THE PAPPAS STUDY

COOK COUNTY TREASURER

MARIA PAPPAS PRESENTS

20-YEAR PROPERTY TAX HISTORY

"The Pappas Study" 20-Year Property Tax History 2

DEDICATION

This study is dedicated to John McCormick and R. Bruce Dold for their tireless efforts

to make Chicagoland a better place to live.

Maria Pappas

Cook County Treasurer

October 2020

20 YEARS OF PROPERTY TAXES IN COOK COUNTY

TABLE OF CONTENTS PAGE

• 20-Year Property Tax Change on cookcountytreasurer.com 5

• Overall Historical Property Taxes Billed 14

• Overall Impact on Residential Property Tax Bills 28

• Overall Impact on Commercial Property Tax Bills 37

• Levy Increases by Individual Taxing Districts 46

• Historical Impact of Referenda 70

• Summary Findings of the Pappas Study 79

"The Pappas Study" 20-Year Property Tax History 3October 2020

20 YEARS OF PROPERTY TAXES IN COOK COUNTY

"The Pappas Study" 20-Year Property Tax History 4

EXECUTIVE SUMMARY

Homeowners and business owners in Cook County are overburdened by

property taxes, a trend that began more than two decades ago and is reaching a

crisis today because of the pandemic.

No local government office hears daily tales of financial woe more than the

Cook County Treasurer’s Office, where taxpayers, especially seniors, pour out their

hearts to staff along with their list of unpaid bills for property taxes, utilities, and

medical care.

For the first time ever, Treasurer Maria Pappas has created a new tool on

cookcountytreasurer.com for property owners to see the 20-year change in their

property taxes. Enter a property address to see taxes in 2000 compared to taxes in

2019 for all 1.7 million properties. Further, interactive maps show overall changes by

suburb or Chicago ward.

October 2020

20 YEARS OF PROPERTY TAXES IN COOK COUNTY

"The Pappas Study" 20-Year Property Tax History 5

20-YEAR PROPERTY TAX CHANGE ON

COOKCOUNTYTREASURER.COM

October 2020

"The Pappas Study" 20-Year Property Tax History

cookcountytreasurer.com

6October 2020

20 YEARS OF PROPERTY TAXES IN COOK COUNTY

"The Pappas Study" 20-Year Property Tax History 7October 2020

Links to download the study

and view interactive maps.

20 YEARS OF PROPERTY TAXES IN COOK COUNTY

cookcountytreasurer.com

Search by Address or

Property Index Number (PIN)

"The Pappas Study" 20-Year Property Tax History 8

Amount in Tax Year 2000

Amount in Tax Year 2019

Difference

Percent Changed

October 2020

20 YEARS OF PROPERTY TAXES IN COOK COUNTY

cookcountytreasurer.com

Sample: City of Chicago

"The Pappas Study" 20-Year Property Tax History 9

Amount in Tax Year 2000

Amount in Tax Year 2019

Difference

Percent Changed

October 2020

20 YEARS OF PROPERTY TAXES IN COOK COUNTY

cookcountytreasurer.com

Sample: Suburban Cook

"The Pappas Study" 20-Year Property Tax History 10

View Pappas Study and

Interactive Maps (By Suburban

Municipality or City Ward)

October 2020

20 YEARS OF PROPERTY TAXES IN COOK COUNTY

cookcountytreasurer.com

"The Pappas Study" 20-Year Property Tax History 11

Summary by Individual Tax Year

Pay Status by Tax Year

October 2020

20 YEARS OF PROPERTY TAXES IN COOK COUNTY

cookcountytreasurer.com

"The Pappas Study" 20-Year Property Tax History 12

Interactive Chicago Ward Map

October 2020

20 YEARS OF PROPERTY TAXES IN COOK COUNTY

cookcountytreasurer.com

"The Pappas Study" 20-Year Property Tax History 13October 2020

20 YEARS OF PROPERTY TAXES IN COOK COUNTY

cookcountytreasurer.com

Interactive Suburban Map

14

OVERALL HISTORICAL

PROPERTY TAXES BILLED

October 2020 "The Pappas Study" 20-Year Property Tax History

HISTORICAL PROPERTY TAX BILLED

• Total taxes billed all Cook County increased 99 percent in 20 years, rising from

$7.85 billion in 2000 to $15.58 billion in 2019.

• Total taxes billed in the City of Chicago increased 115 percent in 20 years,

jumping from $3.25 billion to $6.99 billion.

• Total taxes billed in Suburban Cook County increased 87 percent in 20 years,

increasing from $4.59 billion in 2000 to $8.59 billion in 2019.

• The analysis is based on the tax bills sent to Cook County property owners each

year from Tax Year 2000 to Tax Year 2019. These are the amounts property

owners were actually asked to pay.

"The Pappas Study" 20-Year Property Tax History 15October 2020

20 YEARS OF PROPERTY TAXES IN COOK COUNTY

$7.85

$15.58

$0

$2

$4

$6

$8

$10

$12

$14

$16

$18

All Property Taxes Billed in Cook County – Tax Years 2000 – 2019

20 YEARS OF PROPERTY TAXES IN COOK COUNTY

Increase:

$7.73 billion

99%

"The Pappas Study" 20-Year Property Tax History

Billions

16October 2020

$3.25

$6.99

$0

$1

$2

$3

$4

$5

$6

$7

$8

All Property Taxes Billed in Chicago – Tax Years 2000 – 2019

20 YEARS OF PROPERTY TAXES IN CHICAGO

"The Pappas Study" 20-Year Property Tax History

Increase:

$3.74 billion

115%

Billions

17October 2020

$4.59

$8.59

$0

$1

$2

$3

$4

$5

$6

$7

$8

$9

$10

All Property Taxes Billed in Suburban Cook – Tax Years 2000 – 2019

20 YEARS OF PROPERTY TAXES IN SUBURBAN COOK

"The Pappas Study" 20-Year Property Tax History

Increase:

$4.00 billion

87%

Billions

18October 2020

PROPERTY TAX INCREASES VS. WAGE AND COST OF LIVING

• Since 2000, property tax bills have increased

• 99 percent in all of Cook County.

• 115 percent in all of Chicago.

• 87 percent in all of the Suburbs.

• Average wages have increased 57 percent for all public and private employees in

Cook County since 2000.

• Source: Wages, U.S. Bureau of Labor Statistics; Quarterly Census of

Employment and Wages.

• Cost of living has increased 36 percent during the same period.

• Cost of living is the average increase in consumer goods and services.

• Source: U.S. Bureau of Labor Statistics, Consumer Price Index for all Urban

Consumers, Chicago-Naperville-Elgin.

"The Pappas Study" 20-Year Property Tax History 19October 2020

20 YEARS OF PROPERTY TAXES IN COOK COUNTY

114.8%

98.6%

87.1%

56.8%

36.3%

0.0% 20.0% 40.0% 60.0% 80.0% 100.0% 120.0% 140.0%

20 YEARS OF PROPERTY TAXES IN COOK COUNTY

"The Pappas Study" 20-Year Property Tax History 20October 2020

Definitions and Sources:

Wages – Average annual salary in Cook County (2000-2018), U.S. Bureau of Labor Statistics

Cost of Living – Consumer Price Index for All Urban Consumers, U.S. Bureau of Labor Statistics

Total Property Taxes Billed – The amount property owners are asked to pay, Cook County Property Master File

Cost of Living

Wages

Suburban Cook County

All Cook County

City of Chicago

All Property Taxes Billed vs. Average Annual Wages vs. Cost of Living

Tax Year 2000 to 2019

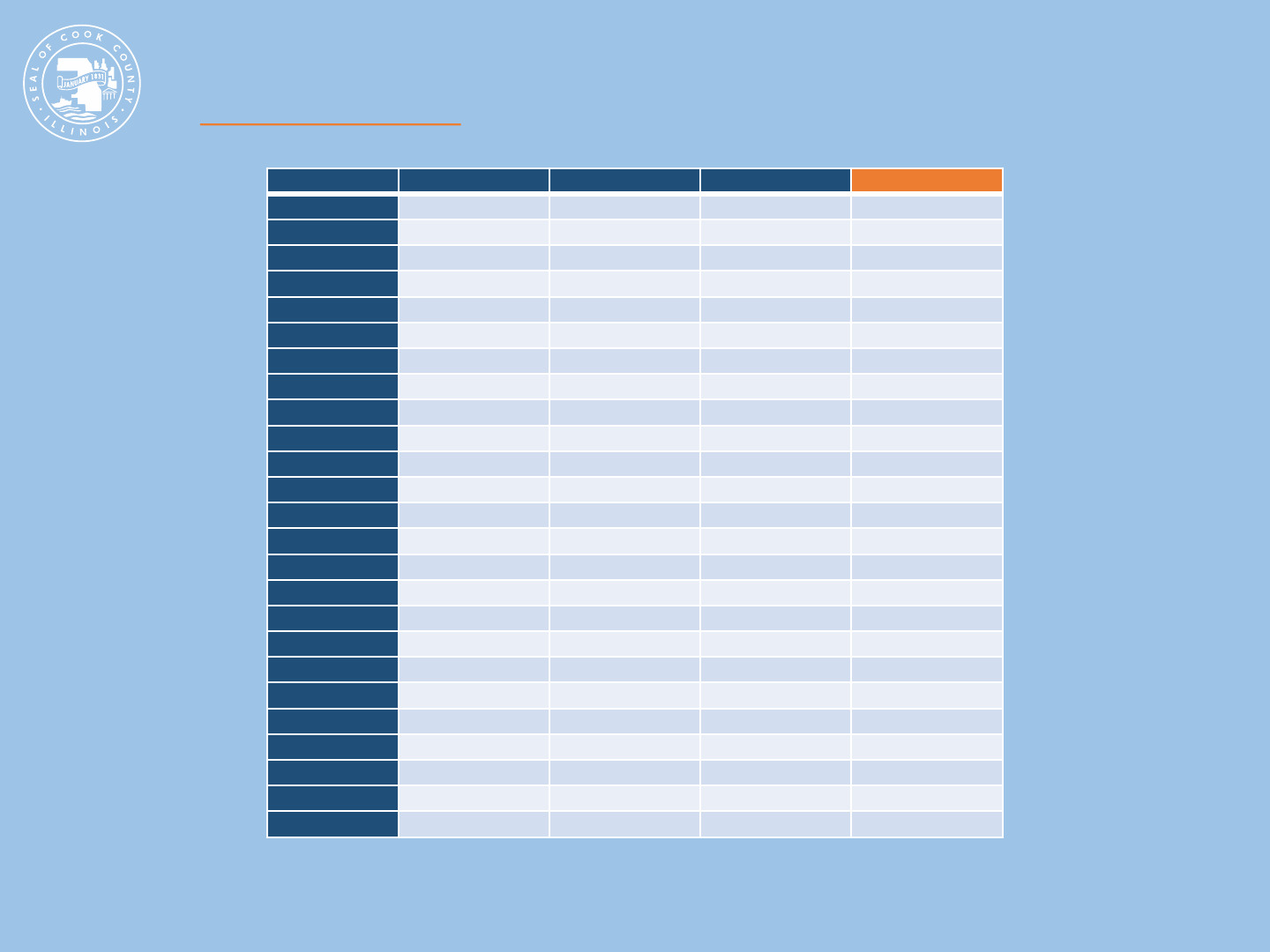

Ward 2000 2019 $ Change % Change

3 $32,851,636 $174,367,671 $141,516,034 431%

27 $69,239,254 $291,973,284 $222,734,031 322%

1 $44,017,241 $160,114,334 $116,097,093 264%

25 $50,992,708 $181,931,356 $130,938,648 257%

32 $80,492,418 $251,039,198 $170,546,781 212%

26 $25,810,774 $69,968,254 $44,157,481 171%

47 $76,747,754 $203,372,197 $126,624,442 165%

11 $42,577,289 $112,665,386 $70,088,098 165%

28 $32,485,746 $78,787,890 $46,302,144 143%

2 $169,789,395 $399,168,046 $229,378,651 135%

33 $39,804,930 $91,525,742 $51,720,812 130%

43 $138,990,708 $317,958,254 $178,967,546 129%

44 $100,205,041 $227,921,253 $127,716,212 127%

42 $914,771,498 $2,022,955,461 $1,108,183,963 121%

4 $75,002,836 $164,365,520 $89,362,684 119%

46 $54,327,111 $116,542,909 $62,215,797 115%

40 $51,546,534 $107,277,140 $55,730,606 108%

35 $32,080,695 $66,482,693 $34,401,998 107%

12 $27,807,294 $55,586,726 $27,779,432 100%

48 $51,194,973 $99,591,540 $48,396,568 95%

24 $16,031,561 $30,180,884 $14,149,323 88%

19 $49,275,739 $92,103,201 $42,827,462 87%

37 $24,792,173 $44,535,350 $19,743,177 80%

20 $19,459,964 $34,870,273 $15,410,309 79%

30 $36,913,383 $65,296,034 $28,382,652 77%

"The Pappas Study" 20-Year Property Tax History

50 CHICAGO WARDS – ALL PROPERTIES

21

Sorted by % Change – All Property Taxes Billed – Tax Years 2000 – 2019

October 2020

Ctrl-F to search

Ward 2000 2019 $ Change % Change

5 $41,212,157 $72,789,739 $31,577,581 77%

45 $64,287,928 $112,452,494 $48,164,566 75%

36 $37,103,726 $63,673,833 $26,570,106 72%

39 $65,504,876 $111,916,237 $46,411,362 71%

13 $33,192,060 $55,080,399 $21,888,339 66%

31 $36,921,414 $61,249,614 $24,328,200 66%

23 $40,418,390 $66,239,848 $25,821,458 64%

38 $53,660,552 $86,873,225 $33,212,672 62%

15 $14,340,089 $23,158,443 $8,818,354 61%

50 $48,822,517 $75,922,534 $27,100,017 56%

6 $24,190,092 $37,602,498 $13,412,406 55%

29 $41,193,156 $63,876,355 $22,683,199 55%

14 $39,157,379 $60,704,307 $21,546,928 55%

21 $26,726,702 $41,157,532 $14,430,831 54%

49 $41,241,327 $63,032,894 $21,791,567 53%

8 $35,198,886 $53,730,610 $18,531,724 53%

22 $23,643,386 $34,920,376 $11,276,990 48%

9 $26,723,411 $38,998,565 $12,275,155 46%

16 $19,629,564 $28,544,290 $8,914,726 45%

7 $24,810,961 $35,465,763 $10,654,802 43%

34 $24,169,298 $33,952,771 $9,783,473 40%

17 $20,915,266 $28,393,629 $7,478,363 36%

41 $135,360,579 $180,545,003 $45,184,424 33%

10 $33,956,379 $43,316,425 $9,360,046 28%

18 $44,116,499 $56,080,693 $11,964,195 27%

"The Pappas Study" 20-Year Property Tax History 22October 2020

50 CHICAGO WARDS – ALL PROPERTIES

Sorted by % Change – All Property Taxes Billed – Tax Years 2000 – 2019

Ctrl-F to search

"The Pappas Study" 20-Year Property Tax History

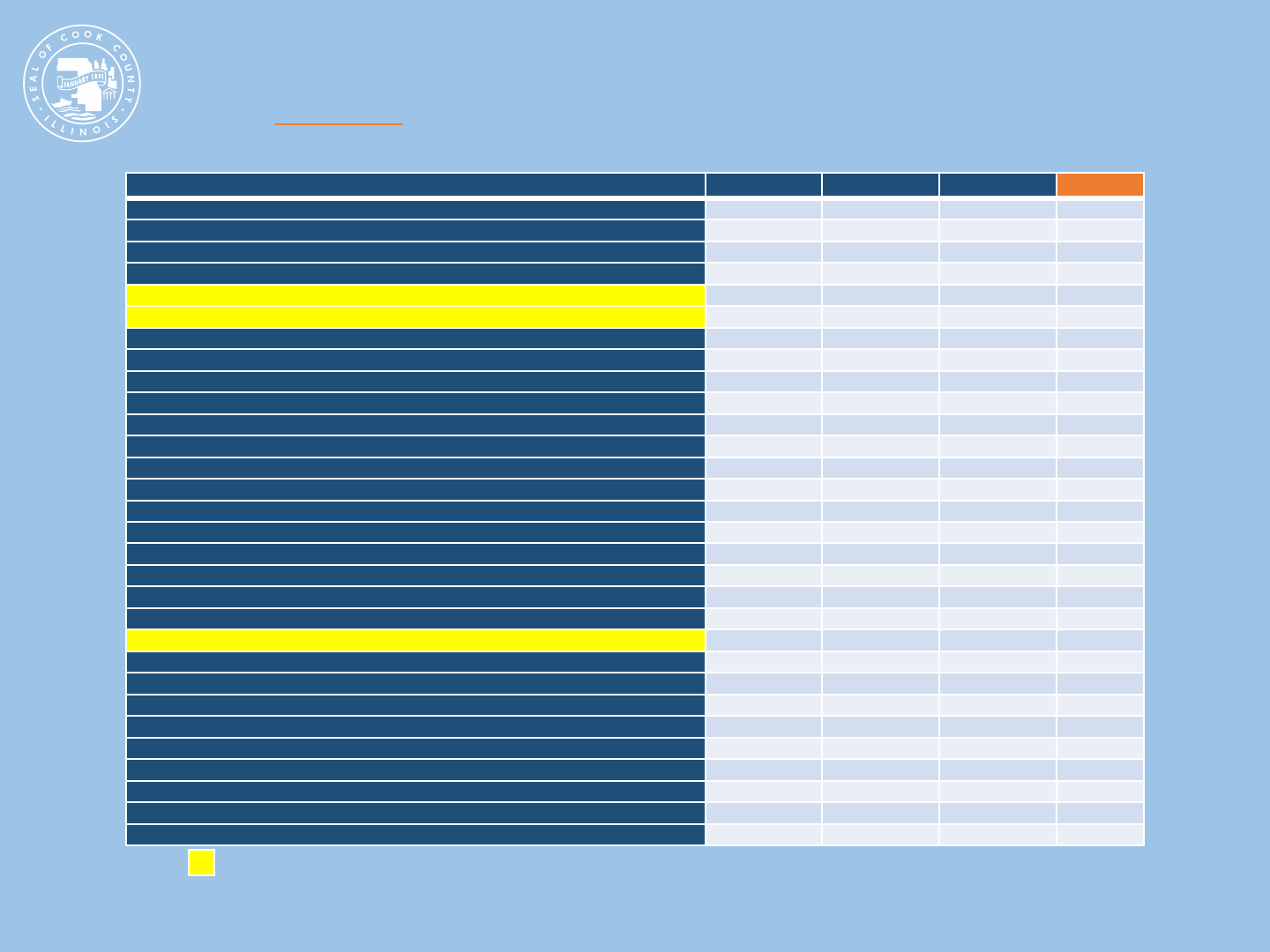

127 CITIES / VILLAGES IN COOK COUNTY

23

*Cities / Villages with over 100 taxable properties in Cook County.

October 2020

Sorted by % Change – All Property Taxes Billed – Tax Years 2000 – 2019

City / Village 2000 2019 $ Change % Change

Markham $13,998,329 $36,168,270 $22,169,941 158%

Lemont $21,174,275 $54,346,262 $33,171,987 157%

Bartlett $19,291,264 $47,949,989 $28,658,725 149%

South Barrington $15,272,795 $37,903,471 $22,630,676 148%

Western Springs $24,323,455 $60,004,934 $35,681,479 147%

Glenview $100,290,403 $245,997,451 $145,707,048 145%

McCook $8,488,231 $20,365,321 $11,877,089 140%

Lynwood $8,567,057 $19,904,217 $11,337,160 132%

Country Club Hills $19,720,926 $45,805,016 $26,084,090 132%

Brookfield $22,090,537 $50,830,699 $28,740,162 130%

Oak Park $96,944,344 $222,969,357 $126,025,013 130%

Kenilworth $12,358,568 $28,177,382 $15,818,814 128%

Burr Ridge $13,310,026 $30,163,901 $16,853,875 127%

Riverside $15,942,139 $36,112,987 $20,170,849 127%

Hometown $2,592,499 $5,815,456 $3,222,957 124%

Willow Springs $9,346,379 $20,935,946 $11,589,568 124%

North Lake $23,177,969 $51,660,541 $28,482,572 123%

La Grange $30,714,072 $68,016,483 $37,302,411 121%

Hinsdale $6,790,840 $14,978,603 $8,187,763 121%

River Grove $12,622,867 $27,472,415 $14,849,549 118%

Evergreen Park $26,413,907 $57,091,643 $30,677,736 116%

Winnetka $55,252,956 $119,334,370 $64,081,414 116%

Chicago $3,253,705,251 $6,990,258,676 $3,736,553,425 115%

Tinley Park $68,473,760 $146,176,016 $77,702,255 113%

Barrington $12,871,797 $27,382,658 $14,510,861 113%

Ctrl-F to search

"The Pappas Study" 20-Year Property Tax History

127 CITIES / VILLAGES IN COOK COUNTY

24October 2020

Sorted by % Change – All Property Taxes Billed – Tax Years 2000 – 2019

City / Village 2000 2019 $ Change % Change

Matteson $36,471,078 $77,000,363 $40,529,284 111%

Phoenix $1,295,068 $2,728,903 $1,433,835 111%

Morton Grove $44,072,479 $92,737,670 $48,665,191 110%

Buffalo Grove $19,290,841 $40,537,001 $21,246,161 110%

Maywood $23,890,718 $50,100,192 $26,209,474 110%

Glencoe $39,194,128 $82,124,600 $42,930,472 110%

Wilmette $76,926,093 $160,861,724 $83,935,631 109%

Inverness $20,203,398 $42,147,860 $21,944,462 109%

Robbins $3,067,686 $6,372,380 $3,304,694 108%

Rosemont $44,584,721 $92,030,850 $47,446,129 106%

Schiller Park $22,023,946 $45,118,327 $23,094,381 105%

Midlothian $14,593,797 $29,871,072 $15,277,275 105%

River Forest $29,585,780 $59,501,774 $29,915,994 101%

Barrington Hills $9,141,121 $18,376,911 $9,235,789 101%

La Grange Park $19,491,153 $39,129,394 $19,638,241 101%

Park Ridge $82,513,354 $165,402,183 $82,888,828 100%

Streamwood $47,735,421 $95,394,868 $47,659,448 100%

Palos Heights $23,726,252 $47,296,547 $23,570,295 99%

Burbank $29,428,571 $58,569,065 $29,140,494 99%

Blue Island $19,683,404 $38,994,717 $19,311,312 98%

Orland Park $112,573,641 $222,175,838 $109,602,196 97%

Burnham $5,045,495 $9,893,224 $4,847,729 96%

Roselle $5,415,104 $10,602,702 $5,187,597 96%

Palos Park $11,047,520 $21,462,953 $10,415,433 94%

Northfield $22,535,652 $43,718,010 $21,182,359 94%

*Cities / Villages with over 100 taxable properties in Cook County.

Ctrl-F to search

"The Pappas Study" 20-Year Property Tax History

127 CITIES / VILLAGES IN COOK COUNTY

25October 2020

Sorted by % Change – All Property Taxes Billed – Tax Years 2000 – 2019

City / Village 2000 2019 $ Change % Change

Lincolnwood $33,753,615 $65,479,620 $31,726,005 94%

Harwood Heights $12,644,114 $24,494,534 $11,850,421 94%

Golf $1,888,238 $3,651,413 $1,763,175 93%

Wheeling $72,020,440 $139,143,228 $67,122,787 93%

Northbrook $113,086,468 $218,266,897 $105,180,429 93%

Evanston $146,132,037 $281,781,123 $135,649,087 93%

Franklin Park $53,114,994 $102,406,499 $49,291,506 93%

Calumet Park $8,031,318 $15,443,268 $7,411,950 92%

Norridge $22,071,571 $42,368,170 $20,296,599 92%

Harvey $30,686,658 $58,681,702 $27,995,044 91%

South Holland $38,355,041 $72,847,294 $34,492,254 90%

Summit $13,137,562 $24,907,548 $11,769,986 90%

Skokie $137,024,098 $258,971,336 $121,947,239 89%

Posen $4,625,509 $8,723,518 $4,098,009 89%

Elgin $27,085,393 $51,004,622 $23,919,229 88%

Forest Park $23,542,764 $44,305,274 $20,762,511 88%

Dolton $27,195,722 $51,161,589 $23,965,867 88%

Ford Heights $1,802,952 $3,385,013 $1,582,060 88%

Richton Park $15,768,744 $29,468,037 $13,699,293 87%

Oak Lawn $77,535,583 $144,632,259 $67,096,676 87%

Crestwood $20,646,871 $38,494,194 $17,847,322 86%

Hanover Park $19,551,029 $36,221,143 $16,670,114 85%

Palatine $115,579,991 $214,058,569 $98,478,578 85%

Flossmoor $22,119,653 $40,715,527 $18,595,874 84%

Worth $11,906,934 $21,803,893 $9,896,959 83%

*Cities / Villages with over 100 taxable properties in Cook County.

Ctrl-F to search

"The Pappas Study" 20-Year Property Tax History

127 CITIES / VILLAGES IN COOK COUNTY

26October 2020

Sorted by % Change – All Property Taxes Billed – Tax Years 2000 – 2019

City / Village 2000 2019 $ Change % Change

Elk Grove Village $114,595,828 $209,768,572 $95,172,744 83%

Mount Prospect $100,839,892 $184,557,150 $83,717,258 83%

Glenwood $11,863,337 $21,705,360 $9,842,023 83%

Bridgeview $34,911,608 $63,568,467 $28,656,859 82%

Melrose Park $45,014,609 $81,857,421 $36,842,812 82%

Park Forest $20,966,284 $38,121,334 $17,155,050 82%

Stone Park $4,579,867 $8,325,808 $3,745,941 82%

Alsip $42,738,084 $77,276,861 $34,538,777 81%

Orland Hills $8,314,174 $14,987,615 $6,673,440 80%

Lansing $43,330,419 $78,090,720 $34,760,301 80%

Des Plaines $119,604,136 $215,522,395 $95,918,259 80%

Lyons $13,386,447 $23,824,249 $10,437,802 78%

Oak Forest $37,399,085 $66,346,453 $28,947,368 77%

Merrionette Park $2,894,480 $5,122,952 $2,228,472 77%

Dixmoor $3,334,165 $5,899,496 $2,565,331 77%

Calumet City $52,467,499 $92,058,533 $39,591,035 75%

Berwyn $61,146,721 $106,978,949 $45,832,228 75%

Hillside $18,950,595 $33,065,902 $14,115,308 74%

Prospect Heights $26,187,517 $45,505,797 $19,318,280 74%

Bellwood $25,536,304 $44,250,654 $18,714,350 73%

Elmwood Park $30,612,813 $52,942,903 $22,330,091 73%

Arlington Heights $181,583,726 $311,913,746 $130,330,020 72%

Hickory Hills $20,875,019 $35,767,826 $14,892,807 71%

Justice $11,969,675 $20,440,838 $8,471,163 71%

Niles $68,949,510 $117,517,266 $48,567,756 70%

Sauk Village $10,126,769 $17,222,908 $7,096,139

70%

*Cities / Villages with over 100 taxable properties in Cook County.

Ctrl-F to search

"The Pappas Study" 20-Year Property Tax History

127 CITIES / VILLAGES IN COOK COUNTY

27October 2020

Sorted by % Change – All Property Taxes Billed – Tax Years 2000 – 2019

City / Village 2000 2019 $ Change % Change

Hazel Crest $18,393,275 $31,205,232 $12,811,958 70%

East Hazel Crest $2,551,306 $4,324,211 $1,772,905 69%

North Riverside $15,274,314 $25,845,778 $10,571,464 69%

Forest View $4,673,667 $7,902,189 $3,228,522 69%

Stickney $9,129,597 $15,345,268 $6,215,671 68%

Chicago Ridge $25,250,639 $41,930,813 $16,680,174 66%

Palos Hills $23,516,331 $38,993,213 $15,476,883 66%

Riverdale $17,620,479 $29,211,952 $11,591,473 66%

Westchester $30,324,676 $50,185,531 $19,860,855 65%

Indian Head Park $7,505,684 $12,336,734 $4,831,050 64%

Berkeley $8,428,706 $13,833,030 $5,404,324 64%

Hoffman Estates $106,946,875 $173,891,259 $66,944,384 63%

Countryside $15,423,584 $24,999,108 $9,575,524 62%

Homewood $37,703,353 $60,978,737 $23,275,383 62%

Olympia Fields $15,324,018 $24,514,850 $9,190,832 60%

Schaumburg $232,101,417 $370,285,355 $138,183,938 60%

Cicero $74,306,264 $118,292,126 $43,985,862 59%

Steger $4,415,735 $6,835,955 $2,420,220 55%

Rolling Meadows $62,788,285 $96,844,354 $34,056,069 54%

Chicago Heights $46,764,929 $72,036,231 $25,271,302 54%

Hodgkins $14,613,190 $22,492,089 $7,878,898 54%

Bedford Park $42,444,490 $61,986,618 $19,542,128 46%

Thornton $6,936,780 $10,047,271 $3,110,491 45%

South Chicago

Heights

$6,424,840 $9,294,237 $2,869,397 45%

Broadview $23,481,394 $33,018,286 $9,536,892 41%

Unincorporated $162,204,494 $224,113,170

$61,908,677 38%

*Cities / Villages with over 100 taxable properties in Cook County.

Ctrl-F to search

"The Pappas Study" 20-Year Property Tax History 28

OVERALL IMPACT ON RESIDENTIAL

PROPERTY TAX BILLS

October 2020

$1.33

$2.45

$3.51

$5.29

$0.00

$1.00

$2.00

$3.00

$4.00

$5.00

$6.00

Chicago Suburbs

Billions

"The Pappas Study" 20-Year Property Tax History 29

Residential Tax Increase

$2.18 billion

164%

Residential Tax Increase

$2.84 billion

116%

2000

2000

2019

2019

October 2020

Property Taxes Billed – Tax Years 2000 – 2019

RESIDENTIAL PROPERTY TAXES

CHICAGO VS. SUBURBAN COOK

Ward 2000 2019 $ Change % Change

3

$11,163,557 $107,510,371 $96,346,814

863%

42

$56,845,640 $332,480,365 $275,634,725

485%

25

$13,473,281 $77,919,389 $64,446,107

478%

27

$15,744,582 $84,395,719 $68,651,137

436%

1

$27,472,734 $125,528,083 $98,055,349

357%

11

$17,770,539 $74,652,176 $56,881,638

320%

4

$16,763,487 $60,528,773 $43,765,285

261%

32

$57,443,992 $204,120,205 $146,676,213

255%

26

$16,590,222 $55,489,225 $38,899,003

234%

47

$46,699,474 $154,171,979 $107,472,505

230%

33

$21,748,775 $68,050,374 $46,301,599

213%

28

$13,553,942 $40,389,274 $26,835,332

198%

2

$81,679,303 $236,966,210 $155,286,906

190%

46

$25,232,146 $72,733,561 $47,501,415

188%

40

$29,395,589 $80,098,135 $50,702,546

172%

48

$25,064,374 $67,162,714 $42,098,341

168%

44

$56,718,458 $151,270,426 $94,551,968

167%

43

$100,389,157 $264,663,516 $164,274,359

164%

49

$13,383,318 $35,055,870 $21,672,552

162%

35

$18,879,299 $49,311,625 $30,432,325

161%

20

$7,149,334 $17,837,115 $10,687,781

149%

12

$12,688,321 $28,329,044 $15,640,723

123%

24

$7,226,297 $15,752,112 $8,525,815

118%

5

$20,607,899 $41,813,613 $21,205,714

103%

30

$24,718,439 $49,833,794 $25,115,355

102%

"The Pappas Study" 20-Year Property Tax History

50 CHICAGO WARDS – RESIDENTIAL PROPERTY

30

Sorted by % Change – Property Taxes Billed – Tax Years 2000 – 2019

October 2020

Ctrl-F to search

Ward 2000 2019 $ Change % Change

45

$43,237,472 $86,850,618 $43,613,146

101%

39

$43,116,229 $86,517,305 $43,401,076

101%

19

$39,348,255 $77,893,182 $38,544,927

98%

50

$28,465,324 $53,802,191 $25,336,866

89%

41

$58,077,989 $108,344,758 $50,266,769

87%

31

$21,158,087 $39,265,573 $18,107,486

86%

23

$23,742,407 $41,895,483 $18,153,076

76%

36

$25,182,297 $44,112,374 $18,930,077

75%

29

$21,391,342 $37,377,028 $15,985,687

75%

13

$26,862,444 $46,503,179 $19,640,735

73%

37

$14,241,812 $24,608,314 $10,366,502

73%

14

$18,286,227 $30,885,491 $12,599,264

69%

38

$45,096,598 $75,942,887 $30,846,289

68%

6

$14,122,949 $22,452,039 $8,329,090

59%

10

$13,943,114 $21,356,313 $7,413,199

53%

8

$18,547,889 $28,353,329 $9,805,440

53%

15

$10,343,774 $15,564,130 $5,220,356

50%

18

$25,088,245 $37,610,104 $12,521,859

50%

22

$12,929,251 $19,122,546 $6,193,295

48%

7

$13,705,708 $20,251,937 $6,546,229

48%

21

$16,020,415 $23,347,989 $7,327,574

46%

9

$16,720,266 $23,575,107 $6,854,841

41%

16

$10,686,063 $14,696,144 $4,010,080

38%

17

$13,004,302 $16,804,169 $3,799,867

29%

34

$17,409,681 $20,932,287 $3,522,606

20%

"The Pappas Study" 20-Year Property Tax History 31

Sorted by % Change – Property Taxes Billed – Tax Years 2000 – 2019

October 2020

50 CHICAGO WARDS – RESIDENTIAL PROPERTY

Ctrl-F to search

"The Pappas Study" 20-Year Property Tax History

126 SUBURBS – RESIDENTIAL PROPERTY

32October 2020

Sorted by % Change – Property Taxes Billed – Tax Years 2000 – 2019

City / Village 2000 2019 $ Change % Change

Matteson $10,839,614 $39,657,827 $28,818,213 266%

Phoenix $599,834 $1,913,649 $1,313,815 219%

Lemont $14,268,254 $42,926,834 $28,658,580 201%

Markham $6,020,696 $17,830,263 $11,809,567 196%

South Barrington $10,470,657 $29,904,416 $19,433,759 186%

McCook $267,689 $744,314 $476,625 178%

Willow Springs $6,340,407 $17,409,164 $11,068,758 175%

Schiller Park $6,215,105 $17,064,911 $10,849,806 175%

Bartlett $14,289,287 $39,061,083 $24,771,797 173%

Forest Park $10,274,410 $27,000,813 $16,726,404 163%

Oak Park $67,719,707 $177,658,116 $109,938,409 162%

Barrington $6,880,807 $17,577,247 $10,696,439 155%

Western Springs $22,368,263 $57,011,531 $34,643,268 155%

Lynwood $5,287,633 $13,447,915 $8,160,282 154%

Wheeling $23,739,201 $59,873,046 $36,133,844 152%

Morton Grove $25,849,898 $64,951,385 $39,101,487 151%

Brookfield $17,910,110 $44,955,656 $27,045,547 151%

La Grange $22,868,334 $56,087,475 $33,219,142 145%

Rosemont $2,351,366 $5,765,253 $3,413,887 145%

Summit $5,564,635 $13,521,142 $7,956,507 143%

Glenview $69,164,657 $167,586,249 $98,421,593 142%

Franklin Park $11,438,937 $27,599,434 $16,160,497 141%

Riverside $13,921,474 $33,458,634 $19,537,160 140%

Tinley Park $45,438,074 $108,039,890 $62,601,816 138%

Burr Ridge $9,502,883 $22,431,307 $12,928,423 136%

*Cities / Villages with over 100 taxable properties in Cook County.

Ctrl-F to search

"The Pappas Study" 20-Year Property Tax History

126 SUBURBS – RESIDENTIAL PROPERTY

33October 2020

Sorted by % Change – Property Taxes Billed – Tax Years 2000 – 2019

City / Village 2000 2019 $ Change % Change

Countryside $4,270,534 $10,076,081 $5,805,547 136%

Alsip $11,165,355 $26,160,352 $14,994,997 134%

North Riverside $4,730,874 $11,082,130 $6,351,256 134%

Hoffman Estates $45,690,125 $106,569,689 $60,879,564 133%

Roselle $3,514,783 $8,186,257 $4,671,473 133%

Hodgkins $379,904 $883,508 $503,603 133%

Bedford Park $542,534 $1,261,162 $718,628 132%

Kenilworth $11,796,478 $27,246,339 $15,449,861 131%

Bridgeview $10,056,394 $23,192,135 $13,135,740 131%

River Grove $7,097,214 $16,340,635 $9,243,421 130%

Evergreen Park $15,618,126 $35,909,422 $20,291,295 130%

Midlothian $9,643,260 $22,152,589 $12,509,328 130%

Des Plaines $47,779,178 $109,209,289 $61,430,111 129%

Hometown $2,179,982 $4,964,573 $2,784,591 128%

Robbins $1,353,243 $3,077,265 $1,724,022 127%

Palatine $69,521,320 $157,826,832 $88,305,512 127%

Hinsdale $6,361,861 $14,438,912 $8,077,050 127%

Northfield $14,121,825 $31,895,103 $17,773,279 126%

Burbank $19,409,336 $43,693,190 $24,283,855 125%

Palos Heights $15,536,775 $34,812,482 $19,275,707 124%

Skokie $64,888,965 $145,329,896 $80,440,931 124%

La Grange Park $15,538,551 $34,643,418 $19,104,867 123%

Streamwood $32,063,948 $71,180,747 $39,116,799 122%

Orland Hills $4,933,061 $10,930,664 $5,997,603 122%

Northbrook $62,774,690 $139,063,220 $76,288,530 122%

*Cities / Villages with over 100 taxable properties in Cook County.

Ctrl-F to search

"The Pappas Study" 20-Year Property Tax History

126 SUBURBS – RESIDENTIAL PROPERTY

34October 2020

Sorted by % Change – Property Taxes Billed – Tax Years 2000 – 2019

City / Village 2000 2019 $ Change % Change

Winnetka $50,780,413 $112,270,640 $61,490,227 121%

North Lake $6,797,631 $14,980,552 $8,182,921 120%

Schaumburg $65,232,677 $142,739,902 $77,507,225 119%

Buffalo Grove $14,929,219 $32,658,411 $17,729,193 119%

Harwood Heights $6,359,580 $13,905,018 $7,545,438 119%

Park Ridge $64,281,815 $139,687,325 $75,405,510 117%

Posen $2,533,154 $5,494,964 $2,961,810 117%

Blue Island $10,085,179 $21,874,972 $11,789,793 117%

Inverness $18,391,949 $39,748,728 $21,356,779 116%

East Hazel Crest $906,833 $1,958,804 $1,051,971 116%

Elk Grove Village $29,723,326 $63,897,276 $34,173,950 115%

Orland Park $66,100,966 $141,784,197 $75,683,231 114%

Lincolnwood $18,578,902 $39,776,452 $21,197,550 114%

Norridge $13,122,488 $28,072,252 $14,949,764 114%

Barrington Hills $8,344,495 $17,844,440 $9,499,946 114%

Wilmette $66,084,282 $141,308,951 $75,224,669 114%

Worth $7,356,593 $15,690,326 $8,333,734 113%

Maywood $15,162,531 $32,164,520 $17,001,989 112%

River Forest $25,336,297 $53,698,390 $28,362,093 112%

Hanover Park $12,483,231 $26,337,463 $13,854,231 111%

Glencoe $36,583,050 $77,128,653 $40,545,603 111%

Mount Prospect $56,000,130 $117,587,501 $61,587,371 110%

Evanston $88,869,348 $186,342,018 $97,472,670 110%

Rolling Meadows $21,837,287 $45,748,542 $23,911,255 109%

Arlington Heights $98,627,049 $206,357,060 $107,730,011 109%

*Cities / Villages with over 100 taxable properties in Cook County.

Ctrl-F to search

"The Pappas Study" 20-Year Property Tax History

126 SUBURBS – RESIDENTIAL PROPERTY

35October 2020

Sorted by % Change – Property Taxes Billed – Tax Years 2000 – 2019

City / Village 2000 2019 $ Change % Change

Justice $7,135,194 $14,862,110 $7,726,915 108%

Hillside $5,639,311 $11,727,628 $6,088,317 108%

Country Club Hills $16,006,171 $32,822,365 $16,816,193 105%

Golf $1,593,818 $3,264,068 $1,670,250 105%

Richton Park $9,382,827 $19,148,635 $9,765,809 104%

Harvey $11,733,337 $23,926,914 $12,193,576 104%

Burnham $2,207,106 $4,463,597 $2,256,491 102%

Lyons $6,689,647 $13,501,009 $6,811,362 102%

Oak Lawn $50,278,816 $100,611,852 $50,333,037 100%

Elgin $16,263,643 $32,452,162 $16,188,519 100%

Melrose Park $11,577,101 $23,000,965 $11,423,864 99%

Calumet City $21,619,674 $42,836,859 $21,217,185 98%

Niles $28,718,060 $56,877,572 $28,159,512 98%

Lansing $21,160,524 $41,835,849 $20,675,325 98%

Stickney $4,489,977 $8,872,901 $4,382,924 98%

Riverdale $7,195,266 $14,210,640 $7,015,375 97%

Forest View $684,795 $1,350,747 $665,953 97%

Oak Forest $26,212,043 $51,354,437 $25,142,393 96%

Berkeley $4,280,812 $8,364,830 $4,084,019 95%

Prospect Heights $17,439,081 $34,001,437 $16,562,356 95%

Palos Park $9,224,114 $17,973,365 $8,749,251 95%

South Holland $20,066,185 $38,505,524 $18,439,339 92%

Hickory Hills $12,881,548 $24,596,197 $11,714,649 91%

Berwyn $41,383,436 $78,799,173 $37,415,737 90%

Dixmoor $735,029 $1,396,332 $661,303 90%

Chicago Ridge $8,022,453 $15,231,175 $7,208,722

90%

*Cities / Villages with over 100 taxable properties in Cook County.

Ctrl-F to search

"The Pappas Study" 20-Year Property Tax History

126 SUBURBS – RESIDENTIAL PROPERTY

36October 2020

Sorted by % Change – Property Taxes Billed – Tax Years 2000 – 2019

City / Village 2000 2019 $ Change % Change

Stone Park $2,164,771 $4,088,079 $1,923,308 89%

Dolton $16,855,496 $31,775,181 $14,919,685 89%

Elmwood Park $23,644,508 $44,429,955 $20,785,447 88%

Westchester $19,283,325 $36,171,736 $16,888,411 88%

Park Forest $14,881,518 $27,784,158 $12,902,640 87%

Glenwood $7,653,627 $14,231,604 $6,577,978 86%

Calumet Park $4,126,353 $7,640,725 $3,514,372 85%

Merrionette Park $936,018 $1,726,076 $790,059 84%

Chicago Heights $17,622,076 $32,340,053 $14,717,978 84%

Crestwood $7,913,906 $14,517,077 $6,603,170 83%

Palos Hills $16,643,168 $30,276,583 $13,633,415 82%

Flossmoor $19,032,575 $34,548,594 $15,516,019 82%

Steger $2,844,047 $5,122,513 $2,278,466 80%

Olympia Fields $9,242,959 $16,644,085 $7,401,126 80%

Bellwood $14,005,134 $25,189,046 $11,183,912 80%

Unincorporated $98,162,645 $175,688,505 $77,525,860 79%

Broadview $5,483,534 $9,609,205 $4,125,672 75%

Hazel Crest $12,144,224 $20,863,148 $8,718,925 72%

Cicero $38,319,493 $65,214,985 $26,895,492 70%

Indian Head Park $6,634,949 $11,178,397 $4,543,449 68%

Homewood $22,466,072 $37,750,802 $15,284,730 68%

South Chicago

Heights

$2,328,562 $3,898,842 $1,570,280 67%

Ford Heights $769,422 $1,264,034 $494,612 64%

Thornton $2,106,227 $3,302,003 $1,195,777 57%

Sauk Village $5,203,131 $7,793,332 $2,590,201 50%

*Cities / Villages with over 100 taxable properties in Cook County.

Ctrl-F to search

"The Pappas Study" 20-Year Property Tax History 37

OVERALL IMPACT ON COMMERCIAL

PROPERTY TAX BILLS

October 2020

$1.92

$2.15

$3.48

$3.30

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

$4.00

Chicago Suburbs

Billions

2000

2000

2019

2019

"The Pappas Study" 20-Year Property Tax History 38

Commercial Tax Increase

$1.55 billion

81%

Commercial Tax Increase

$1.16 billion

54%

October 2020

COMMERCIAL PROPERTY TAXES

CHICAGO VS. SUBURBAN COOK

Property Taxes Billed – Tax Years 2000 – 2019

"The Pappas Study" 20-Year Property Tax History 39

Sorted by % Change – Property Taxes Billed – Tax Years 2000 – 2019

October 2020

Ward 2000 2019 $ Change % Change

27

$53,562,420 $207,577,565 $154,015,145

288%

3

$21,690,495 $66,857,300 $45,166,806

208%

25

$36,952,730 $104,011,967 $67,059,237

181%

1

$16,507,571 $34,611,496 $18,103,925

110%

32

$23,019,772 $46,893,748 $23,873,976

104%

28

$18,923,196 $38,398,617 $19,475,421

103%

42

$858,339,333 $1,690,475,096 $832,135,763

97%

34

$6,755,058 $13,020,485 $6,265,426

93%

37

$10,536,745 $19,927,036 $9,390,291

89%

15

$4,025,238 $7,594,313 $3,569,075

89%

2

$88,081,075 $162,201,836 $74,120,761

84%

12

$15,121,846 $27,257,682 $12,135,836

80%

4

$58,206,181 $103,836,748 $45,630,566

78%

44

$43,454,931 $76,650,826 $33,195,895

76%

21

$10,707,388 $17,809,543 $7,102,156

66%

47

$29,727,857 $49,200,218 $19,472,361

66%

24

$8,803,887 $14,428,772 $5,624,885

64%

36

$11,954,823 $19,561,458 $7,606,636

64%

26

$9,262,128 $14,479,029 $5,216,901

56%

16

$8,914,577 $13,848,146 $4,933,569

55%

9

$10,002,400 $15,423,458 $5,421,058

54%

8

$16,650,998 $25,377,282 $8,726,284

52%

11

$24,954,863 $38,013,210 $13,058,347

52%

6

$10,067,143 $15,150,459 $5,083,316

50%

46

$29,161,913 $43,809,348 $14,647,435

50%

50 CHICAGO WARDS – COMMERCIAL PROPERTY

Ctrl-F to search

"The Pappas Study" 20-Year Property Tax History 40October 2020

Sorted by % Change – Property Taxes Billed – Tax Years 2000 – 2019

Ward 2000 2019 $ Change % Change

5

$20,630,295 $30,977,667 $10,347,373

50%

22

$10,714,135 $15,797,830 $5,083,695

47%

17

$7,911,506 $11,589,459 $3,677,954

46%

23

$16,719,538 $24,344,365 $7,624,827

46%

19

$9,931,686 $14,210,019 $4,278,333

43%

14

$20,874,299 $29,818,816 $8,944,517

43%

31

$15,754,126 $21,984,042 $6,229,916

40%

20

$12,315,347 $17,031,617 $4,716,271

38%

43

$38,596,969 $53,294,738 $14,697,769

38%

7

$11,105,252 $15,213,826 $4,108,573

37%

13

$6,282,372 $8,577,220 $2,294,848

37%

29

$19,777,622 $26,499,327 $6,721,704

34%

33

$17,929,599 $23,475,368 $5,545,769

31%

35

$13,318,506 $17,171,068 $3,852,563

29%

38

$8,563,955 $10,930,338 $2,366,383

28%

30

$12,220,006 $15,462,241 $3,242,235

27%

48

$26,130,599 $32,428,826 $6,298,227

24%

45

$21,025,394 $25,601,876 $4,576,483

22%

40

$22,492,439 $27,179,005 $4,686,566

21%

39

$22,377,131 $25,398,933 $3,021,802

14%

10

$20,013,265 $21,960,112 $1,946,847

10%

50

$20,354,087 $22,120,344 $1,766,257

9%

49

$27,841,412 $27,977,024 $135,612

0%

18

$19,028,253 $18,470,589 ($557,664)

-3%

41

$77,282,590 $72,200,245 ($5,082,345)

-7%

50 CHICAGO WARDS – COMMERCIAL PROPERTY

Ctrl-F to search

"The Pappas Study" 20-Year Property Tax History

126 SUBURBS – COMMERCIAL PROPERTY

41October 2020

Sorted by % Change – Property Taxes Billed – Tax Years 2000 – 2019

City / Village 2000 2019 $ Change % Change

Country Club Hills $3,714,755 $12,982,651 $9,267,897 249%

Glenview $31,125,746 $78,411,201 $47,285,455 152%

McCook $8,220,542 $19,621,007 $11,400,465 139%

Markham $7,977,633 $18,338,008 $10,360,374 130%

North Lake $16,380,338 $36,679,989 $20,299,651 124%

Hometown $412,518 $850,883 $438,365 106%

Maywood $8,728,187 $17,935,672 $9,207,485 105%

Ford Heights $1,033,530 $2,120,978 $1,087,449 105%

Rosemont $42,233,355 $86,265,597 $44,032,242 104%

Burr Ridge $3,807,143 $7,732,594 $3,925,451 103%

River Grove $5,525,653 $11,131,780 $5,606,127 101%

Calumet Park $3,904,966 $7,802,543 $3,897,577 100%

Flossmoor $3,087,079 $6,166,934 $3,079,855 100%

Lynwood $3,279,424 $6,456,302 $3,176,878 97%

Evergreen Park $10,795,781 $21,182,222 $10,386,441 96%

Robbins $1,714,443 $3,295,114 $1,580,672 92%

Sauk Village $4,923,638 $9,429,576 $4,505,938 92%

Palos Park $1,823,407 $3,489,589 $1,666,182 91%

Glencoe $2,611,078 $4,995,947 $2,384,869 91%

Burnham $2,838,389 $5,429,628 $2,591,239 91%

Crestwood $12,732,965 $23,977,117 $11,244,152 88%

South Holland $18,288,856 $34,341,771 $16,052,915 88%

Dolton $10,340,226 $19,386,408 $9,046,182 87%

Harvey $18,953,321 $34,754,788 $15,801,467 83%

Buffalo Grove $4,361,622 $7,878,590 $3,516,968 81%

*Cities / Villages with over 100 taxable properties in Cook County.

Ctrl-F to search

"The Pappas Study" 20-Year Property Tax History

126 SUBURBS – COMMERCIAL PROPERTY

42October 2020

Sorted by % Change – Property Taxes Billed – Tax Years 2000 – 2019

City / Village 2000 2019 $ Change % Change

Wilmette $10,841,811 $19,552,773 $8,710,962 80%

Franklin Park $41,676,057 $74,807,066 $33,131,009 79%

Blue Island $9,598,226 $17,119,745 $7,521,519 78%

Bartlett $5,001,977 $8,888,905 $3,886,929 78%

Glenwood $4,209,710 $7,473,756 $3,264,045 78%

Schiller Park $15,808,841 $28,053,416 $12,244,575 77%

Melrose Park $33,437,508 $58,856,456 $25,418,948 76%

Stone Park $2,415,096 $4,237,729 $1,822,633 75%

Merrionette Park $1,958,462 $3,396,876 $1,438,414 73%

Dixmoor $2,599,136 $4,503,164 $1,904,028 73%

Orland Park $46,472,675 $80,391,641 $33,918,965 73%

Elk Grove Village $84,872,502 $145,871,297 $60,998,794 72%

Elgin $10,821,750 $18,552,459 $7,730,710 71%

Park Forest $6,084,766 $10,337,176 $4,252,410 70%

Lincolnwood $15,174,713 $25,703,168 $10,528,455 69%

Harwood Heights $6,284,534 $10,589,517 $4,304,983 69%

Evanston $57,262,689 $95,439,105 $38,176,416 67%

South Barrington $4,802,138 $7,999,055 $3,196,917 67%

Kenilworth $562,090 $931,043 $368,953 66%

Tinley Park $23,035,687 $38,136,126 $15,100,439 66%

Hazel Crest $6,249,051 $10,342,084 $4,093,033 65%

Lemont $6,906,021 $11,419,428 $4,513,407 65%

Bellwood $11,531,170 $19,061,608 $7,530,438 65%

Forest View $3,988,872 $6,551,441 $2,562,569 64%

Wheeling $48,281,239 $79,270,182 $30,988,943 64%

*Cities / Villages with over 100 taxable properties in Cook County.

Ctrl-F to search

"The Pappas Study" 20-Year Property Tax History

126 SUBURBS – COMMERCIAL PROPERTY

43October 2020

Sorted by % Change – Property Taxes Billed – Tax Years 2000 – 2019

City / Village 2000 2019 $ Change % Change

Barrington $5,990,989 $9,805,411 $3,814,422 64%

Lansing $22,169,895 $36,254,871 $14,084,976 64%

Bridgeview $24,855,214 $40,376,333 $15,521,119 62%

Alsip $31,572,729 $51,116,509 $19,543,780 62%

Richton Park $6,385,918 $10,319,401 $3,933,484 62%

Oak Lawn $27,256,767 $44,020,406 $16,763,639 62%

Hillside $13,311,284 $21,338,275 $8,026,991 60%

Norridge $8,949,083 $14,295,917 $5,346,835 60%

Calumet City $30,847,825 $49,221,674 $18,373,849 60%

Winnetka $4,472,543 $7,063,730 $2,591,187 58%

Skokie $72,135,132 $113,641,440 $41,506,308 58%

Northbrook $50,311,778 $79,203,677 $28,891,899 57%

Midlothian $4,950,537 $7,718,484 $2,767,947 56%

Oak Park $29,224,637 $45,311,241 $16,086,604 55%

Chicago Ridge $17,228,187 $26,699,638 $9,471,452 55%

Streamwood $15,671,473 $24,214,122 $8,542,649 55%

Posen $2,092,355 $3,228,554 $1,136,200 54%

Lyons $6,696,800 $10,323,240 $3,626,441 54%

Western Springs $1,955,192 $2,993,404 $1,038,211 53%

Morton Grove $18,222,581 $27,786,285 $9,563,704 52%

Homewood $15,237,282 $23,227,935 $7,990,653 52%

Palos Heights $8,189,477 $12,484,066 $4,294,588 52%

La Grange $7,845,738 $11,929,008 $4,083,269 52%

Hodgkins $14,233,286 $21,608,581 $7,375,295 52%

Niles $40,231,450 $60,639,694 $20,408,244 51%

*Cities / Villages with over 100 taxable properties in Cook County.

Ctrl-F to search

"The Pappas Study" 20-Year Property Tax History

126 SUBURBS – COMMERCIAL PROPERTY

44October 2020

Sorted by % Change – Property Taxes Billed – Tax Years 2000 – 2019

City / Village 2000 2019 $ Change % Change

Summit $7,572,927 $11,386,405 $3,813,479 50%

Mount Prospect $44,839,762 $66,969,648 $22,129,886 49%

Burbank $10,019,235 $14,875,875 $4,856,639 48%

Des Plaines $71,824,958 $106,313,106 $34,488,148 48%

Cicero $35,986,771 $53,077,141 $17,090,370 47%

Matteson $25,631,464 $37,342,535 $11,711,071 46%

Bedford Park $41,901,957 $60,725,457 $18,823,500 45%

Riverdale $10,425,213 $15,001,311 $4,576,098 44%

East Hazel Crest $1,644,473 $2,365,407 $720,934 44%

Berwyn $19,763,286 $28,179,776 $8,416,490 43%

Park Ridge $18,231,540 $25,714,858 $7,483,318 41%

Brookfield $4,180,428 $5,875,043 $1,694,615 41%

Northfield $8,413,827 $11,822,907 $3,409,080 41%

North Riverside $10,543,439 $14,763,648 $4,220,209 40%

Hanover Park $7,067,797 $9,883,680 $2,815,882 40%

Hickory Hills $7,993,471 $11,171,629 $3,178,158 40%

Thornton $4,830,553 $6,745,268 $1,914,715 40%

Stickney $4,639,620 $6,472,367 $1,832,747 40%

River Forest $4,249,483 $5,803,384 $1,553,901 37%

Schaumburg $166,868,741 $227,545,453 $60,676,713 36%

Chicago Heights $29,142,853 $39,696,178 $10,553,324 36%

Worth $4,550,341 $6,113,567 $1,563,226 34%

Oak Forest $11,187,042 $14,992,017 $3,804,975 34%

Countryside $11,153,050 $14,923,028 $3,769,977 34%

Indian Head Park $870,735 $1,158,337 $287,601 33%

*Cities / Villages with over 100 taxable properties in Cook County.

Ctrl-F to search

"The Pappas Study" 20-Year Property Tax History

126 SUBURBS – COMMERCIAL PROPERTY

45October 2020

Sorted by % Change – Property Taxes Billed – Tax Years 2000 – 2019

City / Village 2000 2019 $ Change % Change

Inverness $1,811,449 $2,399,131 $587,683 32%

Berkeley $4,147,895 $5,468,200 $1,320,306 32%

South Chicago

Heights

$4,096,278 $5,395,395 $1,299,117 32%

Golf $294,420 $387,345 $92,925 32%

Prospect Heights $8,748,436 $11,504,360 $2,755,924 32%

Riverside $2,020,665 $2,654,353 $633,689 31%

Forest Park $13,268,354 $17,304,461 $4,036,107 30%

Broadview $17,997,860 $23,409,080 $5,411,220 30%

Olympia Fields $6,081,059 $7,870,765 $1,789,706 29%

Arlington Heights $82,956,678 $105,556,686 $22,600,009 27%

Roselle $1,900,321 $2,416,445 $516,124 27%

Westchester $11,041,351 $14,013,795 $2,972,444 27%

Palos Hills $6,873,163 $8,716,630 $1,843,467 27%

Hinsdale $428,979 $539,692 $110,712 26%

Rolling Meadows $40,950,998 $51,095,812 $10,144,814 25%

Elmwood Park $6,968,304 $8,512,948 $1,544,644 22%

Palatine $46,058,671 $56,231,737 $10,173,066 22%

Orland Hills $3,381,114 $4,056,951 $675,837 20%

Willow Springs $3,005,972 $3,526,782 $520,810 17%

Phoenix $695,234 $815,253 $120,020 17%

Justice $4,834,480 $5,578,728 $744,248 15%

La Grange Park $3,952,602 $4,485,977 $533,374 13%

Hoffman Estates $61,256,750 $67,321,570 $6,064,820 10%

Steger $1,571,688 $1,713,442 $141,753 9%

Unincorporated $64,041,849 $48,424,665 ($15,617,184) -24%

Barrington Hills $796,627 $532,470

($264,157) -33%

*Cities / Villages with over 100 taxable properties in Cook County.

Ctrl-F to search

"The Pappas Study" 20-Year Property Tax History 46

LEVY INCREASES BY

INDIVIDUAL TAXING DISTRICTS

October 2020

• To examine Cook County’s 558 individual taxing districts requires analyzing tax

levy extensions.

• Tax levy extensions are the amounts requested by taxing districts from property

taxes.

• 39 taxing districts have more than doubled their tax levy extension.

• This analysis examines tax levy extensions from Tax Year 2006 to Tax Year 2019.

Tax levies and extensions prior to this are not available.

October 2020 "The Pappas Study" 20-Year Property Tax History 47

TAXING DISTRICT LEVY EXTENDED TO TAX BILLS

20 YEARS OF PROPERTY TAXES IN COOK COUNTY

• Cook County has 82 home rule taxing districts which do not need to obtain

voter approval to increase property taxes.

• Home rule authority applies only to cities / villages that either have

populations of more than 25,000 or whose voters elect home rule powers via

referendum.

• Cook County has 476 non-home rule taxing districts whose property taxes are

capped by law unless voters approve otherwise.

• By referenda, voters can:

1. Raise the tax caps – Property Tax Extension Limitation Law (PTELL)

restricts a non-home rule taxing districts from increasing property

taxes by the cost of living

or 5 percent, whichever is lower.

2. Approve bond issues – A bond is a form of debt that local

governments can issue in order to finance long term projects.

October 2020 "The Pappas Study" 20-Year Property Tax History 48

WHAT DOES “HOME RULE” MEAN?

20 YEARS OF PROPERTY TAXES IN COOK COUNTY

October 2020 "The Pappas Study" 20-Year Property Tax History 49

TAX LEVY EXTENSIONS – HOME RULE VS NON- HOME RULE

20 YEARS OF PROPERTY TAXES IN COOK COUNTY

Classification

Number of Taxing

Districts

2006 2019 $ Change % Change

Home Rule

(Voter approval NOT

required to raise taxes)

82 $2,146,949,389 $3,586,348,779 $1,439,399,391 67%

Non-Home Rule

(Voter approval IS

required to raise taxes)

476 $7,462,769,807 $10,736,453,856 $3,273,684,049 44%

Total 558 $9,609,719,195 $14,322,802,635 $4,713,083,440 49%

• Property tax levy extensions have increased much more, on a percentage basis, in

home-rule governments compared to their counterparts without home-rule powers.

Cook County government is one of

the largest taxing districts, but has

increased its tax levy extension by

only 8% since 2006.

October 2020 "The Pappas Study" 20-Year Property Tax History 50

COUNTY OF COOK AS AN INDIVIDUAL TAXING DISTRICT

20 YEARS OF PROPERTY TAXES IN COOK COUNTY

$721.72

$781.54

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

2006 2019

Millions

Increase: 8%

October 2020 "The Pappas Study" 20-Year Property Tax History 51

Taxing District 2006 2019 $ Change % Change

Village of Schaumburg

$110,687

$19,698,205

$19,587,518

17696%

Village of Midlothian

$1,169,964

$6,761,563

$5,591,598

478%

Robbins Park District

$62,347

$271,392

$209,046

335%

City of Prospect Heights

$506,832

$2,134,787

$1,627,955

321%

Hometown Fire Protection District

$160,919

$592,712

$431,793

268%

Village of Bridgeview

$4,897,512

$16,702,221

$11,804,709

241%

Riverdale Park District

$235,104

$795,709

$560,604

238%

Mokena Fire Protection Disttrict

$558

$1,815

$1,257

225%

Community Unit School District 300 (Carpentersville)

$1,630,239

$4,906,006

$3,275,768

201%

Village of Olympia Fields

$1,005,025

$2,983,857

$1,978,832

197%

Village of Hazel Crest

$3,817,583

$10,755,056

$6,937,472

182%

Oak Brook Park District

$990

$2,667

$1,677

169%

Village of Riverdale

$3,780,977

$9,957,098

$6,176,121

163%

Rosemont School District 78

$2,350,964

$5,864,867

$3,513,903

149%

Village of Lansing

$6,330,865

$15,727,019

$9,396,153

148%

Village of Orland Hills

$398,473

$989,110

$590,637

148%

East Dundee – Countryside Fire

$488,825

$1,195,593

$706,768

145%

Village of Inverness

$1,133,631

$2,716,086

$1,582,455

140%

Village of River Grove

$2,739,108

$6,550,997

$3,811,889

139%

South Cook Mosquito Abatement Harvey

$1,368,093

$3,265,135

$1,897,042

139%

Village of Burnham

$1,463,491

$3,453,732

$1,990,241

136%

Richton Park Public Library District

$628,554

$1,458,244

$829,690

132%

Village of Phoenix

$300,371

$694,150

$393,779

131%

Village of Alsip

$5,911,173

$13,632,313

$7,721,141

131%

City of Chicago

$749,130,159

$1,689,081,206

$939,951,047

125%

Village of Rosemont

$5,697,670

$12,753,561

$7,055,891

124%

Village of Deerfield

$789,938

$1,716,471

$926,533

117%

Midlothian Park District

$1,026,108

$2,228,043

$1,201,934

117%

Village of Stone Park

$1,506,996

$3,225,984

$1,718,988

114%

Kenilworth Park District

$335,916

$714,453

$378,536

113%

558 TAXING DISTRICTS

% Change – Tax Levy Extension – Tax Years 2006 – 2019

Denotes Home Rule authority; voter approval NOT required to raise taxes.

Ctrl-F to search

October 2020 "The Pappas Study" 20-Year Property Tax History 52

Taxing District 2006 2019 $ Change % Change

City of North Lake

$3,084,668

$6,506,099

$3,421,431

111%

Village of Northbrook

$14,663,812

$30,904,581

$16,240,769

111%

Roselle Fire Protection District

$175,418

$361,040

$185,622

106%

Village of McCook

$2,135,690

$4,372,158

$2,236,467

105%

Village of Dolton

$7,517,761

$15,355,604

$7,837,842

104%

City of Harvey

$9,480,645

$19,263,472

$9,782,827

103%

Lemont Park District

$2,231,047

$4,486,272

$2,255,224

101%

City of Chicago Heights

$14,233,212

$28,526,535

$14,293,323

100%

Village of Forest View

$1,014,000

$2,030,704

$1,016,704

100%

Village of Norridge

$0

$2,184,948

$2,184,948

100%

Matteson Area Public Library District

$2,765,740

$2,765,740

100%

Tri-State Fire Protection District

$1,265,294

$1,265,294

100%

Logan Square Avondale Hermosas Expanded Mental Health Services

$904,046

$904,046

100%

Thorn Creek Basin Sanitary District Chicago Heights

$0

$92,744

$92,744

100%

Ford Heights Park District

$38,753

$38,753

100%

Palos Fire Protection District

$3,502,211

$6,975,088

$3,472,877

99%

Village of Calumet Park

$2,975,991

$5,917,496

$2,941,504

99%

Village of Thornton

$1,492,090

$2,961,949

$1,469,859

99%

Village of Maywood

$13,158,090

$26,040,198

$12,882,107

98%

City of Country Club Hills

$9,372,718

$18,491,377

$9,118,658

97%

Winnetka-Northfield Public Library District

$2,227,439

$4,384,072

$2,156,633

97%

City of Markham

$7,226,559

$14,194,352

$6,967,793

96%

Rosemont Park District

$980,640

$1,919,485

$938,846

96%

Brookfield - La Grange Park School District 95

$6,713,682

$13,061,079

$6,347,397

95%

Maywood Park District

$317,122

$616,846

$299,723

95%

City of Berwyn

$17,759,320

$34,499,538

$16,740,218

94%

Village of Park Forest

$8,809,023

$17,088,983

$8,279,960

94%

Village of Wheeling

$8,971,350

$17,313,912

$8,342,562

93%

East Prairie School District 73 (Skokie)

$5,540,492

$10,547,474

$5,006,982

90%

Elmhurst Community Unit School District 205

$20,402

$38,732

$18,330

90%

558 TAXING DISTRICTS

% Change – Tax Levy Extension – Tax Years 2006 – 2019

Denotes Home Rule authority; voter approval NOT required to raise taxes.

Ctrl-F to search

October 2020 "The Pappas Study" 20-Year Property Tax History 53

Taxing District 2006 2019 $ Change % Change

Village of Oak Park

$24,322,229

$46,131,386

$21,809,157

90%

Harvey Public Library District

$1,387,028

$2,628,918

$1,241,890

90%

City of Rolling Meadows

$10,207,451

$19,205,687

$8,998,235

88%

Poplar Creek Public Library District Streamwood

$3,061,088

$5,741,666

$2,680,578

88%

Oak Park School District 97

$45,847,985

$84,894,366

$39,046,381

85%

Village of Western Springs

$4,893,785

$9,038,668

$4,144,883

85%

Hodgkins Park District

$479,041

$883,968

$404,927

85%

Village of South Holland

$9,099,488

$16,687,635

$7,588,147

83%

Village of Robbins

$949,521

$1,737,661

$788,140

83%

Village of Kenilworth

$2,552,298

$4,621,039

$2,068,741

81%

Broadview Public Library District

$818,519

$1,481,368

$662,849

81%

Village of East Hazel Crest

$419,886

$756,042

$336,156

80%

Bartlett Fire District

$2,278,645

$4,082,423

$1,803,778

79%

Village of Hinsdale

$859,826

$1,530,901

$671,075

78%

Village of La Grange Park

$2,781,460

$4,938,075

$2,156,615

78%

Village of South Barrington

$1,877,278

$3,330,252

$1,452,975

77%

Village of Hanover Park

$3,743,901

$6,634,446

$2,890,545

77%

Village of Lynwood

$1,074,742

$1,898,717

$823,975

77%

Hodgkins Public Library District

$342,012

$599,550

$257,538

75%

City of Calumet City

$18,721,902

$32,660,939

$13,939,037

74%

Elgin Community College District 509

$7,511,704

$13,067,224

$5,555,520

74%

Roberts Park Fire Protection District (Hickory Hills/Justice)

$2,248,451

$3,910,894

$1,662,443

74%

Village of Melrose Park

$10,304,881

$17,866,369

$7,561,487

73%

Lighthouse Park District of Evanston

$74,442

$129,015

$54,573

73%

New Trier Township

$1,781,122

$3,079,960

$1,298,838

73%

Joliet Junior College District 525

$1,534,334

$2,652,205

$1,117,870

73%

City of Oak Forest

$6,545,687

$11,291,762

$4,746,075

73%

Kenilworth School District 38

$7,800,832

$13,440,131

$5,639,299

72%

Niles Township

$1,536,353

$2,630,441

$1,094,089

71%

Schiller Park School District 81

$9,518,506

$16,226,919

$6,708,413

70%

558 TAXING DISTRICTS

% Change – Tax Levy Extension – Tax Years 2006 – 2019

Denotes Home Rule authority; voter approval NOT required to raise taxes.

Ctrl-F to search

October 2020 "The Pappas Study" 20-Year Property Tax History 54

Taxing District 2006 2019 $ Change % Change

School District 69 (Skokie/Morton Grove)

$15,456,398

$26,315,963

$10,859,565

70%

Country Club Hills School District 160

$5,706,205

$9,667,801

$3,961,595

69%

Village of Buffalo Grove

$2,572,578

$4,336,296

$1,763,718

69%

Central Stickney Park District

$421,654

$710,434

$288,780

68%

Village of Glenwood

$3,511,816

$5,907,257

$2,395,440

68%

South Palos Township Sanitary District Palos Park

$134,033

$225,324

$91,291

68%

Hinsdale Township High School District 86

$3,365,428

$5,652,261

$2,286,833

68%

Chicago Ridge Park District

$1,398,860

$2,338,367

$939,507

67%

Oak Park Park District

$6,359,654

$10,628,721

$4,269,067

67%

Village of Franklin Park

$10,074,521

$16,822,919

$6,748,398

67%

Village of Lemont

$2,189,644

$3,647,507

$1,457,863

67%

Wilmette Public School District 39

$34,218,848

$56,812,169

$22,593,321

66%

Village of Brookfield

$8,302,205

$13,765,433

$5,463,229

66%

Village of Wilmette

$11,810,029

$19,564,054

$7,754,025

66%

Berwyn South School District 100

$13,198,683

$21,854,850

$8,656,168

66%

Barrington Park District

$1,865,067

$3,079,038

$1,213,971

65%

Village of Elk Grove

$13,970,212

$23,036,697

$9,066,485

65%

River Forest School District 90

$14,338,661

$23,576,358

$9,237,697

64%

Mount Prospect Public School District 57

$16,062,323

$26,381,767

$10,319,444

64%

Golf School District 67 (Morton Grove)

$6,193,050

$10,137,709

$3,944,659

64%

La Grange School District 102

$23,078,777

$37,776,498

$14,697,721

64%

Bedford Park Public Library District

$873,684

$1,429,615

$555,932

64%

Barrington Hills Park District

$73,253

$119,717

$46,464

63%

North Palos Fire Protection District Palos Hills

$3,417,344

$5,573,194

$2,155,850

63%

Leyden Township

$5,608,088

$9,116,402

$3,508,314

63%

Chicago Board of Education

$1,956,740,063

$3,178,945,619

$1,222,205,556

62%

Northbrook/Glenview School District 30

$16,090,947

$26,025,654

$9,934,707

62%

Homewood School District 153

$10,949,619

$17,703,220

$6,753,601

62%

City of Blue Island

$5,623,462

$9,090,954

$3,467,492

62%

Village of Hodgkins

$2,531,683

$4,091,752

$1,560,070

62%

558 TAXING DISTRICTS

% Change – Tax Levy Extension – Tax Years 2006 – 2019

Denotes Home Rule authority; voter approval NOT required to raise taxes.

Ctrl-F to search

October 2020 "The Pappas Study" 20-Year Property Tax History 55

Taxing District 2006 2019 $ Change % Change

Village of Northfield

$3,261,151

$5,267,673

$2,006,522

62%

Village of Niles

$4,267,994

$6,882,079

$2,614,085

61%

Northfield Township

$3,001,215

$4,826,001

$1,824,786

61%

Palos Heights Fire Protection District

$2,490,363

$3,999,984

$1,509,621

61%

City of Evanston

$36,307,630

$58,159,146

$21,851,516

60%

Calumet Township

$912,360

$1,459,470

$547,109

60%

Riverside Public School District 96

$16,384,070

$26,188,574

$9,804,504

60%

Calumet School District 132

$4,030,130

$6,436,979

$2,406,849

60%

Orland Hills Library District

$153,446

$244,534

$91,089

59%

McCook Public Library District

$379,520

$603,452

$223,932

59%

Oakton College District Skokie Desplaines

$35,495,442

$56,406,271

$20,910,829

59%

Village of Hoffman Estates

$13,725,645

$21,809,928

$8,084,283

59%

Metro Water Reclamation District of Greater Chicago

$401,770,945

$638,197,855

$236,426,910

59%

Bartlett Park District

$1,916,905

$3,041,739

$1,124,834

59%

Village of Elmwood Park

$10,004,992

$15,844,983

$5,839,991

58%

Bremen Township

$1,728,260

$2,722,877

$994,617

58%

Barrington-Countryside Fire Protection District

$2,850,994

$4,488,308

$1,637,314

57%

Prairie-Hills School District 144 (Markham)

$10,945,822

$17,218,118

$6,272,296

57%

Village of Posen

$865,746

$1,358,615

$492,869

57%

Forest Park Park District

$1,879,360

$2,945,953

$1,066,593

57%

Broadview Park District

$738,272

$1,157,088

$418,816

57%

Barrington Library Dist

$2,355,898

$3,691,386

$1,335,488

57%

Evanston/Skokie School District 65

$76,236,516

$119,341,181

$43,104,665

57%

Palos Township

$1,245,264

$1,942,918

$697,654

56%

Western Springs Park District

$613,714

$955,001

$341,286

56%

City of Burbank

$4,663,349

$7,256,344

$2,592,995

56%

Ridgewood Community High School District 234 (Norridge)

$11,228,422

$17,430,818

$6,202,396

55%

City of Palos Heights

$5,560,488

$8,604,457

$3,043,969

55%

Park Ridge Park District

$5,134,857

$7,944,916

$2,810,059

55%

Elementary School District 159 (Matteson)

$21,003,153

$32,479,774

$11,476,620

55%

558 TAXING DISTRICTS

% Change – Tax Levy Extension – Tax Years 2006 – 2019

Denotes Home Rule authority; voter approval NOT required to raise taxes.

Ctrl-F to search

October 2020 "The Pappas Study" 20-Year Property Tax History 56

Taxing District 2006 2019 $ Change % Change

Leyden High School District 212 (Franklin Park)

$48,380,655

$74,740,504

$26,359,849

54%

Village of Tinley Park

$14,091,323

$21,744,276

$7,652,952

54%

Lemont Fire Protection District

$4,932,208

$7,599,186

$2,666,978

54%

Central Stickney Fire Protection District

$562,309

$865,921

$303,612

54%

West Northfield School District 31 (Northbrook)

$11,313,745

$17,411,847

$6,098,102

54%

Maine Township High School District 207

$90,205,276

$138,788,932

$48,583,655

54%

Pleasantview Fire Protection District (La Grange Highlands, Burr Ridge, Hodgkins)

$6,260,334

$9,632,017

$3,371,683

54%

Village of Hillside

$8,543,365

$13,136,737

$4,593,372

54%

Glenbrook Sanitary District (Northbrook)

$59,898

$92,095

$32,197

54%

La Grange Highlands Sanitary District

$371,675

$571,283

$199,608

54%

Gail Borden Library District (Elgin)

$3,093,985

$4,744,887

$1,650,903

53%

Western Springs School District 101

$11,687,986

$17,914,143

$6,226,157

53%

La Grange School District 105

$14,889,443

$22,755,432

$7,865,989

53%

Village of Schiller Park

$6,626,253

$10,118,007

$3,491,754

53%

Community Consolidated School District 181 (Burr Ridge)

$5,933,143

$9,056,689

$3,123,546

53%

Berwyn Township

$1,338,360

$2,042,373

$704,012

53%

Lemont-Bromberek Combined School District 113A

$13,432,103

$20,488,749

$7,056,646

53%

Alsip, Hazelgreen and Oak Lawn School District 126

$15,495,910

$23,630,977

$8,135,067

52%

Palatine Park District

$10,286,289

$15,648,678

$5,362,389

52%

Dolton Riverside School District 148

$11,070,689

$16,810,053

$5,739,364

52%

Village of Roselle

$624,410

$947,752

$323,343

52%

Village of Palos Park

$1,291,634

$1,958,088

$666,454

52%

Markham Park District

$347,371

$526,532

$179,161

52%

North Maine Fire Protection District (Des Plaines)

$3,352,825

$5,073,114

$1,720,289

51%

Calumet City School District 155

$5,051,595

$7,631,577

$2,579,981

51%

Village of Streamwood

$8,325,874

$12,572,385

$4,246,510

51%

Lan-Oak Park District

$1,255,618

$1,894,216

$638,597

51%

Forest View Park District

$105,765

$159,260

$53,495

51%

Central Stickney Sanitary District Chicago

$35,744

$53,817

$18,073

51%

Winnetka Public School District 36

$30,412,844

$45,780,530

$15,367,686

51%

558 TAXING DISTRICTS

% Change – Tax Levy Extension – Tax Years 2006 – 2019

Denotes Home Rule authority; voter approval NOT required to raise taxes.

Ctrl-F to search

October 2020 "The Pappas Study" 20-Year Property Tax History 57

Taxing District 2006 2019 $ Change % Change

Village of Willow Springs

$1,943,770

$2,922,546

$978,776

50%

Oak Lawn Community High School District 229

$18,207,930

$27,365,371

$9,157,441

50%

Village of Flossmoor

$5,359,243

$8,045,728

$2,686,485

50%

Village of Berkeley

$3,373,898

$5,050,871

$1,676,973

50%

Avoca School District 37 (Glenview/Wilmette)

$9,639,223

$14,399,113

$4,759,890

49%

Reavis High School District 220 (Burbank)

$19,087,668

$28,467,511

$9,379,843

49%

Komarek School District 94 (North Riverside)

$3,768,626

$5,617,707

$1,849,081

49%

Oak Park Township

$3,523,394

$5,246,661

$1,723,267

49%

New Trier High School 203 (Winnetka)

$78,427,302

$116,560,576

$38,133,274

49%

Kirby School District 140 (Tinley Park)

$28,125,147

$41,766,089

$13,640,941

49%

Hickory Hills Park District

$1,026,365

$1,523,741

$497,376

48%

Lyons Township High School District 204

$48,616,902

$72,158,620

$23,541,718

48%

Hanover Township

$6,084,942

$9,027,457

$2,942,515

48%

Village of Chicago Ridge

$5,067,670

$7,513,243

$2,445,573

48%

Northwest Homer Fire Protection District Lockport

$56,398

$83,596

$27,198

48%

Village of Glenview

$14,485,026

$21,463,405

$6,978,380

48%

South Lyons Township Sanitary District Countryside

$256,728

$379,978

$123,250

48%

Thornton Township

$11,941,570

$17,660,913

$5,719,343

48%

Harper College Community College District 512 (Palatine)

$54,405,683

$80,423,679

$26,017,996

48%

Palatine Rural Fire Protection District

$2,956,574

$4,364,564

$1,407,990

48%

North Lake Fire Protection District

$2,623,274

$3,869,291

$1,246,017

47%

Glenview Park District

$13,026,490

$19,205,673

$6,179,183

47%

Village of River Forest

$5,694,160

$8,389,886

$2,695,726

47%

Riverside Township

$883,156

$1,300,570

$417,414

47%

Burbank School District 111

$25,124,791

$36,947,617

$11,822,826

47%

Village of Broadview

$4,745,272

$6,962,184

$2,216,912

47%

Indian Prairie Library District Darien

$151,157

$221,667

$70,510

47%

Glenbrook High Schools District 225 (Glenview)

$83,457,530

$122,377,006

$38,919,476

47%

Lemont High School District 210

$12,822,652

$18,736,253

$5,913,602

46%

Pennoyer School District 79 (Norridge)

$2,877,875

$4,205,018

$1,327,143

46%

558 TAXING DISTRICTS

% Change – Tax Levy Extension – Tax Years 2006 – 2019

Denotes Home Rule authority; voter approval NOT required to raise taxes.

Ctrl-F to search

October 2020 "The Pappas Study" 20-Year Property Tax History 58

Taxing District 2006 2019 $ Change % Change

Village of Bedford Park

$9,568,209

$13,964,952

$4,396,743

46%

Winnetka Park District

$4,097,204

$5,967,703

$1,870,498

46%

Oak Lawn-Hometown School District 123

$26,433,658

$38,344,736

$11,911,078

45%

Village of Evergreen Park

$6,883,659

$9,979,110

$3,095,451

45%

Glenwood Lynwood Library

$1,395,771

$2,021,564

$625,793

45%

Northbrook School District 28

$25,700,627

$37,212,217

$11,511,591

45%

Village of Harwood Heights

$1,377,627

$1,993,124

$615,497

45%

Park Ridge/Niles School District 64

$49,029,337

$70,844,756

$21,815,419

44%

Evanston Township High School District 202

$52,551,871

$75,838,791

$23,286,921

44%

Veterans Park District Melrose Park

$3,829,336

$5,518,324

$1,688,988

44%

Green Hills Library District (Palos Hills)

$1,959,530

$2,810,517

$850,987

43%

Franklin Park Library District

$1,437,284

$2,059,323

$622,038

43%

Central Stickney School District 110

$3,105,572

$4,447,675

$1,342,104

43%

Community Consolidated School District 62 (Des Plaines)

$51,255,210

$73,355,113

$22,099,904

43%

Morton Grove Park District

$2,610,450

$3,735,534

$1,125,084

43%

Franklin Park School District 84

$12,470,416

$17,827,598

$5,357,182

43%

Village of Bartlett

$3,942,174

$5,631,152

$1,688,979

43%

School District U-46 (Elgin)

$98,132,216

$140,086,358

$41,954,143

43%

Crestwood Library District

$408,680

$582,898

$174,219

43%

Plum Grove Woodlands Sanitary District Palatine

$27,757

$39,557

$11,800

43%

Cicero Township

$30,997,279

$44,163,184

$13,165,905

42%

Hanover Park Park District

$1,000,326

$1,424,962

$424,636

42%

Village of Bensenville

$77,599

$110,486

$32,887

42%

South Holland School District 150

$6,144,955

$8,747,281

$2,602,326

42%

Roselle Public Library

$158,055

$224,631

$66,575

42%

Village of Crestwood

$1,325,332

$1,881,361

$556,029

42%

Mannheim School District 83 (Franklin Park)

$30,051,021

$42,651,710

$12,600,689

42%

Village of Richton Park

$2,240,876

$3,175,880

$935,004

42%

Northlake Public Library

$1,900,296

$2,691,864

$791,568

42%

Grande Prairie Library (Hazel Crest)

$1,162,245

$1,645,624

$483,378

42%

558 TAXING DISTRICTS

% Change – Tax Levy Extension – Tax Years 2006 – 2019

Denotes Home Rule authority; voter approval NOT required to raise taxes.

Ctrl-F to search

October 2020 "The Pappas Study" 20-Year Property Tax History 59

Taxing District 2006 2019 $ Change % Change

Glenview Public School District 34

$40,117,317

$56,744,652

$16,627,335

41%

Northfield Park District

$830,694

$1,174,948

$344,253

41%

Nancy L McConathy Public Library District Sauk Village

$246,374

$348,246

$101,872

41%

Burhman School District 154 1/2

$742,038

$1,048,196

$306,158

41%

Leyden Fire Protection District Franklin Park

$1,914,041

$2,701,675

$787,633

41%

Community Consolidated School District 146 (Tinley Park)

$26,510,594

$37,390,603

$10,880,009

41%

Norwood Park Fire Protection District Harwood Heights

$4,110,165

$5,794,530

$1,684,365

41%

Village of Arlington Heights

$36,796,414

$51,847,173

$15,050,759

41%

River Grove Public Library District

$332,573

$468,417

$135,845

41%

Lemont Public Library District

$1,197,720

$1,684,621

$486,900

41%

Niles Township High School District 219 (Skokie)

$98,734,792

$138,696,505

$39,961,713

40%

Westchester School District 92 1/2

$9,945,995

$13,967,575

$4,021,579

40%

Glencoe School District 35

$20,363,353

$28,587,277

$8,223,924

40%

Schaumburg Township

$5,237,522

$7,337,925

$2,100,404

40%

Village of Forest Park

$5,602,123

$7,845,664

$2,243,541

40%

Village of Indian Head Park

$893,843

$1,251,538

$357,695

40%

Village of La Grange

$7,609,972

$10,650,163

$3,040,190

40%

Indian Trails Public Library District Wheeling

$3,970,975

$5,547,660

$1,576,685

40%

Evergreen Park School District 124

$16,418,892

$22,923,910

$6,505,019

40%

Norridge School District 80

$6,651,545

$9,280,162

$2,628,617

40%

Lyons Township

$5,942,363

$8,283,284

$2,340,921

39%

Hillside School District 93

$5,394,302

$7,517,446

$2,123,143

39%

Buffalo Grove Park District

$1,837,254

$2,556,066

$718,811

39%

Village of Homewood

$4,601,915

$6,397,390

$1,795,475

39%

Moraine Valley Community College District 524 (Palos Hills)

$28,721,637

$39,868,286

$11,146,649

39%

Atwood Heights School District 125 (Alsip)

$4,291,781

$5,955,434

$1,663,653

39%

Prairie State Community College District 515 (Chicago Heights)

$8,348,349

$11,577,874

$3,229,525

39%

Lagrange Highlands School District 106

$9,916,374

$13,752,192

$3,835,819

39%

Forest River Fire Protection District

$45,916

$63,672

$17,755

39%

Township High School District 214 (Arlington Heights)

$170,103,357

$235,848,038

$65,744,681

39%

558 TAXING DISTRICTS

% Change – Tax Levy Extension – Tax Years 2006 – 2019

Denotes Home Rule authority; voter approval NOT required to raise taxes.

Ctrl-F to search

October 2020 "The Pappas Study" 20-Year Property Tax History 60

Taxing District 2006 2019 $ Change % Change

Sunnybrook School District 171 (Lansing)

$5,479,791

$7,594,138

$2,114,346

39%

Wheeling Park District

$6,189,833

$8,577,072

$2,387,240

39%

Kenilworth Library District

$236,116

$327,067

$90,952

39%

Worth Park District

$611,037

$845,425

$234,388

38%

Des Plaines Park District

$6,373,664

$8,816,486

$2,442,823

38%

Proviso Township

$6,977,150

$9,649,128

$2,671,978

38%

Berkeley School District 87

$15,645,506

$21,633,369

$5,987,863

38%

West Harvey-Dixmoor Public School District 147

$4,105,337

$5,668,114