Page 1 of 10

IL-2220 Instructions (R-12/23)

Illinois Department of Revenue

IL-2220 Instructions 2023

General Information

What is the purpose of this form?

This form allows you to calculate penalties you may owe if you did not

• make timely estimated payments,

• pay the tax you owe by the original due date, or

• le a processable return by the extended due date.

Note: The late-payment penalty for underpayment of estimated tax is based on the tax shown due on your original return.

Do not use the tax shown on an amended return led after the extended due date of the return to compute your required

installments in Step 2.

In addition, this form must be used if your income was not received evenly throughout the year and you choose to annualize

your income. The annualized income installment method may be able to lower or eliminate the amount of your required

installments.

To use the annualized income installment method complete Form IL-2220, Computation of Penalties for Businesses, including

the annualization worksheet in Step 6. See the specic instructions for Step 6 for more information. If you fail to follow these

instructions, we may calculate your late-payment penalty for underpayment of estimated tax based on four equal installments.

Note: Check the box in Step 1 of your return and attach Form IL-2220 to your return if you are annualizing your income.

Should I round?

You must round the dollar amounts on Form IL-2220 to whole-dollar amounts. To do this, you should drop any amount less than

50 cents and increase any amount of 50 cents or more to the next higher dollar.

Do I need to complete this form if I owe penalties?

No, you do not need to complete this form if you owe penalties. We encourage you to let us gure your penalties and send you

a bill instead of completing and ling this form yourself. If you let us gure your penalties, complete your return as usual and do

not attach Form IL-2220.

You must complete this form if you are using the annualized income installment method for late-payment penalty for

underpayment of estimated tax in Step 6.

For more information, see Publication 103, Penalties and Interest for Illinois Taxes. To receive a copy of this publication, visit

our website at tax.illinois.gov.

What is late-payment penalty?

A late-payment penalty is assessed when you fail to pay the tax you owe by the due date. This penalty could result from two

dierent underpayment situations and is assessed at either 2 percent or 10 percent of the unpaid liability based on the number

of days the payment is late. The penalty rates used on this form are for returns due on or after January 1, 2005. For returns

due before January 1, 2005, see Publication 103, Penalties and Interest for Illinois Taxes.

You will be assessed a late-payment penalty for unpaid tax if you do not pay the total tax you owe by the original due date of

the return. An extension of time to le your return does not extend the amount of time you have to make your payment.

You will be assessed a late-payment penalty for underpayment of estimated tax if you were required to make estimated tax

payments and failed to do so, or failed to pay the required amount by the payment due date.

Note: If in the previous taxable year you led a short year return or a return showing no liability, you may still owe the

late-payment penalty for underpayment of estimated tax. See the specic instructions for details.

You do not owe the late-payment penalty for underpayment of estimated taxes if

• you are ling Form IL-1120, Corporation Income and Replacement Tax Return, and

• you were not required to le Form IL-1120 for last year; or

• your current year’s tax liability (Form IL-1120, Step 8, Line 58 minus Lines 61c, 61d, and 61e) is $400 or less; or

• you made timely estimated installment payments equaling at least 90 percent of this year’s tax liability or 100 percent of

the prior year’s tax liability (provided you reported a tax liability in the prior year and it was not a short taxable year).

• you are ling Form IL-1120-ST or Form IL-1065 and

• you were not required to le Form IL-1120-ST or Form IL-1065 last year; or

• you did not elect to pay pass-through entity (PTE) tax this year; or

Printed by the authority of the state of Illinois - electronic only - one copy.

Page 2 of 10

IL-2220 Instructions (R-12/23)

• you elected to pay PTE tax this year, but your current year’s tax liability (Form IL-1120-ST, Step 8, Line 62 minus

Step 9, Lines 65c and 65d, or Form IL-1065, Step 8, Line 62 minus Step 9, Lines 65c and 65d) is $500 or less; or

• you made the election to pay PTE tax this year and you made timely estimated installment payments equaling at least

90 percent of this year’s tax liability or 100 percent of the prior year’s tax liability (provided you reported a tax liability in

the prior year and it was not a short taxable year).

• you are ling Form IL-1041, Fiduciary Income and Replacement Tax Return.

Note: You will still be assessed the late-payment penalty for underpayment of estimated tax if you failed to pay the required

installment amount by each installment due date.

What is late-ling or non-ling penalty?

A late-ling or non-ling penalty is a penalty assessed for failure to le a processable return by the extended due date. The

penalty is the lesser of $250 or 2 percent of the tax amount required to be shown due on your return, reduced by any payments

made by the original due date and any credits allowed on your return.

An additional penalty will be assessed if you do not le a processable return within 30 days of the date we notify you that we

are not able to process your return. This additional penalty is equal to the greater of $250 or 2 percent of the tax shown due on

your return, determined without regard to payments and credits, and may be assessed up to a maximum of $5,000. For more

information, see Publication 103, Penalties and Interest for Illinois Taxes.

What if I underpaid my estimated tax because of a change in the law during the tax year?

If a change in the IITA enacted during the tax year increased your liability, and the new statute does not specically provide

for relief from penalties, you may reduce or eliminate your penalty for underpayment of estimated tax by using the annualized

income installment method in Step 6 and computing your income and liability for each period according to the IITA in eect as

of the end of that period. See Specic Instructions for Step 6.

Do I use the investment partnership withholding credit I received when calculating my penalties?

Some taxpayers may not be eligible to claim the investment partnership withholding credit that is reported to them on

Schedule K-1-P, Step 7, Line 55. Partners in an investment partnership who treat the income received from the investment

partnership as nonbusiness income may not use the amount reported to them as investment partnership withholding credit.

If you are eligible to claim the investment partnership withholding credit you received, you may use the credit as if it were

pass-through withholding credit when calculating your penalties. See Schedule K-1-P(2), Partner’s and Shareholder’s

Instructions, for more information about investment partnership income.

What if I need additional assistance or forms?

• For assistance, forms, or schedules, visit our website at tax.illinois.gov or scan the QR code

provided.

• Write us at:

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19001

SPRINGFIELD IL 62794-9001

• Call 1 800 732-8866 or 217 782-3336 (TTY at 1 800 544-5304).

• Visit a taxpayer assistance oce - 8:00 a.m. to 5:00 p.m. (Springeld oce) and 8:30 a.m. to

5:00 p.m. (all other oces), Monday through Friday.

Specic Instructions

Note: If a specic line is not referenced, follow the instructions on the form.

Step 2: Figure your required installments (Form IL-1120 lers and Forms IL-1120-ST and IL-1065 lers who

elect to pay PTE tax)

Line 5 —

Column A -

• Form IL-1120 - Enter the total net income and replacement taxes and surcharges entered on your 2023 Form IL-1120,

Step 8, Line 58.

• Form IL-1120-ST - Enter the total net replacement tax, surcharges, pass-through withholding, and PTE tax entered on your

2023 Form IL-1120-ST, Step 8, Line 62.

• Form IL-1065 - Enter the total net replacement tax, withholding, and PTE tax entered on your 2023 Form IL-1065, Step 8,

Line 62.

Page 3 of 10

IL-2220 Instructions (R-12/23)

Column B -

• Form IL-1120 lers - Enter the total net income and replacement taxes and surcharges as entered on your 2022

Form IL-1120, Step 8, Line 58.

• Form IL-1120-ST - Enter the total net replacement tax, surcharges, pass-through withholding, and PTE tax as entered on

your 2022 Form IL-1120-ST, Step 8, Line 62.

• Form IL-1065 - Enter the total net replacement tax, pass-through withholding, and PTE tax as entered on your 2022

Form IL-1065, Step 8, Line 62.

Note: Enter “N/A” in Step 2, Column B, Line 5, if:

• your prior year’s tax was zero; or

• the prior year’s return was a short tax year.

“N/A” does not equal zero. If you entered “N/A” on Step 2, Column B, Line 5, you still may be required to make installments.

See the instructions for Line 9.

Line 6 —

• Form IL-1120 - Enter the total amount from your Form IL-1120, Step 8, Lines 61c, 61d, and 61e.

• Form IL-1120-ST - Enter the total amount from your Form IL-1120-ST, Step 9, Lines 65c and 65d.

• Form IL-1065 - Enter the total amount from your Form IL-1065, Step 9, Lines 65c and 65d.

Line 9 —

• Form IL-1120 - If Line 7 is $400 or less, enter zero and go to Step 3. Otherwise, enter the lesser of Column A, Line 8, or

Column B, Line 5. If you entered “N/A” in Column B, Line 5, enter the amount from Column A, Line 8.

• Form IL-1120-ST - If Line 7 is $500 or less, enter zero and go to Step 3. Otherwise, enter the lesser of Column A,

Line 8, or Column B, Line 5. If you entered “N/A” in Column B, Line 5, enter the amount from Column A, Line 8.

• Form IL-1065 - If Line 7 is $500 or less, enter zero and go to Step 3. Otherwise, enter the lesser of Column A, Line 8,

or Column B, Line 5. If you entered “N/A” in Column B, Line 5, enter the amount from Column A, Line 8.

Line 12 — Enter the amount of your required installment for each due date. For most taxpayers, this is the amount shown

on Line 10. (In this case, the total amount of all columns of Line 12 should equal Line 9.) However, if you are annualizing your

income, you must complete Step 6 and enter the required installments from Line 51.

Annualized income installment method: If your income was not received evenly throughout the year, you may be able to

lower or eliminate the amount of your required installments by using the annualized income installment method in Step 6. If you

choose to annualize your income in Step 6, you must use this method for all installments.

Line 13 —

• Gambling withholding: If you received a Form W-2G, Certain Gambling Winnings, enter the entire Illinois amount of

withholding in the quarter in which the gambling winnings were received.

• Sports wagering withholding: If you received a Form W-2G, Certain Gambling Winnings, enter the entire amount of

Illinois withholding in the quarter in which the sports wagering winnings were received.

• PTE tax credit: If you received an Illinois Schedule K-1-P or K-1-T showing PTE tax credit, enter the entire amount in the

quarter in which the pass-through entity’s tax year ended.

• Pass-through withholding (including investment partnership withholding): If you received an Illinois

Schedule K-1-P or K-1-T showing pass-through withholding (including any applicable investment partnership withholding)

made on your behalf, enter the entire amount in the quarter in which the pass-through entity’s tax year ended.

For example, if your tax year ended on March 31, 2023, and your Schedule K-1-P shows a tax year ending of

June 30, 2022, you would put the pass-through withholding payment amount in Quarter 1.

Line 14 — Quarters 1 through 4 — Subtract Line 13 from Line 12 and enter that amount here. If this amount is negative, use

brackets. If Line 13 is blank or zero, enter the amount from Line 12.

Lines 15 and 16 — Complete Lines 15 and 16 of each quarter before proceeding to the next quarter. Follow the instructions

on the form.

Step 3: Figure your unpaid tax (all lers)

Line 17 — Enter the total from:

• Form IL-1120, Step 8, Line 58;

• Form IL-1120-ST, Step 8, Line 62;

• Form IL-1065, Step 8, Line 62;

Page 4 of 10

IL-2220 Instructions (R-12/23)

• Form IL-1041, Step 7, Line 54; or

• Form IL-990-T, Step 6, Line 28.

Line 18a — Enter the total of all payments you made on or before the original due date of your tax return. Include

overpayment credit(s) carried forward to 2023 from a prior year original or amended return if the prior year return was led on

or before the original due date of your 2023 return. You must also include withholding (including gambling and sports wagering

withholding), estimated payments (voluntary prepayments), extension payments, PTE tax credit, pass-through withholding

(including any applicable investment partnership withholding credits) made on your behalf, payments made with a voucher

generated by a software program, electronic payments, and payments made with your tax return or “V” vouchers.

Line 18b —

• Form IL-1120 lers and Forms IL-1120-ST and IL-1065 lers who elect to pay PTE tax - Add the amounts from Step 2,

Line 12, all columns. Enter the result on Line 18b.

• All other lers (including Forms IL-1120-ST and IL-1065 lers who did not elect to pay pass-through entity tax) - Enter

zero.

Line 18 — Enter the greater of 18a or 18b.

Line 19 — Subtract Line 18 from Line 17. If the amount is

• positive, enter the amount here. You owe a late-payment penalty for unpaid tax. Continue to Step 4 and enter this amount

in Penalty Worksheet 2, Column C, Line 23.

• zero or negative, enter the amount here. If the result is negative, use brackets.

Step 4: Figure your late-payment penalty

Use Penalty Worksheet 1 to gure your late-payment penalty for underpayment of estimated tax.

Use Penalty Worksheet 2 to gure your late-payment penalty for unpaid tax.

You must follow the instructions in order to properly complete the penalty worksheets.

Line 20 — Follow the instructions below for your tax type.

Corporations and S corporations and Partnerships who elect to pay pass-through entity tax

Enter your payments, regardless of the type of payment, and the date you made the payment. List the payments in date order.

Include any overpayment credit(s) carried forward from a prior year original or amended return.

Note: If you do not complete Penalty Worksheet 1, only enter payments made and credits received after the original due date

of your tax return.

Do not include income tax credits, PTE tax credits, withholding (including gambling or sports wagering), or

pass-through withholding (including investment partnership withholding credits) made on your behalf.

To determine the correct date to enter for overpayment credit(s) carried forward, refer to the instructions below.

If your prior year return that made the election to credit your overpayment against your 2023 tax was led

on or before the extended due date of that prior year return, your credit is considered to be paid on the due date of

your rst estimated tax installment for the current year.

Example 1: You led your 2022 Form IL-1120 calendar-year return on or before the extended due date of that return

requesting $500 be applied against estimated tax. All of your payments were made before the original due date of your

2022 return.

In this case, your credit of $500 will be considered to be paid on April 17, 2023. Enter $500 and a date paid of

April 17, 2023, on Line 20.

Example 2: You led your 2022 Form IL-1120 calendar-year return on or before the extended due date of that return

requesting $500 be applied against estimated tax. Your overpayment includes payments of $400 you made before the

original due date of your return, and a $100 payment you made on July 3, 2023.

In this case, a credit of $400 will be considered to be paid on April 17, 2023. The remaining $100 credit will be

considered to be paid on July 3, 2023. You will enter two credits on Line 20. One for $400 reporting a date paid of

April 17, 2023, and another for $100 reporting a date paid of July 3, 2023.

Note: If all or a portion of your overpayment results from payments made after the due date of your rst estimated tax

installment, that portion of your credit is considered to be paid on the date you made the payment.

Page 5 of 10

IL-2220 Instructions (R-12/23)

after the extended due date of that prior year return, your credit is considered to be paid on the date you led the return

on which you made the election.

Example 3: You led your 2022 Form IL-1120 calendar-year return on December 1, 2023, requesting $500 be applied

against estimated tax.

In this case, your credit of $500 will be considered to be paid on December 1, 2023, because you led your return after

the extended due date of your 2022 calendar-year return. Enter $500 and a date paid of December 1, 2023, on Line 20.

Note: If you are ling your return after the extended due date, you may only elect to claim an overpayment credit for payments

received on or before the date you led your return. Any payments made after the date you led that return can only be claimed

as an overpayment credit on a subsequent amended return.

All other tax types (including S corporations and Partnerships not electing to pay pass-through

entity tax)

Enter any payments made after the original due date of your tax return, regardless of the type of payment, and the date you

made the payment. List the payments in date order. Include any overpayment credit(s) carried forward from a prior year original

or amended return.

Do not include income tax credits, withholding (including gambling or sports wagering), PTE tax credits, or

pass-through withholding (including investment partnership withholding credits) payments made on your behalf.

Only include overpayment credit(s) which are considered to be paid after the original due date of your current year tax return.

To determine when the overpayment credit(s) are considered to be paid, refer to the following instructions.

If your prior year return that made the election to credit your overpayment against your 2023 tax was led

on or before the extended due date of that prior year return, do not include the credit(s) on Line 20. Your credit(s) will

be considered to be paid before the original due date of the current year tax return. See the instructions for your return for

details.

after the extended due date of that prior year return, your credit is considered to be paid on the date you led the return

on which you made the election.

Example 1: You led your 2022 Form IL-1120-ST calendar-year return late on December 1, 2023, requesting $500 be

applied against estimated tax. Your credit of $500 will be considered to be paid on December 1, 2023, because you led

your return after the extended due date of your 2022 calendar-year return.

In this case, the credit is considered to be paid before the original due date of your 2023 Form IL-1120-ST,

March 15, 2024, and would be included on Line 20 when listing your 2023 payments.

Example 2: You led and paid your 2022 Form IL-1120-ST calendar-year return late on July 3, 2024, requesting $500 be

applied against estimated tax. Your credit of $500 will be considered to be paid on July 3, 2024, because you led your

return after the extended due date of your 2022 calendar-year return.

In this case, the credit is considered to be paid before the original due date of your 2024 IL-1120-ST, March 17, 2025,

and would not be included on Line 20 when listing your 2023 payments.

Note: If you are ling your return after the extended due date, you may only elect to claim an overpayment credit for payments

received on or before the date you led your return. Any payments made after the date you led that return can only be claimed

as an overpayment credit on a subsequent amended return.

Penalty Worksheet 1

Late-payment penalty for underpayment of estimated tax

(Form IL-1120 lers and Forms IL-1120-ST and IL-1065 lers who elected to pay pass-through entity tax)

If the amount on Line 16 is positive (greater than zero) for any quarter, you may owe a late-payment penalty for

underpayment of estimated tax. Use this worksheet to gure the penalty for any unpaid quarter.

Note: If you paid the required amount from Line 16 by the due date on Line 11 for each quarter, do not complete Penalty

Worksheet 1.

Line 21 —

Column B — Use the dates from Step 2, Line 11.

Column C — Enter the underpaid amount from Line 16 on the rst line of the appropriate quarter. Do not enter any overpaid

amounts in this column.

Column D — Apply to the rst unpaid quarter, the payment from Line 20 with the earliest payment date.

Page 6 of 10

IL-2220 Instructions (R-12/23)

Continue applying payments in date order until all unpaid amounts in Column C have been satised (Column E is zero or a

negative gure for all unpaid quarters) or you have no more payments to apply.

For quarters two through four: If you have an overpayment available from the previous quarter (quarters one through three,

respectively) in Column E, you may use that amount for the rst available payment in the current quarter.

Note: See the example on the nal page of these instructions.

Column E — Subtract the payment in Column D from the unpaid amount in Column C. If this amount is

• positive, enter the amount here and complete Columns F through I. Enter this positive (unpaid) amount on the next line in

Column C. Continue applying payments in date order until the unpaid amount in Column C has been satised (Column E is

a negative gure, zero, or you entered zero in Column D).

• zero or negative, you have paid your tax. Enter the amount here and, if negative, use brackets. Complete Columns F

through I.

Note: If this amount is negative in the 4th quarter, and the payment date in Column F is after the original due date of the return,

apply this overpayment to any unpaid tax shown on Penalty Worksheet 2, Line 23 when guring your late-payment penalty for

unpaid tax. See the instructions for Penalty Worksheet 2, Column D.

If you entered “0” in Column D, enter the amount from Column C here, and complete Columns F through I.

Column F — Enter the date the payment in Column D was made. If Column D is zero, do not enter a date and skip to

Column H.

Column G — Figure the number of days from the date in Column B to the date in Column F and enter that number here. This is

the number of days the payment was late.

Column H — For payments made after the due date listed in Column B, enter the penalty rate that applies to the number of

days you entered in Column G. See the penalty rates listed on Form IL-2220, Page 2. For payments made before the due date

listed in Column B, enter zero in Column H.

Column I — Figure this amount using the payment portion in either Column C or Column D.

If Column D is zero or if Column E is zero or a negative gure, multiply Column C by Column H and enter the amount here.

Otherwise, multiply Column D by Column H and enter the amount here.

Line 22 — Add Column I, Quarters 1 through 4. This is your late-payment penalty for underpayment of estimated tax.

Enter the total amount here and on:

• For Form IL-1120 lers - Step 8, Line 59;

• For Form IL-1120-ST lers who elected to pay pass-through entity tax - Step 8, Line 63; or

• For Form IL-1065 lers who elected to pay pass-through entity tax - Step 8, Line 63.

Penalty Worksheet 2

Late-payment penalty for unpaid tax

Line 23 —

Column B — Enter the original due date of your return.

Column C — Enter any positive amount from Line 19 on the rst line of Column C.

Column D — If you completed Penalty Worksheet 1, and you have a negative amount (overpayment) in Column E of the

4th quarter of Penalty Worksheet 1, and the payment date shown in the 4th quarter of Column F of Penalty Worksheet 1 is

after the date listed in Line 23, Column B, you may apply the overpayment from Line 21, Column E, as the rst available

payment for Line 23, Column D.

Continue applying unused payments from Line 20 received after the date in Column B, in date order until the unpaid amount in

Column C has been satised (Column E is zero or a negative gure).

If you did not complete Penalty Worksheet 1, apply payments received after the date in Column B from Line 20, in date order

until the unpaid amount in Column C has been satised (Column E is zero or a negative gure).

If you have no more payments to apply and Column C remains unpaid, enter “0” in Column D. See example at the end of these

instructions.

Page 7 of 10

IL-2220 Instructions (R-12/23)

Complete Columns E through I

Column E — Subtract the payment in Column D from the unpaid amount in Column C. If this amount is

• positive, enter the amount here and complete Columns F through I.

Enter this positive (unpaid) amount on the next line in Column C. Continue applying payments in date order until Column E

is an overpayment, zero, or you have entered zero in Column D.

• zero or negative, you have paid your tax. Enter the amount here and, if negative, use brackets. Complete Columns F

through I.

If you entered zero in Column D, enter the amount from Column C here, and complete Columns F through I.

Column F — Enter the date of the payment you applied in Column D. If

• you are applying an overpayment from Penalty Worksheet 1, Column E, enter the date that corresponds to that payment,

shown on Line 20.

• Column D is zero, do not enter a date in Column F and skip to Column H.

Column G — Figure the number of days from the date in Column B to the date in Column F and enter that number here. This is

the number of days the payment was late.

Column H — For payments made after the due date listed in Column B, enter the penalty rate that applies to the number of

days you entered in Column G. See the penalty rates listed on Form IL-2220, Page 2. For payments made before the due date

listed in Column B, enter zero in Column H.

Column I — Figure this amount using the payment portion in either Column C or Column D.

If Column D is zero or if Column E is zero or a negative gure multiply Column C by Column H. Otherwise, multiply Column D

by Column H and enter the amount here.

Line 24 — Add Column I. This is your late-payment penalty for unpaid tax. Enter the amount here and on Step 5, Line 28.

Step 5: Figure your late-ling penalty, total penalties, and the amount you owe

Complete Lines 25 through 27 to gure your late-ling penalty only if

• you are ling your return after your extended due date; and

• your tax was not paid by the original due date.

Otherwise, you do not owe a late-ling penalty.

Line 25 — Enter the amount of tax due from your return. Your tax due is tax, surcharge, pass-through withholding you owe on

behalf of your members, and PTE tax you owe minus any credits and payments made on or before the original due date.

Line 28 — Enter your late-payment penalty for unpaid tax from Step 4, Line 24.

Line 29 — If your annual tax return shows that you have an

• overpayment (before any amount to be carried to the next year’s estimated payments), enter that amount as a negative

number.

• balance due, enter that amount as a positive number.

Form Overpayment Line Balance Due Line

IL-1120 Step 8, Line 63 Step 8, Line 67

IL-1120-ST Step 9, Line 67 Step 9, Line 71

IL-1065 Step 9, Line 67 Step 9, Line 71

IL-1041 Step 7, Line 57 Step 7, Line 61

IL-990-T Step 6, Line 31 Step 6, Line 35

Line 30 — Add Lines 27, 28, and 29. This is your total tax and penalty amounts. This amount may not match the overpayment

and may reduce any available amount to be credited to a subsequent period, or the total amount due on your original tax return.

If Line 30 shows a balance due and you wish to pay your calculated penalty amounts, pay the amount shown here. Otherwise,

we will send you a bill.

Page 8 of 10

IL-2220 Instructions (R-12/23)

Step 6: Complete the annualization worksheet for Step 2, Line 12

You should complete this worksheet if your income was not received evenly throughout the year and you choose to annualize

your income.

If you complete this worksheet, check the box on Form IL-1120, Step 1, Line W, Form IL-1120-ST, Step 1, Line M, or

Form IL-1065, Step 1, Line J and attach this form to your return. Beginning with Column A, complete Lines 31 through 51 of

each column.

You must complete all lines of Columns A through D in order to use this worksheet. If you fail to complete all lines of Step 6,

Lines 31 through 51, Columns A through D, we may disregard your election to annualize your income and calculate your

late-payment penalty for underpayment of estimated tax based on four equal installments.

If the IITA was amended during your tax year and changed how you compute your net income or tax, and the amendment does

not provide relief for taxpayers who computed their estimated tax obligations following the old law, use the old law to compute

your net income and tax for each period ending before the date the amendment became law.

Example: If an income tax credit was repealed by law, eective June 22, 2022, for tax years ending on or after

December 31, 2022, and the credit was reinstated July 31, 2023, for tax years ending on or after December 31, 2023, a

calendar-year taxpayer could use the credit to reduce the tax liability on the 2022 Form IL-2220, in Columns A and B, Line 39,

but not for Columns C or D.

The credit could be used again on the 2023 Form IL-2220, in Column D, Line 39, but not Columns A and B. The credit may

be used in Column C of the 2023 Form IL-2220 only if the income used to compute the liability on Line 39 is the annualized

amount for the rst eight months of the year on Line 36. The credit may not be used if the annualized income for the rst six

months of the year on Line 33 is used, because the law restoring the credit was not in eect as of June 30, 2023.

Line 31 — In Columns B through D,

• Form IL-1120 lers - calculate and enter the net income that would have been shown on Form IL-1120, Step 5, Line 39, as

if you had completed a 2023 return for the rst three months, the rst six months, and the rst nine months of the tax year.

Note: Net income from Form IL-1120, Step 5, Line 39, is base income after apportionment and Illinois net loss deduction

(during applicable years).

• Forms IL-1120-ST and IL-1065 lers who elected to pay pass-through entity tax - calculate and enter the net income

from Form IL-1120-ST, Step 7, Line 51, or Form IL-1065, Step 7, Line 53, as if you had completed a 2023 return for the rst

three months, the rst six months, and the rst nine months of the tax year.

Line 34 — In Columns A through D,

• Form IL-1120 lers - calculate and enter the net income that would have been shown on Form IL-1120, Step 5, Line 39,

as if you had completed a 2023 return for the rst three months, the rst ve months, the rst eight months, and the rst

eleven months of the tax year.

• Forms IL-1120-ST and IL-1065 lers who elected to pay pass-through entity tax - calculate and enter the net income

from Form IL-1120-ST, Step 7, Line 51, or Form IL-1065, Step 7, Line 53, as if you had completed a 2023 return for the rst

three months, the rst ve months, the rst eight months, and the rst eleven months of the tax year.

Note: To avoid a common mistake, ensure you have completed all columns of Lines 31 through 36, as applicable. If you

complete this step, do not leave these lines blank. If you have no net income to report in a column on Lines 31 or 34 or

amounts to enter in a column on Lines 33 or 36, enter zero on the applicable lines. Failure to comply with this requirement may

result in further correspondence and a delay in the processing of your return.

Line 38 — Using the net income on Line 37, calculate and enter in each column the total net replacement tax that would have

been shown on

• Form IL-1120, Step 8, Line 52, as if you had completed a 2023 Form IL-1120 for each period.

• Form IL-1120-ST, Step 8, Line 56, as if you had completed a 2023 Form IL-1120-ST for each period.

• Form IL-1065, Step 8, Line 58, as if you had completed a 2023 Form IL-1065 for each period.

Note: The net replacement tax from Form IL-1120 (Step 8, Line 52), Form IL-1120-ST (Step 8, Line 56), or Form IL-1065

(Step 8, Line 58) are amounts after recapture and all appropriate credits. (Refer to Form IL-1120, Step 6, Form IL-1120-ST,

Step 8, or Form IL-1065, Step 8.) See 86 Ill. Adm. Code 100.8010 for more information.

Page 9 of 10

IL-2220 Instructions (R-12/23)

Line 39 —

• Form IL-1120 lers - Using the net income on Line 37, calculate and enter in each column the total net income tax that

would have been shown on Form IL-1120, Step 8, Line 55, as if you had completed a 2023 Form IL-1120 for each period.

Note: Your net income tax from Form IL-1120, Step 8, Line 55, is an amount after recapture and all appropriate credits.

(Refer to Form IL-1120, Step 7.) See 86 Ill. Adm. Code 100.8010 for more information.

• Forms IL-1120-ST and IL-1065 lers who elected to pay PTE tax - Use the PTE Tax Worksheet to determine the PTE

tax amounts to enter on each column of Line 39.

Line 40 — For each column, determine the period and annualization factor used when calculating Line 37. Next, compute the

amount of surcharge that would have been shown on Form IL-1120, Step 8, Line 56, or Form IL-1120-ST, Step 8, Line 57, as if

you had completed a 2023 return for each period. Finally, multiply that amount by the annualization factor used for that period.

Enter the result on Line 40.

Line 41 — For each column, determine the period and annualization factor used when calculating Line 37. Next, compute the

amount of surcharge that would have been shown on Form IL-1120, Step 8, Line 57, or Form IL-1120-ST, Step 8, Line 58, as if

you had completed a 2023 return for each period. Finally, multiply that amount by the annualization factor used for that period.

Enter the result on Line 41.

Line 47 — Enter the amount you would have entered in the corresponding column of Step 2, Line 12, if you were not

annualizing your income.

PTE Tax Worksheet (Form IL-1120-ST and Form IL-1065 lers)

You should complete this worksheet if you are annualizing your income and you elected to le and pay pass-through entity (PTE)

tax.

Line 52 — In columns B through D, calculate and enter the amount of Illinois net pass-through entity income that would have been

shown on Form IL-1120-ST, Step 8, Line 60 or Form IL-1065, Step 8, Line 60, as if you had completed a 2023 return for the rst

three months, the rst six months, and the rst nine months of the tax year.

Line 55 — In columns A through D, calculate and enter the amount of Illinois net pass-through entity income that would have

been shown on Form IL-1120-ST, Step 8, Line 60 or Form IL-1065, Step 8, Line 60, as if you had completed a 2023 return for

the rst three months, the rst ve months, the rst eight months, and the rst eleven months of the tax year.

Note: To avoid a common mistake, ensure you have completed all columns of Lines 52 through 57, as applicable. If you

complete this worksheet, do not leave these lines blank. If you have no net PTE income to report in a column on Lines 52 or 55

or amounts to enter in a column on Lines 54 or 57, enter zero on the applicable lines.

Line 59 — For each column, multiply the amounts on Line 58 by 4.95 percent (0.0495). Enter the result on Line 59 and in the

applicable columns on Step 6, Line 39.

Page 10 of 10

IL-2220 Instructions (R-12/23)

Step 3: Figure your unpaid tax - all taxpayers

17 Enter your total net income and replacement tax, surcharge, and pass-through withholding you owed

and reported on behalf of your members, and pass-through entity tax you owed. See instructions. 17 ____________ 00

18 a Enter the total amount of all payments made on or before the original due date of your

tax return. Include credit(s) carried forward from a prior year (see instructions); total

estimated payments, prepayments, extension payments or annual payments made

with your tax return; pass-through withholding reported on your behalf; pass-through

entity tax credit, and withholding shown on your W-2G or 1099 forms. 18a ____________ 00

b Forms IL-1120, IL-1120-ST, and IL-1065 lers:

Enter the total of all Columns, Line 12. All others, enter zero. 18b ____________ 00

Enter the greater of Line 18a or Line 18b here. 18 ____________ 00

19 Subtract Line 18 from Line 17. If this amount is

—positive, enter that amount here. Continue to Step 4 and enter this amount in

Penalty Worksheet 2, Line 23, Column C.

—zero or negative, enter that amount here and, if negative, use brackets. 19 ____________ 00

Step 4: Figure your late-payment penalty

Use Penalty Worksheet 1 to gure your late-payment penalty for underpayment of estimated tax.

Use Penalty Worksheet 2 to gure your late-payment penalty for underpaid tax.

You must follow the instructions in order to properly complete the penalty worksheets.

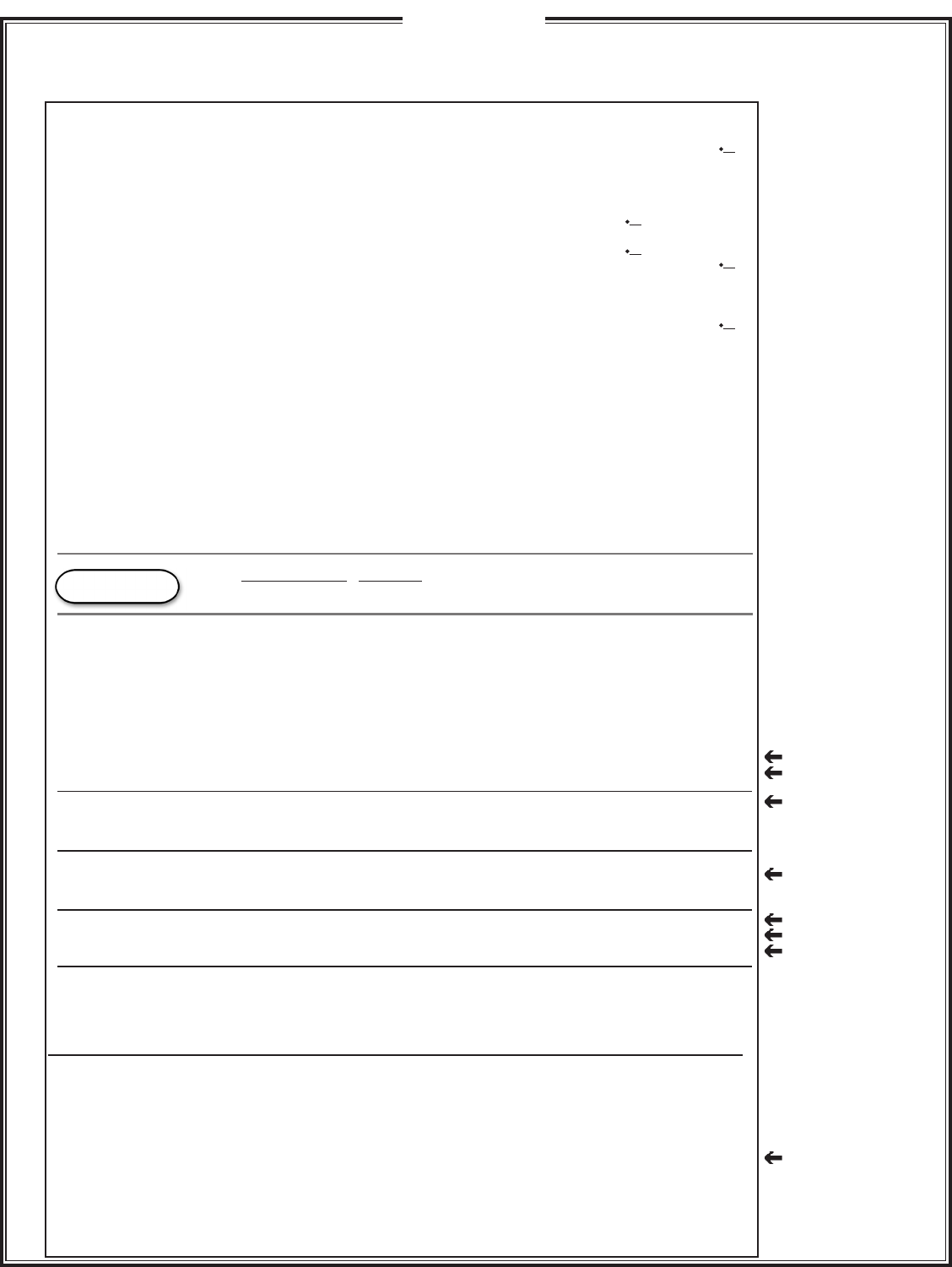

20 Enter the amount and the date of each payment you made. Include any credit(s) carried forward from a prior year. See instructions.

Amount Date paid Amount Date paid Amount Date paid

a ____________ _ _/_ _/_ _ _ _ e ____________ _ _/_ _/_ _ _ _ i ____________ _ _/_ _/_ _ _ _

b ____________ _ _/_ _/_ _ _ _ f ____________ _ _/_ _/_ _ _ _ j ____________ _ _/_ _/_ _ _ _

c ____________ _ _/_ _/_ _ __ g ____________ _ _/_ _/_ _ _ _ k ____________ _ _/_ _/_ _ _ _

d ____________ _ _/_ _/_ _ _ _ h ____________ _ _/_ _/_ _ _ _ l ____________ _ _/_ _/_ _ _ _

Number of days late Penalty rate

1 - 30 .............................02

31 or more ........................10

Penalty Worksheet 1 — Late-payment penalty for underpayment of estimated tax - (Form IL-1120 lers

and Forms IL-1120-ST and IL-1065 lers who elect to pay pass-through entity (PTE) tax)

If you paid the required amount from Line 16 by the payment due date on Line 11 for each quarter, do not complete this worksheet.

21 Enter the unpaid amounts from Line 16, Quarters 1 through 4, on the rst line of the appropriate quarters in Column C below.

A B C D E F G H I

Due Unpaid Payment Balance due Payment No. of Penalty rate

Period date amount applied (Col. C - Col. D) date days late (see above) Penalty

Qtr. 1 _ _/_ _/_ _ _ _ __________ __________ __________ _ _/_ _/_ _ _ _ _____ __________ ______

__________ __________ __________ _ _/_ _/_ _ _ _ _____ __________ ______

__________ __________ __________ _ _/_ _/_ _ _ _ _____ __________ ______

Qtr. 2 _ _/_ _/_ _ _ _ __________ __________ __________ _ _/_ _/_ _ _ _ _____ __________ ______

__________ __________ __________ _ _/_ _/_ _ _ _ _____ __________ ______

__________ __________ __________ _ _/_ _/_ _ _ _ _____ __________ ______

Qtr. 3 _ _/_ _/_ _ _ _ __________ __________ __________ _ _/_ _/_ _ _ _ _____ __________ ______

__________ __________ __________ _ _/_ _/_ _ _ _ _____ __________ ______

__________ __________ __________ _ _/_ _/_ _ _ _ _____ __________ ______

Qtr. 4 _ _/_ _/_ _ _ _ __________ __________ __________ _ _/_ _/_ _ _ _ _____ __________ ______

__________ __________ __________ _ _/_ _/_ _ _ _ _____ __________ ______

__________ __________ __________ _ _/_ _/_ _ _ _ _____ __________ ______

22 Add Column I, Quarters 1 through 4. This is your late-payment penalty for underpayment of estimated tax.

Enter the total amount here and on Form IL-1120, Step 8, Line 59; Form IL-1120-ST, Step 8, Line 63;

or Form IL-1065, Step 8, Line 63. . 22 __________

You may apply any remaining overpayment from the 4th quarter in Column E above to any underpayment when guring

Penalty Worksheet 2, only if the payment date shown in the 4th quarter of Column F is after the original due date of the return.

Penalty Worksheet 2 — Late-payment penalty for unpaid tax

23 Enter any positive amount from Line 19 on the rst line of Column C below.

A B C D E F G H I

Due Unpaid Payment Balance due Payment No. of Penalty rate

date amount applied (Col. C - Col. D) date days late (see above) Penalty

Return _ _/_ _/_ _ _ _ __________ __________ __________ _ _/_ _/_ _ _ _ _____ _____ __________

__________ __________ __________ _ _/_ _/_ _ _ _ _____ _____ __________

__________ __________ __________ _ _/_ _/_ _ _ _ _____ _____ __________

__________ __________ __________ _ _/_ _/_ _ _ _ _____ _____ __________

24 Add Column I. This is your late-payment penalty for unpaid tax.

Enter the total amount here and on Step 5, Line 28. 24 ___________

(200 x .10 = 20.00)

(122 x .10 = 12.20)

(422 x .10 = 42.20)

(216 x .10 = 21.60)

(34 x .02 = .68)

(300 x .10 = 30.00)

(88 x .10 = 8.80)

(187 x .10 = 18.70)

Calculations

1875

1688

187

Example

300 09 04 2024

04 15 2024 187 0 187 .10 18.70

100

04 17

2023

200 06 19 2023

750

09 15

2023

250 12 19 2023

04 17 2023 422 100 322 04 17 2023 0 0 0.00

322 200 122 06 19 2023 63 .10 20.00

122 750 (628) 09 15 2023 151 .10 12.20

06 15 2023 422 628 (206) 09 15 2023 92 .10 42.20

09 15 2023 422 206 216 09 15 2023 0 0 0.00

216 250 (34) 12 19 2023 95 .10 21.60

12 15 2023 422 34 388 12 19 2023 4 .02 .68

388 300 88 09 04 2024 264 .10 30.00

88 0 88 .10 8.80

135.48

1300

1688

18.70

Penalty rates

ABC Corporation’s total Illinois net income and replacement tax and surcharge is $1,875, as shown on its 2023 Form IL-1120, Step 8,

Line 58. The 2022 tax was $2,600. The corporation led Form IL-1120 and paid $300 with the return on September 4, 2024.

The corporation made the following estimated payments:

$100 4-17-23 $200 6-19-23 $750 9-15-23 $250 12-19-23