QUICK START SUPPLEMENT • QUICK START SUPPLEMENT • QUICK START SUPPLEMENT

• The Guide to Cashing Savings Bonds • The Guide to Cashing Savings Bonds •

• The Guide to Cashing Savings Bonds • The Guide to Cashing Savings Bonds •

The Guide to Cashing Savings Bonds • The Guide to Cashing Savings Bonds • The Guide to Cashing

Cashing Savings Bonds • The Guide to Cashing Savings Bonds • The Guide to Cashing Savings Bonds

Section Title Here

FS Publication 0022

Revised October 2022

QUICK START SUPPLEMENT • QUICK START SUPPLEMENT • QUICK START SUPPLEMENT

2

2

The Guide To Cashing Savings Bonds (FS P 0022)

T

he United States Treasury created this guide to help nancial institutions navigate the process of

redeeming and cashing paper savings bonds so you can balance quality customer service with ecient

and accurate performance. It’s a win-win for your nancial institution – knowing the procedures and

processes helps protect your nancial institution from loss.

If you accidentally cash a bond or note for the wrong person or if you cash a bond or note that otherwise

results in a nancial loss, your nancial institution is liable for the loss unless the Department of the Treasury

can determine your institution was not at fault or negligent as a paying agent. That’s where individual

responsibility comes in. If you follow this guide whenever you cash a savings bond (and you may on

occasion need to refer to additional instructions and guidance provided through www.frbservices.

org), it will be easier for Treasury to make that determination.

How this guide works

The Guide to Cashing Savings Bonds is designed to help nancial institutions ow through decisions you

must make when a customer brings a note or bond to redeem. Here are the basic questions to answer and

steps to take:

1.

Is each bond authentic and eligible to be redeemed?

2. Is the person cashing the bond entitled to it?

3. What is the bond’s redemption value?

4. Can you verify the customer’s identity?

5. Documents for identication

6. Making a payment

7. Final steps for internal processing

Your nancial institution’s basic responsibilities

Required: Cash savings bonds or notes that are eligible for payment for an established account holder at

your bank who presents the proper identication and who seems worthy of your trust.

Optional: Payment to a person who doesn’t hold an account at your bank or who only recently opened an

account at your bank is at the option of your nancial institution. The Secret Service recommends a bank not

cash bonds for a customer not established at the bank for at least 12 months. If you choose for any reason

not to cash a bond, you may refer the customer to the TreasuryDirect.gov website and its instructions for

cashing by mail. In this case, the customer mails the bond, FS Form 1522, and possibly other materials to

Treasury Retail Securities Services in Minneapolis.

Prohibited: Do NOT cash bonds or notes presented and signed by:

n an attorney-in-fact (an individual acting under a power of attorney);

n a step-parent on behalf of a minor;

n someone whose name is the same as, or similar to, the bond owner’s name when you know that the

presenter is not the owner and not entitled to payment; or

n someone whose name appears only in the address in a bond’s inscription after the words “Mail to.”

QUICK START SUPPLEMENT • QUICK START SUPPLEMENT • QUICK START SUPPLEMENT

3

3

Do NOT cash bonds or notes if:

n any information on those bonds or notes has been altered;

n the bonds or notes are mutilated or defaced in any way;

n there are any noticeable irregularities in the texture, feel, or appearance of the bonds or notes;

n they are photocopies, images, or photographs – or any other types of copies; or

n you are suspicious of the bonds or notes or the person presenting them.

Disasters and Hardship Cases

In the event of nancial hardship or certain designated disasters, exceptions may be available for quicker

redemptions. In such situations, please contact Treasury Retail Securities Services at 1-844-284-2676.

Why notations are SO important

It’s very important to note the identication or evidence you accept. You can make that notation on the

bond or on a separate record (which must be retained). Either way, make sure your notation is clear, readable

and detailed enough to show exactly how you established the customer’s identication and/or where any

evidence can be found if ever necessary. The goal is to ensure your notes can be easily read on images,

copies, photocopies, or photographs of redeemed bonds and notes.

We even provide examples of adequate notations. This is important because if Treasury has any question

about the liability of your nancial institution as a result of the payment, the institution must be able to

provide complete information about the payment and the identication that was used.

Examples of common forms of registration

Sole Owner: “John A. Doe”

Co-owner: “John A. Doe OR Mary B. Doe”

Owner with Beneciary: “John A. Doe POD Mary B. Doe”

Understanding Issue Dates and Validation Dates

Issue Date – Use the Issue Date to price the bond. Issue dates consist of the month and year

(eg: 5/89 or Nov. 1989)

Validation Date – The Validation Date simply represents the date the bond was printed. Do NOT use it to

determine the value of the bond. Validation dates consist of the month, day, and year (eg: 1/02/89).

A validation date could dier from the issue date if, for example, the bond was reissued or was included

in a claim for lost bonds and consequently replaced.

However, be sure to compare the Issue Date to the Validation Date. If you nd an obvious dierence, it could

indicate an error in the Issue Date that may cause the bond to be paid incorrectly. As an example: an Issue

Date of January 2011 and a Validation Date of January 2, 2012.

For unanswered questions, please follow established procedures to contact Treasury Retail Securities

Services at PO Box 9150, Minneapolis, MN 55480-9150 or call 1-844-284-2676.

CLICK TO BEGIN

QUICK START SUPPLEMENT • QUICK START SUPPLEMENT • QUICK START SUPPLEMENT

4

4

YES

YES

YES

NO

NO

NO

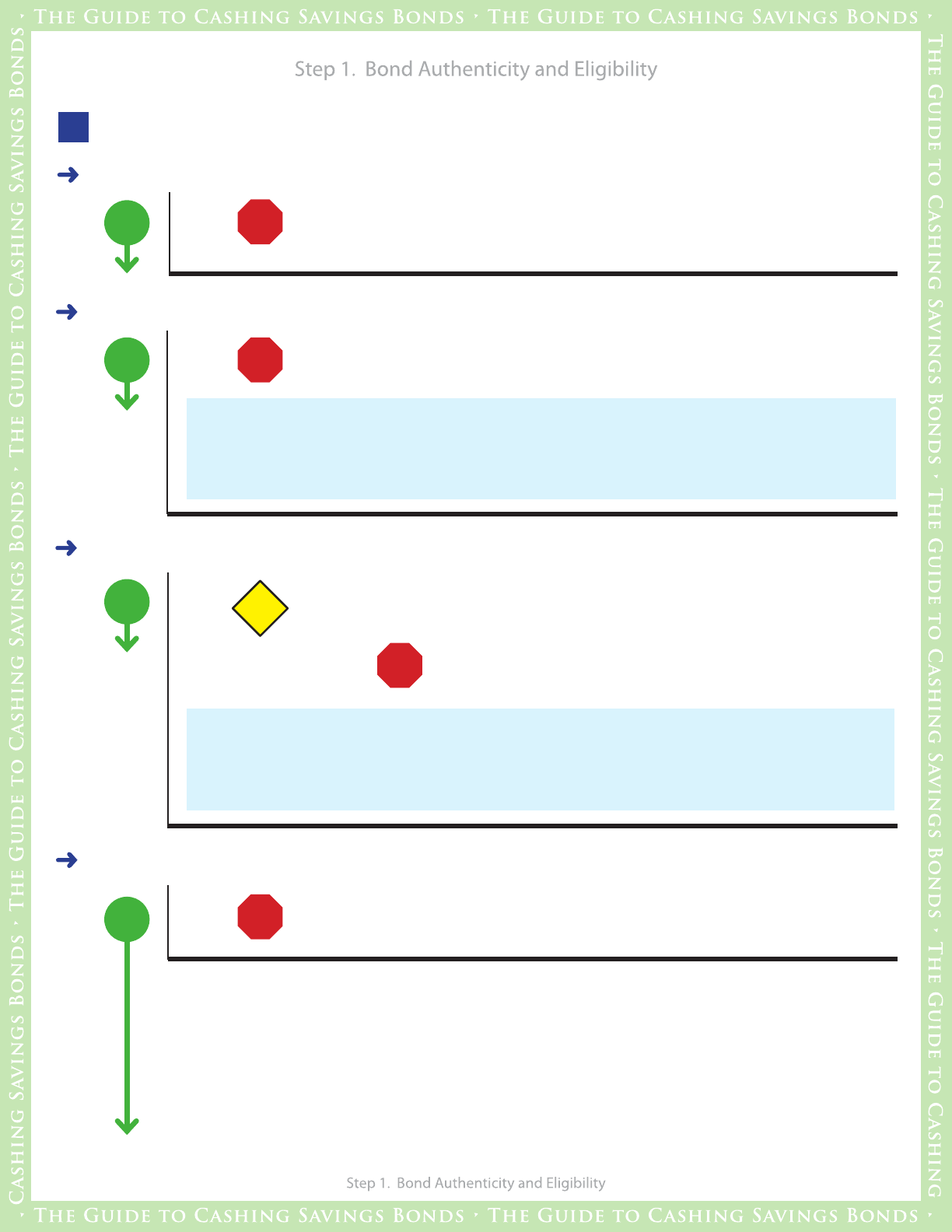

Is each bond authentic and eligible to be redeemed?

STOP

STOP

STOP

STOP

GO

GO

GO

GO

1

Don’t cash the bond. Refer the customer to TreasuryDirect.gov and its

instructions for cashing by mail. (Don’t cash or redeem Series F, G, J, K, H, and

HH or Individual Retirement Bonds or Retirement Plan Bonds.)

Don’t cash the bond. Refer the customer to TreasuryDirect.gov and its

instructions for cashing by mail.

Is the bond a Series E, Savings Note, Series EE, or Series I?

HINT: Valid Issue Dates are: Series E – May 1941 – June 1980

Savings notes – May 1967 – October 1970

Series EE – January 1980 – December 2011

Series I – September 1998 – Present

Is the Issue Date valid?

YES NO

HINT: Price bonds using the Issue Date, NOT the Validation Date. Be sure to compare the

Issue Date with the Validation Date for obvious errors on bonds that were issued Over

the Counter (OTC). For example, an Issue Date may show 1/02 while the Validation Date

shows 1/2/03, or vice versa.

Use caution. Some bonds may have legitimate variation in dates, generally

when the bonds were reissued as a result of a claim or reissue transaction.

WAIT

Does the Issue Date match the bond’s Printed Date?

If you are at all unsure,

Refer the customer to TreasuryDirect.gov and its

instructions for cashing by mail.

Has the bond been held for the minimum retention period of 12 months?

Don’t cash the bond. It’s not yet eligible for payment. Explain to the

customer that the bond must be held for the minimum holding period.

QUICK START SUPPLEMENT • QUICK START SUPPLEMENT • QUICK START SUPPLEMENT

5

5

NO

YES

Don’t cash the bond if there’s any indication that someone has visibly,

physically changed the names, addresses, issue dates, or any other

information. For example: the person added a name to the front; there

appear to be erasures; someone changed or tried to change the issue date.

HINT: Check for variations in the font and type size. There should be none.

HINT: Check to be sure the printed area of the bond (the inscription on the face of the

bond) is aligned LEFT. Any variance in alignment indicates changes.

Has information printed on the savings bond been altered in any way?

Has the bond been mutilated or defaced in any way?

NO YES

Is the bond a photocopy or some other kind of copy?

Are there any noticeable irregularities in the texture, feel, or appearance of the bond?

Don’t accept or cash any bond that appears to be copied. Is it printed on

bond stock? Is it black and white? (Color copies are no guarantee – printers

are getting more sophisticated.) Check the back of the bond for two things:

(1) reference to regulations and (2) signature lines printed on the bond.

Finally, make sure everything lines up correctly – check for any slight slants

or o-kilter printing or graphics.

HINT: Check for serrated edges on newer bonds (where they were printed, perforated,

and separated). Be aware that many older bonds do not have serrated edges, however.

HINT: If a presenter asks you if a bond is good, that’s a tip he or she knows it may not

be. We offer two tools that can help. Savings Bond Valuation and Verification (SBVV)

and Savings Bond Pro allow you to verify bonds’ serial numbers against a Treasury file

of bonds reported lost, stolen, or never received.

More information:

n SBVV — Send e-mail to [email protected]

n Savings Bond Pro — See https://www.treasurydirect.gov/savings-bonds/cashing-a-

bond/savings-bond-pro/features

STOP

STOP

GO

GO

QUICK START SUPPLEMENT • QUICK START SUPPLEMENT • QUICK START SUPPLEMENT

6

6

Is the person cashing the bond entitled to it?

2

YES

NO

NO

to ANY

HINT: If there is a “Mail To:” name printed on the bond, that person is NOT a registered

owner and is NOT entitled to payment.

Is the customer:

ACTION

Is the customer named as owner or co-owner (“or”) on the bond?

Don’t cash the bond. Refer the customer to TreasuryDirect.gov

and its instructions for cashing by mail.

a parent of a minor who is named as owner or co-owner? GO to 2-a

named as beneciary? GO to 2-b

requesting payment as a legal representative? GO to 2-c

NO YES

Don’t cash the bonds. This might happen if two people in the same family

have the same name. For example, the presenter is a Jr., Sr., I, II, III but there

is no sux on the bond (or vice versa). The names are the same with the

exception of the bond showing either a dierent or no middle initial.

Do you have any reason to think the person requesting payment might not be the actual owner, co-

owner, or other person named on the bonds, even though he or she seems to have the same name as

one of those printed on the bonds?

YES NO

Has the person signed the Requests for Payment on the backs of the bonds in your presence?

Don’t cash the bond until the customer signs or re-signs in our presence.

YES

NO

HINT: If the names don’t match, remember that it could be a situation where family

members share names or suxes are dierent.

Use caution. Is it an obvious dierence, like a shortened rst name, a

maiden or married name? Have them re-sign, note the explanation, and

proceed. If it’s not obvious or the explanation doesn’t satisfy you, don’t cash

the bond; refer the customer to TreasuryDirect.gov and its instructions for

cashing by mail.

Do the SIGNATURE and NAME match the name on the bond exactly?

STOP

STOP

GO

GO

GO

GO

WAIT

WAIT

OPTION: Payment to a person who doesn’t hold an account at your bank or who only recently opened

an account at your bank is at the option of your nancial institution. If you choose for any reason not to

cash a bond, you may refer the customer to TreasuryDirect.gov and its instructions for cashing by mail.

QUICK START SUPPLEMENT • QUICK START SUPPLEMENT • QUICK START SUPPLEMENT

7

7

Special Cases: Parents

2 a

OPTION: Payment to a parent is at the option of your nancial institution. If your institution doesn’t want

to make the payment, refer the customer to TreasuryDirect.gov and its instructions for cashing by mail.

YES

YES

NO

NO

Don’t cash the bond. Refer the customer to TreasuryDirect.gov and its

instructions for cashing by mail.

Don’t cash the bond. Refer the customer to TreasuryDirect.gov and its

instructions for cashing by mail. Payment can only be requested by the

parent with whom the child resides or who has been given legal custody.

Is the customer the parent of a child named as owner or co-owner?

Is the customer the custodial parent with legal custody?

HINT: A step-parent is not permitted to request or receive payment on behalf of a child

named as an owner or co-owner.

YES NO

Is the child too young to sign the request and understand the transaction?

Have the child sign the request. Obtain and note identication.

On the back of the bond, have the parent enter a request similar to: “I certify that I am the

parent of Jane Doe with whom Jane Doe resides (or to whom legal custody has been granted).

She is X years old and is not of sucient understanding to make this request. John Doe on

behalf of Jane Doe.”

And then proceed.

STOP

STOP

GO

GO

GO

ACTION

ACTION

ACTION

Is the address on the bond the customer’s current address?

Is the Social Security Number on the bond the customer’s?

Ask the customer to enter the correct SSN

and/or the correct address on the back of

the bond before continuing.

GO

Go to 2-e

Is the answer

YES to BOTH?

Is the answer

NO to EITHER?

QUICK START SUPPLEMENT • QUICK START SUPPLEMENT • QUICK START SUPPLEMENT

8

8

Special Cases: Beneciary

2 b

OPTION: Payment to a beneciary is at the option of your nancial institution. If your institution doesn’t

want to make the payment, refer the customer to TreasuryDirect.gov and its instructions for cashing by mail.

YES

YES

NO

NO

Don’t cash the bond. The customer must have a certied death certicate.

Don’t cash the bond. The customer must have a certied death certicate.

Does the customer have a death certicate for the owner?

Is the death certicate certied under seal of the state or local registrar?

YES NO

Is the name on the death certicate the same as the owner’s name on the bond?

Use caution. Is it an obvious dierence, like a shortened rst name,

a maiden or married name? Have the customer re-sign, note the

explanation, and continue.

Don’t cash the bond. Refer the customer

to TreasuryDirect.gov and its instructions

for cashing by mail.

If it’s not obvious

or the explanation

doesn’t satisfy you:

STOP

STOP

GO

GO

WAIT

GO

STOP

YES NO

Is the address on the bond the child’s current address?

Ask the customer to enter the child’s address on the back of the bond and

go to 2-e.

Go to 2-e

GO

ACTION

YES NO

Is the Social Security Number on the bond the child’s?

Ask the customer to enter the child’s SSN on the back of the bond

before continuing.

Inform the customer that he/she must obtain one for the

child before the bond can be cashed on the child’s behalf.

If the child does not have

a Social Security Number:

STOP

GO

ACTION

YES NO

Has the beneciary signed the request for payment in your presence?

Ask the customer to sign or re-sign the request before continuing.

GO

ACTION

QUICK START SUPPLEMENT • QUICK START SUPPLEMENT • QUICK START SUPPLEMENT

9

9

YES NO

Is the address on the bond the beneciary’s current address?

Ask the customer to enter his or her address on the back of the bond and

go to 2-e.

GO

ACTION

YES NO

Is the Social Security Number on the bond the beneciary’s?

Ask the customer to enter his or her number

on the back of the bond before continuing.

GO

ACTION

YES NO

Does the signature match EXACTLY the name on the bond?

Use caution. Is it an obvious dierence, like a shortened rst name,

a maiden or married name? Have the customer re-sign, note the

explanation, and continue.

Don’t cash the bond. Refer the customer

to TreasuryDirect.gov and its instructions

for cashing by mail.

If it’s not obvious

or the explanation

doesn’t satisfy you:

STOP

GO

WAIT

Go to 2-e

Special Cases: Legal Representative

2 c

OPTION: Payment to a legal representative is at the option of your nancial institution. If your institution

doesn’t want to make the payment, refer the customer to TreasuryDirect.gov and its instructions for

cashing by mail.

NO

YES

Don’t cash the bond. Refer the customer to TreasuryDirect.gov

and its instructions for cashing by mail. You may not pay to an

attorney-in-fact.

Is the customer an attorney-in-fact (acting under a power of attorney)?

YES NO

Is the legal representative designated on the bond by both name and title

(EX: “John Doe EX U/W Mary Doe Decd”)?

If the legal representative was NOT designated on the bond by name and

duciary title but WAS appointed by the court to settle and represent a

decedent’s estate, go to 2-d Legal Representative Not Named on Bond.

If the legal representative was NOT designated on the bond, and if that representative is a

guardian, trustee, or other representative who was NOT appointed by the court to represent

and settle a decedent’s estate:

Don’t cash the bond. Refer the customer to

TreasuryDirect.gov and its instructions for cashing

by mail.

STOP

STOP

GO

GO

ACTION

QUICK START SUPPLEMENT • QUICK START SUPPLEMENT • QUICK START SUPPLEMENT

10

10

YES NO

Has the legal representative signed the request for payment in your presence?

Is the taxpayer identication number on the bond the same one used for the estate?

Does that signature include the capacity in which he or she is acting?

Is the address on the bond the same mailing address for the estate?

Ask the customer to sign or re-sign the request and provide the capacity

(Ex: “U/W Mary Doe Decd”) before continuing.

YES NO

Use caution. Is it an obvious dierence, like a shortened rst name,

a maiden or married name? Have the customer re-sign, note the

explanation, and continue.

Does the signature with duciary title (ex: guardian, executor, trustee, etc.) match exactly the name and

duciary title on the bond?

Don’t cash the bond. Refer the customer

to TreasuryDirect.gov and its instructions

for cashing by mail.

If it’s not obvious

or the explanation

doesn’t satisfy you:

YES NO

Ask the customer to enter the correct TIN and/or address on the

back of the bond and go to 2-e.

STOP

GO

GO

GO

WAIT

ACTION

ACTION

Go to 2-e

QUICK START SUPPLEMENT • QUICK START SUPPLEMENT • QUICK START SUPPLEMENT

11

11

Special Cases: Legal Representative Not Named on Bond

2 d

OPTION: Payment to a legal representative is at the option of your nancial institution. If your institution

doesn’t want to make the payment, refer the customer to TreasuryDirect.gov and its instructions for

cashing by mail.

YES

NO

Don’t cash the bond. Refer the customer to TreasuryDirect.gov and its

instructions for cashing by mail. The customer must have a certied death

certicate for each person named on the bond.

Does the customer have a death certicate (certied under seal of the state or local registrar) for each

person named on the bond?

YES NO

Use caution. Is it an obvious dierence, like a shortened rst name, a

maiden or married name? Have the customer re-sign, note the

explanation, and continue.

Is the name on the death certicate(s) the same as the name on the bond?

Don’t cash the bond. Refer the customer

to TreasuryDirect.gov and its instructions

for cashing by mail.

If it’s not obvious

or the explanation

doesn’t satisfy you:

YES

NO

The customer may not request payment. The bond belongs to the estate

of the named owner who died last.

Is the customer acting for the estate of the LAST deceased?

HINT: When two people named on a bond (as co-owners or as owner and beneciary)

are both dead, that bond belongs to the estate of the person named on the bond who

died last. In this situation, reject any request from anyone acting for or representing the

estate of the person who died rst.

When two people are named on a bond (as co-owners or as owner and beneciary) and

only one is dead, the bond belongs to the living, surviving person who is named on it.

YES

NO

Don’t cash the bond. The customer must have a certied copy of his or

her authority or appointment.

Does the customer have evidence of his/her authority or appointment?

Does it show that he/she is the representative of the decedent’s estate with full authority to represent

and settle the estate?

STOP

STOP

STOP

STOP

GO

GO

GO

GO

WAIT

QUICK START SUPPLEMENT • QUICK START SUPPLEMENT • QUICK START SUPPLEMENT

12

12

Refer the customer to TreasuryDirect.gov and its instructions for cashing by mail if:

n

Evidence of the representative’s authority is “limited” or “special” rather than “full”

general authority to settle the estate.

n

The customer states that he/she is designated in a will as the executor, but there

is no legal evidence or other indication that the will was probated and that the

customer was appointed through court proceedings.

n

The estate is being settled using a small estate adavit, a special estate settlement

process under State law.

n

The estate is being settled informally.

YES

NO

Don’t cash the bond. The customer must have a certied copy of his or her

authority or appointment.

Is the evidence of authority or appointment certied to be true and correct under court seal?

YES

NO

Don’t cash the bond. The customer must have evidence of an appointment

that’s in full force and eect.

Is the evidence of authority or appointment current?

HINT: Consider evidence current if:

n

The appointment was made no more than 1 year prior to today’s date, or

n

The evidence bears a full force and eect statement issued within one year of the

presentation of the bonds.

YES

YES

NO

NO

Has the customer signed the request for payment in your presence?

Does that signature include the capacity in which he/she is acting (Ex: U/W Mary Doe Decd”)?

Is the Taxpayer Identication Number on the bond also the one used for the estate?

Is the address on the bond the same as the one used for the estate?

Ask the customer to sign or re-sign the request,

including the capacity before continuing.

Ask the customer to enter the correct TIN and/or mailing address on the

back of the bond before continuing.

STOP

STOP

GO

GO

GO

GO

ACTION

ACTION

ACTION

QUICK START SUPPLEMENT • QUICK START SUPPLEMENT • QUICK START SUPPLEMENT

13

13

For a case involving a death certicate or evidence of authority or appointment, note either on the bond or

in a separate record the following information:

From each death certicate:

n

the document number or case number,

n

the name and location of the issuing authority, and

n

the date of death of each person named on the bond.

From the evidence of authority or appointment:

n

the document number or case number,

n

the date of issuance or full force and eect certication, and

n

the name and location of the issuing authority.

EX: “D/C John Doe, St of KS, No 50-87, DOD 7/30/90; L/A John Doe, St of KS, Kay Cty, No P87-5,

Dist Ct 7/17/90”.)

Make Clear and Complete Notes

2 e

Go to Step 3

QUICK START SUPPLEMENT • QUICK START SUPPLEMENT • QUICK START SUPPLEMENT

14

14

What is the bond’s redemption value?

3

The Fiscal Service oers banks two tools for determining the redemption value of a savings bond. They are

Savings Bond Pro and Savings Bond Valuation and Verication (SBVV). Also, your bank may have a pricing

tool of its own.

Though Bond Pro and SBVV both price bonds, the two tools are different. For information on SBVV, send

an e-mail to [email protected]. For information on Bond Pro, see below.

Characteristics of Bond Pro:

n A caveat file that shows bonds reported lost, stolen, damaged, etc., is updated once every six

months, when we perform the values update.

n You download a program and then download updates every six months.

n Banks track how many bonds they redeem and who redeems them, and can create a 1099 data file

for tax reporting.

n For each customer, Bond Pro stores information such as address, Social Security Number, and bonds

purchased and cashed.

Go to Step 4

More: https://www.treasurydirect.gov/savings-bonds/cashing-a-bond/financial-institutions/#pro

QUICK START SUPPLEMENT • QUICK START SUPPLEMENT • QUICK START SUPPLEMENT

15

15

ACTION

Can you verify the customer’s identity?

4

There are three kinds of identication you may use:

n

the individual is an established account holder at your nancial institution

n

the individual is identied by another person

n

the individual presents an identication document (used only for payments of $1,000 or less)

Individual is an established account holder

4 a

Go to 4-c.

Does the customer have an account at your nancial institution?

Is the account at least 12 months old?

Does the customer’s signature on the bond match that person’s signature on le at your institution?

Are you condent the bond and the person presenting it are legitimate?

YES

YES NO

NO

Don’t cash the bond. Refer the customer to TreasuryDirect.gov and its

instructions for cashing by mail.

Don’t cash the bond. Refer the customer to TreasuryDirect.gov and its

instructions for cashing by mail.

Cash the bond. Makes notes to clearly show the identication you are using to verify the customer.

n

Type of account,

n

Account number, and

n

Date account was established.

(Ex: “Ck Acct 3421, 4/1/80”)

GO

GO

ACTION

ACTION

Individual is identied by another person

4 b

Go to 4-c.

GO

GO

Is the customer with another person who’s an established customer of your nancial institution?

Does the identier know the customer by the name on the bond?

Is the answer

YES to BOTH?

Is the answer

YES to BOTH?

Is the answer

NO to EITHER?

Is the answer

NO to EITHER?

HINT: The established customer must have had an account open for at

least 12 months or be well known to an ocer at your nancial institution.

STOP

STOP

QUICK START SUPPLEMENT • QUICK START SUPPLEMENT • QUICK START SUPPLEMENT

16

16

Does the identier reliably know the customer?

Is their acquaintance of sucient duration?

HINT: Personal identication based on a casual acquaintance isn’t reliable. Ex: a brief

landlord-tenant relationship or identication made of patrons by owners or employees of

hotels, bars, restaurants, bowling alleys, etc.

YES

NO

Go to 4-c.

Have the identier sign the back of the bond, then cash the bond. Clearly note what kind of

identication you accepted. Include:

n

name and address of the identier,

n

relationship, and

n

length of the acquaintance.

(Ex: “John Smith, 98 Oak St, ex-college roommate, 10 yrs”)

STOP

STOP

GO

ACTION

Individual is identied through documentation

4 c

Does the customer have a motor vehicle operator’s license or state identication card?

YES NO

If the customer:

n

has another form of ID, check the document lists in Step 5, conrm it’s

acceptable, and then continue.

n

Doesn’t have acceptable ID, Don’t cash the bond.

The customer may take the bond to a nancial institution where he or

she is an established customer or may try to cash by mail, following

instructions on TreasuryDirect.gov.

STOP

GO

ACTION

Are you condent the bond and the person presenting it are legitimate?

YES NO

Don’t cash the bond. Refer the customer to TreasuryDirect.gov and its

instructions for cashing by mail.

GO

YES

NO

Don’t cash the bond. You may refer the customer either to a

nancial institution where he or she is an established customer or

to TreasuryDirect.gov and its instructions for cashing by mail.

Is the value of the bonds $1,000 or less?

STOP

GO

QUICK START SUPPLEMENT • QUICK START SUPPLEMENT • QUICK START SUPPLEMENT

17

17

YES NO

Is it an obvious dierence, like a shortened rst name, a maiden or married

name? Have the customer re-sign, note the explanation, and continue.

Is the name on the identication the same as the name on the bond?

Don’t cash the bond. Refer the customer to

TreasuryDirect.gov and its instructions for cashing by mail.

STOP

STOP

STOP

STOP

GO

WAIT

Is there a picture and/or physical description that matches the customer?

YES NO

Don’t cash the bond. Refer the customer to TreasuryDirect.gov and its

instructions for cashing by mail.

GO

Do the signatures on the ID and the bond match?

YES NO

Don’t cash the bond. Refer the customer to TreasuryDirect.gov and its

instructions for cashing by mail.

Cash the bond. Make notes to show the identication you accepted. A motor

vehicle operator’s license notation must be readable and include the issuer and the

number. EX: “NY D/L A07346-9975-73882.” Refer to the document tables in Step 5 for

requirements for other documents.

GO

ACTION

HINT: A motor vehicle operator’s license or state ID must have a photograph or physical

description of the customer, be signed by the customer, and be countersigned or

otherwise validated. See the Document Table if you have questions.

YES

NO

Don’t cash the bond. The customer may take the bond to a nancial

institution where he or she is an established customer or may try to cash

by mail, following instructions on TreasuryDirect.gov.

STOP

GO

Does the ID appear genuine and meet the specic requirements for the type of document?

Are you condent the bond and the person presenting it are legitimate?

YES NO

Don’t cash the bond. Refer the customer to TreasuryDirect.gov and its

instructions for cashing by mail.

GO

If it’s not obvious or the explanation doesn’t satisfy you, or if the presenter and

the owner have the same or similar names but you’re aware they’re not the

same person:

QUICK START SUPPLEMENT • QUICK START SUPPLEMENT • QUICK START SUPPLEMENT

18

18

Type of ID Requirements Notation

Craft/trade license issued by

state or local government, for

example, a barber, cab driver,

electrician, etc.

License with licensee’s photograph

or physical description and signature, and

countersigned or otherwise validated.

Issuer, document,

number

EX: “DC barber

lic. 4513”

Employer identication card

including those of state and

local governmental agencies

Card with employee’s photograph or physical

description and signature, and countersigned

or otherwise validated by employer whose

existence is known to the paying agent.

Issuer, number

EX: “ABC Co.

ID 879,065”

Motor vehicle operator’s license

License with licensee’s photograph or physical

description and signature, and countersigned

or otherwise validated.

Issuer, number

EX: “NY D/L A07348-

99753-738826”

State-issued identication card

Card with holder’s photograph or physical

description and signature, and countersigned

or otherwise validated.

Issuer, number

EX: “CA ID K123456”

Acceptable General Documents

Documents for Identication

5

5

a

QUICK START SUPPLEMENT • QUICK START SUPPLEMENT • QUICK START SUPPLEMENT

19

19

Type of ID Requirements Notation

Alien Registration

Receipt Card

(“Green Card”)

Form I-151 or I-551, with holder’s

photograph, date of birth, port of

entry, thumbprint and signature.

Form number (from lower

right corner on back) and

alien number (in center on front of card)

EX: “Form I-151, AI 2345678”

Armed Forces

identication card

Active duty - DD Form 2, followed

by branch of service, for example,

“A” (Army) and word “Active”

printed in green ink.

Reserve - same form, green ink.

Retired - same form, gray ink.

Form number (appears in left marginal

border on face of card), service number,

card number, issue date

EX: “DD 2A Active, 33,215,626/12951 -

8/3/89”

Federal employee

identication card

or badge

Card or badge with employee’s

photograph or physical

description and signature, and

countersigned or otherwise

validated.

Form number (if any), issuer, card

number, issue date

EX: E&P 9309 OD, US Treasury,

4464,1/2/89”

Uniformed Services

Identication and

Privilege Card

DD Form 1173 - orange color.

Form number (appears on left lower

corner on back of card), card number

(appears on upper right face of form),

place of issue, issue date

EX: “DD1173,A812,994 / Fort Lee - 4/1/89”

United States passport

Booklet with holder’s photograph,

signature and physical description.

Passport, number, issue date

EX: “US passport EL 2345 - 8 /30/89”

Acceptable U.S. Government Documents

5 b

QUICK START SUPPLEMENT • QUICK START SUPPLEMENT • QUICK START SUPPLEMENT

20

20

These and similar documents are inadequate for identication because they don’t contain both a physical

description and a validated signature, and they are usually easy to obtain without having to establish

identication to the issuing authority.

However, for payments of $1,000 cash value or less, paying agents may request both this kind of

identication as well as additional acceptable documents to corroborate identity. This might be helpful

if the presenter doesn’t have a 12-month-old or older account with the institution.

n

Armed Forces discharge or separation documents;

n

Automobile registration certicates;

n

Birth and marriage certicates;

n

Credit cards or plates;

n

Health or other insurance policy holder cards;

n

ID cards purchased from commercial ID business;

n

Organization, union, professional, etc., membership and identication cards;

n

Passbooks - banks, etc.;

n

Selective Service classication cards;

n

Selective Service registration certicates;

n

Social security cards; and

n

Voter registration cards.

Unacceptable Documents

5 c

Go to Step 6

QUICK START SUPPLEMENT • QUICK START SUPPLEMENT • QUICK START SUPPLEMENT

• The Guide to Cashing Savings Bonds • The Guide to Cashing Savings Bonds •

• The Guide to Cashing Savings Bonds • The Guide to Cashing Savings Bonds •

The Guide to Cashing Savings Bonds • The Guide to Cashing Savings Bonds • The Guide to Cashing

Cashing Savings Bonds • The Guide to Cashing Savings Bonds • The Guide to Cashing Savings Bonds

21

Step 6. Making a Payment

Step 6. Making a Payment

21

Making a Payment

6

Have you made clear and complete notes describing the identication documents used to verify the

customer? That’s important because image quality and readability are necessary when considering

liability for any future losses resulting from improperly cashed savings bonds. So here’s a guide:

Have you noted the correct nancial information? When paying the bond, be sure to pay and show the

Current Redemption Value (CRV) of the bond, not just the Interest Paid amount.

For Established

Account Holders

For All Customers

Show the complete account number and type of account as well as the date the

account was established. (Ck Acct 3421, 4/1/80)

Write on the backs of the bonds with readable, clear notes. Up to 10 years

later, your notes must be clear enough so we know what identication and

documents were accepted and how you established the person’s eligibility.

It’s the same for notes about legal documents – make them complete and

clear so we can easily retrieve documents from a court or agency.

You may keep notations in separate records, but remember that your

institution must have those records easily accessible for 10 years.

Stamp each bond with a “PAID STAMP.” The stamp must show:

n

The full Current Redemption Value (CRV)

n

Initials of the employee cashing the bonds

n

The transaction date

n

Name and location of your branch or office

n

Serial Numbers

n

Addresses

n

Names

n

Issue dates

Be sure the PAID STAMP does not cover up or print over information already on the bonds, such as:

QUICK START SUPPLEMENT • QUICK START SUPPLEMENT • QUICK START SUPPLEMENT

• The Guide to Cashing Savings Bonds • The Guide to Cashing Savings Bonds •

• The Guide to Cashing Savings Bonds • The Guide to Cashing Savings Bonds •

The Guide to Cashing Savings Bonds • The Guide to Cashing Savings Bonds • The Guide to Cashing

Cashing Savings Bonds • The Guide to Cashing Savings Bonds • The Guide to Cashing Savings Bonds

22

Step 7. Final Steps for Internal Processing

Step 7. Final Steps for Internal Processing

22

Final Steps For Internal Processing

7

Remove images of any bonds that WERE NOT PAID BUT WERE FORWARDED FOR PROCESSING

from the images/bonds your institution paid and are submitting for credit. This will avoid

duplicate submissions.

Make sure each bond has a unique serial number whenever you submit more than one bond

for credit.

When encoding bonds for submission, be sure to MICR encode the Current Redemption Value

(CRV), NOT the Interest Paid, to avoid errors.

When imaging bonds for Check 21 submission, be sure the bond is not folded to obscure

essential information (stamps, requests for payment, serial numbers, signatures, etc.).

Be especially careful when imaging the larger Series E half-sheet bonds to ensure no

information is obscured.