Userid: CPM Schema:

instrx

Leadpct: 98% Pt. size: 10

Draft Ok to Print

AH XSL/XML

Fileid: … ns/i1098/202201/a/xml/cycle04/source (Init. & Date) _______

Page 1 of 6 18:18 - 29-Dec-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Instructions for Form 1098

(Rev. January 2022)

Mortgage Interest Statement

Department of the Treasury

Internal Revenue Service

Section references are to the Internal Revenue Code

unless otherwise noted.

Future Developments

For the latest information about developments related to

Form 1098 and its instructions, such as legislation

enacted after they were published, go to

IRS.gov/

Form1098.

What's New

Continuous-use form and instructions. Form 1098

and these instructions have been converted from an

annual revision to continuous use. Both the form and

instructions will be updated as needed. For the most

recent version, go to

IRS.gov/Form1098.

Reminders

General instructions. In addition to these specific

instructions, you should use the current General

Instructions for Certain Information Returns. Those

general instructions include information about the

following topics.

•

Who must file.

•

When and where to file.

•

Electronic reporting.

•

Corrected and void returns.

•

Statements to recipients.

•

Taxpayer identification numbers (TINs).

•

Backup withholding.

•

Penalties.

•

Other general topics.

You can get the general instructions at General

Instructions for Certain Information Returns, available at

IRS.gov/1099GeneralInstructions, or IRS.gov/Form1098.

Online PDF fillable Copies B and C. To ease statement

furnishing requirements, Copies B and C are fillable online

in a PDF format, available at

IRS.gov/Form1098. You can

complete these copies online for furnishing statements to

recipients and for retaining in your own files.

Specific Instructions

Use Form 1098, Mortgage Interest Statement, to report

mortgage interest (including points, defined later) of $600

or more you received during the year in the course of your

trade or business from an individual, including a sole

proprietor. Report only interest on a mortgage, defined

later.

File a separate Form 1098 for each mortgage. The

$600 threshold applies separately to each mortgage, so

you are not required to file Form 1098 for a mortgage on

which you have received less than $600 in interest, even if

an individual paid you over $600 in total on multiple

mortgages. You may, at your option, file Form 1098 to

report mortgage interest of less than $600, but if you do,

you are subject to the rules in these instructions.

If an overpayment of interest on an adjustable rate

mortgage or other mortgage was made in a prior year and

you refund (or credit) that overpayment, you may have to

file Form 1098 to report the refund (or credit) of the

overpayment. See

Reimbursement of Overpaid Interest,

later.

Also use Form 1098 to report mortgage insurance

premiums (MIP) of $600 or more you received during the

calendar year in the course of your trade or business from

an individual, including a sole proprietor, but only if

section 163(h)(3)(E) applies. See the instructions for

Box

5. Mortgage Insurance Premiums, later.

Exceptions

You need not file Form 1098 for interest received from a

corporation, partnership, trust, estate, association, or

company (other than a sole proprietor) even if an

individual is a co-borrower and all the trustees,

beneficiaries, partners, members, or shareholders of the

payer of record are individuals.

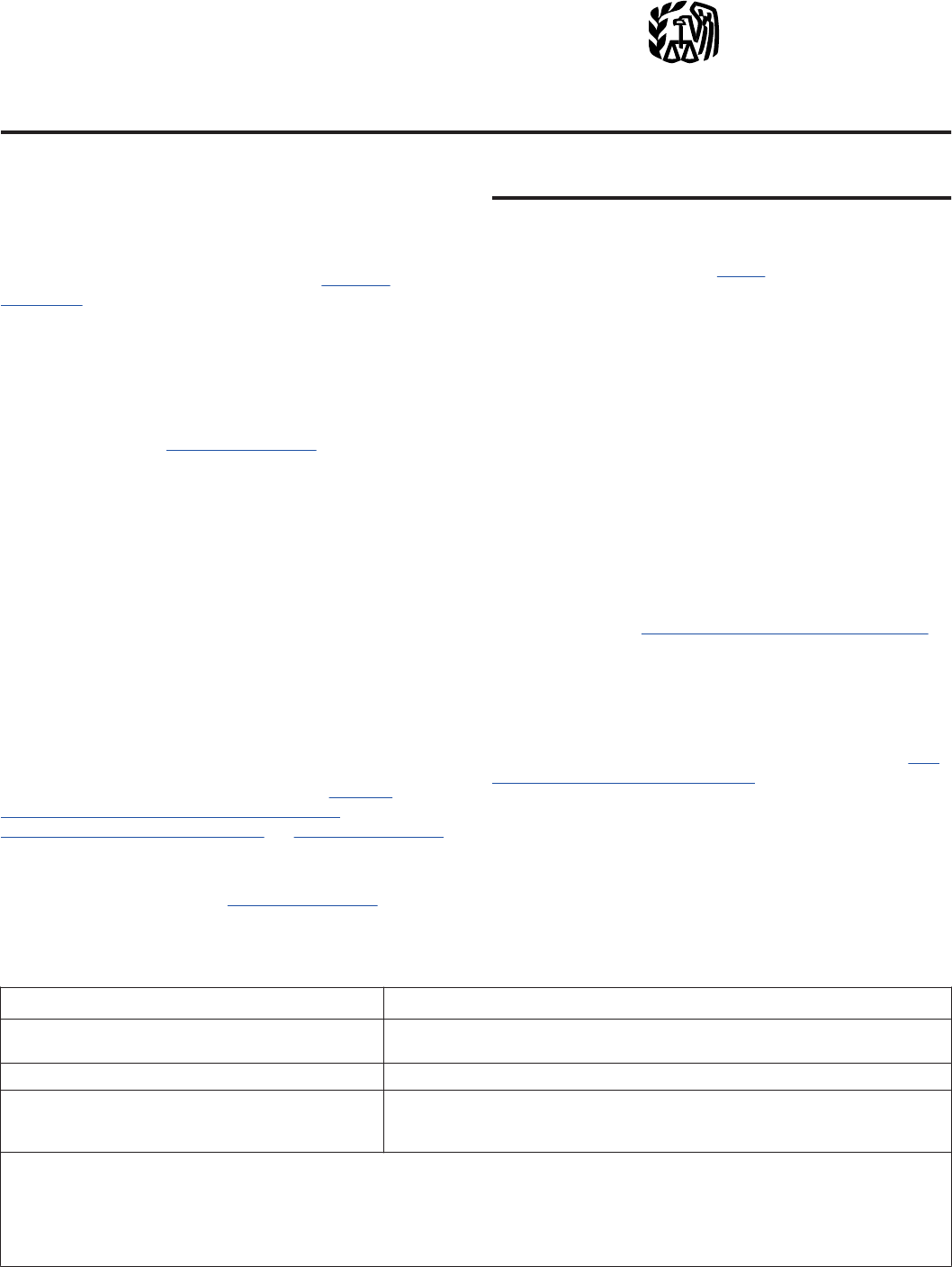

Obligation Classification Table

IF an obligation is... THEN...

incurred after 1987 it is a mortgage if real property that is located inside or outside the United States

secures all or part of the obligation.

1

incurred after 1984 but before 1988 it is a mortgage only if secured primarily by real property.

in existence on December 31, 1984 it is not a mortgage if, at the time the obligation was incurred, the interest recipient

reasonably classified the obligation as other than a mortgage, real property loan, real

estate loan, or other similar type of obligation.

2

1

This applies even though the interest recipient classifies the obligation as other than a mortgage, for example, as a commercial loan.

2

For example, if an obligation incurred in 1983 was secured by real property, but the interest recipient reasonably classified the obligation as a commercial loan

because the proceeds were used to finance the borrower's business, the obligation is not considered a mortgage and reporting is not required. However, it is not

reasonable to classify those obligations as other than mortgages for reporting purposes if over half the obligations in a class established by the interest recipient are

primarily secured by real property.

Dec 29, 2021 Cat. No. 27977Q

Page 2 of 6 Fileid: … ns/i1098/202201/a/xml/cycle04/source 18:18 - 29-Dec-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Mortgage Defined

A mortgage is any obligation secured by real property.

Use the Obligation Classification Table to determine

which obligations are mortgages.

Real property is land and generally anything built on it,

growing on it, or attached to the land. Among other things,

real property includes a manufactured home with a

minimum living space of 400 square feet and a minimum

width of more than 102 inches and which is of a kind

customarily used at a fixed location. See section 25(e)

(10).

If the loan is not secured by any real property, you are

not required to file Form 1098. However, the borrower

may be entitled to a deduction for qualified residence

interest, such as in the case of a loan for a boat. The boat

must have sleeping space, cooking facilities, and toilet

facilities. The borrower must use the boat as a home.

Lines of credit and credit card obligations. Interest

(other than points) received on any mortgage that is in the

form of a line of credit or credit card obligation is

reportable regardless of how you classified the obligation.

A borrower incurs a line of credit or credit card obligation

when the borrower first has the right to borrow against the

line of credit or credit card, whether or not the borrower

actually borrows an amount at that time.

Who Must File

File this form if you are engaged in a trade or business

and, in the course of such trade or business, you receive

from an individual $600 or more of mortgage interest (or

$600 or more of MIP, if section 163(h)(3)(E) applies for

the reporting year) on any one mortgage during the

calendar year. See the instructions for

box 5, later, for MIP

reporting requirements. You are not required to file this

form if the interest is not received in the course of your

trade or business. For example, you hold the mortgage on

your former personal residence. The buyer makes

mortgage payments to you. You are not required to file

Form 1098.

For information about who must file to report points,

see

Who must report points, later.

Not in the lending business. If you receive mortgage

interest of $600 or more in the course of your trade or

business, you are subject to the requirement to file Form

1098, even if you are not in the business of lending

money. For example, if you are a real estate developer

and you provide financing to an individual to buy a home

in your subdivision, and that home is security for the

financing, you are subject to this reporting requirement.

However, if you are a physician not engaged in any other

business and you lend money to an individual to buy your

home, you are not subject to this reporting requirement

because you did not receive the interest in the course of

your trade or business as a physician.

Governmental unit. A governmental unit (or any

subsidiary agency) receiving mortgage interest from an

individual of $600 or more must file this form.

Cooperative housing corporation. A cooperative

housing corporation is an interest recipient and must file

Form 1098 to report an amount received from its

tenant-stockholders that represents the

tenant-stockholders' proportionate share of interest

described in section 216(a)(2). This rule applies only to

tenant-stockholders who are individuals and from whom

the cooperative has received at least $600 of interest

during the year. See the

TIP under box 1, later.

Collection agents. Generally, if you receive reportable

interest payments (other than points) on behalf of

someone else and you are the first person to receive the

interest, such as a servicing bank collecting payments for

a lender, you must file this form. Enter your name,

address, TIN, and telephone number in the recipient entity

area. You must file this form even though you do not

include the interest received in your income but you

merely transfer it to another person. If you wish, you may

enter the name of the person for whom you collected the

interest in box 10. The person for whom you collected the

interest need not file Form 1098.

However, there is an exception to this rule for any

period that (a) the first person to receive or collect the

interest does not have the information needed to report on

Form 1098, and (b) the person for whom the interest is

received or collected would receive the interest in its trade

or business if the interest were paid directly to such

person. If (a) and (b) apply, the person on whose behalf

the interest is received or collected is required to report on

Form 1098. If interest is received or collected on behalf of

another person other than an individual, such person is

presumed to receive the interest in a trade or business.

Foreign interest recipient. If you are not a U.S. person,

you must file Form 1098 if the interest is received in the

United States. A U.S. person is a citizen or resident of the

United States, a domestic partnership or corporation, or a

nonforeign estate or trust. If the interest is received

outside the United States, you must file Form 1098 if (a)

you are a controlled foreign corporation, or (b) at least

50% of your gross income from all sources for the 3-year

period ending with the close of the tax year preceding the

receipt of interest (or for such part of the period as you

were in existence) was effectively connected with the

conduct of a trade or business in the United States.

Designation agreement. An interest recipient, including

a recipient of points, can designate a qualified person to

file Form 1098 and to provide a statement to the payer of

record.

A qualified person is either (a) a trade or business in

which the interest recipient is under common control as

specified in Regulations section 1.414(c)-2, or (b) a

designee, named by the lender of record or by a qualified

person, who either was involved in the original loan

transaction or is a subsequent purchaser of the loan.

A lender of record is the person who, at the time the

loan is made, is named as the lender on the loan

documents and whose right to receive payment from the

payer of record is secured by the payer of record's

principal residence. Even if the lender of record intends to

sell or otherwise transfer the loan to a third party after the

close of the transaction, such intention does not change

who is the lender of record.

The agreement must be in writing, identify the

mortgage(s) and calendar years for which the qualified

person must report, and be signed by the designator and

the designee. A designee may report points on Form 1098

-2-

Instructions for Form 1098 (Rev. 01-2022)

Page 3 of 6 Fileid: … ns/i1098/202201/a/xml/cycle04/source 18:18 - 29-Dec-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

(as having been paid directly by the payer of record) only

if the designation agreement contains the designator's

representation that it did not lend such amount to the

payer of record as part of the overall transaction. The

agreement need not be filed with the IRS, but the

designator must keep a copy of it for 4 years after the

close of the year in which the loan is made.

A designated qualified person is subject to any

applicable penalties as if it were the interest recipient.

Thus, a designator is relieved from liability for any

applicable penalties.

Nonresident Alien Interest Payer

You must file Form 1098 to report interest paid by a

nonresident alien only if all or part of the security for the

mortgage is real property located in the United States.

Report the interest based on the following.

•

If the interest is paid within the United States, you must

request from the payer the applicable Form W-8

(withholding certificate) as described in Regulations

section 1.1441-1(e)(1).

•

If the interest is paid outside the United States, you

must satisfy the documentary evidence standard

described in Regulations section 1.6049-5(c).

Payer of Record

The payer of record is the individual carried on your books

and records as the principal borrower. If your books and

records do not indicate which borrower is the principal

borrower, you must designate one.

If you permit a subsequent purchaser of the property to

assume the loan without releasing the first purchaser from

personal liability, the subsequent purchaser is the payer of

record. Such subsequent purchaser's name, address, and

TIN must appear on Form 1098.

Multiple borrowers. Even though there may be more

than one borrower on the mortgage, you are required to

prepare Form 1098 only for the payer of record, and only if

such payer of record is an individual, showing the total

interest received on the mortgage. Even if an individual is

a co-borrower, no Form 1098 is required unless the payer

of record is also an individual.

Payments by Third Party

Report all interest received on the mortgage as received

from the borrower, except as explained under Seller

Payments, later. For example, if the borrower's mother

makes payments on the mortgage, the interest received

from the mother is reportable on Form 1098 as received

from the borrower.

However, do not report mortgage interest received

from any governmental unit (or any subsidiary agency).

For example, do not report any interest received as

housing assistance payments from the Department of

Housing and Urban Development (HUD) on mortgages

insured under section 235 of the National Housing Act.

The IRS will not assert information reporting penalties

against mortgage servicers that report as interest

mortgage assistance payments received under a state

program funded by the Housing Finance Agency

Innovative Fund for the Hardest Hit Housing Markets

(HFA Hardest Hit Fund) if the mortgage servicer notifies

the homeowner that the amounts reported on the Form

1098 are overstated because they include governmental

subsidy payments. State housing finance agencies

receiving funds allocated from the HFA Hardest Hit Fund

may comply with the mortgage interest reporting

requirement by reporting payments on either Form

1098-MA, Mortgage Assistance Payments, available at

IRS.gov/Form1098MA, or on the statement described in

section 2.04 of Rev. Proc. 2011-55, available at

IRS.gov/irb/2011-47_IRB#RP-2011-55. For more

information, see Notice 2017-40, available at IRS.gov/irb/

2017-32_IRB#NOT-2017-40, amplified and modified by

Notice 2018-63, available at

IRS.gov/irb/

2018-34_IRB#NOT-2018-63.

Seller Payments

Do not report in box 1 of Form 1098 any interest paid by a

seller on a purchaser's/borrower's mortgage, such as on a

“buy-down” mortgage. For example, if a real estate

developer deposits an amount in escrow and tells you to

draw on that escrow account to pay interest on the

borrower's mortgage, do not report in box 1 the interest

received from that escrow account. Also, do not report in

box 1 any lump sum paid by a real estate developer to pay

interest on a purchaser's/borrower's mortgage. However,

if you wish, you may use box 10 to report to the payer of

record any interest paid by the seller. See

Points next for

information about reporting seller-paid points in box 6.

Points

You must report certain points paid for the purchase of the

payer of record's principal residence on Form 1098. You

must report points if the points, plus other interest on the

mortgage, are $600 or more. For example, if a borrower

pays points of $300 and other mortgage interest of $300,

the lender has received $600 of mortgage interest and

must file Form 1098.

Report the total points on Form 1098 for the calendar

year of closing regardless of the accounting method used

to report points for federal income tax purposes.

Who must report points. The lender of record or a

qualified person must file Form 1098 to report all points

paid by the payer of record in connection with the

purchase of the principal residence. If a designation

agreement is in effect for a mortgage, only the person

designated in the agreement must file Form 1098 to report

all points on that mortgage. See

Designation agreement,

earlier.

Amounts received directly or indirectly by a mortgage

broker are treated as points to the same extent they would

be treated as points if paid to and retained by the lender of

record. The lender of record must report those points paid

to a mortgage broker.

Reportable points. Report on Form 1098 points that

meet all the following conditions.

1. They are clearly designated on the Settlement

Statement (Form HUD-1) or HUD Closing Disclosure as

points; for example, “loan origination fee” (including

amounts for VA and FHA loans), “loan discount,”

“discount points,” or “points.”

2. They are computed as a percentage of the stated

principal loan amount.

Instructions for Form 1098 (Rev. 01-2022)

-3-

Page 4 of 6 Fileid: … ns/i1098/202201/a/xml/cycle04/source 18:18 - 29-Dec-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

3. They are charged under an established business

practice of charging points in the area where the loan was

issued and do not exceed the amount generally charged

in that area.

4. They are paid for the acquisition of the payer of

record's principal residence, and the loan is secured by

that residence. You may rely on a signed written

statement from the payer of record that states that the

proceeds of the loan are for the purchase of the payer of

record's principal residence.

5. They are paid directly by the payer of record. Points

are paid directly if either (a) or (b) below applies.

a. The payer of record provides funds that were not

borrowed from the lender of record for this purpose as

part of the overall transaction. The funds may include

down payments, escrow deposits, earnest money applied

at closing, and other funds actually paid over by the payer

of record at or before closing.

b. The seller pays points on behalf of the payer of

record. Points paid by the seller to the interest recipient on

behalf of the payer of record are treated as paid to the

payer of record and then paid directly by the payer of

record to the interest recipient.

Report points paid under items 5a and 5b on the payer

of record's Form 1098 in box 6.

Exceptions. Do not report as points on Form 1098

amounts paid:

•

For loans to improve a principal residence;

•

For loans to purchase or improve a residence that is not

the payer of record's principal residence, such as a

second home, vacation, investment, or trade or business

property, even though the borrower may be entitled to

amortize points paid for the purchase of a second home,

vacation home, etc., and deduct them over the life of the

loan;

•

For a home equity or line of credit loan, even if secured

by the principal residence;

•

For refinancing (see Construction loans, later),

including a loan to refinance a debt owed by the borrower

under a land contract, a contract for deed, or similar forms

of seller financing;

•

In lieu of items ordinarily stated separately on the Form

HUD-1, such as appraisal fees, inspection fees, title fees,

attorney fees, and property taxes; and

•

To acquire a principal residence to the extent the points

are allocable to an amount of principal in excess of the

amount treated as acquisition indebtedness. Generally,

the amount treated as acquisition indebtedness cannot

exceed $750,000, but it may be up to $1 million if the

borrower entered into a written binding contract before

December 15, 2017, to close on the purchase before

January 1, 2018, and purchased the residence before

April 1, 2018 (the "written binding contract exception"). If

you know that the written binding contract exception

applies, report points that are allocable to an amount of

principal up to $1 million.

Construction loans. Amounts paid on a loan to

construct a residence (construction loan) or to refinance a

loan incurred to construct a residence are reportable on

Form 1098 as points if they:

•

Are clearly designated on the loan documents as points

incurred in connection with the loan, such as loan

origination fees, loan discount, discount points, or points;

•

Are computed as a percentage of the stated principal

loan amount;

•

Conform to an established business practice of

charging points in the area where the loan is issued and

do not exceed the amount generally charged in the area;

•

Are paid in connection with a loan incurred by the payer

of record to construct (or refinance construction of) a

residence that is to be used, when completed, as the

principal residence of the payer of record;

•

Are paid directly by the payer of record; and

•

Are not allocable to an amount of principal in excess of

$750,000, or $1 million if you know that the written binding

contract exception applies.

Amounts paid to refinance a loan to construct a

residence are not points to the extent they are allocable to

debt that exceeds the debt incurred to construct the

residence.

Prepaid Interest

Report prepaid interest (other than points) only in the year

in which it properly accrues.

Example. Interest received on December 20, of the

current year, that accrues by December 31, of the current

year, but is not due until January 31, of the following year,

is reportable on the current year Form 1098.

Exception. Interest received during the current year that

will properly accrue in full by January 15 of the following

year may be considered received in the current year, at

your option, and is reportable on Form 1098 for the

current year. However, if any part of an interest payment

accrues after January 15, then only the amount that

properly accrues by December 31 of the current year is

reportable on Form 1098 for the current year. For

example, if you receive a payment of interest that accrues

for the period December 20 through January 20, you

cannot report any of the interest that accrues after

December 31 for the current year. You must report the

interest that accrues after December 31 on Form 1098 for

the following year.

Prepaid Mortgage Insurance

Except for amounts paid to the Department of Veterans

Affairs or the Rural Housing Service, payments allocable

to periods after 2007 are treated as paid in the periods to

which they are allocable.

The Treasury Department has issued regulations for

allocating prepaid qualified mortgage insurance

premiums. Regulations section 1.163-11 applies to

prepaid qualified mortgage insurance premiums paid or

accrued on or after January 1, 2011, provided by the

Federal Housing Administration or private mortgage

insurers. For regulations applicable before January 1,

2011, see Regulations section 1.163-11T.

Reimbursement of Overpaid Interest

You are required to report reimbursements of overpaid

interest aggregating $600 or more to a payer of record on

Form 1098. You are not required to report

reimbursements of overpaid interest aggregating less

than $600 unless you are otherwise required to file Form

-4-

Instructions for Form 1098 (Rev. 01-2022)

Page 5 of 6 Fileid: … ns/i1098/202201/a/xml/cycle04/source 18:18 - 29-Dec-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

1098. That is, if you did not receive at least $600 of

mortgage interest during the year of reimbursement from

the person to whom you made the reimbursement, you

are not required to file Form 1098 merely to report a

reimbursement of less than $600. However, you may

report any reimbursement of overpaid interest that you are

not otherwise required to report, but if you do, you are

subject to the rules in these instructions.

The reimbursement must be reported on Form 1098 for

the year in which the reimbursement is made. No change

should be made to the prior year Form 1098 because of

this reimbursement. Report the total reimbursement even

if it is for overpayments made in more than 1 year.

To be reportable, the reimbursement must be a refund

or credit of mortgage interest received in a prior year that

was required to be reported for that prior year by any

interest recipient on Form 1098. Only the person who

makes the reimbursement is required to report it on Form

1098. For example, if you bought a mortgage on which

interest was overpaid in a prior year, you made a

reimbursement of the overpaid interest, and the previous

mortgage holder was required to report mortgage interest

on Form 1098 in the prior year, you must file Form 1098 to

report the reimbursement because you are the one

making the reimbursement.

Example. In the previous year, you received $5,000 of

mortgage interest from the payer/borrower and reported

that amount on Form 1098 for the previous year. In the

current year, you determined that interest due on the

mortgage for the previous year was $4,500, and the

payer/borrower had overpaid $500. You refunded the

$500 overpayment to the payer/borrower in the current

year. If you received $600 or more of interest on the

mortgage from the payer/borrower in the current year, you

must report the $500 refund in box 4 of the current year

Form 1098. No change to the previous year Form 1098 is

required. If, instead of refunding the $500 overpayment,

you credited the payer’s/borrower's current year mortgage

interest payments due, $500 is still shown in box 4, and

the interest received from the payer/borrower in the

current year shown in box 1 must include the $500 credit.

Overpayment and reimbursement in same year. If

you reimburse interest in the same year it is overpaid, do

not report the overpayment on Form 1098 as interest

received during the year or as a reimbursement of

overpaid interest. For example, if the borrower paid

$5,000 and you reimbursed $500 of that amount in the

current year, enter $4,500 in box 1 as interest paid by the

borrower. Do not enter the $500 reimbursement in box 4.

Interest on reimbursement. A financial institution (or its

middleman) that pays interest of $10 or more on the

reimbursement must report that interest (under section

6049) on Form 1099-INT, Interest Income. Others that pay

$600 or more of such interest in the course of their trade

or business must report that interest (under section 6041)

on Form 1099-INT. Do not include such interest on Form

1098.

Statements to Payers of Record

If you are required to file Form 1098, you must provide a

statement to the payer of record. For more information

about the requirement to furnish a statement to the payer

of record, see part M in the current General Instructions

for Certain Information Returns.

Truncating payer's/borrower's TIN on payee state-

ments. Pursuant to Regulations section 301.6109-4, all

filers of this form may truncate a payee’s TIN (social

security number (SSN), individual taxpayer identification

number (ITIN), adoption taxpayer identification number

(ATIN), or employer identification number (EIN)) on payee

statements. Truncation is not allowed on any documents

the filer files with the IRS. A recipient's/lender's TIN may

not be truncated on any form. See part J in the current

General Instructions for Certain Information Returns for

additional information.

Recipient's/Lender's Name, Address, and

Telephone Number Box

Enter the name, address, and telephone number of the

filer of Form 1098. Use this same name and address on

Form 1096.

Payer's/Borrower's Name and Address Boxes

Enter the name and address, in the appropriate boxes, of

the person who paid the interest (payer of record).

Be careful to enter the recipient's and payer's

information in the proper boxes.

Account Number

The account number is required if you have multiple

accounts for a payer/borrower for whom you are filing

more than one Form 1098. Additionally, the IRS

encourages you to designate an account number for all

Forms 1098 that you file. See part L in the current General

Instructions for Certain Information Returns.

Box 1. Mortgage Interest Received From

Payer(s)/Borrower(s)

Enter the interest (not including points) received on the

mortgage from borrowers during the calendar year.

Include interest on a mortgage, a home equity loan, or a

line of credit or credit card loan secured by real property.

Do not include government subsidy payments, seller

payments, or prepaid interest that does not meet the

exception explained under

Prepaid Interest, earlier.

Interest includes prepayment penalties and late charges

unless the late charges are for a specific mortgage

service.

A cooperative housing corporation that receives

any cash part of a patronage dividend from the

National Consumer Cooperative Bank must

reduce the interest to be reported on each

tenant-stockholder's Form 1098 by a proportionate

amount of the cash payment in the year the cooperative

receives the cash payment. See Rev. Proc. 94-40, 1994-1

C.B. 711.

Box 2. Outstanding Mortgage Principal

Enter the amount of outstanding principal on the mortgage

as of January 1, of the current year. If you originated the

mortgage in the current year, enter the mortgage principal

as of the date of origination. If you acquired the mortgage

TIP

TIP

Instructions for Form 1098 (Rev. 01-2022)

-5-

Page 6 of 6 Fileid: … ns/i1098/202201/a/xml/cycle04/source 18:18 - 29-Dec-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

in the current year, enter the outstanding mortgage

principal as of the date of acquisition.

Box 3. Mortgage Origination Date

Enter the date of the origination of the mortgage. If you

acquired this mortgage, do not enter the date of

acquisition (see Box 11, later). Enter the date the

mortgage originated with the original lender.

Box 4. Refund of Overpaid Interest

Enter the total refund or credit of a prior year(s)

overpayment of interest. See Reimbursement of Overpaid

Interest, earlier.

Box 5. Mortgage Insurance Premiums

To see if the applicability of this provision has

been extended, and therefore reporting is

required, go to

IRS.gov/Form1098.

If section 163(h)(3)(E) applies for the tax year being

reported, enter the total premiums of $600 or more paid

(received) for the tax year being reported, including

prepaid premiums, for qualified mortgage insurance.

Qualified mortgage insurance is mortgage insurance

under a contract issued after December 31, 2006, and

provided by the Department of Veterans Affairs, the

Federal Housing Administration, or the Rural Housing

Service (or their successor organizations), and private

mortgage insurance, as defined by section 2 of the

Homeowners Protection Act of 1998 (as in effect on

December 20, 2006).

Receipt of $600 or more of MIP is determined on a

mortgage-by-mortgage basis. Do not aggregate MIP

received on all of the mortgages of an individual to

determine whether the $600 threshold is met. You do not

need to report MIP of less than $600 received on a

mortgage, even though you receive a total of $600 or

more of MIP on all of the mortgages for an individual in a

calendar year.

See Prepaid Mortgage Insurance, earlier, for the tax

treatment of prepaid MIP.

Box 6. Points Paid on Purchase of Principal

Residence

Enter points paid on the purchase of the payer of record's

principal residence. For an explanation of reportable

points, see

Reportable points, earlier.

Box 7. Address of Property Securing Mortgage

If the address of the property securing the mortgage is the

same as the payer’s/borrower’s mailing address, either

check the box or leave the box blank and complete box 8.

If the address or description of the property securing the

mortgage is not the same as the payer’s/borrower’s

mailing address, complete box 8.

Box 8. Address or Description of Property

Securing Mortgage

If the address of the property securing the mortgage is not

the same as the payer’s/borrower’s mailing address, or

CAUTION

!

you did not complete box 7, enter the street address

(including the apartment number) of the property securing

the mortgage. Immediately below the street address,

enter the city or town; state or province; country; and ZIP

or foreign postal code of the property securing the

mortgage.

If the property securing the mortgage has no address,

enter the property’s jurisdiction and the property’s

Assessor Parcel Number(s) (APN), as indicated in the

examples below. Synonyms for the APN include the

Assessor’s Identification Number (AIN), the Property

Identification Number (PIN), the Property Account

Number, and the Tax Account Number. Examples:

Washtenaw County, MI

VV-WW-XX-YYY-ZZZ

Jackson County, MO

AA-BBB-CC-DD-EE-F-GG-HHH

Nashua, NH

XX-YY

If an APN or other such identifying number needed to

complete box 8 is not readily available for the property

(having no address) securing the mortgage, enter a

description of the property, using metes and bounds if

available, or other descriptive language to properly

identify the property. You may abbreviate as necessary.

The following statement applies to boxes 7 and 8.

If there is more than one property securing the

mortgage, you may report the address of any one

of the properties using boxes 7 and 8 and enter in box 9

the total number of properties securing the mortgage.

Box 9. Number of Mortgaged Properties

If there is more than one property securing the mortgage,

enter in box 9 the total number of properties secured by

this mortgage. If only one property secures the mortgage,

you may leave this box blank. For purposes of

determining the number of properties, you may consider

any single physical street address, 911 address, lot,

parcel, APN, or tract of land to be one property.

Box 10. Other

Enter any other item you wish to report to the payer, such

as real estate taxes, insurance paid from escrow, or, if you

are a collection agent, the name of the person for whom

you collected the interest.

Box 11. Mortgage Acquisition Date

If you acquired the mortgage in the calendar year, enter

the date of acquisition. Otherwise, leave this box blank.

CAUTION

!

-6-

Instructions for Form 1098 (Rev. 01-2022)