DIMENSIONAL WHOLESALE TRUSTS

Application Form | 23 July 2021

Issuer: DFA Australia Limited (‘Dimensional’) ABN 46 065 937 671 Australian Financial Services Licence number: 238093

Date of Product Disclosure Statements: 26 May 2020 (with the exception of the PDS for the Dimensional Emerging Markets

Sustainability Trust which is dated 23 July 2021)

Denitions of certain capitalised terms used in this application form appear in the Glossary attached to the Additional Information Guide

Application Form - Dimensional Wholesale Trusts

DFA Australia Limited ABN 46 065 937 671

AFS Licence Number 238093 1

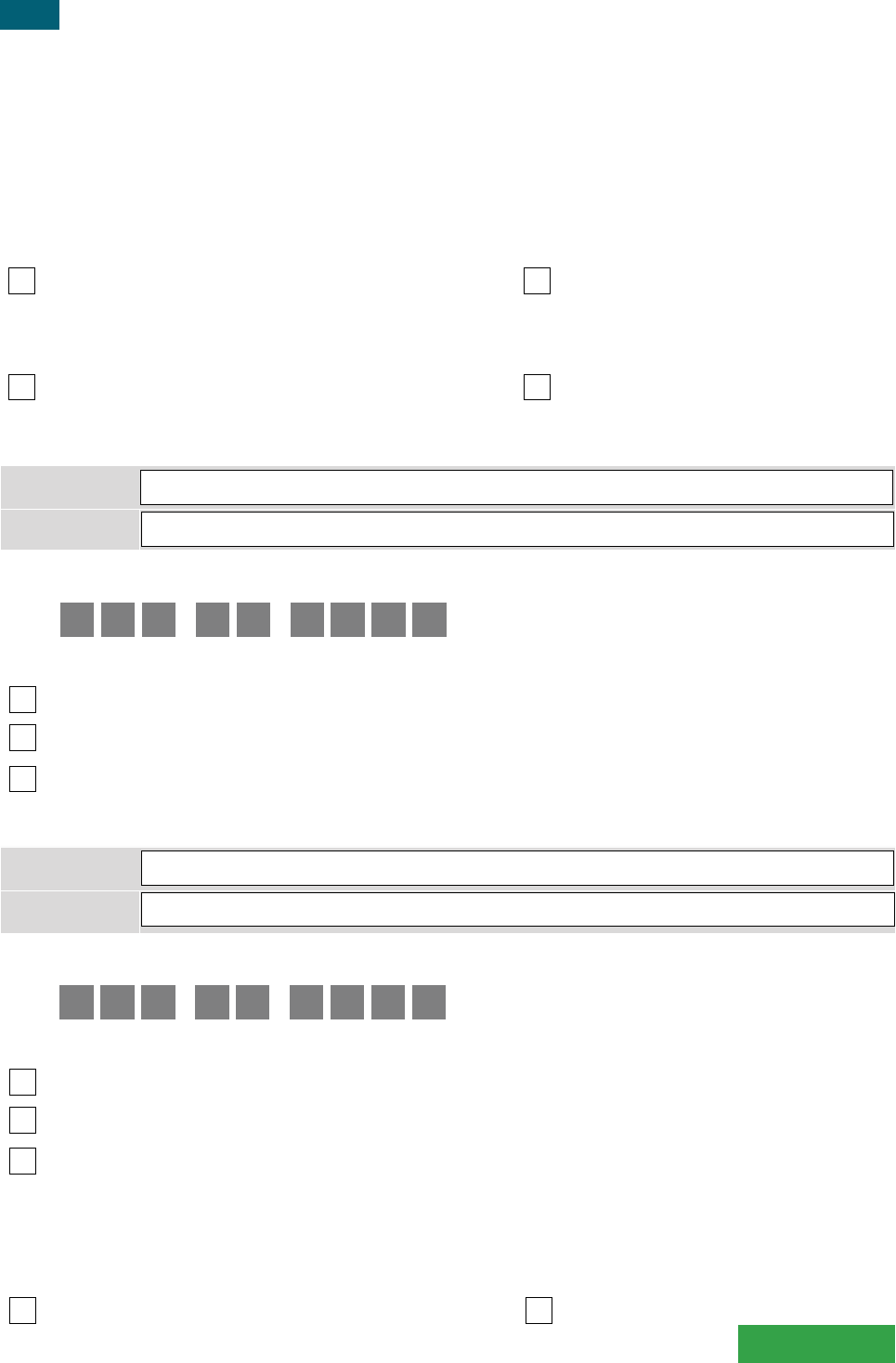

SECTION TOPIC

1 Introduction

2 Investor Details

3 Individual / Individual Trustee(s) / Sole Trader(s)

4 Company / Corporate Trustee / Association / Co-operative / Partnership / Government Body

5 Trust / Superannuation Fund / Deceased Estate / Other

6 Foreign Account Tax Compliance Act (FATCA) and Common Reporting Standard (CRS)

7 Investor Contact Details

8 Annual Report

9 Investment Details

10 Redemption and Distribution Bank Details

11 Adviser Contact Details

12 Investor Identication

13 Third-Party Technology Providers

14 Declarations and Signatures

15 Appendix

Application Form - Dimensional Wholesale Trusts

Date of Application Form: 23 July 20212

SECTION 1 INTRODUCTION

All new applications must either have approval through a Dimensional relationship or be submitted through a participating adviser

(Section 12) and meet our minimum initial investment requirements (Section 9). If you do not have an existing relationship with

Dimensional or a participating adviser please contact our client services team at (+612) 8336 6556 before submitting an application.

Please complete all relevant sections of the application form in CAPITAL LETTERS and sign Section 14.1

Please email through your application form and Identication Information to Dimensional at [email protected]

for review. Once approved your original application form and certied copies of Identication Information for initial investments MUST

be mailed to the Unit Registry postal address. Dimensional will not accept an application form or Identication Information from a new

investor via facsimile or email.

1.1

Are you an existing investor with Dimensional?

Yes (If yes, please provide existing account number and name) No (Go to Section 1.2)

Existing account number:

Existing account name:

If any of your details have changed please complete the relevant sections for your investor type specied in Section 1.3.

If there are no changes to the details of your existing account, please complete Section 9 and sign Section 14.1

1.2

Anti Money Laundering and Counter Terrorism Financing Identication Information

As detailed in Section 1.1.4 of the Additional Information Guide, the AML/CTF Act and Rules oblige Dimensional to collect

Identication Information from prospective Investors.

You or your Participating Adviser must submit the application form with the relevant supporting evidence of your identity (‘Identication

Information’) as outlined in Section 12 and the Appendix. If the application form is not completed properly, or Dimensional is not

satised with the Identication Information, Dimensional may request additional Identication Information or reject the application.

If you have already provided the required Identication Information to Dimensional, you do not need to resupply it with this application

form.

1.3

Completing your application form based on Investor Type

Note that ONLY legal entities are allowed to hold units in the Trusts. Applications must be in the name of a natural person, company

or a legal entity acceptable to Dimensional.

Please your investor type and complete all referenced sections:

INVESTOR TYPE SECTIONS

Individual, which includes:

• Joint investors

• Child/minor accounts

• Sole traders

2, 3, 6 to 14

Company, which includes:

• Custodians/Wraps

2, 4, 6 to 14

Trust and Superannuation Fund, which includes:

• Individual(s) acting as Trustee(s) or Executor(s)

• Company acting as Trustee(s)

• Company acting as Nominee/Custodian

2, 3, 5, 6 to 14

2, 4, 5, 6 to 14

2, 4, 5, 6 to 14

Partnership 2, 4, 6 to 14

Association 2, 4, 6 to 14

Co-operative 2, 4, 6 to 14

Government Body 2, 4, 6 to 14

Clear

Application Form - Dimensional Wholesale Trusts

DFA Australia Limited ABN 46 065 937 671

AFS Licence Number 238093 3

SECTION 2 INVESTOR DETAILS

You are not obliged to quote your Tax File Number (TFN) or Australian Business Number (ABN). However, if you do not quote either

of them, Dimensional is required to deduct tax from your distributions at the highest marginal tax rate, plus the Medicare Levy. If you

are exempt from quoting a TFN, please provide your reason for the exemption and your exemption number.

All non-resident investors are required to provide their tax information in Section 6 of this application.

2.1

Residency status

Please appropriate option:

Residency status for tax purposes: Australian resident Non-resident

SECTION 3 INDIVIDUAL / INDIVIDUAL TRUSTEE(S) / SOLE TRADER(S)

3.1

Individual 1 (all elds are mandatory)

Title: Mr Mrs Miss Ms Dr

Surname:

Given name(s):

Date of birth: / /

Tax le number:

OR reason

for exemption:

Are you a ‘Politically Exposed Person’?

(Politically Exposed Persons are individuals who occupy, or have occupied, prominent public positions, including prominent positions

in international organisations both within and outside Australia, or their close family or associates). See full denition in the Appendix.

Note, Dimensional may request additional information from you.

Yes No

3.2

Individual 2 (for joint investors, all elds are mandatory)

Title: Mr Mrs Miss Ms Dr

Surname:

Given name(s):

Date of birth: / /

Tax le number:

OR reason

for exemption:

Are you a ‘Politically Exposed Person’?

(Politically Exposed Persons are individuals who occupy, or have occupied, prominent public positions, including prominent positions

in international organisations both within and outside Australia, or their close family or associates). See full denition in the Appendix.

Note, Dimensional may request additional information from you.

Yes No

If you are a joint investor, go to Section 3.2

Otherwise, go to Section 3.3

Go to Section 3.3

Clear

Application Form - Dimensional Wholesale Trusts

Date of Application Form: 23 July 20214

3.3

Individual trustee(s)

Are you making this investment in your capacity as trustee(s)?

Yes (If yes, please complete Section 5 for trust details) No (Go to Section 3.4)

3.4

Sole traders

Are you making this investment as a sole trader?

Yes (If yes, please provide business name and ABN) No

Business name:

ABN:

Go to Section 6

Clear

Application Form - Dimensional Wholesale Trusts

DFA Australia Limited ABN 46 065 937 671

AFS Licence Number 238093 5

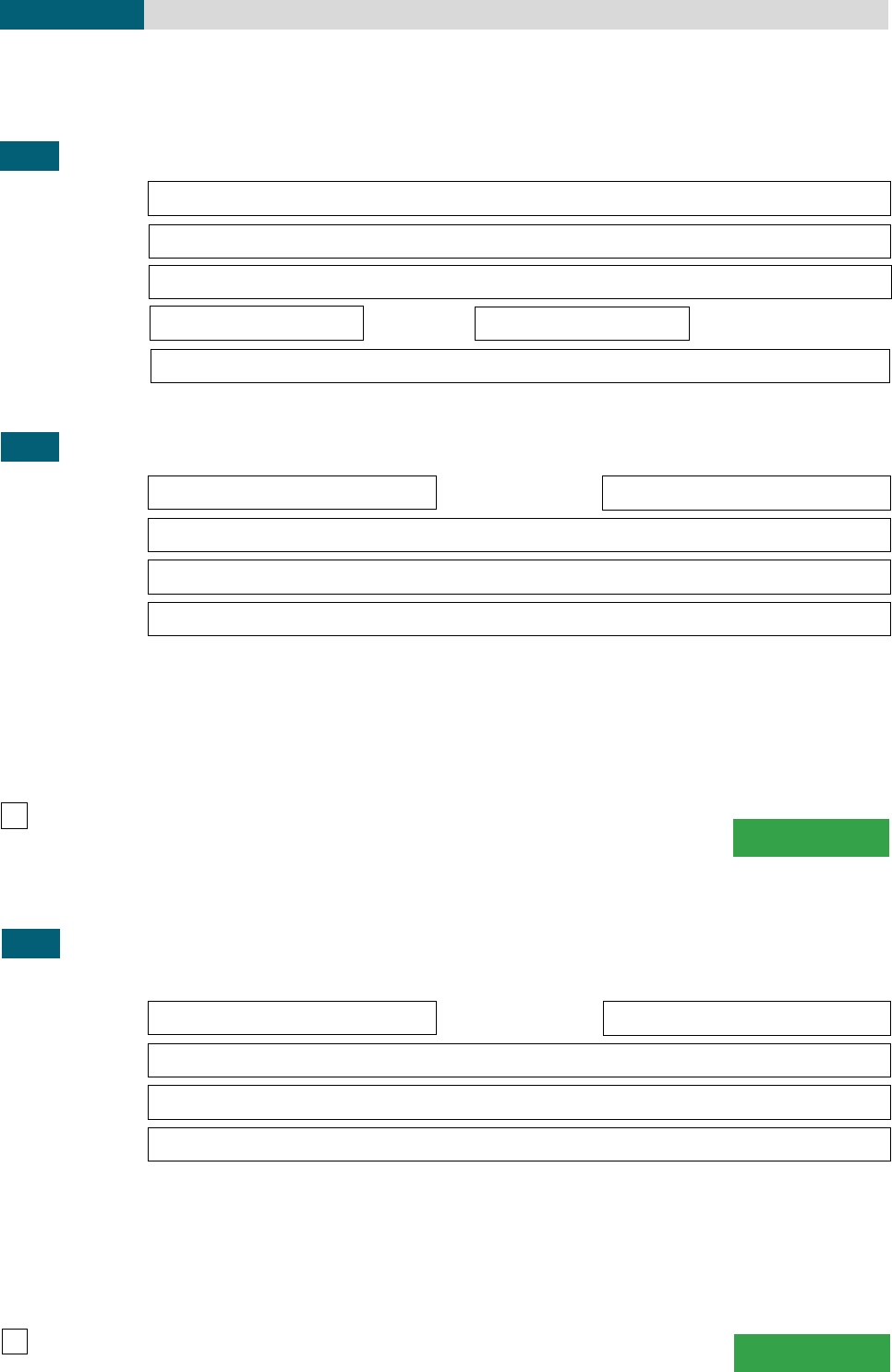

SECTION 4 COMPANY / CORPORATE TRUSTEE / ASSOCIATION / CO-OPERATIVE

/ PARTNERSHIP / GOVERNMENT BODY

For accounts with multiple entities / trustees, please submit a separate Section 4 with details of each additional entity / trustee.

4.1

Entity Details (all elds are mandatory)

Full legal name:

Tax le number:

OR reason

for exemption:

ABN/ACN/ARBN:

Country

of establishment:

4.2

Entity type

Please appropriate option:

ENTITY TYPE YES DETAILS

Listed company Name of market:

Regulated company Name of regulator and licence no:

Majority-owned

subsidiary of

an Australian

listed company

Australian listed company name:

Name of market:

Other company*

Provide description:

Public: Proprietary:

Association*

Provide ID number issued by

relevant registration body (if any):

Incorporated: Unincorporated:

Co-operative*

Provide ID number issued by

relevant registration body (if any):

Partnership*

Name of association regulating

partnership and membership

details (if any):

Government Body Commonwealth of Australia: Australian State or Territory: Foreign country:

Provide name of legislation

establishing the government body:

Go to Section 4.2

* Go to Section 4.2a

Otherwise, go to Section 4.3

Clear

Application Form - Dimensional Wholesale Trusts

Date of Application Form: 23 July 20216

4.2a

Benecial Owner details

‘Benecial Owner’ means an individual (natural person) who ultimately owns or controls (directly or indirectly) the investor. ‘Control’

includes control as a result of, or by means of, trusts, agreements, arrangements, understandings and practices, whether or not

having legal or equitable force and whether or not based on legal or equitable rights, and includes exercising control through the

capacity to determine decisions about nancial and operating policies. ‘Owns’ means ownership (either directly or indirectly) of 25%

or more of the investor.

Full name:

Residential address of the Benecial Owner (P.O. Box not accepted):

Date of birth: / /

Are you a ‘Politically Exposed Person’?

(Politically Exposed Persons are individuals who occupy, or have occupied, prominent public positions, including prominent

positions in international organisations both within and outside Australia, or their close family or associates). See full denition in the

Appendix. Note, Dimensional may request additional information from you.

Yes No

If there is more than one Benecial Owner, please provide additional Benecial Owner details on a separate piece of paper that is

marked with the investor’s name and include it with this application form.

4.3

Corporate trustee

Are you making this investment as a corporate trustee?

Yes (go to Section 5) No (go to Section 6)

Go to Section 4.3

Clear

Application Form - Dimensional Wholesale Trusts

DFA Australia Limited ABN 46 065 937 671

AFS Licence Number 238093 7

SECTION 5 TRUST / SUPERANNUATION FUND / DECEASED ESTATE / OTHER

5.1

Trust Details

A trust or superannuation fund is not a legal entity and cannot be the registered investor in its own right.

The trustee must be the registered investor. An application form cannot be accepted where the trustee details are missing.

Please the relevant category below:

Individual trustee(s) ensure Section 3 is completed

Corporate trustee(s) ensure Section 4 is completed

Full name of Trust:

Full name of Trustee:

Tax le number of Trust:

OR reason for exemption:

ABN/ACN/ARBN of Trust:

Country of establishment:

5.2

Type of Trust

Please appropriate option:

TRUST TYPE YES DETAILS

Regulated Trusts

Registered managed

investment scheme

Provide ARSN:

Australia APRA regulated

trust or fund

(industry, retail or public sector fund)

Provide SFN:

Self-managed

superannuation fund

(SMSF)

Provide ABN:

Government

superannuation fund

Provide name of legislation

establishing the fund:

Non-Australian pension

fund

Provide name of regulator/

registration/licence details:

Master fund (IDPS

platforms such as WRAP’s

and Master Trusts)

Provide name of regulator:

Continued on next page

Go to Section 5.2

Clear

Application Form - Dimensional Wholesale Trusts

Date of Application Form: 23 July 20218

5.2

Type of Trust (continued)

Please appropriate option:

TRUST TYPE YES DETAILS

Unregulated Trusts

Family trust

*

Provide full name of the ‘Settlor’ of the trust (if applicable, see below):

(Provide certied copy or certied extract of the trust deed)

Charitable trust*

Provide full name of the ‘Settlor’ of the trust (if applicable, see below):

(Provide certied copy or certied extract of the trust deed)

Deceased Estate

(Provide certified copy of the death certificate and Grant of Probate/Letters of Administration)

Other trust*

Provide full name of the ‘Settlor’ of the trust (if applicable, see below):

(Provide certied copy or certied extract of the trust deed)

Settlor of the trust (i.e. the grantor or donor of the trust): provide details of the Settlor of the trust if they contributed $10,000 or

more to the trust and they are alive at the date of this application.

5.2a

Benecial Owner details (if Unregulated Trust type is selected in Section 5.2)

‘Benecial Owner’ means an individual (natural person) who ultimately owns or controls (directly or indirectly) the investor. ‘Control’

includes control as a result of, or by means of, trusts, agreements, arrangements, understandings and practices, whether or not having

legal or equitable force and whether or not based on legal or equitable rights, and includes exercising control through the capacity to

determine decisions about nancial and operating policies. ‘Owns’ means ownership (either directly or indirectly) of 25% or more of the

investor.

Full name:

Residential address of the Benecial Owner (P.O. Box not accepted):

Street Address:

Suburb: State:

Postcode: Country:

Date of birth: / /

Is the Benecial Owner a ‘Politically Exposed Person’?

(Politically Exposed Persons are individuals who occupy, or have occupied, prominent public positions, including prominent positions

in international organisations both within and outside Australia, or their close family or associates). See full denition in the Appendix.

Note, Dimensional may request additional information from you.

Yes No

If there is more than one Benecial Owner, please provide additional Benecial Owner details on a separate piece of paper that is

marked with the investor’s name and include it with this application form.

*Go to Section 5.2a

Otherwise, go to Section 6

Go to Section 6

Clear

Application Form - Dimensional Wholesale Trusts

DFA Australia Limited ABN 46 065 937 671

AFS Licence Number 238093 9

SECTION 6 FOREIGN ACCOUNT TAX COMPLIANCE ACT (FATCA) AND COMMON

REPORTING STANDARD (CRS) - MANDATORY

The collection of personal information in this Section is in accordance with the United States Foreign Account Tax Compliance Act

(FATCA) and Organisation for Economic Cooperation and Development (OECD) Common Reporting Standard (CRS).

If you do not provide the requested information, Dimensional will not be able to accept your application.

Kindly tick the appropriate box below relating to your application;

Individual, sole trader or deceased estate *

Entity (e.g. company, trust, partnership, association, registered co-operative or government body).

6.1

FATCA/CRS certication of individual, joint individual, sole trader or deceased estate

(A) Is the account to be held by an individual acting in the capacity of executor or administrator of a deceased estate?

Yes – ensure one of the following supporting documents have been submitted with your application;

• Certied copy of the death certicate or Grant of Probate/Letters of Administration

If you selected Yes above, your FATCA/CRS certication is complete.

No – proceed to question B.

(B) Is/are all of the individual applicants (including the person/s for whom the account will be held e.g. a children’s account) a citizen

or a resident for tax purposes in a country other than Australia?

Yes – provide the Foreign Individual Investors and Individual Benecial Owner details below. Note: If an individual is both

an Australian and a foreign tax resident, or a tax resident of more than one foreign country, you must also provide this

information.

No – your FATCA/CRS certication is complete and no further information is required.

Only some of the individuals are Australian tax residents:

• For those Individuals who are Australian tax residents only, no further information is required

• For the remaining individuals (ie who are NOT solely Australian tax residents), please provide the Foreign Individual

Investors and Individual Benecial Owner details below.

Foreign Individual Investor(s) and Individual Benecial Owner(s) details

Please provide ALL information, including your foreign TIN (Taxpayer Identication Number), or exclusions, as relevant.

Full name of individual 1:

Date of Birth: / /

Street address

(P.O. Box not accepted):

Country 1

of tax residency:

Country 2

of tax residency:

Continued on next page

*Go to Section 6.1

Otherwise, go to Section 6.2

Go to Section 7

Go to Section 7

Clear

Application Form - Dimensional Wholesale Trusts

Date of Application Form: 23 July 202110

TIN 1

If you do not have a TIN (or equivalent) select one of the following:

The country of tax residency does not issue TINs to tax residents

The individual has not been issued with a TIN

The country of tax residency does not require the TIN to be disclosed

TIN 2

If you do not have a TIN (or equivalent) select one of the following:

Country does not require the TIN to be disclosed

The individual has not been issued with a TIN

The country of tax residency does not require the TIN to be disclosed

Full name of individual 2:

Date of Birth: / /

Street address

(P.O. Box not accepted):

Country 1

of tax residency:

Country 2

of tax residency:

TIN 1

If you do not have a TIN (or equivalent) select one of the following:

The country of tax residency does not issue TINs to tax residents

The individual has not been issued with a TIN

The country of tax residency does not require the TIN to be disclosed

TIN 2

If you do not have a TIN (or equivalent) select one of the following:

The country of tax residency does not issue TINs to tax residents

The individual has not been issued with a TIN

The country of tax residency does not require the TIN to be disclosed

Please provide additional Benecial Owner details on a separate piece of paper that is marked with the investor’s name and

include it with this application form.

6.1

FATCA/CRS certication of individual (continued)

Go to Section 7

Clear

Application Form - Dimensional Wholesale Trusts

DFA Australia Limited ABN 46 065 937 671

AFS Licence Number 238093 11

6.2

FATCA and CRS certication of an entity

Answer questions A, B & C (where applicable) if you are one of the following entities:

• A company or other incorporated body, or

• Another type of entity e.g. a trust, partnership, cooperative or association etc., or

• An individual/s that will hold the account on behalf of another entity that is a superannuation fund, trust, partnership,

government body, co-operative, association or other type of entity.

(A) Is the entity registered for Australian tax purposes?

Yes (If yes, ensure your ABN, ACN or ARBN has

been provided in Section 4.1 and go to question B)

No (Go to question B)

(B) Is this account holder a US citizen or a resident for tax purposes in a country other than Australia?

Yes (provide ALL information below, including your

foreign TIN (Taxpayer Identication Number), or

exclusions, as relevant)

No (Go to Section 6.3)

Country of

tax residency 1:

Address:

TIN 1

If you do not have a TIN (or equivalent) select one of the following:

The country of tax residency does not issue TINs to tax residents

The entity has not been issued with a TIN

The country of tax residency does not require the TIN to be disclosed

Country of

tax residency 2:

Address:

TIN 2

If you do not have a TIN (or equivalent) select one of the following:

The country of tax residency does not issue TINs to tax residents

The entity has not been issued with a TIN

The country of tax residency does not require the TIN to be disclosed

(C) If you answered Yes to question B above, is the account holder a “specied US person”?

Denition of "specied US person" can be found in the glossary of our Additional Information Guide on our public site

https://au.dimensional.com/funds

Yes No

Go to Section 6.3

Clear

Application Form - Dimensional Wholesale Trusts

Date of Application Form: 23 July 202112

6.3

Entity classication

Please appropriate classication:

An Australian regulated superannuation fund (including a complying SMSF), retirement or pension fund.

Please ensure you have provided the fund’s ABN in Section 4.1 to complete your certication.

If you selected this option, your certication is complete.

An account held by an entity acting in the capacity of executor or administrator of a deceased estate.

Ensure one of the following supporting documents have been submitted with your application:

• Certied copy of the death certicate or Grant of Probate/Letters of Administration

If you selected this option, your certication is complete.

Public Listed Company, or a Majority Owned Subsidiary of a Public Listed company or Registered Charity (includes

public listed companies or majority owned subsidiaries of listed companies that are not Financial Institutions).

Please ensure entity’s details are provided in Section 4.2

If you selected this option, your certication is complete.

Not a Financial Account. Certain accounts are NOT considered to be ‘Financial Accounts’ for the purposes of CRS and

FATCA. These include:

• An Employee Share Scheme or Trust as dened in the Income Tax Assessment Act 1997

• An Escrow Account established in connection with a court order or judgment, or a sale, exchange, or lease of real or

personal property where certain requirements have been met

If you selected this option, your certication is complete.

Exempt Benecial Owner. Under CRS and FATCA, an Exempt Benecial Owner includes, but is not limited to:

• Australian government organisation or agency

• Reserve Bank of Australia

• International (including intergovernmental) organisation

If you selected this option, your certication is complete.

Financial institution. Includes:

• Depository institution

• Investment entity

• Specied insurance company

• Custodian institution

Provide your Global Intermediary Identication Number (GIIN)*

* If GIIN not available, answer the following questions (A, B & C) on the following page.

Go to Section 7

Go to Section 7

Go to Section 7

Go to Section 7

Go to Section 7

Go to Section 7

Clear

Application Form - Dimensional Wholesale Trusts

DFA Australia Limited ABN 46 065 937 671

AFS Licence Number 238093 13

Financial institution (continued)

(A) If you do not have a GIIN, what is your nancial institution status? (tick one):

Deemed Compliant Financial Institution

Excepted Financial Institution

Non-Reporting IGA Financial Institution

Non-participating Financial Institution

Other (describe the entity’s FATCA Status in the box provided)

(B) Are you an Investment Entity (nancial institution) located in a non-CRS participating jurisdiction and professionally managed by

another nancial institution? (Please refer to the Australian Tax Ofce (ATO) website for a list of CRS Participating Jurisdictions):

Yes (Go to question C & Complete Section 6.5) No (Go to question C)

(C) Is the registered holder of this account also a nancial institution?

Yes (provide the GIIN below for the registered holder) No*

*If the registered holder does not have a GIIN, what is its nancial institution status? (tick one):

Deemed Compliant Financial Institution

Excepted Financial Institution

Non-participating Financial Institution

Other (describe the entity’s FATCA Status in the box provided)

Non-Financial Entity (NFE) or (NFFE). This includes the following entity types:

• Private or proprietary company that is NOT a nancial institution

• Public unlisted company that is NOT a nancial institution

• Partnership

• Trust

• Co-operative

• Association or club

• Non-registered charitable organisation

• Other type of entity

Go to Section 6.4

6.3

Entity classication (continued)

Go to Section 7

Clear

Application Form - Dimensional Wholesale Trusts

Date of Application Form: 23 July 202114

6.4

NFE/NFFE entities

An entity is Active if it derives more than 50% of its income from the sale of goods or services AND it uses more than 50% of its assets

to generate income from the sale of goods or services. An NFE is Passive if it does not t the description of an Active entity OR is a

professionally-managed investment entity located in a non-participating CRS (Common Reporting Standard) jurisdiction.

(A) Is the NFE/NFFE Active or Passive?

Active (Go to Section 7) Passive (Go to question B)

(B) If the NFE/NFFE is Passive, are any of the entity’s Benecial Owners or Controlling Persons tax residents of countries other than

Australia?

Yes (provide the details of these individuals in

Section 6.5)

No (Go to Section 7)

6.5

Benecial Owner(s) Details

Entity foreign **Benecial owner(s) details (NB only foreign entities, Passive NFEs/NFFEs need to complete this section).

Please provide ALL information, including your foreign TIN (Taxpayer Identication Number) or exclusions, as relevant.

Full name of individual 1:

Date of Birth: / /

Street address

(P.O. Box not accepted):

Country 1

of tax residency:

Country 2

of tax residency:

TIN 1

If you do not have a TIN (or equivalent):

The country of tax residency does not issue TINs to tax residents

The individual has not been issued with a TIN

The country of tax residency does not require the TIN to be disclosed

TIN 2

If you do not have a TIN (or equivalent):

The country of tax residency does not issue TINs to tax residents

The individual has not been issued with a TIN

The country of tax residency does not require the TIN to be disclosed

Clear

Application Form - Dimensional Wholesale Trusts

DFA Australia Limited ABN 46 065 937 671

AFS Licence Number 238093 15

TIN 1

If you do not have a TIN (or equivalent):

The country of tax residency does not issue TINs to tax residents

The individual has not been issued with a TIN

The country of tax residency does not require the TIN to be disclosed

TIN 2

If you do not have a TIN (or equivalent):

The country of tax residency does not issue TINs to tax residents

The individual has not been issued with a TIN

The country of tax residency does not require the TIN to be disclosed

** ‘Benecial Owner’ means an individual (natural person) who ultimately owns or controls (directly or indirectly) the investor. ‘Control’

includes control as a result of, or by means of, trusts, agreements, arrangements, understandings and practices, whether or not having

legal or equitable force and whether or not based on legal or equitable rights and includes exercising control through the capacity to

determine decisions about nancial and operating policies. ‘Owns’ means ownership (either directly or indirectly) of 25% or more of the

investor.

Go to Section 7

6.5

Benecial Owner(s) (continued)

Full name of individual 2:

Date of Birth: / /

Street address

(P.O. Box not accepted):

Country 1

of tax residency:

Country 2

of tax residency:

Clear

Application Form - Dimensional Wholesale Trusts

Date of Application Form: 23 July 202116

SECTION 7 INVESTOR CONTACT DETAILS

An individual applicant is required to supply his/her residential address. Business applicants are required to supply the registered

ofce address and principal place of business address. The Corporations Act 2001 requires Dimensional to record the applicant’s

address and to provide disclosure and periodic statements directly to the investor. Dimensional will not accept an applicant’s

residential or registered address that is care of an agent who is a nancial services licensee or an authorised representative or

employee of a nancial services licensee.

7.1

Residential/Registered ofce address (mandatory): PO Box not accepted

Street address:

c/- (if applicable):

Suburb:

State: Postcode:

Country

(if not Australia):

Telephone (Home):

Telephone

(Business):

Telephone

(Mobile):

Email:

Facsimile:

The Unit Registry’s default communication is via email. If you have provided us with your email address, you are consenting to

Dimensional using this email address to provide you with information about your investment (such as transaction conrmations,

statements, reports and other materials or notications required by the Corporations Act) or Dimensional’s products, services and

offers. You agree that Dimensional may use your email address to provide you with a PDS, including by notifying you when a PDS

has been published on its website and how you can download it. You may at any time unsubscribe from receiving disclosures from

Dimensional, in which case you will receive disclosures by mail. If you would prefer to receive paper copies via mail, tick the box below.

Opt out of electronic correspondence

Telephone (Home):

Telephone

(Business):

Telephone

(Mobile):

Email:

Facsimile:

The Unit Registry’s default communication is via email. If you have provided us with your email address, you are consenting to

Dimensional using this email address to provide you with information about your investment (such as transaction conrmations,

statements, reports and other materials or notications required by the Corporations Act) or Dimensional’s products, services and

offers. You agree that Dimensional may use your email address to provide you with a PDS, including by notifying you when a PDS

has been published on its website and how you can download it. You may at any time unsubscribe from receiving disclosures from

Dimensional, in which case you will receive disclosures by mail. If you would prefer to receive paper copies via mail, tick the box below.

Opt out of electronic correspondence

Go to Section 7.2

7.1a

Contact details for Individual 1 or Primary contact (mandatory)

7.1b

Contact details for Individual 2 (mandatory if applicable to the application)

Go to Section 7.2

Clear

Application Form - Dimensional Wholesale Trusts

DFA Australia Limited ABN 46 065 937 671

AFS Licence Number 238093 17

7.3

Principal place of business (mandatory for business applicants only)

Street address:

Suburb:

State: Postcode:

Country

(if not Australia):

Telephone

(Business):

Fax:

Email:

SECTION 8 ANNUAL REPORT

Please appropriate option:

I/We would like to be notied by email when the annual report is available on the Dimensional website

I/We would like to receive a printed copy of the annual report in the mail each year

I/We do not want to be notied by email, and do not want to receive a printed copy in the mail

Note: If you do not select an option you are expressly consenting to receiving the annual report electronically, and you are choosing

not to receive a printed copy of these documents in the mail. When the annual report is ready, Dimensional will notify you how to

access an electronic copy of these documents.

Go to Section 8

Go to Section 9

7.2

Address for correspondence (leave blank if same as Section 7.1)

Street address:

Suburb:

State: Postcode:

Country

(if not Australia):

Go to Section 7.3

Clear

Application Form - Dimensional Wholesale Trusts

Date of Application Form: 23 July 202118

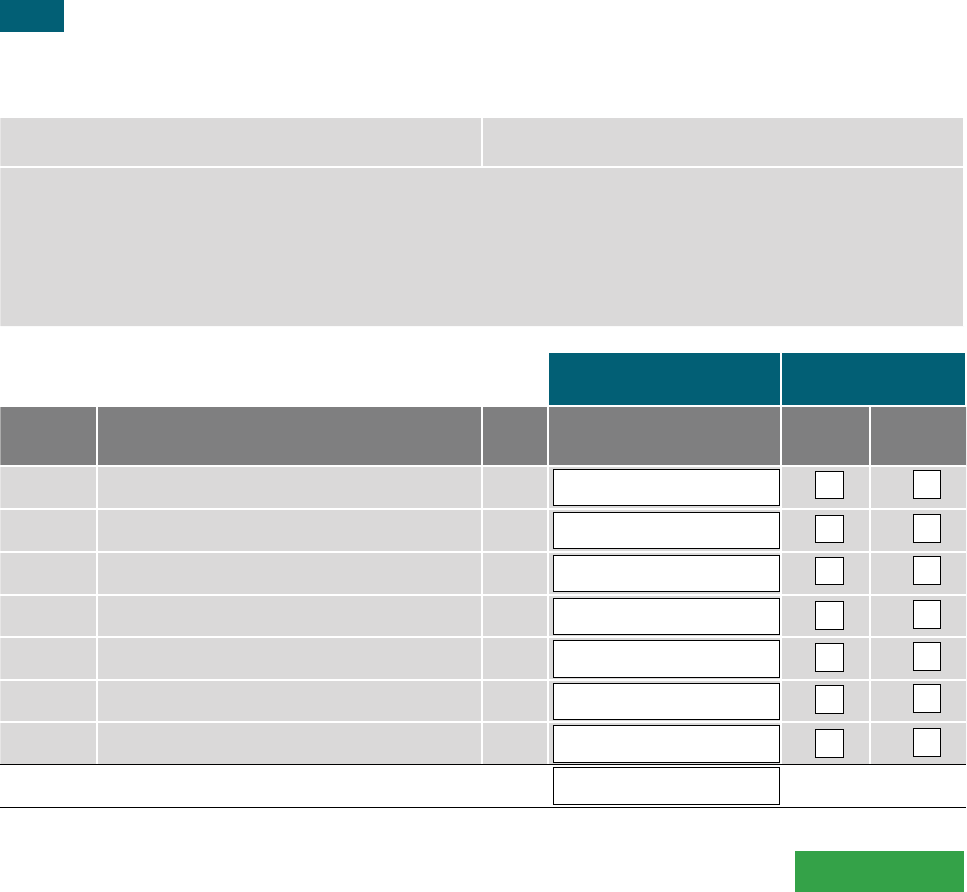

SECTION 9 INVESTMENT DETAILS

9.1

Investment amounts for applications made in Australian dollars (AUD)

Initial Investment

Minimum initial investment is $25,000

Additional Investment

Minimum additional investment is $5,000

Dimensional may refuse any investment which would not result in the investor having an account balance across all Dimensional

Wholesale Trusts of at least $500,000. Dimensional has discretion to accept lesser amounts.

A contribution fee may be charged and deducted from each investment amount. Please see section 6 of the relevant PDS for details.

If you do not make a distribution election, distributions will automatically be reinvested in additional units in the relevant Trust.

Investment Amount (A$)

Distribution Option

Please option:

APIR

Code

Fund Name

Fund

Code

Currency Reinvest

Deposit in

Nominated

Account

DFA0100AU Dimensional Short Term Fixed Interest Trust DFA01

DFA0002AU

Dimensional Two-Year Diversied Fixed Interest Trust

- AUD Class

DFA02

DFA0108AU

Dimensional Five-Year Diversied Fixed Interest Trust -

AUD Class

DFA03

DFA0005AU Dimensional Global Real Estate Trust - Unhedged Class DFA05

DFA0003AU Dimensional Australian Core Equity Trust DFA06

DFA0101AU Dimensional Australian Value Trust DFA07

DFA0103AU Dimensional Australian Large Company Trust DFA08

DFA0104AU Dimensional Australian Small Company Trust DFA09

DFA2068AU Dimensional Australian Sustainability Trust DFA30

DFA0004AU Dimensional Global Core Equity Trust - Unhedged Class DFA10

DFA0009AU Dimensional Global Core Equity Trust - AUD Hedged Class DFA11

DFA0102AU Dimensional Global Value Trust DFA13

DFA0105AU Dimensional Global Large Company Trust DFA14

DFA0106AU Dimensional Global Small Company Trust DFA15

DFA0107AU Dimensional Emerging Markets Trust DFA16

DFA8887AU Dimensional Emerging Markets Sustainability Trust DFA33

DFA0028AU Dimensional Global Bond Trust - AUD Class DFA17

DFA8313AU Dimensional World Allocation 30/70 Trust DFA31

DFA7518AU Dimensional Sustainability World Allocation 70/30 Trust DFA32

DFA0029AU Dimensional World Allocation 70/30 Trust DFA19

DFA0033AU Dimensional World Allocation 50/50 Trust DFA20

DFA0035AU Dimensional World Equity Trust DFA21

DFA0036AU Dimensional Australian Core Imputation Trust DFA22

DFA0041AU Dimensional Global Sustainability Trust Unhedged Class DFA23

DFA0042AU Dimensional Global Sustainability Trust AUD Hedged Class DFA24

DFA0642AU Dimensional Global Bond Sustainability Trust - AUD Class DFA28

TOTAL

Please refer to Section 9.2 for New Zealand funds.

A$

A$

A$

A$

A$

A$

A$

A$

A$

A$

A$

A$

A$

A$

A$

A$

A$

A$

A$

A$

A$

A$

A$

A$

A$

A$

A$

Clear

0.00

Application Form - Dimensional Wholesale Trusts

DFA Australia Limited ABN 46 065 937 671

AFS Licence Number 238093 19

9.2

Investment amounts for applications made in New Zealand dollars (NZD)

Initial Investment

Minimum initial investment is $25,000

Additional Investment

Minimum additional investment is $5,000

Dimensional may refuse any investment (i) which would not result in the investor having an account balance across all Dimensional

Wholesale Trusts of at least $500,000; or (ii) in NZD class units by an investor who is not a wholesale client under the Corporations

Act. Dimensional has discretion to accept lesser amounts.

A contribution fee may be charged and deducted from each investment amount. Please see section 6 of the relevant PDS for details.

If you do not make a distribution election, distributions will automatically be reinvested in additional units in the relevant Trust.

Investment Amount (NZ$)

Distribution Option

Please option:

APIR

Code

Fund Name

Fund

Code

Currency Reinvest

Deposit in

Nominated

Account

DFA0045AU

Dimensional Two-Year Diversied Fixed Interest Trust

- NZD Class

DFA26

DFA0001AU

Dimensional Five-Year Diversied Fixed Interest Trust -

NZD Class

DFA04

DFA0044AU Dimensional Global Real Estate Trust - NZD Hedged Class DFA27

DFA0039AU Dimensional Global Core Equity Trust - NZD Hedged Class DFA12

DFA0038AU Dimensional Global Bond Trust - NZD Class DFA18

DFA0043AU Dimensional Global Sustainability Trust NZD Hedged Class DFA25

DFA6872AU Dimensional Global Bond Sustainability Trust - NZD Class DFA29

TOTAL

Go to Section 9.3

NZ$

NZ$

NZ$

NZ$

NZ$

NZ$

NZ$

NZ$

Clear

0.00

Application Form - Dimensional Wholesale Trusts

Date of Application Form: 23 July 202120

9.3

How to invest

Please how payment will be made:

Cheque Please make cheques payable to:

‘Dimensional Wholesale Trusts (1017E App Acct)’ and crossed not negotiable. Please send the completed application

form, Identication Information (if applicable – refer to Section 12 and the Appendix) and cheque to the Unit Registry (Please

refer to Section 14.2 for postal address).

Note: Cheques cannot be accepted in New Zealand dollars.

Please note that Dimensional only accepts cheque applications after cleared funds are available. Dimensional reserves the

right to waive this condition at its discretion. Cheques generally require several business days to clear.

Electronic Transfer

For Australian dollar transfers

Account name: Dimensional Wholesale Trusts

(AUD 1017E App Acct)

Bank: Citibank NA, Australia

BSB: 242 000

Account Number: 214274027

Swift code: CITIAU2X

For New Zealand dollar transfers (only for NZD class units)

Account name: Dimensional Wholesale Trusts

(NZD 1017E App Acct)

Bank: Citibank NA, Australia

BSB: 242 000

Account Number: 214274035

Swift code: CITIAU2X

Intermediary bank Swift code: CITINZ2X

Notes:

• Please quote your eight digit investor number as a payment description for electronic application payments (existing investors only).

• Please fax (existing investors only) OR mail your completed application form to the contact details specified in Section 14.2 of the

application form.

• Original documentation for initial investments MUST be mailed to the Unit Registry postal address.

Go to Section 10

Clear

Application Form - Dimensional Wholesale Trusts

DFA Australia Limited ABN 46 065 937 671

AFS Licence Number 238093 21

SECTION 10 REDEMPTION AND DISTRIBUTION BANK DETAILS

All nominated bank account(s) must be in the name of the investor. If the investor is a trustee, the bank account name should include

the name of the trustee.

10.1

Redemption bank account details (mandatory)

Please appropriate option:

Australia dollar bank account New Zealand dollar bank account

Name of bank:

Full account name:

BSB: Account No:

Swift Code

(for NZD accounts only):

10.2

Distribution bank account details (if different to redemption account in Section 10.1)

Please appropriate option:

If you do not make a distribution election in Section 9.1 and/or Section 9.2, distributions will automatically be reinvested in additional

units in the relevant Trust.

Australia dollar bank account New Zealand dollar bank account

Name of bank:

Full account name:

BSB: Account No:

Swift Code

(for NZD accounts only):

Go to Section 10.2

Go to Section 11

Clear

Application Form - Dimensional Wholesale Trusts

Date of Application Form: 23 July 202122

SECTION 11 ADVISER CONTACT DETAILS

If you are making this investment via a Participating Adviser, please complete the following details. Where an adviser is noted on your

account, Dimensional may provide information about your investment to that adviser (including online access), unless you notify us

otherwise.

Licensed

adviser entity:

AFSL no:

Individual

adviser:

Adviser no

(if applicable):

Mailing address:

Suburb: State:

Postcode: Country:

Telephone

(Business):

Fax:

Telephone

(Mobile):

Email:

The Unit Registry’s default communication is via email. If you have provided us with your adviser’s email address, you are consenting

for your adviser to receive information about your investment (such as transaction conrmations, statements, reports and other

materials or notications required by the Corporations Act) or Dimensional’s products, services and offers.

If your adviser prefers paper copies via mail, tick the box below.

Opt out of electronic correspondence.

Go to Section 12

Clear

Application Form - Dimensional Wholesale Trusts

DFA Australia Limited ABN 46 065 937 671

AFS Licence Number 238093 23

SECTION 12 INVESTOR IDENTIFICATION

Under the AML/CTF Act and Rules, Dimensional is obligated to collect Identication Information from investors.

If you have provided Identication Information previously, then you do not need to provide additional Identication Information unless

your details have changed

12.1

Is this investment made via a Participating Adviser?

Please appropriate option:

Yes, I have applied through a Participating Adviser (See Section 1.1.2 of the Additional Information Guide). The Participating

Adviser must complete Section 12.2 of the application form.

No, I am NOT investing through a Participating Adviser. Please refer to the Appendix of the application form for the Identication

Information requirements. (Go to Section 14)

12.2

AML/CTF investor identication certication (Participating Adviser to complete)

In accordance with Part 7.2 of the AML/CTF Rules, Dimensional is relying upon you to verify the identity of the investor and where

relevant any Benecial Owners or Politically Exposed Persons (collectively “Applicant”).

In verifying the identity of the Applicant:

• I confirm that I have complied with the requirements of the AML/CTF Act and Rules (as defined in the Additional Information Guide).

• I understand that I am legally required to have verified the identity of the Applicant prior to providing the designated service (that is,

arranging for the Applicant to invest in the Trusts).

• I acknowledge that, as permitted by the AML/CTF Act and Rules, Dimensional will rely on the Applicant identification that I conduct.

Unless requested, Dimensional does not require certified copies or originals of documents used by me to verify the identity of an

Applicant.

• Dimensional may (as required) seek additional information from me or the Applicant to verify the identity of the Applicant.

• I acknowledge that Dimensional will not accept an application until it is satisfied that the identity of the Applicant is verified.

• I confirm that, in accordance with the requirements of the AML/CTF Act and Rules, I will retain all documentation (for up to seven years

after our relationship with the Applicant has ended) used by me to verify the identity of the Applicant, and will grant Dimensional access

to such documents upon request.

Please attach a copy of the appropriate FPA/FSC identication form.

I conrm that I have veried the identity of the Applicant in accordance with the AML/CTF Act and Rules.

I have read, understood and agreed to comply with the above:

Signed (must be signed by the Participating Adviser)

Sign here

Date: / /

SECTION 13 THIRD-PARTY TECHNOLOGY PROVIDERS

Consent to provide details to Third-party Technology Providers

To assist with your personal portfolio reporting in conjunction with your Participating Adviser, you may choose to allow your account

details (including Investor Number, Tax File Number (if applicable), holdings in the Dimensional Wholesale Trusts, transaction details

and distribution data) to be shared with a Third-Party Technology Provider such as Class Limited and Iress Ltd (operating Xplan), on

the terms set out in the Applicant Declarations.

Iress Ltd (operating Xplan)

I/We consent to provide account details to Iress Ltd

I/We do not consent to provide account details to Iress Ltd

Go to Section 13

Go to Section 14

Clear

Application Form - Dimensional Wholesale Trusts

Date of Application Form: 23 July 202124

SECTION 14 DECLARATIONS AND SIGNATURES

The following declarations are made by an investor and where an

investor is not an individual, by the authorised signatories acting

for and on behalf of an investor entity (which includes companies,

trusts and partnerships).

• I/We must pay application monies equal to the total investment

amount plus any applicable fees payable at the time of

submission of this application form (Application Monies), in

accordance with the PDS for the relevant Trusts that I am /we

are investing in (Relevant Trusts) and this application form, and

I/we acknowledge that Dimensional has discretion to accept my/

our application in part only, including where Dimensional receives

Application Monies that are less than the total investment amount

plus any applicable fees payable (whether due to the deduction of

bank fees or otherwise);

• I/We have personally received the PDS and Additional Information

Guide for each Relevant Trust in Australia or New Zealand* and

read the PDS and Additional Information Guide (which forms part

of the PDS) for each Relevant Trust in Australia or New Zealand*

(either printed or by electronic means) accompanied by or

attached to the application form;

• If I am/we are investing or will invest in the Trusts via the

Investment Portal (as described in the PDS), I/we have accessed,

read and accepted the terms and conditions for the Investment

Portal available on Dimensional’s public web site at www.

dimensional.com.au;

• I/We have read Section 8 covering ‘Privacy’ in the PDS for each

Relevant Trust, and Dimensional’s Privacy Policy available at

https://au.dimensional.com/privacy-policy (Privacy Policy) and

agree Dimensional may collect, use and/ or disclose information

about me/us of the type and in the manner referred to in that

section and in accordance with the Privacy Policy;

• I/We acknowledge that my/our instructions to any financial

institution to electronically transfer Application Monies to the

application account provided in this application form are not

processed instantly; inherent limitations in the banking system

can delay the receipt and identification of my/ our Application

Monies and Dimensional does not accept any responsibility for

deposits it does not know about or otherwise not made known to

Dimensional including, without limitation, Application Monies that

have been deposited in the application account but are only made

known to Dimensional at a later date and/or time (regardless if

such deposits are recorded with an earlier deposit date and/or

time);

• I/We agree to indemnify Dimensional and the Trust(s) against

any liability, losses, damages, costs and expenses reasonably

suffered or incurred by Dimensional or the Trust(s) (whether

arising in contract or tort (including negligence) or under any

statute or under any other cause of action) in the event that

Application Monies are not received in cleared funds. Such costs

could for example include losses incurred by the Trusts as a direct

result of adverse market movement where Dimensional exercises

its discretion to enter into transactions on behalf of the Trusts in

anticipation of the receipt of cleared funds;

• I am/We are not, nor to the best of my/our knowledge are any

Beneficial Owners or Controlling Persons, commonly known by

any other names different to those disclosed in this application

form;

• I/We have read Section 1.1.4 of the Additional Information Guide

for each Relevant Trust titled ‘Anti-money laundering’ and have

provided my/ our Participating Adviser with certified copies of

acceptable Identification Information OR I/We are not investing

through a Participating Adviser, and therefore have included

certified copies of acceptable Identification Information with this

completed application form as described in the Appendix to the

application form;

• I/We declare that I/We are not aware and have no reason to

suspect that the Application Monies have been derived from,

or are related to, money laundering activities or the financing of

terrorism (as those terms are defined in the AML/CTF Act and

Rules);

• I/We agree to be bound by the PDS and Additional Information

Guide, and the relevant Constitution, for each Relevant Trust (as

amended from time to time);

• Neither Dimensional nor any of its related bodies corporate or

associates guarantees the repayment of capital invested in, or

the performance of, any Trust;

• If I am/We are an individual(s), that I am/we are aged 18 years or

over;

• It is my/our sole responsibility to keep Dimensional updated with

any changes to my/our personal or bank account details;

• If I/We have accessed an electronic version of the PDS and

Additional Information Guide for each Relevant Trust, I/We have

only accessed that PDS and Additional Information Guide for

each Relevant Trust from within Australia or New Zealand*;

• If this application is by a body corporate, this application form is

signed in accordance with its constitution and the Corporations

Act; and

• If I am/we are signing this application form under a power of

attorney, no notice of revocation of that power has been received

and the donor that appointed me/us is still living.

Unless otherwise disclosed expressly to the contrary in this

application form:

• I/We am/are not a United States citizen or a resident of the

United States for taxation purposes (US Person) or otherwise a

resident of a country other than Australia;

• No person or entity controlling, owning or otherwise holding an

interest in me/us is a US Person or otherwise a resident of a

country other than Australia;

• l/We will not be receiving any financial product referred to in,

or contemplated by, the PDS for each Relevant Trust or any

payment in connection therewith for the account or benefit of

a US Person or otherwise a resident of a country other than

Australia;

• I/We agree to promptly provide Dimensional with any

information it may request from me/us from time to time,

including information it requires to comply with its obligations

under the Foreign Account Tax Compliance Act (FATCA) and

the Agreement between the Government of Australia and

the Government of the United States of America to Improve

International Tax Compliance and to Implement FATCA entered

into on 28 April 2014 and any related Australian Law or guidance

implementing the same (FATCA IGA);

• I/We agree to promptly provide Dimensional with any information

it may request from me/us from time to time, including

information it requires to comply with its obligations under

the Common Reporting Standard (CRS) in order to assist

in exchanging financial account information on foreign tax

residents;

• I/We agree to promptly notify Dimensional of any change to the

information I/We have previously provided Dimensional including

any changes which result in a person or entity, controlling or

otherwise holding an interest in me/us who is a US person or

otherwise a resident of a country other than Australia;

• I/We consent to Dimensional using and/or disclosing any

information it has in compliance with its obligations under the

FATCA IGA and CRS. This may include disclosing information

to the Australian Taxation Office, who may in turn report that

information to the US IRS or alternatively, any other regulatory

tax body participating under the CRS framework;

• I/We waive any provision of domestic or foreign law that would,

absent a waiver, prevent Dimensional from complying with its

obligations under FATCA, the FATCA IGA or CRS regime.

*Except for the Dimensional Australian Core Imputation Trust which is not currently registered or offered in New Zealand.

Application Form - Dimensional Wholesale Trusts

DFA Australia Limited ABN 46 065 937 671

AFS Licence Number 238093 25

SECTION 14 DECLARATIONS AND SIGNATURES

Third-party Technology Providers Declarations

If I/we have selected the option to provide details to a Third-party

Technology Provider, I/we:

• consent to Dimensional and/or its agents (including the Unit

Registry) providing, on an ongoing basis, the following details

regarding my/our account (which may constitute personal

information) to Third-party Technology Providers:

• Investor Number;

• Tax file number (if applicable);

• Holdings in the Dimensional Wholesale Trusts (by units and

by value);

• Transaction details;

• Distribution data; and

• Any other details considered appropriate by Dimensional

from time to time;

• acknowledge that Dimensional will only provide to Third-party

Technology Providers details regarding the account which is the

subject of this application, and not for any other accounts also

held in my/our name in a Dimensional Wholesale Trust;

• acknowledge that Dimensional will only provide to Third-party

Technology Providers the details set out above until (i) I/we

notify Dimensional in writing that I/we no longer wish for this to

occur; and/or (ii) Dimensional determines in its discretion to no

longer provide the details to one or more Third-party Technology

Providers;

• acknowledge that to the extent permitted by law, Dimensional

will not be responsible or liable for losses, damages, expenses

and costs suffered or incurred directly or indirectly as a result

of the actions of any Third-party Technology Provider or for

the availability, accuracy or currency of any of the information

provided by any Third-party Technology Provider;

• acknowledge that, until otherwise advised, the Third-party

Technology Providers cannot be used to make transactions in

respect of the Dimensional Wholesale Trusts; and

• declare and warrant that I/we will notify Dimensional as soon as

possible if I/we:

• no longer use, or wish to use, Third-party Technology

Providers; or

• no longer want Dimensional to continue providing my/

our details to a Third-party Technology Provider. Neither

Dimensional nor the Unit Registry will be liable for losses,

damages, expenses and costs suffered or incurred directly

or indirectly as a result of the actions of my/our current

or former Participating Adviser (including the actions of a

nominated person (if any)).

“Third-party Technology Providers” means any of the following

entities to whom I/we request or consent from time to time for

Dimensional and/or its agents (including the Unit Registry) to

provide my/our details:

• Class Limited;

• Iress Ltd (operating Xplan); and/or

• any other third-party technology provider determined by

Dimensional from time to time.

Application Form - Dimensional Wholesale Trusts

Date of Application Form: 23 July 202126

14.1

Account signing authorities

Please indicate below who can give Dimensional instructions in relation to your investment. If you do not tick one of the options, all

instructions must be signed by all the signatories below, or as otherwise permitted by law. You must provide a certied copy of all

authorised signatories.

Please one option:

Either Signatory 1 and 2 OR Signatory 1 and 2 OR Separate signatories list

Signatory 1:

Sign here

Date: / /

Name and Title (Director/Secretary/Sole Director/Trustee/Power of Attorney) – mandatory for corporate investors:*

Signatory 2:

Sign here

Date: / /

Name and Title (Director/Secretary/Sole Director/Trustee/Power of Attorney) – mandatory for corporate investors:*

* Please state your name and title in the company beneath your signature (e.g. director, secretary, sole director)

Signing the application form

INVESTOR TYPE REQUIRED SIGNATURE(S)

Individual Investor Where the investment is in one name, the investor must sign

Joint investors Must be signed by both investors

Corporate investors / Corporate

Trustee

A) Two directors; or

B) A director and secretary, or

C) A director (if signing as a sole director and sole company secretary of a proprietary company)

Superannuation/Trust Each trustee must sign

Power of attorney Please enclose an originally certied copy of the Power of Attorney with your application form.

The attorney certies that he/she has not received notice of revocation of that power.

14.2

Contact details

Post new account documentation to:

Citi Unit Registry Australia

GPO Box 764

Melbourne VIC 3001

Fax or Email subsequent transactions to: **

Citi Unit Registry Australia

Toll Free: 1300 886 407 (Australia)

Toll: +61 1300 886 407 (International) (existing investors only)

Email: DF[email protected]

** For further information on subsequent transactions please refer to the

Additional Information Guide (AIG)

Clear

Application Form - Dimensional Wholesale Trusts

DFA Australia Limited ABN 46 065 937 671

AFS Licence Number 238093 27

SECTION 15 APPENDIX - DIRECT INVESTOR IDENTIFICATION INFORMATION

REQUIREMENTS

Please provide the Identication Information (via post) with your

application form as set out below. If you are not able to provide all

the Identication Information, please contact the Unit Registry on

the client enquiry line Toll: (+613) 8643 9010 or Toll Free:

1300 884 560.

Individuals, sole traders, joint investors or

Benecial Owners

(i) Please provide a Certified copy of the following which

confirms the full name and either the date of birth or

residential address of the individual:

• photo page of an Australian passport; or

• an Australian driver’s licence containing a photo of the

person; or

• identity card issued under State or Territory for the purpose

of proving a person’s age containing a photo of the person;

or

• photo page of a foreign passport; if this is not available a

foreign driver’s licence containing a photo of the person.

Note: if the application is for a minor, the application should be

completed by the parent/guardian who will be the registered

holder. If you wish to include the name of the minor in the account,

please provide a Certied copy of the minor’s birth certicate.

Companies

(i) Regulated Company/listed company or majority owned

subsidiary of an Australian listed company: please

provide the following which confirms the full name and

that the company is regulated, listed or a majority owned

subsidiary of an Australian listed company:

• extract from the relevant market/exchange; or

• extract from the ASIC database; or

• details of the licence from the relevant regulator.

(ii) Other companies: please provide the following which

confirms the full name, identification number (e.g. ABN, ACN

or ARBN or foreign identification number) and whether the

company is registered as public or proprietary (private):

• Search of the ASIC or relevant foreign registration body

database; or

• Certified copy of the certificate of incorporation.

(iii) Unregulated proprietary company: please also provide

the full name of each director.

Regulated Company means a company that is licensed and

subject to the regulatory oversight of a Commonwealth, State

or Territory statutory regulator in relation to its activities as a

company.

Note: this section also applies to companies that are investing in

the capacity of a custodian of a separate entity such as custodian

of a superannuation fund, trust or platform.

Trusts and Trustees (including superannuation

funds)

(i) Australian Regulated Trusts: please provide the following

which confirms the full name of the trust and type of trust:

• Certified copy of the trust deed (or suitable extract thereof);

or

• extract from the ASIC database, ATO or relevant regulator’s

website; or

• offer document of the managed investment scheme (PDS);

or

• extract of the legislation establishing the government

superannuation fund.

(ii) Unregulated trusts: please provide the following which

confirms the full name of the trust:

• Certified copy of the trust deed (or suitable extract thereof);

or

• notice issued by the ATO within the last 12 months (e.g. a

Notice of Assessment).

Individual trustee: in relation to one of the trustees, please also

provide Identication Information required for an individual.

Corporate trustee: please also provide Identication Information

required for a company.

Regulated Trust means a trust that is: (i) a managed investment

scheme registered by ASIC; (ii) a managed investment scheme

that is not registered by ASIC and that: only has wholesale

clients; and does not make small scale offerings to which

section 1012E of the Corporation Act applies; (iii) registered and

subject to regulatory oversight of a Commonwealth statutory

regulator in relation to its activities as a trust (e.g. self-managed

superannuation fund); or (iv) a government superannuation fund

established by legislation.

Partnership and Partners

(i) Please provide a Certified copy of:

• the partnership agreement (or suitable extract thereof); or

• a notice issued by the ATO within the last 12 months (e.g.

Notice of Assessment).

(ii) If the partnership is regulated by a professional association,

please also provide a Certified copy of the current

membership certificate.

Partner: in relation to one of the partners, please also provide

Identication Information required for an individual.

Association and Member

(i) Please provide a Certified copy of the following which

confirms the full name of the association and ID number

issued on incorporation (if incorporated):

• constitution or rules of the association (or suitable extract

thereof); or

• extract from the ASIC database or the government body

responsible for the incorporation of the association.

Member: in relation to the member signing on behalf of the

association, please also provide the Identication Information

required for an individual.

Co-operative

(i) Please provide the following which confirms the full name

and any ID number issued to the co-operative (if any):

• extract from the ASIC database or the government body

responsible for the registration of the co-operative; or

• Certified copy of the register maintained by the co-operative

(or suitable extract thereof).

Application Form - Dimensional Wholesale Trusts

Date of Application Form: 23 July 202128

Government Body

(i) Please provide a copy of the following which confirms the

full name, principle place of operation and whether the

government body is a body of the Commonwealth, State or

Territory of Australia or a foreign country:

• relevant extract of the legislation establishing the

government body; or

• details of the government website.

Denitions

Certied copy means a document that has been certied as a

true copy of an original document by one of the following persons:

(i) a person who, under a law in force in a State or Territory, is

currently licensed or registered to practise in an occupation

listed in Part 1 of Schedule 2 of the Statutory Declarations

Regulations 2018;

(ii) a person who is enrolled on the roll of the Supreme Court of

a State or Territory, or the High Court of Australia, as a legal

practitioner (however described);

(iii) a person listed in Part 2 of Schedule 2 of the Statutory

Declarations Regulations 2018. For the purposes of these

Rules, where Part 2 uses the term ‘five or more years of

continuous service’, this should be read as ‘two or more

years of continuous service’;

(iv) an officer with, or authorised representative of, a holder of

an Australian financial services licence, having two or more

years of continuous service with one or more licensees;

(v) an officer with, or a credit representative of, a holder of

an Australian credit licence, having two or more years of

continuous service with one or more licensees; or

(vi) a person authorised as a notary public in a foreign country.

Benecial Owner means an individual who ultimately owns or

controls (directly or indirectly) the investor. ‘Control’ includes

control as a result of, or by means of, trusts, agreements,

arrangements, understandings and practices, whether or not

having legal or equitable force and whether or not based on legal

or equitable rights, and includes exercising control through the

capacity to determine decisions about nancial and operating

policies. ‘Owns’ means ownership (either directly or indirectly) of

25% or more of the investor.

Controlling Person means the natural persons who exercise

control over an Entity. For example, for a trust, this may include

the settlor(s), the trustee(s) or beneciary(ies), and any other

natural person(s) exercising ultimate effective control. The term

“Controlling Persons” must be interpreted in a manner consistent

with the Financial Action Task Force Recommendations.

Non-Financial Entity means an entity that is not a nancial

institution. An NFE may be an ‘Active NFE’ or ‘Passive NFE’

pursuant to the CRS regulations.

(i) An ‘Active NFE’ is one, which amongst other things, is:

• where less than 50% of the NFE’s gross income for the

preceding calendar year or other appropriate reporting

period is passive income and less than 50% of the assets

held by the NFE during the preceding calendar year are

assets that produce or are held for the production of passive

income’;

• the stock of the NFE is regularly traded on an established

securities market or the NFE is a Related Entity of an Entity

the stock of which is regularly traded on an established

securities market;

• the NFE is a Governmental Entity, an International

Organisation or Central Bank;

• the NFE is not yet operating a business and has no prior

operating history, but is investing capital into assets

with the intent to operate a business other than that of a Financial

Institution, provided that the NFE does not qualify for this

exception after the date that is 24 months after the date of the

initial organisation of the NFE; or

• the NFE was not a Financial Institution in the past five

years, and is in the process of liquidating its assets or is

reorganising with the intent to continue or recommence

operations in a business other than that of a Financial

Institution.

(ii) A ‘Passive NFE’ is any NFE that is not an Active NFE.

Politically Exposed Person:

(i) a Head of State or head of a country or government,

including Australia;

(ii) a government minister or equivalent senior politician;

(iii) a senior government official;

(iv) a Judge of the High Court of Australia, the Federal Court

of Australia or a Supreme Court of a State or Territory, or a

Judge of a court of equivalent seniority in a foreign country

or international organisation;

(v) a governor of a central bank or any other position that has

comparable influence to the Governor of the Reserve Bank

of Australia;

(vi) a senior foreign representative, ambassador, or high

commissioner or a high-ranking member of the armed

forces;

(vii) a board chair, chief executive, or chief financial officer of,

or any other position that has comparable influence in, any

State enterprise or international organisation; or

(viii) an individual who otherwise holds a prominent public

position or function in a government body or an international

organisation.

An immediate family member or close associate of any of the

above. An immediate family member includes a spouse, de facto

partner, child, child’s spouse or de facto partner, or a parent.

A close associate is any individual who has joint Benecial

Ownership of a legal entity or legal arrangement with a person

listed above or sole Benecial Ownership of a legal entity or legal

arrangement for the benet of a person listed above.

Settlor of the trust is the grantor or donor of the trust if they

contributed $10,000 or more to the trust and they are alive at the

date of this application.

Direct investor is an individual or an entity not investing via an

Investor Service or a Participating Adviser.

SECTION 15 APPENDIX - DIRECT INVESTOR IDENTIFICATION INFORMATION

REQUIREMENTS

THIS PAGE HAS BEEN INTENTIONALLY LEFT BLANK

Application Form - Dimensional Wholesale Trusts

Date of Application Form: 23 July 202130

Dimensional

Gateway Building

Level 43, 1 Macquarie Place

Sydney NSW 2000

PO Box R1830

Royal Exchange NSW 1225

Australia

General Enquiries:

(+612) 8336 7100

Email: [email protected]

Web: www.dimensional.com.au

Unit Registry

Citi Unit Registry Australia

GPO Box 764

Melbourne VIC 3001

Client Enquiries:

Toll free 1300 884 560

Toll (+613) 8643 9010

Email: [email protected]

Client Instructions:

Fax:

Toll Free: 1300 886 407 (Australia)

Toll: +61 1300 886 407 (International)

Email: DF[email protected]