1

2008 First Quarter Results

Conference call

14 May 2008

2

Results highlights and sales review

Bob Kunze-Concewitz, CEO

3

First quarter ended 31 March 2008

> In an expected tougher environment we are performing as planned

> In small quarter, net sales were negatively affected by changes in US portfolio (perimeter and

SKYY destocking) and forex

> Achieved objective of offsetting Tequila 1800 profit loss via new brands (Cabo Wabo, X-Rated

and new agency brands)

> A&P shift from Q1 to Q2 and Q3 on the back of SKYY Infusions launch and CampariSoda

return to tv advertising

> Continued strong cash generation driven by improvement in operating working capital (€ 53.6 m

vs Dec 07)

Q1 2008

% change % change

€ million at actual forex at constant forex

Net sales

190.9 -2.9% -0.7%

Contribution after A&P

(1)

76.7 1.1% 3.3%

EBITDA before one-off's

47.3 1.8% 3.9%

EBITDA

50.2 8.0% 10.1%

EBIT before one-off's

42.1 1.1% 3.4%

Operating profit = EBIT

45.0 8.0% 10.3%

Group's pretax profit

40.1 6.8% 8.6%

(1)

According to new P&L format

4

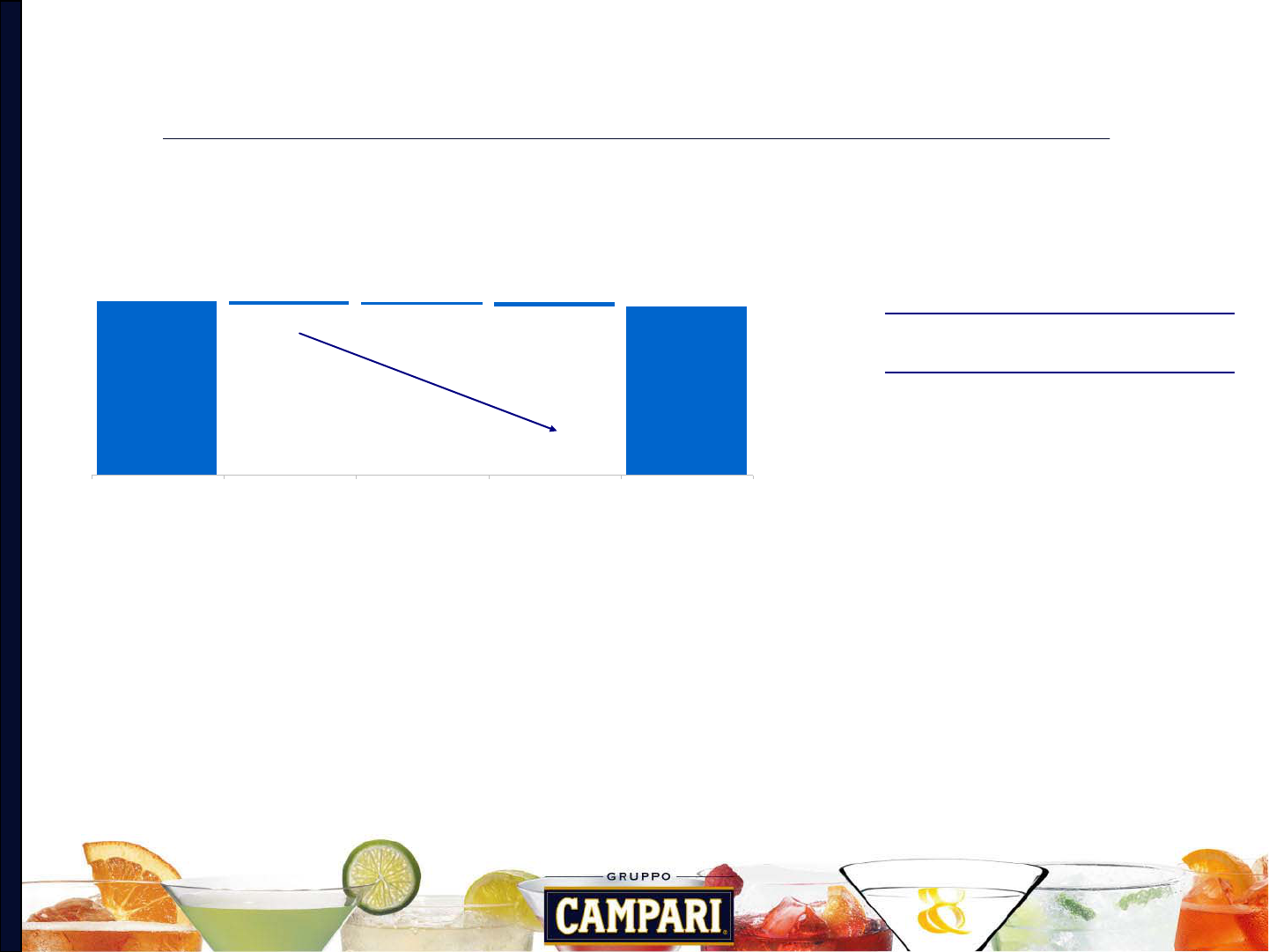

2008 First quarter net sales - Growth drivers

> Organic growth was soft as expected driven by previously announced SKYY destocking, ahead

of franchise relaunch, and tough comps (Q107: +11.3% vs Q106)

> Negative change in perimeter related to termination of Tequila 1800, partly offset by positive

contribution of Cabo Wabo, X-Rated, Bowmore and Flor de Cana

> Negative foreign exchange impact was attributable to significant US Dollar decline (-12.6%)

Q1 2007 Change in perimeter

(*)

Organic grow th Forex impact Q1 2008

€ (4.1) m

-2.1%

€ (4.1) m

-2.1%

€ 190.9m

€196.6m

€ 2.6 m

+1.3%

-2.9%

(*) Breakdown of change in perimeter

€ m

Acquisitions

(1)

5.3

Agency brands

(2)

(9.4)

Total external growth (4.1)

(1) Cabo Wabo ; X-Rated Brands

(2) Tequila 1800 ; Bowmore and Flor de Cana (US)

5

Net sales analysis by region

Italy Europe

Americas

> Good organic growth across all key categories in a tough

market environment

> Solid progression across major markets

> Negative change in perimeter due to Tequila 1800 distribution agreement termination, partly

offset by Cabo Wabo, X-Rated, Bowmore and Flor de Cana

> Negative organic growth driven by planned US SKYY destocking and tough comps (strong

Q1 ahead of price increase in Apr 07)

> Sizable negative US$ effect

Q1 2007 External Organic Forex Q1 2008

€

95.0 m +0.0% +4.4% +0.0% € 99.2 m

+4.4%

Q1 2007 External Organic Forex Q1 2008

+0.0% +7.5% -0.6% € 39.1 m

€

36.6 m

+6.9%

Q1 2007 External Organic Forex Q1 2008

-7.4% -8.7% -6.5% € 44.3 m

€

57.3 m

-22.6%

6

Net sales analysis by segment

Soft drinks

Spirits

Wines

> Overall organic sales driven by planned US SKYY destocking and tough

comps (Q1 ahead of price increase in Apr 07)

> Negative change in perimeter due to Tequila 1800 distribution agreement

termination, partly offset by Cabo Wabo, X-Rated, Bowmore and Flor de

Cana

> Continued strong performance of Cinzano mitigated

by tough comps (Q107: +24,5%) and a weak quarter

on Riccadonna in Australasia

> Excellent performance driven by strong Crodino as well

as good carbonated soft drinks results

Q1 2007 External Organic Forex Q1 2008

€ 139.2 m

-2.9% -1.6% -2.7% € 129.1 m

-7.2%

Q1 2007 External Organic Forex Q1 2008

€ 28.1 m +0.0% +12.8% +0.0%

€

31.7 m

+12.8%

Q1 2007 External Organic Forex Q1 2008

€ 25.7 m +0.0% € 26.5 m

+3.7%

-0.4%

+3.3%

7

Q1 2008 consolidated net sales : € 190.9 m

Net sales breakdown

Breakdown by region

Breakdown by segment

Italy

52.0%

Europe

20.5%

Americas

(1)

23.2%

RoW and

Duty Free

4.3%

(48.3% in 2007)

(1) Include:

USA 17.9%

Brazil 3.9 %

Other 1.5 %

(3.9% in 2007)

(29.1% in 2007)

(18.6% in 2007)

Soft Drinks

16.6%

Other

1.9%

Wines

13.9%

Spirits

67.6%

(14.3% in 2007)

(70.8% in 2007)

(13.1% in 2007)

(1.8% in 2007)

8

Review of main brands

% change in sales value

Q1 2008 / Q1 2007

Spirits

at constant FX at actual FX

Campari

1.4% 0.9%

> Overall satisfactory progression, with impact of positive consumption mitigated by tough

shipments comps (Q107: +10.7%)

SKYY

-2.3% -13.2%

> Weak quarter in US shipments due to planned destocking and tough comps (Q107: +21.5%),

ahead of price increase

CampariSoda

2.8% 2.8%

> Positive quarter in Italy, ahead of start of new campaign

Aperol

11.6% 11.5%

> Double digit organic growth driven by strong performance in Italy and Germany

Brazilian brands

-20.3% -15.4%

> Weak shipments in a very small quarter due to early Carnival; Nielsen growth continued double

digit

Cynar

-9.3% -8.9%

> Good performance in Europe mitigated by weak shipments in Brazil

Glen Grant

-15.5% -15.6%

> Weak performance in a small quarter (representing 15% of volumes)

9

Review of main brands (cont’d)

% change in sales value

Q1 2008 / Q1 2007

Wines

at constant FX at actual FX

Cinzano

sparkling wines

9.3% 9.1%

> Strong performance mainly driven by innovation and brand building in major markets

(Germany and Italy)

Cinzano

vermouths

9.7% 8.5%

> Strong result achieved in major markets, in particular Eastern Europe

Sella & Mosca

2.2% 2.2%

> Satisfactory results in Europe mitigated by weak shipments in US

Soft drinks

Crodino

14.1% 14.1%

> Continued very strong results

10

Q1 2008 consolidated results

Paolo Marchesini, CFO

11

Q1 2007

Previous format New format

€ m % € m %

Net sales 196.6 100.0% Net sales 196.6 100.0%

COGS (81.7) -41.6%

COGS

(1)

(88.9) -45.2%

Gross margin 114.8 58.4%

Gross margin after distribution costs 107.6 54.8%

Advertising and promotion (31.8) -16.2% Advertising and promotion (31.8) -16.2%

Selling and distribution expenses (25.3) -12.9%

Contribution after A&P 75.8 38.6%

Trading profit 57.7 29.4%

G&A and other operating income/expenses (16.0) -8.2%

SG&

A

(2)

(34.2) -17.4%

EBIT before one-off's 41.7 21.2% EBIT before one-off's 41.7 21.2%

One-off's 0.0 0.0% One-off's 0.0 0.0%

Operating profit = EBIT 41.7 21.2% Operating profit = EBIT 41.7 21.2%

Change in P&L format

> Key changes:

Selling and distribution expenses Distribution expenses to COGS (COGS at point of sale)

Selling expenses to SG&A

> Therefore:

> Gross margin > Gross margin after distribution expenses

> Trading profit > CAA&P (excl. selling expenses)

> EBIT = EBIT

CONSOLIDATED INCOME STATEMENT

(1)

Cost of materials + Production costs + distribution expenses

(2)

G&A + other operating income/expenses + selling expenses

12

Consolidated EBIT

> Increase in COGS by 20bp on net sales

> A&P decrease on net sales mainly driven by a different phasing of advertising initiatives quarter on quarter

> Increase in contribution after A&P of 1.1% was composed of:

- organic growth: +3.7%

- change in perimeter: -0.4% (contribution of Cabo Wabo and X-Rated almost offset profit lost from termination of

Tequila 1800)

- forex impact: -2.2%

> SG&A increased by 1.1% overall. At constant forex: +3.2%

> One-off’s of € 2.9 m reflect capital gain from real estate disposal (warehouse in Italy), net of provision for assets

write-downs and personnel restructuring cost

(1)

Cost of materials + Production costs + distribution expenses

(2)

G&A + other operating income/expenses + selling expenses

(3)

According to IAS/IFRS net exceptional income (renamed as one-off’s) is reclassified as a component of operating profit.

(€ million) Q1 2008 Q1 2007

Change at

actual forex

Change at

constant forex

Net sales 190.9

100.0%

196.6

100.0% -2.9% -0.7%

COGS

(1)

(86.7) -45.4% (88.9) -45.2% -2.6%

Gross margin after distribution costs 104.3

54.6%

107.6

54.8% -3.1%

Advertising and promotion (27.6) -14.5% (31.8) -16.2% -13.2%

Contribution after A&P 76.7

40.2%

75.8

38.6% 1.1% +3.3%

SG&A

(2)

(34.6) -18.1% (34.2) -17.4% 1.1%

EBIT before one-off's 42.1

22.1%

41.7

21.2% 1.1% +3.4%

One-off's

(3)

2.9 1.5% 0.0 0.0% -

Operating profit = EBIT 45.0

23.6%

41.7

21.2% 8.0% +10.3%

Other information:

Depreciation (5.1) -2.7% (4.8) -2.4% 7.3%

EBITDA before one-off's 47.3

24.8%

46.4

23.6% 1.8% +3.9%

EBITDA

50.2 26.3% 46.5 23.6% 8.0%

+10.1%

13

Consolidated Group’s pretax profit

> Net financial expenses up due to floating rates increase quarter on quarter

> Increase in minority interests due to recognition of Cabo Wabo minorities

(€ million) Q1 2008 Q1 2007

Change at

actual forex

Change at

constant forex

Operating profit = EBIT 45.0 23.6% 41.7 21.2% 8.0%

+10.3%

Net financial income (expenses) (4.5) -2.3% (4.2) -2.1% 7.2%

Income from associates 0.1 0.0% 0.0 0.0% 55.0%

Pretax profit

40.6 21.3% 37.6 19.1% 8.2%

Minority interests (0.6) -0.3% (0.0) 0.0% 0.0%

Group's pretax profit 40.1 21.0% 37.5 19.1% 6.8% +8.6%

14

Analysis of net debt

> Net debt on ordinary activities down by € 20.3 m to € 267.8 after:

> Payment of 80% stake in Cabo Wabo ($ 80.8 m) in January 2008

> Sale of warehouse in Italy (€ 6.7 m)

> Total net debt down by € 1.9 m to 286.2 after provisioning € 18.4 m for exercise cost of Cabo

Wabo put/call options

€ million

31 March 2008 31 December 2007

Cash and cash e

q

uivalents

191.0 199.8

Pa

y

ables to banks

(99.7) (114.4)

Real estate lease

p

a

y

ables

(3.2) (3.2)

Private

p

lacement and bond issues

(11.6) (17.3)

Other assets or liabilities

1.1 1.3

Total short-term cash/(debt) 77.6 66.3

Payables to banks

(1.8) (1.8)

Real estate lease

p

a

y

ables

(12.1) (12.9)

Private

p

lacement and bond issues

(330.7) (338.8)

Other financial

p

a

y

ables

(0.8) (1.0)

Total medium to long-term cash/(debt)

(345.4) (354.4)

Total cash/(debt) on ordinary activities

(267.8) (288.1)

Estimated debt for possible exercise of put option on

remainin

g

Cabo Wabo stake

(1)

(18.4) 0.0

Total net cash/(debt)

(286.2) (288.1)

(1) Estimated debt for possible exercise of put option (15% and 5% to be exercised in 2012 and 2015 respectively) on remaining 20% minority stake in Cabo Wabo

15

Net Working Capital

> On a like for like basis net working capital as % of sales down from 25.1% to 24.9%

> Net working capital in March 08 decreases by € 53.6 m vs Dec 07, mainly due to expected

reduction in trade receivables following seasonal peak

(€ million)

31 Mar 2008 31 Dec 2007 Change 31 Mar 2007

Trade receivables 202.9 280.0 (77.1) 186.0

Inventories 172.8 166.9 5.8 179.2

Trade payables (138.9) (156.6) 17.6 (127.6)

Net Working Capital 236.7 290.4 (53.6) 237.6

Last 12 months sales to 31 Mar 2008 951.9 957.5 (5.6) 946.9

NWC / LTM (%)

(1)

24.9% 30.3% 25.1%

(1) LTM = Last 12 Months

16

Outlook

Bob Kunze-Concewitz, CEO

17

Outlook

> Outlook for 2008 remains unchanged despite tougher market

environment

– Confirmed good performance in major Italian market

– US business expected to return to growth following completion of

portfolio changes in Q1

– Brazilian business expected to leverage positive consumption trends

across portfolio

– US dollar negative effects expected to continue

18

Supplementary schedules

Schedule - 1 Analysis of net sales growth by segment and region

Schedule - 2 Consolidated income statement

Schedule - 3 Consolidated income statement new format

Schedule - 4 Trading profit/CAA&P by business area new format

Schedule - 5 Average exchange rates

19

Supplementary

schedule - 1

Net sales analysis by segment and region

Consolidated net sales by segment

Q1 2008 Q1 2007 Change of which:

€ m % € m % %

external organic currency

Spirits 129.1 67.6% 139.2 70.8%

-7.2%

-2.9% -1.6% -2.7%

Wines 26.5 13.9% 25.7 13.1% 3.3% 0.0% 3.7% -0.4%

Soft drinks 31.7 16.6% 28.1 14.3%

12.8%

0.0% 12.8% 0.0%

Other revenues 3.6 1.9% 3.6 1.8% 1.3% 0.0% 8.2% -6.9%

Total 190.9 100.0% 196.6 100.0% -2.9% -2.1% 1.3% -2.1%

Consolidated net sales by region

Q1 2008 Q1 2007 Change

of which:

€ m % € m %

% external organic currency

Italy 99.2 52.0% 95.0 48.3% 4.4% 0.0% 5.2% 0.0%

Europe 39.1 20.5% 36.6 18.6% 6.9% 0.0% 7.5% -0.6%

Americas (1) 44.3 23.2% 57.3 29.1% -22.6% -7.4% -8.7% -6.5%

RoW & Duty Free 8.3 4.3% 7.7 3.9% 7.8% 1.5% 8.7% -2.4%

Total 190.9 100.0% 196.6 100.0% -2.9%

-2.1% 1.3% -2.1%

(1) Breakdown of Americas

Q1 2008 Q1 2007 Change of which:

€ m % € m %

%

external organic currency

USA 34.2 77.1% 45.7 79.8%

-25.2%

-9.5% -7.0% -8.6%

Brazil 7.4 16.6% 9.1 15.9% -19.1% 0.0% -23.7% 4.7%

Other countries 2.8 6.3% 2.5 4.3% 10.8% 5.7% 14.9% -8.1%

Total 44.3 100.0% 57.3 100.0% -22.7% -7.4% -8.7% -6.5%

20

Supplementary

schedule - 2

Consolidated income statement

Q1 2008 Q1 2007 Chan

g

e

€ m % € m % %

Net sales (1) 190.9 100.0% 196.6 100.0% -2.9%

COGS

(2)

(86.7) -45.4% (88.9) -45.2% -2.6%

Gross margin after distribution costs 104.3 54.6% 107.6 54.8% -3.1%

Advertising and promotion (27.6) -14.5% (31.8) -16.2% -13.2%

Contribution after A&P

76.7 40.2% 75.8 38.6% 1.1%

SG&A

(3)

(34.6) -18.1% (34.2) -17.4% 1.1%

EBIT before one-off's 42.1 22.1% 41.7 21.2% 1.1%

One-off's 2.9 1.5% 0.0 0.0%

Operating profit = EBIT 45.0 23.6% 41.7 21.2% 8.0%

Net financial income (expenses) (4.5) -2.3% (4.2) -2.1% 7.2%

Income from associates 0.1 0.0% 0.0 0.0% 55.0%

Pretax profit 40.6 21.3% 37.6 19.1% 8.2%

Minority interests (0.6) -0.3% (0.0) 0.0%

Group's pretax profit 40.1 21.0% 37.5 19.1% 6.8%

Other information:

Depreciation (5.1) -2.7% (4.8) -2.4% 7.3%

EBITDA before one-off's 47.3 24.8% 46.4 23.6% 1.8%

EBITDA 50.2 26.3% 46.5 23.6% 8.0%

Notes:

(1)

Net of discounts and excise duties

(2)

Cost of materials + Production costs + distribution expenses

(3)

G&A + other operating income/expenses + selling expenses

21

Supplementary

schedule - 3

Consolidated income statement new format

(1)

Cost of materials + Production costs + distribution expenses

(2)

G&

A +

o

th

e

r

ope

r

a

tin

g

in

co

m

e/e

x

pe

n

ses

+

se

llin

g

e

x

pe

n

ses

Q1 2007

Previous format New format

€ m % € m %

Net sales 196.6 100.0% Net sales 196.6 100.0%

COGS (81.7) -41.6%

COGS

(1)

(88.9) -45.2%

Gross margin 114.8 58.4%

Gross margin after distribution costs 107.6 54.8%

Advertising and promotion (31.8) -16.2% Advertising and promotion (31.8) -16.2%

Selling and distribution expenses (25.3) -12.9%

Contribution after A&P 75.8 38.6%

Trading profit 57.7 29.4%

G&A and other operating income/expenses (16.0) -8.2%

SG&A

(2)

(34.2) -17.4%

EBIT before one-off's 41.7 21.2% EBIT before one-off's 41.7 21.2%

One-off's 0.0 0.0% One-off's 0.0 0.0%

Operating profit = EBIT 41.7 21.2% Operating profit = EBIT 41.7 21.2%

Q2 2007

Previous format New format

€ m % € m %

Net sales 244.0 100.0% Net sales 244.0 100.0%

COGS (103.2) -42.3%

COGS

(1)

(112.2) -46.0%

Gross margin 140.8 57.7%

Gross margin after distribution costs 131.8 54.0%

Advertising and promotion (48.0) -19.7% Advertising and promotion (48.0) -19.7%

Selling and distribution expenses (26.7) -11.0%

Contribution after A&P 83.8 34.3%

Trading profit 66.0 27.0%

G&A and other operating income/expenses (14.9) -6.1%

SG&A

(2)

(32.7) -13.4%

EBIT before one-off's 51.1 20.9% EBIT before one-off's 51.1 20.9%

One-off's (1.7) -0.7% One-off's (1.7) -0.7%

Operating profit = EBIT 49.4 20.3% Operating profit = EBIT 49.4 20.3%

22

Supplementary

schedule - 3

Consolidated income statement new format (cont’d)

(1)

Cost of materials + Production costs + distribution expenses

(2)

G&

A +

o

th

e

r

ope

r

a

tin

g

in

co

m

e/e

x

pe

n

ses

+

se

llin

g

e

x

pe

n

ses

Q3 2007

Previous format New format

€ m % € m %

Net sales 204.0 100.0% Net sales 204.0 100.0%

COGS (88.7) -43.5%

COGS

(1)

(96.4) -47.2%

Gross margin 115.3 56.5%

Gross margin after distribution costs 107.7 52.8%

Advertising and promotion (37.5) -18.4% Advertising and promotion (37.5) -18.4%

Selling and distribution expenses (24.8) -12.2%

Contribution after A&P 70.1 34.4%

Trading profit 53.0 26.0%

G&A and other operating income/expenses (15.6) -7.6%

SG&A

(2)

(32.8) -16.1%

EBIT before one-off's 37.3 18.3% EBIT before one-off's 37.3 18.3%

One-off's 0.4 0.2% One-off's 0.4 0.2%

Operating profit = EBIT 37.7 18.5% Operating profit = EBIT 37.7 18.5%

Q4 2007

Previous format New format

€ m % € m %

Net sales 312.9 100.0% Net sales 312.9 100.0%

COGS (133.5) -42.7%

COGS

(1)

(143.8) -46.0%

Gross margin 179.4 57.3%

Gross margin after distribution costs 169.1 54.0%

Advertising and promotion (57.3) -18.3% Advertising and promotion (57.3) -18.3%

Selling and distribution expenses (28.2) -9.0%

Contribution after A&P 111.8 35.7%

Trading profit 94.0 30.0%

G&A and other operating income/expenses (20.6) -6.6%

SG&A

(2)

(38.5) -12.3%

EBIT before one-off's 73.3 23.4% EBIT before one-off's 73.3 23.4%

One-off's (1.6) -0.5% One-off's (1.6) -0.5%

Operating profit = EBIT 71.7 22.9% Operating profit = EBIT 71.7 22.9%

23

Supplementary

schedule - 3

Consolidated income statement new format (cont’d)

(1)

Cost of materials + Production costs + distribution expenses

(2)

G&

A +

o

th

e

r

ope

r

a

tin

g

in

co

m

e/e

x

pe

n

ses

+

se

llin

g

e

x

pe

n

ses

Previous format New format

€ m % € m %

Net sales 440.6 100.0% Net sales 440.6 100.0%

COGS (185.0) -42.0%

COGS

(1)

(201.1) -45.7%

Gross margin 255.6 58.0%

Gross margin after distribution costs 239.4 54.3%

Advertising and promotion (79.8) -18.1% Advertising and promotion (79.8) -18.1%

Selling and distribution expenses (52.1) -11.8%

Contribution after A&P 159.6 36.2%

Trading profit 123.7 28.1%

G&A and other operating income/expenses (31.0) -7.0%

SG&A

(2)

(66.9) -15.2%

EBIT before one-off's 92.7 21.0% EBIT before one-off's 92.7 21.0%

One-off's (1.6) -0.4% One-off's (1.6) -0.4%

Operating profit = EBIT 91.1 20.7% Operating profit = EBIT 91.1 20.7%

Previous format New format

€ m % € m %

Net sales 644.6 100.0% Net sales 644.6 100.0%

COGS (273.7) -42.5%

COGS

(1)

(297.5) -46.2%

Gross margin 370.9 57.5%

Gross margin after distribution costs 347.1 53.8%

Advertising and promotion (117.4) -18.2% Advertising and promotion (117.4) -18.2%

Selling and distribution expenses (76.9) -11.9%

Contribution after A&P 229.7 35.6%

Trading profit 176.7 27.4%

G&A and other operating income/expenses (46.6) -7.2%

SG&A

(2)

(99.7) -15.5%

EBIT before one-off's 130.1 20.2% EBIT before one-off's 130.1 20.2%

One-off's (1.2) -0.2% One-off's (1.2) -0.2%

Operating profit = EBIT 128.8 20.0% Operating profit = EBIT 128.8 20.0%

H1 2007

9M 2007

24

Supplementary

schedule - 3

Consolidated income statement new format (cont’d)

(1)

Cost of materials + Production costs + distribution expenses

(2)

G&

A +

o

th

e

r

ope

r

a

tin

g

in

co

m

e/e

x

pe

n

ses

+

se

llin

g

e

x

pe

n

ses

FY 2007

Previous format New format

€ m % € m %

Net sales 957.5 100.0% Net sales 957.5 100.0%

COGS (407.2) -42.5%

COGS

(1)

(441.4) -46.1%

Gross margin 550.3 57.5%

Gross margin after distribution costs 516.2 53.9%

Advertising and promotion (174.6) -18.2% Advertising and promotion (174.6) -18.2%

Selling and distribution expenses (105.1) -11.0%

Contribution after A&P 341.5 35.7%

Trading profit 270.6 28.3%

G&A and other operating income/expenses (67.2) -7.0%

SG&A

(2)

(138.1) -14.4%

EBIT before one-off's 203.4 21.2% EBIT before one-off's 203.4 21.2%

One-off's (2.8) -0.3% One-off's (2.8) -0.3%

Operating profit = EBIT 200.6 20.9% Operating profit = EBIT 200.6 20.9%

25

Supplementary

schedule - 4

Trading profit/CAA&P by business area new format

SPIRITS WINES

Previous format New format Previous format New format

€ m % € m % € m % € m %

Net sales 318.7 100.0% Net sales 318.7 100.0% Net sales 56.9 100.0% Net sales 56.9 100.0%

COGS (122.2) -38.3% COGS (31.5) -55.3%

COGS

(1)

(131.2) -41.2%

COGS

(1)

(33.8) -59.5%

Gross margin 196.5 61.7% Gross margin 25.4 44.7%

Gross margin after distribution costs 187.5 58.8% Gross margin after distribution costs 23.1 40.5%

Advertising and promotion (64.0) -20.1% Advertising and promotion (64.0) -20.1% Advertising and promotion (10.7) -18.8% Advertising and promotion (10.7) -18.8%

Selling and distribution expenses (34.8) -10.9% Selling and distribution expenses (8.9) -15.6%

Contribution after A&P 123.4 38.7% Contribution after A&P 12.3 21.7%

Trading profit 97.7 30.7% Trading profit 5.9 10.3%

SOFT DRINKS OTHERS

Previous format New format Previous format New format

€ m % € m % € m % € m %

Net sales 57.4 100.0% Net sales 57.4 100.0% Net sales 7.6 100.0% Net sales 7.6 100.0%

COGS (25.1) -43.8% COGS (6.2) -81.6%

COGS

(1)

(29.8) -52.0%

COGS

(1)

(6.2) -82.4%

Gross margin 32.3 56.2% Gross margin 1.4 18.4%

Gross margin after distribution costs 27.6 48.0% Gross margin after distribution costs 1.3 17.6%

Advertising and promotion (5.0) -8.8% Advertising and promotion (5.0) -8.8% Advertising and promotion (0.0) -0.2% Advertising and promotion (0.0) -0.2%

Selling and distribution expenses (8.3) -14.5% Selling and distribution expenses (0.1) -1.1%

Contribution after A&P 22.5 39.3% Contribution after A&P 1.3 17.4%

Trading profit 18.9 32.9% Trading profit 1.3 17.1%

H1 2007

(1)

Cost of materials + Production costs + distribution expenses

26

Supplementary

schedule - 4

Trading profit/CAA&P by business area new format (cont’d)

FY 2007

SPIRITS WINES

Previous format New format Previous format New format

€ m % € m % € m % € m %

Net sales 687.1 100.0% Net sales 687.1 100.0% Net sales 151.3 100.0% Net sales 151.3 100.0%

COGS (262.6) -38.2% COGS (85.6) -56.6%

COGS

(1)

(281.2) -40.9%

COGS

(1)

(92.1) -60.8%

Gross margin 424.6 61.8% Gross margin 65.7 43.4%

Gross margin after distribution 405.9 59.1% Gross margin after distribution 59.3 39.2%

Advertising and promotion (136.3) -19.8% Advertising and promotion (136.3) -19.8% Advertising and promotion (28.9) -19.1% Advertising and promotion (28.9) -19.1%

Selling and distribution expenses (69.0) -10.0% Selling and distribution expenses (20.3) -13.4%

Contribution after A&P 269.7 39.2% Contribution after A&P 30.4 20.1%

Trading profit 219.3 31.9% Trading profit 16.6 11.0%

SOFT DRINKS OTHERS

Previous format New format Previous format New format

€ m % € m % € m % € m %

Net sales 102.4 100.0% Net sales 102.4 100.0% Net sales 16.7 100.0% Net sales 16.7 100.0%

COGS (45.5) -44.5% COGS (13.5) -81.0%

COGS

(1)

(54.4) -53.1%

COGS

(1)

(13.7) -82.3%

Gross margin 56.9 55.5% Gross margin 3.2 19.0%

Gross margin after distribution 48.0 46.9% Gross margin after distribution 2.9 17.7%

Advertising and promotion (9.5) -9.3% Advertising and promotion (9.5) -9.3% Advertising and promotion 0.0 0.0% Advertising and promotion 0.0 0.0%

Selling and distribution expenses (15.6) -15.2% Selling and distribution expenses (0.2) -1.3%

Contribution after A&P 38.5 37.6% Contribution after A&P 2.9 17.7%

Trading profit 31.8 31.0% Trading profit 2.9 17.7%

(1)

Cost of materials + Production costs + distribution expenses

27

Supplementary

schedule - 5

Average exchange rates

Q1 2008 Q1 2007 % change

US dollar : 1 Euro

1.500 1.310

Euro : 1 US dollar

0.6667 0.7631 -12.6%

Brazilian Real : 1 Euro

2.602 2.763

Euro : 1 Brazilian Real

0.3843 0.3620 6.2%

28

WWW.CAMPARIGROUP.COM

For additional information:

Investor Relations - Gruppo Campari

Phone: +39 02 6225 330; Fax: +39 02 6225 479

E-mail: [email protected]; Website:http://investors.camparigroup.com/