APPRAISAL REPORT FOR

3010 N Mannheim Road,

Franklin Park,

Cook County, Illinois, 60131

AS OF

January 24, 2024

PREPARED FOR

Mr. Nicholas Walny

Director of Community

Development

Village of Franklin Park

9500 W Belmont Ave

Franklin Park, IL 60131

PREPARED BY

Praedium Valuation Group

1658 N Milwaukee Ave., Ste B,

PMB 5460

Chicago, Illinois 60647

File Name: 22379

www.pvgchicago.com

1658 N. Milwaukee Ave,

Ste B PMB 5460

Chicago

Illinois

, 606

47

www.pvgchicago.com

773-665-8361

Fax: 773-665-8342

February 6, 2024

Mr. Nicholas Walny

Director of Community Development

Village of Franklin Park

9500 W Belmont Ave

Franklin Park, IL 60131

Re:

Appraisal Report

3010 N Mannheim Road, Franklin Park,

Cook County, Illinois, 60131

File Name:

22379

Dear Mr. Walny:

At your request, we have prepared an appraisal for the above referenced property, which is

briefly described as follows:

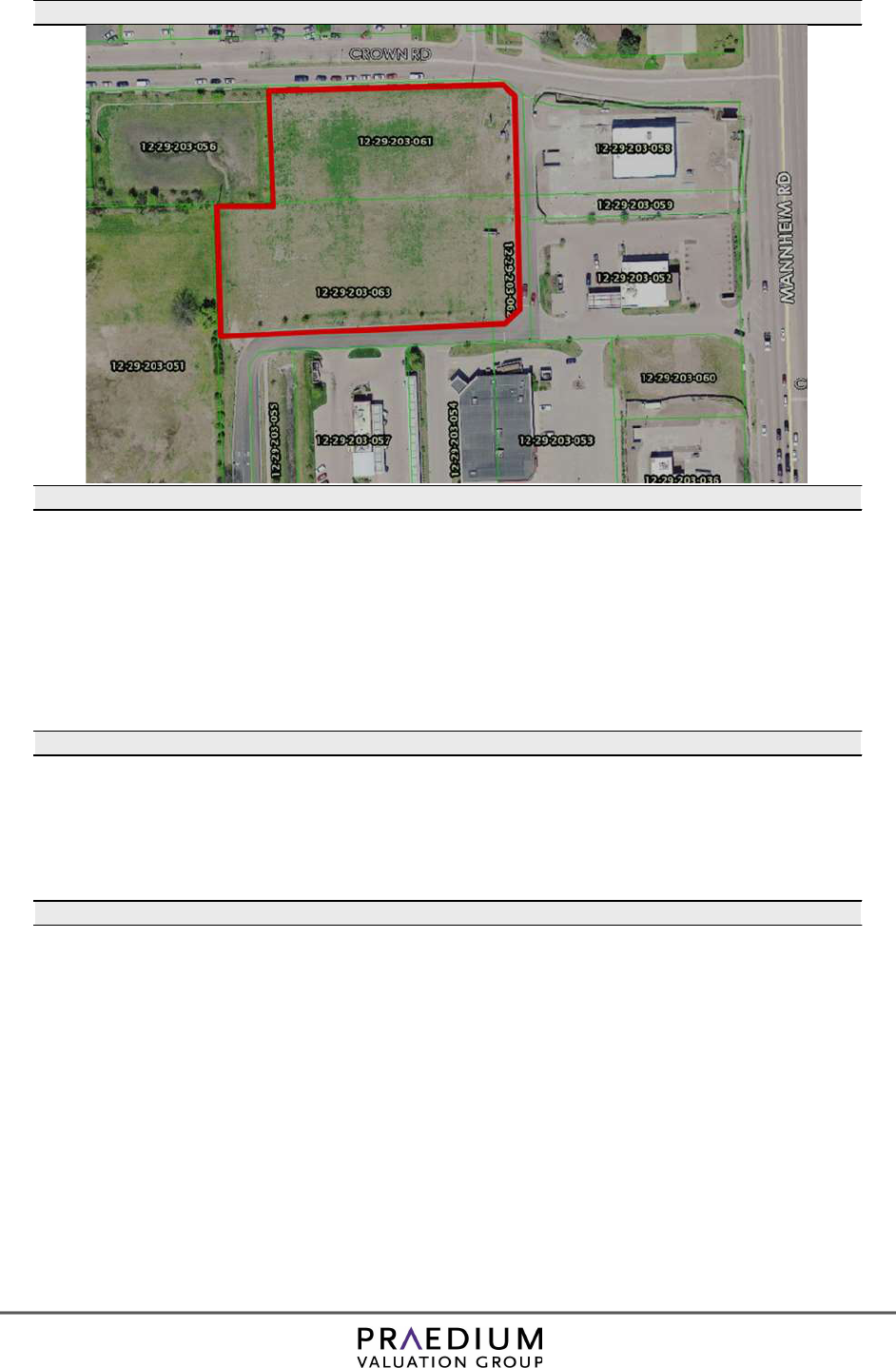

The subject property is a dual corner, rectangular vacant site comprising approximately 56,480

square feet (sf) of land along a primary commercial thoroughfare in the Village of Franklin Park.

It is zoned C-3. The site had previously been improved with a Super 8 motel, which was

demolished in 2011 subsequent to a fire. The subject property and valuation methodology are

further detailed in the appropriate sections of this report.

Please reference page 11 of this report for important information regarding the scope of research

and analysis for this appraisal, including property identification, inspection, highest and best use

analysis and valuation methodology.

We certify that we have no present or contemplated future interest in the property beyond this

estimate of value. We have not performed any prior services regarding the subject within the

three years immediately preceding the appraisal date.

www.pvgchicago.com

Mr. Walny

Village of Franklin Park

February 6, 2024

Page 2

Your attention is directed to the Limiting Conditions and Assumptions section of this report

(page 47). Acceptance of this report constitutes an agreement with these conditions and

assumptions. In particular, we note the following:

Hypothetical Conditions:

There are no hypothetical conditions for this appraisal.

Extraordinary Assumptions:

There are no extraordinary assumptions for this appraisal.

Based on the appraisal described in the accompanying report, subject to the Limiting Conditions

and Assumptions, Extraordinary Assumptions and Hypothetical Conditions (if any), we have

made the following value conclusions:

Current Market Value of the Subject Property, As Is:

The market value of the fee simple estate of the property, as is, as of January 24, 2024, is:

$540,000

Five Hundred Forty Thousand Dollars

The market exposure time preceding January 24, 2024 would have been 6 to 12 months and the

estimated marketing period

as of January 24, 2024 is 6 to 12 months.

This report was prepared in conformance with USPAP appraisal guidelines as well as those of

the Appraisal Institute.

Respectfully submitted,

Praedium Valuation Group

Mary Wagner, MAI

IL Certified General Real Estate

Appraiser

License No. 553-001102

License Expires:

September 30, 2025

www.pvgchicago.com

TABLE OF CONTENTS

Aerial View ..................................................................................................................................... 1

Subject Photographs........................................................................................................................ 2

Summary of Important Facts and Conclusions ............................................................................... 7

Key Analysis Points ........................................................................................................................ 9

Scope of Work .............................................................................................................................. 11

Market Area Analysis ................................................................................................................... 13

Location Map – Metro Area ..................................................................................................... 13

Market Area Location ............................................................................................................... 14

Community Map ....................................................................................................................... 15

Property Description ................................................................................................................. 19

Site ............................................................................................................................................ 19

Sidwell Map .............................................................................................................................. 21

Flood Map ................................................................................................................................. 22

Assessment and Taxes .................................................................................................................. 24

Zoning ........................................................................................................................................... 25

Zoning Map ................................................................................................................................... 26

Highest and Best Use .................................................................................................................... 27

Highest and Best Use – “As If Vacant” .................................................................................... 27

Highest and Best Use – “As Improved” ................................................................................... 28

Valuation Methodology ................................................................................................................ 29

Analyses Applied ...................................................................................................................... 30

Sales Comparison Approach ......................................................................................................... 31

Land Comparables .................................................................................................................... 31

Comparables Map ..................................................................................................................... 38

Analysis Grid ............................................................................................................................ 38

Comparable Land Sale Adjustments ......................................................................................... 40

Conclusion – Land Valuation ................................................................................................... 44

Certification .................................................................................................................................. 45

Addenda ........................................................................................................................................ 46

Limiting Conditions and Assumptions ..................................................................................... 47

Legal Description ...................................................................................................................... 49

Environmental Phase I Site Assessment Executive Summary ................................................. 50

Appraiser Qualifications ........................................................................................................... 52

Engagement Letter .................................................................................................................... 54

www.pvgchicago.com 1

AERIAL VIEW

Source: Cook County GIS

Note: Subject outlined in red above

www.pvgchicago.com 2

SUBJECT PHOTOGRAPHS

LOOKING WEST AT SUBJECT FROM MANNHEIM ROAD

LOOKING NORTHWEST AT SUBJECT SITE

www.pvgchicago.com 3

LOOKING NORTHEAST AT SUBJECT SITE

LOOKING SOUTH AT SUBJECT SITE

www.pvgchicago.com 4

LOOKING SOUTHEAST AT SUBJECT SITE

VIEW NORTH ON MANNHEIM ROAD

www.pvgchicago.com 5

VIEW WEST ON SCHILLER BOULEVARD

VIEW EAST ON CENTER AVENUE

www.pvgchicago.com 6

VIEW WEST ON CENTER AVENUE

www.pvgchicago.com 7

SUMMARY OF IMPORTANT FACTS AND CONCLUSIONS

PROPERTY IDENTIFICATION

Address:

3010 N Mannheim Road, Franklin Park,

Cook

County,

Illinois

,

60131

Description: The subject property is a dual corner, rectangular vacant site

comprising approximately 56,480 square feet (sf) of land along a

primary commercial thoroughfare in the Village of Franklin Park.

It is zoned C-3. The site had previously been improved with a

Super 8 motel, which was demolished in 2011 subsequent to a

fire. The subject property and valuation methodology are further

detailed in the appropriate sections of this report.

Tax Identification:

12

-

29

-

212

-

002,

-

003,

-

008,

-

009 and

-

013

Census Tract:

8117.01

Owner:

Village

of Franklin Park

Sale & Listing History

And Pending Contract:

The subject property was acquired by the Village of Franklin Park

via a Warranty Deed in Lieu of Foreclosure due to a demolition

lien against the grantor, ANZ Enterprises, Inc. According to the

deed (doc. #1425134073) the amount of the lien was $541,084.0

3.

This represents the expenditures by the Village to demolish the

former hotel that was on the property. There was a major fire at

the hotel in 2011 which caused significant damage and the

building required demolition. The former owner deeded the

proper

ty to the village instead of paying for the cost of demolition.

The village subsequently had a contract with a developer for

$575,000 to purchase the site and construct a strip center, but the

deal fell through as the contract purchaser was not able to o

btain a

construction loan. The TIF that used to exist for the subject has

since expired. The village is currently negotiating with another

potential purchaser.

SCOPE OF WORK SUMMARY

Report Type:

Appraisal Report

Date of Report:

February

6, 2024

Type of Value:

Market Value

Property Rights

Appraised:

Fee Simple

www.pvgchicago.com 8

Intended Use: The intended use is to establish market value to be used in

determining a fair selling price.

Intended Users: The intended user is our client, Mr. Nicholas Walny of the

Village of Franklin Park.

PROPERTY CHARACTERISTICS

Land:

Land Summary

Parcel ID

Gross Land

Area (Acres)

Gross Land

Area (Sq Ft)

Usable Land

Area (Sq Ft) Topography Shape

12-29-212-002, -003, -

008, -009, -013

1.30 56,480 56,480 Slopes up slightly

to the west

Rectangular

Zoning:

C

-

3

,

General Commercial District

Highest and Best Use

of the Site:

For a build-to-suit commercial development in accordance

with existing zoning.

Highest and Best Use

as Improved:

The subject property is a vacant site. Therefore, a Highest &

Best Use 'as improved' analysis is not applicable.

Hypothetical Conditions: There are no hypothetical conditions for this appraisal.

Extraordinary Assumptions:

There are no extraordinary assumptions for this appraisal.

VALUE CONCLUSION

Reconciled Value:

Premise:

As Is

Value Type:

Market Value

Property Rights:

Fee Simple

Effective Date:

January 24, 2024

Value Conclusion:

$540,000

www.pvgchicago.com 9

KEY ANALYSIS POINTS

The subject property consists of rectangular, dual corner, vacant site having 56,480 square feet of

land. The property is zoned C-3, General Commercial District. The site has 200 feet of frontage

on the west side of Mannheim Road, and roughly 282.4 feet of frontage on the south side of Center

Avenue and the north side of Schiller Boulevard. According to IDOT, 27,100 vehicles per day

travel along Mannheim Road, providing good exposure. There are two curb cuts onto the site from

Mannheim Road, though they have been blocked by concrete barricades. The site is currently

vacant and grass covered.

Improvements along Mannheim Road include a variety of commercial properties including

neighborhood and community shopping centers, single tenant commercial buildings, offices, auto

repair, gas stations, restaurants, hotels and motels. There are also some light industrial buildings,

particularly to the north, and township offices further to the south. There are shopping centers on

the northwest and southeast corners of Grand Avenue and Mannheim Road, two blocks south of

the subject. Rio Valley at the southeast corner is anchored by Rio Valley Supermarket, along with

a mix of local and national tenants. Wendy’s and White Castle are on outlots. The northwest

corner is improved as Franklin Marketplace which has tenants including Starbucks, Sonic, Chase,

Jersey Mikes, AT&T, T-Mobile and Pizza Hut. A new 110-room Wyndam Garden hotel is

currently under construction in Franklin Marketplace and will serve as the anchor for the shopping

center. There had been a free-standing CVS in the subdivision but the store has gone dark. The

Starbucks is at the northwest corner of Grand Avenue and Mannheim Road and is technically not

a part of the subdivision. An elementary school and a house of worship are located at the southwest

corner of Mannheim Road and Grand Avenue, and a gas station is located on the northeast corner.

The area to the west of the subject site contains older and modest residential (single family and

low-rise multifamily) and some industrial improvements.

The subject location offers good access to the area’s major thoroughfares and expressways. Access

to Interstate 290 and Interstate 294 from North Avenue is located approximately 3 miles southwest

of the subject. Interstate 294 can also be accessed approximately 2 miles north of the subject just

east of Mannheim Road. These expressways provide quick access to O’Hare International Airport,

the southern boundary of which is 1.5 miles north of the subject. Public bus service is available

along Mannheim Road. Metra Rail serves the community with two lines and two stations. The

Milwaukee District West line has a depot at 3148 Rose Street while the North Central Line has a

station at 9280 Belmont.

Following the last recession, there was little to no development of any type in the Village for a few

years. The industrial market began to recover first locally and there have been several large

industrial projects in the village. In 2016 / 2017, two new commercial strip center buildings were

constructed in the Franklin Marketplace, and the aforementioned Wyndam Garden hotel is

currently under construction. A McDonald’s, a car wash and a Quik Trip gas station were recently

approved for commercial sites in the village. Many commercial and industrial zoned sites in the

village are located within Enterprise Zones and TIF zones, which are an incentive for new

development. The subject site had been within a TIF district, but the TIF expired in 2022.

www.pvgchicago.com 10

Subject Property History

The subject property was acquired by the Village of Franklin Park via a Warranty Deed in Lieu

of Foreclosure due to a demolition lien against the grantor, ANZ Enterprises, Inc. According to

the deed (doc. #1425134073) the amount of the lien was $541,084.03. This represents the

expenditures by the Village to demolish the former hotel that was on the property. There was a

major fire at the hotel in 2011 which caused significant damage and the building required

demolition. The former owner deeded the property to the village instead of paying for the cost of

demolition. The village subsequently had a contract with a developer for $575,000 to purchase

the site and construct a strip center, but the deal fell through as the contract purchaser was not

able to obtain a construction loan. The TIF that used to exist for the subject has since expired.

The village is currently negotiating with another potential purchaser.

The last occupancy of the subject property was as a Super 8 motel operated by ANZ Enterprises.

The Village revoked their license for multiple code violations in 2009. In August of 2011, the

building was destroyed in a major fire which was later determined to be arson. The village

ordered the demolition of the building and the former owner was required to pay for it. A while

after the site was cleared and sodded, the village erected a sign on the property offering it for

sale, with the price subject to negotiation. It was not listed with a realtor or on the MLS. The

village is currently in negotiations with an interested party after a prior contract fell through.

The client provided a Phase I Environmental Site Assessment report for a prior appraisal and the

report concluded that there was no evidence of recognized environmental conditions based on

the limited assessment. Additionally, the client provided a report of findings from a limited soil

bearing analysis of the site which concluded that the site has “rubberized or intact elements of

previous structures” which prevented a thorough analysis of the soil. Reportedly, the former

hotel on the subject site had a subsurface swimming pool, and that area may have been filled

with debris from the fire during the clean-up process. The area was then covered with soil and

sod and the pool remained buried underground and filled with debris. The village has since

excavated, cleared and refilled the site, and it is reported to be construction ready.

www.pvgchicago.com 11

SCOPE OF WORK

According to the Uniform Standards of Professional Appraisal Practice, it is the appraiser’s

responsibility to develop and report a scope of work that results in credible results that are

appropriate for the appraisal problem and intended user. Therefore, the appraiser must identify

and consider:

● the client and intended users;

● the intended use of the report;

● the type and definition of value;

● the effective date of value;

● assignment conditions;

● typical client expectations; and

● typical appraisal work by peers for similar assignments.

This appraisal is prepared for Mr. Nicholas Walny, at Village of Franklin Park. The problem to

be solved is to estimate the current market value of the subject property, as is.

The definition of market value used in this appraisal is found in The Dictionary of Real Estate

Appraisal, 6

th

edition (Chicago: Appraisal Institute, 2015), and the same definition can also can

be found in the Code of Federal Regulations; “12 CFR, part 34, subpart C-Appraisal 34.42 (g).

The most probable price which a property should bring in a competitive and open

market under all conditions requisite to a fair sale, the buyer and seller each acting

prudently and knowledgeably, and assuming the price is not affected by undue

stimulus. Implicit in this definition is the consummation of a sale as of a specified date

and the passing of title from seller to buyer under conditions whereby:

Buyer and seller are typically motivated;

Both parties are well informed or well advised, and acting in what they consider their

best interests;

A reasonable time is allowed for exposure in the open market;

Payment was made in cash in U.S. dollars or in terms of financial arrangements

comparable thereto; and

The price represents the normal consideration for the property sold, unaffected by

special or creative financing or sales concessions granted by anyone associated with

the sale.

The intended use is to establish market value to be used in determining a fair selling price. This

appraisal is intended for the use of our client, Mr. Nicholas Walny of the Village of Franklin

Park.

www.pvgchicago.com 12

SCOPE OF WORK

Report Type: This is an Appraisal Report as defined by Uniform

Standards of Professional Appraisal Practice under

Standards Rule 2-2(a). This format provides a summary

or description of the appraisal process, subject and

market data and valuation analyses.

Property Identification: The subject has been identified by the Assessor's parcel

numbers. A Plat of Survey was not provided for this

assignment.

Inspection: An observation of the subject property has been made,

and photographs taken.

Market Area and Analysis of

Market Conditions:

An analysis of market conditions has been made. The

appraiser maintains and has access to comprehensive

databases for this market area and has reviewed the

market for sales and listings relevant to this analysis.

Highest and Best Use Analysis:

An as vacant highest and best use analysis for the

subject has been made. Physically possible, legally

permissible and financially feasible uses were

considered, and the maximally productive use was

concluded.

Type of Values: Market Value

Valuation Analyses

Cost Approach:

A cost approach was not applied as the subject is vacant

land and this Approach was not applicable.

Sales Comparison Approach:

A sales comparison approach was developed as there is

adequate data to develop a value estimate and this

approach reflects market behavior for this property

type.

Income Capitalization

Approach:

An income capitalization approach was not developed

as the subject is a vacant land parcel not generating any

income. There is not a demonstrable rental market for

commercial zoned sites in the area and therefore, this

approach was not applicable and has not been

developed for this appraisal.

Hypothetical Conditions:

There are no hypothetical conditions for this appraisal.

Extraordinary Assumptions:

There are no extraordinary assumptions for this

appraisal.

www.pvgchicago.com 13

MARKET AREA ANALYSIS

Location Map – Metro Area

The subject is located in the Village of Franklin Park, approximately 14 miles northwest of

the Loop, 1.5 miles south of the southern boundary of O’Hare Airport, and 12 miles

northwest of Midway Airport.

www.pvgchicago.com 14

Market Area Location

The subject is located in the Village of Franklin Park, approximately 14 miles northwest of the

Loop, four miles south of O’Hare Airport, and 12 miles northwest of Midway Airport. The

major employers in the Chicago market area are as follows:

CHICAGO AREA MAJOR EMPLOYERS 2020

Top Employers – Chicago

Local

Employees

1. U.S. Government 52,357

2. Chicago Public Schools 38,637

3. City of Chicago 30,928

4. Advocate Aurora Health 26,335

5. Cook County 22,074

6. Northwestern Memorial Healthcare 21,999

7. University of Chicago 18,732

8. Walmart Inc. 16,711

9. Amazon.com Inc. 16,610

10. Amita Health 14,282

Source: Crain’s Chicago Business

The nation’s unemployment rate as of November 2023 was 3.7%, according to the Bureau of

Labor Statistics. The Illinois unemployment rate as of November 2023 was 4.7%, and the

Chicago metro area rate was 4.4%.

www.pvgchicago.com 15

Community Map

The subject is located within the Village of Franklin Park, IL, less than one mile south of the

“Mannheim” station along the Metra Rail’s Milwaukee District West Line. The subject has

proximate expressway access just over one mile north to I-294. Bus routes run in proximity to

the subject along Mannheim Road and Grand Avenue. The southern boundary of O’Hare

Airport is approximately 1.5 miles north of the subject.

SUBJECT

www.pvgchicago.com 16

Population Trends

The following chart details household income and population within one-mile, three-mile, and five-

mile radii of the subject property:

The populations within each of the radii cited above are expected to decline modestly between

2023 and 2028 which is consistent with many Chicago suburbs. This population trend is typical

of a market in the stabilization phase of the neighborhood life cycle.

Household Income

2023 median household income within a one-mile radius of the subject property was $71,497

while household incomes were $66,859 and $76,900 for the three-mile and five-mile radii,

respectively. The median income in the subject’s area is below the median for the Metro Area as

a whole which was estimated at $82,900 as of 2022 by the US Census Bureau. Median

household incomes within each of the aforementioned rings of the subject are expected to

increase by between 1.95% to 2.52% per year through 2028.

www.pvgchicago.com 17

Housing Trends

For-Sale Housing

The subject property is located in the Village of Franklin Park. The housing stock consists

primarily of single-family detached housing units, with limited sales of attached and 2-4 unit

properties. Median selling prices over the last three years for these housing types in the subject’s

market area follow.

Median sale prices for detached properties, which make up the majority of the market area, have

increased year-over-year for the past two years on declining volume. The median price for an

attached housing unit increased in 2023 after a decline in 2022. Overall the median price in 2023

exceeds the median in 2021. The median price for two-to-four unit residential properties was down

this past year after having increased in the previous year, however, volume is insufficient to

determine trends. Sales volume for detached housing has declined significantly in the past two

years due to higher interest rates. The median sale price for detached properties in the subject area

is slightly below the median for the Chicago Metro Area as a whole, which was $310,500 as of

year-end 2022. Overall, this area's for-sale residential market is appreciating, but on lower volume.

As interest rates remain elevated, volume is expected to remain low. However, the Fed has signaled

that the rate hike cycle is most likely over and rate cuts may occur later this year, which would

result in an increase in sales volume.

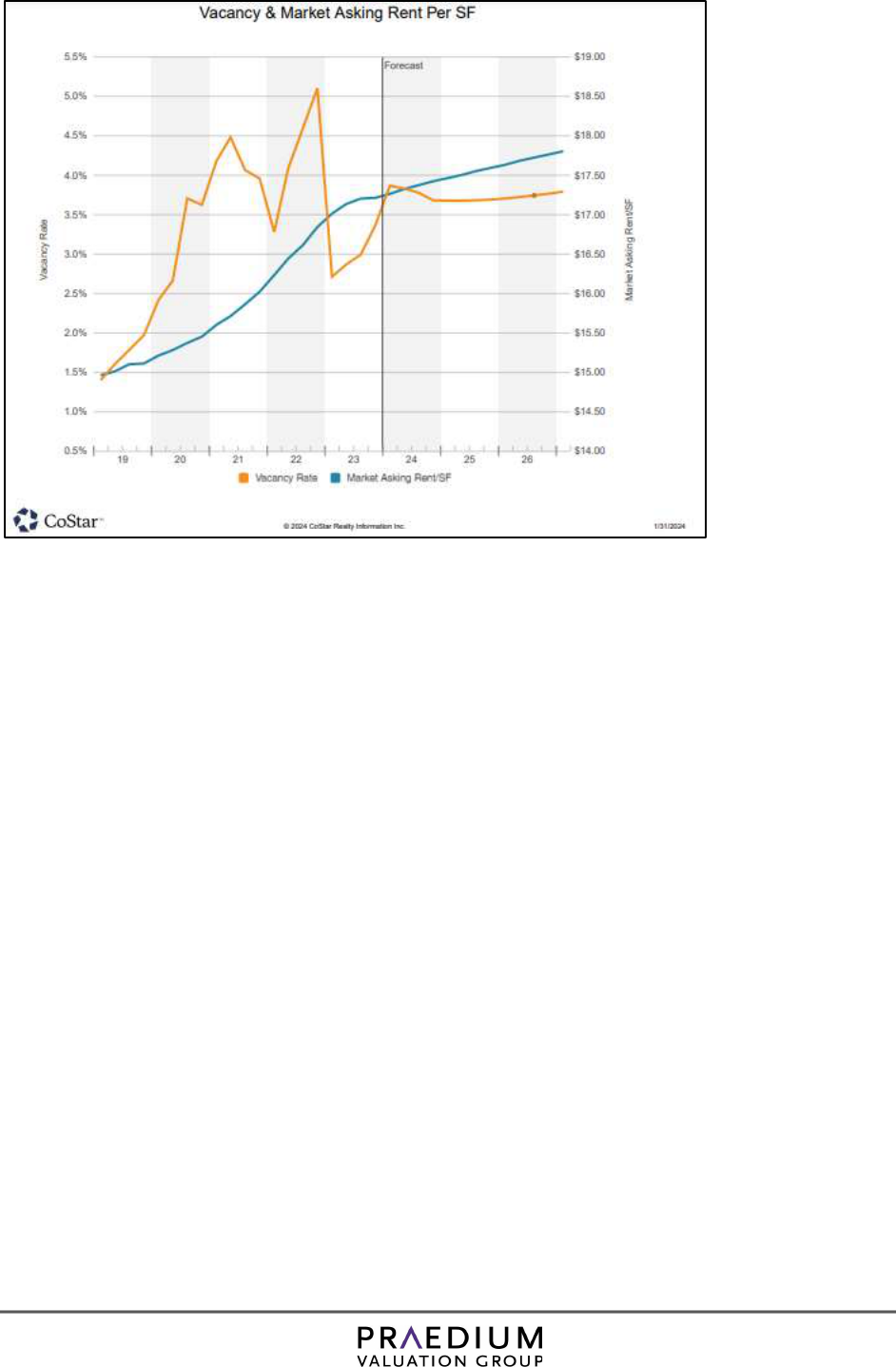

Retail Market

The subject site has commercial zoning and was recently under contract to a developer that planned

a strip center. We have considered data from CoStar pertaining to the retail market within a two-

mile radius of the subject. According to CoStar, the local retail vacancy rate has fluctuated between

1.5% and 5.2% in the last five years and currently stands at 3.9%. Our tour of the area indicated

slightly higher retail vacancy, including the aforementioned CVS, a couple of free-standing

restaurant vacancies and vacancies in area retail centers. CoStar projects that vacancy will remain

near the current level in the coming years. Further, they report that the average asking retail rental

rate has been trending upward in the past five years though at a lower rate in the past year. The

current average asking rental rate is $17.25 psf. It is projected to continue to trend upwards slightly

in the coming years.

Property % Change % Change

Type # Units Med. Price # Units Med. Price # Units Med. Price Prior Year Most Recent Yr.

Detached 202 $274,950 162 $280,000 137 $300,000 1.8% 7.1%

Attached 19 $195,000 12 $190,750 15 $200,000 -2.2% 4.8%

2-4 Unit 7 $385,000 6 $392,500 3 $380,000 1.9% -3.2%

MLS 131: FRANKLIN PARK

1/1/2023 - 12/31/20231/1/2021 - 12/31/2021 1/1/2022 - 12/31/2022

www.pvgchicago.com 18

Although income and occupancy fundamentals are strong for the retail market, sales volume is

down sharply and cap rates are higher due to the substantial increase in interest rates over the past

two years. This has outweighed the benefit of rising rents and low vacancy in most instances. Also,

construction levels are down due to tightened credit and higher financing costs.

Market Area Summary

The market conditions in which a property exists will change over the life of an asset. Generally

a neighborhood passes through four stages, briefly described as follows:

• Growth, during which time the neighborhood is establishing and gaining public favor and

acceptance.

• Stability, which is a static period evidenced by a lack of available land for continued new

development.

• Decline, during which time shifting neighborhood use patterns result in a secondary

location.

• Redevelopment, which results in a removal of or renovation of outdated improvements

and construction of more modern improvements.

Overall, the subject’s location on Mannheim Road in Franklin Park indicates positive demographic

trends and a for-sale housing market trending upward, though on lower sales volume. The local

retail market has good fundamentals, including rising rents and stable occupancy, however,

higher interest rates have resulted in higher cap rates and tightened credit. This has resulted in

lower transaction volume and construction levels. The Fed has signaled that interest rate cuts are

likely in 2024, which should ease credit conditions and increase transaction volume. Locally, the

subject had been in a TIF district which expired in 2022 making the site less appealing for

potential new development. Due to the preceding, the subject’s location remains in the

growth/stabilization phase of the market life cycle.

www.pvgchicago.com 19

Property Description

Site

SITE

Location: The subject property is a vacant, dual corner site located on the

west side of Mannheim Road between Center Avenue (SWC) and

Schiller Boulevard (NWC) in the Village of Franklin Park, IL.

Current Use of the

Property:

Vacant land

Land Summary

Parcel ID

Gross Land

Area (Acres)

Gross Land

Area (Sq Ft)

Usable Land

Area (Sq Ft) Topography Shape

12-29-212-002, -003, -

008, -009, -013

1.30 56,480 56,480 Slopes up slightly

to the west

Rectangular

Site Size: Total: 1.30 acres; 56,480 square feet

Usable: 1.30 acres; 56,480 square feet

The entire subject site is usable.

Shape: Rectangular

Frontage/Access:

The subject property has above average access with frontage as

follows:

Mannheim Road : 200.00 feet

Center Avenue: 282.31 feet

Schiller Blvd: 282.49 feet

The site has an average depth of 282.40 feet. It is a corner lot.

According to IDOT, the average daily traffic count along

Mannheim Road is 27,100 vehicles per day.

Visibility: Unobstructed

Topography: The subject has mostly level topography but slopes up slightly to

the west at the rear of the site. Overall, the site slopes modestly

downward to the southeast. There are no known areas of wetlands

or floodplain.

Soil Conditions: Based on the previous use of the site as a motel property, the soil

conditions at the subject appear to be typical of the region and

adequate to support development.

Utilities:

Electricity: The site is served by public electricity.

Sewer: City sewer

Water:

City

water

www.pvgchicago.com 20

Natural Gas: Nicor or People's Gas

Underground Utilities: The site is serviced by underground

utilities, aside from electric which is overhead on poles.

Adequacy: The subject's utilities are typical and adequate for the

market area.

Site Improvements:

Overhead Street Lights

Concrete Sidewalk

Concrete Curb and Gutter

Flood Zone: The subject is located in an area mapped by the Federal

Emergency Management Agency (FEMA). The subject is located

in FEMA zone X, which is not classified as a special flood hazard

area.

FEMA Map Number: 17031C0386J

FEMA Map Date: August 19, 2008

The subject is not in a special flood hazard area.

Environmental Issues:

According to a Phase I ESA, there are no known adverse

environmental conditions on the subject site. Please reference the

Limiting Conditions and Assumptions.

Encumbrance /

Easements:

Surrounding

Improvements:

There are no known adverse encumbrances or easements. Please

reference Limiting Conditions and Assumptions.

Hotel across Mannheim Road to the east; medspa to the south; auto

related to the north (Ziebart and Auto Zone); low-rise multifamily

to the west

Site Comments: The subject is a 56,480 sf, rectangular, commercial-zoned, dual

corner site located along a primary arterial road. The site has two

curb cuts along Mannheim Road which would provide good

access, however, they have been blocked by concrete barricades.

www.pvgchicago.com 21

Sidwell Map

Subject highlighted above

www.pvgchicago.com 22

Flood Map

www.pvgchicago.com 23

Wetlands Map

Based on a review of the National Wetlands Inventory Maps on the US Fish and Wildlife Service

website, the subject site does not contain any mapped wetlands. These are preliminary maps

based on dated aerial imagery, and are not a final determination. Persons intending to engage in

activities involving modifications within or adjacent to wetland areas should seek the advice of

appropriate federal, state, or local agencies concerning specified agency regulatory programs and

proprietary jurisdictions that may affect such activities.

www.pvgchicago.com 24

ASSESSMENT AND TAXES

Taxing Authority: Cook County

Assessment Year: 2023

Tax Identification:

12-29-212-002, -003, -008, -009 and -013

ASSESSED VALUE

Real estate in Cook County is reassessed every three years. Taxes are payable in arrears in two

installments. The first installment is an estimated bill based on the prior year’s tax rate and

assessed value. The second installment is then adjusted to reflect changes in assessed valuation or

tax rates for that year. Taxes for 2023 will be payable in 2024.

The subject property is owned by the Village of Franklin Park and is therefore tax exempt.

The local property tax rate is 11.832%, which is above average when compared to all

other Cook County municipalities, but similar to or lower than rates in some surrounding suburbs

(Stone Park, Northlake, Melrose Park, Schiller Park). Also, the effective property tax rate in

Franklin Park and surrounding Cook County communities is much higher than the effective tax

rates in nearby communities in DuPage County, a couple of miles west of the subject, which puts

the Cook County municipalities at a disadvantage in attracting new businesses. TIF districts,

enterprise zones and tax incentive classes are some of the available tools to attract new business

despite the real estate tax disadvantage.

www.pvgchicago.com 25

ZONING

The subject is zoned C-3, General Commercial District by the Village of Franklin Park.

Zoning

District:

C-3 General Commercial District

Purpose:

“…to accommodate those commercial activities which may be incompatible

with the predominantly retail uses permitted in other business districts.”

Permitted

Uses:

Public/Civic

:

Conditional only

Commercial:

Auto service stations and sales, medical clinics, recording

studios, wholesale establishments, electrical showrooms,

etc.

Residential: Hotel / motel (conditional), and watchmen’s quarters only

Conditional: Hospitals, hotels, car washes, printing and publishing,

schools, theaters, etc.

Minimum Lot

Size:

3,000 sf

Max. Bldg.

Height:

45 feet

Yard Req.:

Front: 25 ft

Side: 25 ft

Rear: 20 ft

Maximum

Floor-Area-

Ratio (FAR):

3.5:1

Parking

Requirements:

Varies by use. See full Ordinance for complete listing.

Source: Village of

Franklin

Park Zoning Ordinance

www.pvgchicago.com 26

ZONING MAP

The subject is zoned C-3, General Commercial District by the Village of Franklin Park.

Note: The subject is indicated by the blue arrow above

www.pvgchicago.com 27

HIGHEST AND BEST USE

Land is appraised as if vacant and available for development to its Highest and Best Use, and the

appraisal of improvements is based on their actual contribution to the site.

Highest and Best Use may be defined as:

The reasonably probable and legal use of vacant land or improved property, which is

physically possible, appropriately supported, financially feasible, and that results in the

highest value. The four criteria the highest and best use must meet are legal permissibility,

physical possibility, financial feasibility, and maximum profitability.

Highest and Best Use – “As If Vacant”

1. Legally Permissible: Private restrictions, zoning, building codes and other regulations

establish use that are legally permitted. As indicated in the zoning section of this report,

the subject is zoned C-3. The current zoning allows for a variety of commercial uses.

Residential units are not allowed other than hotel / motel rooms (as a conditional use) and

watchmen’s quarters. There are no known deed restrictions preventing development of

the site in accordance with the existing C-3 zoning requirements.

2. Physically Possible: Factors such as the size, shape, terrain, accessibility of land and the

risk of natural disasters such as floods or earthquakes affect the use to which vacant land

can be used. In the case of the subject, the site is adequate in terms of size, frontage, terrain

and depth to accommodate most types of developments permitted by the subject’s C-3

zoning.

3. Financially Feasible: Based on surrounding land uses and zoning, commercial

development is the probable use. The majority of the surrounding uses along Mannheim

Road are single-story commercial buildings, though there are also some light industrial and

a couple of hotel / motel properties. Our review of the area indicated that there is a limited

amount of vacant land inventory in the area. Although retail rental rates have been

increasing and vacancy is near a frictional level, due to higher construction costs and

interest rates, most developers are holding off on speculative commercial construction at

this time. Therefore, financially feasible uses include a commercial build-to-suit or to hold

for future development.

4. Maximally Productive: Of the financially feasible uses, the one creating the highest present

land value is the most profitable use of the site as if vacant. Under current economic

conditions, the most probable use would be a build-to-suit retail development.

5. The most probable buyer of the subject would be an investor or developer for land

development purposes.

6. In conclusion, the Highest and Best Use of the site, as if vacant and ready for development,

is: For a build-to-suit commercial development in accordance with existing zoning.

www.pvgchicago.com 28

Highest and Best Use – “As Improved”

The subject property is a vacant site. Therefore, a Highest & Best Use 'as improved' analysis is

not applicable.

www.pvgchicago.com 29

VALUATION METHODOLOGY

Three basic Approaches may be used to arrive at an estimate of market value. They are:

1. The Cost Approach

2. The Income Capitalization Approach

3. The Sales Comparison Approach

Cost Approach

The Cost Approach is based on the principle that a prudent buyer would not pay more for a property

than the cost of obtaining a similar site and having similar improvements constructed on the site.

The land and the improvements are separately valued. The land is valued based on sales of

comparable sites, adjusting their sale prices for differences indicated by the market. The

replacement cost new of the improvements is estimated, and then adjusted for depreciation. The

depreciated value of the improvements is then added to the value of the land to arrive at an estimate

of value for the subject by the Cost Approach. The Cost Approach is summarized as follows:

Cost New

- Depreciation

+ Land Value

= Value

Sales Comparison Approach

The Sales Comparison Approach is based on the principle that a prudent buyer would not pay more

to purchase a property than it would cost to purchase a similar alternative property. The first step

in this Approach is to collect sale prices (or asking prices) for properties that are comparable to

the subject. These sales are then analyzed using common units of comparison, such as price per

square foot, price per dwelling unit, or price per acre, depending on the property type. The unit

prices that are derived are then adjusted for differences between the comparable sales and the

subject. An adjusted unit price is applied to the subject, resulting in an estimate of value by the

Sales Comparison Approach.

Income Capitalization Approach

The Income Capitalization Approach is based on the principle that a prudent buyer will pay no

more for an income-producing property than the value of the projected income capitalized (or

discounted) to a current lump-sum value at a given rate of return. This Approach forecasts a gross

income for the subject, which is reduced to a net income by deducting a vacancy allowance and

reasonable expenses. The net income is then capitalized (or discounted) based on a rate that is

required in the market, taking into account the perceived risks and benefits that would apply to

owning the subject property. The capitalization process results in an estimate of value by the

Income Capitalization Approach.

Final Reconciliation

The appraisal process concludes with the final reconciliation of the values derived from the

Approaches applied for a single estimate of market value. Different properties require different

means of analysis and lend themselves to one Approach over the others.

www.pvgchicago.com 30

Analyses Applied

A cost analysis was considered and was not developed because the subject is vacant land and this

Approach was not applicable.

A sales comparison analysis was considered and was developed because there is adequate data

to develop a value estimate and this approach reflects market behavior for this property type.

An income analysis was considered and was not developed because the subject is a vacant land

parcel not generating any income. There is not a demonstrable rental market for commercial zoned

sites in the area and therefore, this approach was not applicable and has not been developed for

this appraisal.

www.pvgchicago.com 31

SALES COMPARISON APPROACH

Land Valuation

The Sales Comparison Approach is based on the premise that a buyer would pay no more for a

specific property than the cost of obtaining a property with the same quality, utility, and

perceived benefits of ownership. It is based on the principles of supply and demand, balance,

substitution and externalities. The following steps describe the applied process of the Sales

Comparison Approach.

The market in which the subject property competes is investigated; comparable sales,

contracts for sale and current offerings are reviewed.

The most pertinent data is further analyzed and the quality of the transaction is

determined.

The most meaningful unit of value for the subject property is determined.

Each comparable sale is analyzed and where appropriate, adjusted to equate with the

subject property.

The value indication of each comparable sale is analyzed and the data reconciled for a

final indication of value via the Sales Comparison Approach.

Land Comparables

We have researched several land sales for this analysis, and the following five were most relevant

for this appraisal. The comparables are documented on the following pages followed by a location

map and analysis grid. All sales have been researched through numerous sources, inspected and

verified by a party to the transaction and/or by public record. The following data is considered the

most pertinent available.

www.pvgchicago.com 32

Comparable Sales Summary Table

Comp Address Date Land SF Zoning

Comp City Price Price Per

Land SF

Road Frontage

Subje ct

3010 N Mannheim Road N/A 56,480 C-3

Subje ct

Franklin Park N/A N/A Dual Corner

1

3700 N Mannheim Road 2/11/2022 269,645 C-3

Franklin Park $1,060,000 $3.93 Signalized corner

2

800 N River Rd 10/18/2022 28,837 B-4, Corridor Commercial

Mount Prospect $295,000 $10.23 Sig., Corner; T-intersctn.

3

2506-2516 N Mannheim Rd. 12/22/2022 88,019 C-4, Cook County

Franklin Park $1,025,000 $11.65 Corner

4

Lot C Franklin Marketplace 11/29/2022 120,226 C-3

Franklin Park $862,861 $7.18 Corner within subdiv.

5

800 W Irving Park Rd. 12/1/2021 72,300 C-2

Bensenville $1,100,000 $15.21 Corner

www.pvgchicago.com 33

ID

10062

Date

2/11/2022

Address

3700 N Mannheim Road

Price

$1,060,000

City

Franklin Park

Price Per Land SF

$3.93

State

IL

Financing

Conventional

Tax ID

12-20-202-007 & -039

Property Rights

Fee Simple

Grantor

3700 Mannheim Arena

Days on Market

--

Grantee

Quicktrip Corp.

Verification

Book/Page or Reference

2204622017

Conditions of Sale

Normal

Acres

6.2

Topography

Primarily level

Land SF

269,645

Zoning

C-3

Road Frontage

Signalized corner

Flood Zone

No

Shape

Irregular - Avg.

Encumbrance or

Overhead tollway &

Utilities

At site

Environmental Issues

None known

Broker, CoStar, Deed

Transaction

Site

Comments

According to Jack Reardon at NAI Hiffman, broker, this is an irregular-shaped site located at the southwest

corner of Mannheim Road and Waveland Avenue, a signalized intersection. It has additional frontage on

Front Avenue and Waveland Avenue. The Tri-State Tollway overpass runs above approximately 47,500 sf

of the south portion of the property, limiting the use of this area to parking or perhaps storage if approved

by the village. The broker reported that the village was very particular as to what they would allow on the

site, and prohibited warehouse and distribution uses. This adversely impacted the price. Also, the buyer

would be required to complete infrastructure upgrades, including some offsite work. The buyer plans a

Quik Trip fueling station and convenience store, which required special use approval. The site has some

visibility from I-294, which is elevated in this area.

Land Comparable 1

www.pvgchicago.com 34

ID

12565

Date

10/18/2022

Address

800 N River Rd

Price

$295,000

City

Mount Prospect

Price Per Land SF

$10.23

State

IL

Financing

Conventional

Tax ID

03-25-400-018

Property Rights

Fee Simple

Grantor

JLK Enterprises LLC

Days on Market

119

Grantee

Basit Trading LLC

Verification

CoStar, CCC, Broker

Book/Page or Reference

2229410050

Conditions of Sale

Normal

Acres

0.7

Topography

Level

Land SF

28,837

Zoning

B-4, Corridor Commercial

Road Frontage

Sig., Corner; T-intersctn.

Flood Zone

X

Shape

Rectangular

Encumbrance or

None Known

Utilities

City

Environmental Issues

None Known

Land Comparable 2

Comments

Site

Transaction

This was the sale of a 28,837 sf parcel that was improved with a car wash at the time of sale. It has been

vacant since the sale. The broker was not sure what the buyer planned to do, but he said that the village

was open to residential use, even though it is zoned B-4, Corridor Commercial District which does not permit

residential. Broker said the property was clean with no environmental issues.

www.pvgchicago.com 35

ID

12682

Date

12/22/2022

Address

2506-2516 N Mannheim

Price

$1,025,000

City

Franklin Park

Price Per Land SF

$11.65

State

IL

Financing

Cash

Tax ID

12-29-418-010, -011, -021

& -022

Property Rights

Fee Simple

Grantor

Neveda Property LLC

Days on Market

700

Grantee

Leyden Township

Verification

Broker, MLS, CoStar,

Book/Page or Reference

2300625157

Conditions of Sale

Assemblage

Acres

2.0

Topography

Slight slopes

Land SF

88,019

Zoning

C-4, Cook County

Road Frontage

Corner

Flood Zone

No SFHA

Shape

Rectangular

Encumbrance or

None known

Utilities

At site

Environmental Issues

None per Phase I

Land Comparable 3

The sale property is a rectangular, corner site located in an unincorporated area of Cook County, but has a

Franklin Park mailing address. According to the listing agent, Ben Cocogliato of RCI Realty, former

improvements on the site had been demolished at the time of listing.

The site had a clear Phase I environmental. The site had been on the market for nearly two years prior to

the contract with an original list of $1,300,000, which was eventually reduced to $1,150,000. The buyer was

Leyden Township and they also own adjacent land. Their plans are for a senior center on the site. The

broker thought that the price was reflective of market value.

Site

Comments

Transaction

www.pvgchicago.com 36

ID

12690

Date

11/29/2022

Address

Lot C Franklin

Marketplace

Price

$862,861

City

Franklin Park

Price Per Land SF

$7.18

State

IL

Financing

Conventional

Tax ID

12-29-203-069 to -071

Property Rights

Fee Simple

Grantor

Village of Franklin Park

Days on Market

--

Grantee

WG Hotels LLC / John

Verification

Seller, Appraisal

Book/Page or Reference

2234208087

Acres

2.8

Topography

Mostly level

Land SF

120,226

Zoning

C-3

Road Frontage

Corner within subdiv.

Flood Zone

Minimal

Shape

Nearly rectangular

Encumbrance or

VIllage RDA, Subdiv.

Utilities

At site

Environmental Issues

None known

Transaction

Land Comparable 4

Site

Comments

The sale property is a vacant lot located along the south side of Crown Drive, about 315 feet west of

Mannheim Road and 300 feet north of Grand Avenue within Franklin Marketplace, a commercial

subdivision. The site is nearly rectangular in shape and has approximately 325 feet of frontage on the

south side of Crown Road. Franklin Marketplace has curb cuts on Mannheim Road, Grand Avenue and

Crown Road, and there are cross access easements throughout the development. The buyer is currently

developing a Wyndham Garden hotel on the site. A small portion of the site along the north lot line is in a

special flood hazard area. A new plat was created for the sale site and the new PINs do not yet show on

most county sites.

www.pvgchicago.com 37

ID

12683

Date

12/1/2021

Address

800 W Irving Park Rd.

Price

$1,100,000

City

Bensenville

Price Per Land SF

$15.21

State

IL

Financing

Village Funds

Tax ID

03-14-118-001

Property Rights

Fee Simple

Grantor

Mason Grave Realty LLC

Days on Market

--

Grantee

Village of Bensenville

Verification

Buyer, CoStar

Book/Page or Reference

R2022-05331

Acres

1.7

Topography

Primarily level

Land SF

72,300

Zoning

C-2

Road Frontage

Corner

Flood Zone

No SFHA

Shape

Rectangular

Encumbrance or

None known

Utilities

At site

Environmental Issues

None known

According to Kurtis Pozsgay with the Community & Economic Development Department of the Village of

Bensenville, the sale property is a rectangular corner site that was improved with an older, vacant banquet

hall having approximately 15,488 sf. It was primarily marketed as a redevelopment site and that was the

village's intended use. The property was bank owned at the time of sale, but the purchaser indicated that it

was widely marketed and they believe the price they paid was near market, but they may have overpaid

slightly. They had an end user for a mixed-use development but the deal fell through as interest rates

increased substantially. The improvements remain on the land, but the village has since secured a

development partner for a mixed-use retail and residential development.

Comments

Site

Transaction

Land Comparable 5

www.pvgchicago.com 38

Comparables Map

Analysis Grid

The above sales have been analyzed and compared with the subject property. We have

considered adjustments in the areas of:

Property Rights Sold

Financing

Conditions of Sale

Market Trends

Location

Physical Characteristics

On the following page is a sales comparison grid displaying the subject property, the

comparables, and the adjustments applied.

www.pvgchicago.com 39

Address

City

State

Date

Price

Land SF

Unit Price per SF

Property Rights

Fee Simple

0.0%

Fee Simple

0.0% Fee Simple 0.0%

Fee Simple

0.0% Fee Simple 0.0%

Financing

Conventional

0.0%

Conventional

0.0% Cash 0.0%

Conventional

0.0%

Village Funds

0.0%

Conditions of Sale Normal 0.0% Normal 0.0% Assemblage -3.0% Village

owned

land

0.0% REO,

Village

redevl.

-3.0%

Expenditures After Sale

Market T rends T hrough

1/24/2024

Location

% Adjustment

$ Adjustment

Land SF

% Adjustment

$ Adjustment

Shape

% Adjustment

$ Adjustment

Zoning

% Adjustment

$ Adjustment

Site Improvements

Pad in shop. Cntr.

% Adjustment

$ Adjustment

Road Frontage

% Adjustment

$ Adjustment

Other

% Adjustment

$ Adjustment

Net Adjustments

Gross Adjustments

Utilites at site

Adjusted Land SF Unit Price

Adjusted Price Per Unit

Adjusted Unit Price

50.0% -17.0%

$13.00$10.52

-2.0%

18.0%

0.0%

50.0% 10.0%

$5.88 $7.89$11.07

-2.0%

5.0% -5.0%

-20.0%

C-2

3.0%

Corner

$0.00

0.0%

Rectangular

$0.00

$0.47

None

-$3.13

Utilites at site

0.0%

$0.00

3.0%

None

-$0.81

$0.00

$0.24$0.33

$0.00

3.0%

0%

None

Corner

0%

-2.0%

$0.32

3.0%0.0%

$0.00

None

0%

Sig., Corner; T-

intersctn.

Utilites at site

Dual corner

$0.59

Portion under

interstate

None

Signalized corner

15%

$0.00

56,480

5.0%

$0.20

C-3

Rectangular

269,645

10.0%

C-3 B-4, Corridor

Commercial

28,837

-$0.54

-5.0%

$0.54

-$0.54

0.0%

$3.92

Similar

$10.96

$21,000.00

7.1%

$4.13

-5.0%

Inferior

-2.0%

$10.74

3010 N Mannheim

Road

IL

$11.30

Typical

Franklin Park Mount Prospect

ILIllinois

$11.65

88,019

Conventional

5.0% 0.0%

Fee Simple

$53,000

Transaction Adjustments

Franklin Park

Land Analysis Grid

Comp 1

56,480

N/A $3.93

IL

3700 N Mannheim

Road

800 N River Rd

Franklin Park

28,837

Comp 2

$10.23

Comp 4

Franklin Park

Comp 5

2506-2516 N

Mannheim Rd.

Comp 3

269,645

12/22/2022

$0.78

0.0%

$0.00

Superior

20.0%

Irregular - Avg.

$0.00

$0.39

Requires

infrstructure & off-

site work

0.0%

Utilites, paved

parking

$1,025,000$1,060,000

-$0.55$0.00

0.0%

Nearly rectangular

88,019

$11.07

$0.00$0.00

0.0%

2.0%

$0.00

Rectangular

$0.00

$0.22

-5.0%

$0.00

-10.0%

Rectangular

0.0%

$0.00

C-3

$0.00

0.0%

C-4, Cook County

$0.40

0.0%0.0%

IL

Lot C Franklin

Marketplace

$8.22

-2.0%

$1,100,000

Bensenville

$862,861

12/1/2021

IL

11/29/2022

800 W Irving Park Rd.

Corner within

subdiv.

0%

$0.00

$0.00

72,300

$125,000.00

-5.0%

72,300

0.0%

$15.66

0.0%

11.4%

$0.00

0.0%

$0.00

120,226

Similar

$15.21

$16.49

$7.18

120,226

23.0%

N/A

10/18/20221/24/2024 2/11/2022

$295,000

18.0%

14.5%

5.0%

$8.05

Similar

www.pvgchicago.com 40

Comparable Land Sale Adjustments

Property Rights

The subject is valued on a fee simple basis.

It appears that all of the comparables sold on a fee simple basis; therefore, no property rights

adjustments are required.

Financing

The availability of financing affects both the supply of real estate and property values. In most

cases, the cost and availability of financing have an inverse relationship; high interest rates and

other costs usually are accompanied by a decline in the demand for credit. The adjustment for

financing considers the differences in financing terms between the subject property and the

comparable sales. Adjustments are made for sales financed with terms not readily available to

typical buyers.

None of the comparables indicated that unusual financing factors affected the indicated sales

prices. The comparable sales are cash, are conventionally financed at market rates, or involved

terms equivalent to cash and therefore need no adjustments.

Conditions of Sale

If a comparable sale reflects unusual situations, we make appropriate adjustments for the

motivations of the buyer and the seller, or for atypical conditions of sale. Situations requiring

adjustment may include 1031 tax exchanges, assemblies, condemnation, sales between related

parties and partnership dissolution.

While most sales have varying conditions, usually, they do not result in prices that vary from

market. To the best of our knowledge, Comps 1, 2 and 4 did not have any atypical conditions that

impacted the price and no adjustments are warranted. Although the broker said that the village

would not allow what some potential buyers wanted, he was referring to industrial users and the

site is not zoned for that, nor is the subject. An adjustment is not warranted.

Comp 3 was purchased by Leyden Township, an adjacent land owner. They were looking for a

suitable site to construct a senior center and this site, in combination with their adjacent land, met

the need. Given that they may have been more highly motivated, a downward adjustment is

warranted.

Comp 5 was an REO property, but it was widely marketed. The eventual buyer was the village

and they were looking to redevelop the vacant banquet hall site and had secured a developer for

the project. According to the Community and Economic Development department representative,

the REO status did not impact the price but the village may have overpaid because they wanted to

control the site and had a developer lined up. The deal with the developer subsequently fell through

as interest rates increased. Overall, a downward adjustment is warranted.

Expenditures After Purchase

The subject is vacant land, as were Comps 3 and 4.

www.pvgchicago.com 41

Comp 1 was a parking lot and had an old water tower on the site. The pre-construction site work

would be more costly than compared to a construction-ready site, though the amount of work is

not known. An upward adjustment of 5% is made for this factor.

Comp 2 was improved with a small car wash while Comp 5 was improved with a banquet hall

and the improvements will have to be demolished at the buyer’s expense. Upward adjustments

are made for this factor.

Economic Trends

An adjustment for market conditions may be necessary for sales if price appreciation or

depreciation is common in the market, or if other factors such as tax law changes, moratoriums,

or fluctuations in supply and demand have influenced values over the time of the sales. Although

sometimes called a “time” adjustment, time is not the cause of the adjustment. Values do not

change owing to the passage of time; they change along with changing market conditions.

As stated, though the retail market is performing well, sharply higher interest rates paired with

elevated construction costs have resulted in a drop in transaction volume and new construction as

projects that were feasible at low interest rates are not at the current higher rates. A proposed project

on the subject site fell through for this reason and the same is true of Comp 5.

Comps 1 and 5 transacted near the height of the market in late 2021 and Q1 2022 and downward

adjustments are warranted. Comps 2, 3 and 4 sold in the 4

th

quarter of 2022 when rates were higher

but the impact on the market was not as pronounced as it currently is. Less significant downward

adjustments are warranted. The adjustments consider the positive retail fundamentals along with the

impact of higher rates and market uncertainty.

Location

Adjustments may be necessary to reflect the differences in value attributable to a property's

location or market area. Although comparable properties in the same market area have similar

general locational characteristics, property specific variations may exist. The key locational

characteristics we considered include access, visibility, traffic count, tax rate, demographics and

surrounding uses.

The subject property is located in Franklin Park on Mannheim Road, which has an average daily

traffic count (ADTC) of 27,100 vehicles per day in this area. Surrounding properties on

Mannheim Road are primarily commercial along with some light industrial, and there are some

national tenants in the area. The site has two curb cuts on Mannheim Road and others on the

side streets.

Comp 1 is located on Mannheim Road to the north of the subject. It has a superior traffic count

at 40,700 vehicles per day and is also closer to O’Hare and the expressway interchange.

Conversely, its visibility is partially obstructed to traffic approaching from the south due to the

expressway overpass, and Mannheim becomes elevated at this point as it passes over the railroad

tracks. Overall, these factors offset and the two properties are nearly similar in location.

Comp 2 is located on the corner of River Road and Kensington Avenue in Mt. Prospect. The

total traffic count at 23,000 vpd is lower, and the east side of River is forest preserve land along

the Des Plaines River, resulting in inferior commercial co-tenancy. Many improvements along

this stretch of Mannheim are residential. Mt. Prospect has significantly higher home values and

www.pvgchicago.com 42

household income levels, but a lower population density. Overall, it is inferior and adjusted

upward.

Comp 3 is located 0.6 miles south of the subject on Mannheim Road. It has a Franklin Park

mailing address but is in an unincorporated area. The traffic count is higher on this portion of

Mannheim Road, and the tax rate is lower at 10.3% (vs. 11.8% for subject). Overall, a slight

downward adjustment is warranted.

Comp 4 is located in the Franklin Marketplace, which is a seven-lot commercial subdivision that

wraps around the northwest corner of Mannheim Road and Grand Avenue. As such, this sale has

superior access from two primary thoroughfares and a secondary street. However, the sale site is

set back from both thoroughfares and has inferior visibility, which is partially offset by signage.

At the time of sale, subdivision tenants included Chase, Sonic, Jersey Mikes, Chipotle, AT&T

and T-Mobile with an adjacent Starbucks. It has superior co-tenancy. Despite the advantages, it

is overall similar as it set back 300 feet from a thoroughfare.

Comp 5 is located on Irving Park Road in neighboring Bensenville. The traffic count is slightly

higher at 30,700 vehicles per day. The population density is inferior and the median home value

is lower than the subject’s (within a 1-mile radius) but the household income level is higher. It

has an advantage due to its DuPage County location and lower effective property tax rate.

Conversely, this portion of Irving Park Road has many residential improvements and commercial

tenants are mostly local businesses. It is inferior in this respect. Overall, the two properties are

generally similar and not adjusted.

Size

Size adjustments are necessary when there are significant differences in site size. There is

usually an inverse relationship between unit value and size, with smaller sites selling at higher

prices per square foot of value than larger sites, all else being equal. The subject property

contains 56,480 sf of land.

Comps 1, 3 and 4 are larger sites warranting upward adjustments for size. Comp 2 is smaller

and adjusted downward, while Comp 5 is generally similar in size and not adjusted,

Shape

The subject site is rectangular in shape. Comp 1 is irregular and is adjusted upward. Comps 2

through 5 are rectangular or nearly rectangular and are not adjusted.

Zoning

Zoning and characteristics of the site may affect how a site can be used and how much of the

parcel is buildable. In this instance, the most appropriate unit of adjustment was determined to

be the price per square foot.

The subject is zoned C-3, General Commercial District by the Village of Franklin Park, which

indicates a maximum FAR of 3.5. Residential units are not permitted as a part of a mixed-use

development in the C-3 district.

www.pvgchicago.com 43

Comps 1, 3 and 4 are similar in this respect. Comp 2 is zoned B-4 which also does not permit

residential as a part of a mixed-use development, but the village was willing to consider such a

use. A modest downward adjustment is warranted for this factor.

Comp 5 allows for mixed-use and the planned use is for a four-story building with residential

units on the upper levels. There is strong demand for apartment units and they are less risky than

retail space. A significant downward adjustment is warranted.

Site Improvements

The subject site was previously improved as a hotel property and has all utilities available at the

site lines.

According to the broker, Comp 1 would require infrastructure improvements and off-site work

prior to development. The estimated cost was not reported. An upward adjustment is

warranted.

Comps 2, 3 and 5 are similar sites that had previously been improved and had all utilities at the

lot lines. No adjustments are warranted for these comps.

Comp 4 is a pad-ready site within a commercial subdivision, and has off-site detention. All

common area roads were completed and the subdivision signage was erected, and these

amenities benefitted the sale property. A downward adjustment is warranted.

Road Frontage / Block Location

The subject is a dual corner lot.

Comp 1 is a signalized corner lot and is generally similar. Comp 2 is a signalized corner lot, but

it is at a T-intersection and not a true four-corner intersection. A modest upward adjustment is

warranted.

Comps 3 through 5 are single corner lots and are adjusted upward slightly.

Other

Approximately one acre of Comp 1 is located beneath the Tri-State Tollway and is not buildable.

It could potentially be used for parking or storage but the Tollway has easements for the right to

access this land as needed. There is a small portion south of the part that is beneath the

expressway, but it is separated from the north fully usable portion, and has less utility. Overall, a

significant upward adjustment is warranted.

www.pvgchicago.com 44

Conclusion – Land Valuation

The adjusted unit values of the comparable properties range from $5.88 to $13.00 psf; the

average is $9.67 psf. Comps 3 and 4 were given primary consideration in this analysis due to

their proximity to the subject and because they are the most recent sales. The adjusted average

of Comps 3 and 4 was $9.48 psf. The subject was recently under contract for $575,000 or

$10.18 psf, but it fell through due to elevated interest rates which resulted in the proposed project

no longer being financially feasible for the contract purchaser. Also, the local TIF expired since

then. Therefore, the concluded value is between the average adjusted unit price of Comps 3 and 4

($9.48 psf), and the adjusted average of all of the comparables of $9.57 psf, or say $9.50 per

square foot.

56,480 square feet x $9.50 psf = $536,560 rounded to $540,000

Market Value, As Is

Indicated Value per Square Foot:

$9.50

Subject Size (SF):

56,480

sf

Indicated Value:

$536,560

Rounded:

$540,000

Five Hundred Forty Thousand

Dollars

www.pvgchicago.com 45

CERTIFICATION

We certify that, to the best of our knowledge and belief:

The statements of fact contained in this report are true and correct.

The reported analyses, opinions, and conclusions are limited only by the reported assumptions and limiting

conditions and are our personal, impartial, and unbiased professional analyses, opinions, and conclusions.

We have no present or prospective interest in the property that is the subject of this report and no personal

interest with respect to the parties involved.

Mary Wagner previously appraised the property for the same client in 2018, but otherwise the appraisers

have not performed any appraisal work or any other type of work on the subject property in the past three

years.

We have no bias with respect to the property that is the subject of this report or to the parties involved with

this assignment.

Our engagement in this assignment was not contingent upon developing or reporting predetermined results.

Our compensation for completing this assignment is not contingent upon the development or reporting of a

predetermined value or direction in value that favors the cause of the client, the amount of the value

opinion, the attainment of a stipulated result, or the occurrence of a subsequent event directly related to the

intended use of this appraisal.

Our analyses, opinions, and conclusions were developed, and this report has been prepared, in conformity

with the Uniform Standards of Professional Appraisal Practice.

Elizabeth Gulis, MAI has not made a personal inspection of the property that is the subject of this report.

Mary Wagner, MAI, has made a personal inspection of the property.

The reported analyses, opinions, and conclusions were developed, and this report has been prepared, in

conformity with the Code of Professional Ethics and Standards of Professional Appraisal Practice of the

Appraisal Institute.

The use of this report is subject to the requirements of the Appraisal Institute relating to review by its duly

authorized representatives.

As of the date of this report, Mary Wagner, MAI, and Elizabeth Gulis, MAI, have completed the continuing

education program of the Appraisal Institute.

Mary Wagner, MAI

IL Certified General Real Estate Appraiser

License No. 553-001102

License Expires:

September 30, 2025

Elizabeth Gulis, MAI

IL Certified General Real Estate Appraiser

License No. 553.002269

License Expires:

September 30, 2025

www.pvgchicago.com 46

ADDENDA

www.pvgchicago.com 47

Limiting Conditions and Assumptions

Acceptance of and/or use of this report constitutes acceptance of the following limiting

conditions and assumptions; these can only be modified by written documents executed by both

parties.

This appraisal is to be used only for the purpose stated herein. While distribution of this

appraisal in its entirety is at the discretion of the client, individual sections shall not be

distributed; this report is intended to be used in whole and not in part.

No part of this appraisal, its value estimates or the identity of the firm or the appraiser(s) may be

communicated to the public through advertising, public relations, media sales, or other media.

All files, work papers and documents developed in connection with this assignment are the

property of Praedium Valuation Group Information, estimates and opinions are verified where

possible, but cannot be guaranteed. Plans provided are intended to assist the client in visualizing

the property; no other use of these plans is intended or permitted.

No hidden or unapparent conditions of the property, subsoil or structure, which would make the

property more or less valuable, were discovered by the appraiser(s) or made known to the

appraiser(s). No responsibility is assumed for such conditions or engineering necessary to

discover them. Unless otherwise stated, this appraisal assumes there is no existence of hazardous

materials or conditions, in any form, on or near the subject property.

Unless otherwise stated in this report, the existence of hazardous substances, including without

limitation asbestos, polychlorinated biphenyl, petroleum leakage, or agricultural chemicals,

which may or may not be present on the property, was not called to the attention of the appraiser

nor did the appraiser become aware of such during the appraiser’s inspection. The appraiser has

no knowledge of the existence of such materials on or in the property unless otherwise stated.

The appraiser, however, is not qualified to test for such substances. The presence of such

hazardous substances may affect the value of the property. The value opinion developed herein is

predicated on the assumption that no such hazardous substances exist on or in the property or in

such proximity thereto, which would cause a loss in value. No responsibility is assumed for any