Florida Housing Finance Corporation

Credit Underwriting Report

RIVERVIEW6

Competitive 9%

Housing Credits (“HC”) and Invitation to

Participate (“ITP”) 2022 Construction Housing Inflation Response

Program (“CHIRP”)

RFA 2020-201 / 2021-111C

H

ousing Credit Financing for Affordable Housing Developments Located in

Medium and Small Counties

S

ection A: Report Summary

S

ection B: Housing Credit Allocation Recommendation & Contingencies

S

ection C: Supporting Information & Schedules

P

repared by

First Housing Development Corporation of Florida

FINAL REPORT

October 31, 2022

Exhibit E

Page 1 of 43

RIVERVIEW6

TABLE OF CONTENTS

Page

Section A

Report Summary

Recommendation

A1-A9

Overview

A10-A14

Uses of Funds

A15-A21

Operating Pro Forma

A22-A24

Section B

Housing Credit Allocation Recommendation & Contingencies

B1

Section C

Supporting Information & Schedules

Additional Development & Third Party Information

C1-C9

Applicant Information

C10-C14

Syndication Information

C15

General Contractor Information

C16-C17

Property Management Information

C18-C19

Exhibits

15 Year Pro Forma

1

Housing Credit Allocation Calculation

Description of Features and Amenities

2. 1-4

3. 1-6

Completion and Issues Checklist

4. 1-2

Exhibit E

Page 2 of 43

Section A

Report Summary

Exhibit E

Page 3 of 43

Recommendation

HTG RIVERVIEW6, LTD. ("Applicant") has applied for a Federal 9% HC determination to

finance the new construction of RIVERVIEW6 (“Development”). First Housing Development

Corporation of Florida (“FHDC”, “First Housing”, or “Servicer”) recommends an annual 9% HC

Allocation of $1,699,990 and an annual allocation of HC CHIRP in the amount of $500,000, for

an overall annual HC allocation of $2,199,990 be awarded to finance the new construction

Development.

Development Name:

RFA/Program Numbers: /

Address:

City: Zip Code: County: County Size:

Development Category: Development Type:

Construction Type:

Demographic Commitment:

Primary: of the Units

Unit Composition:

# of ELI Units: ELI Units Are Restricted to AMI, or less. Total # of units with PBRA?

# of Link Units: Are the Link Units Demographically Restricted? # of NHTF Units:

6

Yes

0

12

30%

0

New Construction

Mid-Rise (5-6 Stories)

Masonry

Family

for

100%

901 6th Avenue West

Bradenton

34205

Manatee

Medium

DEVELOPMENT & SET-ASIDES

RIVERVIEW6

RFA 2020-201

2021-111C

Manatee County, North Port-Sarasota-Bradenton MSA

1,005,924$

80

66,016

3

2.0

7

1,093

60%

$139

1,432$

1,432$

1,246$

1,246$

1,246$

2

2.0

22

$1,571

1,208$

1,208$

3

2.0

7

1,093

70%

$1,347

$139

1,208$

1,208$

3

2.0

2

1,093

30%

$673

$139

534$

534$

534$

1,432$

120,288$

534$

12,816$

101,472$

1,432$

803

70%

$1,359

$1,165

469$

469$

39,396$

$113

469$

469$

1,052$

239,856$

$113

1,052$

1,052$

1,052$

328,944$

$113

1,246$

2

2.0

19

803

60%

$582

2

2.0

7

803

30%

1,032$

1,032$

1,032$

1,032$

86,688$

62,640$

1

1.0

7

624

70%

$1,134

$102

$102

870$

870$

870$

870$

384$

13,824$

1

1.0

6

624

60%

$972

$486

$102

384$

384$

384$

1

1.0

3

624

30%

High

HOME

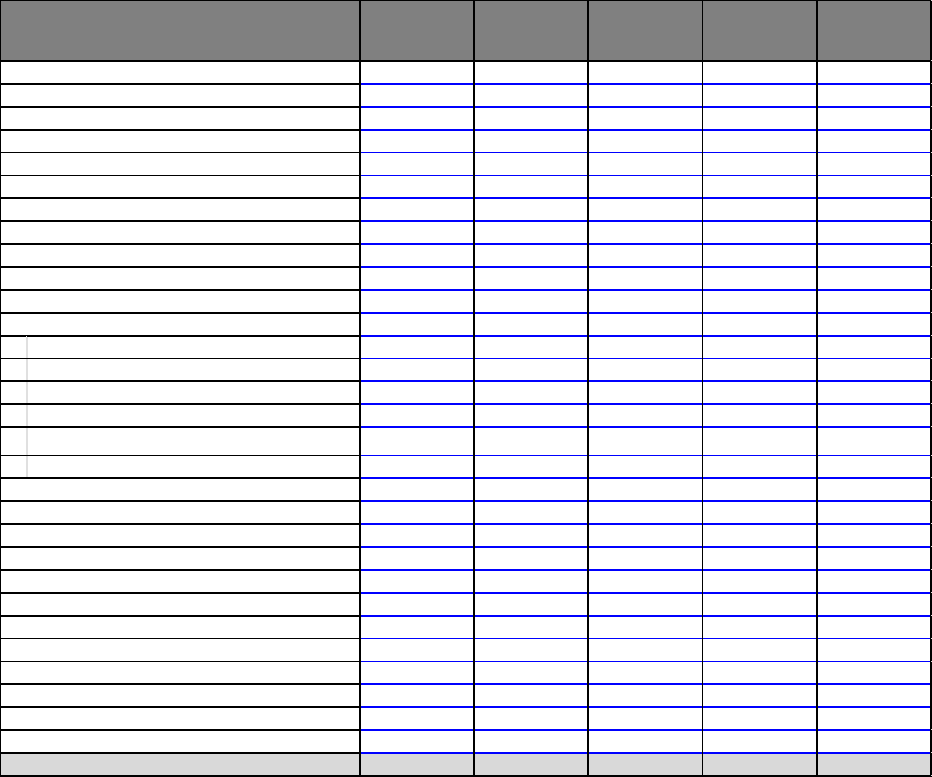

Rents

Gross HC

Rent

Bed

Rooms

Bath

Rooms

Units

Square

Feet

AMI%

Low

HOME

Rents

Appraiser

Rents

CU Rents

Annual Rental

Income

Utility

Allow.

Net

Restricted

Rents

PBRA

Contr

Rents

Applicant

Rents

The Applicant selected Average Income Test; therefore, the Applicant must set-aside 15% of the

total units (12 units) as ELI Set-Aside units at 30% or less of Area Median Income (“AMI”). The

Exhibit E

Page 4 of 43

proposed Development must set aside 50% of the ELI Set-Aside units (6 units) as Link units for

Persons with Special Needs. In order to meet the commitment to set aside ELI units as Link units

for Persons with Special Needs, the Applicant must develop and execute a Memorandum of

Understanding (“MOU”) with at least one designated Special Needs Household Referral Agency

that provides supportive services for Persons with Special Needs for the county where the proposed

Development will be located (Manatee County). The MOU was approved by Florida Housing

Finance Corporation (“Florida Housing” or “FHFC”) on September 9, 2021.

The Tenant Selection Plan was approved by FHFC on April 28, 2022.

Buildings: Residential - Non-Residential -

Parking: Parking Spaces - Accessible Spaces -

Set Asides:

Absorption Rate:

units per month for

months.

Occupancy Rate at Stabilization: Physical Occupancy Economic Occupancy

Occupancy Comments

DDA: QCT: Multi-Phase Boost: QAP Boost:

Site Acreage: Density: Flood Zone Designation:

Zoning: Flood Insurance Required?:

1.402

57.06

X

T5, Urban Center

No

96.00%

95.00%

N/A - New Construction

No

Yes

No

Yes

30

2.7

Housing Credits

40.0%

32

60%

50

Housing Credits

45.0%

36

70%

50

Program

% of Units

# of Units

% AMI

Term (Years)

Housing Credits

15.0%

12

30%

50

1

0

99

4

Appraiser:

Integra Real ty Res ources - Orl ando ("Integra")

Architect:

Fl ux Archi tects , LLC | Eddi e Seymour

Market Study Provider:

Meridian Appraisal Group, Inc. ("Meridian")

Syndicator:

RJAHI

General Contractor 1:

Hennessy Construction Services Corp. ("Hennessy")

Management Company:

HTG Ma nagement, LLC ("HTG Ma nagement")

Devel oper:

HTG RIVERVIEW6 DEVELOPER, LLC

Li mited Partner

Raymond James Affordable Housing Investments, Inc. ("RJAHI")

99.9900%

Applicant/Borrower:

HTG RIVERVIEW6, LTD.

% Ownership

General Pa rtner

HTG RIVERVI EW6 GP, LLC

0.0100%

DEVELOPMENT TEAM

Exhibit E

Page 5 of 43

Credit Underwriter:

Date of Final CUR:

TDC PU Limitation at Application: TD

C PU Limitation at Credit Underwriting:

Minimum 1st Mortgage per Rule: Amount Dev. Fee Reduced for TDC Limit:

10/31/2022

$292,100

$437,239

$6,702,139

$0

First Housing

TOTAL

$33,857,873

$33,857,873

$423,223

HC Equity

RJAHI

$6,137,358

$20,457,861

$255,723

Deferred Developer Fee

HTG RIVERVIEW6 DEVELOPER,

LLC

$3,108,012

$3,108,012

$38,850

Local Government

Manatee County

$1,400,000

$1,400,000

$17,500

Local Government

City of Bradenton CRA

$1,300,000

$1,300,000

$16,250

Regulated Mortgage

Lender

Fifth Third Bank / Grandbridge/

Freddie Mac

$21,452,503

$7,132,000

$89,150

Local Government

City of Bradenton

$460,000

$460,000

$5,750

CONSTRUCTION/PERMANENT SOURCES:

Source

Lender

Construction

Permanent

Perm Loan/Unit

HC Annual Allocation - Initial Award

$1,699,990

HC Annual Allocation - Qualified in CUR

$2,199,990

HC Annual Allocation - Equity Letter of Interest

$2,199,990

Year 15 Pro Forma Expense Escalation Rate

3.00%

Housing Credit (HC) Syndication Price

$0.93

Proj ected Net Operati ng Income (NOI) - Year 1

$608,219

Proj ected Net Operati ng Income (NOI) - 15 Yea r

$716,018

Year 15 Pro Forma Income Escalation Rate

2.00%

Market Rent/Market Financing Stabilized Value

$25,700,000

Rent Restricted Market Financing Stabilized Value

$13,200,000

Deferred Devel oper Fee

$3,108,012

As-Is Land Value

$2,040,000

# of Months covered

by the Res erves

2.7

Operating Deficit &

Debt Servi ce Reserves

$253,068

Debt Servi ce

Coverage

1.13

1.11

1.07

1.07

1.07

Loan to Cost -

Cumulative

21%

22%

27%

30%

30%

Res tri cted Market

Financing LTV

54%

58%

68%

78%

78%

Ma rket Rate/Market

Financing LTV

28%

30%

35%

40%

40%

Amortizati on

40

0

0

0

-

Loan Term

15

15

18

15

-

Underwri tten Interes t

Rate

7.09%

1.75%

1.75%

0.00%

0.00%

Amount

$7,132,000

$460,000

$1,400,000

$1,300,000

$ -

Lender/Grantor

Grandbridge

Real Estate

Ca

pital LLC

("Grandbridge")

/ Freddie Mac

City of

Bradenton

Manatee

County

City of

Bradenton

Co

mmunity

Redevelopment

Agency ("CRA")

Lender

Lien Position

First

Second

Third

Fourth

Fifth

PERMANENT FINANCING INFORMATION

1st Source

2nd Source

3rd Source

4th Source

5th Source

Other

Exhibit E

Page 6 of 43

Changes from the Application:

COMPARISON CRITERIA

YES

NO

Does the level of experience of the current team equal or exceed that of the team

described in the application?

1-2.

Are all funding sources the same as shown in the Application?

3-4.

Are all local government recommendations/contributions still in place at the

level described in the Application?

X

Is the Development feasible with all amenities/features listed in the Application?

X

Do the site plans/architectural drawings account for all amenities/features listed

in the Application?

X

Does the applicant have site control at or above the level indicated in the

Application?

X

Does the applicant have adequate zoning as indicated in the Application?

X

Has the Development been evaluated for feasibility using the total length of set-

aside committed to in the Application?

X

Have the Development costs remained equal to or less than those listed in the

Application?

5.

Is the Development feasible using the set-asides committed to in the

Application?

X

If the Development has committed to serve a special target group (e.g. elderly,

large family, etc.), do the development and operating plans contain specific

provisions for implementation?

X

HOME ONLY: If points were given for match funds, is the match percentage

the same as or greater than that indicated in the Application?

N/A

HC ONLY: Is the rate of syndication the same as or greater than that shown in

the Application?

6.

Is the Development in all other material respects the same as presented in the

Application?

7-

11.

The following are explanations of each item checked "No" in the table above:

1. Since the Application, the Developer’s organizational structure has changed. Please see

Waiver Requests/Special Conditions for further information.

Developer Ownership (From):

Developer Ownership (To):

HTG RIVERVIEW6 DEVELOPER, LLC

Matthew A. Rieger – Manager

HTG Affordable Holdings, LLC - Sole Member

HTG RIVERVIEW6 DEVELOPER, LLC

Matthew A. Rieger – Manager

HTG Florida Developer, LLC – Sole Member

Exhibit E

Page 7 of 43

2. The General Partner, HTG RIVERVIEW6 GP, LLC is comprised of one Member, HTG

Affordable Holdings, LLC and one Manager, Mathew Rieger. Since the Application, the

ownership interests in HTG Affordable Holdings, LLC has changed and was approved by

FHFC’s staff on July 1, 2022.

Ownership (From):

Ownership (To):

HTG Affordable Holdings, LLC

Matthew A. Rieger – Manager

Matthew A. Rieger Investment Trust – 40%

Mathew A. Rieger Irrevocable MGM Trust – 10%

Gina Rieger Irrevocable MGM Trust – 10%

Meredith Branciforte Irrevocable MGM Trust – 10%

Alexandra B. Balogh Trust – 15%

Andrew C. Balogh Trust – 15%

HTG Affordable Holdings, LLC

Matthew A. Rieger – Manager

Matthew A. Rieger Investment Trust – 50%

Mathew A. Rieger Irrevocable MGM Trust – 8.3334%

Gina Rieger Irrevocable MGM Trust – 8.3333%

Meredith Branciforte Irrevocable MGM Trust – 8.3333%

Alexandra B. Balogh Trust – 12.5%

Andrew C. Balogh Trust – 12.5%

3. The Application indicated JPMorgan Chase Bank, N.A. would be providing the

construction and permanent financing; however, Fifth Third Bank will be providing the

construction financing and Grandbridge will be providing the permanent financing. In

addition, the construction loan amount has increased from $14,400,000 to an amount up to

$23,500,000; however, to balance source and uses First Housing anticipates a construction

loan in the amount of $21,452,503. The permanent loan amount has increased from

$5,200,000 to $7,132,000.

4. Since the Application, additional sources have been included, a loan from Manatee County

in the amount of $1,400,000 and a Bradenton CRA forgivable loan in the amount of

$1,300,000.

5. The Total Development Costs (“TDC”) have increased by a total of $11,268,737 or 49.89%

from $22,589,136 to $33,857,873 since the Application. The increase is mainly due to the

increase in construction costs.

6. Since the Application, the HC syndication rate has decreased from $0.94 to $0.93 and the

Syndicator name has changed from Raymond James Tax Credit Funds (“RJTCF”) to

RJAHI.

7. Since the Application, the unit mix has changed, which was approved by FHFC’s staff on

August 31, 2021.

Unit Mix (From)

Unit Mix (To)

(20) 1 Bed/1 Bath – 3 ELI Units

(40) 2 Bed/2 Bath – 6 ELI Units

(20) 3 Bed/2 Bath – 3 ELI Units

80 Total Units

(16) 1 Bed/1 Bath – 3 ELI Units

(48) 2 Bed/2 Bath – 7 ELI Units

(16) 3 Bed/2 Bath – 2 ELI Units

80 Total Units

Exhibit E

Page 8 of 43

8. Since the Application, the legal description has changed and was approved by FHFC’s staff

on August 31, 2021.

9. The Application indicated the Development is the first phase of a multiphase development.

However, according to the 21-Day Items, the Applicant no longer wishes to identify the

Development as a first phase of a multiphase development.

10. The 21-Day Requirements identified HTG Hennessy, LLC as the General Contractor

(“GC”); however, the GC is now Hennessy Construction Services Corp. First Housing

received the Florida Housing Finance Corporations General Contractor Certification form

for Hennessy Construction Services Corp., along with the experience chart.

11. At Application the address was 8th Street W, 8th Street W and 7th Avenue W intersection,

Bradenton. The address is 901 6

th

Avenue West, Bradenton, FL 34205.

The above changes have no substantial material impact to the HC recommendation for this

Development.

Does the Development Team have any FHFC Financed Developments on the Past

Due/Noncompliance Report?

According to the FHFC Asset Management Noncompliance Report, dated June 9, 2020, the

Development Team has the following noncompliance item(s) not in the correction period:

None

According to the FHFC Past Due report, dated September 22, 2022, the Development Team has

the following past due item(s):

None

Strengths:

1. The Principals, Developer, General Contractor, and the Management Company are

experienced in affordable multifamily housing.

2. The Principals have sufficient experience and substantial financial resources to develop

and operate the proposed Development.

Exhibit E

Page 9 of 43

3. Meridian prepared a Market Study for the Development, dated July 27, 2021 (Report Date).

The research indicates there is sufficient demand in the market to support the Development.

Within the competitive market area (“CMA”), the weighted average occupancy rate for

like-kind, existing, stabilized properties was 97%.

4. According to the Market Study, the absorption comparables range from 9 to 133 units per

month, with an average of 47 units per month. Meridian has projected an average

absorption rate of 30 units per month for the Development.

Issues and Concerns:

None

Mitigating Factors:

None

Waiver/Special Conditions:

1. According to the RFA, the Corporation will review the limited partnership agreement or

limited liability company operating agreement language on reserves for compliance with

the RFA requirement. If the limited partnership agreement or limited liability company

operating agreement does not specifically state that the parties will comply with the

Corporation’s RFA requirements, the Corporation will require an amendment of the

agreement and will not issue IRS form(s) 8609 until the amendment is executed and

provided to the Corporation.

The RFA includes language restricting the disposition of any funds remaining in any

operating deficit reserve(s) after the term of the reserve’s original purpose has terminated

or is near termination. The RFA also requires the Corporation to review the limited

partnership agreement or limited liability company operating agreement language on

reserves for compliance with the RFA requirement. While Florida Housing will continue

to require the Applicant to adhere to all requirements in the RFA including the restrictions

on the disposition of any funds in an operating deficit reserve account, Florida Housing

will not monitor the limited partnership agreement or limited liability company operating

agreement language for compliance with these requirements, as this would require analysis

of a legal contract. This deviation in process was included as an Information Item in the

April 29, 2022 FHFC Board meeting.

2. First Housing reviewed a letter, dated February 1, 2022, requesting approval to change the

principals of HTG RIVERVIEW6 DEVELOPER, LLC. Per the RFA, The Principals of

each Developer identified in the Application, including all co-Developers, may be changed

Exhibit E

Page 10 of 43

only by written request of an Applicant to Corporation staff and approval of the Board after

the Applicant has been invited to enter credit underwriting. The request was approved at

the June 17, 2022 FHFC Board meeting.

Additional Information:

1. Based on the TDC per unit limitations in affect as of the April 1, 2022 Board Meeting,

FHFC has set the TDC for Request for Applications 2020-201, exclusive of land costs and

Operating Deficit Reserves (“ODR”), of $437,239 per unit for new construction, mid-rise

(5-6 story) Enhanced Structural Systems (“ESS”) Construction developments. The TDC

for the Development, exclusive of demolition, land costs and operating deficit reserves, is

$31,528,055 or $394,101 per unit, which is within the parameters.

2. FHDC has completed the required minimum first mortgage qualifying test and finds that

the proposed first mortgage amount of $7,132,000 exceeds the minimum requirement of

$6,702,139.

3. The Development will contain approximately 3,765 square feet of commercial space.

Exhibit E

Page 11 of 43

Recommendation:

First Housing recommends an annual 9% HC allocation of $1,699,990 and an annual allocation of

HC CHIRP in the amount of $500,000, for an overall annual HC allocation of $2,199,990 be

awarded to finance the Development.

This recommendation is based upon the assumptions detailed in the Report Summary (Section A)

and Supporting Information and Schedules (Section C). In addition, this recommendation is

subject to the Housing Credit Allocation Recommendation and Contingencies (Section B). This

recommendation is only valid for six months from the date of the report.

The United States is currently under a national emergency due to the spread of the virus known as

COVID-19. The extent of the virus’ impact to the overall economy is unknown. More specifically,

it is unknown as to the magnitude and timeframe the residential rental market (e.g. absorption

rates, vacancy rates, collection losses, appraised value, etc.) and the construction industry (e.g.

construction schedules, construction costs, subcontractors, insurance, etc.) will be impacted.

Recommendations made by First Housing in this report, in part, rely upon assumptions made by

third-party reports that are unable to predict the impacts of the virus.

The reader is cautioned to refer to these sections for complete information.

Prepared by: Reviewed by:

Stephanie Petty Ed Busansky

Senior Credit Underwriter Senior Vice President

Exhibit E

Page 12 of 43

Overview

Construction Financing Sources:

Construction Sources Lender Application Revised Applicant Underwriter

Construction

Interest Rate

Annual

Construction Debt

Service

Regulated Mortgage Lender Firfth Third Bank $14,400,000 $23,200,000 $21,452,503 7.49% $1,606,792

Local Government Subsidy City of Bradenton $460,000 $460,000 $460,000 0.00% $0

Local Government Subsidy Manatee County $0 $1,400,000 $1,400,000 0.00% $0

Local Government Subsidy City of Bradenton CRA $0 $1,300,000 $1,300,000 0.00% $0

HC Equity RJAHI $7,989,150 $4,091,572 $6,137,358 N/A N/A

Deferred Developer Fee HTG RIVERVIEW6 DEVELOPER, LLC $2,888,156 $3,349,039 $3,108,012 N/A N/A

Tota l $25,737,306 $33,800,611 $33,857,873 $1,606,792

First Mortgage:

First Housing received a Term Sheet, dated September 12, 2022, provided by Fifth Third Bank,

which indicates Fifth Third Bank will provide a construction loan in the amount up to $23,500,000.

First Housing has concluded to a construction loan in the amount of $21,452,503, in order to

balance sources and uses. The term of the construction loan will be up to thirty (30) months from

the closing date, with unpaid principal and interest due at maturity. Interest shall accrue on the

outstanding principal balance at a variable rate equal to the Term Secured Overnight Financing

Rate (“SOFR”) plus a spread of 2.50%, with a Term SOFR floor of 0.75%. The construction

interest rate is calculated based upon the SOFR rate of 3.49% (as of October 19, 2022), plus a

2.50% spread, and a 1.50% underwriting cushion, for an “all-in” interest rate of 7.49%.

City of Bradenton

First Housing received a letter, dated January 5, 2022, from the City of Bradenton for construction

and permanent financing in the amount of $460,000. The term of the loan is 17 years with an

interest rate of 1.75%. Annual interest rate-only payments shall commence on the second year

following construction completion and are subject to available cash flow. The annual interest rate

shall also commence to accrue on the second year following construction completion. Any unpaid

accrued interest shall be repaid at the end of the loan term. First Housing is estimating a

construction period of 2 years and a permanent period of 15 years.

Manatee County

First Housing received a letter, dated September 22, 2022, with the proposed terms and conditions

of a loan in the amount of $1,400,000 from Manatee County. A portion or all can be drawn during

construction in 2023 or after substantial completion in 2024. The interest rate will be fixed at the

date of execution of the loan documents based on the greater of i) 1.75%; or ii) half of the

Exhibit E

Page 13 of 43

Applicable Federal Rate (“AFR”) Mid-Term Annual Rate. No interest or capital shall accrue until

conversion and interest payments shall begin after conversion. The total term is 20 years, of which

2 years is for construction and 18 years is for permanent phase. Annual payments of interest only

if cash flow is available after payment of operating expenses and required debt service on the

senior mortgage loan. All remaining unpaid interest shall accrue and will be due in full at maturity

along with the principal balance. As of October 2022, the AFR Mid-Term Annual rate is 3.28%,

of which half is 1.64%; therefore, First Housing concluded to an interest rate of 1.75%.

Bradenton CRA

First Housing received a City of Bradenton, City Council Agenda Memorandum, dated July 20,

2022. The Memorandum included a draft Land Use Restriction Agreement (“LURA”) which

detailed the CRA loan in the amount of $1,300,000. The term of the loan is 15 years following the

issuance of the certificate of occupancy. The interest rate of the loan shall be 0% and shall be non-

amortizing. The initial disbursement of the loan will in the amount of $150,000 and shall be made

to the owner within 30 days following commencement of construction. The remainder of the loan

shall be disbursed within 30 days following the achievement of 90% construction completion. The

loan is forgivable at the sole discretion of the CRA.

Housing Credit Equity:

The Applicant applied to the ITP 2022 CHIRP for additional HC in order to assist the Development

with increases related to market inflation. As the Applicant has an active HC Award, the maximum

amount of the HC CHIRP funding allowable is $500,000. The amount of the HC CHIRP has been

sized to $500,000. Please note the equity letter from RJAHI includes the HC CHIRP of $500,000

in addition to the original requested annual HC amount of $1,699,990.

First Housing received a letter of intent (“LOI”), dated September 8, 2022, which indicates that

RJAHI will attempt to effect a closing of an investment by a Fund sponsored by RJAHI and will

acquire 99.99% ownership interest in the Applicant. Based on the LOI, the annual HC allocation

is estimated to be in the amount of $2,199,990 and a syndication rate of $0.93 per dollar. RJAHI

anticipates a net capital contribution of $20,457,861 and has committed to make available 30.00%

or $6,137,358 of the total net equity during the construction period. An additional $14,320,503

will be available at stabilization and upon receipt of the Form 8609. The first installment, in the

amount of $3,068,679 or 15.00%, meets the FHFC requirement that 15% of the total equity must

be contributed at or prior to the closing.

Deferred Developer Fee:

To balance the sources and uses of funds during construction, the Developer is required to defer

$3,108,012 or approximately 71.36% of the total Developer Fee of $4,355,593.

Exhibit E

Page 14 of 43

Permanent Financing Sources:

Permanent Sources Lender Application Re

vised Applicant Underwriter Term Yrs. Amort. Yrs.

Interest

Rate

Annual Debt

Service

Regulated Mortgage Lender Grandbridge/Freddie Mac $5,200,000 $7,132,000 $7,132,000 15 40 7.09% $537,450

Local Government Subsidy City of Bradenton $460,000 $460,000 $460,000 15 0 1.75% $8,050

Local Government Subsidy Manatee County $0 $1,400,000 $1,400,000 18 0 1.75% $24,500

Local Government Subsidy City of Bradenton CRA $0 $1,300,000 $1,300,000 15 0 0.00% $0

HC Equity RJAHI $15,978,300 $20,457,861 $20,457,861 N/A N/A N/A N/A

Deferred Developer Fee HTG RIVERVIEW6 DEVELOPER, LLC $2,888,156 $3,050,750 $3,108,012 N/A N/A N/A N/A

Total $24,526,456 $33,800,611 $33,857,873 $570,000

First Mortgage:

First Housing received a Mortgage Loan Term Sheet from Grandbridge, dated July 11, 2022. The

permanent loan is in the maximum amount of $7,132,000, which is subject to: i) maximum 90%

loan-to-value ratio and a minimum 1.15 debt service coverage ratio; and ii) additional lender terms.

The term of the permanent loan is 15 years with a 40-year amortization schedule. The interest rate

will be fixed prior to or at closing and will be based on the 10-year U.S. Treasury, with a floor of

2.74%, plus a spread of 2.95%. For underwriting purposes, the interest is calculated based upon

the current 10 Year U.S. Treasury rate of 4.14% (as of October 19, 2022) and a spread of 2.95%,

for an all-in interest rate of 7.09%.

City of Bradenton

First Housing received a letter, dated January 5, 2022, from the City of Bradenton for construction

and permanent financing in the amount of $460,000. The term of the loan is 17 years with an

interest rate of 1.75%. Annual interest rate-only payments shall commence on the second year

following construction completion and are subject to available cash flow. The annual interest rate

shall also commence to accrue on the second year following construction completion. Any unpaid

accrued interest shall be repaid at the end of the loan term. First Housing is estimating a

construction period of 2 years and a permanent period of 15 years.

Manatee County

First Housing received a letter, dated September 22, 2022, with the proposed terms and conditions

of a loan in the amount of $1,400,000 from Manatee County. A portion or all can be drawn during

construction in 2023 or after substantial completion in 2024. The interest rate will be fixed at the

date of execution of the loan documents based on the greater of: i) 1.75%; or ii) half of AFR Mid-

Term Annual Rate. Interest payments shall begin after conversion. The total term is 20 years, of

which 2 years is for construction and 18 years is for permanent phase. Annual payments of interest

only if cash flow is available after payment of operating expenses and required debt service on the

Exhibit E

Page 15 of 43

senior mortgage loan. All remaining unpaid interest shall accrue and will be due in full at maturity

along with the principal balance. As of October 2022, the AFR Mid-Term Annual rate is 3.28%,

of which half is 1.64%; therefore, First Housing concluded to an interest rate of 1.75%.

Bradenton CRA

First Housing received a City of Bradenton, City Council Agenda Memorandum, dated July 20,

2022. The Memorandum included a draft LURA which detailed the CRA loan in the amount of

$1,300,000. The term of the loan is 15 years following the issuance of the certificate of occupancy.

The interest rate of the loan shall be 0% and shall be non-amortizing. The initial disbursement of

the loan will in the amount of $150,000 and shall be made to the owner within 30 days following

commencement of construction. The remainder of the loan shall be disbursed within 30 days

following the achievement of 90% construction completion. The loan is forgivable at the sole

discretion of the CRA.

Housing Credit Equity:

The Applicant applied to the ITP 2022 CHIRP for additional HC in order to assist the Development

with increases related to market inflation. As the Applicant has an active HC Award, the maximum

amount of the HC CHIRP funding allowable is $500,000. The amount of the HC CHIRP has been

sized to $500,000. Please note the equity letter from RJAHI includes the HC CHIRP of $500,000

in addition to the original requested annual HC amount of $1,699,990.

First Housing has reviewed an executed equity letter, dated September 8, 2022, indicating RJAHI

shall attempt to effect a closing of an investment by a Fund sponsored by RJAHI and will provide

HC equity as follows:

Exhibit E

Page 16 of 43

Syndication Contributions

Capital Contributions Amount Percentage of Total Wh

en Due

1st Installment $3,068,679 15.00%

Closing

2nd Installment $1,022,893 5.00%

Paid at 50% Construction

Completion

3rd Installment $2,045,786 10.00%

Paid at 98% Construction

Completion

4th Installment $14,320,503 70.00%

Paid at project stabilization

and receipt of 8609s

Tota l $20,457,861 100.00%

Annual Credit Per Syndication Agreement

$2,199,990

Calculated HC Exchange Rate

$0.93

Limited Partner Ownership Percentage

99.99%

Proceeds Available During Construction

$6,137,358

Deferred Developer Fee:

To balance the sources and uses of funds during the permanent period the Developer is required

to defer $3,108,012 or approximately 71.36% of the total Developer Fee of $4,355,593. This meets

the CHIRP Requirement that the Applicant must defer at least 30% of their Developer Fee.

Exhibit E

Page 17 of 43

Uses of Funds

CONSTRUCTION COSTS:

Applicant Costs

Revised

Applicant Costs

Underwriters

Total Costs - CUR

Cost Per Unit

HC Ineligible

Costs - CUR

Demolition

$50,000 $0 $50,000 $625 $50,000

New Rental Units

$11,923,570 $18,463,289 $16,483,124 $206,039 $392,376

Si te Work

$0 $0 $1,930,165 $24,127 $193,017

Constr. Contr. Costs subject to GC Fee

$11,973,570 $18,463,289 $18,463,289 $230,791 $635,392

General Conditions

$0 $1,107,797 $1,107,797 $13,847 $0

Overhea d

$0 $369,266 $369,266 $4,616 $0

Profit

$1,669,300 $553,899 $553,899 $6,924 $0

General Liability Insurance

$0 $118,165 $118,165 $1,477 $0

Payment and Performance Bonds

$0 $152,322 $152,322 $1,904 $0

Total Constructi on Contract/Costs

$13,642,870 $20,764,738 $20,764,738 $259,559 $635,392

Hard Cost Contingency

$679,643 $1,038,237 $1,038,236 $12,978 $0

FF&E paid outside Constr. Contr.

$100,000 $275,000 $275,000 $3,438 $0

Other: Si te Prepara ti on

$0 $20,000 $20,000 $250 $0

Other: Construction-offsi te

$50,000 $50,000 $625 $50,000

$14,422,513 $22,147,975 $22,147,974 $276,850 $685,392

Total Construction Costs:

Notes to the General Development Costs:

1. The Applicant has provided an executed construction contract, dated September 15, 2022.

The contract is a Standard Form of Agreement between HTG RIVERVIEW6, LTD.

(“Owner”) and Hennessy Construction Services (“Contractor”) where the basis of payment

is the Cost of Work Plus a fee with a Guaranteed Maximum Price (“GMP”) in the amount

of $20,764,738. The contract requires a substantial completion date no later than 425 days

from the date of commencement. A 10% retainage on the Cost of the Work completed will

be withheld per draw until 50% of the GMP, no retainage thereafter.

2. First Housing utilized the Schedule of Values (“SOV”) to break out the construction costs.

3. The Schedule of Values does not breakout the demolition costs as it is lumped within the

Site Work costs of $1,980,165. According to an email dated October 5, 2022, the Applicant

is estimating demolition costs at $50,000.

4. The ineligible cost of $392,376 includes an ineligible cost of $297,600 for the commercial

hard costs and the cost of purchasing washers/dryers. Since the Applicant will be renting

the washers/dryers to the residents, the estimated cost of $94,776 to purchase these

appliances is ineligible.

5. First Housing has estimated that 10% of the site work as ineligible.

6. The GC Fees are within the maximum 14% of hard costs allowed by Rule Chapter 67-48.

The GC Fee stated herein is for credit underwriting purposes only, and the final GC fee

Exhibit E

Page 18 of 43

will be determined pursuant to the final cost certification process as per Rule Chapter 67-

48.023, F.A.C.

7. The GC Contract includes $225,713 in Allowances, which is 1.09% of the GMP.

According to Global Realty Services Group (“GRS”), the allowances are within an

acceptable range for the scope of work indicated.

All ROW & Offsite Landscape & Irrigation

$6,280

Irrigation Well w/Power (Included in Landscaping

Number)

$16,500

Closeout ALTA Survey

$5,000

Furnish & Install Primary Conduit

$42,000

Fire Department BDA System (Raceways & Wiring)

$102,451

CCTV/Access Control

$40,122

Common Area Interior Millwork: Shelving, Slatwall,

& Decorative Items

$8,360

Common Area Window Coverings

$5,000

Total

$225,713

8. Hard Cost Contingency is within 5% of total construction costs, as allowed for new

construction developments by Rule Chapter 67-48.

Exhibit E

Page 19 of 43

GENERAL DEVELOPMENT COSTS:

Applicant Costs

Revised

Applicant Costs

Underwriters

Total Costs - CUR

Cost Per Unit

HC Ineligible

Costs - CUR

Accounting Fees

$40,000 $25,000 $25,000 $313 $6,250

Appraisal

$5,500 $7,000 $7,000 $88 $0

Archi tect's Fee - La nds ca pe

$0 $7,000 $7,000 $88 $0

Architect's Fee - Site/Building Design

$339,822 $348,200 $348,200 $4,353 $0

Archi tect's Fee - Supervi s i on

$57,250 $40,500 $40,500 $506 $0

Building Permits

$160,000 $100,000 $100,000 $1,250 $0

Builder's Risk Insurance

$119,236 $184,633 $184,633 $2,308 $0

Engi neeri ng Fees

$55,250 $84,250 $84,250 $1,053 $0

Environmental Report

$10,000 $14,800 $14,800 $185 $0

FHFC Admi nis trative Fees

$152,999 $197,999 $197,999 $2,475 $197,999

FHFC Application Fee

$3,000 $3,000 $3,000 $38 $3,000

FHFC Credit Underwriting Fee

$17,845 $17,845 $19,717 $246 $19,717

FHFC Compliance Fee

$212,332 $198,506 $223,041 $2,788 $223,041

Impact Fee

$450,000 $556,859 $556,859 $6,961 $0

Lender Inspection Fees / Const Admin

$90,000 $65,000 $65,000 $813 $0

Green Bui ldi ng Cert. (LEED, FGBC, NAHB)

$20,000 $25,000 $25,000 $313 $0

Insurance

$55,001 $64,000 $64,000 $800 $0

Lega l Fees - Organizati onal Costs

$200,000 $160,000 $160,000 $2,000 $48,000

Market Study

$5,000 $5,000 $5,500 $69 $5,500

Marketing and Advertising

$75,000 $71,000 $71,000 $888 $71,000

Plan and Cost Review Analysis

$0 $5,000 $5,000 $63 $0

Property Taxes

$92,000 $68,931 $68,931 $862 $0

Soil Test

$12,000 $17,200 $17,200 $215 $0

Survey

$25,000 $25,000 $25,000 $313 $0

Tenant Relocati on Cos ts

$122,291 $0 $0 $0 $0

Title Insurance and Recording Fees

$195,800 $118,303 $118,303 $1,479 $11,830

Utility Connection Fees

$0 $268,000 $268,000 $3,350 $0

Soft Cost Contingency

$125,766 $135,401 $137,496 $1,719 $0

Other: Organizational Costs

$0 $10,000 $10,000 $125 $0

Other: FHFC Proces si ng Fees

$0 $0 $35,000 $438 $35,000

$2,641,092 $2,823,427 $2,887,429 $36,093 $621,337

Total General Development Costs:

Notes to the General Development Costs:

1. General Development Costs are the Applicant's updated estimates, which appear

reasonable.

2. First Housing has utilized actual costs for the Market Study.

3. FHFC Compliance Fee of $223,041 is based on the compliance fee calculator spreadsheet

provided by FHFC.

4. The FHFC Administrative Fee is based on 9% of the recommended annual housing credit

allocation.

5. The FHFC Credit Underwriting Fee includes an original underwriting fee of $14,721 and

a HC CHIRP Underwriting Fee of $4,996.

Exhibit E

Page 20 of 43

6. The Applicant provided a Professional Services Proposal between Abney + Abney Green

Solutions and HTG RIVERVIEW6, LTD. The Agreement is for National Green Building

Standard (“NGBS”) Administration and Green Verification services.

7. Organizational Costs of $10,000 is reimbursement for all filling fees associated with the

creation of the entities involved in the transaction.

8. FHFC Processing Fees of $35,000 includes a NOC Extension Fee of $10,000, LPA

Extension Fee of $10,000, CUR Extension Fee of $5,000, 10% Extension Fee of $5,000,

and a Site Control Extension Fee of $5,000.

9. The Underwriter adjusted Soft Cost Contingency to be 5% of the General Development

Costs, less the contingency as allowed for new construction developments.

Applicant Costs

Revised

Applicant Costs

Underwriters

Total Costs - CUR

Cost Per Unit

HC Ineligible

Costs - CUR

Construction Loan Origination Fee

$144,000 $176,250 $117,500 $1,469 $0

Construction Loan Closing Costs

$28,800 $47,000 $47,000 $588 $0

Construction Loan Interest

$752,175 $1,767,092 $1,799,607 $22,495 $921,399

Permanent Loan Application Fee

$0 $0 $11,632 $145 $11,632

Permanent Loan Origination Fee

$52,000 $71,320 $71,320 $892 $71,320

Permanent Loan Closing Costs

$10,400 $10,000 $10,000 $125 $10,000

Other: Legal - Lender

$0 $55,000 $55,000 $688 $27,500

Other: Syndication Fees

$0 $25,000 $25,000 $313 $25,000

Other: Predevel opment Loan Interest

$0 $50,000 $50,000 $625 $50,000

$987,375 $2,201,662 $2,187,059 $27,338 $1,116,851

$18,050,980 $27,173,064 $27,222,462 $340,281 $2,423,580

FINANCIAL COSTS:

Total Financial Costs:

Dev. Costs before Acq., Dev. Fee & Reserves

Notes to the Financial Costs:

1. The Construction Loan Origination Fee is based on 0.50% of the construction loan in the

amount of $23,500,000.

2. The Construction Loan Interest of $1,799,607 is based an interest rate of 7.49% on a loan

amount of $21,452,503, an estimated 2 year term, and an average outstanding loan balance

of 56%.

3. The Permanent Loan Application Fee includes a Freddie Mac Application Fee equal to the

greater of $3,000 or 0.1% of the Loan amount and a Lender’s Processing Fee of $4,500.

Exhibit E

Page 21 of 43

4. The Permanent Loan Origination Fee is based on 1% of the permanent loan in the amount

of $7,132,000.

5. The Predevelopment Loan Interest is payable to RJAHI. First Housing received a Second

Amended and Restated Promissory Note, dated October 21, 2021, where HTG Riverview6,

Ltd. promises to pay to the order of RJAHI the principal sum of $1,000,000.

Applicant Costs

Revised

Applicant Costs

Underwriters

Total Costs - CUR

Cost Per Unit

HC Ineligible

Costs - CUR

$0 $0 $0 $

0 $0

NON-LAND ACQUISITION COSTS

Total Non-Land Acquisition Costs:

Notes to the Non-Land Acquisition Costs:

1. As this is new construction, there are no non-land acquisition costs.

Applicant Costs

Revised

Applicant Costs

Underwriters

Total Costs - CUR

Cost Per Unit

HC Ineligible

Costs - CUR

Devel oper Fee - Unapportioned

$2,888,156 $4,347,729 $4,355,593 $54,445 $0

$2,888,156 $4,347,729 $4,355,593 $54,445 $0

Total Other Development Costs:

DEVELOPER FEE ON NON-ACQUISTION COSTS

Notes to the Other Development Costs:

1. The recommended Developer Fee does not exceed 16% of total development cost before

Developer Fee and Operating Deficit Reserves as allowed by RFA 2020-201 and Rule

Chapter 67-48.

Applicant Costs

Revised

Applicant Costs

Underwriters

Total Costs - CUR

Cost Per Unit

HC Ineligible

Costs - CUR

Land

$1,650,000 $2,026,750 $2,026,750 $25,334 $2,026,750

$1,650,000 $2,026,750 $2,026,750 $25,334 $2,026,750

LAND ACQUISITION COSTS

Total Acquisition Costs:

Notes to Acquisition Costs:

1. First Housing received five Settlement Statements with a total purchase price of

$2,026,750.

i. First Housing received a Buyer’s and Seller’s Combined Closing Statement, dated

March 28, 2022, between GCAPS Property Group LLC and HTG Riverview6, Ltd.

which has a purchase price of $120,000.

ii. First Housing received a Buyer’s and Seller’s Combined Closing Statement, dated

March 28, 2022, between Liberty Rains, LLC and HTG Riverview6, Ltd. which

has a purchase price of $120,000.

Exhibit E

Page 22 of 43

iii. First Housing received a Closing Statement, dated June 23, 2022, between Ernest

S. Marshall and Patricia K. Marshall, individually and as Co-Trustees of the

Revocable Trust Agreement of Ernest S. Marshall & Patricia K. Marshall, dated

June 23, 2016 and HTG Riverview6, Ltd., which has a purchase price of

$1,196,750.

iv. First Housing received a Closing Statement, dated July 28, 2022, between Daniel

G. Anderson and HTG Riverview6, Ltd. which has a purchase price of $190,000.

v. First Housing received a Closing Statement, dated September 7, 2022, between

Richard Lewis West and Heather R. West and HTG Riverview6, Ltd. which has a

purchase price of $400,000.

2. The appraisal, dated October 28, 2022, indicated that the market value “as is”, as of August

2, 2022, is $2,040,000. Therefore, the appraisal supports the total purchase price.

Applicant Costs

Revised

Applicant Costs

Underwriters

Total Costs - CUR

Cost Per Unit

HC Ineligible

Costs - CUR

Debt Servi ce Coverage Reserve (Syndicator)

$0 $253,068 $253,068 $3,163 $253,068

$0 $253,068 $253,068 $3,163 $253,068

RESERVE ACCOUNTS

Total Reserve Accounts:

Notes to Reserve Accounts:

1. An ODR in the estimated amount of $253,068 and is required by the Syndicator. In

exchange for receiving funding from the Corporation, the Corporation reserves the

authority to restrict the disposition of any funds remaining in any operating deficit

reserve(s) after the term of the reserve’s original purpose has terminated or is near

termination. Authorized disposition uses are limited to payments towards any outstanding

loan balances of the Development funded from the Corporation, any outstanding

Corporation fees, any unpaid costs incurred in the completion of the Development (i.e.,

deferred Developer Fee), the Development’s capital replacement reserve account

(provided, however, that any operating deficit reserve funds deposited to the replacement

reserve account will not replace, negate, or otherwise be considered an advance payment

or pre-funding of the Applicant’s obligation to periodically fund the replacement reserve

account), the reimbursement of any loan(s) provided by a partner, member or guarantor as

set forth in the Applicant’s organizational agreement (i.e., operating or limited partnership

agreement whereby its final disposition remains under this same restriction. The actual

direction of the disposition is at the Applicant’s discretion so long as it is an option

permitted by the Corporation. In no event, shall the payment of amounts to the Applicant

or the Developer from any operating deficit reserve established for the Development cause

the Developer Fee or General Contractor fee to exceed the applicable percentage

limitations provided for in this RFA.

Exhibit E

Page 23 of 43

At the end of the Compliance Period, any remaining balance of the ODR less amounts that

may be permitted to be drawn (which includes Deferred Developer Fee and

reimbursements for authorized member/partner and guarantor loan(s) pursuant to the

operating/partnership agreement), will be used to pay FHFC loan debt; if there is no FHFC

loan debt on the proposed Development at the end of the Compliance Period, any remaining

balance shall be used to pay any outstanding FHFC fees. If any balance is remaining in the

ODR after the payments above, the amount should be placed in a Replacement Reserve

account for the Development. In no event shall the payments of amounts to the Applicant

or the Developer from the Reserve Account cause the Developer Fee or General Contractor

Fee to exceed the applicable percentage limitations provided for in Rule Chapter 67-48.

Any and all terms and conditions of the ODR must be acceptable to Florida Housing, its

legal counsel, and its Servicer.

Applicant Costs

Revised

Applicant Costs

Underwriters

Total Costs - CUR

Cost Per Unit

HC Ineligible

Costs - CUR

$22,589,136 $33,800,611 $33,857,873 $423,223 $4,703,398

TOTAL DEVELOPMENT COSTS:

TOTAL DEVELOPMENT COSTS

Notes to Total Development Costs:

1. The Total Development Costs has increased by a total of $11,268,737 or 49.89% from

$22,589,136 to $33,857,873 since the Application. The increase is mainly due to the

increase in construction costs.

Exhibit E

Page 24 of 43

Operating Pro Forma – RIVERVIEW6

FINANCIAL COSTS:

Year 1

Year 1

Per Unit

OPERATING PRO FORMA

Gross Potential Rental Income $1,005,924 $12,574

O

ther Income

Ancillary Income $84,211 $1,053

Miscellaneous $68,000 $850

Gross Potential Income $1,158,135 $14,477

Less:

Physical Vac. Loss Percentage: 4.00% $46,325 $579

Collection Loss Percentage: 1.00% $11,581 $145

Total Effective Gross Income $1,100,228 $13,753

Fi xed:

Real Estate Taxes $76,000 $950

Insurance $88,000 $1,100

Variable:

Management Fee Percentage: 4.00% $44,009 $550

General and Administrative $36,000 $450

Payroll Expenses $112,000 $1,400

Utilities $36,000 $450

Marketing and Advertising $4,000 $50

Maintenance and Repairs/Pest Control $72,000 $900

Reserve for Replacements $24,000 $300

Total Expenses $492,009 $6,150

Net Operating Income $608,219 $7,603

Debt Service Payments

First Mortgage - Grandbridge/Freddie Mac $537,450 $6,718

Second Mortgage - City of Bradenton $8,050 $101

Third Mortgage - Manatee County $24,500 $306

Fourth Mortgage - Bradenton CRA $0 $0

Total Debt Service Payments $570,000 $7,125

Cash Flow after Debt Service $38,219 $478

FINANCIAL COSTS:

Annual Per Unit

Debt Service Coverage Ratios

DSC - First Mortgage plus Fees 1.13x

DS

C - Second Mortgage plus Fees 1.11x

DSC - Third Mortgage plus Fees 1.07x

Financial Ratios

Operating Expense Ratio 44.72%

Break-even Economic Occupancy Ratio (all debt) 91.90%

INCOME:

EXPENSES:

Please note, the subordinate debt is payable from available cash flow. First Housing has included

the payments for illustrative purposes only.

Exhibit E

Page 25 of 43

Notes to the Operating Pro Forma and Ratios:

1. The rent levels are based on the 2022 maximum LIHTC rents published on FHFC’s website

for Manatee County less the applicable utility allowance. See the chart below.

Manatee County, North Port-Sarasota-Bradenton MSA

1,005,924$

80

66,016

3

2.0

7

1,093

60%

$139

1,432$

1,432$

1,246$

1,246$

1,246$

2

2.0

22

$1,571

1,208$

1,208$

3

2.0

7

1,093

70%

$1,347

$139

1,208$

1,208$

3

2.0

2

1,093

30%

$673

$139

534$

534$

534$

1,432$

120,288$

534$

12,816$

101,472$

1,432$

803

70%

$1,359

$1,165

469$

469$

39,396$

$113

469$

469$

1,052$

239,856$

$113

1,052$

1,052$

1,052$

328,944$

$113

1,246$

2

2.0

19

803

60%

$582

2

2.0

7

803

30%

1,032$

1,032$

1,032$

1,032$

86,688$

62,640$

1

1.0

7

624

70%

$1,134

$102

$102

870$

870$

870$

870$

384$

13,824$

1

1.0

6

624

60%

$972

$486

$102

384$

384$

384$

1

1.0

3

624

30%

High

HOME

Rents

Gross HC

Rent

Bed

Rooms

Bath

Rooms

Units

Square

Feet

AMI%

Low

HOME

Rents

Appraiser

Rents

CU Rents

Annual Rental

Income

Utility

Allow.

Net

Restricted

Rents

PBRA

Contr

Rents

Applicant

Rents

2. The utility allowances are based on an Energy Consumption Model Estimate for electricity

prepared by Matern Professional Engineering, Inc. (“Matern”) and a Manatee County

Utility Allowance Schedule, dated January 1, 2022, for water and sewer. The utility

allowance for electricity was approved by David Hines at Florida Housing on September

6, 2022, for credit underwriting purposes.

3. The appraisal projected a vacancy and collection loss of 3.5%. First Housing utilized a

vacancy and collection loss of 5.0% to be more conservative.

4. The Development will include approximately 3,765 s.f. of commercial space; however, the

Appraisal indicates only 3,198 s.f. Currently no letters of interest are available. The

Appraiser projected commercial income of $80,000, which includes a 5% vacancy loss.

First Housing concluded to $84,211, as a 5% vacancy and collection loss is applied to this

number, resulting in the same retail income of $80,000.

5. The Miscellaneous Income category includes other income from the property including

revenues from administrative fees, washer/dryer, vending machines, and miscellaneous

sources. The Miscellaneous Income is projected at $68,000 or $850/unit/year and

supported by the appraisal.

Exhibit E

Page 26 of 43

6. Based upon operating data from comparable properties, third-party reports (Appraisal and

Market Study) and the Credit Underwriter's independent due diligence, First Housing

represents that, in its professional opinion, estimates for Rental Income, Vacancy, Other

Income, and Operating Expenses fall within a band of reasonableness.

7. The appraisal concluded to an insurance amount of $74,000 or $925/unit. First Housing

concluded to an insurance amount of $88,000 or $1,100/unit to be more conservative.

8. The Applicant has submitted an executed Management Agreement, dated February 9, 2022

between HTG RIVERVIEW6, LTD. (“Owner”) and HTG Management, LLC (“Agent”).

The agreement states the Agent will receive a monthly fee of $2,500 or 4% per month of

gross collections, whichever is greater. The Manager shall be entitled to receive an

additional 2% management fee, subject to available cash low as an incentive management

fee, not to exceed a total management fee of 6%.

9. Residents are responsible for electric and water/sewer expenses. The landlord is

responsible for trash and pest control expenses.

10. Replacement Reserves of $300 per unit per year are required per Rule 67-48. Per an email,

dated October 5, 2022, RJAHI is requiring Replacement Reserves at $300 per unit,

increasing by 3% per year.

11. The Break-even Economic Occupancy Ratio includes all debt; however, the subordinate

debt is payable from available cash flow. This ratio would improve to 89.09% if the

subordinate debt payments were not included in the calculation.

12. Refer to Exhibit 1, Page 1 for a 15-Year Pro Forma, which reflects rental income increasing

at an annual rate of 2%, and expenses increasing at an annual rate of 3%.

Exhibit E

Page 27 of 43

Section B

Housing Credit Allocation Recommendation & Contingencies

Exhibit E

Page 28 of 43

Housing Credit Allocation Recommendation

First Housing Development Corporation has estimated a preliminary annual 9% HC allocation of

$1,699,990 and an annual HC CHRIP allocation of $500,000 for an overall annual HC allocation

of $2,199,990. Please see the HC Allocation Calculation in Exhibit 2 of this report for further

details.

Contingencies

The HC allocation will be contingent upon the receipt and satisfactory review of the following

items by First Housing and Florida Housing by the deadline established in the Preliminary

Determination. Failure to submit these items within this time frame may result in forfeiture of the

HC Allocation.

1. Satisfactory resolution of any outstanding past due or noncompliance issues applicable to

the Development Team prior to closing.

2. This report is subject to Florida Housing’s Asset Management Department’s approval of

the Applicant’s selection of management company.

3. This report is subject to continued approval of the management agent by Florida Housing.

4. The General Contractor shall secure a payment and performance bond equal to 100 percent

of the total construction cost.

5. Receipt of executed FHFC Fair Housing, Section 504, and ADA as built certification forms

122, 127, 129.

6. At least 30% of the Developer Fee must be deferred pursuant to the requirements of the

CHIRP.

7. Any other reasonable requirements of the Servicer, Florida Housing, or its Legal Counsel.

Exhibit E

Page 29 of 43

Section C

Supporting Information & Schedules

Exhibit E

Page 30 of 43

15-Year Pro Forma

FINANCIAL COSTS:

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11 Year 12 Year 13 Year 14 Year 15

OPERATING PRO FORMA

Gross Potential Rental Income $1,005,924 $1,026,042 $1,046,

563 $1,067,495 $1,088,844 $1,110,621 $1,132,834 $1,155,490 $1,178,600 $1,202,172 $1,226,216 $1,250,740 $1,275,755 $1,301,270 $1,327,295

Other Income

Ancillary Income $84,211 $85,895 $87,613 $89,365 $91,153 $92,976 $94,835 $96,732 $98,667 $100,640 $102,653 $104,706 $106,800 $108,936 $111,115

Miscellaneous $68,000 $69,360 $70,747 $72,162 $73,605 $75,077 $76,579 $78,111 $79,673 $81,266 $82,892 $84,549 $86,240 $87,965 $89,725

Gross Potential Income $1,158,135 $1,181,298 $1,204,924 $1,229,022 $1,253,603 $1,278,675 $1,304,248 $1,330,333 $1,356,940 $1,384,079 $1,411,760 $1,439,995 $1,468,795 $1,498,171 $1,528,135

Less:

Physical Vac. Loss Percentage: 4.00% $46,325 $47,252 $48,197 $49,161 $50,144 $51,147 $52,170 $53,213 $54,278 $55,363 $56,470 $57,600 $58,752 $59,927 $61,125

Collection Loss Percentage: 1.00% $11,581 $11,813 $12,049 $12,290 $12,536 $12,787 $13,042 $13,303 $13,569 $13,841 $14,118 $14,400 $14,688 $14,982 $15,281

Total Effective Gross Income $1,100,228 $1,122,233 $1,144,677 $1,167,571 $1,190,922 $1,214,741 $1,239,036 $1,263,816 $1,289,093 $1,314,875 $1,341,172 $1,367,996 $1,395,355 $1,423,263 $1,451,728

Fi xe d:

Real Estate Taxes $76,000 $78,280 $80,628 $83,047 $85,539 $88,105 $90,748 $93,470 $96,275 $99,163 $102,138 $105,202 $108,358 $111,609 $114,957

Insurance $88,000 $90,640 $93,359 $96,160 $99,045 $102,016 $105,077 $108,229 $111,476 $114,820 $118,265 $121,813 $125,467 $129,231 $133,108

Variable:

Management Fee Percentage: 4.00% $44,009 $44,889 $45,787 $46,703 $47,637 $48,590 $49,561 $50,553 $51,564 $52,595 $53,647 $54,720 $55,814 $56,931 $58,069

General and Administrative $36,000 $37,080 $38,192 $39,338 $40,518 $41,734 $42,986 $44,275 $45,604 $46,972 $48,381 $49,832 $51,327 $52,867 $54,453

Payroll Expenses $112,000 $115,360 $118,821 $122,385 $126,057 $129,839 $133,734 $137,746 $141,878 $146,135 $150,519 $155,034 $159,685 $164,476 $169,410

Utilities $36,000 $37,080 $38,192 $39,338 $40,518 $41,734 $42,986 $44,275 $45,604 $46,972 $48,381 $49,832 $51,327 $52,867 $54,453

Marketing and Advertising $4,000 $4,120 $4,244 $4,371 $4,502 $4,637 $4,776 $4,919 $5,067 $5,219 $5,376 $5,537 $5,703 $5,874 $6,050

Maintenance and Repairs/Pest Control $72,000 $74,160 $76,385 $78,676 $81,037 $83,468 $85,972 $88,551 $91,207 $93,944 $96,762 $99,665 $102,655 $105,734 $108,906

Reserve for Replacements $24,000 $24,720 $25,462 $26,225 $27,012 $27,823 $28,657 $29,517 $30,402 $31,315 $32,254 $33,222 $34,218 $35,245 $36,302

Total Expenses $492,009 $506,329 $521,070 $536,245 $551,865 $567,944 $584,497 $601,536 $619,077 $637,133 $655,721 $674,857 $694,555 $714,834 $735,709

Net Operating Income $608,219 $615,903 $623,607 $631,326 $639,058 $646,796 $654,539 $662,280 $670,016 $677,741 $685,451 $693,139 $700,800 $708,429 $716,018

Debt Service Payments

First Mortgage - Grandbridge/Freddie Mac $537,450 $537,450 $537,450 $537,450 $537,450 $537,450 $537,450 $537,450 $537,450 $537,450 $537,450 $537,450 $537,450 $537,450 $537,450

Second Mortgage - City of Bradenton $8,050 $8,050 $8,050 $8,050 $8,050 $8,050 $8,050 $8,050 $8,050 $8,050 $8,050 $8,050 $8,050 $8,050 $8,050

Third Mortgage - Manatee County $24,500 $24,500 $24,500 $24,500 $24,500 $24,500 $24,500 $24,500 $24,500 $24,500 $24,500 $24,500 $24,500 $24,500 $24,500

Fourth Mortgage - Bradenton CRA $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Debt Service Payments $570,000 $570,000 $570,000 $570,000 $570,000 $570,000 $570,000 $570,000 $570,000 $570,000 $570,000 $570,000 $570,000 $570,000 $570,000

Cash Flow after Debt Service $38,219 $45,904 $53,607 $61,327 $69,058 $76,797 $84,539 $92,281 $100,016 $107,742 $115,451 $123,139 $130,801 $138,429 $146,019

FINANCIAL COSTS:

Annual Annual Annual Annual Annual Annual Annual Annual Annual Annual Annual Annual Annual Annual Annual

Debt Service Coverage Ratios

DSC - First Mortgage plus Fees 1.13 1.15

1.16 1.17 1.19 1.20 1.22 1.23 1.25 1.26 1.28 1.29 1.30 1.32 1.33

DSC - Second Mortgage plus Fees 1.11 1.13 1.14 1.16 1.17 1.19 1.20 1.21 1.23 1.24 1.26 1.27 1.28 1.30 1.31

DSC - Third Mortgage plus Fees 1.07 1.08 1.09 1.11 1.12 1.13 1.15 1.16 1.18 1.19 1.20 1.22 1.23 1.24 1.26

Financial Ratios

Operating Expense Ratio 44.72% 45.12% 45.52% 45.93% 46.34% 46.75% 47.17% 47.60% 48.02% 48.46% 48.89% 49.33% 49.78% 50.22% 50.68%

Break-even Economic Occupancy Ratio (all debt) 91.90% 91.31% 90.75% 90.21% 89.69% 89.19% 88.72% 88.26% 87.83% 87.42% 87.02% 86.65% 86.29% 85.96% 85.64%

INCOME:

EXPENSES:

Please note, the subordinate debt payments are payable from available cash flow but have been show for illustrative purposes. According to an email,

dated October 5, 2022, RJAHI will require replacement reserves at $300 per unit per year, increasing 3% per year.

Exhibit E

Page 31 of 43

HC Allocation Calculation

Section I: Qualified Basis Calculation

Total Development Costs(including land and ineligible Costs)

$33,857,873

Less Land Costs

$2,026,750

Less Federal Grants and Loans

$0

Less Other Ineligible Costs

$2,676,648

Total Eligible Basis

$29,154,475

Applicable Fraction

100%

DDA/QCT Basis Credit

130%

Qualified Basis

$37,900,818

Housing Credit Percentage

9.00%

Annual Housing Credit Allocation

$3,411,074

Notes to the Qualified Basis Calculation:

1. Other ineligible costs include, demolition, retail space, washer/dryers, site work, off-site

construction, accounting fees, FHFC fees, legal, market study, advertising/marketing fees,

title insurance and recoding fees, construction interest, permanent loan costs, and operating

deficit reserves.

2. The Development has a 100% set-aside; therefore, the Applicable Fraction is 100%.

3. For purposes of this analysis, the development is located in a QCT and Geographic Areas

of Opportunity and qualifies as a Local Government Areas of Opportunity; therefore, the

130% basis credit was applied.

4. For purposes of this recommendation a HC percentage of 9% was applied based on the 9%

floor rate which as permanently extended through the Protecting Americans from Tax

Hikes (PATH) Act of 2015 as part of the Omnibus Consolidated Appropriations Act of

2016.

Exhibit E

Page 32 of 43

Section II: GAP Calculation

Total Development Costs(including land and ineligible Costs)

$33,857,873

Less Mortgages

$10,292,000

Less Grants

$0

Equity Gap

$23,565,873

HC Syndication Percentage to Investment Partnership

99.99%

HC Syndication Pricing

$0.93

HC Required to meet Equity Gap

$25,342,183

Annual HC Required

$2,534,218

Notes to the Gap Calculation:

1. The syndication information was taken from LOI, dated September 8, 2022.

2. The committed first mortgage in the amount of $7,132,000 exceeds the minimum first

mortgage requirement of $6,702,139

Section III: Summary

HC Per Applicant's Request

$1,699,990

HC Per Qualified Basis

$3,411,074

HC Per GAP Calculation

$2,534,218

Annual HC Recommended

$2,199,990

Syndication Proceeds based upon Syndication Agreement

$20,457,861

1. The HC Per Application Request is based on the original annual HC request of $1,699,990.

2. The estimated annual housing credit allocation is limited to the lesser of the Qualified Basis

calculation, the GAP calculation or the Applicant's Request. The recommendation is based

on the Applicant’s original Request of $1,699,990 plus the requested HC CHIRP of

$500,000 for a total recommended amount of $2,199,990.

3. FHFC reserves the right to resize the Housing Credit preliminary awarded to the Applicant.

The next opportunity for a feasibility review of this transaction will be at cost certification.

If the cost certification indicates a need to resize the HC allocation, FHFC will do so at that

time.

Exhibit E

Page 33 of 43

Rule Chapter 67-48.0072(28)(g)

Determination of the minimum first mortgage for use in the Housing Credit gap calculation

Input Variables

Annual rate of increase for revenues 2.00%

Annual rate of increase for operating expenses 3.00%

Vacancy & Collection Factor in CUR 5.00%

Minimum Vacancy & Collection Factor 7.00%

Which Rule was applicable at time of Application? Post 7/11/2019

M in imu m DSCR Year 15 1.25x

M in imu m DSCR Year 1 1.50x

Minimum NCF after DS Year 1 $1,000.00

Minimum qualifying 1st mortgage $500,000.00

Number of units in the proposed Development 80

Potential Gross Income Year 1 $1,158,135.00

Vacancy & Collection Loss (7.00%) $81,069.45

Effective Gross Income Year 1 $1,077,065.55

Operating Expenses Year 1 $492,009.13

(i) Actual Debt of Development $7,132,000.00

Actual interest rate 7.09%

Actual term of debt amortization 40.00 Yrs

DS Interest Rate floor 7.00%

Application deadline 11/05/20

10-Year Treasury Rate as of App deadline 0.768%

Spread over 10-yr Treasury 325 bps

10-yr Treasury plus the stated spread 4.02%

Greater of interes t rate floor or spread over Treas ury 7.00%

M aximu m Rate 8.00%

Interest Rate to be used for qualifying debt 7.09%

Minimum stated term of debt amortization per RFA 30.00 Yrs

Term of debt amortization to be us ed for qualifying debt 40.00 Yrs

Resulting Mortgage Constant to be used for qualifying debt 7.53575%

Minimum De bt Se rvice

NOI Year 15 $676,957.17

DSCR DS limitation $541,565.73

(a) Res ulting Debt, Year 15 limitation $7,186,619.96

NOI Year 1 $585,056.42

(b)(i) DSCR DS limitation $390,037.61

(b)(i) DSCR Debt Sizing $5,175,829.88

(b)(ii) NCF DS limitation $505,056.42

(b)(ii) NCF Debt Sizing $6,702,138.51

(b) Greater of (i) DSCR debt or (ii) NCF debt, Year 1 limitation $6,702,138.51

(ii) Minimum qualifying first mortgage (les ser of (a) or (b)) $6,702,138.51

Gre ate r of Actual or M inimum

$7,132,000.00

Exhibit E

Page 34 of 43

Select the RFA of the Active Award 2020-201

Actual DSCR in approved CUR

1st Mtg LOI Number of units 80

Actual DSCR in current

1st Mtg LOI

(Yr 1 NOI)

1.13x Total Development Costs $33,857,873

Maximum CHIRP DSCR 1.30x Active Award Annual HC Allocation 1,699,990.00$

Minimum Per Rule Chapter 67-48.0072(28)(g)2. 1.13x Traditional 1st Mtg Amort. Years 40.00

DSCR used for sizing (lowest DSCs from above) 1.13x Traditional 1st Mtg Interest Rate 7.09%

Actual Traditional 1st Mtg Amount to be stated in CUR

7,132,000.00$ Total Vacancy & Collection Rate in CUR 5.00%

Calculated 1st Mtg at Restricted DSCR (1.13x) 7,132,000.00$ Total Effective Gross Income in CUR Yr 1 1,100,228.25$

1st Mtg Restricted to 1.13x DSCR 7,132,000.00$ Total Operating Expenses in CUR Yr 1 492,009.13$

RESULT: 1st Mtg amount for sizing purposes 7,132,000.00$

Net Operating Income in CUR Yr 1 608,219.12$

Net Operating Income in CUR Yr 15 716,018.50$

1st Mtg amt. for sizing from above 7,132,000.00$ Syndication Rate 0.930000$

2nd Mortgage - City of Bradenton 460,000.00$ Percentage sold to Syndicator 99.990%

3rd Mortgage - Manatee County 1,400,000.00$ Annual HC from LOI or Servicer LOI

4th Mortgage - City of Bradenton CRA 1,300,000.00$ Stated HC Allocation from: LOI 1,699,990.00$

5th Mortgage - -$ Total HC Equity from: LOI 15,808,326.01$

6th Mortgage - -$ Developer Fee % Basis for Deferral (16%) 16%

Total HC Equity 15,808,326.01$ Total 16% Developer Fee $4,355,593

30% Deferred Developr Fee for Sizing 1,306,677.90$

Is the Demographic Commitment either

Homeless or Persons with Special Needs?**

No

Total Sources 27,407,003.91$ Loan using lowest 1.13x DSCR 7,132,000.00$

Total Uses 33,857,873.09$ Loan using Max CHIRP 1.30x DSCR 6,208,550.52$

NOI for 67-48.0072(28)(g)2.a. 676,957.17$

Loan using 67-48.0072(28)(g)2.a. $7,186,619.96

RESULT: Total Gap 6,450,869.18$ NOI for 67-48.0072(28)(g)2.b. 585,056.42$

Associated HC Allocation 693,711.00$ Loan using 67-48.0072(28)(g)2.b.(I) 5,175,829.88$

Loan using 67-48.0072(28)(g)2.b.(II) 6,702,138.51$

Lesser of a. or greater of b.(I) and b.(II) 6,702,138.51$

Greater of Actual 1st or above minimum 7,132,000.00$

Minimum Qualifying 1st Mtg per 67-48 7,132,000.00$

Current GC Contract Amount $20,764,738 Debt Service on 67-48.0072(28)(g)2. 537,449.71$

30% of GC Contract (est. Increased costs)* 6,229,421.40$ DSC Ratio for 67-48.0072(28)(g)2. 1.13x

Increased Corporation Fees -$

Increased Construction Financing Costs -$

Increased Dev. Fee (16.00% x sum of new costs) 996,707.42$ Dev Fee Deduct for Incorporating Actual Fee 0.00%

RESULT: Total Increased Costs 7,226,128.82$

Associated HC Allocation 777,080.00$

*(This amount already meets or exceeds the maximum CHIRP award so there is no need to enter any values in the next two rows.)

Development Name: RIVERVIEW6

Permanent Period 1st Mortgages for Sizing Purposes

Assumptions

Total Sources

FINAL: TOTAL NEW 9% HC ALLOCATION AMOUNT

$2,199,990.00

Test 1 - GAP ANALYSIS

Test 2 - INCREASED COST ANALYSIS

(This amount will be deducted from 16.00%, yielding a net 16.00%)

ADDITIONAL FHFC LOAN AMOUNT

Lessor of: Tests 1 & 2 or $500,000

$500,000.00

Exhibit E

Page 35 of 43

RFA 2020-201

(RIVERVIEW6 / 2021-111C)

DESCRIPTION OF FEATURES AND AMENITIES

The Development will consist of:

80 apartment units located in 1 mid-rise, 5 to 6 story residential building.

Unit Mix:

Sixteen (16) one bedroom/one bath units;

Forty-Eight (48) two bedroom/two bath units; and

Sixteen (16) three bedroom/two bath units.

80 Total Units

All units are expected to meet all requirements as outlined below. If the proposed Development

consists of rehabilitation, the proposed Development’s ability to provide all construction features

will be confirmed as outlined in Exhibit F of the RFA. The quality of the construction features

committed to by the Applicant is subject to approval of the Board of Directors.

a. Federal Requirements and State Building Code Requirements for all Developments

All proposed Developments must meet all federal requirements and state building

code requirements, including the following, incorporating the most recent

amendments, regulations and rules:

• Florida Accessibility Code for Building Construction as adopted pursuant to

Section 553.503, Florida Statutes;

• The Fair Housing Act as implemented by 24 CFR 100;

• Section 504 of the Rehabilitation Act of 1973*; and

• Titles II and III of the Americans with Disabilities Act of 1990 as implemented

by 28 CFR 35.

*All Developments must comply with Section 504 of the Rehabilitation Act of 1973, as implemented by 24

CFR Part 8 (“Section 504 and its related regulations”). All Developments must meet accessibility standards of

Section 504. Section 504 accessibility standards require a minimum of 5 percent of the total dwelling units,

but not fewer than one unit, to be accessible for individuals with mobility impairments. An additional 2 percent

of the total units, but not fewer than one unit, must be accessible for persons with hearing or vision impairments.

To the extent that a Development is not otherwise subject to Section 504 and its related regulations, the

Development shall nevertheless comply with Section 504 and its related regulations as requirements of the

Corporation funding program to the same extent as if the Development were subject to Section 504 and its

related regulations in all respects. To that end, all Corporation funding shall be deemed “Federal financial

assistance” within the meaning of that term as used in Section 504 and its related regulations for all

Developments.

Exhibit E

Page 36 of 43

b. General Features

The Development will provide the following General Features:

1. Termite prevention;

2. Pest control;

3. Window covering for each window and glass door inside each unit;

4. Cable or satellite TV hook-up in each unit and, if the Development offers cable or

satellite TV service to the residents, the price cannot exceed the market rate for

service of similar quality available to the Development’s residents from a primary

provider of cable or satellite TV;

5. Washer and dryer hook ups in each of the Development’s units or an on-site laundry

facility for resident use. If the proposed Development will have an on-site laundry

facility, the following requirements must be met:

o There must be a minimum of one Energy Star certified washer and one

Energy Star certified or commercial dryer per every 15 units. To determine

the required number of washers and dryers for the on-site laundry facility;

divide the total number of the Development’s units by 15, and then round

the equation’s total up to the nearest whole number;

o At least one washing machine and one dryer shall be front loading that

meets the accessibility standards of Section 504;

o If the proposed Development consists of Scattered Sites, the laundry facility

shall be located on each of the Scattered Sites, or no more than 1/16 mile

from the Scattered Site with the most units, or a combination of both.

• At least two full bathrooms in all 3 bedroom or larger new construction units;

• Bathtub with shower in at least one bathroom in at least 90 percent of the new

construction non-Elderly units;

• Elderly Developments must have a minimum of one elevator per residential

building provided for all Elderly Set-Aside Units that are located on a floor higher

than the first floor; and

• Full-size range and oven must be provided in all units.

c. Required Accessibility Features, regardless of the age of the Development

Federal and state law and building code regulations requires that programs, activities, and

facilities be readily accessible to and usable by persons with disabilities. Florida Housing

requires that the design, construction, or alteration of its financed Developments be in