Energy with purpose

BPX Energy:

Delivering synergies

We have been transforming BPX Energy,

our US onshore oil and gas business,

with the purchase of world-class

unconventional assets from BHP.

• The acquisition gave us access to

some of the best basins in the

onshore US, with 487,000 acres of

leasehold across a new position in the

liquids-rich Permian-Delaware basin,

and two positions in the Eagle Ford

and Haynesville basins.

• It positions BP as a top producer in

the region.

Good progress

Since we began operating the assets,

we have delivered synergies of

$240 million in 2019, above our

planned target of $90 million.

Energy with purpose means

transforming while performing.

130 BP Annual Report and Form 20-F 2019

131BP Annual Report and Form 20-F 2019

Financial statements

Consolidated financial statements of the BP group

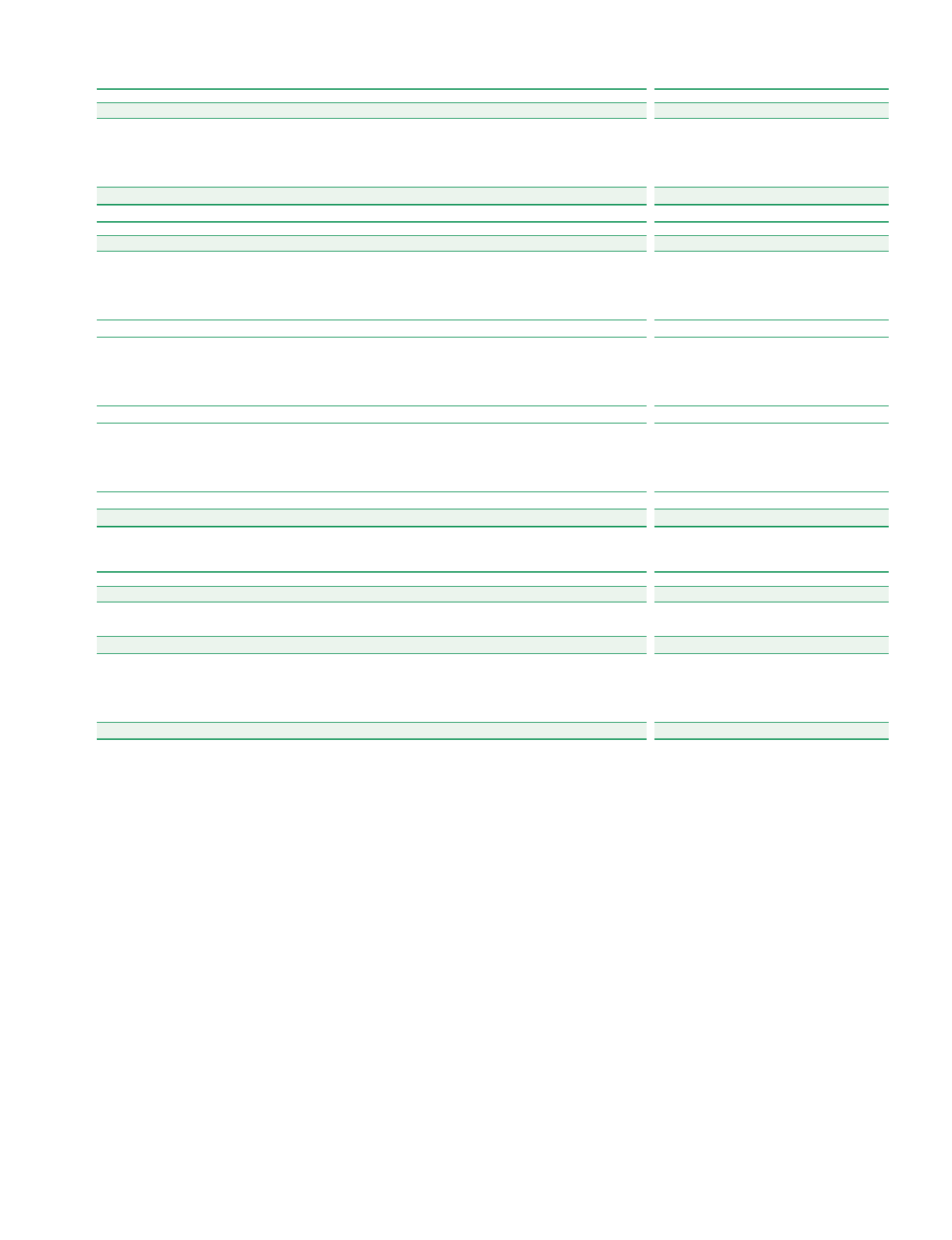

Independent auditor’s reports 132

Group income statement 152

Group statement of comprehensive income 153

Group statement of changes in equity 154

Group balance sheet 155

Group cash flow statement 156

Notes on financial statements

1. Significant accounting policies 157

2. Non-current assets held for sale 173

3. Business combinations and other

significant transactions 174

4. Disposals and impairment 175

5. Segmental analysis 177

6. Revenue from contracts with customers 180

7. Income statement analysis 180

8. Exploration expenditure 181

9. Taxation 181

10. Dividends 184

11. Earnings per share 184

12. Property, plant and equipment 186

13. Capital commitments 187

14. Goodwill 187

15. Intangible assets 188

16. Investments in joint ventures 189

17. Investments in associates 189

18. Other investments 191

19. Inventories 191

20. Trade and other receivables 192

21. Valuation and qualifying accounts 192

22. Trade and other payables 193

23. Provisions 193

24. Pensions and other post-retirement benefits 194

25. Cash and cash equivalents 200

26. Finance debt 200

27. Capital disclosures and net debt 201

28. Leases 202

29. Financial instruments and financial 202

risk factors

30. Derivative financial instruments 207

31. Called-up share capital 215

32. Capital and reserves 216

33. Contingent liabilities 219

34. Remuneration of senior management 220

and non-executive directors

35. Employee costs and numbers 221

36. Auditor’s remuneration 221

37. Subsidiaries, joint arrangements 222

and associates

38. Condensed consolidating information 223

on certain US subsidiaries

Supplementary information on oil and natural gas (unaudited)

Oil and natural gas exploration 233

and production activities

Movements in estimated net proved reserves 239

Standardized measure of discounted future 254

net cash flows and changes therein relating

to proved oil and gas reserves

Operational and statistical information 257

Parent company financial statements of BP p.l.c.

Company balance sheet 260

Company statement of changes in equity 261

Notes on financial statements 262

1. Significant accounting policies 262

2. Investments 265

3. Receivables 265

4. Pensions 265

5. Payables 269

6. Taxation 269

7. Called-up share capital 270

8. Capital and reserves 270

9. Financial guarantees 271

10. Share-based payments 271

11. Auditor’s remuneration 271

12. Directors’ remuneration 271

13. Employee costs and numbers 272

14. Related undertakings 273

Consolidated financial statements of the BP group

This page does not form part of BP's Annual Report on Form 20-F as filed with the SEC.

132 BP Annual Report and Form 20-F 2019

Independent auditor’s report on the Annual Report and Accounts to the members of BP

p.l.c.

Report on the audit of the financial statements

Opinion

In our opinion:

• The financial statements of BP p.l.c. (the ‘parent company’) and its subsidiaries (the ‘group’) give a true and fair view of the state of the

group’s and of the parent company’s affairs as at 31 December 2019 and of the group’s profit for the year then ended.

• The group financial statements have been properly prepared in accordance with International Financial Reporting Standards (IFRSs) as

adopted by the European Union (EU) and IFRSs as issued by the International Accounting Standards Board (IASB).

• The parent company financial statements have been properly prepared in accordance with United Kingdom generally accepted accounting

practice including Financial Reporting Standard (FRS) 101 ‘Reduced Disclosure Framework'.

• The financial statements have been prepared in accordance with the requirements of the Companies Act 2006 and, as regards the group

financial statements, Article 4 of the IAS Regulation.

We have audited the financial statements of BP p.l.c. which comprise the:

• Group income statement;

• Group statement of comprehensive income;

• Group and parent company statements of changes in equity;

• Group and parent company balance sheets;

• Group cash flow statement;

• Group related Notes 1 to 38 to the financial statements, including a summary of significant accounting policies; and

• Parent company related Notes 1 to 14 to the financial statements, including a summary of significant accounting policies.

The financial reporting framework that has been applied in the preparation of the group financial statements is applicable law and IFRSs as

adopted by the European Union and as issued by the IASB. The financial reporting framework that has been applied in the preparation of the

parent company financial statements is applicable law and United Kingdom Accounting Standards, including FRS 101 “Reduced Disclosure

Framework” (United Kingdom Generally Accepted Accounting Practice).

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our responsibilities under

those standards are further described in the auditor’s responsibilities for the audit of the financial statements section of our report.

We are independent of the group and the parent company in accordance with the ethical requirements that are relevant to our audit of the

financial statements in the UK, including the Financial Reporting Council’s (the ‘FRC’s’) Ethical Standard as applied to listed public interest

entities, and we have fulfilled our other ethical responsibilities in accordance with these requirements. The non-audit services provided to the

group and parent company for the year are disclosed in note 36 to the financial statements. We confirm that the non-audit services prohibited

by the FRC’s Ethical Standard were not provided to the group or the parent company.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

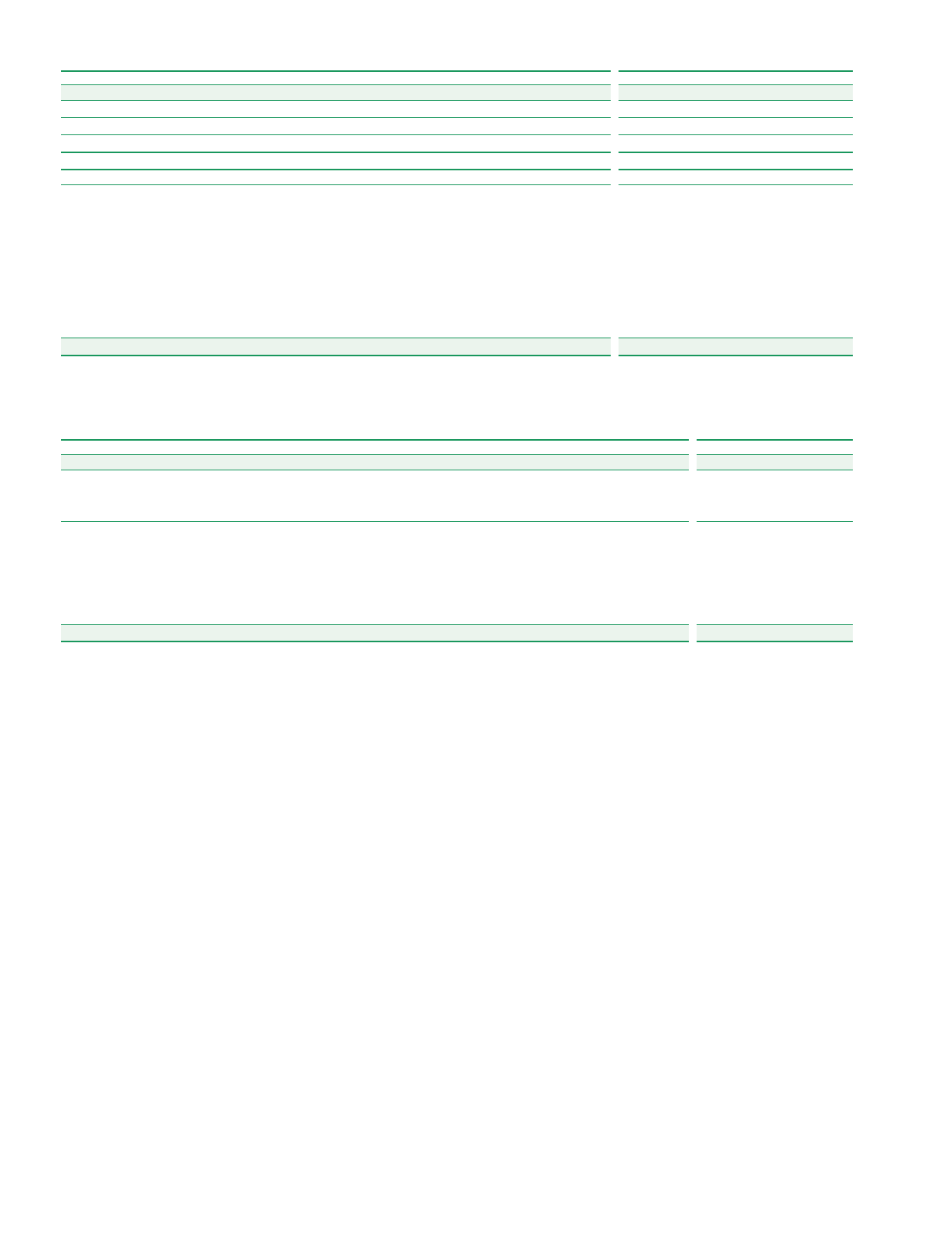

Summary of our audit approach

Key audit matters The key audit matters that we identified in the current year are as follows:

• Potential impact of climate change and the energy transition (impacting PP&E, goodwill, intangible assets and

provisions);

• Impairment of upstream oil and gas property, plant and equipment (PP&E) assets;

• Impairment of exploration and appraisal assets (included within 'intangible assets' in the Group balance sheet);

• Accounting for structured commodity transactions (SCTs) within the integrated supply and trading (IST) function,

and the valuation of other level 3 financial instruments (potentially impacting all financial statement accounts, in

particular finance debt);

• IT controls relating to financial systems (potentially impacting all financial statement accounts); and

• Management override of controls (potentially impacting all financial statement accounts).

Changes in our key

audit matters since

the prior year

These key audit matters are consistent with those we identified in the prior year except that:

• This year we identified the potential impact of climate change and the energy transition as a key audit matter, given

the significant increase in focus on this issue by management and by external stakeholders, and the potential impact

on the financial statements as a consequence.

• In our report for the year ended 31 December 2018 we identified the accounting for acquisitions and disposals

within the upstream segment as a key audit matter, in large part as a consequence of the accounting complexities

surrounding the $10.3 billion acquisition of BHP Billiton assets in the US. During the current year, there were no

material acquisitions and there were fewer significant accounting complexities and judgements in the disposal

transactions undertaken by BP. Accordingly, we did not identify this as a key audit matter for 2019.

Materiality

We have set materiality for the current year at $850 million (2018 $750 million) based on profit before tax, profit before

impairment charges and tax, and underlying replacement cost profit before interest and tax.

Scoping

Our scope covered 263 components. Of these, 179 were full-scope audits and the remaining 84 were subject to

specific procedures on certain account balances by component audit teams or the group audit team. These covered

81% of group revenue and 75% of PP&E.

Conclusions relating to going concern, principal risks and viability statement

Going concern

We have reviewed the directors’ statement on page 157 to the financial statements about whether they

considered it appropriate to adopt the going concern basis of accounting in preparing them and their

identification of any material uncertainties to the group’s and company’s ability to continue to do so over a

period of at least 12 months from the date of approval of the financial statements.

We considered as part of our risk assessment the nature of the group, its business model and related

risks including where relevant the impact of Brexit, the requirements of the applicable financial reporting

framework and the system of internal control. We evaluated the directors’ assessment of the group’s

ability to continue as a going concern, including challenging the underlying data and key assumptions

used to make the assessment, and evaluated the directors’ plans for future actions in relation to their

going concern assessment.

We are required to state whether we have anything material to add or draw attention to in relation to that

statement required by Listing Rule 9.8.6R(3) and report if the statement is materially inconsistent with

our knowledge obtained in the audit.

Going concern is the basis of

preparation of the financial

statements that assumes an

entity will remain in operation

for a period of at least 12

months from the date of

approval of the financial

statements.

We confirm that we have nothing

material to report, add or draw

attention to in respect of these

matters.

Principal risks and viability statement

Based solely on reading the directors’ statements and considering whether they were consistent with

the knowledge we obtained in the course of the audit, including the knowledge obtained in the evaluation

of the directors’ assessment of the group’s and the company’s ability to continue as a going concern, we

are required to state whether we have anything material to add or draw attention to in relation to:

• the disclosures on pages 68-71 that describe the principal risks, procedures to identify emerging risks,

and an explanation of how these are being managed or mitigated;

• the directors' confirmation on page 128 that they have carried out a robust assessment of the principal

and emerging risks facing the group, including those that would threaten its business model, future

performance, solvency or liquidity; or

• the directors’ explanation on page 129 as to how they have assessed the prospects of the group, over

what period they have done so and why they consider that period to be appropriate, and their

statement as to whether they have a reasonable expectation that the group will be able to continue in

operation and meet its liabilities as they fall due over the period of their assessment, including any

related disclosures drawing attention to any necessary qualifications or assumptions.

We are also required to report whether the directors’ statement relating to the prospects of the group

required by Listing Rule 9.8.6R(3) is materially inconsistent with our knowledge obtained in the audit.

Viability means the ability of

the company to continue over

the time horizon considered

appropriate by the directors,

which for BP is three years.

We confirm that we have nothing

material to report, add or draw

attention to in respect of these

matters.

Key audit matters

Key audit matters are those matters that, in our professional judgement, were of most significance in our audit of the financial statements of

the current period and include the most significant assessed risks of material misstatement (whether or not due to fraud) that we identified.

These matters included those which had the greatest effect on: the overall audit strategy; the allocation of resources in the audit; and directing

the efforts of the engagement team. All of these matters were considered and discussed with the audit committee as described on page 93.

Throughout the course of our audit we identify risks of material misstatement ('risks'). We consider both the likelihood of a risk and the

potential magnitude of a misstatement in making the assessment. Certain risks are classified as 'significant' or 'higher' depending on their

severity. The category of the risk determines the level of evidence we seek in providing assurance that the associated financial statement item

is not materially misstated.

These matters were addressed in the context of our audit of the financial statements as a whole, and in forming our opinion thereon, and we

do not provide a separate opinion on these matters.

This page does not form part of BP's Annual Report on Form 20-F as filed with the SEC.

BP Annual Report and Form 20-F 2019 133

Potential impact of climate change and the energy transition (impacting PP&E, goodwill, intangible assets and provisions)

Key audit matter description How the scope of our audit responded to the key audit matter

Climate change impacts BP’s business in a number of ways as set

out in the strategic report on pages 2-71 of the Annual Report and

Accounts.

It represents a strategic challenge with its implications becoming

increasingly significant towards 2050 and beyond. Whilst many of

BP’s oil and gas properties and refining assets are long-term in

nature, none are being amortised over a period that extends beyond

this date. At current rates of depreciation, depletion and amortisation

(DD&A), the average life of the upstream PP&E is seven years and the

downstream PP&E is 13 years. Accordingly, the related principal risks

that we have identified for our audit are as follows:

• Forecast assumptions used in assessing the value of assets

within BP’s balance sheet for impairment testing, particularly oil

and gas price assumptions relevant to upstream oil and gas

PP&E assets, may not appropriately reflect changes in supply

and demand due to climate change and the energy transition

(see 'impairment of upstream PP&E' below);

• Recoverability of exploration and appraisal (E&A) assets included

within BP’s balance sheet where the investment required in

order to develop particular projects into producing oil and gas

PP&E assets might not be sanctioned by the board in future due

to climate change considerations or a potential development

may not be considered to be economic due to the impact of

climate change and the energy transition on oil and gas prices

(see 'impairment of exploration and appraisal assets' below)

Management also assessed the following potential risks that could

arise from climate change considerations.

• The carrying value of goodwill may no longer be recoverable and

therefore may need to be impaired;

• The useful economic lives of the group’s PP&E may be

shortened as society moves towards 'net zero' emissions

targets, such that the DD&A charge is materially understated;

• Decommissioning and asset retirement obligations may need to

be brought forward with a resulting increase in the present value

of the associated liabilities; and

• Climate change-related litigation brought against BP, as disclosed

in Note 33 to the financial statements and described on page 320

under legal proceedings, may lead to an outflow of funds

requiring provision in the current year.

The material upstream goodwill balance is recorded and tested at the

segment level. The most significant assumption in the goodwill

impairment test affected by climate change relates to future oil and

gas prices (see 'impairment of upstream PP&E' below). Given the

significant headroom in the goodwill impairment test, management

identified no other assumption that could lead to a material

misstatement of goodwill due to the energy transition and other

climate change factors. Disclosures in relation to sensitivities for

goodwill are included within Note 14 on pages 187-188.

The downstream segment has a goodwill balance at 31 December

2019 of $3.9 billion, of which the most significant element is $2.8

billion relating to the Lubricants business. Notwithstanding the

expected global transition to electric vehicles, management noted

that demand for lubricants is forecast to continue to grow until at

least 2040, underpinning the substantial headroom in the most recent

impairment test as described in Note 14.

As described on pages 70-71 and in Note 1, the impact of potential

changes in DD&A charges, or to decommissioning dates would not

have a material impact on the amounts reported in the current period.

Overall response

We held discussions with management, with Deloitte specialists and

within the Group engagement team to identify the areas where we

felt climate change could have a potential impact on the financial

statements.

We also established a climate change steering committee comprising

a group of senior partners with specific sustainability and technical

audit and accounting expertise within Deloitte to provide an

independent challenge to our key decisions and conclusions with

respect to this area.

Audit procedures in respect of impairment of upstream oil and gas

PP&E assets and exploration and appraisal assets

The audit response related to the two principal risks identified is set

out under the key audit matters for impairment of upstream oil and

gas PP&E assets on pages 135-136 and the impairment of exploration

and appraisal assets on page 137.

Other audit procedures performed

We challenged management’s assertion that the impact of potential

changes in DD&A charges, or to decommissioning dates, would not

have a material impact on the amounts reported in the current period,

by making inquiries of relevant BP personnel outside the finance

function, reviewing internal and external documents and conducting

sensitivity analysis as part of our audit risk assessment procedures.

We obtained third party forecasts of future refined petroleum product

demand for those countries which are included in our group full audit

scope for downstream, under a range of scenarios including

scenarios noted as being consistent with achieving the 2015 COP 21

Paris agreement goal to limit temperature rises to well below 2°C

('Paris 2°C Goal'). These indicated that global demand for such

products was expected to remain significant until at least 2040.

We performed procedures to satisfy ourselves that, other than future

oil and gas price assumptions, there were no other assumptions in

management's goodwill calculations to which reasonably possible

changes could cause goodwill to be materially misstated.

We obtained an understanding of the controls identified by management

as being relevant to ensuring the completeness and accuracy of litigation

and climate change related disclosure within the Annual Report; we

performed procedures to test these controls.

With regard to climate change litigation, we designed procedures

specifically to respond to the risks that provisions could be

understated or that contingent liability disclosures may be omitted or

be inaccurate including:

• Holding discussions with the group general counsel and other

senior BP lawyers regarding climate change matters;

• Conducting a search for climate change litigation and claims

brought against the group; and

• Making written inquiries of, and holding discussions with,

external legal counsel advising BP in relation to climate change

litigation.

We read the other information included in the Annual Report and

considered (a) whether there was any material inconsistency

between the other information and the financial statements; or (b)

whether there was any material inconsistency between the other

information and our understanding of the business based on audit

evidence obtained and conclusions reached in the audit.

The above considerations were a significant focus of management

during the period which led to this being a matter that we

communicated to the audit committee, and which had a significant

effect on the overall audit strategy. We therefore identified this as a

key audit matter.

This page does not form part of BP's Annual Report on Form 20-F as filed with the SEC.

134 BP Annual Report and Form 20-F 2019

Impairment of upstream oil and gas property, plant and equipment (PP&E) assets

Key audit matter description How the scope of our audit responded to the key audit matter

The group balance sheet includes property, plant and equipment (PP&E)

of $133 billion (2018 $135 billion), of which $90 billion (2018 $99 billion)

is oil and gas properties within the upstream segment.

Management announced an approximately $10 billion disposal

programme for 2019 and 2020. As a consequence of this, certain

assets identified for disposal have been assessed for impairment in

the context of their fair value based on the expected disposal

proceeds from third parties, as opposed to their value in use.

The transition to a lower carbon global economy may potentially lead

to a lower oil and gas price scenario in the future due to declining

demand. Management took into account considerations of

uncertainty over the pace of the transition to lower-carbon supply and

demand and the social, political and environmental actions that will

be taken to meet the goals of the Paris climate change agreement

when determining their future oil and gas price assumptions and

revised the future price assumptions downwards when compared

with the prior year assumptions as set out in Note 1 on page 162. As

a consequence, they identified a risk of impairment across all

upstream CGUs.

Accordingly, as required by International Accounting Standard (IAS)

36 'Impairment of Assets', management performed a review of all

the upstream cash generating units (CGUs) for indicators of

impairment and impairment reversal as at 31 December 2019.

Further information has been provided in Note 1.

In large part due to the disposal programme, for the year ended 31

December 2019, BP recorded $5,871 million (2018 $400 million) of

upstream impairment charges and $129 million (2018 $580 million) of

impairment reversals. Through our risk assessment procedures, we

have determined that there are three key estimates in management’s

determination of the level of impairment charge/reversal to record.

These are:

• Oil and gas prices - BP’s oil and gas price assumptions have a

significant impact on CGU impairment assessments and

valuations performed across the portfolio, and are inherently

uncertain. Furthermore, as noted above the estimation of future

oil and gas prices is subject to increased uncertainty, given

climate change and the global energy transition. There is a risk

that management’s oil and gas price assumptions are not

reasonable, leading to a material misstatement. The assumptions

are highly judgemental.

We tested management’s internal controls over the setting of oil and

gas prices, discount rates and reserve estimates, as well as the

controls over the performance of the impairment valuation tests. In

addition, we conducted the following substantive procedures.

Oil and gas prices

• We independently developed a reasonable range of forecasts

based on external data obtained, against which we compared the

company’s future oil and gas price assumptions in order to

challenge whether they are reasonable.

• In developing this range we obtained a variety of reputable third

party forecasts, peer information and market data.

• In challenging management's price assumptions, we considered

the extent to which they and each of the forecast pricing

scenarios obtained from third parties reflect the impact of lower

oil and gas demand due to climate change. We specifically

reviewed third party forecasts stated as being, or interpreted by

us as being, consistent with achieving the Paris 2°C Goal and

considered whether they presented contradictory evidence.

• We reviewed and challenged management’s disclosures

including in relation to the sensitivity of oil and gas price

assumptions to reduced demand scenarios whether due to

climate change or other reasons.

Discount rates

• We independently evaluated BP’s discount rates used in

impairment tests with input from Deloitte valuation specialists.

• We assessed whether country risks and tax adjustments were

appropriately reflected in BP’s discount rates.

Reserves estimates

• We reviewed BP’s reserves estimation methods and policies,

assisted by Deloitte reserves experts.

• We assessed, with the assistance of Deloitte reserves experts,

how these policies had been applied to a sample of internal

reserves estimates.

• We reviewed reports provided by external experts and assessed

their scope of work and findings.

Key observations Key observations in relation to oil and gas price assumptions used in upstream oil and gas PP&E assets

impairment tests, and the recoverability of exploration and appraisal assets including the impacts of climate

change, are set out in the relevant key audit matter below.

Based on the audit evidence obtained both from internal and external legal counsel, we were satisfied with

management’s assertion that no provision should currently be made in respect of climate change litigation.

We reviewed management’s disclosure of the contingent liabilities in respect of these matters and concluded

that the disclosures are appropriate.

We were satisfied with the results of our procedures relating to DD&A charges, goodwill and

decommissioning.

We are satisfied that management’s other disclosures in the Annual Report relating to climate change are

consistent with the financial statements and our understanding of the business.

This page does not form part of BP's Annual Report on Form 20-F as filed with the SEC.

BP Annual Report and Form 20-F 2019 135

Impairment of upstream oil and gas property, plant and equipment (PP&E) assets (continued)

Key audit matter description How the scope of our audit responded to the key audit matter

• Discount rates - Given the long timeframes involved, certain

recoverable amounts of assets are sensitive to the discount rate

applied. There is a risk that discount rates do not reflect the

return required by the market and the risks inherent in the cash

flows being discounted, leading to a material misstatement.

Determination of the appropriate discount rate can be

judgemental.

• Reserves estimates - A key input to impairment assessments

and valuations is the production forecast, in turn closely related

to the group’s reserves estimates and field development

assumptions. CGU-specific estimates are not generally material.

However, material misstatements could arise either from

systematic flaws in reserves estimation policies, or due to flawed

estimates in a particularly material individual impairment test.

We identified and focused on certain individual CGUs with a total

carrying value of $12.3 billion (2018 $21.8 billion) which we

determined would be most at risk of a material impairment as a result

of a reasonably possible change in the key assumptions, particularly

the oil and gas price assumptions. Accordingly, we identified these as

a significant audit risk. We also focused on assets with a further $33.4

billion (2018 $31.5 billion) of combined CGU carrying value which

were less sensitive. We identified these as a higher audit risk as they

would be potentially at risk in aggregate to a material impairment by a

change in such assumptions. Further information regarding these

sensitivities is given in Note 1 to the consolidated financial

statements.

• We assessed the competence, capability and objectivity of BP’s

internal and external reserve experts, through obtaining their

relevant professional qualifications and experience.

• We compared hydrocarbon production forecasts used in

impairment tests to estimates and reports and our

understanding of the life of fields.

• We performed a retrospective review to check for indications of

estimation bias over time.

Other procedures

• We challenged management’s cash generating unit

determination and considered whether there was any

contradictory evidence present.

• We validated that BP’s asset impairment methodology was

appropriate and tested the integrity of impairment models.

• Where relevant, we also assessed management’s historical

forecasting accuracy and whether the estimates had been

determined and applied on a consistent basis across the group.

Since 31 December 2019, the oil price has fallen sharply in large part

due to the impact of the international spread of COVID-19

(Coronavirus) and geopolitical factors. As part of our post balance

sheet audit procedures we considered whether these events provide

evidence of conditions that existed at the balance sheet date.

Key observations Oil and gas prices

The long-term oil and gas price assumptions used to determine recoverable amount through value-in-use

impairment tests are derived from the central case long term price assumption used for investment

appraisal purposes (as set out on page 19) and represent management’s best estimate of future prices as

set out in Note 1. We determined that BP’s oil and gas price assumptions are reasonable when compared

against the range of third party forecasts we identified as being appropriate for the purpose. In forming

this view, we included each forecaster’s 'best case', 'central case' or 'most likely' estimate.

For the purpose of PP&E impairment tests, management is required under IAS 36 to apply its current

'best estimate' of future oil and gas prices.

We observed that, as well as publishing a 'best case', 'central case' or 'most likely' estimate, the majority

of third party price forecasters publish a number of other future scenarios under different plausible

economic assumption sets, and that the price forecasts stated as being or interpreted by us as being

'Paris 2°C Goal' scenarios were the lowest of all scenarios from those forecasters. We observed that for

oil, all the prices in third party 'Paris 2°C Goal' scenarios in our sample were lower than BP’s oil price

assumption from 2023 onwards, and for gas, BP's price assumptions for impairment purposes were

close to the highest 'Paris 2°C Goal' scenario.

While these 'Paris 2°C Goal' scenarios indicate that BP’s price assumptions for impairment purposes are

not consistent with the world being on a path to achieving the Paris 2°C Goal we observed that none of

those third party forecasters described their 'Paris 2°C Goal' scenarios as their 'best case', 'central case'

or “most likely” estimate.

We reviewed the disclosures included in Note 1 to the accounts in respect of price assumptions,

including the sensitivity analysis presented therein. We observed that the second downside sensitivity, in

which prices start 15% lower than the best estimate and gradually reduce to 25% lower than the best

estimate by 2040, is within the range of third party Paris 2°C Goal forecasts both for oil and for gas albeit

towards the upper end for oil.

We are satisfied that the COVID-19 outbreak and the geopolitical factors are both non-adjusting events

and accordingly the recent sharp fall in the oil price is a result of conditions that arose after the balance

sheet date. As such we concluded that management’s future oil and gas price assumptions used in

impairment tests to assess the recoverable amount of assets at the balance sheet date should not be

adjusted.

Discount rates

BP’s post-tax nominal 6% weighted average cost of capital, used as the starting point for setting discount

rates used for impairment testing, was within the independent range calculated by our Deloitte valuation

specialists.

We were also satisfied with the calculation of country risk premia. When the rates were grossed up for

tax as required for impairment testing the rates for a small number of countries fell outside of our

reasonable range but there was an insignificant impact in respect of a small number of CGUs.

Accordingly, we are satisfied with the discount rates used in the impairment testing.

This page does not form part of BP's Annual Report on Form 20-F as filed with the SEC.

136 BP Annual Report and Form 20-F 2019

Key observations We reviewed the disclosures included in Note 1 to the accounts in respect of discount rate assumptions

used and confirmed that they are consistent with the IFRS disclosure requirements.

Reserves estimates

We concluded that the assumptions used to derive the estimates were reasonable.

Impairment of exploration and appraisal assets (included within intangible assets within the Group balance sheet)

Key audit matter description How the scope of our audit responded to the key audit matter

The group capitalizes exploration and appraisal (E&A) expenditure on

a project-by-project basis in line with IFRS 6 'Exploration for and

Evaluation of Mineral Resources'. At the end of 2019, $14 billion

(2018 $16 billion) of E&A expenditure was carried in the group

balance sheet. E&A activity is inherently risky and a significant

proportion of projects fail, requiring the write-off of the related

capitalized costs when the relevant criteria in IFRS 6 and BP’s

accounting policy are met.

There is a significant judgement relating to the risk that certain

capitalized E&A costs are not written off promptly at the appropriate

time, in line with information from, and decisions about E&A

activities, and the impairment requirements of IFRS 6.

Furthermore, similar to upstream PP&E assets discussed above, E&A

assets are also potentially exposed to climate change and the global

energy transition. A greater number of projects may be expected not

to proceed as a consequence of lower forecast future demand, lower

appetite by management and the board to allocate capital to certain

projects, or increased objections from stakeholders to the

development of certain projects. In response, management has

updated its internal controls over its IFRS 6 assessment to reflect the

potential impact that climate change and the energy transition may

have on E&A assets.

In the prior year audit, we had identified this key audit matter as a

significant risk primarily on account of uncertainty arising from the

potential inability of the Company to secure key license extensions

in respect of assets in the Gulf of Mexico and on three licenses in

other regions.

During the current year, and subsequent to the year end,

management have obtained licence extensions in the Gulf of Mexico

and other regions such that we have concluded this no longer

represents a significant audit risk. Nevertheless, given the inherent

uncertainty associated with the development and deployment of

these assets, we still consider this area to be a higher risk.

We obtained an understanding of the group’s E&A impairment

assessment processes and tested management’s internal controls,

including the new control procedures implemented to address

potential climate change considerations.

We performed a licence-by-licence risk assessment of the group’s

E&A balance through to year end, to identify significant carrying

amounts with a current period risk of impairment (e.g. new

information from exploration activities, or imminent licence expiry).

We performed a retrospective review of impairment charges

recorded in the period, and assessed whether impairment charges

were timely.

We reviewed and challenged management’s significant IFRS 6

impairment judgements, having regard to the impairment criteria of

IFRS 6 and BP’s accounting policy. We verified key facts relevant to

significant carrying amounts (by obtaining for example evidence of

future E&A plans and budgets, and evidence of active dialogue with

partners and regulators including negotiations to renew licences or

modify key terms).

We tested the completeness and accuracy of information used in

management’s E&A impairment assessment, by reviewing and

testing key controls over management’s register of E&A licences and

agreeing key aspects of this to underlying support (e.g. licence

documentation); holding meetings and discussions with operational

and finance management; considering adverse changes in

management’s reserves and resource estimates associated with E&A

assets; reviewing correspondence with regulators and joint

arrangement partners; and considering the implications of capital

allocation decisions. When considering capital allocation decision

making, we considered whether the development of any projects

would be inconsistent with the elements of BP’s current strategy

which are designed to ensure it is resilient to the energy transition

and climate change considerations or which would otherwise have a

prohibitively high environmental or social impact for the directors to

sanction the necessary investment.

Key observations We concluded that the key assumptions had been appropriately determined, the judgements management

had made were appropriately supported, and no additional impairments were identified from the work we

performed.

Where E&A costs were carried in respect of projects where licences had previously expired, we obtained

evidence that these licences have been renewed.

We also confirmed management's view that they did not consider that the development of any of their

E&A assets is inconsistent with BP’s current strategy. In that context we particularly considered the

Canadian oil sands assets (see Note 1) and concluded that, given low-carbon extraction technologies

required to optimise the development of these assets are being researched, continuing to carry the

assets was consistent with IFRS6.

This page does not form part of BP's Annual Report on Form 20-F as filed with the SEC.

BP Annual Report and Form 20-F 2019 137

Accounting for structured commodity transactions (SCTs) within the integrated supply and trading function (IST), and the valuation

of other level 3 financial instruments, where fraud risks may arise in revenue recognition (potentially impacting all financial

statement accounts, in particular finance debt)

Key audit matter description How the scope of our audit responded to the key audit matter

In the normal course of business, IST enters into a variety of

transactions for delivering value across the group’s supply chain. The

nature of these transactions requires significant audit effort be

directed towards challenging management’s valuation estimates or

the adopted accounting treatment.

Accounting for structured commodity transactions: IST may also

enter into a variety of transactions which we refer to as SCTs. We

generally consider a SCT to be an arrangement having one of the

following features:

a) two or more counterparties with non-standard contractual

terms;

b) multiple commodity-based transactions; and/or

c) contractual arrangements entered into in contemplation of each

other.

SCTs are often long-dated, can have a significant multi-year financial

impact, and may require the use of complex valuation models or

unobservable market inputs when determining their fair value, in

which case they will be classified as level 3 financial instruments

under IFRS 13, Fair Value Measurement.

Accounting for SCTs is often complex and involves significant

judgement, as these transactions often feature multiple elements

that will have a material impact on the presentation and disclosure of

these transactions in the financial statements and on key

performance measures, including in particular classification of

liabilities as finance debt. We have identified the accounting for SCTs

as a significant audit risk.

Level 3 financial instruments: Unlike other financial instruments

whose values or inputs are readily observable and therefore more

easily independently corroborated, there are certain transactions for

which the valuation is inherently more subjective due to the use of

either complex valuation models and/or unobservable inputs. These

instruments are classified as level 3 financial assets or liabilities

under IFRS 13. This degree of subjectivity also gives rise to potential

fraud through management incorporating bias in determining fair

values. Accordingly, we have identified these as a significant audit

risk.

As at 31 December 2019, the group’s total financial assets and

liabilities measured at fair value were $12.5 billion (2018 $12.8 billion)

and $8.8 billion (2018 $8.9 billion), of which level 3 derivative financial

assets were $5.3 billion (2018 $3.6 billion) and level 3 derivative

financial liabilities were $4.4 billion (2018 $3.1 billion).

Accounting for structured commodity transactions:

For structured commodity transactions, we performed audit

procedures to:

• Test controls related to the transactions.

• Develop an understanding of the commercial rationale of the

transactions through review of transaction support documents

and executed agreements, and discussions with management.

• Perform a detailed accounting analysis for a sample of structured

commodity transactions involving significant day 1 profits,

deferred working capital arrangements, offtake arrangements

and/or commitments.

To assess the appropriateness of the accounting treatment of SCTs,

we embedded technical accounting specialists within the audit team.

During the year we identified two new SCTs which were subjected to

our audit procedures listed above. We also reconsidered the SCTs

which were identified during 2018 and which have been subject to

ongoing assessment in 2019.

Other level 3 financial instruments:

To address the complexities associated with auditing the value of

level 3 financial instruments, the engagement team included valuation

specialists having significant quantitative and modelling expertise to

assist in performing our audit procedures. Our valuation audit

procedures included the following control and substantive

procedures:

• We tested the group’s valuation controls including the:

• Model certification control, which is designed to review a

model’s theoretical soundness and the appropriateness of its

valuation methodology; and

• Independent price verification control, which is designed to

review the appropriateness of valuation inputs that are not

observable and are significant to the financial instrument’s

valuation.

We performed substantive valuation testing procedures at interim

and year-end balance sheet dates, including:

• Engaging a Deloitte valuations specialist to develop fair value

estimates, using independently sourced inputs where these

were available, and challenge models to evaluate against

management’s fair value estimates by evaluating whether the

differences between our independent estimates and

management’s estimates were within a reasonable range. In

situations where we utilised management’s inputs, these were

compared to external data sources to ensure they were

reasonable;

• Evaluating management’s valuation methodologies against

standard valuation practice and analysing whether a consistent

framework is applied across the business period over period; and

• Comparing management’s input assumptions against the

expected assumptions of other market participants and

observable market data.

Key observations We reviewed the features of the SCTs and determined that the accounting adopted for each of these was

appropriate and in accordance with IFRS.

We concluded that management’s valuations relating to level 3 instruments were appropriate.

We did not identify any indications of fraudulent misrepresentation of revenue recognition in the

transactions, valuation estimates or accounting entries that we tested.

This page does not form part of BP's Annual Report on Form 20-F as filed with the SEC.

138 BP Annual Report and Form 20-F 2019

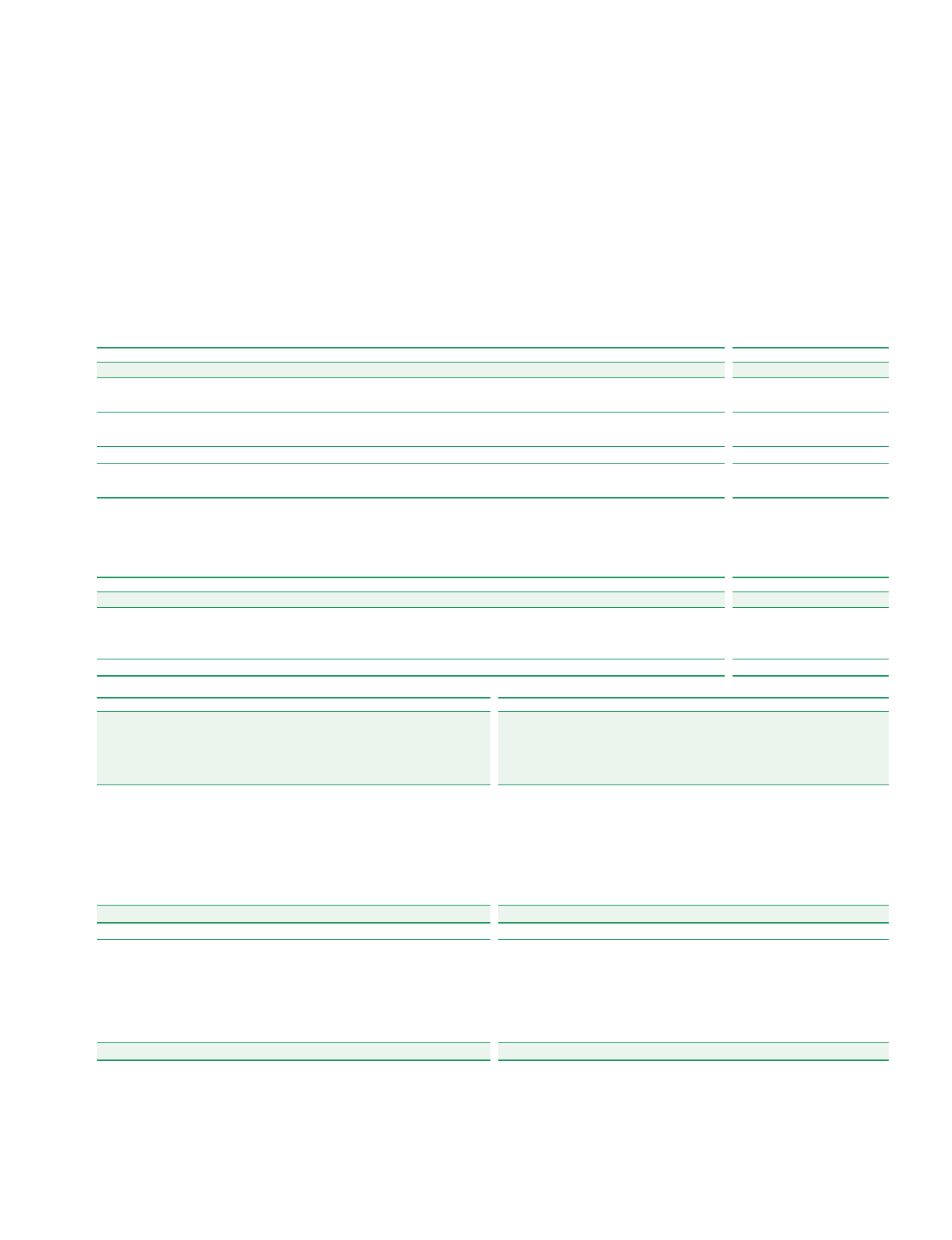

IT controls relating to financial systems (potentially impacting all financial statement accounts)

Key audit matter description How the scope of our audit responded to the key audit matter

The group’s financial systems environment is complex, with 121

separate systems scoped as being relevant for the group audit.

Due to the reliance on financial systems within the group, IT controls

which support these systems are critical to maintaining an effective

control environment.

We identified IT control deficiencies in two key areas.

User Access Management:

In the prior year, we identified a number of deficiencies relating to

user access management, both within the group and at the

group’s IT service organizations (together ‘access deficiencies’).

Management commenced the implementation of a remediation

programme in the prior year, although this programme extends

into 2020.

During our 2019 audit we identified a number of additional

deficiencies relating to user access management in the IT

environment as a result of new systems in scope, the control of

highly privileged finance access and the management of

segregation of duties.

The access deficiencies identified increase the risk that individuals

across BP had inappropriate access during the period. This results in

an increased risk that data and reports from the affected systems

are not reliable. The access deficiencies impact all components

within the scope of our group audit.

Management remediated some of the deficiencies during 2019. For

the remaining deficiencies, management implemented mitigating

controls to confirm that no inappropriate access had been exploited.

Change Management:

A new change management process and change control ticketing

system, ServiceNow, was implemented for 2019. Following the change

in process and tool a number of deficiencies were identified by Deloitte

and by management around the consistent implementation of the

minimum change management controls.

The change management deficiencies identified increase the risk of

inappropriate or untested changes being made which could negatively

impact the way a system operates and accordingly, the ongoing integrity

of the controls, reports and data within key financial systems.

In responding to the identified deficiencies management have

implemented retrospective approvals for all exceptions identified.

Management also performed a full review of all changes made to all

systems in the scope of our group audit to ensure all changes were

appropriate and that change management controls were documented.

In addition management established a programme to remediate all the

identified deficiencies.

The change management issues identified impact all components

within the scope of our group audit.

Both the user access management controls and the controls over the

management of system change are pervasive to the group’s operations

and accordingly the level of risk ascribed to our work in this area is

dependent on the nature and complexity of the control itself and the

risks addressed by the control.

We obtained an understanding of management’s processes and

relevant financial systems, and tested the associated general IT

controls and automated business controls. We also tested the

integrity of key reports. This testing led us to identify a number of

deficiencies, notably in relation to user access and change

management.

User Access Management:

In responding to the identified deficiencies in user access, our IT

audit specialists performed procedures to:

• Test the controls that management has implemented or re-

designed in order to remediate the deficiencies;

• Assess and test the mitigating controls that management

identified, including directly testing those controls operated by IT

service organizations; and

• Determine the impact that utilizing inappropriate levels of access

could feasibly have had on the affected systems including

assessing the likelihood of inappropriate user access impacting

the financial statements, and test controls implemented by

management to identify instances of the use of inappropriate

access.

Change Management:

In responding to the identified deficiencies our IT audit specialists

performed independent testing over:

• The mitigating controls performed by management; and

• Key automated business controls and the logic and accuracy of key

reports to ensure no changes had impacted their effectiveness.

These procedures were designed to address the likelihood and

impact of inappropriate or untested changes being implemented.

Key observations Our testing confirmed that the remediated controls were operating effectively.

Our testing of the mitigating controls management performed, alongside our independent testing to

demonstrate whether the access and change management deficiencies were exploited during the year, did

not identify instances of inappropriate access usage or change implementation.

Accordingly, we were satisfied with the results of the remediation to date and the mitigation such that we

continued to adopt an audit approach which places reliance on the operating effectiveness of financial

controls. Under our methodology, this enables us to apply lower sample sizes in our substantive testing.

Management continues to work to remediate fully the access and change management deficiencies

identified.

This page does not form part of BP's Annual Report on Form 20-F as filed with the SEC.

BP Annual Report and Form 20-F 2019 139

Management override of controls (potentially impacting all financial statement accounts)

Key audit matter description How the scope of our audit responded to the key audit matter

We conducted an assessment of the fraud risks arising from

management override of controls by considering potential areas

where the group’s financial statements could be manipulated,

including:

• Inappropriate accounting estimates and judgements; and

• Accounting for significant unusual transactions arising from

changes to the business.

In performing this assessment we considered pressures or

incentives to achieve certain IFRS or non-GAAP measures due to the

remuneration arrangements of people in Financial Reporting

Oversight Roles (FRORs), including management and senior

executives.

During our 2018 audit we identified control deficiencies relating to the

posting of accounting journal entries at the components where

testing was performed. These control deficiencies remain as of the

end of 2019 and extended to other components where testing was

performed. There were also other changes to BP’s processes for the

posting of certain journals which created further deficiencies. As in

the previous year, management directed us to other compensating

controls which they considered to mitigate the risks, which we

subsequently tested. Management has initiated a remediation

programme which will extend into 2020.

This had a significant bearing again this year on the allocation of

resources in the audit, and the direction of effort of the audit team

globally and was a matter we discussed with the audit committee.

Accordingly, we identified this as a key audit matter.

We tested the relevant primary and, where necessary, compensating

controls that management identified as responding to the risk of

fraudulent journal entries.

In addition, we:

• Made inquiries of individuals involved in the financial reporting

process about inappropriate or unusual activity relating to the

processing of journal entries and other adjustments.

• Identified and tested relevant entity-level controls, in particular

those related to the BP Code of Conduct, whistleblowing (BP

OpenTalk) and controls monitoring financial reporting processes

and financial results.

• Used our data analytics tools to select journal entries and other

adjustments made at the end of a reporting period or otherwise

having characteristics which are associated with common fraud

schemes for testing.

• Tested journal entries and other adjustments recorded in the

general ledger throughout the period, with a particular focus on

adjustments that occur late in the financial close process.

We have reviewed accounting estimates for bias and evaluated

whether the circumstances producing the bias, if any, represent a risk

of material misstatement due to fraud. A number of the most

significant estimates are covered by the other Key Audit Matters set

out above. This assessment included:

• Evaluating whether the judgements and decisions made by

management in making the accounting estimates included in the

financial statements, even if they are individually reasonable,

indicate a possible bias on the part of BP's management that

may represent a risk of material misstatement due to fraud; and

• Performing a retrospective review of management judgements

and assumptions related to significant accounting estimates

reflected in the financial statements of the prior year.

We considered whether there were any significant transactions that

are outside the normal course of business, or that otherwise appear

to be unusual due to their nature, timing or size.

The risks and responses to the revenue recognition risks within the

integrated supply and trading function are set out on page 138.

Key observations The nature of the identified deficiencies over journal entry controls varies from business to business, so

there is no single root cause. Management identified compensating controls to mitigate the risk

associated with the design deficiencies identified. These included low-level analytical reviews, controls

over closing balances, period-end analytical review controls and certain automated business controls. Our

testing of these compensating controls concluded they were, in combination, appropriately designed and

implemented and that they were operating effectively for the year.

Our substantive testing of journal entries and other adjustments, selected through the use of our data

analytics tools, did not identify any inappropriate items.

We did not identify evidence of overall bias or any significant and unusual transactions for which the

business rationale (or the lack thereof) of the transaction suggested that it may have been entered into to

engage in fraudulent financial reporting or to conceal misappropriation of assets.

Management is continuing to design and implement appropriate process level controls over journal

entries in 2020.

Our application of materiality

We define materiality as the magnitude of misstatement in the financial statements that makes it probable that the economic decisions of a

reasonably knowledgeable person would be changed or influenced. We use materiality both in planning the scope of our audit work and in

evaluating the results of our work.

Based on our professional judgement, we determined materiality for the financial statements as a whole as follows:

This page does not form part of BP's Annual Report on Form 20-F as filed with the SEC.

140 BP Annual Report and Form 20-F 2019

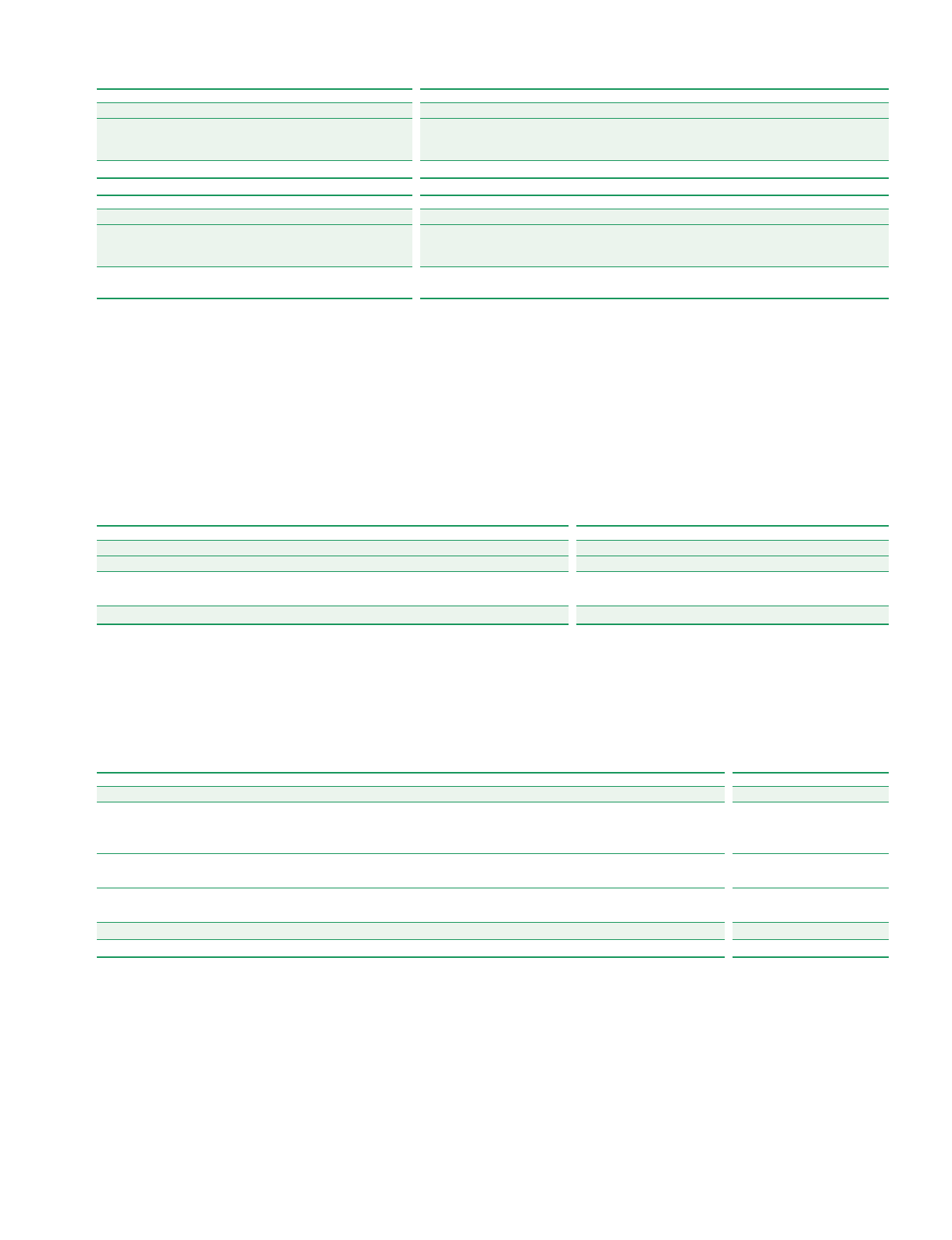

Group financial statements Parent company financial statements

Materiality Materiality has been set at $850 million for the current

year. In 2018, we used a materiality of $750 million. The

increase is partly due to BP’s financial performance in

2019 and also the fact that our 2018 materiality level

reflected some conservatism in our first year as auditor.

Materiality has been set at $1,200 million for the

current year. (2018 $1,200 million)

Basis for determining

materiality

We considered a number of metrics when determining

group materiality, including profit before taxation, profit

before impairment charges and taxation and underlying

replacement cost profit before interest and taxation.

Our selected materiality figure represents 10.3% of

profit before taxation, 5.7% of profit before impairment

charges and taxation, and 5.0% of underlying

replacement cost profit before interest and taxation. In

2018, we determined materiality to be $750m which

represented 4.5% of profit before taxation and 3.2% of

underlying replacement cost profit before interest and

taxation. The significant impairment charges of

$6,847m recognized in 2019 caused us to place more

emphasis on profit before impairment charges and

taxation in our determination of materiality this year.

We determined materiality for our audit of the

standalone parent using 1% (2018 1%) of net assets.

Rationale for the

benchmark applied

We conducted an assessment of which line items are

the most important to investors and analysts by

reviewing analyst reports and BP's communications to

shareholders and lenders, as well as the

communications of peer companies. This assessment

resulted in us selecting the financial statement line

items above.

Profit before tax is the benchmark ordinarily considered

by us when auditing listed entities. It provides

comparability against other companies across all

sectors, but has limitations when auditing companies

whose earnings are strongly correlated to commodity

prices, which can be volatile from one period to the

next, and therefore may not be representative of the

volume of transactions and the overall size of the

business in the year, or where the impact of price

volatility may result in material impairment charges or

reversals in a particular year. The significant impairment

charges recognized in 2019 caused us to place more

emphasis on profit before impairment charges and

taxation this year.

Whilst not a GAAP measure, underlying replacement

cost profit before interest and tax is one of the key

metrics communicated by management in BP's results

announcements. It excludes some of the volatility

arising from changes in crude oil, gas and product

prices as well as non-operating items.

The materiality determined for the standalone parent

company financial statements exceeds the group

materiality as it is determined on a different basis given

the nature of the parent company operations. As the

company is non…trading and operates primarily as a

holding company, we believe the net asset position is

the most appropriate benchmark to use.

Where there were balances and transactions within the

parent company accounts that were within the scope

of the audit of the group financial statements, our

procedures were undertaken using the lower

materiality level applying to the group audit

components. It was only for the purposes of testing

balances not relevant to the group audit, such as

intercompany investment balances, that the higher

level of materiality applied in practice.

This page does not form part of BP's Annual Report on Form 20-F as filed with the SEC.

BP Annual Report and Form 20-F 2019 141

Performance materiality

We set performance materiality at a level lower than materiality to reduce the probability that, in aggregate, uncorrected and undetected

misstatements exceed the materiality for the financial statements as a whole. Group performance materiality was set at 60% of group

materiality for the 2019 audit (2018 50%). The increase was due to performance materiality being set at a conservative level for 2018, given it

was our first year as auditor, and to reflect our increased knowledge of the business.

Error reporting threshold

We agreed with the audit committee that we would report to the committee all audit differences in excess of $35 million (2018 $25 million), as

well as differences below that threshold that, in our view, warranted reporting on qualitative grounds. We also report to the audit committee on

disclosure matters that we identified when assessing the overall presentation of the financial statements.

An overview of the scope of our audit

Identification and scoping of components

As a result of the highly disaggregated nature of the group, with operations in over 70 countries through approximately 1,000 components, a

significant portion of our audit planning effort was ensuring that the scope of our work is appropriate in addressing the identified risks of

material misstatement.

The factors that we considered when assessing the scope of the BP audit, and the level of work to be performed at the components that are

in scope for group reporting purposes, included the following:

• The financial significance of an operating unit to BP’s revenue and profit before tax, or PP&E, including consideration of the financial

significance of specific account balances or transactions.

• The significance of specific risks relating to an operating unit, history of unusual or complex transactions, identification of significant audit

issues or the potential for, or a history of, material misstatements.

• The effectiveness of the control environment and monitoring activities, including entity-level controls.

• The findings, observations and audit differences that we noted as a result of our 2018 audit engagement.

Our audit approach was generally to place reliance on management’s controls over financial reporting.

To ensure we were able to obtain sufficient, appropriate audit evidence for the purposes of our audit of the financial statements, we performed

full scope audit procedures for 179 reporting consolidation units ('cons units' or components) (2018 108) which were selected based on their

size or risk characteristics. The primary reason for the change in scope is a change in our approach to the global audit of the IST function. We

also added to our full scope audit components for 2019 the new businesses acquired in onshore US in 2018 from BHP. Our full-scope audits are

in the UK, US, Azerbaijan, Germany and Singapore. One of the full-scope cons units includes the investment in Rosneft, a material associate

not controlled by BP.

In addition, component teams performed audit procedures on specified account balances for 55 cons units (2018 16) also covering operations

in Angola, Alaska, Trinidad & Tobago and Australia. The group engagement team performed audit procedures on specified account balances by

segment teams to component materiality, with certain additional specific procedures performed by component teams, covering an additional

29 cons units (2018 12).

In our assessment of the residual balances, we have considered in particular the risk that there could be a material misstatement within the

large number of geographically dispersed businesses, in particular within the downstream segment. This assessment included use of our

analytic tools to interrogate data, preparation of trend analysis and comparison of business performance to market benchmark prices. We

concluded that through this additional risk assessment, we have reduced the audit risk of such a misstatement arising to a sufficiently low

level.

The remaining components are not significant individually and include many small, low risk components and balances. On average, they each

represent 0.03% of group revenue (2018 0.06%) and 0.03% of property, plant and equipment (2018 0.08%). For these components, we

performed other procedures, including conducting analytical review procedures, making inquiries, and evaluating and testing management's

group-wide controls across a range of locations and segments in order to address the risk of residual misstatement on a segment-wide and

component basis.

Working with other auditors

The group audit team provides direct oversight, review, and coordination of our component audit teams. The group audit team interacted

regularly with the compnent Deloitte teams during each stage of the audit, were responsible for the scope and direction of the audit process

and reviewed key working papers. We maintained continuous and open dialogue with our component teams in addition to holding formal

meetings quarterly to ensure that we were fully aware of their progress and results of their procedures.

The senior statutory auditor and other group audit partners and staff conducted visits to meet with the component teams responsible for all of

the full scope locations during the year as well as Egypt, Trinidad & Tobago, and key Global Business Services (GBS) accounting locations. These

visits included attending planning meetings, discussing the audit approach and any issues arising from the component team's work, meetings

with local management, and reviewing key audit working papers on higher and significant-risk areas to drive a consistent and high-quality audit.

In addition, a global audit planning meeting was held in London for two days in July led by the senior statutory auditor and involving the group

audit team, partners and staff from all full scope component teams, audit teams responsible for testing at key GBS locations, senior

management from BP, and the audit committee chairman.

We were provided with direct access to Rosneft's auditor in order to evaluate their audit work on the financial statements of Rosneft, used as

the basis for BP's equity accounting. We held meetings with Rosneft's auditor throughout the year, issued audit instructions to them, reviewed

their written clearance reports responding to these instructions and, through our direct access, were able to exercise appropriate supervision

and oversight of their audit work. We also tested directly BP's procedures and controls over its accounting for the investment in Rosneft.

This page does not form part of BP's Annual Report on Form 20-F as filed with the SEC.

142 BP Annual Report and Form 20-F 2019

Other information

The directors are responsible for the other information. The other information comprises the information included

in the annual report, other than the financial statements and our auditor’s report thereon.

Our opinion on the financial statements does not cover the other information and, except to the extent otherwise

explicitly stated in our report, we do not express any form of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is to read the other information and, in

doing so, consider whether the other information is materially inconsistent with the financial statements or our

knowledge obtained in the audit or otherwise appears to be materially misstated.

If we identify such material inconsistencies or apparent material misstatements, we are required to determine

whether there is a material misstatement in the financial statements or a material misstatement of the other

information. If, based on the work we have performed, we conclude that there is a material misstatement of this

other information, we are required to report that fact.

In this context, matters that we are specifically required to report to you as uncorrected material misstatements

of the other information include where we conclude that:

• Fair, balanced and understandable - the statement given by the directors that they consider the annual report

and financial statements taken as a whole is fair, balanced and understandable and provides the information

necessary for shareholders to assess the group’s position and performance, business model and strategy, is

materially inconsistent with our knowledge obtained in the audit; or

• Audit committee reporting - the section describing the work of the audit committee does not appropriately

address matters communicated by us to the audit committee; or

• Directors’ statement of compliance with the UK Corporate Governance Code - the parts of the directors’

statement required under the Listing Rules relating to the company’s compliance with the UK Corporate

Governance Code containing provisions specified for review by the auditor in accordance with Listing Rule

9.8.10R(2) do not properly disclose a departure from a relevant provision of the UK Corporate Governance

Code.

We have nothing to

report in respect of

these matters.

Responsibilities of directors

As explained more fully in the directors’ responsibilities statement, the directors are responsible for the preparation of the financial statements

and for being satisfied that they give a true and fair view, and for such internal control as the directors determine is necessary to enable the

preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, the directors are responsible for assessing the group’s and the parent company’s ability to continue as a

going concern, disclosing as applicable, matters related to going concern and using the going concern basis of accounting unless the directors

either intend to liquidate the group or the parent company or to cease operations, or have no realistic alternative but to do so.

Auditor’s responsibilities for the audit of the financial statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement,

whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but

is not a guarantee that an audit conducted in accordance with ISAs (UK) will always detect a material misstatement when it exists.

Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected

to influence the economic decisions of users taken on the basis of these financial statements.

Details of the extent to which the audit was considered capable of detecting irregularities, including fraud and non-compliance with laws and

regulations are set out below.

This page does not form part of BP's Annual Report on Form 20-F as filed with the SEC.

BP Annual Report and Form 20-F 2019 143

A further description of our responsibilities for the audit of the financial statements is located on the FRC’s website at: frc.org.uk/

auditorsresponsibilities. This description forms part of our auditor’s report.

Extent to which the audit was considered capable of detecting irregularities, including fraud

We identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and then design and

perform audit procedures responsive to those risks, including obtaining audit evidence that is sufficient and appropriate to provide a basis for

our opinion.

Identifying and assessing potential risks related to irregularities

In identifying and assessing risks of material misstatement in respect of irregularities, including fraud and non-compliance with laws and

regulations, we considered the following:

• Our meetings throughout the year with the Group Head of Ethics and Compliance and reviews of BP’s internal ethics and compliance

reporting summaries, including those concerning investigations;

• Enquiries of management, internal audit, and the audit committee, including obtaining and reviewing supporting documentation, concerning

the Group’s policies and procedures relating to:

– identifying, evaluating and complying with laws and regulations and whether they were aware of any instances of non-compliance

– detecting and responding to the risks of fraud and whether they have knowledge of any actual, suspected or alleged fraud; and

– the internal controls established to mitigate risks related to fraud or non-compliance with laws and regulations;

• The group’s remuneration policies, key drivers for remuneration and bonus levels; and

• Discussions among the engagement team regarding how and where fraud might occur in the financial statements and any potential

indicators of fraud. The engagement team includes audit partners and staff who have extensive experience of working with companies in the

same sectors as BP operates, and this experience was relevant to the discussion about where fraud risks may arise. The discussions also

involved fraud experts from Deloitte's forensic accounting function in the Financial Advisory service line, who advised the engagement team

of fraud schemes that had arisen in similar sectors and industries and participated in the initial fraud risk assessment discussions.

In common with all audits under ISAs (UK), we are also required to perform specific procedures to respond to the risk of management

override.

We also obtained an understanding of the legal and regulatory framework that the group operates in, focusing on provisions of those laws and

regulations that had a direct effect on the determination of material amounts and disclosures in the financial statements. The key laws and

regulations we considered in this context included the UK Companies Act, UK Corporate Governance Code, IFRS as issued by the IASB and

adopted by the EU, FRS 101, US Securities Exchange Act 1934 and relevant SEC regulations, as well as laws and regulations prevailing in each

country in which we identified a full-scope component.

In addition, we considered provisions of other laws and regulations that do not have a direct effect on the financial statements but compliance

with which may be fundamental to the group’s ability to operate or to avoid a material penalty. These included the group’s operating licences,