, the public, and other interested parties with an overview of the financial results of

the Lottery’s activities and to show the Lottery’s accountability for the money it receives.

Percentages presented in the Management’s Discussion and Analysis are based on the

rounded figures presented in the tables. If you have questions about this report or need

additional financial information, contact the Deputy Commissioner for Administration at the

Michigan Lottery, P.O. Box 30023, Lansing, Michigan 48909.

Bureau of State Lottery, State of Michigan

Statement of Net Position

September 30, 2023 and 2022

2023 2022

Assets

Current assets:

Equity in State Treasurer's Common Cash Fund $ 19,234,673 $ 10,854,388

Investments, at fair value 13,398,230 13,774,740

Accounts receivable - net 220,776,059 203,816,654

Inventory 23,536,875 24,317,916

Total current assets 276,945,837 252,763,698

Non-current assets:

Investments, at fair value 108,445,897 119,979,658

Other assets 1,127,805 1,456,968

Capital assets:

Leasehold improvements and equipment 4,609,370 4,919,251

Right-to-use assets 1,471,245 1,561,770

Accumulated depreciation (4,772,609) (4,777,580)

Total capital assets 1,308,006 1,703,441

Total noncurrent assets 110,881,708 123,140,067

Total assets 387,827,545 375,903,765

Deferred Outflows of Resources:

Deferred outflows related to pensions 3,103,946 2,874,148

Deferred outflows related to OPEB health 8,409,272 7,559,314

Deferred outflows related to OPEB life insurance 711,487 959,630

Total deferred outflows of resources 12,224,705 11,393,092

Liabilities

Current liabilities:

Accounts payable and other liabilities 29,687,789 31,297,108

Due to School Aid Fund 31,981,420 14,350,784

Prize awards payable - net of discount 210,607,834 199,858,773

Total current liabilities 272,277,043 245,506,665

Noncurrent liabilities:

Prize awards payable - net of discount 117,501,462 126,618,702

Net pension liability 27,382,880 17,628,158

Net OPEB liability - health 16,474,032 16,590,706

Net OPEB liability - life insurance 4,137,774 5,825,534

Lease liability - net of current portion 1,159,148 1,302,731

Accrual for compensated absences, less current portion 1,212,731 991,182

Total noncurrent liabilities 167,868,027 168,957,013

Total liabilities 440,145,070 414,463,678

Deferred Inflows of Resources: