Accounts Receivable

Applications, 2023

Market Insights, Competitive Evaluation, and Vendor Rankings

June 2023

Supply Chain Management, Procurement and Retail

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

2

TABLE OF CONTENTS

Executive Overview ..........................................................................................................3

Market Dynamics and Overview .....................................................................................4

Competitive Landscape and Analysis ............................................................................8

Key Competitive Factors and Technology Differentiators ........................................ 12

SPARK Matrix™: Strategic Performance Assessment and Ranking ...................... 17

Vendors Prole ............................................................................................................... 21

Research Methodologies .............................................................................................. 25

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

3

This research service includes a detailed

analysis of global Accounts Receivable

Applications platform market dynamics,

major trends, vendor landscape, and

competitive positioning analysis. The

study provides competition analysis and

ranking of the leading Accounts Receivable

Applications vendors in the form of SPARK

Matrix. This research provides strategic

information for technology vendors to better

understand the market supporting their

growth strategies and for users to evaluate

different vendors capabilities, competitive

differentiation, and its market position.

Executive OverviewExecutive Overview

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

4

MARKET DYNAMICS AND OVERVIEWMARKET DYNAMICS AND OVERVIEW

Accounts receivable application (ARA) is a software tool used by businesses to

manage and track their incoming payments. ARA helps in automating tasks such as

invoice generation, and payment collection as well as providing real-time visibility

into the status of outstanding invoices. Also, accounts receivable applications are

essential tools for businesses to manage their cash flow, maintain good customer

relationships, and ensure accurate nancial reporting.

Accounts Receivable Applications (ARA) are essential in all types of enterprises.

By tracking and managing overdue bills, payments, and client interactions, AR

applications assist organizations in managing their cash flow. The market for

accounts receivable applications has risen signicantly over the years, and this

growth is anticipated to continue into the foreseeable future. Increased acceptance

of cloud-based software and demand for automation, digitalization, and the rise of

e-commerce and digital payment systems are driving the industry.

The desire for automation is a signicant market driver for accounts receivable

applications. Account Receivable Application assists rms in streamlining their

nancial procedures, minimizing errors, reducing churn risk, and enhancing

productivity. Accounts receivable applications are designed to help businesses

manage their invoices, payments, and customer relationships. They typically

include features such as invoice creation, payment processing, payment

reminders, and reporting. Some applications also offer advanced features such

as automated payment reconciliation, integrations with payment systems and

accounting software, and analytics. Also, accounts receivable applications are

essential tools for businesses to manage their cash flow, maintain good customer

relationships, and ensure accurate nancial reporting. By using these applications,

businesses can streamline their invoicing and payment processes, reduce the risk

of cash flow problems, and make better-informed decisions about their nances.

In recent years, there has been a shift towards AR applications hosted in the

cloud. Cloud-based solutions allow organizations to access their data from any

location and at any time. In addition, they offer greater security features, automatic

upgrades, and scalability. It is anticipated that this tendency will continue as more

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

5

rms use cloud-based solutions. The rise of e-commerce and digital payment

methods also contributes to the expansion of the market for accounts receivables

apps. Businesses want software that can keep up with the volume and complexity

of online transactions as the number of online transactions increases. More crucial

are accounts receivable applications that can interact with numerous payment

methods and provide real-time status updates.

Moreover, each geography has its regulatory compliance regarding billing and

collections. Accounts receivable applications consider local and global compliances

and send out invoices, communications, and collection updates to the customers

accordingly. The application also provides a user-friendly interface for customers

so they can easily access details of their proles, generate invoices, and check

the details of the plan they are enrolled for, such as outstanding balances and

issue dates. This self-service capability reduces the customers’ dependency on

the organization and allows customers to receive information and make payments

as per their choice.

Some of the major account receivable application capabilities includes:

• Invoice Processing and Management: A Accounts receivable

applications streamline the process of generating, sending, and

tracking invoices. These applications automate tasks such as invoice

creation, delivery, and payment reminders. They also provide features

for managing invoice disputes and adjustments, allowing businesses

to efciently handle billing discrepancies and ensure timely payment.

• Credit Risk Management: Accounts receivable applications help

businesses assess the creditworthiness of their customers. These

applications analyze various factors such as credit scores, payment

histories, and nancial data to evaluate the risk associated with

extending credit. They provide insights and tools for setting credit

limits, monitoring credit exposure, and identifying high-risk customers,

enabling businesses to make informed decisions about credit terms

and minimize the risk of non-payment.

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

6

• Dispute and Collection Management: Accounts receivable

applications assist in managing and resolving disputes related to

invoices and payments. They provide a centralized platform for

tracking and documenting disputes, communication with customers,

and managing the resolution process. These applications automate

collections workflows, including sending automated reminders,

generating collection letters, and escalating unpaid invoices. They

help businesses streamline the collection process, improve cash

flow, and minimize the impact of unpaid invoices on their nancial

performance.

• Cash Management: Accounts receivable applications help

businesses efciently manage their cash inflows. These applications

provide real-time visibility into outstanding invoices and payment

statuses, allowing businesses to forecast and plan their cash flow

effectively. They automate the reconciliation process by matching

payments received with corresponding invoices, reducing manual

effort and errors. Accounts receivable applications also integrate

with accounting systems and banking platforms to streamline cash

application and ensure accurate nancial reporting.

• Dashboard and Analytics: Accounts receivable applications offer

comprehensive dashboards and analytics capabilities. They provide

visual representations of key performance indicators (KPIs) such

as aging of receivables, average days sales outstanding (DSO),

and collection efciency. These applications generate reports

and insights on customer payment trends, overdue accounts, and

collection performance. Businesses can leverage this data to identify

bottlenecks, optimize collection strategies, and make data-driven

decisions to improve overall accounts receivable management. The

dashboards and analytics in these applications provide a holistic view

of receivables, empowering businesses to track performance and

drive continuous improvement.

• Customization: Customization of applications increases customer

satisfaction to a higher level. Different businesses have different billing

and invoicing processes, and the ability to customize an accounts

receivable application ensures that the software can accommodate

these varying needs. Customization features may include the ability

to set up unique payment terms, apply discounts or fees, and

create customized reports. Additionally, customization can improve

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

7

the user experience and make it easier for businesses to manage

their accounts receivable processes. With customizable elds and

templates, businesses can quickly generate invoices, track payments,

and manage customer accounts.

• Data Security: In a data-driven world, data security is of utmost

importance. Account receivable applications can provide robust

security measures to protect sensitive nancial information. These

applications contain sensitive nancial information, including customer

data, payment information, and transaction details. With the rise of

cyber threats and data breaches, it is crucial for businesses to ensure

that their accounts receivable data is secure. A data security system

in accounts receivable applications can prevent unauthorized access,

safeguard sensitive information, and protect against data breaches.

To achieve this, accounts receivable applications use various security

measures, such as encryption, authentication protocols, and access

controls. By implementing these measures, businesses can ensure

that their accounts receivable data is protected, and their customers’

sensitive information is secure.

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

8

Competitive Landscape Competitive Landscape

and Analysisand Analysis

Quadrant Knowledge Solutions recently conducted a study on the major accounts

receivable applications vendors and evaluated them based on their products,

market presence, and customer value proposition. The evaluation was done

through primary research, expert interviews, analysis of use cases, and internal

analysis of the overall market. The study included an analysis of 19 key vendors,

such as Aptic, Bill.com, Billtrust, BlackLine, BlueSnap, Cforia, Doxee, Emagia,

Esker, Exela, HighRadius, Invoiced, Lockstep, Sage, Serrala, Sidetrade, Tesorio,

VersaPay, and Quadient.

HighRadius, Billtrust, Esker, Blackline, Quadient, Sidetrade, and BlueSnap

emerged as the top performers and technology leaders in the global accounts

receivable applications market. These companies were recognized as leaders

due to their ability to develop and deploy dedicated frameworks designed as per

the specic use cases or for adaptability with reference to change in the market.

They were also working on improving their product offerings by adopting the

latest trends such as a unied platform to provide AR, AP, and treasury, adopting

ML for recognizing debtors, and new offerings such as buy now pay later (BNPL).

HighRadius and Billtrust received the highest overall ratings across the

performance parameters of technology excellence and customer impact.

HighRadius is known for its RadiusOne A/R suite, which combines machine and

human work to simplify status updating and tracking processes. The company’s

platform offers automation and optimization of critical A/R functions, including

collections agency data exchange and streamlining cash application. With a focus

on technology excellence and customer impact, HighRadius delivers innovative

solutions to enhance accounts receivable management.

Billtrust offers comprehensive solutions to automate invoice delivery, payment

processing, and cash application. The company’s strategic advantage lies in

its range of services, including managed services, professional consulting,

and implementation support. By accelerating cash flow and providing a unied

platform, Billtrust empowers businesses with improved visibility, simplied tech

stack, and enhanced payment reception capabilities.

Sidetrade leverages AI and proprietary solutions like Sidetrade Payment

Intelligence (SPi) and Sidetrade Disputes Intelligence (SDi). Their AI integration

helps to analyze customer spending patterns and streamline processes such as

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

9

prediction analysis, text classication, and predictive analytics, offering valuable

insights for effective accounts receivable management.

BlackLine focuses on implementing decision intelligence and a unied platform for

nancial applications. With a strong emphasis on simplifying business intelligence

and enabling streamlined nancial processes, BlackLine empowers organizations

to enhance their accounts receivable operations and achieve greater efciency

and accuracy.

Quadient offers YayPay, a solution that leverages advanced technologies like

machine learning for identifying at-risk invoices and customers, predicting bad

debt, and providing forecasting solutions. Quadient’s offering also includes

seamless integration with ERP systems for efcient invoice processing and

customer communication.

Esker differentiates itself through its global presence and least-cost routing

capability. By enabling customers to offer transactions at local postal rates, Esker

optimizes costs. Additionally, Esker leverages its expertise in document automation

to provide seamless and efcient accounts receivable management solutions.

BlueSnap focuses on strengthening workflow offerings. Their solution emphasizes

streamlining accounting workflows by connecting email communication

with accounting systems. With features like automated reminders, vendor

communications, and key metric visualization, BlueSnap empowers businesses

to enhance efciency and optimize their accounts receivable processes.

Sage, Bill.com, Exela, Serrala, Versapay, Emagia, BlueSnap, Lockstep, Doxee,

Cforia, and Aptic are positioned amongst the strong contenders in the accounts

receivable applications market after thoroughly considering their product offerings,

market presence, and impact of their solutions & services on end users.

Sage offers Sage Intacct, a comprehensive platform that automates and

streamlines various accounts receivable processes. With features such as

invoicing, receivables management, reporting, and collections, Sage Intacct

enables businesses to automate tasks, improve communication, and track

payments for effective accounts receivable management.

Bill.com offers a unied platform that simplies the entire accounts receivable

process. With a focus on creating, sending, tracking, and accelerating payment

receipts, Bill.com enables businesses to improve visibility, streamline their tech

stack, and expedite cash flow for enhanced accounts receivable management.

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

10

Exela is known for its champion challenger program that offers contractual

partnerships for managing account assignments. The company emphasizes a

unied platform approach, facilitating seamless integration of various nancial

applications which enables efcient and comprehensive accounts receivable

management.

Serrala stands out in the accounts receivable applications market with its “Digital

Ofce of the CFO,” which optimizes and automates nancial processes and

payments. Offering an in-house SaaS solution without third-party applications,

Serrala differentiates itself by ensuring data capturing is seamless and providing a

comprehensive suite of solutions for effective accounts receivable management.

VersaPay offers personalized and customized invoice solutions to enhance

customer experience. Leveraging machine learning, VersaPay automates payment

matching, ensuring accurate and efcient accounts receivable management.

With its focus on delivering improved customer satisfaction, VersaPay empowers

businesses to optimize their payment collection processes.

Emagia offers innovative solutions for optimizing nancial processes. Their

platform leverages emerging technologies like AI and automation to streamline

receivables management, credit and collections, and cash application. Emagia

empowers businesses to enhance their accounts receivable operations and

improve overall nancial efciency.

BlueSnap’s focuses on strengthening its workflow offerings rather than

identication offerings, which is a common trend in the accounts receivable

applications market. Its solution simplies the payment process for merchants,

enabling them to accept payments from customers globally through a single

integration. BlueSnap’s platform supports a range of payment methods, including

credit cards, e-wallets, and bank transfers. Its streamlined workflow enables

businesses to manage accounts receivable, automate invoice processing, and

track payments more efciently.

Doxee delivers solutions that optimize nancial processes and document

management. Their platform leverages advanced technologies such as AI and

automation to streamline invoice generation, document delivery, and payment

processing. Doxee empowers businesses to enhance their accounts receivable

operations and improve overall nancial efciency.

Lockstep specializes in streamlining accounting workflows. Their innovative

solution, Lockstep Inbox, seamlessly integrates email communication with

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

11

accounting systems. This integration enhances efciency by automating reminders,

prioritizing customers, facilitating vendor communications, and providing valuable

visualizations of key accounting metrics. Lockstep optimizes accounts receivable

processes for businesses.

Aptic offers a platform that supports asset-based nance solutions like factoring,

debt collection, and lending. Their solution extends the platform’s capabilities

to cater to specic nancial needs, providing businesses with comprehensive

tools for effective accounts receivable management and nancing operations.

Cforia offers Cforia Autonomy, a comprehensive solution that optimizes nancial

transactions at every stage. With visibility across currencies, languages,

businesses, and ERPs, Cforia empowers businesses to streamline and optimize

their accounts receivable processes. Their solution provides valuable insights for

effective nancial transaction management.

Invoiced is positioned as an aspirant in the accounts receivable application

market after thoroughly considering its product offerings, market presence,

and the impact of its solutions & services on end users. Invoiced, a prominent

player in accounts receivable applications, offers comprehensive solutions for

efcient invoicing and payment management. Their cloud-based platform enables

businesses to automate invoice generation, track payments, and provide flexible

payment options to customers. Invoiced empowers organizations to streamline

their accounts receivable processes, accelerate cash flow, and enhance customer

payment experiences.

The increased demand for digital transformation across various industries and the

need for streamlining nancial processes is expected to drive the growth of the

accounts receivable applications market. Additionally, the growing trend of AI, ML,

and NLP in accounts receivable applications is expected to fuel market growth as

it offers better accuracy, faster processing, and reduced errors. The competitive

landscape of the accounts receivable applications market is highly fragmented,

with vendors offering a wide range of solutions and services. Additionally,

partnerships, collaborations, and mergers & acquisitions are expected to be key

strategies adopted by vendors to strengthen their market position.

In conclusion, the global accounts receivable applications market is highly

competitive, with many strong players offering a range of innovative solutions.

To succeed in this market, vendors need to continually innovate and adapt to

evolving customer needs, leveraging advanced technologies such as machine

learning, articial intelligence, and automation to provide differentiated solutions.

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

12

Key Competitive Factors and

Technology Dierentiators

While most accounts receivable application vendors provide comprehensive

functionalities to support various use cases, their technology and customer value

proposition may differ based on the customer size, industry vertical, geographical

markets, and organization-specic requirements. Some of the key competitive

factors and technology differentiators for an account receivable application

include:

• Integration, Interoperability & Scalability: The Organizations

work on various legacy enterprise software. Each platform/software

should be interconnected, as each software/platform has its unique

linkages and data sources. Accounts receivable application vendors

need to provide seamless integration with all the existing enterprise

software and remove the overlapping of information as an accounts

receivable cycle requires information from various system software

related to customer history, last communication, and customer prole.

In addition, the platform should ideally come with an open or no- code

API to ease the integration process and its operational value to nance,

accounting, collection, and other teams involved. Users should analyze

vendors based on their capability to offer a robust and flexible platform

structure, which could be scaled up based on the business requirement

and growth rate, highlighting the importance of scalability.

• Maturity of Cloud Architecture: Many organizations are choosing

cloud-based deployment due to the evolution of digital and security

technologies, increasing penetration of internet and mobile devices

throughout the globe, and increased big data ingestion. Organizations

are required to manage multiple private clouds, public clouds, and

SaaS platforms to enable applications to run on the most appropriate

platform with an optimized customer experience. Users often prefer a

cloud-native architecture to gain advanced agility, flexibility, scalability,

and performance compared to traditional architecture applications.

Users should evaluate the vendor’s cloud architecture, along with its

ability to support a multi-cloud strategy, to improve the overall customer

ownership experience.

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

13

• The Sophistication of Real-time Analytics: Organizations’ nancial

health is dependent on a positive cash flow. Account receivable

vendors provide real-time analytics, updates, and prediction by using

various AI and ML algorithms. Organizations can use these real-time

insights to form operational, tactical, and strategic decisions. Users

should evaluate vendors based on their capability to provide strong

insights and predictions on the defaults and payment health of the

customers along with real-time remittance data in minute details. Users

should also look for vendors that provide a user- friendly dashboard

with a holistic view of the company’s cash flow and predict cash flow &

defaults, which has the capacity to be drill down deep into a particular

area of interest or a customer’s prole.

• Self-Service Portal: With digitalizing, customers are no longer

dependent on companies to provide them with minute details. Instead,

they are expecting organizations to provide them with user- friendly

portals through which they can update their prole, make payments,

and download invoices and documents. Hence, accounts receivable

vendors are providing self-service portals and are focusing on increasing

the customer experience through various articial intelligence and

machine learning capabilities to keep up with the customers’ growing

needs & expectations. Users are advised to evaluate vendors based

on their ability to provide interactive UI and UX and various payment

options.

• Customer Connections: Customer connections can help to develop

strong relationships between companies and their customers.

Organizations should look for vendors who can offer features such

as automated reminders, personalized communications, and self-

service portals, accounts receivable applications which can provide

customers with a seamless and convenient experience, improving their

satisfaction and loyalty. Additionally, customer connection features

can help companies anticipate and address potential payment issues

before they become problems, reducing the risk of delinquencies or

disputes. Companies that prioritize customer connection can standout

form their competitors by demonstrating a commitment to customer

service and building long-term relationships with their clients.

• Strong Partner Ecosystem: Organizations should evaluate vendors

on the lines of the strong partner ecosystem they offer which makes

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

14

accounts receivable applications more efcient, as it can provide

customers with access to a wide range of complementary products

and services. By partnering with other organizations in the nancial

technology space, accounts receivable applications can offer features

such as payment processing, credit scoring, and data analytics that can

help customers optimize their nancial operations. Additionally, a strong

partner ecosystem can provide customers with access to experts in

specic areas, such as compliance or data security, helping them stay

up to date on industry best practices and regulations. Organizations

that have a robust partner ecosystem for their accounts receivable

applications can differentiate themselves by offering a comprehensive

solution that meets the unique needs of their customers.

• Multilingual & Multicurrency Support: An organization that has

a global presence should look for vendors who offer Multilingual

and Multicurrency support. With these features, companies can

communicate with customers in their preferred language and currency,

which can help improve customer relationships and reduce errors in

payment processing. Additionally, these features can help streamline

the invoicing and payment process, reducing the risk of payment delays

or errors due to currency conversion issues. Companies that can offer

these capabilities in their accounts receivable applications are better

positioned to operate effectively in a global marketplace, maintain

strong customer relationships, and maximize cash flow.

• User-Friendly Interface: A user-friendly interface can help streamline

processes and improve user productivity. With a well-designed

interface, users can easily access the information they need, perform

tasks efciently, and quickly resolve issues. This can help reduce

errors, improve communication with customers, and ultimately improve

cash flow. Additionally, a user-friendly interface can reduce the learning

curve for new users, improving adoption rates and reducing the need

for extensive training. Primarily, organizations should look for vendors

that prioritize user experience in their accounts receivable applications

that can differentiate themselves by offering a solution that is both

effective and easy to use, improving customer satisfaction and loyalty.

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

15

• Dynamic Terms Discounting: Dynamic term discounting is a feature

that can serve as a signicant boost for businesses seeking to improve

their nancial management and customer relationships. By offering

customers discounts on their invoices based on the time remaining

until the due date, businesses can incentivize prompt payment, reduce

the risk of delinquent accounts, and improve cash flow. Accounts

receivable applications with dynamic term discounting can also

provide businesses with a competitive advantage by offering a flexible

payment option that enhances customer satisfaction and strengthens

relationships. By leveraging this innovative feature, businesses can set

themselves apart from competitors, drive revenue growth, and achieve

long-term success.

• Maturity of AI & ML: Articial intelligence (AI) and machine learning (ML)

are increasingly mature technologies that are being used to enhance

accounts receivable applications. With AI and ML, organizations can

more effectively manage their receivables, reduce delinquencies, and

improve cash flow. AI and ML can help identify patterns and trends in

customer payment behavior, flag high-risk accounts, and automate the

collections process. These technologies can also provide insights into

the effectiveness of credit and collection policies and help identify areas

for improvement. Therefore, it is suggested that organizations look for

vendors offering AI and ML in their accounts receivable application to

enhance their AR processes.

• Digital & Legal Document Archiving: Digital and legal document

archiving can help organizations comply with regulatory requirements

and maintain accurate records of nancial transactions. With digital

archiving, organizations can store and access invoices, receipts, and

other nancial documents securely and centrally, reducing the risk

of loss or damage. Legal document archiving feature can also help

companies meet legal requirements for document retention. Therefore,

organizations should look for vendors who offer digital & legal document

archiving features that help organizations to operate more efciently,

reduce the risk of compliance issues, and maintain accurate records of

their nancial transactions over time.

• Tool For Enterprise-Class Data Management: Tools for enterprise

data class management can help organizations organize and manage

their nancial data more effectively. With features such as data

classication, indexing, and search, accounts receivable applications

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

16

can provide users with easy access to the information they need to make

informed decisions. Additionally, enterprise data class management

tools can help companies identify patterns and trends in their nancial

data, improving their ability to forecast cash flow and manage risks.

By offering these features, accounts receivable applications can

differentiate themselves by providing a comprehensive solution that

helps organizations manage their nancial operations more effectively

and efciently.

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

17

SPARK Matrix™: Strategic

Performance Assessment and Ranking

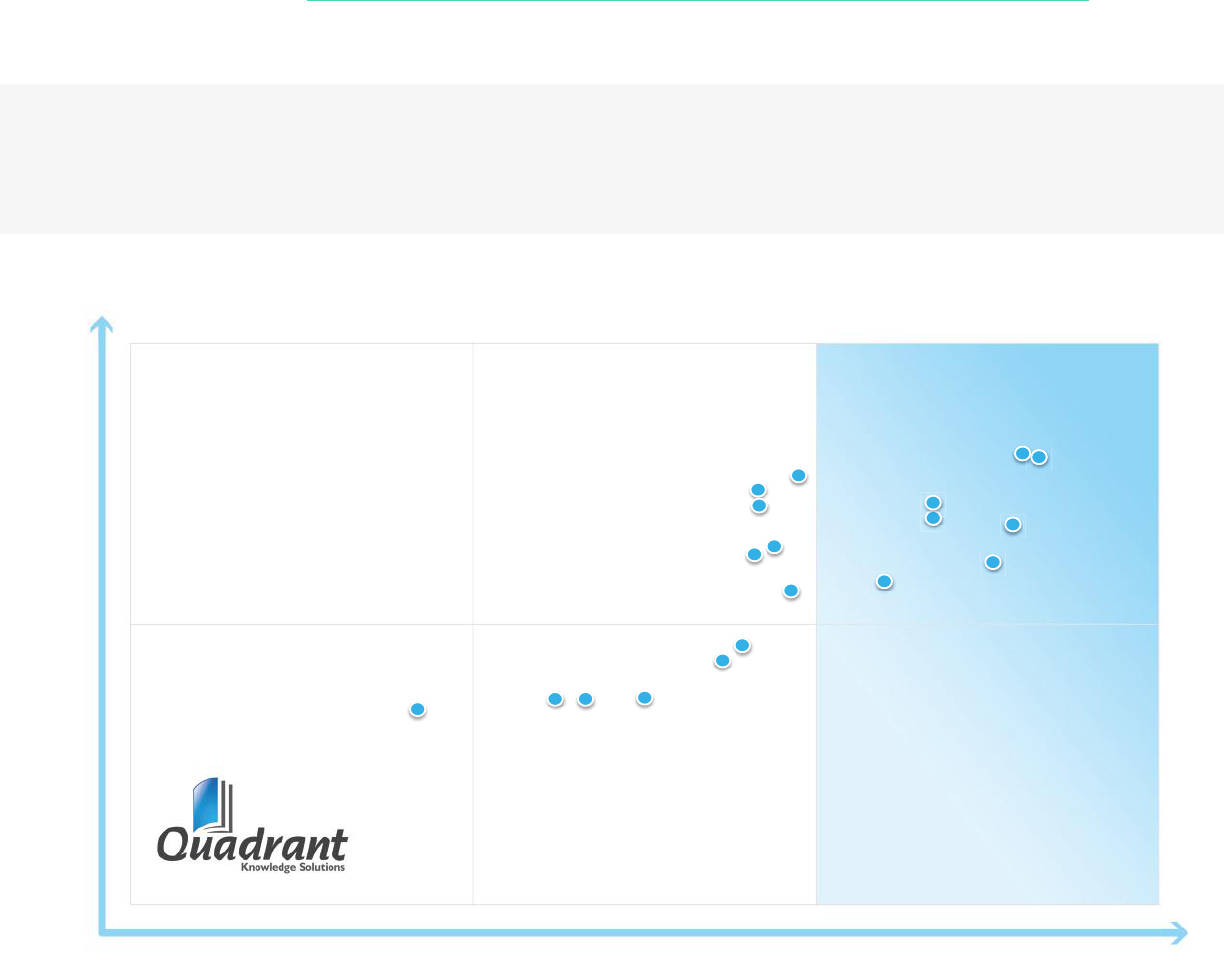

Quadrant Knowledge Solutions’ SPARK Matrix provides a snapshot of the market

positioning of the key market participants. SPARK Matrix provides a visual

representation of market participants and provides strategic insights on how

each supplier ranks related to their competitors, concerning various performance

parameters based on the category of technology excellence and customer

impact. Quadrant’s Competitive Landscape Analysis is a useful planning guide

for strategic decision makings, such as nding M&A prospects, partnership,

geographical expansion, portfolio expansion, and similar others.

Each market participants are analyzed against several parameters of Technology

Excellence and Customer Impact. In each of the parameters (see charts), an

index is assigned to each supplier from 1 (lowest) to 10 (highest). These ratings

are designated to each market participant based on the research ndings. Based

on the individual participant ratings, X and Y coordinate values are calculated.

These coordinates are nally used to make SPARK Matrix.

Evaluation Criteria: Technology Excellence

• The sophistication of Technology: The ability to provide

comprehensive functional capabilities and product features,

technology innovations, product/platform architecture, and such

others.

• Competitive Differentiation Strategy: The ability to differentiate

from competitors through functional capabilities and/or innovations

and/or GTM strategy, customer value proposition, and such others.

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

18

• Application Diversity: The ability to demonstrate product deployment

for a range of industry verticals and/or multiple use cases.

• Scalability: The ability to demonstrate that the solution supports

enterprise-grade scalability along with customer case examples.

• Integration & Interoperability: The ability to offer a product and

technology solution that supports integration with multiple best-of-

breed technologies, provides prebuilt out-of-the-box integrations,

and open API support and services.

• Vision & Roadmap: Evaluation of the vendor’s product strategy and

roadmap with the analysis of key planned enhancements to offer

superior products/technology and improve the customer ownership

experience.

Evaluation Criteria: Customer Impact

• Product Strategy & Performance: Evaluation of multiple aspects

of product strategy and performance in terms of product availability,

price to performance ratio, excellence in GTM strategy, and other

product-specic parameters.

• Market Presence: The ability to demonstrate revenue, client base,

and market growth along with a presence in various geographical

regions and industry verticals.

• Proven Record: Evaluation of the existing client base from SMB, mid-

market and large enterprise segment, growth rate, and analysis of the

customer case studies.

• Ease of Deployment & Use: The ability to provide superior

deployment experience to clients supporting flexible deployment

or demonstrate superior purchase, implementation, and usage

experience. Additionally, vendors’ products are analyzed to offer

user-friendly UI and ownership experience.

• Customer Service Excellence: The ability to demonstrate vendors

capability to provide a range of professional services from consulting,

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

19

training, and support. Additionally, the company’s service partner

strategy or system integration capability across geographical regions

is also considered.

• Unique Value Proposition: The ability to demonstrate unique

differentiators driven by ongoing industry trends, industry

convergence, technology innovation, and such others.

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

20

Figure: 2023 SPARK Matrix™

(Strategic Performance Assessment and Ranking)

Accounts Receivable Applications Market

8IGLRSPSK]0IEHIVW

%WTMVERXW7XVSRK'SRXIRHIVW

74%6/1EXVM\

%GGSYRXW6IGIMZEFPI%TTPMGEXMSRW5

-XQH4XDGUDQW.QRZOHGJH6ROXWLRQV

&XVWRPHU,PSDFW

7HFKQRORJ\([FHOOHQFH

%TXMG

&MPP

GSQ

&MPPXVYWX

&PEGO0MRI

&PYI7RET

'JSVME

PP

GSQ

(S\II

EGO0

M

5YEHMIRX

(S\II

YI

7R

5

MPPXVYW

:IVWETE]

7MHIXVEHI

)QEKME

)\IPE

7IVVEPE

7EKI

)WOIV

-RZSMGIH

0SGOWXIT

,MKL6EHMYW

8IWSVMS

IWSVMS

%TXMG

8

SPARK Matrix™: Accounts Receivable

Applications Q2, 2023.

Strategic Performance Assessment and Ranking

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

21

Following are the proles of the accounts receivable

applications vendors with a global impact. The

following vendor proles are written based on the

information provided by the vendor’s executives as

part of the research process. Quadrant research

team has also referred to the company’s website,

whitepapers, blogs, and other sources for writing

the prole. A detailed vendor prole and analysis

of all the vendors, along with various competitive

scenarios, are available as a custom research

deliverable to our clients. Users are advised to

directly speak to respective vendors for a more

comprehensive understanding of their technology

capabilities. Users are advised to consult Quadrant

Knowledge Solutions before making any purchase

decisions, regarding know your customer

technology and vendor selection based on research

ndings included in this research service.

Vendor ProlesVendor Proles

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

22

Billtrust

URL: https://www.billtrust.com/

Founded in 2001 and headquartered in Lawrenceville, New Jersey, USA, Billtrust

is a nancial service provider that specializes in cloud-based software and

integrated payment processing. The company provides automated order-to-

cash solutions that meet diverse buyer requirements and speed cash application

through tailored invoice delivery, secure multi-channel payment enablement, and

intelligent matching and payment posting. In July 2020, Billtrust acquired Credit2B,

a provider of data & intelligence regarding credit & accounts receivable. The

acquisition enhanced Billtrust’s ability to offer credit risk and collections analytics

to its customers by leveraging the capabilities of Credit2B. Billtrust’s Account

Receivable Application (ARA) capabilities include electronic invoicing and billing,

credit risk management, cash application, payments, collection management, and

business payments network..

Analyst Perspective

Following is the analysis of Billtrust’s capabilities in the global Accounts Receivable

Application (ARA) market:

• Billtrust offers an ARA that enables organizations to streamline

invoicing, payment processing, and collection workflow. Billtrust’s

cloud-based AR platform accelerates order-to-cash cycles using

nancial expertise and automation, resulting in greater operational

efciency. The platform is also designed to integrate with various

accounting and ERP systems.

• The electronic invoicing and billing capability of Billtrust enables

organizations to send automatic e-invoices to customers across

the globe using multiple channels. It maintains compliance with

government mandates by standardizing e-invoices globally. Billtrust’s

ARA credit management capability allows organizations to monitor

credit risk changes and conduct frequent portfolio analyses to check

& alert in case of major credit events.

• Billtrust’s ARA provides cash application capability to accelerate

digital payments through integration with multiple customer accounts’

payable portals. It also helps retrieve decoupled ACH remittances

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

23

to resolve possible disputes. Digital payments are monitored with

a digital lockbox, a capability within cash applications that captures

and standardizes decoupled remittance data and helps improve

cash flow. Billtrust ARA collections management capability provides

organizations with cash forecasting through AI that helps to identify

when a customer will pay an invoice based on past payment activity

and predict cash flow and possible resolution plan to clear outstanding

invoices.

• Billtrust ARA provides a fully brandable payment portal which

minimizes fraud. It provides flexibility for customers to pay through the

preferred channels. Billtrust ARA business payment network saves

fees that are wasted while paying with a credit card and captures

insights from customers’ invoices. It automates acceptance policies

such as inclusion lists and payment within terms, thus removing the

required manual inquiries.

• The company’s key differentiators include its scalability and Advanced

AI integration. Billtrust’s ARA is highly scalable, making it suitable for

businesses of all sizes. AI-integrated accounts receivable application

provides valuable insights into customers, which is benecial for

future decisions when solving complex transactions.

• Some of the top use cases of Billtrust’s ARA offering consist of an

increase in the number of electronic card transactions, automatic

routing of transactions, decrease in the card processing rates,

reduction in reconciliation time, customized solution with cross-

border payment, and an all-in-one payment platform for credit’s

multiple payment needs.

• In terms of geographical presence, Billtrust has a presence in North

America and Europe. The company holds a strong customer base

across various verticals, such as transportation, heavy machinery

& equipment, manufacturing, technology, legal, stafng, business &

professional services, and medical & equipment supplies.

• Billtrust encounters various market dynamics and competition

that are prevalent in the industry. The emergence of vendors with

innovative technology solutions, as well as niche vendors catering to

specic segments of the account receivable market, has intensied

the competitive landscape. These competitors have successfully

gained a notable market share, particularly among large enterprise

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

24

organizations, and have become attractive targets for mergers and

acquisitions.

• Nonetheless, Billtrust remains well-positioned to navigate these

challenges and maintain its global market share. The company’s

extensive range of features, bolstered by impressive customer

testimonials, underscores its commitment to delivering exceptional

value to its clients. With a compelling value proposition, Billtrust has

the potential not only to retain its existing customer base but also to

expand its market presence.

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

25

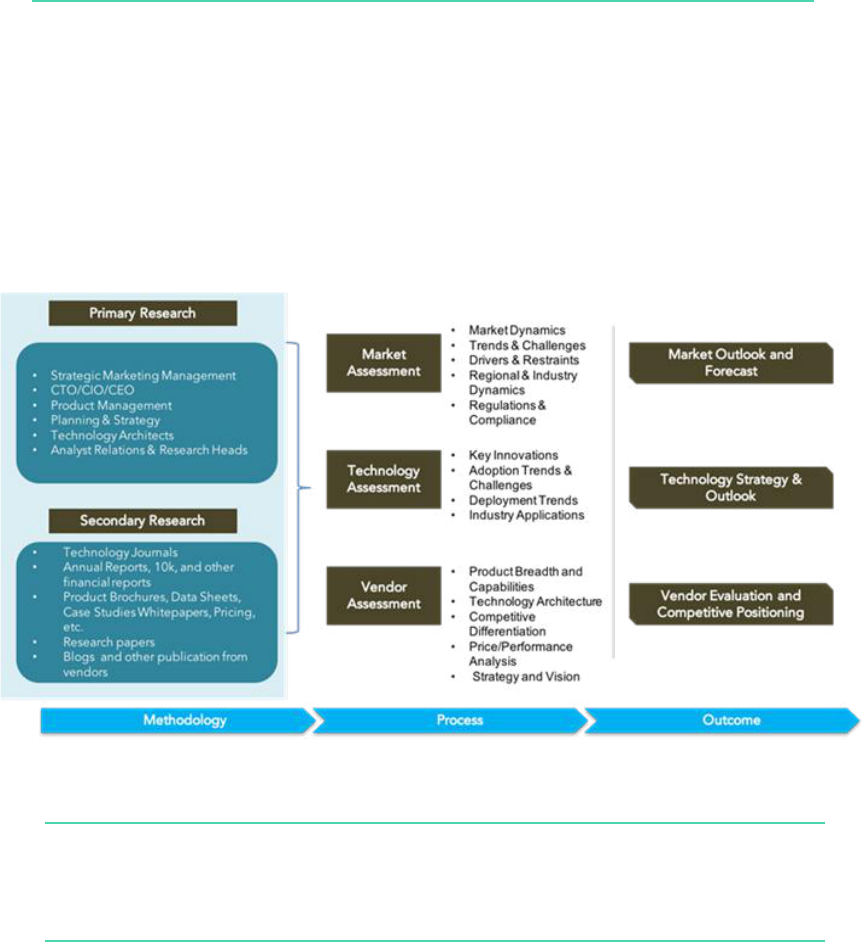

Research Methodologies

Quadrant Knowledge Solutions uses a comprehensive approach to conduct global

market outlook research for various technologies. Quadrant’s research approach

provides our analysts with the most effective framework to identify market and

technology trends and helps in formulating meaningful growth strategies for our

clients. All the sections of our research report are prepared with a considerable

amount of time and thought process before moving on to the next step. Following

is the brief description of the major sections of our research methodologies.

Secondary Research

Following are the major sources of information for conducting secondary research:

Quadrant’s Internal Database

Quadrant Knowledge Solutions maintains a proprietary database in several

technology marketplaces. This database provides our analyst with an adequate

foundation to kick- start the research project. This database includes information

from the following sources:

• Annual reports and other nancial reports

• Industry participant lists

• Published secondary data on companies and their products

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

26

• Database of market sizes and forecast data for different market

segments

• Major market and technology trends

Literature Research

Quadrant Knowledge Solutions leverages on several magazine subscriptions

and other publications that cover a wide range of subjects related to technology

research. We also use the extensive library of directories and Journals on various

technology domains. Our analysts use blog posts, whitepapers, case studies,

and other literature published by major technology vendors, online experts, and

industry news publications.

Inputs from Industry Participants

Quadrant analysts collect relevant documents such as whitepaper, brochures,

case studies, price lists, datasheet, and other reports from all major industry

participants.

Primary Research

Quadrant analysts use a two-step process for conducting primary research that

helps us in capturing meaningful and most accurate market information. Below is

the two-step process of our primary research:

Market Estimation: Based on the top-down and bottom-up approach, our analyst

analyses all industry participants to estimate their business in the technology

market for various market segments. We also seek information and verication of

client business performance as part of our primary research interviews or through

a detailed market questionnaire. The Quadrant research team conducts a detailed

analysis of the comments and inputs provided by the industry participants.

Client Interview: Quadrant analyst team conducts a detailed telephonic

interview of all major industry participants to get their perspectives of the current

and future market dynamics. Our analyst also gets their rst-hand experience

with the vendor’s product demo to understand their technology capabilities, user

experience, product features, and other aspects. Based on the requirements,

Quadrant analysts interview with more than one person from each of the market

participants to verify the accuracy of the information provided. We typically engage

with client personnel in one of the following functions:

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

27

• Strategic Marketing Management

• Product Management

• Product Planning

• Planning & Strategy

Feedback from Channel Partners and End Users

Quadrant research team research with various sales channel partners, including

distributors, system integrators, and consultants to understand the detailed

perspective of the market. Our analysts also get feedback from end-users from

multiple industries and geographical regions to understand key issues, technology

trends, and supplier capabilities in the technology market.

Data Analysis:

Market Forecast & Competition Analysis

Quadrant’s analysts’ team gathers all the necessary information from secondary

research and primary research to a computer database. These databases are then

analyzed, veried, and cross-tabulated in numerous ways to get the right picture

of the overall market and its segments. After analyzing all the market data, industry

trends, market trends, technology trends, and key issues, we prepare preliminary

market forecasts. This preliminary market forecast is tested against several market

scenarios, economic most accurate forecast scenario for the overall market and

its segments.

In addition to market forecasts, our team conducts a detailed review of industry

participants to prepare competitive landscape and market positioning analysis for

the overall market as well as for various market segments.

SPARK Matrix:

Strategic Performance Assessment and Ranking

Quadrant Knowledge Solutions’ SPARK Matrix provides a snapshot of the market

positioning of the key market participants. SPARK Matrix representation provides

a visual representation of market participants and provides strategic insights on

how each supplier ranks in comparison to their competitors, concerning various

performance parameters based on the category of technology excellence and

customer impact.

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

28

Final Report Preparation

After nalization of market analysis and forecasts, our analyst prepares necessary

graphs, charts, and table to get further insights and preparation of the nal

research report. Our nal research report includes information including market

forecast; competitive analysis; major market & technology trends; market drivers;

vendor proles, and such others.

Copyright 2023 © Quadrant Knowledge Solutions Private Limited

For Citation, [email protected]

29

Client Support

For information on hard-copy or electronic reprints, please contact Client Support at

rmehar@quadrant-solutions.com | www.quadrant-solutions.com