2024 CALIFORNIA

EMPLOYER’S GUIDE

DE 44 Rev. 50 (1-24) (INTERNET)

Cover + 125 pages

CU

Please note updates:

Page: 3

The Redding Employment Tax Office is closed.

We apologize for the inconvenience.

Important Information

Eective January 1, 2024, Senate Bill 951 removes the taxable wage limit and maximum withholdings for

each employee subject to State Disability Insurance (SDI) contributions.

Electronic Reporting and Payment Requirement: All employers must electronically submit employment tax

returns, wage reports, and payroll tax deposits to the Employment Development Department (EDD). For more

information, visit E-file and E-pay mandate (edd.ca.gov/EfileMandate) or refer to page 49.

e-Services for Business: Employers can file, pay, and manage their employer payroll tax account online. For

more information, visit e-Services for Business (edd.ca.gov/eServices) or refer to page 50.

State Information Data Exchange System (SIDES): Employers and third-party administrators can elect to

electronically receive and respond to the EDD Notice of Unemployment Insurance Claim Filed (DE 1101CZ)

using SIDES. For more information, visit SIDES (edd.ca.gov/SIDES).

New Employee Registry (NER): All employers are required by law to report all newly hired or

rehired employees to the NER within 20 days of their start-of-work date. For more information, visit

NER California’s New Hire Reporting Program (edd.ca.gov/Payroll_Taxes/New_Hire_Reporting.htm) or refer to

page 53.

Payroll Tax Seminars: The EDD offers no-cost seminars to help employers comply with state payroll tax

laws. For more information, visit Payroll Tax Seminars (edd.ca.gov/payroll_tax_seminars) or refer to page 1.

Fraud Prevention, Detection, and Reporting: For information on how to prevent and detect fraud, visit

Help Fight Fraud (edd.ca.gov/about_edd/fraud.htm). Refer to page 83 for information about UI fraud, or

page 95 for DI fraud.

Improper Payment of UI Benets: When an employer is financially impacted by improper UI payments, the

problem can result in higher UI taxes for all employers. You can help by responding timely to requests for wage

information. For more information, visit UI claim notices (edd.ca.gov/unemployment/responding_to_ui_claim_

notices.htm).

California Employer News and Updates: Find the latest tax news, annual updates, and resources to support

you and your business. Visit Employer News and Updates (edd.ca.gov/payroll_taxes/employer-news.htm) and

subscribe to receive emails about employment and payroll tax updates.

2024 Payroll Tax Rates, Taxable Wage Limits, and Maximum Benet Amounts

Unemployment Insurance (UI)

• The 2024 taxable wage limit is $7,000 per employee.

• The UI maximum weekly benefit amount is $450.

• The UI tax rate for new employers is 3.4 percent (.034) for a period of two to three years.

• The employer rates are available online at

e-Services for Business

(edd.ca.gov/eServices).

Employment Training Tax (ETT)

• The 2024 ETT rate is 0.1 percent (.001) on the first $7,000 of each employee’s wages.

State Disability Insurance (SDI)

• The 2024 SDI withholding rate is 1.1 percent (.011). The rate includes Disability Insurance (DI) and Paid

Family Leave (PFL).

• There is no SDI taxable wage limit beginning January 1, 2024. DI and PFL maximum weekly benefit

amount are available online at Quick Statistics (edd.ca.gov/en/about_edd/quick_statistics).

California Personal Income Tax (PIT) Withholding

California PIT withholding is based on the amount of wages paid, the number of withholding allowances

claimed by the employee, and the payroll period.

For additional information on PIT withholding refer to pages 15 and 17 or visit Rates and Withholding

(edd.ca.gov/payroll_taxes/rates_and_withholding.htm).

Gavin Newsom, Governor

California Labor and Workforce Development Agency

PO Box 826880

•

Sacramento, CA 94280-0001

•

edd.ca.gov

Dear California Employer:

The Employment Development Department (EDD) understands your time is valuable.

We are committed to providing you with the tools and resources to manage your payroll

tax account online.

We’ve made it easier to file and pay with e-Services for Business (edd.ca.gov/

eServices), available 24 hours a day, 7 days a week. You can file, adjust, print returns,

make payments, update your account information, and much more!

The EDD has recently streamlined our website, creating a more functional and

user-friendly experience, including a virtual agent who can help answer common

questions. We encourage you to explore our improved EDD website (edd.ca.gov) to

learn more about many of our programs and services. As a valued employer, we have

a Payroll Taxes (edd.ca.gov/Payroll_Taxes) resource page to help you understand

your California payroll tax reporting responsibilities. You can also register for

Payroll Tax Seminars (edd.ca.gov/payroll_tax_seminars) at no-cost to help established

employers and new employers understand and comply with state payroll tax laws.

Join the many employers taking advantage of going paperless, to save time

and space, while helping to preserve the environment. You can access the

California Employer’s Guide (DE 44) at (edd.ca.gov/en/Payroll_Taxes/Employers_

Guides). If you’re currently receiving a paper guide, you can opt-out on e-Services for

Business.

Take advantage of our email subscription service (edd.ca.gov/about_edd/get_email_

notices.htm) and receive the latest updates, reminders, and information on our

programs and services.

We are available and stand ready to answer your payroll tax questions, contact our

Taxpayer Assistance Center at 1-888-745-3886.

We wish you continued success in the year ahead.

Sincerely,

NANCY FARIAS

Director

Manage Your Employer Payroll Tax Account Online!

Use e-Services for Business to electronically:

• File tax returns and wage reports

• Make payments

• Update addresses

• And much more

Enroll at e-Services for Business

(edd.ca.gov/eServices).

You can view or download this

guide at California Employer Guides

(edd.ca.gov/en/Payroll_Taxes/Employers_Guides).

edd.ca.gov i

Table of Contents

Seminars to Help Employers Succeed ...................................................................................................................................................................................................... 1

Introduction ............................................................................................................................................................................................................................................................................... 2

Payroll Tax Help, Forms, and Publications .......................................................................................................................................................................................... 3

Start Here ...................................................................................................................................................................................................................................................................................... 4

Flowchart

............................................................................................................................................................................................................................................................................. 5

2024 Forms and Due Dates

..................................................................................................................................................................................................................................... 6

About Employers and When to Register ................................................................................................................................................................................................. 7

Classifying Employees ................................................................................................................................................................................................................................................. 8

ABC Test, Employee or Independent Contractor? ..................................................................................................................................................................... 8

State Payroll Taxes ............................................................................................................................................................................................................................................................ 9

Unemployment Insurance ................................................................................................................................................................................................................................... 9

Employment Training Tax .................................................................................................................................................................................................................................... 9

State Disability Insurance Tax ........................................................................................................................................................................................................................ 9

California Personal Income Tax .................................................................................................................................................................................................................... 9

State Payroll Taxes (table) .............................................................................................................................................................................................................................. 10

Help Us Fight Fraud .............................................................................................................................................................................................................................................. 10

Wages ............................................................................................................................................................................................................................................................................................. 11

Subject Wages ............................................................................................................................................................................................................................................................. 11

Personal Income Tax Wages ......................................................................................................................................................................................................................... 11

Are Subject Wages and Personal Income Tax Wages the Same? ......................................................................................................................... 11

Employers Subject to California Personal Income Tax Only ......................................................................................................................................... 11

Meals and Lodging ................................................................................................................................................................................................................................................. 12

Additional Information .......................................................................................................................................................................................................................................... 12

California Personal Income Tax Withholding ................................................................................................................................................................................. 13

How to Determine Which Wages Require PIT Withholding .......................................................................................................................................... 13

Marital Status, Withholding Allowances, and Exemptions Form W-4 and DE 4 ....................................................................................... 13

Employer Obligations for Forms W-4 and DE 4 ........................................................................................................................................................................ 14

How to Determine PIT Withholding Amounts .............................................................................................................................................................................. 15

What if Your Employee Wants Additional PIT Withholding? .............................................................................................................................. 15

How to Withhold PIT on Supplemental Wages .......................................................................................................................................................................... 15

Quarterly Estimated Payments ................................................................................................................................................................................................................... 15

Wages Paid to:

California Residents .................................................................................................................................................................................................................................... 16

Nonresidents of California .................................................................................................................................................................................................................... 16

PIT Withholding on Payments to Nonresident Independent Contractors ........................................................................................................ 16

Additional Information .......................................................................................................................................................................................................................................... 16

California Withholding Schedules for 2024 ...................................................................................................................................................................................... 17

Electronic Filing and Payment Requirements ............................................................................................................................................................................... 49

E-file and E-pay Mandate for Employers ......................................................................................................................................................................................... 49

Online Services .................................................................................................................................................................................................................................................................. 50

e-Services for Business ..................................................................................................................................................................................................................................... 50

Express Pay ................................................................................................................................................................................................................................................................... 51

e-Services for Business Tutorials and User Guide ................................................................................................................................................................. 51

Frequently Asked Questions ......................................................................................................................................................................................................................... 51

Required Forms ................................................................................................................................................................................................................................................................. 52

Report of New Employee(s) (DE 34)

Overview ................................................................................................................................................................................................................................................................ 53

Sample DE 34 Form ................................................................................................................................................................................................................................... 54

Report of Independent Contractor(s) (DE 542)

Overview ................................................................................................................................................................................................................................................................ 55

Sample DE 542 Form ............................................................................................................................................................................................................................... 56

Taxpayer Assistance Center 1-888-745-3886

ii Taxpayer Assistance Center 1-888-745-3886

Table of Contents

Payroll Tax Deposit (DE 88)

Overview ................................................................................................................................................................................................................................................................ 57

Withholding Deposits ................................................................................................................................................................................................................................. 58

California Deposit Requirements ................................................................................................................................................................................................... 58

Due Dates for Quarterly Tax Deposits ...................................................................................................................................................................................... 59

2024 Quarterly Payment Table ........................................................................................................................................................................................................ 59

Correcting Previously Submitted Payroll Tax Deposit (DE 88) ....................................................................................................................... 60

Quarterly Contribution Return and Report of Wages (DE 9)

Overview ................................................................................................................................................................................................................................................................ 62

2024 Due Dates for the DE 9 ............................................................................................................................................................................................................ 62

Correcting a Previously Filed DE 9 ............................................................................................................................................................................................. 62

Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C)

Overview ................................................................................................................................................................................................................................................................ 63

2024 Due Dates for the DE 9C ........................................................................................................................................................................................................ 63

Correcting a Previously Filed DE 9C ......................................................................................................................................................................................... 64

Quarterly Contribution and Wage Adjustment Form (DE 9ADJ)

Overview ................................................................................................................................................................................................................................................................ 65

Sample DE 9ADJ Form ........................................................................................................................................................................................................................... 66

Federal Forms W-2 and 1099 ...................................................................................................................................................................................................................... 68

Change to Your Business Status .................................................................................................................................................................................................................. 70

Business Name and Mailing Address Change ........................................................................................................................................................................... 70

No Longer Have Employees ......................................................................................................................................................................................................................... 70

Close Your Business ............................................................................................................................................................................................................................................. 70

Reopen Your Employer Payroll Tax Account ................................................................................................................................................................................ 70

Purchase, Sell, Transfer, or Change Ownership ...................................................................................................................................................................... 71

What Is A Successor Employer? ............................................................................................................................................................................................................... 71

It Is Against the Law to Change or Purchase a Business Entity Solely to Obtain a Lower UI Rate ..................................... 71

Additional Requirements ........................................................................................................................................................................................................................................ 72

Posting Requirements ......................................................................................................................................................................................................................................... 72

Required Notices and Pamphlets ............................................................................................................................................................................................................ 72

Earned Income Tax Credit Information Act ..................................................................................................................................................................................... 73

Plant Closure or Mass Layoff ....................................................................................................................................................................................................................... 74

U.S. Government Contractor Job Listing Requirements .................................................................................................................................................. 76

Recordkeeping ............................................................................................................................................................................................................................................................ 77

Employers’ Bill of Rights ........................................................................................................................................................................................................................................ 78

Commitment .................................................................................................................................................................................................................................................................. 78

Employer Rights ........................................................................................................................................................................................................................................................ 78

Office of the Taxpayer Rights Advocate ............................................................................................................................................................................................. 78

Taxpayer Advocate Office ..................................................................................................................................................................................................................... 78

Settlements Office ........................................................................................................................................................................................................................................ 79

Protecting Your Privacy ...................................................................................................................................................................................................................................... 79

Offers in Compromise .......................................................................................................................................................................................................................................... 79

Unemployment Insurance – Taxes .............................................................................................................................................................................................................. 80

Methods of Paying for UI Benefits ........................................................................................................................................................................................................... 80

How Your UI Tax Rate Is Determined .................................................................................................................................................................................................. 80

Notice of Tax Rates ................................................................................................................................................................................................................................................ 81

Federal Unemployment Tax Act Certification ............................................................................................................................................................................... 81

Reserve Account Transfers ............................................................................................................................................................................................................................ 81

Wages in Another State ..................................................................................................................................................................................................................................... 81

Interstate Reciprocal Coverage Elections for Multistate Workers ........................................................................................................................... 82

Tips for Reducing Your UI Tax Rate ....................................................................................................................................................................................................... 82

Fraud Prevention, Detection, and Reporting ................................................................................................................................................................................ 83

UI Rate Manipulation ............................................................................................................................................................................................................................................ 83

edd.ca.gov

edd.ca.gov iii

Table of Contents

Unemployment Insurance Benets ........................................................................................................................................................................................................... 84

Unemployment Insurance Funding ........................................................................................................................................................................................................ 84

Benefit Amount ............................................................................................................................................................................................................................................................ 84

Benefit Qualifications ............................................................................................................................................................................................................................................ 84

Qualifying UI Wages .............................................................................................................................................................................................................................................. 85

UI Eligibility Determination .............................................................................................................................................................................................................................. 85

How to Designate an Agent or Single Address .......................................................................................................................................................................... 85

How to Request an Electronic DE 1545 ............................................................................................................................................................................................ 85

Responding to Notices ........................................................................................................................................................................................................................................ 86

Subsequent Benefit Year .................................................................................................................................................................................................................................. 87

Notices of Determination, Ruling, or Modification ................................................................................................................................................................... 88

Unemployment Insurance Benefits – Appeal Rights ............................................................................................................................................................ 89

False Statement Penalty ................................................................................................................................................................................................................................... 90

Benefit Audits to Determine Fraud .......................................................................................................................................................................................................... 90

Back Pay Award ......................................................................................................................................................................................................................................................... 91

Workers’ Compensation Benefits ............................................................................................................................................................................................................. 91

Statement of Charges .......................................................................................................................................................................................................................................... 92

Alternate Base Period .......................................................................................................................................................................................................................................... 92

Layoff Alternatives ................................................................................................................................................................................................................................................... 93

Partial UI Claims ............................................................................................................................................................................................................................................. 93

Work Sharing Program ............................................................................................................................................................................................................................ 93

Notice of Layoff ........................................................................................................................................................................................................................................................... 93

Wages Notices ............................................................................................................................................................................................................................................................ 93

State Disability Insurance ...................................................................................................................................................................................................................................... 94

Taxes – Who Pays for State Disability Insurance? ................................................................................................................................................................. 94

Employee Benefits .................................................................................................................................................................................................................................................. 94

Employer Claim Notices .................................................................................................................................................................................................................................... 94

SDI Online ....................................................................................................................................................................................................................................................................... 95

Voluntary Plan .............................................................................................................................................................................................................................................................. 95

Self-Employed Benefits ...................................................................................................................................................................................................................................... 95

Workers’ Compensation Insurance ........................................................................................................................................................................................................ 95

SDI Fraud ......................................................................................................................................................................................................................................................................... 95

Employment and Training Services ........................................................................................................................................................................................................... 96

Workforce Services ................................................................................................................................................................................................................................................ 96

CalJOBS

SM

....................................................................................................................................................................................................................................................................... 96

Employment Training Panel ........................................................................................................................................................................................................................... 96

Funding .................................................................................................................................................................................................................................................................... 96

How Is ETP Different? .............................................................................................................................................................................................................................. 96

General Information ............................................................................................................................................................................................................................................... 97

Trade Adjustment Assistance ....................................................................................................................................................................................................................... 97

Work Opportunity Tax Credit ......................................................................................................................................................................................................................... 98

eWOTC ............................................................................................................................................................................................................................................................................... 98

Labor Market Information ....................................................................................................................................................................................................................................... 99

What Labor Market Information Is Available Online? ........................................................................................................................................................... 99

Multiple Location and Function Employers .................................................................................................................................................................................... 99

How Your Industry Code Is Determined ............................................................................................................................................................................................ 99

The Importance of Occupational Information ............................................................................................................................................................................ 100

Information and Assistance by Topic ................................................................................................................................................................................................... 101

Glossary ................................................................................................................................................................................................................................................................................. 108

Index ........................................................................................................................................................................................................................................................................................... 113

Instructions for Ordering Forms and Publications ............................................................................................................................................................... 117

Taxpayer Assistance Center 1-888-745-3886

1 Taxpayer Assistance Center 1-888-745-3886

Seminars To Help

Employers Succeed

Seminars to Help Employers Succeed

We offer no-cost seminars to help employers understand and comply with California’s payroll tax laws.

EDD oers seminars on the following topics:

•

State payroll tax reporting requirements and

recordkeeping.

• Federal and State Basic Payroll Tax Seminar.

• State Labor Law and Payroll Tax Seminar.

• Employment Status Tax Seminar.

• Cannabis Industry and State Payroll Tax Seminar.

• AB 5 Motor Carrier Worker Classification Online

Webinar.

EDD and the Internal Revenue Service (IRS)

jointly oer seminars on:

EDD and the Department of Industrial Relations’

Division of Labor Standards Enforcement jointly

present classes on:

• Federal and state payroll reporting and

withholding requirements.

• Difference between employees and independent

contractors and the importance of proper worker

classification.

• Wage and hour laws and regulations.

• Employer and employee rights and responsibilities.

• Recordkeeping, reporting, and posting requirements.

Register for a tax seminar at Payroll Tax Seminar

(edd.ca.gov/payroll_tax_seminars).

Go Paperless!

You can view or download this guide at

California Employer Guides

(edd.ca.gov/en/Payroll_Taxes/Employers_Guides).

edd.ca.gov

edd.ca.gov 2

Introduction

Introduction

This guide helps you understand your rights and responsibilities as an employer.

How to Use This Guide

This guide provides information you need to know as an employer, such as when to register, how to determine who is

an employee, what are wages, payment and posting requirements. Find the topics you need in the table of contents

then review the information and web resources provided for additional information.

The Employment Development Department (EDD) administers payroll tax reporting laws according to the California

Unemployment Insurance Code (CUIC) and Labor Code (LC). Regardless of the size of your business, this guide is

an important resource on the procedures required for compliance with California payroll tax laws. This guide will help

clarify how the CUIC and California Code of Regulations (CCR) impact your business. We follow federal tax guidelines

and due dates. However, California laws and rates may differ from federal laws and rates.

This guide provides general information that applies to most employers and references information on specialized

topics. Information on detailed or complex issues applicable to a small number of employers is not included.

How to Obtain Assistance and Additional Information

If you have questions not addressed in this guide and/or need additional information, visit the EDD (edd.ca.gov)

website or contact the Taxpayer Assistance Center at 1-888-745-3886.

We offer seminars and presentations on California payroll tax reporting requirements to help you:

•

Understand your California payroll tax reporting requirements.

•

Avoid common pitfalls and costly mistakes.

•

Learn the differences between employees and independent contractors.

•

Understand your reporting requirements for new employees and independent contractors.

•

Discover no-cost services and resources available to you.

•

Develop a better understanding of the State Disability Insurance (SDI) program.

For additional information about a payroll tax education event near you, contact the Taxpayer Assistance Center at

1-888-745-3886 or register for a Payroll Tax Seminar (edd.ca.gov/payroll_tax_seminars).

Learn more about SDI educational presentations for California workers, military family members, employers, and

licensed health professionals by visiting Outreach Events Information (edd.ca.gov/disability/events_calendar.htm) or

emailing the SDI Outreach Development Section at [email protected]

Other Services

This guide also contains useful information about our services specifically for employers including programs offering

tax credits. We also provide employment services, such as job development and job search workshops, designed to

reduce unemployment and your taxes. A variety of services for new and established employers can help you in building

a more successful business while complying with California laws.

We Want to Hear From You

How can we improve this guide to better meet your needs? You may send your comments and suggestions to:

Employment Development Department

Publications and Marketing Services Group, MIC 93

PO Box 826880

Sacramento, CA 94280-0001

Email: [email protected]

Other Website of Interest

taxes.ca.gov – This website is sponsored by the California Department of Tax and Fee Administration, the EDD,

the Franchise Tax Board, and the Internal Revenue Service (IRS).

Taxpayer Assistance Center 1-888-745-3886

3 Taxpayer Assistance Center 1-888-745-3886

Walk-In Oces

For information and advice on your

payroll tax responsibilities, visit your

local Employment Tax Office from 8

a.m. to 5 p.m., Pacific Time, Monday

through Friday.

Anaheim ................. 2099 S. State College Blvd., Suite 401, 92806

Audit and Collection Office Phone Number: 1-888-745-3886

Fresno .................... 1050 O Street, 93721

Audit Office Phone Number: 1-888-745-3886

Oakland .................. 7677 Oakport Street, Suite 400, 94621

Audit Office Phone Number: 1-888-745-3886

Collection Office Phone Number: 1-888-745-3886

Redding .................. 1325 Pine Street, 96001

Audit Office Phone Number: 1-888-745-3886

Sacramento ........... 3321 Power Inn Road, Suite 220, 95826

Audit Office Phone Number: 1-888-745-3886

Collection Office Phone Number: 1-888-745-3886

San Bernardino...... 658 East Brier Drive, Suite 300, 92408

Audit Office Phone Number: 1-888-745-3886

Collection Office Phone Number: 1-888-745-3886

San Diego .............. 10636 Scripps Summit Ct., Suite 202, 92131

Audit Office Phone Number: 1-888-745-3886

San Jose ................ 906 Ruff Drive, 95110

Audit Office Phone Number: 1-888-745-3886

Santa Fe Springs ... 10330 Pioneer Blvd., Suite 150, 90670

Audit Office Phone Number: 1-888-745-3886

Collection Office Phone Number: 1-888-745-3886

Van Nuys ............... 6150 Van Nuys Blvd., Room 210, 91401

Audit Office Phone Number: 1-888-745-3886

To find an office near you, visit the

Office Locator

(edd.ca.gov/Office_Locator).

Self-Service Oces

Tax forms and free direct-line phones are available from 8

a.m. to 5 p.m., Pacific Time, Monday through Friday at our

self-service offices.

Bakersfield ........... 1800 30th Street, Suite 240, 93301

Modesto ............... 3340 Tully Road, Suite E-10, 95350

San Francisco ..... 745 Franklin Street, Suite 400, 94102

Santa Rosa .......... 50 D Street, Suite 100, 95404

Vallejo .................. 1440 Marin Street, Suite 114, 94590

Ventura ................ 4820 McGrath Street, Suite 200, 93003

Forms and Publications

Download and order forms, instructions, and

publications at EDD Forms (edd.ca.gov/forms).

Payroll Tax Help, Forms, and Publications

e-Services for Business

•

Fulfills the e-file and e-pay

mandate.

• Manage your employer

payroll tax account

online.

• Register as an employer.

• File tax returns and wage reports.

• Pay deposits and liabilities.

• Make address changes.

Register online using

e-Services for Business

,

(edd.ca.gov/eServices).

Online

Visit the

EDD

(edd.ca.gov)

website.

• Frequently asked questions

(edd.ca.gov/payroll_taxes/faqs.htm).

• Payroll Tax Seminars

(edd.ca.gov/payroll_tax_seminars).

• Tax Professionals

(edd.ca.gov/payroll_taxes/tax_practitioners.htm).

• Ask EDD (askedd.edd.ca.gov).

Visit

California Tax Service Center

(taxes.ca.gov) for

federal and California tax information for businesses

and individuals.

Phone

Toll-free from the U.S. or

Canada: 1-888-745-3886

Hearing impaired:

1-800-547-9565

Outside the U.S. or

Canada: 1-916-464-3502

Staff are available from 8 a.m. to 5 p.m., Pacific

Time, Monday through Friday to answer your

questions.

Quick and Easy Access for Tax

Help, Forms, and Publications

edd.ca.gov

Redding - Office Closed

We apologize for the inconvenience.

edd.ca.gov 4

Start Here

Start Here

As a new employer, the following steps ensure you meet your employer reporting, and tax payment

obligations. Keep in mind that your employer requirements may not be limited to information on this page.

Refer to page 5 for a flowchart of these steps.

You are a subject employer if you pay wages for employment to one or more people in excess of $100

during any calendar quarter.

Note: If you pay wages to people who work in or around your home, you may be considered

a household employer. Refer to page 7 for additional information or view the

Household Employer’s Guide (DE 8829) (edd.ca.gov/pdf_pub_ctr/de8829.pdf).

Register for an EDD employer payroll tax account number online at e-Services for Business

(edd.ca.gov/eServices). You must register with EDD within 15 days of becoming a subject employer.

A commercial employer is a business connected with commerce or trade, operating primarily for profit. We

will assign you an eight-digit employer payroll tax account number to identify your business when reporting

and paying payroll taxes. Include your employer payroll tax account number on all deposits, returns, and

correspondence submitted to us. For additional information and registration options, refer to page 7.

Action Required:

• Report new employees using the online Report of New Employee(s) (DE 34) at

e-Services for Business (edd.ca.gov/eServices) within 20 days of the employee’s start-of-work

date. All employees who are newly hired, rehired after a separation of at least 60 consecutive

days, or returning to work from a furlough, separation, leave of absence without pay, or termination

must be reported to us. If you acquire an ongoing business and employ any of the former

owner’s workers, these employees are considered new hires, and you must report them to the

EDD’s New Employee Registry (edd.ca.gov/en/Payroll_Taxes/New_Hire_Reporting). For additional

information and available reporting methods for reporting new employees, refer to page 53.

• Report independent contractor information using the online Report of Independent Contractor(s)

(DE 542) at e-Services for Business (edd.ca.gov/eServices) within 20 days of either paying an

independent contractor $600 or more for services performed or entering into a contract for $600 or

more, whichever is earlier. Independent contractor information must be reported to the EDD. For

additional information and available reporting methods for independent contractor reporting, refer to

page 55.

• Provide your employees with pamphlets on employee withholdings, Unemployment Insurance

(UI), Disability Insurance (DI), and Paid Family Leave (PFL). For additional information on

employee pamphlets, refer to page 72.

• Post an employee notice with UI, DI, and PFL claim and benefit information. This notice should be

posted in a prominent location, easily seen by your employees. The appropriate notice will be sent

to you after you register. For additional information on employee notices, refer to page 72.

Make your Payroll Tax Deposits (DE 88) payments for UI, Employment Training Tax (ETT), State

Disability Insurance (SDI), and California Personal Income Tax (PIT) online at e-Services for Business

(edd.ca.gov/eServices). Your SDI and PIT withholdings deposit due dates are based on your federal deposit

schedule and requirement and the amount of accumulated PIT that you have withheld. Your UI and ETT

payments are due quarterly. For additional information about deposit requirements, refer to pages 58 and 59.

File a Quarterly Contribution Return and Report of Wages (DE 9) online at e-Services for Business

(edd.ca.gov/eServices) to reconcile the tax and withholding amounts with your DE 88 deposits for the

quarter. Also, file a Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C) to report total

subject wages paid, PIT wages, and PIT withheld for each employee for the quarter.

These reports are due on January 1, April 1, July 1, and October 1 of each year. These reports must be

submitted even if you have no payroll during a calendar quarter. For additional information and available

filing options, refer to pages 62 and 63.

Note: Failure to complete the above steps on time may result in penalty and interest charges. For

information on your federal employment tax reporting requirements, access the IRS (irs.gov)

website or contact the IRS at 1-800-829-4933.

Step 1

Step 2

Step 3

Step 4

Step 5

Taxpayer Assistance Center 1-888-745-3886

5 Taxpayer Assistance Center 1-888-745-3886

Start Here

Most forms are available online at EDD (edd.ca.gov) or by calling the Taxpayer Assistance Center at 1-888-745-3886.

Did you pay wages in excess of

$100 in a calendar quarter?

Step 1

Register online for an employer payroll tax

account number at e-Services for Business

(edd.ca.gov/eServices).

Refer to page 7 for alternate registration options.

Step 2

Continuous Filing Requirements

File required reports online at e-Services for Business

(edd.ca.gov/eServices).

Payroll Tax Deposit (DE 88)

File online at e-Services for Business

(edd.ca.gov/eServices).

Refer to page 57 for deposit requirements.

Step 4

Quarterly Contribution Return and Report of Wages (DE 9)

Form DE 9 reconciles tax and withholding amounts with deposits for the quarter.

and

Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C)

Form DE 9C reports total subject wages and Personal Income Tax (PIT) wages

paid and PIT withheld for each employee for the quarter.

File online at e-Services for Business (edd.ca.gov/eServices)

Refer to pages 62 and 63 for additional information and available filing options.

Step 5

No registration

required.

No

Yes

Provide to EDD

within 20 days

Report of New Employee(s)

(DE 34)

Report of Independent

Contractor(s) (DE 542)

Step 3

Give to Employees

Employee’s Withholding Allowance

Certicate (DE 4)

Employee’s Withholding Certicate (Form

W-4)

For Your Benet: California’s Programs

for the Unemployed (DE 2320)

Paid Family Leave (DE 2511)

Disability Insurance Provisions (DE 2515)

Post in Workplace

Notice to Employees

(DE 1857A)

(If you are a public entity or not

subject to UI, refer to page 75

for

your posting requirements.)

Flowchart

edd.ca.gov

edd.ca.gov 6

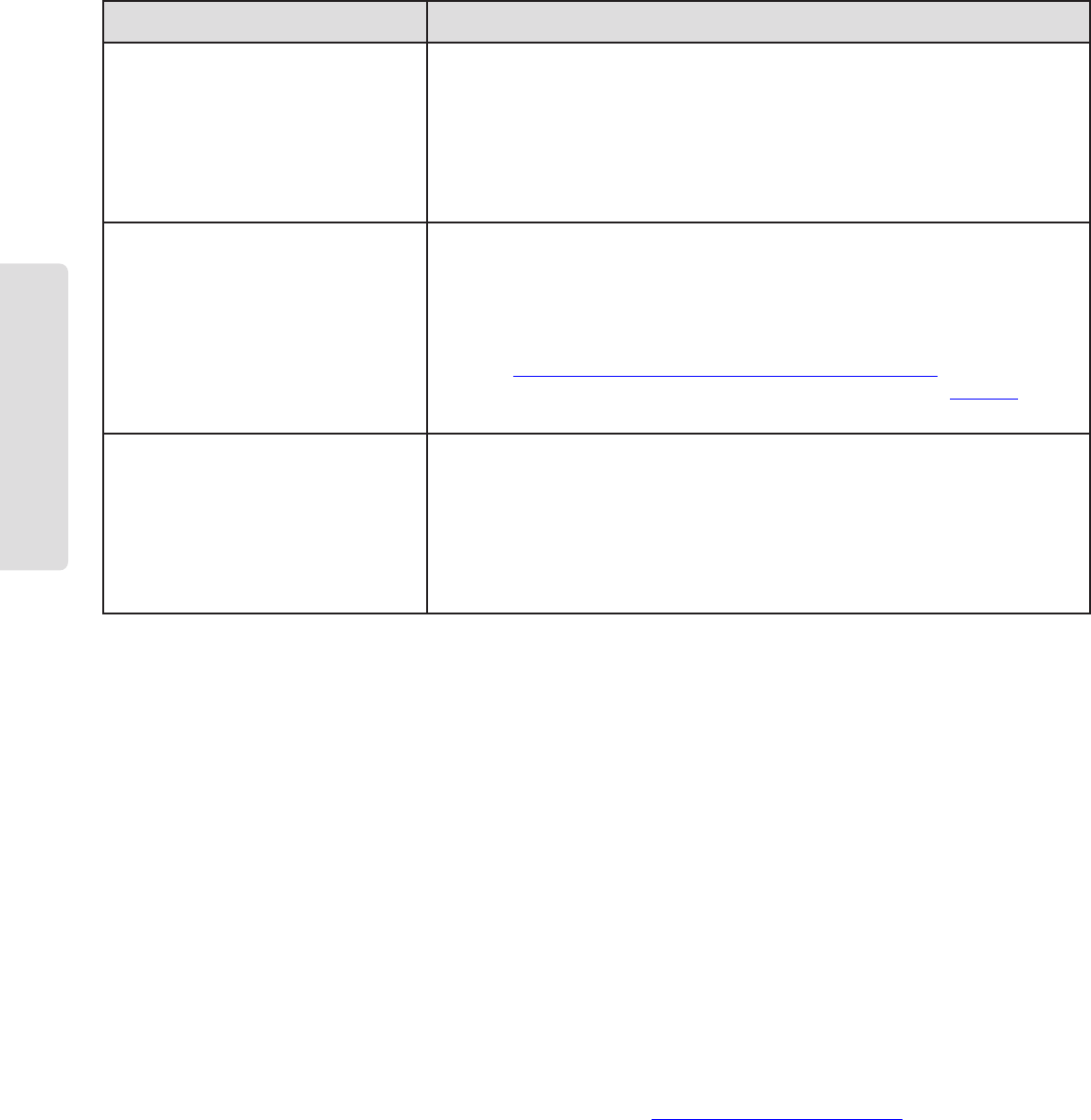

2024 Forms and Due Dates

Form Name Due

DE 1

Commercial Employer Account Registration

and Update Form (If you are not a commercial

employer, refer to page 7.)

Within 15 calendar days after paying more

than $100 in wages during any calendar

quarter.

DE 34 Report of New Employee(s)

Within 20 days of start-of-work date for new or

rehired employees.

DE 542 Report of Independent Contractor(s)

Within 20 days of paying an independent

contractor $600 or more or entering into a

contract for $600 or more, whichever is earlier.

Report Quarter Due

Delinquent if Not

Filed By

1

DE 9/DE 9C 1

st

(January, February, March) April 1, 2024 April 30, 2024

DE 9/DE 9C 2

nd

(April, May, June) July 1, 2024 July 31, 2024

DE 9/DE 9C 3

rd

(July, August, September) October 1, 2024 October 31, 2024

DE 9/DE 9C 4

th

(October, November, December) January 1, 2025 January 31, 2025

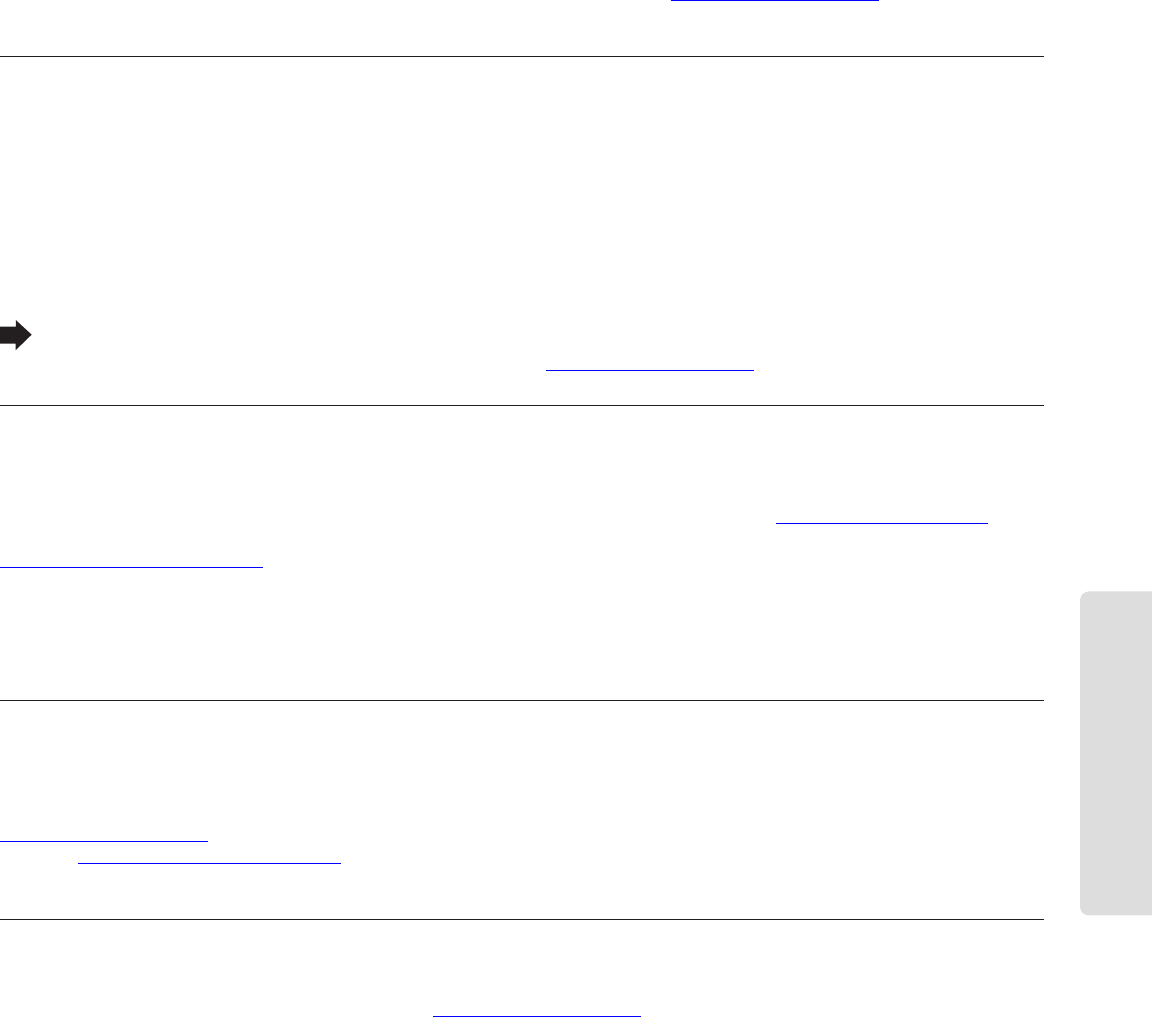

California Deposit Requirements

If Your Federal

Deposit Schedule/

Requirement Is

1

And You Have

Accumulated State

PIT Withholding Of

If Pay Date Is

PIT and SDI

Deposit Due by

2

California Deposit

Schedule box

to indicate on

the DE 88

Next-Day

Less than $350 Any payday Quarterly

3

Quarterly

$350 to $500 Any payday

15th of the

following month

Monthly

More than $500 Any payday Next-Day Next-Day

Semi-weekly

Less than $350 Any payday Quarterly

3

Quarterly

$350 to $500 Any payday

15th of the

following month

Monthly

More than $500 Wed., Thurs., or Fri. Following Wednesday

7

Semi-weekly

More than $500

Sat., Sun., Mon., or

Tues.

Following Friday

7

Semi-weekly

Monthly

Less than $350 Any payday Quarterly

3

Quarterly

$350 or more Any payday

15th of the

following month

Monthly

Quarterly

4, 5

or

Annually

6

Less than $350 Any payday

April 30, 2024

July 31, 2024

October 31, 2024

January 31, 2025

Quarterly

$350 or more Any payday

15th of the

following month

Monthly

1. If the due date falls on a Saturday, Sunday, or legal holiday, the due date is extended to the next business day. For example, if a deposit is due on

Friday, but Friday is a holiday, the deposit due date is extended to the following Monday.

2. Electronic transactions for Next-Day deposits must be settled in the state’s bank account on or before the third business day following the payroll

date.

3. If the due date falls on a Saturday, Sunday, or legal holiday, the due date is extended to the next business day. For example, if a deposit is due on

Friday, but Friday is a holiday, the deposit due date is extended to the following Monday.

4. If you have accumulated less than $350 of Personal Income Tax (PIT) and you choose to make an additional deposit before the quarterly due date,

designate the deposit schedule as quarterly on your DE 88.

5. If you are not required to follow one of the above federal deposit schedules/requirements, you are still required to make California payroll tax

deposits of accumulated State Disability Insurance (SDI) deductions and PIT withholdings quarterly or more often, based on the guidelines in this

table. Information about federal deposit schedules is located in the Internal Revenue Service’s Employer Tax Guide (Publication 15).

6. A deposit of employer Unemployment Insurance (UI) and Employment Training Tax (ETT) taxes and any accumulated SDI and PIT withholdings

not previously paid must be deposited each quarter by the due dates shown.

7. If your federal deposit requirement is annually, you are required to make California payroll tax deposits quarterly or monthly based on the

guidelines in this table.

2024 Forms and Due Dates

Taxpayer Assistance Center 1-888-745-3886

7 Taxpayer Assistance Center 1-888-745-3886

Who is an Employer

and When to Register?

About Employers

An employer is a person or legal entity that hires one or more employees to work for a wage, salary, or other

compensation. Employers include sole proprietors, partnerships, corporations, nonprofit organizations, charitable

organizations, foundations, limited liability companies, limited liability partnerships, public entities, including state and

federal agencies, schools, associations, trusts, estates, joint ventures, and Indian Tribes.

When Do I Become a Subject Employer?

You become a subject employer when you pay wages in excess of $100 during any calendar quarter to one or

more employees. Wages are compensation for services performed, including, but not limited to, cash payments,

commissions, bonuses, and the reasonable cash value of nonmonetary payments for services, such as meals and

lodging. For additional information, refer to What Are Wages? on page 11.

Private households, local college clubs, and local chapters of fraternities and sororities that employ workers to

perform household services are household employers. Additional information about household employment is

available online at Household Employer (edd.ca.gov/payroll_taxes/household_employer.htm). You can also refer to

the Household Employer’s Guide (DE 8829) (PDF) (edd.ca.gov/pdf_pub_ctr/de8829.pdf) online or obtain a copy by

contacting the Taxpayer Assistance Center at 1-888-745-3886.

Note: If you acquired an existing business, refer to What Is a Successor Employer? on page 71 for further details.

When to Register

All employers conducting business in California are subject to the employment tax laws of the California Unemployment

Insurance Code (CUIC). Once a business hires an employee and pays wages in excess of $100 during any

calendar quarter, the business is considered to be a subject employer and must register at e-Services for Business

(edd.ca.gov/eServices) or submit a registration form to us within 15 days after paying wages.

Employers are responsible for reporting wages paid to their employees and paying Unemployment Insurance (UI) tax

and Employment Training Tax (ETT) on those wages, as well as withholding and remitting State Disability Insurance

(SDI) and Personal Income Tax (PIT) due on those wages.

Action Required: Register with the EDD for an employer payroll tax account number if you pay wages in excess of

$100 during any calendar quarter to one or more employees.

How to Register for an EDD Employer Payroll Tax Account Number

Register online using the EDD e-Services for Business

(edd.ca.gov/eServices).

Additional Options for Registering for an Employer Payroll Tax Account Number

1. Select the appropriate registration form for your industry available at Forms and Publications

(edd.ca.gov/payroll_taxes/forms_and_publications.htm). The registration forms available are:

• Commercial Employer Account Registration and Update Form (DE 1)

• Agriculture Employer Account Registration and Update Form (DE 1AG)

• Governmental Organizations, Public Schools, and Indian Tribes Registration and Update Form (DE 1GS)

• Employers of Household Workers Registration and Update Form (DE 1HW)

• Nonprot Employers Registration and Update Form (DE 1NP)

• Employers Depositing Only Personal Income Tax Withholding Registration and Update Form (DE 1P)

2. Submit the completed registration form by mail or fax to the EDD:

Employment Development Department

Account Services Group, MIC 28

PO Box 826880

Sacramento, CA 94280-0001

Fax: 1-916-654-9211

Remember:

• Employment occurs when an employer engages the services of an employee for pay.

• You become a subject employer when you pay wages over $100 during any calendar quarter to one or more

employees.

• You must register with the EDD within 15 days of paying wages in excess of $100.

• Employers are responsible for reporting wages paid to employees and paying UI and ETT on the wages, as well

as withholding and remitting SDI and PIT.

edd.ca.gov

edd.ca.gov 8

Classifying Employees

Classifying Employees

An employee includes all of the following:

• Any officer of a corporation.

• Any worker who is an employee under the ABC test or Borello test.

• Any worker whose services are specifically covered by law.

An employee may perform services on a temporary or less than full-time basis. The law does not exclude services from

employment that are commonly referred to as day labor, part-time help, casual labor, temporary help, probationary, or

outside labor.

ABC Test, Employee or Independent Contractor?

What Is the ABC Test?

Under section 621 (b) of the CUIC and section 2775 of the Labor Code, an individual providing labor or services for

payment shall be considered an employee rather than an independent contractor unless the hiring entity demonstrates

that all of the following are satisfied:

A. The individual is free from the control and direction of the hiring entity in connection with the performance of the work,

both under the contract for the performance of the work and in fact.

B. The individual performs work that is outside the usual course of the hiring entity’s business.

C. The individual is customarily engaged in an independently established trade, occupation, or business of the same

nature as that involved in the work performed.

Note: California does not provide relief under the Safe Harbor provisions of the Internal Revenue Code. Therefore,

it is important that workers are properly classified under the ABC test which determines employer-employee

relationships.

How Can I Get Additional Information on This Topic?

Incorrectly classifying your workers can be a costly mistake. If you have incorrectly classified employees as

independent contractors, you could be liable for back taxes, penalties, and interest. The following EDD resources can

help you determine if you have correctly classified your workers:

• Employment Determination Guide (DE 38) (PDF) (edd.ca.gov/pdf_pub_ctr/de38.pdf) – Asks a series of Yes or No

questions regarding your treatment of workers to help determine if a problem may exist and whether you need

to seek additional guidance. The DE 38 is available to download online.

• Determination of Employment Work Status for Purposes of State of California Employment Taxes and Personal

Income Tax Withholding (DE 1870) (PDF) (edd.ca.gov/pdf_pub_ctr/de1870.pdf) – Provides a series of

questions regarding your relationship with your workers. Complete and return this form to the EDD for a written

determination stating whether your workers are employees or independent contractors based on the facts that

you provide. The DE 1870 is available to download online.

• Information Sheets – Provide general and industry-specific information. To obtain information sheets, visit

Forms and Publications (edd.ca.gov/payroll_taxes/forms_and_publications.htm) or contact the Taxpayer

Assistance Center at 1-888-745-3886.

• Independent Contractor Information – The Frequently Asked Questions and Answers About the California

Independent Contractor Reporting Law (DE 542FAQ) (PDF) (edd.ca.gov/pdf_pub_ctr/de542faq.pdf) and

Independent Contractors Misconceptions Brochure (DE 573M) (PDF) (edd.ca.gov/pdf_pub_ctr/de573m.pdf)

provides detailed information and are available online to download.

• Payroll Tax Seminars – EDD offers no-cost seminars online to help employers comply with the California payroll

tax laws. To enroll, visit Payroll Tax Seminars (edd.ca.gov/payroll_tax_seminars) or contact the Taxpayer

Assistance Center at 1-888-745-3886.

Remember:

• An employee includes any officer of a corporation, a worker who is an employee under the ABC test, and a worker

whose services are specifically covered by law. Refer to Information Sheet: Types of Employment

(DE 231TE) (PDF) (edd.ca.gov/pdf_pub_ctr/de231te.pdf) for more information.

• An employee may perform services on a temporary or less than full-time basis.

• We have several resources available to help you correctly classify your workers.

Taxpayer Assistance Center 1-888-745-3886

9 Taxpayer Assistance Center 1-888-745-3886

State Payroll Taxes

The Employment Development Department (EDD) administers the following California payroll tax programs:

• Unemployment Insurance (UI) Tax • State Disability Insurance (SDI) Withholding

• Employment Training Tax (ETT) • California Personal Income Tax (PIT) Withholding

Note: Paid Family Leave (PFL) is a component of the SDI program.

UI and ETT are employer paid contributions. SDI and PIT are withheld from employee wages. Wages are generally

subject to all four payroll taxes unless otherwise stated by law.

Unemployment Insurance Tax

What Is UI Tax?

The UI program was established as part of a national program administered by the U.S. Department of Labor under the

Social Security Act. The UI program provides temporary payments to individuals who are unemployed through no fault

of their own.

Who Pays It?

The UI program is funded through payroll taxes paid by the employer. Tax-rated employers pay a percentage on the

first $7,000 in wages paid to each employee in a calendar year. The UI rate schedule and amount of taxable wages

are determined annually. New employers pay 3.4 percent (.034) for a period of two to three years. The UI rate could

increase to a maximum of 6.2 percent (.062) or decrease to a minimum of 1.5 percent (0.015) based on an employer’s

experience rating and the balance in the UI Fund. For a detailed explanation of the experience rating method, refer to

Information Sheet: California System of Experience Rating (DE 231Z) (PDF) (edd.ca.gov/pdf_pub_ctr/de231z.pdf).

Government entities and certain nonprofit employers may elect the reimbursable method of financing UI in which they

reimburse the UI Fund on a dollar-for-dollar basis for all benefits paid to their former employees.

Employment Training Tax

What Is ETT?

ETT provides funds to train employees in targeted industries to improve the competitiveness of California businesses.

The ETT fund promotes a healthy labor market by helping California businesses invest in a skilled and productive

workforce while developing the skills of new and incumbent workers.

Who Pays It?

ETT is an employer-paid tax. Employers are subject to pay 0.1 percent (.001) for ETT on the first $7,000 in wages

paid to each employee in a calendar year. The tax rate is set by statute at 0.1 percent (.001) of UI taxable wages for

employers with positive UI reserve account balances and subject to section 977(c) of the California Unemployment

Insurance Code (CUIC). The maximum tax is $7 per employee per year ($7,000 x .001).

State Disability Insurance Tax

What Is SDI Tax?

SDI allows the Disability Fund to pay Disability Insurance (DI) and PFL benefits to eligible California workers. DI

benefits are paid to eligible California workers who lose wages when they are unable to work due to a non-work-related

illness, injury, or pregnancy.

PFL benefits are paid to eligible California workers who take time off work to care for a seriously ill child, parent,

parent-in-law, grandparent, grandchild, sibling, spouse, or registered domestic partner. Benefits are also available to

new parents who need time to bond with a new child entering the family by birth, adoption, or foster care placement.

Benefits are also available to California workers who participate in a qualifying event because of a family member’s

spouse, registered domestic partner, parent, or child’s military deployment to a foreign country.

Who Pays It?

The SDI program is funded through a payroll deduction from employees’ wages. Employers withhold 1.1 percent (.011)

for SDI on all subject wages paid to each employee in a calendar year. The SDI rates may change each year.

California Personal Income Tax

What Is California PIT?

California PIT is a tax levied on California residents’ income and on income that California nonresidents derive from

California. The EDD reports, collects, and enforces PIT withholding. Taxes collected from the Franchise Tax Board

(FTB) and the EDD support California public services such as schools, public parks, roads, health, and human

services.

Who Pays It?

California PIT is either withheld from employee wages based on the Employee’s Withholding Allowance Certicate

(DE 4) on file with their employer or is based on the supplemental tax rates, refer to page 15.

What Are State

Payroll Taxes?

edd.ca.gov

edd.ca.gov 10

What Are State

Payroll Taxes?

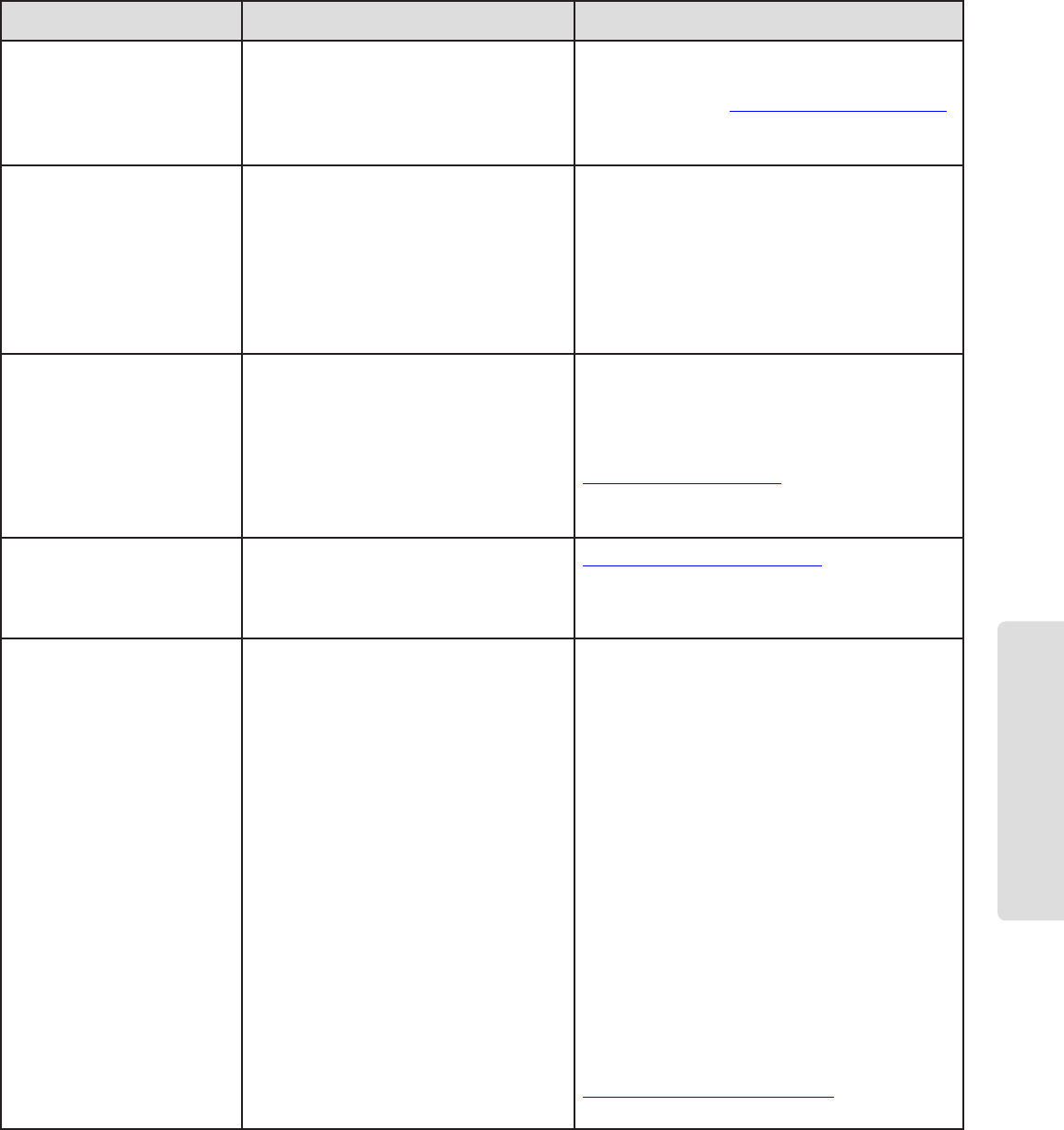

State Payroll Taxes

Unemployment

Insurance

Employment

Training Tax

State Disability

Insurance

California Personal

Income Tax

Who Pays? Employer Employer Employee (employer

withholds from

employee wages)

Employee (employer

withholds from

employee wages)

Taxable Wages First $7,000 of

subject wages per

employee, per year.

First $7,000 of

subject wages per

employee, per year.

No limit.

No limit. Refer to

PIT withholding

(edd.ca.gov/payroll_

taxes/rates_and_

withholding.htm).

Tax Rate New employer tax

rate is 3.4 percent

(.034) for a period of

two to three years.

Following this period,

the tax rate is

calculated annually

based on each

employer’s previous

experience and the

condition of the UI

Fund. The EDD

notifies employers of

their new rate each

December.

Set by statute at

0.1 percent (.001)

of UI taxable wages

for employers with

positive UI reserve

account balances

and employers

subject to section

977(c) of the CUIC.

The 2024 SDI

withholding rate is

1.1 percent (.011).

The SDI tax rate is

set by law and may

change each year

Withheld based

on the Employee’s

Withholding

Allowance Certicate

(DE 4).

Maximum Tax

(Except when

employer is subject

to section 977[c] of

the CUIC.)

$434 per employee,

per year. (The

amount has been

calculated at the

highest UI tax rate of

6.2 percent [$7,000 x

.062].)

$7 per employee,

per year

($7,000 x .001).

No maximum. No maximum.

Note: Some types of employment are not subject to payroll taxes or PIT withholding. Refer to

Information Sheet: Types of Employment (DE 231TE) (PDF) (edd.ca.gov/pdf_pub_ctr/