November 2017

QUARTERLY CONSUMER CREDIT TRENDS

Growth in Longer-Term Auto

Loans

Kenneth P. Brevoort

Jasper Clarkberg

Michelle Kambara

Ryan Kelly

This is part of a series of quarterly reports of consumer credit trends produced by the

Consumer Financial Protection Bureau using a longitudinal, nationally-

representative sample of approximately five million de-identified credit records from

one of the three nationwide credit reporting agencies.

2 QUARTERLY CONSUMER CREDIT TRENDS: GROWTH IN LONGER-TERM AUTO LOANS

This quarter’s update to the CFPB’s Consumer Credit Trends dashboard shows that

the rapid increase in auto lending experienced for most of this decade started to

subside in 2016 and has continued to cool in 2017. Year-over-year lending declines,

which first began among borrowers with subprime or deep subprime credit scores,

have spread to consumers with prime or near-prime credit scores. Only lending to

consumers with super-prime scores has continued to show year-over-year gains.

The rapid growth in auto lending was accompanied by a second trend, an increase in

the use of longer-term financing for automobiles. The trend towards longer-term

auto loans has continued even as the auto financing market has begun to cool. In

this, the first Quarterly Consumer Credit Trends report, we explore what the data

reveal about the increased use of these longer-term loans.

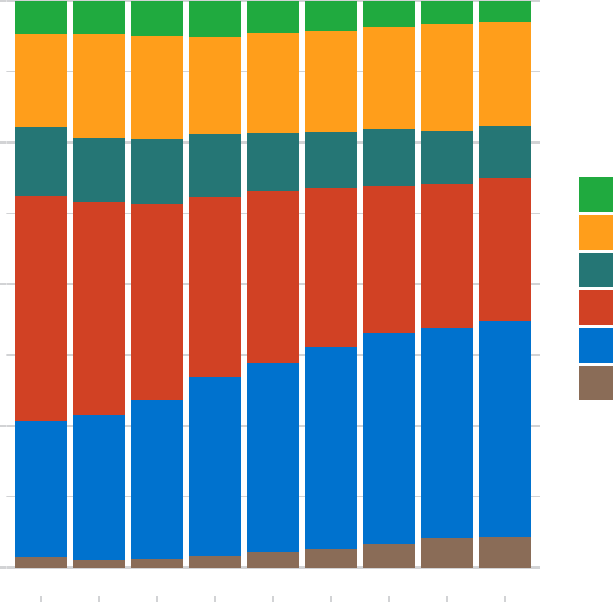

FIGURE 1: DISTRIBUTION OF LOAN TERMS BY ORIGINATION YEAR

0%

25%

50%

75%

100%

2009 2010 2011 2012 2013 2014 2015 2016 2017

Origination year

<3 years

3 years

4 years

5 years

6 years

7 years+

3 QUARTERLY CONSUMER CREDIT TRENDS: GROWTH IN LONGER-TERM AUTO LOANS

Figure 1 shows the distribution of lengths of auto loans for each origination year

since 2009.

1

As the figure shows, the share of loans with terms of six or more years

(“longer-term loans”) has increased steadily. These longer-term loans increased from

26 percent of auto loans originated in 2009 to 42 percent of 2017 originations. Most

of this growth can be attributed to six-year auto loans, which have become the most

common term used to finance automobiles, though loan originations with terms of

seven years or longer have also increased. The growth in these longer-term loans

appears to have come at the expense of five-year loans, as the share of loans with

terms under five years has remained relatively constant over this time period.

FIGURE 2: DISTRIBUTIONS OF CREDIT SCORES BY LOAN TERM

<3 years

3 years

4 years

5 years

6 years

7+ years

300 400 500 600 700 800

Credit score

Loan term

The use of longer-term auto loans is closely related to the credit score of the

borrower. Figure 2 shows the distributions of credit scores at origination by the term

of the loan. The credit scores of borrowers taking out loans with terms of six years or

longer are notably lower than the scores of borrowers who take out five-year loans.

2

1

For consistency, we use the same definition of “auto loans” in this analysis as is used in the Consumer

Credit Trends dashboard. This definition includes closed-end loans or leases used by consumers to

finance new or used automobile purchases.

2

The lowest credit scores, on average, are for borrowers who take out loans with terms of less than

three years. Distributions are for years 2009 through mid-2017.

4 QUARTERLY CONSUMER CREDIT TRENDS: GROWTH IN LONGER-TERM AUTO LOANS

The average credit score for borrowers taking out six-year loans is 674, which is 39

points below the average for borrowers taking out five-year loans.

FIGURE 3: DISTRIBUTIONS OF LOAN AMOUNTS BY LOAN TERM

<3 years

3 years

4 years

5 years

6 years

7+ years

10 20 30 40 50

Loan amount (thousands)

Loan term

Longer-term loan use is also related to the dollar amount being financed. Figure 3

shows the distributions of loan amounts by the term of the loan. As shown,

longer-term loans tend to be used to finance larger amounts. The average original

loan amount for a five-year loan was $20,100, compared to $25,300 for a six-year

loan. The average size of loans with terms of seven years or more was even larger at

$32,200. To the extent that consumers are buying more expensive cars, making

smaller down payments, or otherwise financing larger loan amounts, the increased

use of these longer-term loans may be a result.

Using a longer-term loan to finance an automobile reduces the size of the monthly

payment, while increasing the financing costs over the life of the loan. The data

suggest that the movement toward longer-loan terms has reduced the growth in

borrowers’ monthly payments. Figure 4 shows the average size of an auto loan at the

time of origination. The data have been indexed so that a value of 100 equals the

average 2009 loan size of $18,179. By 2016, average loan amounts had increased by

16 percent. This increase in loan amounts has mildly outpaced the inflation rate, as

5 QUARTERLY CONSUMER CREDIT TRENDS: GROWTH IN LONGER-TERM AUTO LOANS

FIGURE 4: LOAN AMOUNTS AND MONTHLY PAYMENTS

Average loan amount

Average payment

100

105

110

115

2009 2010 2011 2012 2013 2014 2015 2016 2017

Origination year

Index value (2009 = 100)

measured by the Consumer Price Index, which increased by 12 percent over this

same period. In large part because of the use of longer-term loans, monthly

payments have not experienced the same increase. The average monthly payment

over this time period, which is also shown in Figure 4 indexed to its 2009 average of

$375, increased by 7 percent.

3

While longer loan terms may make monthly payments more affordable, it is not clear

that consumers are better off taking out longer-term loans or that they will be more

likely to successfully repay the loan. Longer-term loans amortize more slowly and, as

a result, financing costs will be higher over the life of the loan. For example, a

borrower who uses a five-year loan to finance $20,000 at a 5 percent interest rate

will, after three years, have paid $2,190.27 in interest and have a remaining balance

of $8,602.98. If the same loan had been financed over six years at the same interest

rate, she would have paid about $152 more interest over the same three-year period

and had a remaining balance that was over $2,000 higher.

3

Another factor that may have limited the growth of monthly payments as loan amounts rose was the

interest rate environment that prevailed over this time period. According to data from the Federal

Reserve Board’s G.19 release, interest rates for five-year auto loans to finance new automobiles

decreased from 6.96 percent in 2009Q1 to 4.05 percent in 2016Q4.

6 QUARTERLY CONSUMER CREDIT TRENDS: GROWTH IN LONGER-TERM AUTO LOANS

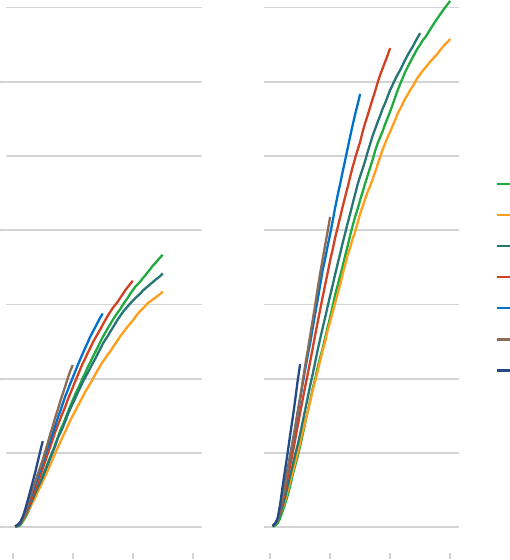

FIGURE 5: CUMULATIVE DEFAULT RATES ON AUTO LOANS BY ORIGINATION-YEAR COHORT,

FIVE- AND SIX-YEAR LOANS

5−year loans

6−year loans

0 2 4 6 0 2 4 6

0.0%

2.5%

5.0%

7.5%

Years since origination

Cumulative default rate

Origination year

2009

2010

2011

2012

2013

2014

2015

7 QUARTERLY CONSUMER CREDIT TRENDS: GROWTH IN LONGER-TERM AUTO LOANS

In fact, the default rates associated with longer-term loans are higher than those for

shorter-term loans. Figure 5 shows the cumulative default rates for five- and

six-year auto loans originated from 2009 to 2015. We consider a loan to be in default

once it is 90 or more days past due or has a major derogatory event, such as a

repossession. Each line shows the cumulative default rate as a function of the

number of months since the loan was originated.

The higher default rates observed for six-year loans should not be interpreted as a

causal relationship. Borrowers who expect to struggle making the payments on a

loan financed over five years may be more likely to opt for a longer-term financing to

ease their financial burden each month. Riskier borrowers may thus prefer

longer-term loans, which is consistent with our earlier finding in Figure 2 that

borrowers taking out six-year loans tend to have lower credit scores than borrowers

with five-year loans. Nevertheless, the fact that there has been no decline in the

default rates associated with six-year loans as they have become more widely used

(in fact, default rates for both five- and six-year loans have been been increasing for

the most recent vintages) suggests that the movement toward these longer loan

terms may increase the likelihood of borrower default, potentially posing greater

risks to both borrowers and lenders.

8 QUARTERLY CONSUMER CREDIT TRENDS: GROWTH IN LONGER-TERM AUTO LOANS