INCOME GENERATION

OPTIONS FOR

UNDOCUMENTED STUDENTS

TOOLKIT

Created for the

University of California

Office of the President

Released 05/2020

2

5 Preface

6 Message from the University of California

7 Frequently Asked Questions

7 Student FAQs About Income Generation

9 Staff/Faculty/Admin FAQs About Income Generation

11 Section I: Understanding Income Generation, Regardless of Immigration Status

11 Legal Considerations for Independent Contracting

12 Independent Contracting

13 IRS Forms Required of Independent Contractors

13 Basic Guidelines for Independent Contractors

14 Employees vs. Independent Contracting

14 California Common Law Test and the ABC Test

16 Section II: How To Start Earning a Living as an Independent Contractor

16 Participating in the Gig Economy

16 Working as a Professional Service Provider

17 Professional Licensing (California SB 1159)

18 Additional Consideration for Independent Contracting

18 Liability Insurance

18 Contractor Agreement

19 Invoicing

19 Budgeting

20 Paying Taxes as an Independent Contractor

21 Section III: Starting a Business as an Immigrant

22 Step 1. Tax Information, ITINs and EINs

TABLE OF CONTENTS

3

22 Step 2. Business Plans and Business Model Canvas

23 Step 3. Getting Access to Financial Capital

23 Building Credit

23 Business Loans

24 Free Money for Business Start-Up

24 Funding for Students at UCs

24 Step 4. Deciding the Location of a Business

25 Step 5. Choosing a Business Structure

25 Sole Proprietorship

25 Partnership

26 Corporations (S and C)

27 Limited Liability Company (LLC)

27 Starting an LLC as a Worker Cooperative

29 Step 6: Registering a Business Name (DBA)

29 Step 7: Business Licenses and Permits

30 Step 8. Marketing and Promotion

31 Section IV: Support and Resources

31 UC Support and Resources

31 UC Entrepreneurship Centers

31 UC Business School Courses

31 UC Transactional Legal Clinics

31 UC Undocumented Student Services and Centers

32 External Support and Resources

32 California Small Business Development Centers (SBDCs)

32 Venturize

33 Section V: Career Pathways

34 Appendices

34 Appendix A: List of the Top Consulting Businesses Thriving Today

TABLE OF CONTENTS

4

35 Appendix B: Independent Contractor Brainstorming Worksheet

39 Appendix C: Sample Independent Contractor Agreement

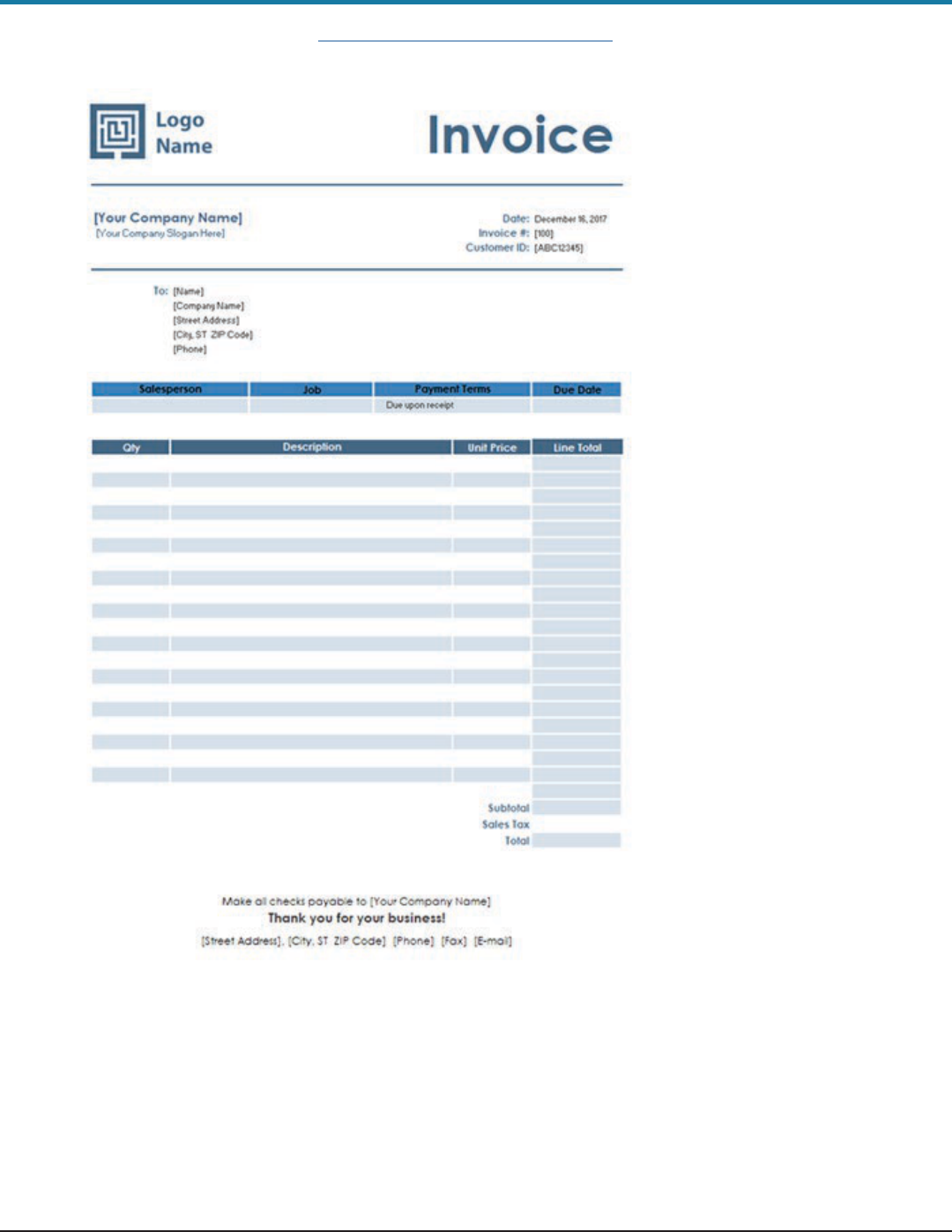

43 Appendix D: Sample Invoice

44 Appendix E: Business Plan Outline

45 Appendix F: Business Model Canvas Template

46 Appendix G: Business Model Canvas Example

47 Acknowledgments

47 About us

TABLE OF CONTENTS

5

PREFACE

Thanks to widespread student advocacy efforts to pass legislation allowing undocumented students to pay in-

state tuition (AB1540), get state financial aid (AB130-131) and apply for professional licensing (SB1159), higher

education and career opportunities have become much more accessible for undocumented young people in

California. But after graduation, undocumented students must identify ways to utilize their degrees and earn a living.

While it’s true that being undocumented creates barriers to pursuing employment in the U.S., there are many ways

to earn a living through entrepreneurship regardless of your status.

Becoming an entrepreneur is not easy, but it is possible and can serve as a way to participate in—and help shape—

today’s changing economy. This toolkit provides in-depth information, resources and templates that address

questions about independent contracting and business start-ups, as well as profiles of immigrant entrepreneurs

to see real life examples of what people are doing. At a time when there is much uncertainty regarding the future

of immigrants in the U.S., particularly DACA beneficiaries who may lose the opportunity to legally work, this toolkit

outlines legal ways for all immigrants, regardless of their status, to utilize their degrees and thrive in the U.S.

This toolkit is intended as a resource for educators who wish to support undocumented students and for

undocumented students and alumni who are trying to figure out their career options. This toolkit is not intended to

be read in one sitting, but rather used as a resource directory that is frequently referenced. The appendix section

includes templates that can be downloaded whenever they are needed.

6

MESSAGE FROM THE UNIVERSITY OF

CALIFORNIA

The University of California Office of the President (UCOP) is pleased to co-present with Immigrants Rising,

an inclusive toolkit that provides income generation options to UC students and alumni, with or without work

authorization. This resource provides guidance on how to earn a living as an independent contractor, confers

advice on how to incorporate a business, and shares resources that are available both on and off UC campuses. I

encourage UC student affairs practitioners, career center advisors, faculty members, and staff to use this toolkit to

support the career pathways of all students, regardless of their immigration status.

This toolkit grew from a spring 2018 convening of the UC President’s Advisory Council on the Undocumented

Community & Immigration and UCOP Student Affairs. The convening sought to develop strategies to prepare

undocumented students for post-graduation career opportunities. A prominent recommendation that emerged

called for UCOP to equip each campus with information geared toward undocumented students on alternatives to

employment and post-graduation opportunities. In response, UCOP partnered with Immigrants Rising to produce

this toolkit. To begin dissemination of this important information, Immigrants Rising produced and delivered several

in-person and online trainings to UC stakeholders, including directors and coordinators of undocumented student

services, financial aid directors, career center staff, instructional faculty, hiring managers, UC students, and alumni

from across the University system. We heard from participants they found these trainings to be very insightful.

The University of California remains steadfast to its commitment of supporting undocumented students’ higher

education, career readiness, and post-graduation opportunities. We will work to ensure they have a path forward to

fulfilling their aspirations during and after their time at UC.

I am excited to share this project with you and hope that students, alumni, and student affairs staff find this to be a

useful resource. Thank you for your time, effort, and dedication to supporting UC students.

Sincerely,

Elizabeth Halimah

Associate Vice Provost for Diversity & Engagement

University of California

Office of the President

7

FREQUENTLY ASKED QUESTIONS

Student FAQs About Income Generation

Career Options

I am an undocumented student trying to choose a

major, where should I start?

You can choose any major you like, however, some

professions, such as those in the health industry, may

require work authorization. Also, keep in my mind that

your immigration status may change at some point

in the future, so don’t limit your options solely based

on your status. See Section V of this toolkit for more

information about career pathways for undocumented

students.

I selected a major and all internships/work

opportunities require work authorization, what

should I do?

Depending on your major, you may be able to get

training and experience through fellowships (considered

financial aid), unpaid internships or independent

contracting. You may want to search for existing

fellowships at your campus related to your field of study

and identify ways to utilize your skills and experience

to engage in work as an independent contractor.

See Section V of this toolkit for more information

about career pathways and training opportunities for

undocumented students.

I know I can’t get employed in my field, so how can

I use my degree?

Any immigrant, regardless of status, can generate

income through freelancing, independent contracting,

or the establishment of their own business. Review

Section II of this toolkit to learn how to get started as an

independent contractor.

Can I pursue graduate school as an undocumented

student?

Yes, undocumented students may pursue graduate or

professional school. However, either option requires

careful consideration and research. Learn more about

graduate and professional school opportunities for

undocumented students in Immigrant Rising’s Life After

College Guide. Also refer to UCLA’s Undocumented

Graduate and Professional Students Handbook

for more specific information about graduate and

professional school at UCLA.

Freelancing and Entrepreneurship

I know I can work as an independent contractor,

but how do I start?

First, you should familiarize yourself with the legal

aspects of working as an independent contractor, which

you can learn about in Section I of this toolkit. Next,

identify what skills, abilities, and knowledge you have

that could be turned into contracting opportunities. Use

the Independent Contractor Brainstorming Worksheet

in Appendix B to help you get started.

I am already doing independent contracting and

would like to incorporate as a business to hire

employees, where do I start?

There are multiple ways to incorporate as a business.

Review Section III of this Toolkit to become more

familiar with the different types of business structures.

Afterward, you can use the Centro Community

Business Plan App to draft a business plan or use the

Business Model Canvas Worksheet in Appendix F to

help you develop your business model.

I have been offered a job, but I do not have work

authorization, what should I say?

Undocumented people without work authorization are

not allowed to work as employees. However, there may

be an opportunity to work as an independent contractor.

Start by familiarizing yourself with the independent

contracting rules, which you can learn about in Section I

of this Toolkit.

When preparing to speak with potential clients about

working as an independent contractor, you may

consider doing the following:

» Make sure the type of work you wish to do follows

the independent contractor guidelines; you

cannot simply turn employment into independent

contracting

» Become familiar with the legal aspects of working

as an independent contractor

8

» Highlight your assets and skills and be prepared

to demonstrate how they meet the needs of your

clients

» Research similar types of work so you know the

standard rate for your services

» Become familiar with writing contracts and make

sure to sign a contract with every client

Working with DACA

I have been offered a job and I have DACA, do I

have to disclose my undocumented status?

You are not required to disclose your undocumented

status to your employer. For more information, see the

National Immigrants Law Center’s (NILC) Frequently

Asked Questions: DACA and Your Workplace Rights.

I was previously employed with my DACA work

authorization, but I was not able to renew my

DACA, what should I do?

If a DACA beneficiary were to lose their work permit, the

company that hired them would not be able to contract

with them. If the beneficiary were to have their DACA

status revoked, they could pursue independent contract

work or start a business using his or her assigned SSN,

as long as he or she contracts with any other entity

other than the one that is aware of the expired work

authorization.

ITINs, SSNs and Taxes

I was not able to renew my DACA and would like

to work as an independent contractor, do I have to

get an ITIN?

If you obtained DACA and used it to get an SSN you

should not continue to use or renew your ITIN; you

should only have either the SSN or ITIN, not both.

Regardless of the possible termination of DACA,

the assigned SSN will remain yours even if your

work authorization terminates. The SSN is separate

from a work permit and can be used to work as an

independent contractor or start a business, which are

options that do not require work authorization.

Regardless of the possible termination of DACA,

the assigned SSN will remain yours even if your

work authorization terminates.

I need to file taxes this year for some independent

contractor work and money I received through a

fellowship. What do I have to report and how much

do I have to pay in taxes?

As an independent contractor, you are considered self-

employed and will need to pay self-employment tax if

your net income is greater than $400. Fellowship grants

are not subject to tax withholding and not reported on a

year-end tax form (W2 or Form 1099), but you are still

required to report them on IRS Form 1040 and may

need to make estimated tax payments directly to the

IRS. For enrolled students, gift aid (i.e., scholarships)

that exceed tuition, fees, books & supplies are taxable

to the recipient per IRS publication 970. Please check

with a tax accountant regarding your need to make

estimated tax payments. How much you make, and

how you file (single, married filing jointly, married filing

separately), will determine how much you need to pay

in taxes. It is recommended that you save about 20%

of your earnings to pay taxes. Also keep in mind that

the IRS allows business expenses to be deducted

from your earnings as long as they are business-related

and not personal. See Section II of this toolkit for more

information about taxes.

How do I find out about other immigration

options?

Learn about options for gaining longer-term status and

categories that might work for you now, or in the future

in Immigrants Rising’s Beyond DACA: Immigration

Options Every Undocumented Person Should Know.

Learn about your possible immigration options by using

Immigrants Rising’s Immigration Legal Intake Service.

9

Staff/Faculty/Admin FAQs About Income

Generation

Income Generation Through Freelancing and

Entrepreneurship

I know all students, regardless of immigration

status, can earn a living through freelancing/

entrepreneurship, but how do I learn more

about income generation options other than

employment?

You may want to start by reviewing this Toolkit to learn

more about income generation options, other than

employment. The Toolkit includes comprehensive

guides, templates, and handouts to help students get

started in freelancing and entrepreneurship.

How can we support undocumented students

interested in entrepreneurship at our campus?

You may want to partner with the business school,

law school, or entrepreneurship program (if available)

on your campus. Business schools can offer classes,

help develop curriculum, host workshops, or create

certificate programs for undocumented students.

Law schools often offer pro bono business legal

assistance through transactional clinics (see a list of

all transacational clinics at the UCs in Section IV) that

can benefit undocumented students and their families.

Entrepreneurship programs at your campus may be

able to provide 1-on-1 support to students interested in

starting a business, may have start-up funds available

and may have incubators that can help undocumented

students develop and launch a business idea (see a list

of all entrepreneurship centers at the UCs in Section

IV).

Where can I find local entrepreneurship service

providers to refer students to?

In addition to support offered at your UC campus

(Section IV), you and your students can find local

entrepreneurship service providers on venturize.

org. Venturize is an online resource portal for small

businesses that need help starting a business, scaling a

business, and accessing capital, particularly enterprises

located in underserved areas. All resources on Venturize

are available in Spanish and the list of service providers

indicates in which languages services are offered.

Venturize’s interactive map allows you to search for

local service providers by zip code. You may also

want to refer students to your local Small Business

Development Agency (see a complete list of agencies

in California in Section V of this Toolkit).

Are there any repercussions I should consider, as a

result of sharing this information with students?

No. Under federal law, as mandated by the Immigration

Reform and Control Act of 1986 (IRCA), it is illegal to

knowingly employ unauthorized workers in the United

States. However, neither work authorization nor an SSN

are required to engage in independent contracting or

business start-up.

Career Advice

How do I advise undocumented students who are

trying to choose a major?

Undocumented students may choose any major they

like, however, some professions, such as those in the

health industry, may require work authorization. Also,

keep in my mind that undocumented students may be

able to adjust their status at some point in the future,

so they should not limit their options solely based on

status. See Section V of this toolkit for more information

about career pathways for undocumented students.

I know that undocumented students can get

professional licenses in the state of California, but

how does it work?

SB1159 allows any immigrant, regardless of

immigration status, to get a professional license in the

state of California. There are specific requirements

for each license that may include training, exams,

certifications or an hourly commitment. For more

information, see Section II in this Toolkit that discusses

California’s SB1159. To see a complete list of licensing

and requirements, visit the California Department of

Consumer Affairs website.

On-Campus Training Opportunities

We have a great student we’d like to work with,

how can we hire that student?

Undocumented students without work authorization

cannot be hired as employees under any circumstance.

Can undocumented students engage in work

study?

Work study is a form of employment and undocumented

students who do not have work authorization cannot

be employed. Undocumented students who are DACA

recipients and have non-expired work authorization

10

might be eligible for instiuttional work-study. Students

should inquire with the Financial Aid Office to see if

they qualify.

There are also ways to create career development and

training opportunities for undocumented students, and

potentially offer a stipend through fellowships. Currently,

at UC a “stipend” must be administered through

financial aid or through payroll (which requires work

authorization).

Additionally, the terms, conditions and compensation

for many graduate-level employment opportunities—

research, teaching assistant, tutor—are addressed

in collective bargaining agreements and cannot

be modified to accommodate those without work

authorization.

Sponsorship

Is it possible for the UC to sponsor an

undocumented student for a work visa?

While the UC generally limits sponsorship opportunities

to high-level academic positions, it may be able

to petition a student for an H-1B Visa. An H-1B

nonimmigrant visa is a temporary visa for professional

workers in specialty occupations that normally require

a bachelor’s degree or equivalent as a minimum

requirement. For an H-1B, the employer is the petitioner,

and they are required to make successive filings with

the Department of Labor and then with USCIS. The

employer must “attest” (promise) that it will pay the

prevailing wage for that job in that geographic area,

as well as to the actual wage paid at the company

for others in the same job, among other attestations.

For more information about the H1-B Visa and other

long-term status and categories, see Immigrants

Rising’s Beyond DACA: Immigration Options Every

Undocumented Person Should Know.

11

SECTION I: UNDERSTANDING

INCOME GENERATION, REGARDLESS

OF IMMIGRATION STATUS

1 Immigration Reform and Control Act of 1986, Pub. L. No. 99-6603, 100 Stat. 3359 (codified at 8 U.S.C § 1324a). The IRCA amended the Immigration

and Nationality Act (“INA”).

2 8 CFR § 274a.2(b)(1)(i)(B).

3 8 CFR § 274a.1.

Most undocumented immigrants face significant

barriers when pursuing employment in the United

States. Employers are required to ask for proof of legal

status, and it is illegal for any employer to hire a person

knowing that the individual is not lawfully authorized

to work. In this section, we outline some legal ways

to earn money in the United States. It is the worker’s

responsibility to determine whether they may legally

pursue these options based on their immigration status.

For more information on obtaining legal advice, visit the

Student Legal Services Department at your campus.

There are multiple ways to work for yourself, including

independent contracting (also called consulting or

freelancing) and establishing a formal business. Many

individuals, including professionals, do independent

work outside of their regular employment as a way to

boost earnings or lay the foundation for a business. This

section will cover what it means to be an independent

contractor, personal information needed to pursue

this option, tax liability, and independent contractor

guidelines.

For more information on obtaining legal advice,

considering visiting the Student Legal Services

Department at your campus.

Legal Considerations for Independent

Contracting

It is important to consider the legal aspects of earning a

living as an independent contractor without legal status.

Under federal law, as mandated by the Immigration

Reform and Control Act of 1986 (IRCA)

1

, it is illegal

to knowingly employ unauthorized workers in the

United States. This applies to all workers, however, an

employer’s responsibility to verify work authorization

is much higher for workers classified as employees

than for workers classified as independent contractors,

sporadic domestic workers, or workers who are hired

through contracts with other legal entities. The IRCA

requires employers to verify that every new employee is

legally authorized to work in the U.S., through a two-part

federal employment verification system, known as the

“I-9 System”. First, an employee must complete Form

I-9, Employment Eligibility Verification and assert under

penalty of perjury that they are legally authorized to

work in the U.S. Second, the employer must review the

original documentation from a specified list (e.g., birth

certificates, passports and work permits) to verify both

the worker’s identity and eligibility to work. After review,

the employer must certify under penalty of perjury that

they have examined the original documentation

2

.

There are exceptions to the I-9 System obligations

when not dealing with employees. An individual or entity

is not required to obtain Form I-9 from independent

contractors or sporadic domestic workers.

3

Further,

Individuals or entities are generally not obligated to

affirmatively verify the work authorization of individuals

whom they engage as independent contractors.

While employment is now allowed without

work authorization, independent contracting

and business start-up do not require work

authorization and therefore, are viable

opportunities for anyone, regardless of

immigration status.

However, Federal Statute 8 U.S. Code 1324a(a)(4)

prohibits an individual or entity (a client) from knowingly

engaging an unauthorized individual to provide services

12

as a contractor.

4

This means that if an employer is aware

that an employee’s work authorization has expired,

he or she cannot contract with that same individual

as an independent contractor. Therefore, if a DACA

beneficiary were to lose their work permit, the company

that hired them would not be able to contract with

them. In the case of DACA getting revoked, a DACA

beneficiary could pursue independent contract work

or start a business using their assigned SSN, as long

as they contract with an entity other than the one that

is aware of the expired work authorization. Individuals

who fail to comply with Form I-9, or knowingly hire or

contract undocumented individuals may face civil fines,

criminal penalties, or debarment from government

contracts.

5

It should be noted that in some instances, engaging

in unauthorized employment (which USCIS has

interpreted to include unauthorized self-employment)

may adversely impact the ability of the individual to

adjust his or her immigration status at a later time.

However, legal experts who consulted with us could

not imagine a scenario in which prior unauthorized work

caused an additional adverse impact to adjustment

beyond the adverse impact of having been present

without authorization.

Independent Contracting

Although employers may not knowingly hire an

unauthorized immigrant, federal and state laws often do

not require proof of immigration status for an individual

to go into business for themselves and receive payment

for goods or services. Individuals who perform services,

but are not employees, are sometimes categorized as

independent contractors.

An independent contractor is defined as a self-

employed person who produces a specific type of work

product in a determined amount of time. The difference

between an independent contractor and an employee is

discussed below, but the general rule is that the person

paying an independent contractor has the right to

control or direct only the result of the work and not what

will be done and how it will be done.

6

The independent

contractor may be paid an hourly rate or a flat fee.

Independent contractors generally use their own name

to do business, but they may decide to start their own

4 United States Code, 2006 Edition, Supplement 5, Title 8 - ALIENS AND NATIONALITY https://www.govinfo.gov/app/details/USCODE-2011-title8/

USCODE-2011-title8-chap12-subchapII-partVIII-sec1324a

5 https://www.uscis.gov/i-9-central/penalties

6 For further information on independent contractor work and guidelines see http://www.irs.gov/businesses/small/article/0,,id=99921,00.html

7 For more information about ITINS, see Immigrants Rising’s ITIN Guide, https://immigrantsrising.org/resource/individual-tax-identification-number-guide/

company by starting a sole proprietorship and using a

business name instead.

Personal Identification Required: The person

or company that pays is not required to ask an

independent contractor to fill out an I-9 or otherwise

inquire about immigration status. They will, however,

require a Social Security Number (SSN) or an Individual

Taxpayer Identification Number (ITIN)

7

to commence

work.

NOTE: DACA beneficiaries who receive SSNs

should use their SSN to engage in work as

independent contractors even if their work

authorization expires.

The ITIN is a processing number issued by the IRS.

The ITIN may be used to report earnings to the Internal

Revenue Service, open interest-bearing bank accounts

with certain banks, and conduct business in the United

States. The IRS issues ITINs regardless of immigration

status, because both citizens and noncitizens may

have a U.S. tax filing or reporting requirement under

the Internal Revenue Code. If you obtained DACA and

used it to get an SSN you should not continue to use or

renew your ITIN. Regardless of the possible termination

of DACA, the assigned SSN will remain your SSN even

if the individual’s work authorization terminates. The

SSN used to keep track of earnings generated through

Bo Daraphant’s Story

“My entrepreneurship was

born out of two things:

necessity—because I

couldn’t get hired and

needed to do something

on my own—and passion

for my art.”

Bo Thai is an

undocumented artist from

Thailand and owner of illegal Drip, a clothing line that

blends art and advocacy. Bo is also the co-founder

of Monarch Mercado, a network and marketplace for

undocumented people to find community, grow, and

hustle. Bo graduated from UC Irvine with a degree in

International Studies. Watch Bo’s Story

13

employment (which requires work authorization) or

independent contracting (which does not require work

authorization). Therefore, individuals who lose their work

authorization may continue to generate income through

independent contracting or business start-up using their

SSNs. To learn more about the ITIN, see Immigrants

Rising’s ITIN Guide.

Taxes: An independent contractor must pay self-

employment tax and income tax. An independent

contractor may use an ITIN to file and pay taxes instead

of an SSN using Form 1099. Independent contractors

can get free tax prep help through the IRS Volunteer

Income Tax Assistance (VITA). Independent contractors

may also receive support from the IRS Low Income

Taxpayer Clinics (LITC). LITCs can represent people

before the IRS or in court on audits, appeals, tax

collection matters, and other tax disputes. Services are

provided for free or for a small fee.

IRS Forms Required of Independent

Contractors

An independent contractor is responsible for having a

valid SSN, ITIN or EIN to complete a W-9 Form. The

following forms are used to keep track of payment and

pay taxes on earned income, and do not require work

authorization.

W-9: The IRS requires that payers (clients) use Form

W-9 to obtain taxpayer identification numbers from

independent contractors. The W-9 Form is filled out at

the start of work by an independent contractor and kept

on record by the payer. Note that if, in one calendar

year, an independent contractor is paid anything less

than $600 then the payer does not need to request a

W-9 Form.

8

Regardless of whether or not a W-9 Form

is requested, independent contractors should keep

track of their earnings and pay taxes on all earnings. A

W-9 Form is likely to be requested by each client. The

only personal information that is required on the form is

name, current mailing address and either an SSN, ITIN

or EIN; work authorization is not required.

1099: The IRS requires that payers (clients) use Form

1099 to record the total amount of money paid to

independent contractors in any given calendar year. A

payer must file a 1099 for each independent contractor

paid $600 or more. A copy of the 1099 is mailed to the

8 http://www.mbahro.com/News/tabid/110/entryid/147/W9-Tax-Form-FAQ.aspx

9 https://www.irs.gov/businesses/small-businesses-self-employed/independent-contractor-self-employed-or-employee

independent contractor at the end of the year and he or

she becomes responsible for paying taxes thereafter.

Basic Guidelines for Independent

Contractors

For federal tax purposes, the IRS common law

rules

9

are applicable to determine if a worker is

an independent contractor or an employee. Facts

that provide evidence of the degree of control and

independence fall into three categories:

Behavioral: Does the company control or have the right

to control what the worker does and how the worker

does his or her job?

Financial: Are the business aspects of the worker’s job

controlled by the payer? (these include things like how

worker is paid, whether expenses are reimbursed, who

provides tools/supplies, etc.)

Type of Relationship: Are there written contracts or

employee type benefits (i.e. pension plan, insurance,

Kai Martin’s Story

“The drive and the hustle

just became natural to me,

so once I was of age I

found myself looking to

learn tips and tricks. I was

determined never to sit

still and never say I can’t

do it, because I know I can

always find something to

do.”

Kai is a native of the twin islands of Trinidad and

Tobago. After immigrating to the United States,

she began her U.S. educational journey in the New

York City public school system. She completed her

associate’s degree at the Borough of Manhattan

Community College and later attended John Jay

College of Criminal Justice, where she graduated

cum laude with a bachelor’s degree in law. While

currently pursuing her MPP at George Washington

University, Kai provides professional consulting

services in product and personal branding, small

business startup, social media management, and

marketing and public relations. Watch Kai’s Story

14

vacation pay, etc.)? Will the relationship continue and is

the work performed a key aspect of the business?

Businesses must weigh all these factors when

determining whether a worker is an employee or

independent contractor. Some factors may indicate that

the worker is an employee, while other factors indicate

that the worker is an independent contractor. There is

no “magic” or set number of factors that “makes” the

worker an employee or an independent contractor, and

no one factor stands alone in making this determination.

Also, factors which are relevant in one situation may not

be relevant in another.

The keys are to look at the entire relationship, consider

the degree or extent of the right to direct and control,

and finally, to document each of the factors used in

coming up with the determination.

Employment vs. Independent Contracting

It is very important to understand the differences

between employment and independent contracting.

Please refer to Table 1 to understand the main

differences.

California Common Law Test and the ABC

Test

California courts and administrative agencies have

generally applied common law principles to determine

independent contractor status. Recently, however,

there have been major developments in independent

contractor law.

Beginning January 1, 2020, a new law, commonly

referred to as Assembly Bill 5 (AB 5), significantly

altered the way California law distinguishes between

employees and independent contractors. The new law

codifies into law the 2018 California Supreme Court’s

decision in Dynamex Operations West, Inc v. Superior

Court. In that case, the Court adopted a standard that

presumes that all workers are employees instead of

contractors. The burden is now on any entity classifying

an individual as an independent contractor using the

“ABC Test”. Under the newly adopted “ABC test,” a

worker may be classified as an independent contractor,

instead of an employee, only if the hiring entity

establishes all of the following:

(A) that the worker is free from the control and direction

of the hirer in connection with the performance of the

work, both under the contract for the performance of

such work and in fact;

(B) that the worker performs work that is outside the

usual course of the hiring entity’s business; and

(C) that the worker is customarily engaged in an

independently established trade, occupation, or

business of the same nature as the work performed for

the hiring entity.

Before engaging in independent contracting,

we suggest carefully thinking about the type

of services one could provide that meet the

requirements. See Appendix A for a list of

top consulting opportunities that can be done

independently.

California’s new AB5 applies to all of California, but

exempts many professional workers and many other

Table 1. Employees vs. Independent Contractors: Main Differences

Employee Independent Contractor

Behavioral Control

Employer trains and directs work, including

hours of work, what tools or equipment to

be used, specific tasks to be performed

and how the work is to be done

Worker can set their own hours and works

with little or no direction or training

Financial Control

A worker is paid a salary, is restricted from

working for others, and does not participate

in company profits or losses

Worker may work for others at the same time

and can incur a profit or loss

Type of Relationship

Worker is entitled to benefits; work is

directly related to the company’s core work

Worker finance his or her own benefits out

of the overall profits of the enterprise; worker

works on a specific project or period of time

15

workers with licenses, such as stylists and barbers. The

following professions were excluded from AB5

10

:

» Doctors: physicians, surgeons, dentists, podiatrists,

veterinarians, psychologists.

» Some licensed professionals: lawyers, architects,

engineers.

» Financial Services: insurance brokers, accountants,

securities broker-dealers, investment advisors.

» Real estate agents.

» Direct sales: provided the salesperson’s

compensation is based on actual sales rather than

wholesale purchases or referrals.

» Commercial fishermen.

» Builders & contractors: construction firms that build

major infrastructure projects and big buildings.

» Professional services: marketing, human resources

administrator, travel agents, graphic designers,

grant writers, fine artists.

» Freelance writers, photographers: provided the

worker contributes no more than 35 submissions to

an outlet in a year.

» Hair stylists, barbers:defined as a licensed barber or

cosmetologist provided that person sets their own

rates and schedule.

» Estheticians, electrologists, manicurists: provided

they are licensed.

» Tutors: provided they teach their own curriculum.

Does not apply to public school tutors.

» AAA-affiliated tow truck drivers.

However, workers in these exempt categories are not

automatically independent contractors. They must pass

the 11-point “Borello test” after the California Supreme

Court case it is drawn from; S. G. Borello & Sons, Inc.

v. Department of Industrial Relations. The Borello test

focuses primarily on the hiring entity’s right to control

the manner and means of performing the work but also

requires consideration of the following factors:

1. Whether the worker is engaged in an occupation or

business that is distinct from that of the hiring firm

2. Whether the work is part of the hiring firm’s regular

business

3. Whether the hiring firm or the worker supplies the

equipment, tools, and the place for the person

doing the work

4. The worker’s financial investment in the equipment

10 https://calmatters.org/economy/2019/09/whos-in-whos-out-of-ab-5/

or materials required to perform the work

5. The skill required in the particular occupation

6. The kind of occupation—whether, in the locality, the

work is usually done under the hiring firm’s direction

or by a specialist without supervision

7. The worker’s opportunity for profit or loss

depending on his or her own managerial skill

8. How long the services are to be performed

9. The degree of permanence of the working

relationship

10. The payment method, whether by time or by the job,

and

11. Whether the parties believe they are creating an

employer/employee relationship.

The first factor on the list is given the most weight.

To pass all tests, we recommend incorporating as

a business (see Section III) and actively engaging

in promotion of services.

To learn more about AB5, please review the California

Immigrant Policy Center’s (CPIC) AB5 Frequently

Asked Questions.

16

SECTION II: HOW TO START EARNING

A LIVING AS AN INDEPENDENT

CONTRACTOR

Independent contracting requires a change of mindset,

from working for a boss to working for oneself. This

means establishing an expertise (through a product or

service), marketing oneself, networking, understanding

the rules of independent contracting, understanding

taxes, engaging in continuous learning, and most

importantly, believing in oneself!

Participating in the Gig Economy

The gig economy refers to a growing segment of the

labor market where individuals earn a living outside of

traditional part-time or full-time employment, usually as

independent contractors, also known as freelancers.

The gig economy has grown tremendously over

the past few years, as a result of technology, which

has facilitated the connection between workers

and clients in a variety of sectors. Individuals who

choose to participate in the gig economy may do it

out of necessity or by choice. Some individuals may

experience employment barriers in the traditional

labor market due to lack of experience or educational

attainment, language barriers, immigration status,

having a criminal record, being a survivor, or a lack of

interest in traditional employment. The gig economy

has endless options and often does not require high

educational attainment.

Gig opportunities include:

» Driving for car services such as Uber or Lyft

» Selling products or services on sites such as Etsy

or eBay

» Working as a freelance writer, web designer or

musician

» Working for pay apps such as TaskRabbit

» Selling products such as Mary Kay or Princess

House

» Renting space in your personal home with sites

such as Airbnb

» Any one-time, task-based job

Samaschool, a San Francisco-based nonprofit focused

on preparing low-income populations to succeed

as independent workers, offers a variety of tools to

help people get started in the gig economy. Their

Work Finder includes a vast list of work organized

by categories that include Care, Creative, Delivery

and Driving, Design and Tech, to name a few. Each

specific type of work includes a description, types of

skills and experience needed, estimated hourly range,

and whether or not it is suitable for English learners.

Samaschool also includes online marketplaces to find

work in the desired field/industry of choice.

Working as a Professional Service

Provider

In addition to participating in the gig economy,

individuals may choose to leverage their expertise, skills,

abilities, certification, and professional and academic

training to independently offer professional services

to the public. These professional services exist in a

variety of industries, however, the ability to provide

them requires experience, passion for a specific type of

work, and in some instances, licensing or educational

attainment.

Professional services include:

» Accounting

» Advertising

» Legal

» Medical

» Engineering

» Computer programming

» Graphic design

» Website design

17

» Payroll management

» Taxes

» Writing and editing

» Fine art

» Photography

» Landscaping

» Construction

» Real estate

» Cosmetology

What to Consider When Providing Professional

Services

11

:

» What certifications or special licenses are

needed? Depending upon your profession, you

may need special certification or a special license

before you can begin operating as a consultant.

For example, fund-raising consultants don’t need

special certification, although you can become

certified through the National Society of Fund

Raising Executives. And in some states, you may

need to register as a professional fund-raising

consultant before starting your business. On the

other hand, if you wish to become an independent

lawyer, accountant, or real estate agent, you will

need to pursue higher education and complete

the licensing requirements for these options. See

SB1159 in Section II for additional information

about professional licenses for undocumented

people in California.

» Am I qualified to become a consultant? Before

becoming a consultant, you need to make sure you

have the qualifications to get the job done. This

includes having experience and staying up to date

with current trends and changes. You may also

consider acquiring additional skills or knowledge.

Skillshare is an online platform with thousands of

online classes taught by professionals on topics

including illustration, design, photography, video,

freelancing, and more.

» Am I organized enough to become a consultant?

Becoming a professional consultant requires having

excellent time management and planning skills in

order to juggle multiple clients and tasks.

» Who are my potential clients? In order to find

clients, professional consultants should have a

large network of contacts and become familiar with

marketplaces to find clients. LinkedIn Pro Finder

11 Adapted from https://www.entrepreneur.com/article/41384

helps connect freelance professionals with high

quality leads, utilizing LinkedIn profiles.

To see a list of the top consulting businesses thriving

today, see Appendix A.

Professional Licensing (California SB 1159)

California’s SB1159, approved by Governor Brown in

2014, requires licensing boards within the Department

of Consumer Affairs to accept an individual tax

identification number in lieu of a social security number

for professional licenses. The law enables all California

students who qualify to sit for specific licensing exams,

including the California Bar Exam, and to become

licensed upon passing the exams. The law also

prohibits any entity within the department from denying

licensure to an applicant based on his or her citizenship

status or immigration status.

Individuals who wish to get a professional license

should review the requirements and associated fees

ahead of time. While undocumented individuals may

not get legally hired as employees without work

authorization, immigrants, regardless of status, may

utlilize their professional license to earn a living as

professional consultants.

A complete list of professional licenses issued by

the Department of Consumer Affairs is found on their

Pedro Moura’s Story

“I was able to break out of

a cycle of poverty and I

want to help others in my

community do the same. I

have developed a scalable

business and crafted a

product that helps people

in their day to day lives.”

Pedro Moura is a

formerly undocumented immigrant from Brazil and

the cofounder of Flourish Savings, a free mobile

app geared toward empowering young adults

to build savings habits by making it feel like play.

Pedro graduated from UC Davis with a degree

in economics and completed an MBA at the UC

Berkeley Haas School of Business. Watch Pedro’s

Story

18

website: https://www.dca.ca.gov/about_us/entities.

shtml.

Additional Consideration for Independent

Contracting

In addition to understanding the IRS and state rules for

independent contracting, it is important for individuals

who wish to earn a living as independent contractors

to learn about additional responsibilities such as liability

insurance, contracts, invoicing, budgeting, and taxes.

Liability Insurance

In some instances, independent contractors may be

asked to provide liability insurance. General liability

insurance is a type of insurance policy for independent

contractors or business owners that would cover

legal expenses resulting from a lawsuit. Independent

contractors have the same legal obligations and

liability exposures as larger firms. They can be sued

for damaging client property, causing bodily harm, or

advertising injury. Clients may require general liability

insurance before they sign a contract to avoid being

held responsible for alleged wrongdoing or accidents

caused by a contractor. Some industries, such as

construction, require by law for independent contractors

to carry general liability coverage by law.

Liability policies typically cover the following:

» Bodily injury caused to someone else (who is not

your employee)

» Slip and fall accidents

» Copyright infringement

» Product liability

» Slander and libel

» Property damage

Finding the right insurance provider may involve

doing some research. There are a number

of different coverage types, monthly fees,

and deductibles that need to be taken into

consideration. There are also free online tools,

such as Insureon, to get free quotes and compare

policies.

Contractor Agreement

Independent Contractor Agreements are legally binding

documents that clearly outline the scope of work,

payment schedules and deadline expectations of a

freelance arrangement. The first distinction that needs

to be made about these contracts is that they are not

for employees. The contract serves as an agreement

between a company or individual (the client) and an

independent or freelance worker. Some examples

include a handyman that is contracted to install

new windows in a home, a freelance web designer

contracted to create a company’s website, or an editor

contracted to provide copy-editing services to a non-

profit organization. The contractors are independent

workers, not employees, and are therefore, responsible

for most of their own tax obligations.

The contract agreement outlines exactly what the work

consists of, when it needs to be completed by and the

fee due to the contractor upon completion. The second

is that it shields clients from liability issues and helps

protect assets and proprietary information. If a client is

taken to court, the signed agreement will clearly show

the judge what the expectations of the arrangement

were. A contract may also be needed in the case of an

IRS audit.

For the freelancer, the contract serves as a legally

binding document in the case of a payment

disagreement. In addition, the contract adds a level

of professionalism for the contractor and shows a

willingness to commit to work and time agreements.

To see a sample contract, refer to Appendix C.

Sumana Kaluvai’s Story

“My background in

entrepreneurship primarily

stems from a myriad of

side hustles that I

stumbled into over time.”

Sumana Kaluvai and her

family immigrated to the US

from India when she was 2

years old. She graduated

in 2019 from UCLA with a degree in bioengineering.

While at UCLA, Sumana was a member of the

professional entrepreneurship fraternity, Sigma Eta

Pi, and a fellow in the Dream Summer Program. She

currently works at a biotech-related consulting firm in

San Francisco. Watch Sumana’s Story

19

Invoicing

Independent contractors are not on payroll, which

means that they need to know how to create an invoice

to request payment for services provided to a client.

An invoice is a document that lists the products and

services an individual or business provides to a client

and establishes an obligation on the part of the client

to pay the business for those products and services.

Invoices are important for both the business sending

them and the client receiving them. For independent

contractors or small businesses, an invoice helps

expedite the payment process by giving clients a

notification of the payment that is due. For clients,

invoices provide an organized record of an expense with

itemized details, and can help with record keeping. It is

the responsibility of the contractor to provide an invoice

to the client.

The most common way to create an invoice is to use

a template. However, individuals should understand

the key components of an invoice. The most effective

invoices include the following elements, organized by

section.

» Header: Includes information about the independent

contractor or business, including contact

information.

» Invoice Number: This is an individual number

assigned by the seller to distinguish this invoice

from all others the seller sends.

» Invoice Date: The invoice is generated and sent on

the invoice

» Payment Terms: When a payment is expected.

» Billing Company Information: The name of the

business (or the contractor) and the contact person

should be included in the header, with contact

information.

» Customer or client information: The person or

business receiving the invoice should be identified,

with their contact information, in the header.

» Line items: The bulk of the body section is made

up by line items. Line items name or describe the

goods sold or services rendered, the cost per unit

or hourly rate, the number of units bought or hours

billed, and the total due for that particular item.

» Billable expenses: If you’ve had to pay for some

things that the customer needs to cover, include

these expenses on the invoice. These could also be

included separately, depending on client protocols.

» Total charges: A summary of all charges associated

with the items or services being billed.

» Payment instructions: Payment instructions appear

in the footer of the invoice, if necessary. These

instructions might include a line about where to

send checks, what credit cards are accepted, any

early payment discounts, or applicable late fees if

the payment isn’t received by the due date.

To see a sample invoice, refer to Appendix D.

Invoices can also be generated online easily,

using tools such as the Quickbooks Invoice

Generator or Microsoft Office Templates.

Budgeting

Unlike traditional employees, who receive a paycheck

every two weeks, independent contractors may have

more inconsistency in their income and therefore,

should do a bit more planning. The first step is to keep

track of all expenses, including personal and business

expenses. Individuals may choose to do this manually

or use online tools, such as Mint. The next step is

to determine monthly income, including all revenue

streams. Freelance or gig income is likely sporadic,

depending on the type of work, the hourly rate and

Norma Castañeda’s Story

“As immigrants we’ve been

resilient our whole lives

and that creates

persistence that we bring

along with us to the

business world. We have

the mentality that, ‘yes, I

can do it. It’s going to take

a while, but it’s possible.’”

Norma immigrated to the U.S. from Michoacan,

Mexico at the age of fifteen. She is a first-generation

college student and graduated from California State

University, Los Angeles with a degree in business

administration and an emphasis on marketing

management. While attending college she launched

and managed a small business through eBay for

two years. After gaining experience in business

management, she started offering consulting

services in 2012 and launched her real estate

business in 2017. Norma became a Notary Public in

December 2019. Watch Norma’s Story

20

availability. The purpose of keeping track of expenses

and income is to spend less than what you earn.

Independent contractors also have to set aside cash

to pay for income taxes and self-employment tax. The

recommended amount to put aside is 20-30% of all

income received. The amount of money that is left

behind after expenses, bills, food, tax and savings, is

called disposable income. If there is not much cash

leftover, individuals run the risk of going into debt each

month. Part of maintaining a budget as a freelancer

is knowing where and when the money is coming

in, having multiple revenue streams and possibly

working long hours (i.e. a combination of gig work and

professional consulting).

Paying Taxes as an Independent Contractor

Filing taxes as an employee and independent contractor

are very different. When an individual works for

themself there are no deductions from their paycheck

for income taxes, social security or Medicare, as would

be the case if they were working as an employee.

Independent contractors or small business owners are

held responsible for paying federal and state income

tax, social security and Medicare; this combined tax is

called self-employment tax for independent contractors.

How much money is reported and how a person files

(single, married filing jointly, married filing separately,

etc.) determines the amount needed to pay for taxes.

Independent contractors or business owners pay taxes

by subtracting business deductions and expenses

from the net income of all business activities. This

amount gets added to any other income, and then the

tax is calculated on total adjusted gross income. There

are federal and state tax brackets depending on how

much money is made and how an individual files. It is

recommended to refer to the IRS website for yearly

federal tax brackets and state websites for yearly state

tax brackets.

It is recommended to work with a reliable tax preparer

or accountant who can help complete the correct

tax forms and determine deductions and expenses.

Students may also find free tax preparation support

through local IRS’s Low Income Taxpayer Clinics (LITC)

or Volunteer Income Tax Assistance Program (VITA).

Individuals who do not have a Social Security

Number (SSN) may file taxes using an Individual Tax

Identification Number (ITIN). The IRS issues ITINs

to individuals not eligible to obtain an SSN. The ITIN

allows individuals to report earnings to the IRS, open

interest-bearing bank accounts with certain banks and

start a business in the U.S. For more information about

the ITIN, see Immigrant’s Rising’s ITIN Guide.

21

SECTION III: STARTING A BUSINESS

AS AN IMMIGRANT

12 These steps were derived from the U.S. Small Business Administration (SBA). For more detailed information visit https://www.sba.gov/starting-business.

Individuals may consider incorporating as a business to

(1) hire employees (who have work authorization), (2)

create a layer of identity protection between the person

and the business; (3) avoid questions related to work

authorization, (4) be exempt from freelance laws, (5)

access financial capital for business, (6) have the ability

to seek larger, more competitive contracts, and (7) get

more cost-effective benefits, such as cheaper health

insurance premiums.

All immigrants, regardless of legal status, are eligible

to start a business in the U.S. using an SSN, ITIN, or

EIN. However, before considering starting a business,

there are important decisions that need to be made

and rules and procedures that must be addressed.

While there is no single source for filing requirements,

the following steps can give you an idea of the general

process.

12

Each of these steps are outlined below and

are discussed in more detail in the following sections,

focusing on what immigrants, regardless of legal status,

may or may not be eligible for.

NOTE: The following steps provide a very

general overview of the steps needed to start

a business. There are many development and

incubator programs that can help people learn

about how to start a business and support

individuals throughout the process. Venturize.org

helps people learn about loans, retirement and

healthcare for small businesses. Their interactive

map helps people identify local business support

providers across the nation.

Step 1. Understanding taxes and identification

documents required to get started. All immigrants,

regardless of legal status, are able to pursue

entrepreneurship opportunities using a Social Security

Number (SSN) or Individual Tax Identification Number

(ITIN). Before considering starting a business,

individuals should make sure you have a valid SSN or

ITIN.

Step 2. Writing a business plan or utilizing the Business

Model Canvas (BMC). These tools will help individuals

identify the goals and purpose of the business. This

document will help individuals identify their financial

needs to start a business.

Step 3. Financing a business. Individuals need to

think about ways to finance their business early in the

process. There are incurred costs in the beginning

stages (i.e. licensing, permits, etc.) that may require

capital.

Step 4. Deciding the location of a business. Depending

on the type of business individuals wish to start, they

will have to consider whether they will be working from

home or out of home.

Step 5. Choosing a business structure.

» Sole Proprietorship

» Partnership

» Corporation

» Limited Liability Corporation (LLC)

Step 6. Registering a Business Name, often called

Doing Business As (DBA). If an individual chooses to

name their business as anything other than their own

personal name then they’ll need to register it with the

appropriate authorities.

Step 7. Obtaining business licenses and permits.

Almost every business needs some form of license

or permit to operate legally. Licensing and permit

requirements vary depending on the type of business,

where it is located, and what government rules apply.

Step 8. Marketing and promotion. All businesses need

to engage in marketing and promotion to get clients.

A more detailed explanation of each step is discussed

below.

22

Step 1. Tax Information, ITINs and EINs

All immigrants, regardless of legal status, can pursue

entrepreneurship opportunities (business start-up)

using a Social Security Number (SSN) or Individual Tax

Identification Number (ITIN). Before starting a business,

individuals need to make sure they have a valid SSN

or ITIN. The IRS issues ITINs to individuals not eligible

to obtain an SSN. The ITIN allows individuals to

report earnings to the IRS, open interest-bearing bank

accounts with certain banks and start a business in the

U.S. For more information about the ITIN and the latest

changes, please read Immigrants Rising’s ITIN Guide.

REMINDER: If someone previously received

an SSN through DACA or other temporary

protections, they should always use that number

for tax purposes and never revert to using an ITIN.

EINs. In addition to the SSN or ITIN, individuals may

choose to apply for a An Employer Identification

Number (EIN). The EIN, also known as a Federal

Tax Identification Number, is a unique 9-digit number

assigned by the Internal Revenue Service (IRS), and

is used to identify a business entity. Similar in purpose

to the SSN assigned to individuals, EINs are used by

employers, sole proprietors, corporations, partnerships,

non-profit organizations, trusts and estates, government

agencies, certain individuals, and other business

entities.

13

an SSN or ITIN may be used to get an EIN.

Individuals can apply for an EIN online, by fax, or mail

depending on how soon an individual needs to use the

EIN. Applying for an EIN is a free service offered by the

Internal Revenue Service. Visit the IRS website at www.

irs.gov (keyword “EIN”) and apply using the interview-

style online EIN application.

Step 2. Business Plans and Business

Model Canvas

A business plan defines a person’s business or the

services they would like to provide, identifies their goals,

and serves as their business resume.

14

It describes

the products and services they will sell, the clients to

whom they will sell, the production, management, and

marketing activities needed to produce their offerings,

and the projected costs for their work and effort. The

13 https://www.irs.gov/pub/irs-pdf/p1635.pdf

14 Most of this information comes from the SBA, for more information visit https://www.sba.gov/starting-business/write-your-business-plan

business plan generally projects 3-5 years ahead and

outlines the road the company intends to take to grow.

The form and content of a business plan varies for

each individual or business. The main purpose of the

business plan is not necessarily to impress outsiders,

but to force individuals to think about certain aspects

of starting a business. A business plan is a reflection

of the individual and their ability to organize, manage,

and communicate their vision. A business plan will also

provide the basis for a financial proposal, which is the

document submitted to the financial community in order

to acquire start-up capital or expand a business.

The U.S. SBA offers free tutorials on how to create a

business plan. They also offer a Business Plan Tool

that provides step-by-step guidance to help people get

started. To see a business plan outline, see Appendix E.

Formal business plans often involve using informed

judgement about certain aspects of a proposed

business. Entrepreneur, Cris Mercardo, suggests using

the Business Model Canvas (BMC), to test whether or

not there is demand for a product or service. This tool

allows individuals to gather feedback from potential

customers that can be used to develop a business plan.

Alejandro Flores’s Story

“I saw the hustle day in

and day out. Just like

many of you out there, we

see it in our parents. We

see it in our relatives. We

are hustlers by nature,

because we need to

survive.”

Alejandro is a seasoned

entrepreneur and activist who has made it his

mission to advocate for marginalized communities.

As an outspoken queer, DACA, Latinx person,

Flores’ work aims to champion the next generation of

intersectional entrepreneurs. Brought to the United

States by his mother in 1997, Alejandro had strong

progressive values instilled in him from a young

age. His upbringing and family’s commitment to

overcoming adversity is what inspired him to launch

his businesses: Unum Sunglasses, Progressive

Button, and most recently Stokes Poke. Watch

Alejandro’s Story

23

To see a BMC template, see Appendix F and to see an

example of the BMC, see Appendix G.

Entrepreneur, Aashan Shah, suggests following a “lean

startup methodology,”which dictates that the best way

to start a business is to talk to potential customers. It is

important to validate initial efforts before investing too

much time or resources. Aashan recommends using

Launchpad Central, which allows individuals to take

an evolving approach to the Business Model Canvas

by validating and invalidating specific aspects of the

business model. They also have great resources and

videos that will help guide entrepreneurs through the

process.

UC students interested in business start-up

may wish to take a class through the business

department or visit their entrepreneurship center/

department to get individualized support to start a

business. See Section IV of this toolkit for a list of

UC entrepreneurship centers and departments.

Step 3. Getting Access to Financial

Capital

Building Credit

Accessing financial capital for personal or business

purposes requires building credit history and

maintaining a good credit score. There are different

ways to build credit, such as applying for a credit card

at a bank, using a cosigner for a loan, or becoming

an authorized user on someone else’s credit card.

Many banks will accept the ITIN and any form of valid

identification, such as a passport when applying for an

initial credit card or loan. Once a person gets access

to their first lines of credit, they should be responsible

credit users by making on-time payments, disputing

errors and unauthorized charges, checking their credit

limit, and not overspending. All these factors will affect

credit scores and the likelihood to increase a credit line

or apply for other loans.

For more information about building credit, see

Immigrants Rising’s Credit and Financial Capital Guide.

Business Loans

Most businesses will require start-up capital. When

seeking financial capital for a small business, lenders

will typically review personal credit history, which is why

it is important to establish and maintain good personal

credit. The capital that is needed to launch, maintain or

grow a business can come from a variety of sources,

including friends and family, traditional banks and other

alternative lenders. Finding the right funding depends

on the strength of a business and a person’s financial

history. Below is an overview of the most popular

sources of business capital.

Banks: Traditional banks are a great starting point

and can help an individual figure out where they stand

in terms of qualifying for funding. Even if a business

does not have a strong enough track record or enough

assets as collateral to qualify for a bank loan, talking

to someone at a traditional bank can help an individual

figure out what documents are needed and the best

options to pursue.

SBA Loans: The Small Business Administration

(SBA) provides financial assistance in the form of

loans that financial institutions make to eligible small

businesses. The SBA does not lend the money directly

to entrepreneurs to start or grow a business, but sets

the guidelines for loans that are made by its partners

(lenders, community development organizations and

micro-lending institutions). SBA guarantees that these

loans will be repaid, which eliminates some of the risk to

the lending partners.

Cindy Kolade’s Story

“I started my business

because I wanted

something better for

myself and because I love

fashion. I was inspired by

people who were using

African fabric to tell their

story.”

Cindy Kolade is a native

of Ivory Coast, West Africa and a recipient of

DACA and the Maryland Dream Act. A member

of the Maryland chapter of Undocublack network,

Cindy began her entrepreneurial career through the

creation of her own couture fashion line, La Belle

Ivoire, which translates to “The Beautiful Ivory.”

Inspired by the beauty of her culture and heritage,

Cindy’s custom pieces are uniquely designed to

bring the beauty of Ivory Coast to the United States.

In addition to fashion, Cindy is currently pursuing a

degree in Molecular Biology from Towson University.

Watch Cindy’s Story

24

Microloan Programs: Microloans are perhaps the best

option for immigrants because they are controlled

by non-profit organizations that create their own

requirements. The Microloan program provides loans

up to $50,000 to help small businesses and certain

not-for-profit childcare centers start up and expand. The

average microloan is about $13,000.

15

Microloans are available at low interest rates through

organizations such as Opportunity Fund, the nation’s

leading nonprofit microfinance organization or Accion

USA, the largest nationwide nonprofit lending network.

Free Money for Business Start-Up

Crowdfunding: This is a great option for businesses

with products that can capture the public’s interest.

Crowdfunding sites such as Kickstarter or GoFundMe

rely on investors to help get an idea or business off

the ground, often rewarding them with perks or equity

in exchange for cash. Another great resource for

entrepreneurs is Kiva, a non-profit organization that

uses crowdfunding to help a borrower start or grow a

business.

Small Business Grants: Small-business grants offer

a way for small-business owners to get established

or grow without having to worry about paying back

the funds. These grants are typically offered through

nonprofits, government agencies and corporations;

some grants focus on specific types of business

owners, such as minorities, veterans and women. The

downside to free financing is that everybody wants it.

It will take a lot of work to find and apply to grants, but

time spent searching for these opportunities could pay

off in the long run.

Below are a few small business grants and fellowships

specifically for immigrants:

Immigrant’s Rising Entrepreneurship Fund: Immigrants

Rising’s Entrepreneurship Fund provides grants to

undocumented entrepreneurs working to create positive

social change.

The Emerson Collective: The Emerson Collective

Immigration Innovation Incubator is an initiative

that offers individuals financial, organizational, and

professional development support over two years to

develop early-stage ideas

15 https://www.sba.gov/loans-grants/see-what-sba-offers/sba-loan-programs/microloan-program

16 For more information about home-based businesses, visit https://www.sba.gov/starting-business/how-start-business/business-types/home-based-

businesses

17 https://www.sba.gov/starting-business/choose-your-business-location-equipment/tips-choosing-your-business-location

The Roddenbery Fellowship: The Roddenberry

Fellowship is a 12-month program for activists from

across the country who are working to protect the most

vulnerable and to make the U.S. a more inclusive and

equitable place to live. Twenty Fellows will be selected

to receive $50,000 each, as well as tailored support, to

help implement a project or initiative.

Funding for Students at UCs

UC students may have funding available at their

institutions, as part of business competitions or capital

venture funds. For example, CITRIS Foundry, the

University of California tech innovation hub, provides

seed funding, access to campus labs, and mentorship