2023

FISCAL YEAR ENDED

JUNE 30, 2023

MICHELLE WU

Mayor

ASHLEY GROFFENBERGER

Chief Financial Ofcer

& Collector Treasurer

MAUREEN JOYCE

City Auditor

Prepared by the City of Boston Auding Department

City of Boston

Massachuses

Annual Comprehensive

Financial Report

Fiscal Year Ended June 30, 2023

Michelle Wu, Mayor

Ashley Groenberger, Chief Financial Ocer & Collector Treasurer

Maureen Joyce, City Auditor

TABLE OF

CONTENTS

FISCAL YEAR ENDED JUNE 30, 2023

•

INTRODUCTORY SECTION (Unaudited)

i Transmial Leer

xii List of Elected and Appointed Ocials

xiii Organizaonal Chart of Auding Department

xiv List of Auding Department Personnel

•

FINANCIAL SECTION

1 Independent Auditors’ Report

5 Management’s Discussion and Analysis (Unaudited)

Basic Financial Statements:

15 Statement of Net Posion

17 Statement of Acvies

FUND FINANCIAL STATEMENTS

19 Balance Sheet – Governmental Funds

20 Reconciliaon of the Balance Sheet of the Governmental Funds to the Statement

of Net Posion

21 Statement of Revenues, Expenditures, and Changes in Fund Balances –

Governmental Funds

22 Reconciliaon of the Statement of Revenues, Expenditures, and Changes in Fund

Balance

23 Statement of Revenues and Expenditures – Budgetary Basis, General Fund –

Budget and Actual

24 Statement of Net Posion – Proprietary Fund

25 Statement of Revenues, Expenses, and Changes in Net Posion – Proprietary Fund

26 Statement of Cash Flows – Proprietary Fund

27 Statement of Fiduciary Net Posion – Fiduciary Funds

28 Statement of Changes in Fiduciary Net Posion – Fiduciary Funds

29 Notes to the Basic Financial Statements

Required Supplementary Informaon (Unaudited):

74 Schedules of OPEB Contribuons

75 Schedules of Changes in Net OPEB Liability and Related Raos

76 Schedule of City’s Proporonate Share of the Net Pension Liability – Boston

Rerement System

76 Schedule of City’s Contribuons – Boston Rerement System

TABLE OF

CONTENTS

FISCAL YEAR ENDED JUNE 30, 2023

Combining, Individual Fund Statements and Schedules:

GENERAL FUND

78 Fund Descripon

79 Balance Sheet

80 Statement of Revenues, Expenditures and Changes in Fund Balance

81 Schedule of Revenues and Other Financing Sources Compared to Budget

84 Schedule of Expenditures Compared to Budget

SPECIAL REVENUE FUND

88 Fund Descripon

89 Combining Balance Sheet

90 Combining Statement of Revenues, Expenditures, and Changes in Fund Balance

CAPITAL PROJECTS FUND

92 Fund Descripon

93 Balance Sheet

94 Statements of Revenues, Expenditures, and Changes in Fund Balance

OTHER GOVERNMENTAL FUNDS

96 Fund Descripon

97 Combining Balance Sheet

98 Combining Statement of Revenues, Expenditures, and Changes in Fund Balance

INTERNAL SERVICE FUND

100 Fund Descripon

101 Statement of Net Posion

102 Statement of Revenues, Expenses, and Changes in Net Posion

103 Statement of Cash Flows

FIDUCIARY FUNDS

104 Fund Descripon

106 Combining Statement of Plan Net Posion - Pension and OPEB

107 Statement of Plan Net Posion - Boston Rerement System

108 Statement of Plan Net Posion - OPEB Trust Fund

109 Combining Statement of Net Posion - Private Purpose Trust Funds

111 Combining Statement of Net Posion - Custodial Funds

112 Combining Statement of Changes in Plan Net Posion - Pension and OPEB

113 Statement of Changes in Plan Net Posion - Boston Rerement System

114 Statement of Changes in Plan Net Posion - OPEB Trust Fund

TABLE OF

CONTENTS

FISCAL YEAR ENDED JUNE 30, 2023

115 Combining Statement of Changes in Net Posion - Private Purpose Trust Funds

117 Statement of Changes in Net Posion - Custodial Funds

DISCRETELY PRESENTED COMPONENT UNITS

118 Discretely Presented Component Units Descripon

121 Combining Statements of Acvies

•

STATISTICAL SECTION (Unaudited)

126 Stascal Secon Overview

127 General Government Expenditures by Funcon (GAAP Basis)

129 General Government Revenues by Source (GAAP Basis)

131 Net Posion by Component

133 Changes in Net Posion

137 Fund Balances of Governmental Funds

139 Changes in Fund Balances of Governmental Funds

141 Assessed and Esmated Actual Value of All Taxable Property

142 Property Tax Rates – Direct and Overlapping Governments

143 Largest Principal Taxpayers

144 Property Tax Levies and Collecons

145 Raos of Outstanding Debt by Type

147 Raos of Net General Obligaon Bonded Debt to Assessed Value and Net

Bonded Debt per Capita

149 Legal Debt Margin Informaon

151 Demographic and Economic Stascs

152 Principal Employers

153 Full-Time Equivalent City Government Employees by Department

155 Operang Indicators by Funcon

157 Capital Asset Stascs by Department

Introductory

SECTION

(This page intentionally left blank)

FISCAL YEAR ENDED JUNE 30, 2023

ANNUAL COMPREHENSIVE FINANCIAL REPORT

INTRODUCTORY

SECTION

i

Auditing Department

Michelle Wu, Mayor

February 26, 2024

The Honorable Mayor,

Members of the City Council,

We are pleased to submit to you the Annual Comprehensive Financial Report (ACFR) of the City of Boston (City) for the scal year

ended June 30, 2023. The Annual Report is prepared by the City’s Auding Department, and is intended to provide informaon

regarding the nancial posion of the City. This report is prepared in accordance with U.S. generally accepted accounng

principles (GAAP), as established by the Governmental Accounng Standards Board (GASB), and meets all requirements of

state nance law of the Commonwealth of Massachuses, as well as the City Charter.

The responsibility for the accuracy, completeness, and fairness of the data presented, including disclosures, rests with the City.

City management believes this report is accurate in all material respects and is presented in a manner which fairly sets forth

the nancial posion and results of operaons of the City. Management is also responsible for establishing and maintaining

internal accounng controls designed to provide reasonable, but not absolute, assurance that these nancial statements are

complete and accurate in their presentaon.

The Auding Department uses an integrated nancial and human resources management system referred to as the Boston

Administrave Informaon System (BAIS). The system is designed to track and control daily acvies and report the nancial

posion of the City. This soware allows management to directly evaluate the nancial status of individual programs as well

as the enre department, and also supports the rigorous monitoring and reporng requirements enforced by the City.

The Commonwealth of Massachuses, through Chapter 190 of the Acts of 1982, requires that the City undergo an annual

audit performed by a rm of independent public accountants. The City has selected KPMG LLP to perform the June 30, 2023

audit. This audit is conducted in accordance with generally accepted government auding standards (GAGAS) issued by the

Comptroller General of the United States. The audit provides an independent review to help assure a fair presentaon of the

City’s nancial posion and results of operaons.

The City also undergoes an annual audit of its federal grant funds as required by Title 2 U.S. Code of Federal Regulaons Part

200, Uniform Administrave Requirements, Cost Principles, and Audit Requirements for Federal Awards (Uniform Guidance).

KPMG LLP issues separate reports on the City’s internal control systems and compliance with applicable laws and regulaons

that meet the requirements of the Uniform Guidance. A substanal focus of the Single Audit is to evaluate the City’s internal

control structure. The evaluaon includes tesng a signicant number of the major federal program transacons that occurred

during the scal year. The Single Audit also requires that the auditors determine whether the City has complied with laws and

regulaons that may have a material eect on each of its major federal nancial assistance programs. All of the City’s major

federal programs are evaluated for the adequacy of internal controls and compliance with laws and regulaons. The report is

publicly issued under a separate cover.

FISCAL YEAR ENDED JUNE 30, 2023

ANNUAL COMPREHENSIVE FINANCIAL REPORT

ii

Management’s Discussion and Analysis (MD&A) follows the independent auditors’ report and provides a narrave introducon,

overview, and analysis to accompany the basic nancial statements. This leer of transmial is intended to complement the

MD&A and should be read in conjuncon with it.

.

Mayor Michelle Wu

The City of Boston, incorporated as a town in 1630 and as a City in 1822, is located on the Shawmut Peninsula, at the conuence

of the Charles and Mysc Rivers. The City lies adjacent to Boston Harbor, which is a part of Massachuses Bay and leads

ulmately to the North Atlanc Ocean. The Charles River separates Boston from Cambridge and Watertown, while the Mysc

River determines the boundaries between Chelsea and Evere. The Neponset River separates the southern neighborhoods of

Boston from the Town of Milton and City of Quincy.

The City of Boston exists under Chapter 486 of the Acts of 1909 and Chapter 452 of the Acts of 1948 of the Commonwealth of

Massachuses, which, as amended, constute the City’s Charter. The Mayor is elected to a four-year term and serves as chief

execuve ocer of the City. The Mayor has general supervision of and control over the City’s boards, commissions, ocers and

departments. The legislave body of the City is the City Council, which consists of 13 elected members serving two-year terms.

Boston Mayor Michelle Wu is a daughter of immigrants, a Boston Public Schools mom, and an MBTA commuter. She was sworn

into oce in November 2021–the rst woman and rst person of color elected to serve in this role, championing a vision of

Boston as a green and growing city for everyone.

To support and stabilize Boston’s connued economic recovery, Mayor Wu has focused on deploying emergency grants to

neighborhood small businesses, taking acon to revitalize Downtown Boston through citywide collaboraons, and signing

execuve orders to speed up aordable housing development approvals and ensure that Boston’s municipal contracng reaches

the City’s supplier diversity goals to build community wealth.

FISCAL YEAR ENDED JUNE 30, 2023

ANNUAL COMPREHENSIVE FINANCIAL REPORT

INTRODUCTORY

SECTION

iii

Mayor Wu is working in partnership across every level of government, with businesses, and in the community, to make Boston

the leading city where families and businesses can thrive. Her focus is on invesng in infrastructure for the public good—

transportaon, housing, health, and educaon—to ensure that Boston is ready for the jobs of the future.

The City budgets and maintains its books and records on a statutory basis of accounng prescribed by the Massachuses

Division of Local Services, Bureau of Accounts. This basis of accounng diers from Generally Accepted Accounng Principles

(GAAP). The accounts of the City are organized on a fund basis. Each fund is considered to be a separate accounng enty. The

operaons of each fund are accounted for by providing a separate set of self-balancing accounts, which comprise each fund’s

assets, liabilies, fund balance, revenues, and expenses.

The General Fund is the only fund for which a budget is legally adopted. The budgets for all departments included in the General

Fund of the City, except the School Department, are prepared under the direcon of the Mayor and City Council. Departmental

budgets are established at the account level and so voted by the City Council. The School Department budget is prepared under

the direcon of the School Commiee. Original and supplemental appropriaons are submied by the Mayor, approved by the

City Council, and lapse at year end unless encumbered. The legal level of control over appropriaons is at the department level.

Amendments to the original budget must be approved by the City Council, except for a reallocaon of appropriaons of up to

$3 million, which the Mayor may approve. Further, the City Auditor, with the approval of the Mayor, may make transfers from

any appropriaon to any other appropriaon for purposes of eliminang decits before closing the books for the scal year.

Included in the basic nancial statements, which are prepared on the GAAP basis of accounng, are governmental acvies,

each major fund, the aggregate discretely presented component units, and aggregate remaining fund informaon. Discretely

presented component units are reported in a separate column to emphasize their operaonal and/or nancial relaonship

with the City. The Boston Rerement System (BRS) has been presented as a blended component unit because it provides

services almost exclusively to the City. The Dudley Square Realty Corporaon (DSRC) and the Ferdinand Building Development

Corporaon (FBDC) are also presented as a blended component unit. The Notes to the Financial Statements further discuss

the City’s nancial reporng enty.

Local Economy

Boston is the twenty-fourth largest City, in terms of populaon, in the United States and is the economic hub of the

Commonwealth of Massachuses (the “Commonwealth”). It is a center for professional services, business, nance, technology,

research and development, higher educaon and health care, as well as for transportaon, exports, communicaons, culture

and entertainment.

The outbreak of COVID-19 in early 2020, required restricve public health intervenons that created severe economic

disrupons in Boston and across the world and connues to adversely aect global, naonal, state and local economic acvity.

The City is vigorously pursuing economic opportunies and investments, to ensure Boston will connue to be a global leader.

The City is the capital of the Commonwealth and is host to several other governmental agencies. Using the employment data

from Bureau of Economic Analysis (BEA) and Massachuses Execuve Oce of Labor and Workforce Development (EOLWD),

Boston Planning and Development Authority (BPDA) Research esmated that the government employment in the City of

Boston is 74,665 in 2022. Large state government oces, federal regional oces, U.S. Postal Service facilies, state-chartered

authories and commissions such as the Massachuses Port Authority and the Boston Water and Sewer Commission, and the

City’s local government agencies and departments are all located within the City.

FISCAL YEAR ENDED JUNE 30, 2023

ANNUAL COMPREHENSIVE FINANCIAL REPORT

iv

Higher educaon, health care, and nancial services play a major role in Boston’s economy. Boston’s job growth was posive

across most industries since the recession, but was mostly concentrated in health care and social assistance, professional and

technical services, and educaon. The health care and social assistance industry employs the largest number of people in

Boston, 18.5% of total jobs. Educaonal services is an area of specializaon for Boston (8.1% of total jobs), with an employment

share three mes the naonal average. Boston hosts 35 universies, colleges, and community colleges, with a combined

enrollment of approximately 150,000 students annually. Included among the City’s colleges and universies are some of the

nest educaonal instuons in the country, including Boston College, Boston University, Northeastern University and Harvard

University. These instuons of higher educaon have a major eect on Boston’s economy. Because many of these students

remain in Boston aer graduaon, the City’s educaonal instuons are a major source of highly-skilled professionals for

Boston’s workforce. As the COVID-19 pandemic surged throughout the country, and with many instuons connuing remote

and hybrid learning, enrollment gures declined. Boston higher educaon instuons fell by 2.7% from Fall 2019 to Fall 2020

before rebounding 5.8% in Fall 2021. In that me, the percentage of students receiving full me or part-me remote learning

increased 71%. More than one-third of students in Fall 2021 had at least one virtual course.

Many of the naon’s nest research and teaching hospitals are located in Boston, including Massachuses General Hospital

Brigham, Beth Israel Lahey Hospital, Boston Medical Center, Tus Medical Center, and Boston Children’s Hospital. In total, there

are 22 inpaent hospitals in the City. Furthermore, Boston is home to the medical and dental schools of Harvard University,

Tus University, and Boston University. The Boston metropolitan area remains the naon’s foremost region for the life sciences

industry. Boston’s life science industry benets from skilled labor force availability, leading universies in basic academic science

elds, innovave research and development districts, proximity to major research hospitals, and strategic presence of venture

capital resources. Commercial real estate rm CBRE states that the Boston-Cambridge area hosts the largest life sciences cluster

in the naon, as dened by size, growth and concentraon of employment, laboratory inventory, Naonal Instute of Health

(NIH) awards, and venture capital funding.

Many of the country’s leading nancial services rms are located in Boston, including Fidelity Investments, John Hancock/

Manulife Financial, State Street Corporaon, and Wellington Management. In 2022, there were over 141,642 people employed

in the nance, insurance and real estate industries in Boston.

The BPDA esmates that the total number of payroll jobs located in Boston rose from 803,792 in 2020 to 826,967 in 2021, or

a gain of approximately 23,000 payroll jobs (2.9%). Despite this gain, total payroll jobs are sll more than 24,000 payroll jobs

below 2019 levels. This decrease is much greater than the 15,000 average annual jobs lost in Boston between 2001 and 2004

or the 17,500 jobs lost in 2009. Job losses were not felt evenly across industries. Industries that rely on physical proximity

suered signicant job losses. Accommodaon and Food Services suered the highest number of jobs lost as well as the highest

percentage, dropping from 65,645 jobs in 2019 to 38,061 in 2020 – more than 27,000 jobs lost, or 42%. Arts, Entertainment

and Recreaon lost 5,258 jobs, or 30%.

The City is required to have a balanced budget in accordance with Massachuses General Laws (M.G.L.), Chapter 59, Secon

23. In addion to that, management is required to spend within the appropriaons adopted by the Boston City Council and

approved by the Mayor in accordance with Tregor Legislaon Secon 17 of Chapter 190 of the Acts of 1982. The Act states

that “no ocial of the city or county except in the case of extreme emergency involving the health and safety of the people or

their property, shall expend intenonally in any scal year any sum in excess of the appropriaons duly made in accordance

with law, nor involve the city in any contract for the future payment of money in excess of such appropriaons”.

As part of the State Department of Revenue’s tax rate cercaon process, the City must balance all appropriaons, xed

costs, and prior year decits with the approved property tax levy, esmated local revenues, and available prior year surpluses

in order to obtain authorizaon to issue property tax bills. Over two-thirds of the City’s revenues come from the property

tax levy; however, the increase in the levy from year to year is limited by state law. In FY23, the net property tax levy (levy

less a reserve for abatements) totals $2.96 billion, providing 74.0% of recurring revenue. In FY24, the net property tax levy is

esmated to total $3.10 billion and account for 72.4% of budgeted revenues.

FISCAL YEAR ENDED JUNE 30, 2023

ANNUAL COMPREHENSIVE FINANCIAL REPORT

INTRODUCTORY

SECTION

v

State aid from the Commonwealth comprises the second largest single revenue source to the City’s General Fund budget aer

the Property Tax. State aid has been reduced substanally over the course of the last two recessions. Since FY08, net state

aid (dened as state aid revenues less state assessments) to the City has been reduced by $233.7 million or 64.0%. In FY24,

net state aid is budgeted to decrease by $12.9 million or -9.0% compared to FY23, based on the FY24 Governor’s Budget for

assessments and the FY23 State Aid budget. Please see the Management’s Discussion and Analysis Secon for addional

informaon on nancial trends.

In FY23, in order to parally fund the annual required contribuon associated with the other postemployment benets (OPEB)

liability, the City appropriated $40.0 million from the General Fund into the OPEB Liability Trust Fund. The City’s OPEB nancing

plan balances the duty to deliver valuable public services while acknowledging the cost of providing health benets for our

employees, both now and when they rere. More details and informaon on the OPEB liability can be found in Note 13 to the

Financial Statements.

Health benet costs comprise a signicant poron of the City budget and are a crical benet for City employees and rerees.

In 2020, the City of Boston conducted an RFP for its non-Medicare health insurance plans. On July 1, 2021, the City transioned

from two HMO plans to one standard HMO plan and one value HMO plan, with the standard HMO plan under a new provider.

As a result of the RFP process, $12 million in savings were realized in FY22, due to lower administrave fees and ancipated

medical claims and prescripon drug savings. The City connues to benet from health care cost reforms achieved in the FY21-

25 Public Employee Commiee (PEC) agreement, which connues to provide over 30,000 acve and rered employees with

quality healthcare coverage while saving the City $59.7 million over ve years. Funding of health care costs has progressively

moved to self-insurance since FY13. In FY23, roughly 98% of total claims costs are now self-insured, for an esmated annual

City savings of $14.9 million. Actuarially determined reserves are maintained in the Fund to stabilize rate increases and protect

against large claims or cost increases.

The City of Boston parcipates in a contributory dened benet rerement system administered by the Boston Rerement

System (BRS). The current pension schedule is based on an actuarial asset valuaon as of January 1, 2022. The current pension

schedule assumes a long term rate of return of 6.90%. The City’s pension liability is currently 82.4% funded and is on track

to reduce the unfunded liability to zero by 2027, thirteen years prior to the State funding date of 2040. More details can be

found in Note 12 to the Financial Statements.

Most of the City’s workforce is represented by one of 41 dierent unions. Collecvely, these unions represent approximately

20,000 employees. The next round of negoaons for FY21 and beyond has begun with six unions seling during the course

of FY22 and twenty-three unions during FY23. The projected FY24 and FY25 collecve bargaining reserves are intended to

acknowledge some costs in this area but do not indicate an established wage paern for successor contracts.

In FY23, the GAAP General Fund equity increased to $1.61 billion, thus allowing the City to preserve its policy of maintaining

a GAAP unassigned fund balance in the General Fund that is 15% or higher than the current scal year’s GAAP General Fund

operang expenditures. The GAAP unassigned fund balance at the end of FY23 was $1.2 billion and $420.0 million was assigned.

The unassigned fund balance represents approximately 28.5% of GAAP General Fund operang expenditures.

The FY24 Budget totals $4.28 billion and represents an increase of $276.9 million or 6.9% over FY23. This budget sets a

foundaon for our future, connects our communies, and delivers on the details of City services across our neighborhoods.

Through sound scal management, this budget is a roadmap for invesng crical resources to build a more connected City

for everyone.

The $4.2 billion FY24-28 Capital Plan will make crical investments in the City’s infrastructure in every Boston neighborhood,

guided by Imagine Boston 2030 and the schools, streets, arts, climate and resilience plans under its umbrella. Taken together,

these iniaves will support Boston’s dynamic economy and improve quality of life for residents by encouraging aordability,

increasing access to opportunity, promong a healthy environment, and guiding investment in the public realm. The Capital

Plan moves Imagine Boston 2030 from idea to acon. Planned borrowings are expected to increase 27% over last year’s plan,

one-me funding sources are leveraged, and the City connues to collaborate with the Massachuses School Building Authority

on the design and construcon of new schools and the repair of exisng building systems. An esmated 90% of the investment

in the FY24-28 Capital Plan is aligned with the City’s planning eorts.

FISCAL YEAR ENDED JUNE 30, 2023

ANNUAL COMPREHENSIVE FINANCIAL REPORT

vi

The City’s capital plan is an important tool in realizing the goals and vision of Boston 2030. All projects in the Capital Plan are

categorized as New construcon, Major Renovaon, State of Good Repair, Equipment/Technology, or Planning. The Capital

Budgeng Program of the Oce of Budget Management (OBM) tracks the overall distribuon of these categories to maintain

a balance between the upkeep of exisng assets and the expansion or introducon of new ones. The distribuon of allocaons

for FY24 are 42.0% for Major Renovaons, 31.0% for New Construcon, 18.0% for State of Good Repair, 5% for Planning and

4.0% for Equipment/Technology.

Financing for the FY23-FY27 Capital Plan comes from General Obligaon (G.O.) bonds, state and federal funds, trust funds, and

other funds. G.O. bonds represent 76.2% of all project funding. The Capital Plan assumes $2.06 billion in new G.O. borrowings

over the next ve years to support ongoing capital needs, which remains sustainable within the City’s debt aordability

policy. Eecve debt management ensures that the City can meet its capital infrastructure and facility needs. The Treasury

Department manages all borrowings according to the City’s debt management policies. These policies address issues such as

debt aordability and limitaons on the level of variable rate debt the City will use. The City’s goal is to rapidly repay debt,

maintain a conservave level of outstanding debt, and ensure the City’s connued posive nancial standing with the bond

market. More details and informaon on the Long-Term Obligaons can be found in Note 10 to the Financial Statements.

State and federal funds in the ve-year Capital Plan are currently esmated at $310.2 million and $361.4 million, respecvely.

Two of the state nancing programs include the School Building Assistance (SBA) program and the Massachuses Department

of Transportaon’s Highway Division’s Chapter 90 funds.

The SBA, which is administered by the Massachuses School Building Authority (MSBA), provides an important revenue source

for school renovaon and construcon. The MSBA operates two major programs – the Core Program and the Accelerated Repair

Program (ARP). Annually, the MSBA accepts new project requests from cies, towns, and school districts, and if a project is

ulmately approved, the MSBA will pay 40% to 80% of eligible project costs. The City has two projects in the Core program

that are both in construcon: the Josiah Quincy Upper Pilot School, and the Carter School.

The MSBA has approved a maximum project grant totaling $54.1 million for the Josiah Quincy Upper School that covers 24.2%

of the $223.6 million project budget. The Carter School project is currently in construcon. The MSBA has approved a maximum

project grant totaling $26.2 million for the Carter School that supports 23.6% of the $111.4 million project budget. The MSBA

recently selected four projects from Boston for their Accelerated Repair Program. The construcon phase has started at these

schools.

Administered by the Massachuses Highway Department, Chapter 90 funds are allocated by formula through State bond

authorizaons and through the State budget to all cies and towns in the Commonwealth. The City uses Chapter 90 funds

to support its roadway resurfacing and reconstrucon programs as well as its sidewalk reconstrucon programs. The City

ancipates an allocaon of approximately $14.7 million in FY24. The Transportaon Infrastructure Enhancement Fund,

is funded by annual per-ride assessment fees imposed on each transportaon company. The state distributes half of the

assessments proporonately to cies and towns based on the number of rides that originated within the city or town with

funding to be used to address the impact of the transportaon network services on municipal roads, bridges and other

transportaon infrastructure. The FY24-28 Capital Plan includes $16.2 million in new revenue from this source. This funding

will be disconnued as of January 1, 2027.

The City connues to aggressively pursue grant funds, maximize the use of Chapter 90 funds, and acvely manage its projects

to ensure that spending does not exceed projecons and that priority projects move forward. Together, these strategies will

enable the City to maintain a reasonable level of capital spending and borrowing and prudently manage its outstanding debt.

The Government Finance Ocers Associaon of the United States and Canada (GFOA) awarded a Cercate of Achievement

for Excellence in Financial Reporng to the City of Boston for its Annual Report for the scal year ended June 30, 2022.

In order to be awarded a Cercate of Achievement, a governmental unit must publish an easily readable and eciently

organized Annual Report. This report must sasfy both GAAP and applicable state and local legal requirements. A Cercate

of Achievement is valid for a period of only one year. We believe that our current report meets the Cercate of Achievement

program requirements, and we are subming it to the GFOA to determine its eligibility for a cercate.

FISCAL YEAR ENDED JUNE 30, 2023

ANNUAL COMPREHENSIVE FINANCIAL REPORT

INTRODUCTORY

SECTION

vii

In addion, the City also received the GFOA’s Award for Disnguished Budget Presentaon for its Annual Budget document for

the scal year beginning July 1, 2022. The City’s budget document was judged to be procient in several categories including

policy documentaon and nancial planning.

We would like to express our appreciaon to the Accounng sta and all the members of the Auding Department whose

professionalism and dedicaon made the mely preparaon of the Annual Report possible. We also wish to thank the

professional sta of KPMG LLP for their counsel, technical assistance, and connued support in the preparaon of this Annual

Report. Several other City departments and agencies provided addional informaon and assisted in the Annual Report

preparaon. We gratefully acknowledge their eorts and contribuons to this report. Finally, we wish to thank you for your

connued interest in the nancial operaons of the City.

The Annual Report for scal year 2016 through scal year 2023 are featured on the City’s web page www.cityooston.gov/

auding.

Respecully submied,

Maureen Joyce

City Auditor

Ashley Groffenberger

Chief Financial Officer & Collector Treasurer

FISCAL YEAR ENDED JUNE 30, 2023

ANNUAL COMPREHENSIVE FINANCIAL REPORT

viii

The Government Finance Officers Association of

the

United States and Canada

presents this

AWARD OF FINANCIAL REPORTING ACHIEVEMENT

to

The Award of Financial Reporting Achievement is presented by the Government Finance Officers

Association

to the department or individual designated as instrumental in the government unit

achieving

a

Certificate of Achievement for Excellence in Financial Reporting. A Certificate of Achievement

is

presented

to those government units whose annual financial reports are judged to adhere to

program

standards

and represents the highest award in government financial reporting.

Executive Director

Date: 11/22/2023

Auditing Department

City of Boston, Massachusetts

(This page intentionally left blank)

FISCAL YEAR ENDED JUNE 30, 2023

ANNUAL COMPREHENSIVE FINANCIAL REPORT

x

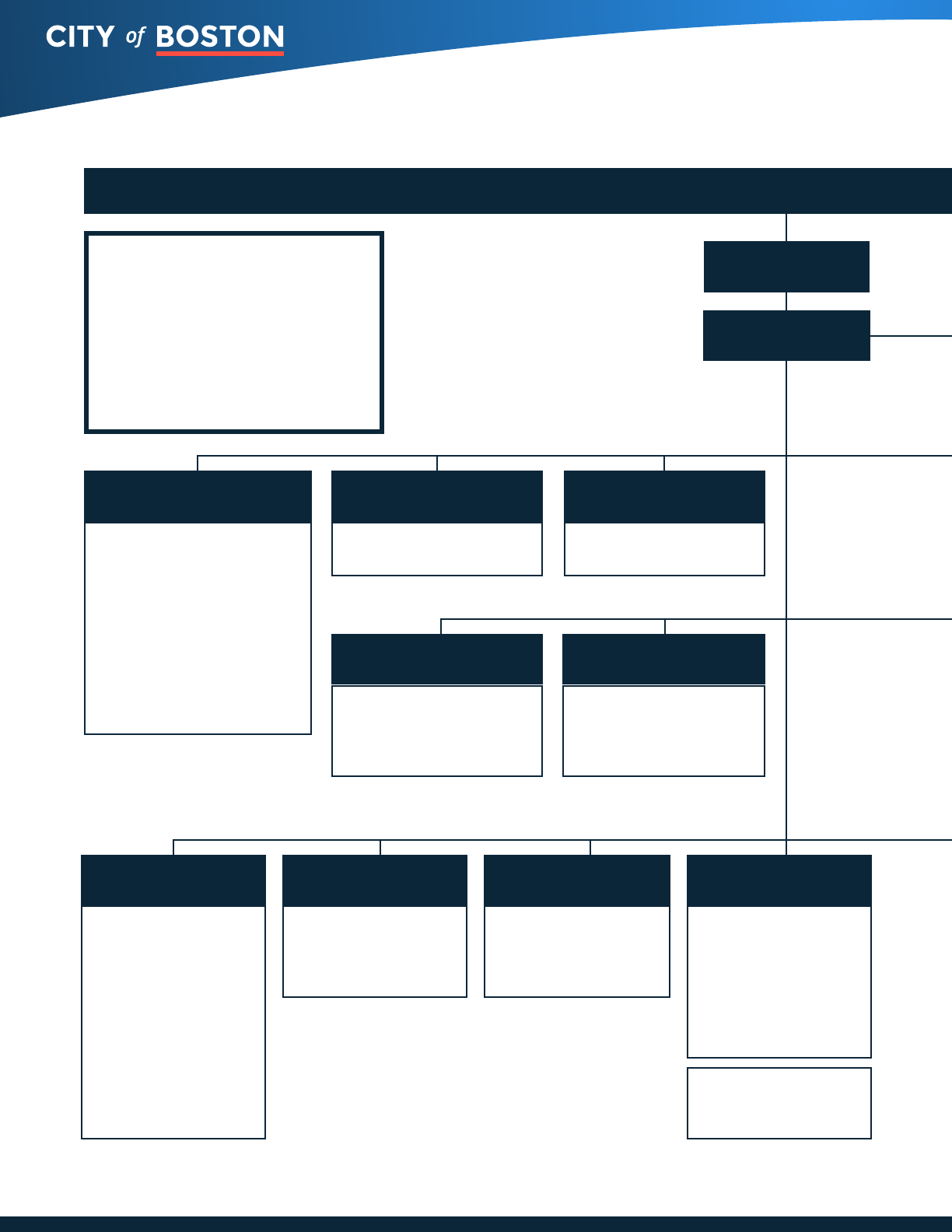

Non-Mayoral

City Council

(elected)

City Clerk

(appointed by City Council)

Finance Commission

(appointed by Governor)

ORGANIZATION OF A CITY GOVERNMENT

PEOPLE OF BOSTON

Mayor

Chief of Staff

z Black Male Advancement

z Disabilities Commission

z Fair Housing & Equity

z Human Rights Commission

z Immigrant Advancement

z Language & Communication

Access

z LGBTQ+ Advancement

z Ofce of Equity

z Women’s Advancement

Chief of

Equity & Inclusion

z Boston Public Schools

Superintendent of

Schools

z Emergency Management

z Fire

z Police

Joint Chiefs of

Public Safety

z Health Insurance

z Human Resources

z Labor Relations

z Medicare

z Ofce of People

Operations

z Registry

z Unemployment

Compensation

z Workers’

Compensation

Chief People

Ofcer

z Environment

z Food Justice

z Historic Preservation

z Parks & Recreation

Chief of Environment,

Energy, & Open Space

z Planning & Design

z Boston Planning &

Development Agency/

EDIC*

Chief of

Planning

z Inspectional Services

z Property Management

z Public Facilities

Chief of

Operations

z Public Health

Commission (1)

Public Health

z Central Fleet

Management

z Ofce of Streets

z Public Works

z Snow & Winter

Management

z Transportation

Chief of

Streets

z Boston Water & Sewer

Commission*

FISCAL YEAR ENDED JUNE 30, 2023

ANNUAL COMPREHENSIVE FINANCIAL REPORT

INTRODUCTORY

SECTION

xi

* NotinOperangBudget

(1) ThePublicHealthCommissionisanindependent

authoritycreatedinJune1996

z Intergovernmental Relations

Chief of Policy

Chief of

Communications

z Elections

z Law

Corporation

Counsel

z Ofce of

Housing

z Boston

Housing

Authority*

z Ofce of Arts &

Culture

Chiefs of

Housing

Chief of

Arts & Culture

z Neighborhood Services

Chief of Community

Engagement

z Innovation & Technology

Chief Information

Ofcer

Ofce of Police

Accountability &

Transparency

z Consumer Affairs & Licensing

z Ofce of Economic Opportunity &

Inclusion

z Supplier & Workforce Diversity

z Tourism, Sports & Entertainment

Chief of Economic

Opportunity & Inclusion

z Labor Compliance and Worker

Protection

z Youth Employment &

Opportunity

Chief of

Worker Empowerment

z Assessing

z Auditing

z Budget Management

z Execution of Courts

z Ofce of Finance

z Participatory Budgeting

z Procurement

z Treasury

z Retirement Board*

Chief Financial

Ofcer

z Age Strong

z Boston Centers for Youth &

Families

z Boston Public Library

z Ofce of Human Services

z Veterans Services

Chief of Human

Services

FISCAL YEAR ENDED JUNE 30, 2023

ANNUAL COMPREHENSIVE FINANCIAL REPORT

xii

LIST OF ELECTED and APPOINTED OFFICIALS

(as of June 30, 2023)

Mayor

City Council Members

Ed Flynn (President) District 2

Ruthzee Louijeune At-Large

Michael Flaherty At-Large

Julia Mejia At-Large

Erin Murphy At-Large

Gabriela Colea District 1

Frank Baker District 3

Brian Worrell District 4

Ricardo Arroyo District 5

Kendra Lara District 6

Tania Fernandes Anderson District 7

Vacant District 8

Liz Breadon District 9

Tiany Chu Chief of Sta

Mike Firestone Chief of Policy and Planning

Dion Irish Chief of Operaons

Adam Cederbaum Corporaon Counselor

Jessicah Pierre Chief Communicaon Ocer

Sanago Garces Chief Informaon Ocer

Ashley Groenberger Chief Financial Ocer & Collector Treasurer

Segun Idowu Chief of Economic Opportunity and Inclusion

Mary Skipper Superintendent of Boston Public Schools

Michael Cox Chief of Public Safety and Police Commissioner

Paul F. Burke Chief of Public Safety and Fire Commissioner

Shumeane L. Benford Chief of the Oce of Emergency Management

Rev. Mariama White-Hammond Chief of Environment and Open Space

Sheila Dillon Chief of Housing and Neighborhood Development

Jose Masso Chief of Human Services

Kenzie Bok Administrator, Housing Authority

James Hooley Chief of Medical Services

Kara Elliot-Ortega Chief of Arts & Culture

Jascha Franklin-Hodge Chief of Streets

James Arthur Jemison

Chief of Planning and Director Boston Planning & Development Agency

Mariangely Solis Cervera Chief of Equity and Inclusion

Alex Lawrence Chief of People Operaons

David Leonard President of Boston Public Library

Brianna Millor Chief of Community Engagement

FISCAL YEAR ENDED JUNE 30, 2023

ANNUAL COMPREHENSIVE FINANCIAL REPORT

INTRODUCTORY

SECTION

xiii

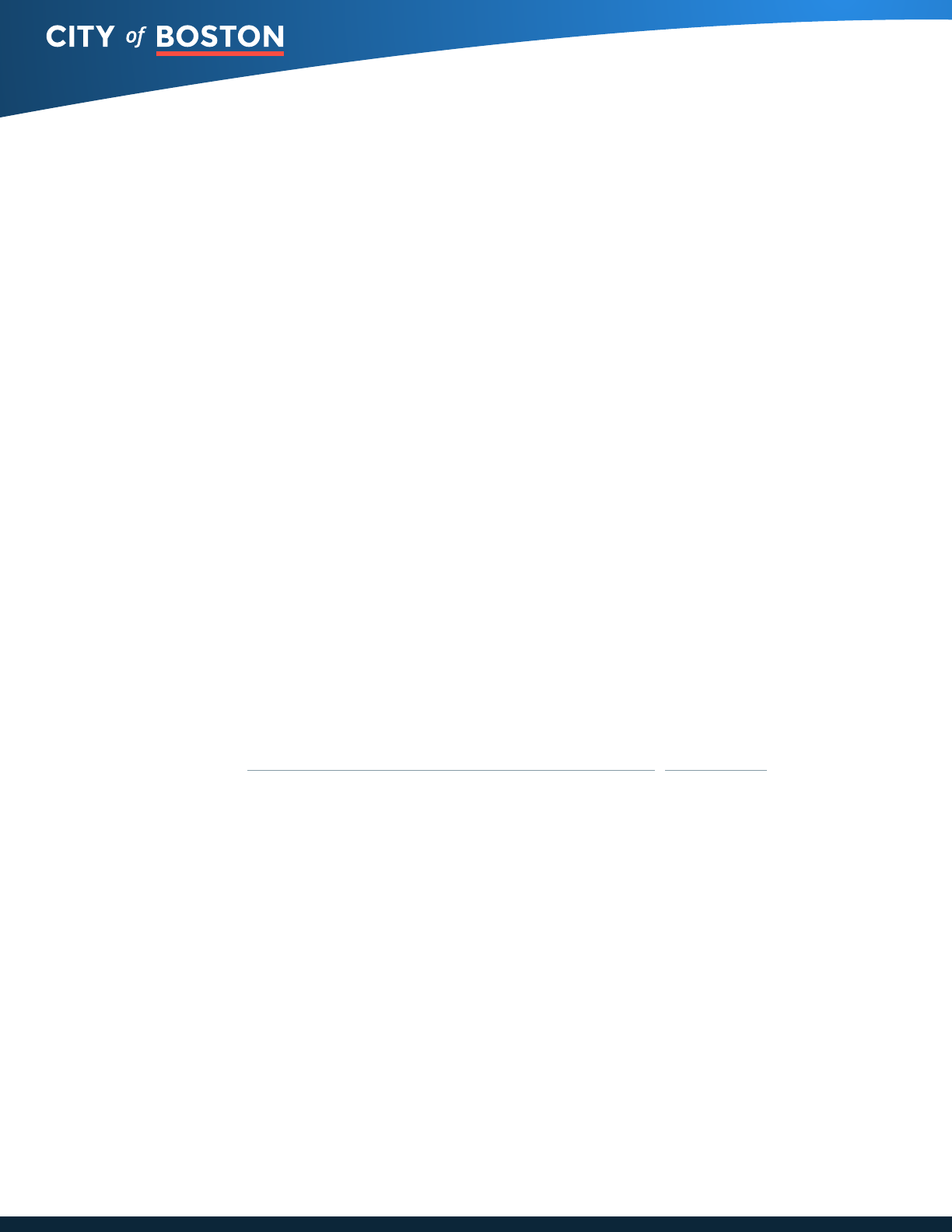

Auditing Department

Organizational Chart

City Auditor

System Support

Administrative

Support

Deputy City Auditor

Accounting Central Payroll Grants Monitoring

Accounts

Payable

General

Accounting

Financial

Reporting

Contracts

Payment

Processing

FISCAL YEAR ENDED JUNE 30, 2023

ANNUAL COMPREHENSIVE FINANCIAL REPORT

xiv

Maureen Joyce, City Auditor

Carrie He

Domenica Cabral

Sinthia Johnson

Sheila Fay

Marie Murray

(This page intentionally left blank)

FISCAL YEAR ENDED JUNE 30, 2023

ANNUAL COMPREHENSIVE FINANCIAL REPORT

1

INDEPENDENT AUDITORS’ REPORT

Independent Auditors’ Report

To the Honorable Mayor and City Council

City of Boston, Massachusetts:

Report on the Audit of the Financial Statements

Opinions

We have audited the financial statements of the governmental activities, the aggregate discretely presented

component units, each major fund, and the aggregate remaining fund information of the City of Boston (the

City), as of and for the year ended June 30, 2023, and the related notes to the financial statements, which

collectively comprise the City’s basic financial statements as listed in the table of contents.

In our opinion, based on our audit and the reports of the other auditors, the accompanying financial statements

referred to above present fairly, in all material respects, the respective financial position of the governmental

activities, the aggregate discretely presented component units, each major fund, and the aggregate remaining

fund information of the City, as of June 30, 2023, and the respective changes in financial position and, where

applicable, cash flows thereof and the respective budgetary comparison for the General Fund for the year then

ended in accordance with U.S. generally accepted accounting principles.

We did not audit the financial statements of the following entities and funds:

• Governmental Activities

– Dudley Square Realty Corporation, Ferdinand Development Corporation, and the Permanent

Funds, which are non-major governmental funds that collectively represent 1.1% and 5.4% of the

total assets and revenues, respectively, of the aggregate remaining fund information as of June 30,

2023 and for the year then ended.

– These entities and funds collectively represent 3.7% and 0.4%, respectively, of the total assets and

revenues of the governmental activities as of June 30, 2023 and the year then ended.

• Fiduciary Activities

– Boston Retirement System, the OPEB Trust Fund, and Private-Purpose Trust Funds that

collectively represent 97.6% and 19.9%, respectively, of the total assets and revenues of the

aggregate remaining fund information as of June 30, 2023 and for the year then ended.

• Aggregate Discretely Presented Component Units

– Boston Public Health Commission, Trustees of the Public Library of the City of Boston, and the

Economic Development and Industrial Corporation of Boston that collectively represent 82.6% and

92.6%, respectively, of the total assets and revenues of the aggregate discretely presented

component units as of June 30, 2023 and for the year then ended.

Those statements were audited by other auditors whose reports have been furnished to us, and our opinions,

insofar as they relate to the amounts included for those entities, are based solely on the reports of the other

auditors.

KPMG LLP

Two Financial Center

60 South Street

Boston, MA 02111

KPMG LLP, a Delaware limited liability partnership and a member firm of

the KPMG global organization of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee.

FISCAL YEAR ENDED JUNE 30, 2023

ANNUAL COMPREHENSIVE FINANCIAL REPORT

2

FINANCIAL

SECTION

INDEPENDENT AUDITORS’ REPORT

2

Basis for Opinions

We conducted our audit in accordance with auditing standards generally accepted in the United States of

America (GAAS) and the standards applicable to financial audits contained in Government Auditing Standards,

issued by the Comptroller General of the United States. Our responsibilities under those standards are further

described in the Auditors’ Responsibilities for the Audit of the Financial Statements section of our report. We

are required to be independent of the City and to meet our other ethical responsibilities, in accordance with the

relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is

sufficient and appropriate to provide a basis for our audit opinions.

Emphasis of Matter

As discussed in Note 2(t) to the basic financial statements, in 2023, the City adopted Governmental Accounting

Board Statement No. 96, Subscription-Based Information Technology Arrangements. Our opinions are not

modified with respect to this matter.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance

with U.S. generally accepted accounting principles, and for the design, implementation, and maintenance of

internal control relevant to the preparation and fair presentation of financial statements that are free from

material misstatement, whether due to fraud or error.

In preparing the financial statements, management is required to evaluate whether there are conditions or

events, considered in the aggregate, that raise substantial doubt about the City’s ability to continue as a going

concern for twelve months beyond the financial statement date, including any currently known information that

may raise substantial doubt shortly thereafter.

Auditors’ Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free

from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our

opinions. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not

a guarantee that an audit conducted in accordance with GAAS and Government Auditing Standards will always

detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from

fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions,

misrepresentations, or the override of internal control. Misstatements are considered material if there is a

substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a

reasonable user based on the financial statements.

In performing an audit in accordance with GAAS and Government Auditing Standards, we:

• Exercise professional judgment and maintain professional skepticism throughout the audit.

• Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or

error, and design and perform audit procedures responsive to those risks. Such procedures include

examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements.

• Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are

appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of

the City’s internal control. Accordingly, no such opinion is expressed.

• Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting

estimates made by management, as well as evaluate the overall presentation of the financial statements.

• Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise

substantial doubt about the City’s ability to continue as a going concern for a reasonable period of time.

FISCAL YEAR ENDED JUNE 30, 2023

ANNUAL COMPREHENSIVE FINANCIAL REPORT

3

INDEPENDENT AUDITORS’ REPORT

3

We are required to communicate with those charged with governance regarding, among other matters, the

planned scope and timing of the audit, significant audit findings, and certain internal control related matters that

we identified during the audit.

Report on Partial Comparative Information

We have previously audited the City's 2022 financial statements, and we expressed unmodified opinions on the

respective financial statements of the governmental activities, the aggregate discretely presented component

units, each major fund, and the aggregate remaining fund information in our report dated March 10, 2023. In

our opinion, the partial comparative actual information presented herein for the budgetary comparison of the

General Fund for the year ended June 30, 2022, is consistent, in all material respects, with the audited financial

statements from which it has been derived.

Required Supplementary Information

U.S. generally accepted accounting principles require that the management’s discussion and analysis and

schedules listed under the Required Supplementary Information in the table of contents be presented to

supplement the basic financial statements. Such information is the responsibility of management and, although

not a part of the basic financial statements, is required by the Governmental Accounting Standards Board who

considers it to be an essential part of financial reporting for placing the basic financial statements in an

appropriate operational, economic, or historical context. We and other auditors have applied certain limited

procedures to the required supplementary information in accordance with GAAS, which consisted of inquiries of

management about the methods of preparing the information and comparing the information for consistency

with management’s responses to our inquiries, the basic financial statements, and other knowledge we

obtained during our audit of the basic financial statements. We do not express an opinion or provide any

assurance on the information because the limited procedures do not provide us with sufficient evidence to

express an opinion or provide any assurance.

Supplementary Information

Our audit was conducted for the purpose of forming opinions on the financial statements that collectively

comprise the City’s basic financial statements. The combining and individual fund statements and schedules

are presented for purposes of additional analysis and are not a required part of the basic financial statements.

Such information is the responsibility of management and was derived from and relates directly to the

underlying accounting and other records used to prepare the basic financial statements. The information has

been subjected to the auditing procedures applied in the audit of the basic financial statements and certain

additional procedures, including comparing and reconciling such information directly to the underlying

accounting and other records used to prepare the basic financial statements or to the basic financial statements

themselves, and other additional procedures in accordance with GAAS. In our opinion, the information is fairly

stated, in all material respects, in relation to the basic financial statements as a whole.

Other Information

Management is responsible for the other information included in the annual comprehensive financial report. The

other information comprises the introductory and statistical sections but does not include the basic financial

statements and our auditors’ report thereon. Our opinions on the basic financial statements do not cover the

other information, and we do not express an opinion or any form of assurance thereon.

In connection with our audit of the basic financial statements, our responsibility is to read the other information

and consider whether a material inconsistency exists between the other information and the basic financial

statements, or the other information otherwise appears to be materially misstated. If, based on the work

performed, we conclude that an uncorrected material misstatement of the other information exists, we are

required to describe it in our report.

FISCAL YEAR ENDED JUNE 30, 2023

ANNUAL COMPREHENSIVE FINANCIAL REPORT

4

FINANCIAL

SECTION

INDEPENDENT AUDITORS’ REPORT

4

Other Reporting Required by Government Auditing Standards

In accordance with Government Auditing Standards, we have also issued our report dated February 26, 2024

on our consideration of the City’s internal control over financial reporting and on our tests of its compliance with

certain provisions of laws, regulations, contracts, and grant agreements and other matters. The purpose of that

report is solely to describe the scope of our testing of internal control over financial reporting and compliance

and the results of that testing, and not to provide an opinion on the effectiveness of the City’s internal control

over financial reporting or on compliance. That report is an integral part of an audit performed in accordance

with Government Auditing Standards in considering the City’s internal control over financial reporting and

compliance.

Boston, Massachusetts

February 26, 2024

FISCAL YEAR ENDED JUNE 30, 2023

ANNUAL COMPREHENSIVE FINANCIAL REPORT

5

MANAGEMENT’S DISCUSSION AND ANALYSIS

(Unaudited)

The City of Boston (the City) provides this Management’s Discussion and Analysis to present addional informaon to the

readers of the City’s basic nancial statements. This narrave overview and analysis of the nancial acvies of the City is for

the scal year ended June 30, 2023. Readers are encouraged to consider this informaon in conjuncon with the addional

informaon that is furnished in the City’s Annual Comprehensive Financial Report (Annual Report).

This discussion and analysis is intended to serve as an introducon to the City’s nancial statements. The City’s basic nancial

statements include three components: 1) Government-wide Financial Statements, 2) Fund Financial Statements, and 3)

Notes to the Financial Statements. This report also contains required supplementary informaon regarding historical pension

informaon and other postemployment benet (OPEB) plan informaon. The components of the nancial statements are

described in the following secons.

The basic nancial statements include two types of nancial statements that present dierent views of the City – the Government-

wide Financial Statements and the Fund Financial Statements. The Notes to the Basic Financial Statements supplement the

nancial statement informaon and clarify line items that are part of the nancial statements.

The Government-wide Financial Statements provide a broad view of the City’s operaons in a manner similar to a private

sector business. The statements provide both short-term and long-term informaon about the City’s nancial posion, which

assists in assessing the City’s economic condion at the end of the scal year. These are prepared using the economic resources

measurement focus and the accrual basis of accounng. This means they follow methods that are similar to those used by

most businesses. They take into account all revenues and expenses connected with the scal year even if cash involved has

not been received or paid. The Government-wide Financial Statements include two statements:

●

The Statement of Net Posion presents all of the government’s assets and deferred oulows of resources and liabilies

and deferred inows of resources, with the dierence between them reported as net posion. Over me, increases

or decreases in the City’s net posion may serve as a useful indicator of whether the nancial posion of the City is

improving or deteriorang.

●

The Statement of Acvies presents informaon showing how the government’s net posion changed during the most

recent scal year. All changes in net posion are reported as soon as the underlying event giving rise to the change

occurs, regardless of the ming of related cash ows. Thus, revenues and expenses are reported in this statement

for some items that will not result in cash ows unl future scal periods (such as uncollected taxes and earned but

unused vacaon leave). This statement also presents a comparison between direct expenses and program revenues

for each funcon of the City.

Both of the above nancial statements present two separate secons as described below.

●

Governmental Acvies – The acvies in this secon are mostly supported by taxes and intergovernmental revenues

(federal and state grants). Most services normally associated with city government fall into this category, including

general government, human services, public safety, public works, property and development, parks and recreaon,

library, schools, public health programs, state and district assessments, and debt service.

●

Discretely Presented Component Units – These are legally separate enes for which the City has nancial accountability

but funcon independent of the City. For the most part, these enes operate similar to private sector businesses.

The City’s four discretely presented component units are the Boston Public Health Commission, the Boston Planning &

Development Agency, the Economic Development Industrial Corporaon, and the Trustees of the Boston Public Library.

FISCAL YEAR ENDED JUNE 30, 2023

ANNUAL COMPREHENSIVE FINANCIAL REPORT

6

FINANCIAL

SECTION

MANAGEMENT’S DISCUSSION AND ANALYSIS

Complete nancial statements of the individual component units can be obtained from their respecve administrave oces.

Addional informaon about the City’s component units is presented in the Notes to the Financial Statements.

The Government-wide Financial Statements can be found immediately following this discussion and analysis.

Fund Financial Statements

A fund is a grouping of related accounts that is used to maintain control over resources that have been segregated for specic

acvies or objecves. The City, like other local governments, uses fund accounng to ensure and demonstrate compliance

with nance-related legal requirements.

The Fund Financial Statements focus on individual parts of the City government, reporng the City’s operaons in more

detail than the Government-wide Financial Statements. All of the funds of the City can be divided into three categories. It is

important to note that these fund categories use dierent accounng approaches and should be interpreted dierently. The

three categories of funds are:

– Most of the basic services provided by the City are nanced through governmental funds. Governmental

funds are used to account for essenally the same funcons reported as governmental acvies in the Government-wide

Financial Statements. However, unlike the Government-wide Financial Statements, the Governmental Fund Financial Statements

focus on near term inows and oulows of spendable resources. They also focus on the balances of spendable resources

available at the end of the scal year. Such informaon may be useful in evaluang the government’s near term nancing

requirements. This approach is known as using the current nancial resources measurement focus and the modied accrual

basis of accounng. Under this approach, revenues are recorded when cash is received or when suscepble to accrual (i.e.,

measurable and available to liquidate liabilies of the current period). Expenditures are generally recorded when liabilies are

incurred, except for those related to long-term liabilies, which are recorded when due and payable. These statements provide

a detailed short term view of the City’s nances to assist in determining whether there will be adequate nancial resources

available to meet the current needs of the City.

Because the focus of governmental funds is narrower than that of the Government-wide Financial Statements, it is useful to

compare the informaon presented for governmental funds with similar informaon presented for governmental acvies in the

Government-wide Financial Statements. By doing so, readers may beer understand the long term impact of the government’s

near term nancing decisions. Both the governmental fund balance sheet and the governmental fund statement of revenues,

expenditures, and changes in fund balances provide a reconciliaon to facilitate this comparison between governmental funds

and the governmental acvies. These reconciliaons are presented on the page immediately following each governmental

fund nancial statement.

The City presents four columns in the governmental fund balance sheet and in the governmental fund statement of revenues,

expenditures, and changes in fund balances. The City’s three major governmental funds are the General Fund, the Special

Revenue Fund, and the Capital Projects Fund. All non-major governmental funds are combined in the “Other Governmental

Funds” column on these statements. The Governmental Fund Financial Statements can be found immediately following the

Government-wide Financial Statements.

Of the City’s governmental funds, the General Fund is the only fund for which a budget is legally adopted. The Statement of

Revenues and Expenditures – Budgetary Basis is presented aer the governmental fund nancial statements. This statement

provides a comparison of the General Fund original and nal budget and the actual expenditures for the current and prior

year on a budgetary basis.

In accordance with state law and regulaons, the City’s legally adopted General Fund budget is prepared on a “budgetary”

basis instead of U.S. generally accepted accounng principles (GAAP). Among the key dierences between these two sets of

accounng principles are that “budgetary” records property tax as it is levied, while GAAP records it as it becomes suscepble

to accrual, “budgetary” records certain acvies and transacons in the General Fund that GAAP records in separate funds,

and “budgetary” records any amount raised to cover a prior year decit as an expenditure and any available funds raised

from prior year surpluses as a revenue, while GAAP ignores these impacts from prior years. The dierence in accounng

principles inevitably leads to varying results in excess or deciency of revenues over expenditures. Addional informaon and

a reconciliaon of “budgetary” to GAAP statements is provided in note 4 to the Financial Statements.

FISCAL YEAR ENDED JUNE 30, 2023

ANNUAL COMPREHENSIVE FINANCIAL REPORT

7

MANAGEMENT’S DISCUSSION AND ANALYSIS

Proprietary Funds – These funds are used to show acvies that operate more like those of commercial enterprises. Like the

Government-wide Financial Statements, Proprietary Fund Financial Statements use the economic resources measurement

focus and accrual basis of accounng. There are two types of proprietary funds – enterprise funds and internal service funds.

Enterprise funds charge fees for services provided to outside customers including local governments. Enterprise Funds provide

the same type of informaon as the business-type acvies of the Government-wide Financial Statements within governmental

acvies, only in more detail. Currently, the City does not have any enterprise funds. The City’s Internal Service Fund provides

health insurance services predominantly to other funds, departments or agencies of the City. Therefore, its acvies are

included in the Government-wide nancial statements within governmental acvies.

The Proprietary Funds Financial Statements can be found immediately following the Governmental Fund Financial Statements.

Fiduciary Funds – These funds are used to account for resources held for the benet of pares outside the City government.

Fiduciary funds are not reected in the Government-wide Financial Statements because the resources of these funds are not

available to support the City’s own programs. The accounng used for duciary funds is much like that used for proprietary

funds. They use the economic resources measurement focus and accrual basis of accounng.

The City’s duciary funds are the Employee Rerement Fund (the Boston Rerement System), which accounts for the

transacons, assets, liabilies, and net posion of the City employees’ pension plan; the Other Postemployment Benets

(OPEB) Trust Fund, which is an irrevocable trust established for the accumulaon of assets to reduce the liability associated

with the City’s obligaon for other postemployment benets; and the Private Purpose Trust and Custodial Funds, which include

money held and administered by the City on behalf of third pares.

The Fiduciary Funds Financial Statements can be found immediately following the Proprietary Fund Financial Statements.

Notes to the Financial Statements

The notes provide addional informaon that is essenal to a full understanding of the data provided in the Government-wide

and the Fund Financial Statements. The Notes to the Financial Statements can be found immediately following the Fiduciary

Funds Financial Statements.

The basic nancial statements are followed by a secon of required supplementary informaon, which includes a schedule

of employer contribuons for the OPEB Trust Fund, a schedule of changes in net OPEB liability and related raos, a schedule

of the City’s proporonate share of the net pension liability of the Boston Rerement System, and a schedule of the City’s

contribuons to the Boston Rerement System.

CURRENT YEAR FINANCIAL IMPACTS

● The City of Boston’s OPEB obligaon signicantly impacts the Government-wide nancial results. The most recent

valuaon of the City’s OPEB obligaon as of June 30, 2021, esmated that the total OPEB liability of the City increased

by $33.4 million to $2.3 billion. This increase was largely due to an increase in costs.

● In scal year 2023, the City’s contribuon to the OPEB Trust Fund ($174.8) million for reree health benets includes

$40 million in advance funding toward reducing the OPEB liability. In 2023 and 2022, the OPEB Trust Fund earned

investment income/loss, net of fees in the amount of $79.5 million and ($81.0) million, respecvely. This increase is

aributed to increased porolio performance and market increases.

●

The City of Boston’s net pension liability signicantly impacts the Government-wide nancial results. The City is

required to report its proporonate share of the collecve net pension liability, deferred oulows of resources,

deferred inows of resources, and pension expense. Based on the measurement of the Boston Rerement System’s

net pension liability as of December 31, 2022, the City’s proporonate share of that net pension liability increased

by $766.7 million and the net pension liability for the City’s non contributory plan as of June 30, 2023 increased by

$27.3 million resulng in a total net pension liability of $1.87 billion.

FISCAL YEAR ENDED JUNE 30, 2023

ANNUAL COMPREHENSIVE FINANCIAL REPORT

8

FINANCIAL

SECTION

MANAGEMENT’S DISCUSSION AND ANALYSIS

This analysis is based on the Statement of Net Posion and the Statement of Acvies found directly aer Management’s

Discussion and Analysis.

Net Posion – Primary Government – The total liabilies and deferred inows of resources of the City exceeded its assets and

deferred oulows of resources at scal year ended June 30, 2023 in a net decit of $614.0 million (presented as net posion).

At year end, the City had a decit in governmental acvies unrestricted net posion in the amount of $2.0 billion.

Changes in Net Posion – Primary Government – The City’s total net posion increased by $201.6 million from the amount

reported in scal year 2022.

As noted earlier, net posion may serve over me as a useful indicator of a government’s nancial posion. The City’s net

decit totaled ($614.0) million at the end of 2023, compared to a net decit of ($815.7) million reported at the end of the

previous year.

The components of net posion comprise the following: the investment in capital assets such as land, buildings, equipment,

and infrastructure (road, bridges, and other immovable assets), less any related debt used to acquire those assets that are sll

outstanding – this amount is $1.21 billion indicang that the net book value of the City’s capital assets exceeds the amount of

related capital debt outstanding. The City uses these capital assets to provide services to cizens; consequently, these assets

are not available for future spending. Although the City’s investment in its capital assets is reported net of related debt, it

should be noted that the resources needed to repay this debt must be provided from other sources, since the capital assets

themselves cannot be used to liquidate these liabilies.

A poron of the City’s governmental acvies net posion, $157.7 million, represents restricted net posion, or resources that

are subject to external restricons on how they may be used. Internally imposed designaons of resources are not presented

as restricted net assets. The unrestricted net posion (decit) decreased by $56.5 million from the 2022 amount.

FISCAL YEAR ENDED JUNE 30, 2023

ANNUAL COMPREHENSIVE FINANCIAL REPORT

9

MANAGEMENT’S DISCUSSION AND ANALYSIS

(In thousands)

2023

2022

Current assets $ 3,448,752

$ 2,934,153

Capital assets 2,959,625

2,730,596

Other assets

26,012

225,000

Total assets

6,434,389

5,889,749

1,001,657

660,114

Current liabilies 1,380,371

1,424,496

Noncurrent liabilies

6,406,539

5,332,769

7,786,910

6,757,265

263,160

608,262

Net investment in capital assets 1,206,883

1,101,116

Restricted 157,701

118,324

Unrestricted

(1,978,608)

(2,035,104)

Total net posion

$ (614,024)

$ (815,664)

FISCAL YEAR ENDED JUNE 30, 2023

ANNUAL COMPREHENSIVE FINANCIAL REPORT

10

FINANCIAL

SECTION

MANAGEMENT’S DISCUSSION AND ANALYSIS

(In thousands)

2023

2022

Program revenues:

Charges for services $ 275,272

$ 304,876

Operang grants and contribuons 1,129,258

864,380

Capital grants and contribuons 57,370

42,584

General revenues:

Taxes 3,358,362

3,114,334

Grants and contribuons not restricted 266,455

245,625

Investment income 109,546

11,264

Miscellaneous

1,734

4,861

5,197,997

4,587,924

General government 260,589

209,435

Human services 69,950

65,555

Public safety 1,262,121

1,172,308

Public works 171,610

173,842

Property and development 324,015

291,461

Parks and recreaon 67,172

54,430

Library 71,312

57,149

Schools 2,575,648

2,123,695

Public health programs 148,884

142,341

Interest on long-term debt

45,056

36,821

4,996,357

4,327,037

201,640

260,887

(815,664)

(1,076,551)

$ (614,024)

$ (815,664)

FISCAL YEAR ENDED JUNE 30, 2023

ANNUAL COMPREHENSIVE FINANCIAL REPORT

11

MANAGEMENT’S DISCUSSION AND ANALYSIS

Expenses - Governmental Activities FY 2023

(in thousands)

$2,575,648$2,575,648$2,575,648

$1,262,121$1,262,121$1,262,121

$260,589$260,589$260,589

$171,610$171,610$171,610

$726,389$726,389$726,389

Schools

Public Safety

General

Government

Public Works

Other

0

500,000

1,000,000

1,500,000

2,000,000

2,500,000

3,000,000

Revenues - Governmental Activities

Fiscal Year 2023

64.61 %64.61 %64.61 %

28.12 %28.12 %28.12 %

7.27 %7.27 %7.27 %

Taxes and Payments in Lieu of Taxes

Program Revenues

Other

FISCAL YEAR ENDED JUNE 30, 2023

ANNUAL COMPREHENSIVE FINANCIAL REPORT

12

FINANCIAL

SECTION

MANAGEMENT’S DISCUSSION AND ANALYSIS

The City’s governmental acvies net posion increased by $201.6 million over the prior scal year. The following net changes

occurred during the course of operaons in scal year 2023. In the assets accounts, cash and investments increased by $239.7

million, receivables increased by $76.4 million, and capital assets increased by $229.0 million. In the liability accounts, there was

an increase in warrants and accounts payable of $8.0 million and an increase in accrued liabilies of $31.9 million. Addionally,

an increase of $33.4 million was recorded relave to the City’s other postemployment benet obligaon and an increase of

$794.0 million was recorded relave to the City’s net pension liability in 2023.

During scal year 2023, the City’s revenues increased by 13.2%. The City’s largest sources of revenues were property taxes,

excise taxes, and payment in lieu of taxes of $3.36 billion (64.6% of total revenues) and $1.46 billion of program revenues

(28.1% of total revenues). Taxes increased by $244.0 million from the previous year. Program revenues increased by $250.1

million for scal year 2023. This is largely due to increases in operang grants and contribuons and charges for services. The

City’s expenses cover a range of services. The largest expenses were for schools ($2.58 billion), public safety ($1.3 billion),

general government ($260.6 billion), public works ($171.6 million), and property and development ($324.0 million). In 2023,

governmental acvies expenses exceeded program revenues (i.e., user charges, operang grants, and capital grants) by $3.53

billion. This shorall was covered primarily through taxes ($3.36 billion) and unrestricted grants and contribuons ($266.5

million).

Comparave data on these revenues and expenses is itemized in the reporng of the Changes in Net Posion – Primary

Government earlier in this Management Discussion and Analysis.

This analysis is based on the Governmental and Proprietary Fund Financial Statements. As noted earlier, the City uses fund

accounng to ensure and demonstrate compliance with nance-related legal requirements.

Governmental Funds – Fund Balances – as of the close of scal year 2023, the City’s governmental funds reported a combined

ending fund balance of $2.39 billion, an increase of $422.0 million from the prior year. Of this total amount, $1.2 billion

represents the unassigned fund balance.

The focus of the City’s governmental funds is to provide informaon on near term inows, oulows, and balances of spendable

resources. Such informaon is useful in assessing the City’s nancial requirements. In parcular, unassigned fund balance may

serve as a useful measure of a government’s nancial posion at the end of the scal year.

– The General Fund is the chief operang fund of the City. The City’s General Fund – Fund

Balance Policy states in part to maintain a GAAP unassigned fund balance in the General Fund that is 15%, or higher, of GAAP

General Fund operang expenditures for the scal year. The GAAP unassigned fund balance at the end of scal year 2023 was

$1.2 billion, which represents approximately 28.6% of GAAP General Fund operang expenditures. The General Fund - fund

balance increased due to an increase in excise taxes, investment income, payments in lieu of taxes, licenses and permits and

intergovernmental revenue.

However, because the City is required to follow the statutory basis of accounng rather than GAAP for determining the amount

of unassigned fund balance that can be appropriated, it is the statutory (not the GAAP) fund balance that is used to calculate

“free cash”. Free cash is the amount of statutory fund balance in the General Fund, as cered by the Commonwealth of

Massachuses’ Department of Revenue, which is available for appropriaon and is generated when actual revenues, on a cash

basis, exceed budgeted amounts and encumbrances are less than appropriaons, or both.

FISCAL YEAR ENDED JUNE 30, 2023

ANNUAL COMPREHENSIVE FINANCIAL REPORT

13

MANAGEMENT’S DISCUSSION AND ANALYSIS

The City has established the General Fund-Fund Balance Policy to ensure that the City maintains adequate levels of fund

balance to migate current and future risks (i.e., revenue shoralls and unancipated expenditures). The policy in full states

that the City shall maintain a GAAP Unassigned Fund Balance in the General Fund that is 15% or higher than the current scal

year’s GAAP General Fund Operang Expenditures. The City shall only consider the cercaon of Free Cash (as dened by the

Commonwealth of Massachuses’ Department of Revenue) in years where the appropriaon of Free Cash shall not cause the

scal year’s GAAP Unassigned Fund Balance to go below 15% of the scal year’s GAAP General Fund Operang Expenditures,

while maintaining a Budgetary Unassigned Fund Balance at 10% or higher of Budgetary Operang Expenditures. The City shall

only consider the appropriaon of Cered Free Cash to oset: (1) certain xed costs such as pension contribuons and related

post-rerement health benets; and/or (2) to fund extraordinary and non-recurring events as determined and cered by the

City Auditor.

– The Special Revenue Fund accounts for the proceeds of specic revenue sources that

are restricted or commied to expenditures for predened purposes. The scal year 2023 Special Revenue Fund balance is

reported at $370.8 million, a $38.2 million increase from scal year 2022. This increase was mainly driven by the increase in

new federal programs related to COVID-19 relief.

– The Capital Projects Fund accounts for nancial resources to be used for the acquision

or construcon of major capital facilies, other than those nanced by proprietary funds and pooled funds. The scal year

2023 Capital Projects Fund balance is $277.4 million, an $85.0 million increase from scal year 2022.

– Other Governmental Funds account for assets held by the City in permanent

funds, as well as the acvies related to DSRC and FBDC. The scal year 2023 Other Governmental Funds fund balance is $130.7

million, a $7.1 million increase from scal year 2022.

The City’s Internal Service Fund accounts for the City’s self-insurance program for health benets provided by Blue Cross Blue

Shield and Mass General Brigham Health Plan, for City employees and their dependents. The Internal Service Fund is included

as part of the governmental acvies in the government-wide nancial statements.